Auditing as a process to inspect and examine the finas

VerifiedAdded on 2021/10/12

|18

|3743

|217

AI Summary

The second part of the report involves in the analysis of the inherent risk of material misstatements of Cochlear Limited at financial report level. Analytical Procedures Comparison of Income Statement and Balance Sheet for Last Three Years Particulars 2016 ($m) 2017 ($m) 2018 ($m) Change in % from 2016 to 2017 Change in % from 2017 to 2018 Revenue 1,130.6 1,253.8 1,363.7 10.9% 8.8% Cost of Sales 333.6 358.4 91.2 7.4% 0.8%

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: AUDITING

Auditing

Name of the Student

Name of the University

Author’s Note

Auditing

Name of the Student

Name of the University

Author’s Note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1AUDITING

Table of Contents

Executive Summary.....................................................................................................................................2

Analytical Procedures..................................................................................................................................3

Risk of Material Misstatements (Inherent Risk) at the Financial Report Level..........................................10

Risk of Material Misstatements (Inherent Risk) at the Assertion Level.....................................................14

References.................................................................................................................................................16

Table of Contents

Executive Summary.....................................................................................................................................2

Analytical Procedures..................................................................................................................................3

Risk of Material Misstatements (Inherent Risk) at the Financial Report Level..........................................10

Risk of Material Misstatements (Inherent Risk) at the Assertion Level.....................................................14

References.................................................................................................................................................16

2AUDITING

Executive Summary

Auditing can be considered as the process to inspect and examine the financial statements of

the companies with the aim to find any kind of material misstatements in them. At the time to conduct

the audit procedures, it is the requirements for the auditors to take into consideration the analysis of

the inherent audit risks in both financial report level and assertion level. The main aim of this report is

the analysis and evaluation of different aspects of audit risk analysis of one of the major Australian

companies that is Cochlear Limited. Cochlear Limited is an Australian Securities Exchange (ASX) listed

company involves in the business of designing, manufacturing and supplying the Nucleus cochlear

implant, the Hybrid electro-acoustic implant and the Baha bone conduction implant. There are three

major parts of this report. The first part of the report involves in the application of two analytical

procedures with the aim to analyze the financial statements and information of Cochlear Limited. More

specifically, this part involves in the application of the comparison of the income statement and balance

sheet of the company for the last three years along with the analysis of profitability, liquidity, efficiency

and leverage ratios. The second part of the report involves in the analysis of the inherent risk of material

misstatements of Cochlear Limited at financial report level. On a specified note, five specific factors are

taken into consideration for this part. The last part of the report involves in the inherent risk of material

misstatements at the assertion level that is the analysis of three specific account balances at risk of

material misstatements.

Executive Summary

Auditing can be considered as the process to inspect and examine the financial statements of

the companies with the aim to find any kind of material misstatements in them. At the time to conduct

the audit procedures, it is the requirements for the auditors to take into consideration the analysis of

the inherent audit risks in both financial report level and assertion level. The main aim of this report is

the analysis and evaluation of different aspects of audit risk analysis of one of the major Australian

companies that is Cochlear Limited. Cochlear Limited is an Australian Securities Exchange (ASX) listed

company involves in the business of designing, manufacturing and supplying the Nucleus cochlear

implant, the Hybrid electro-acoustic implant and the Baha bone conduction implant. There are three

major parts of this report. The first part of the report involves in the application of two analytical

procedures with the aim to analyze the financial statements and information of Cochlear Limited. More

specifically, this part involves in the application of the comparison of the income statement and balance

sheet of the company for the last three years along with the analysis of profitability, liquidity, efficiency

and leverage ratios. The second part of the report involves in the analysis of the inherent risk of material

misstatements of Cochlear Limited at financial report level. On a specified note, five specific factors are

taken into consideration for this part. The last part of the report involves in the inherent risk of material

misstatements at the assertion level that is the analysis of three specific account balances at risk of

material misstatements.

3AUDITING

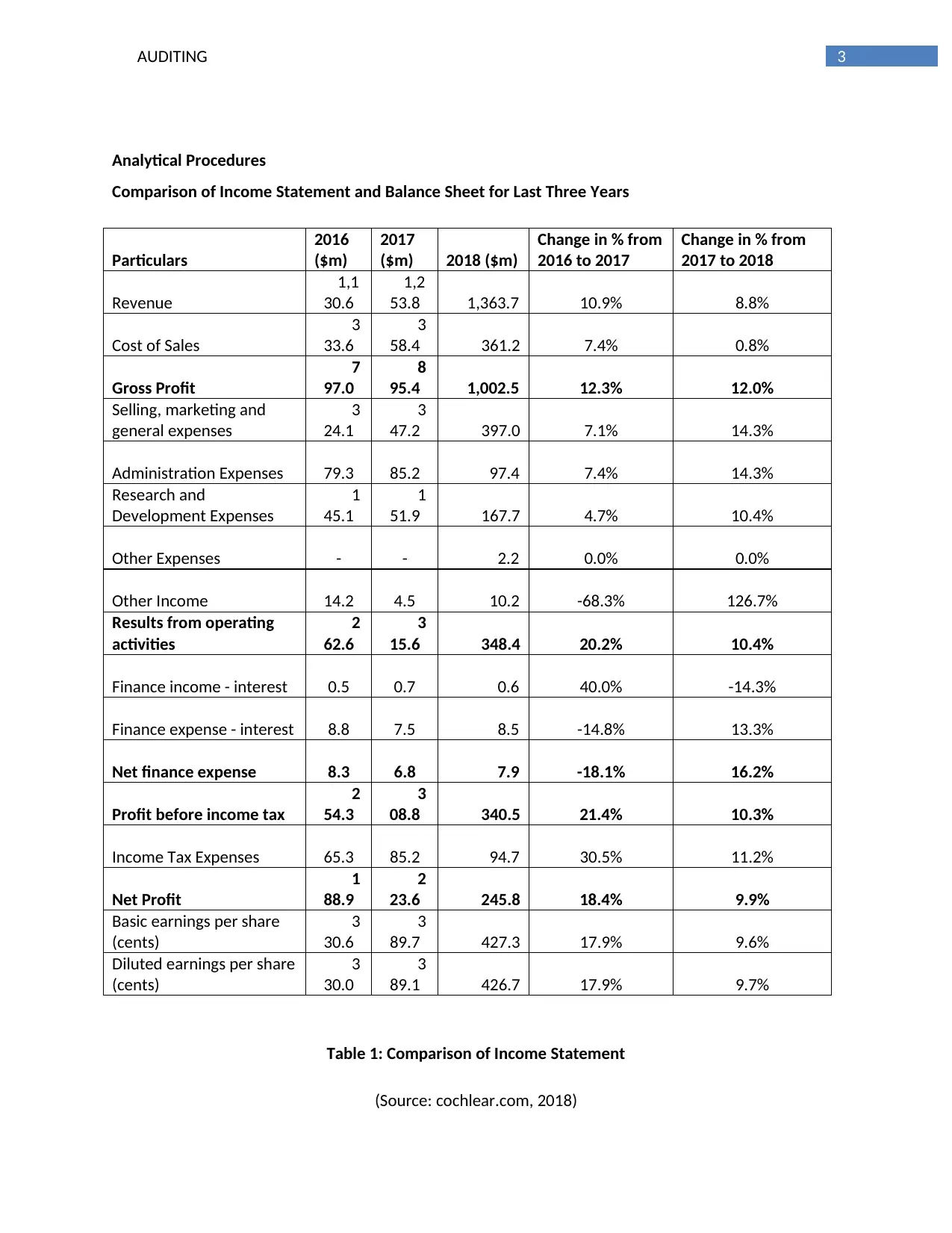

Analytical Procedures

Comparison of Income Statement and Balance Sheet for Last Three Years

Particulars

2016

($m)

2017

($m) 2018 ($m)

Change in % from

2016 to 2017

Change in % from

2017 to 2018

Revenue

1,1

30.6

1,2

53.8 1,363.7 10.9% 8.8%

Cost of Sales

3

33.6

3

58.4 361.2 7.4% 0.8%

Gross Profit

7

97.0

8

95.4 1,002.5 12.3% 12.0%

Selling, marketing and

general expenses

3

24.1

3

47.2 397.0 7.1% 14.3%

Administration Expenses 79.3 85.2 97.4 7.4% 14.3%

Research and

Development Expenses

1

45.1

1

51.9 167.7 4.7% 10.4%

Other Expenses - - 2.2 0.0% 0.0%

Other Income 14.2 4.5 10.2 -68.3% 126.7%

Results from operating

activities

2

62.6

3

15.6 348.4 20.2% 10.4%

Finance income - interest 0.5 0.7 0.6 40.0% -14.3%

Finance expense - interest 8.8 7.5 8.5 -14.8% 13.3%

Net finance expense 8.3 6.8 7.9 -18.1% 16.2%

Profit before income tax

2

54.3

3

08.8 340.5 21.4% 10.3%

Income Tax Expenses 65.3 85.2 94.7 30.5% 11.2%

Net Profit

1

88.9

2

23.6 245.8 18.4% 9.9%

Basic earnings per share

(cents)

3

30.6

3

89.7 427.3 17.9% 9.6%

Diluted earnings per share

(cents)

3

30.0

3

89.1 426.7 17.9% 9.7%

Table 1: Comparison of Income Statement

(Source: cochlear.com, 2018)

Analytical Procedures

Comparison of Income Statement and Balance Sheet for Last Three Years

Particulars

2016

($m)

2017

($m) 2018 ($m)

Change in % from

2016 to 2017

Change in % from

2017 to 2018

Revenue

1,1

30.6

1,2

53.8 1,363.7 10.9% 8.8%

Cost of Sales

3

33.6

3

58.4 361.2 7.4% 0.8%

Gross Profit

7

97.0

8

95.4 1,002.5 12.3% 12.0%

Selling, marketing and

general expenses

3

24.1

3

47.2 397.0 7.1% 14.3%

Administration Expenses 79.3 85.2 97.4 7.4% 14.3%

Research and

Development Expenses

1

45.1

1

51.9 167.7 4.7% 10.4%

Other Expenses - - 2.2 0.0% 0.0%

Other Income 14.2 4.5 10.2 -68.3% 126.7%

Results from operating

activities

2

62.6

3

15.6 348.4 20.2% 10.4%

Finance income - interest 0.5 0.7 0.6 40.0% -14.3%

Finance expense - interest 8.8 7.5 8.5 -14.8% 13.3%

Net finance expense 8.3 6.8 7.9 -18.1% 16.2%

Profit before income tax

2

54.3

3

08.8 340.5 21.4% 10.3%

Income Tax Expenses 65.3 85.2 94.7 30.5% 11.2%

Net Profit

1

88.9

2

23.6 245.8 18.4% 9.9%

Basic earnings per share

(cents)

3

30.6

3

89.7 427.3 17.9% 9.6%

Diluted earnings per share

(cents)

3

30.0

3

89.1 426.7 17.9% 9.7%

Table 1: Comparison of Income Statement

(Source: cochlear.com, 2018)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4AUDITING

According to the above table, there are three items that need a thorough investigation; they are

Other Income, Finance Income (Interest) and Finance Expenses (Interest). In case of all of these three

items, it can be observed that there are some major fluctuations in these amounts in the last three

years. For example, there is an increase in finance income of Cochlear Limited in the year 2017 from

2016; but, decrease can again be seen in the year 2018. In case of both other income and finance

expenses, decrease can be seen in 2017 from 2016 and increase in 2018. These fluctuations are not

healthy for the growth of Cochlear Limited. Investigation of these aspects would helpful in identifying

the reasons for these fluctuations (Fazzini, 2018).

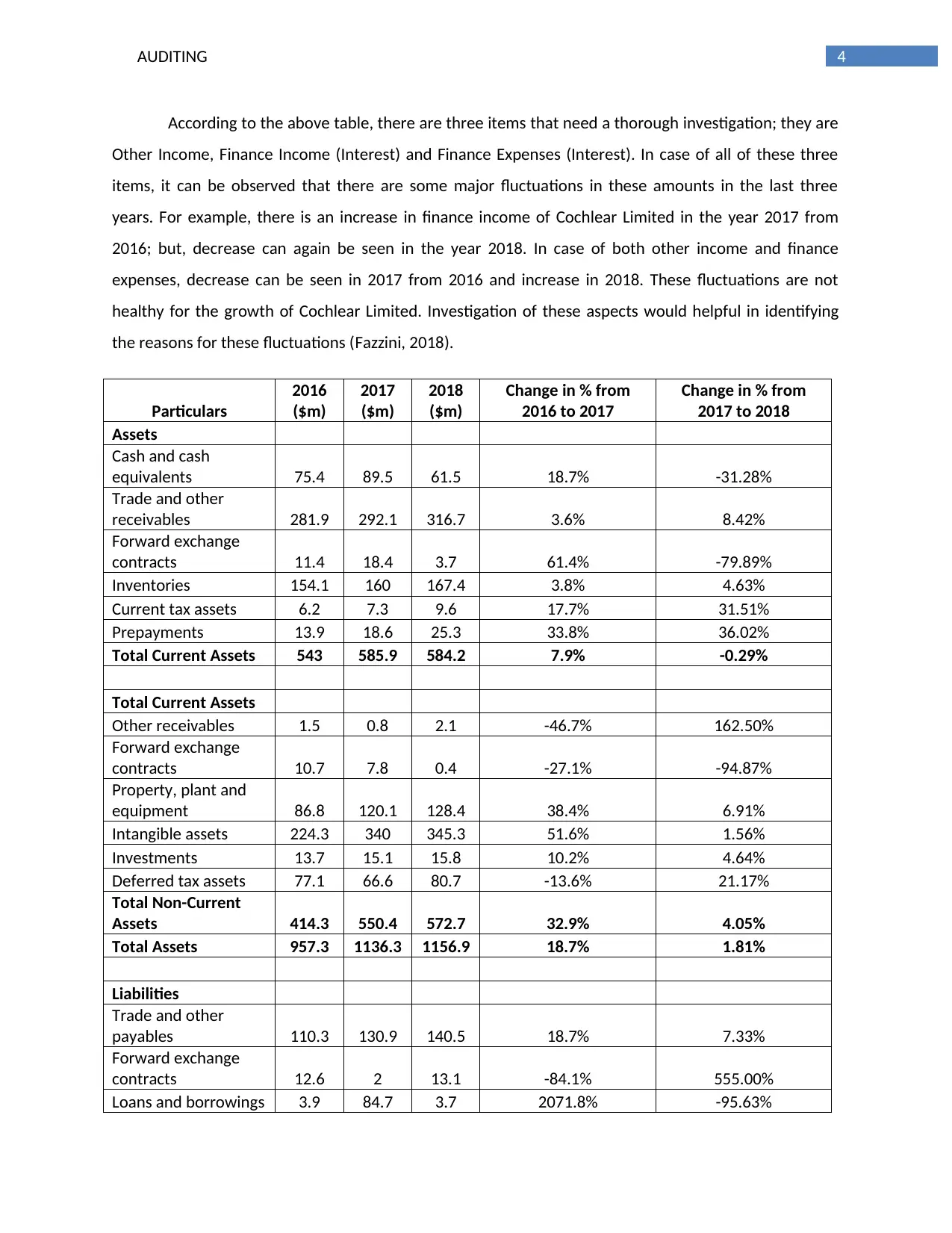

Particulars

2016

($m)

2017

($m)

2018

($m)

Change in % from

2016 to 2017

Change in % from

2017 to 2018

Assets

Cash and cash

equivalents 75.4 89.5 61.5 18.7% -31.28%

Trade and other

receivables 281.9 292.1 316.7 3.6% 8.42%

Forward exchange

contracts 11.4 18.4 3.7 61.4% -79.89%

Inventories 154.1 160 167.4 3.8% 4.63%

Current tax assets 6.2 7.3 9.6 17.7% 31.51%

Prepayments 13.9 18.6 25.3 33.8% 36.02%

Total Current Assets 543 585.9 584.2 7.9% -0.29%

Total Current Assets

Other receivables 1.5 0.8 2.1 -46.7% 162.50%

Forward exchange

contracts 10.7 7.8 0.4 -27.1% -94.87%

Property, plant and

equipment 86.8 120.1 128.4 38.4% 6.91%

Intangible assets 224.3 340 345.3 51.6% 1.56%

Investments 13.7 15.1 15.8 10.2% 4.64%

Deferred tax assets 77.1 66.6 80.7 -13.6% 21.17%

Total Non-Current

Assets 414.3 550.4 572.7 32.9% 4.05%

Total Assets 957.3 1136.3 1156.9 18.7% 1.81%

Liabilities

Trade and other

payables 110.3 130.9 140.5 18.7% 7.33%

Forward exchange

contracts 12.6 2 13.1 -84.1% 555.00%

Loans and borrowings 3.9 84.7 3.7 2071.8% -95.63%

According to the above table, there are three items that need a thorough investigation; they are

Other Income, Finance Income (Interest) and Finance Expenses (Interest). In case of all of these three

items, it can be observed that there are some major fluctuations in these amounts in the last three

years. For example, there is an increase in finance income of Cochlear Limited in the year 2017 from

2016; but, decrease can again be seen in the year 2018. In case of both other income and finance

expenses, decrease can be seen in 2017 from 2016 and increase in 2018. These fluctuations are not

healthy for the growth of Cochlear Limited. Investigation of these aspects would helpful in identifying

the reasons for these fluctuations (Fazzini, 2018).

Particulars

2016

($m)

2017

($m)

2018

($m)

Change in % from

2016 to 2017

Change in % from

2017 to 2018

Assets

Cash and cash

equivalents 75.4 89.5 61.5 18.7% -31.28%

Trade and other

receivables 281.9 292.1 316.7 3.6% 8.42%

Forward exchange

contracts 11.4 18.4 3.7 61.4% -79.89%

Inventories 154.1 160 167.4 3.8% 4.63%

Current tax assets 6.2 7.3 9.6 17.7% 31.51%

Prepayments 13.9 18.6 25.3 33.8% 36.02%

Total Current Assets 543 585.9 584.2 7.9% -0.29%

Total Current Assets

Other receivables 1.5 0.8 2.1 -46.7% 162.50%

Forward exchange

contracts 10.7 7.8 0.4 -27.1% -94.87%

Property, plant and

equipment 86.8 120.1 128.4 38.4% 6.91%

Intangible assets 224.3 340 345.3 51.6% 1.56%

Investments 13.7 15.1 15.8 10.2% 4.64%

Deferred tax assets 77.1 66.6 80.7 -13.6% 21.17%

Total Non-Current

Assets 414.3 550.4 572.7 32.9% 4.05%

Total Assets 957.3 1136.3 1156.9 18.7% 1.81%

Liabilities

Trade and other

payables 110.3 130.9 140.5 18.7% 7.33%

Forward exchange

contracts 12.6 2 13.1 -84.1% 555.00%

Loans and borrowings 3.9 84.7 3.7 2071.8% -95.63%

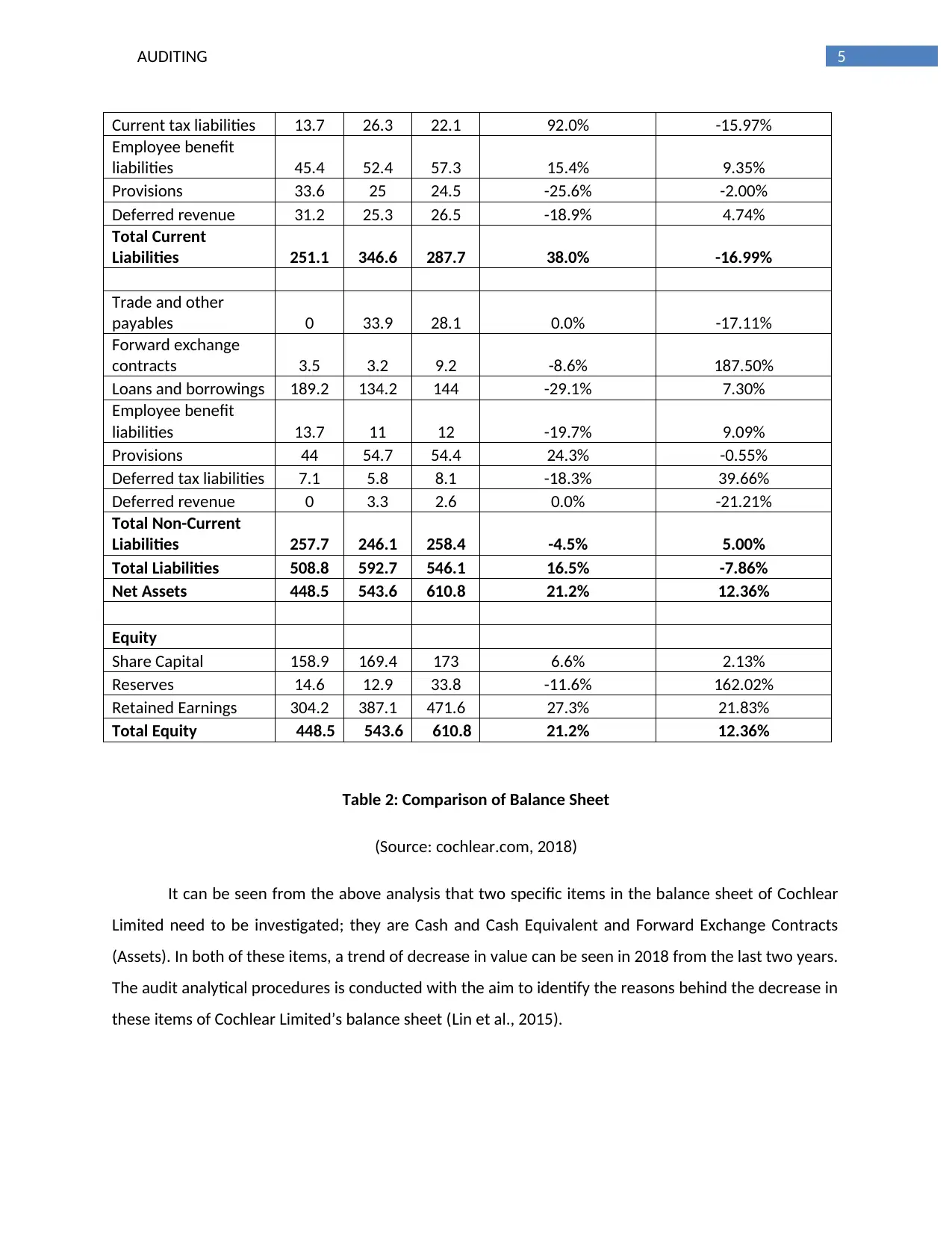

5AUDITING

Current tax liabilities 13.7 26.3 22.1 92.0% -15.97%

Employee benefit

liabilities 45.4 52.4 57.3 15.4% 9.35%

Provisions 33.6 25 24.5 -25.6% -2.00%

Deferred revenue 31.2 25.3 26.5 -18.9% 4.74%

Total Current

Liabilities 251.1 346.6 287.7 38.0% -16.99%

Trade and other

payables 0 33.9 28.1 0.0% -17.11%

Forward exchange

contracts 3.5 3.2 9.2 -8.6% 187.50%

Loans and borrowings 189.2 134.2 144 -29.1% 7.30%

Employee benefit

liabilities 13.7 11 12 -19.7% 9.09%

Provisions 44 54.7 54.4 24.3% -0.55%

Deferred tax liabilities 7.1 5.8 8.1 -18.3% 39.66%

Deferred revenue 0 3.3 2.6 0.0% -21.21%

Total Non-Current

Liabilities 257.7 246.1 258.4 -4.5% 5.00%

Total Liabilities 508.8 592.7 546.1 16.5% -7.86%

Net Assets 448.5 543.6 610.8 21.2% 12.36%

Equity

Share Capital 158.9 169.4 173 6.6% 2.13%

Reserves 14.6 12.9 33.8 -11.6% 162.02%

Retained Earnings 304.2 387.1 471.6 27.3% 21.83%

Total Equity 448.5 543.6 610.8 21.2% 12.36%

Table 2: Comparison of Balance Sheet

(Source: cochlear.com, 2018)

It can be seen from the above analysis that two specific items in the balance sheet of Cochlear

Limited need to be investigated; they are Cash and Cash Equivalent and Forward Exchange Contracts

(Assets). In both of these items, a trend of decrease in value can be seen in 2018 from the last two years.

The audit analytical procedures is conducted with the aim to identify the reasons behind the decrease in

these items of Cochlear Limited’s balance sheet (Lin et al., 2015).

Current tax liabilities 13.7 26.3 22.1 92.0% -15.97%

Employee benefit

liabilities 45.4 52.4 57.3 15.4% 9.35%

Provisions 33.6 25 24.5 -25.6% -2.00%

Deferred revenue 31.2 25.3 26.5 -18.9% 4.74%

Total Current

Liabilities 251.1 346.6 287.7 38.0% -16.99%

Trade and other

payables 0 33.9 28.1 0.0% -17.11%

Forward exchange

contracts 3.5 3.2 9.2 -8.6% 187.50%

Loans and borrowings 189.2 134.2 144 -29.1% 7.30%

Employee benefit

liabilities 13.7 11 12 -19.7% 9.09%

Provisions 44 54.7 54.4 24.3% -0.55%

Deferred tax liabilities 7.1 5.8 8.1 -18.3% 39.66%

Deferred revenue 0 3.3 2.6 0.0% -21.21%

Total Non-Current

Liabilities 257.7 246.1 258.4 -4.5% 5.00%

Total Liabilities 508.8 592.7 546.1 16.5% -7.86%

Net Assets 448.5 543.6 610.8 21.2% 12.36%

Equity

Share Capital 158.9 169.4 173 6.6% 2.13%

Reserves 14.6 12.9 33.8 -11.6% 162.02%

Retained Earnings 304.2 387.1 471.6 27.3% 21.83%

Total Equity 448.5 543.6 610.8 21.2% 12.36%

Table 2: Comparison of Balance Sheet

(Source: cochlear.com, 2018)

It can be seen from the above analysis that two specific items in the balance sheet of Cochlear

Limited need to be investigated; they are Cash and Cash Equivalent and Forward Exchange Contracts

(Assets). In both of these items, a trend of decrease in value can be seen in 2018 from the last two years.

The audit analytical procedures is conducted with the aim to identify the reasons behind the decrease in

these items of Cochlear Limited’s balance sheet (Lin et al., 2015).

6AUDITING

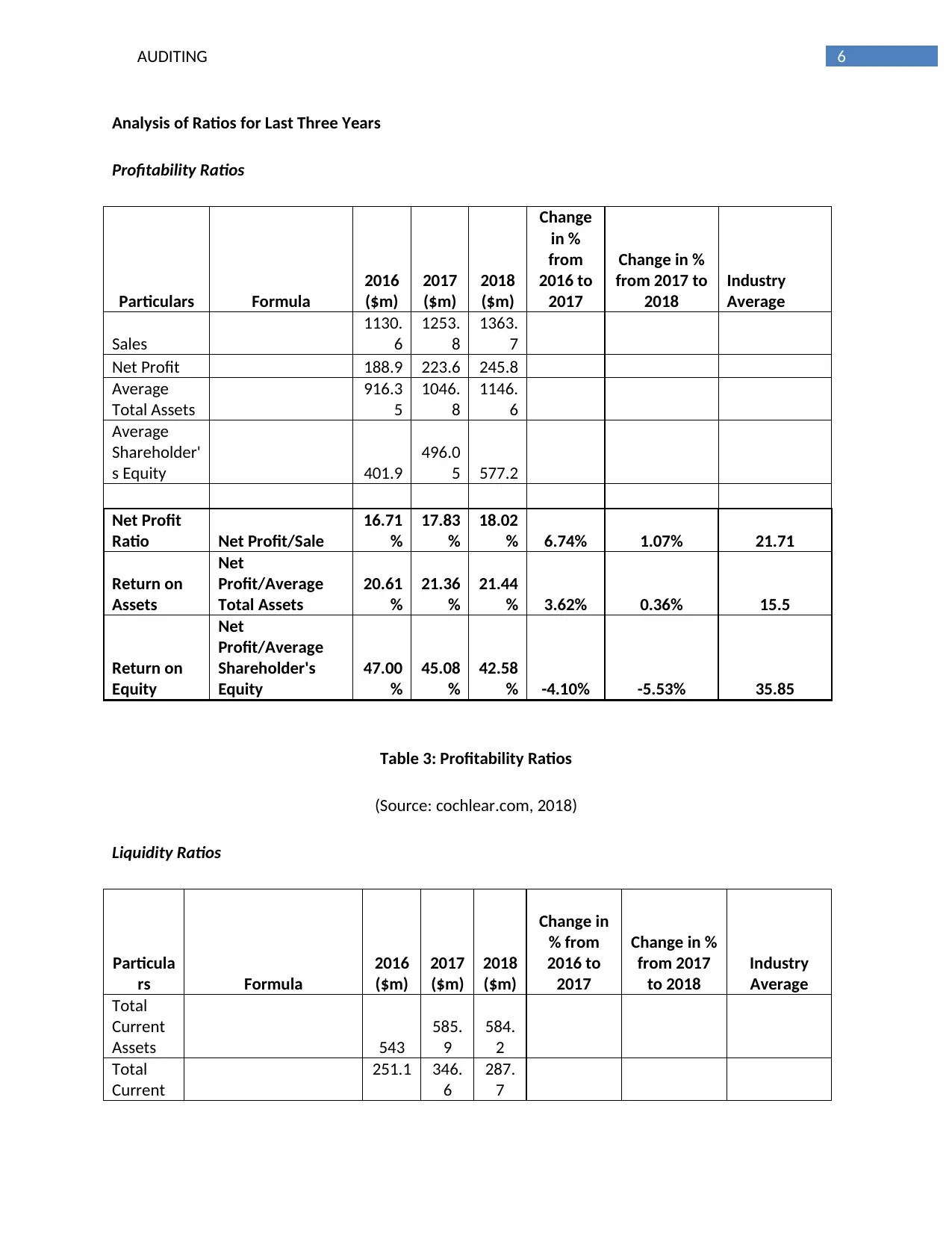

Analysis of Ratios for Last Three Years

Profitability Ratios

Particulars Formula

2016

($m)

2017

($m)

2018

($m)

Change

in %

from

2016 to

2017

Change in %

from 2017 to

2018

Industry

Average

Sales

1130.

6

1253.

8

1363.

7

Net Profit 188.9 223.6 245.8

Average

Total Assets

916.3

5

1046.

8

1146.

6

Average

Shareholder'

s Equity 401.9

496.0

5 577.2

Net Profit

Ratio Net Profit/Sale

16.71

%

17.83

%

18.02

% 6.74% 1.07% 21.71

Return on

Assets

Net

Profit/Average

Total Assets

20.61

%

21.36

%

21.44

% 3.62% 0.36% 15.5

Return on

Equity

Net

Profit/Average

Shareholder's

Equity

47.00

%

45.08

%

42.58

% -4.10% -5.53% 35.85

Table 3: Profitability Ratios

(Source: cochlear.com, 2018)

Liquidity Ratios

Particula

rs Formula

2016

($m)

2017

($m)

2018

($m)

Change in

% from

2016 to

2017

Change in %

from 2017

to 2018

Industry

Average

Total

Current

Assets 543

585.

9

584.

2

Total

Current

251.1 346.

6

287.

7

Analysis of Ratios for Last Three Years

Profitability Ratios

Particulars Formula

2016

($m)

2017

($m)

2018

($m)

Change

in %

from

2016 to

2017

Change in %

from 2017 to

2018

Industry

Average

Sales

1130.

6

1253.

8

1363.

7

Net Profit 188.9 223.6 245.8

Average

Total Assets

916.3

5

1046.

8

1146.

6

Average

Shareholder'

s Equity 401.9

496.0

5 577.2

Net Profit

Ratio Net Profit/Sale

16.71

%

17.83

%

18.02

% 6.74% 1.07% 21.71

Return on

Assets

Net

Profit/Average

Total Assets

20.61

%

21.36

%

21.44

% 3.62% 0.36% 15.5

Return on

Equity

Net

Profit/Average

Shareholder's

Equity

47.00

%

45.08

%

42.58

% -4.10% -5.53% 35.85

Table 3: Profitability Ratios

(Source: cochlear.com, 2018)

Liquidity Ratios

Particula

rs Formula

2016

($m)

2017

($m)

2018

($m)

Change in

% from

2016 to

2017

Change in %

from 2017

to 2018

Industry

Average

Total

Current

Assets 543

585.

9

584.

2

Total

Current

251.1 346.

6

287.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7AUDITING

Liabilitie

s

Inventori

es 154.1 160

167.

4

Prepaid

Expense

s 13.9 18.6 25.3

Current

Ratio

Current

Assets/Current

Liabilities 2.16 1.69 2.03 -21.83% 20.12%

2.76

Quick

Ratio

Current Assets-

Inventories-Prepaid

Expenses/Current

Liabilities 1.49 1.18 1.36 -21.31% 15.80% 1.68

Table 4: Liquidity Ratios

(Source: cochlear.com, 2018)

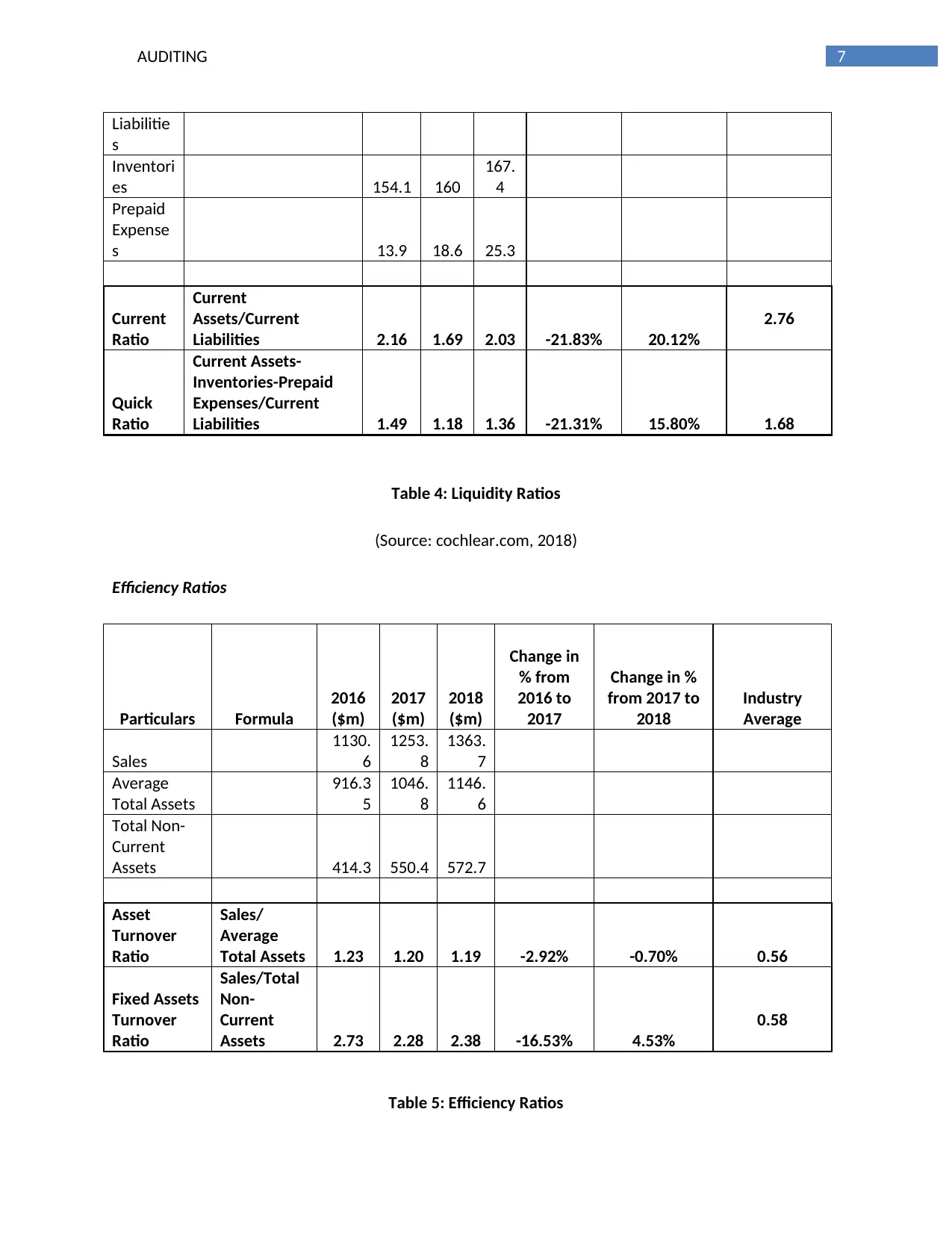

Efficiency Ratios

Particulars Formula

2016

($m)

2017

($m)

2018

($m)

Change in

% from

2016 to

2017

Change in %

from 2017 to

2018

Industry

Average

Sales

1130.

6

1253.

8

1363.

7

Average

Total Assets

916.3

5

1046.

8

1146.

6

Total Non-

Current

Assets 414.3 550.4 572.7

Asset

Turnover

Ratio

Sales/

Average

Total Assets 1.23 1.20 1.19 -2.92% -0.70% 0.56

Fixed Assets

Turnover

Ratio

Sales/Total

Non-

Current

Assets 2.73 2.28 2.38 -16.53% 4.53%

0.58

Table 5: Efficiency Ratios

Liabilitie

s

Inventori

es 154.1 160

167.

4

Prepaid

Expense

s 13.9 18.6 25.3

Current

Ratio

Current

Assets/Current

Liabilities 2.16 1.69 2.03 -21.83% 20.12%

2.76

Quick

Ratio

Current Assets-

Inventories-Prepaid

Expenses/Current

Liabilities 1.49 1.18 1.36 -21.31% 15.80% 1.68

Table 4: Liquidity Ratios

(Source: cochlear.com, 2018)

Efficiency Ratios

Particulars Formula

2016

($m)

2017

($m)

2018

($m)

Change in

% from

2016 to

2017

Change in %

from 2017 to

2018

Industry

Average

Sales

1130.

6

1253.

8

1363.

7

Average

Total Assets

916.3

5

1046.

8

1146.

6

Total Non-

Current

Assets 414.3 550.4 572.7

Asset

Turnover

Ratio

Sales/

Average

Total Assets 1.23 1.20 1.19 -2.92% -0.70% 0.56

Fixed Assets

Turnover

Ratio

Sales/Total

Non-

Current

Assets 2.73 2.28 2.38 -16.53% 4.53%

0.58

Table 5: Efficiency Ratios

8AUDITING

(Source: cochlear.com, 2018)

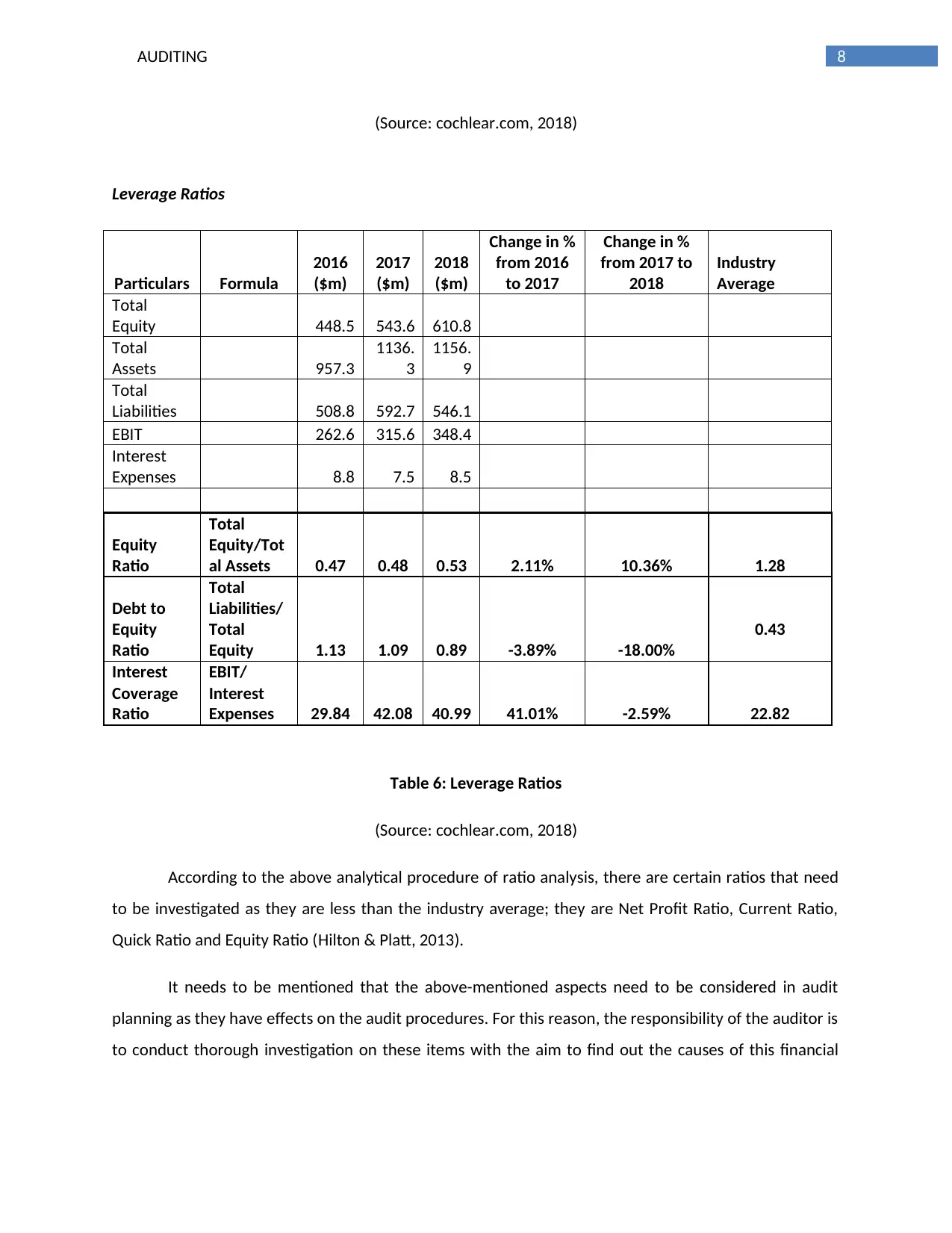

Leverage Ratios

Particulars Formula

2016

($m)

2017

($m)

2018

($m)

Change in %

from 2016

to 2017

Change in %

from 2017 to

2018

Industry

Average

Total

Equity 448.5 543.6 610.8

Total

Assets 957.3

1136.

3

1156.

9

Total

Liabilities 508.8 592.7 546.1

EBIT 262.6 315.6 348.4

Interest

Expenses 8.8 7.5 8.5

Equity

Ratio

Total

Equity/Tot

al Assets 0.47 0.48 0.53 2.11% 10.36% 1.28

Debt to

Equity

Ratio

Total

Liabilities/

Total

Equity 1.13 1.09 0.89 -3.89% -18.00%

0.43

Interest

Coverage

Ratio

EBIT/

Interest

Expenses 29.84 42.08 40.99 41.01% -2.59% 22.82

Table 6: Leverage Ratios

(Source: cochlear.com, 2018)

According to the above analytical procedure of ratio analysis, there are certain ratios that need

to be investigated as they are less than the industry average; they are Net Profit Ratio, Current Ratio,

Quick Ratio and Equity Ratio (Hilton & Platt, 2013).

It needs to be mentioned that the above-mentioned aspects need to be considered in audit

planning as they have effects on the audit procedures. For this reason, the responsibility of the auditor is

to conduct thorough investigation on these items with the aim to find out the causes of this financial

(Source: cochlear.com, 2018)

Leverage Ratios

Particulars Formula

2016

($m)

2017

($m)

2018

($m)

Change in %

from 2016

to 2017

Change in %

from 2017 to

2018

Industry

Average

Total

Equity 448.5 543.6 610.8

Total

Assets 957.3

1136.

3

1156.

9

Total

Liabilities 508.8 592.7 546.1

EBIT 262.6 315.6 348.4

Interest

Expenses 8.8 7.5 8.5

Equity

Ratio

Total

Equity/Tot

al Assets 0.47 0.48 0.53 2.11% 10.36% 1.28

Debt to

Equity

Ratio

Total

Liabilities/

Total

Equity 1.13 1.09 0.89 -3.89% -18.00%

0.43

Interest

Coverage

Ratio

EBIT/

Interest

Expenses 29.84 42.08 40.99 41.01% -2.59% 22.82

Table 6: Leverage Ratios

(Source: cochlear.com, 2018)

According to the above analytical procedure of ratio analysis, there are certain ratios that need

to be investigated as they are less than the industry average; they are Net Profit Ratio, Current Ratio,

Quick Ratio and Equity Ratio (Hilton & Platt, 2013).

It needs to be mentioned that the above-mentioned aspects need to be considered in audit

planning as they have effects on the audit procedures. For this reason, the responsibility of the auditor is

to conduct thorough investigation on these items with the aim to find out the causes of this financial

9AUDITING

inconsistency. Most importantly, the auditor needs to put major emphasis on these items for the

purpose of audit planning decisions.

Conclusion

The above analytical procedures of simple comparison and ratio analysis indicate that the

auditors of Cochlear Limited is needed to take into consideration the above increase or decrease in the

values and ratios for the purpose of audit planning decision.

inconsistency. Most importantly, the auditor needs to put major emphasis on these items for the

purpose of audit planning decisions.

Conclusion

The above analytical procedures of simple comparison and ratio analysis indicate that the

auditors of Cochlear Limited is needed to take into consideration the above increase or decrease in the

values and ratios for the purpose of audit planning decision.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10AUDITING

Risk of Material Misstatements (Inherent Risk) at the Financial Report Level

The following discussion analyzes that inherent risk of material misstatements of Cochlear

Limited at financial report level based on five specific parameters:

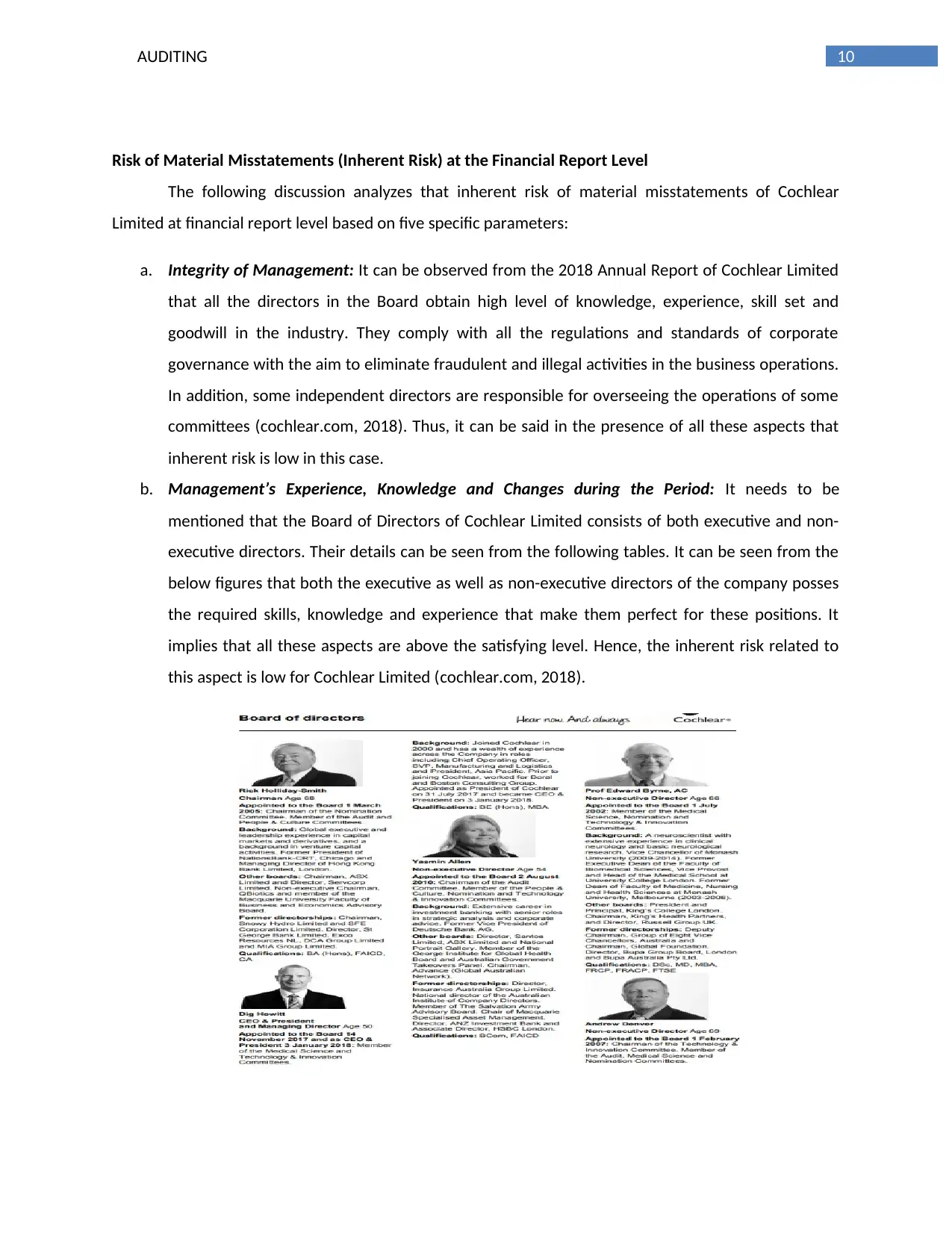

a. Integrity of Management: It can be observed from the 2018 Annual Report of Cochlear Limited

that all the directors in the Board obtain high level of knowledge, experience, skill set and

goodwill in the industry. They comply with all the regulations and standards of corporate

governance with the aim to eliminate fraudulent and illegal activities in the business operations.

In addition, some independent directors are responsible for overseeing the operations of some

committees (cochlear.com, 2018). Thus, it can be said in the presence of all these aspects that

inherent risk is low in this case.

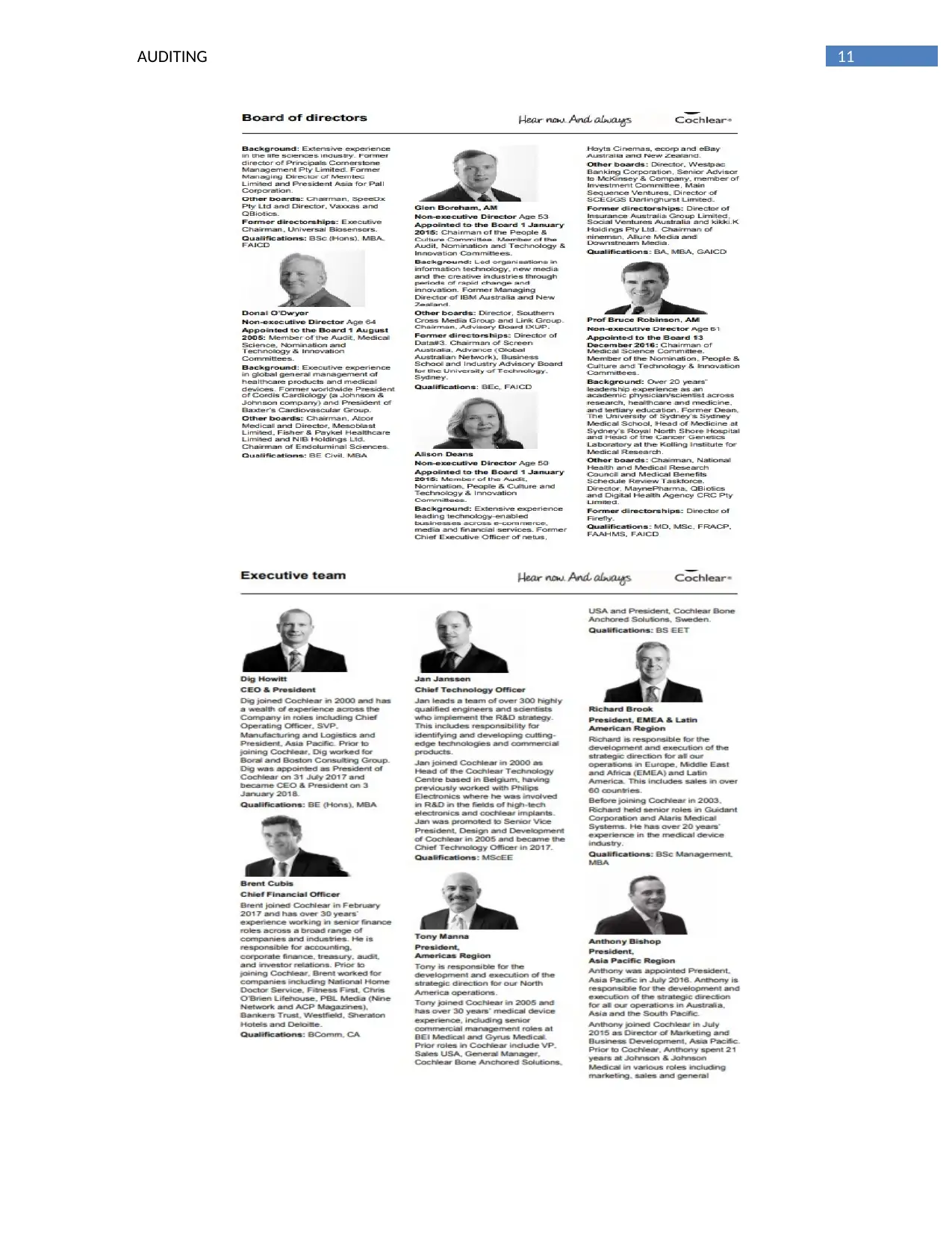

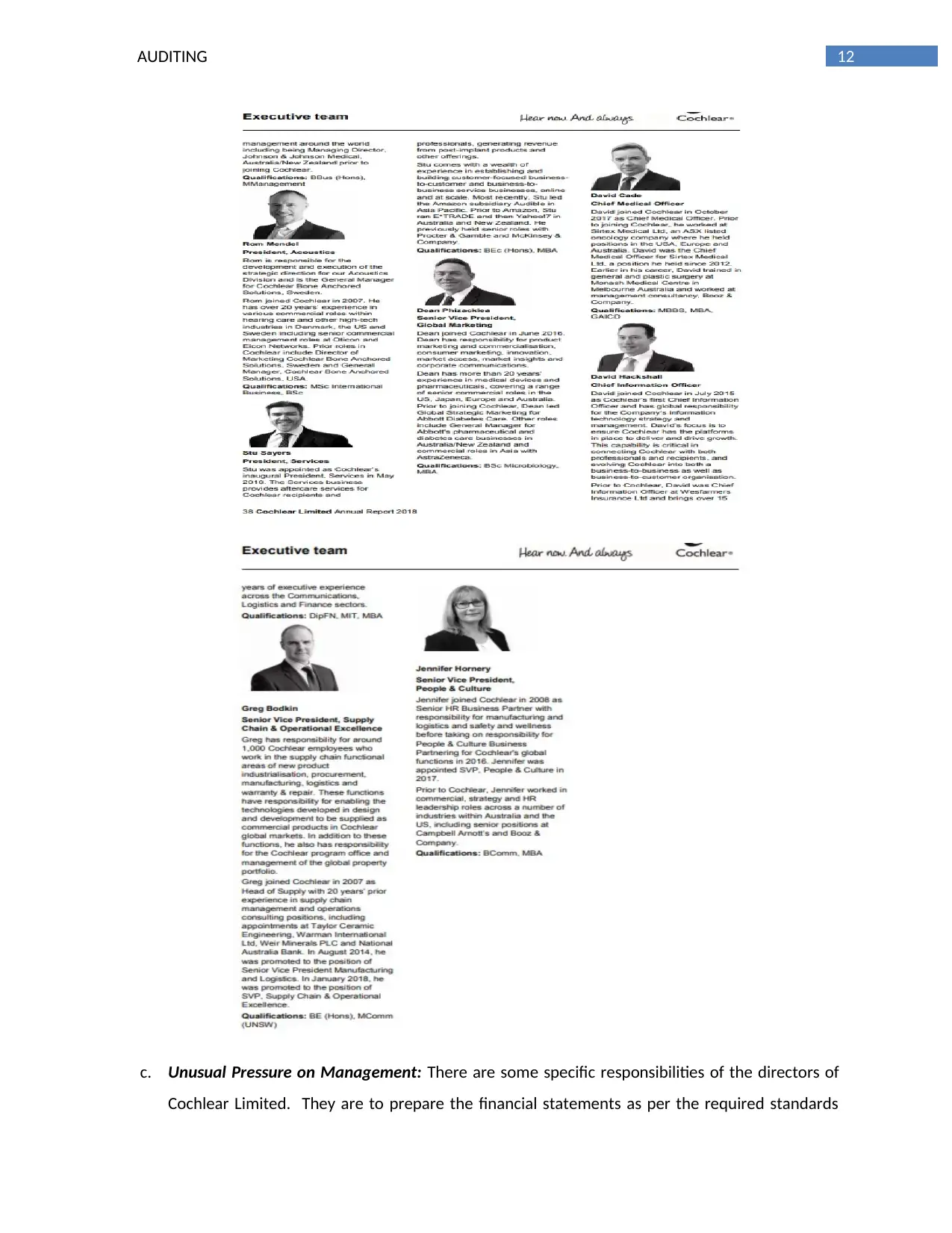

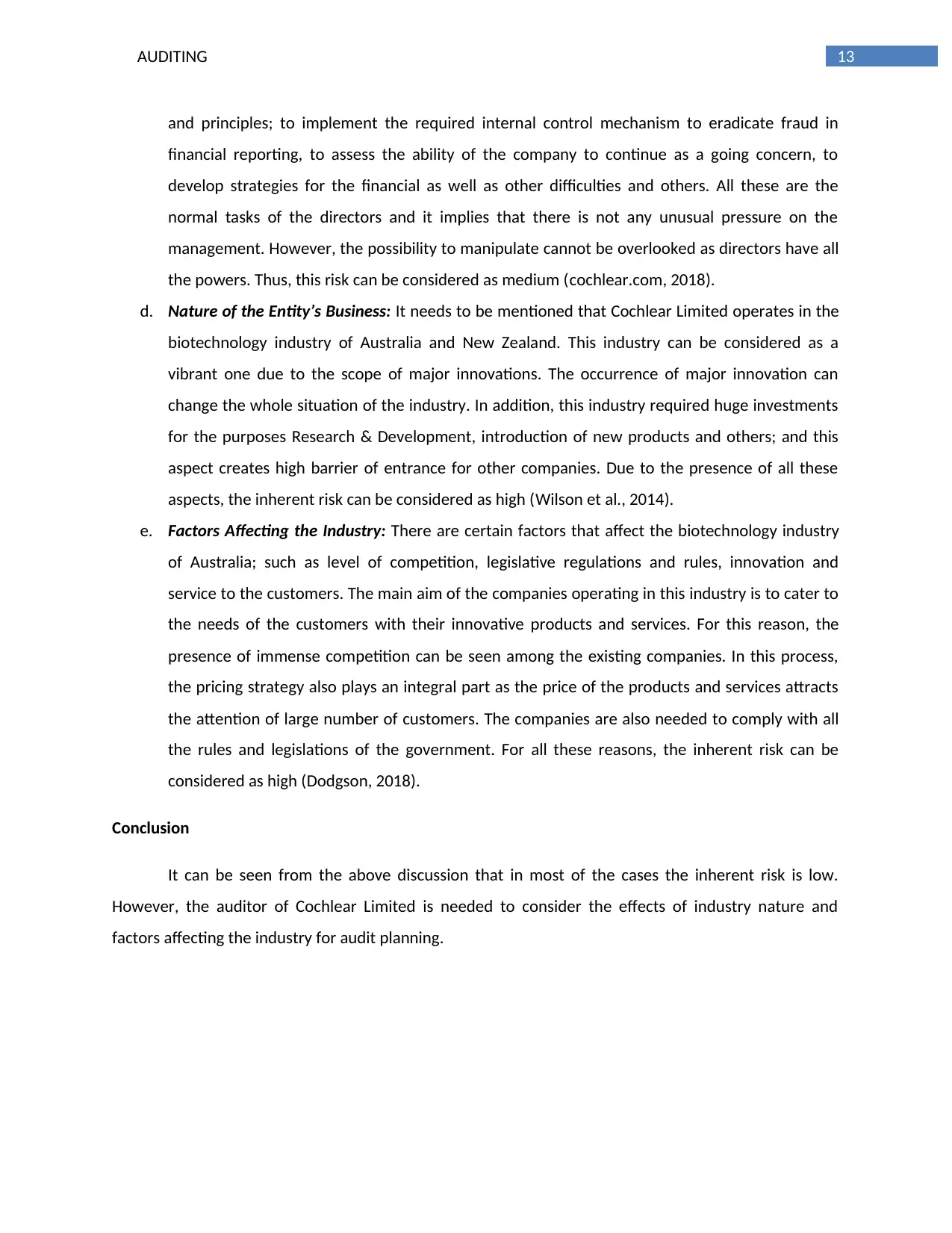

b. Management’s Experience, Knowledge and Changes during the Period: It needs to be

mentioned that the Board of Directors of Cochlear Limited consists of both executive and non-

executive directors. Their details can be seen from the following tables. It can be seen from the

below figures that both the executive as well as non-executive directors of the company posses

the required skills, knowledge and experience that make them perfect for these positions. It

implies that all these aspects are above the satisfying level. Hence, the inherent risk related to

this aspect is low for Cochlear Limited (cochlear.com, 2018).

Risk of Material Misstatements (Inherent Risk) at the Financial Report Level

The following discussion analyzes that inherent risk of material misstatements of Cochlear

Limited at financial report level based on five specific parameters:

a. Integrity of Management: It can be observed from the 2018 Annual Report of Cochlear Limited

that all the directors in the Board obtain high level of knowledge, experience, skill set and

goodwill in the industry. They comply with all the regulations and standards of corporate

governance with the aim to eliminate fraudulent and illegal activities in the business operations.

In addition, some independent directors are responsible for overseeing the operations of some

committees (cochlear.com, 2018). Thus, it can be said in the presence of all these aspects that

inherent risk is low in this case.

b. Management’s Experience, Knowledge and Changes during the Period: It needs to be

mentioned that the Board of Directors of Cochlear Limited consists of both executive and non-

executive directors. Their details can be seen from the following tables. It can be seen from the

below figures that both the executive as well as non-executive directors of the company posses

the required skills, knowledge and experience that make them perfect for these positions. It

implies that all these aspects are above the satisfying level. Hence, the inherent risk related to

this aspect is low for Cochlear Limited (cochlear.com, 2018).

11AUDITING

12AUDITING

c. Unusual Pressure on Management: There are some specific responsibilities of the directors of

Cochlear Limited. They are to prepare the financial statements as per the required standards

c. Unusual Pressure on Management: There are some specific responsibilities of the directors of

Cochlear Limited. They are to prepare the financial statements as per the required standards

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13AUDITING

and principles; to implement the required internal control mechanism to eradicate fraud in

financial reporting, to assess the ability of the company to continue as a going concern, to

develop strategies for the financial as well as other difficulties and others. All these are the

normal tasks of the directors and it implies that there is not any unusual pressure on the

management. However, the possibility to manipulate cannot be overlooked as directors have all

the powers. Thus, this risk can be considered as medium (cochlear.com, 2018).

d. Nature of the Entity’s Business: It needs to be mentioned that Cochlear Limited operates in the

biotechnology industry of Australia and New Zealand. This industry can be considered as a

vibrant one due to the scope of major innovations. The occurrence of major innovation can

change the whole situation of the industry. In addition, this industry required huge investments

for the purposes Research & Development, introduction of new products and others; and this

aspect creates high barrier of entrance for other companies. Due to the presence of all these

aspects, the inherent risk can be considered as high (Wilson et al., 2014).

e. Factors Affecting the Industry: There are certain factors that affect the biotechnology industry

of Australia; such as level of competition, legislative regulations and rules, innovation and

service to the customers. The main aim of the companies operating in this industry is to cater to

the needs of the customers with their innovative products and services. For this reason, the

presence of immense competition can be seen among the existing companies. In this process,

the pricing strategy also plays an integral part as the price of the products and services attracts

the attention of large number of customers. The companies are also needed to comply with all

the rules and legislations of the government. For all these reasons, the inherent risk can be

considered as high (Dodgson, 2018).

Conclusion

It can be seen from the above discussion that in most of the cases the inherent risk is low.

However, the auditor of Cochlear Limited is needed to consider the effects of industry nature and

factors affecting the industry for audit planning.

and principles; to implement the required internal control mechanism to eradicate fraud in

financial reporting, to assess the ability of the company to continue as a going concern, to

develop strategies for the financial as well as other difficulties and others. All these are the

normal tasks of the directors and it implies that there is not any unusual pressure on the

management. However, the possibility to manipulate cannot be overlooked as directors have all

the powers. Thus, this risk can be considered as medium (cochlear.com, 2018).

d. Nature of the Entity’s Business: It needs to be mentioned that Cochlear Limited operates in the

biotechnology industry of Australia and New Zealand. This industry can be considered as a

vibrant one due to the scope of major innovations. The occurrence of major innovation can

change the whole situation of the industry. In addition, this industry required huge investments

for the purposes Research & Development, introduction of new products and others; and this

aspect creates high barrier of entrance for other companies. Due to the presence of all these

aspects, the inherent risk can be considered as high (Wilson et al., 2014).

e. Factors Affecting the Industry: There are certain factors that affect the biotechnology industry

of Australia; such as level of competition, legislative regulations and rules, innovation and

service to the customers. The main aim of the companies operating in this industry is to cater to

the needs of the customers with their innovative products and services. For this reason, the

presence of immense competition can be seen among the existing companies. In this process,

the pricing strategy also plays an integral part as the price of the products and services attracts

the attention of large number of customers. The companies are also needed to comply with all

the rules and legislations of the government. For all these reasons, the inherent risk can be

considered as high (Dodgson, 2018).

Conclusion

It can be seen from the above discussion that in most of the cases the inherent risk is low.

However, the auditor of Cochlear Limited is needed to consider the effects of industry nature and

factors affecting the industry for audit planning.

14AUDITING

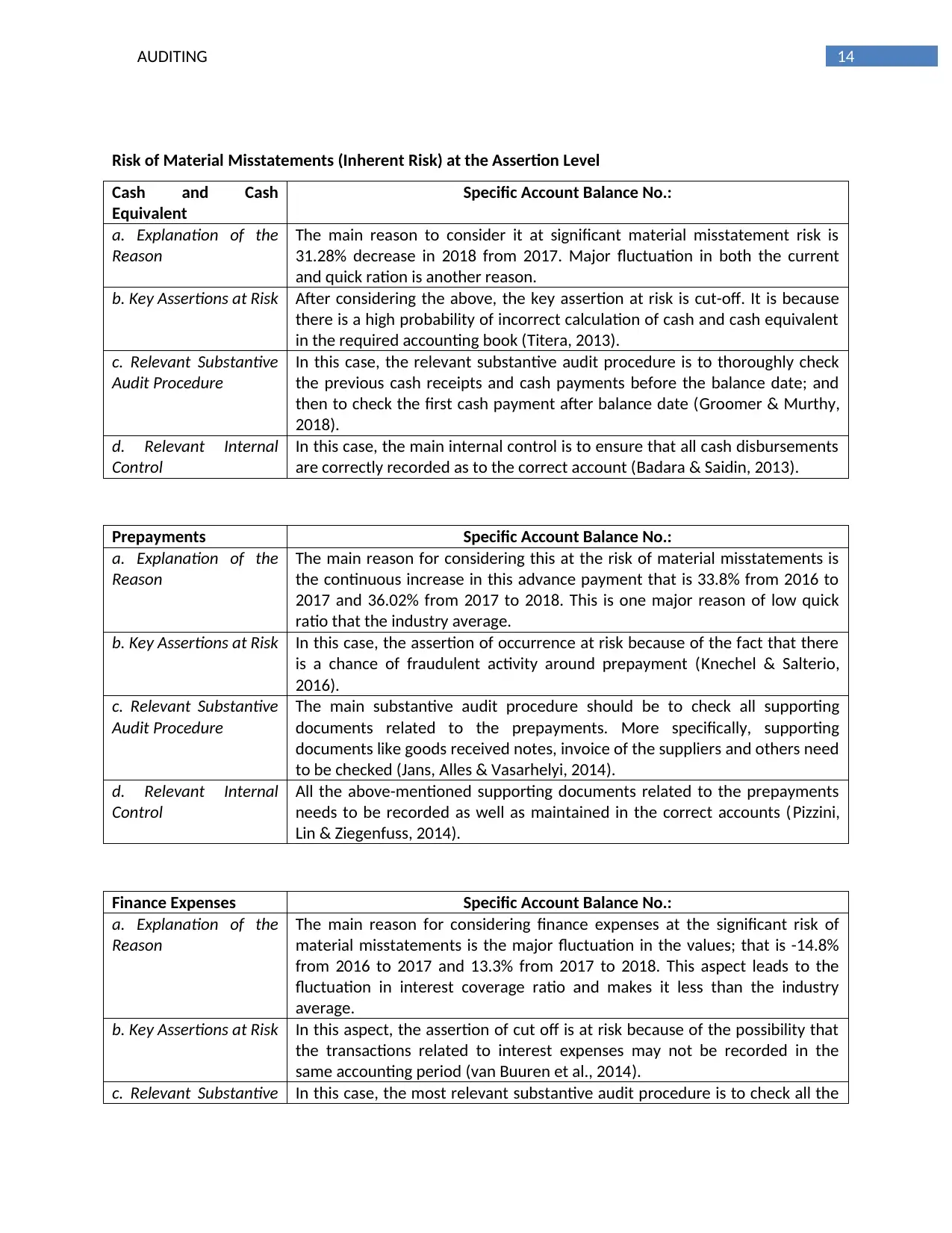

Risk of Material Misstatements (Inherent Risk) at the Assertion Level

Cash and Cash

Equivalent

Specific Account Balance No.:

a. Explanation of the

Reason

The main reason to consider it at significant material misstatement risk is

31.28% decrease in 2018 from 2017. Major fluctuation in both the current

and quick ration is another reason.

b. Key Assertions at Risk After considering the above, the key assertion at risk is cut-off. It is because

there is a high probability of incorrect calculation of cash and cash equivalent

in the required accounting book (Titera, 2013).

c. Relevant Substantive

Audit Procedure

In this case, the relevant substantive audit procedure is to thoroughly check

the previous cash receipts and cash payments before the balance date; and

then to check the first cash payment after balance date (Groomer & Murthy,

2018).

d. Relevant Internal

Control

In this case, the main internal control is to ensure that all cash disbursements

are correctly recorded as to the correct account (Badara & Saidin, 2013).

Prepayments Specific Account Balance No.:

a. Explanation of the

Reason

The main reason for considering this at the risk of material misstatements is

the continuous increase in this advance payment that is 33.8% from 2016 to

2017 and 36.02% from 2017 to 2018. This is one major reason of low quick

ratio that the industry average.

b. Key Assertions at Risk In this case, the assertion of occurrence at risk because of the fact that there

is a chance of fraudulent activity around prepayment (Knechel & Salterio,

2016).

c. Relevant Substantive

Audit Procedure

The main substantive audit procedure should be to check all supporting

documents related to the prepayments. More specifically, supporting

documents like goods received notes, invoice of the suppliers and others need

to be checked (Jans, Alles & Vasarhelyi, 2014).

d. Relevant Internal

Control

All the above-mentioned supporting documents related to the prepayments

needs to be recorded as well as maintained in the correct accounts (Pizzini,

Lin & Ziegenfuss, 2014).

Finance Expenses Specific Account Balance No.:

a. Explanation of the

Reason

The main reason for considering finance expenses at the significant risk of

material misstatements is the major fluctuation in the values; that is -14.8%

from 2016 to 2017 and 13.3% from 2017 to 2018. This aspect leads to the

fluctuation in interest coverage ratio and makes it less than the industry

average.

b. Key Assertions at Risk In this aspect, the assertion of cut off is at risk because of the possibility that

the transactions related to interest expenses may not be recorded in the

same accounting period (van Buuren et al., 2014).

c. Relevant Substantive In this case, the most relevant substantive audit procedure is to check all the

Risk of Material Misstatements (Inherent Risk) at the Assertion Level

Cash and Cash

Equivalent

Specific Account Balance No.:

a. Explanation of the

Reason

The main reason to consider it at significant material misstatement risk is

31.28% decrease in 2018 from 2017. Major fluctuation in both the current

and quick ration is another reason.

b. Key Assertions at Risk After considering the above, the key assertion at risk is cut-off. It is because

there is a high probability of incorrect calculation of cash and cash equivalent

in the required accounting book (Titera, 2013).

c. Relevant Substantive

Audit Procedure

In this case, the relevant substantive audit procedure is to thoroughly check

the previous cash receipts and cash payments before the balance date; and

then to check the first cash payment after balance date (Groomer & Murthy,

2018).

d. Relevant Internal

Control

In this case, the main internal control is to ensure that all cash disbursements

are correctly recorded as to the correct account (Badara & Saidin, 2013).

Prepayments Specific Account Balance No.:

a. Explanation of the

Reason

The main reason for considering this at the risk of material misstatements is

the continuous increase in this advance payment that is 33.8% from 2016 to

2017 and 36.02% from 2017 to 2018. This is one major reason of low quick

ratio that the industry average.

b. Key Assertions at Risk In this case, the assertion of occurrence at risk because of the fact that there

is a chance of fraudulent activity around prepayment (Knechel & Salterio,

2016).

c. Relevant Substantive

Audit Procedure

The main substantive audit procedure should be to check all supporting

documents related to the prepayments. More specifically, supporting

documents like goods received notes, invoice of the suppliers and others need

to be checked (Jans, Alles & Vasarhelyi, 2014).

d. Relevant Internal

Control

All the above-mentioned supporting documents related to the prepayments

needs to be recorded as well as maintained in the correct accounts (Pizzini,

Lin & Ziegenfuss, 2014).

Finance Expenses Specific Account Balance No.:

a. Explanation of the

Reason

The main reason for considering finance expenses at the significant risk of

material misstatements is the major fluctuation in the values; that is -14.8%

from 2016 to 2017 and 13.3% from 2017 to 2018. This aspect leads to the

fluctuation in interest coverage ratio and makes it less than the industry

average.

b. Key Assertions at Risk In this aspect, the assertion of cut off is at risk because of the possibility that

the transactions related to interest expenses may not be recorded in the

same accounting period (van Buuren et al., 2014).

c. Relevant Substantive In this case, the most relevant substantive audit procedure is to check all the

15AUDITING

Audit Procedure documents related to this interest expenses so that any error can be

identified (Mock & Turner, 2013).

d. Relevant Internal

Control

All the documents related to this must be recorded at the correct accounting

period (Mock & Turner, 2013).

Conclusion

As per the above discussion, three major accounts are at the risk of material misstatements. The

main reasons for considering them as material are the fluctuations in the amount and ratios.

Audit Procedure documents related to this interest expenses so that any error can be

identified (Mock & Turner, 2013).

d. Relevant Internal

Control

All the documents related to this must be recorded at the correct accounting

period (Mock & Turner, 2013).

Conclusion

As per the above discussion, three major accounts are at the risk of material misstatements. The

main reasons for considering them as material are the fluctuations in the amount and ratios.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16AUDITING

References

Badara, M. A. S., & Saidin, S. Z. (2013). Impact of the effective internal control system on the internal

audit effectiveness at local government level. Journal of Social and Development Sciences, 4(1),

16-23.

Cochlear Limited. (2018). 2016 Annual Report. Retrieved 6 November 2018, from

https://www.cochlear.com/ebe550d5-d6c2-4b06-a1d2-8f873fb0c345/en_corporate_annualrep

ort2016_2.37mb.pdf?

MOD=AJPERES&CONVERT_TO=url&CACHEID=ROOTWORKSPACE-ebe550d5-d6c2-

4b06-a1d2-8f873fb0c345-lpSVNkn

Cochlear Limited. (2018). 2017 Annual Report. Retrieved 6 November 2018, from

https://www.cochlear.com/b0dffcb0-9826-4c99-9d58-ad7a760bddac/en_corporate_cochlear_a

nnualreport2017_1.78mb.pdf?

MOD=AJPERES&CONVERT_TO=url&CACHEID=ROOTWORKSPACE-b0dffcb0-9826-4c99-

9d58-ad7a760bddac-lTJByF-

Cochlear Limited. (2018). 2018 Annual Report. Retrieved 6 November 2018, from

https://www.cochlear.com/43d56bcc-d510-4a20-ab70-6208fa5af77e/en_annualreport2018_co

chlear2018annualreport_5.69mb.pdf?

MOD=AJPERES&CONVERT_TO=url&CACHEID=ROOTWORKSPACE-43d56bcc-d510-

4a20-ab70-6208fa5af77e-mkRS5RK

Cochlear. (2018). About Cochlear | Cochlear™ AU/NZ About Cochlear | Cochlear™ AU/NZ. Retrieved 6

November 2018, from https://www.cochlear.com/au/about/about-cochlear

Dodgson, M. (2018). Technological collaboration in industry: strategy, policy and internationalization in

innovation. Routledge.

Fazzini, M. (2018). Financial Statement Analysis. In Business Valuation (pp. 39-76). Palgrave Macmillan,

Cham.

References

Badara, M. A. S., & Saidin, S. Z. (2013). Impact of the effective internal control system on the internal

audit effectiveness at local government level. Journal of Social and Development Sciences, 4(1),

16-23.

Cochlear Limited. (2018). 2016 Annual Report. Retrieved 6 November 2018, from

https://www.cochlear.com/ebe550d5-d6c2-4b06-a1d2-8f873fb0c345/en_corporate_annualrep

ort2016_2.37mb.pdf?

MOD=AJPERES&CONVERT_TO=url&CACHEID=ROOTWORKSPACE-ebe550d5-d6c2-

4b06-a1d2-8f873fb0c345-lpSVNkn

Cochlear Limited. (2018). 2017 Annual Report. Retrieved 6 November 2018, from

https://www.cochlear.com/b0dffcb0-9826-4c99-9d58-ad7a760bddac/en_corporate_cochlear_a

nnualreport2017_1.78mb.pdf?

MOD=AJPERES&CONVERT_TO=url&CACHEID=ROOTWORKSPACE-b0dffcb0-9826-4c99-

9d58-ad7a760bddac-lTJByF-

Cochlear Limited. (2018). 2018 Annual Report. Retrieved 6 November 2018, from

https://www.cochlear.com/43d56bcc-d510-4a20-ab70-6208fa5af77e/en_annualreport2018_co

chlear2018annualreport_5.69mb.pdf?

MOD=AJPERES&CONVERT_TO=url&CACHEID=ROOTWORKSPACE-43d56bcc-d510-

4a20-ab70-6208fa5af77e-mkRS5RK

Cochlear. (2018). About Cochlear | Cochlear™ AU/NZ About Cochlear | Cochlear™ AU/NZ. Retrieved 6

November 2018, from https://www.cochlear.com/au/about/about-cochlear

Dodgson, M. (2018). Technological collaboration in industry: strategy, policy and internationalization in

innovation. Routledge.

Fazzini, M. (2018). Financial Statement Analysis. In Business Valuation (pp. 39-76). Palgrave Macmillan,

Cham.

17AUDITING

Groomer, S. M., & Murthy, U. S. (2018). Continuous auditing of database applications: An embedded

audit module approach. In Continuous Auditing: Theory and Application (pp. 105-124). Emerald

Publishing Limited.

Hilton, R. W., & Platt, D. E. (2013). Managerial accounting: creating value in a dynamic business

environment. McGraw-Hill Education.

Jans, M., Alles, M. G., & Vasarhelyi, M. A. (2014). A field study on the use of process mining of event logs

as an analytical procedure in auditing. The Accounting Review, 89(5), 1751-1773.

Knechel, W. R., & Salterio, S. E. (2016). Auditing: Assurance and risk. Routledge.

Lin, C. C., Chiu, A. A., Huang, S. Y., & Yen, D. C. (2015). Detecting the financial statement fraud: The

analysis of the differences between data mining techniques and experts’ judgments. Knowledge-

Based Systems, 89, 459-470.

Mock, T. J., & Turner, J. L. (2013). Internal Accounting Control Evaluation and Auditor Judgement: An

Anthology. Routledge.

Mock, T. J., & Turner, J. L. (2013). Internal Accounting Control Evaluation and Auditor Judgement: An

Anthology. Routledge.

Pizzini, M., Lin, S., & Ziegenfuss, D. E. (2014). The impact of internal audit function quality and

contribution on audit delay. Auditing: A Journal of Practice & Theory, 34(1), 25-58.

Titera, W. R. (2013). Updating audit standard—Enabling audit data analysis. Journal of Information

Systems, 27(1), 325-331.

van Buuren, J., Koch, C., van Nieuw Amerongen, N., & Wright, A. M. (2014). The use of business risk

audit perspectives by non-Big 4 audit firms. Auditing: A Journal of Practice & Theory, 33(3), 105-

128.

Wilson, G. A., Perepelkin, J., Zhang, D. D., & Vachon, M. A. (2014). Market orientation, alliance

orientation, and business performance in the biotechnology industry. Journal of Commercial

Biotechnology, 20(2).

Groomer, S. M., & Murthy, U. S. (2018). Continuous auditing of database applications: An embedded

audit module approach. In Continuous Auditing: Theory and Application (pp. 105-124). Emerald

Publishing Limited.

Hilton, R. W., & Platt, D. E. (2013). Managerial accounting: creating value in a dynamic business

environment. McGraw-Hill Education.

Jans, M., Alles, M. G., & Vasarhelyi, M. A. (2014). A field study on the use of process mining of event logs

as an analytical procedure in auditing. The Accounting Review, 89(5), 1751-1773.

Knechel, W. R., & Salterio, S. E. (2016). Auditing: Assurance and risk. Routledge.

Lin, C. C., Chiu, A. A., Huang, S. Y., & Yen, D. C. (2015). Detecting the financial statement fraud: The

analysis of the differences between data mining techniques and experts’ judgments. Knowledge-

Based Systems, 89, 459-470.

Mock, T. J., & Turner, J. L. (2013). Internal Accounting Control Evaluation and Auditor Judgement: An

Anthology. Routledge.

Mock, T. J., & Turner, J. L. (2013). Internal Accounting Control Evaluation and Auditor Judgement: An

Anthology. Routledge.

Pizzini, M., Lin, S., & Ziegenfuss, D. E. (2014). The impact of internal audit function quality and

contribution on audit delay. Auditing: A Journal of Practice & Theory, 34(1), 25-58.

Titera, W. R. (2013). Updating audit standard—Enabling audit data analysis. Journal of Information

Systems, 27(1), 325-331.

van Buuren, J., Koch, C., van Nieuw Amerongen, N., & Wright, A. M. (2014). The use of business risk

audit perspectives by non-Big 4 audit firms. Auditing: A Journal of Practice & Theory, 33(3), 105-

128.

Wilson, G. A., Perepelkin, J., Zhang, D. D., & Vachon, M. A. (2014). Market orientation, alliance

orientation, and business performance in the biotechnology industry. Journal of Commercial

Biotechnology, 20(2).

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.