ACCT20075 - Auditing and Ethical Practices Report: CQUniversity

VerifiedAdded on 2023/06/07

|15

|3178

|362

Report

AI Summary

This report provides an analysis of auditing and ethical practices, focusing on the concept of materiality and its computation, along with an examination of audit materiality in the context of inventories, cash, and receivables. It includes a quantitative estimate of materiality for a chosen company (ANN) and discusses disclosures and notes of draft financial statements. The report further analyzes key profit and loss and balance sheet ratios, including profitability, stability, liquidity, and efficiency ratios, with an assessment of potential assertions and audit procedures. It also examines the cash flow statement and going concern risk, concluding with a brief overview of the audit report. Desklib offers similar solved assignments and past papers for students.

Running head: AUDITING AND ETHICAL PRACTICES

Auditing and Ethical Practices

Name of the student

Name of the university

Student ID

Author note

Auditing and Ethical Practices

Name of the student

Name of the university

Student ID

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1AUDITING AND ETHICAL PRACTICES

Table of Contents

Section 1..........................................................................................................................................2

Materiality....................................................................................................................................2

The materiality computation........................................................................................................2

Audit materiality..........................................................................................................................3

Quantitative estimate of materiality for the chosen company of ANN.......................................4

Disclosures and notes of draft......................................................................................................4

Section 2..........................................................................................................................................5

Key profit and loss and balance sheet ratios................................................................................5

Section 3..........................................................................................................................................8

Cash flow statement.....................................................................................................................8

Going concern risk.......................................................................................................................9

Audit report..................................................................................................................................9

References......................................................................................................................................10

Table of Contents

Section 1..........................................................................................................................................2

Materiality....................................................................................................................................2

The materiality computation........................................................................................................2

Audit materiality..........................................................................................................................3

Quantitative estimate of materiality for the chosen company of ANN.......................................4

Disclosures and notes of draft......................................................................................................4

Section 2..........................................................................................................................................5

Key profit and loss and balance sheet ratios................................................................................5

Section 3..........................................................................................................................................8

Cash flow statement.....................................................................................................................8

Going concern risk.......................................................................................................................9

Audit report..................................................................................................................................9

References......................................................................................................................................10

2AUDITING AND ETHICAL PRACTICES

Section 1

Materiality

The concept of Materiality in audit is one of the main concepts of the process of auditing.

The Misstatements, which may take place, are omissions can be taken as material in case they

are aggregate or take place individually. This can affect the economic decisions of the user based

on the financial statements. The Audit materiality involves both aspects of quantitative and

quantitative (Guerci et al., 2015). The Materiality in planning and performing the process of

audit throws light on the following features–

The Judgements of the materiality are produced on the basis of the adjacent situations

that involves the nature and size of misstatements.

The Misstatements shall be taken as material in case they impact the decision of the user

concerning the financial statement.

The Judgements are prepared based on the the requirements of the common user as

group (Sikka, 2015).

The materiality computation

According to the approach of qualitative the estimation of materiality is taken as 5% of

the net income before tax for the year under deliberation. However, the concept of materiality is

subject of the professional judgements. Hence, if the net income is risky like the other

benchmarks such as the gross profit or total revenue may be considered. However, for most of

the profit making enterprises, the net income before the charge of tax is considered as the most

appropriate. The Profit before tax for the chosen company of ANN company for the year ended

Section 1

Materiality

The concept of Materiality in audit is one of the main concepts of the process of auditing.

The Misstatements, which may take place, are omissions can be taken as material in case they

are aggregate or take place individually. This can affect the economic decisions of the user based

on the financial statements. The Audit materiality involves both aspects of quantitative and

quantitative (Guerci et al., 2015). The Materiality in planning and performing the process of

audit throws light on the following features–

The Judgements of the materiality are produced on the basis of the adjacent situations

that involves the nature and size of misstatements.

The Misstatements shall be taken as material in case they impact the decision of the user

concerning the financial statement.

The Judgements are prepared based on the the requirements of the common user as

group (Sikka, 2015).

The materiality computation

According to the approach of qualitative the estimation of materiality is taken as 5% of

the net income before tax for the year under deliberation. However, the concept of materiality is

subject of the professional judgements. Hence, if the net income is risky like the other

benchmarks such as the gross profit or total revenue may be considered. However, for most of

the profit making enterprises, the net income before the charge of tax is considered as the most

appropriate. The Profit before tax for the chosen company of ANN company for the year ended

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3AUDITING AND ETHICAL PRACTICES

30th June 2017 amounted to $ 145.3 million (Lebaron & Lister, 2015). Therefore, misstatement

will be taken as material if it amounts to ($ 1,104 million *5%) = $ 55.2 million or greater than

that.

Audit materiality

Inventories –The inventories are by nature are material. Although the inventories quantities are

determined by physical count on specific date that is the balance sheet date, it is needed to be

counted in existence of the auditor with the help of enquiries, observations and appropriate tests.

Moreover, the auditor are needed to please himself with regard to the applied approach

effectiveness for measuring the inventory and reliance which can be placed on the client

representation. As seen in the annual report of ANN Company or Ansell it can be identified that

the inventories amount has been lessened from $331.9 million to $ 329.8 million over the years

from 2017 to 2018 (Lesage, Hottegindre & Baker, 2016). Hence, the closing stock and opening

stock sales register of inventories must be verified efficiently to verify that the physical count of

the inventories match with the amount that is recorded(.

Cash and cash equivalents – The cash and the cash equivalent are also by nature material. As

cash can always be exposed to theft, embezzlement and misappropriation irrespective of the cash

amount will be verified and the balance shall be coordinated with the pass book or bank

statement. In addition to this, it is the responsibility of the auditor are needed to be checked with

all the related cash vouchers, transaction receipts and authorisation for satisfying himself that

there exists no misstatement has been taken place. In the annual report of ANN company

observations can be made that the amount of cash and cash equivalent has been increased from $

316.6 million to $ 582.8 million over the years from 2017 to 2018. Hence, the amount of

30th June 2017 amounted to $ 145.3 million (Lebaron & Lister, 2015). Therefore, misstatement

will be taken as material if it amounts to ($ 1,104 million *5%) = $ 55.2 million or greater than

that.

Audit materiality

Inventories –The inventories are by nature are material. Although the inventories quantities are

determined by physical count on specific date that is the balance sheet date, it is needed to be

counted in existence of the auditor with the help of enquiries, observations and appropriate tests.

Moreover, the auditor are needed to please himself with regard to the applied approach

effectiveness for measuring the inventory and reliance which can be placed on the client

representation. As seen in the annual report of ANN Company or Ansell it can be identified that

the inventories amount has been lessened from $331.9 million to $ 329.8 million over the years

from 2017 to 2018 (Lesage, Hottegindre & Baker, 2016). Hence, the closing stock and opening

stock sales register of inventories must be verified efficiently to verify that the physical count of

the inventories match with the amount that is recorded(.

Cash and cash equivalents – The cash and the cash equivalent are also by nature material. As

cash can always be exposed to theft, embezzlement and misappropriation irrespective of the cash

amount will be verified and the balance shall be coordinated with the pass book or bank

statement. In addition to this, it is the responsibility of the auditor are needed to be checked with

all the related cash vouchers, transaction receipts and authorisation for satisfying himself that

there exists no misstatement has been taken place. In the annual report of ANN company

observations can be made that the amount of cash and cash equivalent has been increased from $

316.6 million to $ 582.8 million over the years from 2017 to 2018. Hence, the amount of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4AUDITING AND ETHICAL PRACTICES

increase shall be verified through verification of the bank statements and the cash payment

receipts.

Receivables – The receivables are considered to be material by the size since it exceeds $ 201

million. The receivables are taken as material item as the receivable those are due for long time

may turn into bad debts (Ferrell & Fraedrich, 2015). Hence, for verification of the status

receivable the assessor shall manufacture the debtors aging analysis and make enquiries

regarding the dues those are dues for more than the period of allowed credit terms.

Quantitative estimate of materiality for the chosen company of ANN

The range that comes within 50% to 75% of the planning materiality will be taken as

allowable misstatement for the ANN Company as the level of risk with regard to financial

statement is reasonable. The allowable misstatement is on the basis of determination of lower

level for items those are significant individually under the financial items, for example

inventories and cash, receivables.

Disclosures and notes of draft

The different items of disclosure that may have importance to audit are in the following –

Assets impairment – In order to carry out the impairment audit the assessor needs to

verify the presumptions that are used for the calculation of the value in use and

calculating the fair value reduced by selling cost. For auditing of the asset impairment the

carrying amount of assets shall be verified with associated documents and asset register.

Depreciation method and market value of the asset shall also be verified and checked

with the assets to satisfy that the proper method has been applied.

increase shall be verified through verification of the bank statements and the cash payment

receipts.

Receivables – The receivables are considered to be material by the size since it exceeds $ 201

million. The receivables are taken as material item as the receivable those are due for long time

may turn into bad debts (Ferrell & Fraedrich, 2015). Hence, for verification of the status

receivable the assessor shall manufacture the debtors aging analysis and make enquiries

regarding the dues those are dues for more than the period of allowed credit terms.

Quantitative estimate of materiality for the chosen company of ANN

The range that comes within 50% to 75% of the planning materiality will be taken as

allowable misstatement for the ANN Company as the level of risk with regard to financial

statement is reasonable. The allowable misstatement is on the basis of determination of lower

level for items those are significant individually under the financial items, for example

inventories and cash, receivables.

Disclosures and notes of draft

The different items of disclosure that may have importance to audit are in the following –

Assets impairment – In order to carry out the impairment audit the assessor needs to

verify the presumptions that are used for the calculation of the value in use and

calculating the fair value reduced by selling cost. For auditing of the asset impairment the

carrying amount of assets shall be verified with associated documents and asset register.

Depreciation method and market value of the asset shall also be verified and checked

with the assets to satisfy that the proper method has been applied.

5AUDITING AND ETHICAL PRACTICES

Contingent liabilities – The contingent liability involves the possible obligation that may

become payable based on the present obligation or future event or that was not probable

for payment or cannot be reliably measured. If the contingent liability amount is material

or the amount cannot be projected, the auditor will anticipate likelihood of the occurrence

of the event. Likelihood can be probable, reasonably possible or remote. To analyse the

likelihood the auditor needs to apply the professional judgement according to him.

However, for probable category of contingent liabilities the auditor can apply unique

accounting treatment. Moreover, the liability shall be disclosed through footnotes in the

disclosure section.

Section 2

Key profit and loss and balance sheet ratios

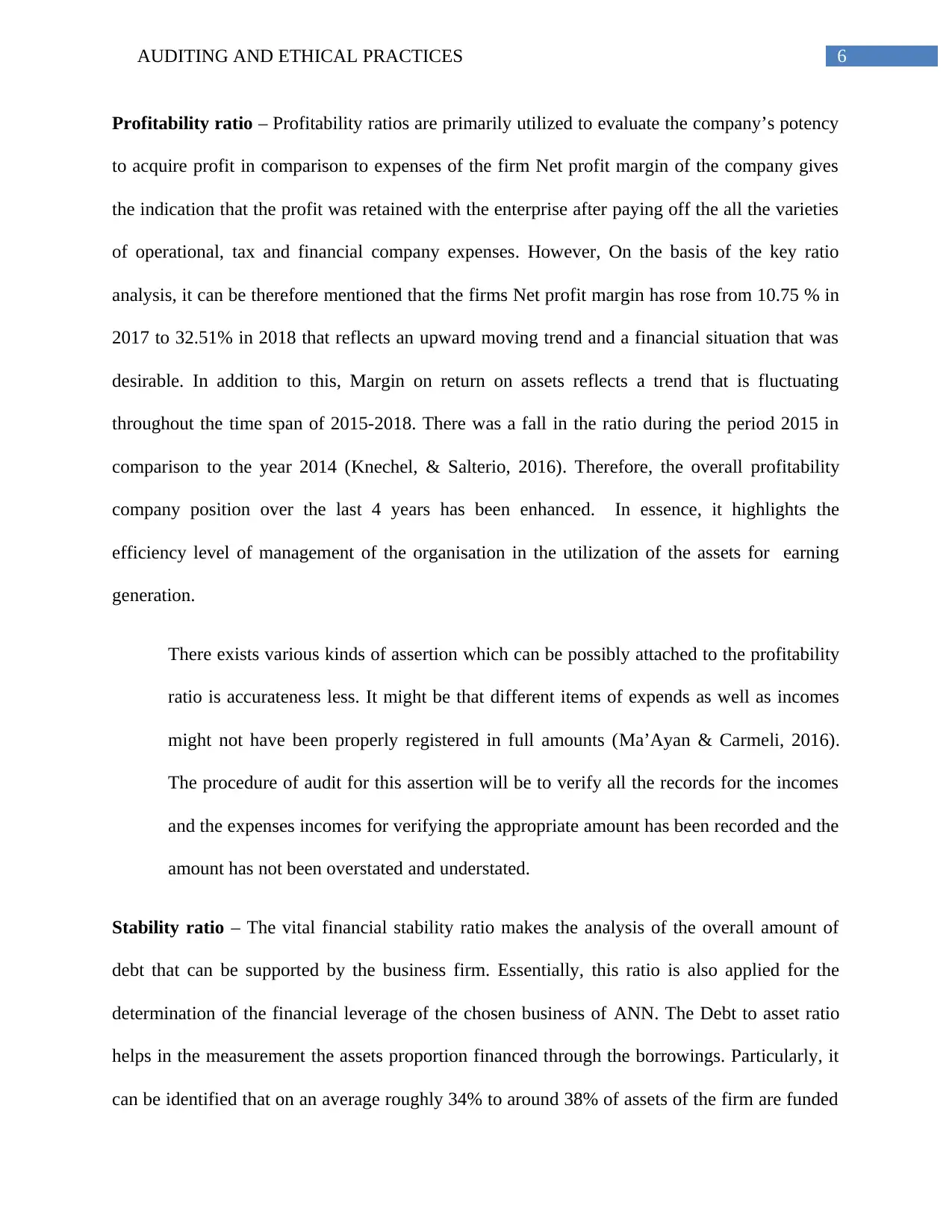

Ratio 2018 2017 2016 2015

Profitability ratio

Net profit margin 32.51 10.75 10.12 11.4

Return on asset 0.61 0.57 0.69 0.77

Stability ratio

Debt to asset ratio 2.06 2.04 2.02 1.64

Debt equity ratio 0.64 0.61 0.59 0.36

Liquidity ratio

Current ratio 3.85 2.92 2.69 2.73

Quick ratio 1.59 1.58 1.4 2.61

Efficiency ratio

Account receivable

ratio 6.44 5.96 5.6 6.61

Contingent liabilities – The contingent liability involves the possible obligation that may

become payable based on the present obligation or future event or that was not probable

for payment or cannot be reliably measured. If the contingent liability amount is material

or the amount cannot be projected, the auditor will anticipate likelihood of the occurrence

of the event. Likelihood can be probable, reasonably possible or remote. To analyse the

likelihood the auditor needs to apply the professional judgement according to him.

However, for probable category of contingent liabilities the auditor can apply unique

accounting treatment. Moreover, the liability shall be disclosed through footnotes in the

disclosure section.

Section 2

Key profit and loss and balance sheet ratios

Ratio 2018 2017 2016 2015

Profitability ratio

Net profit margin 32.51 10.75 10.12 11.4

Return on asset 0.61 0.57 0.69 0.77

Stability ratio

Debt to asset ratio 2.06 2.04 2.02 1.64

Debt equity ratio 0.64 0.61 0.59 0.36

Liquidity ratio

Current ratio 3.85 2.92 2.69 2.73

Quick ratio 1.59 1.58 1.4 2.61

Efficiency ratio

Account receivable

ratio 6.44 5.96 5.6 6.61

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6AUDITING AND ETHICAL PRACTICES

Profitability ratio – Profitability ratios are primarily utilized to evaluate the company’s potency

to acquire profit in comparison to expenses of the firm Net profit margin of the company gives

the indication that the profit was retained with the enterprise after paying off the all the varieties

of operational, tax and financial company expenses. However, On the basis of the key ratio

analysis, it can be therefore mentioned that the firms Net profit margin has rose from 10.75 % in

2017 to 32.51% in 2018 that reflects an upward moving trend and a financial situation that was

desirable. In addition to this, Margin on return on assets reflects a trend that is fluctuating

throughout the time span of 2015-2018. There was a fall in the ratio during the period 2015 in

comparison to the year 2014 (Knechel, & Salterio, 2016). Therefore, the overall profitability

company position over the last 4 years has been enhanced. In essence, it highlights the

efficiency level of management of the organisation in the utilization of the assets for earning

generation.

There exists various kinds of assertion which can be possibly attached to the profitability

ratio is accurateness less. It might be that different items of expends as well as incomes

might not have been properly registered in full amounts (Ma’Ayan & Carmeli, 2016).

The procedure of audit for this assertion will be to verify all the records for the incomes

and the expenses incomes for verifying the appropriate amount has been recorded and the

amount has not been overstated and understated.

Stability ratio – The vital financial stability ratio makes the analysis of the overall amount of

debt that can be supported by the business firm. Essentially, this ratio is also applied for the

determination of the financial leverage of the chosen business of ANN. The Debt to asset ratio

helps in the measurement the assets proportion financed through the borrowings. Particularly, it

can be identified that on an average roughly 34% to around 38% of assets of the firm are funded

Profitability ratio – Profitability ratios are primarily utilized to evaluate the company’s potency

to acquire profit in comparison to expenses of the firm Net profit margin of the company gives

the indication that the profit was retained with the enterprise after paying off the all the varieties

of operational, tax and financial company expenses. However, On the basis of the key ratio

analysis, it can be therefore mentioned that the firms Net profit margin has rose from 10.75 % in

2017 to 32.51% in 2018 that reflects an upward moving trend and a financial situation that was

desirable. In addition to this, Margin on return on assets reflects a trend that is fluctuating

throughout the time span of 2015-2018. There was a fall in the ratio during the period 2015 in

comparison to the year 2014 (Knechel, & Salterio, 2016). Therefore, the overall profitability

company position over the last 4 years has been enhanced. In essence, it highlights the

efficiency level of management of the organisation in the utilization of the assets for earning

generation.

There exists various kinds of assertion which can be possibly attached to the profitability

ratio is accurateness less. It might be that different items of expends as well as incomes

might not have been properly registered in full amounts (Ma’Ayan & Carmeli, 2016).

The procedure of audit for this assertion will be to verify all the records for the incomes

and the expenses incomes for verifying the appropriate amount has been recorded and the

amount has not been overstated and understated.

Stability ratio – The vital financial stability ratio makes the analysis of the overall amount of

debt that can be supported by the business firm. Essentially, this ratio is also applied for the

determination of the financial leverage of the chosen business of ANN. The Debt to asset ratio

helps in the measurement the assets proportion financed through the borrowings. Particularly, it

can be identified that on an average roughly 34% to around 38% of assets of the firm are funded

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7AUDITING AND ETHICAL PRACTICES

by using funds that are borrowed. Therefore, the company is leveraged lowly (Prajogo, et al.,

2016). Oppositely, ratio of the debt equity help in the measurement of the proportion of equity

and debt that are used by the entity for assets financing. It can be hereby identified that the

position of leverage of the entity has improvised as the debt equity ratio has been reduced from

0.61 to 0.64 over the years from 2017 to 2018.

The Variety of categories of assertion that might perhaps be attached to the ratio on

stability is essentially accuracy. It might be the fact that different debt items, assets along with

equities of the firm might not be properly registered in the financial assertions of the firm (Chen,

& Lee,. 2016). Hence, in that case, procedures of audit may involve possibly the procedure of

verifying all the documents on purchase of assets, data on borrowings, examination of register

for sales and catalogue share issue

Liquidity ratio – The liquidity ratios are used primarily with the motive of measurement of the

overall condition of liquidity of the business. The current ratio is calculated for examinig

whether the organisations current assets of ANN company are adequately enough to repay their

current obligations. Based on the enumerated financial ratio it can be said that current ratio has

increased from 2.92 in 2017 to 3.85 in 2018. Thus, the liquidity condition of the firm can be said

to have improved throughout the specified span of time.

A type of assertion method that may perhaps be attached to stability ratio is essentially

accuracy in addition to classification. In this case, it might be the fact that different current assets

as well as current liabilities items might perhaps not have been registered in full amounts It may

further happened that current assets and liabilities may not have been classified properly that is

non-current assets or liabilities have been classified as current (Neu, Everett & Rahaman, 2015).

by using funds that are borrowed. Therefore, the company is leveraged lowly (Prajogo, et al.,

2016). Oppositely, ratio of the debt equity help in the measurement of the proportion of equity

and debt that are used by the entity for assets financing. It can be hereby identified that the

position of leverage of the entity has improvised as the debt equity ratio has been reduced from

0.61 to 0.64 over the years from 2017 to 2018.

The Variety of categories of assertion that might perhaps be attached to the ratio on

stability is essentially accuracy. It might be the fact that different debt items, assets along with

equities of the firm might not be properly registered in the financial assertions of the firm (Chen,

& Lee,. 2016). Hence, in that case, procedures of audit may involve possibly the procedure of

verifying all the documents on purchase of assets, data on borrowings, examination of register

for sales and catalogue share issue

Liquidity ratio – The liquidity ratios are used primarily with the motive of measurement of the

overall condition of liquidity of the business. The current ratio is calculated for examinig

whether the organisations current assets of ANN company are adequately enough to repay their

current obligations. Based on the enumerated financial ratio it can be said that current ratio has

increased from 2.92 in 2017 to 3.85 in 2018. Thus, the liquidity condition of the firm can be said

to have improved throughout the specified span of time.

A type of assertion method that may perhaps be attached to stability ratio is essentially

accuracy in addition to classification. In this case, it might be the fact that different current assets

as well as current liabilities items might perhaps not have been registered in full amounts It may

further happened that current assets and liabilities may not have been classified properly that is

non-current assets or liabilities have been classified as current (Neu, Everett & Rahaman, 2015).

8AUDITING AND ETHICAL PRACTICES

Audit procedure for this assertion will be to verify all the documents and register for current

asses and current liabilities with their respective amounts.

Efficiency ratio – It is used to measure the efficiency of the company with regard to ability of

the company regarding collection of its dues. Account receivable ratio states times the company

collects its receivable in a year. It can be identified that the company’s receivable ratio is in

increasing trend and increased from 5.96 times to 6.44 times over the years from 2017 to 2018.

Therefore, the efficiency of the company over the last 4 years has been improved (Cameron, &

O'Leary, 2015).

Assertion method that may be involved with efficiency ratio is accuracy and

classification that is all the items of receivables may not have been recorded with full amounts. It

may further happened that sales may not have been classified properly that is credit sales has

been classified as cash sales (McAlister & Ferrell, 2016). Audit procedure for this assertion will

be to check all the documents and register for sales to verify credit sales and cash sales and to

verify the credit period allows to the debtors.

Section 3

Cash flow statement

As per the statement Cash flow of the company of ANN for the year ended 30th

June 2018 observations can be made that the maximum of the cash inflows in the category of

operating activities amounted to $ 513 million. Similarly, the investing activities that carried

most of the outflows amounted to $ 645 million (Karadag, 2015).

Audit procedure for this assertion will be to verify all the documents and register for current

asses and current liabilities with their respective amounts.

Efficiency ratio – It is used to measure the efficiency of the company with regard to ability of

the company regarding collection of its dues. Account receivable ratio states times the company

collects its receivable in a year. It can be identified that the company’s receivable ratio is in

increasing trend and increased from 5.96 times to 6.44 times over the years from 2017 to 2018.

Therefore, the efficiency of the company over the last 4 years has been improved (Cameron, &

O'Leary, 2015).

Assertion method that may be involved with efficiency ratio is accuracy and

classification that is all the items of receivables may not have been recorded with full amounts. It

may further happened that sales may not have been classified properly that is credit sales has

been classified as cash sales (McAlister & Ferrell, 2016). Audit procedure for this assertion will

be to check all the documents and register for sales to verify credit sales and cash sales and to

verify the credit period allows to the debtors.

Section 3

Cash flow statement

As per the statement Cash flow of the company of ANN for the year ended 30th

June 2018 observations can be made that the maximum of the cash inflows in the category of

operating activities amounted to $ 513 million. Similarly, the investing activities that carried

most of the outflows amounted to $ 645 million (Karadag, 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9AUDITING AND ETHICAL PRACTICES

According to the statement of cash flow of ANN Company for the year ended 30th June

2018 it can be found out that the cash receipts originated primary provided by the borrowing

proceeds and was mounting to $ 4,387 million. On the other hand, primary cash payments were

towards repayments of borrowings and amounted to $ 4,196 million.

The investing activities that are Non-cash included the downward revaluation of the

investment properties and the investment properties those were under construction amounted to $

540 million. The Other investing items that are non-cash were from the joint ventures proceeds

that were amounting to $ 34 million. Similarly, the financing items that were non-cash consisted

of distribution payment amounting to $ 374 million.

Going concern risk

According to the performance of the chosen organisation, the profitability situation,

position for efficiency as well as the arrangement of stability can be can be identified. The items

have been enhanced throughout the 4 years period. Additionally, As per the report of the auditor

no risk has be found to be attached to the going concern firm. However, probability can be found

for the company to improvise its liquidity position by paying off the short term obligations.

Therefore, it can be said that no risk is associated with the entity’s going concern.(Burtonshaw-

Gunn, 2017).

Audit report

The assessor of the company produced the unqualified report to particularly ANN

Company for the year ended 30th June 2017. As per their opinion, the financial report of the

company and their operations were controlled by it is in compliance with the Corporation Act

2001. Additionally, it includes the following –

According to the statement of cash flow of ANN Company for the year ended 30th June

2018 it can be found out that the cash receipts originated primary provided by the borrowing

proceeds and was mounting to $ 4,387 million. On the other hand, primary cash payments were

towards repayments of borrowings and amounted to $ 4,196 million.

The investing activities that are Non-cash included the downward revaluation of the

investment properties and the investment properties those were under construction amounted to $

540 million. The Other investing items that are non-cash were from the joint ventures proceeds

that were amounting to $ 34 million. Similarly, the financing items that were non-cash consisted

of distribution payment amounting to $ 374 million.

Going concern risk

According to the performance of the chosen organisation, the profitability situation,

position for efficiency as well as the arrangement of stability can be can be identified. The items

have been enhanced throughout the 4 years period. Additionally, As per the report of the auditor

no risk has be found to be attached to the going concern firm. However, probability can be found

for the company to improvise its liquidity position by paying off the short term obligations.

Therefore, it can be said that no risk is associated with the entity’s going concern.(Burtonshaw-

Gunn, 2017).

Audit report

The assessor of the company produced the unqualified report to particularly ANN

Company for the year ended 30th June 2017. As per their opinion, the financial report of the

company and their operations were controlled by it is in compliance with the Corporation Act

2001. Additionally, it includes the following –

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10AUDITING AND ETHICAL PRACTICES

The Financial statements gives the representation of a true and fair view of the chosen

firm’s financial position as on 30th June 2018 and their operational performance for the

end of the year.

It is in compliance with Corporation Regulations 2001 and the Australian Accounting

Standards.

The Financial statements gives the representation of a true and fair view of the chosen

firm’s financial position as on 30th June 2018 and their operational performance for the

end of the year.

It is in compliance with Corporation Regulations 2001 and the Australian Accounting

Standards.

11AUDITING AND ETHICAL PRACTICES

References

Burtonshaw-Gunn, S. A. (2017). Risk and financial management in construction. Routledge.

Cameron, R. A., & O'Leary, C. (2015). Improving ethical attitudes or simply teaching ethical

codes? The reality of accounting ethics education. Accounting Education, 24(4), 275-290.

Chen, L., & Lee, H. L. (2016). Sourcing under supplier responsibility risk: The effects of

certification, audit, and contingency payment. Management Science, 63(9), 2795-2812.

Ferrell, O. C., & Fraedrich, J. (2015). Business ethics: Ethical decision making & cases. Nelson

Education.

Guerci, M., Radaelli, G., Siletti, E., Cirella, S., & Shani, A. R. (2015). The impact of human

resource management practices and corporate sustainability on organizational ethical

climates: An employee perspective. Journal of Business Ethics, 126(2), 325-342.

Karadag, H. (2015). Financial management challenges in small and medium-sized enterprises: A

strategic management approach. EMAJ: Emerging Markets Journal, 5(1), 26-40.

Knechel, W. R., & Salterio, S. E. (2016). Auditing: Assurance and risk. Routledge.

Lebaron, G., & Lister, J. (2015). Benchmarking global supply chains: the power of the ‘ethical

audit’regime. Review of International Studies, 41(5), 905-924.

Lesage, C., Hottegindre, G., & Baker, C. R. (2016). Disciplinary practices in the French auditing

profession: Serving the public interest or the private interests of the

profession?. Accounting, Auditing & Accountability Journal, 29(1), 11-42.

References

Burtonshaw-Gunn, S. A. (2017). Risk and financial management in construction. Routledge.

Cameron, R. A., & O'Leary, C. (2015). Improving ethical attitudes or simply teaching ethical

codes? The reality of accounting ethics education. Accounting Education, 24(4), 275-290.

Chen, L., & Lee, H. L. (2016). Sourcing under supplier responsibility risk: The effects of

certification, audit, and contingency payment. Management Science, 63(9), 2795-2812.

Ferrell, O. C., & Fraedrich, J. (2015). Business ethics: Ethical decision making & cases. Nelson

Education.

Guerci, M., Radaelli, G., Siletti, E., Cirella, S., & Shani, A. R. (2015). The impact of human

resource management practices and corporate sustainability on organizational ethical

climates: An employee perspective. Journal of Business Ethics, 126(2), 325-342.

Karadag, H. (2015). Financial management challenges in small and medium-sized enterprises: A

strategic management approach. EMAJ: Emerging Markets Journal, 5(1), 26-40.

Knechel, W. R., & Salterio, S. E. (2016). Auditing: Assurance and risk. Routledge.

Lebaron, G., & Lister, J. (2015). Benchmarking global supply chains: the power of the ‘ethical

audit’regime. Review of International Studies, 41(5), 905-924.

Lesage, C., Hottegindre, G., & Baker, C. R. (2016). Disciplinary practices in the French auditing

profession: Serving the public interest or the private interests of the

profession?. Accounting, Auditing & Accountability Journal, 29(1), 11-42.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.