Risk of Material Misstatement in Cochlear Limited: Auditing Report

VerifiedAdded on 2023/06/07

|24

|4178

|490

Report

AI Summary

This report presents an audit of Cochlear Limited, a medical device company, focusing on the application of analytical procedures to its financial statements for the fiscal years ending June 30, 2018, along with the two preceding years. The report examines the impact of analytical procedures on audit planning, highlighting significant fluctuations in operating margins and potential misstatements in operating expenses. It delves into inherent risks, including the integrity of management, experience of the board, and the nature of the business. The assessment identifies key account balances with a high risk of material misstatement, specifically sales/revenue, sales, general and administrative expenses, and other income. The report considers relevant auditing standards and provides a detailed analysis of the company's financial performance, including profitability, efficiency, solvency, and liquidity ratios, to identify potential areas of concern for auditors.

Running head: AUDITING

Auditing

Name of the Student:

Name of the University:

Authors Note:

Auditing

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1AUDITING

Executive summary:

In Australia the auditors have to abide by the auditing and assurance standards issued by

Australian Auditing and Assurance Standards Board (AAUSB). The standards on auditing

applicable in the country are abbreviated as ASAs. In this document a detailed discussion on the

risk of material misstatements in the financial statements of Cochlear Limited has been made by

conducting analytical procedures on the financial information of the company. The corporations

established under the Corporations Act, 2001 must follow Accounting standards (AASBs) issued

by the Australian Accounting Standards Board. It shall also be verified whether the accounting

information compiled by Cochlear Limited is in accordance with the AASBs.

Executive summary:

In Australia the auditors have to abide by the auditing and assurance standards issued by

Australian Auditing and Assurance Standards Board (AAUSB). The standards on auditing

applicable in the country are abbreviated as ASAs. In this document a detailed discussion on the

risk of material misstatements in the financial statements of Cochlear Limited has been made by

conducting analytical procedures on the financial information of the company. The corporations

established under the Corporations Act, 2001 must follow Accounting standards (AASBs) issued

by the Australian Accounting Standards Board. It shall also be verified whether the accounting

information compiled by Cochlear Limited is in accordance with the AASBs.

2AUDITING

Contents

Executive summary:........................................................................................................................1

Introduction:....................................................................................................................................3

Part 1:...............................................................................................................................................3

Effects on audit planning due to the results of analytical procedures:........................................3

Part 2:...............................................................................................................................................6

Inherent risks:..............................................................................................................................6

Integrity of management:.............................................................................................................6

Experience and knowledge of the management and changes in the management:.....................7

Pressure on directors and management from higher authority:...................................................8

Entities business and nature of such business:............................................................................9

Part 3:.............................................................................................................................................10

Risk of material misstatement:..................................................................................................10

Conclusion:....................................................................................................................................15

References:....................................................................................................................................16

Appendix:......................................................................................................................................19

Contents

Executive summary:........................................................................................................................1

Introduction:....................................................................................................................................3

Part 1:...............................................................................................................................................3

Effects on audit planning due to the results of analytical procedures:........................................3

Part 2:...............................................................................................................................................6

Inherent risks:..............................................................................................................................6

Integrity of management:.............................................................................................................6

Experience and knowledge of the management and changes in the management:.....................7

Pressure on directors and management from higher authority:...................................................8

Entities business and nature of such business:............................................................................9

Part 3:.............................................................................................................................................10

Risk of material misstatement:..................................................................................................10

Conclusion:....................................................................................................................................15

References:....................................................................................................................................16

Appendix:......................................................................................................................................19

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3AUDITING

Introduction:

A medical device company, Cochlear Limited is a manufacturing company situated in

Sydney, Australia. The auditor of the company has decided to conduct analytical procedures on

the financial statements of the company for last three financial years including the current

financial year ending on June 30, 2018. The analytical procedures would help the auditor to

identify possible risks of misstatement and frauds in the financial information of the company.

Part 1:

An auditor conducts analytical and substantive procedures to complete audit of an entity

efficiently. Analytical procedures involve calculation of different ratios of an organization for

last two or three financial years including current financial year with the objective to identify any

unnatural fluctuations in any of the financial ratios to indicate possible vulnerable areas for the

audit. In case there is significant fluctuations in any of the profitability ratios such as gross profit

ratio, net profit ratio or any other profitability ratio without any valid reason then this could

indicate the risk of material misstatement or fraud in financial statements (Jans, Alles &

Vasarhelyi 2014). Auditor accordingly, will use substantive procedures of items of revenue and

expenditures to the maximum extent possible to unearth the misstatement or fraud.

The financial information containing in the annual reports of the company for last two

years have been used to calculate various for analytical purposes. The table below contains the

profitability, efficiency, solvency and liquidity ratios of the company (Chan & Vasarhelyi 2018).

Effects on audit planning due to the results of analytical procedures:

The changes in gross profit ratios over the last three years have increased at a constant

pace. In 2018 the company has earned a gross profit of 73.46% whereas it was around 71.37% a

Introduction:

A medical device company, Cochlear Limited is a manufacturing company situated in

Sydney, Australia. The auditor of the company has decided to conduct analytical procedures on

the financial statements of the company for last three financial years including the current

financial year ending on June 30, 2018. The analytical procedures would help the auditor to

identify possible risks of misstatement and frauds in the financial information of the company.

Part 1:

An auditor conducts analytical and substantive procedures to complete audit of an entity

efficiently. Analytical procedures involve calculation of different ratios of an organization for

last two or three financial years including current financial year with the objective to identify any

unnatural fluctuations in any of the financial ratios to indicate possible vulnerable areas for the

audit. In case there is significant fluctuations in any of the profitability ratios such as gross profit

ratio, net profit ratio or any other profitability ratio without any valid reason then this could

indicate the risk of material misstatement or fraud in financial statements (Jans, Alles &

Vasarhelyi 2014). Auditor accordingly, will use substantive procedures of items of revenue and

expenditures to the maximum extent possible to unearth the misstatement or fraud.

The financial information containing in the annual reports of the company for last two

years have been used to calculate various for analytical purposes. The table below contains the

profitability, efficiency, solvency and liquidity ratios of the company (Chan & Vasarhelyi 2018).

Effects on audit planning due to the results of analytical procedures:

The changes in gross profit ratios over the last three years have increased at a constant

pace. In 2018 the company has earned a gross profit of 73.46% whereas it was around 71.37% a

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4AUDITING

year back. However, the change in operating margin is quite significant. The company has

earned an operating income of AUD 207 million in 2018 whereas in the last two previous years

the operating incomes were negative. The change in operating margin from -10.79% in 2016 to

15.18% in 2018 certainly indicate that there could be some misstatement in recording operating

expenses of the company (Cao, Chychyla & Stewart 2015). Thus, the auditor will specifically be

extra attentive of operating expenditures while conducting substantive audit procedures. The

inventory turnover ratio, asset turnover ratio do not indicate any unnatural fluctuations and so are

the debt to equity and liquidity ratios. The changes in these ratios have been insignificant and

does not raise an eyebrow (The analytical ratio calculations have been provided in table

attached as appendix).

Hence, the analytical procedure and the results of such procedure has provided the

auditor with a possible area in financial statements that could have material misstatements or

even fraud. Using extensive substantive procedures on each items of operating expenditures will

enable the auditor to evaluate the material risks of misstatements and possibility of fraud in this

area of financial statements (Chiu, Liu & Vasarhelyi 2018).

It is important to note that the standard procedures that an auditor needs to perform as per

the Auditing and Assurance Standards of the country (AUASB) those shall be performed

irrespective of the results of analytical procedures. However, in addition the auditor might decide

to conduct other verifications and tests of items of expenses and revenues depending on the

results of analytical procedures conducted on the financial information of the company. The

auditor on the basis of analytical procedures must extend his review and verification of items of

expenditures and revenue, especially the operating expenditures to find out whether there is any

year back. However, the change in operating margin is quite significant. The company has

earned an operating income of AUD 207 million in 2018 whereas in the last two previous years

the operating incomes were negative. The change in operating margin from -10.79% in 2016 to

15.18% in 2018 certainly indicate that there could be some misstatement in recording operating

expenses of the company (Cao, Chychyla & Stewart 2015). Thus, the auditor will specifically be

extra attentive of operating expenditures while conducting substantive audit procedures. The

inventory turnover ratio, asset turnover ratio do not indicate any unnatural fluctuations and so are

the debt to equity and liquidity ratios. The changes in these ratios have been insignificant and

does not raise an eyebrow (The analytical ratio calculations have been provided in table

attached as appendix).

Hence, the analytical procedure and the results of such procedure has provided the

auditor with a possible area in financial statements that could have material misstatements or

even fraud. Using extensive substantive procedures on each items of operating expenditures will

enable the auditor to evaluate the material risks of misstatements and possibility of fraud in this

area of financial statements (Chiu, Liu & Vasarhelyi 2018).

It is important to note that the standard procedures that an auditor needs to perform as per

the Auditing and Assurance Standards of the country (AUASB) those shall be performed

irrespective of the results of analytical procedures. However, in addition the auditor might decide

to conduct other verifications and tests of items of expenses and revenues depending on the

results of analytical procedures conducted on the financial information of the company. The

auditor on the basis of analytical procedures must extend his review and verification of items of

expenditures and revenue, especially the operating expenditures to find out whether there is any

5AUDITING

material misstatement in reporting these expenditures in the books of accounts (Abernathy,

Hackenbrack, Joe, Pevzner & Wu 2015).

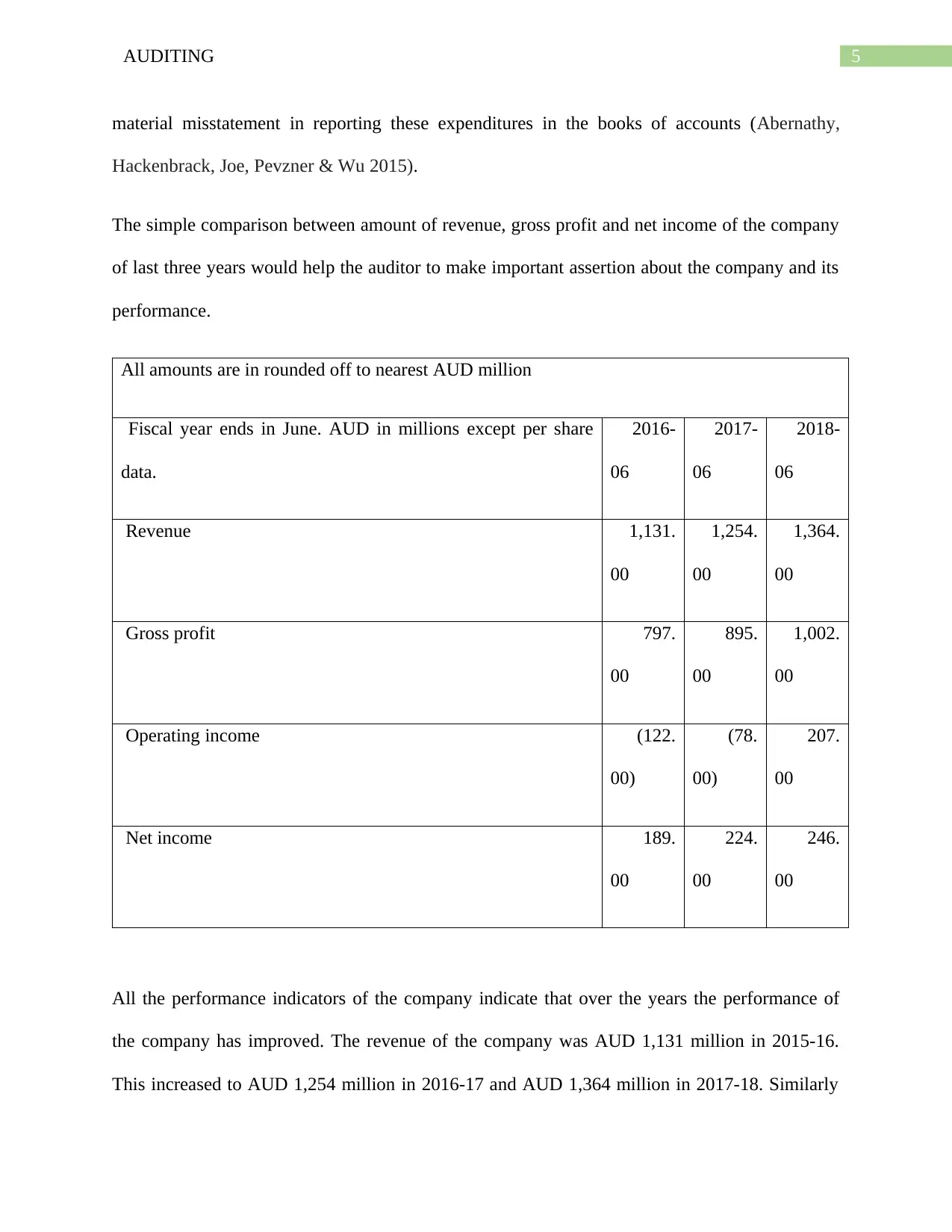

The simple comparison between amount of revenue, gross profit and net income of the company

of last three years would help the auditor to make important assertion about the company and its

performance.

All amounts are in rounded off to nearest AUD million

Fiscal year ends in June. AUD in millions except per share

data.

2016-

06

2017-

06

2018-

06

Revenue 1,131.

00

1,254.

00

1,364.

00

Gross profit 797.

00

895.

00

1,002.

00

Operating income (122.

00)

(78.

00)

207.

00

Net income 189.

00

224.

00

246.

00

All the performance indicators of the company indicate that over the years the performance of

the company has improved. The revenue of the company was AUD 1,131 million in 2015-16.

This increased to AUD 1,254 million in 2016-17 and AUD 1,364 million in 2017-18. Similarly

material misstatement in reporting these expenditures in the books of accounts (Abernathy,

Hackenbrack, Joe, Pevzner & Wu 2015).

The simple comparison between amount of revenue, gross profit and net income of the company

of last three years would help the auditor to make important assertion about the company and its

performance.

All amounts are in rounded off to nearest AUD million

Fiscal year ends in June. AUD in millions except per share

data.

2016-

06

2017-

06

2018-

06

Revenue 1,131.

00

1,254.

00

1,364.

00

Gross profit 797.

00

895.

00

1,002.

00

Operating income (122.

00)

(78.

00)

207.

00

Net income 189.

00

224.

00

246.

00

All the performance indicators of the company indicate that over the years the performance of

the company has improved. The revenue of the company was AUD 1,131 million in 2015-16.

This increased to AUD 1,254 million in 2016-17 and AUD 1,364 million in 2017-18. Similarly

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6AUDITING

the gross profit of AUD 797.00 million in 2015-16 has increased to AUD 1002.00 million after

two financial years. The operating income of AUD 207 million certainly moved extraordinarily

as it was in negative in last two previous years. The net income again has improved in expected

line as it has increased to AUD 246 million in 2017-18 from AUD 189.00 million of 2015-16.

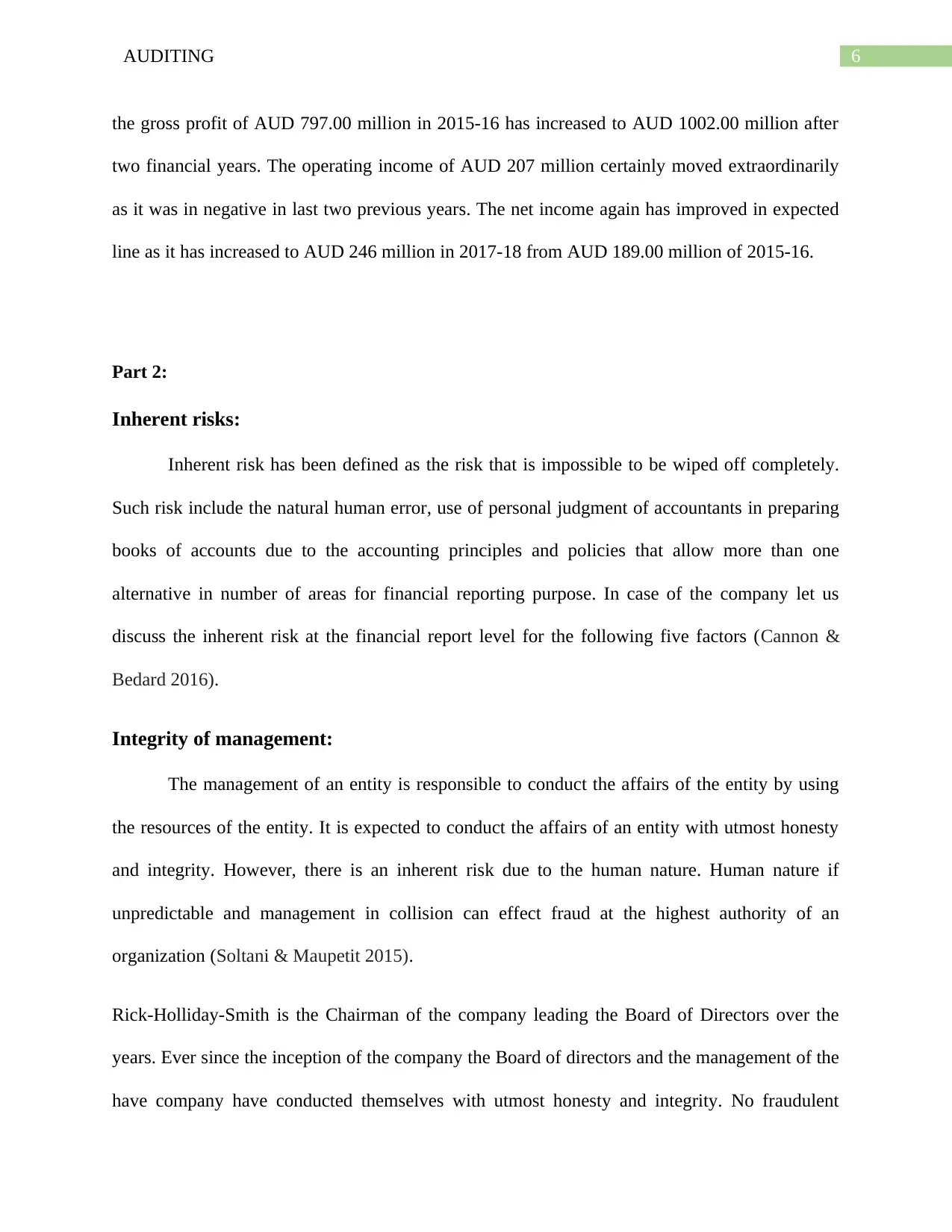

Part 2:

Inherent risks:

Inherent risk has been defined as the risk that is impossible to be wiped off completely.

Such risk include the natural human error, use of personal judgment of accountants in preparing

books of accounts due to the accounting principles and policies that allow more than one

alternative in number of areas for financial reporting purpose. In case of the company let us

discuss the inherent risk at the financial report level for the following five factors (Cannon &

Bedard 2016).

Integrity of management:

The management of an entity is responsible to conduct the affairs of the entity by using

the resources of the entity. It is expected to conduct the affairs of an entity with utmost honesty

and integrity. However, there is an inherent risk due to the human nature. Human nature if

unpredictable and management in collision can effect fraud at the highest authority of an

organization (Soltani & Maupetit 2015).

Rick-Holliday-Smith is the Chairman of the company leading the Board of Directors over the

years. Ever since the inception of the company the Board of directors and the management of the

have company have conducted themselves with utmost honesty and integrity. No fraudulent

the gross profit of AUD 797.00 million in 2015-16 has increased to AUD 1002.00 million after

two financial years. The operating income of AUD 207 million certainly moved extraordinarily

as it was in negative in last two previous years. The net income again has improved in expected

line as it has increased to AUD 246 million in 2017-18 from AUD 189.00 million of 2015-16.

Part 2:

Inherent risks:

Inherent risk has been defined as the risk that is impossible to be wiped off completely.

Such risk include the natural human error, use of personal judgment of accountants in preparing

books of accounts due to the accounting principles and policies that allow more than one

alternative in number of areas for financial reporting purpose. In case of the company let us

discuss the inherent risk at the financial report level for the following five factors (Cannon &

Bedard 2016).

Integrity of management:

The management of an entity is responsible to conduct the affairs of the entity by using

the resources of the entity. It is expected to conduct the affairs of an entity with utmost honesty

and integrity. However, there is an inherent risk due to the human nature. Human nature if

unpredictable and management in collision can effect fraud at the highest authority of an

organization (Soltani & Maupetit 2015).

Rick-Holliday-Smith is the Chairman of the company leading the Board of Directors over the

years. Ever since the inception of the company the Board of directors and the management of the

have company have conducted themselves with utmost honesty and integrity. No fraudulent

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7AUDITING

activities have ever been reported of the directors of the Board since its inception. However, the

inherent risks of integrity of management will continue to remain due to the presence of human

element. However, the inherent risk in this regard is very low.

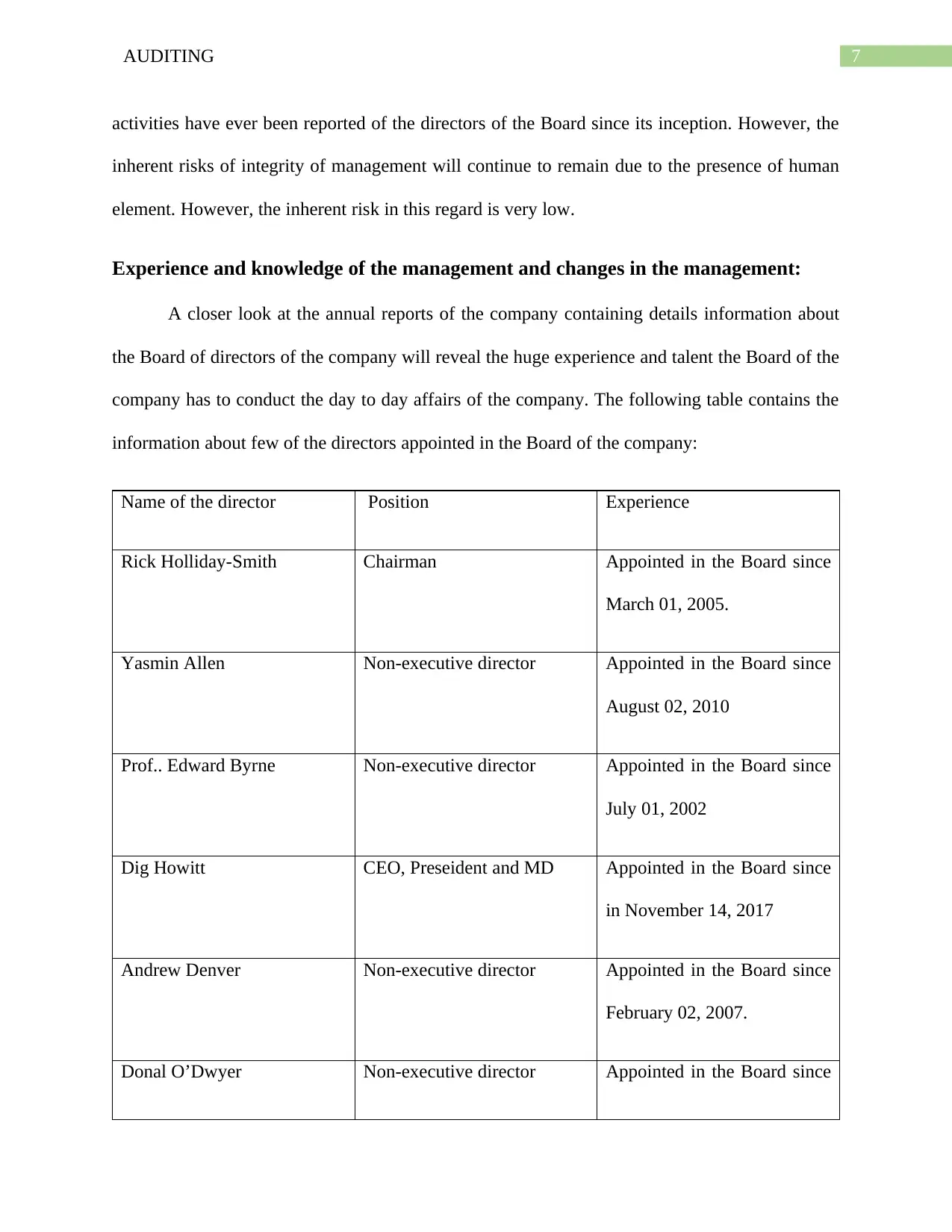

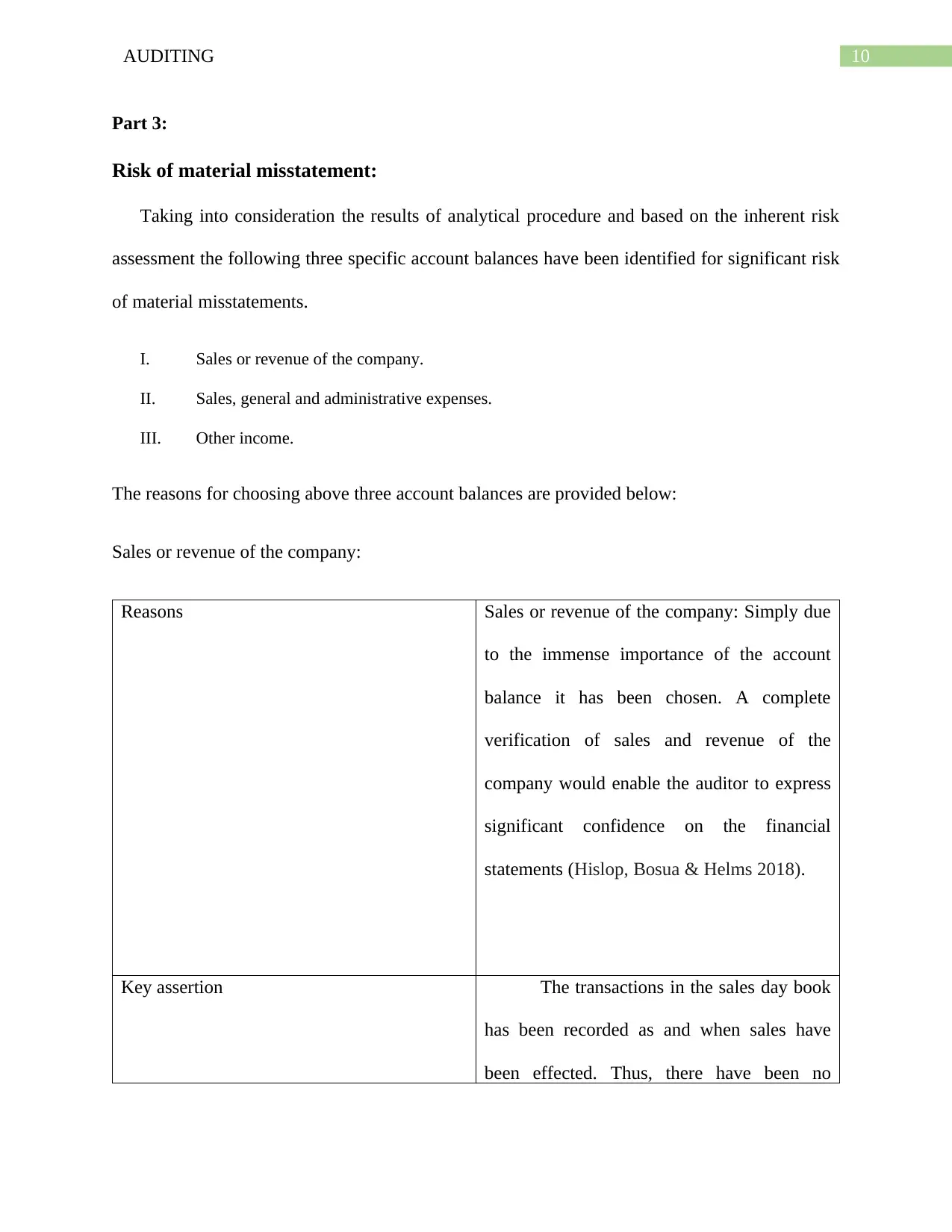

Experience and knowledge of the management and changes in the management:

A closer look at the annual reports of the company containing details information about

the Board of directors of the company will reveal the huge experience and talent the Board of the

company has to conduct the day to day affairs of the company. The following table contains the

information about few of the directors appointed in the Board of the company:

Name of the director Position Experience

Rick Holliday-Smith Chairman Appointed in the Board since

March 01, 2005.

Yasmin Allen Non-executive director Appointed in the Board since

August 02, 2010

Prof.. Edward Byrne Non-executive director Appointed in the Board since

July 01, 2002

Dig Howitt CEO, Preseident and MD Appointed in the Board since

in November 14, 2017

Andrew Denver Non-executive director Appointed in the Board since

February 02, 2007.

Donal O’Dwyer Non-executive director Appointed in the Board since

activities have ever been reported of the directors of the Board since its inception. However, the

inherent risks of integrity of management will continue to remain due to the presence of human

element. However, the inherent risk in this regard is very low.

Experience and knowledge of the management and changes in the management:

A closer look at the annual reports of the company containing details information about

the Board of directors of the company will reveal the huge experience and talent the Board of the

company has to conduct the day to day affairs of the company. The following table contains the

information about few of the directors appointed in the Board of the company:

Name of the director Position Experience

Rick Holliday-Smith Chairman Appointed in the Board since

March 01, 2005.

Yasmin Allen Non-executive director Appointed in the Board since

August 02, 2010

Prof.. Edward Byrne Non-executive director Appointed in the Board since

July 01, 2002

Dig Howitt CEO, Preseident and MD Appointed in the Board since

in November 14, 2017

Andrew Denver Non-executive director Appointed in the Board since

February 02, 2007.

Donal O’Dwyer Non-executive director Appointed in the Board since

8AUDITING

August 01, 2005

Glen Boreham Non-executive director Appointed in the Board since

January 01, 2015

Thus, from the above it can be easily understood that there is no dearth of talent and experience

in the Board of the company. However, it is not only about the amount of experience that the

Board of directors have that only matters it is also about the coordinated efforts put in by the

combined Board of an organization that makes the difference between a successful and

unsuccessful company (Coronel & Morris 2016).

Pressure on directors and management from higher authority:

The company has clearly mentioned in its charter that no director or manager shall be

pressurised by the senior management personnel to influence the operations and financial

statements of the company. The Board and management are definitely under pressure to perform

at a high level and deliver profit and favourable results for the company. However, there has

been no undue pressure on the directors and management from senior executives to manipulate

the books of accounts financial statements of the company (Ferrell & Fraedrich 2015).

Thus, the inherent risk in relation to pressure on directors and management from higher authority

is negligent at the best.

Entities business and nature of such business:

As already mentioned earlier that Cochlear is a manufacturing company involved in

designing, manufacturing and supplying of Nucleus implants specifically developed and

August 01, 2005

Glen Boreham Non-executive director Appointed in the Board since

January 01, 2015

Thus, from the above it can be easily understood that there is no dearth of talent and experience

in the Board of the company. However, it is not only about the amount of experience that the

Board of directors have that only matters it is also about the coordinated efforts put in by the

combined Board of an organization that makes the difference between a successful and

unsuccessful company (Coronel & Morris 2016).

Pressure on directors and management from higher authority:

The company has clearly mentioned in its charter that no director or manager shall be

pressurised by the senior management personnel to influence the operations and financial

statements of the company. The Board and management are definitely under pressure to perform

at a high level and deliver profit and favourable results for the company. However, there has

been no undue pressure on the directors and management from senior executives to manipulate

the books of accounts financial statements of the company (Ferrell & Fraedrich 2015).

Thus, the inherent risk in relation to pressure on directors and management from higher authority

is negligent at the best.

Entities business and nature of such business:

As already mentioned earlier that Cochlear is a manufacturing company involved in

designing, manufacturing and supplying of Nucleus implants specifically developed and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9AUDITING

manufactured by Cochlear. Apart from that the company also manufactures and supplies Electro

Acoustic and bone conduction implants. The entities business involve use of highly technical

materials and designs that are necessary for manufacturing the different types of implants

(Commerford, B. P., Hermanson, Houston & Peters 2016). An auditor must have knowledge of

the manufacturing and development process of these implants in order to conduct audit of

manufacturing expenses and other operating expenses related to the business. Thus, considering

that the auditors are not supposed to have technical knowledge in scientific field thus, it would

be highly improbable to expect them to have significant knowledge about the manufacturing and

development process of these implants. Inherent risk in this case for the company has been

assessed as quite high (Haimes 2015). The auditor accordingly, must take conduct necessary

substantive procedures to ensure that the inherent risk as low as possible.

Factors specific to the industry of which the entity is a part of:

The entity is part of medical implant industry which is a very competitive industry as

there are number of companies that vying for market share in the country. The company is

regulated by the provisions of Corporations Act, 2001 and due to the importance of the implants

the industry is also subjected to the professional and medical ethics standards. The company

must comply with the provisions of Corporations Act, 2001 as well as abide by the industry

norms and guidelines (Serpella, Ferrada, Howard & Rubio 2014). The auditor must in addition to

the requirements of Corporations Act shall also consider the implications ethical and professional

standards of medicine to which the company is subjected to.

Overall the inherent risks of auditing the company from the above five elements are significantly

low and this is a positive sign for the audit of the company.

manufactured by Cochlear. Apart from that the company also manufactures and supplies Electro

Acoustic and bone conduction implants. The entities business involve use of highly technical

materials and designs that are necessary for manufacturing the different types of implants

(Commerford, B. P., Hermanson, Houston & Peters 2016). An auditor must have knowledge of

the manufacturing and development process of these implants in order to conduct audit of

manufacturing expenses and other operating expenses related to the business. Thus, considering

that the auditors are not supposed to have technical knowledge in scientific field thus, it would

be highly improbable to expect them to have significant knowledge about the manufacturing and

development process of these implants. Inherent risk in this case for the company has been

assessed as quite high (Haimes 2015). The auditor accordingly, must take conduct necessary

substantive procedures to ensure that the inherent risk as low as possible.

Factors specific to the industry of which the entity is a part of:

The entity is part of medical implant industry which is a very competitive industry as

there are number of companies that vying for market share in the country. The company is

regulated by the provisions of Corporations Act, 2001 and due to the importance of the implants

the industry is also subjected to the professional and medical ethics standards. The company

must comply with the provisions of Corporations Act, 2001 as well as abide by the industry

norms and guidelines (Serpella, Ferrada, Howard & Rubio 2014). The auditor must in addition to

the requirements of Corporations Act shall also consider the implications ethical and professional

standards of medicine to which the company is subjected to.

Overall the inherent risks of auditing the company from the above five elements are significantly

low and this is a positive sign for the audit of the company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10AUDITING

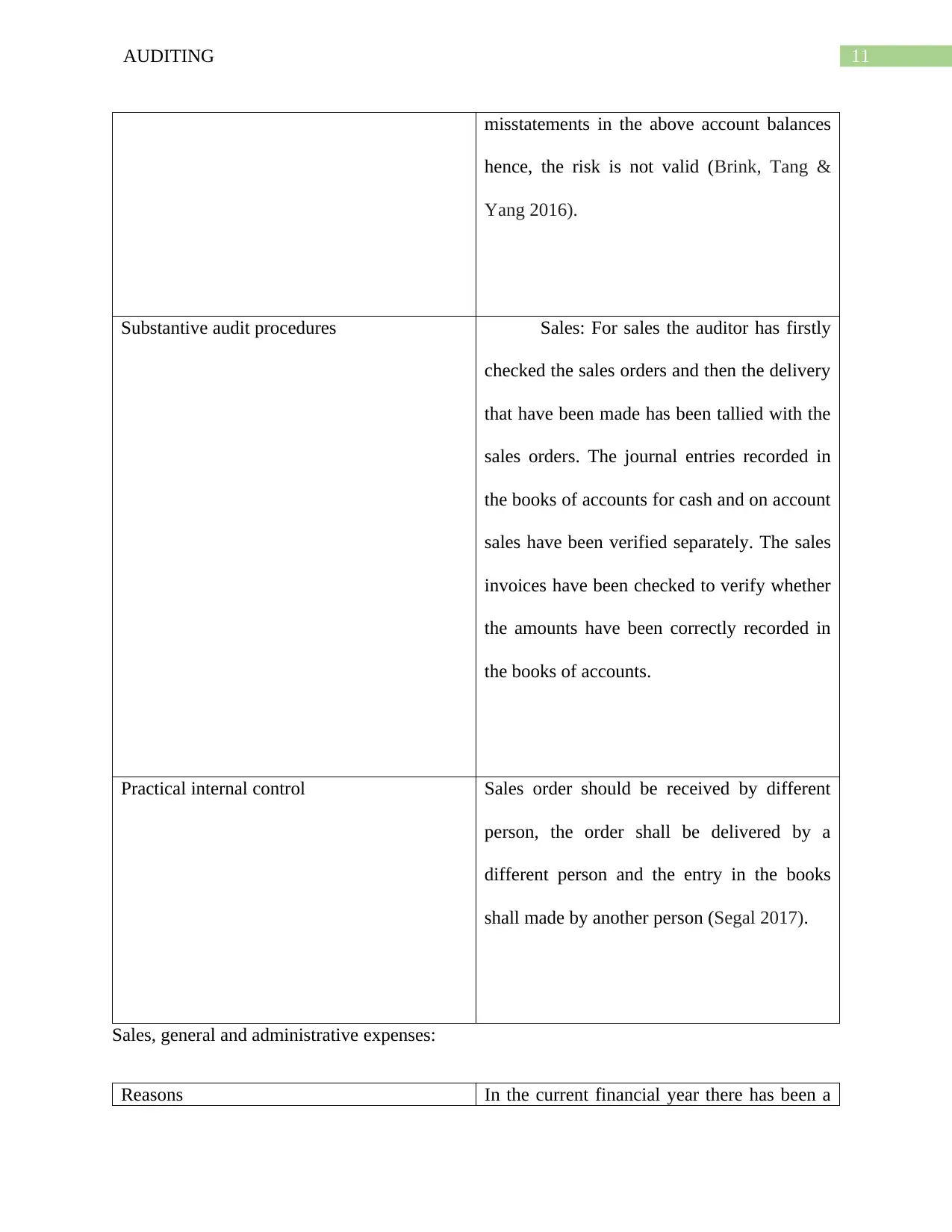

Part 3:

Risk of material misstatement:

Taking into consideration the results of analytical procedure and based on the inherent risk

assessment the following three specific account balances have been identified for significant risk

of material misstatements.

I. Sales or revenue of the company.

II. Sales, general and administrative expenses.

III. Other income.

The reasons for choosing above three account balances are provided below:

Sales or revenue of the company:

Reasons Sales or revenue of the company: Simply due

to the immense importance of the account

balance it has been chosen. A complete

verification of sales and revenue of the

company would enable the auditor to express

significant confidence on the financial

statements (Hislop, Bosua & Helms 2018).

Key assertion The transactions in the sales day book

has been recorded as and when sales have

been effected. Thus, there have been no

Part 3:

Risk of material misstatement:

Taking into consideration the results of analytical procedure and based on the inherent risk

assessment the following three specific account balances have been identified for significant risk

of material misstatements.

I. Sales or revenue of the company.

II. Sales, general and administrative expenses.

III. Other income.

The reasons for choosing above three account balances are provided below:

Sales or revenue of the company:

Reasons Sales or revenue of the company: Simply due

to the immense importance of the account

balance it has been chosen. A complete

verification of sales and revenue of the

company would enable the auditor to express

significant confidence on the financial

statements (Hislop, Bosua & Helms 2018).

Key assertion The transactions in the sales day book

has been recorded as and when sales have

been effected. Thus, there have been no

11AUDITING

misstatements in the above account balances

hence, the risk is not valid (Brink, Tang &

Yang 2016).

Substantive audit procedures Sales: For sales the auditor has firstly

checked the sales orders and then the delivery

that have been made has been tallied with the

sales orders. The journal entries recorded in

the books of accounts for cash and on account

sales have been verified separately. The sales

invoices have been checked to verify whether

the amounts have been correctly recorded in

the books of accounts.

Practical internal control Sales order should be received by different

person, the order shall be delivered by a

different person and the entry in the books

shall made by another person (Segal 2017).

Sales, general and administrative expenses:

Reasons In the current financial year there has been a

misstatements in the above account balances

hence, the risk is not valid (Brink, Tang &

Yang 2016).

Substantive audit procedures Sales: For sales the auditor has firstly

checked the sales orders and then the delivery

that have been made has been tallied with the

sales orders. The journal entries recorded in

the books of accounts for cash and on account

sales have been verified separately. The sales

invoices have been checked to verify whether

the amounts have been correctly recorded in

the books of accounts.

Practical internal control Sales order should be received by different

person, the order shall be delivered by a

different person and the entry in the books

shall made by another person (Segal 2017).

Sales, general and administrative expenses:

Reasons In the current financial year there has been a

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 24

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.