Comprehensive Audit Report: Aeris Environmental Ltd Risk Assessment

VerifiedAdded on 2023/04/21

|17

|4014

|148

Report

AI Summary

This audit report presents a risk-based audit program conducted on Aeris Environmental Ltd, involving a thorough analysis of the company's accounts, substantive tests of transactions and balances, and an evaluation of assertions against account balances. The audit procedures employed by the auditor to assess the risk associated with various accounts were examined, along with a financial analysis utilizing ratio analysis to gauge the company's financial health. Key material account balances, such as cash and cash equivalents, inventories, and long-term debt, were identified and assessed, with a focus on potential misstatements and their impact on the financial statements. The report also outlines the key assertions related to these material accounts and proposes a comprehensive set of audit steps, including a sampling plan, to address the identified risks and ensure the accuracy and reliability of Aeris Environmental Ltd's financial reporting. Desklib provides access to this and many other solved assignments for students.

Running head: AUDIT

Audit of Aeris Environmental Ltd

Name of the Student:

Name of the University:

Author’s Note:

Audit of Aeris Environmental Ltd

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1AUDIT

Executive Summary

The aim of the assignment is to conduct a risk based audit program on the Aeris Environmental

Ltd. The audit programme was conducted by analysing the various accounts of the company. The

substantive tests of transactions and substantive test of balances was evaluated for the company.

The assertion in contrast to the account balances of the company was also analysed. The audit

procedure followed by the auditor for assessing the risk of the various account of the company

was taken into account. The financial analysis of the company was evaluated with the help of the

ratio analysis for the company.

Executive Summary

The aim of the assignment is to conduct a risk based audit program on the Aeris Environmental

Ltd. The audit programme was conducted by analysing the various accounts of the company. The

substantive tests of transactions and substantive test of balances was evaluated for the company.

The assertion in contrast to the account balances of the company was also analysed. The audit

procedure followed by the auditor for assessing the risk of the various account of the company

was taken into account. The financial analysis of the company was evaluated with the help of the

ratio analysis for the company.

2AUDIT

Table of Contents

Introduction......................................................................................................................................3

Discussion........................................................................................................................................3

1.0 Aeris Environmental Ltd.......................................................................................................3

2.0 Identification of Key Audit Risks..........................................................................................3

3.0 Ratio Analysis........................................................................................................................5

4.0 Material Account Balance.....................................................................................................6

5.0 Material Account Balances....................................................................................................7

6.0 Key Assertions of the Material Accounts..............................................................................8

7.0 Comprehensive Set of Audit Steps......................................................................................10

8.0 Sampling Plan......................................................................................................................12

Conclusion.....................................................................................................................................13

Reference.......................................................................................................................................14

Table of Contents

Introduction......................................................................................................................................3

Discussion........................................................................................................................................3

1.0 Aeris Environmental Ltd.......................................................................................................3

2.0 Identification of Key Audit Risks..........................................................................................3

3.0 Ratio Analysis........................................................................................................................5

4.0 Material Account Balance.....................................................................................................6

5.0 Material Account Balances....................................................................................................7

6.0 Key Assertions of the Material Accounts..............................................................................8

7.0 Comprehensive Set of Audit Steps......................................................................................10

8.0 Sampling Plan......................................................................................................................12

Conclusion.....................................................................................................................................13

Reference.......................................................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3AUDIT

Introduction

The auditing of the Aeris Environmental Ltd was evaluated for conducting the financial

inspection of the various accounts of the company. The systematic examination and evaluation of

the various accounts of Aeris Environmental was taken into consideration for the examination of

the various accounts, documents and statuary record of the company. The key accounts for the

company was evaluated for the company by assessing the changes observed in the accounts.

There were many material account balances assessed by including the financial report of the

company. The audit evaluation for the company was evaluated by assessing the material account

balances of the company and the relevant financial report assertions was done for the company

(Vogel 2014).

Discussion

1.0 Aeris Environmental Ltd

The systematic examination and evaluation of the various accounts of the Aeris

Environmental Ltd was taken into consideration for the examination of the various accounts,

documents and statuary record of the company.

2.0 Identification of Key Audit Risks

The business of Aeris Environmental Company is considered for assessing the financial

statement of the business and different risks, which is faced by the business. The risks, which are

to be identified for the business, is from the perspective of audit (DeFond and Zhang 2014). The

main risks, which can be identified from the annual reports, is the significant decrease in the cash

balance of the business. The cash balance is shown to have fallen significantly in comparison to

previous year analysis, which suggest that, the management of the business (Beck and Mauldin

Introduction

The auditing of the Aeris Environmental Ltd was evaluated for conducting the financial

inspection of the various accounts of the company. The systematic examination and evaluation of

the various accounts of Aeris Environmental was taken into consideration for the examination of

the various accounts, documents and statuary record of the company. The key accounts for the

company was evaluated for the company by assessing the changes observed in the accounts.

There were many material account balances assessed by including the financial report of the

company. The audit evaluation for the company was evaluated by assessing the material account

balances of the company and the relevant financial report assertions was done for the company

(Vogel 2014).

Discussion

1.0 Aeris Environmental Ltd

The systematic examination and evaluation of the various accounts of the Aeris

Environmental Ltd was taken into consideration for the examination of the various accounts,

documents and statuary record of the company.

2.0 Identification of Key Audit Risks

The business of Aeris Environmental Company is considered for assessing the financial

statement of the business and different risks, which is faced by the business. The risks, which are

to be identified for the business, is from the perspective of audit (DeFond and Zhang 2014). The

main risks, which can be identified from the annual reports, is the significant decrease in the cash

balance of the business. The cash balance is shown to have fallen significantly in comparison to

previous year analysis, which suggest that, the management of the business (Beck and Mauldin

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4AUDIT

2014). The balance sheet of the company for the year 2017 is shown to be $ 1,519,941 while the

same was $ 5,415,664 in 2016. The auditor needs to check whether the cash item which is shown

in the financial. There is also a risk on interest bearing securities of the business which is shown

in 2016 and the amount which is shown is $ 1,015,000 and in 2017, the interest-bearing

securities of the business is not shown which suggest that the management of the company might

have repaid the interest-bearing securities of the business (Guénin-Paracini, Malsch and Paillé

2014). The audit needs to check whether the balances, which is shown in the balance sheet of the

business, is showing true and fair view (Omar et al. 2014).

Inherent risks are those risks, which are caused due to omission and material

misstatement present in the financial statement of the business. The inherent risks of a business

contributed to the total audit risks of the business (Griffiths 2016). In addition to this, there are

also control risks, which are faced by the business, and the same also form part of the audit risks

which is faced by the auditor during the course of audit (Khlif and Samaha 2014). The control

risk take place due to inefficiency of the internal control of the business. In other words, the

internal control of the business cannot detect the risk.

The audit risks of a business can be considered to a product of various other risks which

is faced by the auditor during the course of audit. The auditor has the role to estimate the risks

which is pertaining to each component of risks during the course of audit and ensure that the

risks are kept at a minimum level (Amir, Kallunki and Nilsson 2014). The auditor also needs to

apply appropriate audit process to ensure the same. The equation which is used in this model is

given below:

Audit Risk=Inherent Risk∗Control Risk∗Detection Risks

2014). The balance sheet of the company for the year 2017 is shown to be $ 1,519,941 while the

same was $ 5,415,664 in 2016. The auditor needs to check whether the cash item which is shown

in the financial. There is also a risk on interest bearing securities of the business which is shown

in 2016 and the amount which is shown is $ 1,015,000 and in 2017, the interest-bearing

securities of the business is not shown which suggest that the management of the company might

have repaid the interest-bearing securities of the business (Guénin-Paracini, Malsch and Paillé

2014). The audit needs to check whether the balances, which is shown in the balance sheet of the

business, is showing true and fair view (Omar et al. 2014).

Inherent risks are those risks, which are caused due to omission and material

misstatement present in the financial statement of the business. The inherent risks of a business

contributed to the total audit risks of the business (Griffiths 2016). In addition to this, there are

also control risks, which are faced by the business, and the same also form part of the audit risks

which is faced by the auditor during the course of audit (Khlif and Samaha 2014). The control

risk take place due to inefficiency of the internal control of the business. In other words, the

internal control of the business cannot detect the risk.

The audit risks of a business can be considered to a product of various other risks which

is faced by the auditor during the course of audit. The auditor has the role to estimate the risks

which is pertaining to each component of risks during the course of audit and ensure that the

risks are kept at a minimum level (Amir, Kallunki and Nilsson 2014). The auditor also needs to

apply appropriate audit process to ensure the same. The equation which is used in this model is

given below:

Audit Risk=Inherent Risk∗Control Risk∗Detection Risks

5AUDIT

The application of the model is done considering the inherent risks and controls risks of

the business as the same are under the control of the auditor. In the case of Aeris Environmental

Company, the annual report of the company for the year 2017 shows fluctuation in cash account

balances as well as in other assets as well (Coetzee and Lubbe 2014). Thus, there might be a

presence of inherent risk and control risks which the auditor must be aware of during the course

of audit (Suryanto 2014). The auditor while applying this model allows detection risk to remain

high if the inherent risk and control risk are low as this keeps the overall audit risks low. The

opposite is also possible depending on the scenario. In the case of Aeris Environmental

Company, the inherent risks and control risks of the business seems to be high therefore the

auditor can increase the sample size to lower the detection risks of the business. The detection

risk is kept at lower level so that the overall risks which is associated with audit can be kept low.

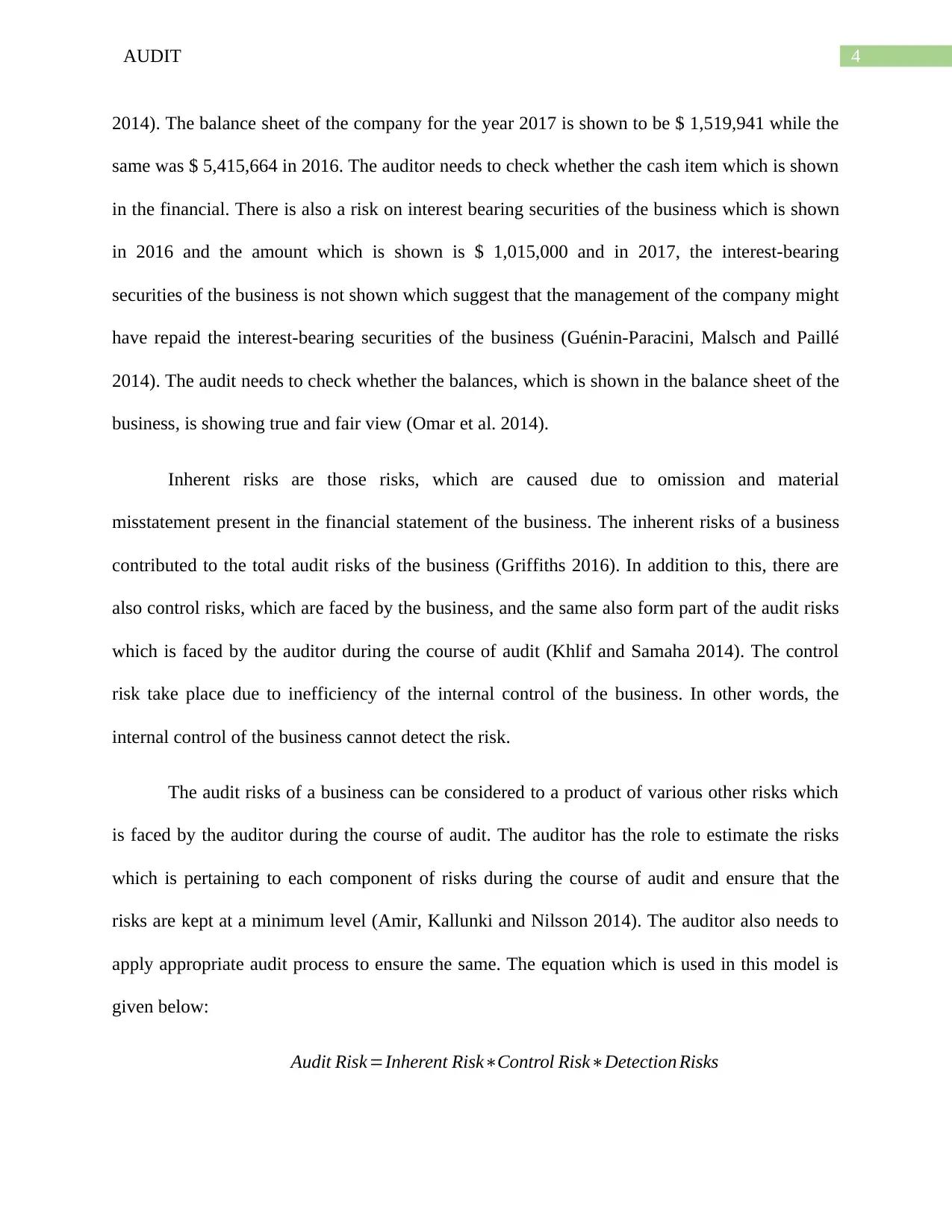

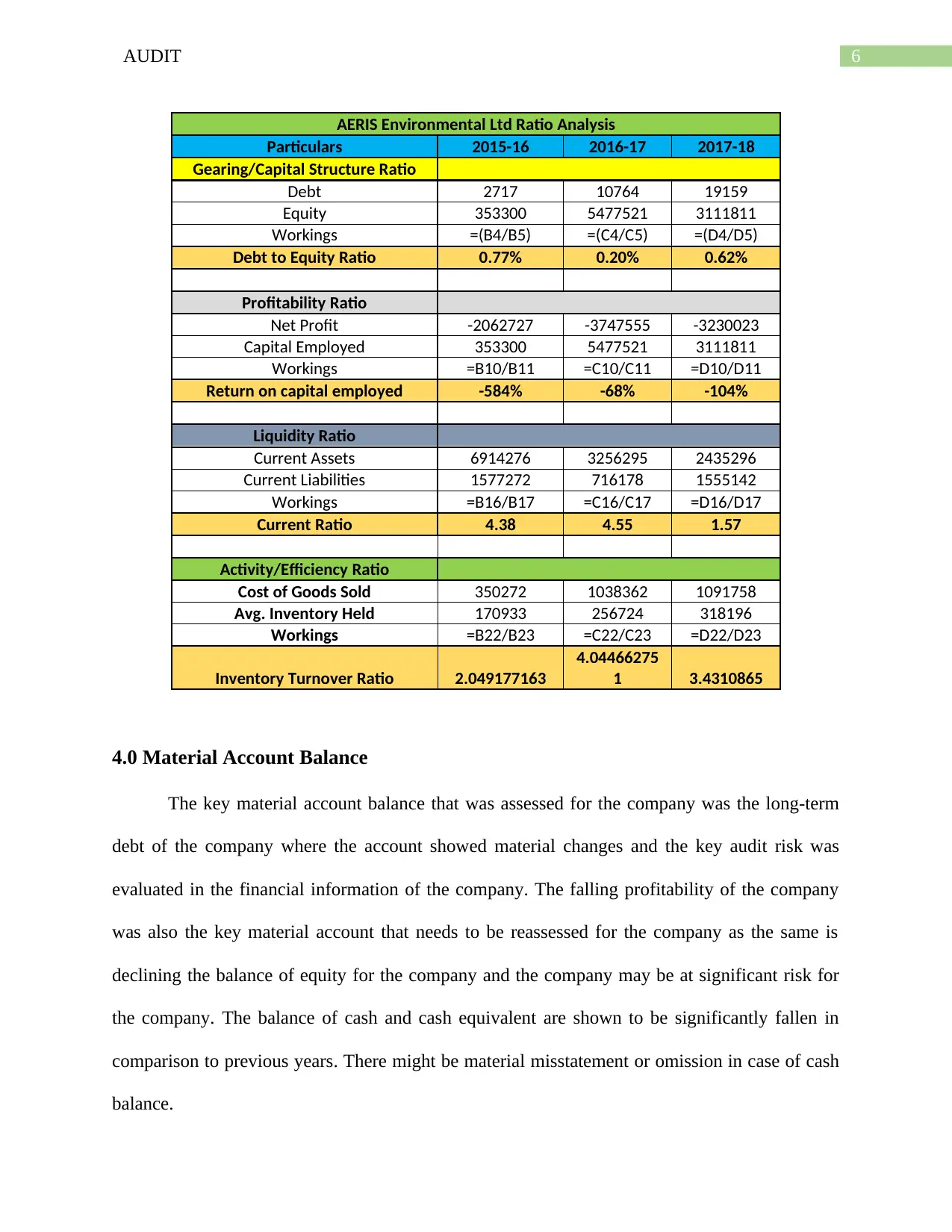

3.0 Ratio Analysis

The ratio analysis for the company was evaluated for the company for assessing the

financial position and the financial performance of the company. The ratios evaluated for the

company was the current ratio, return on capital employed and debt to equity ratio and inventory

turnover ratio for the company. The financial position of the company has been very volatile as

assessed by the ratios for the company. The financial position of the company has been volatile

with the losses of the company rising in the trend period analysed for the company. The return on

capital and the current ratio for the company was the most volatile ratio for the company.

However, the activity and the efficiency ratio which the inventory turnover ratio for the company

has somewhat been similar as compared to other ratio’s analysed for the company (Uechi et al.

2015).

The application of the model is done considering the inherent risks and controls risks of

the business as the same are under the control of the auditor. In the case of Aeris Environmental

Company, the annual report of the company for the year 2017 shows fluctuation in cash account

balances as well as in other assets as well (Coetzee and Lubbe 2014). Thus, there might be a

presence of inherent risk and control risks which the auditor must be aware of during the course

of audit (Suryanto 2014). The auditor while applying this model allows detection risk to remain

high if the inherent risk and control risk are low as this keeps the overall audit risks low. The

opposite is also possible depending on the scenario. In the case of Aeris Environmental

Company, the inherent risks and control risks of the business seems to be high therefore the

auditor can increase the sample size to lower the detection risks of the business. The detection

risk is kept at lower level so that the overall risks which is associated with audit can be kept low.

3.0 Ratio Analysis

The ratio analysis for the company was evaluated for the company for assessing the

financial position and the financial performance of the company. The ratios evaluated for the

company was the current ratio, return on capital employed and debt to equity ratio and inventory

turnover ratio for the company. The financial position of the company has been very volatile as

assessed by the ratios for the company. The financial position of the company has been volatile

with the losses of the company rising in the trend period analysed for the company. The return on

capital and the current ratio for the company was the most volatile ratio for the company.

However, the activity and the efficiency ratio which the inventory turnover ratio for the company

has somewhat been similar as compared to other ratio’s analysed for the company (Uechi et al.

2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6AUDIT

AERIS Environmental Ltd Ratio Analysis

Particulars 2015-16 2016-17 2017-18

Gearing/Capital Structure Ratio

Debt 2717 10764 19159

Equity 353300 5477521 3111811

Workings =(B4/B5) =(C4/C5) =(D4/D5)

Debt to Equity Ratio 0.77% 0.20% 0.62%

Profitability Ratio

Net Profit -2062727 -3747555 -3230023

Capital Employed 353300 5477521 3111811

Workings =B10/B11 =C10/C11 =D10/D11

Return on capital employed -584% -68% -104%

Liquidity Ratio

Current Assets 6914276 3256295 2435296

Current Liabilities 1577272 716178 1555142

Workings =B16/B17 =C16/C17 =D16/D17

Current Ratio 4.38 4.55 1.57

Activity/Efficiency Ratio

Cost of Goods Sold 350272 1038362 1091758

Avg. Inventory Held 170933 256724 318196

Workings =B22/B23 =C22/C23 =D22/D23

Inventory Turnover Ratio 2.049177163

4.04466275

1 3.4310865

4.0 Material Account Balance

The key material account balance that was assessed for the company was the long-term

debt of the company where the account showed material changes and the key audit risk was

evaluated in the financial information of the company. The falling profitability of the company

was also the key material account that needs to be reassessed for the company as the same is

declining the balance of equity for the company and the company may be at significant risk for

the company. The balance of cash and cash equivalent are shown to be significantly fallen in

comparison to previous years. There might be material misstatement or omission in case of cash

balance.

AERIS Environmental Ltd Ratio Analysis

Particulars 2015-16 2016-17 2017-18

Gearing/Capital Structure Ratio

Debt 2717 10764 19159

Equity 353300 5477521 3111811

Workings =(B4/B5) =(C4/C5) =(D4/D5)

Debt to Equity Ratio 0.77% 0.20% 0.62%

Profitability Ratio

Net Profit -2062727 -3747555 -3230023

Capital Employed 353300 5477521 3111811

Workings =B10/B11 =C10/C11 =D10/D11

Return on capital employed -584% -68% -104%

Liquidity Ratio

Current Assets 6914276 3256295 2435296

Current Liabilities 1577272 716178 1555142

Workings =B16/B17 =C16/C17 =D16/D17

Current Ratio 4.38 4.55 1.57

Activity/Efficiency Ratio

Cost of Goods Sold 350272 1038362 1091758

Avg. Inventory Held 170933 256724 318196

Workings =B22/B23 =C22/C23 =D22/D23

Inventory Turnover Ratio 2.049177163

4.04466275

1 3.4310865

4.0 Material Account Balance

The key material account balance that was assessed for the company was the long-term

debt of the company where the account showed material changes and the key audit risk was

evaluated in the financial information of the company. The falling profitability of the company

was also the key material account that needs to be reassessed for the company as the same is

declining the balance of equity for the company and the company may be at significant risk for

the company. The balance of cash and cash equivalent are shown to be significantly fallen in

comparison to previous years. There might be material misstatement or omission in case of cash

balance.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7AUDIT

5.0 Material Account Balances

The annual report of Aeris Environmental Company is considered for identifying the

accounts, which are shown in the financial statement, which can material in nature and can affect

the viability of the financial statements (Eilifsen and Messier Jr 2014). The accounts which are

considered to be material in nature are given below:

Cash and Cash Equivalent: The cash balance, which is shown in the annual report,

demonstrates important balance as the same is related to liquidity of the business and the

same is considered to be material in any business (Edgley, Jones and Atkins 2015). In the

balance sheet of the company, there has been a significant fall in the cash account and the

sane is shown to be $ 1,519,941 while the balance in 2016 was $ 5,415,664.

Inventories: These forms part of the current assets of the business and the same are used

either as raw materials or finished goods by the business and therefore the same are

considered to be material in nature (Cannon and Bedard 2016). The balance of inventory

is shown to be $ 256,724 in 2017.

Trade Receivables: The trade receivables accounts represent the debtors of the business

and also the credit sales which is made by the business. There are a lot of circumstances

that it is mis represented in the financial statement and therefore the same is also

considered to be material in nature (Moroney and Trotman 2016). The trade receivables

for Aeris Environmental Company is shown under both current assets and non-current

assets as shown in the balance sheet of the company. The balance of trade receivables is

shown to be $ 256,724 and $ 434,663 under both the heads of current assets and non-

current assets respectively.

5.0 Material Account Balances

The annual report of Aeris Environmental Company is considered for identifying the

accounts, which are shown in the financial statement, which can material in nature and can affect

the viability of the financial statements (Eilifsen and Messier Jr 2014). The accounts which are

considered to be material in nature are given below:

Cash and Cash Equivalent: The cash balance, which is shown in the annual report,

demonstrates important balance as the same is related to liquidity of the business and the

same is considered to be material in any business (Edgley, Jones and Atkins 2015). In the

balance sheet of the company, there has been a significant fall in the cash account and the

sane is shown to be $ 1,519,941 while the balance in 2016 was $ 5,415,664.

Inventories: These forms part of the current assets of the business and the same are used

either as raw materials or finished goods by the business and therefore the same are

considered to be material in nature (Cannon and Bedard 2016). The balance of inventory

is shown to be $ 256,724 in 2017.

Trade Receivables: The trade receivables accounts represent the debtors of the business

and also the credit sales which is made by the business. There are a lot of circumstances

that it is mis represented in the financial statement and therefore the same is also

considered to be material in nature (Moroney and Trotman 2016). The trade receivables

for Aeris Environmental Company is shown under both current assets and non-current

assets as shown in the balance sheet of the company. The balance of trade receivables is

shown to be $ 256,724 and $ 434,663 under both the heads of current assets and non-

current assets respectively.

8AUDIT

Property, Plant and Equipment: The property, plant and equipment balance are shown in

the non-current asset section of the business and represent the fixed assets which are used

by the business in day to day operations (Mio 2013). The valuation of property, plant and

equipment is a complex process and therefore the same is considered to be material in

nature.

Other Current Assets: The balance sheet of Aeris Environmental Company also shows

some other current assets and the same are shown to be of appropriate value and

therefore, the auditor of the company needs to consider what sorts of assets are included

and whether the same appropriate represented. Therefore, it can be said that the value is

of material nature.

Trade Payables: These accounts are opposite of trade receivables and represents the

creditors of the business. They are considered to be material due to the nature of the

account and the regularity of the same.

Interest Bearing Borrowings: The interest-bearing borrowings of the business are loans

which is taken by the management of the company and the amount which is shown in the

balance sheet of Aeris Environmental Company is material as the amount is huge.

Provisions: The provisions of the business represent the expected loss which the

management of the company anticipates from the operations of the business. In the case

of Aeris Environmental Company, the provisions are shown both as current liabilities and

non-current liabilities of the business.

6.0 Key Assertions of the Material Accounts

The key assertions, which can be identified in the financial reporting for the material

assets of the business and how the same faces certain risks, are given below:

Property, Plant and Equipment: The property, plant and equipment balance are shown in

the non-current asset section of the business and represent the fixed assets which are used

by the business in day to day operations (Mio 2013). The valuation of property, plant and

equipment is a complex process and therefore the same is considered to be material in

nature.

Other Current Assets: The balance sheet of Aeris Environmental Company also shows

some other current assets and the same are shown to be of appropriate value and

therefore, the auditor of the company needs to consider what sorts of assets are included

and whether the same appropriate represented. Therefore, it can be said that the value is

of material nature.

Trade Payables: These accounts are opposite of trade receivables and represents the

creditors of the business. They are considered to be material due to the nature of the

account and the regularity of the same.

Interest Bearing Borrowings: The interest-bearing borrowings of the business are loans

which is taken by the management of the company and the amount which is shown in the

balance sheet of Aeris Environmental Company is material as the amount is huge.

Provisions: The provisions of the business represent the expected loss which the

management of the company anticipates from the operations of the business. In the case

of Aeris Environmental Company, the provisions are shown both as current liabilities and

non-current liabilities of the business.

6.0 Key Assertions of the Material Accounts

The key assertions, which can be identified in the financial reporting for the material

assets of the business and how the same faces certain risks, are given below:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9AUDIT

Cash and Cash Equivalent: The balance of cash and cash equivalent are shown to be

significantly fallen in comparison to previous years. There might be material

misstatement or omission in case of cash balance. The fall in the cash balance has an

adverse effect on the liquidity of the business and therefore, the auditor needs to consider

the risks for this account seriously. There is another chance that the cash balance of the

business might be misappropriated by some employee which the auditor should take into

account.

Inventories: The inventories balance has not fluctuated that much but the nature of the

account makes it a vulnerable to manipulation. The valuation of the inventory must be as

per accounting standard requirements and also the same should be displayed

appropriately in the financial statements.

Trade Receivables: The trade receivables of the business are recognized as one of the

major accounts of the business. The auditor needs to assess the balances which is shown

in the annual reports of the business and ensure that the balance is appropriately shown in

the financial statements of the business. The trade receivables of the business is show for

both current and non-current assets. The auditor needs to assess the receivable collection

period and ensure that the same are appropriately represented.

Property, Plant and Equipment: The property, plant and equipment of the business

represent the fixed asset component of the business and the management of the company

needs to consider such item and ensure that all provisions of impairments and

depreciation is charged by the business (Lai, Melloni and Stacchezzini 2017). The asset

might be undervalued or overvalued which should be considered by the business.

Cash and Cash Equivalent: The balance of cash and cash equivalent are shown to be

significantly fallen in comparison to previous years. There might be material

misstatement or omission in case of cash balance. The fall in the cash balance has an

adverse effect on the liquidity of the business and therefore, the auditor needs to consider

the risks for this account seriously. There is another chance that the cash balance of the

business might be misappropriated by some employee which the auditor should take into

account.

Inventories: The inventories balance has not fluctuated that much but the nature of the

account makes it a vulnerable to manipulation. The valuation of the inventory must be as

per accounting standard requirements and also the same should be displayed

appropriately in the financial statements.

Trade Receivables: The trade receivables of the business are recognized as one of the

major accounts of the business. The auditor needs to assess the balances which is shown

in the annual reports of the business and ensure that the balance is appropriately shown in

the financial statements of the business. The trade receivables of the business is show for

both current and non-current assets. The auditor needs to assess the receivable collection

period and ensure that the same are appropriately represented.

Property, Plant and Equipment: The property, plant and equipment of the business

represent the fixed asset component of the business and the management of the company

needs to consider such item and ensure that all provisions of impairments and

depreciation is charged by the business (Lai, Melloni and Stacchezzini 2017). The asset

might be undervalued or overvalued which should be considered by the business.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10AUDIT

Other Current Assets: The other assets which are shown in the balance sheet of the

company are of significant amount and therefore the auditor needs to consider such an

amount while conducting the audit process (Ruhnke and Schmidt 2014). The balance of

other current assets of the business is shown to be $ 116,059. The other current assets of

the business are of significant amount and therefore the auditor needs to consider the

same.

Trade Payables: The trade payables figures are directly associated with the purchases of

the business and therefore are considered to be material. The main cash outflows of the

business are from purchases and therefore the auditor needs to assess the balance of

creditors in order to ensure that the balances which are shown in the annual reports are

appropriate (Vîlsănoiu and Buzenche 2014). The auditor of the business need to take into

account the related accounts which are affected by trade payables such as cash account,

income statement.

Interest Bearing Borrowings: The interest-bearing liabilities of the business represent the

loans of the business and the same are considered to be important as the same form part

of the liability side of the balance sheet. There is a high-level chance that the item can be

shown in excess or shown at a lower value.

Provisions: The provisions represent part of liabilities of the business on which the

management is uncertain. The provisions are generally applied when a business is

expecting losses. The auditor needs to exercise audit procedures to check the genuineness

of item.

Other Current Assets: The other assets which are shown in the balance sheet of the

company are of significant amount and therefore the auditor needs to consider such an

amount while conducting the audit process (Ruhnke and Schmidt 2014). The balance of

other current assets of the business is shown to be $ 116,059. The other current assets of

the business are of significant amount and therefore the auditor needs to consider the

same.

Trade Payables: The trade payables figures are directly associated with the purchases of

the business and therefore are considered to be material. The main cash outflows of the

business are from purchases and therefore the auditor needs to assess the balance of

creditors in order to ensure that the balances which are shown in the annual reports are

appropriate (Vîlsănoiu and Buzenche 2014). The auditor of the business need to take into

account the related accounts which are affected by trade payables such as cash account,

income statement.

Interest Bearing Borrowings: The interest-bearing liabilities of the business represent the

loans of the business and the same are considered to be important as the same form part

of the liability side of the balance sheet. There is a high-level chance that the item can be

shown in excess or shown at a lower value.

Provisions: The provisions represent part of liabilities of the business on which the

management is uncertain. The provisions are generally applied when a business is

expecting losses. The auditor needs to exercise audit procedures to check the genuineness

of item.

11AUDIT

7.0 Comprehensive Set of Audit Steps

The auditor needs to apply substantive procedures for the purpose of ensuring the

financial statements are free from material misstatements (Beasley 2015). The sets which needs

to be taken by the auditor are listed below:

Cash and Cash Equivalent

Auditor need to verify the cash book and cash related documents such as invoices, notes,

receipts

Verify the cash flow account

Verify the cash register and cash which is deposit at bank

Inventory

Auditor needs to verify the purchase ledger and sales ledger for any issuance of

inventory, verify store ledger accounts and show the flow of stock.

Auditor needs to verify the stock valuation process which is followed by the business

In extraordinary situation, the auditor can also under physical stock take to appropriately

value the stock.

Trade Receivables

The auditor needs to assess the trade receivables of the business and also ensure that the

internal control of the business is strong.

The auditor needs to make external confirmation regarding the balances of trade

receivables.

The auditor also needs to check the credit sales of the business.

Property, Plant and Equipment

7.0 Comprehensive Set of Audit Steps

The auditor needs to apply substantive procedures for the purpose of ensuring the

financial statements are free from material misstatements (Beasley 2015). The sets which needs

to be taken by the auditor are listed below:

Cash and Cash Equivalent

Auditor need to verify the cash book and cash related documents such as invoices, notes,

receipts

Verify the cash flow account

Verify the cash register and cash which is deposit at bank

Inventory

Auditor needs to verify the purchase ledger and sales ledger for any issuance of

inventory, verify store ledger accounts and show the flow of stock.

Auditor needs to verify the stock valuation process which is followed by the business

In extraordinary situation, the auditor can also under physical stock take to appropriately

value the stock.

Trade Receivables

The auditor needs to assess the trade receivables of the business and also ensure that the

internal control of the business is strong.

The auditor needs to make external confirmation regarding the balances of trade

receivables.

The auditor also needs to check the credit sales of the business.

Property, Plant and Equipment

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.