Analysis of Audit Risks and Internal Control Weaknesses: API (ACC568)

VerifiedAdded on 2023/03/17

|15

|3701

|33

Report

AI Summary

This report, prepared as a memo from an audit manager to an audit senior, analyzes the audit risks associated with Always Precise Instruments Pty Limited (API), a manufacturer of military equipment. The report examines various financial ratios, including current ratio, quick ratio, return on equity, return on assets, gross profit margin, marketing expenses, administrative expenses, times interest earned, days in inventory, days in accounts receivable, and debt to equity ratio, identifying potential audit risks and recommending appropriate audit procedures for each. Additionally, the report addresses internal control weaknesses, specifically concerning inventory management and the computer system generating purchase orders, outlining associated audit risks and suggested audit procedures. The analysis aims to ensure the accuracy of API's financial statements and the effectiveness of its internal controls.

Running head: AUDITING

Auditing

Name of the Student:

Name of the University:

Author’s Note

Auditing

Name of the Student:

Name of the University:

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

AUDITING

Memo

To: Mr Wayne of Always Precise Ltd

From: Auditing Manager

Date: 12th May, 2019

Subject: Discussion Regarding Audit risks of API

Purpose and Scope

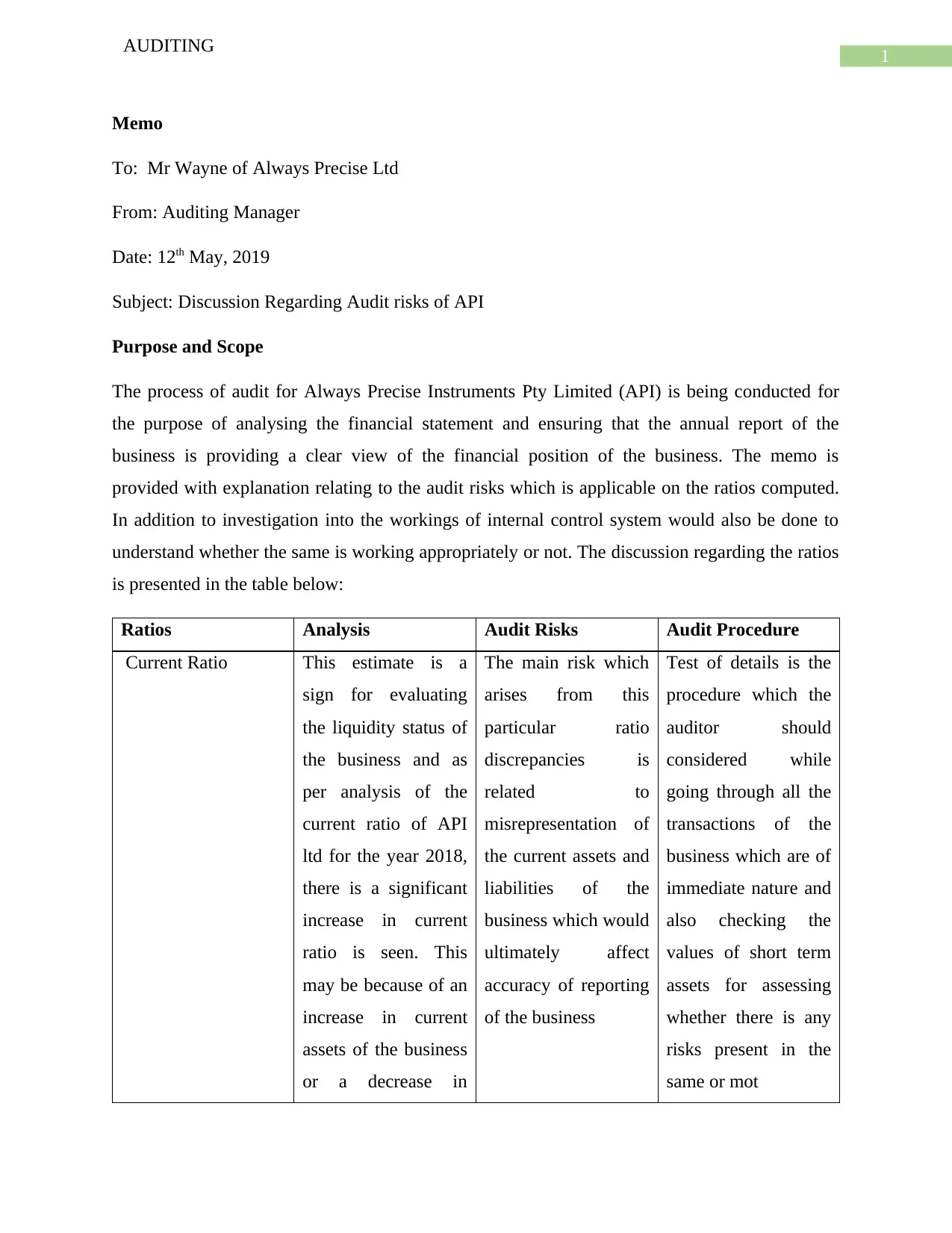

The process of audit for Always Precise Instruments Pty Limited (API) is being conducted for

the purpose of analysing the financial statement and ensuring that the annual report of the

business is providing a clear view of the financial position of the business. The memo is

provided with explanation relating to the audit risks which is applicable on the ratios computed.

In addition to investigation into the workings of internal control system would also be done to

understand whether the same is working appropriately or not. The discussion regarding the ratios

is presented in the table below:

Ratios Analysis Audit Risks Audit Procedure

Current Ratio This estimate is a

sign for evaluating

the liquidity status of

the business and as

per analysis of the

current ratio of API

ltd for the year 2018,

there is a significant

increase in current

ratio is seen. This

may be because of an

increase in current

assets of the business

or a decrease in

The main risk which

arises from this

particular ratio

discrepancies is

related to

misrepresentation of

the current assets and

liabilities of the

business which would

ultimately affect

accuracy of reporting

of the business

Test of details is the

procedure which the

auditor should

considered while

going through all the

transactions of the

business which are of

immediate nature and

also checking the

values of short term

assets for assessing

whether there is any

risks present in the

same or mot

AUDITING

Memo

To: Mr Wayne of Always Precise Ltd

From: Auditing Manager

Date: 12th May, 2019

Subject: Discussion Regarding Audit risks of API

Purpose and Scope

The process of audit for Always Precise Instruments Pty Limited (API) is being conducted for

the purpose of analysing the financial statement and ensuring that the annual report of the

business is providing a clear view of the financial position of the business. The memo is

provided with explanation relating to the audit risks which is applicable on the ratios computed.

In addition to investigation into the workings of internal control system would also be done to

understand whether the same is working appropriately or not. The discussion regarding the ratios

is presented in the table below:

Ratios Analysis Audit Risks Audit Procedure

Current Ratio This estimate is a

sign for evaluating

the liquidity status of

the business and as

per analysis of the

current ratio of API

ltd for the year 2018,

there is a significant

increase in current

ratio is seen. This

may be because of an

increase in current

assets of the business

or a decrease in

The main risk which

arises from this

particular ratio

discrepancies is

related to

misrepresentation of

the current assets and

liabilities of the

business which would

ultimately affect

accuracy of reporting

of the business

Test of details is the

procedure which the

auditor should

considered while

going through all the

transactions of the

business which are of

immediate nature and

also checking the

values of short term

assets for assessing

whether there is any

risks present in the

same or mot

2

AUDITING

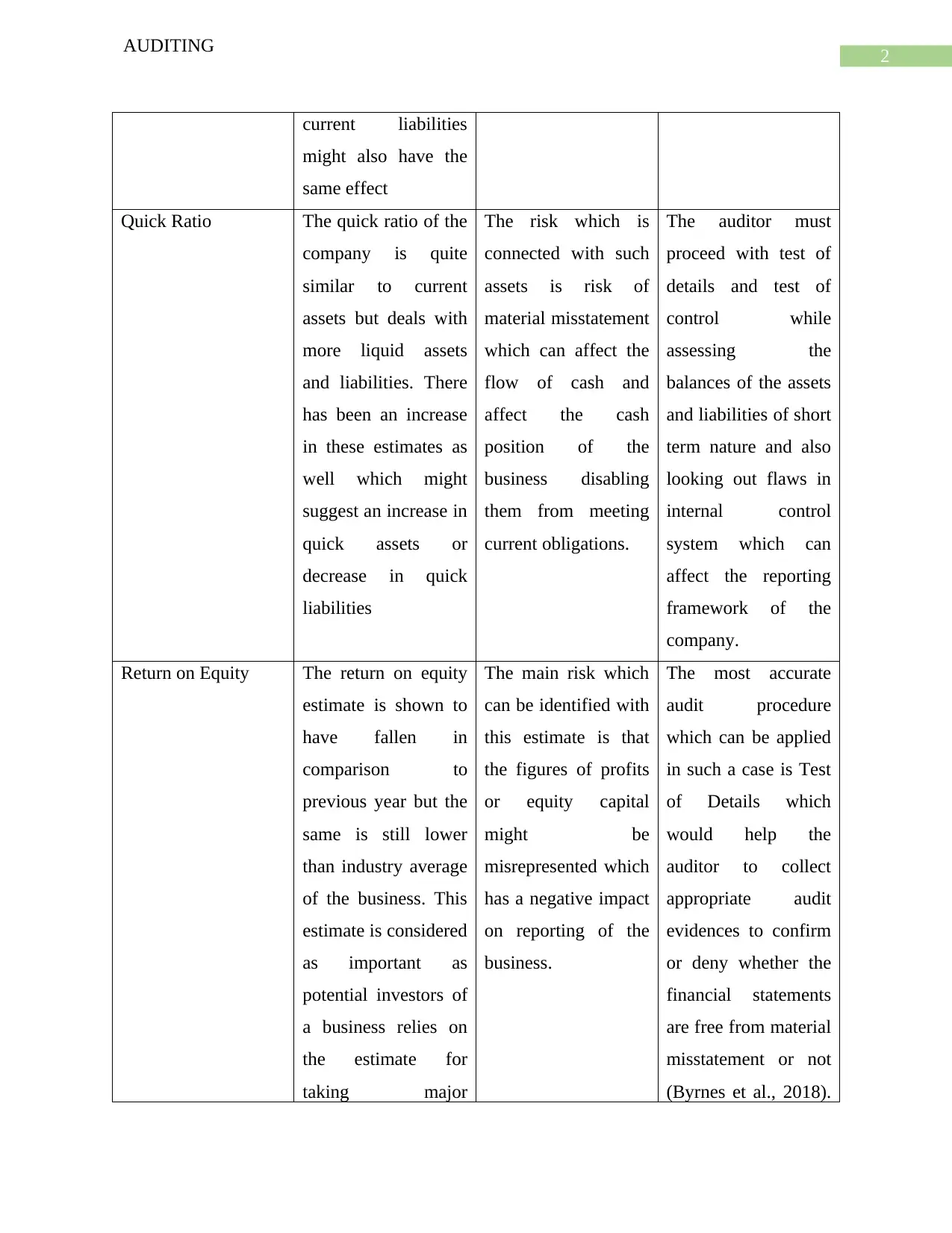

current liabilities

might also have the

same effect

Quick Ratio The quick ratio of the

company is quite

similar to current

assets but deals with

more liquid assets

and liabilities. There

has been an increase

in these estimates as

well which might

suggest an increase in

quick assets or

decrease in quick

liabilities

The risk which is

connected with such

assets is risk of

material misstatement

which can affect the

flow of cash and

affect the cash

position of the

business disabling

them from meeting

current obligations.

The auditor must

proceed with test of

details and test of

control while

assessing the

balances of the assets

and liabilities of short

term nature and also

looking out flaws in

internal control

system which can

affect the reporting

framework of the

company.

Return on Equity The return on equity

estimate is shown to

have fallen in

comparison to

previous year but the

same is still lower

than industry average

of the business. This

estimate is considered

as important as

potential investors of

a business relies on

the estimate for

taking major

The main risk which

can be identified with

this estimate is that

the figures of profits

or equity capital

might be

misrepresented which

has a negative impact

on reporting of the

business.

The most accurate

audit procedure

which can be applied

in such a case is Test

of Details which

would help the

auditor to collect

appropriate audit

evidences to confirm

or deny whether the

financial statements

are free from material

misstatement or not

(Byrnes et al., 2018).

AUDITING

current liabilities

might also have the

same effect

Quick Ratio The quick ratio of the

company is quite

similar to current

assets but deals with

more liquid assets

and liabilities. There

has been an increase

in these estimates as

well which might

suggest an increase in

quick assets or

decrease in quick

liabilities

The risk which is

connected with such

assets is risk of

material misstatement

which can affect the

flow of cash and

affect the cash

position of the

business disabling

them from meeting

current obligations.

The auditor must

proceed with test of

details and test of

control while

assessing the

balances of the assets

and liabilities of short

term nature and also

looking out flaws in

internal control

system which can

affect the reporting

framework of the

company.

Return on Equity The return on equity

estimate is shown to

have fallen in

comparison to

previous year but the

same is still lower

than industry average

of the business. This

estimate is considered

as important as

potential investors of

a business relies on

the estimate for

taking major

The main risk which

can be identified with

this estimate is that

the figures of profits

or equity capital

might be

misrepresented which

has a negative impact

on reporting of the

business.

The most accurate

audit procedure

which can be applied

in such a case is Test

of Details which

would help the

auditor to collect

appropriate audit

evidences to confirm

or deny whether the

financial statements

are free from material

misstatement or not

(Byrnes et al., 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

AUDITING

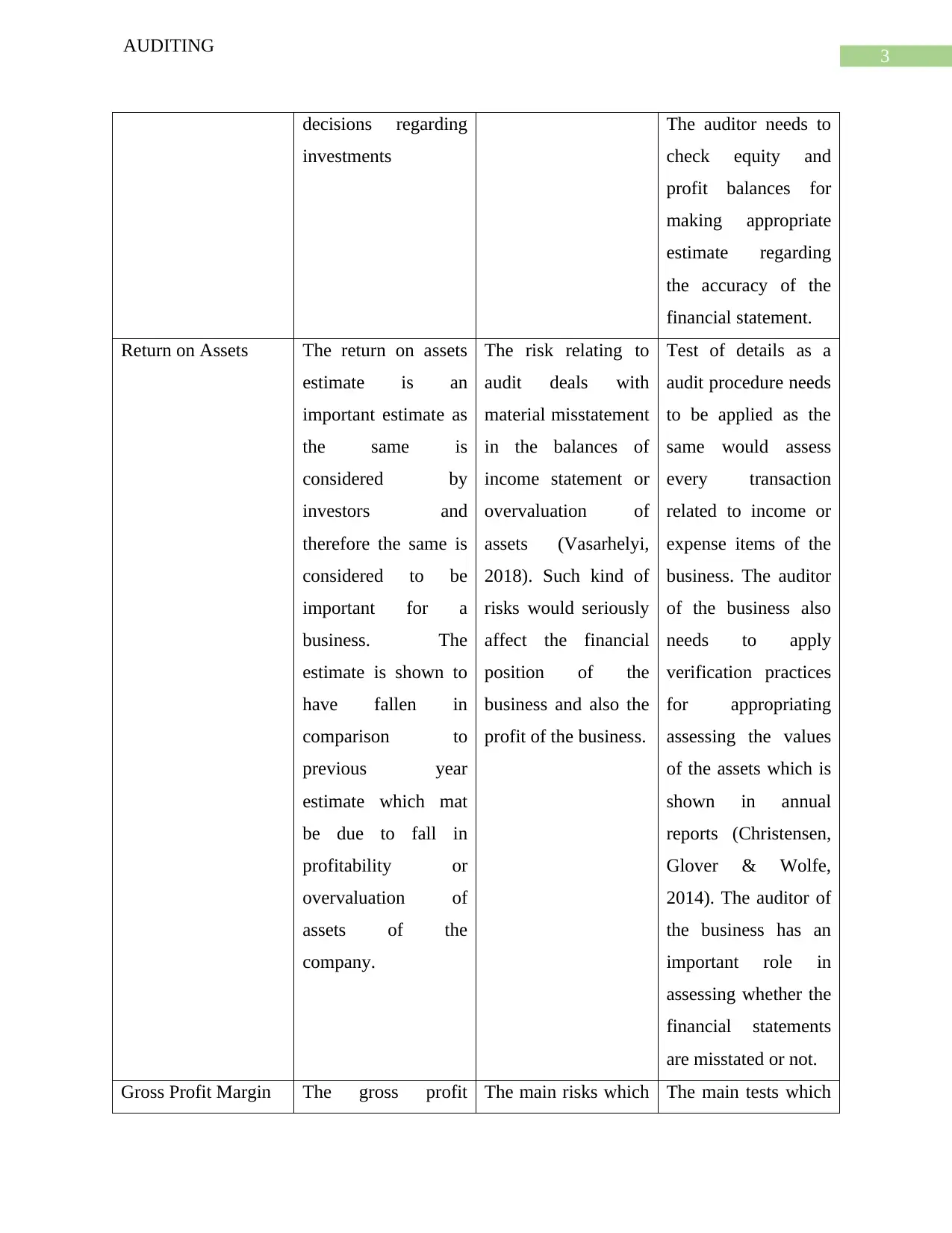

decisions regarding

investments

The auditor needs to

check equity and

profit balances for

making appropriate

estimate regarding

the accuracy of the

financial statement.

Return on Assets The return on assets

estimate is an

important estimate as

the same is

considered by

investors and

therefore the same is

considered to be

important for a

business. The

estimate is shown to

have fallen in

comparison to

previous year

estimate which mat

be due to fall in

profitability or

overvaluation of

assets of the

company.

The risk relating to

audit deals with

material misstatement

in the balances of

income statement or

overvaluation of

assets (Vasarhelyi,

2018). Such kind of

risks would seriously

affect the financial

position of the

business and also the

profit of the business.

Test of details as a

audit procedure needs

to be applied as the

same would assess

every transaction

related to income or

expense items of the

business. The auditor

of the business also

needs to apply

verification practices

for appropriating

assessing the values

of the assets which is

shown in annual

reports (Christensen,

Glover & Wolfe,

2014). The auditor of

the business has an

important role in

assessing whether the

financial statements

are misstated or not.

Gross Profit Margin The gross profit The main risks which The main tests which

AUDITING

decisions regarding

investments

The auditor needs to

check equity and

profit balances for

making appropriate

estimate regarding

the accuracy of the

financial statement.

Return on Assets The return on assets

estimate is an

important estimate as

the same is

considered by

investors and

therefore the same is

considered to be

important for a

business. The

estimate is shown to

have fallen in

comparison to

previous year

estimate which mat

be due to fall in

profitability or

overvaluation of

assets of the

company.

The risk relating to

audit deals with

material misstatement

in the balances of

income statement or

overvaluation of

assets (Vasarhelyi,

2018). Such kind of

risks would seriously

affect the financial

position of the

business and also the

profit of the business.

Test of details as a

audit procedure needs

to be applied as the

same would assess

every transaction

related to income or

expense items of the

business. The auditor

of the business also

needs to apply

verification practices

for appropriating

assessing the values

of the assets which is

shown in annual

reports (Christensen,

Glover & Wolfe,

2014). The auditor of

the business has an

important role in

assessing whether the

financial statements

are misstated or not.

Gross Profit Margin The gross profit The main risks which The main tests which

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

AUDITING

margin represents the

profits which is

generated by the

business from

operations. The

estimate is shown to

have fallen which

may be due to fall in

the sales of the

business or increase

in the costs of the

business.

arises from such a

situation is

misstatement in

income statement

items which may be

related to revenue

generated or expenses

incurred during

process of

production.

can be applied by the

auditor in such a case

is test of details and

test of control (De

Simone, Ege &

Stomberg, 2014).

Substantive audit

procedures can be

applied for

conducting the audit

and at the same time

review the internal

control system and

different ledgers

which includes sales

and cost transactions

information.

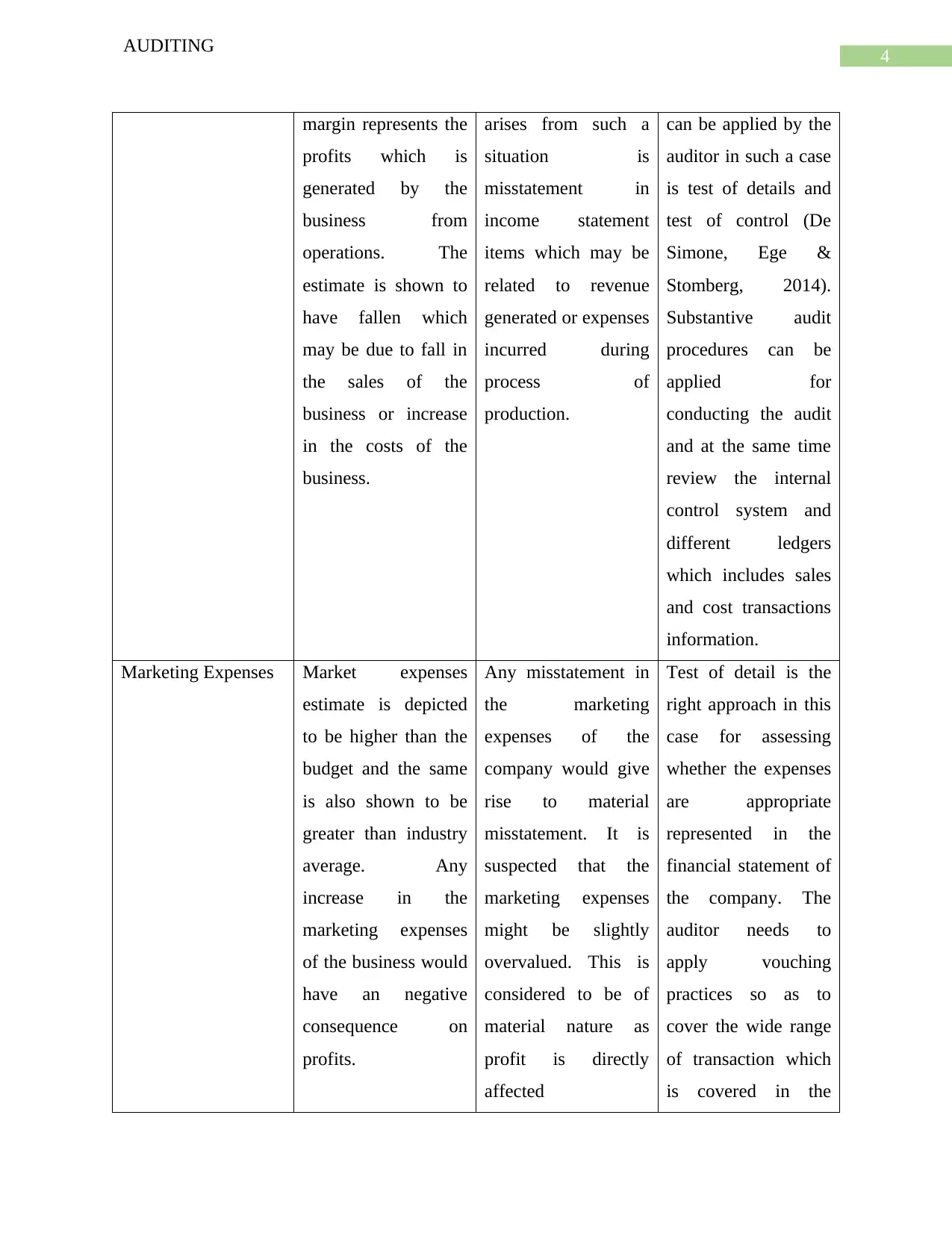

Marketing Expenses Market expenses

estimate is depicted

to be higher than the

budget and the same

is also shown to be

greater than industry

average. Any

increase in the

marketing expenses

of the business would

have an negative

consequence on

profits.

Any misstatement in

the marketing

expenses of the

company would give

rise to material

misstatement. It is

suspected that the

marketing expenses

might be slightly

overvalued. This is

considered to be of

material nature as

profit is directly

affected

Test of detail is the

right approach in this

case for assessing

whether the expenses

are appropriate

represented in the

financial statement of

the company. The

auditor needs to

apply vouching

practices so as to

cover the wide range

of transaction which

is covered in the

AUDITING

margin represents the

profits which is

generated by the

business from

operations. The

estimate is shown to

have fallen which

may be due to fall in

the sales of the

business or increase

in the costs of the

business.

arises from such a

situation is

misstatement in

income statement

items which may be

related to revenue

generated or expenses

incurred during

process of

production.

can be applied by the

auditor in such a case

is test of details and

test of control (De

Simone, Ege &

Stomberg, 2014).

Substantive audit

procedures can be

applied for

conducting the audit

and at the same time

review the internal

control system and

different ledgers

which includes sales

and cost transactions

information.

Marketing Expenses Market expenses

estimate is depicted

to be higher than the

budget and the same

is also shown to be

greater than industry

average. Any

increase in the

marketing expenses

of the business would

have an negative

consequence on

profits.

Any misstatement in

the marketing

expenses of the

company would give

rise to material

misstatement. It is

suspected that the

marketing expenses

might be slightly

overvalued. This is

considered to be of

material nature as

profit is directly

affected

Test of detail is the

right approach in this

case for assessing

whether the expenses

are appropriate

represented in the

financial statement of

the company. The

auditor needs to

apply vouching

practices so as to

cover the wide range

of transaction which

is covered in the

5

AUDITING

financial statement of

the business.

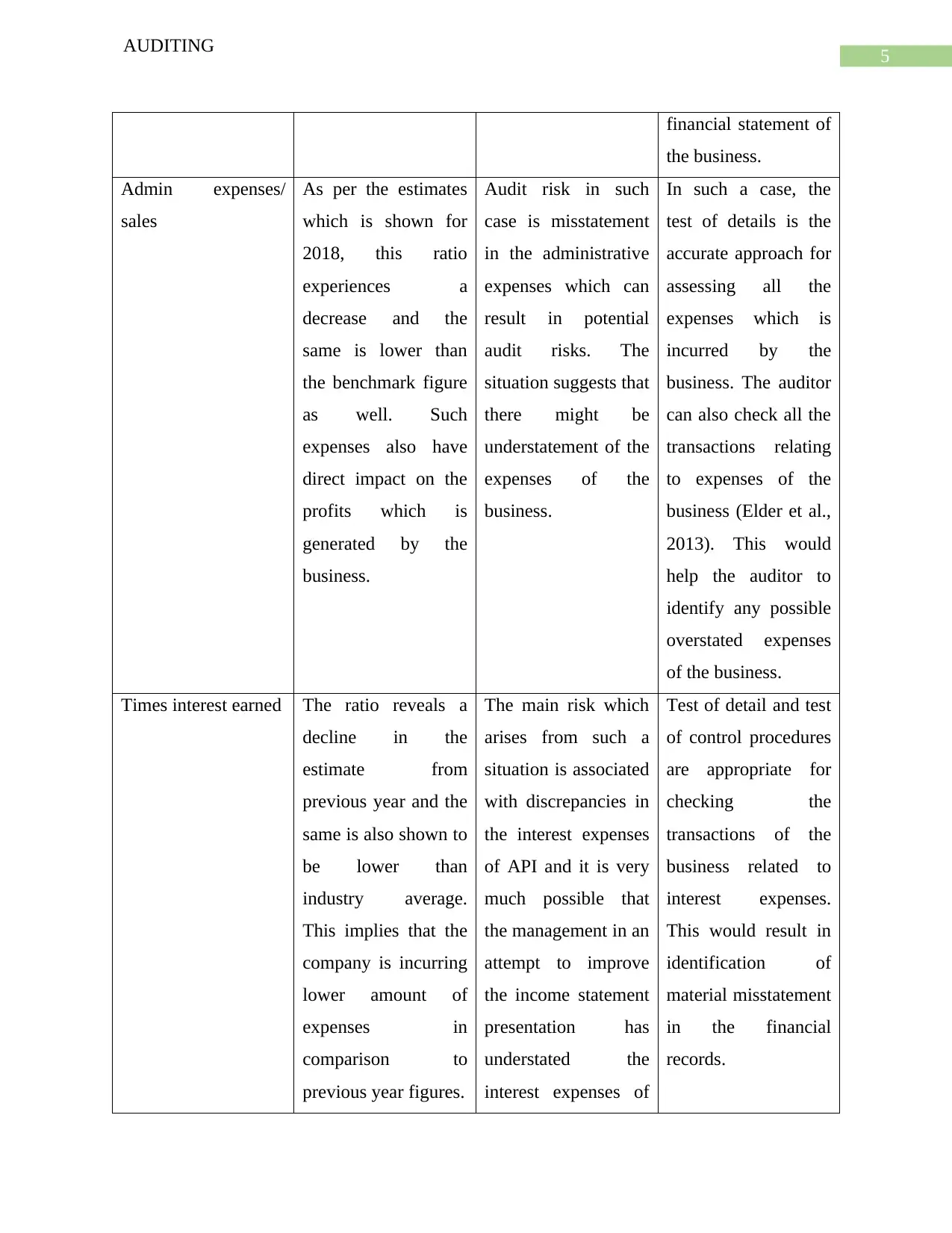

Admin expenses/

sales

As per the estimates

which is shown for

2018, this ratio

experiences a

decrease and the

same is lower than

the benchmark figure

as well. Such

expenses also have

direct impact on the

profits which is

generated by the

business.

Audit risk in such

case is misstatement

in the administrative

expenses which can

result in potential

audit risks. The

situation suggests that

there might be

understatement of the

expenses of the

business.

In such a case, the

test of details is the

accurate approach for

assessing all the

expenses which is

incurred by the

business. The auditor

can also check all the

transactions relating

to expenses of the

business (Elder et al.,

2013). This would

help the auditor to

identify any possible

overstated expenses

of the business.

Times interest earned The ratio reveals a

decline in the

estimate from

previous year and the

same is also shown to

be lower than

industry average.

This implies that the

company is incurring

lower amount of

expenses in

comparison to

previous year figures.

The main risk which

arises from such a

situation is associated

with discrepancies in

the interest expenses

of API and it is very

much possible that

the management in an

attempt to improve

the income statement

presentation has

understated the

interest expenses of

Test of detail and test

of control procedures

are appropriate for

checking the

transactions of the

business related to

interest expenses.

This would result in

identification of

material misstatement

in the financial

records.

AUDITING

financial statement of

the business.

Admin expenses/

sales

As per the estimates

which is shown for

2018, this ratio

experiences a

decrease and the

same is lower than

the benchmark figure

as well. Such

expenses also have

direct impact on the

profits which is

generated by the

business.

Audit risk in such

case is misstatement

in the administrative

expenses which can

result in potential

audit risks. The

situation suggests that

there might be

understatement of the

expenses of the

business.

In such a case, the

test of details is the

accurate approach for

assessing all the

expenses which is

incurred by the

business. The auditor

can also check all the

transactions relating

to expenses of the

business (Elder et al.,

2013). This would

help the auditor to

identify any possible

overstated expenses

of the business.

Times interest earned The ratio reveals a

decline in the

estimate from

previous year and the

same is also shown to

be lower than

industry average.

This implies that the

company is incurring

lower amount of

expenses in

comparison to

previous year figures.

The main risk which

arises from such a

situation is associated

with discrepancies in

the interest expenses

of API and it is very

much possible that

the management in an

attempt to improve

the income statement

presentation has

understated the

interest expenses of

Test of detail and test

of control procedures

are appropriate for

checking the

transactions of the

business related to

interest expenses.

This would result in

identification of

material misstatement

in the financial

records.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

AUDITING

the business.

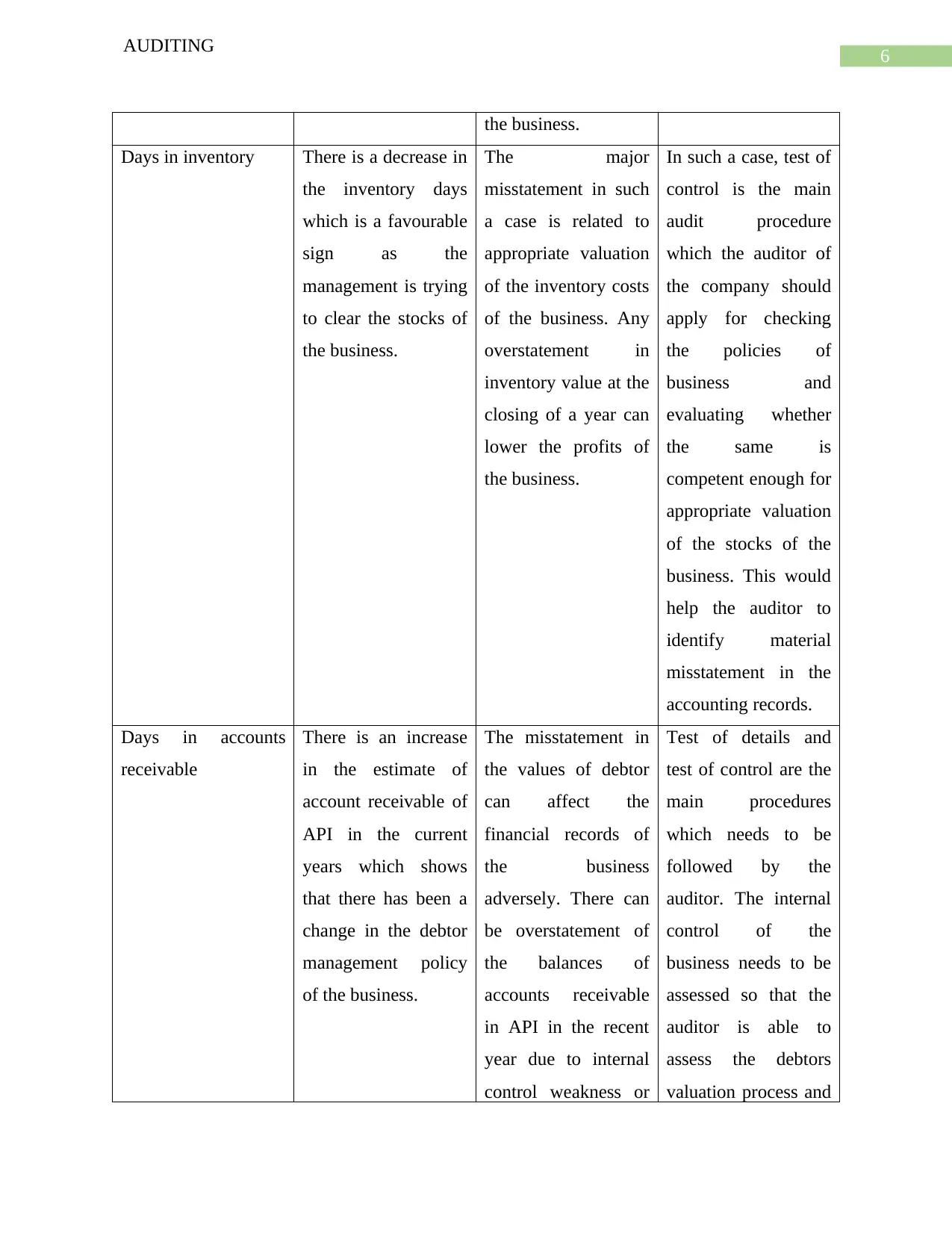

Days in inventory There is a decrease in

the inventory days

which is a favourable

sign as the

management is trying

to clear the stocks of

the business.

The major

misstatement in such

a case is related to

appropriate valuation

of the inventory costs

of the business. Any

overstatement in

inventory value at the

closing of a year can

lower the profits of

the business.

In such a case, test of

control is the main

audit procedure

which the auditor of

the company should

apply for checking

the policies of

business and

evaluating whether

the same is

competent enough for

appropriate valuation

of the stocks of the

business. This would

help the auditor to

identify material

misstatement in the

accounting records.

Days in accounts

receivable

There is an increase

in the estimate of

account receivable of

API in the current

years which shows

that there has been a

change in the debtor

management policy

of the business.

The misstatement in

the values of debtor

can affect the

financial records of

the business

adversely. There can

be overstatement of

the balances of

accounts receivable

in API in the recent

year due to internal

control weakness or

Test of details and

test of control are the

main procedures

which needs to be

followed by the

auditor. The internal

control of the

business needs to be

assessed so that the

auditor is able to

assess the debtors

valuation process and

AUDITING

the business.

Days in inventory There is a decrease in

the inventory days

which is a favourable

sign as the

management is trying

to clear the stocks of

the business.

The major

misstatement in such

a case is related to

appropriate valuation

of the inventory costs

of the business. Any

overstatement in

inventory value at the

closing of a year can

lower the profits of

the business.

In such a case, test of

control is the main

audit procedure

which the auditor of

the company should

apply for checking

the policies of

business and

evaluating whether

the same is

competent enough for

appropriate valuation

of the stocks of the

business. This would

help the auditor to

identify material

misstatement in the

accounting records.

Days in accounts

receivable

There is an increase

in the estimate of

account receivable of

API in the current

years which shows

that there has been a

change in the debtor

management policy

of the business.

The misstatement in

the values of debtor

can affect the

financial records of

the business

adversely. There can

be overstatement of

the balances of

accounts receivable

in API in the recent

year due to internal

control weakness or

Test of details and

test of control are the

main procedures

which needs to be

followed by the

auditor. The internal

control of the

business needs to be

assessed so that the

auditor is able to

assess the debtors

valuation process and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

AUDITING

other factors. also ensure that the

value of the debtor is

appropriately

represented or not.

The auditor of the

business also needs to

assess the debtor

management policies

which is followed by

business.

Debt to equity ratio: The estimate shows a

decrease in the ratio

for API in

comparison to

previous year. The

main reason for the

same might be

increase in debts of

the business.

Misstatement in the

value of debts can be

potentially risky for

the business. An

overstatement in the

balances of debt has

resulted in decrease

of the ratio

Test of detail is the

main audit procedure

which the auditor

needs to assess and

the auditor of the

business can also

apply verification

practices in order to

ensure that there is no

material misstatement

in the financial

records.

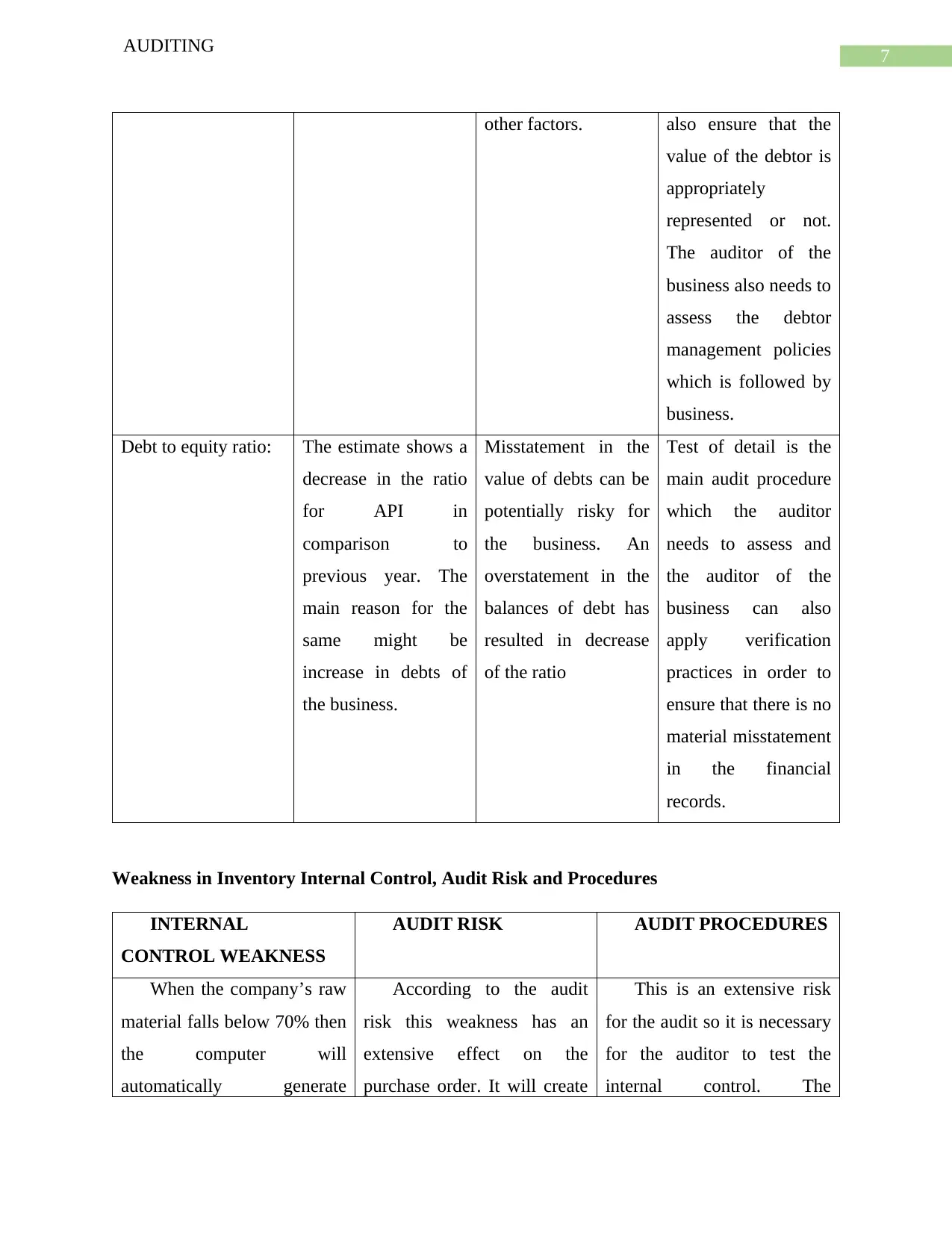

Weakness in Inventory Internal Control, Audit Risk and Procedures

INTERNAL

CONTROL WEAKNESS

AUDIT RISK AUDIT PROCEDURES

When the company’s raw

material falls below 70% then

the computer will

automatically generate

According to the audit

risk this weakness has an

extensive effect on the

purchase order. It will create

This is an extensive risk

for the audit so it is necessary

for the auditor to test the

internal control. The

AUDITING

other factors. also ensure that the

value of the debtor is

appropriately

represented or not.

The auditor of the

business also needs to

assess the debtor

management policies

which is followed by

business.

Debt to equity ratio: The estimate shows a

decrease in the ratio

for API in

comparison to

previous year. The

main reason for the

same might be

increase in debts of

the business.

Misstatement in the

value of debts can be

potentially risky for

the business. An

overstatement in the

balances of debt has

resulted in decrease

of the ratio

Test of detail is the

main audit procedure

which the auditor

needs to assess and

the auditor of the

business can also

apply verification

practices in order to

ensure that there is no

material misstatement

in the financial

records.

Weakness in Inventory Internal Control, Audit Risk and Procedures

INTERNAL

CONTROL WEAKNESS

AUDIT RISK AUDIT PROCEDURES

When the company’s raw

material falls below 70% then

the computer will

automatically generate

According to the audit

risk this weakness has an

extensive effect on the

purchase order. It will create

This is an extensive risk

for the audit so it is necessary

for the auditor to test the

internal control. The

8

AUDITING

purchase order for the raw

material. This can be termed

as a weakness if by chance

the company’s computer

system have an error or the

system is having any

malfunction then it can lead

to generate dispute purchase

order.

loss for API no matter it is

below the requirement or

above the requirement.

responsibility of the auditor

includes the regular testing of

the computer system and

ensures that this kind of

problem should not arise in

the future (Ruhnke &

Schmidt, 2014). The auditor

should also check that the

computer system should be

updated on regular basis.

As the above case

suggests, one of the weakness

which can be distinguishes is

that the whole process of

producing purchase order is

solely dependent on the

computer system of API. If

the computer persists any

kind of problem then the

whole process will fall down

and hence no production

order can be generated.

The audit risk associated

with it creates a major

problem in terms of the

production process of the

company and hence the

whole process will come

under the risk (Vîlsănoiu &

Buzenche, 2014). Due to this

risk, the company may have

serious problem in

accordance of order of the

raw material because there

might be a situation the

computer may have over

order and under order the raw

material. The date of ordering

the raw material may change

because of the glitch will

provide the adverse effect on

the raw material and finished

goods.

The above-mentioned risk

requires attention from the

auditor in terms of audit

control. The auditor need to

test the control periodically so

that the such problem does

not adhere with the

production order process. The

auditor need to ensure the

system is working and

placing correct order

periodically. It is also

important for the auditor to

see whether the system is

updated properly on a regular

basis.

AUDITING

purchase order for the raw

material. This can be termed

as a weakness if by chance

the company’s computer

system have an error or the

system is having any

malfunction then it can lead

to generate dispute purchase

order.

loss for API no matter it is

below the requirement or

above the requirement.

responsibility of the auditor

includes the regular testing of

the computer system and

ensures that this kind of

problem should not arise in

the future (Ruhnke &

Schmidt, 2014). The auditor

should also check that the

computer system should be

updated on regular basis.

As the above case

suggests, one of the weakness

which can be distinguishes is

that the whole process of

producing purchase order is

solely dependent on the

computer system of API. If

the computer persists any

kind of problem then the

whole process will fall down

and hence no production

order can be generated.

The audit risk associated

with it creates a major

problem in terms of the

production process of the

company and hence the

whole process will come

under the risk (Vîlsănoiu &

Buzenche, 2014). Due to this

risk, the company may have

serious problem in

accordance of order of the

raw material because there

might be a situation the

computer may have over

order and under order the raw

material. The date of ordering

the raw material may change

because of the glitch will

provide the adverse effect on

the raw material and finished

goods.

The above-mentioned risk

requires attention from the

auditor in terms of audit

control. The auditor need to

test the control periodically so

that the such problem does

not adhere with the

production order process. The

auditor need to ensure the

system is working and

placing correct order

periodically. It is also

important for the auditor to

see whether the system is

updated properly on a regular

basis.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

AUDITING

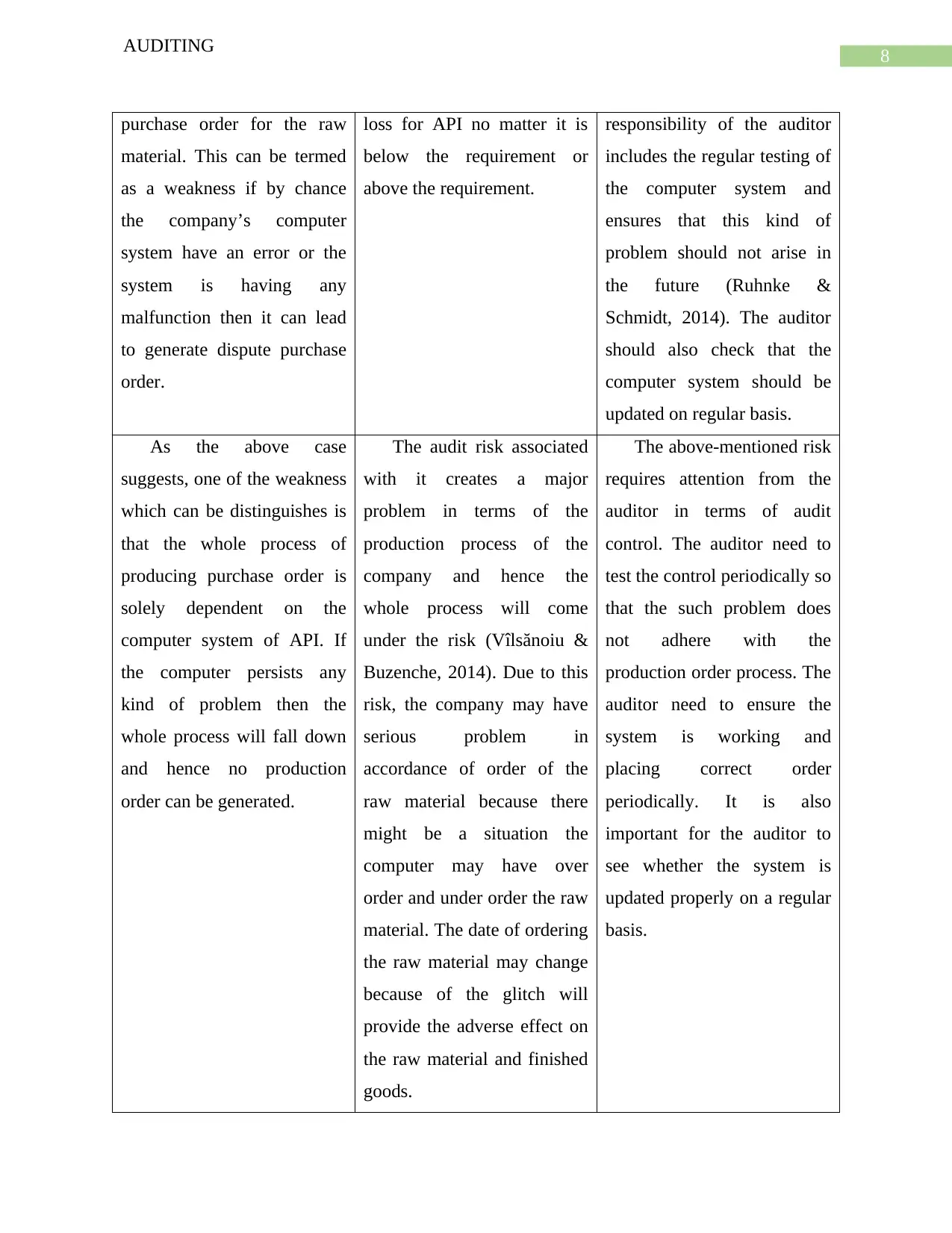

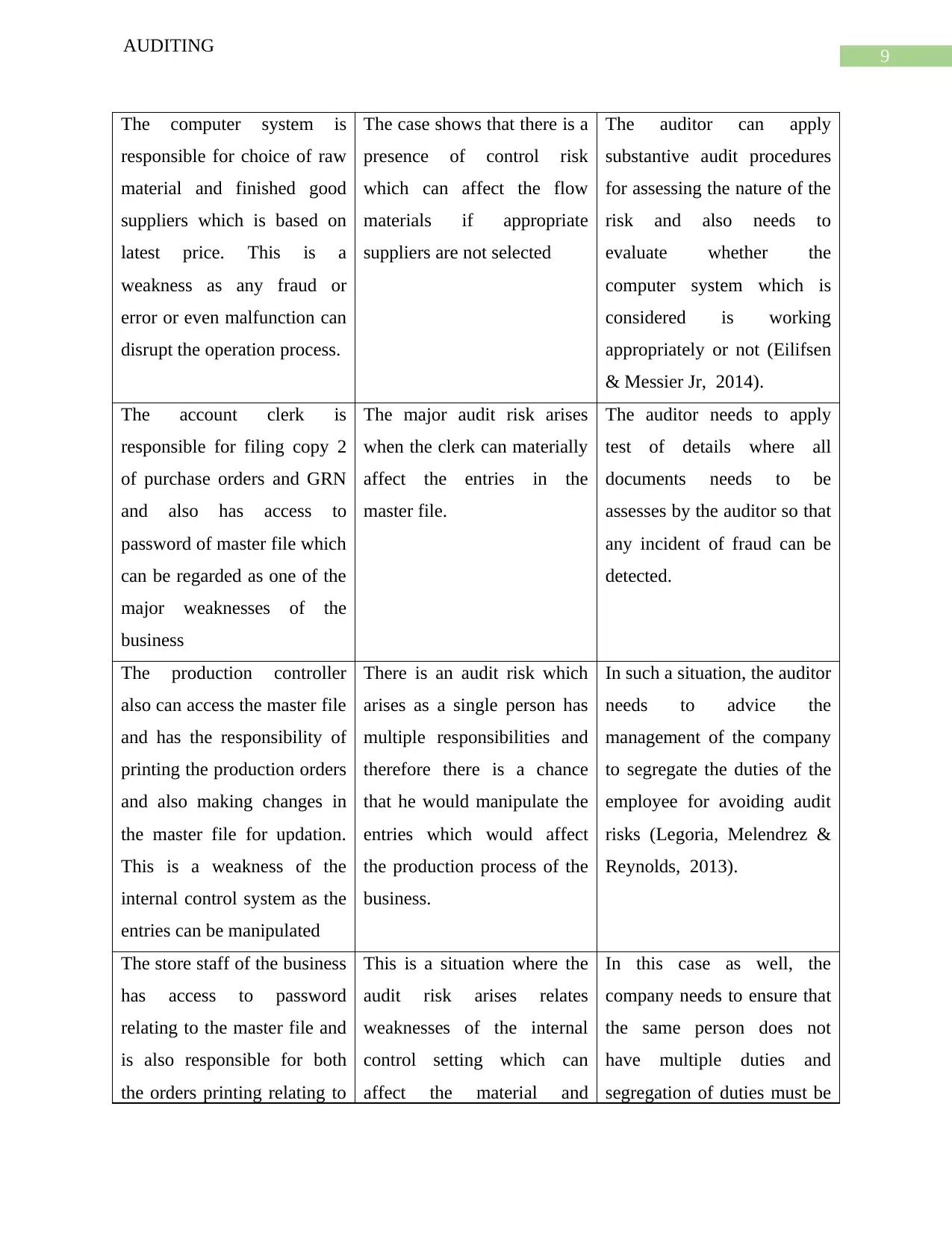

The computer system is

responsible for choice of raw

material and finished good

suppliers which is based on

latest price. This is a

weakness as any fraud or

error or even malfunction can

disrupt the operation process.

The case shows that there is a

presence of control risk

which can affect the flow

materials if appropriate

suppliers are not selected

The auditor can apply

substantive audit procedures

for assessing the nature of the

risk and also needs to

evaluate whether the

computer system which is

considered is working

appropriately or not (Eilifsen

& Messier Jr, 2014).

The account clerk is

responsible for filing copy 2

of purchase orders and GRN

and also has access to

password of master file which

can be regarded as one of the

major weaknesses of the

business

The major audit risk arises

when the clerk can materially

affect the entries in the

master file.

The auditor needs to apply

test of details where all

documents needs to be

assesses by the auditor so that

any incident of fraud can be

detected.

The production controller

also can access the master file

and has the responsibility of

printing the production orders

and also making changes in

the master file for updation.

This is a weakness of the

internal control system as the

entries can be manipulated

There is an audit risk which

arises as a single person has

multiple responsibilities and

therefore there is a chance

that he would manipulate the

entries which would affect

the production process of the

business.

In such a situation, the auditor

needs to advice the

management of the company

to segregate the duties of the

employee for avoiding audit

risks (Legoria, Melendrez &

Reynolds, 2013).

The store staff of the business

has access to password

relating to the master file and

is also responsible for both

the orders printing relating to

This is a situation where the

audit risk arises relates

weaknesses of the internal

control setting which can

affect the material and

In this case as well, the

company needs to ensure that

the same person does not

have multiple duties and

segregation of duties must be

AUDITING

The computer system is

responsible for choice of raw

material and finished good

suppliers which is based on

latest price. This is a

weakness as any fraud or

error or even malfunction can

disrupt the operation process.

The case shows that there is a

presence of control risk

which can affect the flow

materials if appropriate

suppliers are not selected

The auditor can apply

substantive audit procedures

for assessing the nature of the

risk and also needs to

evaluate whether the

computer system which is

considered is working

appropriately or not (Eilifsen

& Messier Jr, 2014).

The account clerk is

responsible for filing copy 2

of purchase orders and GRN

and also has access to

password of master file which

can be regarded as one of the

major weaknesses of the

business

The major audit risk arises

when the clerk can materially

affect the entries in the

master file.

The auditor needs to apply

test of details where all

documents needs to be

assesses by the auditor so that

any incident of fraud can be

detected.

The production controller

also can access the master file

and has the responsibility of

printing the production orders

and also making changes in

the master file for updation.

This is a weakness of the

internal control system as the

entries can be manipulated

There is an audit risk which

arises as a single person has

multiple responsibilities and

therefore there is a chance

that he would manipulate the

entries which would affect

the production process of the

business.

In such a situation, the auditor

needs to advice the

management of the company

to segregate the duties of the

employee for avoiding audit

risks (Legoria, Melendrez &

Reynolds, 2013).

The store staff of the business

has access to password

relating to the master file and

is also responsible for both

the orders printing relating to

This is a situation where the

audit risk arises relates

weaknesses of the internal

control setting which can

affect the material and

In this case as well, the

company needs to ensure that

the same person does not

have multiple duties and

segregation of duties must be

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

AUDITING

raw materials as well as GRN

printing. This is recognised as

a weakness as there is an

opportunity of fraud in the

business.

production process of the

business thereby attracting

losses for the business.

done.

Orders which are generated to

suppliers and sub-contractors

are based on master file. This

is a weakness since many

people have the access to the

password of the master file

for making amendments. This

would make the situation

susceptible to fraudulent

activities.

This is a weakness as the

whole of the process of the

business would be affected as

there is a high chance of

manipulation in the financial

records of the business. The

whole process of the business

would be disrupted.

The appropriate measure

which can be taken by the

management of the company

is that limited access should

be provided on the password

and this would reduce the

possibility of frauds.

The stock sheet which reports

stock value does not show the

quantity of stocks of the

business which is a weakness

as this would lead to wrong

valuation of stock of the

business.

This type of audit risk is

related to weakness in

internal control which can

affect value of the stocks of

the business. The stocks can

be overstated or understated

in company records

The auditor needs to apply

detail scrutiny of the records

of store ledgers and every

invoices and receipt issued by

store staff. If required the

auditor of the business also

can apply physical stock take

for appropriate quantities of

the stock values.

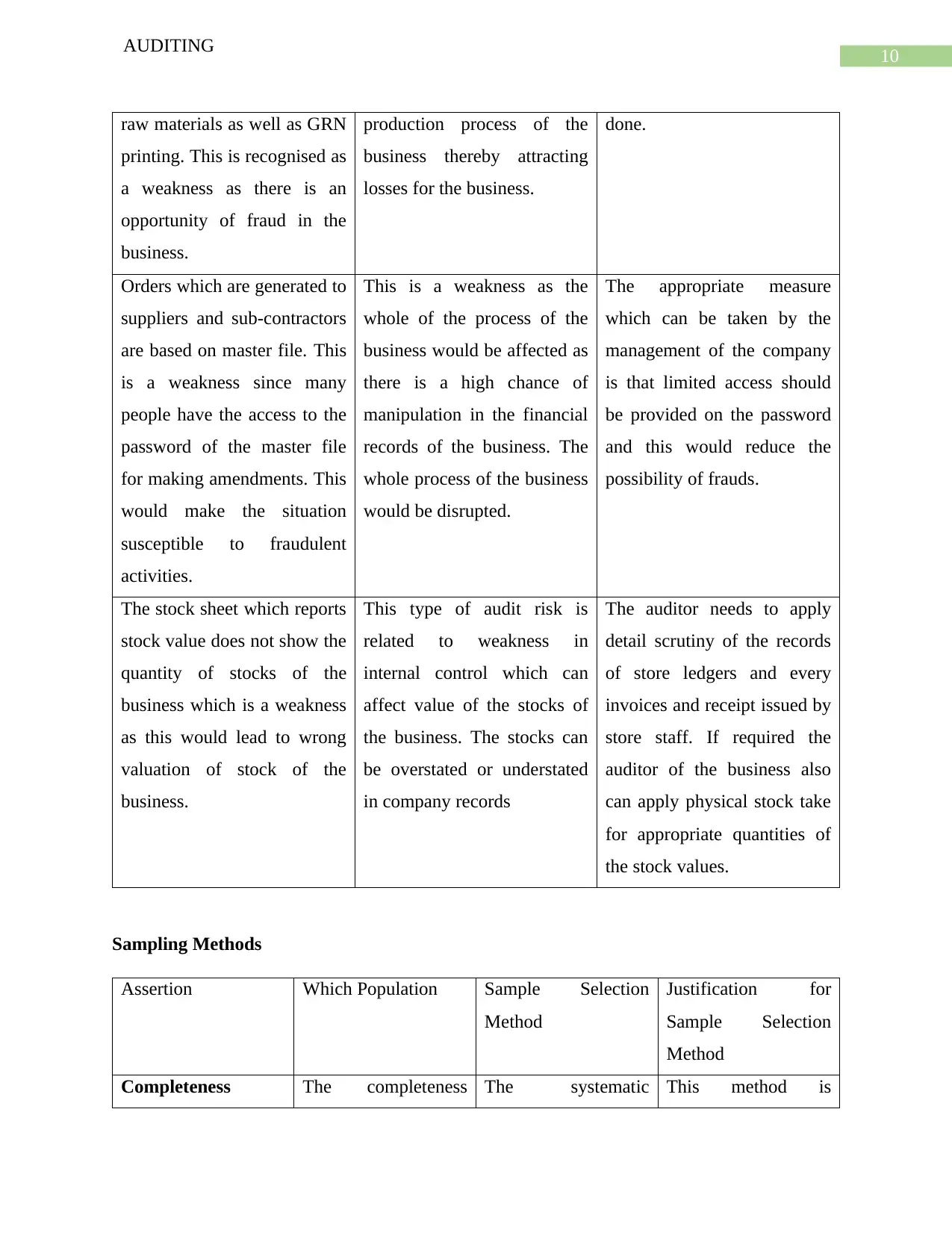

Sampling Methods

Assertion Which Population Sample Selection

Method

Justification for

Sample Selection

Method

Completeness The completeness The systematic This method is

AUDITING

raw materials as well as GRN

printing. This is recognised as

a weakness as there is an

opportunity of fraud in the

business.

production process of the

business thereby attracting

losses for the business.

done.

Orders which are generated to

suppliers and sub-contractors

are based on master file. This

is a weakness since many

people have the access to the

password of the master file

for making amendments. This

would make the situation

susceptible to fraudulent

activities.

This is a weakness as the

whole of the process of the

business would be affected as

there is a high chance of

manipulation in the financial

records of the business. The

whole process of the business

would be disrupted.

The appropriate measure

which can be taken by the

management of the company

is that limited access should

be provided on the password

and this would reduce the

possibility of frauds.

The stock sheet which reports

stock value does not show the

quantity of stocks of the

business which is a weakness

as this would lead to wrong

valuation of stock of the

business.

This type of audit risk is

related to weakness in

internal control which can

affect value of the stocks of

the business. The stocks can

be overstated or understated

in company records

The auditor needs to apply

detail scrutiny of the records

of store ledgers and every

invoices and receipt issued by

store staff. If required the

auditor of the business also

can apply physical stock take

for appropriate quantities of

the stock values.

Sampling Methods

Assertion Which Population Sample Selection

Method

Justification for

Sample Selection

Method

Completeness The completeness The systematic This method is

11

AUDITING

assertion states that

all the transactions

and accounts which

are presented in the

financial statements

must be complete.

This assertion is

mainly associated

with understatement

of inventory values. It

is for this reason that

Wayne needs to

collect sample from

finished goods and

raw materials

sampling method

would most suit the

needs of the situation.

The method involves

determination of

uniform intervals

through dividing

whole physical units

from the source

considered to be most

simple from the

perspective of the

auditor. In this

system of sampling

assurance can be

given to Wayne that

even sampling of the

total population

would be done. In

case of API, even

sampling can be done

for raw materials and

finished goods.

Therefore, there is a

chance of detection

of errors and

misstatement

following this

sampling method

(Jones, 2017). This

method includes the

use of random

number tables which

would be useful for

assessment

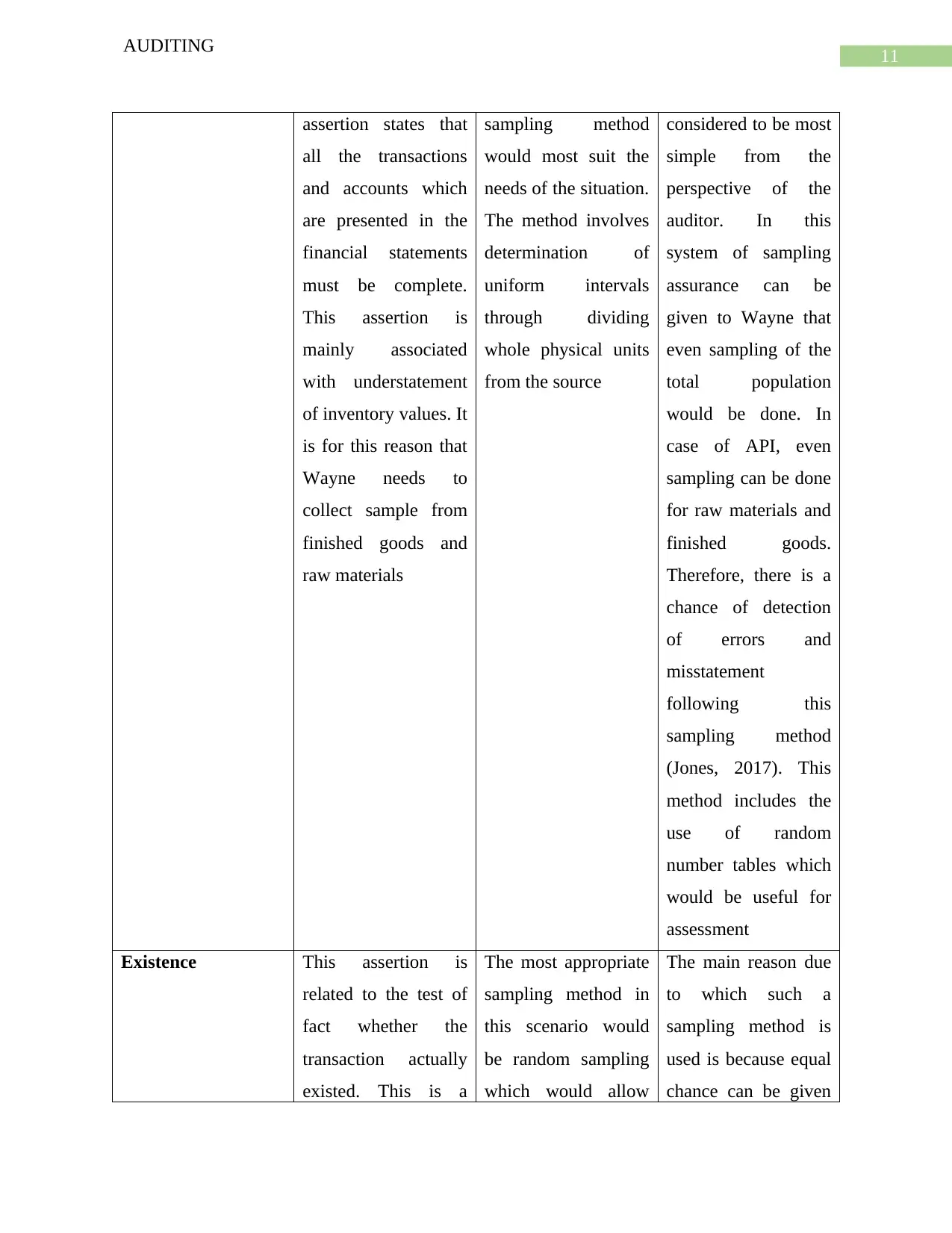

Existence This assertion is

related to the test of

fact whether the

transaction actually

existed. This is a

The most appropriate

sampling method in

this scenario would

be random sampling

which would allow

The main reason due

to which such a

sampling method is

used is because equal

chance can be given

AUDITING

assertion states that

all the transactions

and accounts which

are presented in the

financial statements

must be complete.

This assertion is

mainly associated

with understatement

of inventory values. It

is for this reason that

Wayne needs to

collect sample from

finished goods and

raw materials

sampling method

would most suit the

needs of the situation.

The method involves

determination of

uniform intervals

through dividing

whole physical units

from the source

considered to be most

simple from the

perspective of the

auditor. In this

system of sampling

assurance can be

given to Wayne that

even sampling of the

total population

would be done. In

case of API, even

sampling can be done

for raw materials and

finished goods.

Therefore, there is a

chance of detection

of errors and

misstatement

following this

sampling method

(Jones, 2017). This

method includes the

use of random

number tables which

would be useful for

assessment

Existence This assertion is

related to the test of

fact whether the

transaction actually

existed. This is a

The most appropriate

sampling method in

this scenario would

be random sampling

which would allow

The main reason due

to which such a

sampling method is

used is because equal

chance can be given

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.