Auditing Theory and Practice

VerifiedAdded on 2023/06/04

|13

|3083

|233

AI Summary

This article discusses the key audit events of BHP Billiton and their impact on audit planning. It also evaluates the risks of material misstatements and the compliance of financial reports with IFRSs and AASBs.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: AUDITING THEORY AND PRACTICE

Auditing Theory and Practice

Name of the Student:

Name of the University:

Authors Note:

Auditing Theory and Practice

Name of the Student:

Name of the University:

Authors Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1

AUDITING THEORY AND PRACTICE

Contents

Introduction:....................................................................................................................................2

Answer 1:.........................................................................................................................................2

Answer 2:.........................................................................................................................................5

Conclusion:......................................................................................................................................9

References:....................................................................................................................................10

AUDITING THEORY AND PRACTICE

Contents

Introduction:....................................................................................................................................2

Answer 1:.........................................................................................................................................2

Answer 2:.........................................................................................................................................5

Conclusion:......................................................................................................................................9

References:....................................................................................................................................10

2

AUDITING THEORY AND PRACTICE

Introduction:

An Anglo-Australian mining company BHP Billiton, trading name BHP in the Australian

Securities Exchange (ASX), is one of the most sought-after mining , metal and petroleum

company in the country. The company is a listed entity and has it’s headquarter in Melbourne,

Victoria, Australia. Based on market capitalization, the company was the largest mining

company in 2017. The profit after taxation from continuing and discontinuing operations of the

company in 2018 has reduced by almost 25% within a year. The reason for such huge drop in

profit shall be evaluated by the auditor during the course of auditing. After considering the

annual report of the company a detailed discussion on four key events shall be made that are

expected to have an impact on the audit of the company. In addition the impact of these key

events and identified risks on audit planning of the company shall also be explained in

appropriate detail.

Answer 1:

The key audit events are the events that have taken place during the period between

October 1, 2017 and 30th September, 2018 which are expected to influence and impact the audit

of the company. Since the annual report of the company is prepared for the period of July 1 to

June 30 each year the auditor has to rely on internet and other sources to gather important

information about company in determining four key events (Arens et. al. 2015).

Critical and key events expected to influence the audit of the company:

BHP being one of the largest Australian companies has its operations spreading to different parts

of the globe including Australia, North and South America, United Kingdom, Trinidad and

Tobago and Algeria. The four primary units for operations of the company include Coal, Iron

AUDITING THEORY AND PRACTICE

Introduction:

An Anglo-Australian mining company BHP Billiton, trading name BHP in the Australian

Securities Exchange (ASX), is one of the most sought-after mining , metal and petroleum

company in the country. The company is a listed entity and has it’s headquarter in Melbourne,

Victoria, Australia. Based on market capitalization, the company was the largest mining

company in 2017. The profit after taxation from continuing and discontinuing operations of the

company in 2018 has reduced by almost 25% within a year. The reason for such huge drop in

profit shall be evaluated by the auditor during the course of auditing. After considering the

annual report of the company a detailed discussion on four key events shall be made that are

expected to have an impact on the audit of the company. In addition the impact of these key

events and identified risks on audit planning of the company shall also be explained in

appropriate detail.

Answer 1:

The key audit events are the events that have taken place during the period between

October 1, 2017 and 30th September, 2018 which are expected to influence and impact the audit

of the company. Since the annual report of the company is prepared for the period of July 1 to

June 30 each year the auditor has to rely on internet and other sources to gather important

information about company in determining four key events (Arens et. al. 2015).

Critical and key events expected to influence the audit of the company:

BHP being one of the largest Australian companies has its operations spreading to different parts

of the globe including Australia, North and South America, United Kingdom, Trinidad and

Tobago and Algeria. The four primary units for operations of the company include Coal, Iron

3

AUDITING THEORY AND PRACTICE

ore, Copper and petroleum. Taking into consideration the above and on the basis of annual report

2018 the company the four key events identified are enumerated below (Bhattacharjee, Maletta

and Moreno, 2015).

Onshore US sale agreement worth $10.8 billion:

In July, 2018 the company has entered into an agreement to sale its entire interests in the

Onshore US. The Onshore US oil and gas assets in Eagle Ford, Haynesville, Permian and

Fayetteville were sold for a combined consideration of $10.8 billion under the agreement and

was announced by the company on July 27, 2018 (Brasel et. al. 2016). Companies operating in

Australia are bound to comply with the requirements of AASB 101 to present its financial

statements. The sale agreement and its effect on the financial position of the company must be

disclosed in accordance with the requirements of AASB 101. The auditor is responsible to

independently verify the financial statements to check whether the event, sale of US onshore

operations, has been correctly presented in the financial statements to disclose the effects of such

sale on the financial position and performance of the company.

As per the agreement the entire consideration of $10.8 billion shall be payable in cash. As per the

agreement, 100% of the stock in the subsidiary company of BHP, Petrohawk Energy

Corporation, shall be acquired by BP America Production Company at $10.5 billion. Petrohawk

Energy Corporation holds Eagle Ford, Haynesville and Permian. As per the agreement the

balance of $10.8 billion consideration, i.e. $0.3 billion shall be paid by MMGJ Hugoton III, LLC

to acquire the assets at Fayetteville (Mubako and O'Donnell, 2018). The event is significant and

affects the financial position of the company as both the nature and quantum of amount are of

huge significance to the disclosure of true and fair picture of the company (Wright, 2016). In

AUDITING THEORY AND PRACTICE

ore, Copper and petroleum. Taking into consideration the above and on the basis of annual report

2018 the company the four key events identified are enumerated below (Bhattacharjee, Maletta

and Moreno, 2015).

Onshore US sale agreement worth $10.8 billion:

In July, 2018 the company has entered into an agreement to sale its entire interests in the

Onshore US. The Onshore US oil and gas assets in Eagle Ford, Haynesville, Permian and

Fayetteville were sold for a combined consideration of $10.8 billion under the agreement and

was announced by the company on July 27, 2018 (Brasel et. al. 2016). Companies operating in

Australia are bound to comply with the requirements of AASB 101 to present its financial

statements. The sale agreement and its effect on the financial position of the company must be

disclosed in accordance with the requirements of AASB 101. The auditor is responsible to

independently verify the financial statements to check whether the event, sale of US onshore

operations, has been correctly presented in the financial statements to disclose the effects of such

sale on the financial position and performance of the company.

As per the agreement the entire consideration of $10.8 billion shall be payable in cash. As per the

agreement, 100% of the stock in the subsidiary company of BHP, Petrohawk Energy

Corporation, shall be acquired by BP America Production Company at $10.5 billion. Petrohawk

Energy Corporation holds Eagle Ford, Haynesville and Permian. As per the agreement the

balance of $10.8 billion consideration, i.e. $0.3 billion shall be paid by MMGJ Hugoton III, LLC

to acquire the assets at Fayetteville (Mubako and O'Donnell, 2018). The event is significant and

affects the financial position of the company as both the nature and quantum of amount are of

huge significance to the disclosure of true and fair picture of the company (Wright, 2016). In

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4

AUDITING THEORY AND PRACTICE

case of sale of non-current assets by an entity held for sale and discontinued operations,

requirements of AASB 5 must be fulfilled by the entity to disclose the event in the financial

statements. The reporting entities in Australia must prepare financial reports in accordance with

the reporting requirements of Part 2M.3 of the Corporations Act, 2001. AASB 5 applies to the

reporting entities and must be followed while preparing and presenting the financial statements.

AASB 5 specifies the accounting treatments for assets held for sale and discontinued operations.

The auditor needs to verify the financial statements of BHP to check whether the reporting

requirements of this particular standard has been followed to disclose the $10.8 billion sale of US

onshore non-current assets and assets held for sale (Simon, Smith and Zimbelman, 2018).

Guyana Goldfield Agreement:

The company has entered into an agreement with Guyana Goldfield Incorporation to 6.1%

interests in the company. The agreement terms and conditions shall be thoroughly evaluated to

ensure that there is no misinformation about the agreement in the financial reports of the

company (Kachelmeier, Schmidt and Valentine, 2017).

In case of investments in associates and joint ventures, accountants in Australia must follow the

reporting requirements of AASB 128. Ensuring compliance with AASB 128 for reporting such

acquisition of interests in associates is essential to disclose investment in associates and joint

ventures as per equity method. Verifying the disclosure made in the financial reports of the

company in respect of the acquisition of 6.1% interests in SolGold Plc. has to be evaluated with

the reporting requirements of AASB 128 to evaluate that there is no material misstatements in

the financial reports (Cao, Chychyla and Stewart, 2015).

Samarco Dam failure:

AUDITING THEORY AND PRACTICE

case of sale of non-current assets by an entity held for sale and discontinued operations,

requirements of AASB 5 must be fulfilled by the entity to disclose the event in the financial

statements. The reporting entities in Australia must prepare financial reports in accordance with

the reporting requirements of Part 2M.3 of the Corporations Act, 2001. AASB 5 applies to the

reporting entities and must be followed while preparing and presenting the financial statements.

AASB 5 specifies the accounting treatments for assets held for sale and discontinued operations.

The auditor needs to verify the financial statements of BHP to check whether the reporting

requirements of this particular standard has been followed to disclose the $10.8 billion sale of US

onshore non-current assets and assets held for sale (Simon, Smith and Zimbelman, 2018).

Guyana Goldfield Agreement:

The company has entered into an agreement with Guyana Goldfield Incorporation to 6.1%

interests in the company. The agreement terms and conditions shall be thoroughly evaluated to

ensure that there is no misinformation about the agreement in the financial reports of the

company (Kachelmeier, Schmidt and Valentine, 2017).

In case of investments in associates and joint ventures, accountants in Australia must follow the

reporting requirements of AASB 128. Ensuring compliance with AASB 128 for reporting such

acquisition of interests in associates is essential to disclose investment in associates and joint

ventures as per equity method. Verifying the disclosure made in the financial reports of the

company in respect of the acquisition of 6.1% interests in SolGold Plc. has to be evaluated with

the reporting requirements of AASB 128 to evaluate that there is no material misstatements in

the financial reports (Cao, Chychyla and Stewart, 2015).

Samarco Dam failure:

5

AUDITING THEORY AND PRACTICE

BHP Billiton has reported exceptional items to calculate profits from continuous operations. A

net loss of $2,970 million has been reported in the income statement of the BHP Billiton Group

in 2018 to calculate the amount of profit from continuous operations. Loss from exceptional

items include Samarco Dam failure. The group has reported net loss of $650 million from the

dam failure and included the same to account for the income from continuous operations.

Considering the size and nature of amount, the auditor must use substantive audit procedures to

corroborate necessary audit evidence to form his opinion on the amount of loss recognized for

the Samarco Dam failure and whether it is justified (Patterson and Smith, 2015).

US Tax reform and its effects:

US President on December 22, 2018 signed the Tax Cut and Job Act with the effects of the Act

starting from January 01, 2018. The corporate tax rate in the country lowered from 35% to 21%.

As a result the Group has to immediately re-measure its deferred tax position. Recognition of

income tax charge $2,320 million resulted in reduction of profit from continuous operations of

the group. The loss due to US Tax reforms has been reported under exceptional items. The basis

used in reporting the exceptional items and measurement technique used to measure the loss

from US tax reforms as well as Samarco Dam failure shall be evaluated by the auditor to report

on both the items (Knechel and Salterio, 2016).

Answer 2:

The purpose of carrying out an independent audit is to independently verify the financial

reports of an entity with an objective of providing an opinion on these reports as to their nature

and quality. In order to provide an appropriate opinion on the financial reports of an entity, an

auditor requires to collect necessary audit evidence to conclude about the nature and quality of

AUDITING THEORY AND PRACTICE

BHP Billiton has reported exceptional items to calculate profits from continuous operations. A

net loss of $2,970 million has been reported in the income statement of the BHP Billiton Group

in 2018 to calculate the amount of profit from continuous operations. Loss from exceptional

items include Samarco Dam failure. The group has reported net loss of $650 million from the

dam failure and included the same to account for the income from continuous operations.

Considering the size and nature of amount, the auditor must use substantive audit procedures to

corroborate necessary audit evidence to form his opinion on the amount of loss recognized for

the Samarco Dam failure and whether it is justified (Patterson and Smith, 2015).

US Tax reform and its effects:

US President on December 22, 2018 signed the Tax Cut and Job Act with the effects of the Act

starting from January 01, 2018. The corporate tax rate in the country lowered from 35% to 21%.

As a result the Group has to immediately re-measure its deferred tax position. Recognition of

income tax charge $2,320 million resulted in reduction of profit from continuous operations of

the group. The loss due to US Tax reforms has been reported under exceptional items. The basis

used in reporting the exceptional items and measurement technique used to measure the loss

from US tax reforms as well as Samarco Dam failure shall be evaluated by the auditor to report

on both the items (Knechel and Salterio, 2016).

Answer 2:

The purpose of carrying out an independent audit is to independently verify the financial

reports of an entity with an objective of providing an opinion on these reports as to their nature

and quality. In order to provide an appropriate opinion on the financial reports of an entity, an

auditor requires to collect necessary audit evidence to conclude about the nature and quality of

6

AUDITING THEORY AND PRACTICE

financial reports of such an entity (Jones, 2017). The above mentioned risks in the audit of BHP

Billiton Limited will have significant impact on the audit evidence mix. Accordingly, the audit

planning has to be done by taking into consideration the risk of material misstatements resulting

from above audit risk.

Onshore US sale agreement:

The inherent audit risk with the reporting of sale of US onshore is dependent on the internal

controls and their effectiveness within the company. BHP Billiton has a strong internal control

system and these worked effectively throughout the year. Thus, inherent risk associated with the

reporting of the above tem is relatively low. However, since the amount involved is highly

significant hence, it is important to conduct necessary audit procedures to be sure that the matter

has been correctly reported in the financial statements and there is no misstatement in the

financial statements (Hall, 2015).

Since the sale agreement provides for sale of entire oil and gas assets in Eagle Ford, Haynesville,

Permian and Fayetteville it is clear that the company is winding up its operations in these parts of

the world. AASB 5 provides the financial reporting requirements to be followed at the time of

sale of non-current assets held for sale and discontinued operations. Meeting the reporting

requirements of AASB 5 that incorporates IFRS 5 is essential to disclose all necessary

information about its decision to sale US onshore to the users of financial information. The

amount of evidence to be collected by the auditor is quite high for the item as the auditor expects

have all evidence for such an agreement (Levy, 2015). The agreement between BHP and the

buyer shall be verified to check all the terms and conditions of the sale agreement. The

AUDITING THEORY AND PRACTICE

financial reports of such an entity (Jones, 2017). The above mentioned risks in the audit of BHP

Billiton Limited will have significant impact on the audit evidence mix. Accordingly, the audit

planning has to be done by taking into consideration the risk of material misstatements resulting

from above audit risk.

Onshore US sale agreement:

The inherent audit risk with the reporting of sale of US onshore is dependent on the internal

controls and their effectiveness within the company. BHP Billiton has a strong internal control

system and these worked effectively throughout the year. Thus, inherent risk associated with the

reporting of the above tem is relatively low. However, since the amount involved is highly

significant hence, it is important to conduct necessary audit procedures to be sure that the matter

has been correctly reported in the financial statements and there is no misstatement in the

financial statements (Hall, 2015).

Since the sale agreement provides for sale of entire oil and gas assets in Eagle Ford, Haynesville,

Permian and Fayetteville it is clear that the company is winding up its operations in these parts of

the world. AASB 5 provides the financial reporting requirements to be followed at the time of

sale of non-current assets held for sale and discontinued operations. Meeting the reporting

requirements of AASB 5 that incorporates IFRS 5 is essential to disclose all necessary

information about its decision to sale US onshore to the users of financial information. The

amount of evidence to be collected by the auditor is quite high for the item as the auditor expects

have all evidence for such an agreement (Levy, 2015). The agreement between BHP and the

buyer shall be verified to check all the terms and conditions of the sale agreement. The

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

AUDITING THEORY AND PRACTICE

transaction recorded in the books of accounts of the company shall be checked to evaluate

whether the transaction is as per AASB 5 (Bumgarner and Vasarhelyi, 2018).

Guyana Goldfield Agreement:

The agreement to buy stake in SolGold PLC and the amount paid for the 6.1% interests in the

company shall be evaluated properly by the auditor. The auditor requires to conduct and

independent appraisal as to net assets acquired by the company under the Guyana Goldfield

agreement. The amount paid to buy the 6.1% stake in Guyana goldfield shall be compared with

the net assets acquired to evaluate whether the intangible asset such as goodwill, or capital

reserve arising from the acquisition of interests in SolGold has been correctly accounted or in the

books of accounts (Chan and Vasarhelyi, 2018). Auditor needs to check the accounting treatment

for the acquisition of business interest to verify whether the same is as per the requirements of

AASB 128. Verification of details as to how the investment in Guyana Goldfield has been valued

and whether the equity method has been followed properly as required under the accounting

standard shall be verified from agreement entered into by BHP and SolGold Plc.

It is important for the auditor to assess that the impact of the acquisition is properly accounted

for in the books of accounts of the company to show the actual impact of such transaction on the

financial performance and position of the company. Based on the findings the auditor can come

to a particular assertion regarding the risk of material misstatements for the transaction (Chou,

2015).

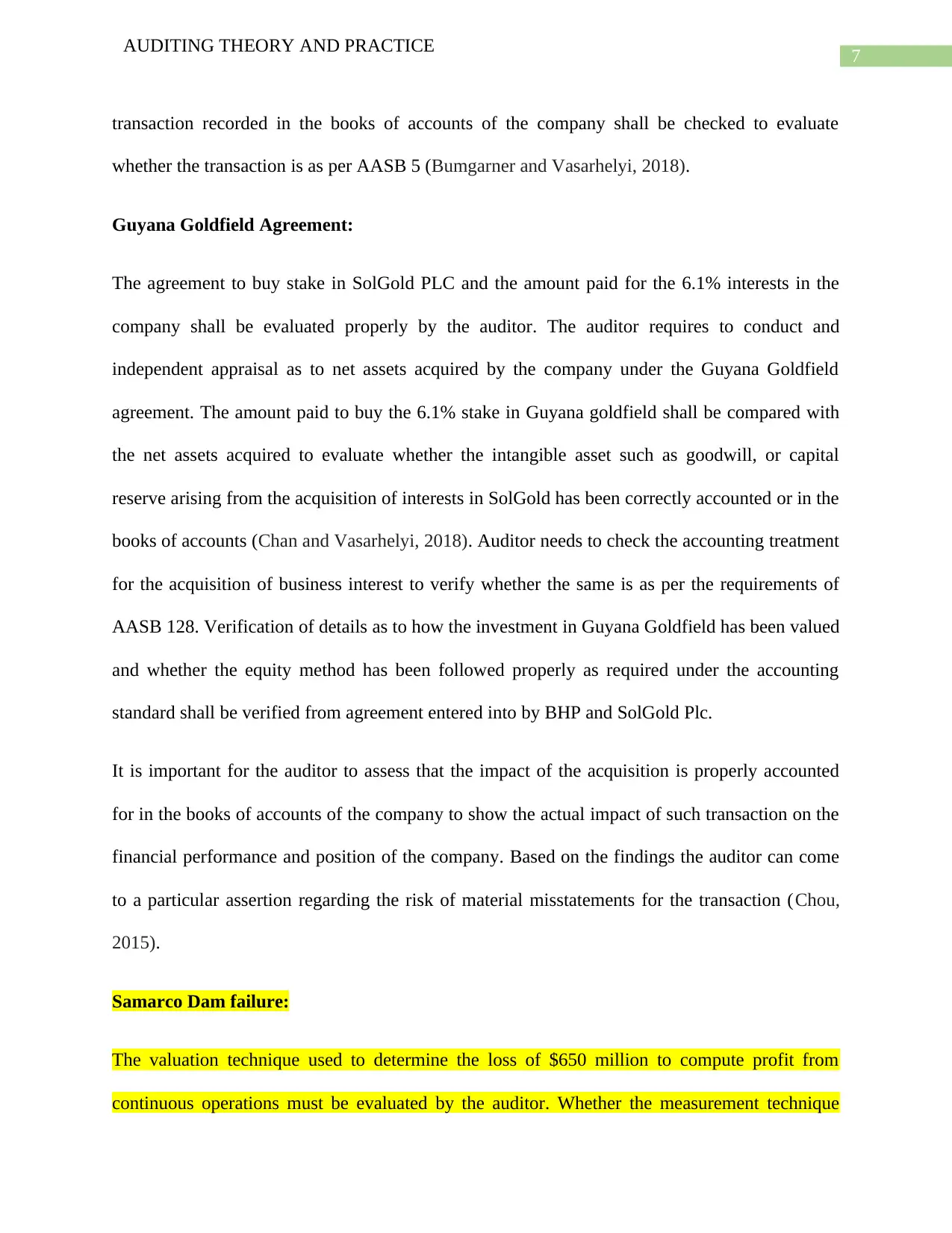

Samarco Dam failure:

The valuation technique used to determine the loss of $650 million to compute profit from

continuous operations must be evaluated by the auditor. Whether the measurement technique

AUDITING THEORY AND PRACTICE

transaction recorded in the books of accounts of the company shall be checked to evaluate

whether the transaction is as per AASB 5 (Bumgarner and Vasarhelyi, 2018).

Guyana Goldfield Agreement:

The agreement to buy stake in SolGold PLC and the amount paid for the 6.1% interests in the

company shall be evaluated properly by the auditor. The auditor requires to conduct and

independent appraisal as to net assets acquired by the company under the Guyana Goldfield

agreement. The amount paid to buy the 6.1% stake in Guyana goldfield shall be compared with

the net assets acquired to evaluate whether the intangible asset such as goodwill, or capital

reserve arising from the acquisition of interests in SolGold has been correctly accounted or in the

books of accounts (Chan and Vasarhelyi, 2018). Auditor needs to check the accounting treatment

for the acquisition of business interest to verify whether the same is as per the requirements of

AASB 128. Verification of details as to how the investment in Guyana Goldfield has been valued

and whether the equity method has been followed properly as required under the accounting

standard shall be verified from agreement entered into by BHP and SolGold Plc.

It is important for the auditor to assess that the impact of the acquisition is properly accounted

for in the books of accounts of the company to show the actual impact of such transaction on the

financial performance and position of the company. Based on the findings the auditor can come

to a particular assertion regarding the risk of material misstatements for the transaction (Chou,

2015).

Samarco Dam failure:

The valuation technique used to determine the loss of $650 million to compute profit from

continuous operations must be evaluated by the auditor. Whether the measurement technique

8

AUDITING THEORY AND PRACTICE

used to measure the loss is in accordance with the IFRSs and correctly reflects the financial

impact of Samarco Dam failure is to be verified by the auditor. The following details would help

the auditor to verify the amount recorded in the books (Cannon and Bedard, 2016).

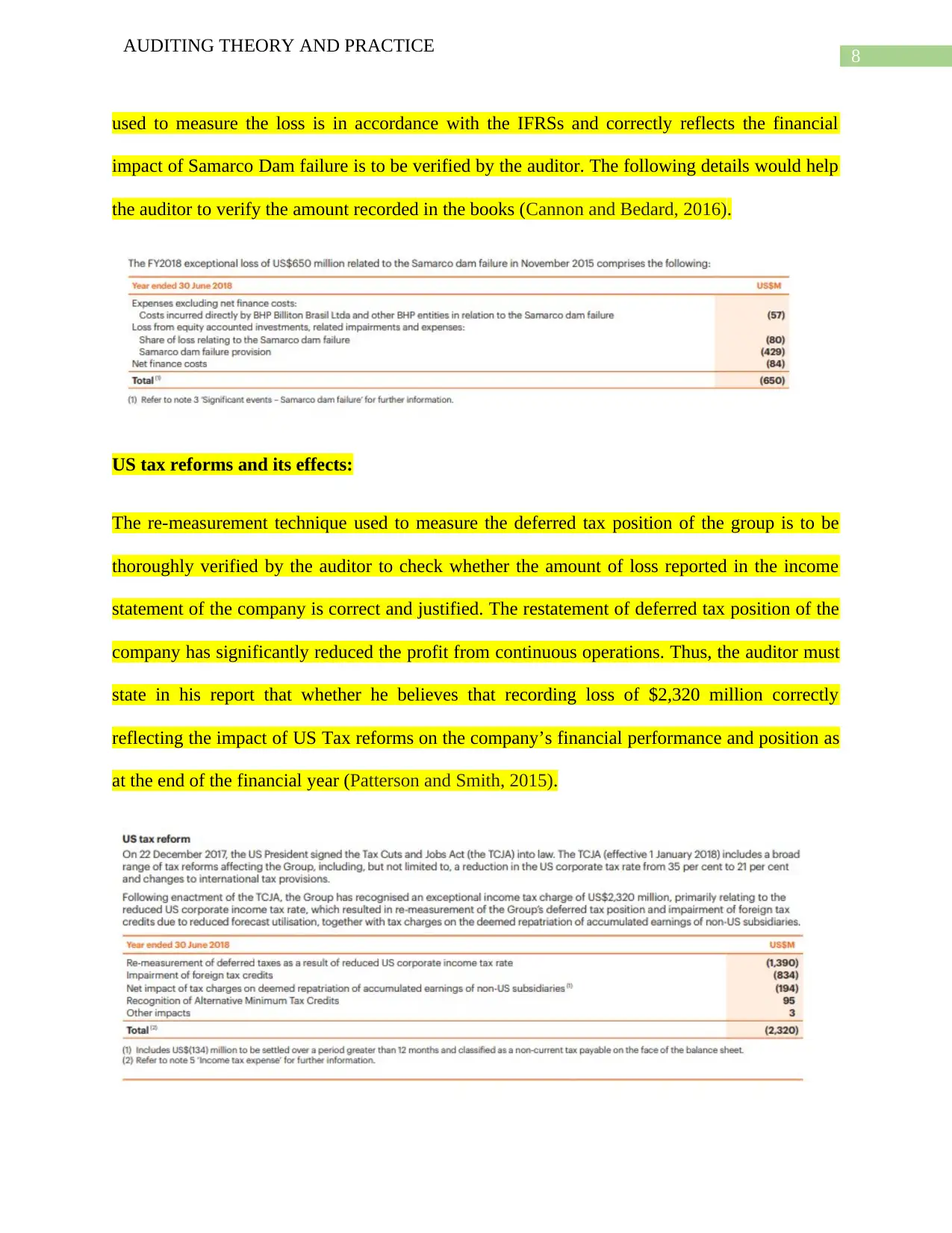

US tax reforms and its effects:

The re-measurement technique used to measure the deferred tax position of the group is to be

thoroughly verified by the auditor to check whether the amount of loss reported in the income

statement of the company is correct and justified. The restatement of deferred tax position of the

company has significantly reduced the profit from continuous operations. Thus, the auditor must

state in his report that whether he believes that recording loss of $2,320 million correctly

reflecting the impact of US Tax reforms on the company’s financial performance and position as

at the end of the financial year (Patterson and Smith, 2015).

AUDITING THEORY AND PRACTICE

used to measure the loss is in accordance with the IFRSs and correctly reflects the financial

impact of Samarco Dam failure is to be verified by the auditor. The following details would help

the auditor to verify the amount recorded in the books (Cannon and Bedard, 2016).

US tax reforms and its effects:

The re-measurement technique used to measure the deferred tax position of the group is to be

thoroughly verified by the auditor to check whether the amount of loss reported in the income

statement of the company is correct and justified. The restatement of deferred tax position of the

company has significantly reduced the profit from continuous operations. Thus, the auditor must

state in his report that whether he believes that recording loss of $2,320 million correctly

reflecting the impact of US Tax reforms on the company’s financial performance and position as

at the end of the financial year (Patterson and Smith, 2015).

9

AUDITING THEORY AND PRACTICE

Conclusion:

The items of revenue, expenditures, assets and liabilities must be correctly recorded and reported

in the books of accounts of an organization, i.e. BHP Billiton in this case, in order to disclose

true and fair picture of an organization. An auditor verifies the financial statements to provide his

opinion on the quality of financial statements and whether such statements correctly reflect the

financial performance and position of BHP. The auditor during the course of auditing must

evaluate whether the requirements of IFRSs and AASBs have been complied with in recording

different elements of financial statements of the company.

AUDITING THEORY AND PRACTICE

Conclusion:

The items of revenue, expenditures, assets and liabilities must be correctly recorded and reported

in the books of accounts of an organization, i.e. BHP Billiton in this case, in order to disclose

true and fair picture of an organization. An auditor verifies the financial statements to provide his

opinion on the quality of financial statements and whether such statements correctly reflect the

financial performance and position of BHP. The auditor during the course of auditing must

evaluate whether the requirements of IFRSs and AASBs have been complied with in recording

different elements of financial statements of the company.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10

AUDITING THEORY AND PRACTICE

References:

Arens, A.A., Elder, R.J., Beasley, M.S. and Jones, J., 2015. Auditing: The Art and Science of

Assurance Engagements. Pearson Canada.

Bhattacharjee, S., Maletta, M.J. and Moreno, K.K., 2015. The role of account subjectivity and

risk of material misstatement on auditors' internal audit reliance judgments. Accounting

Horizons, 30(2), pp.225-238.

Brasel, K., Doxey, M.M., Grenier, J.H. and Reffett, A., 2016. Risk disclosure preceding negative

outcomes: The effects of reporting critical audit matters on judgments of auditor liability. The

Accounting Review, 91(5), pp.1345-1362. [Online] Available from:

http://www.aaajournals.org/doi/abs/10.2308/accr-51380 [Accessed 27 September 2018]

Bumgarner, N. and Vasarhelyi, M.A., 2018. Continuous auditing—a new view. In Continuous

Auditing: Theory and Application (pp. 7-51). Emerald Publishing Limited. [Online] Available

from: https://www.emeraldinsight.com/doi/abs/10.1108/978-1-78743-413-420181002 [Accessed

27 September 2018]

Cannon, N.H. and Bedard, J.C., 2016. Auditing challenging fair value measurements: Evidence

from the field. The Accounting Review, 92(4), pp.81-114.

Cao, M., Chychyla, R. and Stewart, T., 2015. Big Data analytics in financial statement

audits. Accounting Horizons, 29(2), pp.423-429.

AUDITING THEORY AND PRACTICE

References:

Arens, A.A., Elder, R.J., Beasley, M.S. and Jones, J., 2015. Auditing: The Art and Science of

Assurance Engagements. Pearson Canada.

Bhattacharjee, S., Maletta, M.J. and Moreno, K.K., 2015. The role of account subjectivity and

risk of material misstatement on auditors' internal audit reliance judgments. Accounting

Horizons, 30(2), pp.225-238.

Brasel, K., Doxey, M.M., Grenier, J.H. and Reffett, A., 2016. Risk disclosure preceding negative

outcomes: The effects of reporting critical audit matters on judgments of auditor liability. The

Accounting Review, 91(5), pp.1345-1362. [Online] Available from:

http://www.aaajournals.org/doi/abs/10.2308/accr-51380 [Accessed 27 September 2018]

Bumgarner, N. and Vasarhelyi, M.A., 2018. Continuous auditing—a new view. In Continuous

Auditing: Theory and Application (pp. 7-51). Emerald Publishing Limited. [Online] Available

from: https://www.emeraldinsight.com/doi/abs/10.1108/978-1-78743-413-420181002 [Accessed

27 September 2018]

Cannon, N.H. and Bedard, J.C., 2016. Auditing challenging fair value measurements: Evidence

from the field. The Accounting Review, 92(4), pp.81-114.

Cao, M., Chychyla, R. and Stewart, T., 2015. Big Data analytics in financial statement

audits. Accounting Horizons, 29(2), pp.423-429.

11

AUDITING THEORY AND PRACTICE

Chan, D.Y. and Vasarhelyi, M.A., 2018. Innovation and practice of continuous auditing.

In Continuous Auditing: Theory and Application (pp. 271-283). Emerald Publishing Limited.

Chou, D.C., 2015. Cloud computing risk and audit issues. Computer Standards & Interfaces, 42,

pp.137-142.

Groomer, S.M. and Murthy, U.S., 2018. Continuous auditing of database applications: An

embedded audit module approach. In Continuous Auditing: Theory and Application (pp. 105-

124). Emerald Publishing Limited.

Hall, J.A., 2015. Information technology auditing. Cengage Learning. [Online] Available from:

https://books.google.co.in/books?

hl=en&lr=&id=CguyBQAAQBAJ&oi=fnd&pg=PP1&dq=Analytical+and+substantive+tests+on

+cash+management+in+an+audit&ots=HsFDSdNU--

&sig=MM7YzPxOA0BcPlg6GZ7iPEIdHAg#v=onepage&q=Analytical%20and%20substantive

%20tests%20on%20cash%20management%20in%20an%20audit&f=false [Accessed 27

September 2018]

Jones, P., 2017. Statistical sampling and risk analysis in auditing. Routledge. [Online] Available

from: https://www.taylorfrancis.com/books/9781351898010 [Accessed 27 September 2018]

Kachelmeier, S.J., Schmidt, J.J. and Valentine, K., 2017. The disclaimer effect of disclosing

critical audit matters in the auditor’s report.

Knechel, W.R. and Salterio, S.E., 2016. Auditing: Assurance and risk. Routledge. [Online]

Available from: https://onlinelibrary.wiley.com/doi/abs/10.1111/ijau.12104 [Accessed 27

September 2018]

AUDITING THEORY AND PRACTICE

Chan, D.Y. and Vasarhelyi, M.A., 2018. Innovation and practice of continuous auditing.

In Continuous Auditing: Theory and Application (pp. 271-283). Emerald Publishing Limited.

Chou, D.C., 2015. Cloud computing risk and audit issues. Computer Standards & Interfaces, 42,

pp.137-142.

Groomer, S.M. and Murthy, U.S., 2018. Continuous auditing of database applications: An

embedded audit module approach. In Continuous Auditing: Theory and Application (pp. 105-

124). Emerald Publishing Limited.

Hall, J.A., 2015. Information technology auditing. Cengage Learning. [Online] Available from:

https://books.google.co.in/books?

hl=en&lr=&id=CguyBQAAQBAJ&oi=fnd&pg=PP1&dq=Analytical+and+substantive+tests+on

+cash+management+in+an+audit&ots=HsFDSdNU--

&sig=MM7YzPxOA0BcPlg6GZ7iPEIdHAg#v=onepage&q=Analytical%20and%20substantive

%20tests%20on%20cash%20management%20in%20an%20audit&f=false [Accessed 27

September 2018]

Jones, P., 2017. Statistical sampling and risk analysis in auditing. Routledge. [Online] Available

from: https://www.taylorfrancis.com/books/9781351898010 [Accessed 27 September 2018]

Kachelmeier, S.J., Schmidt, J.J. and Valentine, K., 2017. The disclaimer effect of disclosing

critical audit matters in the auditor’s report.

Knechel, W.R. and Salterio, S.E., 2016. Auditing: Assurance and risk. Routledge. [Online]

Available from: https://onlinelibrary.wiley.com/doi/abs/10.1111/ijau.12104 [Accessed 27

September 2018]

12

AUDITING THEORY AND PRACTICE

Levy, H.B., 2015. A Fresh Look at Fraud Risk: Guidance for Auditors. The CPA

Journal, 85(10), p.6.

Mubako, G. and O'Donnell, E., 2018. Effect of fraud risk assessments on auditor skepticism:

Unintended consequences on evidence evaluation. International Journal of Auditing, 22(1),

pp.55-64. [Online] Available from: https://onlinelibrary.wiley.com/doi/abs/10.1111/ijau.12104

[Accessed 27 September 2018]

Patterson, E.R. and Smith, J.R., 2015. The strategic effects of Auditing Standard No. 5 in a

multi-location setting. AUDITING: A Journal of Practice & Theory, 35(1), pp.119-138.

Prentice, J., Bills, K.L. and Peters, G.F., 2018. The Impact of Benefit Plan Audits on Financial

Statement Auditor Choice and Financial Statement Audit Quality.

Simon, C.A., Smith, J.L. and Zimbelman, M.F., 2018. The Influence of Judgment

Decomposition on Auditors' Fraud Risk Assessments: Some Tradeoffs. The Accounting Review.

Wright, W.F., 2016. Client business models, process business risks and the risk of material

misstatement of revenue. Accounting, Organizations and Society, 48, pp.43-55.

AUDITING THEORY AND PRACTICE

Levy, H.B., 2015. A Fresh Look at Fraud Risk: Guidance for Auditors. The CPA

Journal, 85(10), p.6.

Mubako, G. and O'Donnell, E., 2018. Effect of fraud risk assessments on auditor skepticism:

Unintended consequences on evidence evaluation. International Journal of Auditing, 22(1),

pp.55-64. [Online] Available from: https://onlinelibrary.wiley.com/doi/abs/10.1111/ijau.12104

[Accessed 27 September 2018]

Patterson, E.R. and Smith, J.R., 2015. The strategic effects of Auditing Standard No. 5 in a

multi-location setting. AUDITING: A Journal of Practice & Theory, 35(1), pp.119-138.

Prentice, J., Bills, K.L. and Peters, G.F., 2018. The Impact of Benefit Plan Audits on Financial

Statement Auditor Choice and Financial Statement Audit Quality.

Simon, C.A., Smith, J.L. and Zimbelman, M.F., 2018. The Influence of Judgment

Decomposition on Auditors' Fraud Risk Assessments: Some Tradeoffs. The Accounting Review.

Wright, W.F., 2016. Client business models, process business risks and the risk of material

misstatement of revenue. Accounting, Organizations and Society, 48, pp.43-55.

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.