BBAC601: Comprehensive Audit Strategy for Target Energy Ltd

VerifiedAdded on 2023/04/22

|19

|4571

|449

Report

AI Summary

This report presents an audit strategy for Target Energy Ltd, focusing on the analysis of the company's financials for the 2017-2018 financial year. It covers various aspects, including general company information, operational details, and macro-economic environment factors. The audit program addresses key financial elements, accounting policies, and related-party transactions. The analysis includes a review of industry regulators, competition, government support, and market barriers. It also examines accounting policy changes, preliminary analytical procedures, and financial performance measurement, providing a comprehensive overview of the factors influencing the audit strategy. The report further discusses the impact of changes in accounting policies (AASB 9, AASB 15, AASB 16) and their expected effects on the company's financial statements. The report also includes related party disclosures and analysis of their transactions.

Running head: AUDIT STRATEGY

Auditing and Assurance

Name of the Student:

Name of the University:

Author’s Note:

Auditing and Assurance

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2AUDITING STRATEGY

Executive Summary

The aim of the assignment is to conduct an audit programme on Target Energy Ltd by

analysing the financials of the company. The Audit Program covers the major aspect of the

financials of the company and general information about the company covering the

operational information and various other business and macro-economic environment factor

analysis.

Executive Summary

The aim of the assignment is to conduct an audit programme on Target Energy Ltd by

analysing the financials of the company. The Audit Program covers the major aspect of the

financials of the company and general information about the company covering the

operational information and various other business and macro-economic environment factor

analysis.

3AUDITING STRATEGY

Table of Contents

1.0 Introduction.....................................................................................................................4

2.0 Part A: The Client................................................................................................................4

2.1 Information about the client.............................................................................................4

2.2 Industry Regulator and other external factor...................................................................4

2.3 Nature of Operations........................................................................................................5

2.4 Accounting Policy............................................................................................................6

2.5 Related Parties and Transactions with related parties......................................................7

Part B: Analysis of Clients and Impact on Future Audit Works................................................9

2.6 Accounting Policy Changes and their Impact..................................................................9

2.7 Preliminary Analytical Procedures................................................................................10

2.8 Financial Performance review and measurement..........................................................12

Conclusion................................................................................................................................13

References................................................................................................................................14

Appendix..................................................................................................................................16

Table of Contents

1.0 Introduction.....................................................................................................................4

2.0 Part A: The Client................................................................................................................4

2.1 Information about the client.............................................................................................4

2.2 Industry Regulator and other external factor...................................................................4

2.3 Nature of Operations........................................................................................................5

2.4 Accounting Policy............................................................................................................6

2.5 Related Parties and Transactions with related parties......................................................7

Part B: Analysis of Clients and Impact on Future Audit Works................................................9

2.6 Accounting Policy Changes and their Impact..................................................................9

2.7 Preliminary Analytical Procedures................................................................................10

2.8 Financial Performance review and measurement..........................................................12

Conclusion................................................................................................................................13

References................................................................................................................................14

Appendix..................................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4AUDITING STRATEGY

1.0 Introduction

Auditing plays an important prospect for analysing the financial statements of the

company. The financial statement and the Auditing of the Target Energy Ltd was done

thereby to assess the overall financial and operations of the company.

2.0 Part A: The Client

2.1 Information about the client

Name: Target Energy Ltd

Address: SE 5 6 Richardson Street Perth WAS 6005

Year of Establishment: 2006

Field of Operations: Development and Exploration of gas and oil properties in United

States.

Period of Financial Report under consideration: 2017

Type of Financial Report: Consolidated Financial Statement

2.2 Industry Regulator and other external factor

Economic Condition: The economic condition of the Australian Energy Industry has

been growing with the production of coal (Targetenergy.com.au. 2017).

Law and Regulation applicable: Australian Accounting Standards, Corporation Act

2001 and the National Gas Law 2008.

Level of Competition: High

Name of Main Competitors: The main competitors operating in the industry are 88

Energy Ltd, Red Emperor Resources, Oil Basins, Mossman Oil & Gas Ltd and ROC

Oil Company Limited are some of the main competitors of Target Energy Ltd.

Level of Government’s Support: The Australian Government for supporting the

Energy Industry has made several policies like Renewable Energy Target (RET) AND

State Based Feed-in-Tariff (FIT) schemes (Energy.gov.au. 2019).

Level of Demand for various goods and services: The demand for the goods and

services of the energy has been rising for the overall energy industry in Australia after

the demand for oil and gas increased on a global basis. Australia Energy Industry has

been the major supplier of key energy components like Oil, Coal and Gas.

1.0 Introduction

Auditing plays an important prospect for analysing the financial statements of the

company. The financial statement and the Auditing of the Target Energy Ltd was done

thereby to assess the overall financial and operations of the company.

2.0 Part A: The Client

2.1 Information about the client

Name: Target Energy Ltd

Address: SE 5 6 Richardson Street Perth WAS 6005

Year of Establishment: 2006

Field of Operations: Development and Exploration of gas and oil properties in United

States.

Period of Financial Report under consideration: 2017

Type of Financial Report: Consolidated Financial Statement

2.2 Industry Regulator and other external factor

Economic Condition: The economic condition of the Australian Energy Industry has

been growing with the production of coal (Targetenergy.com.au. 2017).

Law and Regulation applicable: Australian Accounting Standards, Corporation Act

2001 and the National Gas Law 2008.

Level of Competition: High

Name of Main Competitors: The main competitors operating in the industry are 88

Energy Ltd, Red Emperor Resources, Oil Basins, Mossman Oil & Gas Ltd and ROC

Oil Company Limited are some of the main competitors of Target Energy Ltd.

Level of Government’s Support: The Australian Government for supporting the

Energy Industry has made several policies like Renewable Energy Target (RET) AND

State Based Feed-in-Tariff (FIT) schemes (Energy.gov.au. 2019).

Level of Demand for various goods and services: The demand for the goods and

services of the energy has been rising for the overall energy industry in Australia after

the demand for oil and gas increased on a global basis. Australia Energy Industry has

been the major supplier of key energy components like Oil, Coal and Gas.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5AUDITING STRATEGY

Current or Potential Industry or Market Barriers: Rising competition in the

overall industry with the volatile raw input prices for the companies has been the key

reason for low profit margins. With tighter government regulations in regard to the

emission of CO2 and various other environmental policies have redefined the

workings and operations of these companies. The Australian Government has various

laws, rules and regulations that needs to be analysed for the purpose of operational

work of the companies. Despite of the above issues and implementation of various

policies the Australian Energy Industry has shown a well growth trend and is

expected to carry on because of the rising global demand for energy based resources.

2.3 Nature of Operations

Operations: The Target Energy Limited is an Oil and Gas exploration and production

company focusing on the drilling of Oil from Oil Wells with better Oilfield

technology which the company deploys in both conventional and unconventional oil

reserves that is owned by the company. The operations of the company is currently

focused in the Texas area as the resources and the raw material availability in the

country is high with minimum laws, rules and regulations in the country. The

operations of the company with better connectivity of operational, technological and

minimum legal requirements provides various growth and development opportunities

for the Target Energy ltd (Cludius, Forrest and MacGill 2014).

Dependency of Customers: The customer base for the Target Energy has been

spread widely. The company is not having any major customer from which the

operations of the company will be affected.

Major Suppliers: The operations of the company is primarily based and the company

does not intake major supplies instead it uses technologies and various other tools and

equipment’s which are helpful in the operations of the business.

Ownership Structure and Corporate Governance: The ownership of the company

is primarily done by the Equity capital, which is the primary source of capital for

financing the activities and operations of the company. The corporate governance

policy of the company is in accordance with the ASX Corporate Governance Council.

The board members of the Target Energy Ltd Company approved the corporate

governance statement, which states the policies and the corporate governance

programmes that will be followed by the company. For the basis of operations and

administration of better control and accountability conducted by the company, the

Current or Potential Industry or Market Barriers: Rising competition in the

overall industry with the volatile raw input prices for the companies has been the key

reason for low profit margins. With tighter government regulations in regard to the

emission of CO2 and various other environmental policies have redefined the

workings and operations of these companies. The Australian Government has various

laws, rules and regulations that needs to be analysed for the purpose of operational

work of the companies. Despite of the above issues and implementation of various

policies the Australian Energy Industry has shown a well growth trend and is

expected to carry on because of the rising global demand for energy based resources.

2.3 Nature of Operations

Operations: The Target Energy Limited is an Oil and Gas exploration and production

company focusing on the drilling of Oil from Oil Wells with better Oilfield

technology which the company deploys in both conventional and unconventional oil

reserves that is owned by the company. The operations of the company is currently

focused in the Texas area as the resources and the raw material availability in the

country is high with minimum laws, rules and regulations in the country. The

operations of the company with better connectivity of operational, technological and

minimum legal requirements provides various growth and development opportunities

for the Target Energy ltd (Cludius, Forrest and MacGill 2014).

Dependency of Customers: The customer base for the Target Energy has been

spread widely. The company is not having any major customer from which the

operations of the company will be affected.

Major Suppliers: The operations of the company is primarily based and the company

does not intake major supplies instead it uses technologies and various other tools and

equipment’s which are helpful in the operations of the business.

Ownership Structure and Corporate Governance: The ownership of the company

is primarily done by the Equity capital, which is the primary source of capital for

financing the activities and operations of the company. The corporate governance

policy of the company is in accordance with the ASX Corporate Governance Council.

The board members of the Target Energy Ltd Company approved the corporate

governance statement, which states the policies and the corporate governance

programmes that will be followed by the company. For the basis of operations and

administration of better control and accountability conducted by the company, the

6AUDITING STRATEGY

company follows the corporate governance policy. However, it is crucial to note that

Wyllie Group Pty Ltd and Invest Met Ltd are the major shareholders of the company

holding about 9.42% and 7.61% of equity ownership in the overall company

(Appendix 1).

Operational Structure: The operations of the company is primarily based in the

Texas where the company operates its operation and has it core operations based in

Texas due to the resources availability and lower environmental regulations. Energy

Ltd has two current projects primarily where the production of oil and operations of

the company is based. The East Chalkley Oil Field- Cameron Parish, Louisiana is an

Oil field appraisal and development programme. After the successful negotiation

between the Target Company and East Chalkley Oil Field, the company is expected to

have a 100% working interest. The Fairway Project- Howard & Glasscock Counties,

Texas where the company is having around 35-60% of working interest.

2.4 Accounting Policy

The Main Accounting Policies analysed for the Target Energy Ltd are:

Policies regarding property, plant and equipment: The property, plant and

equipment is stated at cost less depreciation accumulated and impairment losses. The

stated cost includes cost which are incurred by the company for their business activity

is eligible for the purpose of capitalizing when such costs are incurred. Depreciation

on the assets of the company is done by applying the straight line basis depending on

the useful life or the remaining life of the assets of Target Energy Ltd (El Hanandeh

2015).

Inventory Policies: Target Energy Ltd did not have any inventories in their books of

accounts. However, the accounting policies of the company is well linked with the

Australian Accounting Standards Board that helps the companies in the classification

and measurement of the inventories of the company. The AASB 102 sets out the

inventory policies for the company in the recognition and classification of the

inventory of the company.

Accounts Receivables Policies: The average credit policies for the company and the

service period allowed by the company is around 30-90 days. The capital raising

receivables are subsequent to year-end. Impairment of the trade receivables were in

accordance with the accounting year of 2008-2009.

company follows the corporate governance policy. However, it is crucial to note that

Wyllie Group Pty Ltd and Invest Met Ltd are the major shareholders of the company

holding about 9.42% and 7.61% of equity ownership in the overall company

(Appendix 1).

Operational Structure: The operations of the company is primarily based in the

Texas where the company operates its operation and has it core operations based in

Texas due to the resources availability and lower environmental regulations. Energy

Ltd has two current projects primarily where the production of oil and operations of

the company is based. The East Chalkley Oil Field- Cameron Parish, Louisiana is an

Oil field appraisal and development programme. After the successful negotiation

between the Target Company and East Chalkley Oil Field, the company is expected to

have a 100% working interest. The Fairway Project- Howard & Glasscock Counties,

Texas where the company is having around 35-60% of working interest.

2.4 Accounting Policy

The Main Accounting Policies analysed for the Target Energy Ltd are:

Policies regarding property, plant and equipment: The property, plant and

equipment is stated at cost less depreciation accumulated and impairment losses. The

stated cost includes cost which are incurred by the company for their business activity

is eligible for the purpose of capitalizing when such costs are incurred. Depreciation

on the assets of the company is done by applying the straight line basis depending on

the useful life or the remaining life of the assets of Target Energy Ltd (El Hanandeh

2015).

Inventory Policies: Target Energy Ltd did not have any inventories in their books of

accounts. However, the accounting policies of the company is well linked with the

Australian Accounting Standards Board that helps the companies in the classification

and measurement of the inventories of the company. The AASB 102 sets out the

inventory policies for the company in the recognition and classification of the

inventory of the company.

Accounts Receivables Policies: The average credit policies for the company and the

service period allowed by the company is around 30-90 days. The capital raising

receivables are subsequent to year-end. Impairment of the trade receivables were in

accordance with the accounting year of 2008-2009.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7AUDITING STRATEGY

Financial Instruments Policies: The financial instruments of the company will be

recognized and followed as per the AASB 9, which defines the valuation and the

recording of the financial instruments of the company. The recognition and the

measurement of various financial instruments of the company are classified as fair

value through profit and loss, available for sales and held till maturity. The

classification and recognition of the financial instruments of the company is

dependent on the classification and nature of the asset class and the holding period of

the assets of the company.

Intangible Assets Policies: Target Energy Ltd did not have any intangible assets in

their books of accounts like goodwill, patents and copyright. However, the accounting

policies of the company is well linked with the Australian Accounting Standards

Board that helps the companies in the classification and measurement of the

intangible assets of the company. The relevant policy that would be applicable for the

company for the intangible assets of the company would be following the AASB 138.

Revenue Recognition Policy: The revenue recognition policy of the company is in

accordance with the AASB 15 “Revenue from Contracts with Customers”. The

accounting standard guides the company in the case of the recognition of the revenue.

Revenue received from contracts includes a variable amount and is subject to revised

conditions for the recognition of the revenue of the company.

Leasing Policies: AASB 16 if followed by target Energy for classifying the leasing

activities of the company as either operating or financing lease. The recognition of the

value of the lease is recognized by defining the present value of all cash outflows and

discounting the same using an appropriate discount rate to recognizer the same in the

books of accounts of company (Chapman, McLellan and Tezuka 2016).

2.5 Related Parties and Transactions with related parties

Working Interest: Target Energy Ltd has two current projects primarily where the

production of oil and operations of the company is based. The East Chalkley Oil

Field- Cameron Parish, Louisiana is an Oil field appraisal and development

programme. After the successful negotiation between the Target Company and East

Chalkley Oil Field, the company is expected to have a 100% working interest. The

Fairway Project- Howard & Glasscock Counties, Texas where the company is having

around 35-60% of working interest.

Financial Instruments Policies: The financial instruments of the company will be

recognized and followed as per the AASB 9, which defines the valuation and the

recording of the financial instruments of the company. The recognition and the

measurement of various financial instruments of the company are classified as fair

value through profit and loss, available for sales and held till maturity. The

classification and recognition of the financial instruments of the company is

dependent on the classification and nature of the asset class and the holding period of

the assets of the company.

Intangible Assets Policies: Target Energy Ltd did not have any intangible assets in

their books of accounts like goodwill, patents and copyright. However, the accounting

policies of the company is well linked with the Australian Accounting Standards

Board that helps the companies in the classification and measurement of the

intangible assets of the company. The relevant policy that would be applicable for the

company for the intangible assets of the company would be following the AASB 138.

Revenue Recognition Policy: The revenue recognition policy of the company is in

accordance with the AASB 15 “Revenue from Contracts with Customers”. The

accounting standard guides the company in the case of the recognition of the revenue.

Revenue received from contracts includes a variable amount and is subject to revised

conditions for the recognition of the revenue of the company.

Leasing Policies: AASB 16 if followed by target Energy for classifying the leasing

activities of the company as either operating or financing lease. The recognition of the

value of the lease is recognized by defining the present value of all cash outflows and

discounting the same using an appropriate discount rate to recognizer the same in the

books of accounts of company (Chapman, McLellan and Tezuka 2016).

2.5 Related Parties and Transactions with related parties

Working Interest: Target Energy Ltd has two current projects primarily where the

production of oil and operations of the company is based. The East Chalkley Oil

Field- Cameron Parish, Louisiana is an Oil field appraisal and development

programme. After the successful negotiation between the Target Company and East

Chalkley Oil Field, the company is expected to have a 100% working interest. The

Fairway Project- Howard & Glasscock Counties, Texas where the company is having

around 35-60% of working interest.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8AUDITING STRATEGY

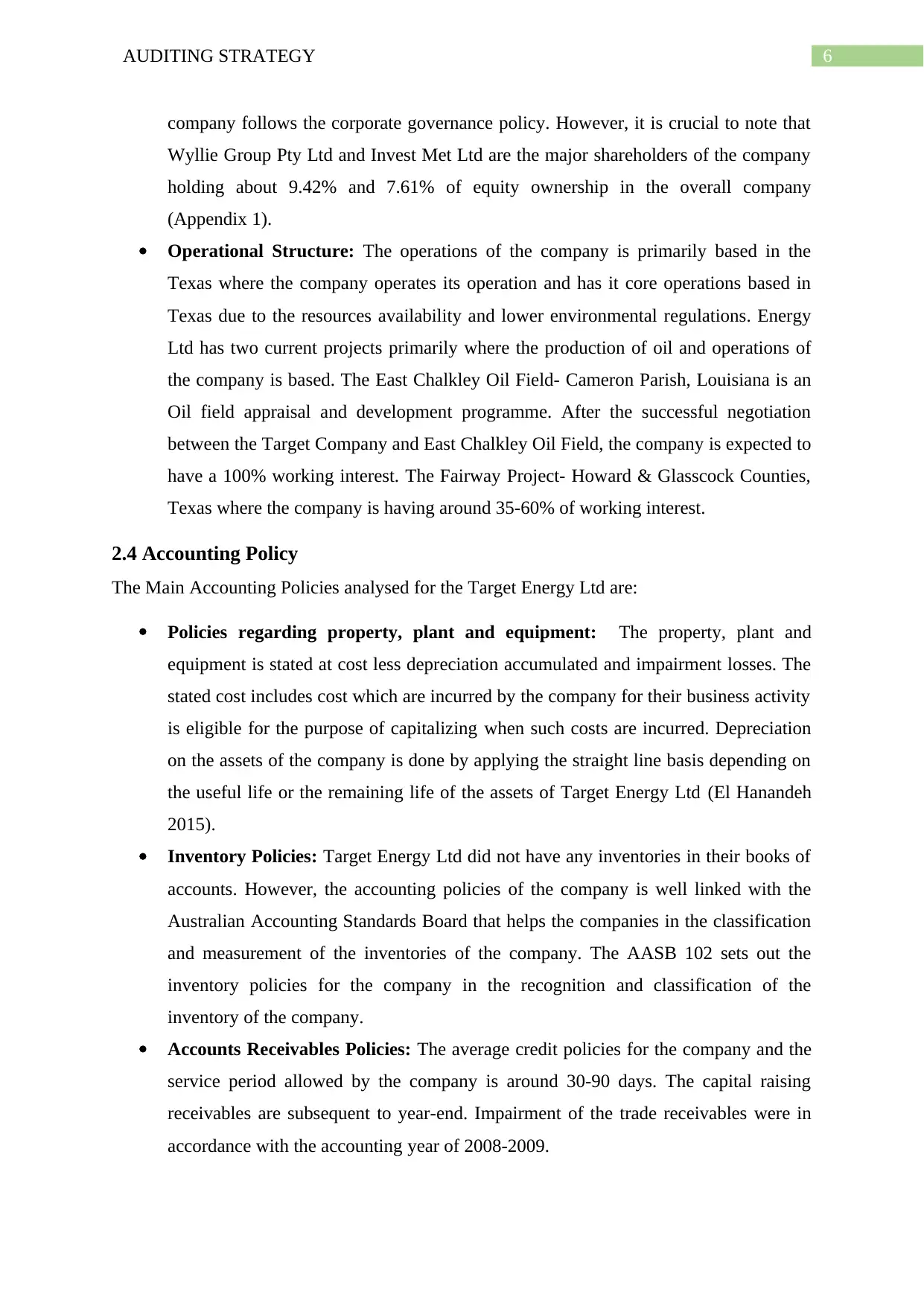

Related Party Disclosures: The Target Energy Ltd has disclosed all the related party

disclosures for the company with respect to the equity interest held by the company

and the change in the equity interest from the year 2016-17 is highlighted in the figure

below:

Figure 1: Related Party Disclosures

(Source: Annual Report 2017)

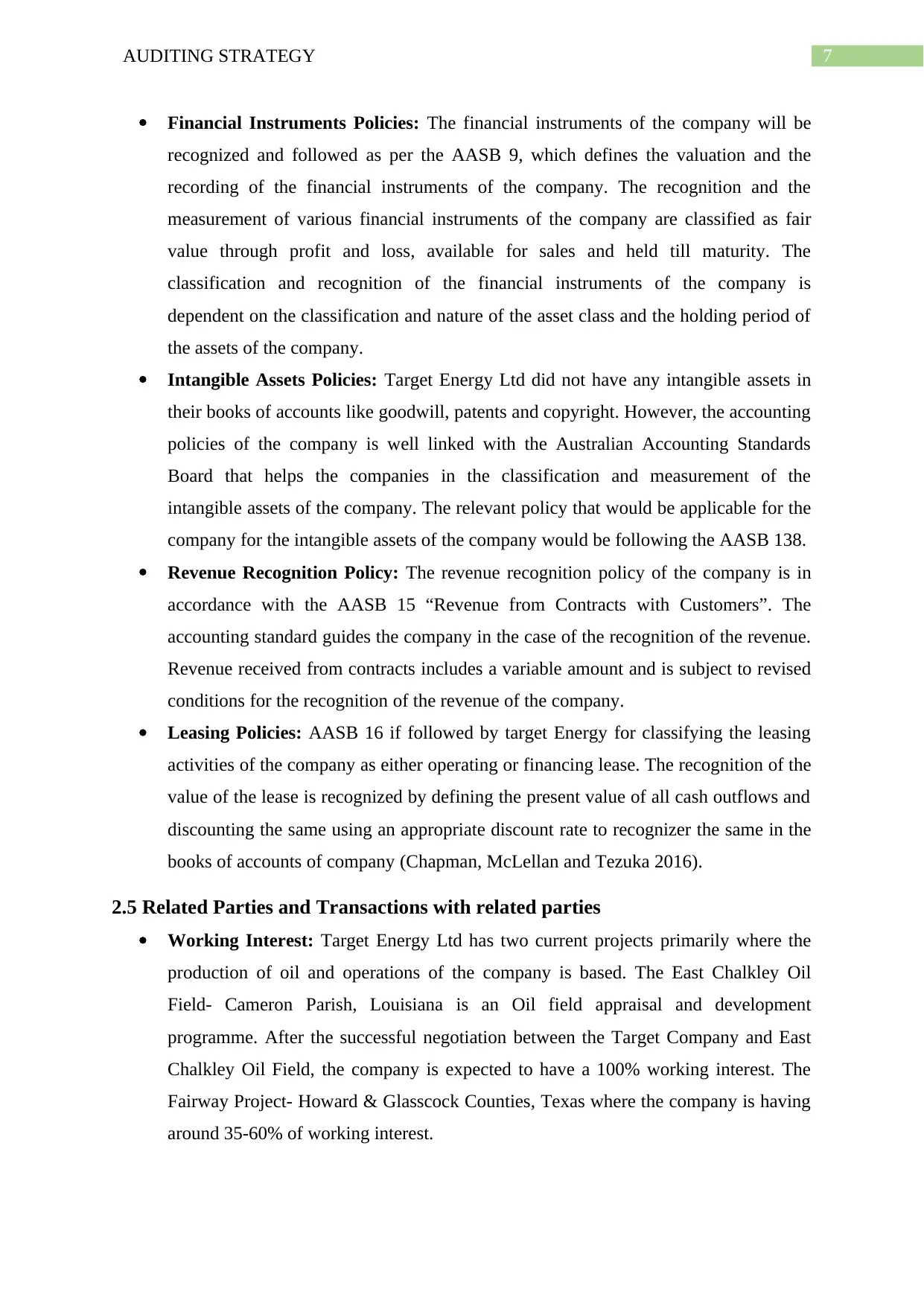

Other Related Parties: Target Energy Ltd has disclosed majorly all the related party

disclosures in the financial year reporting of 2017. The figure below shows the

amount by related parties in the financial year 2017 and 2016.

Figure 2: Related Party Disclosures

Related Party Disclosures: The Target Energy Ltd has disclosed all the related party

disclosures for the company with respect to the equity interest held by the company

and the change in the equity interest from the year 2016-17 is highlighted in the figure

below:

Figure 1: Related Party Disclosures

(Source: Annual Report 2017)

Other Related Parties: Target Energy Ltd has disclosed majorly all the related party

disclosures in the financial year reporting of 2017. The figure below shows the

amount by related parties in the financial year 2017 and 2016.

Figure 2: Related Party Disclosures

9AUDITING STRATEGY

(Source: Annual Report 2017)

(Source: Annual Report 2017)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10AUDITING STRATEGY

Part B: Analysis of Clients and Impact on Future Audit Works

2.6 Accounting Policy Changes and their Impact

Change in Accounting Policies and their Impact: The Company Target Energy Ltd

has reviewed all the new and revised standards of the Australian Accounting

Standards. It has also discussed the implementation of the new policies in the books

of accounts for the company, which are outlined below:

AASB 9 Financial Instruments: The AASB 9 (2014), replaces the existing

financial standards on the financial instruments, which was previously done

with the help of the AASB 9 (2009), (2010), and AASB 139 (Christensen et

al. 2016). The Company has reconsidered the accounting policies and has

made required impairment for the recognition and classification of the

financial instruments in accordance with the AASB (2014).

AASB 15 Revenue Recognition: The introduction of the AASB 15 removes

the existing accounting standard AASB 111 Construction contracts, AASB

118 Revenue recognition and AASB 104 Contribution. The new accounting

standards guides the company based on criteria for recognizing the revenue

and the aspects for the recognition of the revenue for the company (Tepalagul

and Lin 2015).

AASB 16 Leases: The AASB 16 Leases is a more classified and detailed

leasing standard for various operating and financing lease activities, which

will replace the old AASB 17 leasing standards (Jha and Chen 2014). The

AASB 16 recognizes all the leasing activities of the company on the financial

statement company thereby capitalizing the lease of the company with the help

of the discounting and capitalizing the same in the books of accounts for the

company (Pizzini, Lin and Ziegenfuss 2014).

Expected Impact because of Accounting Policies Change: The change in the

accounting policies of the company will be affecting the financial and books of

accounts for the company (Simshauser 2014).

Financial Instruments: The current impairment policy for the company will

be based on forward looking “expected loss model” which was initially as

incurred loss model for the company (Krarti 2016). The change in the

Part B: Analysis of Clients and Impact on Future Audit Works

2.6 Accounting Policy Changes and their Impact

Change in Accounting Policies and their Impact: The Company Target Energy Ltd

has reviewed all the new and revised standards of the Australian Accounting

Standards. It has also discussed the implementation of the new policies in the books

of accounts for the company, which are outlined below:

AASB 9 Financial Instruments: The AASB 9 (2014), replaces the existing

financial standards on the financial instruments, which was previously done

with the help of the AASB 9 (2009), (2010), and AASB 139 (Christensen et

al. 2016). The Company has reconsidered the accounting policies and has

made required impairment for the recognition and classification of the

financial instruments in accordance with the AASB (2014).

AASB 15 Revenue Recognition: The introduction of the AASB 15 removes

the existing accounting standard AASB 111 Construction contracts, AASB

118 Revenue recognition and AASB 104 Contribution. The new accounting

standards guides the company based on criteria for recognizing the revenue

and the aspects for the recognition of the revenue for the company (Tepalagul

and Lin 2015).

AASB 16 Leases: The AASB 16 Leases is a more classified and detailed

leasing standard for various operating and financing lease activities, which

will replace the old AASB 17 leasing standards (Jha and Chen 2014). The

AASB 16 recognizes all the leasing activities of the company on the financial

statement company thereby capitalizing the lease of the company with the help

of the discounting and capitalizing the same in the books of accounts for the

company (Pizzini, Lin and Ziegenfuss 2014).

Expected Impact because of Accounting Policies Change: The change in the

accounting policies of the company will be affecting the financial and books of

accounts for the company (Simshauser 2014).

Financial Instruments: The current impairment policy for the company will

be based on forward looking “expected loss model” which was initially as

incurred loss model for the company (Krarti 2016). The change in the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11AUDITING STRATEGY

accounting policy for the company will be based by the adoption of the AASB

9 (2014).

Revenue Recognition: The recognition of the revenue for the company will

be based on probable economic benefit flowing to the company. The interest

income for the company will be taken into account for the company based on

the effective yield on financial assets of company (Fleming and Measham

2015).

Leasing Activity: The leasing activity of the company will be in accordance

with the AASB 16 Leases for the company. The adoption of the new leasing

standards for the company will be in accordance with the changes to be made

by capitalizing the leasing activity or the cash outflows of the company

(Lennox, Wu and Zhang 2014).

Potential Impact on the Audit Work: The potential impact of the Audit work on the

Target Energy Ltd Company would be in accordance with the new accounting

policies under which the recognition and classification of the assets and liabilities of

the company would be done. The Auditor of the company would need to reclassify

the financial statements of the company with the new revenue recognition policies

(Vincent et al. 2014). The auditor needs to analyse whether the company has followed

and recognized the revenue of the company based on the current accounting

standards. The Leasing standards of the company would also be based on the AASB

16 Lease where the auditor would have to identify the various operating and financing

lease for the companies and the reclassification of the same. Financial instruments of

the company would be also reclassified in accordance with the AASB 9 and the

probable future and loss from the financial instruments of the company will also need

to be reinstated by the company (Groomer and Murthy 2018).

2.7 Preliminary Analytical Procedures

Ratio Analysis: The ratio analysis for the Target Energy Ltd was conducted with the

help of the financial statement of the company for the year 2017. The ratio analysis

was done covering the various aspects of the company including the current ratio,

quick ratio, debt to equity ratio, net profit margin and accounts receivable turnover

ratio (Ettredge, Fuerherm and Li 2014).

Analysis of Financial Ratio: The financial ratio for the company analysed were:

accounting policy for the company will be based by the adoption of the AASB

9 (2014).

Revenue Recognition: The recognition of the revenue for the company will

be based on probable economic benefit flowing to the company. The interest

income for the company will be taken into account for the company based on

the effective yield on financial assets of company (Fleming and Measham

2015).

Leasing Activity: The leasing activity of the company will be in accordance

with the AASB 16 Leases for the company. The adoption of the new leasing

standards for the company will be in accordance with the changes to be made

by capitalizing the leasing activity or the cash outflows of the company

(Lennox, Wu and Zhang 2014).

Potential Impact on the Audit Work: The potential impact of the Audit work on the

Target Energy Ltd Company would be in accordance with the new accounting

policies under which the recognition and classification of the assets and liabilities of

the company would be done. The Auditor of the company would need to reclassify

the financial statements of the company with the new revenue recognition policies

(Vincent et al. 2014). The auditor needs to analyse whether the company has followed

and recognized the revenue of the company based on the current accounting

standards. The Leasing standards of the company would also be based on the AASB

16 Lease where the auditor would have to identify the various operating and financing

lease for the companies and the reclassification of the same. Financial instruments of

the company would be also reclassified in accordance with the AASB 9 and the

probable future and loss from the financial instruments of the company will also need

to be reinstated by the company (Groomer and Murthy 2018).

2.7 Preliminary Analytical Procedures

Ratio Analysis: The ratio analysis for the Target Energy Ltd was conducted with the

help of the financial statement of the company for the year 2017. The ratio analysis

was done covering the various aspects of the company including the current ratio,

quick ratio, debt to equity ratio, net profit margin and accounts receivable turnover

ratio (Ettredge, Fuerherm and Li 2014).

Analysis of Financial Ratio: The financial ratio for the company analysed were:

12AUDITING STRATEGY

Current Ratio: The current ratio for the company was calculated by applying the

formula Current Assets/Current Liabilities. The current ratio of the Target Energy

was around 0.055 times in the year 2016 and was around 0.014 times in the year

2017. The current ratio of the company is significantly down from the current

standard level signifying that the company is running a heavy risk by maintain

such low level of liquidity in the company (Dobele et al. 2014). The low current

ratio can significantly affect the operations of the work (Appendix 2).

Quick Ratio: The quick ratio for the company shows the net liquidity position of

the company. The quick ratio for the company was around 0.055 times and 0.014

times in the year 2016-17. The quick ratio for the company is very poor for the

company indicating poor liquidity position of the company (Vithayasrichareon,

Riesz and MacGill 2015). The quick ratio and current ratio was the same for the

company as the company did not have inventories in there book of accounts

(Appendix 2).

Debt to Equity Ratio: The debt to equity ratio shows the effect and leverage

taken by the company in contrast to the overall equity of the company. The

company is not having major long term interest bearing liabilities however the

current debt to equity ratio for the company is around 0.22 times and 0.23 times in

the year 2016-17 (Hua, Oliphant and Hu 2016). The company is having a negative

overall equity share capital for the company, which has been due to the significant

accumulated loss in the financial statement of the company (Appendix 2).

Net Profit Margin: The net profit margin for the company was around -5.75% in

the year 2017 and was around -23.17% in the year 2018. The declining net profit

margin for the company indicates that falling profitability in the long term could

harm the sustainability and growth of the firm (Appendix 2).

Accounts Receivable Turnover Ratio: The accounts receivables turnover ratio

for the company shows the amount of receivables due for the company with

respect to the overall sales of the company (Hall et al. 2015). The Accounts

Receivable Turnover ratio for the company has been around 1.882 times in the

year 2017 and was around 10.411 times in the year 2016. The Sharp fall in the

ratio for the Target Energy indicates that the company is having a higher amount

of accounts receivables due with respect to the overall sales of the company. Thus,

it is crucial for the company to have a stable receivable turnover ratio for the

company (Appendix 2).

Current Ratio: The current ratio for the company was calculated by applying the

formula Current Assets/Current Liabilities. The current ratio of the Target Energy

was around 0.055 times in the year 2016 and was around 0.014 times in the year

2017. The current ratio of the company is significantly down from the current

standard level signifying that the company is running a heavy risk by maintain

such low level of liquidity in the company (Dobele et al. 2014). The low current

ratio can significantly affect the operations of the work (Appendix 2).

Quick Ratio: The quick ratio for the company shows the net liquidity position of

the company. The quick ratio for the company was around 0.055 times and 0.014

times in the year 2016-17. The quick ratio for the company is very poor for the

company indicating poor liquidity position of the company (Vithayasrichareon,

Riesz and MacGill 2015). The quick ratio and current ratio was the same for the

company as the company did not have inventories in there book of accounts

(Appendix 2).

Debt to Equity Ratio: The debt to equity ratio shows the effect and leverage

taken by the company in contrast to the overall equity of the company. The

company is not having major long term interest bearing liabilities however the

current debt to equity ratio for the company is around 0.22 times and 0.23 times in

the year 2016-17 (Hua, Oliphant and Hu 2016). The company is having a negative

overall equity share capital for the company, which has been due to the significant

accumulated loss in the financial statement of the company (Appendix 2).

Net Profit Margin: The net profit margin for the company was around -5.75% in

the year 2017 and was around -23.17% in the year 2018. The declining net profit

margin for the company indicates that falling profitability in the long term could

harm the sustainability and growth of the firm (Appendix 2).

Accounts Receivable Turnover Ratio: The accounts receivables turnover ratio

for the company shows the amount of receivables due for the company with

respect to the overall sales of the company (Hall et al. 2015). The Accounts

Receivable Turnover ratio for the company has been around 1.882 times in the

year 2017 and was around 10.411 times in the year 2016. The Sharp fall in the

ratio for the Target Energy indicates that the company is having a higher amount

of accounts receivables due with respect to the overall sales of the company. Thus,

it is crucial for the company to have a stable receivable turnover ratio for the

company (Appendix 2).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.