Auditing Report: API Financial Statement Audit and Risks

VerifiedAdded on 2023/03/20

|19

|3629

|98

Report

AI Summary

This report presents an in-depth analysis of the auditing process applied to Always Precise Instruments Private Limited (API). It begins with an examination of audit risks identified through ratio analysis, including current ratio, quick asset ratio, return on equity, return on total assets, gross margin, marketing expenses, administrative expenses, times interest earned, days in inventory, days in receivable accounts, and debt-to-equity ratio. Each ratio is evaluated for potential misstatements and corresponding audit procedures are suggested. The report then investigates inventory control loopholes, detailing weaknesses in the internal control system and their associated audit risks and procedures. Finally, it explains the methods of sampling required for auditing API, providing a comprehensive guide for financial statement analysis and risk mitigation.

Running head: AUDITING

Auditing

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Auditing

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1AUDITING

Table of Contents

Audit risks from ratios and audit procedures:..................................................................................2

Inventory control loopholes, audit risk and audit procedures:......................................................10

Methods of sampling:....................................................................................................................14

References:....................................................................................................................................17

Table of Contents

Audit risks from ratios and audit procedures:..................................................................................2

Inventory control loopholes, audit risk and audit procedures:......................................................10

Methods of sampling:....................................................................................................................14

References:....................................................................................................................................17

2AUDITING

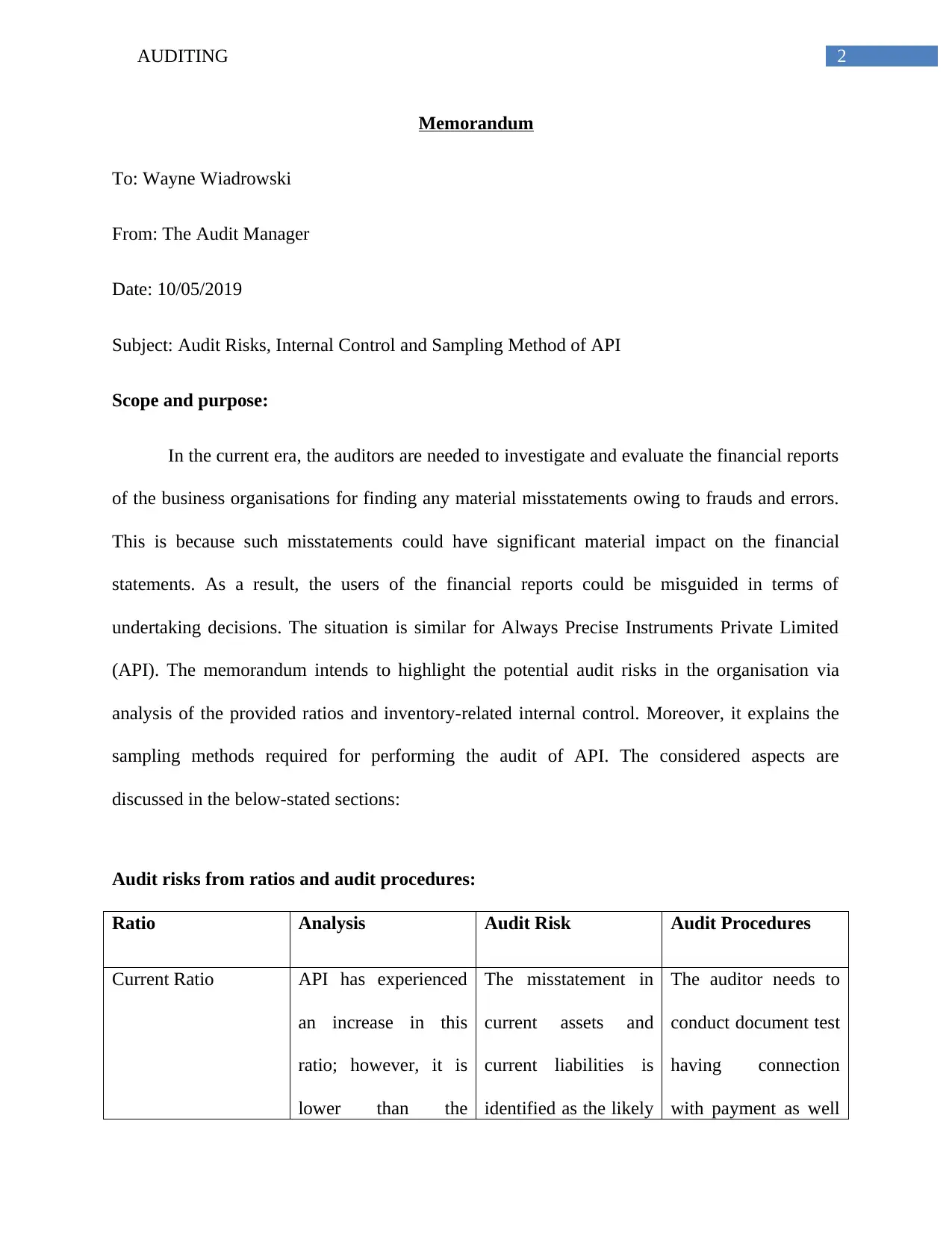

Memorandum

To: Wayne Wiadrowski

From: The Audit Manager

Date: 10/05/2019

Subject: Audit Risks, Internal Control and Sampling Method of API

Scope and purpose:

In the current era, the auditors are needed to investigate and evaluate the financial reports

of the business organisations for finding any material misstatements owing to frauds and errors.

This is because such misstatements could have significant material impact on the financial

statements. As a result, the users of the financial reports could be misguided in terms of

undertaking decisions. The situation is similar for Always Precise Instruments Private Limited

(API). The memorandum intends to highlight the potential audit risks in the organisation via

analysis of the provided ratios and inventory-related internal control. Moreover, it explains the

sampling methods required for performing the audit of API. The considered aspects are

discussed in the below-stated sections:

Audit risks from ratios and audit procedures:

Ratio Analysis Audit Risk Audit Procedures

Current Ratio API has experienced

an increase in this

ratio; however, it is

lower than the

The misstatement in

current assets and

current liabilities is

identified as the likely

The auditor needs to

conduct document test

having connection

with payment as well

Memorandum

To: Wayne Wiadrowski

From: The Audit Manager

Date: 10/05/2019

Subject: Audit Risks, Internal Control and Sampling Method of API

Scope and purpose:

In the current era, the auditors are needed to investigate and evaluate the financial reports

of the business organisations for finding any material misstatements owing to frauds and errors.

This is because such misstatements could have significant material impact on the financial

statements. As a result, the users of the financial reports could be misguided in terms of

undertaking decisions. The situation is similar for Always Precise Instruments Private Limited

(API). The memorandum intends to highlight the potential audit risks in the organisation via

analysis of the provided ratios and inventory-related internal control. Moreover, it explains the

sampling methods required for performing the audit of API. The considered aspects are

discussed in the below-stated sections:

Audit risks from ratios and audit procedures:

Ratio Analysis Audit Risk Audit Procedures

Current Ratio API has experienced

an increase in this

ratio; however, it is

lower than the

The misstatement in

current assets and

current liabilities is

identified as the likely

The auditor needs to

conduct document test

having connection

with payment as well

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3AUDITING

industrial standard. It

might due to decline

in current liabilities or

increase in current

assets.

audit risk like rise or

fall in the above-

stated assets and

liabilities from

management

(Alzeban, 2015).

as acquisition of

current assets and

current liabilities.

This would help in

ascertaining thee

accurate values of the

same (Ball, Tyler &

Wells, 2015).

Quick asset ratio According to the

provided information,

this ratio has risen in

the present year

implying increased

ability of API in

converting its most

liquid assets into cash

that would help in

settling short-term

dues timely.

If there is material

misstatement in quick

assets or liabilities, it

would lead to audit

risk.

The auditor has to

conduct the detailed

test and controls

associated with quick

assets and liabilities.

For this, accounting

entries and books

have to be checked to

find out if there is any

misstatement in quick

assets or liabilities

(Brown, Preiato &

Tarca, 2014).

Return on equity The ratio has declined

in the current year by

Any misstatement in

equity capital could

The auditor has to

examine the

industrial standard. It

might due to decline

in current liabilities or

increase in current

assets.

audit risk like rise or

fall in the above-

stated assets and

liabilities from

management

(Alzeban, 2015).

as acquisition of

current assets and

current liabilities.

This would help in

ascertaining thee

accurate values of the

same (Ball, Tyler &

Wells, 2015).

Quick asset ratio According to the

provided information,

this ratio has risen in

the present year

implying increased

ability of API in

converting its most

liquid assets into cash

that would help in

settling short-term

dues timely.

If there is material

misstatement in quick

assets or liabilities, it

would lead to audit

risk.

The auditor has to

conduct the detailed

test and controls

associated with quick

assets and liabilities.

For this, accounting

entries and books

have to be checked to

find out if there is any

misstatement in quick

assets or liabilities

(Brown, Preiato &

Tarca, 2014).

Return on equity The ratio has declined

in the current year by

Any misstatement in

equity capital could

The auditor has to

examine the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4AUDITING

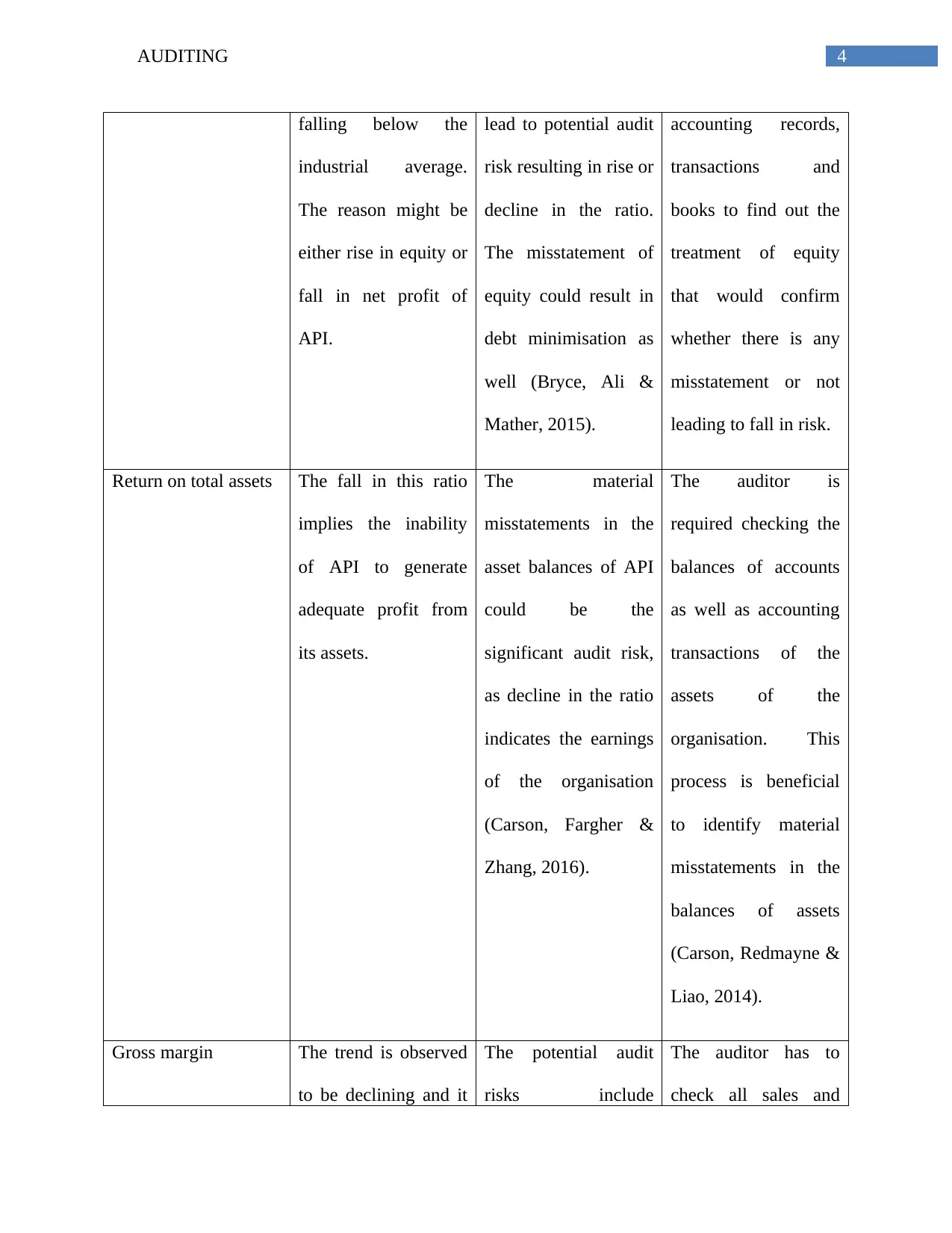

falling below the

industrial average.

The reason might be

either rise in equity or

fall in net profit of

API.

lead to potential audit

risk resulting in rise or

decline in the ratio.

The misstatement of

equity could result in

debt minimisation as

well (Bryce, Ali &

Mather, 2015).

accounting records,

transactions and

books to find out the

treatment of equity

that would confirm

whether there is any

misstatement or not

leading to fall in risk.

Return on total assets The fall in this ratio

implies the inability

of API to generate

adequate profit from

its assets.

The material

misstatements in the

asset balances of API

could be the

significant audit risk,

as decline in the ratio

indicates the earnings

of the organisation

(Carson, Fargher &

Zhang, 2016).

The auditor is

required checking the

balances of accounts

as well as accounting

transactions of the

assets of the

organisation. This

process is beneficial

to identify material

misstatements in the

balances of assets

(Carson, Redmayne &

Liao, 2014).

Gross margin The trend is observed

to be declining and it

The potential audit

risks include

The auditor has to

check all sales and

falling below the

industrial average.

The reason might be

either rise in equity or

fall in net profit of

API.

lead to potential audit

risk resulting in rise or

decline in the ratio.

The misstatement of

equity could result in

debt minimisation as

well (Bryce, Ali &

Mather, 2015).

accounting records,

transactions and

books to find out the

treatment of equity

that would confirm

whether there is any

misstatement or not

leading to fall in risk.

Return on total assets The fall in this ratio

implies the inability

of API to generate

adequate profit from

its assets.

The material

misstatements in the

asset balances of API

could be the

significant audit risk,

as decline in the ratio

indicates the earnings

of the organisation

(Carson, Fargher &

Zhang, 2016).

The auditor is

required checking the

balances of accounts

as well as accounting

transactions of the

assets of the

organisation. This

process is beneficial

to identify material

misstatements in the

balances of assets

(Carson, Redmayne &

Liao, 2014).

Gross margin The trend is observed

to be declining and it

The potential audit

risks include

The auditor has to

check all sales and

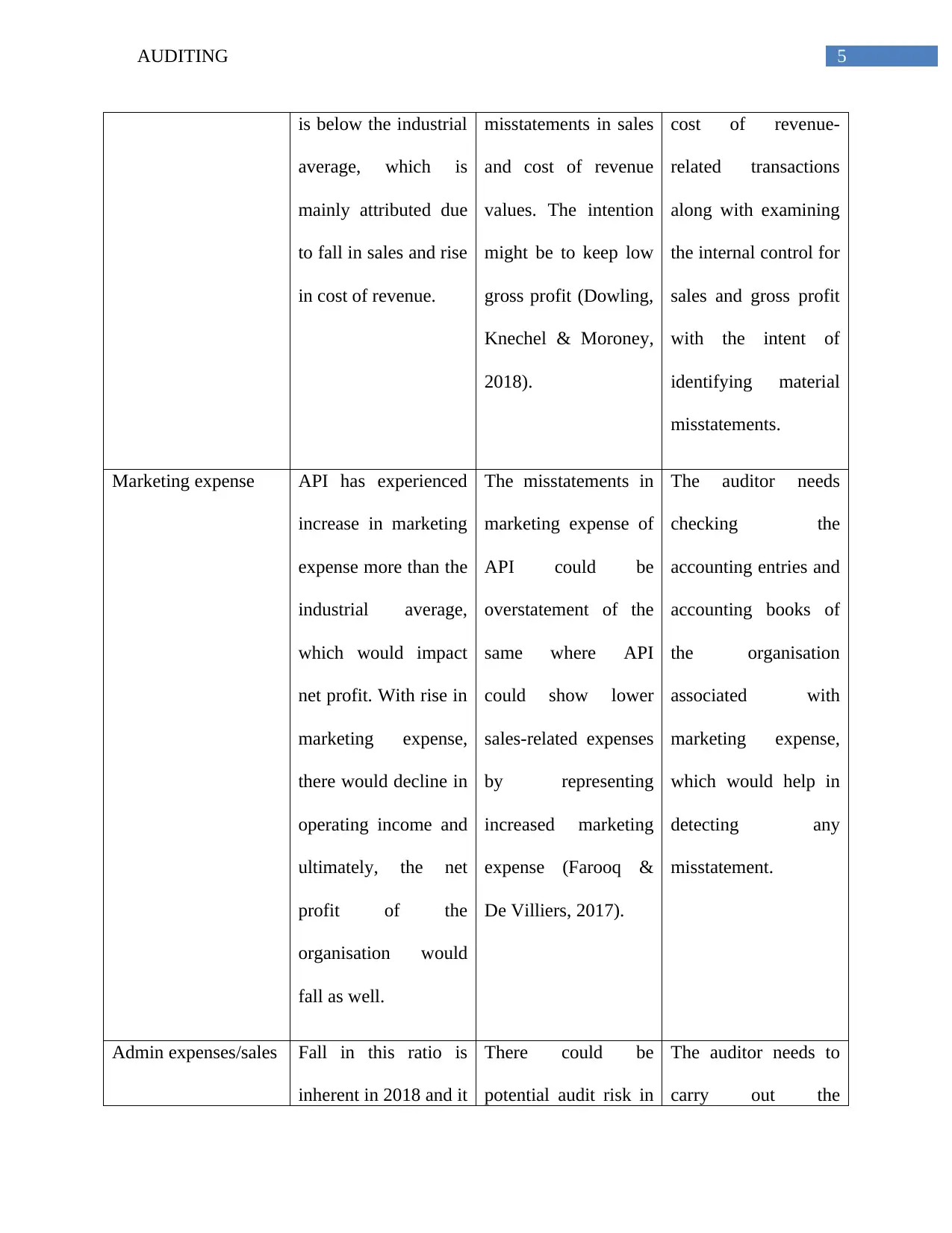

5AUDITING

is below the industrial

average, which is

mainly attributed due

to fall in sales and rise

in cost of revenue.

misstatements in sales

and cost of revenue

values. The intention

might be to keep low

gross profit (Dowling,

Knechel & Moroney,

2018).

cost of revenue-

related transactions

along with examining

the internal control for

sales and gross profit

with the intent of

identifying material

misstatements.

Marketing expense API has experienced

increase in marketing

expense more than the

industrial average,

which would impact

net profit. With rise in

marketing expense,

there would decline in

operating income and

ultimately, the net

profit of the

organisation would

fall as well.

The misstatements in

marketing expense of

API could be

overstatement of the

same where API

could show lower

sales-related expenses

by representing

increased marketing

expense (Farooq &

De Villiers, 2017).

The auditor needs

checking the

accounting entries and

accounting books of

the organisation

associated with

marketing expense,

which would help in

detecting any

misstatement.

Admin expenses/sales Fall in this ratio is

inherent in 2018 and it

There could be

potential audit risk in

The auditor needs to

carry out the

is below the industrial

average, which is

mainly attributed due

to fall in sales and rise

in cost of revenue.

misstatements in sales

and cost of revenue

values. The intention

might be to keep low

gross profit (Dowling,

Knechel & Moroney,

2018).

cost of revenue-

related transactions

along with examining

the internal control for

sales and gross profit

with the intent of

identifying material

misstatements.

Marketing expense API has experienced

increase in marketing

expense more than the

industrial average,

which would impact

net profit. With rise in

marketing expense,

there would decline in

operating income and

ultimately, the net

profit of the

organisation would

fall as well.

The misstatements in

marketing expense of

API could be

overstatement of the

same where API

could show lower

sales-related expenses

by representing

increased marketing

expense (Farooq &

De Villiers, 2017).

The auditor needs

checking the

accounting entries and

accounting books of

the organisation

associated with

marketing expense,

which would help in

detecting any

misstatement.

Admin expenses/sales Fall in this ratio is

inherent in 2018 and it

There could be

potential audit risk in

The auditor needs to

carry out the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

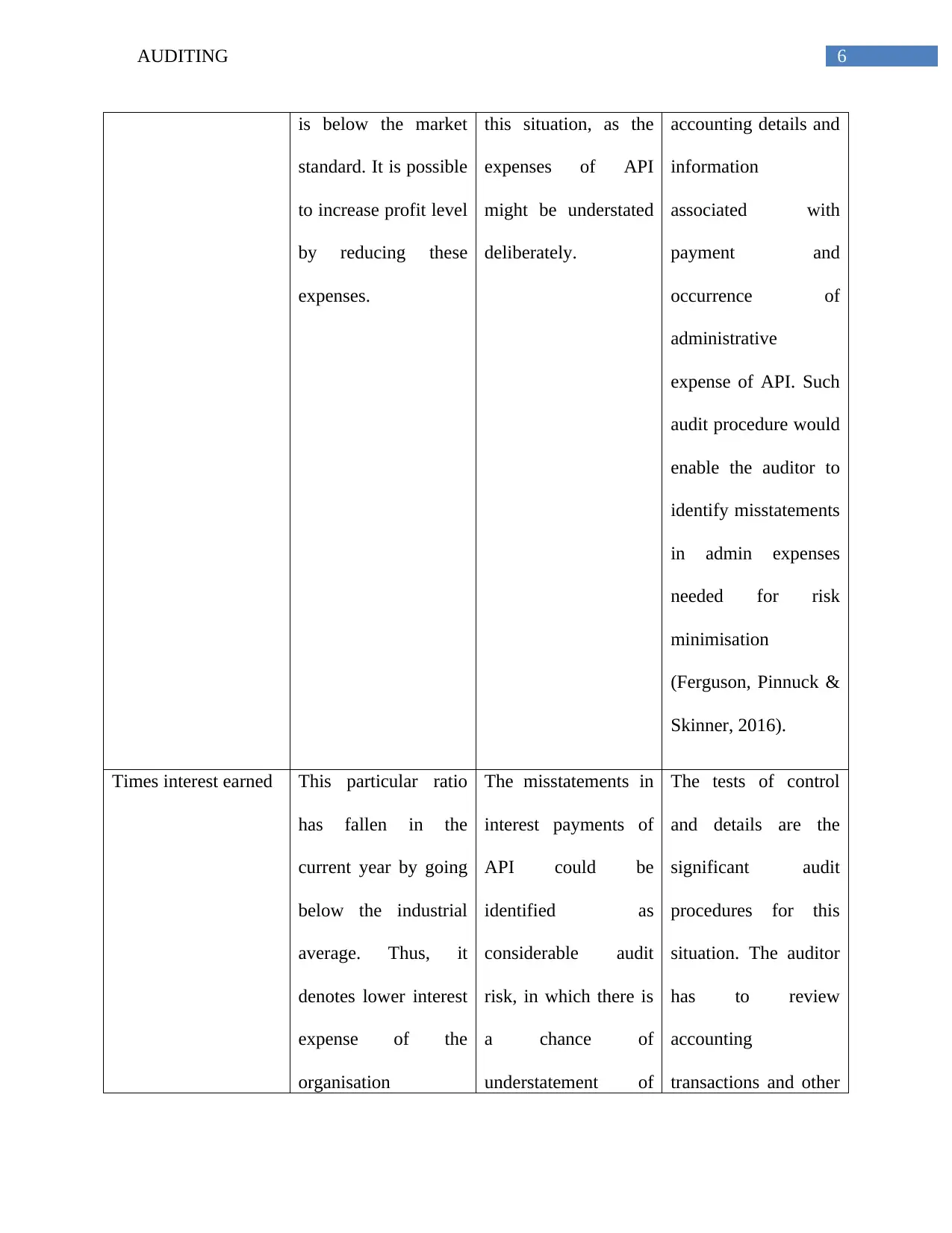

6AUDITING

is below the market

standard. It is possible

to increase profit level

by reducing these

expenses.

this situation, as the

expenses of API

might be understated

deliberately.

accounting details and

information

associated with

payment and

occurrence of

administrative

expense of API. Such

audit procedure would

enable the auditor to

identify misstatements

in admin expenses

needed for risk

minimisation

(Ferguson, Pinnuck &

Skinner, 2016).

Times interest earned This particular ratio

has fallen in the

current year by going

below the industrial

average. Thus, it

denotes lower interest

expense of the

organisation

The misstatements in

interest payments of

API could be

identified as

considerable audit

risk, in which there is

a chance of

understatement of

The tests of control

and details are the

significant audit

procedures for this

situation. The auditor

has to review

accounting

transactions and other

is below the market

standard. It is possible

to increase profit level

by reducing these

expenses.

this situation, as the

expenses of API

might be understated

deliberately.

accounting details and

information

associated with

payment and

occurrence of

administrative

expense of API. Such

audit procedure would

enable the auditor to

identify misstatements

in admin expenses

needed for risk

minimisation

(Ferguson, Pinnuck &

Skinner, 2016).

Times interest earned This particular ratio

has fallen in the

current year by going

below the industrial

average. Thus, it

denotes lower interest

expense of the

organisation

The misstatements in

interest payments of

API could be

identified as

considerable audit

risk, in which there is

a chance of

understatement of

The tests of control

and details are the

significant audit

procedures for this

situation. The auditor

has to review

accounting

transactions and other

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7AUDITING

compared to the past

year. The inability to

manage considerable

earnings could be the

reason.

interest expense

leading to minimised

interest payment.

information related to

interest expense.

Therefore, the

misstatements would

be identified in the

interest expenses of

the organisation (Gay

& Simnett, 2017).

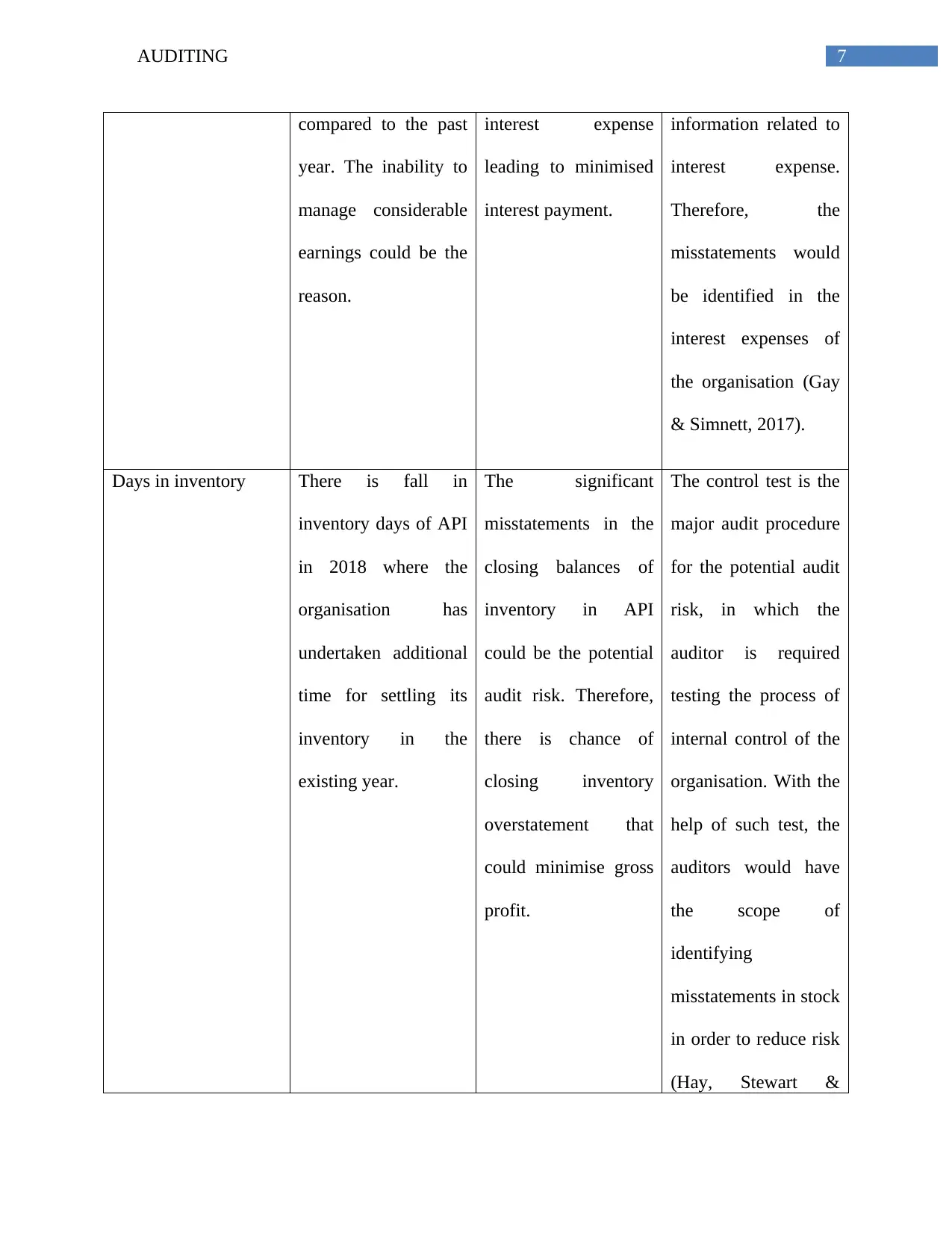

Days in inventory There is fall in

inventory days of API

in 2018 where the

organisation has

undertaken additional

time for settling its

inventory in the

existing year.

The significant

misstatements in the

closing balances of

inventory in API

could be the potential

audit risk. Therefore,

there is chance of

closing inventory

overstatement that

could minimise gross

profit.

The control test is the

major audit procedure

for the potential audit

risk, in which the

auditor is required

testing the process of

internal control of the

organisation. With the

help of such test, the

auditors would have

the scope of

identifying

misstatements in stock

in order to reduce risk

(Hay, Stewart &

compared to the past

year. The inability to

manage considerable

earnings could be the

reason.

interest expense

leading to minimised

interest payment.

information related to

interest expense.

Therefore, the

misstatements would

be identified in the

interest expenses of

the organisation (Gay

& Simnett, 2017).

Days in inventory There is fall in

inventory days of API

in 2018 where the

organisation has

undertaken additional

time for settling its

inventory in the

existing year.

The significant

misstatements in the

closing balances of

inventory in API

could be the potential

audit risk. Therefore,

there is chance of

closing inventory

overstatement that

could minimise gross

profit.

The control test is the

major audit procedure

for the potential audit

risk, in which the

auditor is required

testing the process of

internal control of the

organisation. With the

help of such test, the

auditors would have

the scope of

identifying

misstatements in stock

in order to reduce risk

(Hay, Stewart &

8AUDITING

Botica Redmayne,

2017).

Days in accounts

receivable

Days in accounts

receivable of API

have increased in the

existing year. This

implies decline in

accounts receivable

turnover ratio of the

organisation in the

existing period.

The potential audit

risk includes accounts

receivable balances,

which could have

been overstated in the

present year owing to

weakness in internal

control and other

influential dynamics.

The tests of control

and details are the

significant audit

procedures, which

have to be applied in

this situation. In

accordance with the

processes, the auditors

need to test internal

control of the

organisation

associated with

accounts receivable

and accounting

records such as

transactions and

others associated with

accounts receivable to

be tested in the

current year. This

would assist in

Botica Redmayne,

2017).

Days in accounts

receivable

Days in accounts

receivable of API

have increased in the

existing year. This

implies decline in

accounts receivable

turnover ratio of the

organisation in the

existing period.

The potential audit

risk includes accounts

receivable balances,

which could have

been overstated in the

present year owing to

weakness in internal

control and other

influential dynamics.

The tests of control

and details are the

significant audit

procedures, which

have to be applied in

this situation. In

accordance with the

processes, the auditors

need to test internal

control of the

organisation

associated with

accounts receivable

and accounting

records such as

transactions and

others associated with

accounts receivable to

be tested in the

current year. This

would assist in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9AUDITING

identifying accounts

receivable

misstatements (Kend,

Houghton & Jubb,

2014).

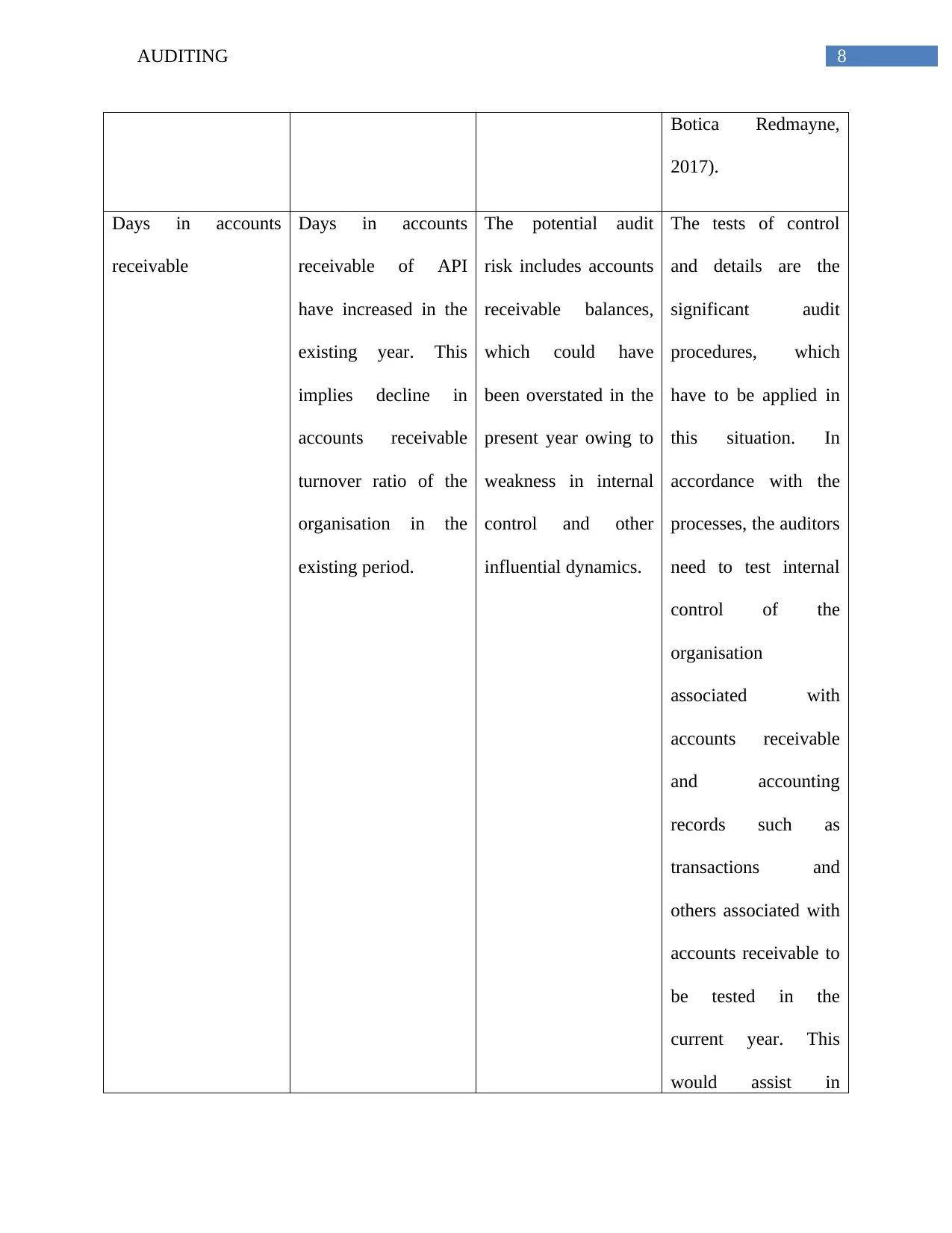

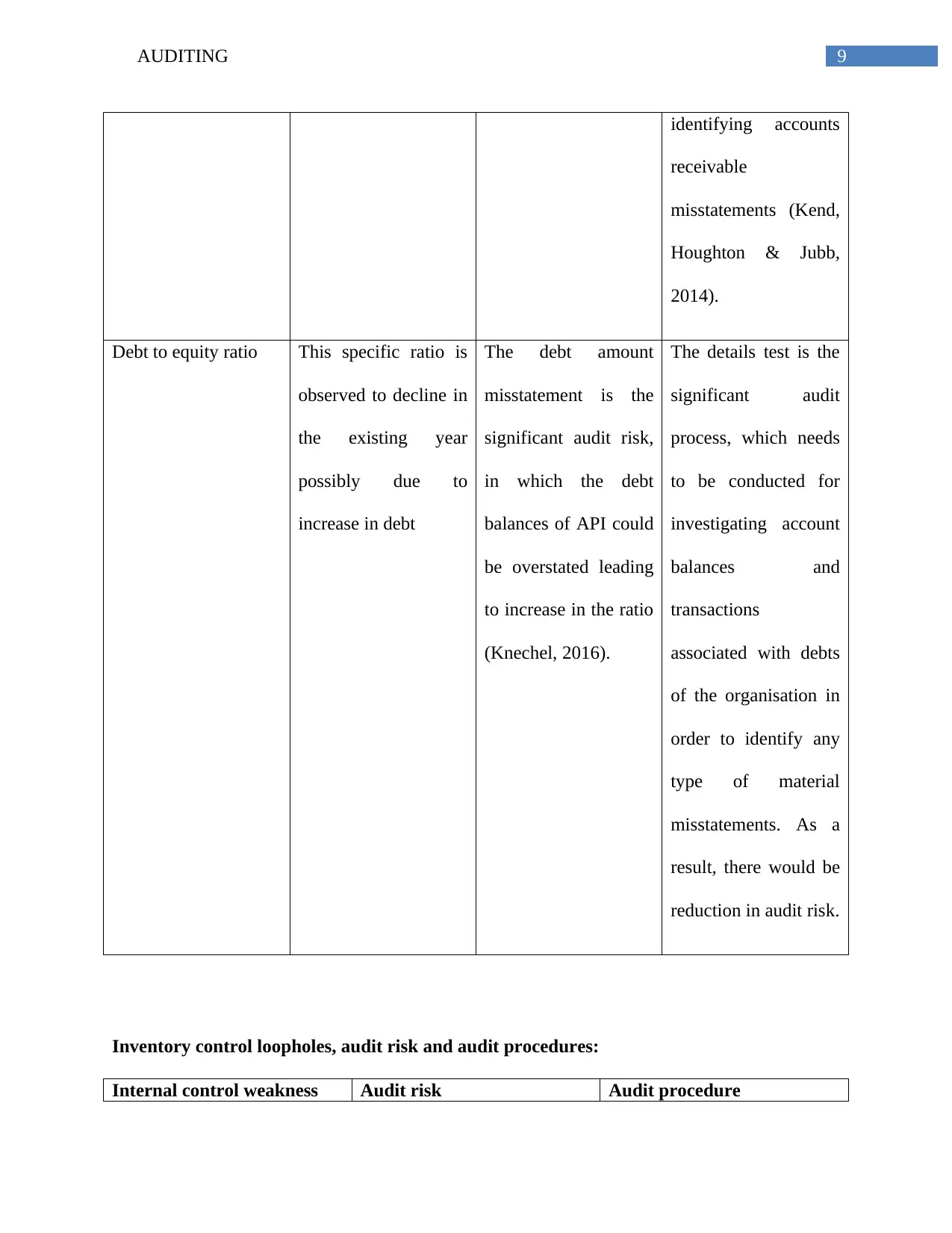

Debt to equity ratio This specific ratio is

observed to decline in

the existing year

possibly due to

increase in debt

The debt amount

misstatement is the

significant audit risk,

in which the debt

balances of API could

be overstated leading

to increase in the ratio

(Knechel, 2016).

The details test is the

significant audit

process, which needs

to be conducted for

investigating account

balances and

transactions

associated with debts

of the organisation in

order to identify any

type of material

misstatements. As a

result, there would be

reduction in audit risk.

Inventory control loopholes, audit risk and audit procedures:

Internal control weakness Audit risk Audit procedure

identifying accounts

receivable

misstatements (Kend,

Houghton & Jubb,

2014).

Debt to equity ratio This specific ratio is

observed to decline in

the existing year

possibly due to

increase in debt

The debt amount

misstatement is the

significant audit risk,

in which the debt

balances of API could

be overstated leading

to increase in the ratio

(Knechel, 2016).

The details test is the

significant audit

process, which needs

to be conducted for

investigating account

balances and

transactions

associated with debts

of the organisation in

order to identify any

type of material

misstatements. As a

result, there would be

reduction in audit risk.

Inventory control loopholes, audit risk and audit procedures:

Internal control weakness Audit risk Audit procedure

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10AUDITING

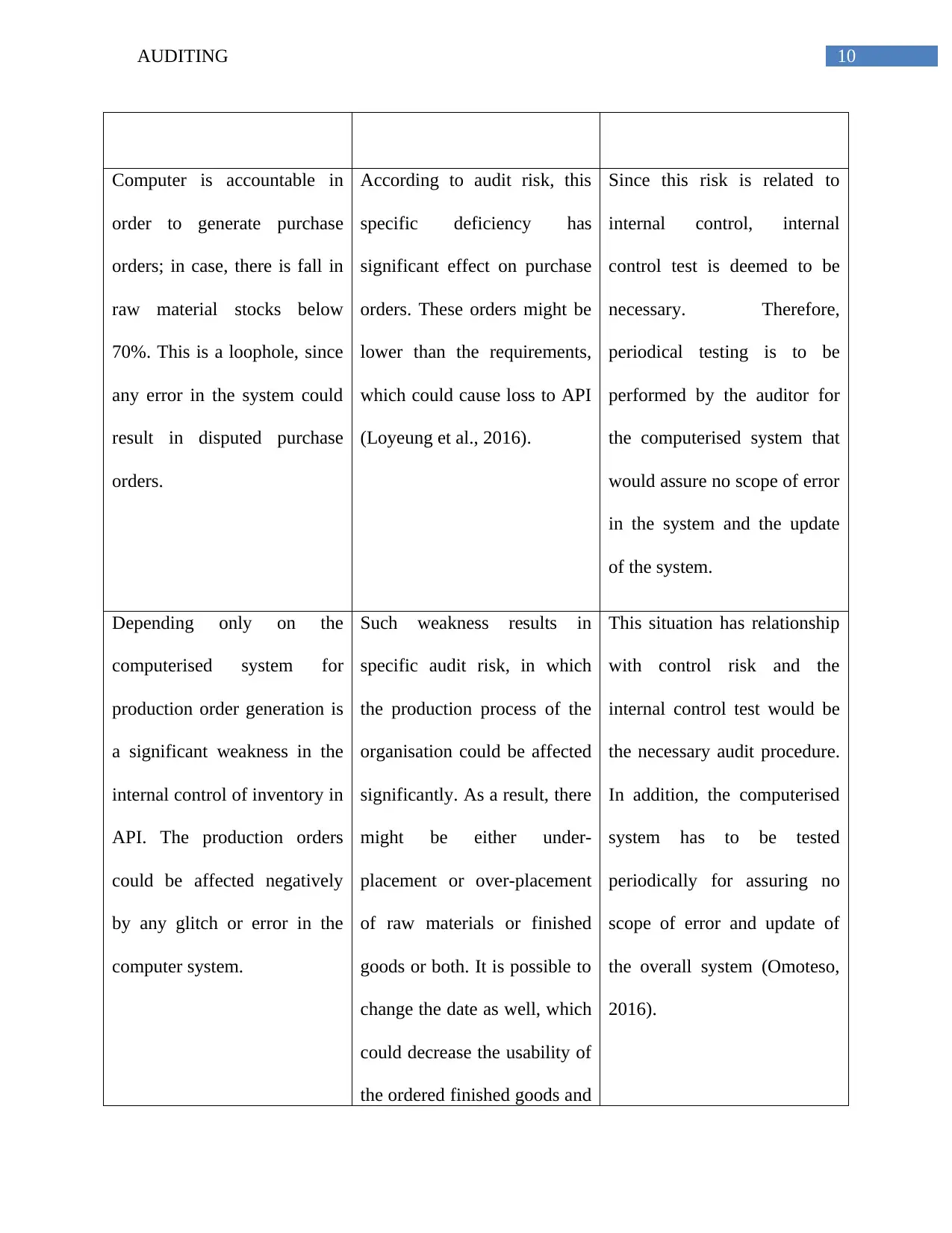

Computer is accountable in

order to generate purchase

orders; in case, there is fall in

raw material stocks below

70%. This is a loophole, since

any error in the system could

result in disputed purchase

orders.

According to audit risk, this

specific deficiency has

significant effect on purchase

orders. These orders might be

lower than the requirements,

which could cause loss to API

(Loyeung et al., 2016).

Since this risk is related to

internal control, internal

control test is deemed to be

necessary. Therefore,

periodical testing is to be

performed by the auditor for

the computerised system that

would assure no scope of error

in the system and the update

of the system.

Depending only on the

computerised system for

production order generation is

a significant weakness in the

internal control of inventory in

API. The production orders

could be affected negatively

by any glitch or error in the

computer system.

Such weakness results in

specific audit risk, in which

the production process of the

organisation could be affected

significantly. As a result, there

might be either under-

placement or over-placement

of raw materials or finished

goods or both. It is possible to

change the date as well, which

could decrease the usability of

the ordered finished goods and

This situation has relationship

with control risk and the

internal control test would be

the necessary audit procedure.

In addition, the computerised

system has to be tested

periodically for assuring no

scope of error and update of

the overall system (Omoteso,

2016).

Computer is accountable in

order to generate purchase

orders; in case, there is fall in

raw material stocks below

70%. This is a loophole, since

any error in the system could

result in disputed purchase

orders.

According to audit risk, this

specific deficiency has

significant effect on purchase

orders. These orders might be

lower than the requirements,

which could cause loss to API

(Loyeung et al., 2016).

Since this risk is related to

internal control, internal

control test is deemed to be

necessary. Therefore,

periodical testing is to be

performed by the auditor for

the computerised system that

would assure no scope of error

in the system and the update

of the system.

Depending only on the

computerised system for

production order generation is

a significant weakness in the

internal control of inventory in

API. The production orders

could be affected negatively

by any glitch or error in the

computer system.

Such weakness results in

specific audit risk, in which

the production process of the

organisation could be affected

significantly. As a result, there

might be either under-

placement or over-placement

of raw materials or finished

goods or both. It is possible to

change the date as well, which

could decrease the usability of

the ordered finished goods and

This situation has relationship

with control risk and the

internal control test would be

the necessary audit procedure.

In addition, the computerised

system has to be tested

periodically for assuring no

scope of error and update of

the overall system (Omoteso,

2016).

11AUDITING

raw materials (Nicoll, 2016).

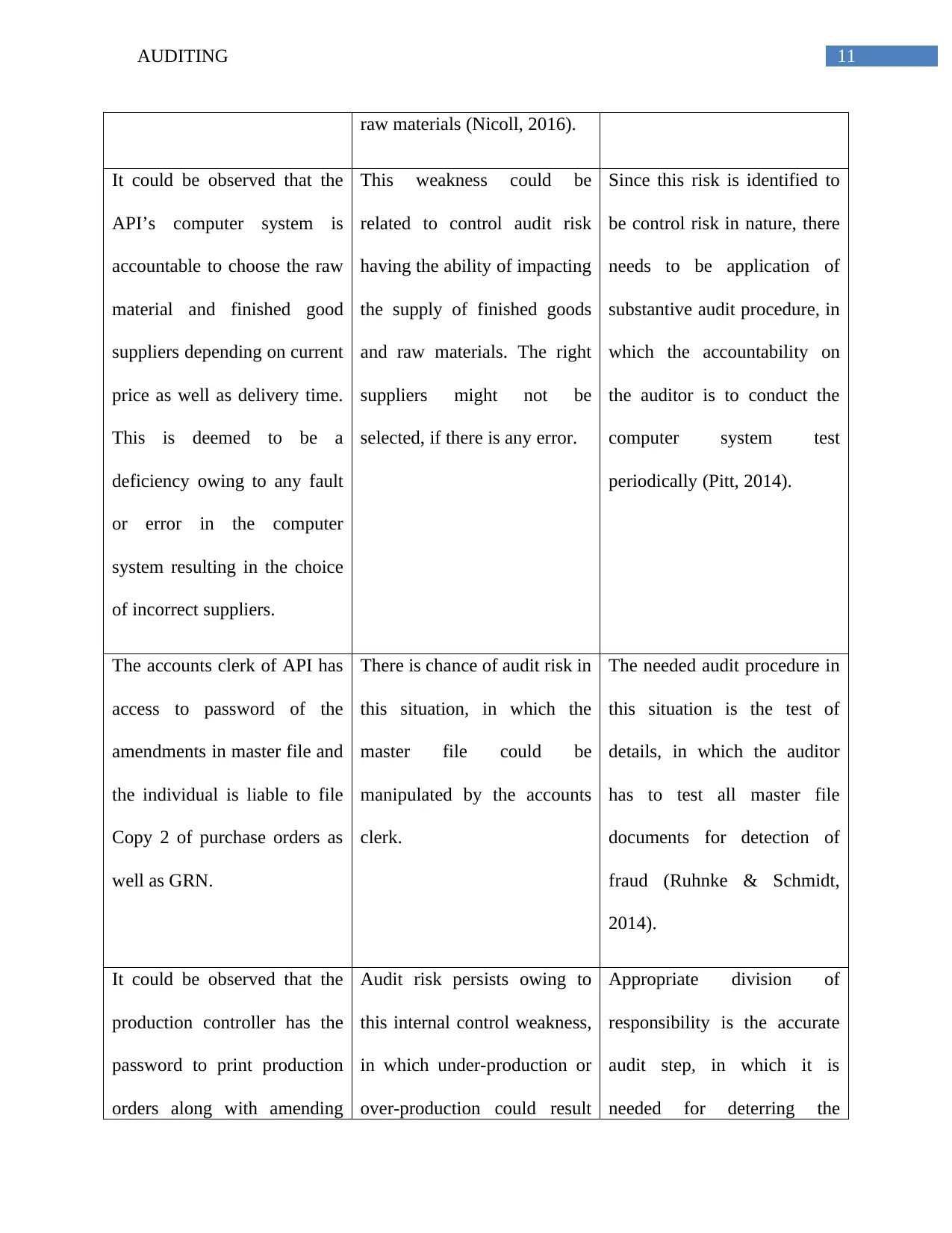

It could be observed that the

API’s computer system is

accountable to choose the raw

material and finished good

suppliers depending on current

price as well as delivery time.

This is deemed to be a

deficiency owing to any fault

or error in the computer

system resulting in the choice

of incorrect suppliers.

This weakness could be

related to control audit risk

having the ability of impacting

the supply of finished goods

and raw materials. The right

suppliers might not be

selected, if there is any error.

Since this risk is identified to

be control risk in nature, there

needs to be application of

substantive audit procedure, in

which the accountability on

the auditor is to conduct the

computer system test

periodically (Pitt, 2014).

The accounts clerk of API has

access to password of the

amendments in master file and

the individual is liable to file

Copy 2 of purchase orders as

well as GRN.

There is chance of audit risk in

this situation, in which the

master file could be

manipulated by the accounts

clerk.

The needed audit procedure in

this situation is the test of

details, in which the auditor

has to test all master file

documents for detection of

fraud (Ruhnke & Schmidt,

2014).

It could be observed that the

production controller has the

password to print production

orders along with amending

Audit risk persists owing to

this internal control weakness,

in which under-production or

over-production could result

Appropriate division of

responsibility is the accurate

audit step, in which it is

needed for deterring the

raw materials (Nicoll, 2016).

It could be observed that the

API’s computer system is

accountable to choose the raw

material and finished good

suppliers depending on current

price as well as delivery time.

This is deemed to be a

deficiency owing to any fault

or error in the computer

system resulting in the choice

of incorrect suppliers.

This weakness could be

related to control audit risk

having the ability of impacting

the supply of finished goods

and raw materials. The right

suppliers might not be

selected, if there is any error.

Since this risk is identified to

be control risk in nature, there

needs to be application of

substantive audit procedure, in

which the accountability on

the auditor is to conduct the

computer system test

periodically (Pitt, 2014).

The accounts clerk of API has

access to password of the

amendments in master file and

the individual is liable to file

Copy 2 of purchase orders as

well as GRN.

There is chance of audit risk in

this situation, in which the

master file could be

manipulated by the accounts

clerk.

The needed audit procedure in

this situation is the test of

details, in which the auditor

has to test all master file

documents for detection of

fraud (Ruhnke & Schmidt,

2014).

It could be observed that the

production controller has the

password to print production

orders along with amending

Audit risk persists owing to

this internal control weakness,

in which under-production or

over-production could result

Appropriate division of

responsibility is the accurate

audit step, in which it is

needed for deterring the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19