Auditing Assignment: Independence, Internal Control and Weaknesses

VerifiedAdded on 2023/01/23

|12

|2886

|100

Homework Assignment

AI Summary

This auditing assignment comprehensively addresses key concepts in auditing, including auditor independence, internal control weaknesses, and related threats. The assignment begins with a discussion on the definitions of actual and perceived independence, and then analyzes several scenarios involving breaches of independence and ethical principles. It then outlines the steps an audit partner should take before accepting a new audit engagement, considering factors such as client integrity and communication with existing auditors. The assignment further examines internal control weaknesses in various contexts, including credit management, accounts receivable, cash handling, and procurement processes, identifying potential risks and implications. Finally, the assignment analyzes specific internal control weaknesses within a company, highlighting the potential for fraud and manipulation across different departments and functions, such as purchase orders, production, and master file amendments.

Running head: AUDITING

Auditing

Name of the Student

Name of the University

Author’s Note

Auditing

Name of the Student

Name of the University

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1AUDITING

Table of Contents

Answer to Question 1......................................................................................................................2

Requirement a..............................................................................................................................2

Requirement b..............................................................................................................................2

Answer to Question 2......................................................................................................................3

Answer to Question 3......................................................................................................................5

Answer to Question 4......................................................................................................................6

Answer to Question 5......................................................................................................................8

Requirement a..............................................................................................................................8

Requirement b..............................................................................................................................9

References......................................................................................................................................10

Table of Contents

Answer to Question 1......................................................................................................................2

Requirement a..............................................................................................................................2

Requirement b..............................................................................................................................2

Answer to Question 2......................................................................................................................3

Answer to Question 3......................................................................................................................5

Answer to Question 4......................................................................................................................6

Answer to Question 5......................................................................................................................8

Requirement a..............................................................................................................................8

Requirement b..............................................................................................................................9

References......................................................................................................................................10

2AUDITING

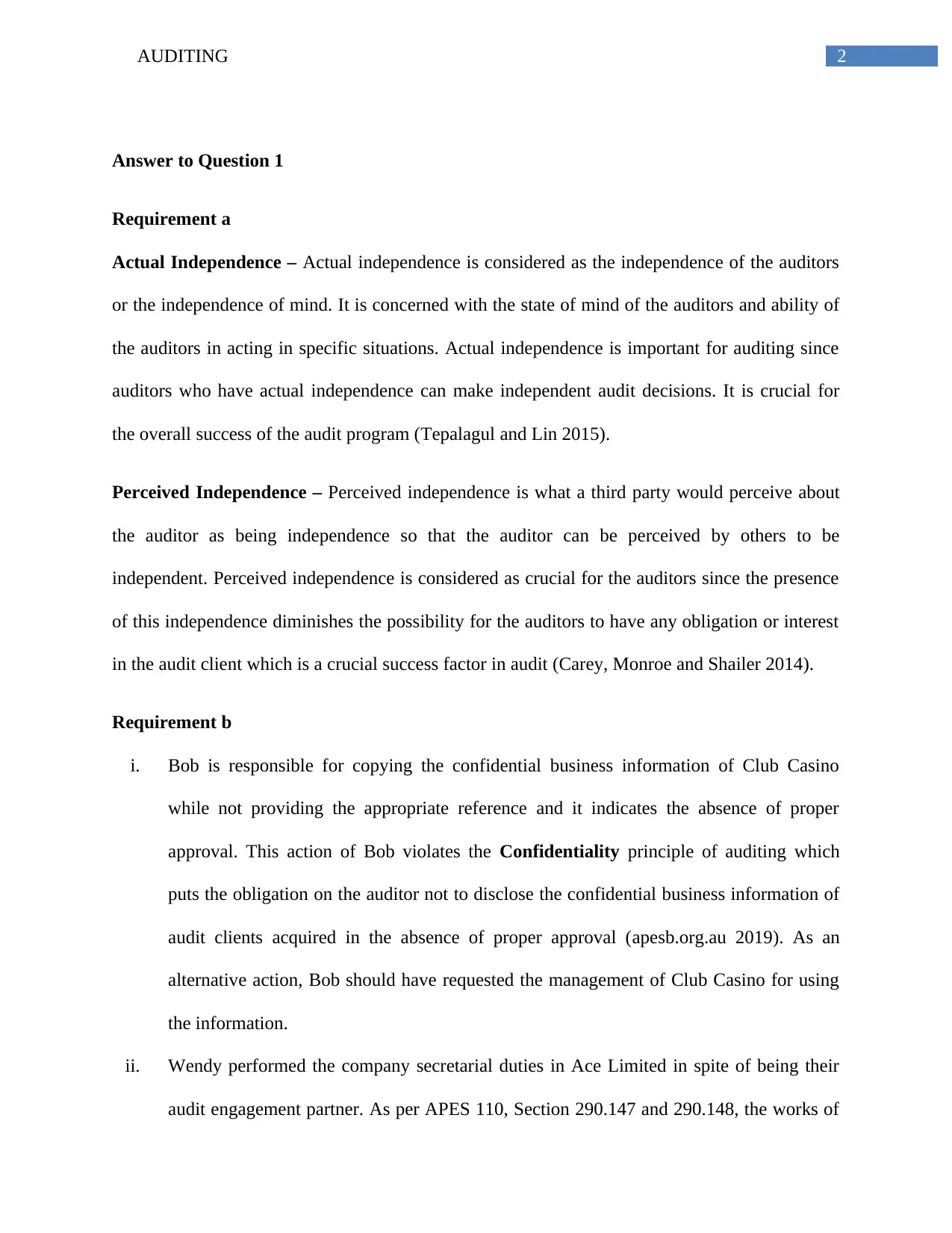

Answer to Question 1

Requirement a

Actual Independence – Actual independence is considered as the independence of the auditors

or the independence of mind. It is concerned with the state of mind of the auditors and ability of

the auditors in acting in specific situations. Actual independence is important for auditing since

auditors who have actual independence can make independent audit decisions. It is crucial for

the overall success of the audit program (Tepalagul and Lin 2015).

Perceived Independence – Perceived independence is what a third party would perceive about

the auditor as being independence so that the auditor can be perceived by others to be

independent. Perceived independence is considered as crucial for the auditors since the presence

of this independence diminishes the possibility for the auditors to have any obligation or interest

in the audit client which is a crucial success factor in audit (Carey, Monroe and Shailer 2014).

Requirement b

i. Bob is responsible for copying the confidential business information of Club Casino

while not providing the appropriate reference and it indicates the absence of proper

approval. This action of Bob violates the Confidentiality principle of auditing which

puts the obligation on the auditor not to disclose the confidential business information of

audit clients acquired in the absence of proper approval (apesb.org.au 2019). As an

alternative action, Bob should have requested the management of Club Casino for using

the information.

ii. Wendy performed the company secretarial duties in Ace Limited in spite of being their

audit engagement partner. As per APES 110, Section 290.147 and 290.148, the works of

Answer to Question 1

Requirement a

Actual Independence – Actual independence is considered as the independence of the auditors

or the independence of mind. It is concerned with the state of mind of the auditors and ability of

the auditors in acting in specific situations. Actual independence is important for auditing since

auditors who have actual independence can make independent audit decisions. It is crucial for

the overall success of the audit program (Tepalagul and Lin 2015).

Perceived Independence – Perceived independence is what a third party would perceive about

the auditor as being independence so that the auditor can be perceived by others to be

independent. Perceived independence is considered as crucial for the auditors since the presence

of this independence diminishes the possibility for the auditors to have any obligation or interest

in the audit client which is a crucial success factor in audit (Carey, Monroe and Shailer 2014).

Requirement b

i. Bob is responsible for copying the confidential business information of Club Casino

while not providing the appropriate reference and it indicates the absence of proper

approval. This action of Bob violates the Confidentiality principle of auditing which

puts the obligation on the auditor not to disclose the confidential business information of

audit clients acquired in the absence of proper approval (apesb.org.au 2019). As an

alternative action, Bob should have requested the management of Club Casino for using

the information.

ii. Wendy performed the company secretarial duties in Ace Limited in spite of being their

audit engagement partner. As per APES 110, Section 290.147 and 290.148, the works of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3AUDITING

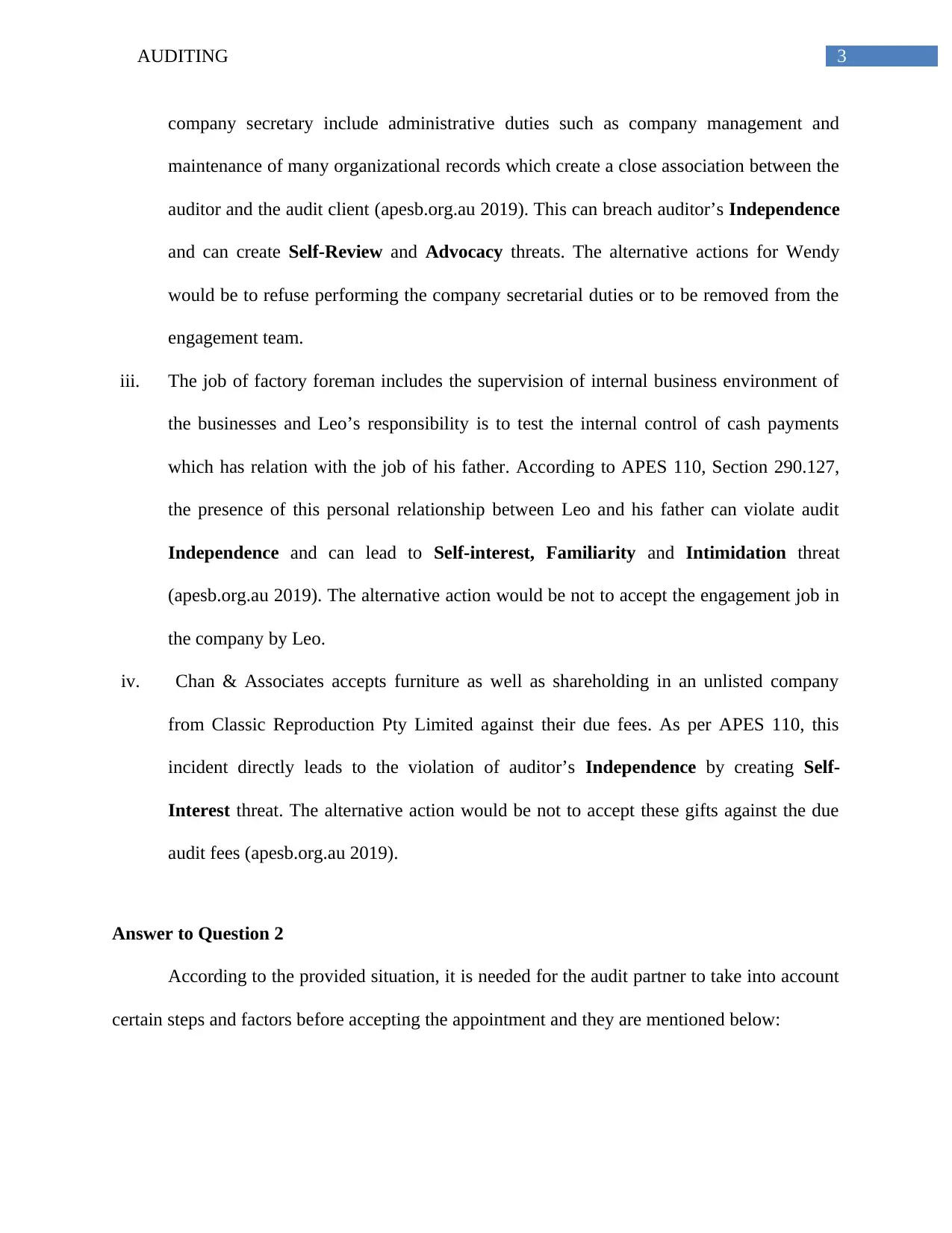

company secretary include administrative duties such as company management and

maintenance of many organizational records which create a close association between the

auditor and the audit client (apesb.org.au 2019). This can breach auditor’s Independence

and can create Self-Review and Advocacy threats. The alternative actions for Wendy

would be to refuse performing the company secretarial duties or to be removed from the

engagement team.

iii. The job of factory foreman includes the supervision of internal business environment of

the businesses and Leo’s responsibility is to test the internal control of cash payments

which has relation with the job of his father. According to APES 110, Section 290.127,

the presence of this personal relationship between Leo and his father can violate audit

Independence and can lead to Self-interest, Familiarity and Intimidation threat

(apesb.org.au 2019). The alternative action would be not to accept the engagement job in

the company by Leo.

iv. Chan & Associates accepts furniture as well as shareholding in an unlisted company

from Classic Reproduction Pty Limited against their due fees. As per APES 110, this

incident directly leads to the violation of auditor’s Independence by creating Self-

Interest threat. The alternative action would be not to accept these gifts against the due

audit fees (apesb.org.au 2019).

Answer to Question 2

According to the provided situation, it is needed for the audit partner to take into account

certain steps and factors before accepting the appointment and they are mentioned below:

company secretary include administrative duties such as company management and

maintenance of many organizational records which create a close association between the

auditor and the audit client (apesb.org.au 2019). This can breach auditor’s Independence

and can create Self-Review and Advocacy threats. The alternative actions for Wendy

would be to refuse performing the company secretarial duties or to be removed from the

engagement team.

iii. The job of factory foreman includes the supervision of internal business environment of

the businesses and Leo’s responsibility is to test the internal control of cash payments

which has relation with the job of his father. According to APES 110, Section 290.127,

the presence of this personal relationship between Leo and his father can violate audit

Independence and can lead to Self-interest, Familiarity and Intimidation threat

(apesb.org.au 2019). The alternative action would be not to accept the engagement job in

the company by Leo.

iv. Chan & Associates accepts furniture as well as shareholding in an unlisted company

from Classic Reproduction Pty Limited against their due fees. As per APES 110, this

incident directly leads to the violation of auditor’s Independence by creating Self-

Interest threat. The alternative action would be not to accept these gifts against the due

audit fees (apesb.org.au 2019).

Answer to Question 2

According to the provided situation, it is needed for the audit partner to take into account

certain steps and factors before accepting the appointment and they are mentioned below:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4AUDITING

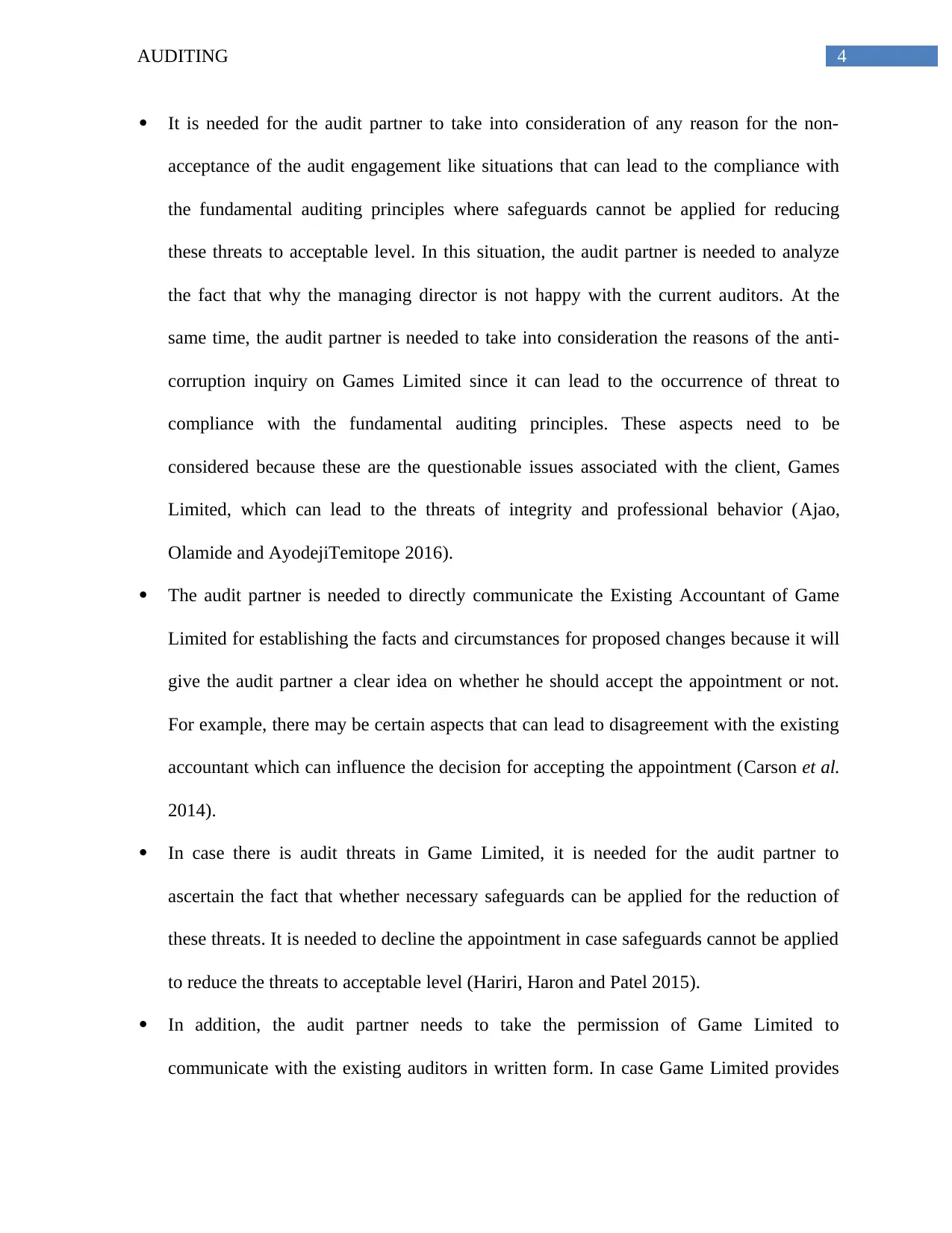

It is needed for the audit partner to take into consideration of any reason for the non-

acceptance of the audit engagement like situations that can lead to the compliance with

the fundamental auditing principles where safeguards cannot be applied for reducing

these threats to acceptable level. In this situation, the audit partner is needed to analyze

the fact that why the managing director is not happy with the current auditors. At the

same time, the audit partner is needed to take into consideration the reasons of the anti-

corruption inquiry on Games Limited since it can lead to the occurrence of threat to

compliance with the fundamental auditing principles. These aspects need to be

considered because these are the questionable issues associated with the client, Games

Limited, which can lead to the threats of integrity and professional behavior (Ajao,

Olamide and AyodejiTemitope 2016).

The audit partner is needed to directly communicate the Existing Accountant of Game

Limited for establishing the facts and circumstances for proposed changes because it will

give the audit partner a clear idea on whether he should accept the appointment or not.

For example, there may be certain aspects that can lead to disagreement with the existing

accountant which can influence the decision for accepting the appointment (Carson et al.

2014).

In case there is audit threats in Game Limited, it is needed for the audit partner to

ascertain the fact that whether necessary safeguards can be applied for the reduction of

these threats. It is needed to decline the appointment in case safeguards cannot be applied

to reduce the threats to acceptable level (Hariri, Haron and Patel 2015).

In addition, the audit partner needs to take the permission of Game Limited to

communicate with the existing auditors in written form. In case Game Limited provides

It is needed for the audit partner to take into consideration of any reason for the non-

acceptance of the audit engagement like situations that can lead to the compliance with

the fundamental auditing principles where safeguards cannot be applied for reducing

these threats to acceptable level. In this situation, the audit partner is needed to analyze

the fact that why the managing director is not happy with the current auditors. At the

same time, the audit partner is needed to take into consideration the reasons of the anti-

corruption inquiry on Games Limited since it can lead to the occurrence of threat to

compliance with the fundamental auditing principles. These aspects need to be

considered because these are the questionable issues associated with the client, Games

Limited, which can lead to the threats of integrity and professional behavior (Ajao,

Olamide and AyodejiTemitope 2016).

The audit partner is needed to directly communicate the Existing Accountant of Game

Limited for establishing the facts and circumstances for proposed changes because it will

give the audit partner a clear idea on whether he should accept the appointment or not.

For example, there may be certain aspects that can lead to disagreement with the existing

accountant which can influence the decision for accepting the appointment (Carson et al.

2014).

In case there is audit threats in Game Limited, it is needed for the audit partner to

ascertain the fact that whether necessary safeguards can be applied for the reduction of

these threats. It is needed to decline the appointment in case safeguards cannot be applied

to reduce the threats to acceptable level (Hariri, Haron and Patel 2015).

In addition, the audit partner needs to take the permission of Game Limited to

communicate with the existing auditors in written form. In case Game Limited provides

5AUDITING

the permission, the audit partner needs to request the existing auditor for all information

required for making decision on audit acceptance. The audit partner needs to decline the

appointment in case Game Limited declines to provide the permission (Hariri, Haron and

Patel 2015).

Answer to Question 3

Sl. No. Internal Control Weakness Reasons

1 Credit manager is solely responsible for

credit permission based on his familiarity

with the contractor’s reputation

The manager can provide approval of

providing credit to his relatives or friends

who do not have reputation. It can lead to

default in payment (Gillett 2016).

2 Accounts receivable supervisor has the

independent responsibility for verifying

the pricing and other details and to

prepare the invoice

The accounts receivable manager can

provide unnecessary discount in prices to

the contracts due to his personal gain

which can be loss making for the company

3 Accounts receivable manager prepares

the monthly computer-generated

accounts receivable subsidiary ledger

without reconciling it with accounts

receivable, control account and overdue

account monthly report

This can lead to the faulty accounts

receivable subsidiary ledger which can

show reduced or excess receivables from

the contracts (Dzomira 2014).

4 Cashier does not have the access to the

journal or ledger

This make the cashier unable to verify

whether the correct cash payments and

collections are recorded in the journal or

ledgers which can lead to errors in cash

payment and received

5 Cashier is solely responsible for

performing the cash receipt function

It provides him the scope to

misappropriate funds from some of the

transactions which can lead to the

the permission, the audit partner needs to request the existing auditor for all information

required for making decision on audit acceptance. The audit partner needs to decline the

appointment in case Game Limited declines to provide the permission (Hariri, Haron and

Patel 2015).

Answer to Question 3

Sl. No. Internal Control Weakness Reasons

1 Credit manager is solely responsible for

credit permission based on his familiarity

with the contractor’s reputation

The manager can provide approval of

providing credit to his relatives or friends

who do not have reputation. It can lead to

default in payment (Gillett 2016).

2 Accounts receivable supervisor has the

independent responsibility for verifying

the pricing and other details and to

prepare the invoice

The accounts receivable manager can

provide unnecessary discount in prices to

the contracts due to his personal gain

which can be loss making for the company

3 Accounts receivable manager prepares

the monthly computer-generated

accounts receivable subsidiary ledger

without reconciling it with accounts

receivable, control account and overdue

account monthly report

This can lead to the faulty accounts

receivable subsidiary ledger which can

show reduced or excess receivables from

the contracts (Dzomira 2014).

4 Cashier does not have the access to the

journal or ledger

This make the cashier unable to verify

whether the correct cash payments and

collections are recorded in the journal or

ledgers which can lead to errors in cash

payment and received

5 Cashier is solely responsible for

performing the cash receipt function

It provides him the scope to

misappropriate funds from some of the

transactions which can lead to the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6AUDITING

falsification in the cash balances. This can

harm the company (Maguire 2014).

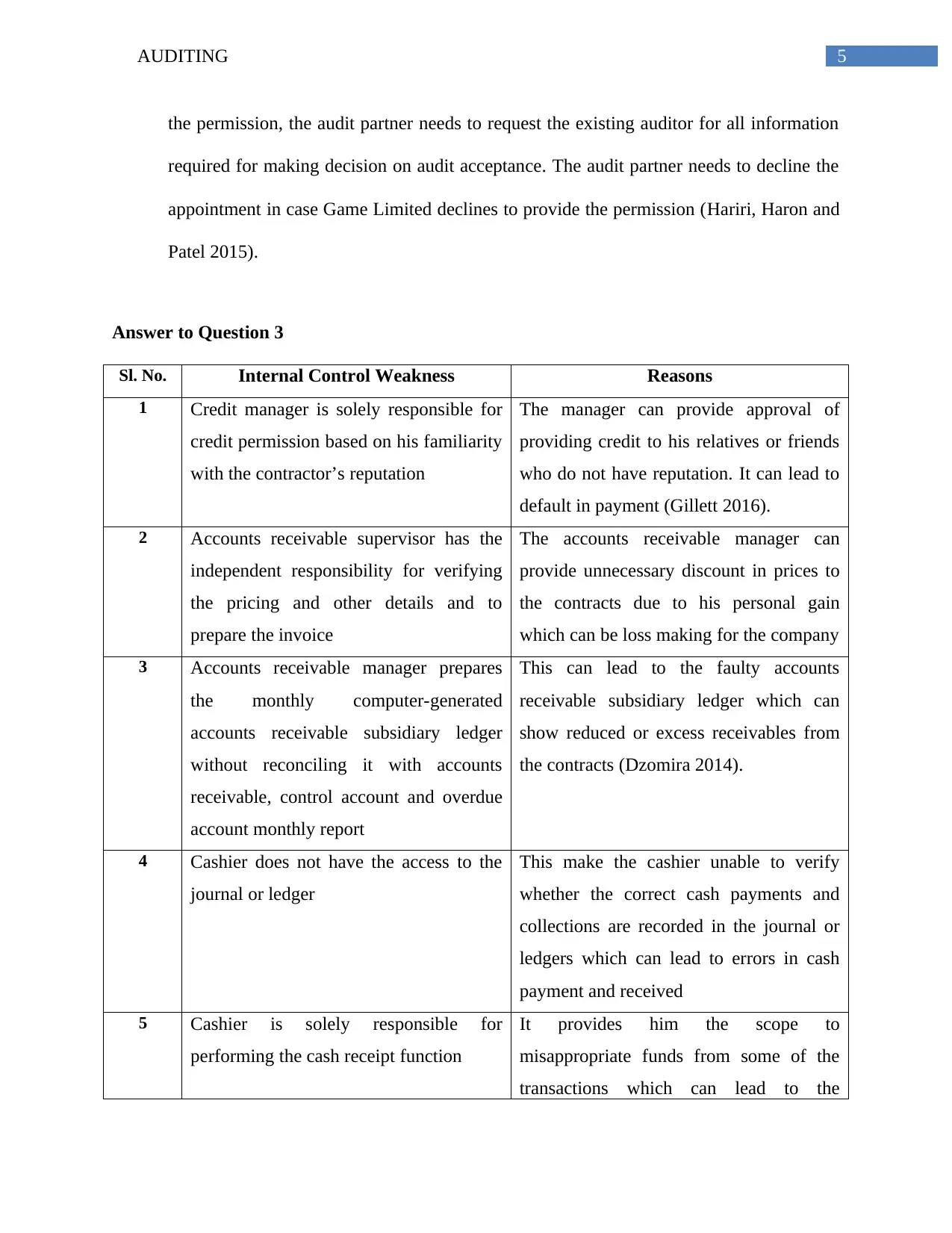

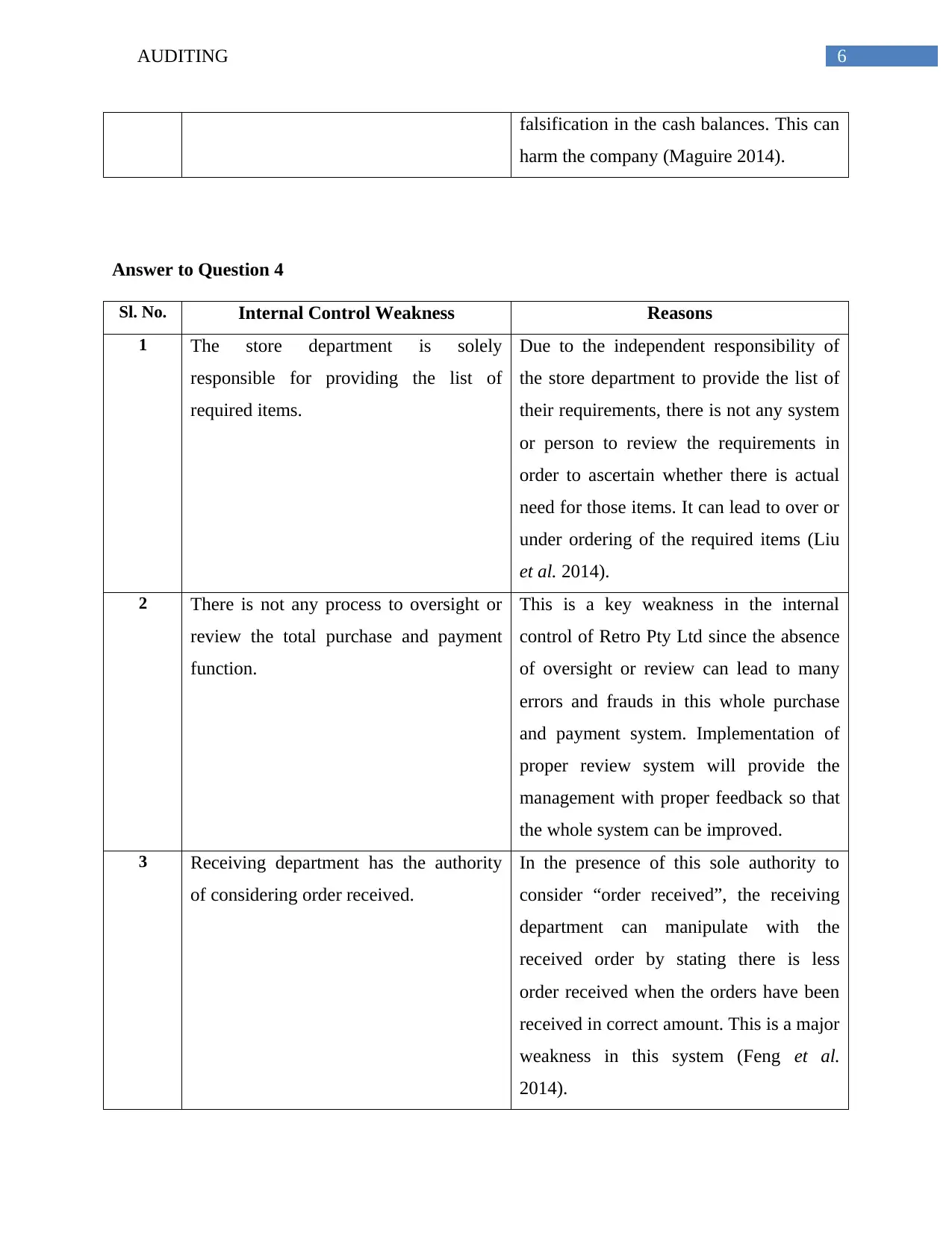

Answer to Question 4

Sl. No. Internal Control Weakness Reasons

1 The store department is solely

responsible for providing the list of

required items.

Due to the independent responsibility of

the store department to provide the list of

their requirements, there is not any system

or person to review the requirements in

order to ascertain whether there is actual

need for those items. It can lead to over or

under ordering of the required items (Liu

et al. 2014).

2 There is not any process to oversight or

review the total purchase and payment

function.

This is a key weakness in the internal

control of Retro Pty Ltd since the absence

of oversight or review can lead to many

errors and frauds in this whole purchase

and payment system. Implementation of

proper review system will provide the

management with proper feedback so that

the whole system can be improved.

3 Receiving department has the authority

of considering order received.

In the presence of this sole authority to

consider “order received”, the receiving

department can manipulate with the

received order by stating there is less

order received when the orders have been

received in correct amount. This is a major

weakness in this system (Feng et al.

2014).

falsification in the cash balances. This can

harm the company (Maguire 2014).

Answer to Question 4

Sl. No. Internal Control Weakness Reasons

1 The store department is solely

responsible for providing the list of

required items.

Due to the independent responsibility of

the store department to provide the list of

their requirements, there is not any system

or person to review the requirements in

order to ascertain whether there is actual

need for those items. It can lead to over or

under ordering of the required items (Liu

et al. 2014).

2 There is not any process to oversight or

review the total purchase and payment

function.

This is a key weakness in the internal

control of Retro Pty Ltd since the absence

of oversight or review can lead to many

errors and frauds in this whole purchase

and payment system. Implementation of

proper review system will provide the

management with proper feedback so that

the whole system can be improved.

3 Receiving department has the authority

of considering order received.

In the presence of this sole authority to

consider “order received”, the receiving

department can manipulate with the

received order by stating there is less

order received when the orders have been

received in correct amount. This is a major

weakness in this system (Feng et al.

2014).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7AUDITING

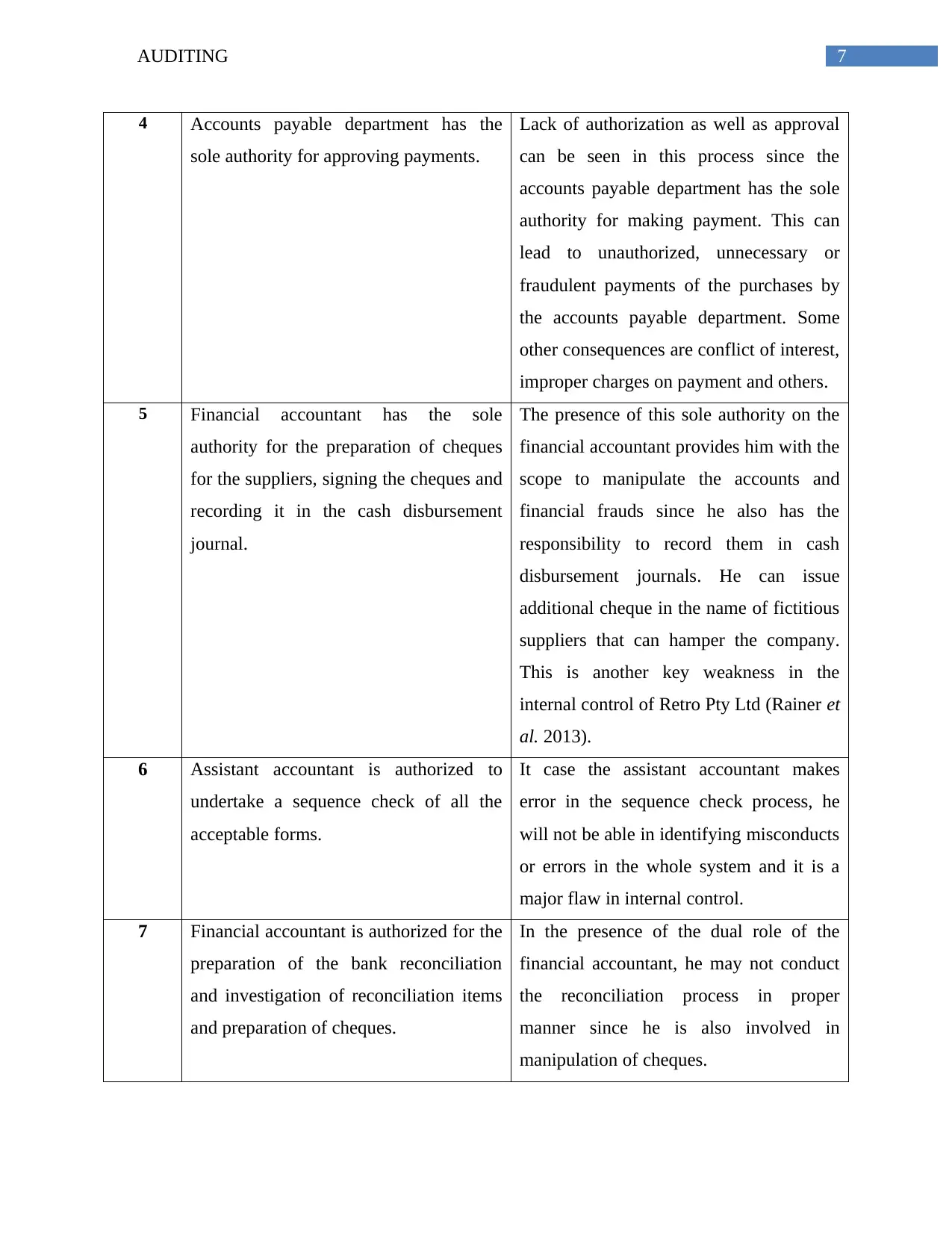

4 Accounts payable department has the

sole authority for approving payments.

Lack of authorization as well as approval

can be seen in this process since the

accounts payable department has the sole

authority for making payment. This can

lead to unauthorized, unnecessary or

fraudulent payments of the purchases by

the accounts payable department. Some

other consequences are conflict of interest,

improper charges on payment and others.

5 Financial accountant has the sole

authority for the preparation of cheques

for the suppliers, signing the cheques and

recording it in the cash disbursement

journal.

The presence of this sole authority on the

financial accountant provides him with the

scope to manipulate the accounts and

financial frauds since he also has the

responsibility to record them in cash

disbursement journals. He can issue

additional cheque in the name of fictitious

suppliers that can hamper the company.

This is another key weakness in the

internal control of Retro Pty Ltd (Rainer et

al. 2013).

6 Assistant accountant is authorized to

undertake a sequence check of all the

acceptable forms.

It case the assistant accountant makes

error in the sequence check process, he

will not be able in identifying misconducts

or errors in the whole system and it is a

major flaw in internal control.

7 Financial accountant is authorized for the

preparation of the bank reconciliation

and investigation of reconciliation items

and preparation of cheques.

In the presence of the dual role of the

financial accountant, he may not conduct

the reconciliation process in proper

manner since he is also involved in

manipulation of cheques.

4 Accounts payable department has the

sole authority for approving payments.

Lack of authorization as well as approval

can be seen in this process since the

accounts payable department has the sole

authority for making payment. This can

lead to unauthorized, unnecessary or

fraudulent payments of the purchases by

the accounts payable department. Some

other consequences are conflict of interest,

improper charges on payment and others.

5 Financial accountant has the sole

authority for the preparation of cheques

for the suppliers, signing the cheques and

recording it in the cash disbursement

journal.

The presence of this sole authority on the

financial accountant provides him with the

scope to manipulate the accounts and

financial frauds since he also has the

responsibility to record them in cash

disbursement journals. He can issue

additional cheque in the name of fictitious

suppliers that can hamper the company.

This is another key weakness in the

internal control of Retro Pty Ltd (Rainer et

al. 2013).

6 Assistant accountant is authorized to

undertake a sequence check of all the

acceptable forms.

It case the assistant accountant makes

error in the sequence check process, he

will not be able in identifying misconducts

or errors in the whole system and it is a

major flaw in internal control.

7 Financial accountant is authorized for the

preparation of the bank reconciliation

and investigation of reconciliation items

and preparation of cheques.

In the presence of the dual role of the

financial accountant, he may not conduct

the reconciliation process in proper

manner since he is also involved in

manipulation of cheques.

8AUDITING

Answer to Question 5

Requirement a

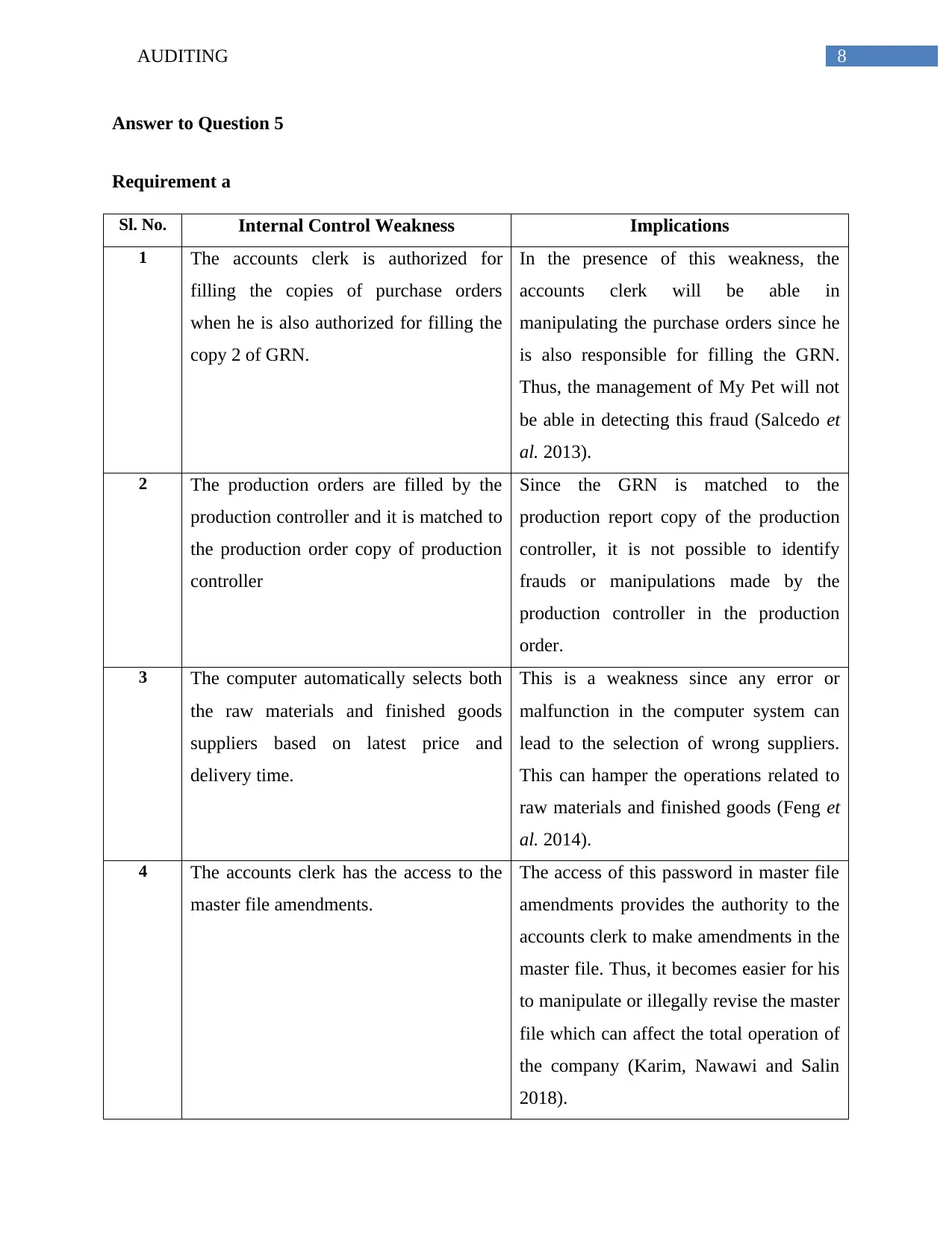

Sl. No. Internal Control Weakness Implications

1 The accounts clerk is authorized for

filling the copies of purchase orders

when he is also authorized for filling the

copy 2 of GRN.

In the presence of this weakness, the

accounts clerk will be able in

manipulating the purchase orders since he

is also responsible for filling the GRN.

Thus, the management of My Pet will not

be able in detecting this fraud (Salcedo et

al. 2013).

2 The production orders are filled by the

production controller and it is matched to

the production order copy of production

controller

Since the GRN is matched to the

production report copy of the production

controller, it is not possible to identify

frauds or manipulations made by the

production controller in the production

order.

3 The computer automatically selects both

the raw materials and finished goods

suppliers based on latest price and

delivery time.

This is a weakness since any error or

malfunction in the computer system can

lead to the selection of wrong suppliers.

This can hamper the operations related to

raw materials and finished goods (Feng et

al. 2014).

4 The accounts clerk has the access to the

master file amendments.

The access of this password in master file

amendments provides the authority to the

accounts clerk to make amendments in the

master file. Thus, it becomes easier for his

to manipulate or illegally revise the master

file which can affect the total operation of

the company (Karim, Nawawi and Salin

2018).

Answer to Question 5

Requirement a

Sl. No. Internal Control Weakness Implications

1 The accounts clerk is authorized for

filling the copies of purchase orders

when he is also authorized for filling the

copy 2 of GRN.

In the presence of this weakness, the

accounts clerk will be able in

manipulating the purchase orders since he

is also responsible for filling the GRN.

Thus, the management of My Pet will not

be able in detecting this fraud (Salcedo et

al. 2013).

2 The production orders are filled by the

production controller and it is matched to

the production order copy of production

controller

Since the GRN is matched to the

production report copy of the production

controller, it is not possible to identify

frauds or manipulations made by the

production controller in the production

order.

3 The computer automatically selects both

the raw materials and finished goods

suppliers based on latest price and

delivery time.

This is a weakness since any error or

malfunction in the computer system can

lead to the selection of wrong suppliers.

This can hamper the operations related to

raw materials and finished goods (Feng et

al. 2014).

4 The accounts clerk has the access to the

master file amendments.

The access of this password in master file

amendments provides the authority to the

accounts clerk to make amendments in the

master file. Thus, it becomes easier for his

to manipulate or illegally revise the master

file which can affect the total operation of

the company (Karim, Nawawi and Salin

2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9AUDITING

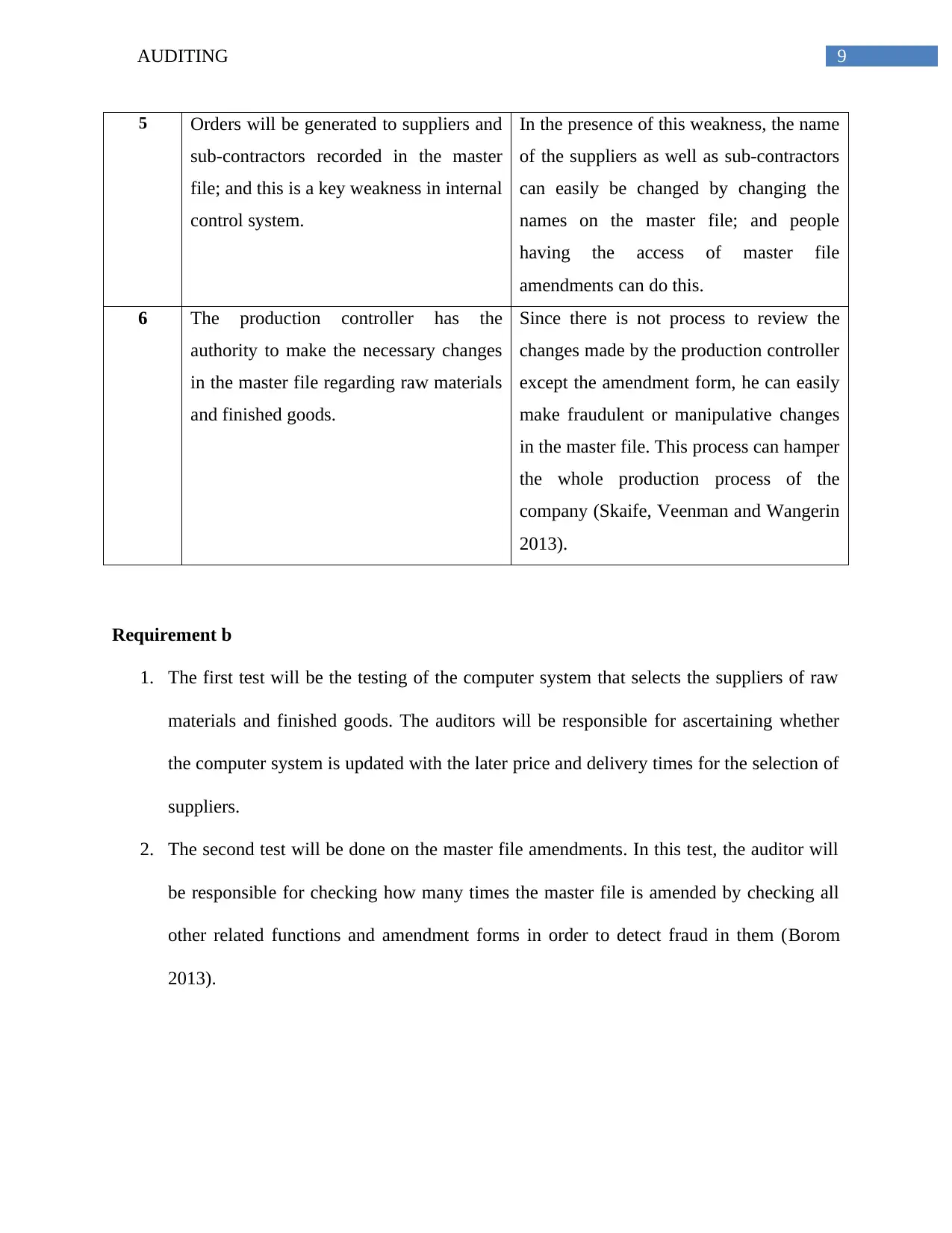

5 Orders will be generated to suppliers and

sub-contractors recorded in the master

file; and this is a key weakness in internal

control system.

In the presence of this weakness, the name

of the suppliers as well as sub-contractors

can easily be changed by changing the

names on the master file; and people

having the access of master file

amendments can do this.

6 The production controller has the

authority to make the necessary changes

in the master file regarding raw materials

and finished goods.

Since there is not process to review the

changes made by the production controller

except the amendment form, he can easily

make fraudulent or manipulative changes

in the master file. This process can hamper

the whole production process of the

company (Skaife, Veenman and Wangerin

2013).

Requirement b

1. The first test will be the testing of the computer system that selects the suppliers of raw

materials and finished goods. The auditors will be responsible for ascertaining whether

the computer system is updated with the later price and delivery times for the selection of

suppliers.

2. The second test will be done on the master file amendments. In this test, the auditor will

be responsible for checking how many times the master file is amended by checking all

other related functions and amendment forms in order to detect fraud in them (Borom

2013).

5 Orders will be generated to suppliers and

sub-contractors recorded in the master

file; and this is a key weakness in internal

control system.

In the presence of this weakness, the name

of the suppliers as well as sub-contractors

can easily be changed by changing the

names on the master file; and people

having the access of master file

amendments can do this.

6 The production controller has the

authority to make the necessary changes

in the master file regarding raw materials

and finished goods.

Since there is not process to review the

changes made by the production controller

except the amendment form, he can easily

make fraudulent or manipulative changes

in the master file. This process can hamper

the whole production process of the

company (Skaife, Veenman and Wangerin

2013).

Requirement b

1. The first test will be the testing of the computer system that selects the suppliers of raw

materials and finished goods. The auditors will be responsible for ascertaining whether

the computer system is updated with the later price and delivery times for the selection of

suppliers.

2. The second test will be done on the master file amendments. In this test, the auditor will

be responsible for checking how many times the master file is amended by checking all

other related functions and amendment forms in order to detect fraud in them (Borom

2013).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10AUDITING

References

Ajao, O.S., Olamide, J.O. and AyodejiTemitope, A., 2016. Evolution and development of

auditing. Unique Journal of Business Management Research, 3(1), pp.32-40.

Apesb.org.au. 2019. APES 110 Code of Ethics for Professional Accountants. [online] Available

at: https://www.apesb.org.au/uploads/standards/apesb_standards/standard1.pdf [Accessed 28

Apr. 2019].

Borom, M.P., RGIS LLC, 2013. Inventory verification system and method. U.S. Patent

8,606,658.

Carey, P.J., Monroe, G.S. and Shailer, G., 2014. Review of Post‐CLERP 9 Australian Auditor

Independence Research. Australian Accounting Review, 24(4), pp.370-380.

Carson, E., Simnett, R., Trompeter, G. and Vanstraelen, A., 2014, July. The Impact of other

component auditors on the costs and quality of multinational group audits. In Proceedings of the

Accounting and Finance Association of Australia and New Zealand (AFAANZ) Conference.

Auckland. New Zealand(Vol. 6, No. 8).

Dzomira, S., 2014. Internal controls and fraud schemes in not-for-profit organisations: a guide to

good practice. Research Journal of Finance and Accounting, 5(2), pp.118-126.

Feng, M., Li, C., McVay, S.E. and Skaife, H., 2014. Does ineffective internal control over

financial reporting affect a firm's operations? Evidence from firms' inventory management. The

Accounting Review, 90(2), pp.529-557.

Gillett, P.R., 2016. Accounting Information Systems. John Wiley & Sons, Incorporated.

References

Ajao, O.S., Olamide, J.O. and AyodejiTemitope, A., 2016. Evolution and development of

auditing. Unique Journal of Business Management Research, 3(1), pp.32-40.

Apesb.org.au. 2019. APES 110 Code of Ethics for Professional Accountants. [online] Available

at: https://www.apesb.org.au/uploads/standards/apesb_standards/standard1.pdf [Accessed 28

Apr. 2019].

Borom, M.P., RGIS LLC, 2013. Inventory verification system and method. U.S. Patent

8,606,658.

Carey, P.J., Monroe, G.S. and Shailer, G., 2014. Review of Post‐CLERP 9 Australian Auditor

Independence Research. Australian Accounting Review, 24(4), pp.370-380.

Carson, E., Simnett, R., Trompeter, G. and Vanstraelen, A., 2014, July. The Impact of other

component auditors on the costs and quality of multinational group audits. In Proceedings of the

Accounting and Finance Association of Australia and New Zealand (AFAANZ) Conference.

Auckland. New Zealand(Vol. 6, No. 8).

Dzomira, S., 2014. Internal controls and fraud schemes in not-for-profit organisations: a guide to

good practice. Research Journal of Finance and Accounting, 5(2), pp.118-126.

Feng, M., Li, C., McVay, S.E. and Skaife, H., 2014. Does ineffective internal control over

financial reporting affect a firm's operations? Evidence from firms' inventory management. The

Accounting Review, 90(2), pp.529-557.

Gillett, P.R., 2016. Accounting Information Systems. John Wiley & Sons, Incorporated.

11AUDITING

Hariri, H., Haron, H. and Patel, C., 2015. Factors influencing the independence of government

auditors. Problems and Prospects in Management, 13(2), pp.380-388.

Karim, N.A., Nawawi, A. and Salin, A.S.A.P., 2018. Inventory control weaknesses–a case study

of lubricant manufacturing company. Journal of Financial Crime, 25(2), pp.436-449.

Liu, Y., Zhu, X. and Ren, J., Metrologic Instruments Inc, 2014. Indicia encoding system with

integrated purchase and payment information. U.S. Patent Application 13/885,218.

Maguire, K.A., 2014. Best Practices for Nonprofits' Internal Control Self-Assessment. Advances

in Management and Applied Economics, 4(1), p.41.

Rainer, R.K., Cegielski, C.G., Splettstoesser-Hogeterp, I. and Sanchez-Rodriguez, C.,

2013. Introduction to information systems. John Wiley & Sons.

Salcedo, C.A.G., Hernandez, A.I., Vilanova, R. and Cuartas, J.H., 2013. Inventory control of

supply chains: Mitigating the bullwhip effect by centralized and decentralized Internal Model

Control approaches. European Journal of Operational Research, 224(2), pp.261-272.

Skaife, H.A., Veenman, D. and Wangerin, D., 2013. Internal control over financial reporting and

managerial rent extraction: Evidence from the profitability of insider trading. Journal of

Accounting and Economics, 55(1), pp.91-110.

Tepalagul, N. and Lin, L., 2015. Auditor independence and audit quality: A literature

review. Journal of Accounting, Auditing & Finance, 30(1), pp.101-121.

Hariri, H., Haron, H. and Patel, C., 2015. Factors influencing the independence of government

auditors. Problems and Prospects in Management, 13(2), pp.380-388.

Karim, N.A., Nawawi, A. and Salin, A.S.A.P., 2018. Inventory control weaknesses–a case study

of lubricant manufacturing company. Journal of Financial Crime, 25(2), pp.436-449.

Liu, Y., Zhu, X. and Ren, J., Metrologic Instruments Inc, 2014. Indicia encoding system with

integrated purchase and payment information. U.S. Patent Application 13/885,218.

Maguire, K.A., 2014. Best Practices for Nonprofits' Internal Control Self-Assessment. Advances

in Management and Applied Economics, 4(1), p.41.

Rainer, R.K., Cegielski, C.G., Splettstoesser-Hogeterp, I. and Sanchez-Rodriguez, C.,

2013. Introduction to information systems. John Wiley & Sons.

Salcedo, C.A.G., Hernandez, A.I., Vilanova, R. and Cuartas, J.H., 2013. Inventory control of

supply chains: Mitigating the bullwhip effect by centralized and decentralized Internal Model

Control approaches. European Journal of Operational Research, 224(2), pp.261-272.

Skaife, H.A., Veenman, D. and Wangerin, D., 2013. Internal control over financial reporting and

managerial rent extraction: Evidence from the profitability of insider trading. Journal of

Accounting and Economics, 55(1), pp.91-110.

Tepalagul, N. and Lin, L., 2015. Auditor independence and audit quality: A literature

review. Journal of Accounting, Auditing & Finance, 30(1), pp.101-121.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.