ACC321 Auditing: Materiality Assessment and Audit Procedures Report

VerifiedAdded on 2023/06/04

|10

|1969

|253

Report

AI Summary

This report provides an analysis of auditing and professional practice, focusing on materiality assessment, analytical review, and recommended audit procedures. It begins by establishing a preliminary judgment for materiality, considering its impact on financial statement users' decisions and the audit budget. The report then delves into analytical review, utilizing trend analysis to identify potential misstatements. Three key accounts—sales, consultancy fees, and repairs and maintenance—are selected for further scrutiny, with justifications for their selection and explanations of relevant assertions. For each account, specific audit procedures are recommended to address potential misstatements. Finally, the report addresses the concept of fraud in auditing, emphasizing the auditor's responsibility to detect material misstatements, even in situations where fraud risk may seem low. This document is available on Desklib, a platform offering a wide range of academic resources, including past papers and solved assignments, to support students in their studies.

Running head: AUDITING AND PROFESSIONAL PRACTICE

Auditing and professional practice

Name of the student

Name of the university

Student ID

Author note

Auditing and professional practice

Name of the student

Name of the university

Student ID

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2AUDITING AND PROFESSIONAL PRACTICE

Table of Contents

1.0 Preliminary judgement for materiality............................................................................3

2.0 Analytical review............................................................................................................3

3.0 Analytical review through trend analysis.............................................................................4

4.0 Accounts under material misstatement................................................................................4

4.1.1 First account selected – Sales........................................................................................4

4.1.2 Rational for selection....................................................................................................4

4.1.3 Assertion and explanation.............................................................................................5

4.2 Second account selected – Consultancy fees...............................................................5

4.2.1 Rational for selection...............................................................................................5

4.2.2 Assertion and explanation........................................................................................5

4.3 Third account selected – Repairs and maintenance.........................................................6

4.3.1 Rational for selection....................................................................................................6

4.3.2 Assertion and explanation.............................................................................................6

5.0 Recommended audit procedure............................................................................................6

5.1 Audit procedure – Sales...................................................................................................6

5.2 Audit procedure – Consultancy fees................................................................................7

5.3 Audit procedure – Repairs and maintenance...................................................................7

6.0 Fraud....................................................................................................................................7

Reference....................................................................................................................................8

Table of Contents

1.0 Preliminary judgement for materiality............................................................................3

2.0 Analytical review............................................................................................................3

3.0 Analytical review through trend analysis.............................................................................4

4.0 Accounts under material misstatement................................................................................4

4.1.1 First account selected – Sales........................................................................................4

4.1.2 Rational for selection....................................................................................................4

4.1.3 Assertion and explanation.............................................................................................5

4.2 Second account selected – Consultancy fees...............................................................5

4.2.1 Rational for selection...............................................................................................5

4.2.2 Assertion and explanation........................................................................................5

4.3 Third account selected – Repairs and maintenance.........................................................6

4.3.1 Rational for selection....................................................................................................6

4.3.2 Assertion and explanation.............................................................................................6

5.0 Recommended audit procedure............................................................................................6

5.1 Audit procedure – Sales...................................................................................................6

5.2 Audit procedure – Consultancy fees................................................................................7

5.3 Audit procedure – Repairs and maintenance...................................................................7

6.0 Fraud....................................................................................................................................7

Reference....................................................................................................................................8

3AUDITING AND PROFESSIONAL PRACTICE

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4AUDITING AND PROFESSIONAL PRACTICE

1.0 Preliminary judgement for materiality

Materiality is the relative factor that asks for a base to support the fact that whether

the misstatement involved due to fraud or errors is material or immaterial. On the other hand,

preliminary judgement indicated the maximum possible amount that can be accepted by the

auditor for misstatement and that will not have any significant impact on the decision making

procedure of the users of the financial statement (Choudhary, Merkley and Schipper 2018).

Whereas some of the misstatements are based on the amount involved, some are based on the

nature of the items even though the amount involved is small. Level of materiality is

calculated through taking the sales revenue as base. Generally, the materiality is established

at 2% to 5% of sales revenue. Therefore, in case of Cadmium Enterprise materiality level will

be from ($ 189,000 *2%) = $ 3,780 to ($ 189,000 * 5%) = $ 9,450. Further, the tolerable

misstatement is established at 50% to 75% of the materiality. Therefore, in case of Cadmium

Enterprise materiality can be established at around $ 6,000 (Eilifsen and Messier 2014).

However, in case of the company the audit partner recommended that the preliminary

assessment with regard to materiality shall be set at $ 15,000. Therefore, the amount of

materiality shall be re-established at $ 6,000. Audit budget includes the number of items to be

audited under the audit procedure of financial statement. Based on the materiality level the

auditor prepares the budget regarding how many items are to be checked. However, if the

tolerable misstatement level is reduced the auditor will have to check more items under audit.

Therefore, changes on preliminary assessment will have great impact on audit budget

(Lessambo 2018).

2.0 Analytical review

Analytical review under audit is carried out through taking into consideration various

analyses like ratio analyses and trend analyses of the company as compared to the previous

1.0 Preliminary judgement for materiality

Materiality is the relative factor that asks for a base to support the fact that whether

the misstatement involved due to fraud or errors is material or immaterial. On the other hand,

preliminary judgement indicated the maximum possible amount that can be accepted by the

auditor for misstatement and that will not have any significant impact on the decision making

procedure of the users of the financial statement (Choudhary, Merkley and Schipper 2018).

Whereas some of the misstatements are based on the amount involved, some are based on the

nature of the items even though the amount involved is small. Level of materiality is

calculated through taking the sales revenue as base. Generally, the materiality is established

at 2% to 5% of sales revenue. Therefore, in case of Cadmium Enterprise materiality level will

be from ($ 189,000 *2%) = $ 3,780 to ($ 189,000 * 5%) = $ 9,450. Further, the tolerable

misstatement is established at 50% to 75% of the materiality. Therefore, in case of Cadmium

Enterprise materiality can be established at around $ 6,000 (Eilifsen and Messier 2014).

However, in case of the company the audit partner recommended that the preliminary

assessment with regard to materiality shall be set at $ 15,000. Therefore, the amount of

materiality shall be re-established at $ 6,000. Audit budget includes the number of items to be

audited under the audit procedure of financial statement. Based on the materiality level the

auditor prepares the budget regarding how many items are to be checked. However, if the

tolerable misstatement level is reduced the auditor will have to check more items under audit.

Therefore, changes on preliminary assessment will have great impact on audit budget

(Lessambo 2018).

2.0 Analytical review

Analytical review under audit is carried out through taking into consideration various

analyses like ratio analyses and trend analyses of the company as compared to the previous

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5AUDITING AND PROFESSIONAL PRACTICE

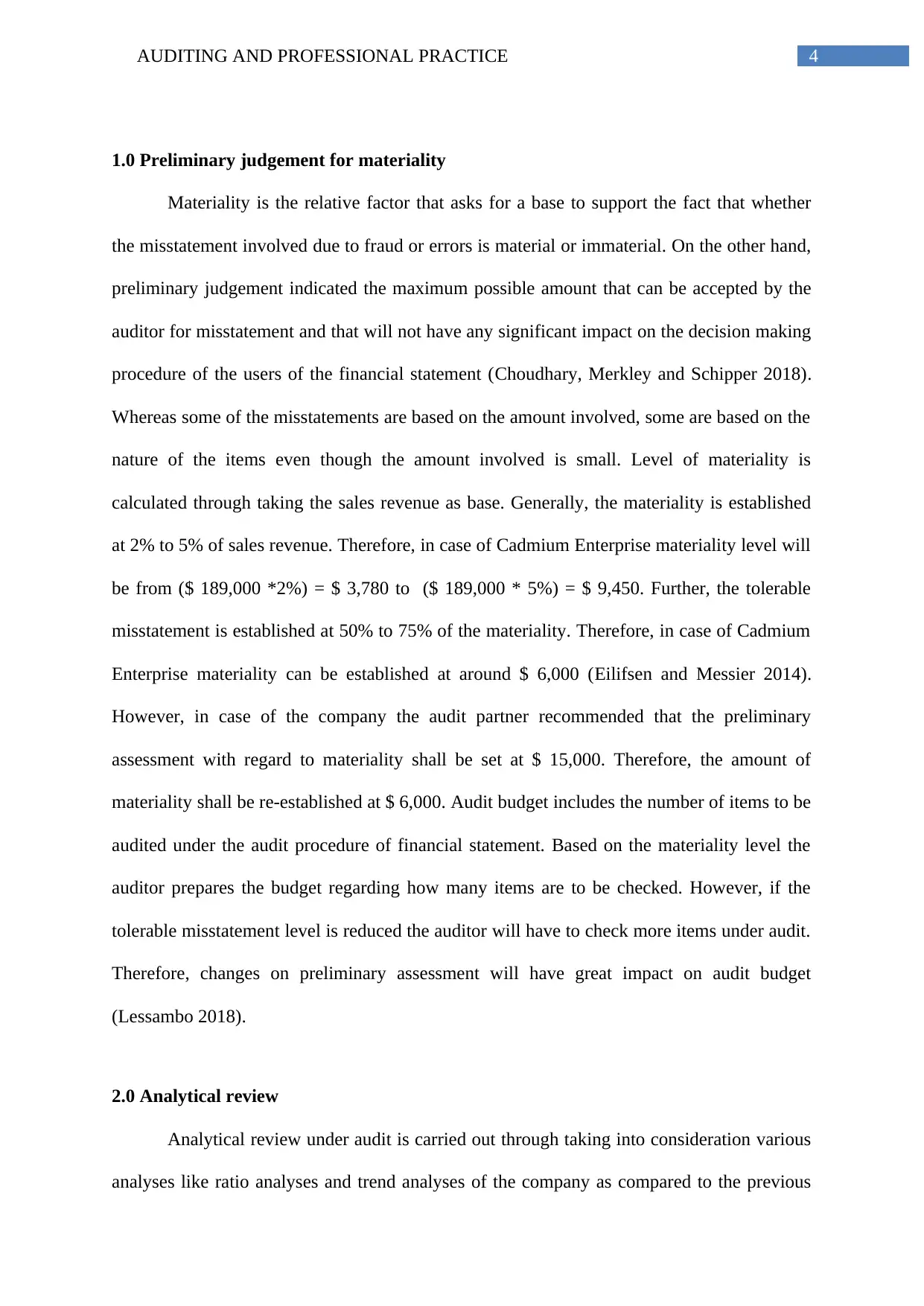

year or as compared to peer entity. This procedure analyse the trends and ratios and thereafter

recognises the exception amount due to the nature or significant changes. Analytical

procedure assists the auditor to establish the level of reliance that can be made depending on

the inherent risk and control risk of the company. It further helps the auditor in planning the

nature, timing and extent of audit (Mock and Fukukawa 2015).

3.0 Analytical review through trend analysis

4.0 Accounts under material misstatement

4.1.1 First account selected – Sales

4.1.2 Rational for selection

Sales plays important role in business operation of the company as all the operating

expenses are paid out of the sales revenue. Though it has been found that the sales revenue of

Cadmium Enterprise has been increased by only $ 1,550 that is by only 0.83%, owing to its

nature this item will be considered as material. Further, the employee’s bonus and manager’s

year or as compared to peer entity. This procedure analyse the trends and ratios and thereafter

recognises the exception amount due to the nature or significant changes. Analytical

procedure assists the auditor to establish the level of reliance that can be made depending on

the inherent risk and control risk of the company. It further helps the auditor in planning the

nature, timing and extent of audit (Mock and Fukukawa 2015).

3.0 Analytical review through trend analysis

4.0 Accounts under material misstatement

4.1.1 First account selected – Sales

4.1.2 Rational for selection

Sales plays important role in business operation of the company as all the operating

expenses are paid out of the sales revenue. Though it has been found that the sales revenue of

Cadmium Enterprise has been increased by only $ 1,550 that is by only 0.83%, owing to its

nature this item will be considered as material. Further, the employee’s bonus and manager’s

6AUDITING AND PROFESSIONAL PRACTICE

remuneration are based on the sales revenue of the company that makes the item susceptible

to misstatement (Legoria, Melendrez and Reynolds 2013).

4.1.3 Assertion and explanation

While auditing the sales revenue the auditor is mainly concerned about the

misstatement and accuracy. Likelihood is there that the management has recorded sales to

fictitious purchasers or for fictitious items for increasing the sales amount which in turn will

make them eligible for higher remuneration. Further, the amount may be misstated through

raising the invoice without actually delivering the products or invoice not raised for the items

already delivered (Kogan et al. 2014). Therefore, the assertion related to sales revenue is

accuracy that is the amount of sales revenue has been misstated or there involved any

mathematical inaccuracy.

4.2 Second account selected – Consultancy fees

4.2.1 Rational for selection

It has been found that the amount received through consultancy fees is a major source

of income for the after sales revenue. Though it has been found that the consultancy fees

receipt by Cadmium Enterprise has been increased by only $ 2,251 that is by only 3.95%,

owing to its nature this item will be considered as material.

4.2.2 Assertion and explanation

While auditing the receipt from consultancy fees the auditor is mainly concerned

about the misstatement regarding accuracy. Likelihood is there that the management has

raised invoice at higher or lower amount than the actual. Further, as the fees has been

increased as compared to the last year likelihood is there that the company started providing

additional services to the existing clients or the charges has been increased or number of

client has been increased (Ruhnke and Schmidt 2014). Therefore, the assertion related to

remuneration are based on the sales revenue of the company that makes the item susceptible

to misstatement (Legoria, Melendrez and Reynolds 2013).

4.1.3 Assertion and explanation

While auditing the sales revenue the auditor is mainly concerned about the

misstatement and accuracy. Likelihood is there that the management has recorded sales to

fictitious purchasers or for fictitious items for increasing the sales amount which in turn will

make them eligible for higher remuneration. Further, the amount may be misstated through

raising the invoice without actually delivering the products or invoice not raised for the items

already delivered (Kogan et al. 2014). Therefore, the assertion related to sales revenue is

accuracy that is the amount of sales revenue has been misstated or there involved any

mathematical inaccuracy.

4.2 Second account selected – Consultancy fees

4.2.1 Rational for selection

It has been found that the amount received through consultancy fees is a major source

of income for the after sales revenue. Though it has been found that the consultancy fees

receipt by Cadmium Enterprise has been increased by only $ 2,251 that is by only 3.95%,

owing to its nature this item will be considered as material.

4.2.2 Assertion and explanation

While auditing the receipt from consultancy fees the auditor is mainly concerned

about the misstatement regarding accuracy. Likelihood is there that the management has

raised invoice at higher or lower amount than the actual. Further, as the fees has been

increased as compared to the last year likelihood is there that the company started providing

additional services to the existing clients or the charges has been increased or number of

client has been increased (Ruhnke and Schmidt 2014). Therefore, the assertion related to

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7AUDITING AND PROFESSIONAL PRACTICE

consultancy fees is accuracy that is the amount of receipt has been misstated or has not been

reported correctly.

4.3 Third account selected – Repairs and maintenance

4.3.1 Rational for selection

It is found in case of Cadmium Enterprise that the amount of repairs and maintenance

has been significantly reduced by $ 3,610 that is by 71.49%. Therefore, the item is material

by amount.

4.3.2 Assertion and explanation

While auditing for repairs and maintenance the auditor shall be concerned about the

misstatement owing to mathematical accuracy and appropriateness of recording the amount.

Likelihood is there that the invoice for consultancy has been raised at lower amount or the

amount has been recorded at lower or higher amount. Therefore, in case of consultancy fees

the assertion is with regard to accuracy that the amount has not been recorded appropriately

and cut-off that is the amount has been recorded under appropriate accounting period.

5.0 Recommended audit procedure

5.1 Audit procedure – Sales

For auditing the sales revenue the auditor shall check the sales register and match the

accounting records with the names, amount receipt from sales and sales basis that is the cash

basis or credit basis. Further, the sales report shall be verified with the invoices and customer

order number shall be matched with that (Christensen, Glover and Wood 2013). The auditor

shall further check the recognition method of sales revenue and whether the recognition

method is used by the entity on consistent basis.

consultancy fees is accuracy that is the amount of receipt has been misstated or has not been

reported correctly.

4.3 Third account selected – Repairs and maintenance

4.3.1 Rational for selection

It is found in case of Cadmium Enterprise that the amount of repairs and maintenance

has been significantly reduced by $ 3,610 that is by 71.49%. Therefore, the item is material

by amount.

4.3.2 Assertion and explanation

While auditing for repairs and maintenance the auditor shall be concerned about the

misstatement owing to mathematical accuracy and appropriateness of recording the amount.

Likelihood is there that the invoice for consultancy has been raised at lower amount or the

amount has been recorded at lower or higher amount. Therefore, in case of consultancy fees

the assertion is with regard to accuracy that the amount has not been recorded appropriately

and cut-off that is the amount has been recorded under appropriate accounting period.

5.0 Recommended audit procedure

5.1 Audit procedure – Sales

For auditing the sales revenue the auditor shall check the sales register and match the

accounting records with the names, amount receipt from sales and sales basis that is the cash

basis or credit basis. Further, the sales report shall be verified with the invoices and customer

order number shall be matched with that (Christensen, Glover and Wood 2013). The auditor

shall further check the recognition method of sales revenue and whether the recognition

method is used by the entity on consistent basis.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8AUDITING AND PROFESSIONAL PRACTICE

5.2 Audit procedure – Consultancy fees

For auditing the fees received from consultancy fees the auditor shall verify the bill

raised to the clients with details of their names, services provided and charges for the

services. If additional services is provided fees charged for that additional service shall be

verified. Further, the auditor shall match the bill number with the amount recorded in the

accounts.

5.3 Audit procedure – Repairs and maintenance

While auditing the repairs and maintenance at 1st the auditor shall verify that whether

the capital expenses incurred for repairing the fixed assets have been capitalized or have been

charged under income statement (Antonio 2014). Further, the auditor shall check that where

the amount involved is big the expenses has been authorised by the proper authorization.

Amount paid for repairs and maintenance shall be verified with the cash books or bank

books.

6.0 Fraud

The term fraud in auditing aspect is stated as the concealment of material fact or false

representation intentionally for persuading any other person to act on that. Professionally the

auditors are responsible for detecting the fraud while auditing the financial statement. It helps

the auditor to sharpen their knowledge and skill which in turn teach them new technique to

detect financial misstatement. Frauds are committed by the management or the employees as

they want to rationalize their activities that include wilful misstatement or weakness in

internal control. Therefore, fraud is very common activities that are used by most of the

organizations (Boyle, DeZoort and Hermanson 2015). Hence, even if the audit partner feels

that fraud risk is not there in case of Cadmium Enterprise as the employees are trustworthy,

the auditor shall not ignore the likelihood of fraud.

5.2 Audit procedure – Consultancy fees

For auditing the fees received from consultancy fees the auditor shall verify the bill

raised to the clients with details of their names, services provided and charges for the

services. If additional services is provided fees charged for that additional service shall be

verified. Further, the auditor shall match the bill number with the amount recorded in the

accounts.

5.3 Audit procedure – Repairs and maintenance

While auditing the repairs and maintenance at 1st the auditor shall verify that whether

the capital expenses incurred for repairing the fixed assets have been capitalized or have been

charged under income statement (Antonio 2014). Further, the auditor shall check that where

the amount involved is big the expenses has been authorised by the proper authorization.

Amount paid for repairs and maintenance shall be verified with the cash books or bank

books.

6.0 Fraud

The term fraud in auditing aspect is stated as the concealment of material fact or false

representation intentionally for persuading any other person to act on that. Professionally the

auditors are responsible for detecting the fraud while auditing the financial statement. It helps

the auditor to sharpen their knowledge and skill which in turn teach them new technique to

detect financial misstatement. Frauds are committed by the management or the employees as

they want to rationalize their activities that include wilful misstatement or weakness in

internal control. Therefore, fraud is very common activities that are used by most of the

organizations (Boyle, DeZoort and Hermanson 2015). Hence, even if the audit partner feels

that fraud risk is not there in case of Cadmium Enterprise as the employees are trustworthy,

the auditor shall not ignore the likelihood of fraud.

9AUDITING AND PROFESSIONAL PRACTICE

Reference

Antonio, G.R., 2014. Continuous auditing: Developing automated audit systems for fraud and

error detections. Journal of Economics, Business & Accountancy Ventura, 17(1), pp.127-144.

Boyle, D.M., DeZoort, F.T. and Hermanson, D.R., 2015. The effect of alternative fraud

model use on auditors’ fraud risk judgments. Journal of Accounting and Public Policy, 34(6),

pp.578-596.

Choudhary, P., Merkley, K.J. and Schipper, K., 2018. Auditors’ Quantitative Materiality

Judgments: Properties and Implications for Financial Reporting Reliability.

Christensen, B.E., Glover, S.M. and Wood, D.A., 2013. Extreme estimation uncertainty and

audit assurance. Current Issues in Auditing, 7(1), pp.P36-P42.

Eilifsen, A. and Messier Jr, W.F., 2014. Materiality guidance of the major public accounting

firms. Auditing: A Journal of Practice & Theory, 34(2), pp.3-26.

Kogan, A., Alles, M.G., Vasarhelyi, M.A. and Wu, J., 2014. Design and evaluation of a

continuous data level auditing system. Auditing: A Journal of Practice & Theory, 33(4),

pp.221-245.

Legoria, J., Melendrez, K.D. and Reynolds, J.K., 2013. Qualitative audit materiality and

earnings management. Review of Accounting Studies, 18(2), pp.414-442.

Lessambo, F.I., 2018. Audit Risks: Identification and Procedures. In Auditing, Assurance

Services, and Forensics(pp. 183-202). Palgrave Macmillan, Cham.

Mock, T.J. and Fukukawa, H., 2015. Auditors' risk assessments: The effects of elicitation

approach and assertion framing. Behavioral Research in Accounting, 28(2), pp.75-84.

Reference

Antonio, G.R., 2014. Continuous auditing: Developing automated audit systems for fraud and

error detections. Journal of Economics, Business & Accountancy Ventura, 17(1), pp.127-144.

Boyle, D.M., DeZoort, F.T. and Hermanson, D.R., 2015. The effect of alternative fraud

model use on auditors’ fraud risk judgments. Journal of Accounting and Public Policy, 34(6),

pp.578-596.

Choudhary, P., Merkley, K.J. and Schipper, K., 2018. Auditors’ Quantitative Materiality

Judgments: Properties and Implications for Financial Reporting Reliability.

Christensen, B.E., Glover, S.M. and Wood, D.A., 2013. Extreme estimation uncertainty and

audit assurance. Current Issues in Auditing, 7(1), pp.P36-P42.

Eilifsen, A. and Messier Jr, W.F., 2014. Materiality guidance of the major public accounting

firms. Auditing: A Journal of Practice & Theory, 34(2), pp.3-26.

Kogan, A., Alles, M.G., Vasarhelyi, M.A. and Wu, J., 2014. Design and evaluation of a

continuous data level auditing system. Auditing: A Journal of Practice & Theory, 33(4),

pp.221-245.

Legoria, J., Melendrez, K.D. and Reynolds, J.K., 2013. Qualitative audit materiality and

earnings management. Review of Accounting Studies, 18(2), pp.414-442.

Lessambo, F.I., 2018. Audit Risks: Identification and Procedures. In Auditing, Assurance

Services, and Forensics(pp. 183-202). Palgrave Macmillan, Cham.

Mock, T.J. and Fukukawa, H., 2015. Auditors' risk assessments: The effects of elicitation

approach and assertion framing. Behavioral Research in Accounting, 28(2), pp.75-84.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10AUDITING AND PROFESSIONAL PRACTICE

Ruhnke, K. and Schmidt, M., 2014. Misstatements in financial statements: The relationship

between inherent and control risk factors and audit adjustments. Auditing: A Journal of

Practice & Theory, 33(4), pp.247-269.

Ruhnke, K. and Schmidt, M., 2014. Misstatements in financial statements: The relationship

between inherent and control risk factors and audit adjustments. Auditing: A Journal of

Practice & Theory, 33(4), pp.247-269.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.