Brexit Capital Limited: Financial Statements & Auditor's Report 2019

VerifiedAdded on 2022/08/12

|21

|2079

|10

Report

AI Summary

This report presents the audited financial statements of Brexit Capital Limited for the period from March 24, 2019, to December 31, 2019. It includes the Director's Report, Independent Auditor's Report, Income Statement, Statement of Financial Position, and Notes to the Financial Statements. The report details the company's activities, financial performance, and position, including revenue, expenses, assets, liabilities, and equity. Key aspects covered are the company's incorporation, principal activity in financial services, and the initial year's loss due to setup costs. The report also covers the appointment of auditors, basis of preparation, accounting policies, revenue sources (interest income), corporation tax expense, director's emoluments, amounts due to shareholders, changes in equity, related party transactions, and comparative figures. The financial statements are prepared in accordance with UK accounting standards, providing a true and fair view of the company's financial position.

Running head: AUDITED FINANCIAL STATEMENTS

BREXIT CAPITAL LIMITED

Director’s Report and Financial Statements

Period: 24th March (Date of Incorporation)

– 31st December’ 2019

UWL C.P.A. LIMITED

Certified Public Accountants (Practising)

BREXIT CAPITAL LIMITED

Director’s Report and Financial Statements

Period: 24th March (Date of Incorporation)

– 31st December’ 2019

UWL C.P.A. LIMITED

Certified Public Accountants (Practising)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

AUDITED FINANCIAL STATEMENTS

Contents Page

Director’s Report.............................................................................................................................2

Independent Auditor’s Report.........................................................................................................4

Income Statement............................................................................................................................7

Statement of Financial Position ………………………………………………………………….8

Notes to Financial Statements:........................................................................................................9

Bibliography..................................................................................................................................17

Appendix........................................................................................................................................18

AUDITED FINANCIAL STATEMENTS

Contents Page

Director’s Report.............................................................................................................................2

Independent Auditor’s Report.........................................................................................................4

Income Statement............................................................................................................................7

Statement of Financial Position ………………………………………………………………….8

Notes to Financial Statements:........................................................................................................9

Bibliography..................................................................................................................................17

Appendix........................................................................................................................................18

2

AUDITED FINANCIAL STATEMENTS

Director’s Report

To the Members,

Introduction:

The Director’s report and the Financial Statements of the entity for the period 24th March

2019 to 31st December 2019 are presented by the company’s directors. Brexit Limited is a

“public limited company” that is incorporated on 24th March 2019.

Principal activity:

Brexit Capital Limited is in the financial service sector and provides financial services.

Directors and date of nomination:

The directors who worked during the period under review are Dwi Jaya and Dikari

Business Review:

The company is in the first year of operation and incurred losses of pound 49,911.39 due

to investing in the setup of the business. The directors are optimistic about the future and growth

of the company.

Permitted indemnity provision:

The company may provide the Director with an indemnity against the third party liability

unless the indemnity is within the mentioned category of indemnity as per the Act.

Auditor:

AUDITED FINANCIAL STATEMENTS

Director’s Report

To the Members,

Introduction:

The Director’s report and the Financial Statements of the entity for the period 24th March

2019 to 31st December 2019 are presented by the company’s directors. Brexit Limited is a

“public limited company” that is incorporated on 24th March 2019.

Principal activity:

Brexit Capital Limited is in the financial service sector and provides financial services.

Directors and date of nomination:

The directors who worked during the period under review are Dwi Jaya and Dikari

Business Review:

The company is in the first year of operation and incurred losses of pound 49,911.39 due

to investing in the setup of the business. The directors are optimistic about the future and growth

of the company.

Permitted indemnity provision:

The company may provide the Director with an indemnity against the third party liability

unless the indemnity is within the mentioned category of indemnity as per the Act.

Auditor:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

AUDITED FINANCIAL STATEMENTS

The resolution to appoint auditors was passed on 9th December 2019, and UWL. C.P.A

Limited, Chartered Accountants, C.P.A. (Practising), are appointed on 16th December 2019 with

immediate effect till the next “Annual General Meeting.” The auditors will retire at the time of

the conclusion of the next A.G.M. and are eligible for re-appointment.

For and behalf of Director,

For Brexit Capital Limited,

(Chairman)

Date:

Place: London

AUDITED FINANCIAL STATEMENTS

The resolution to appoint auditors was passed on 9th December 2019, and UWL. C.P.A

Limited, Chartered Accountants, C.P.A. (Practising), are appointed on 16th December 2019 with

immediate effect till the next “Annual General Meeting.” The auditors will retire at the time of

the conclusion of the next A.G.M. and are eligible for re-appointment.

For and behalf of Director,

For Brexit Capital Limited,

(Chairman)

Date:

Place: London

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

AUDITED FINANCIAL STATEMENTS

Independent Auditor’s Report

The Members,

Brexit Capital Limited

London

Opinion:

We have conducted the audit of the “financial statements” of the company for the period 24th

March to 31st December 2019, that comprises of “Statement of Income” and “Statement of

Financial Position” and “Notes to the Financial Statements” containing a summary of

“significant accounting policies.” The company prepares its financial statements as per the

applicable law and the “United Kingdom Accounting Standards.” The financial statements

provide the following in our opinion:

Gives a “true and fair view” of their financial position for the respective period.

are prepared in compliance with the “United Kingdom Generally Accepted Accounting

Practice” and “Companies Act 2006.”

Basis for opinion:

The audit is conducted as per the “International Standards on Auditing” (U.K.) and

applicable law and regulations. The auditor’s duties and responsibilities, according to the

standards, are discussed in “Auditor’s Responsibilities” for conducting the company’s audit. It is

believed that the collected audit evidence is appropriate and sufficient to provide a reasonable

opinion on the Financial Statements of the company.

“Other Information”:

AUDITED FINANCIAL STATEMENTS

Independent Auditor’s Report

The Members,

Brexit Capital Limited

London

Opinion:

We have conducted the audit of the “financial statements” of the company for the period 24th

March to 31st December 2019, that comprises of “Statement of Income” and “Statement of

Financial Position” and “Notes to the Financial Statements” containing a summary of

“significant accounting policies.” The company prepares its financial statements as per the

applicable law and the “United Kingdom Accounting Standards.” The financial statements

provide the following in our opinion:

Gives a “true and fair view” of their financial position for the respective period.

are prepared in compliance with the “United Kingdom Generally Accepted Accounting

Practice” and “Companies Act 2006.”

Basis for opinion:

The audit is conducted as per the “International Standards on Auditing” (U.K.) and

applicable law and regulations. The auditor’s duties and responsibilities, according to the

standards, are discussed in “Auditor’s Responsibilities” for conducting the company’s audit. It is

believed that the collected audit evidence is appropriate and sufficient to provide a reasonable

opinion on the Financial Statements of the company.

“Other Information”:

5

AUDITED FINANCIAL STATEMENTS

It is the director’s responsibility to provide information other than the financial

statements of the company. The opinion on other information is not covered in our scope of the

audit unless stated in this report. The responsibility of auditor includes reading the Other

Information and assessing whether it is inconsistent with the statements and whether they have a

material impact. When we report that there is a misstatement in other information which is

material, then the fact should be disclosed. There is nothing to report in regard to “Other

Information.”

Director’s Responsibility:

It is the director's responsibility to prepare and present the Financial Statements correctly

and to ensure the application of proper accounting standards and policies. The internal controls

existence and its effectiveness and efficiency is the Director’s responsibility. They have to ensure

that there are no material misstatements present in the financial statements, whether because of

any mistake or fraud, and are prepared in compliance with the prescribed framework. It is their

responsibility to assess whether they can carry on as a going concern or not and, if not, then state

in disclosures.

Auditor’s Responsibility:

Auditor’s objective is to attain reasonable assurance to ensure that the financial

statements do not contain any material misstatements and to express an opinion on the audit. All

the ethical requirements are followed, and plans are performed sufficiently to obtain reasonable

assurances as per the requirements of the standard. We provide reasonable assurance, but it is not

a guarantee that the accounts are prepared in compliance with Uk standards and are always free

from material misstatements. It is not an auditor’s responsibility to detect the error due to fraud.

AUDITED FINANCIAL STATEMENTS

It is the director’s responsibility to provide information other than the financial

statements of the company. The opinion on other information is not covered in our scope of the

audit unless stated in this report. The responsibility of auditor includes reading the Other

Information and assessing whether it is inconsistent with the statements and whether they have a

material impact. When we report that there is a misstatement in other information which is

material, then the fact should be disclosed. There is nothing to report in regard to “Other

Information.”

Director’s Responsibility:

It is the director's responsibility to prepare and present the Financial Statements correctly

and to ensure the application of proper accounting standards and policies. The internal controls

existence and its effectiveness and efficiency is the Director’s responsibility. They have to ensure

that there are no material misstatements present in the financial statements, whether because of

any mistake or fraud, and are prepared in compliance with the prescribed framework. It is their

responsibility to assess whether they can carry on as a going concern or not and, if not, then state

in disclosures.

Auditor’s Responsibility:

Auditor’s objective is to attain reasonable assurance to ensure that the financial

statements do not contain any material misstatements and to express an opinion on the audit. All

the ethical requirements are followed, and plans are performed sufficiently to obtain reasonable

assurances as per the requirements of the standard. We provide reasonable assurance, but it is not

a guarantee that the accounts are prepared in compliance with Uk standards and are always free

from material misstatements. It is not an auditor’s responsibility to detect the error due to fraud.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

AUDITED FINANCIAL STATEMENTS

The misstatements can occur because of fraud or mistakes and might affect the financial

statements; any misstatement alone can be material but immaterial for the financial statements

when taken as a whole.

For UWL C.P.A Limited

Chartered Accountants

Dated:

London

AUDITED FINANCIAL STATEMENTS

The misstatements can occur because of fraud or mistakes and might affect the financial

statements; any misstatement alone can be material but immaterial for the financial statements

when taken as a whole.

For UWL C.P.A Limited

Chartered Accountants

Dated:

London

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

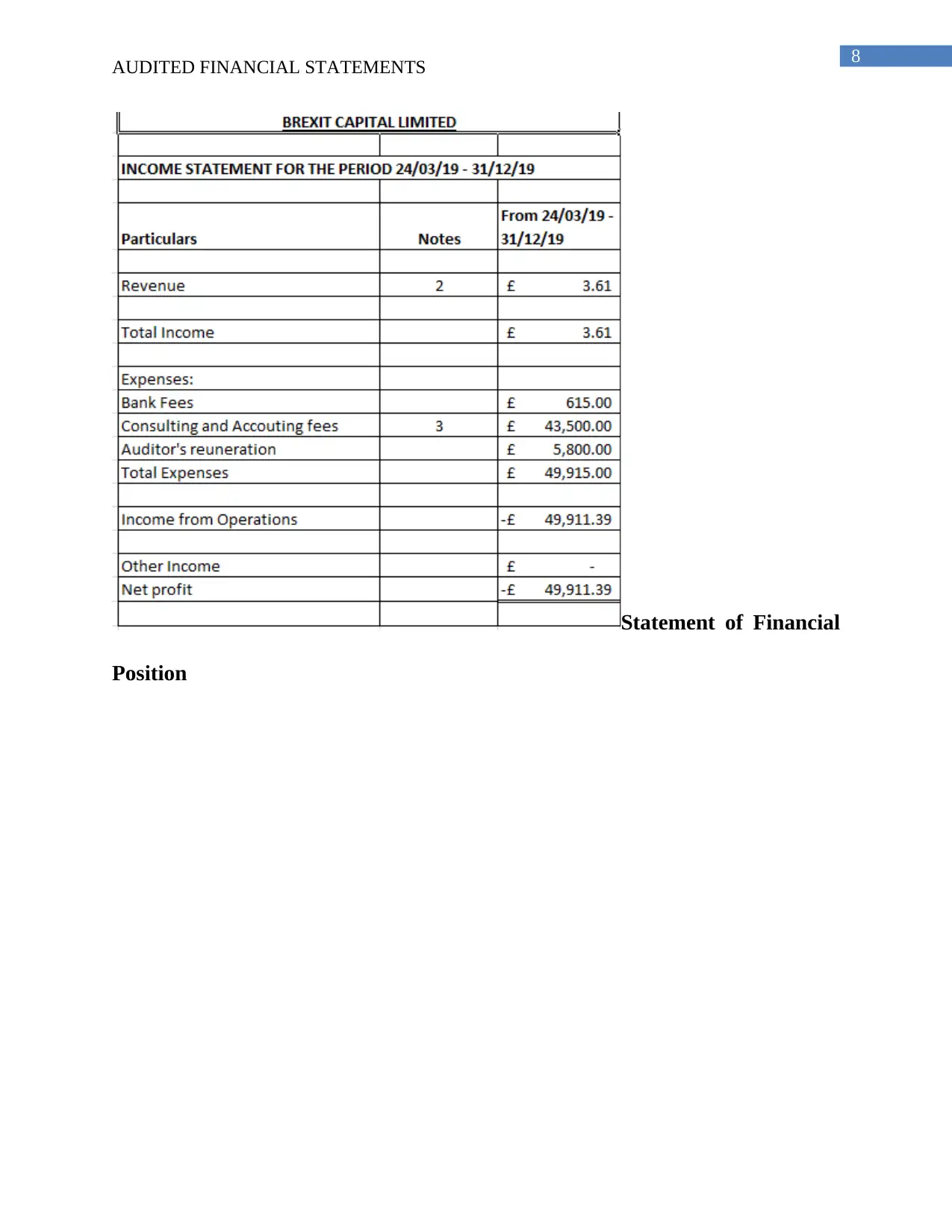

AUDITED FINANCIAL STATEMENTS

Income Statement

AUDITED FINANCIAL STATEMENTS

Income Statement

8

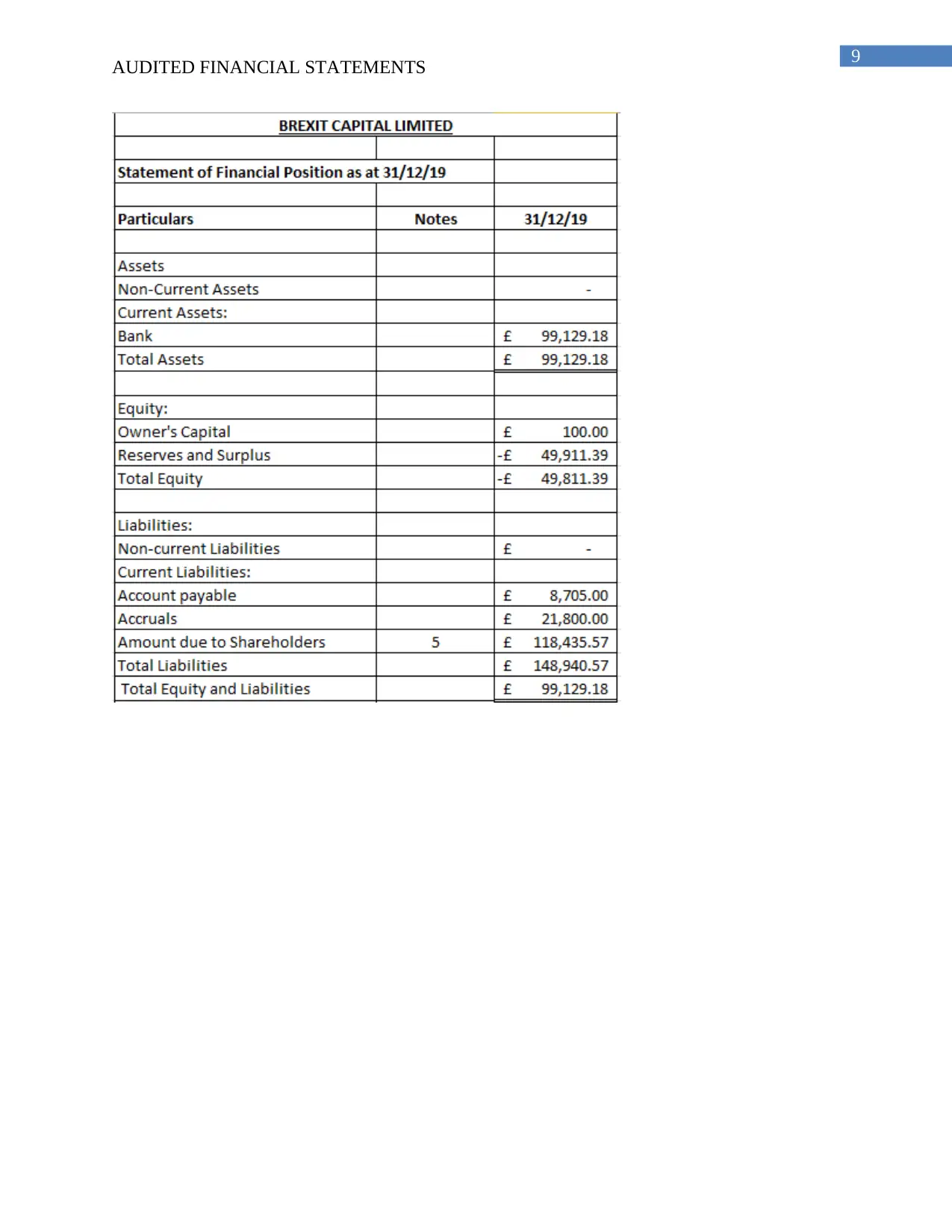

AUDITED FINANCIAL STATEMENTS

Statement of Financial

Position

AUDITED FINANCIAL STATEMENTS

Statement of Financial

Position

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

AUDITED FINANCIAL STATEMENTS

AUDITED FINANCIAL STATEMENTS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

AUDITED FINANCIAL STATEMENTS

Notes to Financial Statements:

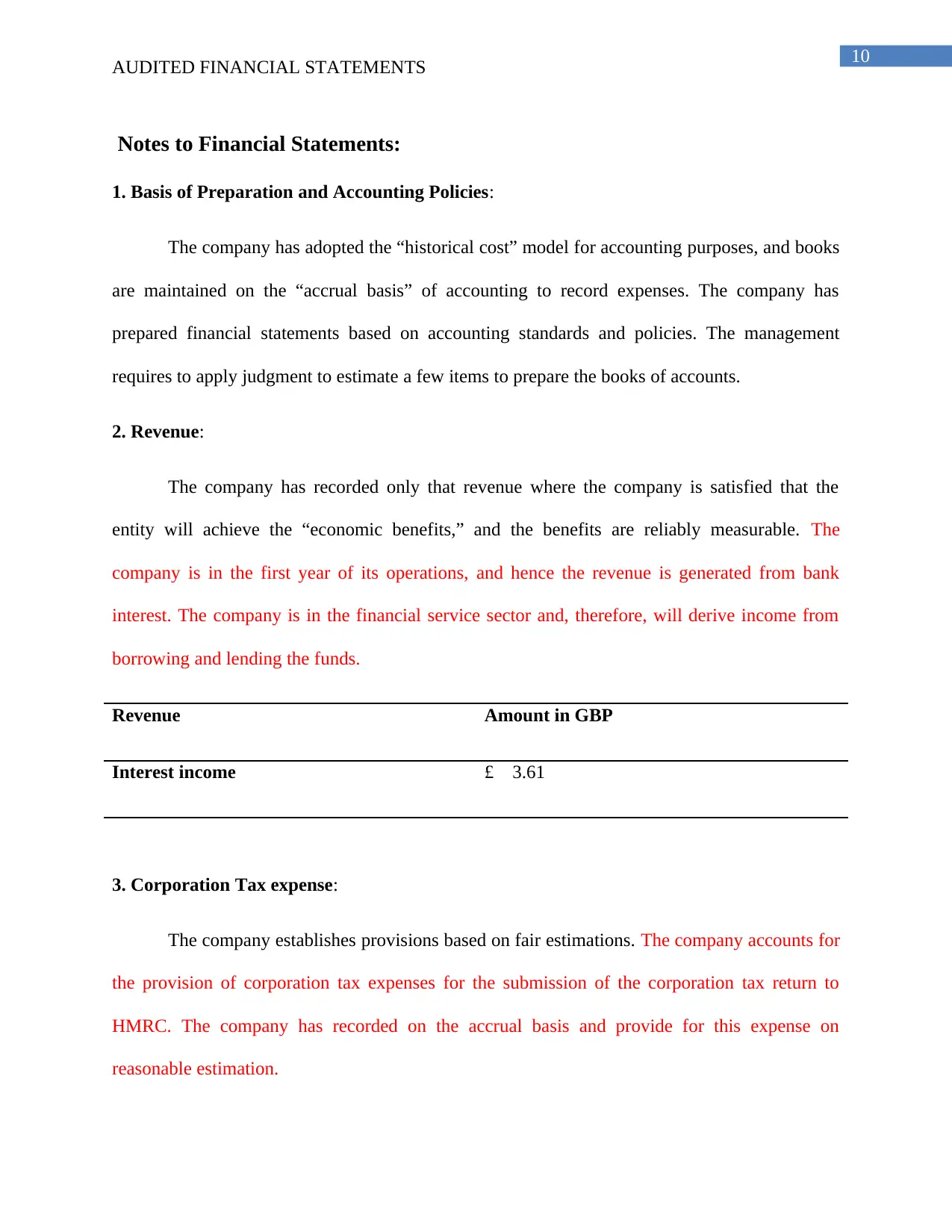

1. Basis of Preparation and Accounting Policies:

The company has adopted the “historical cost” model for accounting purposes, and books

are maintained on the “accrual basis” of accounting to record expenses. The company has

prepared financial statements based on accounting standards and policies. The management

requires to apply judgment to estimate a few items to prepare the books of accounts.

2. Revenue:

The company has recorded only that revenue where the company is satisfied that the

entity will achieve the “economic benefits,” and the benefits are reliably measurable. The

company is in the first year of its operations, and hence the revenue is generated from bank

interest. The company is in the financial service sector and, therefore, will derive income from

borrowing and lending the funds.

Revenue Amount in GBP

Interest income £ 3.61

3. Corporation Tax expense:

The company establishes provisions based on fair estimations. The company accounts for

the provision of corporation tax expenses for the submission of the corporation tax return to

HMRC. The company has recorded on the accrual basis and provide for this expense on

reasonable estimation.

AUDITED FINANCIAL STATEMENTS

Notes to Financial Statements:

1. Basis of Preparation and Accounting Policies:

The company has adopted the “historical cost” model for accounting purposes, and books

are maintained on the “accrual basis” of accounting to record expenses. The company has

prepared financial statements based on accounting standards and policies. The management

requires to apply judgment to estimate a few items to prepare the books of accounts.

2. Revenue:

The company has recorded only that revenue where the company is satisfied that the

entity will achieve the “economic benefits,” and the benefits are reliably measurable. The

company is in the first year of its operations, and hence the revenue is generated from bank

interest. The company is in the financial service sector and, therefore, will derive income from

borrowing and lending the funds.

Revenue Amount in GBP

Interest income £ 3.61

3. Corporation Tax expense:

The company establishes provisions based on fair estimations. The company accounts for

the provision of corporation tax expenses for the submission of the corporation tax return to

HMRC. The company has recorded on the accrual basis and provide for this expense on

reasonable estimation.

11

AUDITED FINANCIAL STATEMENTS

Corporation tax expense Amount in GBP

Provision for corporation tax return £5,000.00

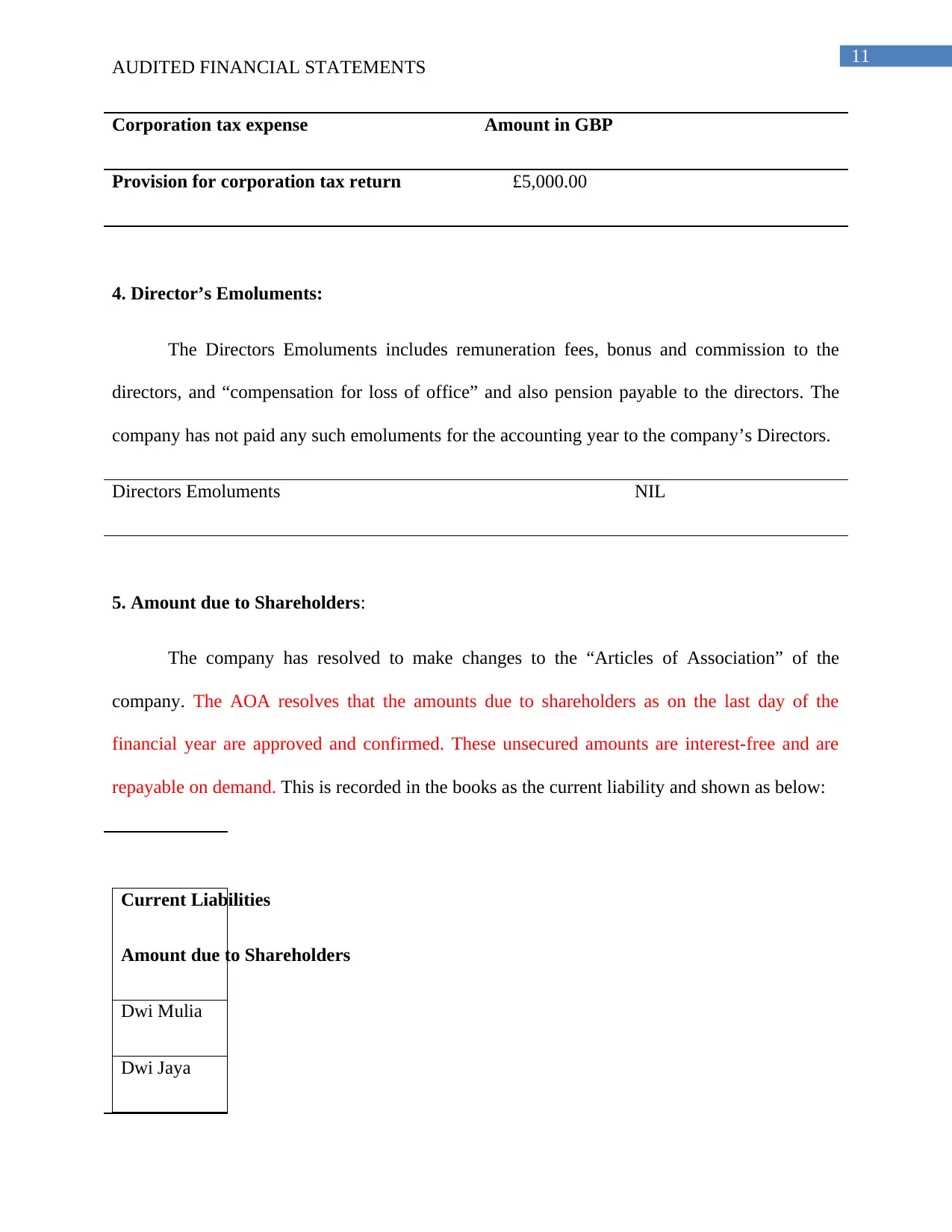

4. Director’s Emoluments:

The Directors Emoluments includes remuneration fees, bonus and commission to the

directors, and “compensation for loss of office” and also pension payable to the directors. The

company has not paid any such emoluments for the accounting year to the company’s Directors.

Directors Emoluments NIL

5. Amount due to Shareholders:

The company has resolved to make changes to the “Articles of Association” of the

company. The AOA resolves that the amounts due to shareholders as on the last day of the

financial year are approved and confirmed. These unsecured amounts are interest-free and are

repayable on demand. This is recorded in the books as the current liability and shown as below:

Current Liabilities

Amount due to Shareholders

Dwi Mulia

Dwi Jaya

AUDITED FINANCIAL STATEMENTS

Corporation tax expense Amount in GBP

Provision for corporation tax return £5,000.00

4. Director’s Emoluments:

The Directors Emoluments includes remuneration fees, bonus and commission to the

directors, and “compensation for loss of office” and also pension payable to the directors. The

company has not paid any such emoluments for the accounting year to the company’s Directors.

Directors Emoluments NIL

5. Amount due to Shareholders:

The company has resolved to make changes to the “Articles of Association” of the

company. The AOA resolves that the amounts due to shareholders as on the last day of the

financial year are approved and confirmed. These unsecured amounts are interest-free and are

repayable on demand. This is recorded in the books as the current liability and shown as below:

Current Liabilities

Amount due to Shareholders

Dwi Mulia

Dwi Jaya

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.