Auditing and Assurance: Trunkey Creek Wines Financial Analysis Report

VerifiedAdded on 2023/06/05

|17

|4449

|361

Report

AI Summary

This report provides a comprehensive audit analysis of Trunkey Creek Wines (TCW), evaluating its financial performance and internal controls. It examines key financial ratios, including accounts receivable, return on equity, and profit margins, comparing audited and unaudited data. The report identifies significant audit risks related to accounts receivable (particularly for beef sales), investments, and marketing expenses, suggesting appropriate audit measures. Furthermore, it explores the company's internal control weaknesses, such as controls overridden by management and segregation of duties, recommending effective risk control measures. The analysis covers aspects of both wine and beef production, assessing the impact of operational leverage and inventory management on the overall business risk. The report concludes with a detailed assessment of the company's financial health, providing insights into its profitability, efficiency, and solvency.

Running head: AUDITING & ASSURANCE

Auditing & Assurance

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Auditing & Assurance

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

AUDITING & ASSURANCE

Executive Summary

The main aspects of the study have evaluated the different types of the audit concerns in TCW.

In order to answer the various issues related to audit the first section of the study will evaluate

the ratios and additional information associated with the four accounts listed by your audit

partner, John Richards. This part of the study will also consider the any appropriate audit

measures which needs to be implemented for the audit risks. This will recommend the audit

measures with account of concern, analysis and audit risk. The second part of the study will

further consider the additional risk pertaining to the overall operations of the business. The latter

section of the study will provide explanation in the internal controls and also recommend the

effective risk control measures for the associated test of controls. This will be stated by points

grouped under weakness and provide justification for the same. The overall concerns for TCW

was recognised as per Controls Overridden by the CEO and management, Overreliance on

Detective Controls vs. Preventative Controls, Segregation of the duties and Informal and Formal

Controls related to the accounts payable and purchases.

AUDITING & ASSURANCE

Executive Summary

The main aspects of the study have evaluated the different types of the audit concerns in TCW.

In order to answer the various issues related to audit the first section of the study will evaluate

the ratios and additional information associated with the four accounts listed by your audit

partner, John Richards. This part of the study will also consider the any appropriate audit

measures which needs to be implemented for the audit risks. This will recommend the audit

measures with account of concern, analysis and audit risk. The second part of the study will

further consider the additional risk pertaining to the overall operations of the business. The latter

section of the study will provide explanation in the internal controls and also recommend the

effective risk control measures for the associated test of controls. This will be stated by points

grouped under weakness and provide justification for the same. The overall concerns for TCW

was recognised as per Controls Overridden by the CEO and management, Overreliance on

Detective Controls vs. Preventative Controls, Segregation of the duties and Informal and Formal

Controls related to the accounts payable and purchases.

2

AUDITING & ASSURANCE

Table of Contents

Introduction......................................................................................................................................3

Question 1A.....................................................................................................................................3

Question 1B.....................................................................................................................................6

Question 2A.....................................................................................................................................8

Question 2B...................................................................................................................................10

Conclusion.....................................................................................................................................13

References......................................................................................................................................14

AUDITING & ASSURANCE

Table of Contents

Introduction......................................................................................................................................3

Question 1A.....................................................................................................................................3

Question 1B.....................................................................................................................................6

Question 2A.....................................................................................................................................8

Question 2B...................................................................................................................................10

Conclusion.....................................................................................................................................13

References......................................................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

AUDITING & ASSURANCE

Introduction

The discourse of the report is aimed to evaluate the audit procedure at Trunkey Creek

Wines (TCW). As per the given information the internal control functions at TCW is related to

define the system of internal control and create greater awareness of controls in the company.

These are mainly related to the factors such as enforcing effective internal controls. The

management staff at Trunkey Creek Wines (TCW) is depicted to receive bonus as per the target

ratios. This will further include the monthly sales volumes, variance of actual to budget

departmental overheads and profit before interest and tax. The board of the company further

aims to take active interest pertaining to the performance and also request for the explanations as

per the variance from the monthly budgets.

The first section of the study will evaluate the ratios and additional information

associated with the four accounts listed by your audit partner, John Richards. This part of the

study will also consider the any appropriate audit measures which needs to be implemented for

the audit risks. This will recommend the audit measures with account of concern, analysis and

audit risk. The second part of the study will further consider the additional risk pertaining to the

overall operations of the business. The latter section of the study will provide explanation in the

internal controls and also recommend the effective risk control measures for the associated test

of controls. This will be stated by points grouped under weakness and provide justification for

the same.

Question 1A

The consideration of the risks of audit are considered with audit measures with account of

concern, analysis and audit risk.

AUDITING & ASSURANCE

Introduction

The discourse of the report is aimed to evaluate the audit procedure at Trunkey Creek

Wines (TCW). As per the given information the internal control functions at TCW is related to

define the system of internal control and create greater awareness of controls in the company.

These are mainly related to the factors such as enforcing effective internal controls. The

management staff at Trunkey Creek Wines (TCW) is depicted to receive bonus as per the target

ratios. This will further include the monthly sales volumes, variance of actual to budget

departmental overheads and profit before interest and tax. The board of the company further

aims to take active interest pertaining to the performance and also request for the explanations as

per the variance from the monthly budgets.

The first section of the study will evaluate the ratios and additional information

associated with the four accounts listed by your audit partner, John Richards. This part of the

study will also consider the any appropriate audit measures which needs to be implemented for

the audit risks. This will recommend the audit measures with account of concern, analysis and

audit risk. The second part of the study will further consider the additional risk pertaining to the

overall operations of the business. The latter section of the study will provide explanation in the

internal controls and also recommend the effective risk control measures for the associated test

of controls. This will be stated by points grouped under weakness and provide justification for

the same.

Question 1A

The consideration of the risks of audit are considered with audit measures with account of

concern, analysis and audit risk.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

AUDITING & ASSURANCE

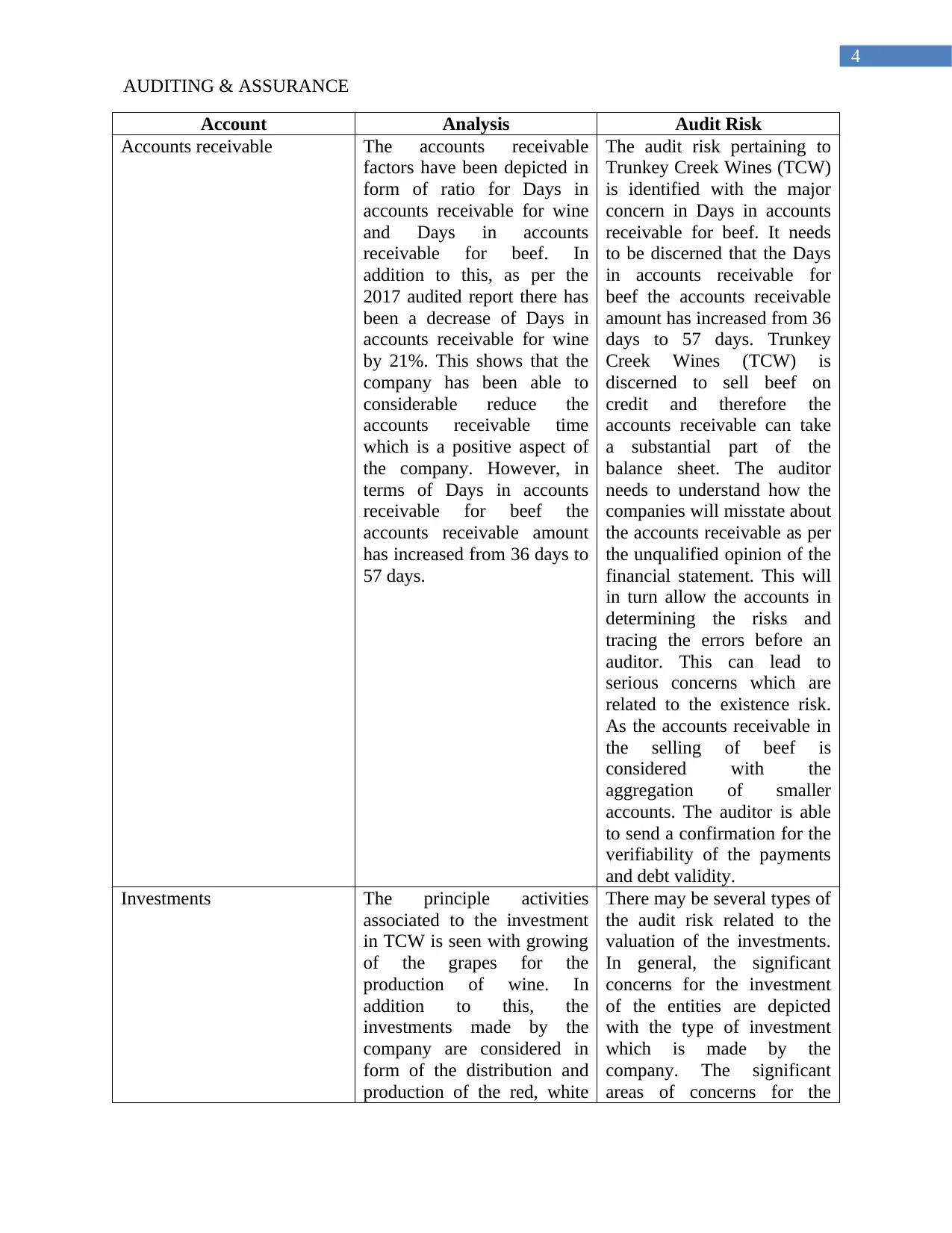

Account Analysis Audit Risk

Accounts receivable The accounts receivable

factors have been depicted in

form of ratio for Days in

accounts receivable for wine

and Days in accounts

receivable for beef. In

addition to this, as per the

2017 audited report there has

been a decrease of Days in

accounts receivable for wine

by 21%. This shows that the

company has been able to

considerable reduce the

accounts receivable time

which is a positive aspect of

the company. However, in

terms of Days in accounts

receivable for beef the

accounts receivable amount

has increased from 36 days to

57 days.

The audit risk pertaining to

Trunkey Creek Wines (TCW)

is identified with the major

concern in Days in accounts

receivable for beef. It needs

to be discerned that the Days

in accounts receivable for

beef the accounts receivable

amount has increased from 36

days to 57 days. Trunkey

Creek Wines (TCW) is

discerned to sell beef on

credit and therefore the

accounts receivable can take

a substantial part of the

balance sheet. The auditor

needs to understand how the

companies will misstate about

the accounts receivable as per

the unqualified opinion of the

financial statement. This will

in turn allow the accounts in

determining the risks and

tracing the errors before an

auditor. This can lead to

serious concerns which are

related to the existence risk.

As the accounts receivable in

the selling of beef is

considered with the

aggregation of smaller

accounts. The auditor is able

to send a confirmation for the

verifiability of the payments

and debt validity.

Investments The principle activities

associated to the investment

in TCW is seen with growing

of the grapes for the

production of wine. In

addition to this, the

investments made by the

company are considered in

form of the distribution and

production of the red, white

There may be several types of

the audit risk related to the

valuation of the investments.

In general, the significant

concerns for the investment

of the entities are depicted

with the type of investment

which is made by the

company. The significant

areas of concerns for the

AUDITING & ASSURANCE

Account Analysis Audit Risk

Accounts receivable The accounts receivable

factors have been depicted in

form of ratio for Days in

accounts receivable for wine

and Days in accounts

receivable for beef. In

addition to this, as per the

2017 audited report there has

been a decrease of Days in

accounts receivable for wine

by 21%. This shows that the

company has been able to

considerable reduce the

accounts receivable time

which is a positive aspect of

the company. However, in

terms of Days in accounts

receivable for beef the

accounts receivable amount

has increased from 36 days to

57 days.

The audit risk pertaining to

Trunkey Creek Wines (TCW)

is identified with the major

concern in Days in accounts

receivable for beef. It needs

to be discerned that the Days

in accounts receivable for

beef the accounts receivable

amount has increased from 36

days to 57 days. Trunkey

Creek Wines (TCW) is

discerned to sell beef on

credit and therefore the

accounts receivable can take

a substantial part of the

balance sheet. The auditor

needs to understand how the

companies will misstate about

the accounts receivable as per

the unqualified opinion of the

financial statement. This will

in turn allow the accounts in

determining the risks and

tracing the errors before an

auditor. This can lead to

serious concerns which are

related to the existence risk.

As the accounts receivable in

the selling of beef is

considered with the

aggregation of smaller

accounts. The auditor is able

to send a confirmation for the

verifiability of the payments

and debt validity.

Investments The principle activities

associated to the investment

in TCW is seen with growing

of the grapes for the

production of wine. In

addition to this, the

investments made by the

company are considered in

form of the distribution and

production of the red, white

There may be several types of

the audit risk related to the

valuation of the investments.

In general, the significant

concerns for the investment

of the entities are depicted

with the type of investment

which is made by the

company. The significant

areas of concerns for the

5

AUDITING & ASSURANCE

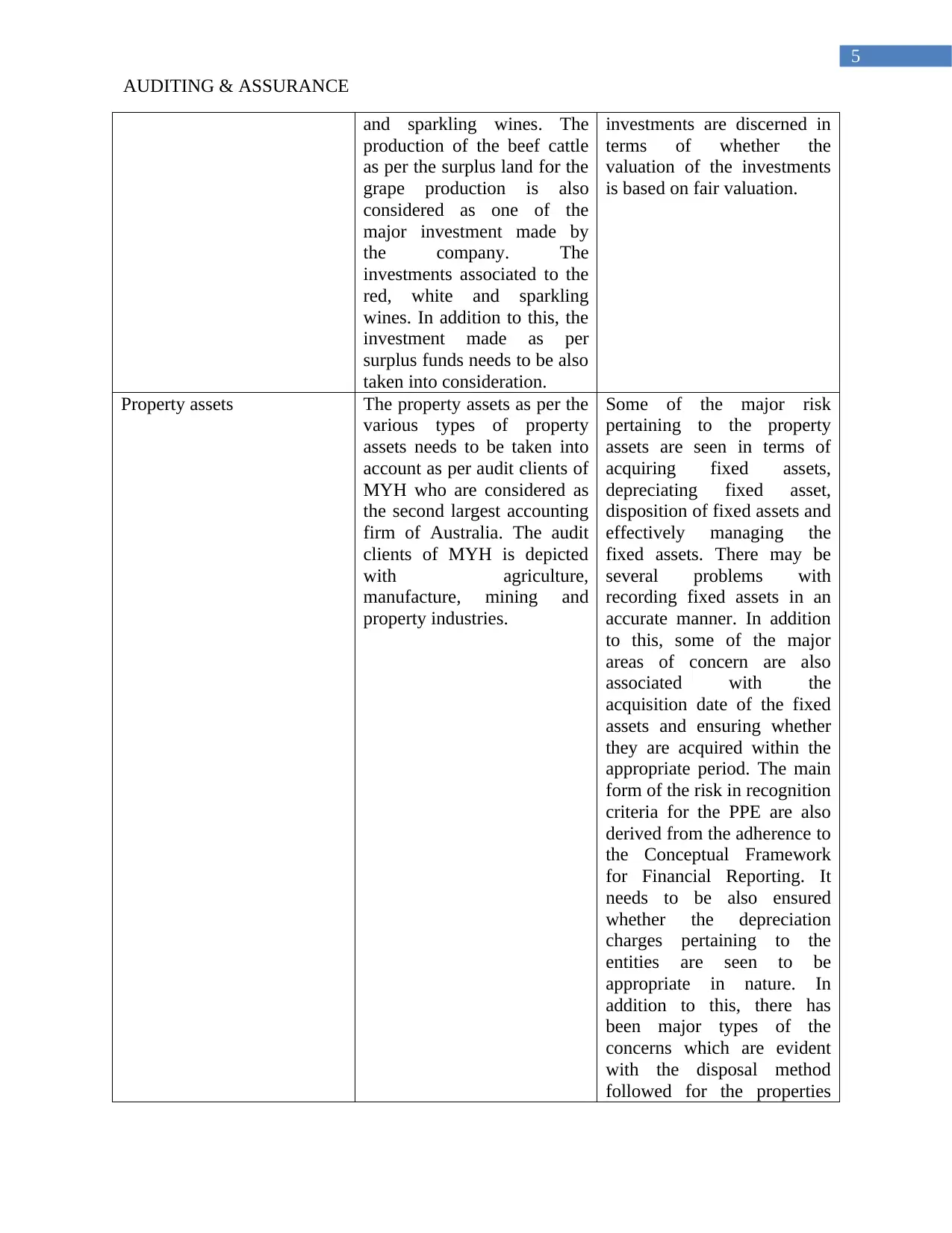

and sparkling wines. The

production of the beef cattle

as per the surplus land for the

grape production is also

considered as one of the

major investment made by

the company. The

investments associated to the

red, white and sparkling

wines. In addition to this, the

investment made as per

surplus funds needs to be also

taken into consideration.

investments are discerned in

terms of whether the

valuation of the investments

is based on fair valuation.

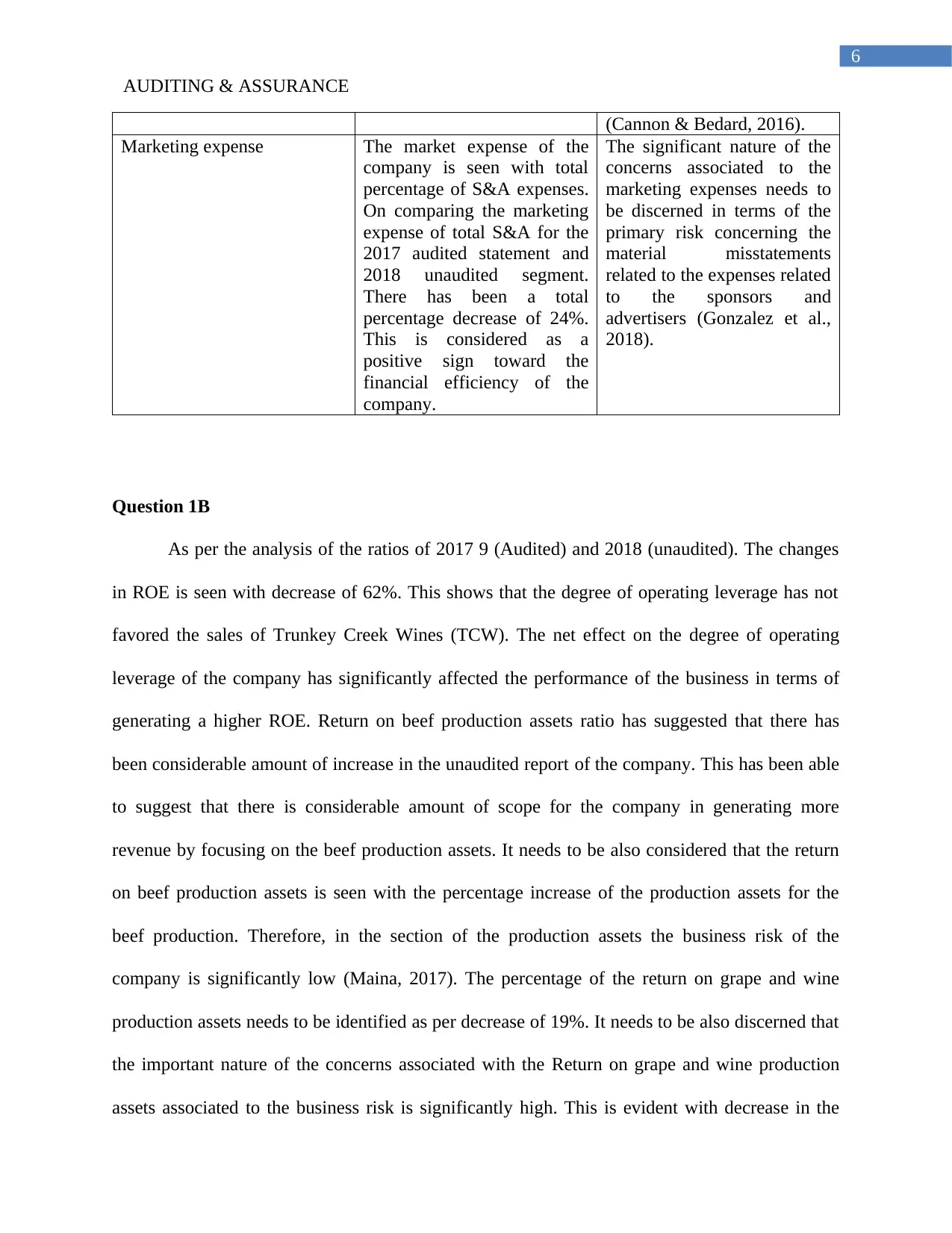

Property assets The property assets as per the

various types of property

assets needs to be taken into

account as per audit clients of

MYH who are considered as

the second largest accounting

firm of Australia. The audit

clients of MYH is depicted

with agriculture,

manufacture, mining and

property industries.

Some of the major risk

pertaining to the property

assets are seen in terms of

acquiring fixed assets,

depreciating fixed asset,

disposition of fixed assets and

effectively managing the

fixed assets. There may be

several problems with

recording fixed assets in an

accurate manner. In addition

to this, some of the major

areas of concern are also

associated with the

acquisition date of the fixed

assets and ensuring whether

they are acquired within the

appropriate period. The main

form of the risk in recognition

criteria for the PPE are also

derived from the adherence to

the Conceptual Framework

for Financial Reporting. It

needs to be also ensured

whether the depreciation

charges pertaining to the

entities are seen to be

appropriate in nature. In

addition to this, there has

been major types of the

concerns which are evident

with the disposal method

followed for the properties

AUDITING & ASSURANCE

and sparkling wines. The

production of the beef cattle

as per the surplus land for the

grape production is also

considered as one of the

major investment made by

the company. The

investments associated to the

red, white and sparkling

wines. In addition to this, the

investment made as per

surplus funds needs to be also

taken into consideration.

investments are discerned in

terms of whether the

valuation of the investments

is based on fair valuation.

Property assets The property assets as per the

various types of property

assets needs to be taken into

account as per audit clients of

MYH who are considered as

the second largest accounting

firm of Australia. The audit

clients of MYH is depicted

with agriculture,

manufacture, mining and

property industries.

Some of the major risk

pertaining to the property

assets are seen in terms of

acquiring fixed assets,

depreciating fixed asset,

disposition of fixed assets and

effectively managing the

fixed assets. There may be

several problems with

recording fixed assets in an

accurate manner. In addition

to this, some of the major

areas of concern are also

associated with the

acquisition date of the fixed

assets and ensuring whether

they are acquired within the

appropriate period. The main

form of the risk in recognition

criteria for the PPE are also

derived from the adherence to

the Conceptual Framework

for Financial Reporting. It

needs to be also ensured

whether the depreciation

charges pertaining to the

entities are seen to be

appropriate in nature. In

addition to this, there has

been major types of the

concerns which are evident

with the disposal method

followed for the properties

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

AUDITING & ASSURANCE

(Cannon & Bedard, 2016).

Marketing expense The market expense of the

company is seen with total

percentage of S&A expenses.

On comparing the marketing

expense of total S&A for the

2017 audited statement and

2018 unaudited segment.

There has been a total

percentage decrease of 24%.

This is considered as a

positive sign toward the

financial efficiency of the

company.

The significant nature of the

concerns associated to the

marketing expenses needs to

be discerned in terms of the

primary risk concerning the

material misstatements

related to the expenses related

to the sponsors and

advertisers (Gonzalez et al.,

2018).

Question 1B

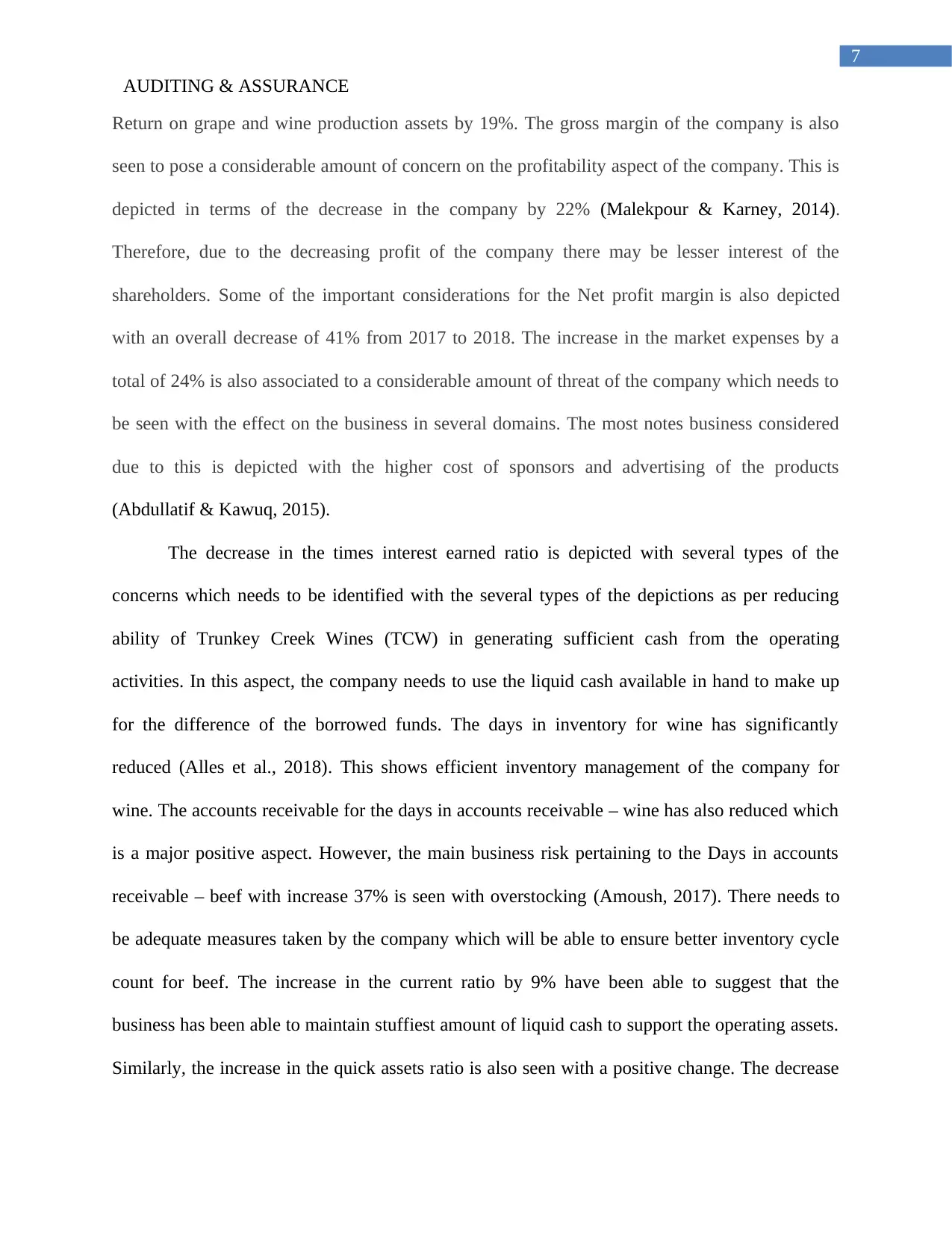

As per the analysis of the ratios of 2017 9 (Audited) and 2018 (unaudited). The changes

in ROE is seen with decrease of 62%. This shows that the degree of operating leverage has not

favored the sales of Trunkey Creek Wines (TCW). The net effect on the degree of operating

leverage of the company has significantly affected the performance of the business in terms of

generating a higher ROE. Return on beef production assets ratio has suggested that there has

been considerable amount of increase in the unaudited report of the company. This has been able

to suggest that there is considerable amount of scope for the company in generating more

revenue by focusing on the beef production assets. It needs to be also considered that the return

on beef production assets is seen with the percentage increase of the production assets for the

beef production. Therefore, in the section of the production assets the business risk of the

company is significantly low (Maina, 2017). The percentage of the return on grape and wine

production assets needs to be identified as per decrease of 19%. It needs to be also discerned that

the important nature of the concerns associated with the Return on grape and wine production

assets associated to the business risk is significantly high. This is evident with decrease in the

AUDITING & ASSURANCE

(Cannon & Bedard, 2016).

Marketing expense The market expense of the

company is seen with total

percentage of S&A expenses.

On comparing the marketing

expense of total S&A for the

2017 audited statement and

2018 unaudited segment.

There has been a total

percentage decrease of 24%.

This is considered as a

positive sign toward the

financial efficiency of the

company.

The significant nature of the

concerns associated to the

marketing expenses needs to

be discerned in terms of the

primary risk concerning the

material misstatements

related to the expenses related

to the sponsors and

advertisers (Gonzalez et al.,

2018).

Question 1B

As per the analysis of the ratios of 2017 9 (Audited) and 2018 (unaudited). The changes

in ROE is seen with decrease of 62%. This shows that the degree of operating leverage has not

favored the sales of Trunkey Creek Wines (TCW). The net effect on the degree of operating

leverage of the company has significantly affected the performance of the business in terms of

generating a higher ROE. Return on beef production assets ratio has suggested that there has

been considerable amount of increase in the unaudited report of the company. This has been able

to suggest that there is considerable amount of scope for the company in generating more

revenue by focusing on the beef production assets. It needs to be also considered that the return

on beef production assets is seen with the percentage increase of the production assets for the

beef production. Therefore, in the section of the production assets the business risk of the

company is significantly low (Maina, 2017). The percentage of the return on grape and wine

production assets needs to be identified as per decrease of 19%. It needs to be also discerned that

the important nature of the concerns associated with the Return on grape and wine production

assets associated to the business risk is significantly high. This is evident with decrease in the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

AUDITING & ASSURANCE

Return on grape and wine production assets by 19%. The gross margin of the company is also

seen to pose a considerable amount of concern on the profitability aspect of the company. This is

depicted in terms of the decrease in the company by 22% (Malekpour & Karney, 2014).

Therefore, due to the decreasing profit of the company there may be lesser interest of the

shareholders. Some of the important considerations for the Net profit margin is also depicted

with an overall decrease of 41% from 2017 to 2018. The increase in the market expenses by a

total of 24% is also associated to a considerable amount of threat of the company which needs to

be seen with the effect on the business in several domains. The most notes business considered

due to this is depicted with the higher cost of sponsors and advertising of the products

(Abdullatif & Kawuq, 2015).

The decrease in the times interest earned ratio is depicted with several types of the

concerns which needs to be identified with the several types of the depictions as per reducing

ability of Trunkey Creek Wines (TCW) in generating sufficient cash from the operating

activities. In this aspect, the company needs to use the liquid cash available in hand to make up

for the difference of the borrowed funds. The days in inventory for wine has significantly

reduced (Alles et al., 2018). This shows efficient inventory management of the company for

wine. The accounts receivable for the days in accounts receivable – wine has also reduced which

is a major positive aspect. However, the main business risk pertaining to the Days in accounts

receivable – beef with increase 37% is seen with overstocking (Amoush, 2017). There needs to

be adequate measures taken by the company which will be able to ensure better inventory cycle

count for beef. The increase in the current ratio by 9% have been able to suggest that the

business has been able to maintain stuffiest amount of liquid cash to support the operating assets.

Similarly, the increase in the quick assets ratio is also seen with a positive change. The decrease

AUDITING & ASSURANCE

Return on grape and wine production assets by 19%. The gross margin of the company is also

seen to pose a considerable amount of concern on the profitability aspect of the company. This is

depicted in terms of the decrease in the company by 22% (Malekpour & Karney, 2014).

Therefore, due to the decreasing profit of the company there may be lesser interest of the

shareholders. Some of the important considerations for the Net profit margin is also depicted

with an overall decrease of 41% from 2017 to 2018. The increase in the market expenses by a

total of 24% is also associated to a considerable amount of threat of the company which needs to

be seen with the effect on the business in several domains. The most notes business considered

due to this is depicted with the higher cost of sponsors and advertising of the products

(Abdullatif & Kawuq, 2015).

The decrease in the times interest earned ratio is depicted with several types of the

concerns which needs to be identified with the several types of the depictions as per reducing

ability of Trunkey Creek Wines (TCW) in generating sufficient cash from the operating

activities. In this aspect, the company needs to use the liquid cash available in hand to make up

for the difference of the borrowed funds. The days in inventory for wine has significantly

reduced (Alles et al., 2018). This shows efficient inventory management of the company for

wine. The accounts receivable for the days in accounts receivable – wine has also reduced which

is a major positive aspect. However, the main business risk pertaining to the Days in accounts

receivable – beef with increase 37% is seen with overstocking (Amoush, 2017). There needs to

be adequate measures taken by the company which will be able to ensure better inventory cycle

count for beef. The increase in the current ratio by 9% have been able to suggest that the

business has been able to maintain stuffiest amount of liquid cash to support the operating assets.

Similarly, the increase in the quick assets ratio is also seen with a positive change. The decrease

8

AUDITING & ASSURANCE

in the debt ratio of the company needs to be taken as the main form of efficiency of Trunkey

Creek Wines (TCW) in supporting the outstanding liabilities with the equity of the shareholders

(Knechel & Salterio, 2016).

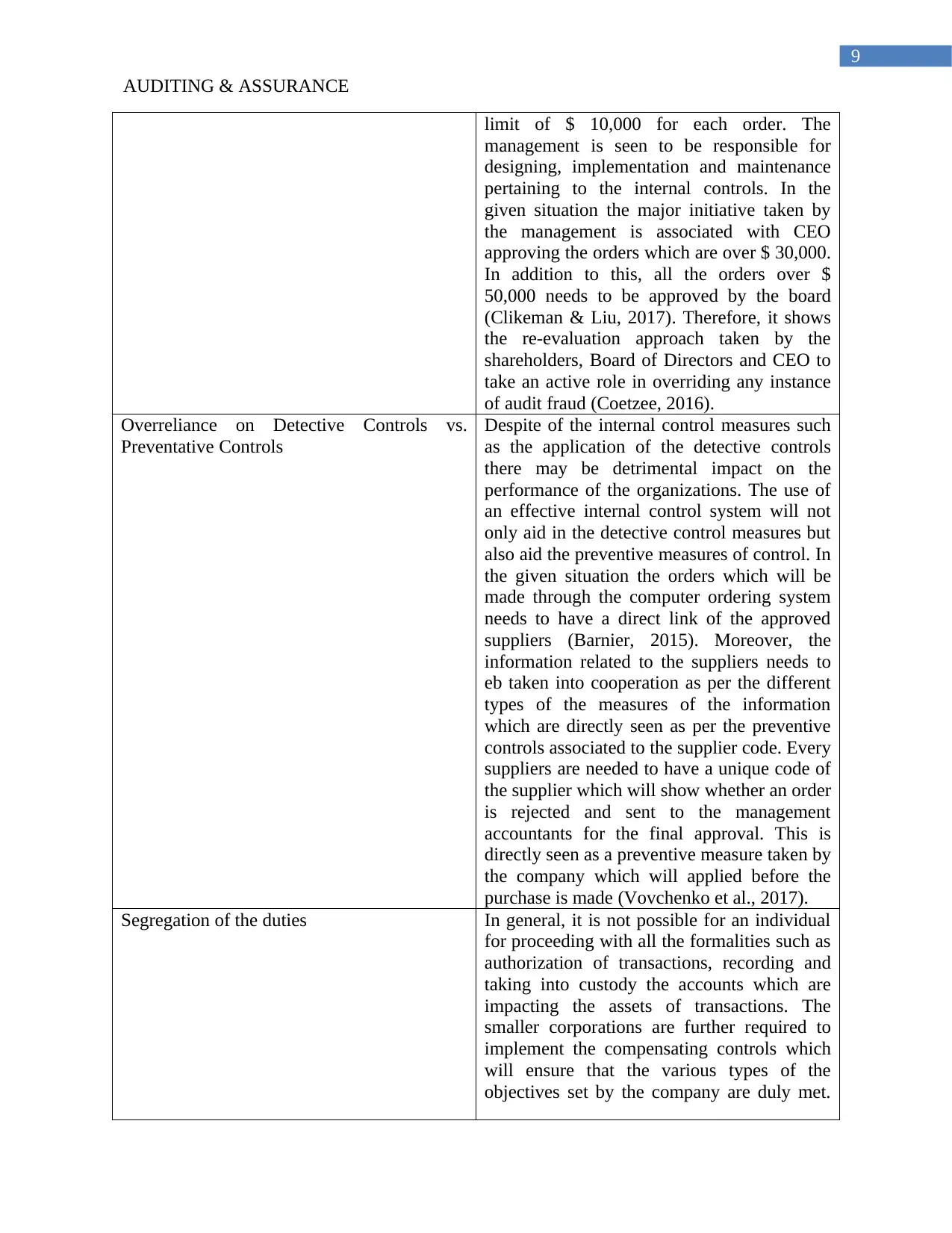

Ratio 2018 (Unaudited) 2017

(Audited)

Percentage

Change

Return on equity % 10.8 17.5 -62%

Return on beef production assets

% 1.67 -0.82 149%

Return on grape and wine

production assets % 12.2 14.5 -19%

Gross margin % 24.5 30 -22%

Net profit margin % 14.38 20.27 -41%

Marketing expense % of total S &

A expenses 23.67 17.89 24%

Times interest earned 6.67 7.51 -13%

Days in inventory - wine 367 423 -15%

Days in accounts receivable -

wine 50.2 60.65 -21%

Days in accounts receivable - beef 57 36 37%

Current ratio:1 2.8 2.54 9%

Quick asset ratio:1 1.18 1.15 3%

Debt to equity ratio:1 0.54 0.63 -17%

Table: Percentage change in values of the audited and unaudited estimation

(Sources: As created by the author)

Question 2A

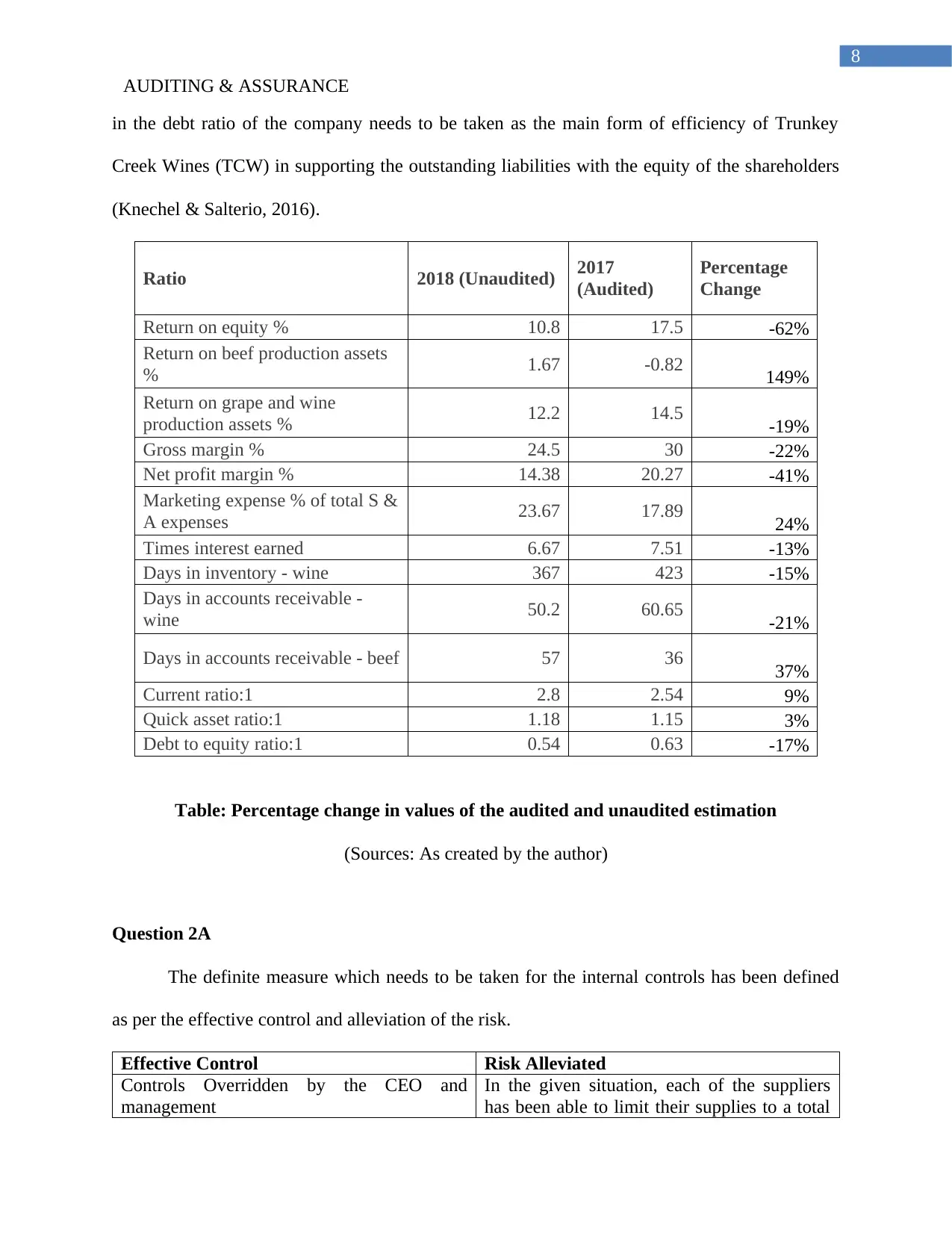

The definite measure which needs to be taken for the internal controls has been defined

as per the effective control and alleviation of the risk.

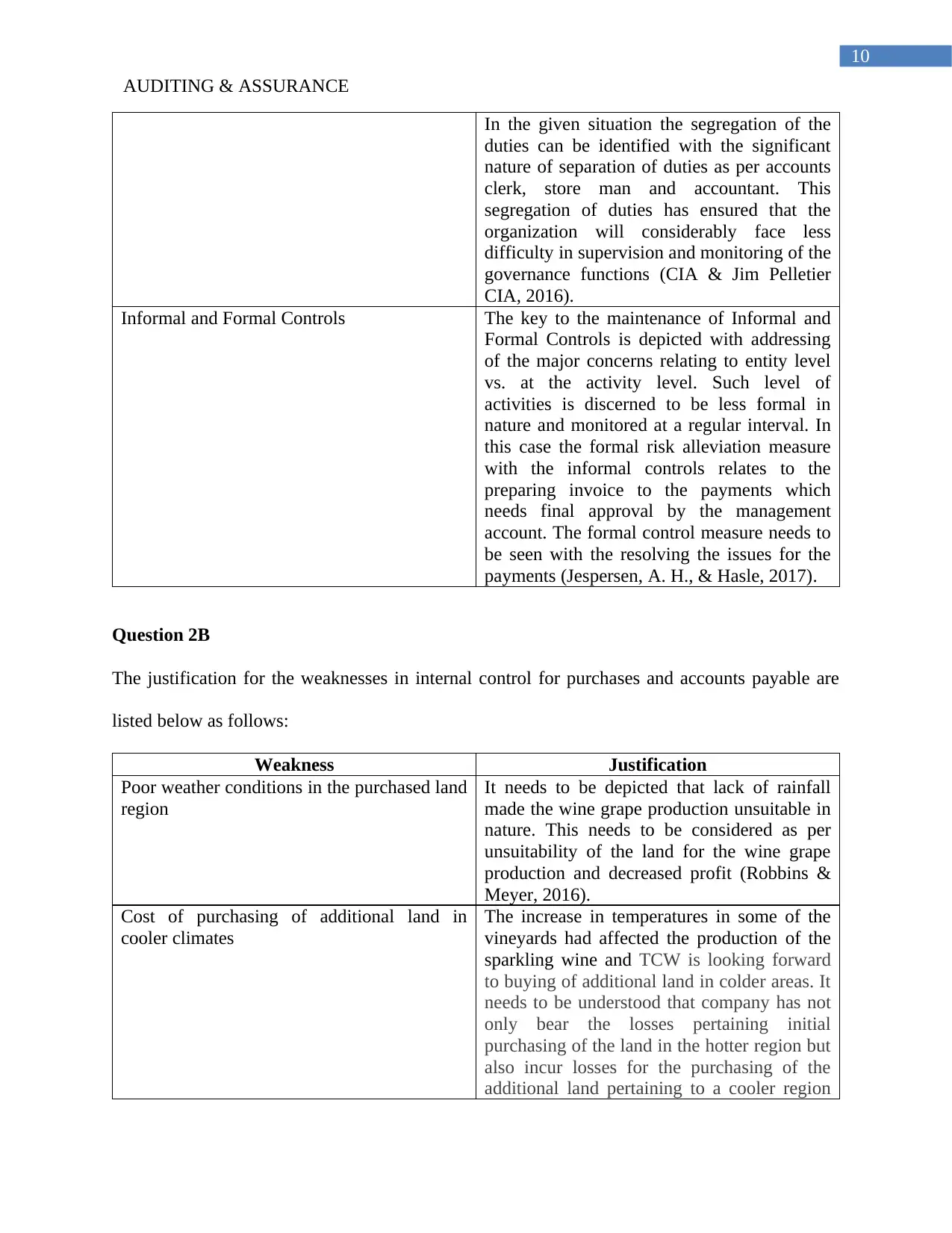

Effective Control Risk Alleviated

Controls Overridden by the CEO and

management

In the given situation, each of the suppliers

has been able to limit their supplies to a total

AUDITING & ASSURANCE

in the debt ratio of the company needs to be taken as the main form of efficiency of Trunkey

Creek Wines (TCW) in supporting the outstanding liabilities with the equity of the shareholders

(Knechel & Salterio, 2016).

Ratio 2018 (Unaudited) 2017

(Audited)

Percentage

Change

Return on equity % 10.8 17.5 -62%

Return on beef production assets

% 1.67 -0.82 149%

Return on grape and wine

production assets % 12.2 14.5 -19%

Gross margin % 24.5 30 -22%

Net profit margin % 14.38 20.27 -41%

Marketing expense % of total S &

A expenses 23.67 17.89 24%

Times interest earned 6.67 7.51 -13%

Days in inventory - wine 367 423 -15%

Days in accounts receivable -

wine 50.2 60.65 -21%

Days in accounts receivable - beef 57 36 37%

Current ratio:1 2.8 2.54 9%

Quick asset ratio:1 1.18 1.15 3%

Debt to equity ratio:1 0.54 0.63 -17%

Table: Percentage change in values of the audited and unaudited estimation

(Sources: As created by the author)

Question 2A

The definite measure which needs to be taken for the internal controls has been defined

as per the effective control and alleviation of the risk.

Effective Control Risk Alleviated

Controls Overridden by the CEO and

management

In the given situation, each of the suppliers

has been able to limit their supplies to a total

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

AUDITING & ASSURANCE

limit of $ 10,000 for each order. The

management is seen to be responsible for

designing, implementation and maintenance

pertaining to the internal controls. In the

given situation the major initiative taken by

the management is associated with CEO

approving the orders which are over $ 30,000.

In addition to this, all the orders over $

50,000 needs to be approved by the board

(Clikeman & Liu, 2017). Therefore, it shows

the re-evaluation approach taken by the

shareholders, Board of Directors and CEO to

take an active role in overriding any instance

of audit fraud (Coetzee, 2016).

Overreliance on Detective Controls vs.

Preventative Controls

Despite of the internal control measures such

as the application of the detective controls

there may be detrimental impact on the

performance of the organizations. The use of

an effective internal control system will not

only aid in the detective control measures but

also aid the preventive measures of control. In

the given situation the orders which will be

made through the computer ordering system

needs to have a direct link of the approved

suppliers (Barnier, 2015). Moreover, the

information related to the suppliers needs to

eb taken into cooperation as per the different

types of the measures of the information

which are directly seen as per the preventive

controls associated to the supplier code. Every

suppliers are needed to have a unique code of

the supplier which will show whether an order

is rejected and sent to the management

accountants for the final approval. This is

directly seen as a preventive measure taken by

the company which will applied before the

purchase is made (Vovchenko et al., 2017).

Segregation of the duties In general, it is not possible for an individual

for proceeding with all the formalities such as

authorization of transactions, recording and

taking into custody the accounts which are

impacting the assets of transactions. The

smaller corporations are further required to

implement the compensating controls which

will ensure that the various types of the

objectives set by the company are duly met.

AUDITING & ASSURANCE

limit of $ 10,000 for each order. The

management is seen to be responsible for

designing, implementation and maintenance

pertaining to the internal controls. In the

given situation the major initiative taken by

the management is associated with CEO

approving the orders which are over $ 30,000.

In addition to this, all the orders over $

50,000 needs to be approved by the board

(Clikeman & Liu, 2017). Therefore, it shows

the re-evaluation approach taken by the

shareholders, Board of Directors and CEO to

take an active role in overriding any instance

of audit fraud (Coetzee, 2016).

Overreliance on Detective Controls vs.

Preventative Controls

Despite of the internal control measures such

as the application of the detective controls

there may be detrimental impact on the

performance of the organizations. The use of

an effective internal control system will not

only aid in the detective control measures but

also aid the preventive measures of control. In

the given situation the orders which will be

made through the computer ordering system

needs to have a direct link of the approved

suppliers (Barnier, 2015). Moreover, the

information related to the suppliers needs to

eb taken into cooperation as per the different

types of the measures of the information

which are directly seen as per the preventive

controls associated to the supplier code. Every

suppliers are needed to have a unique code of

the supplier which will show whether an order

is rejected and sent to the management

accountants for the final approval. This is

directly seen as a preventive measure taken by

the company which will applied before the

purchase is made (Vovchenko et al., 2017).

Segregation of the duties In general, it is not possible for an individual

for proceeding with all the formalities such as

authorization of transactions, recording and

taking into custody the accounts which are

impacting the assets of transactions. The

smaller corporations are further required to

implement the compensating controls which

will ensure that the various types of the

objectives set by the company are duly met.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

AUDITING & ASSURANCE

In the given situation the segregation of the

duties can be identified with the significant

nature of separation of duties as per accounts

clerk, store man and accountant. This

segregation of duties has ensured that the

organization will considerably face less

difficulty in supervision and monitoring of the

governance functions (CIA & Jim Pelletier

CIA, 2016).

Informal and Formal Controls The key to the maintenance of Informal and

Formal Controls is depicted with addressing

of the major concerns relating to entity level

vs. at the activity level. Such level of

activities is discerned to be less formal in

nature and monitored at a regular interval. In

this case the formal risk alleviation measure

with the informal controls relates to the

preparing invoice to the payments which

needs final approval by the management

account. The formal control measure needs to

be seen with the resolving the issues for the

payments (Jespersen, A. H., & Hasle, 2017).

Question 2B

The justification for the weaknesses in internal control for purchases and accounts payable are

listed below as follows:

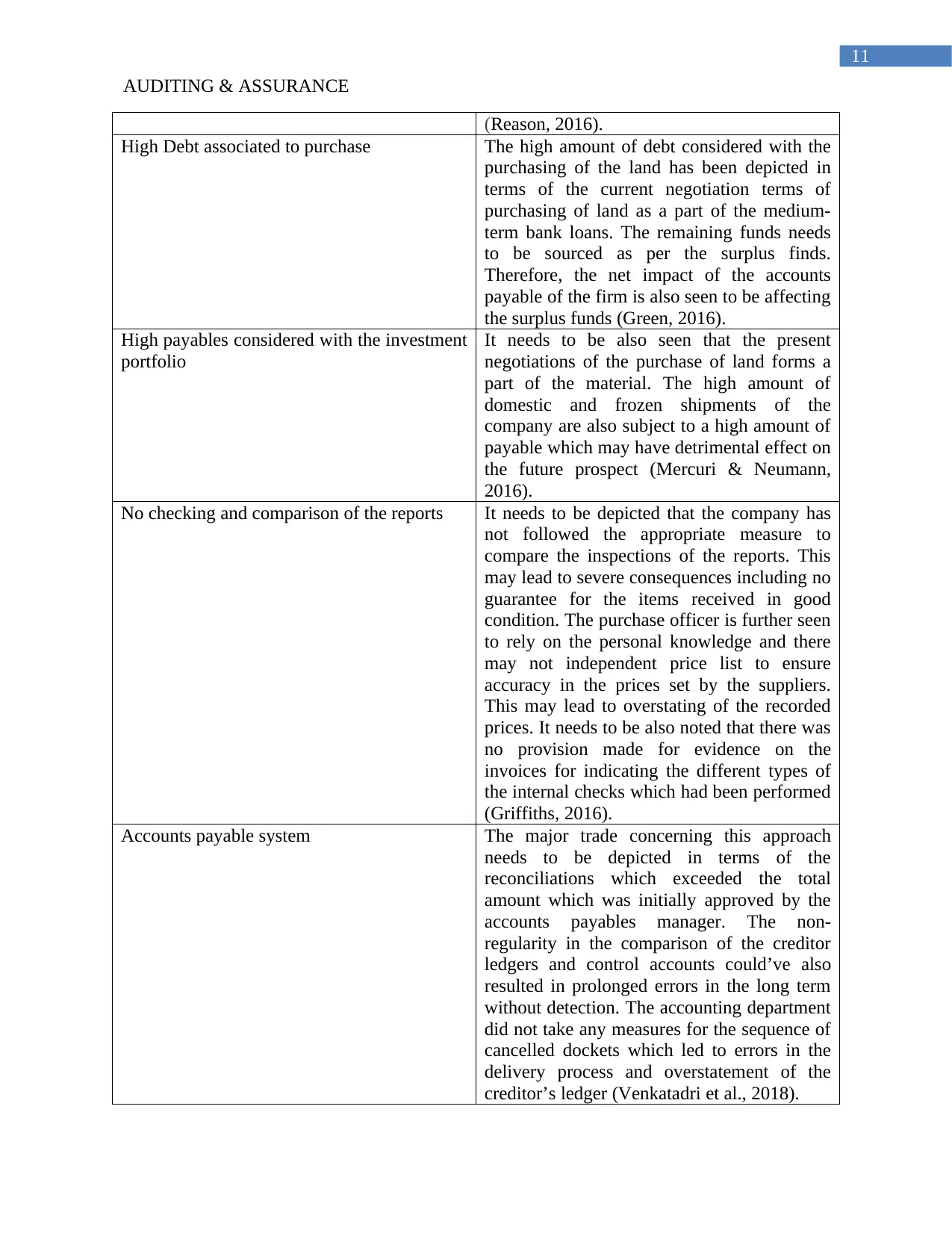

Weakness Justification

Poor weather conditions in the purchased land

region

It needs to be depicted that lack of rainfall

made the wine grape production unsuitable in

nature. This needs to be considered as per

unsuitability of the land for the wine grape

production and decreased profit (Robbins &

Meyer, 2016).

Cost of purchasing of additional land in

cooler climates

The increase in temperatures in some of the

vineyards had affected the production of the

sparkling wine and TCW is looking forward

to buying of additional land in colder areas. It

needs to be understood that company has not

only bear the losses pertaining initial

purchasing of the land in the hotter region but

also incur losses for the purchasing of the

additional land pertaining to a cooler region

AUDITING & ASSURANCE

In the given situation the segregation of the

duties can be identified with the significant

nature of separation of duties as per accounts

clerk, store man and accountant. This

segregation of duties has ensured that the

organization will considerably face less

difficulty in supervision and monitoring of the

governance functions (CIA & Jim Pelletier

CIA, 2016).

Informal and Formal Controls The key to the maintenance of Informal and

Formal Controls is depicted with addressing

of the major concerns relating to entity level

vs. at the activity level. Such level of

activities is discerned to be less formal in

nature and monitored at a regular interval. In

this case the formal risk alleviation measure

with the informal controls relates to the

preparing invoice to the payments which

needs final approval by the management

account. The formal control measure needs to

be seen with the resolving the issues for the

payments (Jespersen, A. H., & Hasle, 2017).

Question 2B

The justification for the weaknesses in internal control for purchases and accounts payable are

listed below as follows:

Weakness Justification

Poor weather conditions in the purchased land

region

It needs to be depicted that lack of rainfall

made the wine grape production unsuitable in

nature. This needs to be considered as per

unsuitability of the land for the wine grape

production and decreased profit (Robbins &

Meyer, 2016).

Cost of purchasing of additional land in

cooler climates

The increase in temperatures in some of the

vineyards had affected the production of the

sparkling wine and TCW is looking forward

to buying of additional land in colder areas. It

needs to be understood that company has not

only bear the losses pertaining initial

purchasing of the land in the hotter region but

also incur losses for the purchasing of the

additional land pertaining to a cooler region

11

AUDITING & ASSURANCE

(Reason, 2016).

High Debt associated to purchase The high amount of debt considered with the

purchasing of the land has been depicted in

terms of the current negotiation terms of

purchasing of land as a part of the medium-

term bank loans. The remaining funds needs

to be sourced as per the surplus finds.

Therefore, the net impact of the accounts

payable of the firm is also seen to be affecting

the surplus funds (Green, 2016).

High payables considered with the investment

portfolio

It needs to be also seen that the present

negotiations of the purchase of land forms a

part of the material. The high amount of

domestic and frozen shipments of the

company are also subject to a high amount of

payable which may have detrimental effect on

the future prospect (Mercuri & Neumann,

2016).

No checking and comparison of the reports It needs to be depicted that the company has

not followed the appropriate measure to

compare the inspections of the reports. This

may lead to severe consequences including no

guarantee for the items received in good

condition. The purchase officer is further seen

to rely on the personal knowledge and there

may not independent price list to ensure

accuracy in the prices set by the suppliers.

This may lead to overstating of the recorded

prices. It needs to be also noted that there was

no provision made for evidence on the

invoices for indicating the different types of

the internal checks which had been performed

(Griffiths, 2016).

Accounts payable system The major trade concerning this approach

needs to be depicted in terms of the

reconciliations which exceeded the total

amount which was initially approved by the

accounts payables manager. The non-

regularity in the comparison of the creditor

ledgers and control accounts could’ve also

resulted in prolonged errors in the long term

without detection. The accounting department

did not take any measures for the sequence of

cancelled dockets which led to errors in the

delivery process and overstatement of the

creditor’s ledger (Venkatadri et al., 2018).

AUDITING & ASSURANCE

(Reason, 2016).

High Debt associated to purchase The high amount of debt considered with the

purchasing of the land has been depicted in

terms of the current negotiation terms of

purchasing of land as a part of the medium-

term bank loans. The remaining funds needs

to be sourced as per the surplus finds.

Therefore, the net impact of the accounts

payable of the firm is also seen to be affecting

the surplus funds (Green, 2016).

High payables considered with the investment

portfolio

It needs to be also seen that the present

negotiations of the purchase of land forms a

part of the material. The high amount of

domestic and frozen shipments of the

company are also subject to a high amount of

payable which may have detrimental effect on

the future prospect (Mercuri & Neumann,

2016).

No checking and comparison of the reports It needs to be depicted that the company has

not followed the appropriate measure to

compare the inspections of the reports. This

may lead to severe consequences including no

guarantee for the items received in good

condition. The purchase officer is further seen

to rely on the personal knowledge and there

may not independent price list to ensure

accuracy in the prices set by the suppliers.

This may lead to overstating of the recorded

prices. It needs to be also noted that there was

no provision made for evidence on the

invoices for indicating the different types of

the internal checks which had been performed

(Griffiths, 2016).

Accounts payable system The major trade concerning this approach

needs to be depicted in terms of the

reconciliations which exceeded the total

amount which was initially approved by the

accounts payables manager. The non-

regularity in the comparison of the creditor

ledgers and control accounts could’ve also

resulted in prolonged errors in the long term

without detection. The accounting department

did not take any measures for the sequence of

cancelled dockets which led to errors in the

delivery process and overstatement of the

creditor’s ledger (Venkatadri et al., 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.