Auditor Reporting in Australia

VerifiedAdded on 2020/12/29

|13

|3034

|113

Report

AI Summary

This report analyzes the enhanced auditor reporting practices in Australia, using Wesfarmers Ltd as a case study. It examines the auditor's independence declaration, non-audit services performed, remuneration, key audit matters, and the role of the audit committee. The report also highlights the differences between the responsibilities of directors, management, and auditors in relation to financial reporting.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Auditor Reporting being

Embraced in Australia

Embraced in Australia

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

EXECUTIVE SUMMARY

In this project, company's auditor report is evaluated based on key information included

in company's annual report. Auditor's independent declaration, audit report, non audit services

performed by auditor is also identified. Various role, functions and composition of audit

committee is analysed. Auditor's independent report to stakeholders is evaluated. All the key

audit matters are noted that are associated with audit procedures. Type of audit opinion was

expressed in this report. At last, how director's and management's responsibilities differ from

auditor's in relation to the financial report are explained under this project.

In this project, company's auditor report is evaluated based on key information included

in company's annual report. Auditor's independent declaration, audit report, non audit services

performed by auditor is also identified. Various role, functions and composition of audit

committee is analysed. Auditor's independent report to stakeholders is evaluated. All the key

audit matters are noted that are associated with audit procedures. Type of audit opinion was

expressed in this report. At last, how director's and management's responsibilities differ from

auditor's in relation to the financial report are explained under this project.

Table of Contents

EXECUTIVE SUMMARY.............................................................................................................1

INTRODUCTION...........................................................................................................................1

Main Body.......................................................................................................................................1

Auditor’s Independence Declaration..........................................................................................1

Non-Audit services performed by the Auditor...........................................................................2

Auditor’s remuneration .............................................................................................................3

Key audit matters.......................................................................................................................3

Audit commission.......................................................................................................................5

Follow up question asked to an auditor at company AGM.........................................................6

Directors’ and Management’s responsibilities differ from the Auditor’s responsibilities .........6

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

APPENDIX......................................................................................................................................1

2

EXECUTIVE SUMMARY.............................................................................................................1

INTRODUCTION...........................................................................................................................1

Main Body.......................................................................................................................................1

Auditor’s Independence Declaration..........................................................................................1

Non-Audit services performed by the Auditor...........................................................................2

Auditor’s remuneration .............................................................................................................3

Key audit matters.......................................................................................................................3

Audit commission.......................................................................................................................5

Follow up question asked to an auditor at company AGM.........................................................6

Directors’ and Management’s responsibilities differ from the Auditor’s responsibilities .........6

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

APPENDIX......................................................................................................................................1

2

INTRODUCTION

Auditing is an essential examination of various account books those are prepared by the

company during an accounting period of time. It can be systematic and independent evaluation

of statutory records, documents and vouchers of an organisation in order to ascertain the way

financial statements as well as non-financial records shows a fair outcome to the investors. The

aim of this report is to analyse “how is enhanced Auditors reporting being embraced in

Australia”. In order to obtain reasonable assurance that can assist in overall management and

recording of financial statements those are based on accurate finding from the audit perspectives.

The company which has been selected for the purpose of evaluating the auditing statements is

“Wesfarmers Ltd”. It is known as the leading Australian listed company which is been focused

on diverse administration that can provide a satisfactory return to their shareholders (Pittock,

Hussey and McGlennon, 2013).

In this report, auditor's independence Declaration report is discussed to show that auditor

complied with independence requirement. Non-audit services performed by the auditor are

mentioned below. Important role and function of audit committee in the given organisation. Each

key audit matter are summarise and paraphrase to provide assurance over each matter.

Main Body

Auditor’s Independence Declaration

A firm account Observer must remain independent from the organisation. It is defined by

unity and an subjective approach to the accounting activity. This concepts allows the accountant

to perform his work free in order to achieve company goal. Securities and exchange commission

set concept on audit freedom that can be organised into 5 primal region: forbidden non audit

work, Accounting committee pre-Approval of work, relative motion, struggle of power and

enhanced connection and revelation. It is clear that when an auditor of Wesfarmers conduct an

view of business document, he necessary supply a graphic deceleration conforming of no

contravention to attender freedom requirement (Burdett and Crossman, 2012).

According to annual report 2017 of Wesfarmers the management accepted the favorable

alteration from Ernst & young. Some of the following important modification are:

(a) zero dispute to the auditor in the corporation Act 2001 that is in abstraction to the audit and

1

Auditing is an essential examination of various account books those are prepared by the

company during an accounting period of time. It can be systematic and independent evaluation

of statutory records, documents and vouchers of an organisation in order to ascertain the way

financial statements as well as non-financial records shows a fair outcome to the investors. The

aim of this report is to analyse “how is enhanced Auditors reporting being embraced in

Australia”. In order to obtain reasonable assurance that can assist in overall management and

recording of financial statements those are based on accurate finding from the audit perspectives.

The company which has been selected for the purpose of evaluating the auditing statements is

“Wesfarmers Ltd”. It is known as the leading Australian listed company which is been focused

on diverse administration that can provide a satisfactory return to their shareholders (Pittock,

Hussey and McGlennon, 2013).

In this report, auditor's independence Declaration report is discussed to show that auditor

complied with independence requirement. Non-audit services performed by the auditor are

mentioned below. Important role and function of audit committee in the given organisation. Each

key audit matter are summarise and paraphrase to provide assurance over each matter.

Main Body

Auditor’s Independence Declaration

A firm account Observer must remain independent from the organisation. It is defined by

unity and an subjective approach to the accounting activity. This concepts allows the accountant

to perform his work free in order to achieve company goal. Securities and exchange commission

set concept on audit freedom that can be organised into 5 primal region: forbidden non audit

work, Accounting committee pre-Approval of work, relative motion, struggle of power and

enhanced connection and revelation. It is clear that when an auditor of Wesfarmers conduct an

view of business document, he necessary supply a graphic deceleration conforming of no

contravention to attender freedom requirement (Burdett and Crossman, 2012).

According to annual report 2017 of Wesfarmers the management accepted the favorable

alteration from Ernst & young. Some of the following important modification are:

(a) zero dispute to the auditor in the corporation Act 2001 that is in abstraction to the audit and

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

(b) none resistance of any relevant tag of vocation conduct in copulation to the audit.

These declaration are in the respect of Wesfarmer and many bodies controlled during the

accounting year. It is clear that auditor complied with their independence requirement according

to the declaration. So it follows the legislation and standard in audit reporting of Wesfarmers:

It also follow section 307 of the corporation act and predate division three four and five

There is a code of ethics for trained accountant. Like APES 110

Accounting regulation ASQC prime control for firm that carry through audit and reviews

of business reports (Griffiths, 2016).

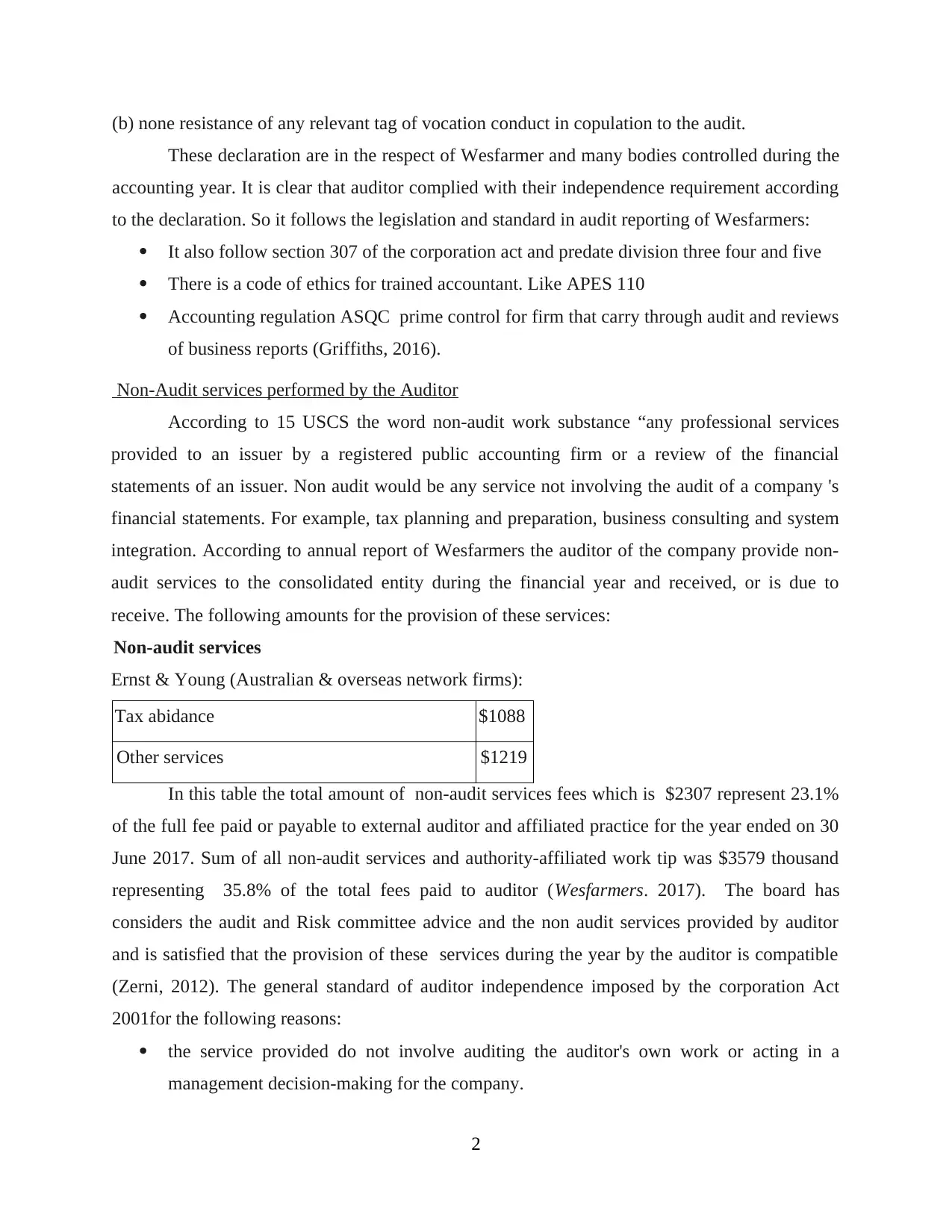

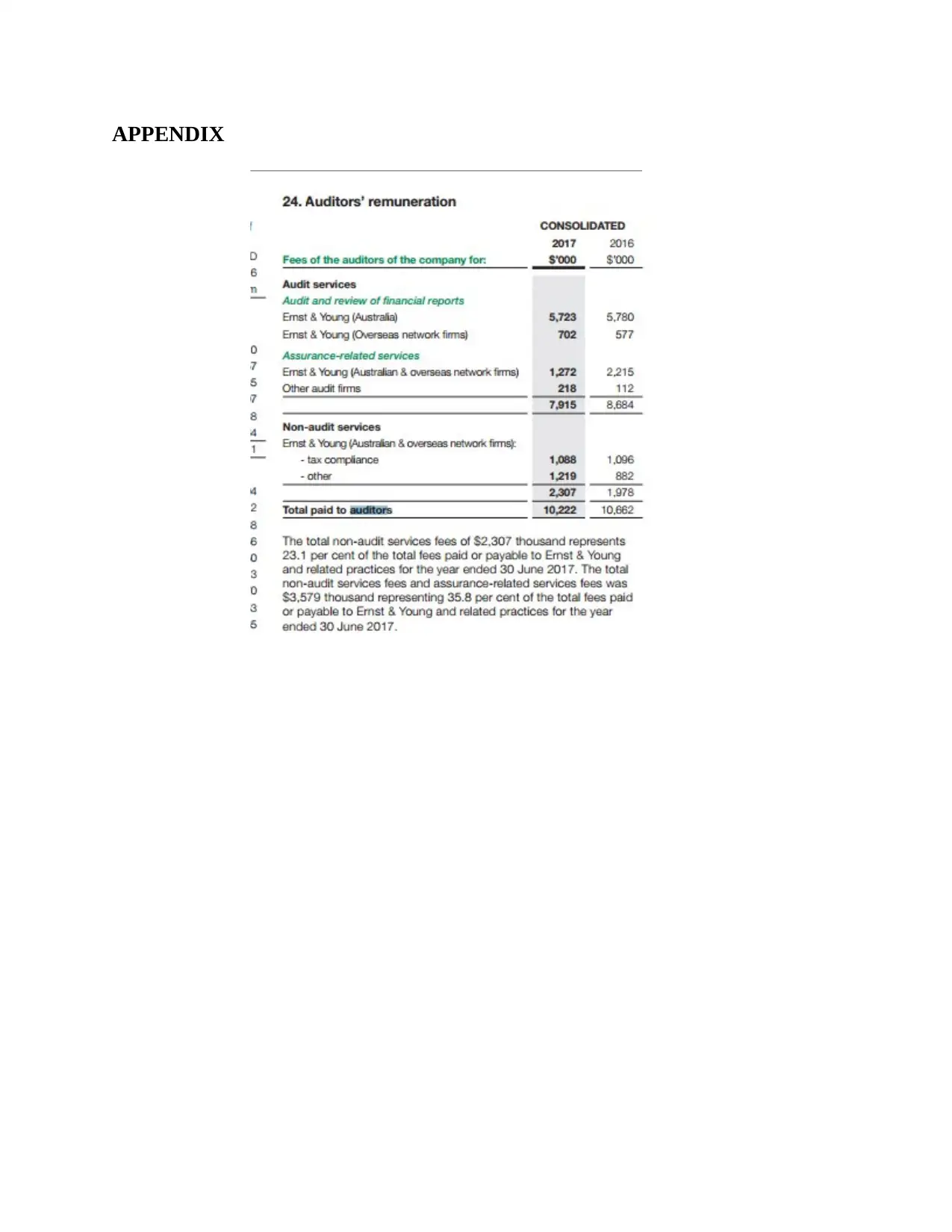

Non-Audit services performed by the Auditor

According to 15 USCS the word non-audit work substance “any professional services

provided to an issuer by a registered public accounting firm or a review of the financial

statements of an issuer. Non audit would be any service not involving the audit of a company 's

financial statements. For example, tax planning and preparation, business consulting and system

integration. According to annual report of Wesfarmers the auditor of the company provide non-

audit services to the consolidated entity during the financial year and received, or is due to

receive. The following amounts for the provision of these services:

Non-audit services

Ernst & Young (Australian & overseas network firms):

Tax abidance $1088

Other services $1219

In this table the total amount of non-audit services fees which is $2307 represent 23.1%

of the full fee paid or payable to external auditor and affiliated practice for the year ended on 30

June 2017. Sum of all non-audit services and authority-affiliated work tip was $3579 thousand

representing 35.8% of the total fees paid to auditor (Wesfarmers. 2017). The board has

considers the audit and Risk committee advice and the non audit services provided by auditor

and is satisfied that the provision of these services during the year by the auditor is compatible

(Zerni, 2012). The general standard of auditor independence imposed by the corporation Act

2001for the following reasons:

the service provided do not involve auditing the auditor's own work or acting in a

management decision-making for the company.

2

These declaration are in the respect of Wesfarmer and many bodies controlled during the

accounting year. It is clear that auditor complied with their independence requirement according

to the declaration. So it follows the legislation and standard in audit reporting of Wesfarmers:

It also follow section 307 of the corporation act and predate division three four and five

There is a code of ethics for trained accountant. Like APES 110

Accounting regulation ASQC prime control for firm that carry through audit and reviews

of business reports (Griffiths, 2016).

Non-Audit services performed by the Auditor

According to 15 USCS the word non-audit work substance “any professional services

provided to an issuer by a registered public accounting firm or a review of the financial

statements of an issuer. Non audit would be any service not involving the audit of a company 's

financial statements. For example, tax planning and preparation, business consulting and system

integration. According to annual report of Wesfarmers the auditor of the company provide non-

audit services to the consolidated entity during the financial year and received, or is due to

receive. The following amounts for the provision of these services:

Non-audit services

Ernst & Young (Australian & overseas network firms):

Tax abidance $1088

Other services $1219

In this table the total amount of non-audit services fees which is $2307 represent 23.1%

of the full fee paid or payable to external auditor and affiliated practice for the year ended on 30

June 2017. Sum of all non-audit services and authority-affiliated work tip was $3579 thousand

representing 35.8% of the total fees paid to auditor (Wesfarmers. 2017). The board has

considers the audit and Risk committee advice and the non audit services provided by auditor

and is satisfied that the provision of these services during the year by the auditor is compatible

(Zerni, 2012). The general standard of auditor independence imposed by the corporation Act

2001for the following reasons:

the service provided do not involve auditing the auditor's own work or acting in a

management decision-making for the company.

2

All these non audit services are subject to corporate governance

policies adopted by the company have been reviewed by the audit and the risk committee

to ensure they do not affect the integrity and objectives of the auditor.

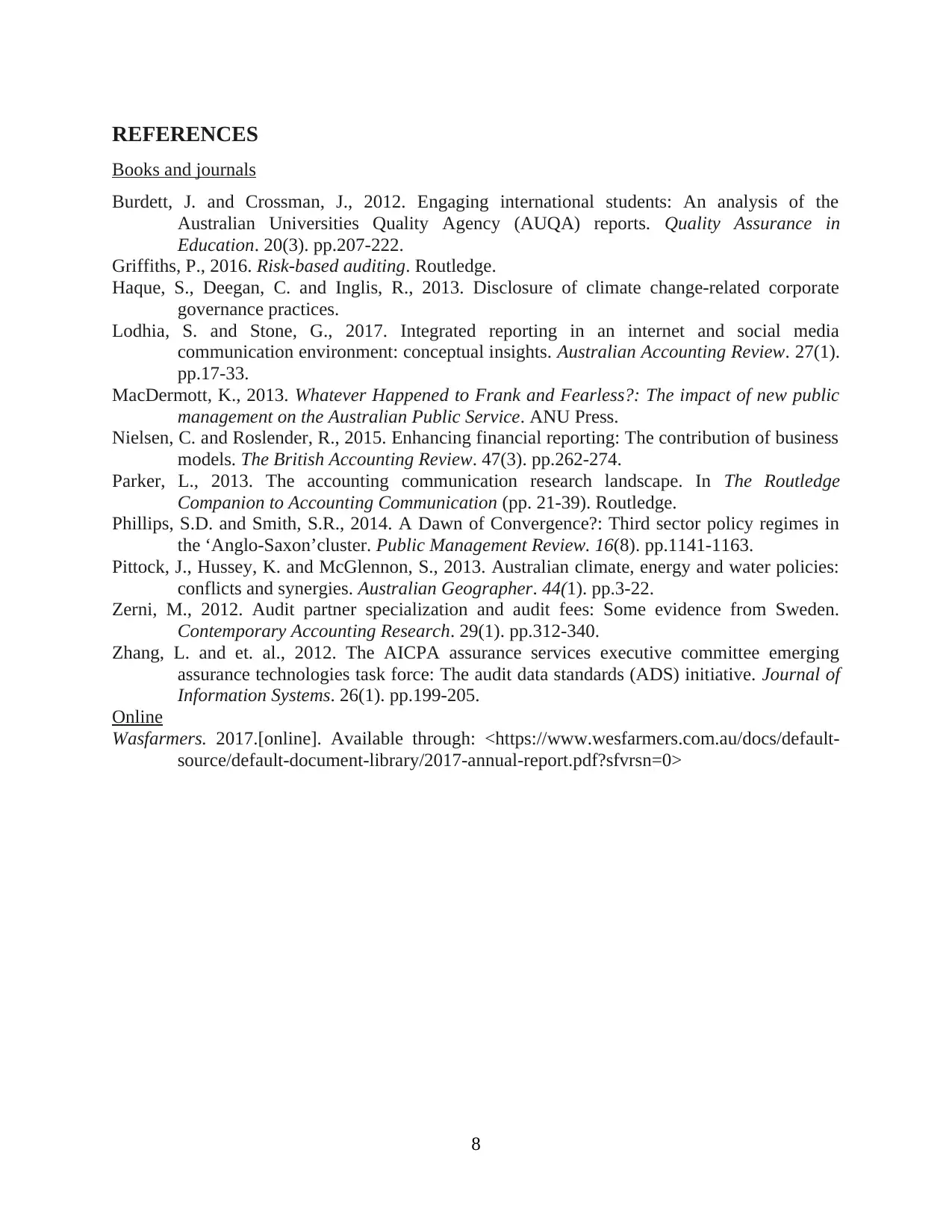

Auditor’s remuneration

Any fee, rewards for the work done or employments in the form of pay, salary, or wages

that also includes allowance, benefits, bounces, cash incentives and monetary value is termed as

remuneration. So, A fees company pay to its external auditor in exchange for performing an

audit. The remuneration of auditor are prefixed by the management on the following basis:

company shall fixed in its general meeting about the remuneration.

The remuneration will include expenses incurred by the auditor in connection with the

audit of company.

According to the annual report of Wesfarmers for the financial year 2017 auditor are

remuneration are done in various ways. Remuneration for auditing and review of financial

reports for Wesfarmers in Australia and overseas network firm have been paid to external

auditor. In Australian firm external auditor is paid with the amount of $5780 in 2016 and

$5723in this ended financial year. Similarly, remuneration paid to auditor in the overseas firm

for year 2016 is $577 and in year 2017 company pay $702. These remuneration provided by the

company also consist an amount of various assurance-related services. In 2016 company pay

$2215 for assurance-related services in Australia & overseas network firm and for year 2017

Wesfarmers pay $1272. Remuneration for assurance-related services other than audit firm in

year 2016 is $112 as compared to $218 in year 2017 (Nielsen and Roslender, 2015). The auditor

remuneration also includes amount paid for non-audit services such as tax compliance in

Australian & overseas firm like for tax compliance company pay $1096 in year 2016 and $1088

in year 2017. Amount paid for other non-audit services in year 2016 is $882 and $1219 in year

2017.

Key audit matters

It is essential matters which is most important in our auditing of the financial reporting of

present period. For evert matter mentioned below, company’s description of how audit would be

addressed the necessary matter which is been provided by the company (MacDermott, 2013). It

is associated with Supplier rebates which is mentioned under the financial statement of the Wes-

farmer annual report. It consists of the rebates received by the group from overall suppliers those

3

policies adopted by the company have been reviewed by the audit and the risk committee

to ensure they do not affect the integrity and objectives of the auditor.

Auditor’s remuneration

Any fee, rewards for the work done or employments in the form of pay, salary, or wages

that also includes allowance, benefits, bounces, cash incentives and monetary value is termed as

remuneration. So, A fees company pay to its external auditor in exchange for performing an

audit. The remuneration of auditor are prefixed by the management on the following basis:

company shall fixed in its general meeting about the remuneration.

The remuneration will include expenses incurred by the auditor in connection with the

audit of company.

According to the annual report of Wesfarmers for the financial year 2017 auditor are

remuneration are done in various ways. Remuneration for auditing and review of financial

reports for Wesfarmers in Australia and overseas network firm have been paid to external

auditor. In Australian firm external auditor is paid with the amount of $5780 in 2016 and

$5723in this ended financial year. Similarly, remuneration paid to auditor in the overseas firm

for year 2016 is $577 and in year 2017 company pay $702. These remuneration provided by the

company also consist an amount of various assurance-related services. In 2016 company pay

$2215 for assurance-related services in Australia & overseas network firm and for year 2017

Wesfarmers pay $1272. Remuneration for assurance-related services other than audit firm in

year 2016 is $112 as compared to $218 in year 2017 (Nielsen and Roslender, 2015). The auditor

remuneration also includes amount paid for non-audit services such as tax compliance in

Australian & overseas firm like for tax compliance company pay $1096 in year 2016 and $1088

in year 2017. Amount paid for other non-audit services in year 2016 is $882 and $1219 in year

2017.

Key audit matters

It is essential matters which is most important in our auditing of the financial reporting of

present period. For evert matter mentioned below, company’s description of how audit would be

addressed the necessary matter which is been provided by the company (MacDermott, 2013). It

is associated with Supplier rebates which is mentioned under the financial statement of the Wes-

farmer annual report. It consists of the rebates received by the group from overall suppliers those

3

are related with the retail operations. It has been analysing as key audit matter as because of the

quantum of commercial profit arises during the year and decision are made on the basis of below

mentioned factors such as:

The profitable terms of every specific rebate.

Consideration of the nature of rebate and deicide, whether the value would be taken into

account among during carrying out the value of stock recorded into the statements.

Process to addressed the key audit matter:

Auditor must have gained proper understanding of effective nature of every material and

types of commercial profit that consist of assessing the important of agreement in place.

Auditor has also assessed the design and operating more effectively of relevant control in

accordance to recognition and measurement of rebate amount.

It has been performed valuable comparison of the different rebate arrangement in

accordance with the prior year and budget that consist of aging profiles and material

variance were examination and supporting evidence (Zhang and et. al., 2012).

Auditor of Wesfarmers work with the representatives that consists of product details such

as supply chain managers and procurement staffs present of any kind of non-standard

agreement or side arrangement.

Finalisation of acquisition accounting of Homebase: This particular group is accountable for

acquisition of Hamden group ltd as business combination as per the AASB 3. As per this specific

standard a 12 months provisional accounting duration during which acquisition accounting can

be easily be revised to indicate the facts and situation that can exists at the period of time.

auditors have determined that there is key audit matter because of the size of acquisition and

judgement is associated with determining the fair value of assets those are needed to be assumed

by the company.

Process:

There audit process in accordance of finalisation of proper acquisition accounting that

consists of below mentioned matters such as:

Auditor of the Wesfarmer group acquisition for accounting method consists of assessing

all changes to key decision and estimation that can supports the updating fair value of

assets amount and debts obligations.

4

quantum of commercial profit arises during the year and decision are made on the basis of below

mentioned factors such as:

The profitable terms of every specific rebate.

Consideration of the nature of rebate and deicide, whether the value would be taken into

account among during carrying out the value of stock recorded into the statements.

Process to addressed the key audit matter:

Auditor must have gained proper understanding of effective nature of every material and

types of commercial profit that consist of assessing the important of agreement in place.

Auditor has also assessed the design and operating more effectively of relevant control in

accordance to recognition and measurement of rebate amount.

It has been performed valuable comparison of the different rebate arrangement in

accordance with the prior year and budget that consist of aging profiles and material

variance were examination and supporting evidence (Zhang and et. al., 2012).

Auditor of Wesfarmers work with the representatives that consists of product details such

as supply chain managers and procurement staffs present of any kind of non-standard

agreement or side arrangement.

Finalisation of acquisition accounting of Homebase: This particular group is accountable for

acquisition of Hamden group ltd as business combination as per the AASB 3. As per this specific

standard a 12 months provisional accounting duration during which acquisition accounting can

be easily be revised to indicate the facts and situation that can exists at the period of time.

auditors have determined that there is key audit matter because of the size of acquisition and

judgement is associated with determining the fair value of assets those are needed to be assumed

by the company.

Process:

There audit process in accordance of finalisation of proper acquisition accounting that

consists of below mentioned matters such as:

Auditor of the Wesfarmer group acquisition for accounting method consists of assessing

all changes to key decision and estimation that can supports the updating fair value of

assets amount and debts obligations.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Auditor also assessed, whether there have been any kind of changes to the overall

provision that are based on the fair value of determined assest and debt which are taken

into account during the time of acquisition from the disclosure of 30 June, 2016 in the

financial report of the company.

Audit commission

It is a administrative body that is selected by number of member of an organisation

commission of director who all are responsible for helping auditor but remain independent of

management. The audit committee show a carping function in supply omission and helping as a

appraisal and equality on a company's financial coverage scheme. In Wesfarmers this committee

give self-directed reviews and direction of a company financial reporting processes, internal

control and independent auditors. According to annual report of Wesfarmers there is an audit

committee , the board currently comprises nine director, including eight non executive director

(Lodhia and Stone, 2017). The role of non administrator directors is to be market emulous: it

aims to set fees at a level contending with non decision maker director in comparator. They also

help in safeguard independence that not to include any performance related elements to preserve

the independence of non executive directors.

revaluation and assessing the group processes which ensure the integrity of financial

statement's and reporting that is associated compliance with accounting, legal and

regulatory requirement.

Review the process and control the recognition of commercial income by the retail

division to ensure in accordance with the accounting standard and accepted industry

practice

Monitoring the ethical sourcing of product for resale through the group retail networks to

ensure that there are appropriate safeguard and processes in place.

Review and evaluate the adequate of the group insurance arrangements to ensure

appropriate cover for identified operational and business risk (Haque, Deegan and Inglis,

2013).

Monitoring the retail shrinkage control measure and reporting procedure in the group

division

5

provision that are based on the fair value of determined assest and debt which are taken

into account during the time of acquisition from the disclosure of 30 June, 2016 in the

financial report of the company.

Audit commission

It is a administrative body that is selected by number of member of an organisation

commission of director who all are responsible for helping auditor but remain independent of

management. The audit committee show a carping function in supply omission and helping as a

appraisal and equality on a company's financial coverage scheme. In Wesfarmers this committee

give self-directed reviews and direction of a company financial reporting processes, internal

control and independent auditors. According to annual report of Wesfarmers there is an audit

committee , the board currently comprises nine director, including eight non executive director

(Lodhia and Stone, 2017). The role of non administrator directors is to be market emulous: it

aims to set fees at a level contending with non decision maker director in comparator. They also

help in safeguard independence that not to include any performance related elements to preserve

the independence of non executive directors.

revaluation and assessing the group processes which ensure the integrity of financial

statement's and reporting that is associated compliance with accounting, legal and

regulatory requirement.

Review the process and control the recognition of commercial income by the retail

division to ensure in accordance with the accounting standard and accepted industry

practice

Monitoring the ethical sourcing of product for resale through the group retail networks to

ensure that there are appropriate safeguard and processes in place.

Review and evaluate the adequate of the group insurance arrangements to ensure

appropriate cover for identified operational and business risk (Haque, Deegan and Inglis,

2013).

Monitoring the retail shrinkage control measure and reporting procedure in the group

division

5

Monitoring the company tax compliance program both in Australia and overseas,

including cross-border intra group transaction, to ensure its obligations are met in the

jurisdiction in which the company operates.

Monitoring the group cyber security frame-work including data protection management

and the reporting structure and escalation process on information security risk.

Follow up question asked to an auditor at company AGM

Basically shareholder asked most of the question to the auditor regarding their financial

position, return on investment, position in the market etc. some of the most commonly asked

question are:

Q1) Who is responsible to submit a supplement to the notice of remuneration paid in previous

year?

Q2) what is the amount of dividend to be paid by company in this financial year?

Q3) why does the company board propose an authorization to repurchase own share?

Q4) what is the process of dividend taxed if shareholder is a register on ADR holder?

Directors’ and Management’s responsibilities differ from the Auditor’s responsibilities

Directors of an organisation are concerned with the proper maintenance of annual reports

but auditors are concerned with the proper examination of the reports. Managers are liable to

manage the financial reports in a proper way and record each and every transaction in the reports

which may help the auditor to analyse the actual position of the company and its financial status.

Directors are mainly liable to direct each and every employee of the organisation. In Wesfarmers

managers prepare the financial reports and the auditors analyse those reports and find out that all

the recorded elements are true and relevant to the company. Auditors of the company take

charge to analyse the financial reports to measure the actual performance in a particular period of

time.

In Wesfarmers the main role of managers is to manage the record of each activity and the

role of auditors is to analyse the recodes and check the transparency of the reports. If they found

any mistake in the reports he is liable to give the information to the directors so that they may

take action to resolve the mistake and make the reports transparent to ignore legal interferences

in the company. Directors focused with the organisational goals which can be achieved with the

help of actual and accurate reports (Parker, 2013).

6

including cross-border intra group transaction, to ensure its obligations are met in the

jurisdiction in which the company operates.

Monitoring the group cyber security frame-work including data protection management

and the reporting structure and escalation process on information security risk.

Follow up question asked to an auditor at company AGM

Basically shareholder asked most of the question to the auditor regarding their financial

position, return on investment, position in the market etc. some of the most commonly asked

question are:

Q1) Who is responsible to submit a supplement to the notice of remuneration paid in previous

year?

Q2) what is the amount of dividend to be paid by company in this financial year?

Q3) why does the company board propose an authorization to repurchase own share?

Q4) what is the process of dividend taxed if shareholder is a register on ADR holder?

Directors’ and Management’s responsibilities differ from the Auditor’s responsibilities

Directors of an organisation are concerned with the proper maintenance of annual reports

but auditors are concerned with the proper examination of the reports. Managers are liable to

manage the financial reports in a proper way and record each and every transaction in the reports

which may help the auditor to analyse the actual position of the company and its financial status.

Directors are mainly liable to direct each and every employee of the organisation. In Wesfarmers

managers prepare the financial reports and the auditors analyse those reports and find out that all

the recorded elements are true and relevant to the company. Auditors of the company take

charge to analyse the financial reports to measure the actual performance in a particular period of

time.

In Wesfarmers the main role of managers is to manage the record of each activity and the

role of auditors is to analyse the recodes and check the transparency of the reports. If they found

any mistake in the reports he is liable to give the information to the directors so that they may

take action to resolve the mistake and make the reports transparent to ignore legal interferences

in the company. Directors focused with the organisational goals which can be achieved with the

help of actual and accurate reports (Parker, 2013).

6

CONCLUSION

It is clear to conclude that audit reporting are essential for company. In this report

company annual report is evaluated in order to attracted stakeholder. Under this project auditor

independence requirements according to independent auditor report have been shown. Auditor

provide various non audit services which is discussed above in the report. Auditors are given

remuneration for the audit services they give to the company. Importance of audit procedure test

are discussed for each key audit matters like lest of control, substantive test of detail, substantive

test of balance and analytical procedures. There are broad of audit committee and non executive

member who manage and audit the report of company.

7

It is clear to conclude that audit reporting are essential for company. In this report

company annual report is evaluated in order to attracted stakeholder. Under this project auditor

independence requirements according to independent auditor report have been shown. Auditor

provide various non audit services which is discussed above in the report. Auditors are given

remuneration for the audit services they give to the company. Importance of audit procedure test

are discussed for each key audit matters like lest of control, substantive test of detail, substantive

test of balance and analytical procedures. There are broad of audit committee and non executive

member who manage and audit the report of company.

7

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REFERENCES

Books and journals

Burdett, J. and Crossman, J., 2012. Engaging international students: An analysis of the

Australian Universities Quality Agency (AUQA) reports. Quality Assurance in

Education. 20(3). pp.207-222.

Griffiths, P., 2016. Risk-based auditing. Routledge.

Haque, S., Deegan, C. and Inglis, R., 2013. Disclosure of climate change-related corporate

governance practices.

Lodhia, S. and Stone, G., 2017. Integrated reporting in an internet and social media

communication environment: conceptual insights. Australian Accounting Review. 27(1).

pp.17-33.

MacDermott, K., 2013. Whatever Happened to Frank and Fearless?: The impact of new public

management on the Australian Public Service. ANU Press.

Nielsen, C. and Roslender, R., 2015. Enhancing financial reporting: The contribution of business

models. The British Accounting Review. 47(3). pp.262-274.

Parker, L., 2013. The accounting communication research landscape. In The Routledge

Companion to Accounting Communication (pp. 21-39). Routledge.

Phillips, S.D. and Smith, S.R., 2014. A Dawn of Convergence?: Third sector policy regimes in

the ‘Anglo-Saxon’cluster. Public Management Review. 16(8). pp.1141-1163.

Pittock, J., Hussey, K. and McGlennon, S., 2013. Australian climate, energy and water policies:

conflicts and synergies. Australian Geographer. 44(1). pp.3-22.

Zerni, M., 2012. Audit partner specialization and audit fees: Some evidence from Sweden.

Contemporary Accounting Research. 29(1). pp.312-340.

Zhang, L. and et. al., 2012. The AICPA assurance services executive committee emerging

assurance technologies task force: The audit data standards (ADS) initiative. Journal of

Information Systems. 26(1). pp.199-205.

Online

Wasfarmers. 2017.[online]. Available through: <https://www.wesfarmers.com.au/docs/default-

source/default-document-library/2017-annual-report.pdf?sfvrsn=0>

8

Books and journals

Burdett, J. and Crossman, J., 2012. Engaging international students: An analysis of the

Australian Universities Quality Agency (AUQA) reports. Quality Assurance in

Education. 20(3). pp.207-222.

Griffiths, P., 2016. Risk-based auditing. Routledge.

Haque, S., Deegan, C. and Inglis, R., 2013. Disclosure of climate change-related corporate

governance practices.

Lodhia, S. and Stone, G., 2017. Integrated reporting in an internet and social media

communication environment: conceptual insights. Australian Accounting Review. 27(1).

pp.17-33.

MacDermott, K., 2013. Whatever Happened to Frank and Fearless?: The impact of new public

management on the Australian Public Service. ANU Press.

Nielsen, C. and Roslender, R., 2015. Enhancing financial reporting: The contribution of business

models. The British Accounting Review. 47(3). pp.262-274.

Parker, L., 2013. The accounting communication research landscape. In The Routledge

Companion to Accounting Communication (pp. 21-39). Routledge.

Phillips, S.D. and Smith, S.R., 2014. A Dawn of Convergence?: Third sector policy regimes in

the ‘Anglo-Saxon’cluster. Public Management Review. 16(8). pp.1141-1163.

Pittock, J., Hussey, K. and McGlennon, S., 2013. Australian climate, energy and water policies:

conflicts and synergies. Australian Geographer. 44(1). pp.3-22.

Zerni, M., 2012. Audit partner specialization and audit fees: Some evidence from Sweden.

Contemporary Accounting Research. 29(1). pp.312-340.

Zhang, L. and et. al., 2012. The AICPA assurance services executive committee emerging

assurance technologies task force: The audit data standards (ADS) initiative. Journal of

Information Systems. 26(1). pp.199-205.

Online

Wasfarmers. 2017.[online]. Available through: <https://www.wesfarmers.com.au/docs/default-

source/default-document-library/2017-annual-report.pdf?sfvrsn=0>

8

APPENDIX

2

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.