Audit Report: Trunkey Creek Wines (TCW) Audit Plan for Year 2018

VerifiedAdded on 2023/06/04

|12

|2486

|127

Report

AI Summary

This report presents an audit plan for Trunkey Creek Wines (TCW) for the year ended June 30, 2018, prepared by Miller Yates Howarth (MYH). It assesses various risks associated with TCW's property assets, investments, and accounts receivables, providing steps to mitigate these risks. The report also discusses business risks impacting the organization's performance, such as increased debt collection days and decreased return on equity. Internal control mechanisms are examined, along with reasons for their failures, particularly within the purchases and accounts payable departments. The analysis highlights inefficiencies in TCW's internal controls and emphasizes the need for effective risk management strategies to ensure the company's financial well-being and ability to meet future obligations. Desklib offers a range of similar solved assignments and past papers for students.

qwertyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopasdfgh

jklzxcvbnmqwertyuiopasdfghjklzxcvb

nmqwertyuiopasdfghjklzxcvbnmqwer

tyuiopasdfghjklzxcvbnmqwertyuiopas

dfghjklzxcvbnmqwertyuiopasdfghjklzx

cvbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyuio

pasdfghjklzxcvbnmqwertyuiopasdfghj

klzxcvbnmqwertyuiopasdfghjklzxcvbn

mqwertyuiopasdfghjklzxcvbnmqwerty

uiopasdfghjklzxcvbnmqwertyuiopasdf

ghjklzxcvbnmqwertyuiopasdfghjklzxc

vbnmqwertyuiopasdfghjklzxcvbnmrty

uiopasdfghjklzxcvbnmqwertyuiopasdf

ghjklzxcvbnmqwertyuiopasdfghjklzxc

vbnmqwertyuiopasdfghjklzxcvbnmqw

ertyuiopasdfghjklzxcvbnmqwertyuiop

AUDITING

opasdfghjklzxcvbnmqwertyuiopasdfgh

jklzxcvbnmqwertyuiopasdfghjklzxcvb

nmqwertyuiopasdfghjklzxcvbnmqwer

tyuiopasdfghjklzxcvbnmqwertyuiopas

dfghjklzxcvbnmqwertyuiopasdfghjklzx

cvbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyuio

pasdfghjklzxcvbnmqwertyuiopasdfghj

klzxcvbnmqwertyuiopasdfghjklzxcvbn

mqwertyuiopasdfghjklzxcvbnmqwerty

uiopasdfghjklzxcvbnmqwertyuiopasdf

ghjklzxcvbnmqwertyuiopasdfghjklzxc

vbnmqwertyuiopasdfghjklzxcvbnmrty

uiopasdfghjklzxcvbnmqwertyuiopasdf

ghjklzxcvbnmqwertyuiopasdfghjklzxc

vbnmqwertyuiopasdfghjklzxcvbnmqw

ertyuiopasdfghjklzxcvbnmqwertyuiop

AUDITING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Audit

Executive summary

To survive in the current competitive scenario, it is always required for the companies to

maintain a true and fair view of its state of affairs. Keeping in mind the intensity of

competition in the industry, it is harder for the companies to persist their existence if it does

not operate with due diligence and compliance with all the necessary independent statutory

requirements. The identification and assessment of various risks involved needs also to be

taken care of. All this together can be achieved by means of incorporating audit measures in

the company and allows the company to not only survive its existence but also creates

opportunities for it to grow and become capable of dealing with its future obligations.

Trunkey Creek Wines (TCW) is the company to be assessed in the following report so as to

evaluate the fairness of its financial statements and financial well being.

2

Executive summary

To survive in the current competitive scenario, it is always required for the companies to

maintain a true and fair view of its state of affairs. Keeping in mind the intensity of

competition in the industry, it is harder for the companies to persist their existence if it does

not operate with due diligence and compliance with all the necessary independent statutory

requirements. The identification and assessment of various risks involved needs also to be

taken care of. All this together can be achieved by means of incorporating audit measures in

the company and allows the company to not only survive its existence but also creates

opportunities for it to grow and become capable of dealing with its future obligations.

Trunkey Creek Wines (TCW) is the company to be assessed in the following report so as to

evaluate the fairness of its financial statements and financial well being.

2

Audit

Contents

Introduction...........................................................................................................................................3

1A. Risk assessment...............................................................................................................................3

1B. Business risks that impacts the performance of organizations........................................................6

2A.Internal control mechanisms............................................................................................................7

2B. Reasons behind the failures of internal control mechanisms..........................................................8

Conclusion...........................................................................................................................................10

References...........................................................................................................................................11

3

Contents

Introduction...........................................................................................................................................3

1A. Risk assessment...............................................................................................................................3

1B. Business risks that impacts the performance of organizations........................................................6

2A.Internal control mechanisms............................................................................................................7

2B. Reasons behind the failures of internal control mechanisms..........................................................8

Conclusion...........................................................................................................................................10

References...........................................................................................................................................11

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Audit

Introduction

Considering the current competitive scenario, audit measures have become essential for the

companies to exist and expand in their industry. It is due to the fact that audit helps in the

detection of existing and probable material risks that can damage the operations and existence

of the company. Audit also helps in disclosing the financial well being of the company and

provides a true and fair view of its state of affairs. Audit eliminates or minimizes the chances

of material misstatements that were due to errors or/and frauds in the company’s financial

statements. The auditing practices and processes incorporated by TCW shall be discussed in

the following report for the purpose of determining and assessing the existing and potential

material risks of the company. The internal control system of the company will be taken into

consideration for the purpose of assessing the material risks and how the same assisted in

eradicating the impacts of such risks. The company’s ethical practices with regards to

compliance of independent statutory requirements and adopting and formulating policies

shall also be determined in the report.

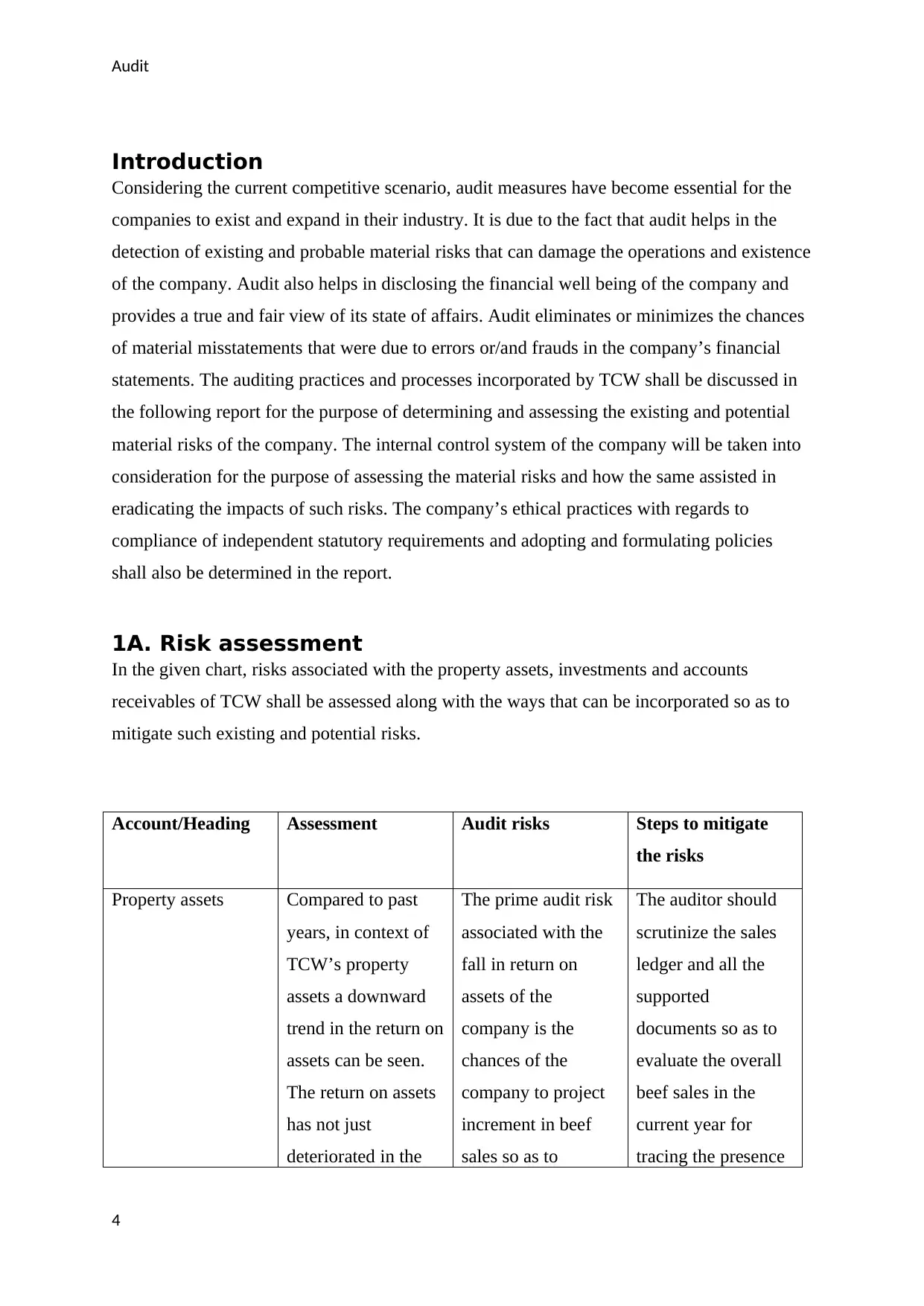

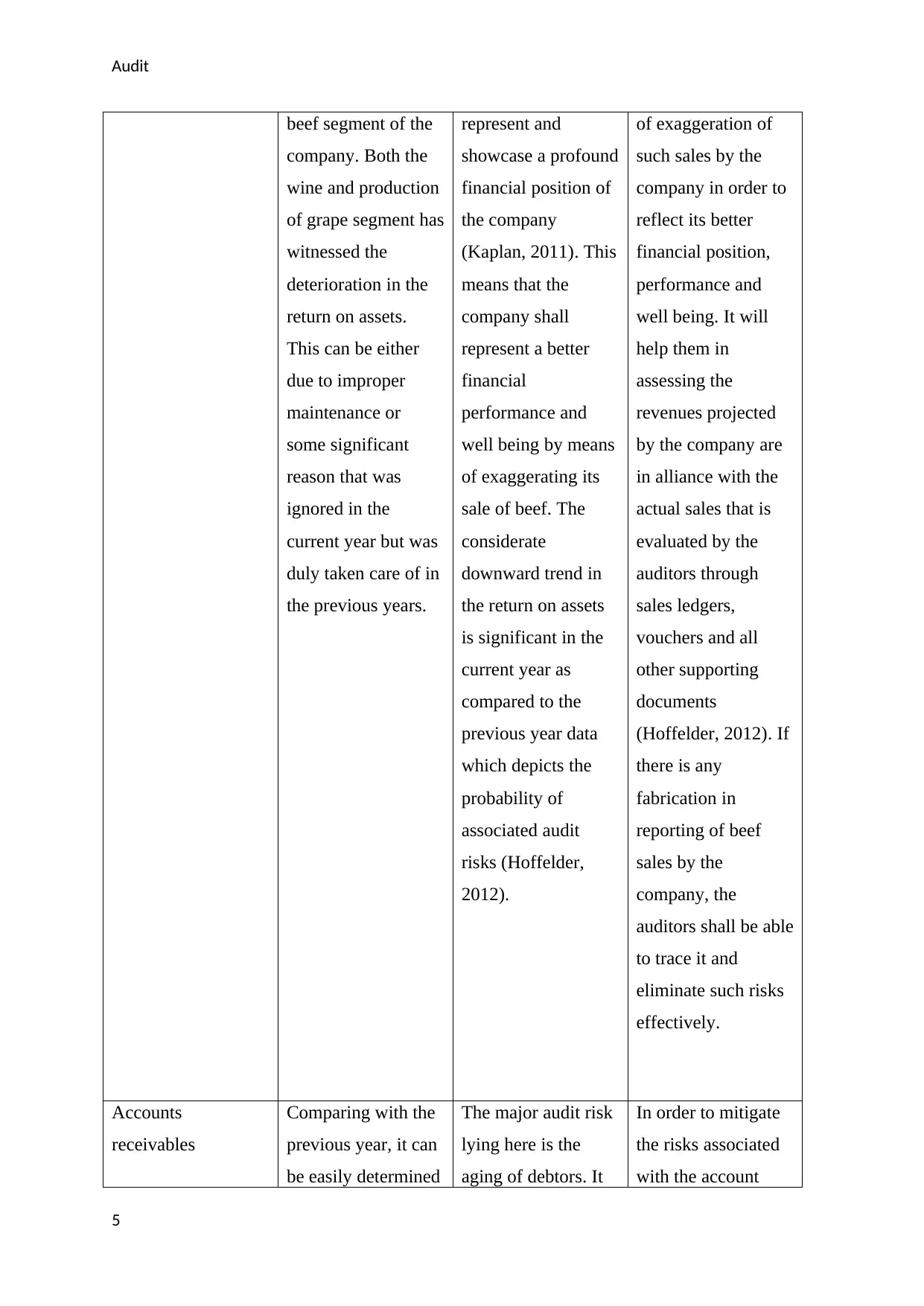

1A. Risk assessment

In the given chart, risks associated with the property assets, investments and accounts

receivables of TCW shall be assessed along with the ways that can be incorporated so as to

mitigate such existing and potential risks.

Account/Heading Assessment Audit risks Steps to mitigate

the risks

Property assets Compared to past

years, in context of

TCW’s property

assets a downward

trend in the return on

assets can be seen.

The return on assets

has not just

deteriorated in the

The prime audit risk

associated with the

fall in return on

assets of the

company is the

chances of the

company to project

increment in beef

sales so as to

The auditor should

scrutinize the sales

ledger and all the

supported

documents so as to

evaluate the overall

beef sales in the

current year for

tracing the presence

4

Introduction

Considering the current competitive scenario, audit measures have become essential for the

companies to exist and expand in their industry. It is due to the fact that audit helps in the

detection of existing and probable material risks that can damage the operations and existence

of the company. Audit also helps in disclosing the financial well being of the company and

provides a true and fair view of its state of affairs. Audit eliminates or minimizes the chances

of material misstatements that were due to errors or/and frauds in the company’s financial

statements. The auditing practices and processes incorporated by TCW shall be discussed in

the following report for the purpose of determining and assessing the existing and potential

material risks of the company. The internal control system of the company will be taken into

consideration for the purpose of assessing the material risks and how the same assisted in

eradicating the impacts of such risks. The company’s ethical practices with regards to

compliance of independent statutory requirements and adopting and formulating policies

shall also be determined in the report.

1A. Risk assessment

In the given chart, risks associated with the property assets, investments and accounts

receivables of TCW shall be assessed along with the ways that can be incorporated so as to

mitigate such existing and potential risks.

Account/Heading Assessment Audit risks Steps to mitigate

the risks

Property assets Compared to past

years, in context of

TCW’s property

assets a downward

trend in the return on

assets can be seen.

The return on assets

has not just

deteriorated in the

The prime audit risk

associated with the

fall in return on

assets of the

company is the

chances of the

company to project

increment in beef

sales so as to

The auditor should

scrutinize the sales

ledger and all the

supported

documents so as to

evaluate the overall

beef sales in the

current year for

tracing the presence

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Audit

beef segment of the

company. Both the

wine and production

of grape segment has

witnessed the

deterioration in the

return on assets.

This can be either

due to improper

maintenance or

some significant

reason that was

ignored in the

current year but was

duly taken care of in

the previous years.

represent and

showcase a profound

financial position of

the company

(Kaplan, 2011). This

means that the

company shall

represent a better

financial

performance and

well being by means

of exaggerating its

sale of beef. The

considerate

downward trend in

the return on assets

is significant in the

current year as

compared to the

previous year data

which depicts the

probability of

associated audit

risks (Hoffelder,

2012).

of exaggeration of

such sales by the

company in order to

reflect its better

financial position,

performance and

well being. It will

help them in

assessing the

revenues projected

by the company are

in alliance with the

actual sales that is

evaluated by the

auditors through

sales ledgers,

vouchers and all

other supporting

documents

(Hoffelder, 2012). If

there is any

fabrication in

reporting of beef

sales by the

company, the

auditors shall be able

to trace it and

eliminate such risks

effectively.

Accounts

receivables

Comparing with the

previous year, it can

be easily determined

The major audit risk

lying here is the

aging of debtors. It

In order to mitigate

the risks associated

with the account

5

beef segment of the

company. Both the

wine and production

of grape segment has

witnessed the

deterioration in the

return on assets.

This can be either

due to improper

maintenance or

some significant

reason that was

ignored in the

current year but was

duly taken care of in

the previous years.

represent and

showcase a profound

financial position of

the company

(Kaplan, 2011). This

means that the

company shall

represent a better

financial

performance and

well being by means

of exaggerating its

sale of beef. The

considerate

downward trend in

the return on assets

is significant in the

current year as

compared to the

previous year data

which depicts the

probability of

associated audit

risks (Hoffelder,

2012).

of exaggeration of

such sales by the

company in order to

reflect its better

financial position,

performance and

well being. It will

help them in

assessing the

revenues projected

by the company are

in alliance with the

actual sales that is

evaluated by the

auditors through

sales ledgers,

vouchers and all

other supporting

documents

(Hoffelder, 2012). If

there is any

fabrication in

reporting of beef

sales by the

company, the

auditors shall be able

to trace it and

eliminate such risks

effectively.

Accounts

receivables

Comparing with the

previous year, it can

be easily determined

The major audit risk

lying here is the

aging of debtors. It

In order to mitigate

the risks associated

with the account

5

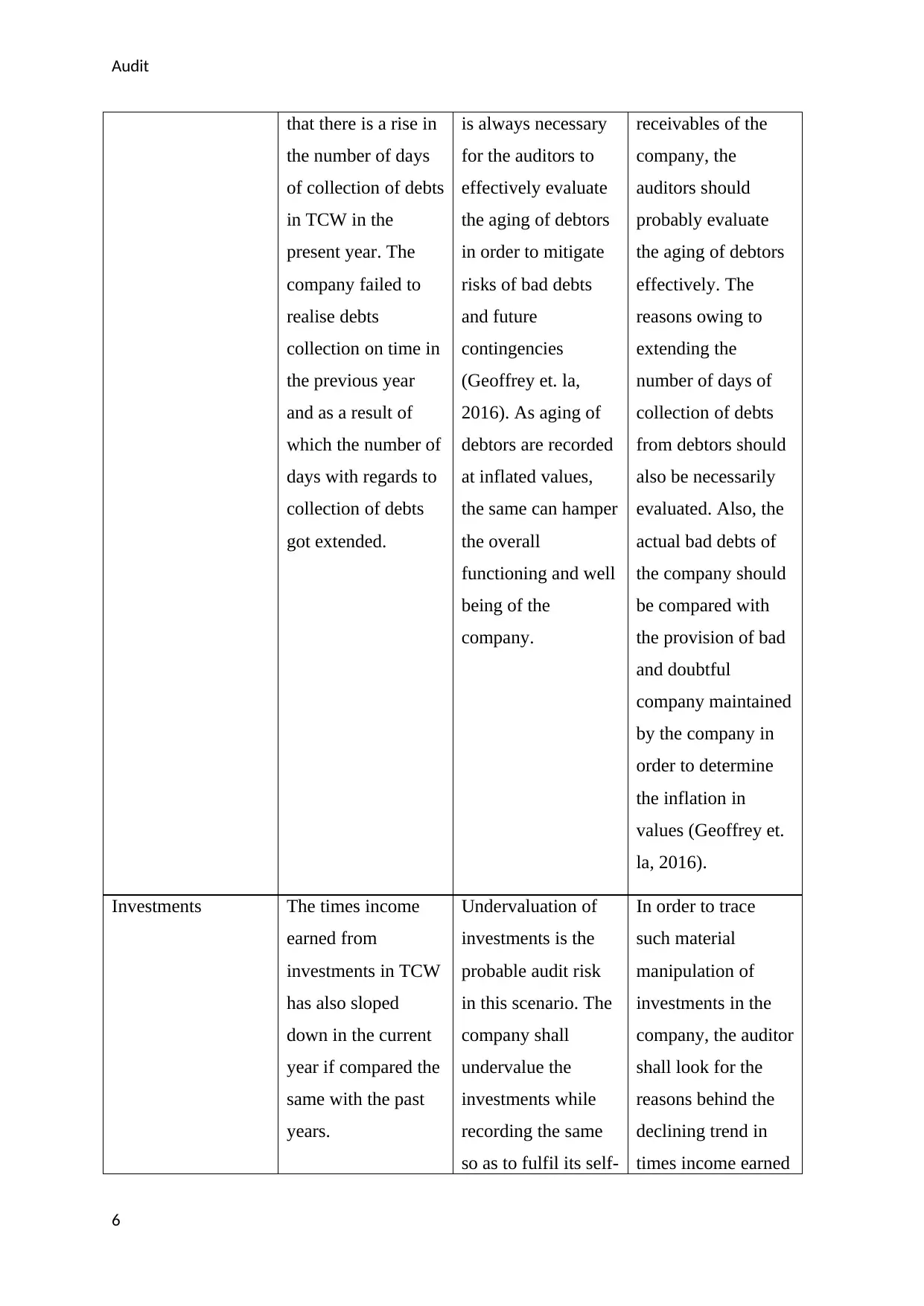

Audit

that there is a rise in

the number of days

of collection of debts

in TCW in the

present year. The

company failed to

realise debts

collection on time in

the previous year

and as a result of

which the number of

days with regards to

collection of debts

got extended.

is always necessary

for the auditors to

effectively evaluate

the aging of debtors

in order to mitigate

risks of bad debts

and future

contingencies

(Geoffrey et. la,

2016). As aging of

debtors are recorded

at inflated values,

the same can hamper

the overall

functioning and well

being of the

company.

receivables of the

company, the

auditors should

probably evaluate

the aging of debtors

effectively. The

reasons owing to

extending the

number of days of

collection of debts

from debtors should

also be necessarily

evaluated. Also, the

actual bad debts of

the company should

be compared with

the provision of bad

and doubtful

company maintained

by the company in

order to determine

the inflation in

values (Geoffrey et.

la, 2016).

Investments The times income

earned from

investments in TCW

has also sloped

down in the current

year if compared the

same with the past

years.

Undervaluation of

investments is the

probable audit risk

in this scenario. The

company shall

undervalue the

investments while

recording the same

so as to fulfil its self-

In order to trace

such material

manipulation of

investments in the

company, the auditor

shall look for the

reasons behind the

declining trend in

times income earned

6

that there is a rise in

the number of days

of collection of debts

in TCW in the

present year. The

company failed to

realise debts

collection on time in

the previous year

and as a result of

which the number of

days with regards to

collection of debts

got extended.

is always necessary

for the auditors to

effectively evaluate

the aging of debtors

in order to mitigate

risks of bad debts

and future

contingencies

(Geoffrey et. la,

2016). As aging of

debtors are recorded

at inflated values,

the same can hamper

the overall

functioning and well

being of the

company.

receivables of the

company, the

auditors should

probably evaluate

the aging of debtors

effectively. The

reasons owing to

extending the

number of days of

collection of debts

from debtors should

also be necessarily

evaluated. Also, the

actual bad debts of

the company should

be compared with

the provision of bad

and doubtful

company maintained

by the company in

order to determine

the inflation in

values (Geoffrey et.

la, 2016).

Investments The times income

earned from

investments in TCW

has also sloped

down in the current

year if compared the

same with the past

years.

Undervaluation of

investments is the

probable audit risk

in this scenario. The

company shall

undervalue the

investments while

recording the same

so as to fulfil its self-

In order to trace

such material

manipulation of

investments in the

company, the auditor

shall look for the

reasons behind the

declining trend in

times income earned

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Audit

interest motives. from investments

comparing with the

previous years and

should verify all the

associated

documents including

vouchers and

receipts so as to

evaluate the same

(Gay & Simnet,

2015). The auditors

should also find out

that if there has been

disposal of any

investments by

TCW which can also

be assessed by

means of various

documents such as

vouchers, contract

notes, etc.

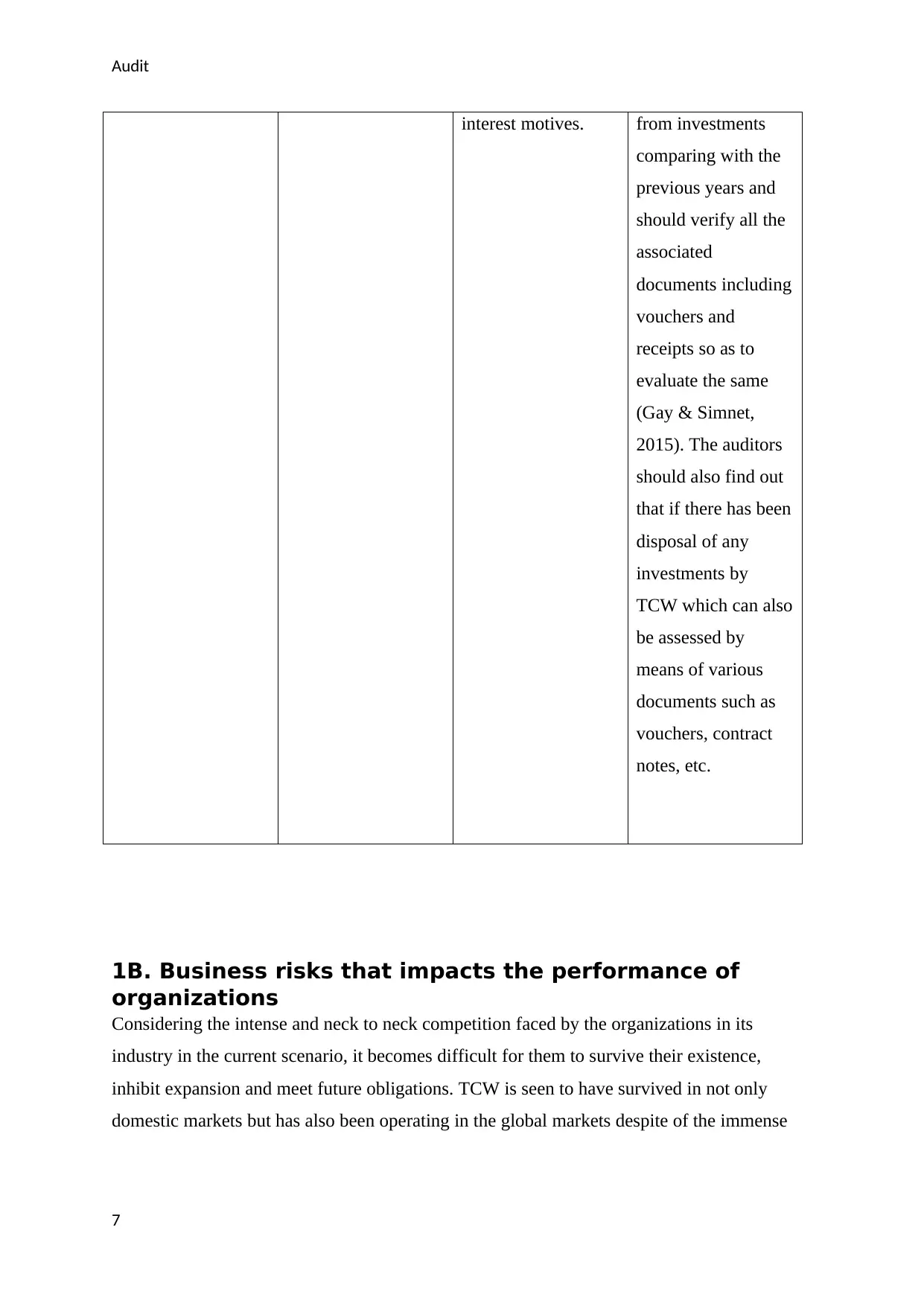

1B. Business risks that impacts the performance of

organizations

Considering the intense and neck to neck competition faced by the organizations in its

industry in the current scenario, it becomes difficult for them to survive their existence,

inhibit expansion and meet future obligations. TCW is seen to have survived in not only

domestic markets but has also been operating in the global markets despite of the immense

7

interest motives. from investments

comparing with the

previous years and

should verify all the

associated

documents including

vouchers and

receipts so as to

evaluate the same

(Gay & Simnet,

2015). The auditors

should also find out

that if there has been

disposal of any

investments by

TCW which can also

be assessed by

means of various

documents such as

vouchers, contract

notes, etc.

1B. Business risks that impacts the performance of

organizations

Considering the intense and neck to neck competition faced by the organizations in its

industry in the current scenario, it becomes difficult for them to survive their existence,

inhibit expansion and meet future obligations. TCW is seen to have survived in not only

domestic markets but has also been operating in the global markets despite of the immense

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Audit

and intense competition and challenges. The company has also been able to operate in

multiple sections of the market (Fazal, 2013).

The company has faced various business risks in the current year when compared to its past

years. If the account receivable of the company is considered, it can be seen that there is a

rise in the number of days of collection of debts as compared to previous 2 years. This is

because of the incapability of the company in timely recovering its dues from its debtors. The

smooth flow of operations has been impacted as recovery of debts has become troublesome

for the company (Elder, Beasley & Arens, 2010). This is a probable audit risk for the

company.

TCW has also failed in offering its investors return on equity in the current year which was

unlikely if compared with the past years. It can be understood by the figures that shows that

the return on equity of the company has come down by 7 % in the current year when

compared the same for the previous years.

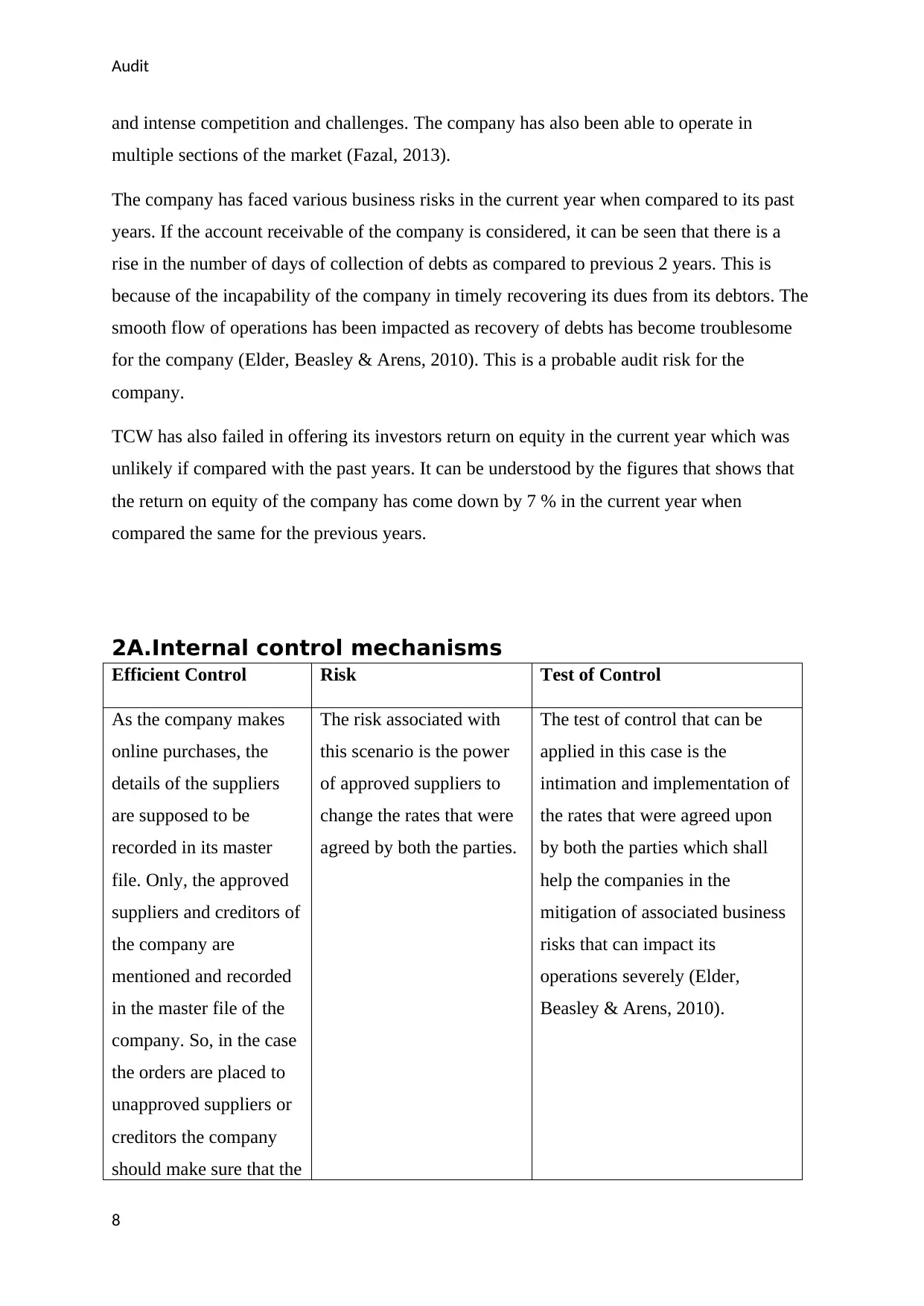

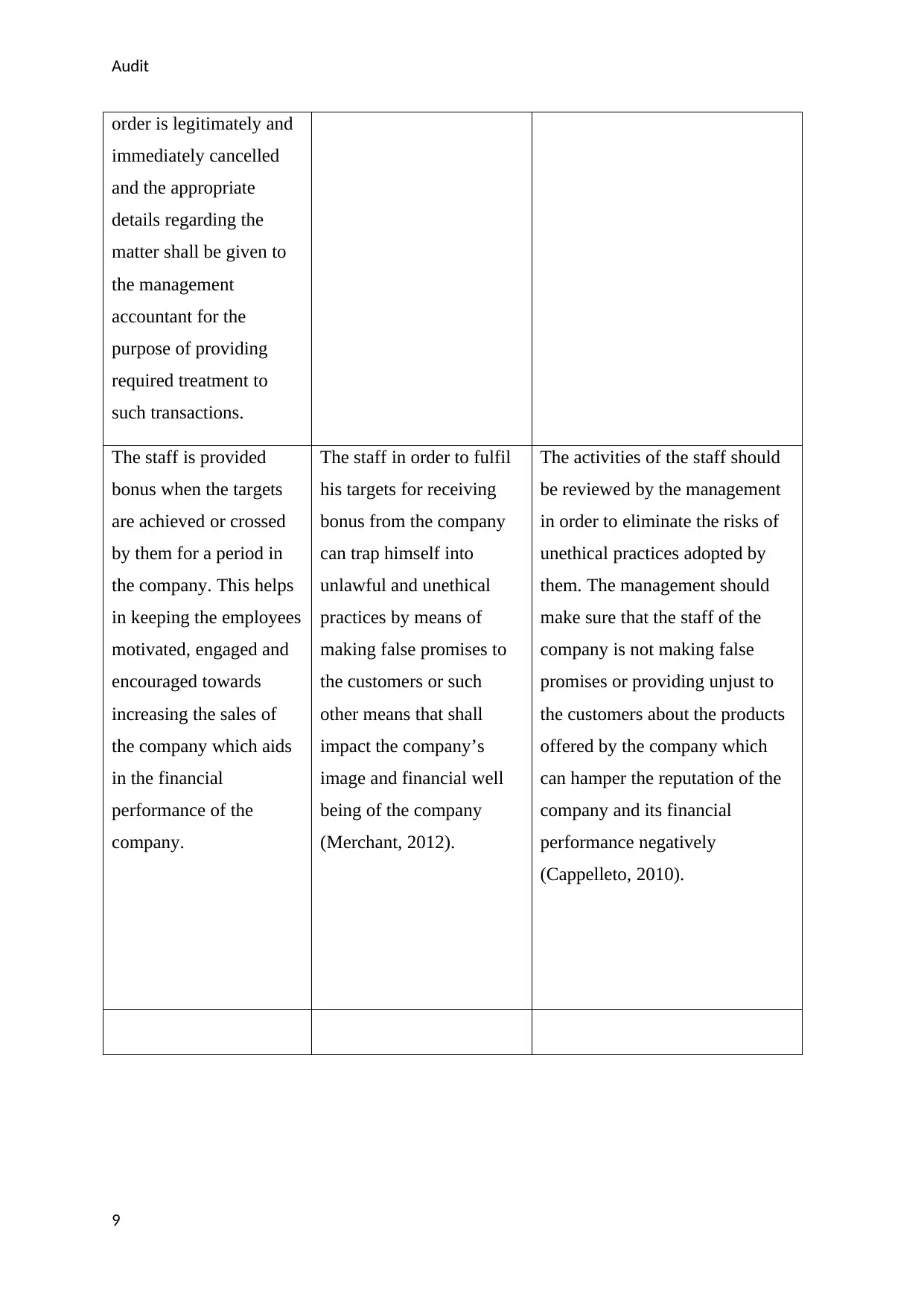

2A.Internal control mechanisms

Efficient Control Risk Test of Control

As the company makes

online purchases, the

details of the suppliers

are supposed to be

recorded in its master

file. Only, the approved

suppliers and creditors of

the company are

mentioned and recorded

in the master file of the

company. So, in the case

the orders are placed to

unapproved suppliers or

creditors the company

should make sure that the

The risk associated with

this scenario is the power

of approved suppliers to

change the rates that were

agreed by both the parties.

The test of control that can be

applied in this case is the

intimation and implementation of

the rates that were agreed upon

by both the parties which shall

help the companies in the

mitigation of associated business

risks that can impact its

operations severely (Elder,

Beasley & Arens, 2010).

8

and intense competition and challenges. The company has also been able to operate in

multiple sections of the market (Fazal, 2013).

The company has faced various business risks in the current year when compared to its past

years. If the account receivable of the company is considered, it can be seen that there is a

rise in the number of days of collection of debts as compared to previous 2 years. This is

because of the incapability of the company in timely recovering its dues from its debtors. The

smooth flow of operations has been impacted as recovery of debts has become troublesome

for the company (Elder, Beasley & Arens, 2010). This is a probable audit risk for the

company.

TCW has also failed in offering its investors return on equity in the current year which was

unlikely if compared with the past years. It can be understood by the figures that shows that

the return on equity of the company has come down by 7 % in the current year when

compared the same for the previous years.

2A.Internal control mechanisms

Efficient Control Risk Test of Control

As the company makes

online purchases, the

details of the suppliers

are supposed to be

recorded in its master

file. Only, the approved

suppliers and creditors of

the company are

mentioned and recorded

in the master file of the

company. So, in the case

the orders are placed to

unapproved suppliers or

creditors the company

should make sure that the

The risk associated with

this scenario is the power

of approved suppliers to

change the rates that were

agreed by both the parties.

The test of control that can be

applied in this case is the

intimation and implementation of

the rates that were agreed upon

by both the parties which shall

help the companies in the

mitigation of associated business

risks that can impact its

operations severely (Elder,

Beasley & Arens, 2010).

8

Audit

order is legitimately and

immediately cancelled

and the appropriate

details regarding the

matter shall be given to

the management

accountant for the

purpose of providing

required treatment to

such transactions.

The staff is provided

bonus when the targets

are achieved or crossed

by them for a period in

the company. This helps

in keeping the employees

motivated, engaged and

encouraged towards

increasing the sales of

the company which aids

in the financial

performance of the

company.

The staff in order to fulfil

his targets for receiving

bonus from the company

can trap himself into

unlawful and unethical

practices by means of

making false promises to

the customers or such

other means that shall

impact the company’s

image and financial well

being of the company

(Merchant, 2012).

The activities of the staff should

be reviewed by the management

in order to eliminate the risks of

unethical practices adopted by

them. The management should

make sure that the staff of the

company is not making false

promises or providing unjust to

the customers about the products

offered by the company which

can hamper the reputation of the

company and its financial

performance negatively

(Cappelleto, 2010).

9

order is legitimately and

immediately cancelled

and the appropriate

details regarding the

matter shall be given to

the management

accountant for the

purpose of providing

required treatment to

such transactions.

The staff is provided

bonus when the targets

are achieved or crossed

by them for a period in

the company. This helps

in keeping the employees

motivated, engaged and

encouraged towards

increasing the sales of

the company which aids

in the financial

performance of the

company.

The staff in order to fulfil

his targets for receiving

bonus from the company

can trap himself into

unlawful and unethical

practices by means of

making false promises to

the customers or such

other means that shall

impact the company’s

image and financial well

being of the company

(Merchant, 2012).

The activities of the staff should

be reviewed by the management

in order to eliminate the risks of

unethical practices adopted by

them. The management should

make sure that the staff of the

company is not making false

promises or providing unjust to

the customers about the products

offered by the company which

can hamper the reputation of the

company and its financial

performance negatively

(Cappelleto, 2010).

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Audit

2B. Reasons behind the failures of internal control

mechanisms

The shortcoming in the purchases and accounts payable department of the company needs

immediate treatment. The reasons behind these shortcomings are elaborated below-

The absence of separate maintenance of files for lower quality of goods that are being

purchased is one of the shortcomings of the purchase department. The company provided

justification with respect to absence of such maintenance of records by justifying that it is the

clerk who is responsible for aligning and recording the order information and their associated

bills. Therefore, the chances of missing out on the accounting of certain inferior or low

quality goods may happen (Livne, 2015). Another shortcoming with respect to payment

segment can be the failure or negligence in assessing of the stores file and the explanation

offered for the same was that purchase order of the company was not checked separately with

the goods and as a result of which over stocking in the company warehouses could have

happened (Niemi & Sundgren, 2012) .

Considering the accounts payable of the company, there are two major shortcomings that are

prominent. The company has failed to conduct its reconciliation strategies in its respective

account. The company provided justification on this segment by blaming the accountant for

relying completely on the IT system and not preparing required reconciliations on his own to

the respective accounts payable ledgers (Baldwin,2010). Another shortcoming is the fact that

there has been no monitoring of payment files on a regular basis. The company justified by

blaming it on its management accountant who verified the payment files just once in a week.

10

2B. Reasons behind the failures of internal control

mechanisms

The shortcoming in the purchases and accounts payable department of the company needs

immediate treatment. The reasons behind these shortcomings are elaborated below-

The absence of separate maintenance of files for lower quality of goods that are being

purchased is one of the shortcomings of the purchase department. The company provided

justification with respect to absence of such maintenance of records by justifying that it is the

clerk who is responsible for aligning and recording the order information and their associated

bills. Therefore, the chances of missing out on the accounting of certain inferior or low

quality goods may happen (Livne, 2015). Another shortcoming with respect to payment

segment can be the failure or negligence in assessing of the stores file and the explanation

offered for the same was that purchase order of the company was not checked separately with

the goods and as a result of which over stocking in the company warehouses could have

happened (Niemi & Sundgren, 2012) .

Considering the accounts payable of the company, there are two major shortcomings that are

prominent. The company has failed to conduct its reconciliation strategies in its respective

account. The company provided justification on this segment by blaming the accountant for

relying completely on the IT system and not preparing required reconciliations on his own to

the respective accounts payable ledgers (Baldwin,2010). Another shortcoming is the fact that

there has been no monitoring of payment files on a regular basis. The company justified by

blaming it on its management accountant who verified the payment files just once in a week.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Audit

Conclusion

With the help of the report, the inefficiencies of TCW in the current year are highlighted. The

internal control measures are inappropriate to an extent that the financial well being of the

company has got impacted. The company can overcome its shortcomings and be able to

survive its existence and become capable of meeting its future obligations in the presence of

effective risk management strategies that will help the company in mitigating existing and

potential risks that shall allow it to expand in its industry.

11

Conclusion

With the help of the report, the inefficiencies of TCW in the current year are highlighted. The

internal control measures are inappropriate to an extent that the financial well being of the

company has got impacted. The company can overcome its shortcomings and be able to

survive its existence and become capable of meeting its future obligations in the presence of

effective risk management strategies that will help the company in mitigating existing and

potential risks that shall allow it to expand in its industry.

11

Audit

References

Baldwin, S. (2010). Doing a content audit or inventory. Pearson Press.

Cappelleto, G. (2010) Challenges Facing Accounting Education in Australia. AFAANZ,

Melbourne

Elder, J. R., Beasley S. M., and Arens A. A. (2010). Auditing and Assurance Services. Person

Education, New Jersey: USA

Fazal, H. (2013, May 13). What is Intimidation threat in auditing?.Retrieved from:

http://pakaccountants.com/what-is-intimidation-threat-in-auditing/

Gay, G., and Simnet, R. (2015). Auditing and Assurance Services. McGraw Hill

Geoffrey D. B., Joleen K., K. K.S., and David A. W. (2016). Attracting Applicants for In-

House and Outsourced Internal Audit Positions: Views from External Auditors. Accounting

Horizons, 30(1), 143-156. https://doi.org/10.2308/acch-51309

Hoffelder, K. (2012). New Audit Standard Encourages More Talking. Harvard Press.

Kaplan, R.S. (2011). Accounting scholarship that advances professional knowledge and

practice. The Accounting Review, 86(2), 367–383. https://doi.org/10.2308/accr.00000031

Livne, G. (2015, May 12). Threats to Auditor Independence and Possible Remedies.

Retrieved from: http://www.financepractitioner.com/auditing-best-practice/threats-to-auditor-

independence-and-possible-remedies?full

Niemi, L., and Sundgren, S. (2012). Are modified audit opinions related to the availability of

credit? Evidence from Finnish SMEs. European Accounting Review, 21(4), 767-796.

https://doi.org/10.1080/09638180.2012.671465

Merchant, K. A. (2012). Making Management Accounting Research More Useful. Pacific

Accounting Review, 24(3), 1-34. https://doi.org/10.1108/01140581211283904

12

References

Baldwin, S. (2010). Doing a content audit or inventory. Pearson Press.

Cappelleto, G. (2010) Challenges Facing Accounting Education in Australia. AFAANZ,

Melbourne

Elder, J. R., Beasley S. M., and Arens A. A. (2010). Auditing and Assurance Services. Person

Education, New Jersey: USA

Fazal, H. (2013, May 13). What is Intimidation threat in auditing?.Retrieved from:

http://pakaccountants.com/what-is-intimidation-threat-in-auditing/

Gay, G., and Simnet, R. (2015). Auditing and Assurance Services. McGraw Hill

Geoffrey D. B., Joleen K., K. K.S., and David A. W. (2016). Attracting Applicants for In-

House and Outsourced Internal Audit Positions: Views from External Auditors. Accounting

Horizons, 30(1), 143-156. https://doi.org/10.2308/acch-51309

Hoffelder, K. (2012). New Audit Standard Encourages More Talking. Harvard Press.

Kaplan, R.S. (2011). Accounting scholarship that advances professional knowledge and

practice. The Accounting Review, 86(2), 367–383. https://doi.org/10.2308/accr.00000031

Livne, G. (2015, May 12). Threats to Auditor Independence and Possible Remedies.

Retrieved from: http://www.financepractitioner.com/auditing-best-practice/threats-to-auditor-

independence-and-possible-remedies?full

Niemi, L., and Sundgren, S. (2012). Are modified audit opinions related to the availability of

credit? Evidence from Finnish SMEs. European Accounting Review, 21(4), 767-796.

https://doi.org/10.1080/09638180.2012.671465

Merchant, K. A. (2012). Making Management Accounting Research More Useful. Pacific

Accounting Review, 24(3), 1-34. https://doi.org/10.1108/01140581211283904

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.