Audit and Assurance Program of Flight Centre Travel Group Limited

VerifiedAdded on 2023/06/04

|14

|3487

|333

AI Summary

This report emphasises upon the audit and assurance program of the auditors which assists in increasing the overall effectiveness of the financial statement of company. The auditors, independences, assurance, responsibilities and auditors opinion have been given on the financial statement of Flight Centre Travel Group Limited.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

HI6026 Audit,

Assurance and

Compliance

Trimester 2 2018

1

Assurance and

Compliance

Trimester 2 2018

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

EXECUTIVE SUMMARY

This report emphasises upon the audit and assurance program of the auditors which

assists in increasing the overall effectiveness of the financial statement of company. The

auditors, independences, assurance, responsibilities and auditors opinion have been given on

the financial statement of Flight Centre Travel Group Limited. Ernst & Young has given non-

qualified audit report on the financial statement of company and shown that company has

complied with the applicable international financial accounting standards. The Ernst &

Young has also declared that company will be sustainable in long run. The auditor of Flight

Centre Travel Group Limited has also provided non-audit services to company apart from the

audit services and all the transactions of the non-audit services have been placed at arm

length price. The compliance program of company is effective and auditor’s opinion has

shown the positive implication on the financial and legal sustainability of company in long

2

This report emphasises upon the audit and assurance program of the auditors which

assists in increasing the overall effectiveness of the financial statement of company. The

auditors, independences, assurance, responsibilities and auditors opinion have been given on

the financial statement of Flight Centre Travel Group Limited. Ernst & Young has given non-

qualified audit report on the financial statement of company and shown that company has

complied with the applicable international financial accounting standards. The Ernst &

Young has also declared that company will be sustainable in long run. The auditor of Flight

Centre Travel Group Limited has also provided non-audit services to company apart from the

audit services and all the transactions of the non-audit services have been placed at arm

length price. The compliance program of company is effective and auditor’s opinion has

shown the positive implication on the financial and legal sustainability of company in long

2

Table of Contents

EXECUTIVE SUMMARY...................................................................................................................2

INTRODUCTION.................................................................................................................................3

Independence of the auditors.................................................................................................................4

PROVISION OF NON-AUDIT SERVICES.........................................................................................4

AUDITER REMUNERATION.............................................................................................................5

KEY AUDIT MATTERS......................................................................................................................6

AUDIT COMMITTEE & AUDIT CHARTER.....................................................................................7

STRUCTURE........................................................................................................................................7

Auditor’s functions and responsibilities................................................................................................8

AUDIT OPINION.................................................................................................................................9

Difference of Responsibility.................................................................................................................10

Responsibility of director.................................................................................................................10

RESPONSIBILITY of auditor..............................................................................................................10

MATERIAL SUBSEQUENT EVENTS........................................................................................................10

CONCLUSION...................................................................................................................................11

REFERENCES....................................................................................................................................13

3

EXECUTIVE SUMMARY...................................................................................................................2

INTRODUCTION.................................................................................................................................3

Independence of the auditors.................................................................................................................4

PROVISION OF NON-AUDIT SERVICES.........................................................................................4

AUDITER REMUNERATION.............................................................................................................5

KEY AUDIT MATTERS......................................................................................................................6

AUDIT COMMITTEE & AUDIT CHARTER.....................................................................................7

STRUCTURE........................................................................................................................................7

Auditor’s functions and responsibilities................................................................................................8

AUDIT OPINION.................................................................................................................................9

Difference of Responsibility.................................................................................................................10

Responsibility of director.................................................................................................................10

RESPONSIBILITY of auditor..............................................................................................................10

MATERIAL SUBSEQUENT EVENTS........................................................................................................10

CONCLUSION...................................................................................................................................11

REFERENCES....................................................................................................................................13

3

INTRODUCTION

In recent times, it has become important for a company to assure that it operates its

activities transparently. Transparently into the business activities can lead to trust and

confidence on the part of stakeholders. All the information regarding the company is revealed

to its stakeholders through the Annual report. The one important information includes the

details of audit functions which will be undertaken by Ernst Young for setting up strong audit

and assurance program for the financial statement of company. The annual report has the

information of auditors, their remuneration system, and any non-audit services if provided by

auditor to the company. The report also has the information regarding the formation of audit

committee with the audit charter and the perception that each auditor. The opinion of the

auditor suggests improving or enhancing the profitability of the organisation. This report

brings out the discussion of independence of auditors, their responsibility, non-audit services,

and other auditor functions to know the material details of key audit matters of Flight Centre

Travel Group Limited. This report has also shown the key understanding on the auditor’s

independence and their responsibilities for setting up strong audit and assurance program

(Flight Centre Travel Group Limited, 2018).

Independence of the auditors

The auditor of Company is Ernst & Young who has been offering audit and assurance

services. The auditors have announced their independent declaration to acknowledge the

report of audit to the management of Flight Travel Limited. The auditors have stated that they

never tried to intervene and disturb the regulation imposed on them by the Corporation Act,

2001. Moreover, the auditors neither contravene the code of professional conduct nor their

independence as per stated in the Act. The key function of auditors is to reflect the

compliance program that is stated in the audit report of the company. Flight Centre Travel

Group limited appointed the audit committee to analyse the fair value of assets and liabilities

regardless of undervaluation recorded in the financial statement of the company (Flight

Centre Travel Group Limited, 2015).

4

In recent times, it has become important for a company to assure that it operates its

activities transparently. Transparently into the business activities can lead to trust and

confidence on the part of stakeholders. All the information regarding the company is revealed

to its stakeholders through the Annual report. The one important information includes the

details of audit functions which will be undertaken by Ernst Young for setting up strong audit

and assurance program for the financial statement of company. The annual report has the

information of auditors, their remuneration system, and any non-audit services if provided by

auditor to the company. The report also has the information regarding the formation of audit

committee with the audit charter and the perception that each auditor. The opinion of the

auditor suggests improving or enhancing the profitability of the organisation. This report

brings out the discussion of independence of auditors, their responsibility, non-audit services,

and other auditor functions to know the material details of key audit matters of Flight Centre

Travel Group Limited. This report has also shown the key understanding on the auditor’s

independence and their responsibilities for setting up strong audit and assurance program

(Flight Centre Travel Group Limited, 2018).

Independence of the auditors

The auditor of Company is Ernst & Young who has been offering audit and assurance

services. The auditors have announced their independent declaration to acknowledge the

report of audit to the management of Flight Travel Limited. The auditors have stated that they

never tried to intervene and disturb the regulation imposed on them by the Corporation Act,

2001. Moreover, the auditors neither contravene the code of professional conduct nor their

independence as per stated in the Act. The key function of auditors is to reflect the

compliance program that is stated in the audit report of the company. Flight Centre Travel

Group limited appointed the audit committee to analyse the fair value of assets and liabilities

regardless of undervaluation recorded in the financial statement of the company (Flight

Centre Travel Group Limited, 2015).

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

PROVISION OF NON-AUDIT SERVICES

The principles has stated in the APES 110 Code of ethics for the Professional Accountants

relates the non-audit services with the auditor`s independence. A set list of non-audit service

includes tax compliance and other services. It goes without saying it is difficult to hire the

human resource as the requirement, especially professional auditors. The non-audit services

offered by auditors are also accordance with the corporation act 2001. In order to derive and

extract maximum benefit from the auditor`s potential, Flight Centre Travel Group tries to

exploit the potential that the auditor have. The benefit from the auditor is only possible if

company starts getting professional assistance even in non-audit matters. To get the

assistance from the auditors even in the non-audit matters, the Company take care and respect

his independence. The company should not impose provisions that can hinder auditor`s

independence that is able to satisfy the audit and risk committee. Managing the current tax

compliance, several adjustment, and audit functions are the ways through which it can be

analysed whether the auditor is performing well to explicit the fair valuation of recorded

details (Flight Centre Travel Group Limited, 2017).

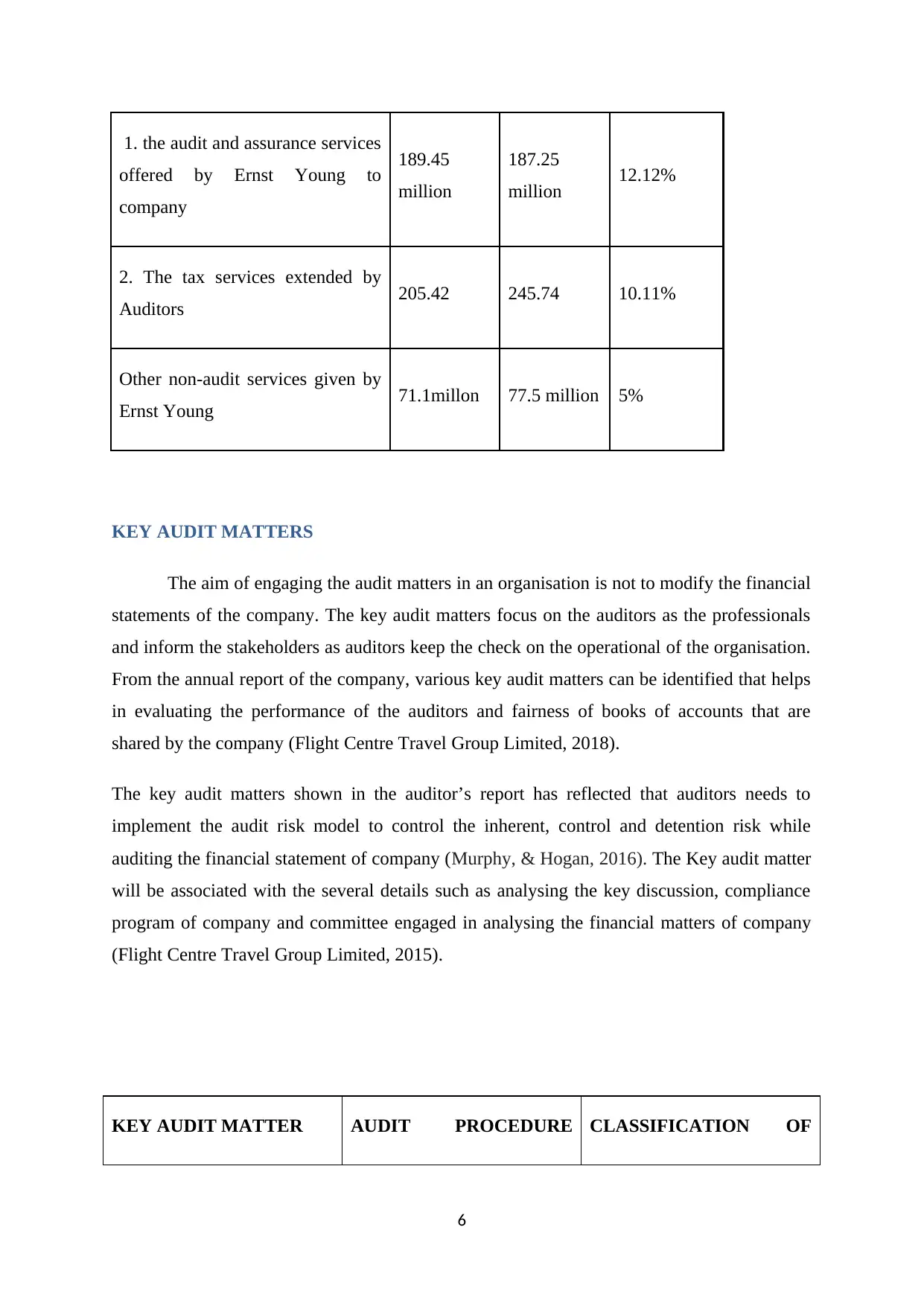

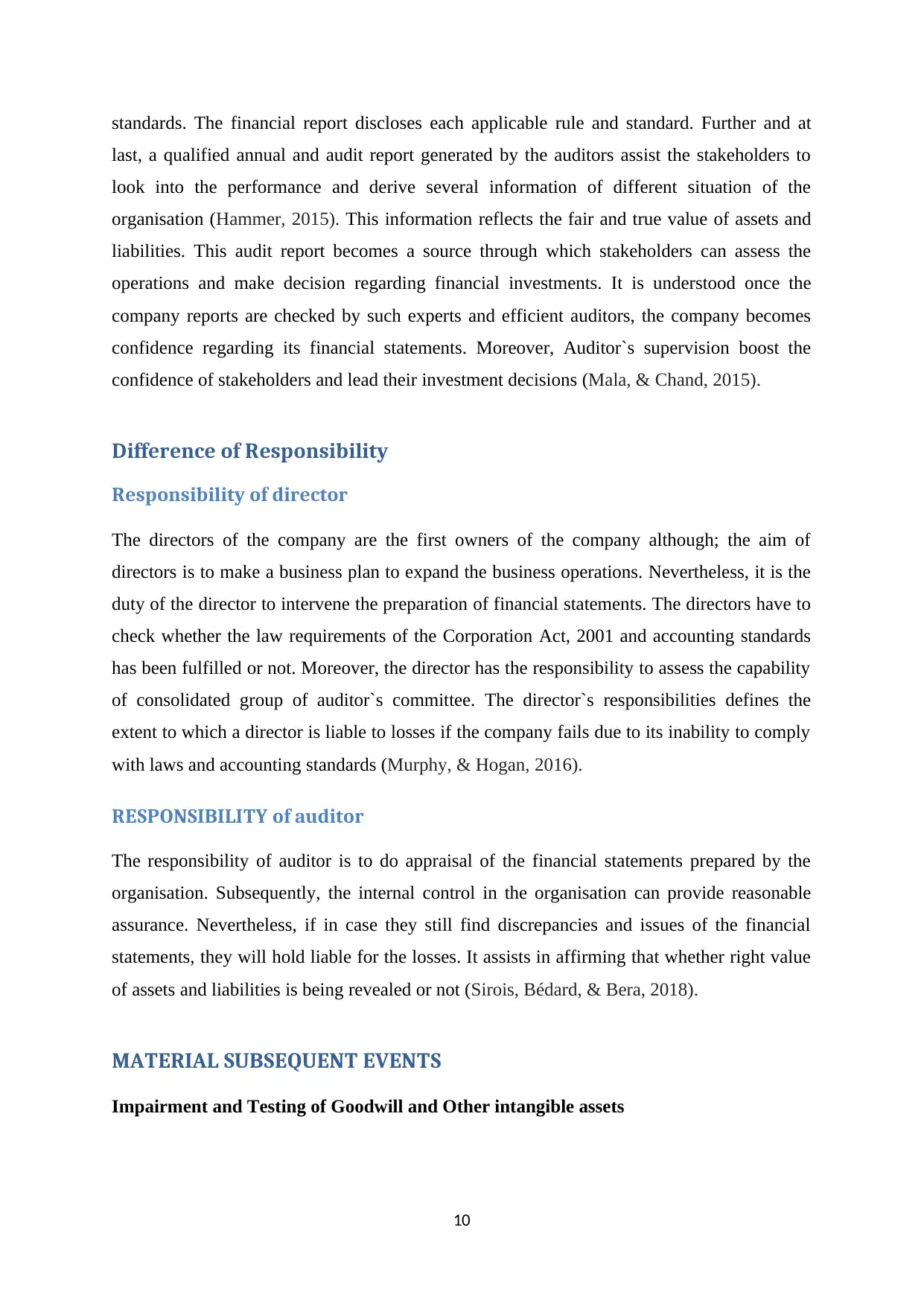

AUDITER REMUNERATION

The remuneration is paid to the head of audit committee. The committee comprises a

number of auditors as its member. The payment made to the lead auditor for all the services

such as audit services, non-audit services, the advice related to tax, and compliance is paid in

the consolidated form to the Audit committee. The remuneration is return payment that is

generally fixed in the annual general meetings (Murphy, & Hogan, 2016). The boards of

directors appoint the first auditor and further the first auditor has the team of auditors. The

expense of remuneration will include service expenses incurred in connection to those audit

services that are provided by the auditors (Flight Centre Travel Group Limited, 2016).

AMOUNTS RECEIVED OR

DUE AND RECEIVABLE BY

ERNST & YOUNG FOR:

JUNE 2017

($)

JUNE 2016

($) % change

5

The principles has stated in the APES 110 Code of ethics for the Professional Accountants

relates the non-audit services with the auditor`s independence. A set list of non-audit service

includes tax compliance and other services. It goes without saying it is difficult to hire the

human resource as the requirement, especially professional auditors. The non-audit services

offered by auditors are also accordance with the corporation act 2001. In order to derive and

extract maximum benefit from the auditor`s potential, Flight Centre Travel Group tries to

exploit the potential that the auditor have. The benefit from the auditor is only possible if

company starts getting professional assistance even in non-audit matters. To get the

assistance from the auditors even in the non-audit matters, the Company take care and respect

his independence. The company should not impose provisions that can hinder auditor`s

independence that is able to satisfy the audit and risk committee. Managing the current tax

compliance, several adjustment, and audit functions are the ways through which it can be

analysed whether the auditor is performing well to explicit the fair valuation of recorded

details (Flight Centre Travel Group Limited, 2017).

AUDITER REMUNERATION

The remuneration is paid to the head of audit committee. The committee comprises a

number of auditors as its member. The payment made to the lead auditor for all the services

such as audit services, non-audit services, the advice related to tax, and compliance is paid in

the consolidated form to the Audit committee. The remuneration is return payment that is

generally fixed in the annual general meetings (Murphy, & Hogan, 2016). The boards of

directors appoint the first auditor and further the first auditor has the team of auditors. The

expense of remuneration will include service expenses incurred in connection to those audit

services that are provided by the auditors (Flight Centre Travel Group Limited, 2016).

AMOUNTS RECEIVED OR

DUE AND RECEIVABLE BY

ERNST & YOUNG FOR:

JUNE 2017

($)

JUNE 2016

($) % change

5

1. the audit and assurance services

offered by Ernst Young to

company

189.45

million

187.25

million 12.12%

2. The tax services extended by

Auditors 205.42 245.74 10.11%

Other non-audit services given by

Ernst Young 71.1millon 77.5 million 5%

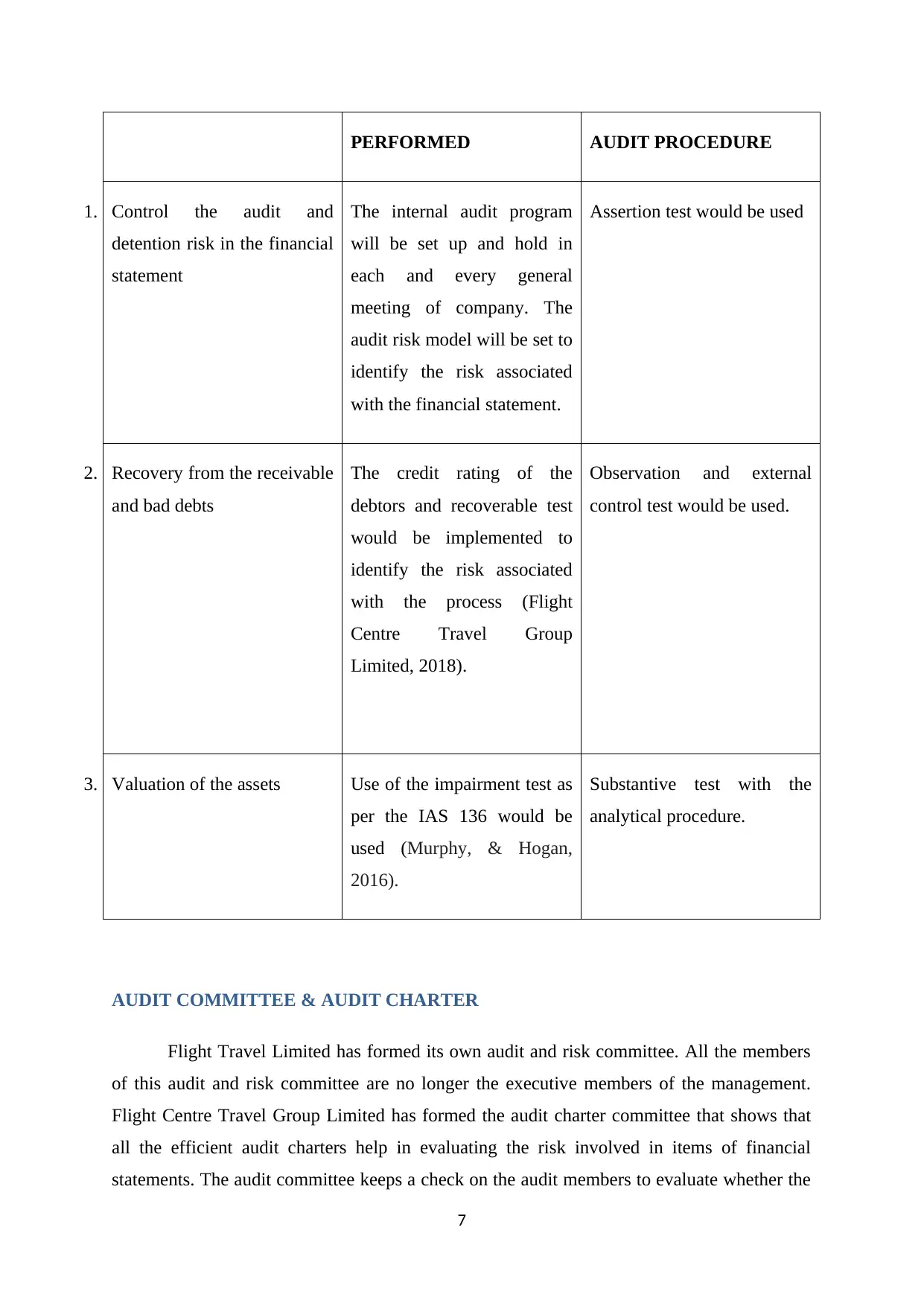

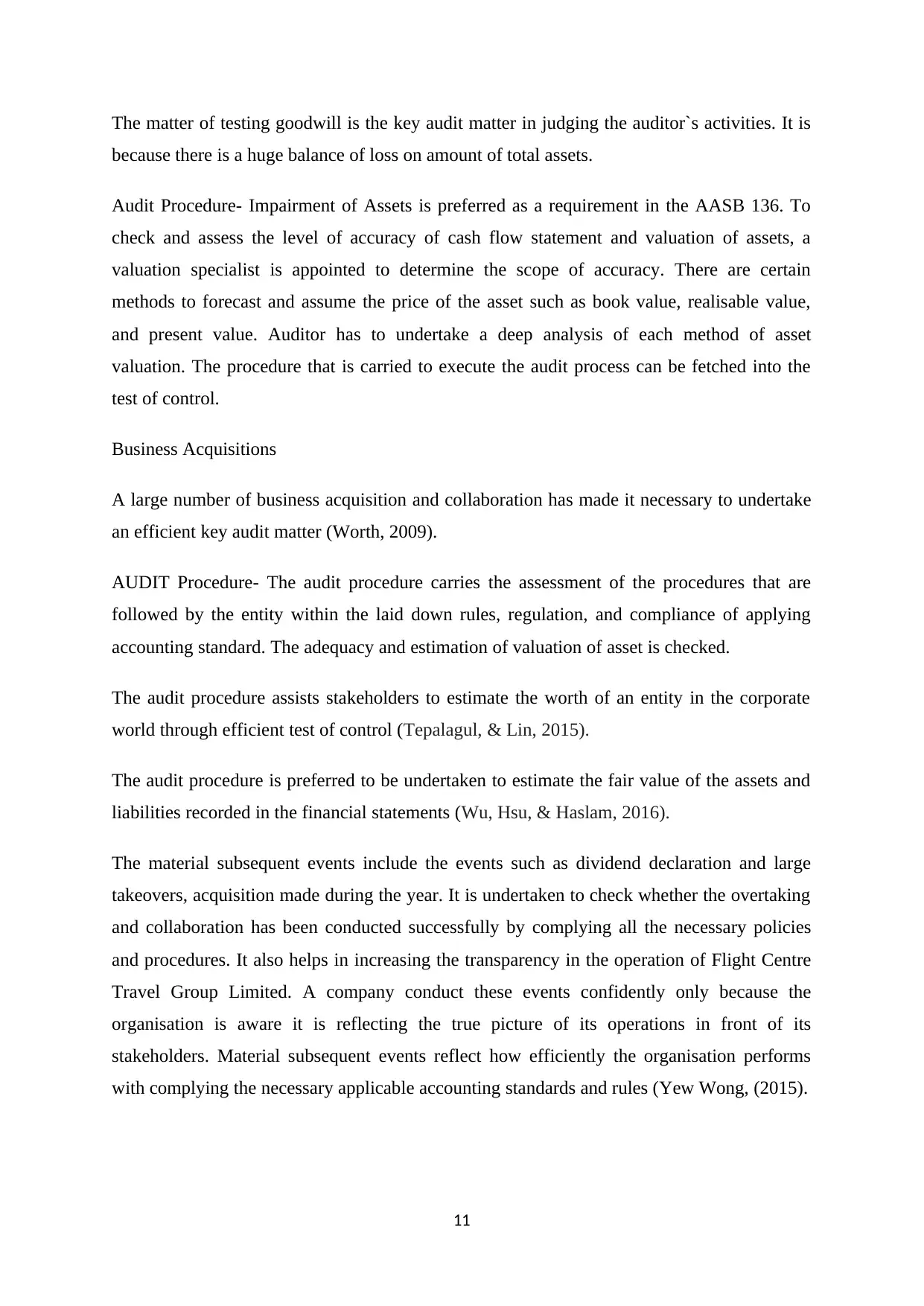

KEY AUDIT MATTERS

The aim of engaging the audit matters in an organisation is not to modify the financial

statements of the company. The key audit matters focus on the auditors as the professionals

and inform the stakeholders as auditors keep the check on the operational of the organisation.

From the annual report of the company, various key audit matters can be identified that helps

in evaluating the performance of the auditors and fairness of books of accounts that are

shared by the company (Flight Centre Travel Group Limited, 2018).

The key audit matters shown in the auditor’s report has reflected that auditors needs to

implement the audit risk model to control the inherent, control and detention risk while

auditing the financial statement of company (Murphy, & Hogan, 2016). The Key audit matter

will be associated with the several details such as analysing the key discussion, compliance

program of company and committee engaged in analysing the financial matters of company

(Flight Centre Travel Group Limited, 2015).

KEY AUDIT MATTER AUDIT PROCEDURE CLASSIFICATION OF

6

offered by Ernst Young to

company

189.45

million

187.25

million 12.12%

2. The tax services extended by

Auditors 205.42 245.74 10.11%

Other non-audit services given by

Ernst Young 71.1millon 77.5 million 5%

KEY AUDIT MATTERS

The aim of engaging the audit matters in an organisation is not to modify the financial

statements of the company. The key audit matters focus on the auditors as the professionals

and inform the stakeholders as auditors keep the check on the operational of the organisation.

From the annual report of the company, various key audit matters can be identified that helps

in evaluating the performance of the auditors and fairness of books of accounts that are

shared by the company (Flight Centre Travel Group Limited, 2018).

The key audit matters shown in the auditor’s report has reflected that auditors needs to

implement the audit risk model to control the inherent, control and detention risk while

auditing the financial statement of company (Murphy, & Hogan, 2016). The Key audit matter

will be associated with the several details such as analysing the key discussion, compliance

program of company and committee engaged in analysing the financial matters of company

(Flight Centre Travel Group Limited, 2015).

KEY AUDIT MATTER AUDIT PROCEDURE CLASSIFICATION OF

6

PERFORMED AUDIT PROCEDURE

1. Control the audit and

detention risk in the financial

statement

The internal audit program

will be set up and hold in

each and every general

meeting of company. The

audit risk model will be set to

identify the risk associated

with the financial statement.

Assertion test would be used

2. Recovery from the receivable

and bad debts

The credit rating of the

debtors and recoverable test

would be implemented to

identify the risk associated

with the process (Flight

Centre Travel Group

Limited, 2018).

Observation and external

control test would be used.

3. Valuation of the assets Use of the impairment test as

per the IAS 136 would be

used (Murphy, & Hogan,

2016).

Substantive test with the

analytical procedure.

AUDIT COMMITTEE & AUDIT CHARTER

Flight Travel Limited has formed its own audit and risk committee. All the members

of this audit and risk committee are no longer the executive members of the management.

Flight Centre Travel Group Limited has formed the audit charter committee that shows that

all the efficient audit charters help in evaluating the risk involved in items of financial

statements. The audit committee keeps a check on the audit members to evaluate whether the

7

1. Control the audit and

detention risk in the financial

statement

The internal audit program

will be set up and hold in

each and every general

meeting of company. The

audit risk model will be set to

identify the risk associated

with the financial statement.

Assertion test would be used

2. Recovery from the receivable

and bad debts

The credit rating of the

debtors and recoverable test

would be implemented to

identify the risk associated

with the process (Flight

Centre Travel Group

Limited, 2018).

Observation and external

control test would be used.

3. Valuation of the assets Use of the impairment test as

per the IAS 136 would be

used (Murphy, & Hogan,

2016).

Substantive test with the

analytical procedure.

AUDIT COMMITTEE & AUDIT CHARTER

Flight Travel Limited has formed its own audit and risk committee. All the members

of this audit and risk committee are no longer the executive members of the management.

Flight Centre Travel Group Limited has formed the audit charter committee that shows that

all the efficient audit charters help in evaluating the risk involved in items of financial

statements. The audit committee keeps a check on the audit members to evaluate whether the

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

company has made default in complying with the accounting standards and laws. It will help

in mitigating the chance of trading that occur inside the company to maintain the long-term

sustainability of the business (Flight Centre Travel Group Limited, 2018).

STRUCTURE

Every organisation has its own pattern of executing and achieving its objectives. The internal

audit committee of the company has a secretary and audit officers. The number of audit

officer depends on the size of operation of the business and the need of the company. The

structure of Audit department is determined on the basis of non-executive and executive

auditors in the organisations. Non- executive chairman includes John Eales, Robert Baker,

and Colette Garnsey who are not the part of executive directors of Flight Centre Travel

Group Limited. Auditors of the company are responsible for analysing the annual report of

the company and maintaining the proper harmonisation between the national and

international accounting standards (Flight Centre Travel Group Limited, 2018).

Auditor’s functions and responsibilities

Auditors are responsible for reviewing and providing recommendation to accept the corporate

reporting as per the required applicable framework.

To check whether the key managerial person is representing the fair financial statements and

the books of accounts (Murphy, & Hogan, 2016).

Auditors delegate audit services, non-audit services, and law & compliance advices to the

company. Audit and charter committee recommend and appoint independent auditors to work

and audit programs.

To analyse how far the book value of assets and the liabilities is fair.

To undertake the review of financial statements of the organisation whether the requirement

of law and compliance has been accomplished or not with their true understanding.

Reviewing the appropriateness of estimations and policies, accounting judgements used by

the organisation to prepare the final accounts.

Auditor has to consider which accounting principles and standards the company do follow.

8

in mitigating the chance of trading that occur inside the company to maintain the long-term

sustainability of the business (Flight Centre Travel Group Limited, 2018).

STRUCTURE

Every organisation has its own pattern of executing and achieving its objectives. The internal

audit committee of the company has a secretary and audit officers. The number of audit

officer depends on the size of operation of the business and the need of the company. The

structure of Audit department is determined on the basis of non-executive and executive

auditors in the organisations. Non- executive chairman includes John Eales, Robert Baker,

and Colette Garnsey who are not the part of executive directors of Flight Centre Travel

Group Limited. Auditors of the company are responsible for analysing the annual report of

the company and maintaining the proper harmonisation between the national and

international accounting standards (Flight Centre Travel Group Limited, 2018).

Auditor’s functions and responsibilities

Auditors are responsible for reviewing and providing recommendation to accept the corporate

reporting as per the required applicable framework.

To check whether the key managerial person is representing the fair financial statements and

the books of accounts (Murphy, & Hogan, 2016).

Auditors delegate audit services, non-audit services, and law & compliance advices to the

company. Audit and charter committee recommend and appoint independent auditors to work

and audit programs.

To analyse how far the book value of assets and the liabilities is fair.

To undertake the review of financial statements of the organisation whether the requirement

of law and compliance has been accomplished or not with their true understanding.

Reviewing the appropriateness of estimations and policies, accounting judgements used by

the organisation to prepare the final accounts.

Auditor has to consider which accounting principles and standards the company do follow.

8

To advice, appoint, and recommend a most suitable external auditor. Existing auditors of the

company also assist the company to make remuneration policies and advice to remove any

independent auditors (Flight Centre Travel Group Limited, 2018).

The charter and risk committee manages the internal audit functions of the company. It also

appoints the head of internal audit team as per the calibre to handle the team.

Auditors helps the organisation to get the knowledge of relevant updates related to financial

reporting and undertake the important changes in relation to compliance field.

To keep a check whether the external auditors are delegating their appropriate services to the

organisation`s books of accounts. To check how auditors are complying the requirement of

independent auditors which are expected out of their duty and service (Murphy, & Hogan,

2016).

Auditors are responsible to keep a check and act as a fiduciary person especially to the

stakeholders in order to receive a transparent detail of the business operation and financial

statement of the company.

Auditors provide non-audit services such as advices to expand the company`s operation,

insurance coverage details, analysing the financial reporting, assisting the accountants to

comply with national and international financial standards (Eilifsen, Hamilton, and Messier

Jr, W. F. (2017).

AUDIT OPINION

The auditors of the company announce unbiased and clear opinion of financial

situation of Flight Centre Travel Group Limited. As per the knowledge and experience of the

auditors, the financial statements of the company are made as per the law and compliance

requirement. According to the audit procedures, books of accounts and the financial

statements are maintained as per the provisions of Corporations Act, 2001. The auditors

accept in their report that regulations stated by Australian Accounting Standards and the

Corporations Regulations 2001 are followed properly. There are no misstatements as of now

that came into the knowledge of the auditor from the regulations performed. Moreover, the

auditors have appreciated and embraced the required independence delegated by the

directors. Auditors expect this independence throughout the audit. Despite auditor`s

independence, the audit report mentioned that the company meets all the ethical requirements

as per the APES 110 code of ethics for Professional Accountants. The perception of the

auditor’s report reflects that it is able to comply with applicable accounting rules and

9

company also assist the company to make remuneration policies and advice to remove any

independent auditors (Flight Centre Travel Group Limited, 2018).

The charter and risk committee manages the internal audit functions of the company. It also

appoints the head of internal audit team as per the calibre to handle the team.

Auditors helps the organisation to get the knowledge of relevant updates related to financial

reporting and undertake the important changes in relation to compliance field.

To keep a check whether the external auditors are delegating their appropriate services to the

organisation`s books of accounts. To check how auditors are complying the requirement of

independent auditors which are expected out of their duty and service (Murphy, & Hogan,

2016).

Auditors are responsible to keep a check and act as a fiduciary person especially to the

stakeholders in order to receive a transparent detail of the business operation and financial

statement of the company.

Auditors provide non-audit services such as advices to expand the company`s operation,

insurance coverage details, analysing the financial reporting, assisting the accountants to

comply with national and international financial standards (Eilifsen, Hamilton, and Messier

Jr, W. F. (2017).

AUDIT OPINION

The auditors of the company announce unbiased and clear opinion of financial

situation of Flight Centre Travel Group Limited. As per the knowledge and experience of the

auditors, the financial statements of the company are made as per the law and compliance

requirement. According to the audit procedures, books of accounts and the financial

statements are maintained as per the provisions of Corporations Act, 2001. The auditors

accept in their report that regulations stated by Australian Accounting Standards and the

Corporations Regulations 2001 are followed properly. There are no misstatements as of now

that came into the knowledge of the auditor from the regulations performed. Moreover, the

auditors have appreciated and embraced the required independence delegated by the

directors. Auditors expect this independence throughout the audit. Despite auditor`s

independence, the audit report mentioned that the company meets all the ethical requirements

as per the APES 110 code of ethics for Professional Accountants. The perception of the

auditor’s report reflects that it is able to comply with applicable accounting rules and

9

standards. The financial report discloses each applicable rule and standard. Further and at

last, a qualified annual and audit report generated by the auditors assist the stakeholders to

look into the performance and derive several information of different situation of the

organisation (Hammer, 2015). This information reflects the fair and true value of assets and

liabilities. This audit report becomes a source through which stakeholders can assess the

operations and make decision regarding financial investments. It is understood once the

company reports are checked by such experts and efficient auditors, the company becomes

confidence regarding its financial statements. Moreover, Auditor`s supervision boost the

confidence of stakeholders and lead their investment decisions (Mala, & Chand, 2015).

Difference of Responsibility

Responsibility of director

The directors of the company are the first owners of the company although; the aim of

directors is to make a business plan to expand the business operations. Nevertheless, it is the

duty of the director to intervene the preparation of financial statements. The directors have to

check whether the law requirements of the Corporation Act, 2001 and accounting standards

has been fulfilled or not. Moreover, the director has the responsibility to assess the capability

of consolidated group of auditor`s committee. The director`s responsibilities defines the

extent to which a director is liable to losses if the company fails due to its inability to comply

with laws and accounting standards (Murphy, & Hogan, 2016).

RESPONSIBILITY of auditor

The responsibility of auditor is to do appraisal of the financial statements prepared by the

organisation. Subsequently, the internal control in the organisation can provide reasonable

assurance. Nevertheless, if in case they still find discrepancies and issues of the financial

statements, they will hold liable for the losses. It assists in affirming that whether right value

of assets and liabilities is being revealed or not (Sirois, Bédard, & Bera, 2018).

MATERIAL SUBSEQUENT EVENTS

Impairment and Testing of Goodwill and Other intangible assets

10

last, a qualified annual and audit report generated by the auditors assist the stakeholders to

look into the performance and derive several information of different situation of the

organisation (Hammer, 2015). This information reflects the fair and true value of assets and

liabilities. This audit report becomes a source through which stakeholders can assess the

operations and make decision regarding financial investments. It is understood once the

company reports are checked by such experts and efficient auditors, the company becomes

confidence regarding its financial statements. Moreover, Auditor`s supervision boost the

confidence of stakeholders and lead their investment decisions (Mala, & Chand, 2015).

Difference of Responsibility

Responsibility of director

The directors of the company are the first owners of the company although; the aim of

directors is to make a business plan to expand the business operations. Nevertheless, it is the

duty of the director to intervene the preparation of financial statements. The directors have to

check whether the law requirements of the Corporation Act, 2001 and accounting standards

has been fulfilled or not. Moreover, the director has the responsibility to assess the capability

of consolidated group of auditor`s committee. The director`s responsibilities defines the

extent to which a director is liable to losses if the company fails due to its inability to comply

with laws and accounting standards (Murphy, & Hogan, 2016).

RESPONSIBILITY of auditor

The responsibility of auditor is to do appraisal of the financial statements prepared by the

organisation. Subsequently, the internal control in the organisation can provide reasonable

assurance. Nevertheless, if in case they still find discrepancies and issues of the financial

statements, they will hold liable for the losses. It assists in affirming that whether right value

of assets and liabilities is being revealed or not (Sirois, Bédard, & Bera, 2018).

MATERIAL SUBSEQUENT EVENTS

Impairment and Testing of Goodwill and Other intangible assets

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

The matter of testing goodwill is the key audit matter in judging the auditor`s activities. It is

because there is a huge balance of loss on amount of total assets.

Audit Procedure- Impairment of Assets is preferred as a requirement in the AASB 136. To

check and assess the level of accuracy of cash flow statement and valuation of assets, a

valuation specialist is appointed to determine the scope of accuracy. There are certain

methods to forecast and assume the price of the asset such as book value, realisable value,

and present value. Auditor has to undertake a deep analysis of each method of asset

valuation. The procedure that is carried to execute the audit process can be fetched into the

test of control.

Business Acquisitions

A large number of business acquisition and collaboration has made it necessary to undertake

an efficient key audit matter (Worth, 2009).

AUDIT Procedure- The audit procedure carries the assessment of the procedures that are

followed by the entity within the laid down rules, regulation, and compliance of applying

accounting standard. The adequacy and estimation of valuation of asset is checked.

The audit procedure assists stakeholders to estimate the worth of an entity in the corporate

world through efficient test of control (Tepalagul, & Lin, 2015).

The audit procedure is preferred to be undertaken to estimate the fair value of the assets and

liabilities recorded in the financial statements (Wu, Hsu, & Haslam, 2016).

The material subsequent events include the events such as dividend declaration and large

takeovers, acquisition made during the year. It is undertaken to check whether the overtaking

and collaboration has been conducted successfully by complying all the necessary policies

and procedures. It also helps in increasing the transparency in the operation of Flight Centre

Travel Group Limited. A company conduct these events confidently only because the

organisation is aware it is reflecting the true picture of its operations in front of its

stakeholders. Material subsequent events reflect how efficiently the organisation performs

with complying the necessary applicable accounting standards and rules (Yew Wong, (2015).

11

because there is a huge balance of loss on amount of total assets.

Audit Procedure- Impairment of Assets is preferred as a requirement in the AASB 136. To

check and assess the level of accuracy of cash flow statement and valuation of assets, a

valuation specialist is appointed to determine the scope of accuracy. There are certain

methods to forecast and assume the price of the asset such as book value, realisable value,

and present value. Auditor has to undertake a deep analysis of each method of asset

valuation. The procedure that is carried to execute the audit process can be fetched into the

test of control.

Business Acquisitions

A large number of business acquisition and collaboration has made it necessary to undertake

an efficient key audit matter (Worth, 2009).

AUDIT Procedure- The audit procedure carries the assessment of the procedures that are

followed by the entity within the laid down rules, regulation, and compliance of applying

accounting standard. The adequacy and estimation of valuation of asset is checked.

The audit procedure assists stakeholders to estimate the worth of an entity in the corporate

world through efficient test of control (Tepalagul, & Lin, 2015).

The audit procedure is preferred to be undertaken to estimate the fair value of the assets and

liabilities recorded in the financial statements (Wu, Hsu, & Haslam, 2016).

The material subsequent events include the events such as dividend declaration and large

takeovers, acquisition made during the year. It is undertaken to check whether the overtaking

and collaboration has been conducted successfully by complying all the necessary policies

and procedures. It also helps in increasing the transparency in the operation of Flight Centre

Travel Group Limited. A company conduct these events confidently only because the

organisation is aware it is reflecting the true picture of its operations in front of its

stakeholders. Material subsequent events reflect how efficiently the organisation performs

with complying the necessary applicable accounting standards and rules (Yew Wong, (2015).

11

CONCLUSION

From the above discussion, it can be concluded that while going through the annual

reports of the Flight Centre Travel Group Limited, Auditor`s performance seemed perfect. No

material information was unnecessarily manipulated or modified. All the necessary

information is well presented and can be easily interpreted to estimate the worth. There were

no questions, which were not answered properly by the auditors. The report is based on

auditors independence stand apart in maintain the transparency of the business operation of

the business. Moreover, auditor should undertake its analysis responsibility seriously to

undertake and increase the overall outcome and efficiency by adding an effective audit

program to it.

12

From the above discussion, it can be concluded that while going through the annual

reports of the Flight Centre Travel Group Limited, Auditor`s performance seemed perfect. No

material information was unnecessarily manipulated or modified. All the necessary

information is well presented and can be easily interpreted to estimate the worth. There were

no questions, which were not answered properly by the auditors. The report is based on

auditors independence stand apart in maintain the transparency of the business operation of

the business. Moreover, auditor should undertake its analysis responsibility seriously to

undertake and increase the overall outcome and efficiency by adding an effective audit

program to it.

12

REFERENCES

Eilifsen, A., Hamilton, E. L., & Messier Jr, W. F. (2017). The Importance of Quantifying

Uncertainty: Examining the Effect of Audit Materiality and Sensitivity Analysis

Disclosures on Investors’ Judgments and Decisions.

Flight Centre Travel Group Limited, 2015 retrieved, from

http://www.fctgl.com/investors/annual-reports/.,

Flight Centre Travel Group Limited, 2016 retrieved, from

http://www.fctgl.com/investors/annual-reports/.,

Flight Centre Travel Group Limited, 2018 retrieved, http://www.fctgl.com/investors/annual-

reports/.,

Hammer, M., (2015). What is business process management?. In Handbook on business

process management, 3rd ed, Springer, Berlin: Heidelberg.

Mala, R., & Chand, P. (2015). Judgment and Decision‐Making Research in Auditing and

Accounting: Future Research Implications of Person, Task, and Environment

Perspective. Accounting Perspectives, 14(1), 1-50.

Murphy, L. & Hogan, R., (2016). Financial Reporting of Nonfinancial Information: The Role

of the Auditor. Journal of Corporate Accounting & Finance, 28(1), pp.42-49.

Sirois, L.P., Bédard, J. & Bera, P., (2018). The informational value of key audit matters in the

auditor's report: evidence from an Eye-tracking study. Journal of Accounting

Horizons. 14(2), 12-50.

Tepalagul, N. & Lin, L., (2015). Auditor independence and audit quality: A literature

review. Journal of Accounting, Auditing & Finance, 30(1), pp.101-121.

Worth, R. (2009). Communication skills (1st ed.). New York: Ferguson.

Wu, C.Y.H., Hsu, H.H. & Haslam, J., (2016). Audit committees, non-audit services, and

auditor reporting decisions prior to failure. The British Accounting Review, 48(2),

pp.240-256.

13

Eilifsen, A., Hamilton, E. L., & Messier Jr, W. F. (2017). The Importance of Quantifying

Uncertainty: Examining the Effect of Audit Materiality and Sensitivity Analysis

Disclosures on Investors’ Judgments and Decisions.

Flight Centre Travel Group Limited, 2015 retrieved, from

http://www.fctgl.com/investors/annual-reports/.,

Flight Centre Travel Group Limited, 2016 retrieved, from

http://www.fctgl.com/investors/annual-reports/.,

Flight Centre Travel Group Limited, 2018 retrieved, http://www.fctgl.com/investors/annual-

reports/.,

Hammer, M., (2015). What is business process management?. In Handbook on business

process management, 3rd ed, Springer, Berlin: Heidelberg.

Mala, R., & Chand, P. (2015). Judgment and Decision‐Making Research in Auditing and

Accounting: Future Research Implications of Person, Task, and Environment

Perspective. Accounting Perspectives, 14(1), 1-50.

Murphy, L. & Hogan, R., (2016). Financial Reporting of Nonfinancial Information: The Role

of the Auditor. Journal of Corporate Accounting & Finance, 28(1), pp.42-49.

Sirois, L.P., Bédard, J. & Bera, P., (2018). The informational value of key audit matters in the

auditor's report: evidence from an Eye-tracking study. Journal of Accounting

Horizons. 14(2), 12-50.

Tepalagul, N. & Lin, L., (2015). Auditor independence and audit quality: A literature

review. Journal of Accounting, Auditing & Finance, 30(1), pp.101-121.

Worth, R. (2009). Communication skills (1st ed.). New York: Ferguson.

Wu, C.Y.H., Hsu, H.H. & Haslam, J., (2016). Audit committees, non-audit services, and

auditor reporting decisions prior to failure. The British Accounting Review, 48(2),

pp.240-256.

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Yew Wong, K. (2015). Critical success factors for implementing knowledge management in

small and medium enterprises. Industrial Management & Data Systems, 105(3), 261-

279.

14

small and medium enterprises. Industrial Management & Data Systems, 105(3), 261-

279.

14

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.