ACCT20075: Ethical Audit Practices and Financial Analysis of Summerset

VerifiedAdded on 2023/06/07

|14

|3110

|201

Report

AI Summary

This report provides a comprehensive audit and ethical review of Summerset Group Holdings Limited, focusing on the 2017 financial year. It begins by determining the materiality and scope of the audit, calculating materiality based on total assets. The report reviews disclosures in the annual rep...

Running head: AUDITING AND ETHICAL PRACTICES

Auditing and Ethical Practices

Name of the Student:

Name of the University:

Authors Note:

Auditing and Ethical Practices

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AUDITING AND ETHICAL PRACTICES

1

Table of Contents

Section 1:....................................................................................................................................2

1.1 Determining the materiality and scope of Audit for Summerset Group Holdings Limited:2

1.2 Reviewing various draft notes and disclosures mentioned in the annual report of

Summerset Group Holdings Limited:........................................................................................3

Section 2:....................................................................................................................................4

2.1 Reviewing the annual report of Summerset Group Holdings Limited by using different

ratios, while discussing the trend in the ratios:..........................................................................4

Section 3:....................................................................................................................................8

3.1 Reviewing the cash flow statement of Summerset Group Holdings Limited:.....................8

3.2 Reviewing the audit report of 2017 financial report of Summerset Group Holdings

Limited:....................................................................................................................................10

References and Bibliography:..................................................................................................12

1

Table of Contents

Section 1:....................................................................................................................................2

1.1 Determining the materiality and scope of Audit for Summerset Group Holdings Limited:2

1.2 Reviewing various draft notes and disclosures mentioned in the annual report of

Summerset Group Holdings Limited:........................................................................................3

Section 2:....................................................................................................................................4

2.1 Reviewing the annual report of Summerset Group Holdings Limited by using different

ratios, while discussing the trend in the ratios:..........................................................................4

Section 3:....................................................................................................................................8

3.1 Reviewing the cash flow statement of Summerset Group Holdings Limited:.....................8

3.2 Reviewing the audit report of 2017 financial report of Summerset Group Holdings

Limited:....................................................................................................................................10

References and Bibliography:..................................................................................................12

AUDITING AND ETHICAL PRACTICES

2

Section 1:

1.1 Determining the materiality and scope of Audit for Summerset Group Holdings

Limited:

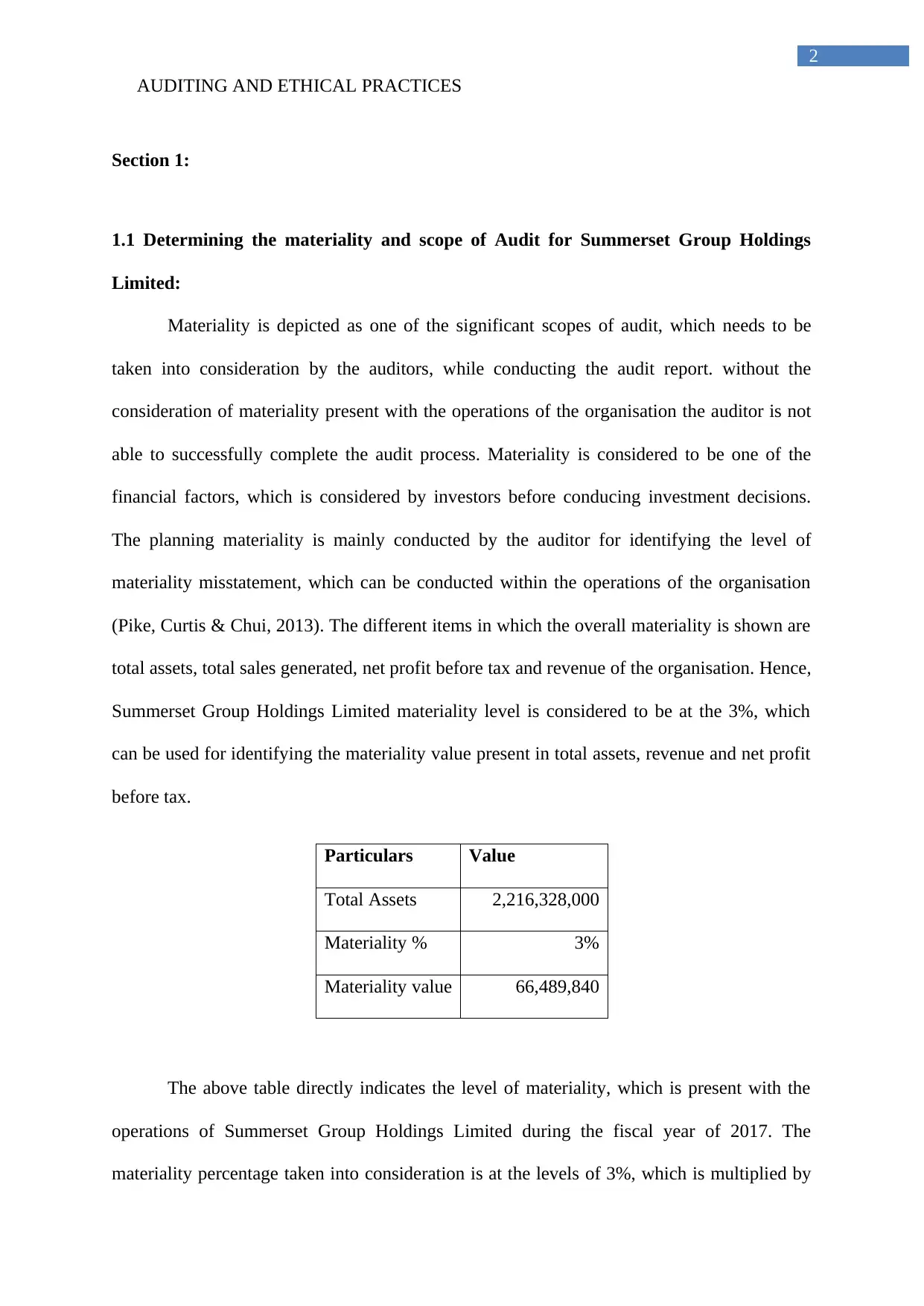

Materiality is depicted as one of the significant scopes of audit, which needs to be

taken into consideration by the auditors, while conducting the audit report. without the

consideration of materiality present with the operations of the organisation the auditor is not

able to successfully complete the audit process. Materiality is considered to be one of the

financial factors, which is considered by investors before conducing investment decisions.

The planning materiality is mainly conducted by the auditor for identifying the level of

materiality misstatement, which can be conducted within the operations of the organisation

(Pike, Curtis & Chui, 2013). The different items in which the overall materiality is shown are

total assets, total sales generated, net profit before tax and revenue of the organisation. Hence,

Summerset Group Holdings Limited materiality level is considered to be at the 3%, which

can be used for identifying the materiality value present in total assets, revenue and net profit

before tax.

Particulars Value

Total Assets 2,216,328,000

Materiality % 3%

Materiality value 66,489,840

The above table directly indicates the level of materiality, which is present with the

operations of Summerset Group Holdings Limited during the fiscal year of 2017. The

materiality percentage taken into consideration is at the levels of 3%, which is multiplied by

2

Section 1:

1.1 Determining the materiality and scope of Audit for Summerset Group Holdings

Limited:

Materiality is depicted as one of the significant scopes of audit, which needs to be

taken into consideration by the auditors, while conducting the audit report. without the

consideration of materiality present with the operations of the organisation the auditor is not

able to successfully complete the audit process. Materiality is considered to be one of the

financial factors, which is considered by investors before conducing investment decisions.

The planning materiality is mainly conducted by the auditor for identifying the level of

materiality misstatement, which can be conducted within the operations of the organisation

(Pike, Curtis & Chui, 2013). The different items in which the overall materiality is shown are

total assets, total sales generated, net profit before tax and revenue of the organisation. Hence,

Summerset Group Holdings Limited materiality level is considered to be at the 3%, which

can be used for identifying the materiality value present in total assets, revenue and net profit

before tax.

Particulars Value

Total Assets 2,216,328,000

Materiality % 3%

Materiality value 66,489,840

The above table directly indicates the level of materiality, which is present with the

operations of Summerset Group Holdings Limited during the fiscal year of 2017. The

materiality percentage taken into consideration is at the levels of 3%, which is multiplied by

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

AUDITING AND ETHICAL PRACTICES

3

the total assets of the company. This mainly holds the overall materiality value of 66,489,840

for the fiscal year of 2017 in the total assets of the organisation. Hence, with the overall value

of materiality the organisation is able to depict the performance material of other items listed

in the annual report. In this context, Ferrell and Fraedrich (2015) stated that with the presence

of materiality the overall investors are able to make decision regarding the investments by

identifying the loopholes in the current financial report of the organisation.

1.2 Reviewing various draft notes and disclosures mentioned in the annual report of

Summerset Group Holdings Limited:

From the evaluation of annual report adequate disclosures that has been made by the

organisation is identified, while there are not draft notes depicted in the financials. In

addition, the relevant disclosures are mainly considered significant for audit process, which

helps in understanding the current financial performance of the company Furthermore,

disclosure are adequately depicted in the annual report, which indicates that the company has

adopted NZ IFRS 9 – Financial Instruments from 1 July 2017. This has helped in drafting the

accurate financial statement for the company in accordance with the IFRS regulations.

Further disclosure regrinding the underlying profits has been conducted by the company in

the annual report, which has also been discussed in the auditor’s report (Espinosa-Pike &

Barrainkua, 2016).

The company has futhre depicted the Market Disclosure and Communications Policy

in the annual report with the Code of Ethics, Securities Trading Policy and Guidelines, Board

and Committee Charters, Diversity and Inclusion Policy, Director and Executive

Remuneration Policy, and Communication policy. The non-financial disclosure such as

health and safety approaches used by the organisation is also depicted in the annual report.

Lastly, the disclosure conducted by the organisation during the fiscal year was from the

3

the total assets of the company. This mainly holds the overall materiality value of 66,489,840

for the fiscal year of 2017 in the total assets of the organisation. Hence, with the overall value

of materiality the organisation is able to depict the performance material of other items listed

in the annual report. In this context, Ferrell and Fraedrich (2015) stated that with the presence

of materiality the overall investors are able to make decision regarding the investments by

identifying the loopholes in the current financial report of the organisation.

1.2 Reviewing various draft notes and disclosures mentioned in the annual report of

Summerset Group Holdings Limited:

From the evaluation of annual report adequate disclosures that has been made by the

organisation is identified, while there are not draft notes depicted in the financials. In

addition, the relevant disclosures are mainly considered significant for audit process, which

helps in understanding the current financial performance of the company Furthermore,

disclosure are adequately depicted in the annual report, which indicates that the company has

adopted NZ IFRS 9 – Financial Instruments from 1 July 2017. This has helped in drafting the

accurate financial statement for the company in accordance with the IFRS regulations.

Further disclosure regrinding the underlying profits has been conducted by the company in

the annual report, which has also been discussed in the auditor’s report (Espinosa-Pike &

Barrainkua, 2016).

The company has futhre depicted the Market Disclosure and Communications Policy

in the annual report with the Code of Ethics, Securities Trading Policy and Guidelines, Board

and Committee Charters, Diversity and Inclusion Policy, Director and Executive

Remuneration Policy, and Communication policy. The non-financial disclosure such as

health and safety approaches used by the organisation is also depicted in the annual report.

Lastly, the disclosure conducted by the organisation during the fiscal year was from the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AUDITING AND ETHICAL PRACTICES

4

changes in the director’s remuneration, interest and other activities. The disclosures depicted

by Summerset Group Holdings Limited mainly helps in understanding its current financial

progress in comparison to previous years (Summerset.co.nz, 2018).

Section 2:

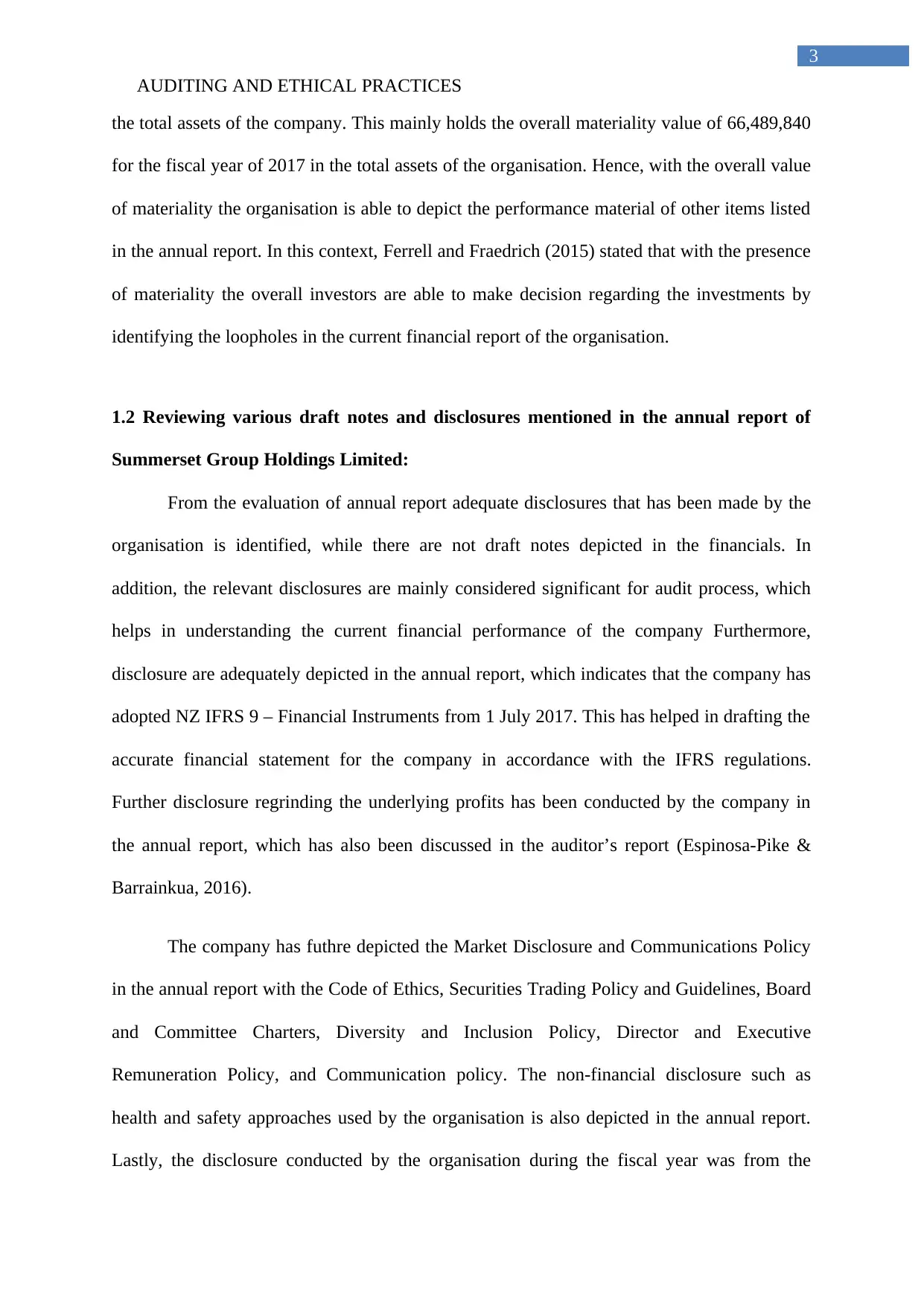

2.1 Reviewing the annual report of Summerset Group Holdings Limited by using

different ratios, while discussing the trend in the ratios:

Particulars 2017 2016 2015 2014

Current Assets 34,175 24,023 24,276 20,095

Current

Liabilities

109,084 69,208 53,125 31,247

Inventory - - - -

Revenue 328,462 229,513 152,215 108,648

Gross profit 239,875 158,426 94,878 63,726

Net profit 223,436 145,480 84,245 54,173

Total Assets 2,216,328 1,706,773 1,363,539 1,043,189

Total debt 1,321,731 1,080,193 888,533 665,515

Total equity 769,284 545,615 409,786 332,270

Particulars 2017 2016 2015 2014

Liquidity ratio

Current ratio 0.31 0.35 0.46 0.64

Working capital (74,909.00) (45,185.00 (28,849.00) (11,152.00)

4

changes in the director’s remuneration, interest and other activities. The disclosures depicted

by Summerset Group Holdings Limited mainly helps in understanding its current financial

progress in comparison to previous years (Summerset.co.nz, 2018).

Section 2:

2.1 Reviewing the annual report of Summerset Group Holdings Limited by using

different ratios, while discussing the trend in the ratios:

Particulars 2017 2016 2015 2014

Current Assets 34,175 24,023 24,276 20,095

Current

Liabilities

109,084 69,208 53,125 31,247

Inventory - - - -

Revenue 328,462 229,513 152,215 108,648

Gross profit 239,875 158,426 94,878 63,726

Net profit 223,436 145,480 84,245 54,173

Total Assets 2,216,328 1,706,773 1,363,539 1,043,189

Total debt 1,321,731 1,080,193 888,533 665,515

Total equity 769,284 545,615 409,786 332,270

Particulars 2017 2016 2015 2014

Liquidity ratio

Current ratio 0.31 0.35 0.46 0.64

Working capital (74,909.00) (45,185.00 (28,849.00) (11,152.00)

AUDITING AND ETHICAL PRACTICES

5

)

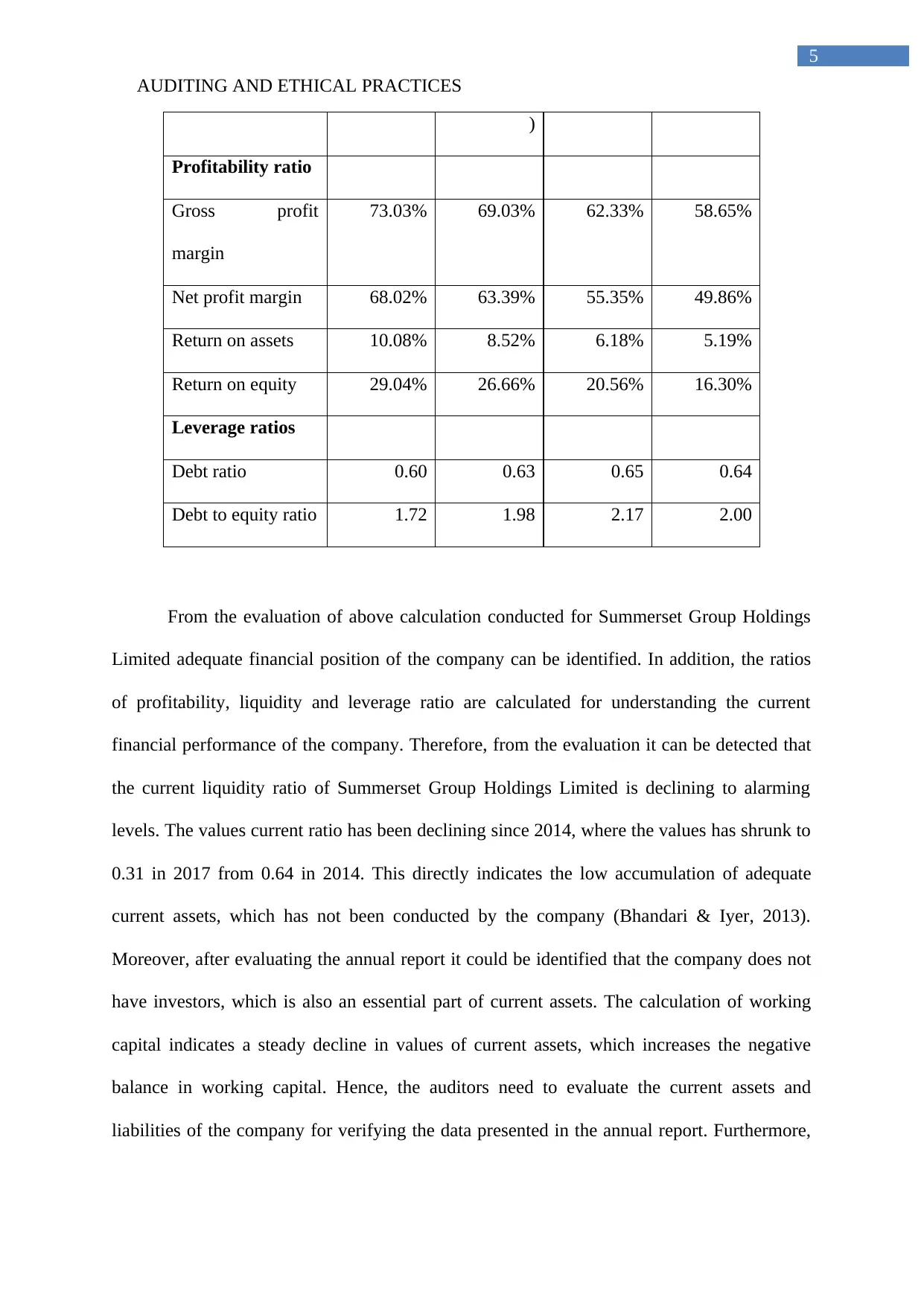

Profitability ratio

Gross profit

margin

73.03% 69.03% 62.33% 58.65%

Net profit margin 68.02% 63.39% 55.35% 49.86%

Return on assets 10.08% 8.52% 6.18% 5.19%

Return on equity 29.04% 26.66% 20.56% 16.30%

Leverage ratios

Debt ratio 0.60 0.63 0.65 0.64

Debt to equity ratio 1.72 1.98 2.17 2.00

From the evaluation of above calculation conducted for Summerset Group Holdings

Limited adequate financial position of the company can be identified. In addition, the ratios

of profitability, liquidity and leverage ratio are calculated for understanding the current

financial performance of the company. Therefore, from the evaluation it can be detected that

the current liquidity ratio of Summerset Group Holdings Limited is declining to alarming

levels. The values current ratio has been declining since 2014, where the values has shrunk to

0.31 in 2017 from 0.64 in 2014. This directly indicates the low accumulation of adequate

current assets, which has not been conducted by the company (Bhandari & Iyer, 2013).

Moreover, after evaluating the annual report it could be identified that the company does not

have investors, which is also an essential part of current assets. The calculation of working

capital indicates a steady decline in values of current assets, which increases the negative

balance in working capital. Hence, the auditors need to evaluate the current assets and

liabilities of the company for verifying the data presented in the annual report. Furthermore,

5

)

Profitability ratio

Gross profit

margin

73.03% 69.03% 62.33% 58.65%

Net profit margin 68.02% 63.39% 55.35% 49.86%

Return on assets 10.08% 8.52% 6.18% 5.19%

Return on equity 29.04% 26.66% 20.56% 16.30%

Leverage ratios

Debt ratio 0.60 0.63 0.65 0.64

Debt to equity ratio 1.72 1.98 2.17 2.00

From the evaluation of above calculation conducted for Summerset Group Holdings

Limited adequate financial position of the company can be identified. In addition, the ratios

of profitability, liquidity and leverage ratio are calculated for understanding the current

financial performance of the company. Therefore, from the evaluation it can be detected that

the current liquidity ratio of Summerset Group Holdings Limited is declining to alarming

levels. The values current ratio has been declining since 2014, where the values has shrunk to

0.31 in 2017 from 0.64 in 2014. This directly indicates the low accumulation of adequate

current assets, which has not been conducted by the company (Bhandari & Iyer, 2013).

Moreover, after evaluating the annual report it could be identified that the company does not

have investors, which is also an essential part of current assets. The calculation of working

capital indicates a steady decline in values of current assets, which increases the negative

balance in working capital. Hence, the auditors need to evaluate the current assets and

liabilities of the company for verifying the data presented in the annual report. Furthermore,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

AUDITING AND ETHICAL PRACTICES

6

the verification process initiated by the auditor would eventually help in detecting the actual

values of assets, which is used by the company.

The second financial ratio that has been used for evaluating the financial performance

of Summerset Group Holdings Limited is the profitability ratio. The profitability ratios listed

in the above table has relevantly increased in value from 2014 to 2017, due to the increment

in the net profits, revenues and gross profit of the company. The company has accumulated

high end profits over four fiscal year, which indicates efficiency and demand for its products.

The company’s net profit margin has mainly increased from 49.86% in 2014 to 68.02% in

2017, while the gross profit inclined from 58.65% in 2014 to 73.03% in 2017. In similar

instance, the increment in net profit has inclined the values of return on assets from 5.19% to

10.8% in 2017, while the return on equity increased from 16.03% to 29.04%. Hence, the

auditors need to check the current sales figures of the organisation for detecting the overall

cash and credit sales, which has been conducted during the fiscal year (Eilifsen & Messier Jr,

2014). The use of vouching procedure can be initiated by the auditor for detecting the

expenses conducted during the fiscal year. Lastly, the use of external sources can be

conducted by for identifying the overall actual expenses, which has been conducted by the

organisation.

The leverage ratios have been calculated for Summerset Group Holdings Limited,

which directly indicates its overall debt position. In addition, the debt ratio of the company

has mainly declined from the levels of 0.64 in 2014 to 0.60 in 2017, which directly indicates

the overall reduction in debt that has been used by the company for increasing its assets.

Furthermore, the relevant decline in debt to equity ratio of the company has also seen from

the level of 2 in 2014 to 1.72 in 2017. This decline directly indicates that the company has

been using equity capital for supporting its activities, while the high accumulated debt has

been reducing. The leverage ratio indicates a positive attribute for Summerset Group

6

the verification process initiated by the auditor would eventually help in detecting the actual

values of assets, which is used by the company.

The second financial ratio that has been used for evaluating the financial performance

of Summerset Group Holdings Limited is the profitability ratio. The profitability ratios listed

in the above table has relevantly increased in value from 2014 to 2017, due to the increment

in the net profits, revenues and gross profit of the company. The company has accumulated

high end profits over four fiscal year, which indicates efficiency and demand for its products.

The company’s net profit margin has mainly increased from 49.86% in 2014 to 68.02% in

2017, while the gross profit inclined from 58.65% in 2014 to 73.03% in 2017. In similar

instance, the increment in net profit has inclined the values of return on assets from 5.19% to

10.8% in 2017, while the return on equity increased from 16.03% to 29.04%. Hence, the

auditors need to check the current sales figures of the organisation for detecting the overall

cash and credit sales, which has been conducted during the fiscal year (Eilifsen & Messier Jr,

2014). The use of vouching procedure can be initiated by the auditor for detecting the

expenses conducted during the fiscal year. Lastly, the use of external sources can be

conducted by for identifying the overall actual expenses, which has been conducted by the

organisation.

The leverage ratios have been calculated for Summerset Group Holdings Limited,

which directly indicates its overall debt position. In addition, the debt ratio of the company

has mainly declined from the levels of 0.64 in 2014 to 0.60 in 2017, which directly indicates

the overall reduction in debt that has been used by the company for increasing its assets.

Furthermore, the relevant decline in debt to equity ratio of the company has also seen from

the level of 2 in 2014 to 1.72 in 2017. This decline directly indicates that the company has

been using equity capital for supporting its activities, while the high accumulated debt has

been reducing. The leverage ratio indicates a positive attribute for Summerset Group

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AUDITING AND ETHICAL PRACTICES

7

Holdings Limited, which directly indicates the positive attributes of the company. Hence, the

auditors need to evaluate the current risk attributes of the company by addressing the debt

capital utilised by Summerset Group Holdings Limited. Further evaluation on debt condition

of Summerset Group Holdings Limited needs to be conducted for understanding whether the

accumulated debt is affecting its operations. The auditor also needs to evaluate whether the

debt has been adequate depicted in the annual report based on their current valuation (Goh,

Krishnan & Li, 2013).

Therefore, the auditor needs to evaluate the current profit and balance sheet statement

of Summerset Group Holdings Limited for identifying the current financial valuation of the

company. This valuation would eventually help in detecting the current position of the

company and understand any kind of discrepancy in the annual report presented by the

management.

7

Holdings Limited, which directly indicates the positive attributes of the company. Hence, the

auditors need to evaluate the current risk attributes of the company by addressing the debt

capital utilised by Summerset Group Holdings Limited. Further evaluation on debt condition

of Summerset Group Holdings Limited needs to be conducted for understanding whether the

accumulated debt is affecting its operations. The auditor also needs to evaluate whether the

debt has been adequate depicted in the annual report based on their current valuation (Goh,

Krishnan & Li, 2013).

Therefore, the auditor needs to evaluate the current profit and balance sheet statement

of Summerset Group Holdings Limited for identifying the current financial valuation of the

company. This valuation would eventually help in detecting the current position of the

company and understand any kind of discrepancy in the annual report presented by the

management.

AUDITING AND ETHICAL PRACTICES

8

Section 3:

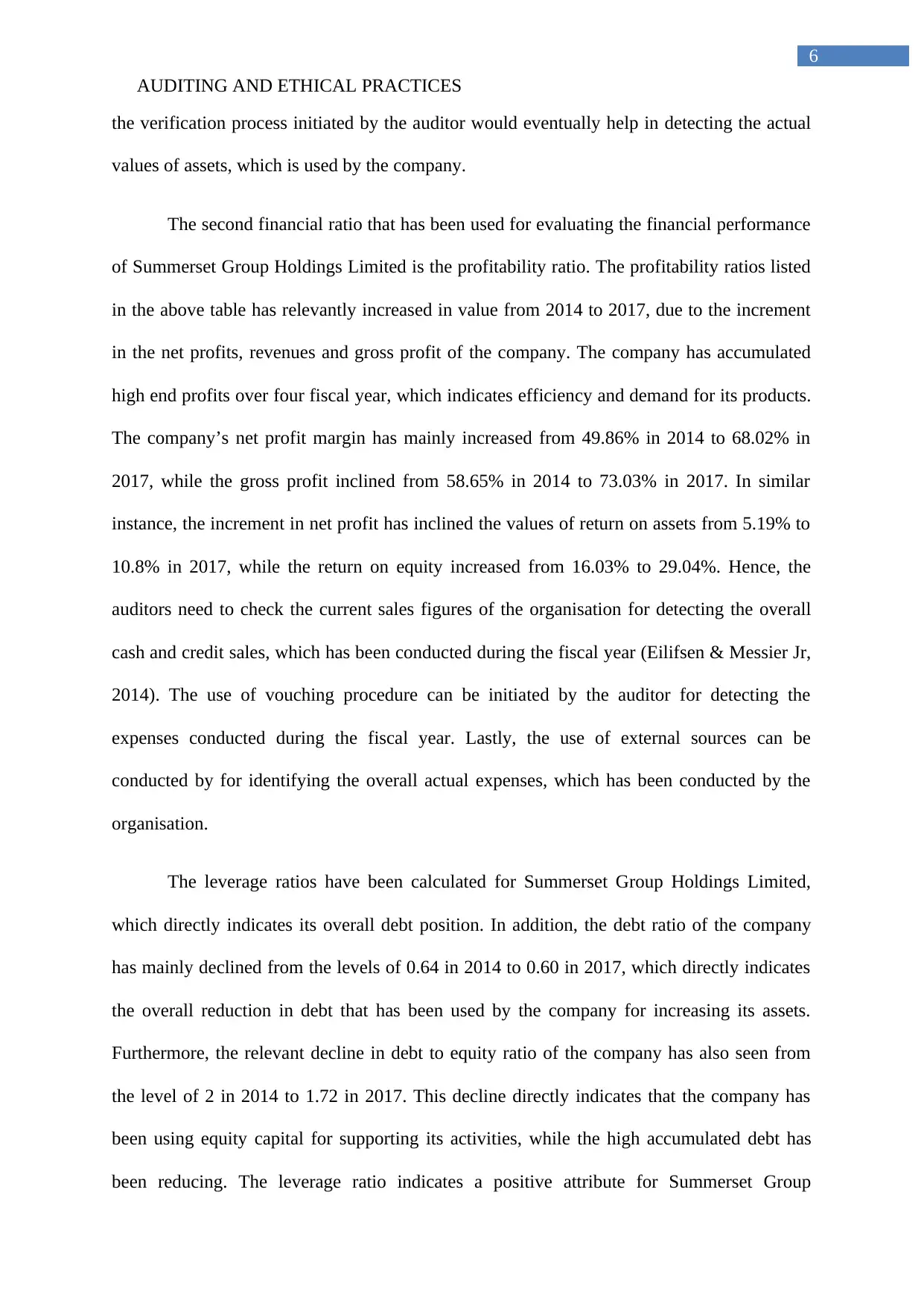

3.1 Reviewing the cash flow statement of Summerset Group Holdings Limited:

Figure 1: Depicting the cash flow statement 2017 and 2016

(Source: Summerset.co.nz, 2018)

The above figure mainly helps in depicting the level of cash flow for Summerset

Group Holdings Limited during 2017 to 2016. From the evaluation it can be detected that the

cash balance of the company has mainly declined from 2016 to 2017, where the values of

8

Section 3:

3.1 Reviewing the cash flow statement of Summerset Group Holdings Limited:

Figure 1: Depicting the cash flow statement 2017 and 2016

(Source: Summerset.co.nz, 2018)

The above figure mainly helps in depicting the level of cash flow for Summerset

Group Holdings Limited during 2017 to 2016. From the evaluation it can be detected that the

cash balance of the company has mainly declined from 2016 to 2017, where the values of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

AUDITING AND ETHICAL PRACTICES

9

cash balance at the end of the period has deteriorated from 8,654,000 in 2016 to 7,566,000 in

2017 (Summerset.co.nz, 2018). Furthermore, this decline in ending balance mainly occurred

due the negative net cash and cash equivalent balance during the fiscal year of 2017, which

was not conducted during 2016. From further evaluation it can be detected that the net cash

flow from operating activities has mainly increased from the levels of 192,610,000 in 2016 to

207,716,000 in 2017, which indicates the high income generated from operations by the

company (Summerset.co.nz, 2018).

Further evaluation of the cash flow statement indicated the rising negative value for

net cash from investing activities, which declined from the values of -199,857,000 in 2016 to

-257,494,000 in 2017 (Summerset.co.nz, 2018). This was mainly possible due to the high

expenses incurred by the organisation in the construction of new villages, purchase of land

and refurbishment in established villages. In addition, sudden rise in the purchase of

intangible assets were also seen, which led to the increment of cash outflow from investing

activities. Furthermore, drastic change in net cash flow from financing activities was seen

from 2016 to 2017, which occurred due to the proceeded from issue of retail bonds. This

increment in the current cash inflow from financial activities was the main reason behind the

reduction in the negative cash balance for the current fiscal year of 2017. From the overall

evaluation of Summerset Group Holdings Limited cash flow statement, it could be identified

that the rising cash flows from investing activities was the main reason behind the negative

balance in net cash and cash equivalents for the fiscal year of 2017 (Summerset.co.nz, 2018).

9

cash balance at the end of the period has deteriorated from 8,654,000 in 2016 to 7,566,000 in

2017 (Summerset.co.nz, 2018). Furthermore, this decline in ending balance mainly occurred

due the negative net cash and cash equivalent balance during the fiscal year of 2017, which

was not conducted during 2016. From further evaluation it can be detected that the net cash

flow from operating activities has mainly increased from the levels of 192,610,000 in 2016 to

207,716,000 in 2017, which indicates the high income generated from operations by the

company (Summerset.co.nz, 2018).

Further evaluation of the cash flow statement indicated the rising negative value for

net cash from investing activities, which declined from the values of -199,857,000 in 2016 to

-257,494,000 in 2017 (Summerset.co.nz, 2018). This was mainly possible due to the high

expenses incurred by the organisation in the construction of new villages, purchase of land

and refurbishment in established villages. In addition, sudden rise in the purchase of

intangible assets were also seen, which led to the increment of cash outflow from investing

activities. Furthermore, drastic change in net cash flow from financing activities was seen

from 2016 to 2017, which occurred due to the proceeded from issue of retail bonds. This

increment in the current cash inflow from financial activities was the main reason behind the

reduction in the negative cash balance for the current fiscal year of 2017. From the overall

evaluation of Summerset Group Holdings Limited cash flow statement, it could be identified

that the rising cash flows from investing activities was the main reason behind the negative

balance in net cash and cash equivalents for the fiscal year of 2017 (Summerset.co.nz, 2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AUDITING AND ETHICAL PRACTICES

10

3.2 Reviewing the audit report of 2017 financial report of Summerset Group Holdings

Limited:

Figure 2: Depicting the auditor’s report for 2017

(Source: Summerset.co.nz, 2018)

The above figure represents the overall auditors report for Summerset Group

Holdings Limited, which has been prepared by Ernst and Young. The annual report indicates

the level of auditor’s statement, which states the reliability on financial statement of

Summerset Group Holdings Limited. The auditor has used the standards of International

Standards on Auditing for evaluating the financial performance of the organisation.

10

3.2 Reviewing the audit report of 2017 financial report of Summerset Group Holdings

Limited:

Figure 2: Depicting the auditor’s report for 2017

(Source: Summerset.co.nz, 2018)

The above figure represents the overall auditors report for Summerset Group

Holdings Limited, which has been prepared by Ernst and Young. The annual report indicates

the level of auditor’s statement, which states the reliability on financial statement of

Summerset Group Holdings Limited. The auditor has used the standards of International

Standards on Auditing for evaluating the financial performance of the organisation.

AUDITING AND ETHICAL PRACTICES

11

Furthermore, the responsibility led by the auditor is adequately depicted in the section

Auditor’s Responsibilities for the Audit of the Financial Statements. The audit partner falls

under the Professional and Ethical Standard 1 (revised) Code of Ethics for Assurance

Practitioners issued by the New Zealand Auditing. This mainly ensures the reliability on the

financial report of the company for the fiscal year of 2017 (Summerset.co.nz, 2018).

Moreover, adequate key audit mattes have been depicted in the auditor’s report, which

helps in understanding the overall financial performance of the organisation. Further

evaluation on the overall valuation of investment properties has been conducted to identify its

actual values, which has been listed in the asset section of the balance sheet. In addition, the

care facility valuation has also been conducted by the auditor’s report, as it taken 4.9% of the

total assets. Moreover, the Recognition and Measurement of Capital Work in Progress has

also been depicted in the auditor’s report, which helps in evaluating the actual financial

performance of the organisation. The auditor’s report also depicts the Deferred Management

Fee Revenue Recognition, which has been conducted in the annual report of the organisation

for identifying its actual financial position during the fiscal year of 2017 (Summerset.co.nz,

2018).

11

Furthermore, the responsibility led by the auditor is adequately depicted in the section

Auditor’s Responsibilities for the Audit of the Financial Statements. The audit partner falls

under the Professional and Ethical Standard 1 (revised) Code of Ethics for Assurance

Practitioners issued by the New Zealand Auditing. This mainly ensures the reliability on the

financial report of the company for the fiscal year of 2017 (Summerset.co.nz, 2018).

Moreover, adequate key audit mattes have been depicted in the auditor’s report, which

helps in understanding the overall financial performance of the organisation. Further

evaluation on the overall valuation of investment properties has been conducted to identify its

actual values, which has been listed in the asset section of the balance sheet. In addition, the

care facility valuation has also been conducted by the auditor’s report, as it taken 4.9% of the

total assets. Moreover, the Recognition and Measurement of Capital Work in Progress has

also been depicted in the auditor’s report, which helps in evaluating the actual financial

performance of the organisation. The auditor’s report also depicts the Deferred Management

Fee Revenue Recognition, which has been conducted in the annual report of the organisation

for identifying its actual financial position during the fiscal year of 2017 (Summerset.co.nz,

2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

AUDITING AND ETHICAL PRACTICES

12

References and Bibliography:

Asx.com.au. (2018). Asx.com.au. Retrieved 2 September 2018, from

https://www.asx.com.au/asx/share-price-research/company/SNZ

Bhandari, S. B., & Iyer, R. (2013). Predicting business failure using cash flow statement

based measures. Managerial Finance, 39(7), 667-676.

Byrnes, A., Banks, M., Mudge, A., Young, A., & Bauer, J. (2018). Enhanced Recovery After

Surgery as an auditing framework for identifying improvements to perioperative

nutrition care of older surgical patients. European journal of clinical nutrition, 72(6),

913.

Eilifsen, A., & Messier Jr, W. F. (2014). Materiality guidance of the major public accounting

firms. Auditing: A Journal of Practice & Theory, 34(2), 3-26.

El-Kassar, A. N., Messarra, L., & Elgammal, W. (2015). Effects of ethical practices on

corporate governance in developing countries: evidence from Lebanon and

Egypt. Corporate Ownership and Control, 12(3), 494-504.

Espinosa-Pike, M., & Barrainkua, I. (2016). An exploratory study of the pressures and ethical

dilemmas in the audit conflict. Revista de Contabilidad, 19(1), 10-20.

Ferrell, O. C., & Fraedrich, J. (2015). Business ethics: Ethical decision making & cases.

Nelson Education.

Goh, B. W., Krishnan, J., & Li, D. (2013). Auditor reporting under Section 404: The

association between the internal control and going concern audit opinions. Contemporary

Accounting Research, 30(3), 970-995.

12

References and Bibliography:

Asx.com.au. (2018). Asx.com.au. Retrieved 2 September 2018, from

https://www.asx.com.au/asx/share-price-research/company/SNZ

Bhandari, S. B., & Iyer, R. (2013). Predicting business failure using cash flow statement

based measures. Managerial Finance, 39(7), 667-676.

Byrnes, A., Banks, M., Mudge, A., Young, A., & Bauer, J. (2018). Enhanced Recovery After

Surgery as an auditing framework for identifying improvements to perioperative

nutrition care of older surgical patients. European journal of clinical nutrition, 72(6),

913.

Eilifsen, A., & Messier Jr, W. F. (2014). Materiality guidance of the major public accounting

firms. Auditing: A Journal of Practice & Theory, 34(2), 3-26.

El-Kassar, A. N., Messarra, L., & Elgammal, W. (2015). Effects of ethical practices on

corporate governance in developing countries: evidence from Lebanon and

Egypt. Corporate Ownership and Control, 12(3), 494-504.

Espinosa-Pike, M., & Barrainkua, I. (2016). An exploratory study of the pressures and ethical

dilemmas in the audit conflict. Revista de Contabilidad, 19(1), 10-20.

Ferrell, O. C., & Fraedrich, J. (2015). Business ethics: Ethical decision making & cases.

Nelson Education.

Goh, B. W., Krishnan, J., & Li, D. (2013). Auditor reporting under Section 404: The

association between the internal control and going concern audit opinions. Contemporary

Accounting Research, 30(3), 970-995.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AUDITING AND ETHICAL PRACTICES

13

Hay, D., Stewart, J., & Botica Redmayne, N. (2017). The Role of Auditing in Corporate

Governance in Australia and New Zealand: A Research Synthesis. Australian

Accounting Review, 27(4), 457-479.

Hayes, R. S., Gortemaker, H., & Wallage, P. (2014). Principles of auditing: an introduction

to international standards on auditing. Prentice Hall, Financial Times.

Liu, T., Wang, Y., & Wilkinson, S. (2016). Identifying critical factors affecting the

effectiveness and efficiency of tendering processes in Public–Private Partnerships

(PPPs): A comparative analysis of Australia and China. International Journal of

Project Management, 34(4), 701-716.

Louwers, T. J., Ramsay, R. J., Sinason, D. H., Strawser, J. R., & Thibodeau, J. C.

(2015). Auditing & assurance services. McGraw-Hill Education.

Neu, D., Everett, J., & Rahaman, A. S. (2015). Preventing corruption within government

procurement: Constructing the disciplined and ethical subject. Critical Perspectives on

Accounting, 28, 49-61.

Pike, B. J., Curtis, M. B., & Chui, L. (2013). How does an initial expectation bias influence

auditors' application and performance of analytical procedures?. The Accounting

Review, 88(4), 1413-1431.

Summerset.co.nz. (2018). Summerset.co.nz. Retrieved 2 September 2018, from

https://www.summerset.co.nz/

Tucker, B. P., & Schaltegger, S. (2016). Comparing the research-practice gap in management

accounting: A view from professional accounting bodies in Australia and

Germany. Accounting, Auditing & Accountability Journal, 29(3), 362-400.

13

Hay, D., Stewart, J., & Botica Redmayne, N. (2017). The Role of Auditing in Corporate

Governance in Australia and New Zealand: A Research Synthesis. Australian

Accounting Review, 27(4), 457-479.

Hayes, R. S., Gortemaker, H., & Wallage, P. (2014). Principles of auditing: an introduction

to international standards on auditing. Prentice Hall, Financial Times.

Liu, T., Wang, Y., & Wilkinson, S. (2016). Identifying critical factors affecting the

effectiveness and efficiency of tendering processes in Public–Private Partnerships

(PPPs): A comparative analysis of Australia and China. International Journal of

Project Management, 34(4), 701-716.

Louwers, T. J., Ramsay, R. J., Sinason, D. H., Strawser, J. R., & Thibodeau, J. C.

(2015). Auditing & assurance services. McGraw-Hill Education.

Neu, D., Everett, J., & Rahaman, A. S. (2015). Preventing corruption within government

procurement: Constructing the disciplined and ethical subject. Critical Perspectives on

Accounting, 28, 49-61.

Pike, B. J., Curtis, M. B., & Chui, L. (2013). How does an initial expectation bias influence

auditors' application and performance of analytical procedures?. The Accounting

Review, 88(4), 1413-1431.

Summerset.co.nz. (2018). Summerset.co.nz. Retrieved 2 September 2018, from

https://www.summerset.co.nz/

Tucker, B. P., & Schaltegger, S. (2016). Comparing the research-practice gap in management

accounting: A view from professional accounting bodies in Australia and

Germany. Accounting, Auditing & Accountability Journal, 29(3), 362-400.

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.