Audit Report of Subsidiary Companies of Las Vegas Group Corporation

VerifiedAdded on 2022/10/01

|18

|2481

|99

AI Summary

This document provides brief audit reports of five subsidiary companies of Las Vegas Group Corporation. The audit of these five subsidiaries companies has been conducted by adhering to the international auditing standards. The document includes insights on analytical procedures and substantive procedures conducted by the auditor.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: AUDITING THEORY AND PRACTICE

Auditing Theory and Practice

Name of the Student:

Name of the University:

Authors Note:

Auditing Theory and Practice

Name of the Student:

Name of the University:

Authors Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1

AUDITING THEORY AND PRACTICE

Contents

Introduction:....................................................................................................................................2

Auditor’s report for the group:........................................................................................................2

Section 1:.....................................................................................................................................2

Section 2:.....................................................................................................................................7

Section 3:...................................................................................................................................10

Section 4:...................................................................................................................................13

Section 5:...................................................................................................................................14

Conclusion:....................................................................................................................................15

References:....................................................................................................................................17

AUDITING THEORY AND PRACTICE

Contents

Introduction:....................................................................................................................................2

Auditor’s report for the group:........................................................................................................2

Section 1:.....................................................................................................................................2

Section 2:.....................................................................................................................................7

Section 3:...................................................................................................................................10

Section 4:...................................................................................................................................13

Section 5:...................................................................................................................................14

Conclusion:....................................................................................................................................15

References:....................................................................................................................................17

2

AUDITING THEORY AND PRACTICE

Introduction:

Audit report of a company is prepared by an independent qualified auditor to express his

independent opinion on the financial statements of the company. The opinion is formed on the

quality of financial statements and whether these statements are correctly reflecting the true and

fair picture of the company. In order to express an appropriate opinion on the financial

statements an auditor must collect necessary evidence by using substantive and analytical

procedures as per the international standards on auditing. In this document brief audit reports of

five subsidiary companies of Las Vegas Group Corporation has been provided for the readers to

assess the state of affairs and performance of these five subsidiaries in recent years.

Auditor’s report for the group:

Las Vegas Group Corporation is the largest multi-national company in USA as per the

information provided in the case study. The company has five subsidiary companies with which

it operates in different parts of the globe including Australia, New Zealand, Hong Kong,

Singapore, Malaysia, China, Japan, and Fiji. The audit of these five subsidiaries companies have

been conducted here by adhering to the international auditing standards.

Section 1:

In order to conduct the audit of an entity firstly, it is important to have knowledge about the

entity and its environment. IAASB provides that before staring out an audit it is important to

have detailed knowledge about the entity and its operations.

In this case firstly, it is clear that Las Vegas Group Corporation has its export business stretched

to different parts of the world including countries such as Australia, New Zealand, Hong Kong,

Singapore, Malaysia, China, Japan, and Fiji. Thus, the operations are bound to be conducted in

AUDITING THEORY AND PRACTICE

Introduction:

Audit report of a company is prepared by an independent qualified auditor to express his

independent opinion on the financial statements of the company. The opinion is formed on the

quality of financial statements and whether these statements are correctly reflecting the true and

fair picture of the company. In order to express an appropriate opinion on the financial

statements an auditor must collect necessary evidence by using substantive and analytical

procedures as per the international standards on auditing. In this document brief audit reports of

five subsidiary companies of Las Vegas Group Corporation has been provided for the readers to

assess the state of affairs and performance of these five subsidiaries in recent years.

Auditor’s report for the group:

Las Vegas Group Corporation is the largest multi-national company in USA as per the

information provided in the case study. The company has five subsidiary companies with which

it operates in different parts of the globe including Australia, New Zealand, Hong Kong,

Singapore, Malaysia, China, Japan, and Fiji. The audit of these five subsidiaries companies have

been conducted here by adhering to the international auditing standards.

Section 1:

In order to conduct the audit of an entity firstly, it is important to have knowledge about the

entity and its environment. IAASB provides that before staring out an audit it is important to

have detailed knowledge about the entity and its operations.

In this case firstly, it is clear that Las Vegas Group Corporation has its export business stretched

to different parts of the world including countries such as Australia, New Zealand, Hong Kong,

Singapore, Malaysia, China, Japan, and Fiji. Thus, the operations are bound to be conducted in

3

AUDITING THEORY AND PRACTICE

international currencies thus, specific attention must be given on translation of foreign exchange

transactions and the policy used by the company to state the transactions affected in foreign

currencies.

Listed in NYSE, Carpet International Limited manufactures and sells carpet in different parts of

the country and around the globe.

The performance and state of affairs of the company can be assessed by using the analytical

procedures effectively. Based on the findings of analytical procedures the auditor will conduct

substantial procedures. Thus, it would not wrong to state that the extent of substantive

procedures would depend on the findings of analytical procedures for the subsidiary of Las

Vegas Group Corporation. In fact the substantive procedures for each one of the five subsidiary

companies would depend on the findings of analytical procedures.

Analytical procedure:

Analytical procedures are methods used to assess the abnormal and normal fluctuations in the

financial position and performance of an organization. It helps in identifying areas within

financial statements that could be materially misstated. Ratio analysis, analysis of financial

statements are included in analytical procedures.

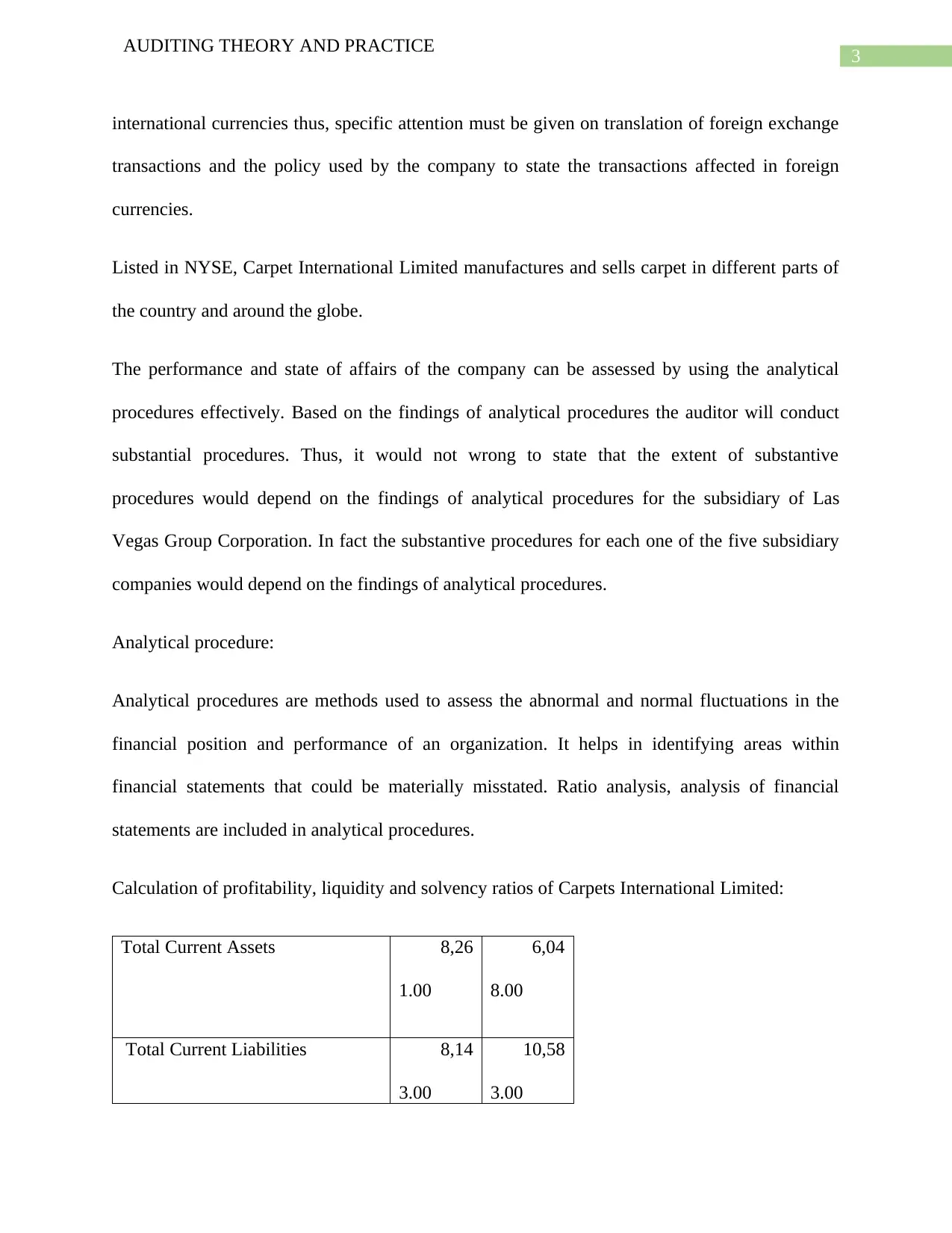

Calculation of profitability, liquidity and solvency ratios of Carpets International Limited:

Total Current Assets 8,26

1.00

6,04

8.00

Total Current Liabilities 8,14

3.00

10,58

3.00

AUDITING THEORY AND PRACTICE

international currencies thus, specific attention must be given on translation of foreign exchange

transactions and the policy used by the company to state the transactions affected in foreign

currencies.

Listed in NYSE, Carpet International Limited manufactures and sells carpet in different parts of

the country and around the globe.

The performance and state of affairs of the company can be assessed by using the analytical

procedures effectively. Based on the findings of analytical procedures the auditor will conduct

substantial procedures. Thus, it would not wrong to state that the extent of substantive

procedures would depend on the findings of analytical procedures for the subsidiary of Las

Vegas Group Corporation. In fact the substantive procedures for each one of the five subsidiary

companies would depend on the findings of analytical procedures.

Analytical procedure:

Analytical procedures are methods used to assess the abnormal and normal fluctuations in the

financial position and performance of an organization. It helps in identifying areas within

financial statements that could be materially misstated. Ratio analysis, analysis of financial

statements are included in analytical procedures.

Calculation of profitability, liquidity and solvency ratios of Carpets International Limited:

Total Current Assets 8,26

1.00

6,04

8.00

Total Current Liabilities 8,14

3.00

10,58

3.00

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4

AUDITING THEORY AND PRACTICE

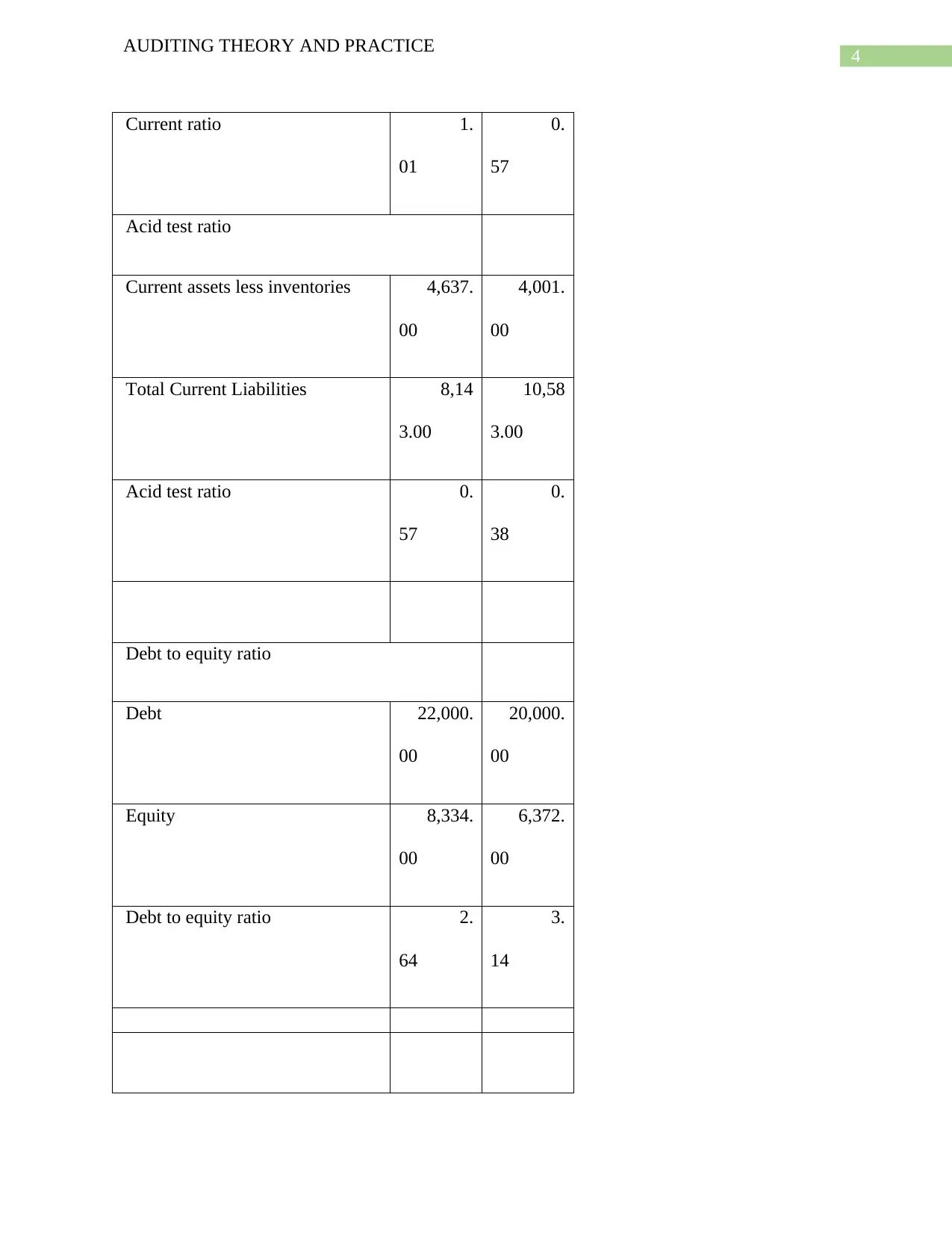

Current ratio 1.

01

0.

57

Acid test ratio

Current assets less inventories 4,637.

00

4,001.

00

Total Current Liabilities 8,14

3.00

10,58

3.00

Acid test ratio 0.

57

0.

38

Debt to equity ratio

Debt 22,000.

00

20,000.

00

Equity 8,334.

00

6,372.

00

Debt to equity ratio 2.

64

3.

14

AUDITING THEORY AND PRACTICE

Current ratio 1.

01

0.

57

Acid test ratio

Current assets less inventories 4,637.

00

4,001.

00

Total Current Liabilities 8,14

3.00

10,58

3.00

Acid test ratio 0.

57

0.

38

Debt to equity ratio

Debt 22,000.

00

20,000.

00

Equity 8,334.

00

6,372.

00

Debt to equity ratio 2.

64

3.

14

5

AUDITING THEORY AND PRACTICE

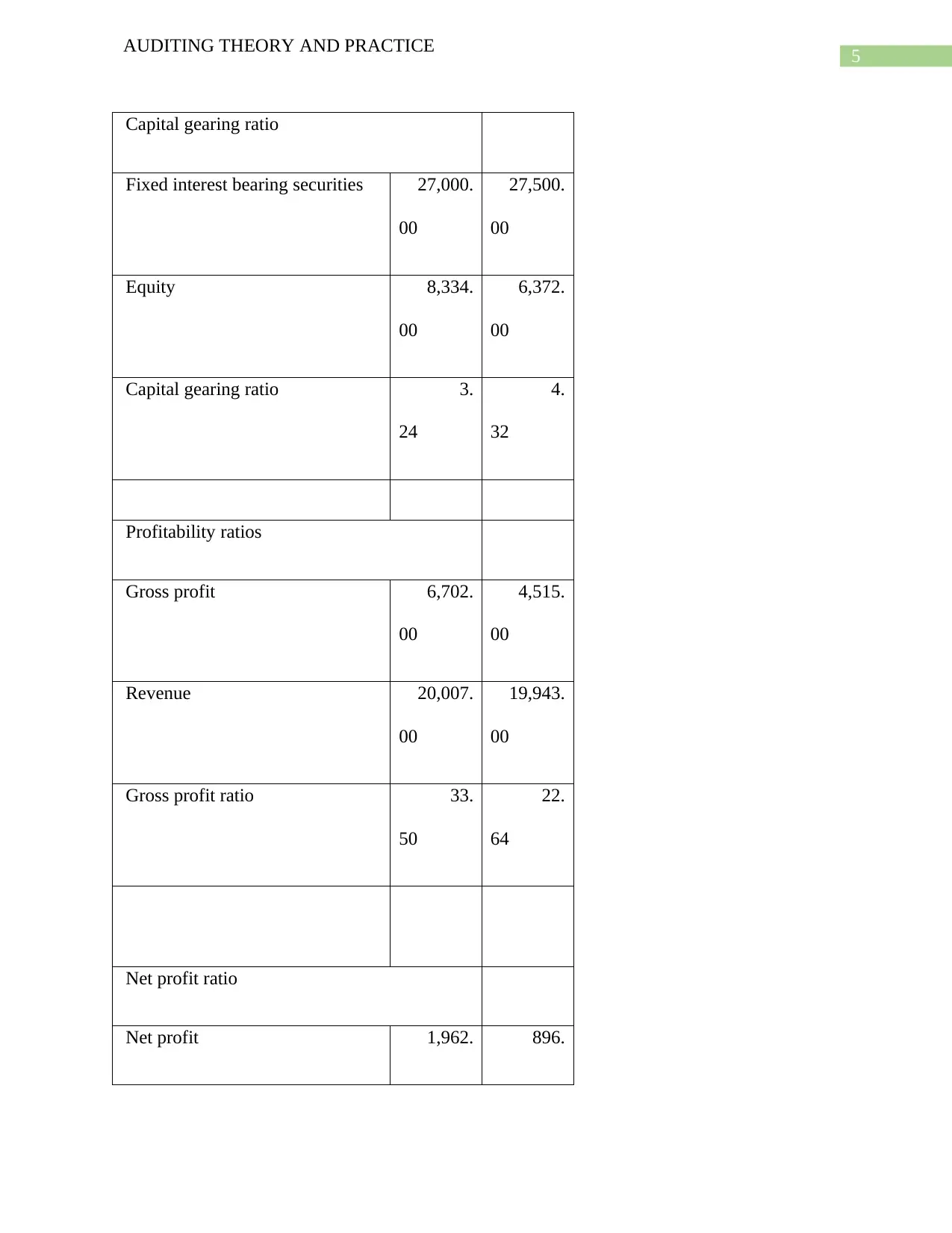

Capital gearing ratio

Fixed interest bearing securities 27,000.

00

27,500.

00

Equity 8,334.

00

6,372.

00

Capital gearing ratio 3.

24

4.

32

Profitability ratios

Gross profit 6,702.

00

4,515.

00

Revenue 20,007.

00

19,943.

00

Gross profit ratio 33.

50

22.

64

Net profit ratio

Net profit 1,962. 896.

AUDITING THEORY AND PRACTICE

Capital gearing ratio

Fixed interest bearing securities 27,000.

00

27,500.

00

Equity 8,334.

00

6,372.

00

Capital gearing ratio 3.

24

4.

32

Profitability ratios

Gross profit 6,702.

00

4,515.

00

Revenue 20,007.

00

19,943.

00

Gross profit ratio 33.

50

22.

64

Net profit ratio

Net profit 1,962. 896.

6

AUDITING THEORY AND PRACTICE

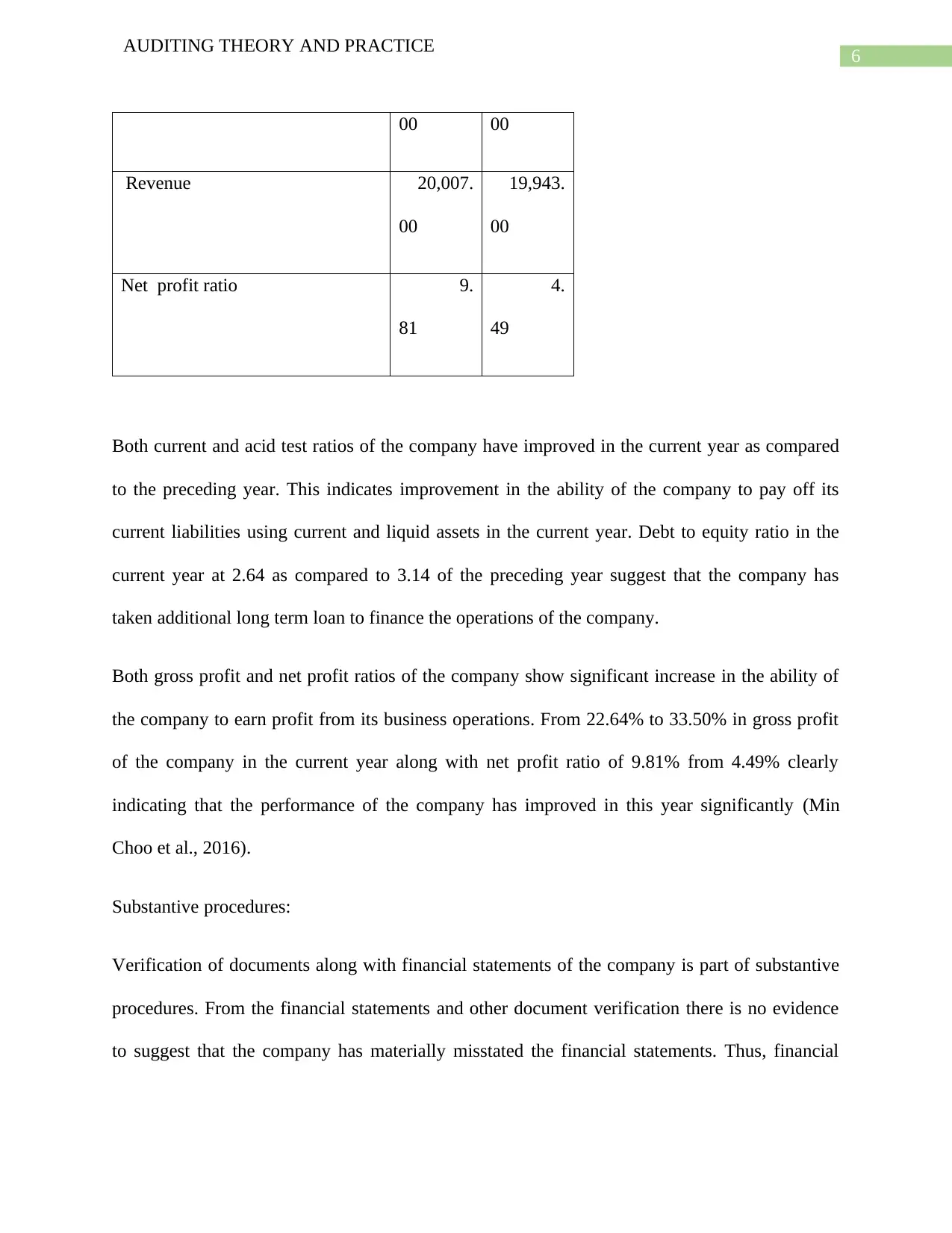

00 00

Revenue 20,007.

00

19,943.

00

Net profit ratio 9.

81

4.

49

Both current and acid test ratios of the company have improved in the current year as compared

to the preceding year. This indicates improvement in the ability of the company to pay off its

current liabilities using current and liquid assets in the current year. Debt to equity ratio in the

current year at 2.64 as compared to 3.14 of the preceding year suggest that the company has

taken additional long term loan to finance the operations of the company.

Both gross profit and net profit ratios of the company show significant increase in the ability of

the company to earn profit from its business operations. From 22.64% to 33.50% in gross profit

of the company in the current year along with net profit ratio of 9.81% from 4.49% clearly

indicating that the performance of the company has improved in this year significantly (Min

Choo et al., 2016).

Substantive procedures:

Verification of documents along with financial statements of the company is part of substantive

procedures. From the financial statements and other document verification there is no evidence

to suggest that the company has materially misstated the financial statements. Thus, financial

AUDITING THEORY AND PRACTICE

00 00

Revenue 20,007.

00

19,943.

00

Net profit ratio 9.

81

4.

49

Both current and acid test ratios of the company have improved in the current year as compared

to the preceding year. This indicates improvement in the ability of the company to pay off its

current liabilities using current and liquid assets in the current year. Debt to equity ratio in the

current year at 2.64 as compared to 3.14 of the preceding year suggest that the company has

taken additional long term loan to finance the operations of the company.

Both gross profit and net profit ratios of the company show significant increase in the ability of

the company to earn profit from its business operations. From 22.64% to 33.50% in gross profit

of the company in the current year along with net profit ratio of 9.81% from 4.49% clearly

indicating that the performance of the company has improved in this year significantly (Min

Choo et al., 2016).

Substantive procedures:

Verification of documents along with financial statements of the company is part of substantive

procedures. From the financial statements and other document verification there is no evidence

to suggest that the company has materially misstated the financial statements. Thus, financial

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

AUDITING THEORY AND PRACTICE

statements of the company genuinely showing a better performance and financial position as far

as the liquidity position of the company is concerned for the current year (Song, 2018).

Section 2:

Fashion Designers Limited is another subsidiary of Las Vegas Group Corporation (LVGC) that

controls the use of accessory brand names in all across the globe. The company mainly operates

out of Australia with its expansion strategy is firmly set on Asia and Eastern Europe.

Analytical procedures:

Calculation of operating, liquidity and solvency ratios:

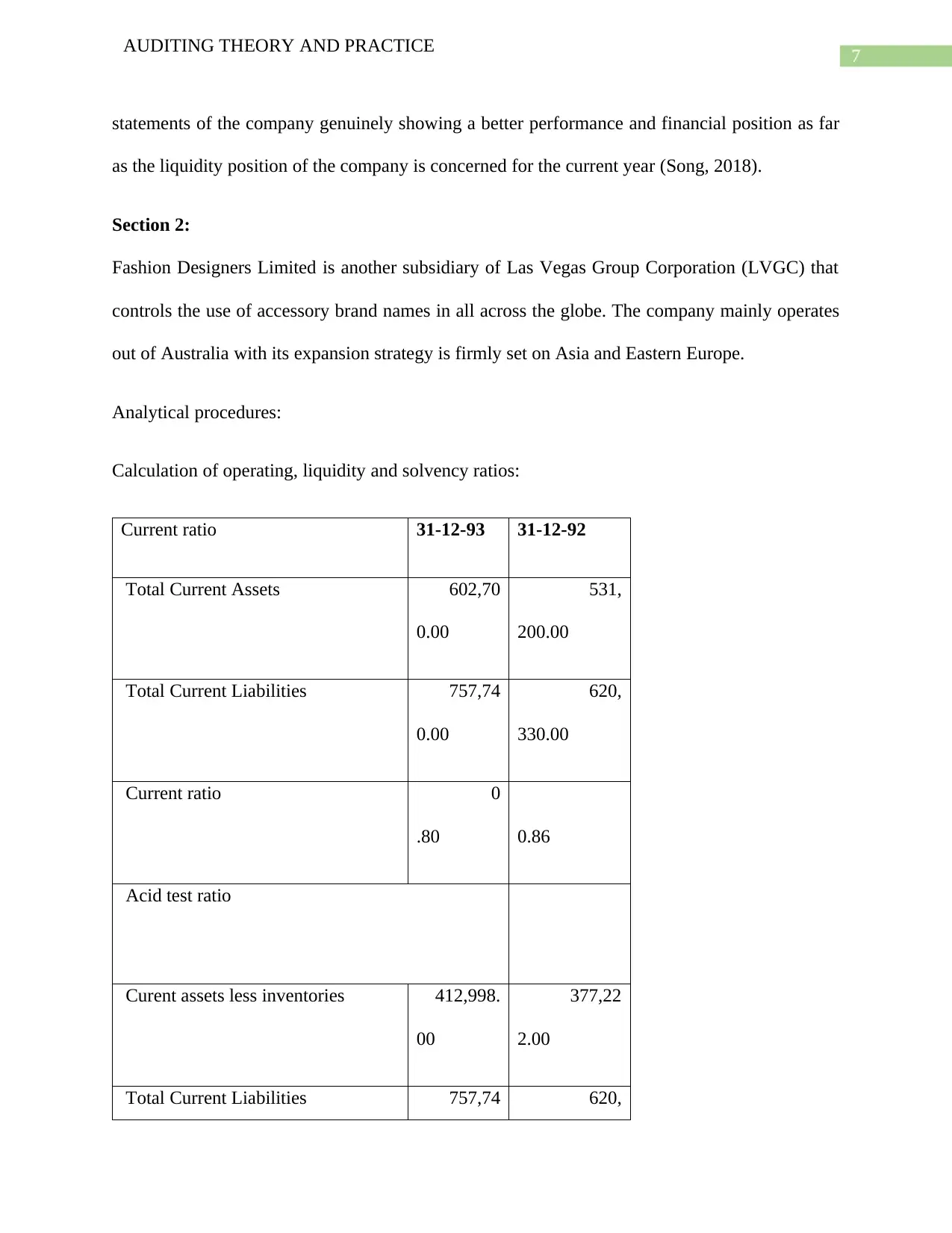

Current ratio 31-12-93 31-12-92

Total Current Assets 602,70

0.00

531,

200.00

Total Current Liabilities 757,74

0.00

620,

330.00

Current ratio 0

.80 0.86

Acid test ratio

Curent assets less inventories 412,998.

00

377,22

2.00

Total Current Liabilities 757,74 620,

AUDITING THEORY AND PRACTICE

statements of the company genuinely showing a better performance and financial position as far

as the liquidity position of the company is concerned for the current year (Song, 2018).

Section 2:

Fashion Designers Limited is another subsidiary of Las Vegas Group Corporation (LVGC) that

controls the use of accessory brand names in all across the globe. The company mainly operates

out of Australia with its expansion strategy is firmly set on Asia and Eastern Europe.

Analytical procedures:

Calculation of operating, liquidity and solvency ratios:

Current ratio 31-12-93 31-12-92

Total Current Assets 602,70

0.00

531,

200.00

Total Current Liabilities 757,74

0.00

620,

330.00

Current ratio 0

.80 0.86

Acid test ratio

Curent assets less inventories 412,998.

00

377,22

2.00

Total Current Liabilities 757,74 620,

8

AUDITING THEORY AND PRACTICE

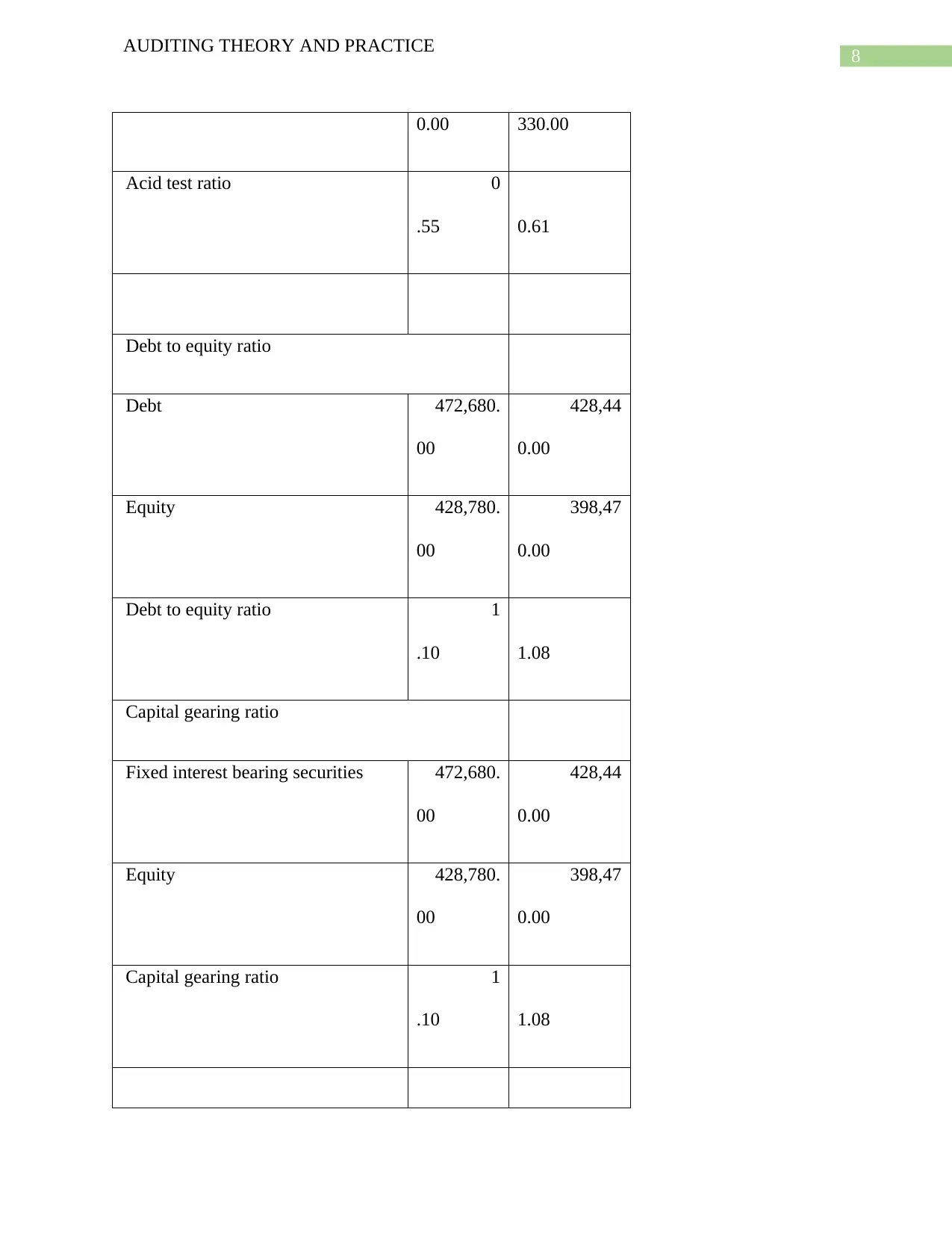

0.00 330.00

Acid test ratio 0

.55 0.61

Debt to equity ratio

Debt 472,680.

00

428,44

0.00

Equity 428,780.

00

398,47

0.00

Debt to equity ratio 1

.10 1.08

Capital gearing ratio

Fixed interest bearing securities 472,680.

00

428,44

0.00

Equity 428,780.

00

398,47

0.00

Capital gearing ratio 1

.10 1.08

AUDITING THEORY AND PRACTICE

0.00 330.00

Acid test ratio 0

.55 0.61

Debt to equity ratio

Debt 472,680.

00

428,44

0.00

Equity 428,780.

00

398,47

0.00

Debt to equity ratio 1

.10 1.08

Capital gearing ratio

Fixed interest bearing securities 472,680.

00

428,44

0.00

Equity 428,780.

00

398,47

0.00

Capital gearing ratio 1

.10 1.08

9

AUDITING THEORY AND PRACTICE

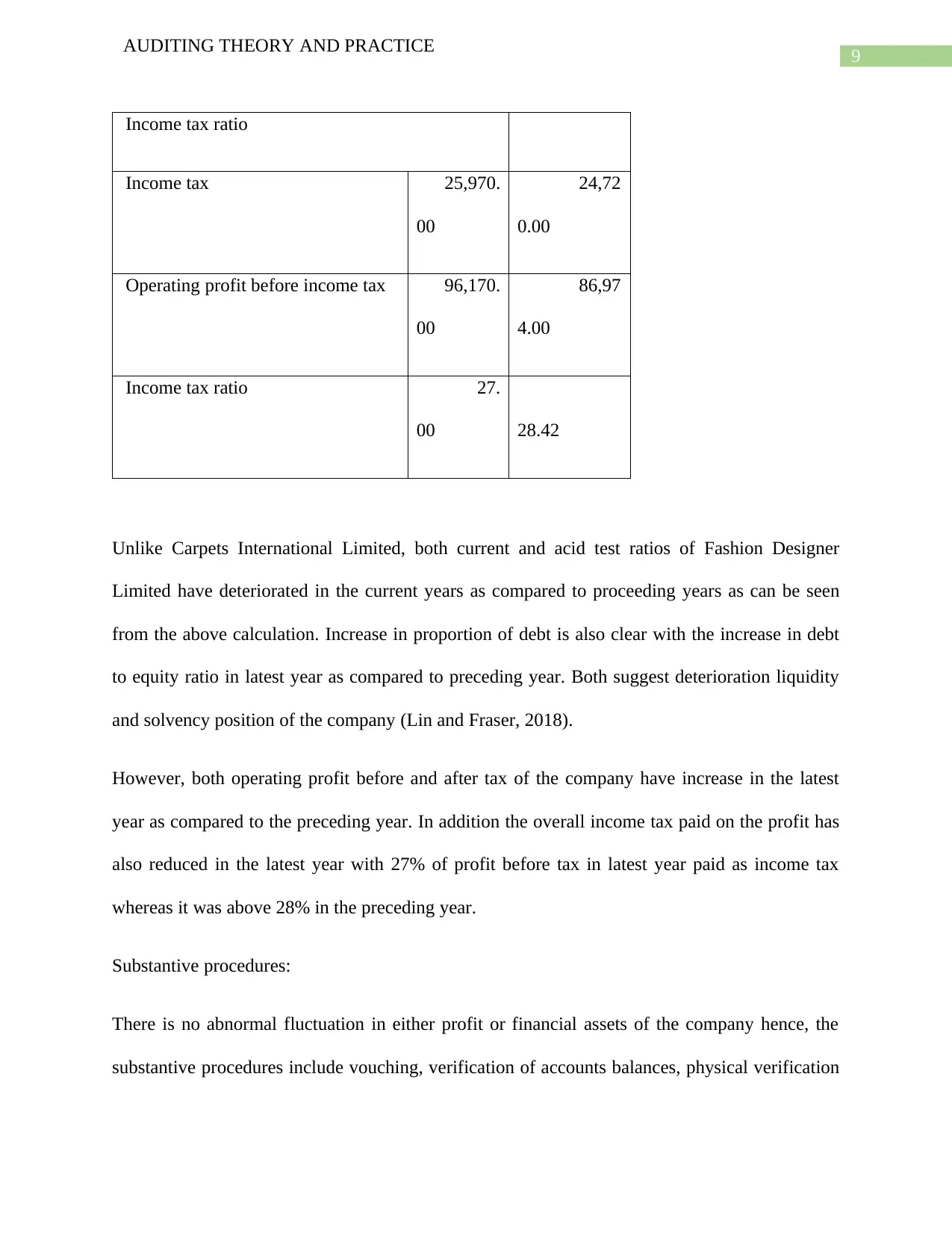

Income tax ratio

Income tax 25,970.

00

24,72

0.00

Operating profit before income tax 96,170.

00

86,97

4.00

Income tax ratio 27.

00 28.42

Unlike Carpets International Limited, both current and acid test ratios of Fashion Designer

Limited have deteriorated in the current years as compared to proceeding years as can be seen

from the above calculation. Increase in proportion of debt is also clear with the increase in debt

to equity ratio in latest year as compared to preceding year. Both suggest deterioration liquidity

and solvency position of the company (Lin and Fraser, 2018).

However, both operating profit before and after tax of the company have increase in the latest

year as compared to the preceding year. In addition the overall income tax paid on the profit has

also reduced in the latest year with 27% of profit before tax in latest year paid as income tax

whereas it was above 28% in the preceding year.

Substantive procedures:

There is no abnormal fluctuation in either profit or financial assets of the company hence, the

substantive procedures include vouching, verification of accounts balances, physical verification

AUDITING THEORY AND PRACTICE

Income tax ratio

Income tax 25,970.

00

24,72

0.00

Operating profit before income tax 96,170.

00

86,97

4.00

Income tax ratio 27.

00 28.42

Unlike Carpets International Limited, both current and acid test ratios of Fashion Designer

Limited have deteriorated in the current years as compared to proceeding years as can be seen

from the above calculation. Increase in proportion of debt is also clear with the increase in debt

to equity ratio in latest year as compared to preceding year. Both suggest deterioration liquidity

and solvency position of the company (Lin and Fraser, 2018).

However, both operating profit before and after tax of the company have increase in the latest

year as compared to the preceding year. In addition the overall income tax paid on the profit has

also reduced in the latest year with 27% of profit before tax in latest year paid as income tax

whereas it was above 28% in the preceding year.

Substantive procedures:

There is no abnormal fluctuation in either profit or financial assets of the company hence, the

substantive procedures include vouching, verification of accounts balances, physical verification

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10

AUDITING THEORY AND PRACTICE

of fixed assets and cash in hand along with other substantive procedures show there is nothing to

suggest that there could be any error or fraud in the financial reporting of the company. Thus, the

financial statements of the company are showing true and fair picture of the company as on the

relevant dates and period (Kostova, 2017).

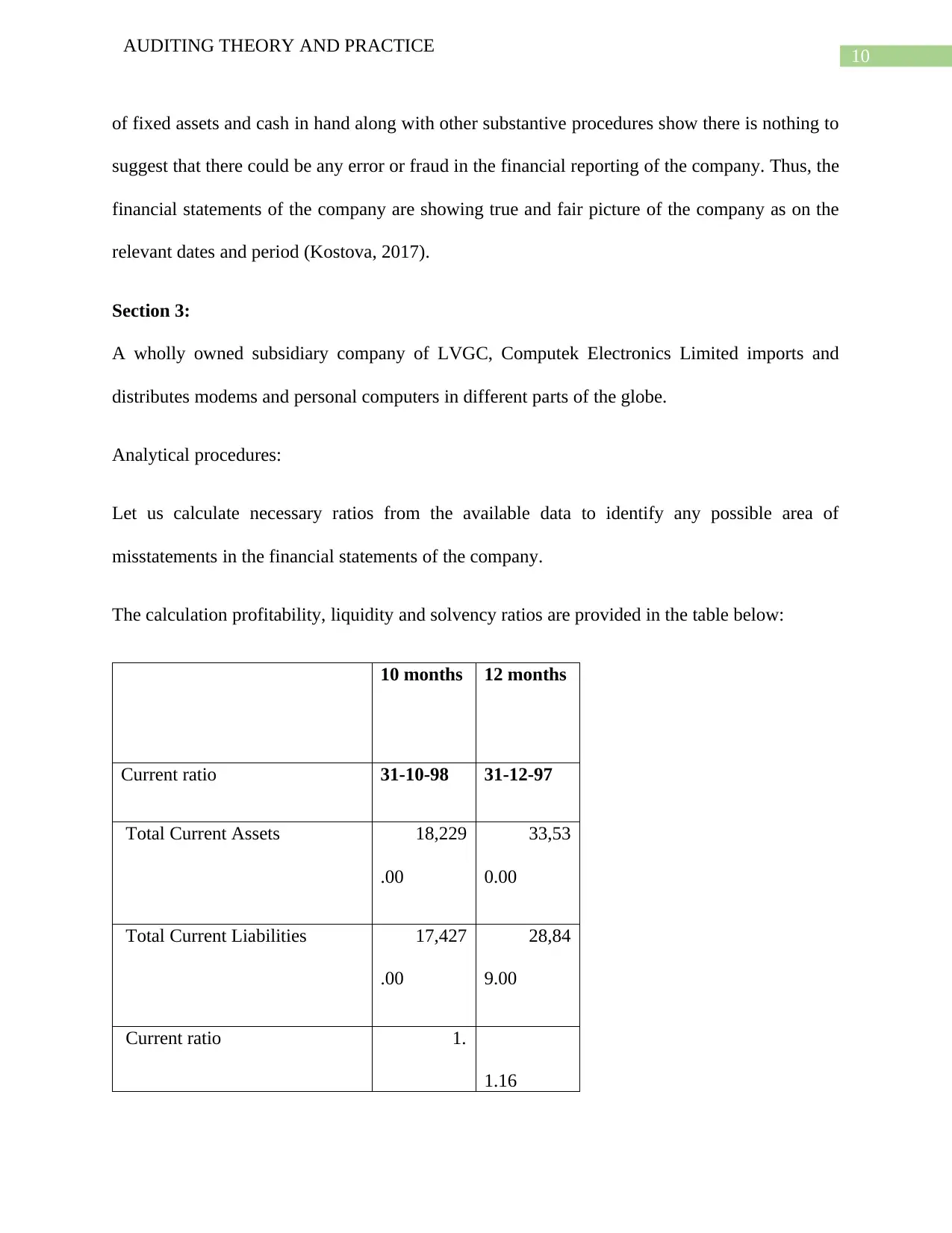

Section 3:

A wholly owned subsidiary company of LVGC, Computek Electronics Limited imports and

distributes modems and personal computers in different parts of the globe.

Analytical procedures:

Let us calculate necessary ratios from the available data to identify any possible area of

misstatements in the financial statements of the company.

The calculation profitability, liquidity and solvency ratios are provided in the table below:

10 months 12 months

Current ratio 31-10-98 31-12-97

Total Current Assets 18,229

.00

33,53

0.00

Total Current Liabilities 17,427

.00

28,84

9.00

Current ratio 1.

1.16

AUDITING THEORY AND PRACTICE

of fixed assets and cash in hand along with other substantive procedures show there is nothing to

suggest that there could be any error or fraud in the financial reporting of the company. Thus, the

financial statements of the company are showing true and fair picture of the company as on the

relevant dates and period (Kostova, 2017).

Section 3:

A wholly owned subsidiary company of LVGC, Computek Electronics Limited imports and

distributes modems and personal computers in different parts of the globe.

Analytical procedures:

Let us calculate necessary ratios from the available data to identify any possible area of

misstatements in the financial statements of the company.

The calculation profitability, liquidity and solvency ratios are provided in the table below:

10 months 12 months

Current ratio 31-10-98 31-12-97

Total Current Assets 18,229

.00

33,53

0.00

Total Current Liabilities 17,427

.00

28,84

9.00

Current ratio 1.

1.16

11

AUDITING THEORY AND PRACTICE

05

Acid test ratio

Current assets less inventories 10,506.0

0

15,457.

00

Total Current Liabilities 17,427

.00

28,84

9.00

Acid test ratio 0.

60 0.54

Debt to equity ratio

Debt 14,517.0

0

14,817.

00

Equity (26,468.0

0)

(22,816.

00)

Debt to equity ratio (0.

55)

(0

.65)

AUDITING THEORY AND PRACTICE

05

Acid test ratio

Current assets less inventories 10,506.0

0

15,457.

00

Total Current Liabilities 17,427

.00

28,84

9.00

Acid test ratio 0.

60 0.54

Debt to equity ratio

Debt 14,517.0

0

14,817.

00

Equity (26,468.0

0)

(22,816.

00)

Debt to equity ratio (0.

55)

(0

.65)

12

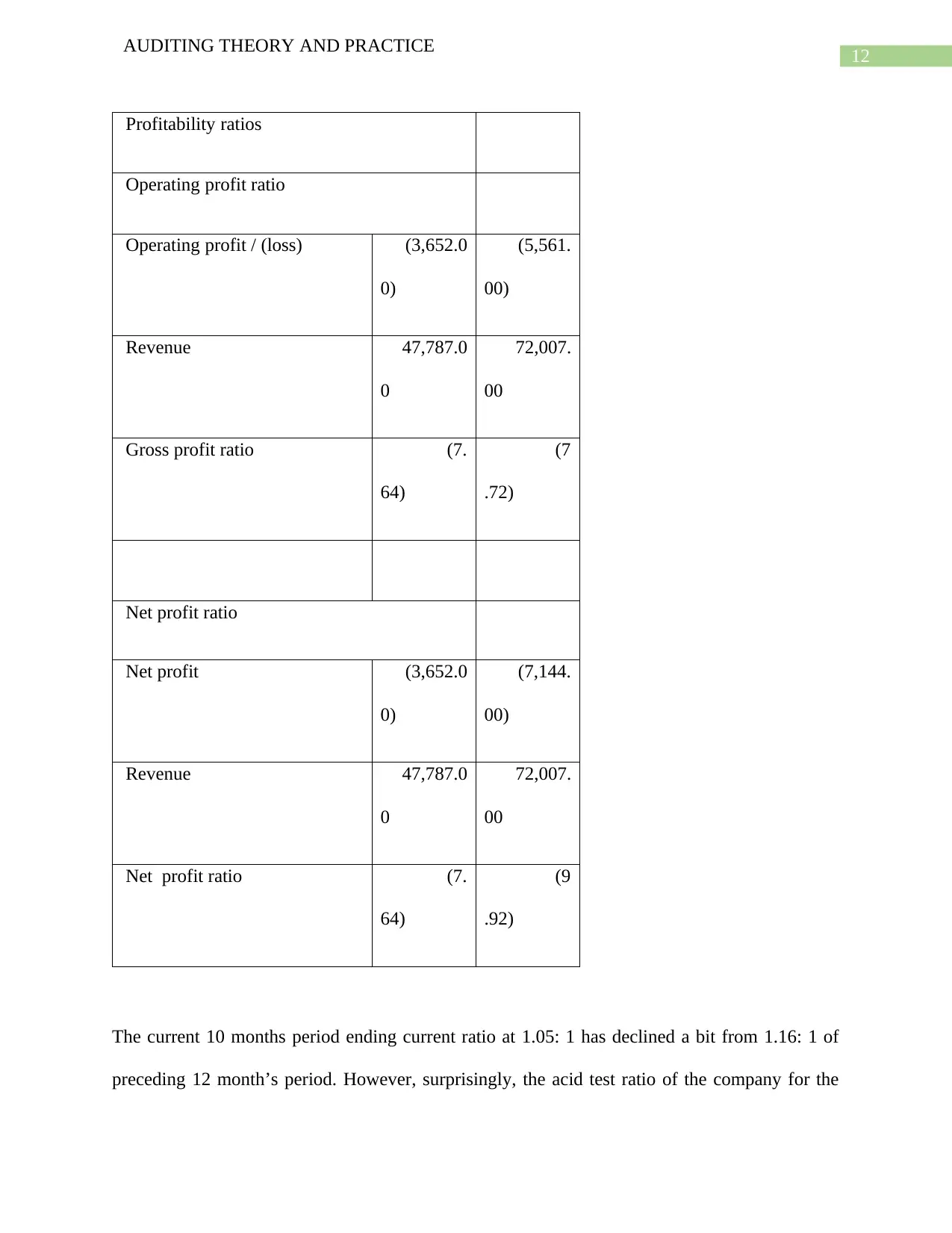

AUDITING THEORY AND PRACTICE

Profitability ratios

Operating profit ratio

Operating profit / (loss) (3,652.0

0)

(5,561.

00)

Revenue 47,787.0

0

72,007.

00

Gross profit ratio (7.

64)

(7

.72)

Net profit ratio

Net profit (3,652.0

0)

(7,144.

00)

Revenue 47,787.0

0

72,007.

00

Net profit ratio (7.

64)

(9

.92)

The current 10 months period ending current ratio at 1.05: 1 has declined a bit from 1.16: 1 of

preceding 12 month’s period. However, surprisingly, the acid test ratio of the company for the

AUDITING THEORY AND PRACTICE

Profitability ratios

Operating profit ratio

Operating profit / (loss) (3,652.0

0)

(5,561.

00)

Revenue 47,787.0

0

72,007.

00

Gross profit ratio (7.

64)

(7

.72)

Net profit ratio

Net profit (3,652.0

0)

(7,144.

00)

Revenue 47,787.0

0

72,007.

00

Net profit ratio (7.

64)

(9

.92)

The current 10 months period ending current ratio at 1.05: 1 has declined a bit from 1.16: 1 of

preceding 12 month’s period. However, surprisingly, the acid test ratio of the company for the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13

AUDITING THEORY AND PRACTICE

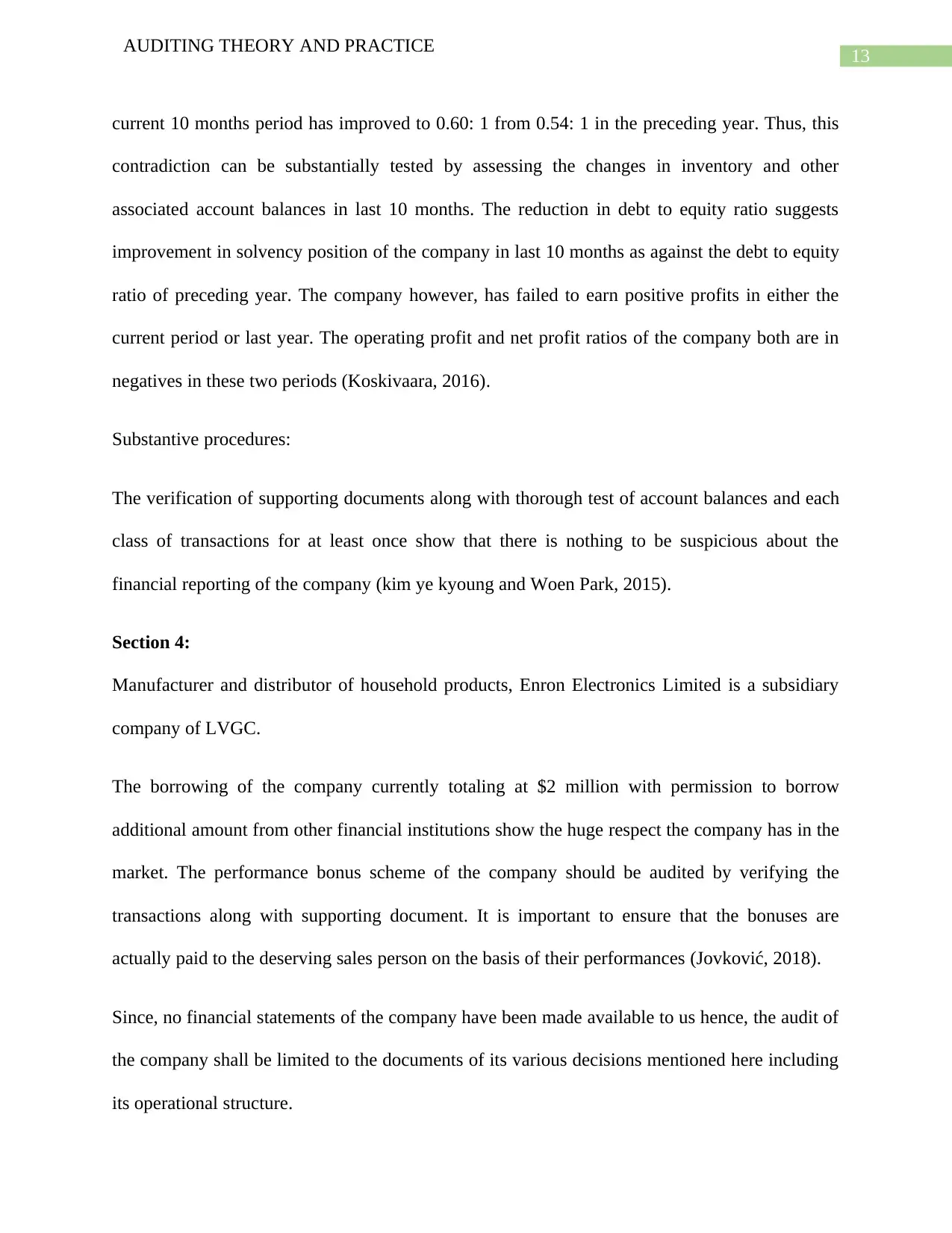

current 10 months period has improved to 0.60: 1 from 0.54: 1 in the preceding year. Thus, this

contradiction can be substantially tested by assessing the changes in inventory and other

associated account balances in last 10 months. The reduction in debt to equity ratio suggests

improvement in solvency position of the company in last 10 months as against the debt to equity

ratio of preceding year. The company however, has failed to earn positive profits in either the

current period or last year. The operating profit and net profit ratios of the company both are in

negatives in these two periods (Koskivaara, 2016).

Substantive procedures:

The verification of supporting documents along with thorough test of account balances and each

class of transactions for at least once show that there is nothing to be suspicious about the

financial reporting of the company (kim ye kyoung and Woen Park, 2015).

Section 4:

Manufacturer and distributor of household products, Enron Electronics Limited is a subsidiary

company of LVGC.

The borrowing of the company currently totaling at $2 million with permission to borrow

additional amount from other financial institutions show the huge respect the company has in the

market. The performance bonus scheme of the company should be audited by verifying the

transactions along with supporting document. It is important to ensure that the bonuses are

actually paid to the deserving sales person on the basis of their performances (Jovković, 2018).

Since, no financial statements of the company have been made available to us hence, the audit of

the company shall be limited to the documents of its various decisions mentioned here including

its operational structure.

AUDITING THEORY AND PRACTICE

current 10 months period has improved to 0.60: 1 from 0.54: 1 in the preceding year. Thus, this

contradiction can be substantially tested by assessing the changes in inventory and other

associated account balances in last 10 months. The reduction in debt to equity ratio suggests

improvement in solvency position of the company in last 10 months as against the debt to equity

ratio of preceding year. The company however, has failed to earn positive profits in either the

current period or last year. The operating profit and net profit ratios of the company both are in

negatives in these two periods (Koskivaara, 2016).

Substantive procedures:

The verification of supporting documents along with thorough test of account balances and each

class of transactions for at least once show that there is nothing to be suspicious about the

financial reporting of the company (kim ye kyoung and Woen Park, 2015).

Section 4:

Manufacturer and distributor of household products, Enron Electronics Limited is a subsidiary

company of LVGC.

The borrowing of the company currently totaling at $2 million with permission to borrow

additional amount from other financial institutions show the huge respect the company has in the

market. The performance bonus scheme of the company should be audited by verifying the

transactions along with supporting document. It is important to ensure that the bonuses are

actually paid to the deserving sales person on the basis of their performances (Jovković, 2018).

Since, no financial statements of the company have been made available to us hence, the audit of

the company shall be limited to the documents of its various decisions mentioned here including

its operational structure.

14

AUDITING THEORY AND PRACTICE

The verification of documents and supporting information raise no suspicion as to its

organizational structure and operations are concerned.

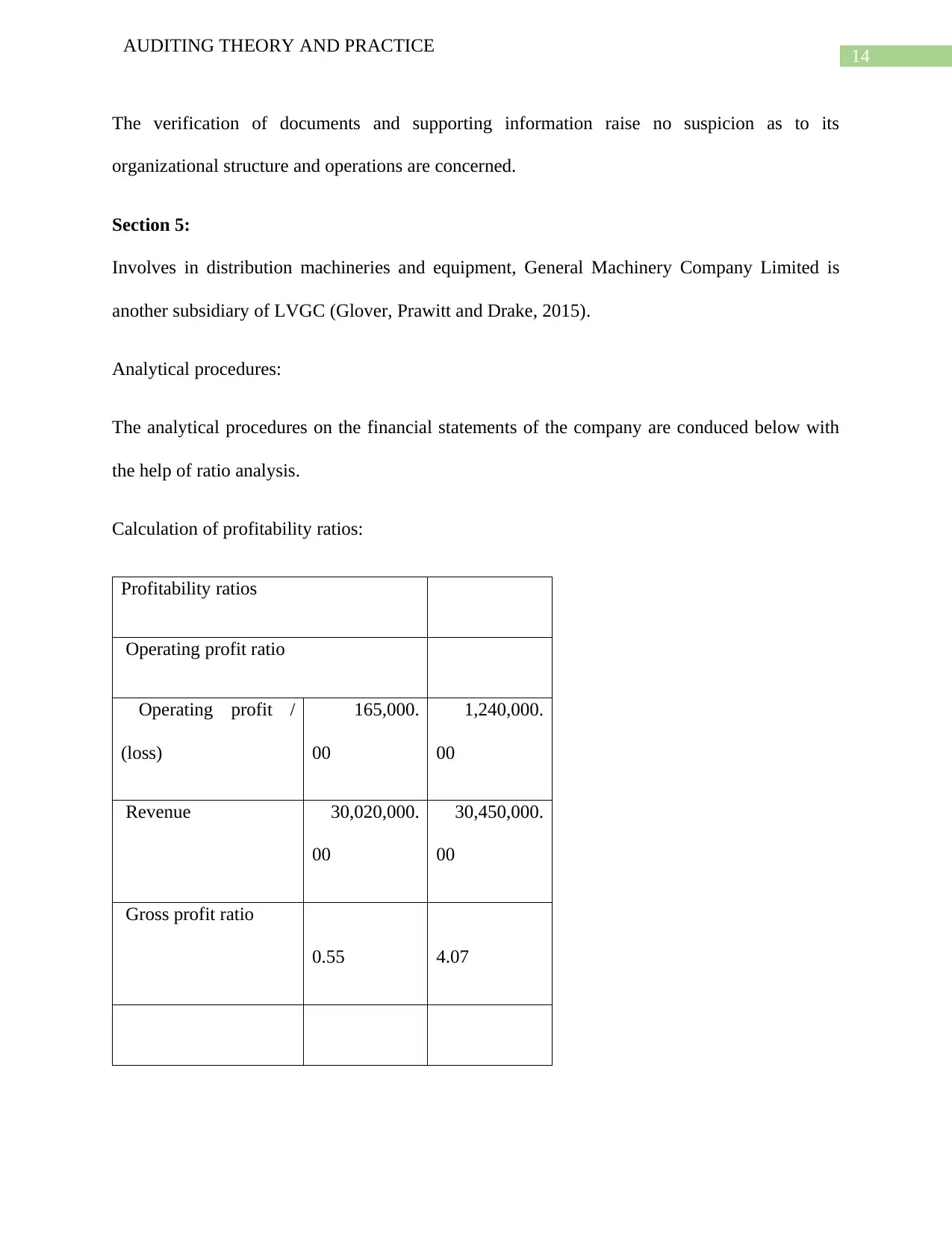

Section 5:

Involves in distribution machineries and equipment, General Machinery Company Limited is

another subsidiary of LVGC (Glover, Prawitt and Drake, 2015).

Analytical procedures:

The analytical procedures on the financial statements of the company are conduced below with

the help of ratio analysis.

Calculation of profitability ratios:

Profitability ratios

Operating profit ratio

Operating profit /

(loss)

165,000.

00

1,240,000.

00

Revenue 30,020,000.

00

30,450,000.

00

Gross profit ratio

0.55 4.07

AUDITING THEORY AND PRACTICE

The verification of documents and supporting information raise no suspicion as to its

organizational structure and operations are concerned.

Section 5:

Involves in distribution machineries and equipment, General Machinery Company Limited is

another subsidiary of LVGC (Glover, Prawitt and Drake, 2015).

Analytical procedures:

The analytical procedures on the financial statements of the company are conduced below with

the help of ratio analysis.

Calculation of profitability ratios:

Profitability ratios

Operating profit ratio

Operating profit /

(loss)

165,000.

00

1,240,000.

00

Revenue 30,020,000.

00

30,450,000.

00

Gross profit ratio

0.55 4.07

15

AUDITING THEORY AND PRACTICE

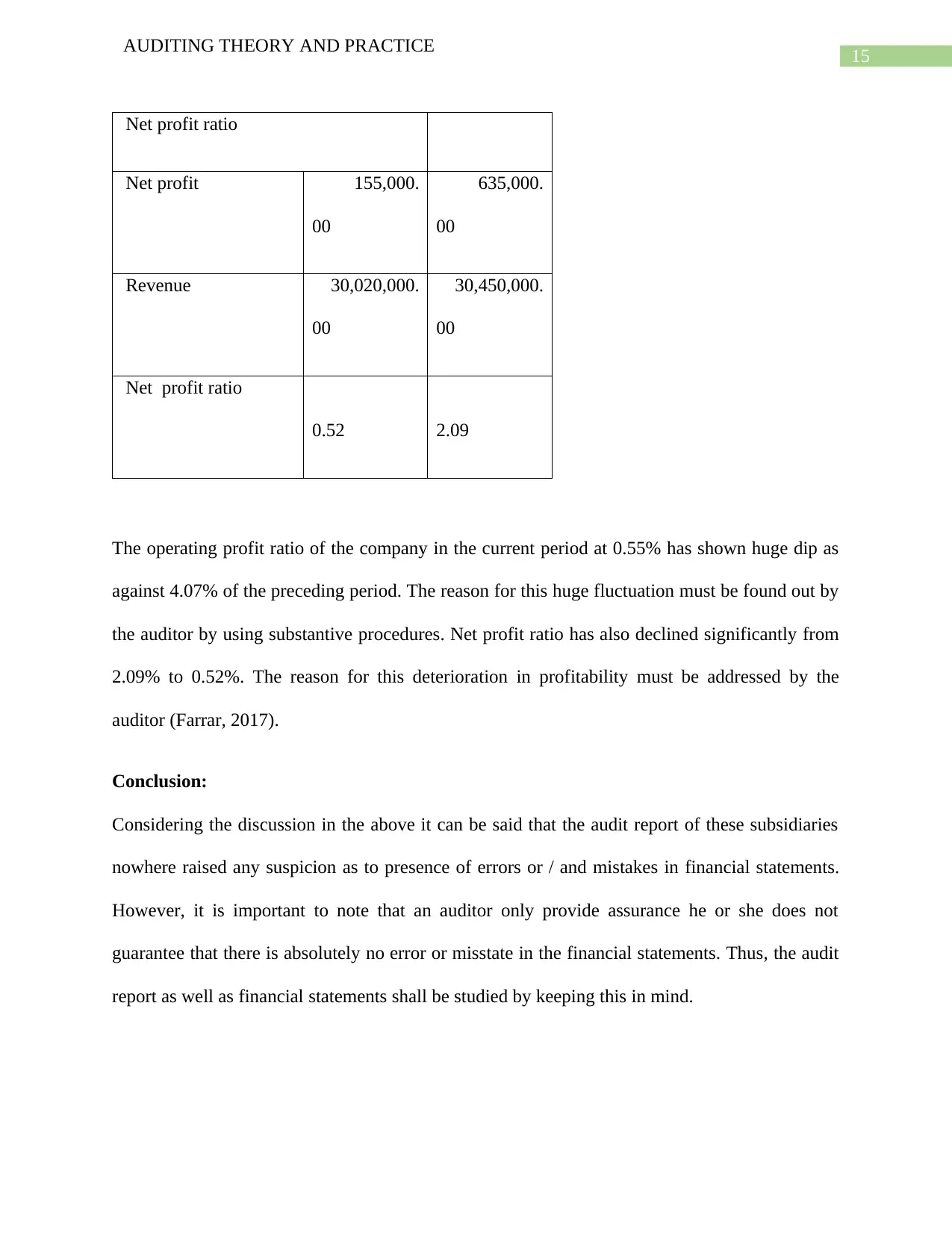

Net profit ratio

Net profit 155,000.

00

635,000.

00

Revenue 30,020,000.

00

30,450,000.

00

Net profit ratio

0.52 2.09

The operating profit ratio of the company in the current period at 0.55% has shown huge dip as

against 4.07% of the preceding period. The reason for this huge fluctuation must be found out by

the auditor by using substantive procedures. Net profit ratio has also declined significantly from

2.09% to 0.52%. The reason for this deterioration in profitability must be addressed by the

auditor (Farrar, 2017).

Conclusion:

Considering the discussion in the above it can be said that the audit report of these subsidiaries

nowhere raised any suspicion as to presence of errors or / and mistakes in financial statements.

However, it is important to note that an auditor only provide assurance he or she does not

guarantee that there is absolutely no error or misstate in the financial statements. Thus, the audit

report as well as financial statements shall be studied by keeping this in mind.

AUDITING THEORY AND PRACTICE

Net profit ratio

Net profit 155,000.

00

635,000.

00

Revenue 30,020,000.

00

30,450,000.

00

Net profit ratio

0.52 2.09

The operating profit ratio of the company in the current period at 0.55% has shown huge dip as

against 4.07% of the preceding period. The reason for this huge fluctuation must be found out by

the auditor by using substantive procedures. Net profit ratio has also declined significantly from

2.09% to 0.52%. The reason for this deterioration in profitability must be addressed by the

auditor (Farrar, 2017).

Conclusion:

Considering the discussion in the above it can be said that the audit report of these subsidiaries

nowhere raised any suspicion as to presence of errors or / and mistakes in financial statements.

However, it is important to note that an auditor only provide assurance he or she does not

guarantee that there is absolutely no error or misstate in the financial statements. Thus, the audit

report as well as financial statements shall be studied by keeping this in mind.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16

AUDITING THEORY AND PRACTICE

References:

Farrar, F. (2017). Role and Function of the Public Company Accounting Oversight Board and

Auditing Standard No. 5 an Audit Internal Control Over Financial Reporting that Integrated with

an Audit of Financial Statements. SSRN Electronic Journal, 5(5), pp.122-220.

Glover, S., Prawitt, D. and Drake, M. (2015). Between a Rock and a Hard Place: A Path Forward

for Using Substantive Analytical Procedures in Auditing Large P&L Accounts: Commentary and

Analysis. AUDITING: A Journal of Practice & Theory, 34(3), pp.161-179.

Jovković, B. (2018). Characteristics of insurance companies' financial statements and their

audit. Poslovna ekonomija, 12(1), pp.110-126.

kim ye kyoung and Woen Park (2015). The analysis of disclosure status and audit opinions on

the consolidated financial statements of Listed Companies. Korea International Accounting

Review, null(58), pp.154-168.

Koskivaara, E. (2016). Artificial neural networks in analytical review procedures. Managerial

Auditing Journal, 21(4), pp.191-223.

Kostova, S. (2017). Audit Procedures for Disclosure of Errors and Fraud in Financial Statements

of Bulgarian Companies. Annals of the Alexandru Ioan Cuza University - Economics, 60(2),

pp.110-120.

Lin, K. and Fraser, I. (2018). The use of analytical procedures by external auditors in

Canada. Journal of International Accounting, Auditing and Taxation, 14(4), pp.153-168.

Min Choo, T., Keong Chua, M., Boon Ong, C. and Hee Tan, T. (2016). Analytical procedures

for new and matured industries. Managerial Auditing Journal, 18(18), pp.123-134.

AUDITING THEORY AND PRACTICE

References:

Farrar, F. (2017). Role and Function of the Public Company Accounting Oversight Board and

Auditing Standard No. 5 an Audit Internal Control Over Financial Reporting that Integrated with

an Audit of Financial Statements. SSRN Electronic Journal, 5(5), pp.122-220.

Glover, S., Prawitt, D. and Drake, M. (2015). Between a Rock and a Hard Place: A Path Forward

for Using Substantive Analytical Procedures in Auditing Large P&L Accounts: Commentary and

Analysis. AUDITING: A Journal of Practice & Theory, 34(3), pp.161-179.

Jovković, B. (2018). Characteristics of insurance companies' financial statements and their

audit. Poslovna ekonomija, 12(1), pp.110-126.

kim ye kyoung and Woen Park (2015). The analysis of disclosure status and audit opinions on

the consolidated financial statements of Listed Companies. Korea International Accounting

Review, null(58), pp.154-168.

Koskivaara, E. (2016). Artificial neural networks in analytical review procedures. Managerial

Auditing Journal, 21(4), pp.191-223.

Kostova, S. (2017). Audit Procedures for Disclosure of Errors and Fraud in Financial Statements

of Bulgarian Companies. Annals of the Alexandru Ioan Cuza University - Economics, 60(2),

pp.110-120.

Lin, K. and Fraser, I. (2018). The use of analytical procedures by external auditors in

Canada. Journal of International Accounting, Auditing and Taxation, 14(4), pp.153-168.

Min Choo, T., Keong Chua, M., Boon Ong, C. and Hee Tan, T. (2016). Analytical procedures

for new and matured industries. Managerial Auditing Journal, 18(18), pp.123-134.

17

AUDITING THEORY AND PRACTICE

Song, C. (2018). Audit Recognition to Falsified Methods in Financial Statements of Listed

Companies in China. International Business Research, 6(8), pp.12-31.

AUDITING THEORY AND PRACTICE

Song, C. (2018). Audit Recognition to Falsified Methods in Financial Statements of Listed

Companies in China. International Business Research, 6(8), pp.12-31.

1 out of 18

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.