University Audit Test 1 Solution: Natural Supplements Finance

VerifiedAdded on 2020/05/11

|13

|2974

|429

Homework Assignment

AI Summary

This document presents a comprehensive solution to an audit test, focusing on the audit of Natural Supplements Nelson Limited (NSNL). The solution addresses acceptable audit risk, inherent and control risks, and their assessment, along with the analysis of financial statements using horizontal and vertical analysis. The assignment includes the calculation of various financial ratios, interpretation of the results, and identification of areas requiring special attention. Furthermore, it explains the concept of materiality, differentiating between performance, planning, and specific materiality levels, and provides calculations for planning and performance materiality. Part B of the solution outlines audit assertions and steps for inventory auditing, emphasizing prior planning, staff organization, and correct stock valuation. The assignment covers all aspects of the audit process, providing a complete and detailed understanding of the subject matter.

Running head: AUDIT TEST

Audit test

Name of the student

Name of the university

Author note

Audit test

Name of the student

Name of the university

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1AUDIT TEST

Table of Contents

Part A.........................................................................................................................................2

Answer to Question (a)..........................................................................................................2

Answer to Question (b)..........................................................................................................2

Answer to Question (c)..........................................................................................................3

Answer to Question (d)..........................................................................................................4

Answer to Question (e)..........................................................................................................7

Part B..........................................................................................................................................9

Answer to Question (a)..........................................................................................................9

Answer to Question (b)..........................................................................................................9

Answer to Question (c)........................................................................................................10

References................................................................................................................................11

Table of Contents

Part A.........................................................................................................................................2

Answer to Question (a)..........................................................................................................2

Answer to Question (b)..........................................................................................................2

Answer to Question (c)..........................................................................................................3

Answer to Question (d)..........................................................................................................4

Answer to Question (e)..........................................................................................................7

Part B..........................................................................................................................................9

Answer to Question (a)..........................................................................................................9

Answer to Question (b)..........................................................................................................9

Answer to Question (c)........................................................................................................10

References................................................................................................................................11

2AUDIT TEST

Part A

Answer to Question (a)

Acceptable audit risk is one of the major factors in the auditing process of the

companies. Acceptable audit risks refer to the particular risks or risks factors that the auditors

willingly take at the time of providing unqualified audit opinions (Botez, 2015). With the

increase in acceptable audit risks, the auditors of the companies become willing to accept

higher detection risks. In case of Natural Supplements Nelson Limited (NSNL), it can be seen

that there are some of the major factors that are the potential of acceptable audit risk of the

company. In this context, it needs to be mentioned that it is the responsibility of the auditors

of the companies to assess the audit risks of their business. For this reason, the auditors are

required to consider each of the potential audit risks incidents (Demartini & Trucco, 2016). It

can be seen that there is a rise in the dollar price of New Zealand. Due to this, there can be a

change in the values of assets and liabilities for NSNL. Another major factor is the approval

of sales order in the absence of sales director, Thomas. There is a possibility that the sales

volumes can be manipulated in the absence of Thomas. This is a major risk factor. It can be

seen that in the absence of hedging process, there is a risk of exchange rate gain and loss

(Guénin-Paracini, Malsch & Paillé, 2014). Many other factors are of medium risk factors.

Thus, based on the above discussion, it can be seen that the level of acceptable audit risk is

neither low nor high as it is medium.

Answer to Question (b)

Inherent and control risks are two of the major audit risks for the business

organizations. Inherent risks are considered as the risks that are natural or intrinsic in the

business organizations (Ruhnke & Schmidt, 2014). However, control risks arise due to the

malfunction in the internal controls of the companies. In case of NSNL, it can be seen that in

Part A

Answer to Question (a)

Acceptable audit risk is one of the major factors in the auditing process of the

companies. Acceptable audit risks refer to the particular risks or risks factors that the auditors

willingly take at the time of providing unqualified audit opinions (Botez, 2015). With the

increase in acceptable audit risks, the auditors of the companies become willing to accept

higher detection risks. In case of Natural Supplements Nelson Limited (NSNL), it can be seen

that there are some of the major factors that are the potential of acceptable audit risk of the

company. In this context, it needs to be mentioned that it is the responsibility of the auditors

of the companies to assess the audit risks of their business. For this reason, the auditors are

required to consider each of the potential audit risks incidents (Demartini & Trucco, 2016). It

can be seen that there is a rise in the dollar price of New Zealand. Due to this, there can be a

change in the values of assets and liabilities for NSNL. Another major factor is the approval

of sales order in the absence of sales director, Thomas. There is a possibility that the sales

volumes can be manipulated in the absence of Thomas. This is a major risk factor. It can be

seen that in the absence of hedging process, there is a risk of exchange rate gain and loss

(Guénin-Paracini, Malsch & Paillé, 2014). Many other factors are of medium risk factors.

Thus, based on the above discussion, it can be seen that the level of acceptable audit risk is

neither low nor high as it is medium.

Answer to Question (b)

Inherent and control risks are two of the major audit risks for the business

organizations. Inherent risks are considered as the risks that are natural or intrinsic in the

business organizations (Ruhnke & Schmidt, 2014). However, control risks arise due to the

malfunction in the internal controls of the companies. In case of NSNL, it can be seen that in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3AUDIT TEST

the presence of the sales director, some other people in the organization record these sales

records (Vijayakumar & Nagaraja, 2012). This process opens the chance for manipulation in

the sales figure of the company and it can lead to material misstatements. As it is due to the

lack of internal control, this risk will be classified as control risks. It can be seen that the

inventory department of NSNL is understaffed and this aspect creates pressure on the

employees of this department. Due to this, there can be mistakes from the end of employees

in the values regarding stocks. This aspect can lead to material misstatements. From the

provided information, it can be seen that 50% of the total inventory includes overseas

suppliers. This particular aspect needs to be mentioned in the financial reports of the

company (Blankley, Hurtt & MacGregor, 2012). In case, this particular amount is not

recorded in the financial reports, it will be an aspect of material misstatement. This risk is

inherent with the accounting system as this is associated with the accounting system of the

company. This risk will be classified as control risks.

Answer to Question (c)

As per the risks assessments, the record of sales in the absence of sales directors can

be regarded as of high risks. In case, any major sales figure are not taken into consideration,

the financial position of the company will be majorly affected. The risk of understaffed in

inventory department is a medium risks for the company as the company will be able to carry

on the works of inventory with limited number of employees (Arens, Elder & Mark, 2012).

The information of 50% foreign suppliers is of low risks. In case this is not mentioned in the

financial statements, it will not put any major effect on the financial statements of the

company.

the presence of the sales director, some other people in the organization record these sales

records (Vijayakumar & Nagaraja, 2012). This process opens the chance for manipulation in

the sales figure of the company and it can lead to material misstatements. As it is due to the

lack of internal control, this risk will be classified as control risks. It can be seen that the

inventory department of NSNL is understaffed and this aspect creates pressure on the

employees of this department. Due to this, there can be mistakes from the end of employees

in the values regarding stocks. This aspect can lead to material misstatements. From the

provided information, it can be seen that 50% of the total inventory includes overseas

suppliers. This particular aspect needs to be mentioned in the financial reports of the

company (Blankley, Hurtt & MacGregor, 2012). In case, this particular amount is not

recorded in the financial reports, it will be an aspect of material misstatement. This risk is

inherent with the accounting system as this is associated with the accounting system of the

company. This risk will be classified as control risks.

Answer to Question (c)

As per the risks assessments, the record of sales in the absence of sales directors can

be regarded as of high risks. In case, any major sales figure are not taken into consideration,

the financial position of the company will be majorly affected. The risk of understaffed in

inventory department is a medium risks for the company as the company will be able to carry

on the works of inventory with limited number of employees (Arens, Elder & Mark, 2012).

The information of 50% foreign suppliers is of low risks. In case this is not mentioned in the

financial statements, it will not put any major effect on the financial statements of the

company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4AUDIT TEST

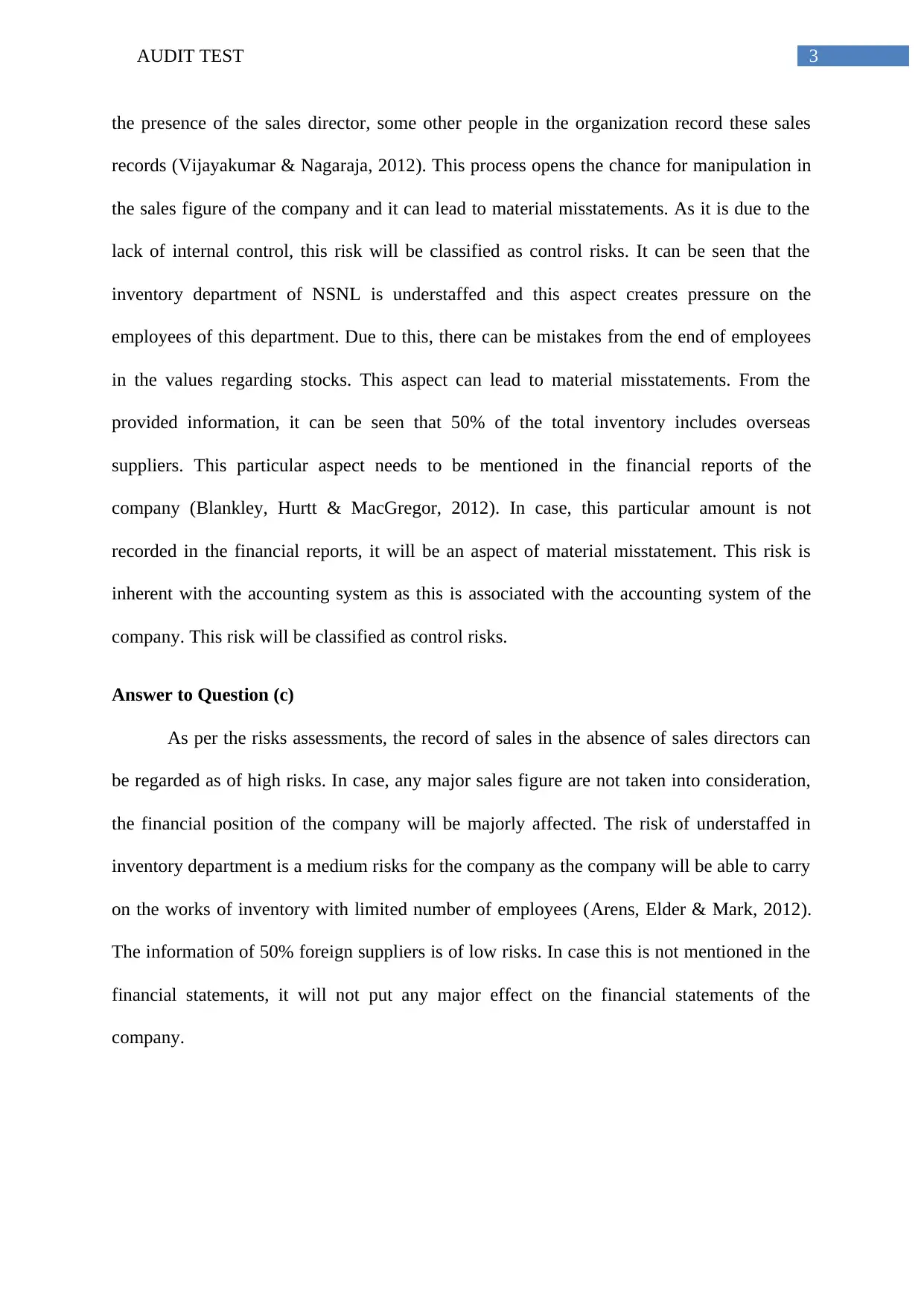

Answer to (d)

i. Horizontal and vertical analysis

Statement of profit or loss statement

HORIZONTAL ANALYSIS

2016 2017 2016 2017

REVENUE AND OTHER

INCOME

Sales revenue $ 7,081,967.00 $ 8,434,638.00 100% 119%

Less: Sales returns $ (68,192.00) $ (85,641.00) 100% 126%

Less: cost of sales $ (3,368,785.00) $ (4,100,134.00) 100% 122%

Gross profit $ 3,644,990.00 $ 4,248,863.00 100% 117%

EXPENSES

Total expenses $ (3,067,731.00) $ (3,348,584.00) 100% 109%

Other income $ (1,347.00) $ 70,599.00 100% -5241%

Profit before income tax $ 575,912.00 $ 970,878.00 100% 169%

Less: Income tax expenses $ (159,445.00) $ (266,031.00) 100% 167%

Net profit after tax $ 416,467.00 $ 704,847.00 100% 169%

Opening retained earnings $ 1,062,255.00 $ 1,437,837.00 100% 135%

Less: Dividend paid $ (40,885.00) $ (48,100.00) 100% 118%

Closing retained earning $ 1,437,837.00 $ 2,094,584.00 100% 146%

VERTICAL ANALYSIS

2016 2016 2017 2017

REVENUE AND OTHER

INCOME

Sales revenue $ 7,081,967.00 194% $ 8,434,638.00 199%

Less: Sales returns $ (68,192.00) -2% $ (85,641.00) -2%

Less: cost of sales $ (3,368,785.00) -92% $ (4,100,134.00) -96%

Gross profit $ 3,644,990.00 100% $ 4,248,863.00 100%

EXPENSES

Total expenses $ (3,067,731.00) -737% $ (3,348,584.00) -475%

Other income $ (1,347.00) 0% $ 70,599.00 10%

Profit before income tax $ 575,912.00 138% $ 970,878.00 138%

Less: Income tax expenses $ (159,445.00) -38% $ (266,031.00) -38%

Net profit after tax $ 416,467.00 100% $ 704,847.00 100%

Opening retained earnings $ 1,062,255.00 $ 1,437,837.00

Less: Dividend paid $ (40,885.00) $ (48,100.00)

Closing retained earning $ 1,437,837.00 100% $ 2,094,584.00 100%

Answer to (d)

i. Horizontal and vertical analysis

Statement of profit or loss statement

HORIZONTAL ANALYSIS

2016 2017 2016 2017

REVENUE AND OTHER

INCOME

Sales revenue $ 7,081,967.00 $ 8,434,638.00 100% 119%

Less: Sales returns $ (68,192.00) $ (85,641.00) 100% 126%

Less: cost of sales $ (3,368,785.00) $ (4,100,134.00) 100% 122%

Gross profit $ 3,644,990.00 $ 4,248,863.00 100% 117%

EXPENSES

Total expenses $ (3,067,731.00) $ (3,348,584.00) 100% 109%

Other income $ (1,347.00) $ 70,599.00 100% -5241%

Profit before income tax $ 575,912.00 $ 970,878.00 100% 169%

Less: Income tax expenses $ (159,445.00) $ (266,031.00) 100% 167%

Net profit after tax $ 416,467.00 $ 704,847.00 100% 169%

Opening retained earnings $ 1,062,255.00 $ 1,437,837.00 100% 135%

Less: Dividend paid $ (40,885.00) $ (48,100.00) 100% 118%

Closing retained earning $ 1,437,837.00 $ 2,094,584.00 100% 146%

VERTICAL ANALYSIS

2016 2016 2017 2017

REVENUE AND OTHER

INCOME

Sales revenue $ 7,081,967.00 194% $ 8,434,638.00 199%

Less: Sales returns $ (68,192.00) -2% $ (85,641.00) -2%

Less: cost of sales $ (3,368,785.00) -92% $ (4,100,134.00) -96%

Gross profit $ 3,644,990.00 100% $ 4,248,863.00 100%

EXPENSES

Total expenses $ (3,067,731.00) -737% $ (3,348,584.00) -475%

Other income $ (1,347.00) 0% $ 70,599.00 10%

Profit before income tax $ 575,912.00 138% $ 970,878.00 138%

Less: Income tax expenses $ (159,445.00) -38% $ (266,031.00) -38%

Net profit after tax $ 416,467.00 100% $ 704,847.00 100%

Opening retained earnings $ 1,062,255.00 $ 1,437,837.00

Less: Dividend paid $ (40,885.00) $ (48,100.00)

Closing retained earning $ 1,437,837.00 100% $ 2,094,584.00 100%

5AUDIT TEST

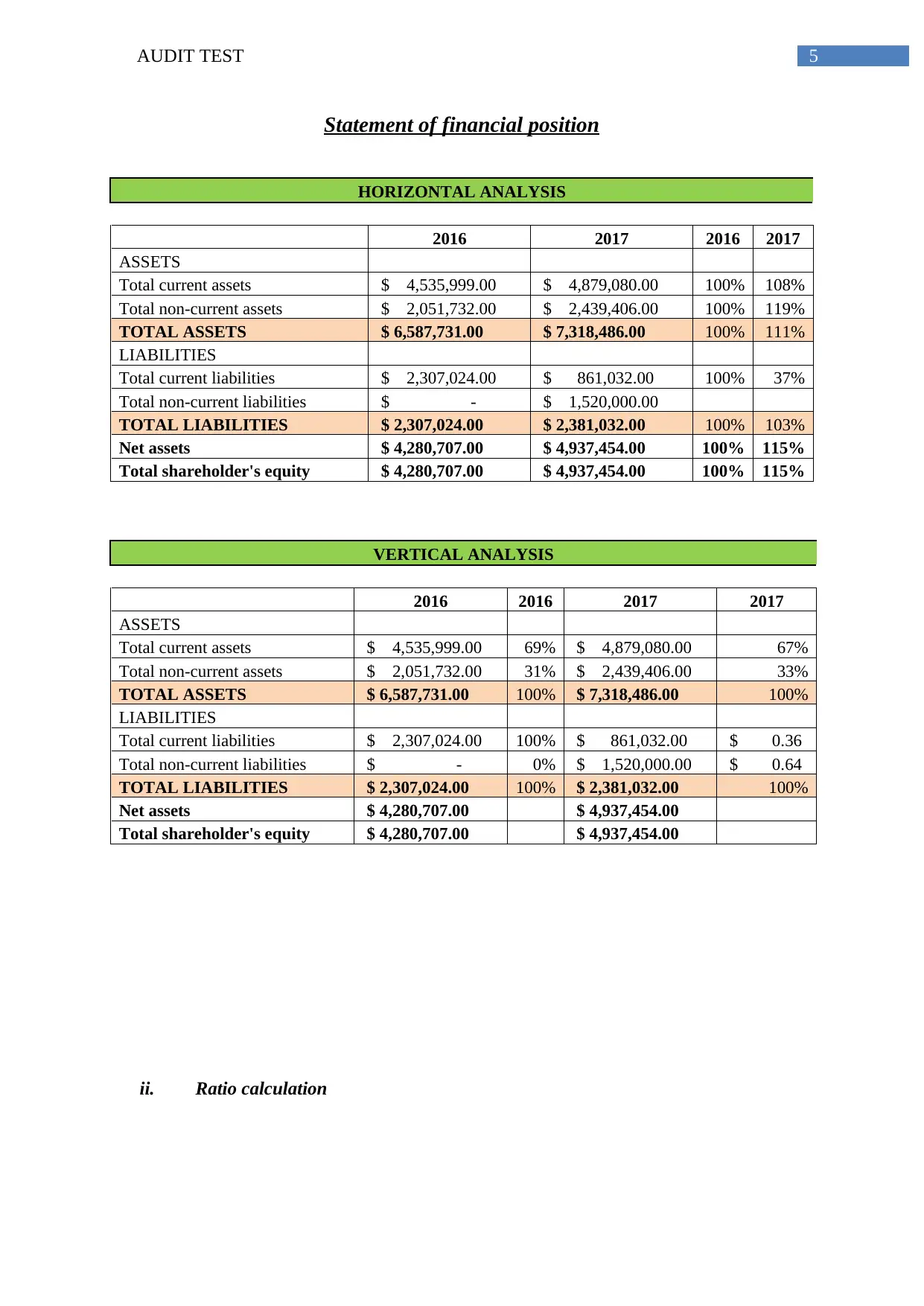

Statement of financial position

HORIZONTAL ANALYSIS

2016 2017 2016 2017

ASSETS

Total current assets $ 4,535,999.00 $ 4,879,080.00 100% 108%

Total non-current assets $ 2,051,732.00 $ 2,439,406.00 100% 119%

TOTAL ASSETS $ 6,587,731.00 $ 7,318,486.00 100% 111%

LIABILITIES

Total current liabilities $ 2,307,024.00 $ 861,032.00 100% 37%

Total non-current liabilities $ - $ 1,520,000.00

TOTAL LIABILITIES $ 2,307,024.00 $ 2,381,032.00 100% 103%

Net assets $ 4,280,707.00 $ 4,937,454.00 100% 115%

Total shareholder's equity $ 4,280,707.00 $ 4,937,454.00 100% 115%

VERTICAL ANALYSIS

2016 2016 2017 2017

ASSETS

Total current assets $ 4,535,999.00 69% $ 4,879,080.00 67%

Total non-current assets $ 2,051,732.00 31% $ 2,439,406.00 33%

TOTAL ASSETS $ 6,587,731.00 100% $ 7,318,486.00 100%

LIABILITIES

Total current liabilities $ 2,307,024.00 100% $ 861,032.00 $ 0.36

Total non-current liabilities $ - 0% $ 1,520,000.00 $ 0.64

TOTAL LIABILITIES $ 2,307,024.00 100% $ 2,381,032.00 100%

Net assets $ 4,280,707.00 $ 4,937,454.00

Total shareholder's equity $ 4,280,707.00 $ 4,937,454.00

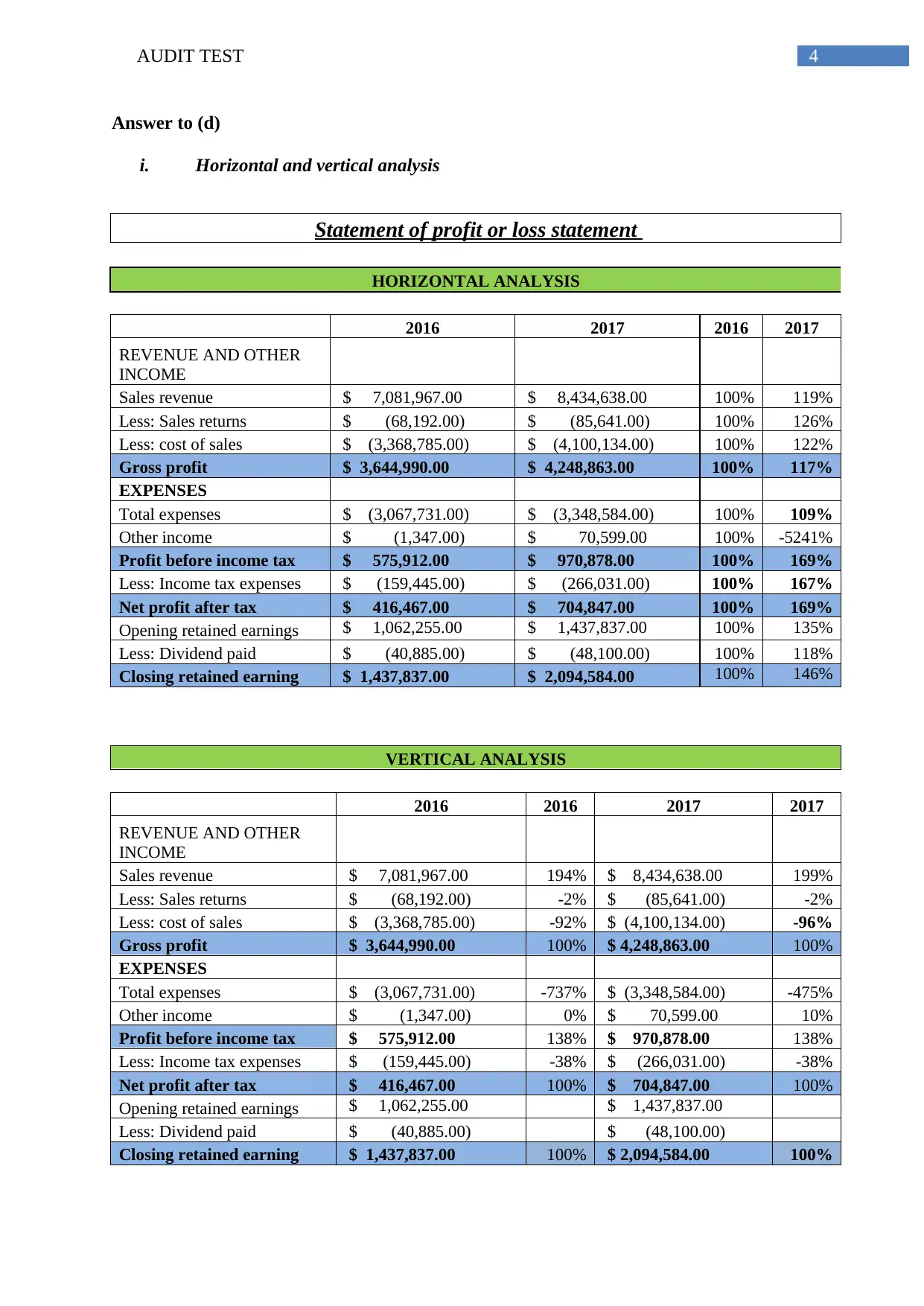

ii. Ratio calculation

Statement of financial position

HORIZONTAL ANALYSIS

2016 2017 2016 2017

ASSETS

Total current assets $ 4,535,999.00 $ 4,879,080.00 100% 108%

Total non-current assets $ 2,051,732.00 $ 2,439,406.00 100% 119%

TOTAL ASSETS $ 6,587,731.00 $ 7,318,486.00 100% 111%

LIABILITIES

Total current liabilities $ 2,307,024.00 $ 861,032.00 100% 37%

Total non-current liabilities $ - $ 1,520,000.00

TOTAL LIABILITIES $ 2,307,024.00 $ 2,381,032.00 100% 103%

Net assets $ 4,280,707.00 $ 4,937,454.00 100% 115%

Total shareholder's equity $ 4,280,707.00 $ 4,937,454.00 100% 115%

VERTICAL ANALYSIS

2016 2016 2017 2017

ASSETS

Total current assets $ 4,535,999.00 69% $ 4,879,080.00 67%

Total non-current assets $ 2,051,732.00 31% $ 2,439,406.00 33%

TOTAL ASSETS $ 6,587,731.00 100% $ 7,318,486.00 100%

LIABILITIES

Total current liabilities $ 2,307,024.00 100% $ 861,032.00 $ 0.36

Total non-current liabilities $ - 0% $ 1,520,000.00 $ 0.64

TOTAL LIABILITIES $ 2,307,024.00 100% $ 2,381,032.00 100%

Net assets $ 4,280,707.00 $ 4,937,454.00

Total shareholder's equity $ 4,280,707.00 $ 4,937,454.00

ii. Ratio calculation

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6AUDIT TEST

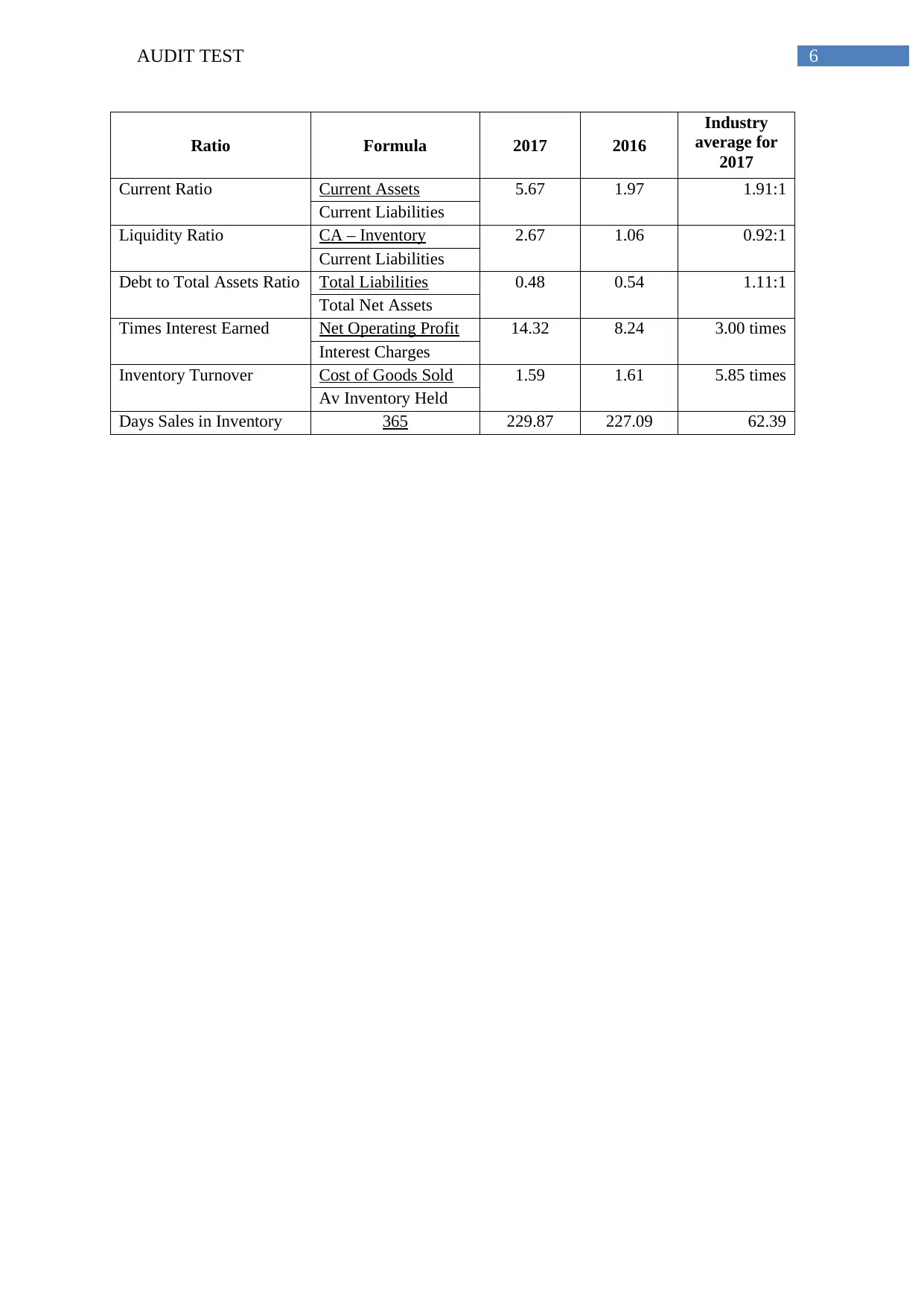

Ratio Formula 2017 2016

Industry

average for

2017

Current Ratio Current Assets 5.67 1.97 1.91:1

Current Liabilities

Liquidity Ratio CA – Inventory 2.67 1.06 0.92:1

Current Liabilities

Debt to Total Assets Ratio Total Liabilities 0.48 0.54 1.11:1

Total Net Assets

Times Interest Earned Net Operating Profit 14.32 8.24 3.00 times

Interest Charges

Inventory Turnover Cost of Goods Sold 1.59 1.61 5.85 times

Av Inventory Held

Days Sales in Inventory

(days)

365 229.87 227.09 62.39

Ratio Formula 2017 2016

Industry

average for

2017

Current Ratio Current Assets 5.67 1.97 1.91:1

Current Liabilities

Liquidity Ratio CA – Inventory 2.67 1.06 0.92:1

Current Liabilities

Debt to Total Assets Ratio Total Liabilities 0.48 0.54 1.11:1

Total Net Assets

Times Interest Earned Net Operating Profit 14.32 8.24 3.00 times

Interest Charges

Inventory Turnover Cost of Goods Sold 1.59 1.61 5.85 times

Av Inventory Held

Days Sales in Inventory

(days)

365 229.87 227.09 62.39

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7AUDIT TEST

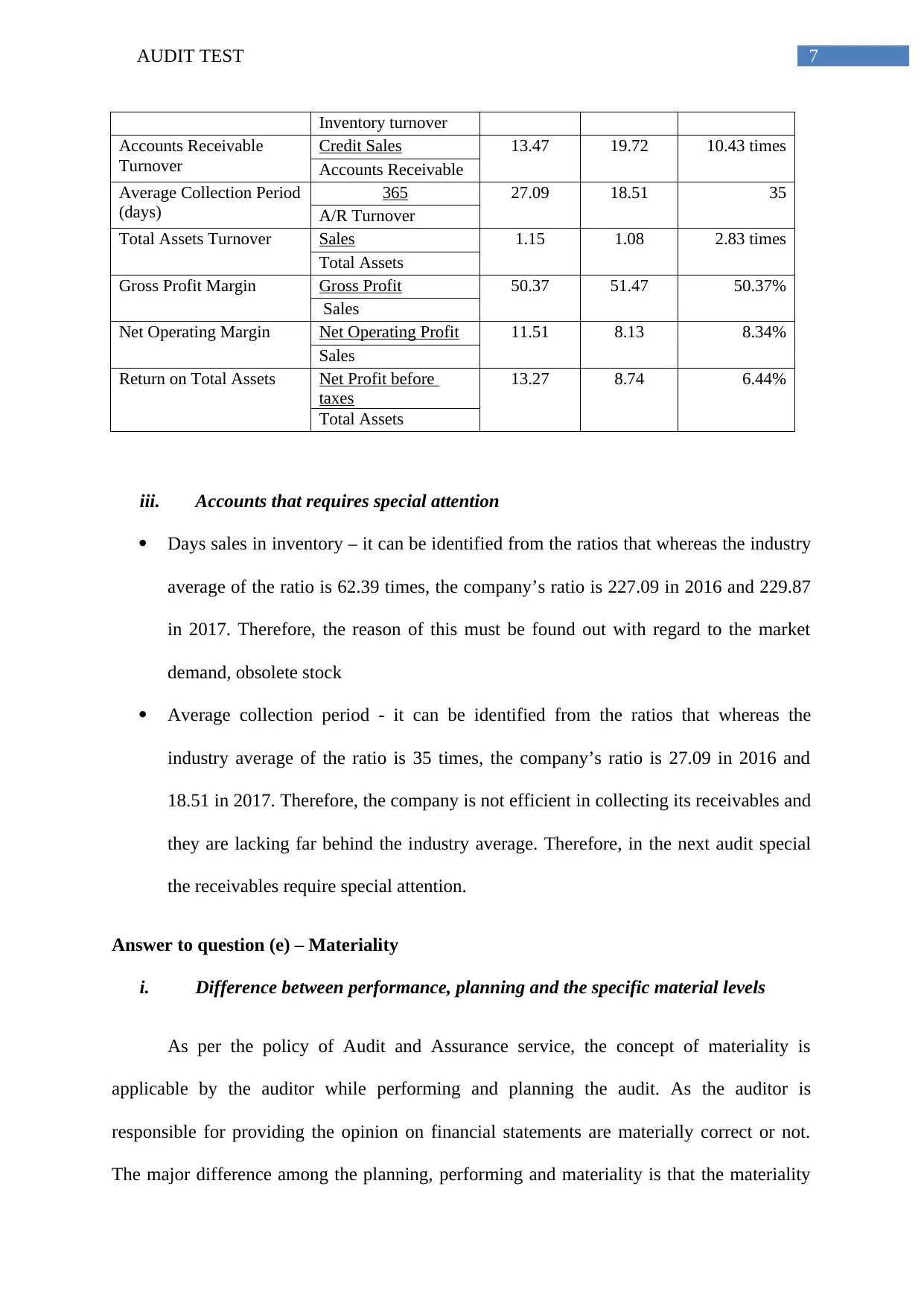

Inventory turnover

Accounts Receivable

Turnover

Credit Sales 13.47 19.72 10.43 times

Accounts Receivable

Average Collection Period

(days)

365 27.09 18.51 35

A/R Turnover

Total Assets Turnover Sales 1.15 1.08 2.83 times

Total Assets

Gross Profit Margin Gross Profit 50.37 51.47 50.37%

Sales

Net Operating Margin Net Operating Profit 11.51 8.13 8.34%

Sales

Return on Total Assets Net Profit before

taxes

13.27 8.74 6.44%

Total Assets

iii. Accounts that requires special attention

Days sales in inventory – it can be identified from the ratios that whereas the industry

average of the ratio is 62.39 times, the company’s ratio is 227.09 in 2016 and 229.87

in 2017. Therefore, the reason of this must be found out with regard to the market

demand, obsolete stock

Average collection period - it can be identified from the ratios that whereas the

industry average of the ratio is 35 times, the company’s ratio is 27.09 in 2016 and

18.51 in 2017. Therefore, the company is not efficient in collecting its receivables and

they are lacking far behind the industry average. Therefore, in the next audit special

the receivables require special attention.

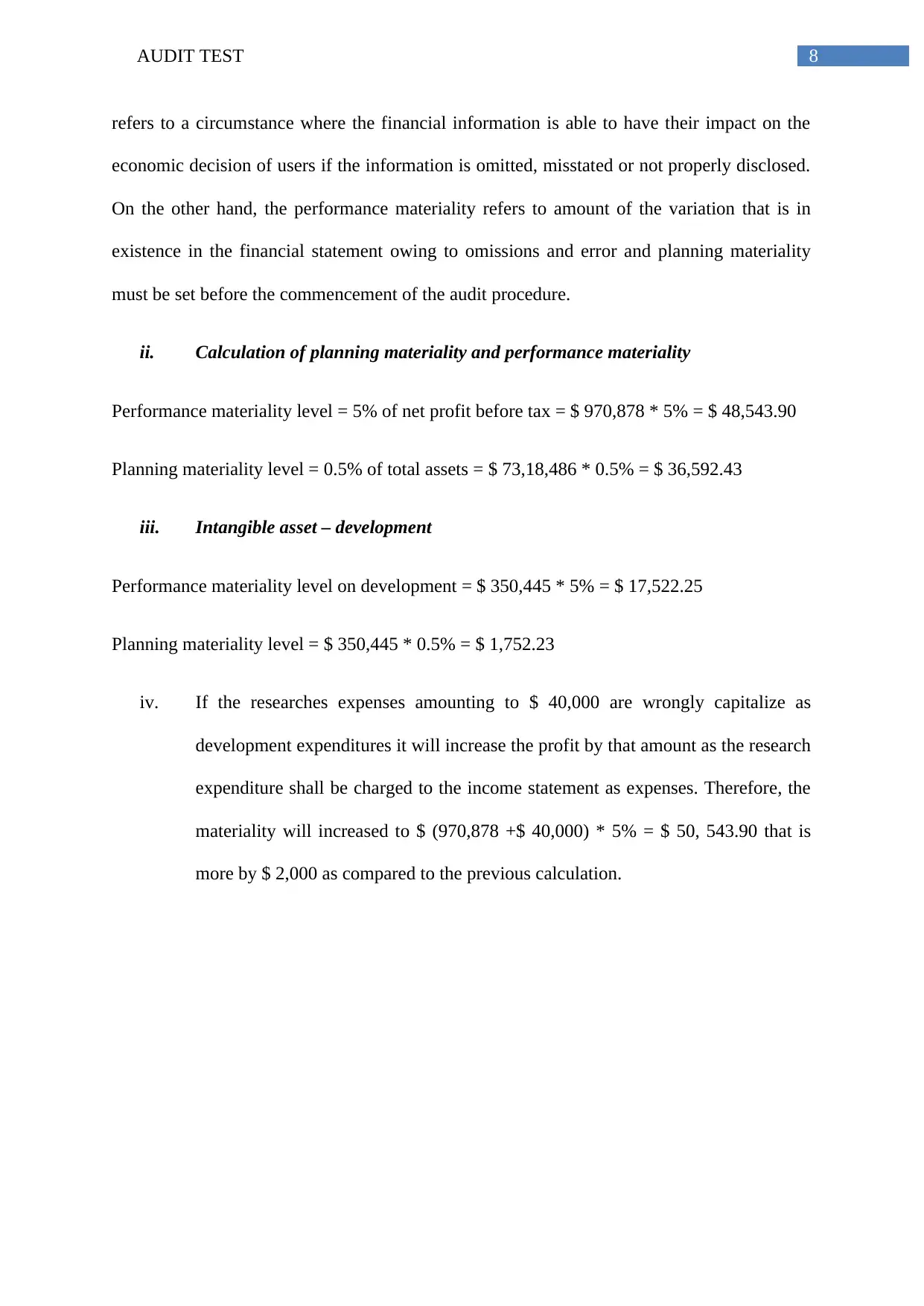

Answer to question (e) – Materiality

i. Difference between performance, planning and the specific material levels

As per the policy of Audit and Assurance service, the concept of materiality is

applicable by the auditor while performing and planning the audit. As the auditor is

responsible for providing the opinion on financial statements are materially correct or not.

The major difference among the planning, performing and materiality is that the materiality

Inventory turnover

Accounts Receivable

Turnover

Credit Sales 13.47 19.72 10.43 times

Accounts Receivable

Average Collection Period

(days)

365 27.09 18.51 35

A/R Turnover

Total Assets Turnover Sales 1.15 1.08 2.83 times

Total Assets

Gross Profit Margin Gross Profit 50.37 51.47 50.37%

Sales

Net Operating Margin Net Operating Profit 11.51 8.13 8.34%

Sales

Return on Total Assets Net Profit before

taxes

13.27 8.74 6.44%

Total Assets

iii. Accounts that requires special attention

Days sales in inventory – it can be identified from the ratios that whereas the industry

average of the ratio is 62.39 times, the company’s ratio is 227.09 in 2016 and 229.87

in 2017. Therefore, the reason of this must be found out with regard to the market

demand, obsolete stock

Average collection period - it can be identified from the ratios that whereas the

industry average of the ratio is 35 times, the company’s ratio is 27.09 in 2016 and

18.51 in 2017. Therefore, the company is not efficient in collecting its receivables and

they are lacking far behind the industry average. Therefore, in the next audit special

the receivables require special attention.

Answer to question (e) – Materiality

i. Difference between performance, planning and the specific material levels

As per the policy of Audit and Assurance service, the concept of materiality is

applicable by the auditor while performing and planning the audit. As the auditor is

responsible for providing the opinion on financial statements are materially correct or not.

The major difference among the planning, performing and materiality is that the materiality

8AUDIT TEST

refers to a circumstance where the financial information is able to have their impact on the

economic decision of users if the information is omitted, misstated or not properly disclosed.

On the other hand, the performance materiality refers to amount of the variation that is in

existence in the financial statement owing to omissions and error and planning materiality

must be set before the commencement of the audit procedure.

ii. Calculation of planning materiality and performance materiality

Performance materiality level = 5% of net profit before tax = $ 970,878 * 5% = $ 48,543.90

Planning materiality level = 0.5% of total assets = $ 73,18,486 * 0.5% = $ 36,592.43

iii. Intangible asset – development

Performance materiality level on development = $ 350,445 * 5% = $ 17,522.25

Planning materiality level = $ 350,445 * 0.5% = $ 1,752.23

iv. If the researches expenses amounting to $ 40,000 are wrongly capitalize as

development expenditures it will increase the profit by that amount as the research

expenditure shall be charged to the income statement as expenses. Therefore, the

materiality will increased to $ (970,878 +$ 40,000) * 5% = $ 50, 543.90 that is

more by $ 2,000 as compared to the previous calculation.

refers to a circumstance where the financial information is able to have their impact on the

economic decision of users if the information is omitted, misstated or not properly disclosed.

On the other hand, the performance materiality refers to amount of the variation that is in

existence in the financial statement owing to omissions and error and planning materiality

must be set before the commencement of the audit procedure.

ii. Calculation of planning materiality and performance materiality

Performance materiality level = 5% of net profit before tax = $ 970,878 * 5% = $ 48,543.90

Planning materiality level = 0.5% of total assets = $ 73,18,486 * 0.5% = $ 36,592.43

iii. Intangible asset – development

Performance materiality level on development = $ 350,445 * 5% = $ 17,522.25

Planning materiality level = $ 350,445 * 0.5% = $ 1,752.23

iv. If the researches expenses amounting to $ 40,000 are wrongly capitalize as

development expenditures it will increase the profit by that amount as the research

expenditure shall be charged to the income statement as expenses. Therefore, the

materiality will increased to $ (970,878 +$ 40,000) * 5% = $ 50, 543.90 that is

more by $ 2,000 as compared to the previous calculation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9AUDIT TEST

Part B

Answer to Question (a)

At the time of conducting the audit operation for the inventory of NSNL, the auditors

need to carry on certain assertions or steps. Some of the steps are suitable with the situation

of NSNL. First, the auditor of the company need to make it sure that there is not any

unauthorized purchase in the company. After that, the auditor needs to trace a sample report

of inventory in order to check that all the shipments are properly recorded. In this process,

they need to conduct analytics in order to measure the fluctuations in the inventories of the

company. After that, the auditors need to check the inventory tags and count sheets for the

verification of the inventory of the company. In this process, the auditors need to test the

inventory counts from the company to the customers in order to verify that all the inventories

of the company are properly counted and included in the inventory lists. These are the main

assertions that the auditors of NSNL need to test for inventory (Knechel et al., 2013).

Answer to question (b)

There are some major steps prior and during the stock take. They are discussed below:

Prior Planning: In the prior stage of stock take, it is needed to have a proper planning that

includes the detailed understanding about resources and time required for the process of stock

take. In order to avoid disturbance while stock take, it is needed to conduct the process of

stock take in the quickest time (de Ridder et al., 2012).

Staff Organization: It is beneficial for the company to employ the staffs of their organization

for the process of stock take. There needs to be different sections in the process of stock take

and each section needs to have assigned employees (Gross, 2013).

Part B

Answer to Question (a)

At the time of conducting the audit operation for the inventory of NSNL, the auditors

need to carry on certain assertions or steps. Some of the steps are suitable with the situation

of NSNL. First, the auditor of the company need to make it sure that there is not any

unauthorized purchase in the company. After that, the auditor needs to trace a sample report

of inventory in order to check that all the shipments are properly recorded. In this process,

they need to conduct analytics in order to measure the fluctuations in the inventories of the

company. After that, the auditors need to check the inventory tags and count sheets for the

verification of the inventory of the company. In this process, the auditors need to test the

inventory counts from the company to the customers in order to verify that all the inventories

of the company are properly counted and included in the inventory lists. These are the main

assertions that the auditors of NSNL need to test for inventory (Knechel et al., 2013).

Answer to question (b)

There are some major steps prior and during the stock take. They are discussed below:

Prior Planning: In the prior stage of stock take, it is needed to have a proper planning that

includes the detailed understanding about resources and time required for the process of stock

take. In order to avoid disturbance while stock take, it is needed to conduct the process of

stock take in the quickest time (de Ridder et al., 2012).

Staff Organization: It is beneficial for the company to employ the staffs of their organization

for the process of stock take. There needs to be different sections in the process of stock take

and each section needs to have assigned employees (Gross, 2013).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10AUDIT TEST

Proper Knowledge: Before the starting of stock take, it is required to know that who the

owners of the stocks of the company are. This process helps in the process of stock take

(Gross, 2013).

Correct Stock Valuation: After the verification of stocks, it is required for the company to

value all of their stocks in the correct manner. In this process, the actual selling process of the

stocks also needs to be determined (de Ridder et al., 2012).

Value of Stock Take: In this particular stage, it is required to gather and analyze all the

necessary information of the above stages. This analysis will provide the company with the

view to the areas that need improvements. These are the stages of stock take (de Ridder et al.,

2012).

Answer to Question (c)

In case there are some errors in one of the steps of stock take, some of the steps need

to be taken. First, the number of stock needs to be re-counted. It needs to be checked that

whether any amount of stocks exists in another location. At the same time, it is needed to

check the basis to measure the stocks. One of the most important steps is to scan the records

of inventory to find the errors (Gedajlovic et al., 2012).

Proper Knowledge: Before the starting of stock take, it is required to know that who the

owners of the stocks of the company are. This process helps in the process of stock take

(Gross, 2013).

Correct Stock Valuation: After the verification of stocks, it is required for the company to

value all of their stocks in the correct manner. In this process, the actual selling process of the

stocks also needs to be determined (de Ridder et al., 2012).

Value of Stock Take: In this particular stage, it is required to gather and analyze all the

necessary information of the above stages. This analysis will provide the company with the

view to the areas that need improvements. These are the stages of stock take (de Ridder et al.,

2012).

Answer to Question (c)

In case there are some errors in one of the steps of stock take, some of the steps need

to be taken. First, the number of stock needs to be re-counted. It needs to be checked that

whether any amount of stocks exists in another location. At the same time, it is needed to

check the basis to measure the stocks. One of the most important steps is to scan the records

of inventory to find the errors (Gedajlovic et al., 2012).

11AUDIT TEST

References

Arens, A. A., Elder, R. J., & Mark, B. (2012). Auditing and assurance services: an integrated

approach. Boston: Prentice Hall.

Blankley, A. I., Hurtt, D. N., & MacGregor, J. E. (2012). Abnormal audit fees and

restatements. Auditing, 31(1), 79.

BOTEZ, D. (2015). Study Regarding the Need to Develop an Audit Risk Model. Audit

financiar, 13(125).

de Ridder, D. T., Lensvelt-Mulders, G., Finkenauer, C., Stok, F. M., & Baumeister, R. F.

(2012). Taking stock of self-control: A meta-analysis of how trait self-control relates

to a wide range of behaviors. Personality and Social Psychology Review, 16(1), 76-

99.

Demartini, C., & Trucco, S. (2016). Does intellectual capital disclosure matter for audit risk?

evidence from the UK and Italy. Sustainability, 8(9), 867.

Gedajlovic, E., Carney, M., Chrisman, J. J., & Kellermanns, F. W. (2012). The adolescence

of family firm research: Taking stock and planning for the future. Journal of

Management, 38(4), 1010-1037.

Gross, J. J. (2013). Emotion regulation: taking stock and moving forward. Emotion, 13(3),

359.

Guénin-Paracini, H., Malsch, B., & Paillé, A. M. (2014). Fear and risk in the audit

process. Accounting, Organizations and Society, 39(4), 264-288.

Knechel, W. R., Krishnan, G. V., Pevzner, M., Bhaskar, L. S., & Velury, U. (2013). Audit

quality: Insights from the academic literature.

References

Arens, A. A., Elder, R. J., & Mark, B. (2012). Auditing and assurance services: an integrated

approach. Boston: Prentice Hall.

Blankley, A. I., Hurtt, D. N., & MacGregor, J. E. (2012). Abnormal audit fees and

restatements. Auditing, 31(1), 79.

BOTEZ, D. (2015). Study Regarding the Need to Develop an Audit Risk Model. Audit

financiar, 13(125).

de Ridder, D. T., Lensvelt-Mulders, G., Finkenauer, C., Stok, F. M., & Baumeister, R. F.

(2012). Taking stock of self-control: A meta-analysis of how trait self-control relates

to a wide range of behaviors. Personality and Social Psychology Review, 16(1), 76-

99.

Demartini, C., & Trucco, S. (2016). Does intellectual capital disclosure matter for audit risk?

evidence from the UK and Italy. Sustainability, 8(9), 867.

Gedajlovic, E., Carney, M., Chrisman, J. J., & Kellermanns, F. W. (2012). The adolescence

of family firm research: Taking stock and planning for the future. Journal of

Management, 38(4), 1010-1037.

Gross, J. J. (2013). Emotion regulation: taking stock and moving forward. Emotion, 13(3),

359.

Guénin-Paracini, H., Malsch, B., & Paillé, A. M. (2014). Fear and risk in the audit

process. Accounting, Organizations and Society, 39(4), 264-288.

Knechel, W. R., Krishnan, G. V., Pevzner, M., Bhaskar, L. S., & Velury, U. (2013). Audit

quality: Insights from the academic literature.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.