CQUniversity Auditing and Ethics Report: Oil Search Limited Analysis

VerifiedAdded on 2023/01/05

|15

|3384

|39

Report

AI Summary

This report analyzes the auditing and ethics of Oil Search Limited, a company operating in Papua New Guinea. It begins by determining the materiality level for the 2018 audit plan, considering factors like revenue and profit before tax. The report reviews key disclosures and draft notes in the annual report, particularly focusing on income tax, asset valuations, and exploration assets. It identifies key risk areas through a preliminary analytical review of balance sheet and profit & loss ratios from 2015 to 2018, including debt-to-equity, current ratio, and gross profit margin. The analysis then evaluates the going concern risk by examining the company's cash flow statement, highlighting major cash inflows and outflows and assessing the impact on the business's ability to continue operating. Finally, the report references the auditor's opinion and concludes that sufficient evidence supports the entity as a going concern. The report is based on the ACCT20075 assignment for CQUniversity.

Running head: AUDITING AND ETHICS

Auditing and ethics

Name of the Student

Name of the University

Author’s note

Auditing and ethics

Name of the Student

Name of the University

Author’s note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1AUDITING AND ETHICS

Table of Contents

Introduction:...............................................................................................................................2

Discussion:.................................................................................................................................2

Section 1:....................................................................................................................................2

Determining the level of materiality to be used in the audit plan for the year 2018:.................2

Reviewing the various disclosures and draft notes in the annual report of the company:.........4

Section 2:....................................................................................................................................5

Identifying the key risk areas for audit matters to be addressed in the audit plan:....................5

Section 3:....................................................................................................................................7

Evaluating the going concern risk of the company by reviewing the cash flow:......................7

Reviewing the audit report and the opinions of the auditors of company for financial year

2018:...........................................................................................................................................8

Conclusion:................................................................................................................................8

Table of Contents

Introduction:...............................................................................................................................2

Discussion:.................................................................................................................................2

Section 1:....................................................................................................................................2

Determining the level of materiality to be used in the audit plan for the year 2018:.................2

Reviewing the various disclosures and draft notes in the annual report of the company:.........4

Section 2:....................................................................................................................................5

Identifying the key risk areas for audit matters to be addressed in the audit plan:....................5

Section 3:....................................................................................................................................7

Evaluating the going concern risk of the company by reviewing the cash flow:......................7

Reviewing the audit report and the opinions of the auditors of company for financial year

2018:...........................................................................................................................................8

Conclusion:................................................................................................................................8

2AUDITING AND ETHICS

Introduction:

The report is prepared to develop the audit plan for one of the chosen companies from

ASX by determining the level of materiality. For this purpose, the company that is selected is

Oil search limited is a biggest company operating in Papua New Guinea that is engaged in the

oil and gas assets development of the country for creating stakeholders value. The interest of

the company lies in the most prospective acreage of PNG that would support the high quality

and multiyear exploration drilling program by targeting gas resources for future

commercialisation. In this report, the quantitative estimate of the materiality has been

provided by discussing different bases and considerations involved in determination of

materiality (Oilsearch.com, 2019). Factors that are significant such as discloses and draft

notes are incorporated for determining materiality in the accounts. The report intends to

preliminary analytical review by addressing key balance sheet and profit and loss ratios for

the financial year 2015 to 2018. Later part of the report demonstrate the evaluating of the

ongoing risk of the company by reviewing the cash flow along with the auditors opinion.

Discussion:

Section 1:

Determining the level of materiality to be used in the audit plan for the year 2018:

The concept of materiality is determined in the context of presentation and

preparation of the financial statements as the discussion of the materiality by the auditors

would provide with a frame of references. At the planning stage of audit, the primary

objective of setting materiality is the identification of performance materiality and the

surrounding circumstances forms the basis of judgement of materiality. The fundamental

factor to the audit is the materiality concept which is applied by the auditors in evaluating the

effects of the material misstatements and when performing audits (Auasb.gov.au, 2019).

Introduction:

The report is prepared to develop the audit plan for one of the chosen companies from

ASX by determining the level of materiality. For this purpose, the company that is selected is

Oil search limited is a biggest company operating in Papua New Guinea that is engaged in the

oil and gas assets development of the country for creating stakeholders value. The interest of

the company lies in the most prospective acreage of PNG that would support the high quality

and multiyear exploration drilling program by targeting gas resources for future

commercialisation. In this report, the quantitative estimate of the materiality has been

provided by discussing different bases and considerations involved in determination of

materiality (Oilsearch.com, 2019). Factors that are significant such as discloses and draft

notes are incorporated for determining materiality in the accounts. The report intends to

preliminary analytical review by addressing key balance sheet and profit and loss ratios for

the financial year 2015 to 2018. Later part of the report demonstrate the evaluating of the

ongoing risk of the company by reviewing the cash flow along with the auditors opinion.

Discussion:

Section 1:

Determining the level of materiality to be used in the audit plan for the year 2018:

The concept of materiality is determined in the context of presentation and

preparation of the financial statements as the discussion of the materiality by the auditors

would provide with a frame of references. At the planning stage of audit, the primary

objective of setting materiality is the identification of performance materiality and the

surrounding circumstances forms the basis of judgement of materiality. The fundamental

factor to the audit is the materiality concept which is applied by the auditors in evaluating the

effects of the material misstatements and when performing audits (Auasb.gov.au, 2019).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3AUDITING AND ETHICS

There are three key steps for determining materiality that is choosing the appropriate

benchmark, determination of the level which is usually the percentage of the benchmark and

justification of the choices. Some of the benchmark that can be used for determining

materiality is given by total income, total equity, total expenses, gross profit and profit before

tax (Icaew.com, 2019). However, for the determination of appropriate benchmark, it is

required by the auditors to have professional judgement by justifying such benchmark.

For the establishment of an appropriate quantitative materiality level to plan selection

strategies and audit strategies, a preliminary assessment of materiality is made by auditors.

The preliminary materiality for the audit planning is determined by auditors by considering

the financial results of prior year, year to year balances and results and budgets for the given

financial year. The initial step for preliminary materiality assumption is provided by the

quantitative materiality level that is applied to the audit procedures for evaluating the

outcome of the procedures (Brennan, 2016).

Materiality of Oil search limited has been determined with reference to the three years

benchmark that is from 2015 to 2018 of average group profit before profits. It also include

exceptional items for continuing operations and these are principal consideration in assessing

the financial performance. Given the volatility in the nature of prices of commodities and

cyclical nature of the industry impacting the profitability, the approach is regarded

appropriate. Materiality is represented by approximately 4% of the three year average profit

before taxation and 1% of the revenue of the group (Kaptein, 2015). Therefore, in the first

step, it is required to compute the average value of three years profit before taxation.

Average profit before taxation and the exceptional items=

(440874+185032-14251)/3= 611655/3=203885.3

There are three key steps for determining materiality that is choosing the appropriate

benchmark, determination of the level which is usually the percentage of the benchmark and

justification of the choices. Some of the benchmark that can be used for determining

materiality is given by total income, total equity, total expenses, gross profit and profit before

tax (Icaew.com, 2019). However, for the determination of appropriate benchmark, it is

required by the auditors to have professional judgement by justifying such benchmark.

For the establishment of an appropriate quantitative materiality level to plan selection

strategies and audit strategies, a preliminary assessment of materiality is made by auditors.

The preliminary materiality for the audit planning is determined by auditors by considering

the financial results of prior year, year to year balances and results and budgets for the given

financial year. The initial step for preliminary materiality assumption is provided by the

quantitative materiality level that is applied to the audit procedures for evaluating the

outcome of the procedures (Brennan, 2016).

Materiality of Oil search limited has been determined with reference to the three years

benchmark that is from 2015 to 2018 of average group profit before profits. It also include

exceptional items for continuing operations and these are principal consideration in assessing

the financial performance. Given the volatility in the nature of prices of commodities and

cyclical nature of the industry impacting the profitability, the approach is regarded

appropriate. Materiality is represented by approximately 4% of the three year average profit

before taxation and 1% of the revenue of the group (Kaptein, 2015). Therefore, in the first

step, it is required to compute the average value of three years profit before taxation.

Average profit before taxation and the exceptional items=

(440874+185032-14251)/3= 611655/3=203885.3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4AUDITING AND ETHICS

Average revenue of the group for three years= 1% of revenue for financial year 2018=

14460

Therefore, materiality for the audit of the consolidated financial statements is 4% of

(203885.3+14460) = $ USD 8700 million.

Reviewing the various disclosures and draft notes in the annual report of the company:

On reviewing the draft disclosure and notes to the financial statement of Oil search

limited, some of the accounts that are considered to be significant in the auditing of the

financial statements are accounting for income tax, carrying value of development and

producing assets and carrying value of exploration and evaluation of assets. Income tax

expense is considered as significant matter because the deferred tax liabilities and assets is

more than the income tax expense for the year ending 2018. The audit procedure concerning

this is testing and evaluating key controls over the tax calculations and cost allocations and

evaluating the carrying value of tax (Sinha & Arena, 2018). In addition to this, the procedure

would also involve evaluating the consistent of the management forecast with the tax

legislation. The procedure for evaluating the carrying value of development and producing

assets is testing the key control of management, assessing estimates of reserve and comparing

the actual and budgeted operating cost. Moreover, the audit procedures for evaluating

carrying value of evaluation and exploration assets include identifying the indicators of

impairment of such assets by testing the key control, evaluating the license status and

assessing the expectation of reasonableness of the management. In addition to this, an

understanding of the appraisal and exploration activity undertaken by participating with the

operational and finance staffs (Cipriano et al., 2019).

Average revenue of the group for three years= 1% of revenue for financial year 2018=

14460

Therefore, materiality for the audit of the consolidated financial statements is 4% of

(203885.3+14460) = $ USD 8700 million.

Reviewing the various disclosures and draft notes in the annual report of the company:

On reviewing the draft disclosure and notes to the financial statement of Oil search

limited, some of the accounts that are considered to be significant in the auditing of the

financial statements are accounting for income tax, carrying value of development and

producing assets and carrying value of exploration and evaluation of assets. Income tax

expense is considered as significant matter because the deferred tax liabilities and assets is

more than the income tax expense for the year ending 2018. The audit procedure concerning

this is testing and evaluating key controls over the tax calculations and cost allocations and

evaluating the carrying value of tax (Sinha & Arena, 2018). In addition to this, the procedure

would also involve evaluating the consistent of the management forecast with the tax

legislation. The procedure for evaluating the carrying value of development and producing

assets is testing the key control of management, assessing estimates of reserve and comparing

the actual and budgeted operating cost. Moreover, the audit procedures for evaluating

carrying value of evaluation and exploration assets include identifying the indicators of

impairment of such assets by testing the key control, evaluating the license status and

assessing the expectation of reasonableness of the management. In addition to this, an

understanding of the appraisal and exploration activity undertaken by participating with the

operational and finance staffs (Cipriano et al., 2019).

5AUDITING AND ETHICS

Section 2:

Identifying the key risk areas for audit matters to be addressed in the audit plan:

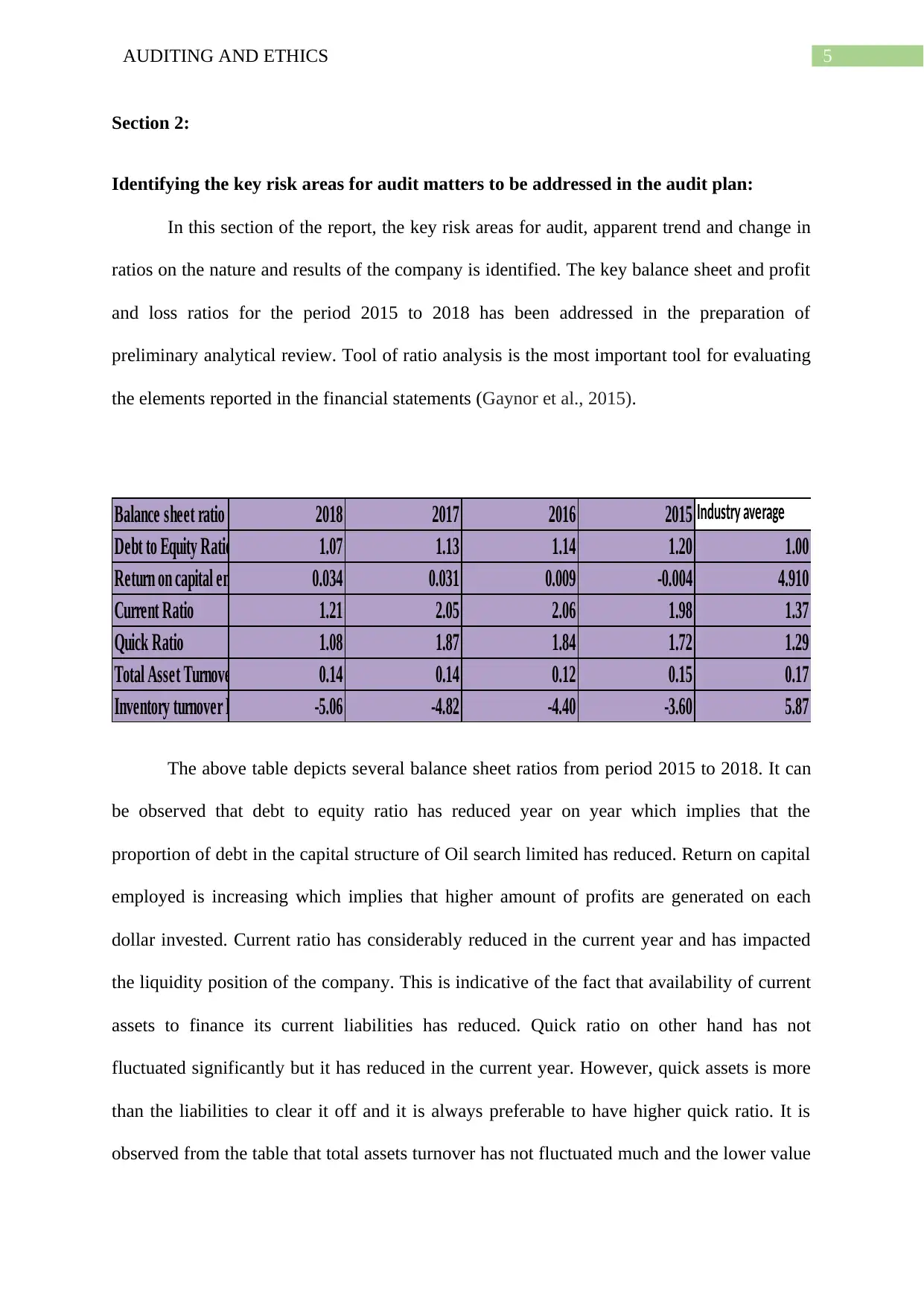

In this section of the report, the key risk areas for audit, apparent trend and change in

ratios on the nature and results of the company is identified. The key balance sheet and profit

and loss ratios for the period 2015 to 2018 has been addressed in the preparation of

preliminary analytical review. Tool of ratio analysis is the most important tool for evaluating

the elements reported in the financial statements (Gaynor et al., 2015).

Balance sheet ratio 2018 2017 2016 2015 Industry average

Debt to Equity Ratio 1.07 1.13 1.14 1.20 1.00

Return on capital employed 0.034 0.031 0.009 -0.004 4.910

Current Ratio 1.21 2.05 2.06 1.98 1.37

Quick Ratio 1.08 1.87 1.84 1.72 1.29

Total Asset Turnover Ratio 0.14 0.14 0.12 0.15 0.17

Inventory turnover Ratio -5.06 -4.82 -4.40 -3.60 5.87

The above table depicts several balance sheet ratios from period 2015 to 2018. It can

be observed that debt to equity ratio has reduced year on year which implies that the

proportion of debt in the capital structure of Oil search limited has reduced. Return on capital

employed is increasing which implies that higher amount of profits are generated on each

dollar invested. Current ratio has considerably reduced in the current year and has impacted

the liquidity position of the company. This is indicative of the fact that availability of current

assets to finance its current liabilities has reduced. Quick ratio on other hand has not

fluctuated significantly but it has reduced in the current year. However, quick assets is more

than the liabilities to clear it off and it is always preferable to have higher quick ratio. It is

observed from the table that total assets turnover has not fluctuated much and the lower value

Section 2:

Identifying the key risk areas for audit matters to be addressed in the audit plan:

In this section of the report, the key risk areas for audit, apparent trend and change in

ratios on the nature and results of the company is identified. The key balance sheet and profit

and loss ratios for the period 2015 to 2018 has been addressed in the preparation of

preliminary analytical review. Tool of ratio analysis is the most important tool for evaluating

the elements reported in the financial statements (Gaynor et al., 2015).

Balance sheet ratio 2018 2017 2016 2015 Industry average

Debt to Equity Ratio 1.07 1.13 1.14 1.20 1.00

Return on capital employed 0.034 0.031 0.009 -0.004 4.910

Current Ratio 1.21 2.05 2.06 1.98 1.37

Quick Ratio 1.08 1.87 1.84 1.72 1.29

Total Asset Turnover Ratio 0.14 0.14 0.12 0.15 0.17

Inventory turnover Ratio -5.06 -4.82 -4.40 -3.60 5.87

The above table depicts several balance sheet ratios from period 2015 to 2018. It can

be observed that debt to equity ratio has reduced year on year which implies that the

proportion of debt in the capital structure of Oil search limited has reduced. Return on capital

employed is increasing which implies that higher amount of profits are generated on each

dollar invested. Current ratio has considerably reduced in the current year and has impacted

the liquidity position of the company. This is indicative of the fact that availability of current

assets to finance its current liabilities has reduced. Quick ratio on other hand has not

fluctuated significantly but it has reduced in the current year. However, quick assets is more

than the liabilities to clear it off and it is always preferable to have higher quick ratio. It is

observed from the table that total assets turnover has not fluctuated much and the lower value

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6AUDITING AND ETHICS

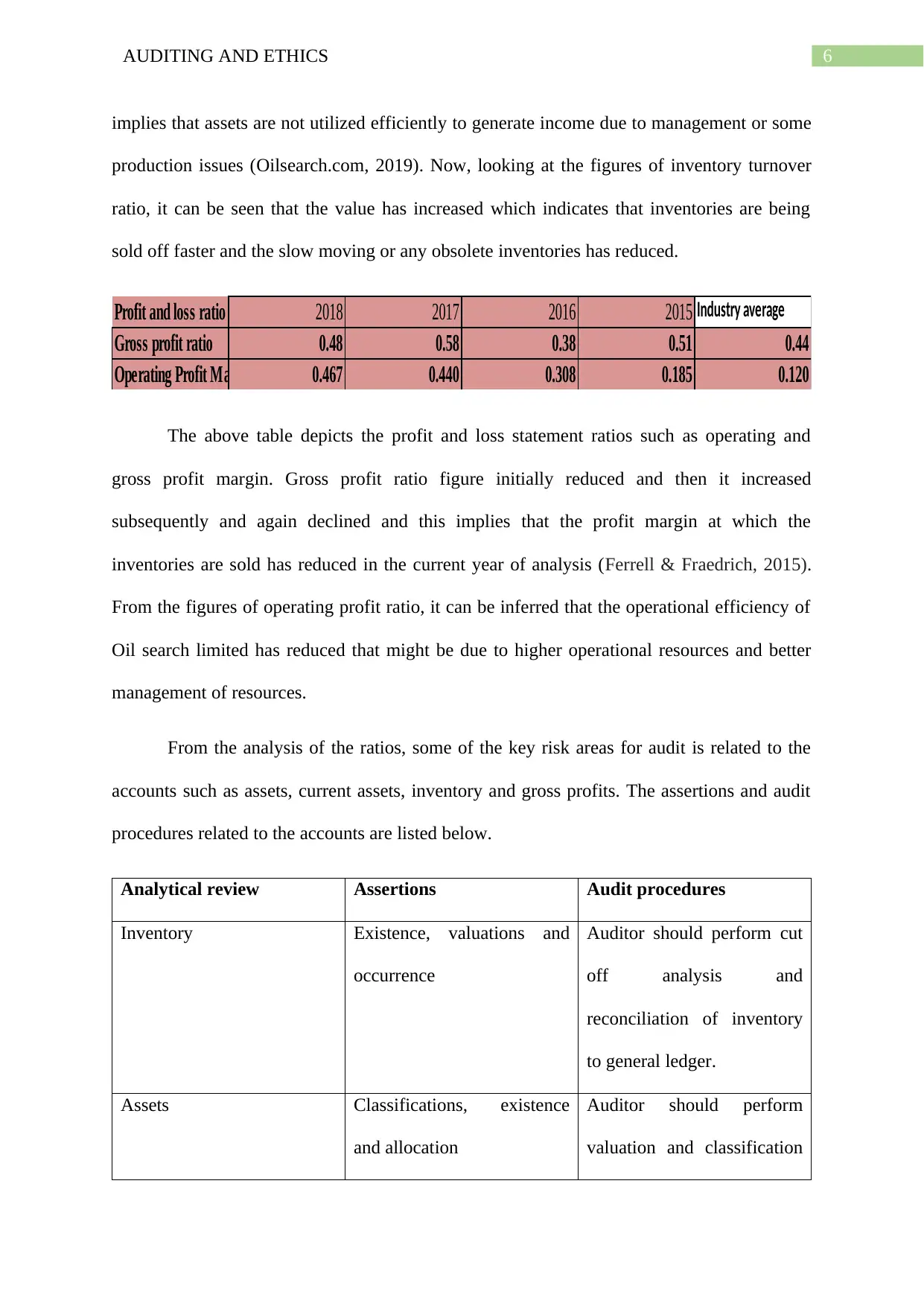

implies that assets are not utilized efficiently to generate income due to management or some

production issues (Oilsearch.com, 2019). Now, looking at the figures of inventory turnover

ratio, it can be seen that the value has increased which indicates that inventories are being

sold off faster and the slow moving or any obsolete inventories has reduced.

Profit and loss ratio 2018 2017 2016 2015 Industry average

Gross profit ratio 0.48 0.58 0.38 0.51 0.44

Operating Profit Margin 0.467 0.440 0.308 0.185 0.120

The above table depicts the profit and loss statement ratios such as operating and

gross profit margin. Gross profit ratio figure initially reduced and then it increased

subsequently and again declined and this implies that the profit margin at which the

inventories are sold has reduced in the current year of analysis (Ferrell & Fraedrich, 2015).

From the figures of operating profit ratio, it can be inferred that the operational efficiency of

Oil search limited has reduced that might be due to higher operational resources and better

management of resources.

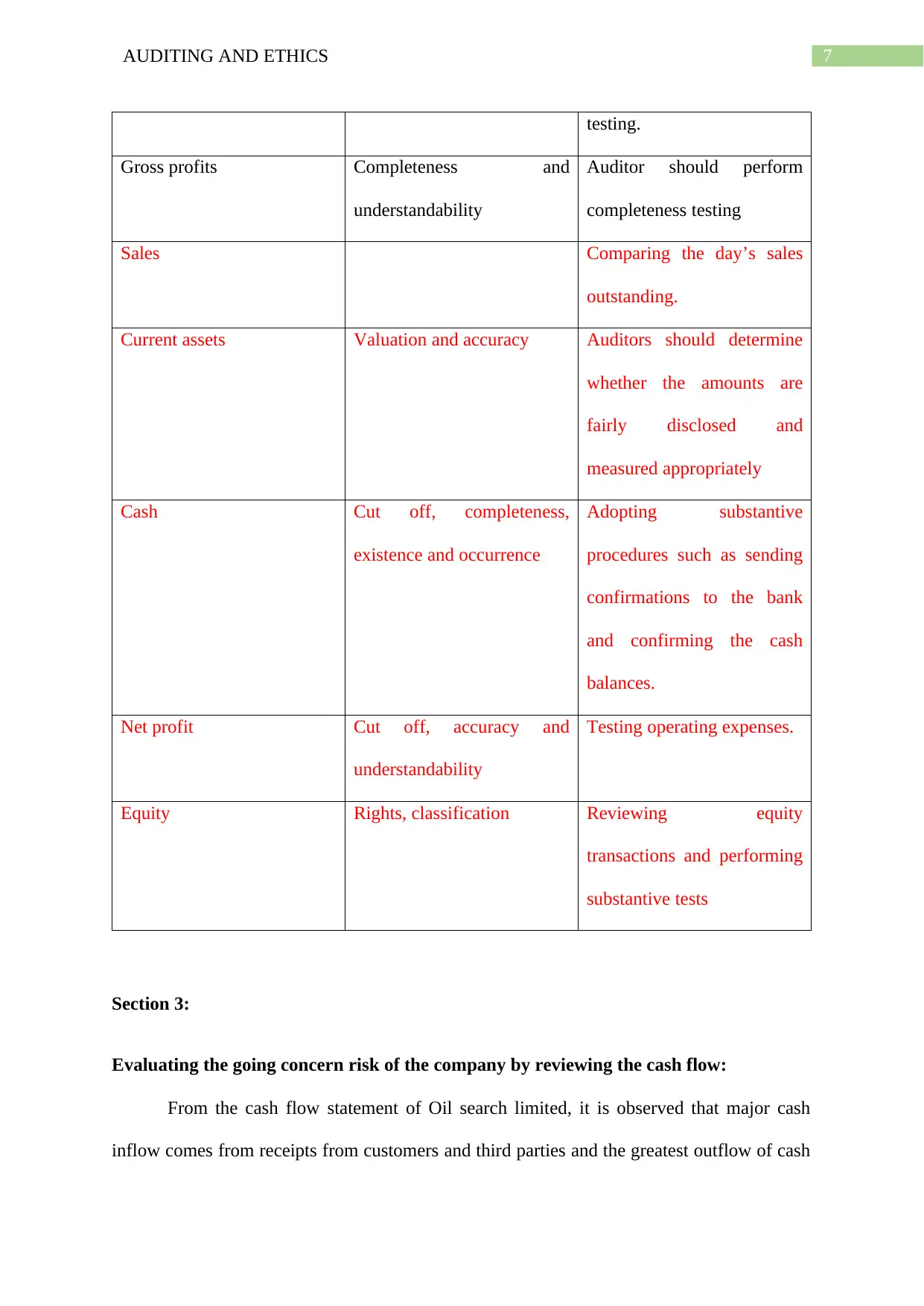

From the analysis of the ratios, some of the key risk areas for audit is related to the

accounts such as assets, current assets, inventory and gross profits. The assertions and audit

procedures related to the accounts are listed below.

Analytical review Assertions Audit procedures

Inventory Existence, valuations and

occurrence

Auditor should perform cut

off analysis and

reconciliation of inventory

to general ledger.

Assets Classifications, existence

and allocation

Auditor should perform

valuation and classification

implies that assets are not utilized efficiently to generate income due to management or some

production issues (Oilsearch.com, 2019). Now, looking at the figures of inventory turnover

ratio, it can be seen that the value has increased which indicates that inventories are being

sold off faster and the slow moving or any obsolete inventories has reduced.

Profit and loss ratio 2018 2017 2016 2015 Industry average

Gross profit ratio 0.48 0.58 0.38 0.51 0.44

Operating Profit Margin 0.467 0.440 0.308 0.185 0.120

The above table depicts the profit and loss statement ratios such as operating and

gross profit margin. Gross profit ratio figure initially reduced and then it increased

subsequently and again declined and this implies that the profit margin at which the

inventories are sold has reduced in the current year of analysis (Ferrell & Fraedrich, 2015).

From the figures of operating profit ratio, it can be inferred that the operational efficiency of

Oil search limited has reduced that might be due to higher operational resources and better

management of resources.

From the analysis of the ratios, some of the key risk areas for audit is related to the

accounts such as assets, current assets, inventory and gross profits. The assertions and audit

procedures related to the accounts are listed below.

Analytical review Assertions Audit procedures

Inventory Existence, valuations and

occurrence

Auditor should perform cut

off analysis and

reconciliation of inventory

to general ledger.

Assets Classifications, existence

and allocation

Auditor should perform

valuation and classification

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7AUDITING AND ETHICS

testing.

Gross profits Completeness and

understandability

Auditor should perform

completeness testing

Sales Comparing the day’s sales

outstanding.

Current assets Valuation and accuracy Auditors should determine

whether the amounts are

fairly disclosed and

measured appropriately

Cash Cut off, completeness,

existence and occurrence

Adopting substantive

procedures such as sending

confirmations to the bank

and confirming the cash

balances.

Net profit Cut off, accuracy and

understandability

Testing operating expenses.

Equity Rights, classification Reviewing equity

transactions and performing

substantive tests

Section 3:

Evaluating the going concern risk of the company by reviewing the cash flow:

From the cash flow statement of Oil search limited, it is observed that major cash

inflow comes from receipts from customers and third parties and the greatest outflow of cash

testing.

Gross profits Completeness and

understandability

Auditor should perform

completeness testing

Sales Comparing the day’s sales

outstanding.

Current assets Valuation and accuracy Auditors should determine

whether the amounts are

fairly disclosed and

measured appropriately

Cash Cut off, completeness,

existence and occurrence

Adopting substantive

procedures such as sending

confirmations to the bank

and confirming the cash

balances.

Net profit Cut off, accuracy and

understandability

Testing operating expenses.

Equity Rights, classification Reviewing equity

transactions and performing

substantive tests

Section 3:

Evaluating the going concern risk of the company by reviewing the cash flow:

From the cash flow statement of Oil search limited, it is observed that major cash

inflow comes from receipts from customers and third parties and the greatest outflow of cash

8AUDITING AND ETHICS

is the payment made to suppliers and employees. The primary cash receipt is from third

parties and receipts made by customers and primary cash payment is done to employees and

suppliers along with the borrowing cost payment. Some of the non-cash items in investing

activities include investment in subsidiaries (Oilsearch.com, 2019). In addition to this,

purchase of treasury shares, contribution received for employee share scheme is the non-cash

items of financing activities. From the analysis of the cash flow statement, it is inferred that

there is considerable increase in net cash used in investing activities while the net cash from

operating activities has increased by fewer value. Therefore, it is seen that there are no

identified factors that would hamper the going concern ability of the entity. However, the

risky areas include increasing payment for exploration and evaluation, increased borrowing

cost and payment for development of assets. The cash and cash equivalent at the end of

financial year 2018 has reduced significantly which might have an impact on the going

concern ability of the business. All the assertions such as accuracy, valuation, classifications,

completeness, presentation, disclosure and existence are applicable for the cash flow (Al

Hosban, 2015). Some of the formal audit procedures involve cash flow forecast, budget and

some other elaborative procedures.

As per ASA 700, auditors are responsible for concluding on the appropriateness of the going

concern basis of the accounting and identifying sufficient audit evidences that would help in

determining the existence of nay material uncertainty. From the analysis of the cash flow

statement, it is inferred that there is considerable increase in net cash used in investing

activities while the net cash from operating activities has increased by fewer value. The net

cash flow available at the end of this year has reduced and therefore, it can be inferred that

auditors have gathered sufficient evidences that support the existence of entity as going

concern as no significant doubt can be casted on it. In addition to this, reviewing of the

auditor’s report, it is found that the auditors of the company has also concluded about the

is the payment made to suppliers and employees. The primary cash receipt is from third

parties and receipts made by customers and primary cash payment is done to employees and

suppliers along with the borrowing cost payment. Some of the non-cash items in investing

activities include investment in subsidiaries (Oilsearch.com, 2019). In addition to this,

purchase of treasury shares, contribution received for employee share scheme is the non-cash

items of financing activities. From the analysis of the cash flow statement, it is inferred that

there is considerable increase in net cash used in investing activities while the net cash from

operating activities has increased by fewer value. Therefore, it is seen that there are no

identified factors that would hamper the going concern ability of the entity. However, the

risky areas include increasing payment for exploration and evaluation, increased borrowing

cost and payment for development of assets. The cash and cash equivalent at the end of

financial year 2018 has reduced significantly which might have an impact on the going

concern ability of the business. All the assertions such as accuracy, valuation, classifications,

completeness, presentation, disclosure and existence are applicable for the cash flow (Al

Hosban, 2015). Some of the formal audit procedures involve cash flow forecast, budget and

some other elaborative procedures.

As per ASA 700, auditors are responsible for concluding on the appropriateness of the going

concern basis of the accounting and identifying sufficient audit evidences that would help in

determining the existence of nay material uncertainty. From the analysis of the cash flow

statement, it is inferred that there is considerable increase in net cash used in investing

activities while the net cash from operating activities has increased by fewer value. The net

cash flow available at the end of this year has reduced and therefore, it can be inferred that

auditors have gathered sufficient evidences that support the existence of entity as going

concern as no significant doubt can be casted on it. In addition to this, reviewing of the

auditor’s report, it is found that the auditors of the company has also concluded about the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9AUDITING AND ETHICS

inexistence of the material uncertainty. Therefore, in accordance with ASA 700, it can be

concluded that there do not exist material uncertainty about the going concern risk of the

company.

Reviewing the audit report and the opinions of the auditors of company for financial

year 2018:

The financial statements of Oil search limited has been audited by Deloitte who are of

the opinion that a fair and true view of the financial performance or position is depicted by

the financial statements of the group. The group has kept the proper accounting records and

the audit evidence obtained are appropriate and sufficient for forming the opinion. For the

other information, the auditors have not expressed any opinion and no assurance of

conclusion is provided thereon. They have also framed an opinion on the remuneration report

stating that the report is prepared by adhering to section 300A of the Corporations Act, 2001

(Adelopo, 2016). In addition to this, there are additional sections indicating some key audit

matters that are considered to be the most significant items in the process of auditing and they

have the likelihood of material misstatement.

Conclusion:

In this paper, the materiality of financial statements of Oil search limited has been

determined by discussing the considerations and basis of determination. All the disclosure

and facts that are significant to the company is highlighted. Tool of ratio analysis is

implemented for preparing a preliminary analytical review of the information which is

disclosed in the annual report of the company. From the analysis of ratio, some of the key

risk areas include inventory, assets and gross profit. In addition to this, the cash flow position

of the company is cited as the significant risky areas against which the relevant assertions and

inexistence of the material uncertainty. Therefore, in accordance with ASA 700, it can be

concluded that there do not exist material uncertainty about the going concern risk of the

company.

Reviewing the audit report and the opinions of the auditors of company for financial

year 2018:

The financial statements of Oil search limited has been audited by Deloitte who are of

the opinion that a fair and true view of the financial performance or position is depicted by

the financial statements of the group. The group has kept the proper accounting records and

the audit evidence obtained are appropriate and sufficient for forming the opinion. For the

other information, the auditors have not expressed any opinion and no assurance of

conclusion is provided thereon. They have also framed an opinion on the remuneration report

stating that the report is prepared by adhering to section 300A of the Corporations Act, 2001

(Adelopo, 2016). In addition to this, there are additional sections indicating some key audit

matters that are considered to be the most significant items in the process of auditing and they

have the likelihood of material misstatement.

Conclusion:

In this paper, the materiality of financial statements of Oil search limited has been

determined by discussing the considerations and basis of determination. All the disclosure

and facts that are significant to the company is highlighted. Tool of ratio analysis is

implemented for preparing a preliminary analytical review of the information which is

disclosed in the annual report of the company. From the analysis of ratio, some of the key

risk areas include inventory, assets and gross profit. In addition to this, the cash flow position

of the company is cited as the significant risky areas against which the relevant assertions and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10AUDITING AND ETHICS

procedures is developed. By reviewing the auditor’s opinion, it is concluded that the financial

statements presents a fair and true view of the financial performance of company.

References list:

Adelopo, I. (2016). Auditor Independence: Auditing, Corporate Governance and Market

Confidence. Routledge.

Al Hosban, A. A. (2015). The role of regulations and ethics auditing to cope with information

technology governance from point view internal auditors. International Journal of

Economics and Finance, 7(1), 167-176.

Alrabba, H. M. (2016). MEASURING THE IMPACT OF CODE OF ETHICS ON THE

QUALITY OF AUDITORS’PROFESSIONAL JUDGMENT. Journal of Governance

and Regulation/Volume, 5(4).

Auasb.gov.au. (2019). Retrieved 2 September 2019, from

https://www.auasb.gov.au/admin/file/content102/c3/AUS_306.pdf

Brennan, N. (2016). Are Ethics Relevant to the Practice of Professional

Accounting?. Accountancy Plus, (1), 23-24.

Cipriano, H. M., Pereira, R., Almeida, R., & da Silva, M. M. (2019). Addressing Continuous

Auditing Challenges in the Digital Age: A Literature Review. In Organizational

Auditing and Assurance in the Digital Age (pp. 153-171). IGI Global.

Ferrell, O. C., & Fraedrich, J. (2015). Business ethics: Ethical decision making & cases.

Nelson Education.

procedures is developed. By reviewing the auditor’s opinion, it is concluded that the financial

statements presents a fair and true view of the financial performance of company.

References list:

Adelopo, I. (2016). Auditor Independence: Auditing, Corporate Governance and Market

Confidence. Routledge.

Al Hosban, A. A. (2015). The role of regulations and ethics auditing to cope with information

technology governance from point view internal auditors. International Journal of

Economics and Finance, 7(1), 167-176.

Alrabba, H. M. (2016). MEASURING THE IMPACT OF CODE OF ETHICS ON THE

QUALITY OF AUDITORS’PROFESSIONAL JUDGMENT. Journal of Governance

and Regulation/Volume, 5(4).

Auasb.gov.au. (2019). Retrieved 2 September 2019, from

https://www.auasb.gov.au/admin/file/content102/c3/AUS_306.pdf

Brennan, N. (2016). Are Ethics Relevant to the Practice of Professional

Accounting?. Accountancy Plus, (1), 23-24.

Cipriano, H. M., Pereira, R., Almeida, R., & da Silva, M. M. (2019). Addressing Continuous

Auditing Challenges in the Digital Age: A Literature Review. In Organizational

Auditing and Assurance in the Digital Age (pp. 153-171). IGI Global.

Ferrell, O. C., & Fraedrich, J. (2015). Business ethics: Ethical decision making & cases.

Nelson Education.

11AUDITING AND ETHICS

Gaynor, G. B., Janvrin, D. J., Pittman, M. K., Pevzner, M. B., & White, L. F. (2015).

Comments of the Auditing Standards Committee of the Auditing Section of the

American Accounting Association on IESBA Consultation Paper: Improving the

Structure of the Code of Ethics for Professional Accountants: Participating Committee

Members. Current Issues in Auditing, 9(1), C12-C17.

Hay, D. C. (2017). Audit fee research on issues related to ethics. Current Issues in

Auditing, 11(2), A1-A22.

Icaew.com. (2019). Retrieved 2 September 2019, from

https://www.icaew.com/-/media/corporate/files/technical/iaa/materiality-in-the-audit-

of-financial-statements.ashx

Kaptein, M. (2015). The effectiveness of ethics programs: The role of scope, composition,

and sequence. Journal of Business Ethics, 132(2), 415-431.

Knechel, W. R., & Salterio, S. E. (2016). Auditing: Assurance and risk. Routledge.

Oilsearch.com. (2019). Retrieved 2 September 2019, from

https://www.oilsearch.com/__data/assets/pdf_file/0012/33114/OSH-2018-Annual-

Report.pdf

Pratama, B. C., Ahmad, Z. A., & Innayah, M. N. (2019). Obedience Pressure, Professional

Ethics, Attitude of Skepticism and Independency Towards Audit Judgment. Journal

of Accounting Science, 2(2), 141-149.

Sheikh, A. S. A. (2019). The impact of the auditor's compliance with the ethics of the

auditing profession on the quality of professional performance Theoretical

research. Qalaai Zanist Journal, 4(1).

Gaynor, G. B., Janvrin, D. J., Pittman, M. K., Pevzner, M. B., & White, L. F. (2015).

Comments of the Auditing Standards Committee of the Auditing Section of the

American Accounting Association on IESBA Consultation Paper: Improving the

Structure of the Code of Ethics for Professional Accountants: Participating Committee

Members. Current Issues in Auditing, 9(1), C12-C17.

Hay, D. C. (2017). Audit fee research on issues related to ethics. Current Issues in

Auditing, 11(2), A1-A22.

Icaew.com. (2019). Retrieved 2 September 2019, from

https://www.icaew.com/-/media/corporate/files/technical/iaa/materiality-in-the-audit-

of-financial-statements.ashx

Kaptein, M. (2015). The effectiveness of ethics programs: The role of scope, composition,

and sequence. Journal of Business Ethics, 132(2), 415-431.

Knechel, W. R., & Salterio, S. E. (2016). Auditing: Assurance and risk. Routledge.

Oilsearch.com. (2019). Retrieved 2 September 2019, from

https://www.oilsearch.com/__data/assets/pdf_file/0012/33114/OSH-2018-Annual-

Report.pdf

Pratama, B. C., Ahmad, Z. A., & Innayah, M. N. (2019). Obedience Pressure, Professional

Ethics, Attitude of Skepticism and Independency Towards Audit Judgment. Journal

of Accounting Science, 2(2), 141-149.

Sheikh, A. S. A. (2019). The impact of the auditor's compliance with the ethics of the

auditing profession on the quality of professional performance Theoretical

research. Qalaai Zanist Journal, 4(1).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.