Auditing Theory and Practice: Material Misstatement Analysis

VerifiedAdded on 2022/09/14

|21

|4764

|14

Report

AI Summary

This report delves into the intricacies of auditing theory and practice, addressing critical aspects such as material misstatements due to fraud, risk assessment, and the roles of auditors and governance. The first part of the report responds to a query regarding material misstatements, empha...

Running head: AUDITING THEORY AND PRACTISE

Auditing theory and practise

Name of the student

Name of the university

Authors note

Auditing theory and practise

Name of the student

Name of the university

Authors note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

AUDITING THEORY AND PRACTISE

Table of Contents

Part 1..............................................................................................................................2

Answer to question 1..................................................................................................2

Part 2..............................................................................................................................8

Answer to question 2..................................................................................................8

References....................................................................................................................15

Appendices...................................................................................................................18

AUDITING THEORY AND PRACTISE

Table of Contents

Part 1..............................................................................................................................2

Answer to question 1..................................................................................................2

Part 2..............................................................................................................................8

Answer to question 2..................................................................................................8

References....................................................................................................................15

Appendices...................................................................................................................18

2

AUDITING THEORY AND PRACTISE

Part 1

Answer to question 1

To Miss Williams

Subject: risks of material misstatements due to fraud

Respected madam

In the response to your query over material misstatement over the fraud of the audit

report based on the auditor and the government role, I personally believe that the as per the

auditing standards of ASA 240 the risk assessment of the potential investors are very much

significant to the case and the fraud detection is higher than the risk statement is not detected

from the error. Hence failure to the transaction could well be making certain auditor

misrepresentation. The auditor concealment may be difficult to detect when accompanied by

the solution. Hence in order to explain the management responsibility towards the

government and the auditor the differences can be recorded as follows-

Auditor

The management assignment related to the risk of material misstatement may be

misled due to fraud which includes the nature, expert and the frequency of such assessment

(Martinez, and Lessa, 2014).

The overall management process is related to the risks identification responding to the

frauds in the entity which includes the specific management have identified or have been

brought to the attention for which the risk stature is likely to exist.

The management communication if charged to the government for identifying the risk

of the fraud of the entity (Cullen et al., 2017).

AUDITING THEORY AND PRACTISE

Part 1

Answer to question 1

To Miss Williams

Subject: risks of material misstatements due to fraud

Respected madam

In the response to your query over material misstatement over the fraud of the audit

report based on the auditor and the government role, I personally believe that the as per the

auditing standards of ASA 240 the risk assessment of the potential investors are very much

significant to the case and the fraud detection is higher than the risk statement is not detected

from the error. Hence failure to the transaction could well be making certain auditor

misrepresentation. The auditor concealment may be difficult to detect when accompanied by

the solution. Hence in order to explain the management responsibility towards the

government and the auditor the differences can be recorded as follows-

Auditor

The management assignment related to the risk of material misstatement may be

misled due to fraud which includes the nature, expert and the frequency of such assessment

(Martinez, and Lessa, 2014).

The overall management process is related to the risks identification responding to the

frauds in the entity which includes the specific management have identified or have been

brought to the attention for which the risk stature is likely to exist.

The management communication if charged to the government for identifying the risk

of the fraud of the entity (Cullen et al., 2017).

You're viewing a preview

Unlock full access by subscribing today!

3

AUDITING THEORY AND PRACTISE

The overall management communication is related to the management exposure

towards the business practices and ethical behaviour.

The auditor of the company on the other hand will be making enquiries to the

management to see whether the knowledge base is actual, suspicious or alleged fraud which

could affect the management.

On the other hand in the case of the internal audit function the auditor he shall make

enquiries the management to determine whether the knowledge of any individual, suspected

or fraud is effecting the country or not.

Governance

As per the governance is concerned they are involved in engaging with the entity.

Hence it is important for the auditor to oversight the effective management risk process while

identifying and responding to the fraud of the risk entity and look to mitigate the same.

Unless all the charges are imposed to the management entity, the management must

look to determine the fraudulence which could affect the entity. Hence the basic difference

lies between the fraudulence identification and the possible risk factor which could affect the

scenario.

Misconception in the auditor role

The auditor misconception to the auditor roles and responsibilities happens to be a big

issue. Hence an auditor if conducting an audit as per the audit standard for obtaining some

reasonable assurance in the financial report is considered as the material misstatement

whether being caused by the error or fraud. Thus due to the audit limitation any risk related to

the material misstatement on the financial report to be detected though it is properly planned

and managed by the auditing standards of Australia .

AUDITING THEORY AND PRACTISE

The overall management communication is related to the management exposure

towards the business practices and ethical behaviour.

The auditor of the company on the other hand will be making enquiries to the

management to see whether the knowledge base is actual, suspicious or alleged fraud which

could affect the management.

On the other hand in the case of the internal audit function the auditor he shall make

enquiries the management to determine whether the knowledge of any individual, suspected

or fraud is effecting the country or not.

Governance

As per the governance is concerned they are involved in engaging with the entity.

Hence it is important for the auditor to oversight the effective management risk process while

identifying and responding to the fraud of the risk entity and look to mitigate the same.

Unless all the charges are imposed to the management entity, the management must

look to determine the fraudulence which could affect the entity. Hence the basic difference

lies between the fraudulence identification and the possible risk factor which could affect the

scenario.

Misconception in the auditor role

The auditor misconception to the auditor roles and responsibilities happens to be a big

issue. Hence an auditor if conducting an audit as per the audit standard for obtaining some

reasonable assurance in the financial report is considered as the material misstatement

whether being caused by the error or fraud. Thus due to the audit limitation any risk related to

the material misstatement on the financial report to be detected though it is properly planned

and managed by the auditing standards of Australia .

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

AUDITING THEORY AND PRACTISE

The inherent limitation are significant to the misstatement resulting the fraud. The

overall risks for not detecting the fraud is higher than the risk inherence. Hence the fraud may

be sophisticated and properly organised to conceal it. The collation may occur to the auditor

in pursuance of the evidence. Thus the detection of the fraud depends upon the skilfulness of

the auditor, the overall frequency and the manipulation to the process could fill with the

possible opportunities over seniority of the Individuals. Thus the auditor finds it difficult to

match the auditor perspectives as a whole. Therefore it becomes tough for the auditor to chalk

out the errors (Chan et al.,2016). As per the ASA 200 potential reporting source the overall

audit limitation is maintained properly. Hence the auditor misconception is been properly

realised with the amounts placed and utilised.

Furthermore if the audit is not properly maintained by the auditor then for that case

there is a overall misconception is made over the audit report. Thus the management is

frequently in a position to directly or indirectly manipulate those data and to present the same

to override the information and to control the procedure which have been designed to control

the similar frauds conducted by the employers (Huang et al.,2014).

On the other hand it can be said that by obtaining the assured risk matrices the auditor

is only responsible to generate and maintain the audit scientism throughout the whole process

of audit. Thus by considering the overall potential for the management effectiveness at the

time of detection of the fraudulence will not be properly effective. Thus the audit

requirements will be helpful to the auditor to identify and manage the best possible risks

status over the material misstatement and the designing procedures to mitigate those risks.

Risk factor related to the material misstatement of the entity

The material misstatement is an important factor as per ASA 240 standards. Hence it

is important for the company auditor to assess the best possible risk factors over the material

AUDITING THEORY AND PRACTISE

The inherent limitation are significant to the misstatement resulting the fraud. The

overall risks for not detecting the fraud is higher than the risk inherence. Hence the fraud may

be sophisticated and properly organised to conceal it. The collation may occur to the auditor

in pursuance of the evidence. Thus the detection of the fraud depends upon the skilfulness of

the auditor, the overall frequency and the manipulation to the process could fill with the

possible opportunities over seniority of the Individuals. Thus the auditor finds it difficult to

match the auditor perspectives as a whole. Therefore it becomes tough for the auditor to chalk

out the errors (Chan et al.,2016). As per the ASA 200 potential reporting source the overall

audit limitation is maintained properly. Hence the auditor misconception is been properly

realised with the amounts placed and utilised.

Furthermore if the audit is not properly maintained by the auditor then for that case

there is a overall misconception is made over the audit report. Thus the management is

frequently in a position to directly or indirectly manipulate those data and to present the same

to override the information and to control the procedure which have been designed to control

the similar frauds conducted by the employers (Huang et al.,2014).

On the other hand it can be said that by obtaining the assured risk matrices the auditor

is only responsible to generate and maintain the audit scientism throughout the whole process

of audit. Thus by considering the overall potential for the management effectiveness at the

time of detection of the fraudulence will not be properly effective. Thus the audit

requirements will be helpful to the auditor to identify and manage the best possible risks

status over the material misstatement and the designing procedures to mitigate those risks.

Risk factor related to the material misstatement of the entity

The material misstatement is an important factor as per ASA 240 standards. Hence it

is important for the company auditor to assess the best possible risk factors over the material

5

AUDITING THEORY AND PRACTISE

misstatement. Thus there is a need of the proper audit evidence to manage the possible risk

exposure as well as to identify the suspected audit fraudulence factors. Hence there are many

reasons for the investor to recognise the basic risks related factors over revenue recognition

factors. These reasons are been described as below-

Professional scepticism

As per the ASA 200 standard the auditor needs to maintain the professional

scepticism throughout the overall audit report which would be important to recognise the

possibility that the material misstatement could be emerging. Now with the auditors past

experience toward the honesty and integrity of the entry management charged in the

governmental process.

Unless there is a chance of contradiction the auditor may look to accept the audit

report as genuine. Hence if the conditions are not valid and the auditor is suspicious over the

audit report, he could look to investigate bit more. Hence in the case of Woodside petroleum

limited the company audit standard are very much useful as per ASA 240 audit fraudulence.

Hence for this company the company auditor could go for further investigation if the said

report is not proper to him.

Discussion among engagement team

As per ASA 315 article there is a discussion needed from the management and

responsibility team which matters to be a part of the communication and discussion forum.

Hence this area shall place particular emphasis over the financial report of the concern.

Hence the major area to focus is on the material misstatement is stated on the fraudulence.

Hence the discussion might occur by setting the beliefs on the engagement with the team

members. Hence for the Woodside petroleum company the discussion team plays an

AUDITING THEORY AND PRACTISE

misstatement. Thus there is a need of the proper audit evidence to manage the possible risk

exposure as well as to identify the suspected audit fraudulence factors. Hence there are many

reasons for the investor to recognise the basic risks related factors over revenue recognition

factors. These reasons are been described as below-

Professional scepticism

As per the ASA 200 standard the auditor needs to maintain the professional

scepticism throughout the overall audit report which would be important to recognise the

possibility that the material misstatement could be emerging. Now with the auditors past

experience toward the honesty and integrity of the entry management charged in the

governmental process.

Unless there is a chance of contradiction the auditor may look to accept the audit

report as genuine. Hence if the conditions are not valid and the auditor is suspicious over the

audit report, he could look to investigate bit more. Hence in the case of Woodside petroleum

limited the company audit standard are very much useful as per ASA 240 audit fraudulence.

Hence for this company the company auditor could go for further investigation if the said

report is not proper to him.

Discussion among engagement team

As per ASA 315 article there is a discussion needed from the management and

responsibility team which matters to be a part of the communication and discussion forum.

Hence this area shall place particular emphasis over the financial report of the concern.

Hence the major area to focus is on the material misstatement is stated on the fraudulence.

Hence the discussion might occur by setting the beliefs on the engagement with the team

members. Hence for the Woodside petroleum company the discussion team plays an

You're viewing a preview

Unlock full access by subscribing today!

6

AUDITING THEORY AND PRACTISE

important role from the end of the management and responsibility team. Hence the risk

factors relating to the material misstatements can be managed (Heck et al., 2013).

Risks assessment process and relative activities

At the time of performing the material misstatement procedures it is important to

understand the value and environment of the entity towards the internal audit control as per

ASA 315. Hence the material misstatement is detected due to the fraudulence. In the same

way for Woodside Petroleum Company also the risk assessment procedure and fraud related

activities are to be determined.

Examples related to material misstatements

The material misstatement is an active topic and throughout the decade there have

been a lot of cases where the material misstatements have occurred and the same have been

reported in the media (Vovchenko et al. 2018).

The Enron scandal (2001)

The Enron Company was the pioneer in the house of energy, commodities and the

service based on Houston. It had been discovered in the year 2001 that the company had been

using the accounting loopholes to hide the bad debts while whiles simultaneously it had

affected the earnings of the company earnings. Hence the scandal had initially reported of a

loss of $74 billion as the Enron share price had drastically collapsed from $90 to $1 within a

year. It had been revealed that the company CEO had kept billions of dollars and closed the

debt of the balance sheet. In addition to this the company had pressured the auditing firm mr

arther Andersen regarding the issues. On the other hand the convictions had been shocking to

the company as the prosecutor Andrew Weismann had indicated that they are not just any

individual. Thus the company CEO had effectively lost the business and had effectively put

the company out of the business. However over 20000 employees had lost their job.

AUDITING THEORY AND PRACTISE

important role from the end of the management and responsibility team. Hence the risk

factors relating to the material misstatements can be managed (Heck et al., 2013).

Risks assessment process and relative activities

At the time of performing the material misstatement procedures it is important to

understand the value and environment of the entity towards the internal audit control as per

ASA 315. Hence the material misstatement is detected due to the fraudulence. In the same

way for Woodside Petroleum Company also the risk assessment procedure and fraud related

activities are to be determined.

Examples related to material misstatements

The material misstatement is an active topic and throughout the decade there have

been a lot of cases where the material misstatements have occurred and the same have been

reported in the media (Vovchenko et al. 2018).

The Enron scandal (2001)

The Enron Company was the pioneer in the house of energy, commodities and the

service based on Houston. It had been discovered in the year 2001 that the company had been

using the accounting loopholes to hide the bad debts while whiles simultaneously it had

affected the earnings of the company earnings. Hence the scandal had initially reported of a

loss of $74 billion as the Enron share price had drastically collapsed from $90 to $1 within a

year. It had been revealed that the company CEO had kept billions of dollars and closed the

debt of the balance sheet. In addition to this the company had pressured the auditing firm mr

arther Andersen regarding the issues. On the other hand the convictions had been shocking to

the company as the prosecutor Andrew Weismann had indicated that they are not just any

individual. Thus the company CEO had effectively lost the business and had effectively put

the company out of the business. However over 20000 employees had lost their job.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

AUDITING THEORY AND PRACTISE

Bernie Madoff scandal (2002)

Bernie Madoff is a former American stockbroker who conceptualized the biggest

Ponzi scheme in the history. Hence Madoff ran the Madoff investment securities LLC. After

the 2008 financial crisis it had been discovered that an amount of $64.8 billion had been

tricked by Madoff from the investors. Hence after the conviction the prisoner had been

charged to pay $170 billion and had been sentenced to prison for 150 years.

Thank you.

AUDITING THEORY AND PRACTISE

Bernie Madoff scandal (2002)

Bernie Madoff is a former American stockbroker who conceptualized the biggest

Ponzi scheme in the history. Hence Madoff ran the Madoff investment securities LLC. After

the 2008 financial crisis it had been discovered that an amount of $64.8 billion had been

tricked by Madoff from the investors. Hence after the conviction the prisoner had been

charged to pay $170 billion and had been sentenced to prison for 150 years.

Thank you.

8

AUDITING THEORY AND PRACTISE

Part 2

Answer to question 2

Audit planning memorandum

Project number……………..

Project name…………………

Prepared by……….. Date………..

Received by……… time………….

From the annual report of Woodside petroleum limited 2016 the company have

basically focused on the reduction of threat and had looked to focus over the adverse impact

on the results or outcome to enhance the value chain opportunities. Thus the process does set

out some differential criteria to evaluate the material risk statements across the company.

Hence the process replicates the systematic assessment to the risk exposure in order to assess

the overall consequence for the risky areas like environment, finance, reputation and brand

recognition. Hence this is been considered as an overall risks status or risk management.

Hence the company had identified like there are four type of business risk like

economic risk, operational risk, taxation risk and reputational risk. Hence the economic risk

is an aspect which could be inculcated by knowing that the company had initially not

properly meet all the initial requirements. Hence due to the economic risks and the market

research had shown reduction on the oil price by 20 percent than the previous year. Hence

this reduction had a huge impact on the profitability of the company as well as to the annual

report. In order to explain the company reputational risk the capital structure, exploration and

the capital acquisitions expenditure had also increased marginally. Apart from this to review

AUDITING THEORY AND PRACTISE

Part 2

Answer to question 2

Audit planning memorandum

Project number……………..

Project name…………………

Prepared by……….. Date………..

Received by……… time………….

From the annual report of Woodside petroleum limited 2016 the company have

basically focused on the reduction of threat and had looked to focus over the adverse impact

on the results or outcome to enhance the value chain opportunities. Thus the process does set

out some differential criteria to evaluate the material risk statements across the company.

Hence the process replicates the systematic assessment to the risk exposure in order to assess

the overall consequence for the risky areas like environment, finance, reputation and brand

recognition. Hence this is been considered as an overall risks status or risk management.

Hence the company had identified like there are four type of business risk like

economic risk, operational risk, taxation risk and reputational risk. Hence the economic risk

is an aspect which could be inculcated by knowing that the company had initially not

properly meet all the initial requirements. Hence due to the economic risks and the market

research had shown reduction on the oil price by 20 percent than the previous year. Hence

this reduction had a huge impact on the profitability of the company as well as to the annual

report. In order to explain the company reputational risk the capital structure, exploration and

the capital acquisitions expenditure had also increased marginally. Apart from this to review

You're viewing a preview

Unlock full access by subscribing today!

9

AUDITING THEORY AND PRACTISE

the taxation risk in the petroleum industry. Hence the Australian government had initially

used to face the taxation risk due to the imposement of risk value which have hampered the

acquisition of finance from the company. Moreover the successful exploration and the

renewal of the upstream resources could also help to improve the strategy as a whole. Apart

from this the company had successfully failed to commercialise a hydrocarbon by selecting a

suboptimal development option and falling to execute a project which could look to activate

the overall cost structure, quality and the schedule expectations and look to reduce the value

which could help to secure from the future development and bring on negativity that could

look to make an impact over the organisation. The sustained, unplanned interruption to the

production may impact our licence to operate and financial performance. Hence the facilities

include operating hazards, inclement weather and the disruption to the supply chain. Which

had been resulted to loss of hydrocarbon containment, diminished choice, production cost as

well as the environmental damage or unintentional disruption. Hence the commodity value is

very much and the same impacted by global economic factors beyond Woodside’s control.

Hence the demands for and pricing of our products remain beyond the woodside petroleum

limited control. Thus the change in the economic and the political factors could well be

including the natural disasters and the overall Introduction to the basic changes with the

buyers preferences for differentiating the value addition of the products and the price range

(Chambers and Odar 2015.). Lastly the commercial transaction undertaken with the

objectives of the growth of the impact the ability to the deliver anticipated value. These

process optimal commercial adaption of certain unfavourable conditions as a whole,

obligations and liabilities by not getting to meet the overall expectations.

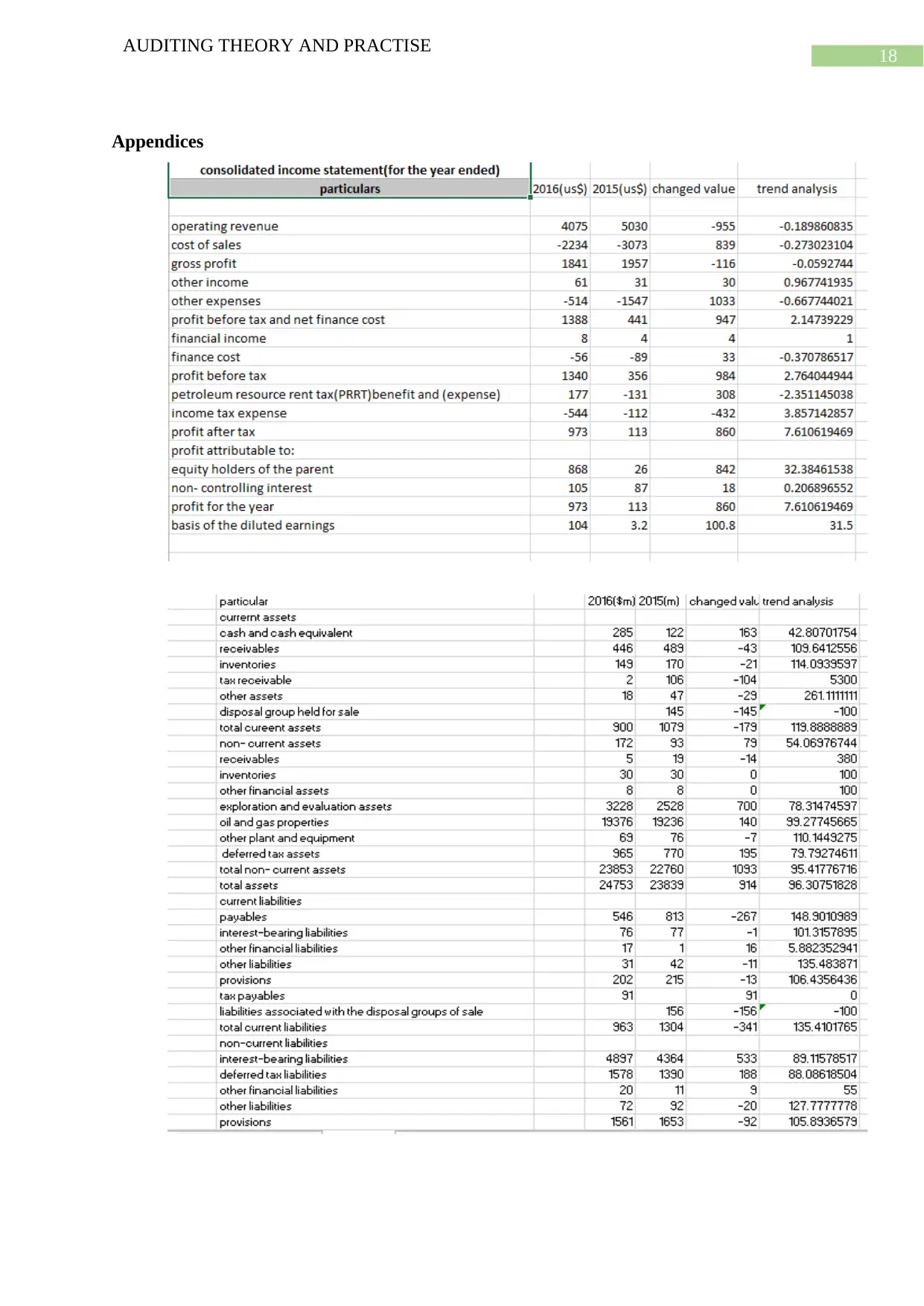

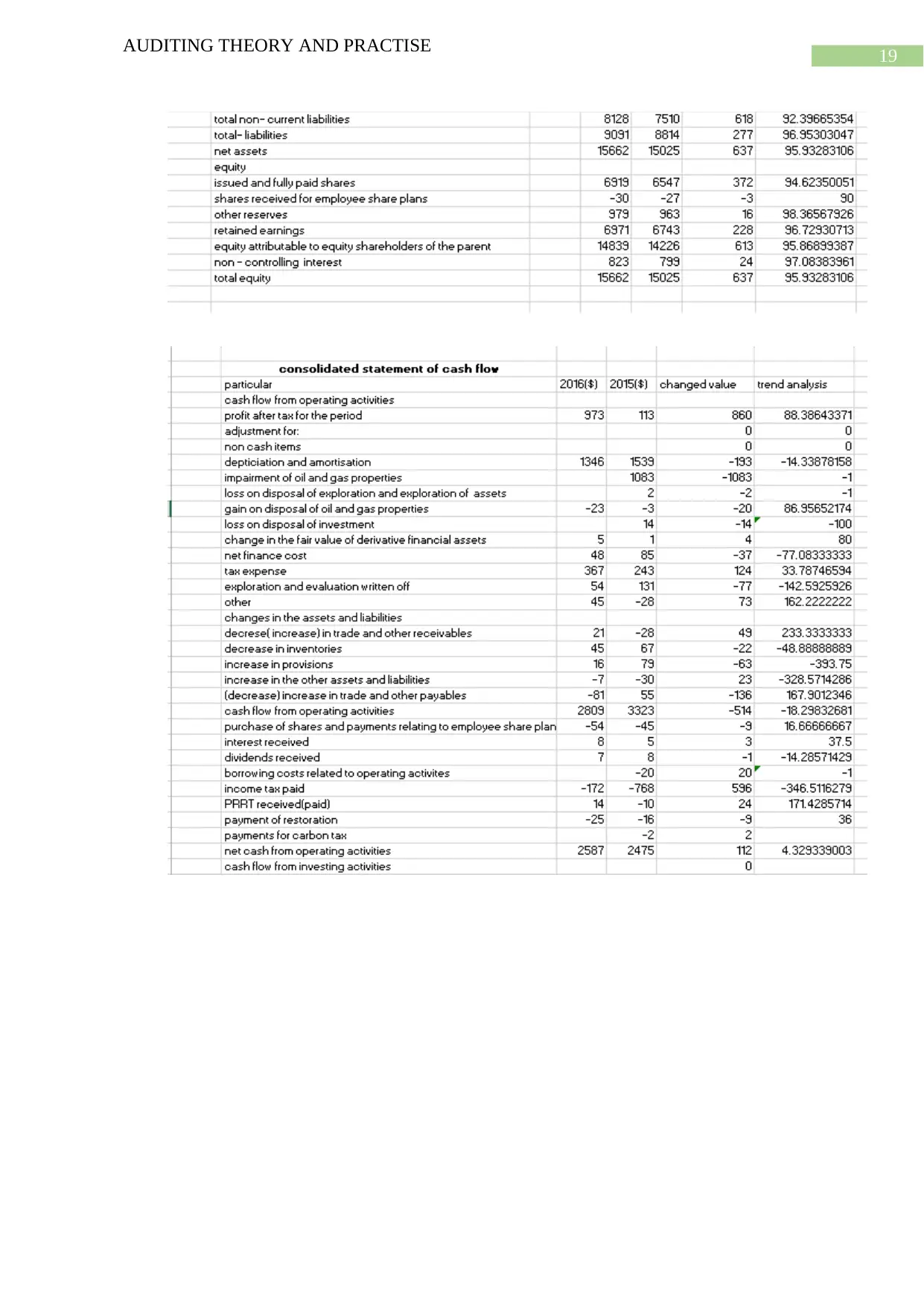

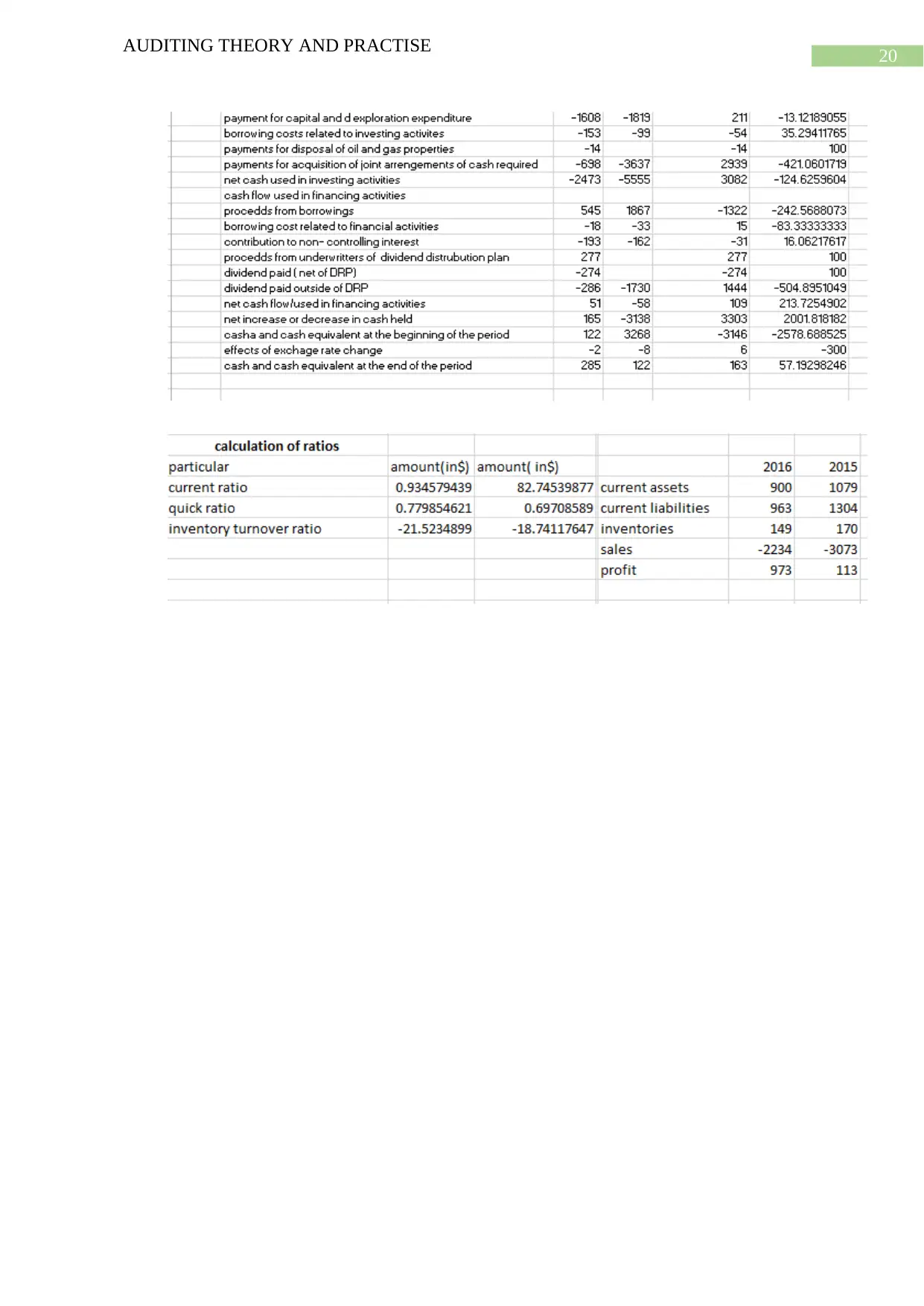

Apart from the actual provided the calculated data have provided a horizontal analysis

to the financial statement of the company. Hence the calculation shows that there have been

an overall growth of 4 percent to the total value of the asset as well as to the company

AUDITING THEORY AND PRACTISE

the taxation risk in the petroleum industry. Hence the Australian government had initially

used to face the taxation risk due to the imposement of risk value which have hampered the

acquisition of finance from the company. Moreover the successful exploration and the

renewal of the upstream resources could also help to improve the strategy as a whole. Apart

from this the company had successfully failed to commercialise a hydrocarbon by selecting a

suboptimal development option and falling to execute a project which could look to activate

the overall cost structure, quality and the schedule expectations and look to reduce the value

which could help to secure from the future development and bring on negativity that could

look to make an impact over the organisation. The sustained, unplanned interruption to the

production may impact our licence to operate and financial performance. Hence the facilities

include operating hazards, inclement weather and the disruption to the supply chain. Which

had been resulted to loss of hydrocarbon containment, diminished choice, production cost as

well as the environmental damage or unintentional disruption. Hence the commodity value is

very much and the same impacted by global economic factors beyond Woodside’s control.

Hence the demands for and pricing of our products remain beyond the woodside petroleum

limited control. Thus the change in the economic and the political factors could well be

including the natural disasters and the overall Introduction to the basic changes with the

buyers preferences for differentiating the value addition of the products and the price range

(Chambers and Odar 2015.). Lastly the commercial transaction undertaken with the

objectives of the growth of the impact the ability to the deliver anticipated value. These

process optimal commercial adaption of certain unfavourable conditions as a whole,

obligations and liabilities by not getting to meet the overall expectations.

Apart from the actual provided the calculated data have provided a horizontal analysis

to the financial statement of the company. Hence the calculation shows that there have been

an overall growth of 4 percent to the total value of the asset as well as to the company

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

AUDITING THEORY AND PRACTISE

position. Apart from this it is also been seen that the current liabilities value have also been

decreased by 26 percent. the changes to the debt and value degradation could look to bring

down the overall liabilities value of the company. On the other hand the total net assets have

been increased by the overall company revenue where there is an increase to equity have

been increased to 4 percent. Hence the changed value have been well determined by the

horizontal analysis. However the revenue valuation is also decreased by the analysis. The net

profit of the company have been also increased by a good number at that point of time.

Moreover there have been use of various ratio values which have been generated during the

process. Hence at the time of calculating the ratios three types of ratio have been calculated in

this case. It is seen that the current ratio value for the company is 0.9345 approx. the general

rate of the current assets and the current liabilities have been considered at 1:1. Here the

company’s current ratio is less than 1. Hence the liquidity position of the assets and liabilities

have been not good from the company perspective. This calls for certain change in the asset

allocation strategy is to be revised. On the other hand the liquidity or acid test ratio have been

also created in this case. It can be said that the quick ratio discuses about the liquidity

position of the assets and liabilities as a whole. It is seen from the collected data that there

have been reduction to the possible assets and the liability value overall. The calculations

show reduction in the ratio where it has reduced to 0.6970. The changes are subjected to be

less than 1 which the standard norm. Thus there is a requirement for revaluation and

recodification to the assets. Lastly the inventory turnover ratio is also calculated in the

process. Since there are no such standards to this value, therefore the overall inventory ratio

is less than 1. It says that the company had not properly managed the inventory in the

financial year that have affected the financial report to the company (Alzeban, and Sawan,

2015).

AUDITING THEORY AND PRACTISE

position. Apart from this it is also been seen that the current liabilities value have also been

decreased by 26 percent. the changes to the debt and value degradation could look to bring

down the overall liabilities value of the company. On the other hand the total net assets have

been increased by the overall company revenue where there is an increase to equity have

been increased to 4 percent. Hence the changed value have been well determined by the

horizontal analysis. However the revenue valuation is also decreased by the analysis. The net

profit of the company have been also increased by a good number at that point of time.

Moreover there have been use of various ratio values which have been generated during the

process. Hence at the time of calculating the ratios three types of ratio have been calculated in

this case. It is seen that the current ratio value for the company is 0.9345 approx. the general

rate of the current assets and the current liabilities have been considered at 1:1. Here the

company’s current ratio is less than 1. Hence the liquidity position of the assets and liabilities

have been not good from the company perspective. This calls for certain change in the asset

allocation strategy is to be revised. On the other hand the liquidity or acid test ratio have been

also created in this case. It can be said that the quick ratio discuses about the liquidity

position of the assets and liabilities as a whole. It is seen from the collected data that there

have been reduction to the possible assets and the liability value overall. The calculations

show reduction in the ratio where it has reduced to 0.6970. The changes are subjected to be

less than 1 which the standard norm. Thus there is a requirement for revaluation and

recodification to the assets. Lastly the inventory turnover ratio is also calculated in the

process. Since there are no such standards to this value, therefore the overall inventory ratio

is less than 1. It says that the company had not properly managed the inventory in the

financial year that have affected the financial report to the company (Alzeban, and Sawan,

2015).

11

AUDITING THEORY AND PRACTISE

The overall risks assessment is helpful for the company auditor to perform the overall

risk management procedure and the same have been able to identify and assess the overall

risk in case of the material misstatement procedure which could possibly occur due to the

implication of error or fraud. Hence these four inherent risks which could well be very much

assessable are taxation risk, operational risk, strategic risk and the exchange risk. The

strategic risk can be assessed towards the management opportunities and the company here

will be able to use certain technologies to mitigate the risk. Here the company could well be

useful to imply certain risks in the process towards the risk development structure. It is seen

from the process that the change in the cash flow and the overall currency fluctuation also

depict the overall performance stage of the company. Hence it is seen from the overall

disruption in the general operations of the company. Hence these disruption is very much

essential to dispose the tax discount rate of the operation. Thus the discount value could be

initiated over the value. Hence in the beginning of the year the company had also lead to

decrease the financial statements of the company in the first quarter. Hence in the respect of

this process the company had not been able to compromise over the changed management

issue with the rather decreases in the overall rate of the production structure. Thus it is

expected that the demand for the petroleum is more likely to be increasing in comprising the

overall market and hence the price could likely to increase in that point of time.

The overall risks assessment is helpful for the company auditor to perform the overall

risk management procedure and the same have been able to identify and assess the overall

risk in case of the material misstatement procedure which could possibly occur due to the

implication of error or fraud. Hence these four inherent risks which could well be very much

assessable are taxation risk, operational risk, strategic risk and the exchange risk. The

strategic risk can be assessed towards the management opportunities and the company here

will be able to use certain technologies to mitigate the risk. Here the company could well be

AUDITING THEORY AND PRACTISE

The overall risks assessment is helpful for the company auditor to perform the overall

risk management procedure and the same have been able to identify and assess the overall

risk in case of the material misstatement procedure which could possibly occur due to the

implication of error or fraud. Hence these four inherent risks which could well be very much

assessable are taxation risk, operational risk, strategic risk and the exchange risk. The

strategic risk can be assessed towards the management opportunities and the company here

will be able to use certain technologies to mitigate the risk. Here the company could well be

useful to imply certain risks in the process towards the risk development structure. It is seen

from the process that the change in the cash flow and the overall currency fluctuation also

depict the overall performance stage of the company. Hence it is seen from the overall

disruption in the general operations of the company. Hence these disruption is very much

essential to dispose the tax discount rate of the operation. Thus the discount value could be

initiated over the value. Hence in the beginning of the year the company had also lead to

decrease the financial statements of the company in the first quarter. Hence in the respect of

this process the company had not been able to compromise over the changed management

issue with the rather decreases in the overall rate of the production structure. Thus it is

expected that the demand for the petroleum is more likely to be increasing in comprising the

overall market and hence the price could likely to increase in that point of time.

The overall risks assessment is helpful for the company auditor to perform the overall

risk management procedure and the same have been able to identify and assess the overall

risk in case of the material misstatement procedure which could possibly occur due to the

implication of error or fraud. Hence these four inherent risks which could well be very much

assessable are taxation risk, operational risk, strategic risk and the exchange risk. The

strategic risk can be assessed towards the management opportunities and the company here

will be able to use certain technologies to mitigate the risk. Here the company could well be

You're viewing a preview

Unlock full access by subscribing today!

12

AUDITING THEORY AND PRACTISE

useful to imply certain risks in the process towards the risk development structure. It is seen

from the process that the change in the cash flow and the overall currency fluctuation also

depict the overall performance stage of the company. Hence all these risk status could be

useful if they had been properly sorted out. However all these inherent risks have certain

limitations which if sorted out properly could turn out to be a massive advantages for the

company. Hence the limitation of the case are as follow-

The US dollar reflects the overall possible changes of Woodside underlying cash

inflow and the other financial asset valuation statement to the performance reporting

standard. Hence the overall change could well be reducing the exposure towards the currency

fluctuations.

Hence the commercial exposure process are used to design and reduce the like hood

of these risks materialised as a result of the commercial transactions. Thus the overall

disciplined standards could look to focus on the disciplined approach in order to ensure that

the basic changes are used to deliver the basic standard changes to the approach over the

shareholders’ value as well as the objectives to manage and mitigate the risks structure.

It is expected the overall cost are initially likely to reduce as well as deploy some

technologically driven solutions in order to meet the overall strategic objectives. On the other

hand to reduce the emergency trends, disruptive innovation and the complementary

technology.

Since the basic footprint it is important to continue strengthen the global framework

and to utilise the supporting tools as well as the government relationships and the other

process have been implemented with the countries In which the process have been operated

along with interest.

AUDITING THEORY AND PRACTISE

useful to imply certain risks in the process towards the risk development structure. It is seen

from the process that the change in the cash flow and the overall currency fluctuation also

depict the overall performance stage of the company. Hence all these risk status could be

useful if they had been properly sorted out. However all these inherent risks have certain

limitations which if sorted out properly could turn out to be a massive advantages for the

company. Hence the limitation of the case are as follow-

The US dollar reflects the overall possible changes of Woodside underlying cash

inflow and the other financial asset valuation statement to the performance reporting

standard. Hence the overall change could well be reducing the exposure towards the currency

fluctuations.

Hence the commercial exposure process are used to design and reduce the like hood

of these risks materialised as a result of the commercial transactions. Thus the overall

disciplined standards could look to focus on the disciplined approach in order to ensure that

the basic changes are used to deliver the basic standard changes to the approach over the

shareholders’ value as well as the objectives to manage and mitigate the risks structure.

It is expected the overall cost are initially likely to reduce as well as deploy some

technologically driven solutions in order to meet the overall strategic objectives. On the other

hand to reduce the emergency trends, disruptive innovation and the complementary

technology.

Since the basic footprint it is important to continue strengthen the global framework

and to utilise the supporting tools as well as the government relationships and the other

process have been implemented with the countries In which the process have been operated

along with interest.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13

AUDITING THEORY AND PRACTISE

Next the overall process have been shifted to the improvement of the energy

efficiency which had initially maintained to the engagement with the engagement with the

stakeholders and looking to modify the change of the climate which could be acting towards

the business and hence there is an opportunity to the company to explore new areas as a

transport fuel and to reduce the emissions and to improve the quality.

The fraud and corruption control programmed that provides some clear framework

and to prevent, detect and to response over the unethical and dishonest behaviour as a whole.

The framework incorporate some policies, programme, training process standards and

guidelines overall. Hence all these guidelines had immensely helped to stand out the changes

and make the possible standpoints.

Hence in a nutshell it can be said that the overall changes will be applicable for the

Woodside petroleum limited that overall assessment of the business risk is inherent at the

process. Hence it can be said that the overall risk structure like the business risk, operational

risk, taxation risk and the institutional risk. Hence in the case of the economic risks it can be

said that due to the bad start of the company the fuel price had been increased as a whole.

Thus the financial statement had revealed that the due to the change in the fuel price there

had been a sharp change in the overall change in the financial statement. The same change

had been implicated on the financial report of the said company. Again on the other hand it

can be said that the overall profitability have also reduced as on the aspect. Secondly in this

case it can be said that due to the change on the capitalised value have majorly been affected

to the overall process. Hence the capitalisation cost of the assets and the revenue expenditure

have also played a significant role to measure the reputational risk of the overall company

operations. Again the tax risk which had been imposed by the Australian government had

also looked to review the imposed tax bracket due to the change in the investment value.

AUDITING THEORY AND PRACTISE

Next the overall process have been shifted to the improvement of the energy

efficiency which had initially maintained to the engagement with the engagement with the

stakeholders and looking to modify the change of the climate which could be acting towards

the business and hence there is an opportunity to the company to explore new areas as a

transport fuel and to reduce the emissions and to improve the quality.

The fraud and corruption control programmed that provides some clear framework

and to prevent, detect and to response over the unethical and dishonest behaviour as a whole.

The framework incorporate some policies, programme, training process standards and

guidelines overall. Hence all these guidelines had immensely helped to stand out the changes

and make the possible standpoints.

Hence in a nutshell it can be said that the overall changes will be applicable for the

Woodside petroleum limited that overall assessment of the business risk is inherent at the

process. Hence it can be said that the overall risk structure like the business risk, operational

risk, taxation risk and the institutional risk. Hence in the case of the economic risks it can be

said that due to the bad start of the company the fuel price had been increased as a whole.

Thus the financial statement had revealed that the due to the change in the fuel price there

had been a sharp change in the overall change in the financial statement. The same change

had been implicated on the financial report of the said company. Again on the other hand it

can be said that the overall profitability have also reduced as on the aspect. Secondly in this

case it can be said that due to the change on the capitalised value have majorly been affected

to the overall process. Hence the capitalisation cost of the assets and the revenue expenditure

have also played a significant role to measure the reputational risk of the overall company

operations. Again the tax risk which had been imposed by the Australian government had

also looked to review the imposed tax bracket due to the change in the investment value.

14

AUDITING THEORY AND PRACTISE

Hence the expected or targeted rate have initially have affected with the operational part and

the same have been considered as operational risk.

AUDITING THEORY AND PRACTISE

Hence the expected or targeted rate have initially have affected with the operational part and

the same have been considered as operational risk.

You're viewing a preview

Unlock full access by subscribing today!

15

AUDITING THEORY AND PRACTISE

References

Alzeban, A. and Sawan, N., 2015. The impact of audit committee characteristics on the

implementation of internal audit recommendations. Journal of International Accounting,

Auditing and Taxation, 24, pp.61-71.

Beck, M.J. and Mauldin, E.G., 2014. Who's really in charge? Audit committee versus CFO

power and audit fees. The Accounting Review, 89(6), pp.2057-2085.

Bédard, J., Coram, P., Espahbodi, R. and Mock, T.J., 2016. Does recent academic research

support changes to audit reporting standards?. Accounting Horizons, 30(2), pp.255-275.

Boers, I., Hoek, F., Van Montford, C. and Wieles, J., 2013. Public-private partnerships:

International audit findings. The Routledge companion to public-private partnerships,

pp.451-478.

Boers, I., Hoek, F., Van Montford, C. and Wieles, J., 2013. Public-private partnerships:

International audit findings. The Routledge companion to public-private partnerships,

pp.451-478.

Chambers, A.D. and Odar, M., 2015. A new vision for internal audit. Managerial Auditing

Journal, 30(1), pp.34-55.

Chan, K.H., Luo, V.W. and Mo, P.L., 2016. Determinants and implications of long audit

reporting lags: evidence from China. Accounting and Business Research, 46(2), pp.145-166.

Chen, Y., Gul, F.A., Veeraraghavan, M. and Zolotoy, L., 2015. Executive equity risk-taking

incentives and audit pricing. The Accounting Review, 90(6), pp.2205-2234.

Coetzee, P. and Lubbe, D., 2014. Improving the efficiency and effectiveness of risk‐based

internal audit engagements. International Journal of Auditing, 18(2), pp.115-125.

AUDITING THEORY AND PRACTISE

References

Alzeban, A. and Sawan, N., 2015. The impact of audit committee characteristics on the

implementation of internal audit recommendations. Journal of International Accounting,

Auditing and Taxation, 24, pp.61-71.

Beck, M.J. and Mauldin, E.G., 2014. Who's really in charge? Audit committee versus CFO

power and audit fees. The Accounting Review, 89(6), pp.2057-2085.

Bédard, J., Coram, P., Espahbodi, R. and Mock, T.J., 2016. Does recent academic research

support changes to audit reporting standards?. Accounting Horizons, 30(2), pp.255-275.

Boers, I., Hoek, F., Van Montford, C. and Wieles, J., 2013. Public-private partnerships:

International audit findings. The Routledge companion to public-private partnerships,

pp.451-478.

Boers, I., Hoek, F., Van Montford, C. and Wieles, J., 2013. Public-private partnerships:

International audit findings. The Routledge companion to public-private partnerships,

pp.451-478.

Chambers, A.D. and Odar, M., 2015. A new vision for internal audit. Managerial Auditing

Journal, 30(1), pp.34-55.

Chan, K.H., Luo, V.W. and Mo, P.L., 2016. Determinants and implications of long audit

reporting lags: evidence from China. Accounting and Business Research, 46(2), pp.145-166.

Chen, Y., Gul, F.A., Veeraraghavan, M. and Zolotoy, L., 2015. Executive equity risk-taking

incentives and audit pricing. The Accounting Review, 90(6), pp.2205-2234.

Coetzee, P. and Lubbe, D., 2014. Improving the efficiency and effectiveness of risk‐based

internal audit engagements. International Journal of Auditing, 18(2), pp.115-125.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

16

AUDITING THEORY AND PRACTISE

Cullen, G., Gasbarro, D., Monroe, G.S., Shailer, G. and Zhang, Y., 2017. Bank audit fees and

asset securitization risks. Auditing: A Journal of Practice & Theory, 37(1), pp.21-48.

Dow, K.E., Watson, M.W. and Shea, V.J., 2013. Understanding the links between audit risks

and audit steps: The case of procurement cards. Issues in Accounting Education, 28(4),

pp.913-921.

Greiner, A., Kohlbeck, M.J. and Smith, T.J., 2016. The relationship between aggressive real

earnings management and current and future audit fees. Auditing: A Journal of Practice &

Theory, 36(1), pp.85-107.

Guénin-Paracini, H., Malsch, B. and Paillé, A.M., 2014. Fear and risk in the audit

process. Accounting, Organizations and Society, 39(4), pp.264-288.

Guénin-Paracini, H., Malsch, B. and Paillé, A.M., 2014. Fear and risk in the audit

process. Accounting, Organizations and Society, 39(4), pp.264-288.

Habib, A., Jiang, H. and Zhou, D., 2015. Related-party transactions and audit fees: Evidence

from China. Journal of International Accounting Research, 14(1), pp.59-83.

Heck, N.C., Flentje, A. and Cochran, B.N., 2013. Offsetting risks: High school gay-straight

alliances and lesbian, gay, bisexual, and transgender (LGBT) youth.

Huang, T.C., Huang, H.W. and Lee, C.C., 2014. Corporate executive’s gender and audit

fees. Managerial Auditing Journal, 29(6), pp.527-547.

Kachelmeier, S.J., Schmidt, J.J. and Valentine, K., 2017. The disclaimer effect of disclosing

critical audit matters in the auditor’s report. Working paper.

Kannan, Y.H., Skantz, T.R. and Higgs, J.L., 2014. The impact of CEO and CFO equity

incentives on audit scope and perceived risks as revealed through audit fees. Auditing: A

Journal of Practice & Theory, 33(2), pp.111-139.

AUDITING THEORY AND PRACTISE

Cullen, G., Gasbarro, D., Monroe, G.S., Shailer, G. and Zhang, Y., 2017. Bank audit fees and

asset securitization risks. Auditing: A Journal of Practice & Theory, 37(1), pp.21-48.

Dow, K.E., Watson, M.W. and Shea, V.J., 2013. Understanding the links between audit risks

and audit steps: The case of procurement cards. Issues in Accounting Education, 28(4),

pp.913-921.

Greiner, A., Kohlbeck, M.J. and Smith, T.J., 2016. The relationship between aggressive real

earnings management and current and future audit fees. Auditing: A Journal of Practice &

Theory, 36(1), pp.85-107.

Guénin-Paracini, H., Malsch, B. and Paillé, A.M., 2014. Fear and risk in the audit

process. Accounting, Organizations and Society, 39(4), pp.264-288.

Guénin-Paracini, H., Malsch, B. and Paillé, A.M., 2014. Fear and risk in the audit

process. Accounting, Organizations and Society, 39(4), pp.264-288.

Habib, A., Jiang, H. and Zhou, D., 2015. Related-party transactions and audit fees: Evidence

from China. Journal of International Accounting Research, 14(1), pp.59-83.

Heck, N.C., Flentje, A. and Cochran, B.N., 2013. Offsetting risks: High school gay-straight

alliances and lesbian, gay, bisexual, and transgender (LGBT) youth.

Huang, T.C., Huang, H.W. and Lee, C.C., 2014. Corporate executive’s gender and audit

fees. Managerial Auditing Journal, 29(6), pp.527-547.

Kachelmeier, S.J., Schmidt, J.J. and Valentine, K., 2017. The disclaimer effect of disclosing

critical audit matters in the auditor’s report. Working paper.

Kannan, Y.H., Skantz, T.R. and Higgs, J.L., 2014. The impact of CEO and CFO equity

incentives on audit scope and perceived risks as revealed through audit fees. Auditing: A

Journal of Practice & Theory, 33(2), pp.111-139.

17

AUDITING THEORY AND PRACTISE

Khlif, H. and Samaha, K., 2014. Internal Control Quality, E gyptian Standards on Auditing

and External Audit Delays: Evidence from the E gyptian Stock Exchange. International

Journal of Auditing, 18(2), pp.139-154.

Khlif, H. and Samaha, K., 2014. Internal Control Quality, E gyptian Standards on Auditing

and External Audit Delays: Evidence from the E gyptian Stock Exchange. International

Journal of Auditing, 18(2), pp.139-154.

King, N., Oracle International Corp, 2014. Audit planning. U.S. Patent 8,712,813.

Liu, L. and Subramaniam, N., 2013. Government ownership, audit firm size and audit

pricing: Evidence from China. Journal of Accounting and Public Policy, 32(2), pp.161-175.

Martinez, A.L. and Lessa, R.C., 2014. The effect of tax aggressiveness and corporate

governance on audit fees evidences from Brazil. Journal of Management Research, 6(1),

p.95.

Petraşcu, D. and Tieanu, A., 2014. The role of internal audit in fraud prevention and

detection. Procedia Economics and Finance, 16, pp.489-497.

Titera, W.R., 2013. Updating audit standard—Enabling audit data analysis. Journal of

Information Systems, 27(1), pp.325-331.

Vovchenko, N.G., Holina, M.G., Orobinskiy, A.S. and Sichev, R.A., 2017. Ensuring financial

stability of companies on the basis of international experience in construction of risks maps,

internal control and audit. European Research Studies Journal, 20(1), pp.350-368.

AUDITING THEORY AND PRACTISE

Khlif, H. and Samaha, K., 2014. Internal Control Quality, E gyptian Standards on Auditing

and External Audit Delays: Evidence from the E gyptian Stock Exchange. International

Journal of Auditing, 18(2), pp.139-154.

Khlif, H. and Samaha, K., 2014. Internal Control Quality, E gyptian Standards on Auditing

and External Audit Delays: Evidence from the E gyptian Stock Exchange. International

Journal of Auditing, 18(2), pp.139-154.

King, N., Oracle International Corp, 2014. Audit planning. U.S. Patent 8,712,813.

Liu, L. and Subramaniam, N., 2013. Government ownership, audit firm size and audit

pricing: Evidence from China. Journal of Accounting and Public Policy, 32(2), pp.161-175.

Martinez, A.L. and Lessa, R.C., 2014. The effect of tax aggressiveness and corporate

governance on audit fees evidences from Brazil. Journal of Management Research, 6(1),

p.95.

Petraşcu, D. and Tieanu, A., 2014. The role of internal audit in fraud prevention and

detection. Procedia Economics and Finance, 16, pp.489-497.

Titera, W.R., 2013. Updating audit standard—Enabling audit data analysis. Journal of

Information Systems, 27(1), pp.325-331.

Vovchenko, N.G., Holina, M.G., Orobinskiy, A.S. and Sichev, R.A., 2017. Ensuring financial

stability of companies on the basis of international experience in construction of risks maps,

internal control and audit. European Research Studies Journal, 20(1), pp.350-368.

You're viewing a preview

Unlock full access by subscribing today!

18

AUDITING THEORY AND PRACTISE

Appendices

AUDITING THEORY AND PRACTISE

Appendices

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

19

AUDITING THEORY AND PRACTISE

AUDITING THEORY AND PRACTISE

20

AUDITING THEORY AND PRACTISE

AUDITING THEORY AND PRACTISE

You're viewing a preview

Unlock full access by subscribing today!

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.