Compliance with Manufacturers in Supply Chain

VerifiedAdded on 2019/10/31

|17

|3991

|86

Report

AI Summary

The study explores the business of Billabong International, a company in the surfwear industry, and its significant business risks. The financial performance of the firm for the years 2015 and 2016 is assessed, with calculations and analysis of financial ratios to identify potential material misstatements. Additionally, the report discusses the company's social responsibility initiatives, including supply chain audits and environmental programs.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: AUDITING & ASSURANCE

Auditing & Assurance

University Name

Student Name

Authors’ Note

Auditing & Assurance

University Name

Student Name

Authors’ Note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2

AUDITING & ASSURANCE

Executive Summary

Audit is essentially an objective exam and analysis of the financial assertions of a corporation

that can make certain that the records of the firm are reliable. The present report aids in

understanding the business of the client Billabong International together with the industry in

which the firm operates. In addition to this, the current study also helps in gaining deep

insight into the significant business risks as well as audit risk of the firm.

AUDITING & ASSURANCE

Executive Summary

Audit is essentially an objective exam and analysis of the financial assertions of a corporation

that can make certain that the records of the firm are reliable. The present report aids in

understanding the business of the client Billabong International together with the industry in

which the firm operates. In addition to this, the current study also helps in gaining deep

insight into the significant business risks as well as audit risk of the firm.

3

AUDITING & ASSURANCE

Table of Contents

Introduction................................................................................................................................2

Overview of the business of the client Billabong......................................................................2

Overview of the industry............................................................................................................3

Significant risks and audit risks for Billabong...........................................................................5

Identification of Five Significant Business and Audit Risks.....................................................5

Analysis using financial statements...........................................................................................8

Material Misstatements............................................................................................................10

Going Concern.........................................................................................................................11

Social Responsibility................................................................................................................12

Conclusion................................................................................................................................13

References................................................................................................................................14

AUDITING & ASSURANCE

Table of Contents

Introduction................................................................................................................................2

Overview of the business of the client Billabong......................................................................2

Overview of the industry............................................................................................................3

Significant risks and audit risks for Billabong...........................................................................5

Identification of Five Significant Business and Audit Risks.....................................................5

Analysis using financial statements...........................................................................................8

Material Misstatements............................................................................................................10

Going Concern.........................................................................................................................11

Social Responsibility................................................................................................................12

Conclusion................................................................................................................................13

References................................................................................................................................14

4

AUDITING & ASSURANCE

Introduction

The current study essentially presents a complete review of compliance audit that speaks

about the organization's adherence to different regulatory strategies with special reference to

the operations of Billabong International Limited, Australia. The present study presents an

official inspection of different accounts of the corporation, financial inspection along with

systematic as well as independent assessment of books of accounts, company literature

together with diverse vouchers of corporation. This can help in determining the business risks

as well as audit risk that can aid in determining the extent to which the financial statements of

the firm presents true and fair view.

Overview of the business of the client Billabong

The core business of the company Billabong International Limited is essentially an Australian

clothing corporation that carries out marketing, suitable distribution, both wholesaling as well

as retailing of garments, accessories, swimsuits, eyewear and hardgoods among many others.

The company Billabong established during 1973 on Australia’s Gold Coast has license of

operations in over and above 100 nations and are offered in nearly 10000 locations across the

world (Billabongbiz.com 2017). The brands of the company are appropriately marketed and

at the same time promoted worldwide through different associations with professional

athletes, specific junior athletes, different brand advocates as well as events. The major

proportion of revenue is created and acquired by means of different wholly-owned functions

in areas such as Australia, Brazil, North America, New Zealand, Europe, Japan, and South

Africa. The business concern Billabong has roughly 4,000 members of the staff throughout

the world and the company’s shares are essentially publicly listed on ASX (Australian

Securities Exchange). Billabong’s products are well distributed by means of focused

AUDITING & ASSURANCE

Introduction

The current study essentially presents a complete review of compliance audit that speaks

about the organization's adherence to different regulatory strategies with special reference to

the operations of Billabong International Limited, Australia. The present study presents an

official inspection of different accounts of the corporation, financial inspection along with

systematic as well as independent assessment of books of accounts, company literature

together with diverse vouchers of corporation. This can help in determining the business risks

as well as audit risk that can aid in determining the extent to which the financial statements of

the firm presents true and fair view.

Overview of the business of the client Billabong

The core business of the company Billabong International Limited is essentially an Australian

clothing corporation that carries out marketing, suitable distribution, both wholesaling as well

as retailing of garments, accessories, swimsuits, eyewear and hardgoods among many others.

The company Billabong established during 1973 on Australia’s Gold Coast has license of

operations in over and above 100 nations and are offered in nearly 10000 locations across the

world (Billabongbiz.com 2017). The brands of the company are appropriately marketed and

at the same time promoted worldwide through different associations with professional

athletes, specific junior athletes, different brand advocates as well as events. The major

proportion of revenue is created and acquired by means of different wholly-owned functions

in areas such as Australia, Brazil, North America, New Zealand, Europe, Japan, and South

Africa. The business concern Billabong has roughly 4,000 members of the staff throughout

the world and the company’s shares are essentially publicly listed on ASX (Australian

Securities Exchange). Billabong’s products are well distributed by means of focused

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

5

AUDITING & ASSURANCE

boardsports retailers as well as through own branded retail stores of the company

(Billabongbiz.com 2017).

Overview of the industry

Billabong operates in the clothing industry in Australia with special orientation to the surf

industry. The operations include wholesaling as well as retailing of products such as surf,

superior quality skate, both snow and sports apparel along with accessories and hardware.

Analysis of the industry in which Billabong operates reveals that there is stiff competition in

the worldwide surf skate as well as apparel (Billabongbiz.com 2017). In addition to this, there

is also increasing costs of raw materials and slowdown of the consumer spending. Evaluation

of the current situation in surf industry reflects that the surf industry developed exponentially

in Australia and professional surfing acquired a mainstream. Thus, Billabong International

Limited could capitalise on the developing opportunities in this segment in Australia and

across the world (Billabongbiz.com 2017).

The industry analysis of Billabong reveals that the company gets government support.

National policies supported nation-building, creation of employment, industrialisation,

consecutive governments set policies of trade to defend regional clothing as well as textiles.

The casual lifestyle in Australia and fair climate directs Australians to expend less on

particularly clothing than individuals in otherwise analogous Western markets

(Billabongbiz.com 2017). During the year 2005 and 2006, retail turnover in particularly

‘Clothing Retail’ stores was approximated to be AUD 10.1 billion, recommending addition of

clothing sales in Department stores.

AUDITING & ASSURANCE

boardsports retailers as well as through own branded retail stores of the company

(Billabongbiz.com 2017).

Overview of the industry

Billabong operates in the clothing industry in Australia with special orientation to the surf

industry. The operations include wholesaling as well as retailing of products such as surf,

superior quality skate, both snow and sports apparel along with accessories and hardware.

Analysis of the industry in which Billabong operates reveals that there is stiff competition in

the worldwide surf skate as well as apparel (Billabongbiz.com 2017). In addition to this, there

is also increasing costs of raw materials and slowdown of the consumer spending. Evaluation

of the current situation in surf industry reflects that the surf industry developed exponentially

in Australia and professional surfing acquired a mainstream. Thus, Billabong International

Limited could capitalise on the developing opportunities in this segment in Australia and

across the world (Billabongbiz.com 2017).

The industry analysis of Billabong reveals that the company gets government support.

National policies supported nation-building, creation of employment, industrialisation,

consecutive governments set policies of trade to defend regional clothing as well as textiles.

The casual lifestyle in Australia and fair climate directs Australians to expend less on

particularly clothing than individuals in otherwise analogous Western markets

(Billabongbiz.com 2017). During the year 2005 and 2006, retail turnover in particularly

‘Clothing Retail’ stores was approximated to be AUD 10.1 billion, recommending addition of

clothing sales in Department stores.

6

AUDITING & ASSURANCE

Significant risks and audit risks for Billabong

The philosophy of Billabong towards risk management is not to be essentially risk averse. In

addition to this, management of the company wants identification, discussion as well as

proper management of risk.

Identification of Five Significant Business and Audit Risks

Risk

1) Translation Risk owing to a considerable fraction of the operations of the group that is

outside the area of Australia, the group is necessarily exposed to certain currency

exchange rate risk (translation risk). In this case, this risk occurs when the offshore

income of the entire group and fluctuations of asset/resources are declared in

Australian dollars. The professional accountants might commit error due to inclusion

of the effects of fluctuations in the report and face audit risk (Arens et al. 2012). The

segment information of the group for the prior period is necessarily presented on a

stable currency basis utilizing the present period average exchange rates on a monthly

basis to transform the previous period foreign income. This is essentially undertaken

to remove the influence of foreign exchange actions from the performance of the

entire group.

2) Material Risk- Material risks refer to the ones that have the capacity to influence the

overall financial prospects of the firm. Some of the material risks that affects the firm

Billabong are hereby mentioned below:-

Brand Risk is the probable damage as well as market loss essentially appeals to the

entire brand or else the image of the group (William Jr et al. 2016). In particular, the

AUDITING & ASSURANCE

Significant risks and audit risks for Billabong

The philosophy of Billabong towards risk management is not to be essentially risk averse. In

addition to this, management of the company wants identification, discussion as well as

proper management of risk.

Identification of Five Significant Business and Audit Risks

Risk

1) Translation Risk owing to a considerable fraction of the operations of the group that is

outside the area of Australia, the group is necessarily exposed to certain currency

exchange rate risk (translation risk). In this case, this risk occurs when the offshore

income of the entire group and fluctuations of asset/resources are declared in

Australian dollars. The professional accountants might commit error due to inclusion

of the effects of fluctuations in the report and face audit risk (Arens et al. 2012). The

segment information of the group for the prior period is necessarily presented on a

stable currency basis utilizing the present period average exchange rates on a monthly

basis to transform the previous period foreign income. This is essentially undertaken

to remove the influence of foreign exchange actions from the performance of the

entire group.

2) Material Risk- Material risks refer to the ones that have the capacity to influence the

overall financial prospects of the firm. Some of the material risks that affects the firm

Billabong are hereby mentioned below:-

Brand Risk is the probable damage as well as market loss essentially appeals to the

entire brand or else the image of the group (William Jr et al. 2016). In particular, the

7

AUDITING & ASSURANCE

group addresses the risk by means of remaining aware of the specific economic as

well as consumer data, advanced innovative product along with brand management.

Fashion Risk refers to the failure of the company to design as well as deliver specific

products that can appeal to target customers.

Macro-economic environment-The company also faces the risk of macro-economic

environment that affects the financial performance of the group because of different

facets that include movements in the Australian as well as worldwide capital markets,

rate of interest, exchange rate of foreign currency, rate of inflation and many others.

The financial performance of the entire group can fluctuate owing to different factors

counting movements in all the Australian and worldwide capital markets, rate of

interest, currency exchange rate, rate of inflation, emotions of customers together with

the micro-economic conditions in the markets (Arens et al. 2015). Again, alterations

in the government policies, fiscal and monetary policies, commodity prices, investor

perceptions along with other facets might affect the overall financial condition of the

firm. The auditors of the firm might perhaps fail to take into consideration effect of

these macro-environmental factors on the financial assertions of the firm.

Social risk- The firm also faces social risk owing to risks surrounding the workplace,

health as well as safety standards. The accounting professional might fail to give

stress on the above mentioned significant business risks in the audit report that again

might affect the financial assertions, leading to audit risk (Louwers et al. 2015).

Competition- The company competes for specifically discretionary earnings and not

only with other activity sport participants. However, the performance of the group

might be adversely affected by different actions of rival players. For instance,

lowering of price of products or else generating new lines of product that are

essentially more attractive in the market place or else by consenting to make more

AUDITING & ASSURANCE

group addresses the risk by means of remaining aware of the specific economic as

well as consumer data, advanced innovative product along with brand management.

Fashion Risk refers to the failure of the company to design as well as deliver specific

products that can appeal to target customers.

Macro-economic environment-The company also faces the risk of macro-economic

environment that affects the financial performance of the group because of different

facets that include movements in the Australian as well as worldwide capital markets,

rate of interest, exchange rate of foreign currency, rate of inflation and many others.

The financial performance of the entire group can fluctuate owing to different factors

counting movements in all the Australian and worldwide capital markets, rate of

interest, currency exchange rate, rate of inflation, emotions of customers together with

the micro-economic conditions in the markets (Arens et al. 2015). Again, alterations

in the government policies, fiscal and monetary policies, commodity prices, investor

perceptions along with other facets might affect the overall financial condition of the

firm. The auditors of the firm might perhaps fail to take into consideration effect of

these macro-environmental factors on the financial assertions of the firm.

Social risk- The firm also faces social risk owing to risks surrounding the workplace,

health as well as safety standards. The accounting professional might fail to give

stress on the above mentioned significant business risks in the audit report that again

might affect the financial assertions, leading to audit risk (Louwers et al. 2015).

Competition- The company competes for specifically discretionary earnings and not

only with other activity sport participants. However, the performance of the group

might be adversely affected by different actions of rival players. For instance,

lowering of price of products or else generating new lines of product that are

essentially more attractive in the market place or else by consenting to make more

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

AUDITING & ASSURANCE

payments for manufacturing, services and employment and developing substitute

channels (Eilifsen et al. 2013).

Seasonal factors-Performance of the firm is also affected by different seasonal

factors that in turn pose material risks. The business of Billabong is necessarily

seasonal in characteristics and long-standing unseasonal conditions of weather might

affect adversely the operations of the group, provided the significance of the overall

quality, performance as well as timely delivery of the products of the company (Arens

et al. 2014).

3) The audit risk of the firm mainly occurs owing to inaccurate opinions in the financial

statements of the firm. The auditors of the firm might fail to identify the risk of debt

covenants. Failure of the firm to act in accordance with the firm’s financial covenants

created by a considerable decrease in revenue or else earnings or material alterations

in the AUD against USD exchange rate might require the company to seek

modifications, waivers of covenant observance or substitute borrowing arrangements

(Arens et al. 2014).

4) Company’s tax affairs might lead to tax risks of operations in each nation. The might

be adverse impact by alterations in both fiscal or else regulatory command, variances

in explanation of the local tax regulations of those nations, and alterations to present

political, judicial or else administrative strategies related to tax (Simnett et al. 2016).

Professional accountants of the firm might fail to understand the tax affairs and this

might lead to material misstatement.

5) Management of the firm also fails to identify the social risks surrounding the business

of the firm and incorporate the effects of social risks in the financial assertions of the

corporation (Arens et al. 2013). The company sources specific goods that are

AUDITING & ASSURANCE

payments for manufacturing, services and employment and developing substitute

channels (Eilifsen et al. 2013).

Seasonal factors-Performance of the firm is also affected by different seasonal

factors that in turn pose material risks. The business of Billabong is necessarily

seasonal in characteristics and long-standing unseasonal conditions of weather might

affect adversely the operations of the group, provided the significance of the overall

quality, performance as well as timely delivery of the products of the company (Arens

et al. 2014).

3) The audit risk of the firm mainly occurs owing to inaccurate opinions in the financial

statements of the firm. The auditors of the firm might fail to identify the risk of debt

covenants. Failure of the firm to act in accordance with the firm’s financial covenants

created by a considerable decrease in revenue or else earnings or material alterations

in the AUD against USD exchange rate might require the company to seek

modifications, waivers of covenant observance or substitute borrowing arrangements

(Arens et al. 2014).

4) Company’s tax affairs might lead to tax risks of operations in each nation. The might

be adverse impact by alterations in both fiscal or else regulatory command, variances

in explanation of the local tax regulations of those nations, and alterations to present

political, judicial or else administrative strategies related to tax (Simnett et al. 2016).

Professional accountants of the firm might fail to understand the tax affairs and this

might lead to material misstatement.

5) Management of the firm also fails to identify the social risks surrounding the business

of the firm and incorporate the effects of social risks in the financial assertions of the

corporation (Arens et al. 2013). The company sources specific goods that are

9

AUDITING & ASSURANCE

manufactured in nations such as China in which there remain risks revolving safety of

workplace, maintenance of health and safety standards.

AUDITING & ASSURANCE

manufactured in nations such as China in which there remain risks revolving safety of

workplace, maintenance of health and safety standards.

10

AUDITING & ASSURANCE

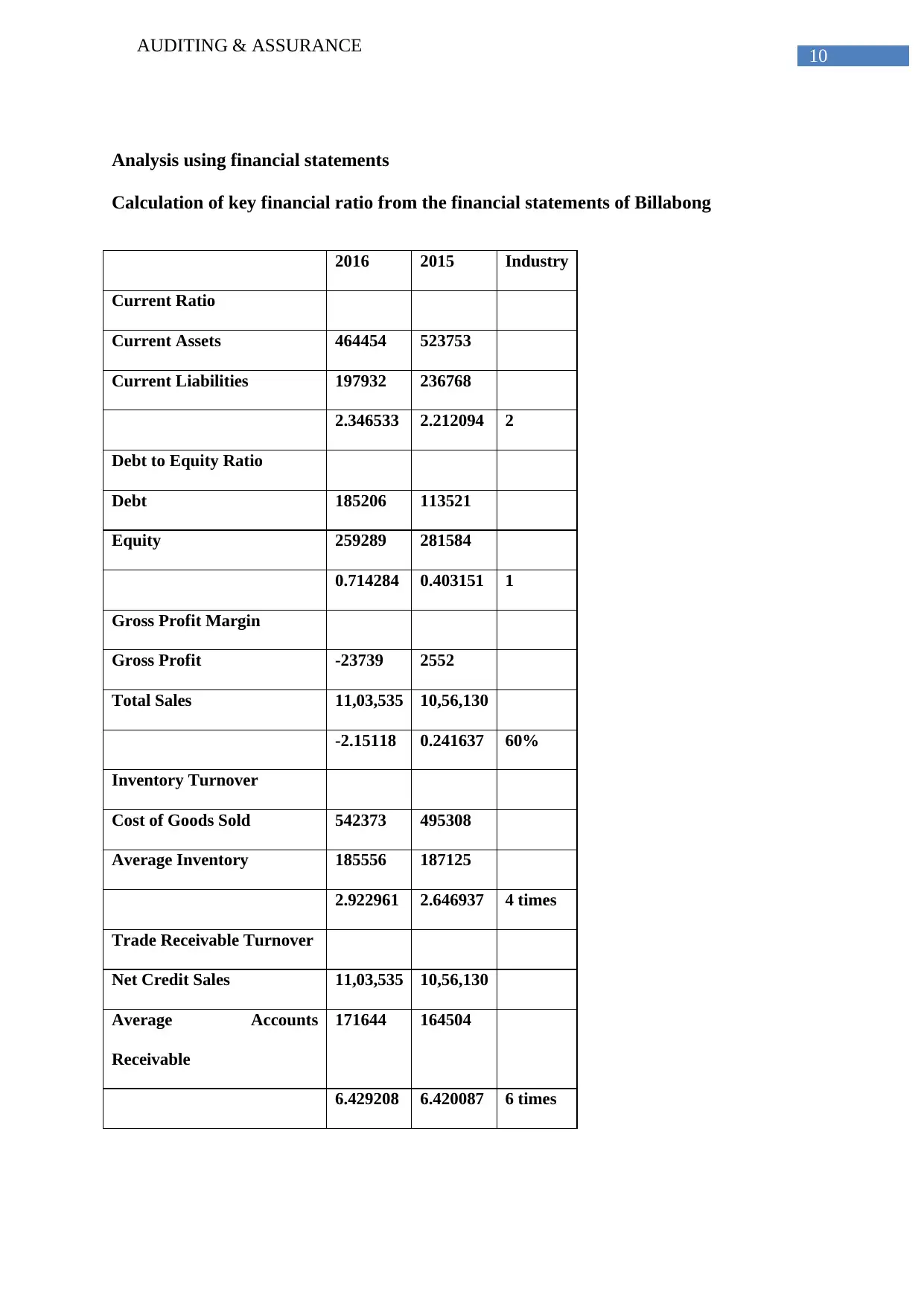

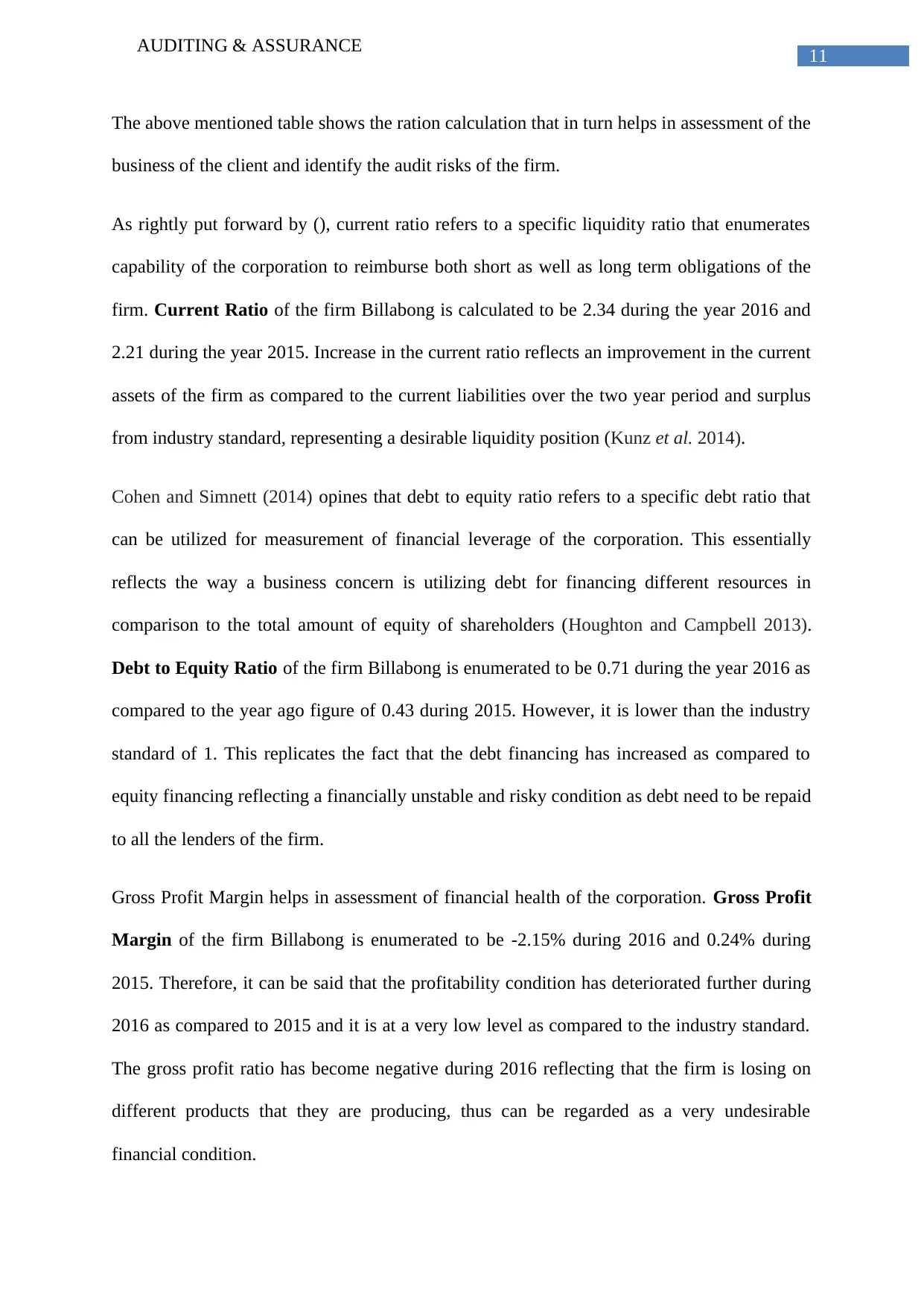

Analysis using financial statements

Calculation of key financial ratio from the financial statements of Billabong

2016 2015 Industry

Current Ratio

Current Assets 464454 523753

Current Liabilities 197932 236768

2.346533 2.212094 2

Debt to Equity Ratio

Debt 185206 113521

Equity 259289 281584

0.714284 0.403151 1

Gross Profit Margin

Gross Profit -23739 2552

Total Sales 11,03,535 10,56,130

-2.15118 0.241637 60%

Inventory Turnover

Cost of Goods Sold 542373 495308

Average Inventory 185556 187125

2.922961 2.646937 4 times

Trade Receivable Turnover

Net Credit Sales 11,03,535 10,56,130

Average Accounts

Receivable

171644 164504

6.429208 6.420087 6 times

AUDITING & ASSURANCE

Analysis using financial statements

Calculation of key financial ratio from the financial statements of Billabong

2016 2015 Industry

Current Ratio

Current Assets 464454 523753

Current Liabilities 197932 236768

2.346533 2.212094 2

Debt to Equity Ratio

Debt 185206 113521

Equity 259289 281584

0.714284 0.403151 1

Gross Profit Margin

Gross Profit -23739 2552

Total Sales 11,03,535 10,56,130

-2.15118 0.241637 60%

Inventory Turnover

Cost of Goods Sold 542373 495308

Average Inventory 185556 187125

2.922961 2.646937 4 times

Trade Receivable Turnover

Net Credit Sales 11,03,535 10,56,130

Average Accounts

Receivable

171644 164504

6.429208 6.420087 6 times

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

11

AUDITING & ASSURANCE

The above mentioned table shows the ration calculation that in turn helps in assessment of the

business of the client and identify the audit risks of the firm.

As rightly put forward by (), current ratio refers to a specific liquidity ratio that enumerates

capability of the corporation to reimburse both short as well as long term obligations of the

firm. Current Ratio of the firm Billabong is calculated to be 2.34 during the year 2016 and

2.21 during the year 2015. Increase in the current ratio reflects an improvement in the current

assets of the firm as compared to the current liabilities over the two year period and surplus

from industry standard, representing a desirable liquidity position (Kunz et al. 2014).

Cohen and Simnett (2014) opines that debt to equity ratio refers to a specific debt ratio that

can be utilized for measurement of financial leverage of the corporation. This essentially

reflects the way a business concern is utilizing debt for financing different resources in

comparison to the total amount of equity of shareholders (Houghton and Campbell 2013).

Debt to Equity Ratio of the firm Billabong is enumerated to be 0.71 during the year 2016 as

compared to the year ago figure of 0.43 during 2015. However, it is lower than the industry

standard of 1. This replicates the fact that the debt financing has increased as compared to

equity financing reflecting a financially unstable and risky condition as debt need to be repaid

to all the lenders of the firm.

Gross Profit Margin helps in assessment of financial health of the corporation. Gross Profit

Margin of the firm Billabong is enumerated to be -2.15% during 2016 and 0.24% during

2015. Therefore, it can be said that the profitability condition has deteriorated further during

2016 as compared to 2015 and it is at a very low level as compared to the industry standard.

The gross profit ratio has become negative during 2016 reflecting that the firm is losing on

different products that they are producing, thus can be regarded as a very undesirable

financial condition.

AUDITING & ASSURANCE

The above mentioned table shows the ration calculation that in turn helps in assessment of the

business of the client and identify the audit risks of the firm.

As rightly put forward by (), current ratio refers to a specific liquidity ratio that enumerates

capability of the corporation to reimburse both short as well as long term obligations of the

firm. Current Ratio of the firm Billabong is calculated to be 2.34 during the year 2016 and

2.21 during the year 2015. Increase in the current ratio reflects an improvement in the current

assets of the firm as compared to the current liabilities over the two year period and surplus

from industry standard, representing a desirable liquidity position (Kunz et al. 2014).

Cohen and Simnett (2014) opines that debt to equity ratio refers to a specific debt ratio that

can be utilized for measurement of financial leverage of the corporation. This essentially

reflects the way a business concern is utilizing debt for financing different resources in

comparison to the total amount of equity of shareholders (Houghton and Campbell 2013).

Debt to Equity Ratio of the firm Billabong is enumerated to be 0.71 during the year 2016 as

compared to the year ago figure of 0.43 during 2015. However, it is lower than the industry

standard of 1. This replicates the fact that the debt financing has increased as compared to

equity financing reflecting a financially unstable and risky condition as debt need to be repaid

to all the lenders of the firm.

Gross Profit Margin helps in assessment of financial health of the corporation. Gross Profit

Margin of the firm Billabong is enumerated to be -2.15% during 2016 and 0.24% during

2015. Therefore, it can be said that the profitability condition has deteriorated further during

2016 as compared to 2015 and it is at a very low level as compared to the industry standard.

The gross profit ratio has become negative during 2016 reflecting that the firm is losing on

different products that they are producing, thus can be regarded as a very undesirable

financial condition.

12

AUDITING & ASSURANCE

Inventory Turnover provides measures of the total times the firm’s inventory of sold (Bodie

2013). Inventory Turnover of the firm Billabong is calculated to be 2.92 during 2016 and

2.64 during 2015. The figure for inventory turnover shows the extent to which a corporation

can control the products; therefore, the increase in the same indicates a high turn. However, it

is lower the industry standard of 4.

Accounts receivable turnover refers to efficiency ratio that calculates the total number of

times a specific business can convert accounts receivable particularly into cash (Entwistle

2015). Trade Receivable Turnover of the firm Billabong is enumerated to be 6.49 during

2016 and 6.42 during 2015. This reveals the total number of times a particular business can

turn the accounts receivable into particularly cash during a specific period of time. The higher

ratio reflects that the business firm is appropriately acquiring the receivables and more

regularly throughout the entire year (Pappa 2015).

Material Misstatements

Depending on calculations of key financial ratio it can be hereby mentioned that the company

faces debt risk evident from the higher debt equity ratio.

-1)Again, the company also faces low earnings (negative earnings) reflecting risks of

operations. In this case, the risk might be related to failures of the accounting professionals of

the firm to identify the risks of different micro and macro economic factors reflected through

the decline in the decline in assets and profit.

-2) The key risk facets related to material misstatement include the debt covenant. Results of

analysis of financial assertions of the firm show that there is lot of burden to carry out debt

financing (Dalnial et al. 2014). There is requirement to have debt equity ratio to be less than

1 and it is observe to be less than 1. The requirement might lead to withdrawal of loan that in

AUDITING & ASSURANCE

Inventory Turnover provides measures of the total times the firm’s inventory of sold (Bodie

2013). Inventory Turnover of the firm Billabong is calculated to be 2.92 during 2016 and

2.64 during 2015. The figure for inventory turnover shows the extent to which a corporation

can control the products; therefore, the increase in the same indicates a high turn. However, it

is lower the industry standard of 4.

Accounts receivable turnover refers to efficiency ratio that calculates the total number of

times a specific business can convert accounts receivable particularly into cash (Entwistle

2015). Trade Receivable Turnover of the firm Billabong is enumerated to be 6.49 during

2016 and 6.42 during 2015. This reveals the total number of times a particular business can

turn the accounts receivable into particularly cash during a specific period of time. The higher

ratio reflects that the business firm is appropriately acquiring the receivables and more

regularly throughout the entire year (Pappa 2015).

Material Misstatements

Depending on calculations of key financial ratio it can be hereby mentioned that the company

faces debt risk evident from the higher debt equity ratio.

-1)Again, the company also faces low earnings (negative earnings) reflecting risks of

operations. In this case, the risk might be related to failures of the accounting professionals of

the firm to identify the risks of different micro and macro economic factors reflected through

the decline in the decline in assets and profit.

-2) The key risk facets related to material misstatement include the debt covenant. Results of

analysis of financial assertions of the firm show that there is lot of burden to carry out debt

financing (Dalnial et al. 2014). There is requirement to have debt equity ratio to be less than

1 and it is observe to be less than 1. The requirement might lead to withdrawal of loan that in

13

AUDITING & ASSURANCE

turn can have an adverse influence on business actions. Professional accountants of the firm

can materially misstate the debt of the firm that in turn can affect the users of the financial

information who arrive at economic decisions based on the financial assertions of the firm.

Financial risk can also identified in this case. Analysis of business operations reveals the

incapability of the firm to reimburse the liabilities of the firm within the stipulated period of

time (evident from the comparative rise of debt in terms of equity) (Richard 2014).

-3)Again, the current ratio is greater than the industry standard of 2. Therefore, there exists a

probability that the current assets of the firm might have been plummeted so that the current

ratio can be maintained at the level of 2 or above (Dung 2016).

-3)The inventory turn of the company is also lower than the industry standard reflecting

lower capability of the corporation to turn inventories into cash. The professional accountants

also might manipulate the inventory of the firm that can lead to risky practice. Therefore,

there exists a probability that the inventory of the firm might be altered by revealing added

inventory during the period of arrival (Dung 2016).

- 5) there is also increase in the financial risk of the corporation as is evident from the

associated risks that needs to be analysed in a bid to assess whether the evidence are provided

in the financial statements

Going Concern

The company Billabong essentially faces a going concern issue as is evident from the

negative trends of potential indicators. This necessarily includes the decrease in the profit

figure of the firm from $2552000 recorded during 2015 to -$23739 during 2016, increase in

the cost of goods sold from (495308) to (542373) during 2016 (Billabongbiz.com 2017). In

addition to this, the other expenses of the firm Billabong has also increased from 127681

AUDITING & ASSURANCE

turn can have an adverse influence on business actions. Professional accountants of the firm

can materially misstate the debt of the firm that in turn can affect the users of the financial

information who arrive at economic decisions based on the financial assertions of the firm.

Financial risk can also identified in this case. Analysis of business operations reveals the

incapability of the firm to reimburse the liabilities of the firm within the stipulated period of

time (evident from the comparative rise of debt in terms of equity) (Richard 2014).

-3)Again, the current ratio is greater than the industry standard of 2. Therefore, there exists a

probability that the current assets of the firm might have been plummeted so that the current

ratio can be maintained at the level of 2 or above (Dung 2016).

-3)The inventory turn of the company is also lower than the industry standard reflecting

lower capability of the corporation to turn inventories into cash. The professional accountants

also might manipulate the inventory of the firm that can lead to risky practice. Therefore,

there exists a probability that the inventory of the firm might be altered by revealing added

inventory during the period of arrival (Dung 2016).

- 5) there is also increase in the financial risk of the corporation as is evident from the

associated risks that needs to be analysed in a bid to assess whether the evidence are provided

in the financial statements

Going Concern

The company Billabong essentially faces a going concern issue as is evident from the

negative trends of potential indicators. This necessarily includes the decrease in the profit

figure of the firm from $2552000 recorded during 2015 to -$23739 during 2016, increase in

the cost of goods sold from (495308) to (542373) during 2016 (Billabongbiz.com 2017). In

addition to this, the other expenses of the firm Billabong has also increased from 127681

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

14

AUDITING & ASSURANCE

during 2015 to nearly 127730 during 2016. A negative trend can also be observed in case of

existence of current assets of the firm that is from 523753 in 2015 to 464454 in 2016.

Furthermore, the company also faces adverse financial ratio that include extreme drop in

gross profit margin (negative), increase in debt equity ratio (Billabongbiz.com 2017). Again,

the inventory turn is also lower than the industry standard of 4 times reflecting lack of

efficiency of the firm.

Social Responsibility

The company Billabong necessarily sources products manufactured in nations namely China

mainly where there are risks surrounding the place of work, standards of both health and

safety standards of factories. Essentially, the business group also utilizes external auditing

unit for auditing social compliance of the corporation’s warehouses when measured against

the approved code of conduct. This code of conduct essentially contains specific standards

that are equivalent to SA8000 as well as Worldwide Responsible Accredited Production

(Billabongbiz.com 2017). In particular, Billabong International has in place a worldwide

social compliance program that focuses on different aspects that includes the following:

The company can concentrate on the youth and linked to the environment. The company can

assess the materials used for production, footprints of different retail stores and the way

products are made.

The company Billabong can carry out audits of particularly supply chain of the corporation as

well as manufacturing procedures in order to make certain social compliance. During 2015,

the company engaged different global assessors for independent assessment of the company’s

compliance with the manufacturers in the firm’s supply chain on a regular basis

(Billabongbiz.com 2017). During 2015, the company Billabong engaged international

auditors Bureau Veritas assume ongoing, sovereign auditing of company’s supply chain for

AUDITING & ASSURANCE

during 2015 to nearly 127730 during 2016. A negative trend can also be observed in case of

existence of current assets of the firm that is from 523753 in 2015 to 464454 in 2016.

Furthermore, the company also faces adverse financial ratio that include extreme drop in

gross profit margin (negative), increase in debt equity ratio (Billabongbiz.com 2017). Again,

the inventory turn is also lower than the industry standard of 4 times reflecting lack of

efficiency of the firm.

Social Responsibility

The company Billabong necessarily sources products manufactured in nations namely China

mainly where there are risks surrounding the place of work, standards of both health and

safety standards of factories. Essentially, the business group also utilizes external auditing

unit for auditing social compliance of the corporation’s warehouses when measured against

the approved code of conduct. This code of conduct essentially contains specific standards

that are equivalent to SA8000 as well as Worldwide Responsible Accredited Production

(Billabongbiz.com 2017). In particular, Billabong International has in place a worldwide

social compliance program that focuses on different aspects that includes the following:

The company can concentrate on the youth and linked to the environment. The company can

assess the materials used for production, footprints of different retail stores and the way

products are made.

The company Billabong can carry out audits of particularly supply chain of the corporation as

well as manufacturing procedures in order to make certain social compliance. During 2015,

the company engaged different global assessors for independent assessment of the company’s

compliance with the manufacturers in the firm’s supply chain on a regular basis

(Billabongbiz.com 2017). During 2015, the company Billabong engaged international

auditors Bureau Veritas assume ongoing, sovereign auditing of company’s supply chain for

15

AUDITING & ASSURANCE

societal compliance as well as quality control. Again, in case if by means of audit procedure,

a warehouse does not secure satisfactory score, a corrective plan of action can be established.

Essentially, subsequent visits can be scheduled by the audit management committee to ensure

implementation of corrective actions. Again, social audit programs can also be undertaken by

the firm founded on the Code of Conduct that reflects the International labour Organizations

Standards (Billabongbiz.com 2017). In addition to this, the company can also develop and

enhance environmental initiatives that can help in confrontation with increasing pollution in

order to lessen the overall impact on environment.

Conclusion

The above mentioned study helps in understanding the business of the client Billabong

International along with the industry in which the firm operates. In addition to this, the

current study also helps in gaining deep insight into the significant business risks of the firm.

Thereafter, with special reference to the financial assertions of the firm for the year 2015 and

2016, the study calculates and assesses the financial performance of the firm. In addition to

this, the study also identifies the areas of material misstatements in the financial statements

and detects the same from the calculated financial ratio. Furthermore, the report also helps in

comprehending the potential going concern issue from the financial outcomes. Moving

further, the current study also provides a brief summary of the company’s social

responsibility.

AUDITING & ASSURANCE

societal compliance as well as quality control. Again, in case if by means of audit procedure,

a warehouse does not secure satisfactory score, a corrective plan of action can be established.

Essentially, subsequent visits can be scheduled by the audit management committee to ensure

implementation of corrective actions. Again, social audit programs can also be undertaken by

the firm founded on the Code of Conduct that reflects the International labour Organizations

Standards (Billabongbiz.com 2017). In addition to this, the company can also develop and

enhance environmental initiatives that can help in confrontation with increasing pollution in

order to lessen the overall impact on environment.

Conclusion

The above mentioned study helps in understanding the business of the client Billabong

International along with the industry in which the firm operates. In addition to this, the

current study also helps in gaining deep insight into the significant business risks of the firm.

Thereafter, with special reference to the financial assertions of the firm for the year 2015 and

2016, the study calculates and assesses the financial performance of the firm. In addition to

this, the study also identifies the areas of material misstatements in the financial statements

and detects the same from the calculated financial ratio. Furthermore, the report also helps in

comprehending the potential going concern issue from the financial outcomes. Moving

further, the current study also provides a brief summary of the company’s social

responsibility.

16

AUDITING & ASSURANCE

References

Arens, A., Elder, R. and Beasley, M., 2014. Auditing and assurance services-An integrated

approach; includes coverage of international standards and global auditing issues, in addition

to coverage of. Boston: Aufl.

Arens, A.A., Best, P., Shailer, G., Fiedler, B., Elder, R.J. and Beasley, M., 2015. Auditing

and assurance services in Australia: an integrated approach. Pearson Education Australia.

Arens, A.A., Elder, R.J. and Beasley, M.S., 2013. Auditing and Assurance Services Plus

NEW MyAccountingLab with Pearson EText: Access Card Package. Prentice-Hall.

Arens, A.A., Elder, R.J. and Mark, B., 2012. Auditing and assurance services: an integrated

approach. Boston: Prentice Hall.

Billabongbiz.com. 2017. Billabong Biz : Behind the Brand - Investors - Investors Home.

[online] Available at: http://www.billabongbiz.com [Accessed 15 Sep. 2017].

Bodie, Z., 2013. Investments. McGraw-Hill.

Cohen, J.R. and Simnett, R., 2014. CSR and assurance services: A research agenda. Auditing:

A Journal of Practice & Theory, 34(1), pp.59-74.

Dalnial, H., Kamaluddin, A., Sanusi, Z.M. and Khairuddin, K.S., 2014. Detecting fraudulent

financial reporting through financial statement analysis. Journal of Advanced Management

Science Vol, 2(1).

Dung, N.V., 2016. Value-relevance of financial statement information: A flexible application

of modern theories to the Vietnamese stock market. Quarterly Journal of Economics, 84,

pp.488-500.

AUDITING & ASSURANCE

References

Arens, A., Elder, R. and Beasley, M., 2014. Auditing and assurance services-An integrated

approach; includes coverage of international standards and global auditing issues, in addition

to coverage of. Boston: Aufl.

Arens, A.A., Best, P., Shailer, G., Fiedler, B., Elder, R.J. and Beasley, M., 2015. Auditing

and assurance services in Australia: an integrated approach. Pearson Education Australia.

Arens, A.A., Elder, R.J. and Beasley, M.S., 2013. Auditing and Assurance Services Plus

NEW MyAccountingLab with Pearson EText: Access Card Package. Prentice-Hall.

Arens, A.A., Elder, R.J. and Mark, B., 2012. Auditing and assurance services: an integrated

approach. Boston: Prentice Hall.

Billabongbiz.com. 2017. Billabong Biz : Behind the Brand - Investors - Investors Home.

[online] Available at: http://www.billabongbiz.com [Accessed 15 Sep. 2017].

Bodie, Z., 2013. Investments. McGraw-Hill.

Cohen, J.R. and Simnett, R., 2014. CSR and assurance services: A research agenda. Auditing:

A Journal of Practice & Theory, 34(1), pp.59-74.

Dalnial, H., Kamaluddin, A., Sanusi, Z.M. and Khairuddin, K.S., 2014. Detecting fraudulent

financial reporting through financial statement analysis. Journal of Advanced Management

Science Vol, 2(1).

Dung, N.V., 2016. Value-relevance of financial statement information: A flexible application

of modern theories to the Vietnamese stock market. Quarterly Journal of Economics, 84,

pp.488-500.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

17

AUDITING & ASSURANCE

Eilifsen, A., Messier, W.F., Glover, S.M. and Prawitt, D.F., 2013. Auditing and assurance

services. McGraw-Hill.

Entwistle, G., 2015. Reflections on Teaching Financial Statement Analysis. Accounting

Education, 24(6), pp.555-558.

Houghton, K. and Campbell, T., 2013. Ethics and auditing (p. 354). ANU Press.

Kunz, R., Josset, D., Scholtz, H., Motholo, V., O'Reilly, G., Penning, G. and Rudman, R.,

2014. Auditing & Assurance: Principles & Practice. OUP Catalogue.

Louwers, T.J., Ramsay, R.J., Sinason, D.H., Strawser, J.R. and Thibodeau, J.C.,

2015. Auditing & assurance services. McGraw-Hill Education.

Pappa, A., 2015. Financial statement analysis of a multinational company and equity

valuation of computer-based technology group.

Richard, P., 2014. The Role of the Accounting Rate of Return in Financial Statement

Analysis. The Continuing Debate Over Depreciation, Capital and Income (RLE

Accounting), 67(2), p.235.

Simnett, R., Carson, E. and Vanstraelen, A., 2016. International Archival Auditing and

Assurance Research: Trends, Methodological Issues, and Opportunities. Auditing: A Journal

of Practice & Theory, 35(3), pp.1-32.

William Jr, M., Glover, S. and Prawitt, D., 2016. Auditing and assurance services: A

systematic approach. McGraw-Hill Education.

AUDITING & ASSURANCE

Eilifsen, A., Messier, W.F., Glover, S.M. and Prawitt, D.F., 2013. Auditing and assurance

services. McGraw-Hill.

Entwistle, G., 2015. Reflections on Teaching Financial Statement Analysis. Accounting

Education, 24(6), pp.555-558.

Houghton, K. and Campbell, T., 2013. Ethics and auditing (p. 354). ANU Press.

Kunz, R., Josset, D., Scholtz, H., Motholo, V., O'Reilly, G., Penning, G. and Rudman, R.,

2014. Auditing & Assurance: Principles & Practice. OUP Catalogue.

Louwers, T.J., Ramsay, R.J., Sinason, D.H., Strawser, J.R. and Thibodeau, J.C.,

2015. Auditing & assurance services. McGraw-Hill Education.

Pappa, A., 2015. Financial statement analysis of a multinational company and equity

valuation of computer-based technology group.

Richard, P., 2014. The Role of the Accounting Rate of Return in Financial Statement

Analysis. The Continuing Debate Over Depreciation, Capital and Income (RLE

Accounting), 67(2), p.235.

Simnett, R., Carson, E. and Vanstraelen, A., 2016. International Archival Auditing and

Assurance Research: Trends, Methodological Issues, and Opportunities. Auditing: A Journal

of Practice & Theory, 35(3), pp.1-32.

William Jr, M., Glover, S. and Prawitt, D., 2016. Auditing and assurance services: A

systematic approach. McGraw-Hill Education.

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.