Auditing and Assurance

VerifiedAdded on 2023/01/16

|19

|5220

|56

AI Summary

This document provides information on auditing and assurance, including key background information, assumptions on the assessment of going concern, areas at risk of material misstatement, assertions for misstated accounts, and analysis of financial information. It also includes identification of control weaknesses and recommendations for improvement.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: AUDITING AND ASSURANCE

Auditing and assurance

Name of the student

Name of the university

Student ID

Author ID

Auditing and assurance

Name of the student

Name of the university

Student ID

Author ID

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

Table of Contents

Question 1........................................................................................................................................2

1. Identifying the key background information including industry details..............................2

2. Providing relevant assumptions on the assessment of going concern, based on the

background and financial analysis...............................................................................................2

3. Identifying the areas that is considered to be at risk of material misstatement....................3

4. Providing two assertions for material misstated accounts identified in the requirements....3

5. Providing relevant analysis of the Financial information.....................................................4

Answer 2..........................................................................................................................................5

1. Identification of control weakness........................................................................................5

2. Account balance assertion....................................................................................................6

3. Recommendation for control improvement..........................................................................7

Answer 3..........................................................................................................................................8

1. Requirement of control test..................................................................................................8

2. Justification about decision...................................................................................................8

Reference and bibliography...........................................................................................................10

Appendix........................................................................................................................................12

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

Table of Contents

Question 1........................................................................................................................................2

1. Identifying the key background information including industry details..............................2

2. Providing relevant assumptions on the assessment of going concern, based on the

background and financial analysis...............................................................................................2

3. Identifying the areas that is considered to be at risk of material misstatement....................3

4. Providing two assertions for material misstated accounts identified in the requirements....3

5. Providing relevant analysis of the Financial information.....................................................4

Answer 2..........................................................................................................................................5

1. Identification of control weakness........................................................................................5

2. Account balance assertion....................................................................................................6

3. Recommendation for control improvement..........................................................................7

Answer 3..........................................................................................................................................8

1. Requirement of control test..................................................................................................8

2. Justification about decision...................................................................................................8

Reference and bibliography...........................................................................................................10

Appendix........................................................................................................................................12

2

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

Question 1

1. Identifying the key background information including industry details

The organization Dalby Logistics Limited (DLL) was mainly formed in 2010 by merging

two companies that dealt in transportations of Forestry products, mineral sand and iron ore. The

company was formed in 2010, where it aims to support the logistics and cargo conglomerate for

generating higher revenues from operations. Moreover, the company not only conducts

transportations of Forestry products, mineral sand and iron ore, it also specializes in conducting

delivery of flammable components such as gas, oil, lithium, coal and manganese. Furthermore,

the operations of Dalby Logistics Limited (DLL) are no limited to transportation but it also

provides warehouse services to its client, for which it has a large hub complex in Sydney.

Additionally, the company also has relevant investments in 5 entities, while operating 20

subsidiaries. Australia considered the logistics industry a part of the productivity chain, where

more than 14.5% of the GDP is contributed by the industry, which is essential to increase the

national productivity. Moreover, the logistics industry is responsible for providing more than 1

million jobs in Australia, while 165,000 companies are currently operating in the region.

2. Providing relevant assumptions on the assessment of going concern, based on the

background and financial analysis

The going concern assumption is relevantly considered as the overall methods that are

followed by the company in accordance with the general-purpose financial reporting framework.

In addition, the going concern assumptions directly indicate that the operations of the

organization need to meet the desired commitments, objectives, obligations and others.

Moreover, the going concern concept directly states that the company’s operations and

objectives should aim in continuing the business for longer duration. Therefore, investors for

assessing the conditions of the organization need to evaluate their historical financial data. The

trend analysis of Dalby Logistics Limited (DLL) has mainly detected that its overall profit level

has declined during the three-year period from 2015 to 2017. On the other hand, the overall

profits of the company during the financial year of 2018 have mainly inclined by the levels of

173.93% in comparison to the previous financial year. In addition, the continuous higher

performance of the organization is a major proof of the organization is following the rules of the

going concern. In addition, the financial position of the company has also increased over the

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

Question 1

1. Identifying the key background information including industry details

The organization Dalby Logistics Limited (DLL) was mainly formed in 2010 by merging

two companies that dealt in transportations of Forestry products, mineral sand and iron ore. The

company was formed in 2010, where it aims to support the logistics and cargo conglomerate for

generating higher revenues from operations. Moreover, the company not only conducts

transportations of Forestry products, mineral sand and iron ore, it also specializes in conducting

delivery of flammable components such as gas, oil, lithium, coal and manganese. Furthermore,

the operations of Dalby Logistics Limited (DLL) are no limited to transportation but it also

provides warehouse services to its client, for which it has a large hub complex in Sydney.

Additionally, the company also has relevant investments in 5 entities, while operating 20

subsidiaries. Australia considered the logistics industry a part of the productivity chain, where

more than 14.5% of the GDP is contributed by the industry, which is essential to increase the

national productivity. Moreover, the logistics industry is responsible for providing more than 1

million jobs in Australia, while 165,000 companies are currently operating in the region.

2. Providing relevant assumptions on the assessment of going concern, based on the

background and financial analysis

The going concern assumption is relevantly considered as the overall methods that are

followed by the company in accordance with the general-purpose financial reporting framework.

In addition, the going concern assumptions directly indicate that the operations of the

organization need to meet the desired commitments, objectives, obligations and others.

Moreover, the going concern concept directly states that the company’s operations and

objectives should aim in continuing the business for longer duration. Therefore, investors for

assessing the conditions of the organization need to evaluate their historical financial data. The

trend analysis of Dalby Logistics Limited (DLL) has mainly detected that its overall profit level

has declined during the three-year period from 2015 to 2017. On the other hand, the overall

profits of the company during the financial year of 2018 have mainly inclined by the levels of

173.93% in comparison to the previous financial year. In addition, the continuous higher

performance of the organization is a major proof of the organization is following the rules of the

going concern. In addition, the financial position of the company has also increased over the

3

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

period of the period of its operations, as the management is increasing their current assets to

support the short-term obligations, which might incur in the future. Furthermore, the company

has been acquiring new organization, which is a relevant proof that indicates that the company’s

going concern factors are valid (Eng, Tian& Robert, 2018).

3. Identifying the areas that is considered to be at risk of material misstatement

After analyzing the financial statement of the Dalby Logistics Limited (DLL) relevant

accounts that might have the most risk if material misstatement is depicted as follows.

Trade receivables- The major problems can be identified from the trade receivables of the

organizations, as there is relevant scope of conducting material misstatement by the

organization. The employee of the organization could misstate the overall trade balances,

which might increase the level of bas debt in the financial account. This could directly

affect the overall financial performance of the organization, as the overall bad debts is

rising instead of the account receivables value in the balance sheet.

Borrowings- The second major accounts, which could be subject to material misstatement

is borrowings, as the management could manipulate the amounts in the borrowings for

increasing the overall expenses in the financial report. Furthermore, the analysis of the

annual report has indicated that the borrowing levels of the company have increased over

the period of the 4 financial years. Hence, it could be possible that the organization has

increased its borrowings for fictitious purposes.

Inventory- Moreover, the maximum misstatement that could be conducted by the

organization is in the investor levels, as the employees could misstate the actual investors

that are being held by the organization. This misstatement in the inventory valuation will

have direct impact on the performance of the company. Inventory level and valuation is

conducted after the completion of the physical stock count by the employees of the

organization, which could be wrong due to the occurrence of human error.

4. Providing two assertions for material misstated accounts identified in the requirements

Trade receivables- There are relevantly two assertions that are present in trade

receivables, where the previous year’s accounts receivable data could be inputted in the

current period, which could have negative impact on the financial performance. In

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

period of the period of its operations, as the management is increasing their current assets to

support the short-term obligations, which might incur in the future. Furthermore, the company

has been acquiring new organization, which is a relevant proof that indicates that the company’s

going concern factors are valid (Eng, Tian& Robert, 2018).

3. Identifying the areas that is considered to be at risk of material misstatement

After analyzing the financial statement of the Dalby Logistics Limited (DLL) relevant

accounts that might have the most risk if material misstatement is depicted as follows.

Trade receivables- The major problems can be identified from the trade receivables of the

organizations, as there is relevant scope of conducting material misstatement by the

organization. The employee of the organization could misstate the overall trade balances,

which might increase the level of bas debt in the financial account. This could directly

affect the overall financial performance of the organization, as the overall bad debts is

rising instead of the account receivables value in the balance sheet.

Borrowings- The second major accounts, which could be subject to material misstatement

is borrowings, as the management could manipulate the amounts in the borrowings for

increasing the overall expenses in the financial report. Furthermore, the analysis of the

annual report has indicated that the borrowing levels of the company have increased over

the period of the 4 financial years. Hence, it could be possible that the organization has

increased its borrowings for fictitious purposes.

Inventory- Moreover, the maximum misstatement that could be conducted by the

organization is in the investor levels, as the employees could misstate the actual investors

that are being held by the organization. This misstatement in the inventory valuation will

have direct impact on the performance of the company. Inventory level and valuation is

conducted after the completion of the physical stock count by the employees of the

organization, which could be wrong due to the occurrence of human error.

4. Providing two assertions for material misstated accounts identified in the requirements

Trade receivables- There are relevantly two assertions that are present in trade

receivables, where the previous year’s accounts receivable data could be inputted in the

current period, which could have negative impact on the financial performance. In

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

addition, the second assertion is that the overall transaction is not been classified in the

financial statement of the organization.

Borrowings- There are two specific assertion that is related to borrowings of the

organization, where the amount inputted it the financial report could be paid off to the

loan provider. The second assertion that might incur for the borrowings accounts is the

inaccuracy in reporting the accurate amount in the financial report

Inventory- The first assertion present in the annual report is the miscalculation of the total

inventory value. The second assertion is the in omission of certain inventory during the

accounting phase

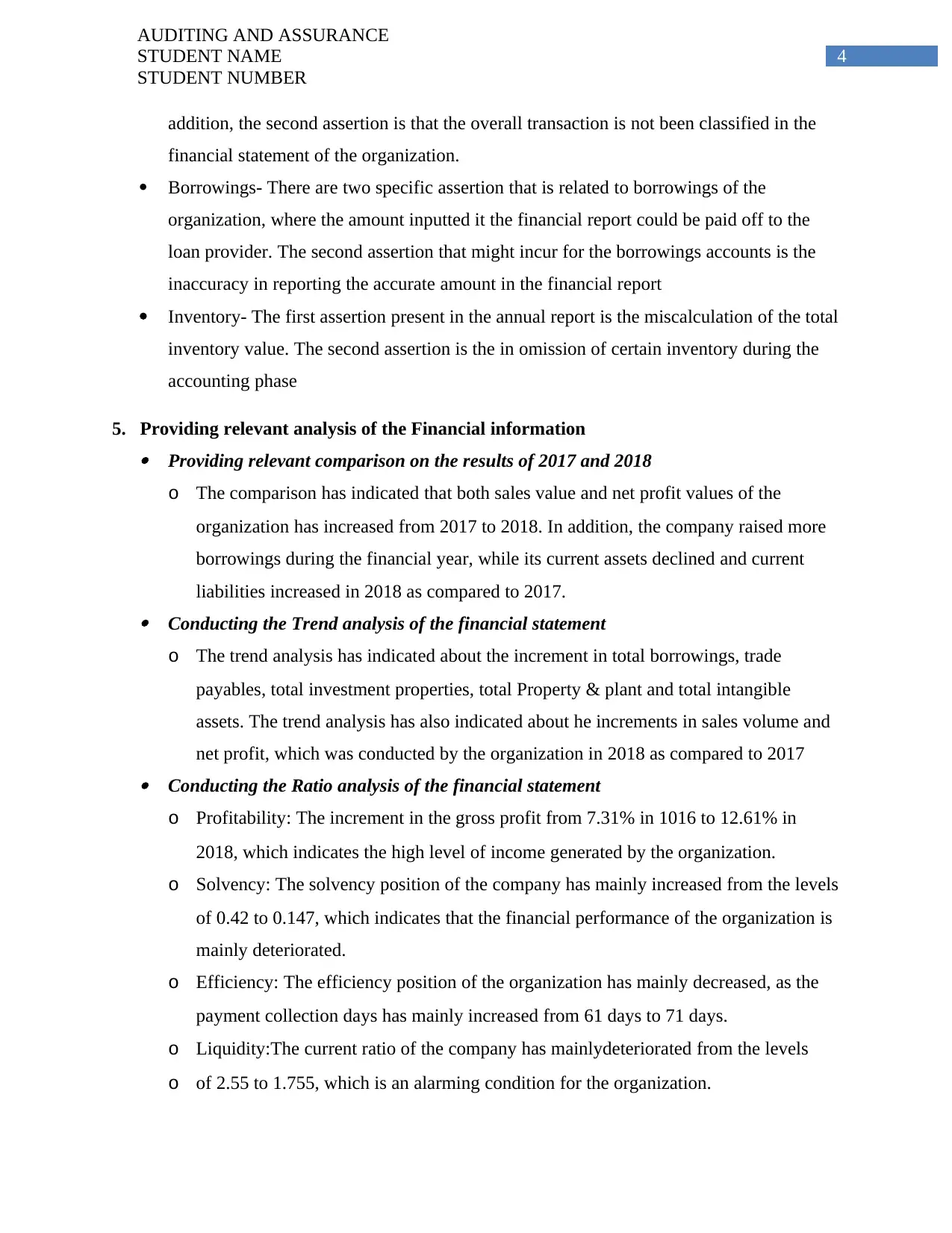

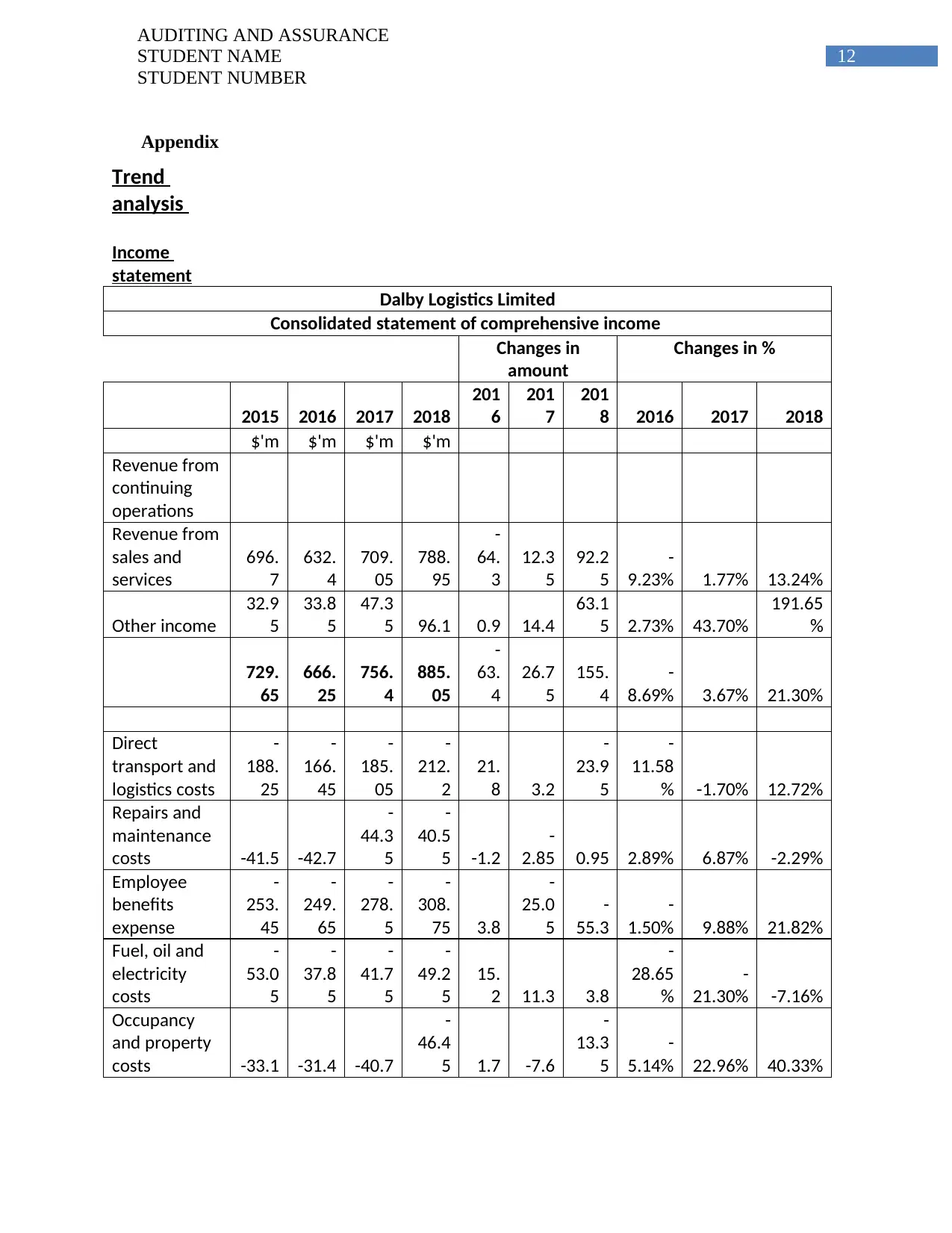

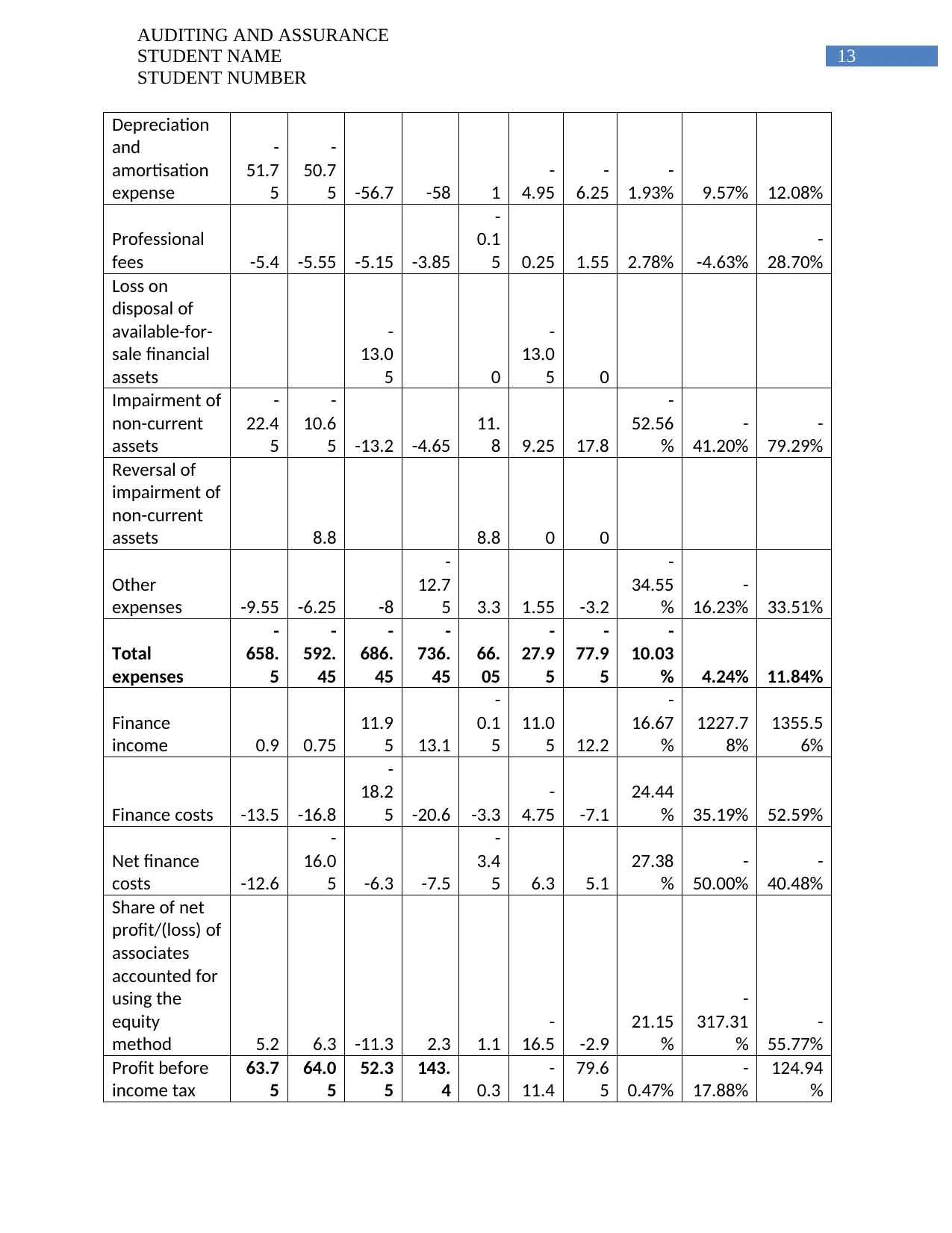

5. Providing relevant analysis of the Financial information Providing relevant comparison on the results of 2017 and 2018

o The comparison has indicated that both sales value and net profit values of the

organization has increased from 2017 to 2018. In addition, the company raised more

borrowings during the financial year, while its current assets declined and current

liabilities increased in 2018 as compared to 2017. Conducting the Trend analysis of the financial statement

o The trend analysis has indicated about the increment in total borrowings, trade

payables, total investment properties, total Property & plant and total intangible

assets. The trend analysis has also indicated about he increments in sales volume and

net profit, which was conducted by the organization in 2018 as compared to 2017 Conducting the Ratio analysis of the financial statement

o Profitability: The increment in the gross profit from 7.31% in 1016 to 12.61% in

2018, which indicates the high level of income generated by the organization.

o Solvency: The solvency position of the company has mainly increased from the levels

of 0.42 to 0.147, which indicates that the financial performance of the organization is

mainly deteriorated.

o Efficiency: The efficiency position of the organization has mainly decreased, as the

payment collection days has mainly increased from 61 days to 71 days.

o Liquidity:The current ratio of the company has mainlydeteriorated from the levels

o of 2.55 to 1.755, which is an alarming condition for the organization.

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

addition, the second assertion is that the overall transaction is not been classified in the

financial statement of the organization.

Borrowings- There are two specific assertion that is related to borrowings of the

organization, where the amount inputted it the financial report could be paid off to the

loan provider. The second assertion that might incur for the borrowings accounts is the

inaccuracy in reporting the accurate amount in the financial report

Inventory- The first assertion present in the annual report is the miscalculation of the total

inventory value. The second assertion is the in omission of certain inventory during the

accounting phase

5. Providing relevant analysis of the Financial information Providing relevant comparison on the results of 2017 and 2018

o The comparison has indicated that both sales value and net profit values of the

organization has increased from 2017 to 2018. In addition, the company raised more

borrowings during the financial year, while its current assets declined and current

liabilities increased in 2018 as compared to 2017. Conducting the Trend analysis of the financial statement

o The trend analysis has indicated about the increment in total borrowings, trade

payables, total investment properties, total Property & plant and total intangible

assets. The trend analysis has also indicated about he increments in sales volume and

net profit, which was conducted by the organization in 2018 as compared to 2017 Conducting the Ratio analysis of the financial statement

o Profitability: The increment in the gross profit from 7.31% in 1016 to 12.61% in

2018, which indicates the high level of income generated by the organization.

o Solvency: The solvency position of the company has mainly increased from the levels

of 0.42 to 0.147, which indicates that the financial performance of the organization is

mainly deteriorated.

o Efficiency: The efficiency position of the organization has mainly decreased, as the

payment collection days has mainly increased from 61 days to 71 days.

o Liquidity:The current ratio of the company has mainlydeteriorated from the levels

o of 2.55 to 1.755, which is an alarming condition for the organization.

5

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

Thus, it could be indicated that only profitability condition of the company is improving,

while other financial ratios are worsening over the period of time.

Answer 2

1. Identification of control weakness

Various weaknesses observes in case of purchases, payments and accounts payable are as

follows –

Only the production manager is in control of entire process for raw material management,

order and looking into the inventories in hand

Company does not follow any system for purchase order which is an important thing for

the purpose of making payments maintaining records related to purchases.

Though the warehouse personnel are trusted and working for long time, on the other side

they will have most of the opportunity of committing fraud.

Only one of warehousing staff is responsible for receiving goods, checking them, signing

the delivery dockets and acknowledging that the material has been received. Hence, if he

commits any fraud it is not possible to detect easily as the entire process is solely

managed by him.

Movements of goods in and out the warehouse are not recorded. Only monitoring the

stock level is not sufficient as it does not maintain from where the goods are coming and

where they are going. Further, daily movement monitoring only cannot specify the stock

at particular point of time.

Receiving the supplier invoice, printing them and stamping them for payment process all

are done by accounts payable clerk. If by mistake any invoice is missed by him it will

cause great problem to the company as the payment for that invoice will not be processed

Accounts payable clerk does not maintain any proper system for communicating

regarding the outstanding invoices to the production managers and just communicate the

same through phone call. If in case he communicates wrong details or the production

manager listen anything incorrect it will create huge miscommunication and will have

impact on entire process.

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

Thus, it could be indicated that only profitability condition of the company is improving,

while other financial ratios are worsening over the period of time.

Answer 2

1. Identification of control weakness

Various weaknesses observes in case of purchases, payments and accounts payable are as

follows –

Only the production manager is in control of entire process for raw material management,

order and looking into the inventories in hand

Company does not follow any system for purchase order which is an important thing for

the purpose of making payments maintaining records related to purchases.

Though the warehouse personnel are trusted and working for long time, on the other side

they will have most of the opportunity of committing fraud.

Only one of warehousing staff is responsible for receiving goods, checking them, signing

the delivery dockets and acknowledging that the material has been received. Hence, if he

commits any fraud it is not possible to detect easily as the entire process is solely

managed by him.

Movements of goods in and out the warehouse are not recorded. Only monitoring the

stock level is not sufficient as it does not maintain from where the goods are coming and

where they are going. Further, daily movement monitoring only cannot specify the stock

at particular point of time.

Receiving the supplier invoice, printing them and stamping them for payment process all

are done by accounts payable clerk. If by mistake any invoice is missed by him it will

cause great problem to the company as the payment for that invoice will not be processed

Accounts payable clerk does not maintain any proper system for communicating

regarding the outstanding invoices to the production managers and just communicate the

same through phone call. If in case he communicates wrong details or the production

manager listen anything incorrect it will create huge miscommunication and will have

impact on entire process.

6

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

Production manager receives the deliveries and check the same solely based on his

memory. He does not maintain any manual or computerized system for outstanding

invoices which is a big internal control issue

Supporting documents attached with the payment cheques are signed for avoiding the

duplicate payment. However, the supporting documents are only attached with the

cheques for the non-major suppliers. Hence, internal control lack is there for the

payments to major suppliers and in worst case double payment also may take place

No particular authorisation requirement is maintained for signing the cheques for making

payment to the suppliers. Generally it is signed by financial controller. However, in his

absence, it is signed by marketing manager irrespective of the fact whether he has

authority for the same or not.

2. Account balance assertion

Raw material inventory – key assertion involved with raw material inventory are –

Completeness that is all the transactions related to raw material inventory those were

supposed to be recorded in books have been recorded in full

Accuracy that is all the raw material related transactions are recorded appropriately with

appropriate amount

Cut off that is purchases made in the current period only entered in the current year

records.

Accounts payable – key assertion involved with accounts payable are –

Valuation that is payment has been made after making proper adjustments like discounts,

returns and taxes

Completeness that is all the transactions related to payment those were supposed to be

recorded in books have been recorded in full

Accuracy that is all the payment related transactions are recorded appropriately with

appropriate amount

Cut off that is payment for prior periods have not been included in current years book

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

Production manager receives the deliveries and check the same solely based on his

memory. He does not maintain any manual or computerized system for outstanding

invoices which is a big internal control issue

Supporting documents attached with the payment cheques are signed for avoiding the

duplicate payment. However, the supporting documents are only attached with the

cheques for the non-major suppliers. Hence, internal control lack is there for the

payments to major suppliers and in worst case double payment also may take place

No particular authorisation requirement is maintained for signing the cheques for making

payment to the suppliers. Generally it is signed by financial controller. However, in his

absence, it is signed by marketing manager irrespective of the fact whether he has

authority for the same or not.

2. Account balance assertion

Raw material inventory – key assertion involved with raw material inventory are –

Completeness that is all the transactions related to raw material inventory those were

supposed to be recorded in books have been recorded in full

Accuracy that is all the raw material related transactions are recorded appropriately with

appropriate amount

Cut off that is purchases made in the current period only entered in the current year

records.

Accounts payable – key assertion involved with accounts payable are –

Valuation that is payment has been made after making proper adjustments like discounts,

returns and taxes

Completeness that is all the transactions related to payment those were supposed to be

recorded in books have been recorded in full

Accuracy that is all the payment related transactions are recorded appropriately with

appropriate amount

Cut off that is payment for prior periods have not been included in current years book

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

3. Recommendation for control improvement

Process for raw material management shall be segregated among 3-4 employees. For

instance, the employee in charge of processing order shall not be in charge of receiving

the goods.

Proper system for purchase order shall be followed. For instance, after receiving

quotation it shall be passed by the higher authority, order process document shall be

properly authorised which is an important thing for assuring that only the required things

have been ordered.

Though the warehouse personnel shall be rotated in regular interval so that one person

will not gain entire control for long time.

Warehousing related activities shall be segregated among 3-4 employees. For instance,

the employee in charge of receiving the goods shall not be in charge of checking them or

acknowledging that the material has been received.

Movements of goods in and out the warehouse shall be recorded for each of the in and

out. Only monitoring the stock level is not sufficient as it does not maintain from where

the goods are coming and where they are going.

Receiving the supplier invoice and payment process, this entire process shall be

segregated among 3-4 employees. For instance, the employee in charge of receiving

invoice shall not be in charge of stamping them for payment process.

Proper system shall be maintained for outstanding invoices and receiving order. Accounts

payable clerk shall pass on the signed copy of outstanding invoice to the production

managers and while the delivery is received the production manager shall match the

delivery with invoice

Instead of depending on memory the production manager shall maintain proper manual or

computerized system for receiving and checking deliveries

Supporting documents shall be attached with all the payment cheques irrespective of

major and non-major suppliers and shall be signed for avoiding duplicate payment.

Proper authorisation shall be there authorisation for signing the cheques for making

payment to the suppliers. Further, for big amounts like $ 100,000 or more the cheque

shall be signed by the CEO.

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

3. Recommendation for control improvement

Process for raw material management shall be segregated among 3-4 employees. For

instance, the employee in charge of processing order shall not be in charge of receiving

the goods.

Proper system for purchase order shall be followed. For instance, after receiving

quotation it shall be passed by the higher authority, order process document shall be

properly authorised which is an important thing for assuring that only the required things

have been ordered.

Though the warehouse personnel shall be rotated in regular interval so that one person

will not gain entire control for long time.

Warehousing related activities shall be segregated among 3-4 employees. For instance,

the employee in charge of receiving the goods shall not be in charge of checking them or

acknowledging that the material has been received.

Movements of goods in and out the warehouse shall be recorded for each of the in and

out. Only monitoring the stock level is not sufficient as it does not maintain from where

the goods are coming and where they are going.

Receiving the supplier invoice and payment process, this entire process shall be

segregated among 3-4 employees. For instance, the employee in charge of receiving

invoice shall not be in charge of stamping them for payment process.

Proper system shall be maintained for outstanding invoices and receiving order. Accounts

payable clerk shall pass on the signed copy of outstanding invoice to the production

managers and while the delivery is received the production manager shall match the

delivery with invoice

Instead of depending on memory the production manager shall maintain proper manual or

computerized system for receiving and checking deliveries

Supporting documents shall be attached with all the payment cheques irrespective of

major and non-major suppliers and shall be signed for avoiding duplicate payment.

Proper authorisation shall be there authorisation for signing the cheques for making

payment to the suppliers. Further, for big amounts like $ 100,000 or more the cheque

shall be signed by the CEO.

8

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

Answer 3

1. Requirement of control test

Yes, the control shall be checked in the audit for the current year. From the given

information it is very clear that all the controls mentioned are of significant important and shall

be tested in regular interval to make sure that the control ate in place. Further, in a year’s time

different changes may take place with regard to the operation of the company, its payment

system, receipt system and inventory control system. Further, though the company has strong

control over its IT security program, IT programmes are always exposed to virus attacks and

sometimes the same are not realised immediately. Hence, for assuring that the controls are in

place, some of the controls shall be tested in current year’s audit, if not all.

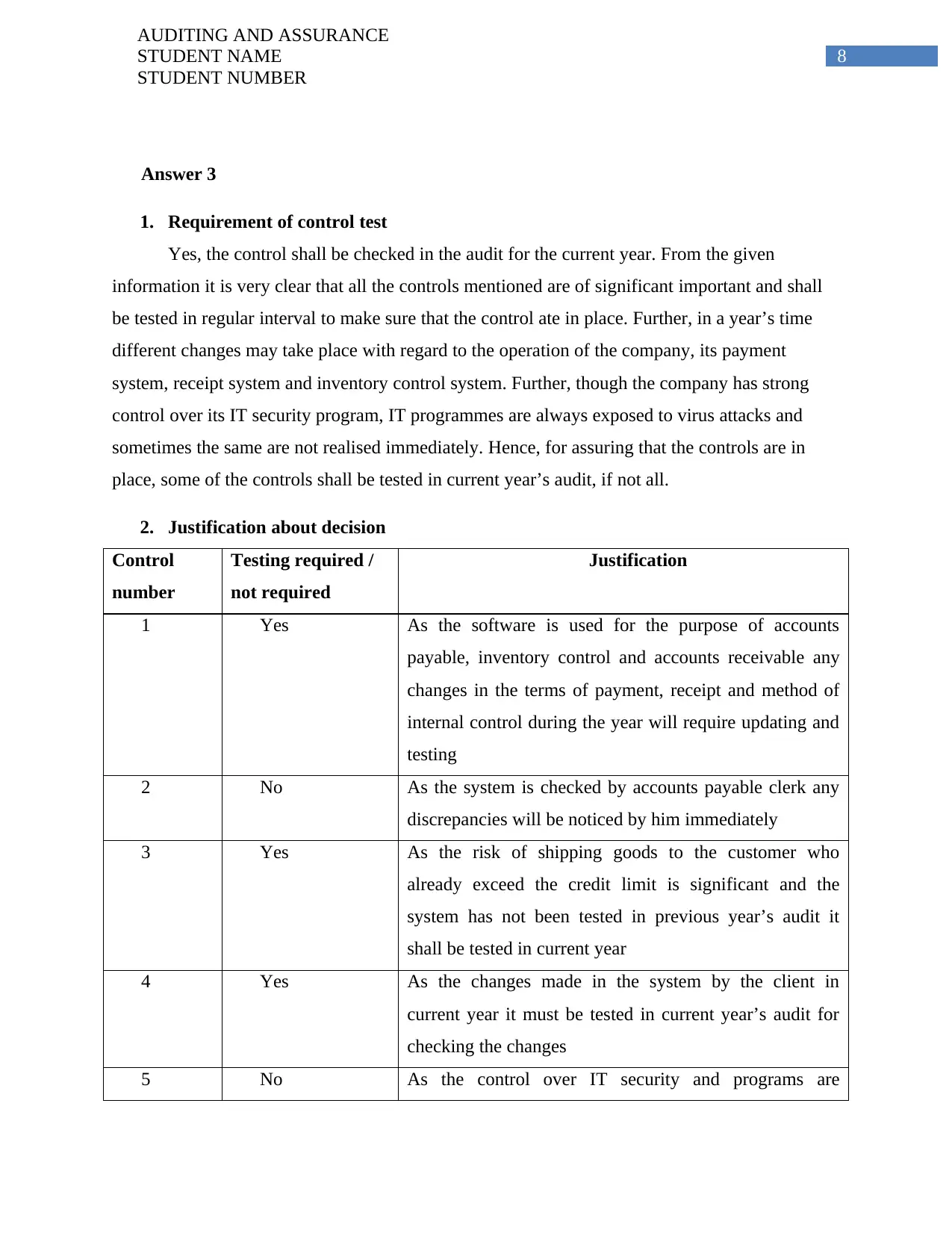

2. Justification about decision

Control

number

Testing required /

not required

Justification

1 Yes As the software is used for the purpose of accounts

payable, inventory control and accounts receivable any

changes in the terms of payment, receipt and method of

internal control during the year will require updating and

testing

2 No As the system is checked by accounts payable clerk any

discrepancies will be noticed by him immediately

3 Yes As the risk of shipping goods to the customer who

already exceed the credit limit is significant and the

system has not been tested in previous year’s audit it

shall be tested in current year

4 Yes As the changes made in the system by the client in

current year it must be tested in current year’s audit for

checking the changes

5 No As the control over IT security and programs are

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

Answer 3

1. Requirement of control test

Yes, the control shall be checked in the audit for the current year. From the given

information it is very clear that all the controls mentioned are of significant important and shall

be tested in regular interval to make sure that the control ate in place. Further, in a year’s time

different changes may take place with regard to the operation of the company, its payment

system, receipt system and inventory control system. Further, though the company has strong

control over its IT security program, IT programmes are always exposed to virus attacks and

sometimes the same are not realised immediately. Hence, for assuring that the controls are in

place, some of the controls shall be tested in current year’s audit, if not all.

2. Justification about decision

Control

number

Testing required /

not required

Justification

1 Yes As the software is used for the purpose of accounts

payable, inventory control and accounts receivable any

changes in the terms of payment, receipt and method of

internal control during the year will require updating and

testing

2 No As the system is checked by accounts payable clerk any

discrepancies will be noticed by him immediately

3 Yes As the risk of shipping goods to the customer who

already exceed the credit limit is significant and the

system has not been tested in previous year’s audit it

shall be tested in current year

4 Yes As the changes made in the system by the client in

current year it must be tested in current year’s audit for

checking the changes

5 No As the control over IT security and programs are

9

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

excellent and the auditors checked in during previous

year.

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

excellent and the auditors checked in during previous

year.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

Reference and bibliography

Altman, E. I., Iwanicz‐Drozdowska, M., Laitinen, E. K., &Suvas, A. (2017). Financial distress

prediction in an international context: A review and empirical analysis of Altman's Z‐

score model. Journal of International Financial Management & Accounting, 28(2), 131-

171.

Amiram, D., Chircop, J., Landsman, W. R., & Peasnell, K. V. (2017). Mandatorily disclosed

materiality thresholds, their determinants, and their association with earnings

multiples. Columbia Business School Research Paper, (15-69).

Chong, H. G. (2015). A review on the evolution of the definitions of materiality. International

Journal of Economics and Accounting, 6(1), 15-32.

Contessotto, C., & Moroney, R. (2014). The association between audit committee effectiveness

and audit risk. Accounting & Finance, 54(2), 393-418.

Crowther, D. (2018). A Social Critique of Corporate Reporting: A Semiotic Analysis of

Corporate Financial and Environmental Reporting: A Semiotic Analysis of Corporate

Financial and Environmental Reporting. Routledge.

DeFusco, R. A., McLeavey, D. W., Pinto, J. E., Anson, M. J., & Runkle, D. E.

(2015). Quantitative investment analysis. John Wiley & Sons.

Elder, R. J., Lowensohn, S., & Reck, J. L. (2015). Audit firm rotation, auditor specialization, and

audit quality in the municipal audit context. Journal of Government & Nonprofit

Accounting, 4(1), 73-100.

Eng, L. L., Tian, X., & Robert Yu, T. (2018). Financial statement analysis: evidence from

Chinese firms. Review of Pacific Basin Financial Markets and Policies, 21(04), 1850027.

Grant, R. M. (2016). Contemporary strategy analysis: Text and cases edition. John Wiley &

Sons.

Kristensen, R. H. (2015). Judgment in an auditor's materiality assessments. Danish Journal of

Management and Business, 79(2), 53-65.

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

Reference and bibliography

Altman, E. I., Iwanicz‐Drozdowska, M., Laitinen, E. K., &Suvas, A. (2017). Financial distress

prediction in an international context: A review and empirical analysis of Altman's Z‐

score model. Journal of International Financial Management & Accounting, 28(2), 131-

171.

Amiram, D., Chircop, J., Landsman, W. R., & Peasnell, K. V. (2017). Mandatorily disclosed

materiality thresholds, their determinants, and their association with earnings

multiples. Columbia Business School Research Paper, (15-69).

Chong, H. G. (2015). A review on the evolution of the definitions of materiality. International

Journal of Economics and Accounting, 6(1), 15-32.

Contessotto, C., & Moroney, R. (2014). The association between audit committee effectiveness

and audit risk. Accounting & Finance, 54(2), 393-418.

Crowther, D. (2018). A Social Critique of Corporate Reporting: A Semiotic Analysis of

Corporate Financial and Environmental Reporting: A Semiotic Analysis of Corporate

Financial and Environmental Reporting. Routledge.

DeFusco, R. A., McLeavey, D. W., Pinto, J. E., Anson, M. J., & Runkle, D. E.

(2015). Quantitative investment analysis. John Wiley & Sons.

Elder, R. J., Lowensohn, S., & Reck, J. L. (2015). Audit firm rotation, auditor specialization, and

audit quality in the municipal audit context. Journal of Government & Nonprofit

Accounting, 4(1), 73-100.

Eng, L. L., Tian, X., & Robert Yu, T. (2018). Financial statement analysis: evidence from

Chinese firms. Review of Pacific Basin Financial Markets and Policies, 21(04), 1850027.

Grant, R. M. (2016). Contemporary strategy analysis: Text and cases edition. John Wiley &

Sons.

Kristensen, R. H. (2015). Judgment in an auditor's materiality assessments. Danish Journal of

Management and Business, 79(2), 53-65.

11

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

Robinson, T. R., Henry, E., Pirie, W. L., &Broihahn, M. A. (2015). International financial

statement analysis. John Wiley & Sons.

Ruhnke, K., Pronobis, P., & Michel, M. (2014). Audit materiality disclosures and credit lending

decisions. Available at SSRN, 2460425.

Sridharan, S. A. (2015). Volatility forecasting using financial statement information. The

Accounting Review, 90(5), 2079-2106.

van Buuren, J., Koch, C., van Nieuw Amerongen, N., & Wright, A. M. (2014). The use of

business risk audit perspectives by non-Big 4 audit firms. Auditing: A Journal of Practice

& Theory, 33(3), 105-128.

Weng, W., Zhu, X., Wang, N., & Peng, B. (2018, July). Analysis on the Whitewashing

Motivation of Financial Statement of Listed Real Estate Companies in China. In 2018

International Conference on Education Science and Social Development (ESSD 2018).

Atlantis Press.

Yoon, K., Hoogduin, L., & Zhang, L. (2015). Big Data as complementary audit

evidence. Accounting Horizons, 29(2), 431-438.

Zamboni, Y., & Litschig, S. (2018). Audit risk and rent extraction: Evidence from a randomized

evaluation in Brazil. Journal of Development Economics, 134, 133-149.

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

Robinson, T. R., Henry, E., Pirie, W. L., &Broihahn, M. A. (2015). International financial

statement analysis. John Wiley & Sons.

Ruhnke, K., Pronobis, P., & Michel, M. (2014). Audit materiality disclosures and credit lending

decisions. Available at SSRN, 2460425.

Sridharan, S. A. (2015). Volatility forecasting using financial statement information. The

Accounting Review, 90(5), 2079-2106.

van Buuren, J., Koch, C., van Nieuw Amerongen, N., & Wright, A. M. (2014). The use of

business risk audit perspectives by non-Big 4 audit firms. Auditing: A Journal of Practice

& Theory, 33(3), 105-128.

Weng, W., Zhu, X., Wang, N., & Peng, B. (2018, July). Analysis on the Whitewashing

Motivation of Financial Statement of Listed Real Estate Companies in China. In 2018

International Conference on Education Science and Social Development (ESSD 2018).

Atlantis Press.

Yoon, K., Hoogduin, L., & Zhang, L. (2015). Big Data as complementary audit

evidence. Accounting Horizons, 29(2), 431-438.

Zamboni, Y., & Litschig, S. (2018). Audit risk and rent extraction: Evidence from a randomized

evaluation in Brazil. Journal of Development Economics, 134, 133-149.

12

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

Appendix

Trend

analysis

Income

statement

Dalby Logistics Limited

Consolidated statement of comprehensive income

Changes in

amount

Changes in %

2015 2016 2017 2018

201

6

201

7

201

8 2016 2017 2018

$'m $'m $'m $'m

Revenue from

continuing

operations

Revenue from

sales and

services

696.

7

632.

4

709.

05

788.

95

-

64.

3

12.3

5

92.2

5

-

9.23% 1.77% 13.24%

Other income

32.9

5

33.8

5

47.3

5 96.1 0.9 14.4

63.1

5 2.73% 43.70%

191.65

%

729.

65

666.

25

756.

4

885.

05

-

63.

4

26.7

5

155.

4

-

8.69% 3.67% 21.30%

Direct

transport and

logistics costs

-

188.

25

-

166.

45

-

185.

05

-

212.

2

21.

8 3.2

-

23.9

5

-

11.58

% -1.70% 12.72%

Repairs and

maintenance

costs -41.5 -42.7

-

44.3

5

-

40.5

5 -1.2

-

2.85 0.95 2.89% 6.87% -2.29%

Employee

benefits

expense

-

253.

45

-

249.

65

-

278.

5

-

308.

75 3.8

-

25.0

5

-

55.3

-

1.50% 9.88% 21.82%

Fuel, oil and

electricity

costs

-

53.0

5

-

37.8

5

-

41.7

5

-

49.2

5

15.

2 11.3 3.8

-

28.65

%

-

21.30% -7.16%

Occupancy

and property

costs -33.1 -31.4 -40.7

-

46.4

5 1.7 -7.6

-

13.3

5

-

5.14% 22.96% 40.33%

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

Appendix

Trend

analysis

Income

statement

Dalby Logistics Limited

Consolidated statement of comprehensive income

Changes in

amount

Changes in %

2015 2016 2017 2018

201

6

201

7

201

8 2016 2017 2018

$'m $'m $'m $'m

Revenue from

continuing

operations

Revenue from

sales and

services

696.

7

632.

4

709.

05

788.

95

-

64.

3

12.3

5

92.2

5

-

9.23% 1.77% 13.24%

Other income

32.9

5

33.8

5

47.3

5 96.1 0.9 14.4

63.1

5 2.73% 43.70%

191.65

%

729.

65

666.

25

756.

4

885.

05

-

63.

4

26.7

5

155.

4

-

8.69% 3.67% 21.30%

Direct

transport and

logistics costs

-

188.

25

-

166.

45

-

185.

05

-

212.

2

21.

8 3.2

-

23.9

5

-

11.58

% -1.70% 12.72%

Repairs and

maintenance

costs -41.5 -42.7

-

44.3

5

-

40.5

5 -1.2

-

2.85 0.95 2.89% 6.87% -2.29%

Employee

benefits

expense

-

253.

45

-

249.

65

-

278.

5

-

308.

75 3.8

-

25.0

5

-

55.3

-

1.50% 9.88% 21.82%

Fuel, oil and

electricity

costs

-

53.0

5

-

37.8

5

-

41.7

5

-

49.2

5

15.

2 11.3 3.8

-

28.65

%

-

21.30% -7.16%

Occupancy

and property

costs -33.1 -31.4 -40.7

-

46.4

5 1.7 -7.6

-

13.3

5

-

5.14% 22.96% 40.33%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

Depreciation

and

amortisation

expense

-

51.7

5

-

50.7

5 -56.7 -58 1

-

4.95

-

6.25

-

1.93% 9.57% 12.08%

Professional

fees -5.4 -5.55 -5.15 -3.85

-

0.1

5 0.25 1.55 2.78% -4.63%

-

28.70%

Loss on

disposal of

available-for-

sale financial

assets

-

13.0

5 0

-

13.0

5 0

Impairment of

non-current

assets

-

22.4

5

-

10.6

5 -13.2 -4.65

11.

8 9.25 17.8

-

52.56

%

-

41.20%

-

79.29%

Reversal of

impairment of

non-current

assets 8.8 8.8 0 0

Other

expenses -9.55 -6.25 -8

-

12.7

5 3.3 1.55 -3.2

-

34.55

%

-

16.23% 33.51%

Total

expenses

-

658.

5

-

592.

45

-

686.

45

-

736.

45

66.

05

-

27.9

5

-

77.9

5

-

10.03

% 4.24% 11.84%

Finance

income 0.9 0.75

11.9

5 13.1

-

0.1

5

11.0

5 12.2

-

16.67

%

1227.7

8%

1355.5

6%

Finance costs -13.5 -16.8

-

18.2

5 -20.6 -3.3

-

4.75 -7.1

24.44

% 35.19% 52.59%

Net finance

costs -12.6

-

16.0

5 -6.3 -7.5

-

3.4

5 6.3 5.1

27.38

%

-

50.00%

-

40.48%

Share of net

profit/(loss) of

associates

accounted for

using the

equity

method 5.2 6.3 -11.3 2.3 1.1

-

16.5 -2.9

21.15

%

-

317.31

%

-

55.77%

Profit before

income tax

63.7

5

64.0

5

52.3

5

143.

4 0.3

-

11.4

79.6

5 0.47%

-

17.88%

124.94

%

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

Depreciation

and

amortisation

expense

-

51.7

5

-

50.7

5 -56.7 -58 1

-

4.95

-

6.25

-

1.93% 9.57% 12.08%

Professional

fees -5.4 -5.55 -5.15 -3.85

-

0.1

5 0.25 1.55 2.78% -4.63%

-

28.70%

Loss on

disposal of

available-for-

sale financial

assets

-

13.0

5 0

-

13.0

5 0

Impairment of

non-current

assets

-

22.4

5

-

10.6

5 -13.2 -4.65

11.

8 9.25 17.8

-

52.56

%

-

41.20%

-

79.29%

Reversal of

impairment of

non-current

assets 8.8 8.8 0 0

Other

expenses -9.55 -6.25 -8

-

12.7

5 3.3 1.55 -3.2

-

34.55

%

-

16.23% 33.51%

Total

expenses

-

658.

5

-

592.

45

-

686.

45

-

736.

45

66.

05

-

27.9

5

-

77.9

5

-

10.03

% 4.24% 11.84%

Finance

income 0.9 0.75

11.9

5 13.1

-

0.1

5

11.0

5 12.2

-

16.67

%

1227.7

8%

1355.5

6%

Finance costs -13.5 -16.8

-

18.2

5 -20.6 -3.3

-

4.75 -7.1

24.44

% 35.19% 52.59%

Net finance

costs -12.6

-

16.0

5 -6.3 -7.5

-

3.4

5 6.3 5.1

27.38

%

-

50.00%

-

40.48%

Share of net

profit/(loss) of

associates

accounted for

using the

equity

method 5.2 6.3 -11.3 2.3 1.1

-

16.5 -2.9

21.15

%

-

317.31

%

-

55.77%

Profit before

income tax

63.7

5

64.0

5

52.3

5

143.

4 0.3

-

11.4

79.6

5 0.47%

-

17.88%

124.94

%

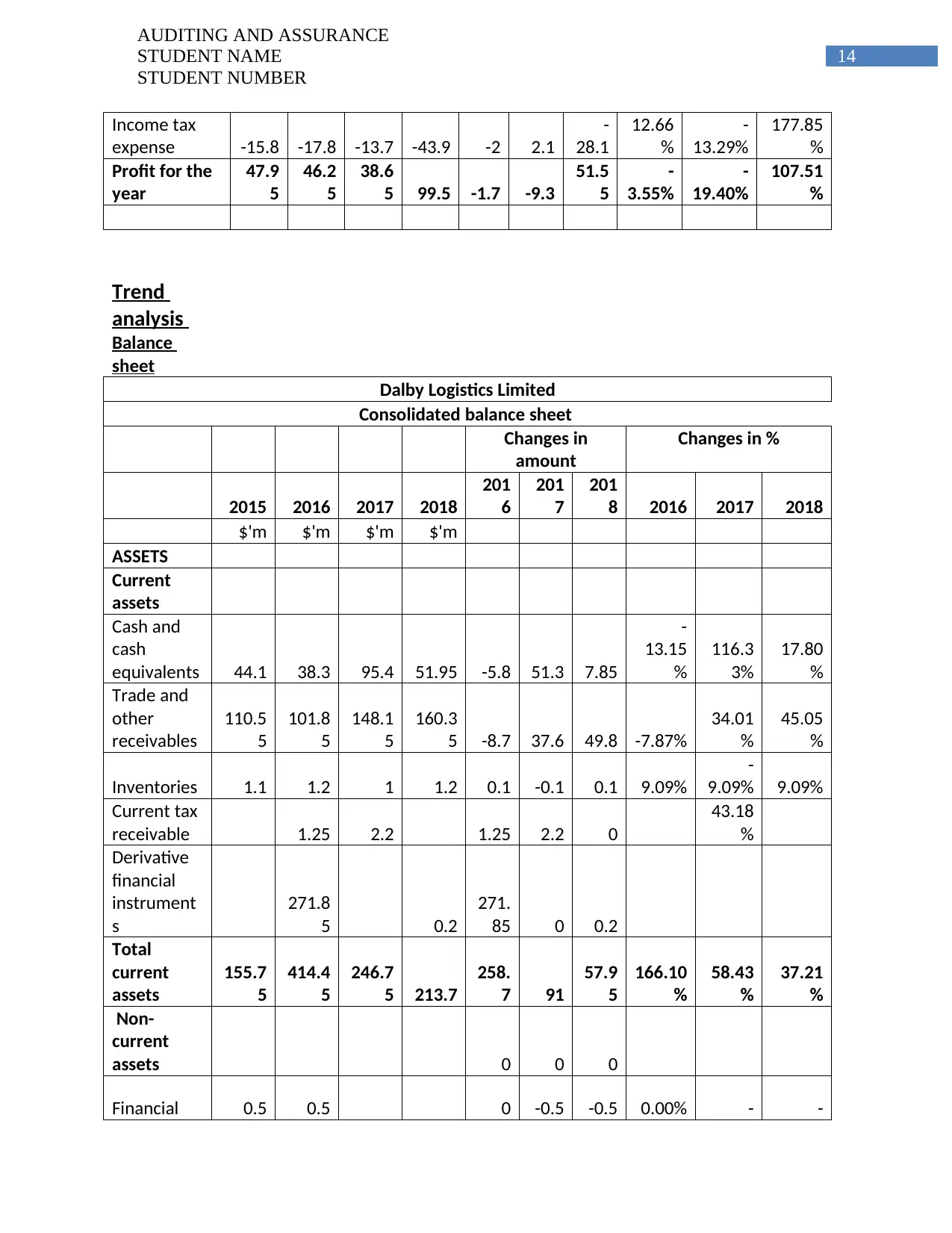

14

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

Income tax

expense -15.8 -17.8 -13.7 -43.9 -2 2.1

-

28.1

12.66

%

-

13.29%

177.85

%

Profit for the

year

47.9

5

46.2

5

38.6

5 99.5 -1.7 -9.3

51.5

5

-

3.55%

-

19.40%

107.51

%

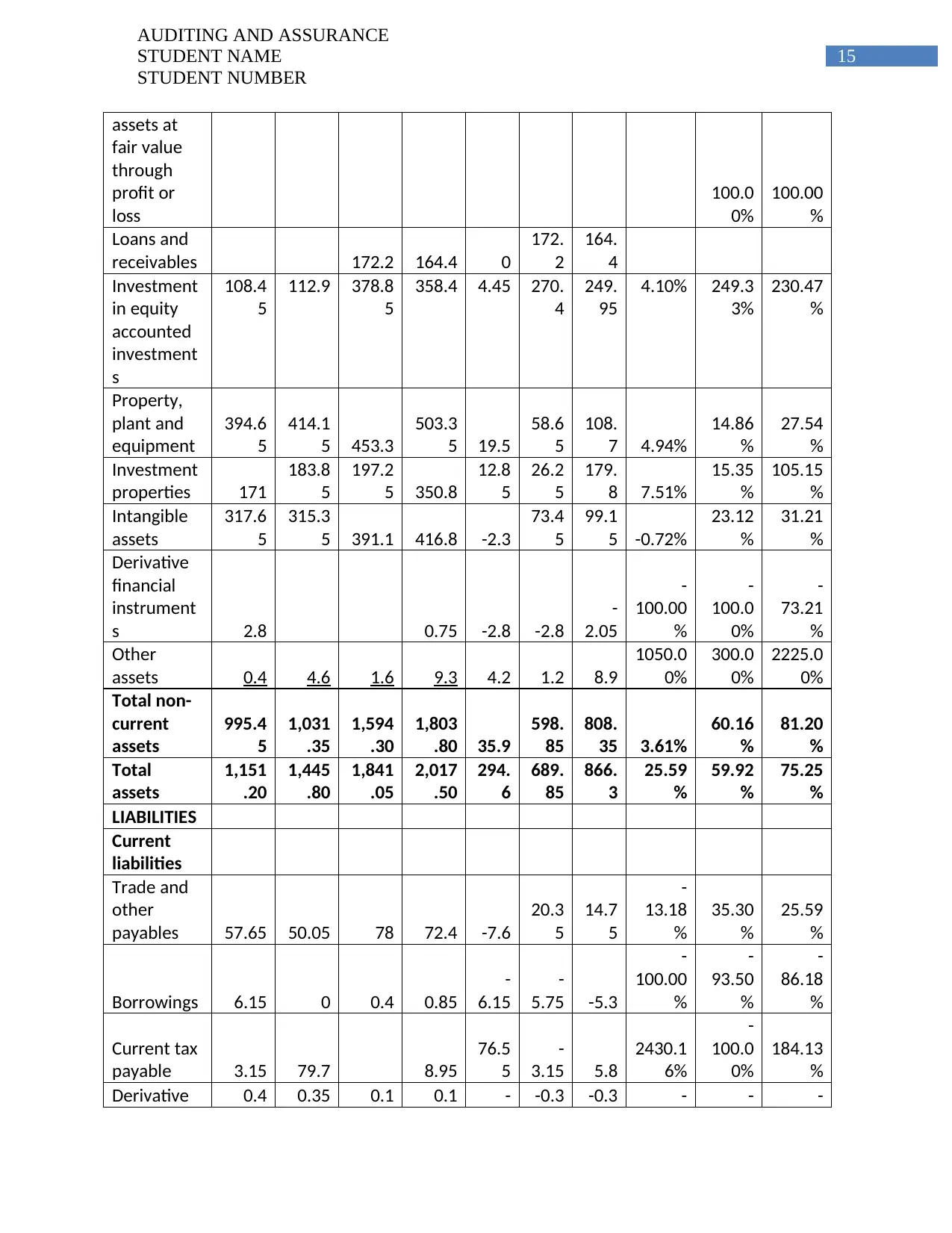

Trend

analysis

Balance

sheet

Dalby Logistics Limited

Consolidated balance sheet

Changes in

amount

Changes in %

2015 2016 2017 2018

201

6

201

7

201

8 2016 2017 2018

$'m $'m $'m $'m

ASSETS

Current

assets

Cash and

cash

equivalents 44.1 38.3 95.4 51.95 -5.8 51.3 7.85

-

13.15

%

116.3

3%

17.80

%

Trade and

other

receivables

110.5

5

101.8

5

148.1

5

160.3

5 -8.7 37.6 49.8 -7.87%

34.01

%

45.05

%

Inventories 1.1 1.2 1 1.2 0.1 -0.1 0.1 9.09%

-

9.09% 9.09%

Current tax

receivable 1.25 2.2 1.25 2.2 0

43.18

%

Derivative

financial

instrument

s

271.8

5 0.2

271.

85 0 0.2

Total

current

assets

155.7

5

414.4

5

246.7

5 213.7

258.

7 91

57.9

5

166.10

%

58.43

%

37.21

%

Non-

current

assets 0 0 0

Financial 0.5 0.5 0 -0.5 -0.5 0.00% - -

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

Income tax

expense -15.8 -17.8 -13.7 -43.9 -2 2.1

-

28.1

12.66

%

-

13.29%

177.85

%

Profit for the

year

47.9

5

46.2

5

38.6

5 99.5 -1.7 -9.3

51.5

5

-

3.55%

-

19.40%

107.51

%

Trend

analysis

Balance

sheet

Dalby Logistics Limited

Consolidated balance sheet

Changes in

amount

Changes in %

2015 2016 2017 2018

201

6

201

7

201

8 2016 2017 2018

$'m $'m $'m $'m

ASSETS

Current

assets

Cash and

cash

equivalents 44.1 38.3 95.4 51.95 -5.8 51.3 7.85

-

13.15

%

116.3

3%

17.80

%

Trade and

other

receivables

110.5

5

101.8

5

148.1

5

160.3

5 -8.7 37.6 49.8 -7.87%

34.01

%

45.05

%

Inventories 1.1 1.2 1 1.2 0.1 -0.1 0.1 9.09%

-

9.09% 9.09%

Current tax

receivable 1.25 2.2 1.25 2.2 0

43.18

%

Derivative

financial

instrument

s

271.8

5 0.2

271.

85 0 0.2

Total

current

assets

155.7

5

414.4

5

246.7

5 213.7

258.

7 91

57.9

5

166.10

%

58.43

%

37.21

%

Non-

current

assets 0 0 0

Financial 0.5 0.5 0 -0.5 -0.5 0.00% - -

15

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

assets at

fair value

through

profit or

loss

100.0

0%

100.00

%

Loans and

receivables 172.2 164.4 0

172.

2

164.

4

Investment

in equity

accounted

investment

s

108.4

5

112.9 378.8

5

358.4 4.45 270.

4

249.

95

4.10% 249.3

3%

230.47

%

Property,

plant and

equipment

394.6

5

414.1

5 453.3

503.3

5 19.5

58.6

5

108.

7 4.94%

14.86

%

27.54

%

Investment

properties 171

183.8

5

197.2

5 350.8

12.8

5

26.2

5

179.

8 7.51%

15.35

%

105.15

%

Intangible

assets

317.6

5

315.3

5 391.1 416.8 -2.3

73.4

5

99.1

5 -0.72%

23.12

%

31.21

%

Derivative

financial

instrument

s 2.8 0.75 -2.8 -2.8

-

2.05

-

100.00

%

-

100.0

0%

-

73.21

%

Other

assets 0.4 4.6 1.6 9.3 4.2 1.2 8.9

1050.0

0%

300.0

0%

2225.0

0%

Total non-

current

assets

995.4

5

1,031

.35

1,594

.30

1,803

.80 35.9

598.

85

808.

35 3.61%

60.16

%

81.20

%

Total

assets

1,151

.20

1,445

.80

1,841

.05

2,017

.50

294.

6

689.

85

866.

3

25.59

%

59.92

%

75.25

%

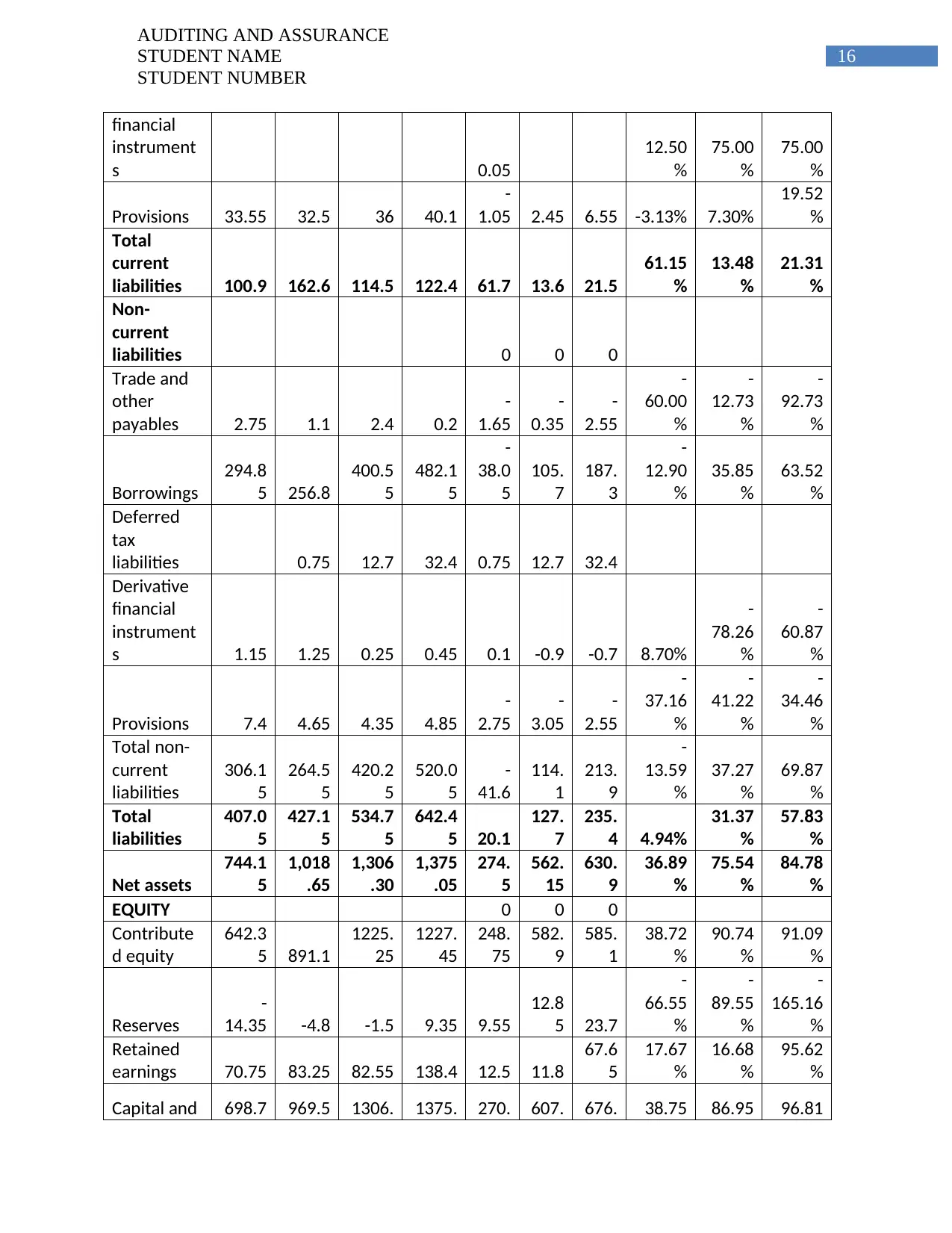

LIABILITIES

Current

liabilities

Trade and

other

payables 57.65 50.05 78 72.4 -7.6

20.3

5

14.7

5

-

13.18

%

35.30

%

25.59

%

Borrowings 6.15 0 0.4 0.85

-

6.15

-

5.75 -5.3

-

100.00

%

-

93.50

%

-

86.18

%

Current tax

payable 3.15 79.7 8.95

76.5

5

-

3.15 5.8

2430.1

6%

-

100.0

0%

184.13

%

Derivative 0.4 0.35 0.1 0.1 - -0.3 -0.3 - - -

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

assets at

fair value

through

profit or

loss

100.0

0%

100.00

%

Loans and

receivables 172.2 164.4 0

172.

2

164.

4

Investment

in equity

accounted

investment

s

108.4

5

112.9 378.8

5

358.4 4.45 270.

4

249.

95

4.10% 249.3

3%

230.47

%

Property,

plant and

equipment

394.6

5

414.1

5 453.3

503.3

5 19.5

58.6

5

108.

7 4.94%

14.86

%

27.54

%

Investment

properties 171

183.8

5

197.2

5 350.8

12.8

5

26.2

5

179.

8 7.51%

15.35

%

105.15

%

Intangible

assets

317.6

5

315.3

5 391.1 416.8 -2.3

73.4

5

99.1

5 -0.72%

23.12

%

31.21

%

Derivative

financial

instrument

s 2.8 0.75 -2.8 -2.8

-

2.05

-

100.00

%

-

100.0

0%

-

73.21

%

Other

assets 0.4 4.6 1.6 9.3 4.2 1.2 8.9

1050.0

0%

300.0

0%

2225.0

0%

Total non-

current

assets

995.4

5

1,031

.35

1,594

.30

1,803

.80 35.9

598.

85

808.

35 3.61%

60.16

%

81.20

%

Total

assets

1,151

.20

1,445

.80

1,841

.05

2,017

.50

294.

6

689.

85

866.

3

25.59

%

59.92

%

75.25

%

LIABILITIES

Current

liabilities

Trade and

other

payables 57.65 50.05 78 72.4 -7.6

20.3

5

14.7

5

-

13.18

%

35.30

%

25.59

%

Borrowings 6.15 0 0.4 0.85

-

6.15

-

5.75 -5.3

-

100.00

%

-

93.50

%

-

86.18

%

Current tax

payable 3.15 79.7 8.95

76.5

5

-

3.15 5.8

2430.1

6%

-

100.0

0%

184.13

%

Derivative 0.4 0.35 0.1 0.1 - -0.3 -0.3 - - -

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

financial

instrument

s 0.05

12.50

%

75.00

%

75.00

%

Provisions 33.55 32.5 36 40.1

-

1.05 2.45 6.55 -3.13% 7.30%

19.52

%

Total

current

liabilities 100.9 162.6 114.5 122.4 61.7 13.6 21.5

61.15

%

13.48

%

21.31

%

Non-

current

liabilities 0 0 0

Trade and

other

payables 2.75 1.1 2.4 0.2

-

1.65

-

0.35

-

2.55

-

60.00

%

-

12.73

%

-

92.73

%

Borrowings

294.8

5 256.8

400.5

5

482.1

5

-

38.0

5

105.

7

187.

3

-

12.90

%

35.85

%

63.52

%

Deferred

tax

liabilities 0.75 12.7 32.4 0.75 12.7 32.4

Derivative

financial

instrument

s 1.15 1.25 0.25 0.45 0.1 -0.9 -0.7 8.70%

-

78.26

%

-

60.87

%

Provisions 7.4 4.65 4.35 4.85

-

2.75

-

3.05

-

2.55

-

37.16

%

-

41.22

%

-

34.46

%

Total non-

current

liabilities

306.1

5

264.5

5

420.2

5

520.0

5

-

41.6

114.

1

213.

9

-

13.59

%

37.27

%

69.87

%

Total

liabilities

407.0

5

427.1

5

534.7

5

642.4

5 20.1

127.

7

235.

4 4.94%

31.37

%

57.83

%

Net assets

744.1

5

1,018

.65

1,306

.30

1,375

.05

274.

5

562.

15

630.

9

36.89

%

75.54

%

84.78

%

EQUITY 0 0 0

Contribute

d equity

642.3

5 891.1

1225.

25

1227.

45

248.

75

582.

9

585.

1

38.72

%

90.74

%

91.09

%

Reserves

-

14.35 -4.8 -1.5 9.35 9.55

12.8

5 23.7

-

66.55

%

-

89.55

%

-

165.16

%

Retained

earnings 70.75 83.25 82.55 138.4 12.5 11.8

67.6

5

17.67

%

16.68

%

95.62

%

Capital and 698.7 969.5 1306. 1375. 270. 607. 676. 38.75 86.95 96.81

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

financial

instrument

s 0.05

12.50

%

75.00

%

75.00

%

Provisions 33.55 32.5 36 40.1

-

1.05 2.45 6.55 -3.13% 7.30%

19.52

%

Total

current

liabilities 100.9 162.6 114.5 122.4 61.7 13.6 21.5

61.15

%

13.48

%

21.31

%

Non-

current

liabilities 0 0 0

Trade and

other

payables 2.75 1.1 2.4 0.2

-

1.65

-

0.35

-

2.55

-

60.00

%

-

12.73

%

-

92.73

%

Borrowings

294.8

5 256.8

400.5

5

482.1

5

-

38.0

5

105.

7

187.

3

-

12.90

%

35.85

%

63.52

%

Deferred

tax

liabilities 0.75 12.7 32.4 0.75 12.7 32.4

Derivative

financial

instrument

s 1.15 1.25 0.25 0.45 0.1 -0.9 -0.7 8.70%

-

78.26

%

-

60.87

%

Provisions 7.4 4.65 4.35 4.85

-

2.75

-

3.05

-

2.55

-

37.16

%

-

41.22

%

-

34.46

%

Total non-

current

liabilities

306.1

5

264.5

5

420.2

5

520.0

5

-

41.6

114.

1

213.

9

-

13.59

%

37.27

%

69.87

%

Total

liabilities

407.0

5

427.1

5

534.7

5

642.4

5 20.1

127.

7

235.

4 4.94%

31.37

%

57.83

%

Net assets

744.1

5

1,018

.65

1,306

.30

1,375

.05

274.

5

562.

15

630.

9

36.89

%

75.54

%

84.78

%

EQUITY 0 0 0

Contribute

d equity

642.3

5 891.1

1225.

25

1227.

45

248.

75

582.

9

585.

1

38.72

%

90.74

%

91.09

%

Reserves

-

14.35 -4.8 -1.5 9.35 9.55

12.8

5 23.7

-

66.55

%

-

89.55

%

-

165.16

%

Retained

earnings 70.75 83.25 82.55 138.4 12.5 11.8

67.6

5

17.67

%

16.68

%

95.62

%

Capital and 698.7 969.5 1306. 1375. 270. 607. 676. 38.75 86.95 96.81

17

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

reserves

attributable

to owners

of Dalby

Logistics

Limited 5 5 3 2 8 55 45 % % %

Non-

controlling

interests 45.4 49.1 -0.15 3.7

-

45.4

-

45.5

5 8.15%

-

100.0

0%

-

100.33

%

Total

equity

744.1

5

1,018

.65

1,306

.30

1,375

.05

274.

5

562.

15

630.

9

36.89

%

75.54

%

84.78

%

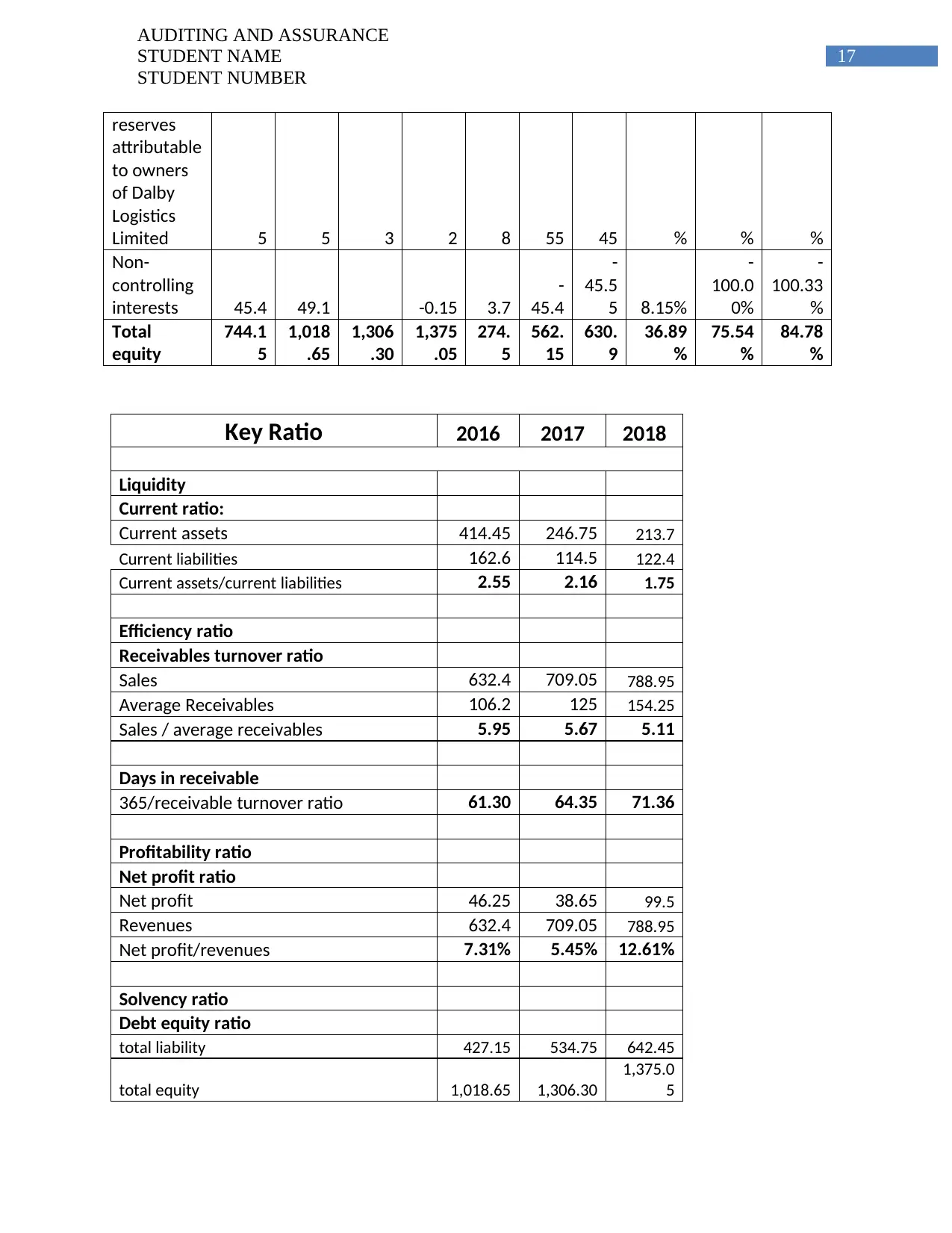

Key Ratio 2016 2017 2018

Liquidity

Current ratio:

Current assets 414.45 246.75 213.7

Current liabilities 162.6 114.5 122.4

Current assets/current liabilities 2.55 2.16 1.75

Efficiency ratio

Receivables turnover ratio

Sales 632.4 709.05 788.95

Average Receivables 106.2 125 154.25

Sales / average receivables 5.95 5.67 5.11

Days in receivable

365/receivable turnover ratio 61.30 64.35 71.36

Profitability ratio

Net profit ratio

Net profit 46.25 38.65 99.5

Revenues 632.4 709.05 788.95

Net profit/revenues 7.31% 5.45% 12.61%

Solvency ratio

Debt equity ratio

total liability 427.15 534.75 642.45

total equity 1,018.65 1,306.30

1,375.0

5

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

reserves

attributable

to owners

of Dalby

Logistics

Limited 5 5 3 2 8 55 45 % % %

Non-

controlling

interests 45.4 49.1 -0.15 3.7

-

45.4

-

45.5

5 8.15%

-

100.0

0%

-

100.33

%

Total

equity

744.1

5

1,018

.65

1,306

.30

1,375

.05

274.

5

562.

15

630.

9

36.89

%

75.54

%

84.78

%

Key Ratio 2016 2017 2018

Liquidity

Current ratio:

Current assets 414.45 246.75 213.7

Current liabilities 162.6 114.5 122.4

Current assets/current liabilities 2.55 2.16 1.75

Efficiency ratio

Receivables turnover ratio

Sales 632.4 709.05 788.95

Average Receivables 106.2 125 154.25

Sales / average receivables 5.95 5.67 5.11

Days in receivable

365/receivable turnover ratio 61.30 64.35 71.36

Profitability ratio

Net profit ratio

Net profit 46.25 38.65 99.5

Revenues 632.4 709.05 788.95

Net profit/revenues 7.31% 5.45% 12.61%

Solvency ratio

Debt equity ratio

total liability 427.15 534.75 642.45

total equity 1,018.65 1,306.30

1,375.0

5

18

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

total liability/total equity 0.42 0.41 0.47

AUDITING AND ASSURANCE

STUDENT NAME

STUDENT NUMBER

total liability/total equity 0.42 0.41 0.47

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.