Auditing & Assurance: Review of International Insurance Inc.

VerifiedAdded on 2023/06/15

|7

|1480

|248

Report

AI Summary

This auditing and assurance report provides an analysis of audit committee practices at International Insurance Inc. (III). It begins by defining auditing components and then compares III’s audit committee practices to published best practices based on internal control frameworks from CPA Canada and the Institute of Internal Auditors (IIA). The report assesses specific aspects of III's practices, including established criteria, reflection of reality, objectivity, independence, and competence. It further evaluates potential violations of Canadian Auditing Standards (CAS), particularly concerning advertising practices, fee quotations, and handling of misstatements. The report also examines the quality of audit evidence obtained through various procedures, such as re-performance of payroll calculations, physical examination of equipment, and inquiries of management, categorizing the evidence as high, moderate, or low based on its reliability and relevance.

Running head: AUDITING & ASSURANCE

Auditing & Assurance

Name of Student:

Name of University:

Author’s Note:

Auditing & Assurance

Name of Student:

Name of University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1AUDITING & ASSURANCE

Table of Contents

Answer to Question 1......................................................................................................................2

Answer to Question 2......................................................................................................................2

Answer to Question 3......................................................................................................................4

References........................................................................................................................................6

Table of Contents

Answer to Question 1......................................................................................................................2

Answer to Question 2......................................................................................................................2

Answer to Question 3......................................................................................................................4

References........................................................................................................................................6

2AUDITING & ASSURANCE

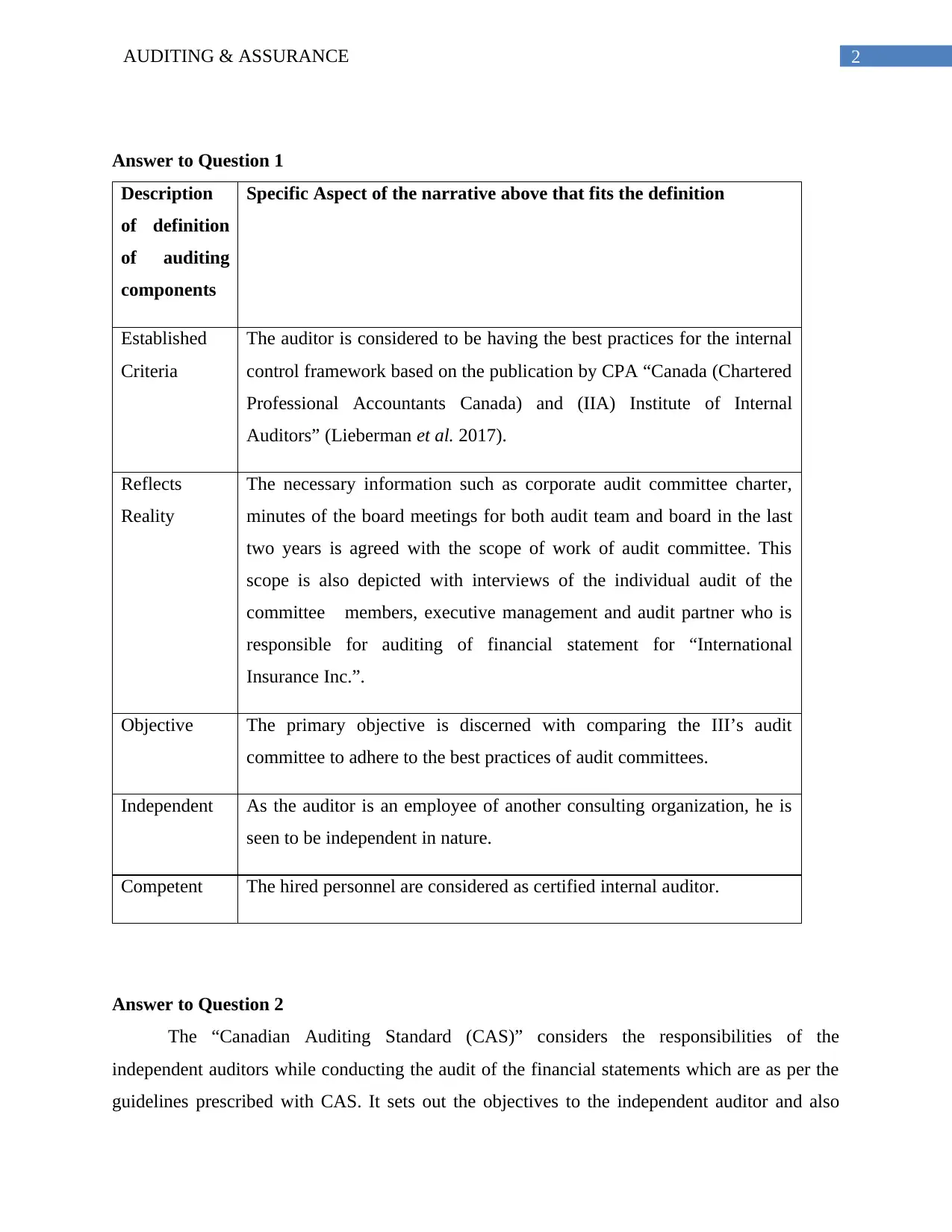

Answer to Question 1

Description

of definition

of auditing

components

Specific Aspect of the narrative above that fits the definition

Established

Criteria

The auditor is considered to be having the best practices for the internal

control framework based on the publication by CPA “Canada (Chartered

Professional Accountants Canada) and (IIA) Institute of Internal

Auditors” (Lieberman et al. 2017).

Reflects

Reality

The necessary information such as corporate audit committee charter,

minutes of the board meetings for both audit team and board in the last

two years is agreed with the scope of work of audit committee. This

scope is also depicted with interviews of the individual audit of the

committee members, executive management and audit partner who is

responsible for auditing of financial statement for “International

Insurance Inc.”.

Objective The primary objective is discerned with comparing the III’s audit

committee to adhere to the best practices of audit committees.

Independent As the auditor is an employee of another consulting organization, he is

seen to be independent in nature.

Competent The hired personnel are considered as certified internal auditor.

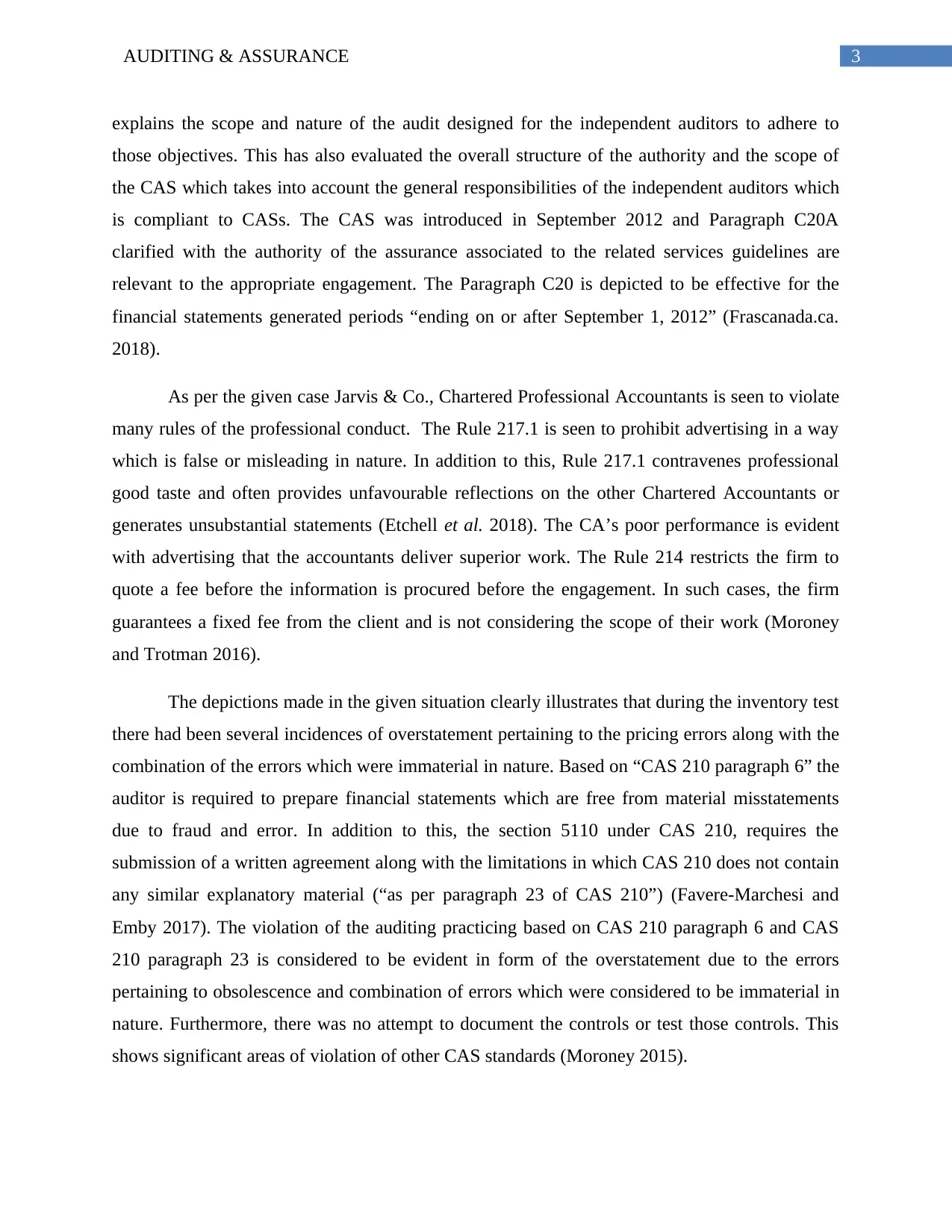

Answer to Question 2

The “Canadian Auditing Standard (CAS)” considers the responsibilities of the

independent auditors while conducting the audit of the financial statements which are as per the

guidelines prescribed with CAS. It sets out the objectives to the independent auditor and also

Answer to Question 1

Description

of definition

of auditing

components

Specific Aspect of the narrative above that fits the definition

Established

Criteria

The auditor is considered to be having the best practices for the internal

control framework based on the publication by CPA “Canada (Chartered

Professional Accountants Canada) and (IIA) Institute of Internal

Auditors” (Lieberman et al. 2017).

Reflects

Reality

The necessary information such as corporate audit committee charter,

minutes of the board meetings for both audit team and board in the last

two years is agreed with the scope of work of audit committee. This

scope is also depicted with interviews of the individual audit of the

committee members, executive management and audit partner who is

responsible for auditing of financial statement for “International

Insurance Inc.”.

Objective The primary objective is discerned with comparing the III’s audit

committee to adhere to the best practices of audit committees.

Independent As the auditor is an employee of another consulting organization, he is

seen to be independent in nature.

Competent The hired personnel are considered as certified internal auditor.

Answer to Question 2

The “Canadian Auditing Standard (CAS)” considers the responsibilities of the

independent auditors while conducting the audit of the financial statements which are as per the

guidelines prescribed with CAS. It sets out the objectives to the independent auditor and also

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3AUDITING & ASSURANCE

explains the scope and nature of the audit designed for the independent auditors to adhere to

those objectives. This has also evaluated the overall structure of the authority and the scope of

the CAS which takes into account the general responsibilities of the independent auditors which

is compliant to CASs. The CAS was introduced in September 2012 and Paragraph C20A

clarified with the authority of the assurance associated to the related services guidelines are

relevant to the appropriate engagement. The Paragraph C20 is depicted to be effective for the

financial statements generated periods “ending on or after September 1, 2012” (Frascanada.ca.

2018).

As per the given case Jarvis & Co., Chartered Professional Accountants is seen to violate

many rules of the professional conduct. The Rule 217.1 is seen to prohibit advertising in a way

which is false or misleading in nature. In addition to this, Rule 217.1 contravenes professional

good taste and often provides unfavourable reflections on the other Chartered Accountants or

generates unsubstantial statements (Etchell et al. 2018). The CA’s poor performance is evident

with advertising that the accountants deliver superior work. The Rule 214 restricts the firm to

quote a fee before the information is procured before the engagement. In such cases, the firm

guarantees a fixed fee from the client and is not considering the scope of their work (Moroney

and Trotman 2016).

The depictions made in the given situation clearly illustrates that during the inventory test

there had been several incidences of overstatement pertaining to the pricing errors along with the

combination of the errors which were immaterial in nature. Based on “CAS 210 paragraph 6” the

auditor is required to prepare financial statements which are free from material misstatements

due to fraud and error. In addition to this, the section 5110 under CAS 210, requires the

submission of a written agreement along with the limitations in which CAS 210 does not contain

any similar explanatory material (“as per paragraph 23 of CAS 210”) (Favere-Marchesi and

Emby 2017). The violation of the auditing practicing based on CAS 210 paragraph 6 and CAS

210 paragraph 23 is considered to be evident in form of the overstatement due to the errors

pertaining to obsolescence and combination of errors which were considered to be immaterial in

nature. Furthermore, there was no attempt to document the controls or test those controls. This

shows significant areas of violation of other CAS standards (Moroney 2015).

explains the scope and nature of the audit designed for the independent auditors to adhere to

those objectives. This has also evaluated the overall structure of the authority and the scope of

the CAS which takes into account the general responsibilities of the independent auditors which

is compliant to CASs. The CAS was introduced in September 2012 and Paragraph C20A

clarified with the authority of the assurance associated to the related services guidelines are

relevant to the appropriate engagement. The Paragraph C20 is depicted to be effective for the

financial statements generated periods “ending on or after September 1, 2012” (Frascanada.ca.

2018).

As per the given case Jarvis & Co., Chartered Professional Accountants is seen to violate

many rules of the professional conduct. The Rule 217.1 is seen to prohibit advertising in a way

which is false or misleading in nature. In addition to this, Rule 217.1 contravenes professional

good taste and often provides unfavourable reflections on the other Chartered Accountants or

generates unsubstantial statements (Etchell et al. 2018). The CA’s poor performance is evident

with advertising that the accountants deliver superior work. The Rule 214 restricts the firm to

quote a fee before the information is procured before the engagement. In such cases, the firm

guarantees a fixed fee from the client and is not considering the scope of their work (Moroney

and Trotman 2016).

The depictions made in the given situation clearly illustrates that during the inventory test

there had been several incidences of overstatement pertaining to the pricing errors along with the

combination of the errors which were immaterial in nature. Based on “CAS 210 paragraph 6” the

auditor is required to prepare financial statements which are free from material misstatements

due to fraud and error. In addition to this, the section 5110 under CAS 210, requires the

submission of a written agreement along with the limitations in which CAS 210 does not contain

any similar explanatory material (“as per paragraph 23 of CAS 210”) (Favere-Marchesi and

Emby 2017). The violation of the auditing practicing based on CAS 210 paragraph 6 and CAS

210 paragraph 23 is considered to be evident in form of the overstatement due to the errors

pertaining to obsolescence and combination of errors which were considered to be immaterial in

nature. Furthermore, there was no attempt to document the controls or test those controls. This

shows significant areas of violation of other CAS standards (Moroney 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4AUDITING & ASSURANCE

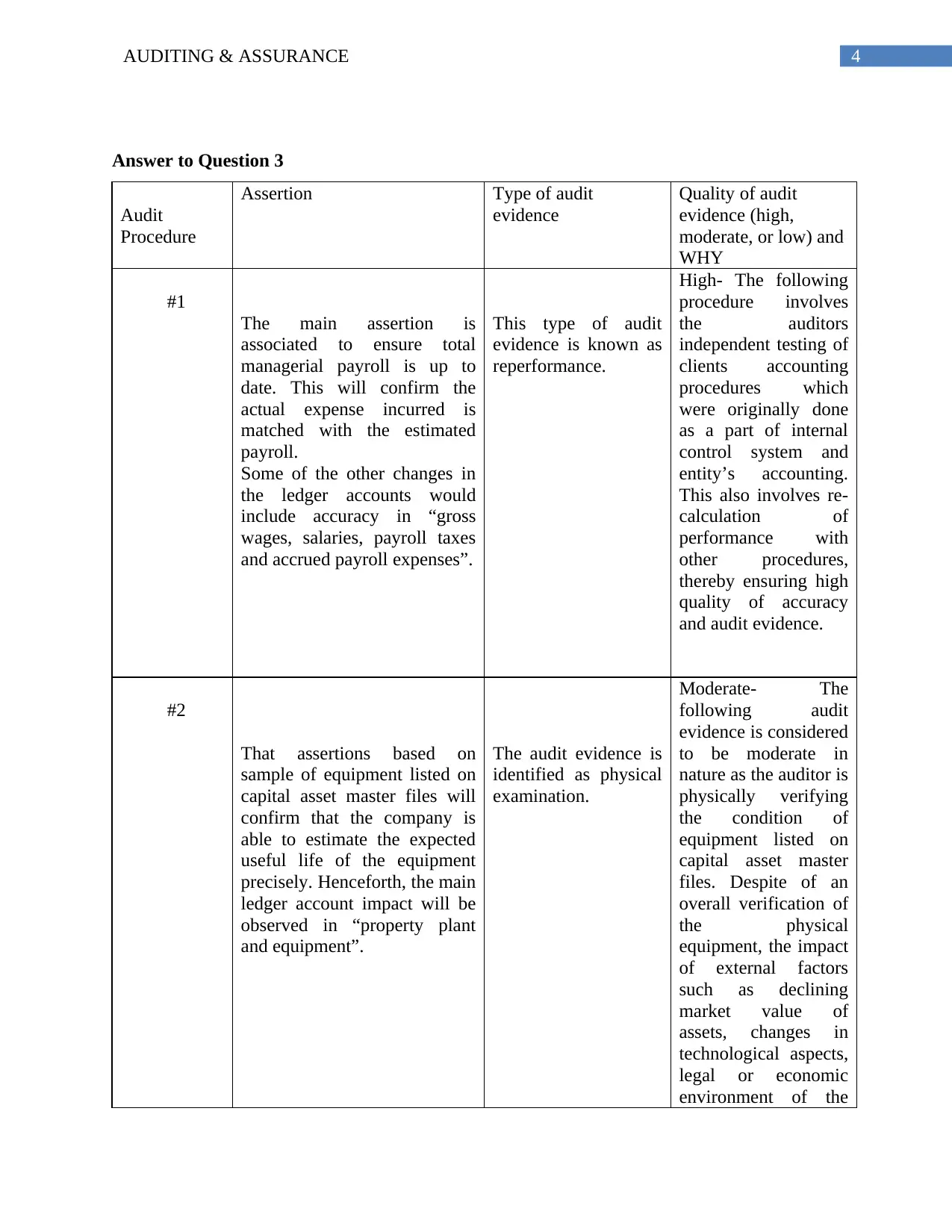

Answer to Question 3

Audit

Procedure

Assertion Type of audit

evidence

Quality of audit

evidence (high,

moderate, or low) and

WHY

#1

The main assertion is

associated to ensure total

managerial payroll is up to

date. This will confirm the

actual expense incurred is

matched with the estimated

payroll.

Some of the other changes in

the ledger accounts would

include accuracy in “gross

wages, salaries, payroll taxes

and accrued payroll expenses”.

This type of audit

evidence is known as

reperformance.

High- The following

procedure involves

the auditors

independent testing of

clients accounting

procedures which

were originally done

as a part of internal

control system and

entity’s accounting.

This also involves re-

calculation of

performance with

other procedures,

thereby ensuring high

quality of accuracy

and audit evidence.

#2

That assertions based on

sample of equipment listed on

capital asset master files will

confirm that the company is

able to estimate the expected

useful life of the equipment

precisely. Henceforth, the main

ledger account impact will be

observed in “property plant

and equipment”.

The audit evidence is

identified as physical

examination.

Moderate- The

following audit

evidence is considered

to be moderate in

nature as the auditor is

physically verifying

the condition of

equipment listed on

capital asset master

files. Despite of an

overall verification of

the physical

equipment, the impact

of external factors

such as declining

market value of

assets, changes in

technological aspects,

legal or economic

environment of the

Answer to Question 3

Audit

Procedure

Assertion Type of audit

evidence

Quality of audit

evidence (high,

moderate, or low) and

WHY

#1

The main assertion is

associated to ensure total

managerial payroll is up to

date. This will confirm the

actual expense incurred is

matched with the estimated

payroll.

Some of the other changes in

the ledger accounts would

include accuracy in “gross

wages, salaries, payroll taxes

and accrued payroll expenses”.

This type of audit

evidence is known as

reperformance.

High- The following

procedure involves

the auditors

independent testing of

clients accounting

procedures which

were originally done

as a part of internal

control system and

entity’s accounting.

This also involves re-

calculation of

performance with

other procedures,

thereby ensuring high

quality of accuracy

and audit evidence.

#2

That assertions based on

sample of equipment listed on

capital asset master files will

confirm that the company is

able to estimate the expected

useful life of the equipment

precisely. Henceforth, the main

ledger account impact will be

observed in “property plant

and equipment”.

The audit evidence is

identified as physical

examination.

Moderate- The

following audit

evidence is considered

to be moderate in

nature as the auditor is

physically verifying

the condition of

equipment listed on

capital asset master

files. Despite of an

overall verification of

the physical

equipment, the impact

of external factors

such as declining

market value of

assets, changes in

technological aspects,

legal or economic

environment of the

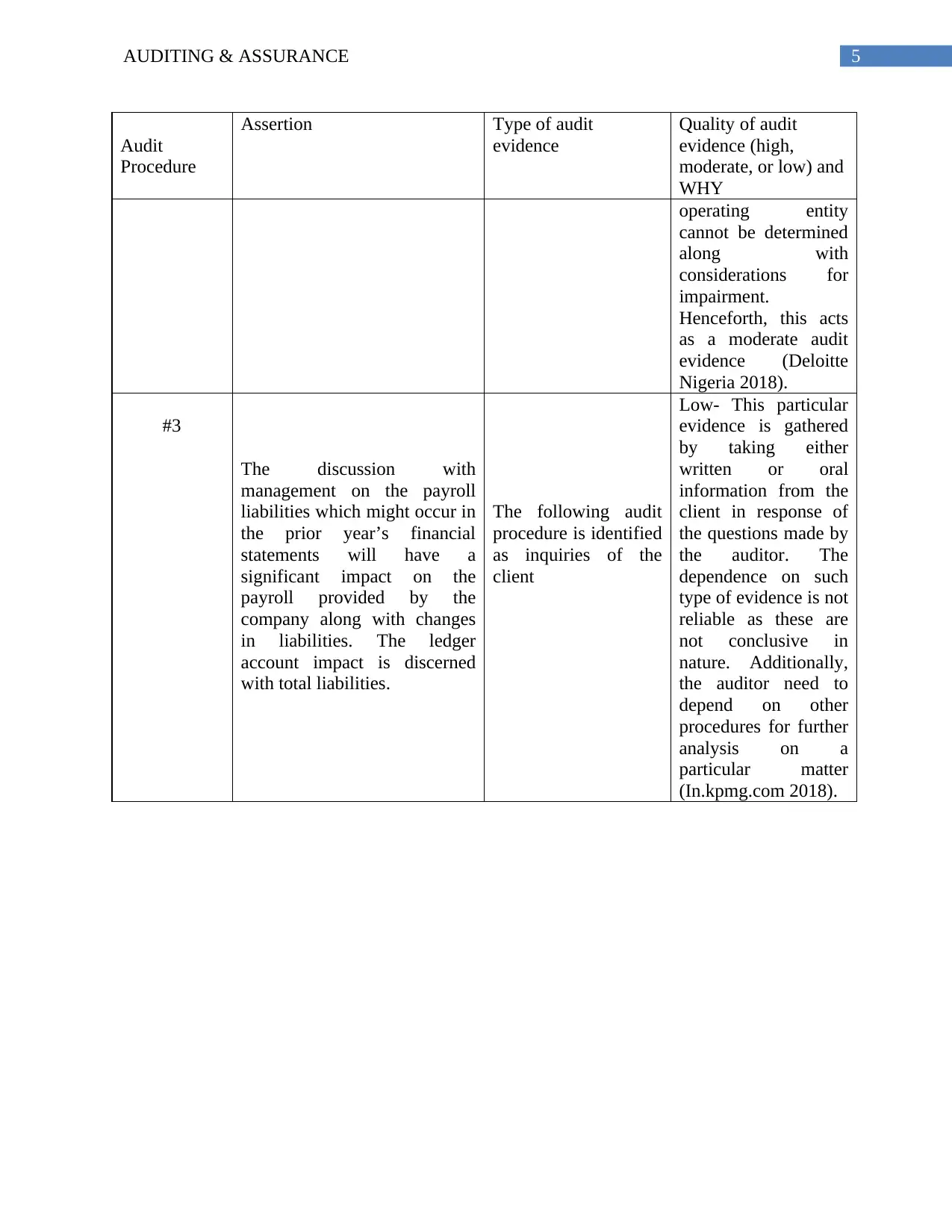

5AUDITING & ASSURANCE

Audit

Procedure

Assertion Type of audit

evidence

Quality of audit

evidence (high,

moderate, or low) and

WHY

operating entity

cannot be determined

along with

considerations for

impairment.

Henceforth, this acts

as a moderate audit

evidence (Deloitte

Nigeria 2018).

#3

The discussion with

management on the payroll

liabilities which might occur in

the prior year’s financial

statements will have a

significant impact on the

payroll provided by the

company along with changes

in liabilities. The ledger

account impact is discerned

with total liabilities.

The following audit

procedure is identified

as inquiries of the

client

Low- This particular

evidence is gathered

by taking either

written or oral

information from the

client in response of

the questions made by

the auditor. The

dependence on such

type of evidence is not

reliable as these are

not conclusive in

nature. Additionally,

the auditor need to

depend on other

procedures for further

analysis on a

particular matter

(In.kpmg.com 2018).

Audit

Procedure

Assertion Type of audit

evidence

Quality of audit

evidence (high,

moderate, or low) and

WHY

operating entity

cannot be determined

along with

considerations for

impairment.

Henceforth, this acts

as a moderate audit

evidence (Deloitte

Nigeria 2018).

#3

The discussion with

management on the payroll

liabilities which might occur in

the prior year’s financial

statements will have a

significant impact on the

payroll provided by the

company along with changes

in liabilities. The ledger

account impact is discerned

with total liabilities.

The following audit

procedure is identified

as inquiries of the

client

Low- This particular

evidence is gathered

by taking either

written or oral

information from the

client in response of

the questions made by

the auditor. The

dependence on such

type of evidence is not

reliable as these are

not conclusive in

nature. Additionally,

the auditor need to

depend on other

procedures for further

analysis on a

particular matter

(In.kpmg.com 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6AUDITING & ASSURANCE

References

Deloitte Nigeria. (2018). Audit Readiness (4) - Property, Plant and Equipment. [online]

Available at: https://www2.deloitte.com/ng/en/pages/audit/articles/financial-reporting/audit-

readiness-4-property-plant-and-equipment.html [Accessed 6 Feb. 2018].

Etchells, M., Spradbrow, J., Cohen, R., Lin, Y., Armali, C., Lieberman, L., Cserti‐Gazdewich,

C., Pendergrast, J. and Callum, J., 2018. Audit of appropriate use of platelet transfusions:

validation of adjudication criteria. Vox sanguinis, 113(1), pp.40-50.

Favere-Marchesi, M. and Emby, C.E., 2017. The Alumni Effect & Professional Skepticism: An

Experimental Investigation. Accounting Horizons.

Frascanada.ca. (2018). [online] Available at: http://www.frascanada.ca/canadian-auditing-

standards/resources/reference-material/item31008.pdf [Accessed 6 Feb. 2018].

In.kpmg.com. (2018). [online] Available at: http://in.kpmg.com/knowledge_update/Guidance-

Note-Audit.pdf [Accessed 6 Feb. 2018].

Lieberman, L., Lin, Y., Cserti‐Gazdewich, C., Yi, Q.L., Pendergrast, J., Lau, W. and Callum, J.,

2017. Utilization of frozen plasma, cryoprecipitate, and recombinant factor VIIa for children

with hemostatic impairments: An audit of transfusion appropriateness. Pediatric blood & cancer.

Moroney, R. and Trotman, K.T., 2016. Differences in Auditors' Materiality Assessments When

Auditing Financial Statements and Sustainability Reports. Contemporary Accounting Research,

33(2), pp.551-575.

Moroney, R., 2015. Auditing: A Practical Approach. Wiley Global Education.

References

Deloitte Nigeria. (2018). Audit Readiness (4) - Property, Plant and Equipment. [online]

Available at: https://www2.deloitte.com/ng/en/pages/audit/articles/financial-reporting/audit-

readiness-4-property-plant-and-equipment.html [Accessed 6 Feb. 2018].

Etchells, M., Spradbrow, J., Cohen, R., Lin, Y., Armali, C., Lieberman, L., Cserti‐Gazdewich,

C., Pendergrast, J. and Callum, J., 2018. Audit of appropriate use of platelet transfusions:

validation of adjudication criteria. Vox sanguinis, 113(1), pp.40-50.

Favere-Marchesi, M. and Emby, C.E., 2017. The Alumni Effect & Professional Skepticism: An

Experimental Investigation. Accounting Horizons.

Frascanada.ca. (2018). [online] Available at: http://www.frascanada.ca/canadian-auditing-

standards/resources/reference-material/item31008.pdf [Accessed 6 Feb. 2018].

In.kpmg.com. (2018). [online] Available at: http://in.kpmg.com/knowledge_update/Guidance-

Note-Audit.pdf [Accessed 6 Feb. 2018].

Lieberman, L., Lin, Y., Cserti‐Gazdewich, C., Yi, Q.L., Pendergrast, J., Lau, W. and Callum, J.,

2017. Utilization of frozen plasma, cryoprecipitate, and recombinant factor VIIa for children

with hemostatic impairments: An audit of transfusion appropriateness. Pediatric blood & cancer.

Moroney, R. and Trotman, K.T., 2016. Differences in Auditors' Materiality Assessments When

Auditing Financial Statements and Sustainability Reports. Contemporary Accounting Research,

33(2), pp.551-575.

Moroney, R., 2015. Auditing: A Practical Approach. Wiley Global Education.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.