Audit of Inventory and Intellectual Property: Key Assertions, Substantive Audit Procedures, and ASA Key Audit Matter (701)

VerifiedAdded on 2022/10/19

|11

|2627

|55

AI Summary

This report analyses the key assertions, substantive audit procedures, and ASA Key Audit Matter (701) in relation to inventory and intellectual property. It includes two key assertions and two substantive audit procedures for each assertion, as well as the requirements and application of ASA Key Audit Matter (701) in the Auditor’s Report. The report also discusses the purpose of inclusion of Key Audit Matter paragraph to raise the understanding user gets while reading the audit report. The subject is Audit, and the document type is Assignment.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Audit

Module Number

Module Number

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

Introduction...........................................................................................................................................2

Answer to question no- 1.......................................................................................................................2

(a) Two Key (Assertion at identifed risk) in relation to inventory.....................................................2

(b) Two substantive audit procedures for each of the above identified key assertion........................3

(c) Requirements and application of ASA Key audit matter (701) in the Auditor’s Report..............4

Answer to question no- 2.......................................................................................................................6

(a) Two Key (Assertion at identifed risk) in relation to intellectual property....................................6

(b) One set Substantive Audit procedurefor each of the above identified key assertion....................7

(c) Requirements and application of ASA Key audit matter (701) in the Auditor’s Report..............7

Conclusion.............................................................................................................................................9

References...........................................................................................................................................10

Introduction...........................................................................................................................................2

Answer to question no- 1.......................................................................................................................2

(a) Two Key (Assertion at identifed risk) in relation to inventory.....................................................2

(b) Two substantive audit procedures for each of the above identified key assertion........................3

(c) Requirements and application of ASA Key audit matter (701) in the Auditor’s Report..............4

Answer to question no- 2.......................................................................................................................6

(a) Two Key (Assertion at identifed risk) in relation to intellectual property....................................6

(b) One set Substantive Audit procedurefor each of the above identified key assertion....................7

(c) Requirements and application of ASA Key audit matter (701) in the Auditor’s Report..............7

Conclusion.............................................................................................................................................9

References...........................................................................................................................................10

Introduction

With the changes in the economic, various companies are facing the audit risk in their

financial statements. However, there is following risks found such as inherent risk, detention

risk and control risk in the business functioning of organization. In this report, main Key

(Assertion at identified risk) related to the inventory is being analysed. This report reveals the

key aspects of the items forming part of inventory and evaluating of the inventory stolen or

might have been lost in various movements or transits in the business process of organization.

After that in the second part of the assignment, two Key (Assertion at identified risk) in

relation to intellectual property have been made to assess the set Substantive Audit procedure

for each of the recorded items. It is analysed that the disclosure in relation to the inventory of

Computing Solutions is being made and application of the ASA Key audit matter (701) in

Audit Report was issued by AUASB on demise of the investment banker Lehman Brothers.

However, in this report, it is divulged that the purpose of inclusion of Key Audit Matter

paragraph to raise the understanding user gets while reading the audit report.

Answer to question no- 1

(a) Two Key (Assertion at identified risk) in relation to inventory

The main Key (Assertion at identified risk) related to the inventory are as follows:

Valuation

Explanation: all the components of inventory present with organisation have been priced

using correct rates i.e. at the lower value among the inventory cost or its market price

(Knechel, and Salterio, 2016). This will be used to strengthen the transparency of recorded

inventory books.

Reason of application of assertion: The value of inventory in terms of sales has fallen by

7% in year 2019 as compared to year 2018. The sales return for the year has risen. This

implies the sales volume must have fallen, and the inventory at hand must have risen. Even

after this has happened, ironically in financial year 2019’s the inventory’s value in hand has

lowered down drastically. Also, the company on account of the fulfilment of tender order,

With the changes in the economic, various companies are facing the audit risk in their

financial statements. However, there is following risks found such as inherent risk, detention

risk and control risk in the business functioning of organization. In this report, main Key

(Assertion at identified risk) related to the inventory is being analysed. This report reveals the

key aspects of the items forming part of inventory and evaluating of the inventory stolen or

might have been lost in various movements or transits in the business process of organization.

After that in the second part of the assignment, two Key (Assertion at identified risk) in

relation to intellectual property have been made to assess the set Substantive Audit procedure

for each of the recorded items. It is analysed that the disclosure in relation to the inventory of

Computing Solutions is being made and application of the ASA Key audit matter (701) in

Audit Report was issued by AUASB on demise of the investment banker Lehman Brothers.

However, in this report, it is divulged that the purpose of inclusion of Key Audit Matter

paragraph to raise the understanding user gets while reading the audit report.

Answer to question no- 1

(a) Two Key (Assertion at identified risk) in relation to inventory

The main Key (Assertion at identified risk) related to the inventory are as follows:

Valuation

Explanation: all the components of inventory present with organisation have been priced

using correct rates i.e. at the lower value among the inventory cost or its market price

(Knechel, and Salterio, 2016). This will be used to strengthen the transparency of recorded

inventory books.

Reason of application of assertion: The value of inventory in terms of sales has fallen by

7% in year 2019 as compared to year 2018. The sales return for the year has risen. This

implies the sales volume must have fallen, and the inventory at hand must have risen. Even

after this has happened, ironically in financial year 2019’s the inventory’s value in hand has

lowered down drastically. Also, the company on account of the fulfilment of tender order,

inventory ought to be high in amount. Further, the company’s sales turnover is way to lower

in year 2019 as compared to 2018. In presence of all these situations, the inventory’s value

must have been higher, as the stock is assumed to be high in 2019 as compared to 2018. This

will increase the overall transparency in the books of accounts.

existence

Explanation: while computing the year-end inventory count, all the components as included

in inventory are present with Computing Solutions. None of the inventory items are

absconded (Brown-Liburd, and Vasarhelyi, 2015).

Reason of application of assertion: the fall in the inventory in 2019 over 2018 could be

possibly because some of the items forming part of inventory are actually stolen or might

have been lost in various movements or transits. This is possible because company has

recently encountered huge returns from customers on account of software problems. Also the

company has reported inventory shifting from central warehouse to regional warehouses of

the entity. The movement and shift witnessed in inventory is high, which could possibly

cause some of the inventory to be lost or be stolen.

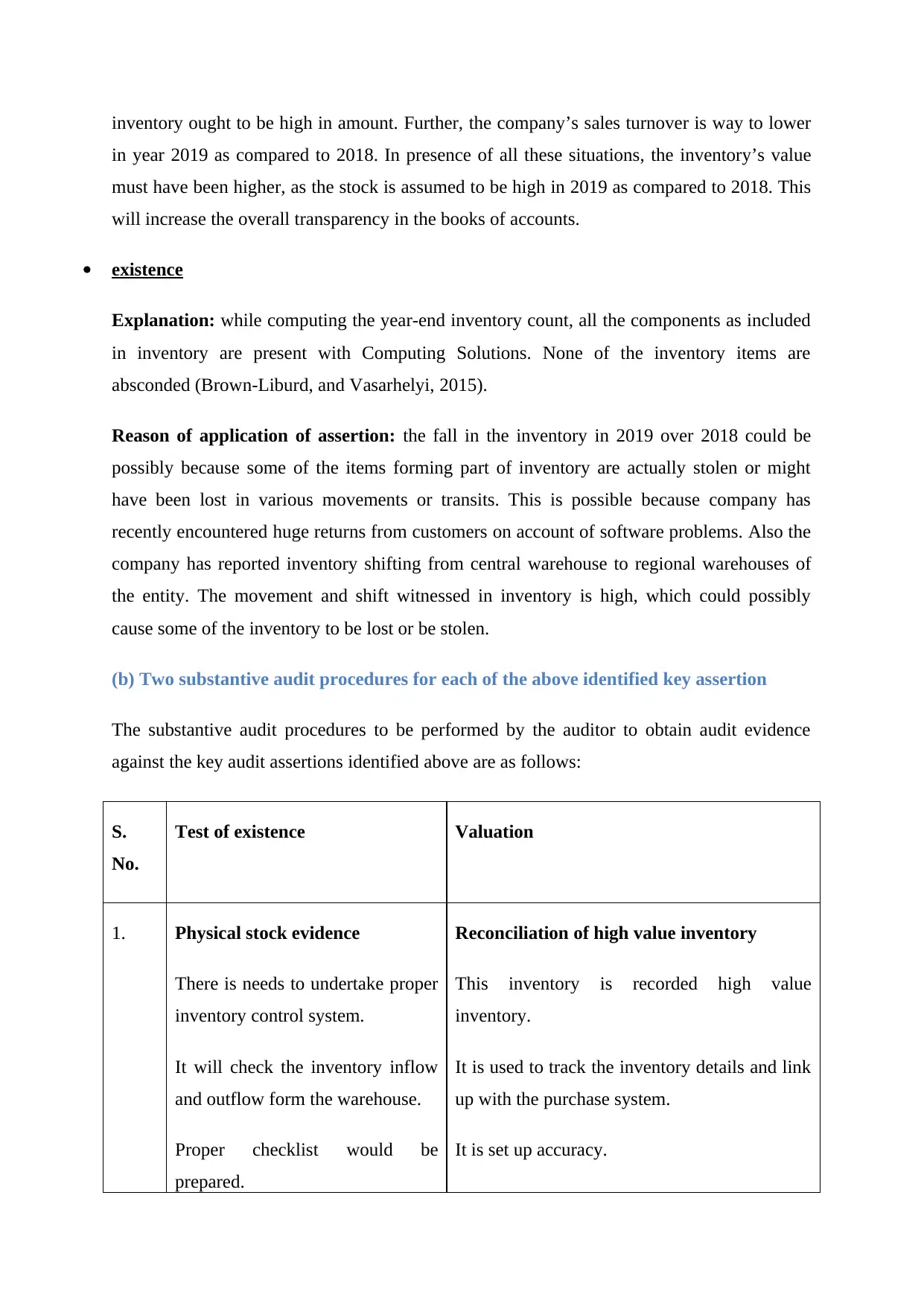

(b) Two substantive audit procedures for each of the above identified key assertion

The substantive audit procedures to be performed by the auditor to obtain audit evidence

against the key audit assertions identified above are as follows:

S.

No.

Test of existence Valuation

1. Physical stock evidence

There is needs to undertake proper

inventory control system.

It will check the inventory inflow

and outflow form the warehouse.

Proper checklist would be

prepared.

Reconciliation of high value inventory

This inventory is recorded high value

inventory.

It is used to track the inventory details and link

up with the purchase system.

It is set up accuracy.

in year 2019 as compared to 2018. In presence of all these situations, the inventory’s value

must have been higher, as the stock is assumed to be high in 2019 as compared to 2018. This

will increase the overall transparency in the books of accounts.

existence

Explanation: while computing the year-end inventory count, all the components as included

in inventory are present with Computing Solutions. None of the inventory items are

absconded (Brown-Liburd, and Vasarhelyi, 2015).

Reason of application of assertion: the fall in the inventory in 2019 over 2018 could be

possibly because some of the items forming part of inventory are actually stolen or might

have been lost in various movements or transits. This is possible because company has

recently encountered huge returns from customers on account of software problems. Also the

company has reported inventory shifting from central warehouse to regional warehouses of

the entity. The movement and shift witnessed in inventory is high, which could possibly

cause some of the inventory to be lost or be stolen.

(b) Two substantive audit procedures for each of the above identified key assertion

The substantive audit procedures to be performed by the auditor to obtain audit evidence

against the key audit assertions identified above are as follows:

S.

No.

Test of existence Valuation

1. Physical stock evidence

There is needs to undertake proper

inventory control system.

It will check the inventory inflow

and outflow form the warehouse.

Proper checklist would be

prepared.

Reconciliation of high value inventory

This inventory is recorded high value

inventory.

It is used to track the inventory details and link

up with the purchase system.

It is set up accuracy.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2. In-transit inventory:

The inventory receipt is checked in

warehouse.

In case of absence, auditor could

check other documents (Mayes Jr,

Landes, and Hasty, 2018).

Re-computation of value:

The reconciliation process is followed.

The time of audit is used to assess the record of

the inventory audit.

The sample audit assessment method is

followed for the inventory check (Kang,

Piercey, and Trotman, 2019).

(c) Requirements and application of ASA Key audit matter (701) in the Auditor’s

Report

Rationale behind ASA 701 and its requirements

There was found biggest collapse of the accounting and finance disclosure in case of Lehman

brother case. In this case, there was failure to maintain the proper transparency in the

recorded accounts and all the stakeholders were deceived by the bank. As per the ASA 701,

all the stakeholders of the company should be given proper information to maintain the

transparency (Vik, and Walter, 2017).

AS per the ASA 701, all the auditors are required to disclose all the required information to

the stakeholders of the company. it will be crucial to maintain the transparency in the books

of account.

In this case, we have taken the mining industry of 10ASX companies, it is analyzed that the

Newcrest Mining Limited comprised needs to be audited to assess the company financial risk.

However, auditor of company gave the proper disclosure of the recorded items through the

given notes to accounts (Newcrest Mining Limited, 2018). In case of the annual document

given by the company Alumina Limited, there is need to set up proper transparency and audit

risk model to assess the transparency level (Aluminalimited.com., 2018). There needs to be

the proper communication by the management to the auditing authority (Fülöp & Pintea,

The inventory receipt is checked in

warehouse.

In case of absence, auditor could

check other documents (Mayes Jr,

Landes, and Hasty, 2018).

Re-computation of value:

The reconciliation process is followed.

The time of audit is used to assess the record of

the inventory audit.

The sample audit assessment method is

followed for the inventory check (Kang,

Piercey, and Trotman, 2019).

(c) Requirements and application of ASA Key audit matter (701) in the Auditor’s

Report

Rationale behind ASA 701 and its requirements

There was found biggest collapse of the accounting and finance disclosure in case of Lehman

brother case. In this case, there was failure to maintain the proper transparency in the

recorded accounts and all the stakeholders were deceived by the bank. As per the ASA 701,

all the stakeholders of the company should be given proper information to maintain the

transparency (Vik, and Walter, 2017).

AS per the ASA 701, all the auditors are required to disclose all the required information to

the stakeholders of the company. it will be crucial to maintain the transparency in the books

of account.

In this case, we have taken the mining industry of 10ASX companies, it is analyzed that the

Newcrest Mining Limited comprised needs to be audited to assess the company financial risk.

However, auditor of company gave the proper disclosure of the recorded items through the

given notes to accounts (Newcrest Mining Limited, 2018). In case of the annual document

given by the company Alumina Limited, there is need to set up proper transparency and audit

risk model to assess the transparency level (Aluminalimited.com., 2018). There needs to be

the proper communication by the management to the auditing authority (Fülöp & Pintea,

2014). The management of the company needs to directly disclose all the information to the

auditors and auditor will take Management representation letter on the shared information.

Is inventory a key audit matter

The inventory record items is considered under the materiality risk and due to its high

materiality risk this is considered as main key audit matter in the books of account of

company.

Required disclosure

The disclosure of the inventory details needs to be made by company.

Key audit matters

The opinion on the financial statements is not subject to any change because of the here

mentioned key audit matters. Also, the opinion on the entire financial statements is equally

applicable to these items. These items have also been communicated to those charged with

governance and are as follows:

o The presentation package of Computing solutions best-selling till date is being returned by

customers at a high rate indicating some serious problem in the software used by the entity.

o The value of the inventory has decreased.

o There will be high risk as selling of the inventory is at 10% is taken to obtain the government

tender. This raises question upon the company’s ability to continue operations in near future.

Answer to question no- 2

(a) Two Key (Assertion at identified risk) in relation to intellectual property

Valuation

Explanation: the intellectual property obtained by Beautiful Hair Limited need to be valued

accurately and should neither be understated nor overstated (Hook, 2017).

Reason of application of assertion: the intellectual property has been recognised owing to

the acquisition made of Shimmer Pty Ltd. However, the formal agreement between the two

organisations does not contain the price of the intellectual property separately. It is necessary

auditors and auditor will take Management representation letter on the shared information.

Is inventory a key audit matter

The inventory record items is considered under the materiality risk and due to its high

materiality risk this is considered as main key audit matter in the books of account of

company.

Required disclosure

The disclosure of the inventory details needs to be made by company.

Key audit matters

The opinion on the financial statements is not subject to any change because of the here

mentioned key audit matters. Also, the opinion on the entire financial statements is equally

applicable to these items. These items have also been communicated to those charged with

governance and are as follows:

o The presentation package of Computing solutions best-selling till date is being returned by

customers at a high rate indicating some serious problem in the software used by the entity.

o The value of the inventory has decreased.

o There will be high risk as selling of the inventory is at 10% is taken to obtain the government

tender. This raises question upon the company’s ability to continue operations in near future.

Answer to question no- 2

(a) Two Key (Assertion at identified risk) in relation to intellectual property

Valuation

Explanation: the intellectual property obtained by Beautiful Hair Limited need to be valued

accurately and should neither be understated nor overstated (Hook, 2017).

Reason of application of assertion: the intellectual property has been recognised owing to

the acquisition made of Shimmer Pty Ltd. However, the formal agreement between the two

organisations does not contain the price of the intellectual property separately. It is necessary

to specifically consider whether or not the provisions of AASB 3 had been correctly applied

or not in valuing the intellectual property rights.

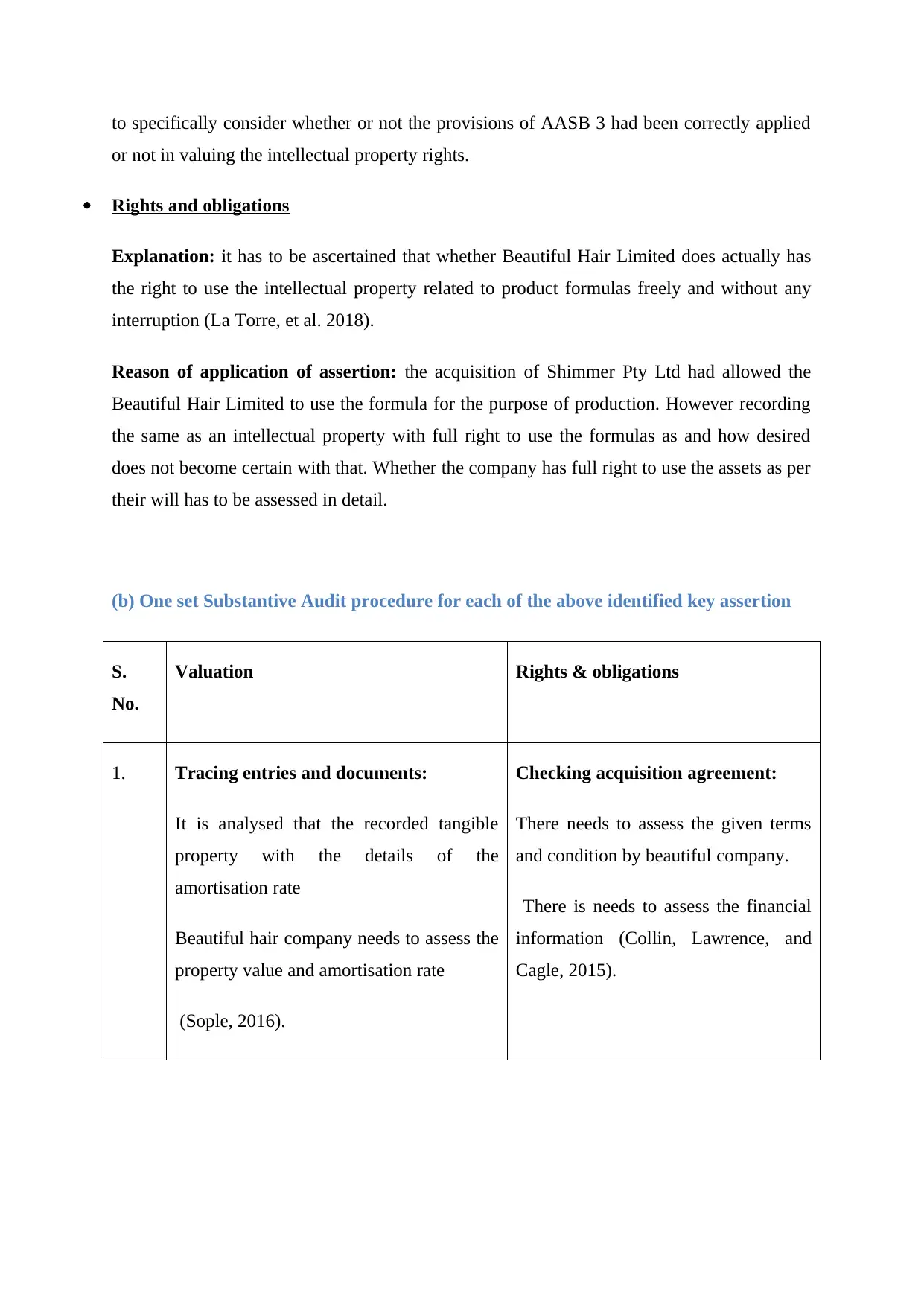

Rights and obligations

Explanation: it has to be ascertained that whether Beautiful Hair Limited does actually has

the right to use the intellectual property related to product formulas freely and without any

interruption (La Torre, et al. 2018).

Reason of application of assertion: the acquisition of Shimmer Pty Ltd had allowed the

Beautiful Hair Limited to use the formula for the purpose of production. However recording

the same as an intellectual property with full right to use the formulas as and how desired

does not become certain with that. Whether the company has full right to use the assets as per

their will has to be assessed in detail.

(b) One set Substantive Audit procedure for each of the above identified key assertion

S.

No.

Valuation Rights & obligations

1. Tracing entries and documents:

It is analysed that the recorded tangible

property with the details of the

amortisation rate

Beautiful hair company needs to assess the

property value and amortisation rate

(Sople, 2016).

Checking acquisition agreement:

There needs to assess the given terms

and condition by beautiful company.

There is needs to assess the financial

information (Collin, Lawrence, and

Cagle, 2015).

or not in valuing the intellectual property rights.

Rights and obligations

Explanation: it has to be ascertained that whether Beautiful Hair Limited does actually has

the right to use the intellectual property related to product formulas freely and without any

interruption (La Torre, et al. 2018).

Reason of application of assertion: the acquisition of Shimmer Pty Ltd had allowed the

Beautiful Hair Limited to use the formula for the purpose of production. However recording

the same as an intellectual property with full right to use the formulas as and how desired

does not become certain with that. Whether the company has full right to use the assets as per

their will has to be assessed in detail.

(b) One set Substantive Audit procedure for each of the above identified key assertion

S.

No.

Valuation Rights & obligations

1. Tracing entries and documents:

It is analysed that the recorded tangible

property with the details of the

amortisation rate

Beautiful hair company needs to assess the

property value and amortisation rate

(Sople, 2016).

Checking acquisition agreement:

There needs to assess the given terms

and condition by beautiful company.

There is needs to assess the financial

information (Collin, Lawrence, and

Cagle, 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(c) Requirements and application of ASA Key audit matter (701) in the Auditor’s

Report

Rationale behind ASA 701 and its requirements

In this case, as per the ASA 701, it is given that there was failure to maintain the proper

transparency in the recorded accounts and all the stakeholders were deceived by the bank. As

per the ASA 701, all the stakeholders of the company should be given proper information to

maintain the transparency (Vik, and Walter, 2017).

AS per the ASA 701, all the auditors are required to disclose all the required information to

the stakeholders of the company. it will be crucial to maintain the transparency in the books

of account.

.

If the time taken to investigate the matter is substantial or if the estimates or judgment laid by

management in this matter is substantial or both, the auditor communicates those matters to

those charged with Governance and enters the same in Key audit matter Paragraph (Brunelli,

2018).

Is intellectual property a key audit matter

There is needs to add the intellectual property in the financial statements and results should

be recorded in the financial structure of the company. The recording of the intellectual

property needs to be made as per the AASB 3. However, management needs to support the

recording of the intellectual property after obtaining evidences and key assertions.

Required disclosure

The disclosure in relation to the inventory of Computing Solutions can be made as follows:

Key audit matters

The opinion on the financial statements is not subject to any change because of the here

mentioned key audit matters. Also, the opinion on the entire financial statements is equally

applicable to these items. These items have also been communicated to those charged with

governance and are as follows:

o In the recent financial year, the company has acquired Shimmer Pty Ltd. on acquisition the

company has also acquired the secret formula of ingredients used by Shimmer Pty Ltd to

Report

Rationale behind ASA 701 and its requirements

In this case, as per the ASA 701, it is given that there was failure to maintain the proper

transparency in the recorded accounts and all the stakeholders were deceived by the bank. As

per the ASA 701, all the stakeholders of the company should be given proper information to

maintain the transparency (Vik, and Walter, 2017).

AS per the ASA 701, all the auditors are required to disclose all the required information to

the stakeholders of the company. it will be crucial to maintain the transparency in the books

of account.

.

If the time taken to investigate the matter is substantial or if the estimates or judgment laid by

management in this matter is substantial or both, the auditor communicates those matters to

those charged with Governance and enters the same in Key audit matter Paragraph (Brunelli,

2018).

Is intellectual property a key audit matter

There is needs to add the intellectual property in the financial statements and results should

be recorded in the financial structure of the company. The recording of the intellectual

property needs to be made as per the AASB 3. However, management needs to support the

recording of the intellectual property after obtaining evidences and key assertions.

Required disclosure

The disclosure in relation to the inventory of Computing Solutions can be made as follows:

Key audit matters

The opinion on the financial statements is not subject to any change because of the here

mentioned key audit matters. Also, the opinion on the entire financial statements is equally

applicable to these items. These items have also been communicated to those charged with

governance and are as follows:

o In the recent financial year, the company has acquired Shimmer Pty Ltd. on acquisition the

company has also acquired the secret formula of ingredients used by Shimmer Pty Ltd to

produce its products. This formula is recorded as intellectual property as per AASB 3 by the

organisation.

o The cost and balances of the intellectual property needs to be recorded and supported by the

given information and evidences.

o There needs to be proper information given by the Shimmer Pty Ltd to allow beautiful

company to record the items.

organisation.

o The cost and balances of the intellectual property needs to be recorded and supported by the

given information and evidences.

o There needs to be proper information given by the Shimmer Pty Ltd to allow beautiful

company to record the items.

Conclusion

In the wake of surveying the case and ramifications of the AASB, it is considered that

including territories of consistence and conforming to the reviewing and corporate accounting

principles doesn't imply that the review report is adjusted or disclaimer of recorded items. It

is considered that organization needs to support in long run to sustain the business, at that

point it needs to conform to the relevant bookkeeping benchmarks and corporate accounting

standards and law while making annual reports. In any case, it is investigations that

evaluators are required to give a review report which to the partners in connection to the

budget reports to keep up the straightforwardness for its stakeholders. The annual report of

the companies needs to be according to the expert decision or judgment.

In the wake of surveying the case and ramifications of the AASB, it is considered that

including territories of consistence and conforming to the reviewing and corporate accounting

principles doesn't imply that the review report is adjusted or disclaimer of recorded items. It

is considered that organization needs to support in long run to sustain the business, at that

point it needs to conform to the relevant bookkeeping benchmarks and corporate accounting

standards and law while making annual reports. In any case, it is investigations that

evaluators are required to give a review report which to the partners in connection to the

budget reports to keep up the straightforwardness for its stakeholders. The annual report of

the companies needs to be according to the expert decision or judgment.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

References

Brown-Liburd, H. and Vasarhelyi, M.A., 2015. Big Data and audit evidence. Journal of Emerging

Technologies in Accounting, 12(1), pp.1-16.

Brunelli, S., 2018. The Firm’Going Concern in the Contemporary Era. In Audit Reporting for Going

Concern Uncertainty (pp. 1-25). Springer, Cham.

Collin, S.L., Lawrence, M.L. and Cagle, C.S., 2015. The Auditing Implications of Adequately

Maintaining and Policing Intellectual Property. Journal of Strategic Innovation and

Sustainability, 10(2), p.18.

Hook, S.A., 2017. Intellectual Property: Nuts and Bolts.

Kang, Y.J., Piercey, M.D. and Trotman, A., 2019. Does an Audit Judgment Rule Increase or

Decrease Auditors' Use of Innovative Audit Procedures?. Contemporary Accounting Research.

Knechel, W.R. and Salterio, S.E., 2016. Auditing: Assurance and risk. Routledge.

La Torre, M., Botes, V.L., Dumay, J., Rea, M.A. and Odendaal, E., 2018. The fall and rise of

intellectual capital accounting: new prospects from the Big Data revolution. Meditari Accountancy

Research, 26(3), pp.381-399.

Mayes Jr, C.R., Landes, C.E. and Hasty, H., 2018. Taking the Risk out of Risk Assessment:

Properly Considering a Client's Risks Is Essential to a Quality Audit. Journal of

Accountancy, 226(2), p.38.

Sople, V.V., 2016. Managing intellectual property: The strategic imperative. PHI Learning Pvt. Ltd..

Vik, C. and Walter, M.C., 2017. The reporting practices of key audit matters in the big five audit

firms in Norway (Master's thesis, BI Norwegian Business School).

Brown-Liburd, H. and Vasarhelyi, M.A., 2015. Big Data and audit evidence. Journal of Emerging

Technologies in Accounting, 12(1), pp.1-16.

Brunelli, S., 2018. The Firm’Going Concern in the Contemporary Era. In Audit Reporting for Going

Concern Uncertainty (pp. 1-25). Springer, Cham.

Collin, S.L., Lawrence, M.L. and Cagle, C.S., 2015. The Auditing Implications of Adequately

Maintaining and Policing Intellectual Property. Journal of Strategic Innovation and

Sustainability, 10(2), p.18.

Hook, S.A., 2017. Intellectual Property: Nuts and Bolts.

Kang, Y.J., Piercey, M.D. and Trotman, A., 2019. Does an Audit Judgment Rule Increase or

Decrease Auditors' Use of Innovative Audit Procedures?. Contemporary Accounting Research.

Knechel, W.R. and Salterio, S.E., 2016. Auditing: Assurance and risk. Routledge.

La Torre, M., Botes, V.L., Dumay, J., Rea, M.A. and Odendaal, E., 2018. The fall and rise of

intellectual capital accounting: new prospects from the Big Data revolution. Meditari Accountancy

Research, 26(3), pp.381-399.

Mayes Jr, C.R., Landes, C.E. and Hasty, H., 2018. Taking the Risk out of Risk Assessment:

Properly Considering a Client's Risks Is Essential to a Quality Audit. Journal of

Accountancy, 226(2), p.38.

Sople, V.V., 2016. Managing intellectual property: The strategic imperative. PHI Learning Pvt. Ltd..

Vik, C. and Walter, M.C., 2017. The reporting practices of key audit matters in the big five audit

firms in Norway (Master's thesis, BI Norwegian Business School).

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.