Investigating Auditor's Role in Fraud Detection: Data Analysis Report

VerifiedAdded on 2023/05/30

|14

|2066

|198

Report

AI Summary

This report presents a data analysis of the role of auditors in fraud detection within UAE banks, based on a survey of 88 respondents from five different banks. The descriptive statistics cover demographic information such as gender, age, education level, job position, career major, and work experience. The analysis explores the respondents' awareness of fraud, the impact of technology in detecting fraud, and the perceived effectiveness of fraud detection and prevention in the UAE. Correlation and regression analyses are performed to examine the relationships between the role of internal auditors, the possibility of fraud detection, the role of technology, and awareness of fraud. The report also discusses the various techniques employed by banks for fraud detection, including bank reconciliation, data mining, segregation of duties, and whistleblowing systems, and assesses the frequency of risk assessment routines conducted by the banks. The findings indicate that while technology and fraud awareness are significant predictors of the role of internal auditors, the perceived possibility of fraud detection is not.

Data analysis, results and discussion

Descriptive statistics

The descriptive statistics give a general structure of the sample dataset used in analysis of the

role of an auditor in fraud detection. It mainly covers the distribution of the variables, that is

frequency, percentages, and averages such as: median, mean, and mode. There are 88

respondents who are involved in the survey working in 5 banks. The banks include:

i. Bank of Sharjah

ii. Sharjah Islamic bank

iii. national bank of Abu Dhabi

iv. bank of Dubai

v. Noor bank

Demographical statistics

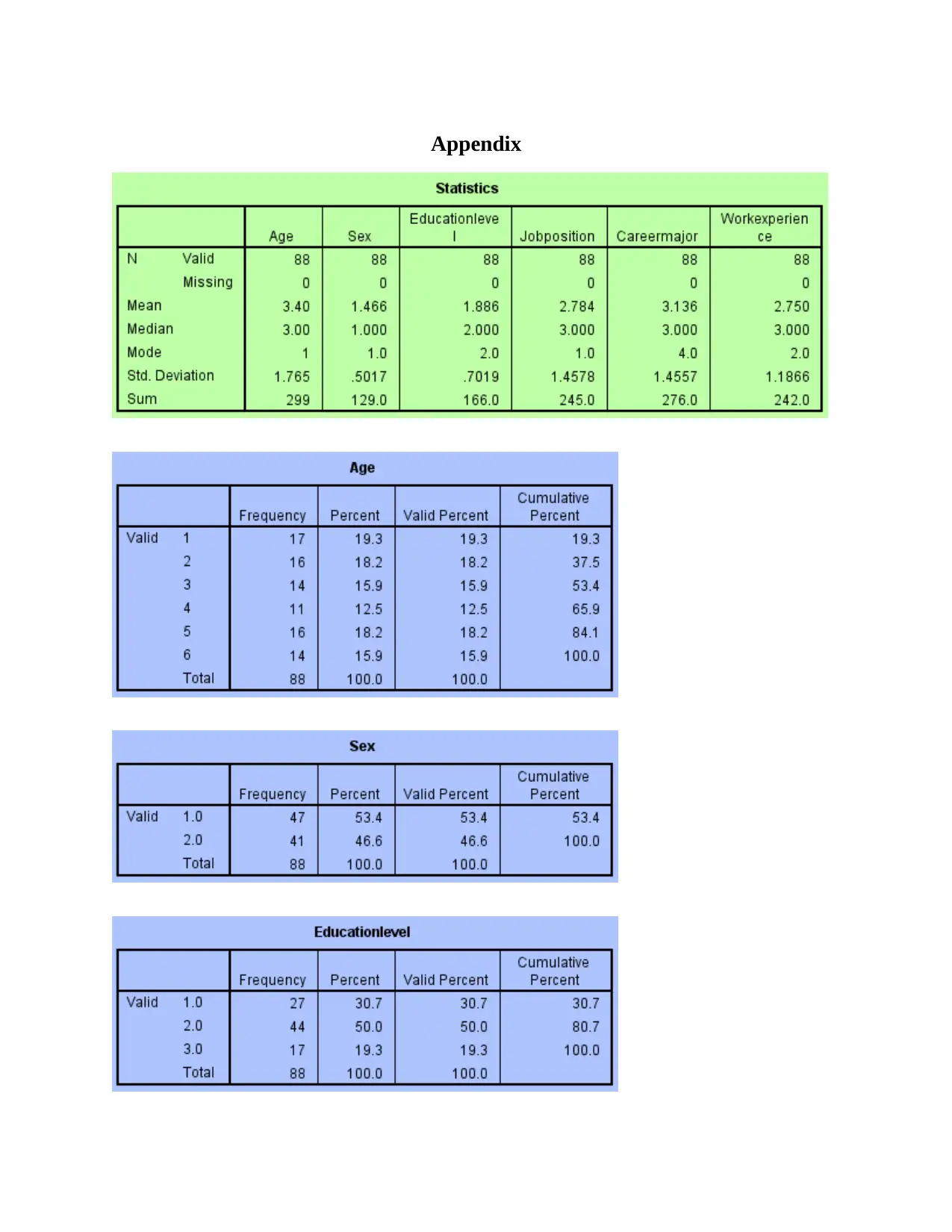

Gender

Out of the 88 respondents, 47 are male which represent 53.4% while there are 41 female

respondents who make up 46.6%. We can therefore infer that there are more male and female

respondents.

Age

The age variable is coded from 1 to 6, where:

Age Code

20-30 1

31-35 2

Descriptive statistics

The descriptive statistics give a general structure of the sample dataset used in analysis of the

role of an auditor in fraud detection. It mainly covers the distribution of the variables, that is

frequency, percentages, and averages such as: median, mean, and mode. There are 88

respondents who are involved in the survey working in 5 banks. The banks include:

i. Bank of Sharjah

ii. Sharjah Islamic bank

iii. national bank of Abu Dhabi

iv. bank of Dubai

v. Noor bank

Demographical statistics

Gender

Out of the 88 respondents, 47 are male which represent 53.4% while there are 41 female

respondents who make up 46.6%. We can therefore infer that there are more male and female

respondents.

Age

The age variable is coded from 1 to 6, where:

Age Code

20-30 1

31-35 2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

36-40 3

41-45 4

46-50 5

50+ 6

From the analysis, most of the survey respondents are between the age of

20 and 25 i.e. they make up 19.3% of the total respondents. Respondents

between the age of 31 and 35 make up to 18.2% while those of the age

bracket 36 and 40 represent 15.9%. In addition, respondents between the

age of 41 and 45 make up 12.5% and those of the age 46-50 make up 18.2%

while those who are 50 years and above comprise 15.9%.

Educational level

Education variable is coded from 1 to 3 representing the highest attained educational level with 1

being bachelor’s degree, master’s degree and 3 being PhD.

Summary results indicate that most of the respondents involved in the survey attained a master’s

degree that is the mode making up to 50% while those with a bachelor’s degrees comprise 30.3%

of the whole respondent population and those with a PhD make up 19.3%. The educational mean

is 1.886 indicating that most respondents are either holders of a bachelor’s degree or a master’s

degree.

Job position

28.4% of the respondents are regular employees while 17% are junior supervisors, 18.2% are

senior managers and 20.5% are executive officers with 15.9% of the respondents being

members of the auditing committee. The mean job position is 2.784

indicating that most respondents are senior managers and are therefore

41-45 4

46-50 5

50+ 6

From the analysis, most of the survey respondents are between the age of

20 and 25 i.e. they make up 19.3% of the total respondents. Respondents

between the age of 31 and 35 make up to 18.2% while those of the age

bracket 36 and 40 represent 15.9%. In addition, respondents between the

age of 41 and 45 make up 12.5% and those of the age 46-50 make up 18.2%

while those who are 50 years and above comprise 15.9%.

Educational level

Education variable is coded from 1 to 3 representing the highest attained educational level with 1

being bachelor’s degree, master’s degree and 3 being PhD.

Summary results indicate that most of the respondents involved in the survey attained a master’s

degree that is the mode making up to 50% while those with a bachelor’s degrees comprise 30.3%

of the whole respondent population and those with a PhD make up 19.3%. The educational mean

is 1.886 indicating that most respondents are either holders of a bachelor’s degree or a master’s

degree.

Job position

28.4% of the respondents are regular employees while 17% are junior supervisors, 18.2% are

senior managers and 20.5% are executive officers with 15.9% of the respondents being

members of the auditing committee. The mean job position is 2.784

indicating that most respondents are senior managers and are therefore

suitable for the research purpose given that they have information on most

of the bank operations.

Career major

Career majoring is coded between 1 and 5 where, 1= accounting, 2= economics, 3=commerce

4=Financial management, 5=other majors.

Most of the respondents majored in financial management making up 25% while 19.3% majored

in accounting, 18.2% majored in economics and 14.8% majored in commerce while 22.7%

majored in other fields.

Work experience

Most of the respondents in the survey have a work experience of between 6 and 10 years making

up 29.5% while those who have a work experience of 1-5 years make up 15.9% and 11-15 years

of work experience comprise 26.1% of the total respondents. Additionally, 20.5% of the

respondents have a work experience of between 16-20 years while 8% have a work experience of

more than 20 years.

Data analysis and discussions

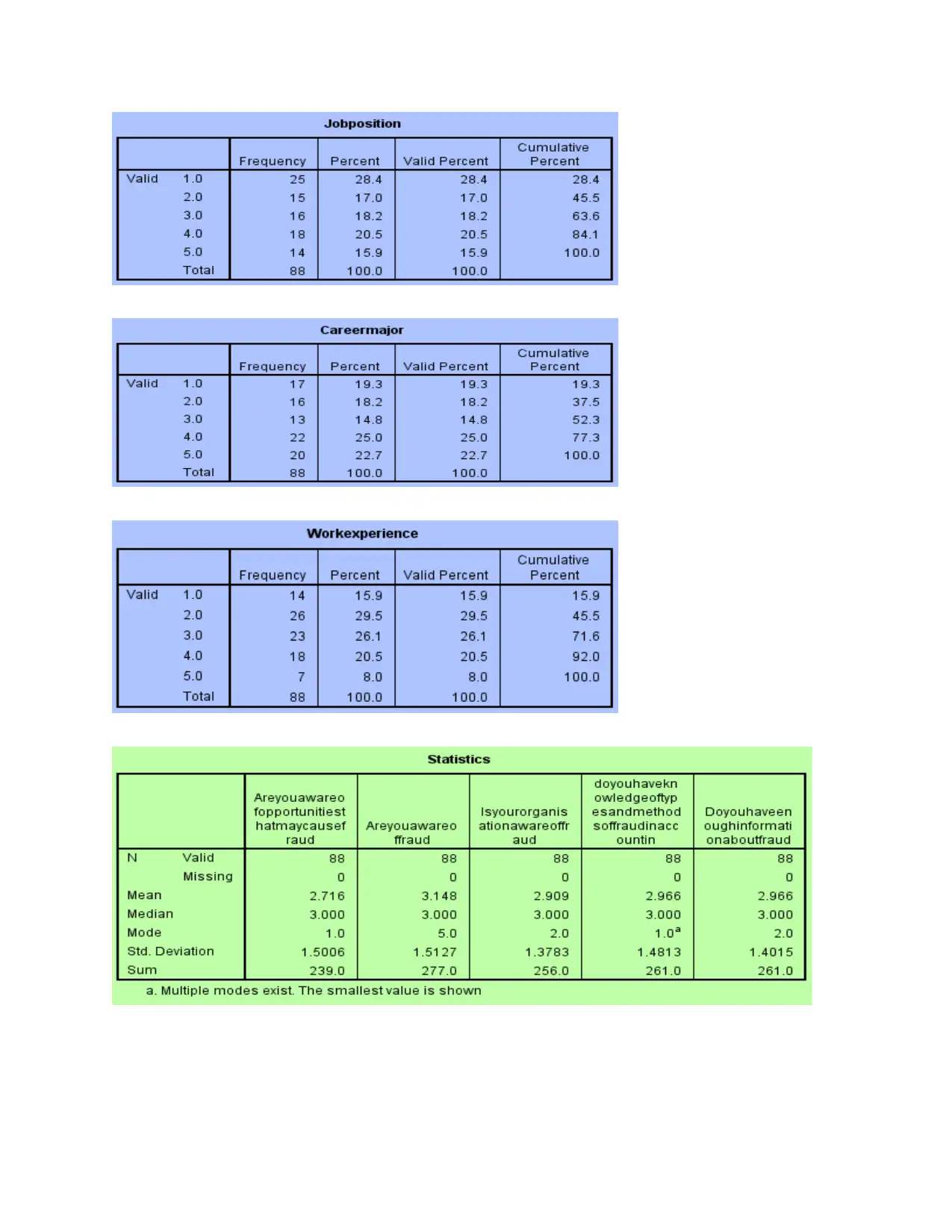

Awareness of fraud

Descriptive results from the data analysis indicate that up to 63.7% of the respondents are fully

aware of the opportunities that cause fraud with a mean value of 2.716. Moreover, with a mean

of 3.148, 53.4% of the respondents have got awareness regarding fraud which may include what

consists of fraud etcetera. In analysis of whether organizations are aware of fraud, 63.3% of the

respondents affirmed that the organizations which they work in have knowledge of fraud and that

56.8% of the respondents are also aware of accounting fraud and would detect one. Therefore, it

of the bank operations.

Career major

Career majoring is coded between 1 and 5 where, 1= accounting, 2= economics, 3=commerce

4=Financial management, 5=other majors.

Most of the respondents majored in financial management making up 25% while 19.3% majored

in accounting, 18.2% majored in economics and 14.8% majored in commerce while 22.7%

majored in other fields.

Work experience

Most of the respondents in the survey have a work experience of between 6 and 10 years making

up 29.5% while those who have a work experience of 1-5 years make up 15.9% and 11-15 years

of work experience comprise 26.1% of the total respondents. Additionally, 20.5% of the

respondents have a work experience of between 16-20 years while 8% have a work experience of

more than 20 years.

Data analysis and discussions

Awareness of fraud

Descriptive results from the data analysis indicate that up to 63.7% of the respondents are fully

aware of the opportunities that cause fraud with a mean value of 2.716. Moreover, with a mean

of 3.148, 53.4% of the respondents have got awareness regarding fraud which may include what

consists of fraud etcetera. In analysis of whether organizations are aware of fraud, 63.3% of the

respondents affirmed that the organizations which they work in have knowledge of fraud and that

56.8% of the respondents are also aware of accounting fraud and would detect one. Therefore, it

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

can be inferred that most of the corporate workers are well aware of the issue of fraud i.e.

approximately more than 60%.

The impact of technology in detecting fraud

In the question of whether technology has made any progress in aiding the campaign against

fraud, 69.3% of the respondents have a general opinion that technology has been successful in

minimizing accounting fraud. The statistics are based on the assumption that respondents having

an opinion between 1 and 3 affirm to the role of technology while those of 4 and 5 do not affirm

that technology aids in minimizing fraud.

Possibility to detect and prevent fraud in UAE

21.5% of the respondents are neutral about the role of UAE in detection and prevention of crime

while 45.5% are affirmative that UAE has played an important role in detection and prevention

of fraud whereas 33% are not of the opinion that UAE is effective in the campaign against fraud.

Regression results for the variables influencing detection of fraud

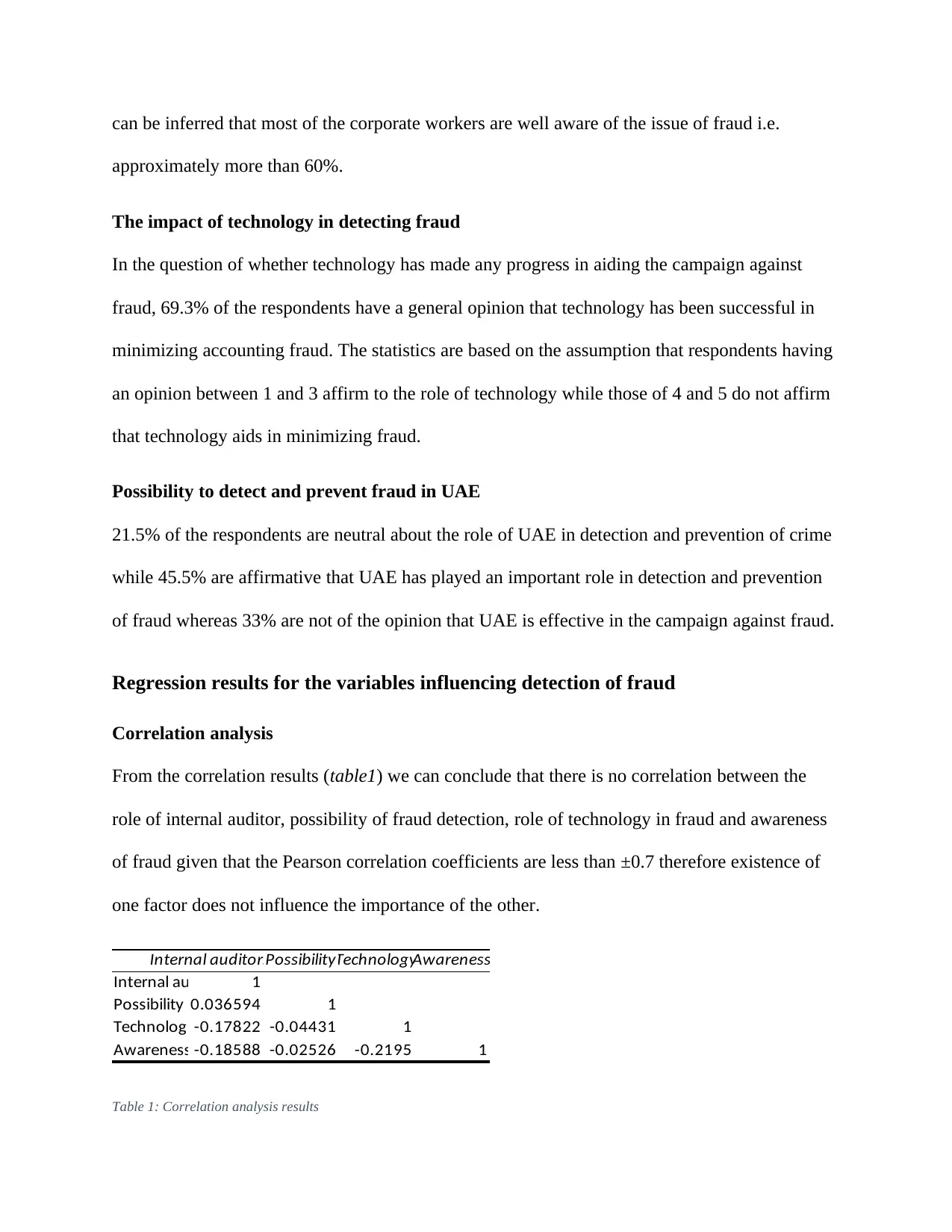

Correlation analysis

From the correlation results (table1) we can conclude that there is no correlation between the

role of internal auditor, possibility of fraud detection, role of technology in fraud and awareness

of fraud given that the Pearson correlation coefficients are less than ±0.7 therefore existence of

one factor does not influence the importance of the other.

Internal auditors rolePossibilityTechnologyAwareness

Internal au 1

Possibility 0.036594 1

Technolog -0.17822 -0.04431 1

Awareness -0.18588 -0.02526 -0.2195 1

Table 1: Correlation analysis results

approximately more than 60%.

The impact of technology in detecting fraud

In the question of whether technology has made any progress in aiding the campaign against

fraud, 69.3% of the respondents have a general opinion that technology has been successful in

minimizing accounting fraud. The statistics are based on the assumption that respondents having

an opinion between 1 and 3 affirm to the role of technology while those of 4 and 5 do not affirm

that technology aids in minimizing fraud.

Possibility to detect and prevent fraud in UAE

21.5% of the respondents are neutral about the role of UAE in detection and prevention of crime

while 45.5% are affirmative that UAE has played an important role in detection and prevention

of fraud whereas 33% are not of the opinion that UAE is effective in the campaign against fraud.

Regression results for the variables influencing detection of fraud

Correlation analysis

From the correlation results (table1) we can conclude that there is no correlation between the

role of internal auditor, possibility of fraud detection, role of technology in fraud and awareness

of fraud given that the Pearson correlation coefficients are less than ±0.7 therefore existence of

one factor does not influence the importance of the other.

Internal auditors rolePossibilityTechnologyAwareness

Internal au 1

Possibility 0.036594 1

Technolog -0.17822 -0.04431 1

Awareness -0.18588 -0.02526 -0.2195 1

Table 1: Correlation analysis results

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

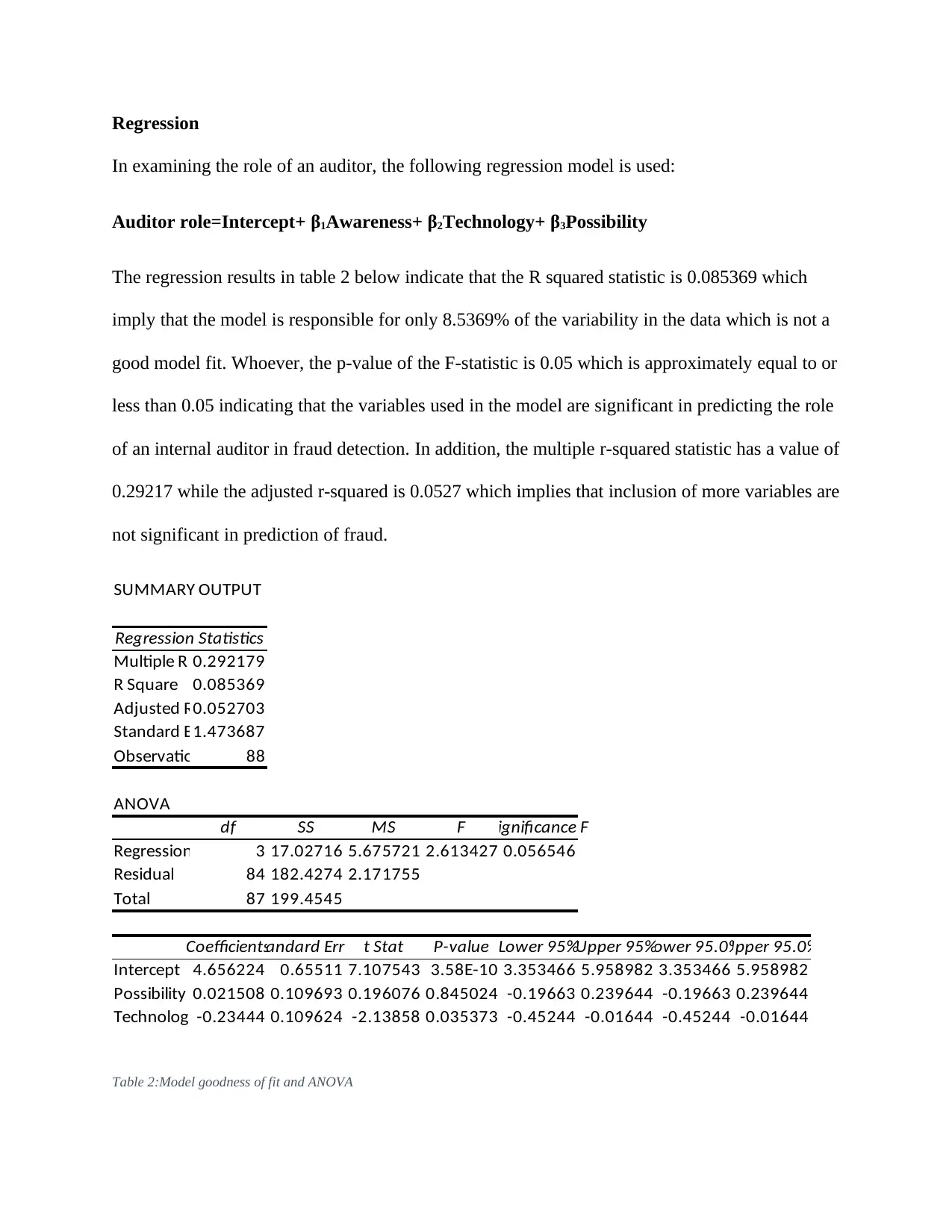

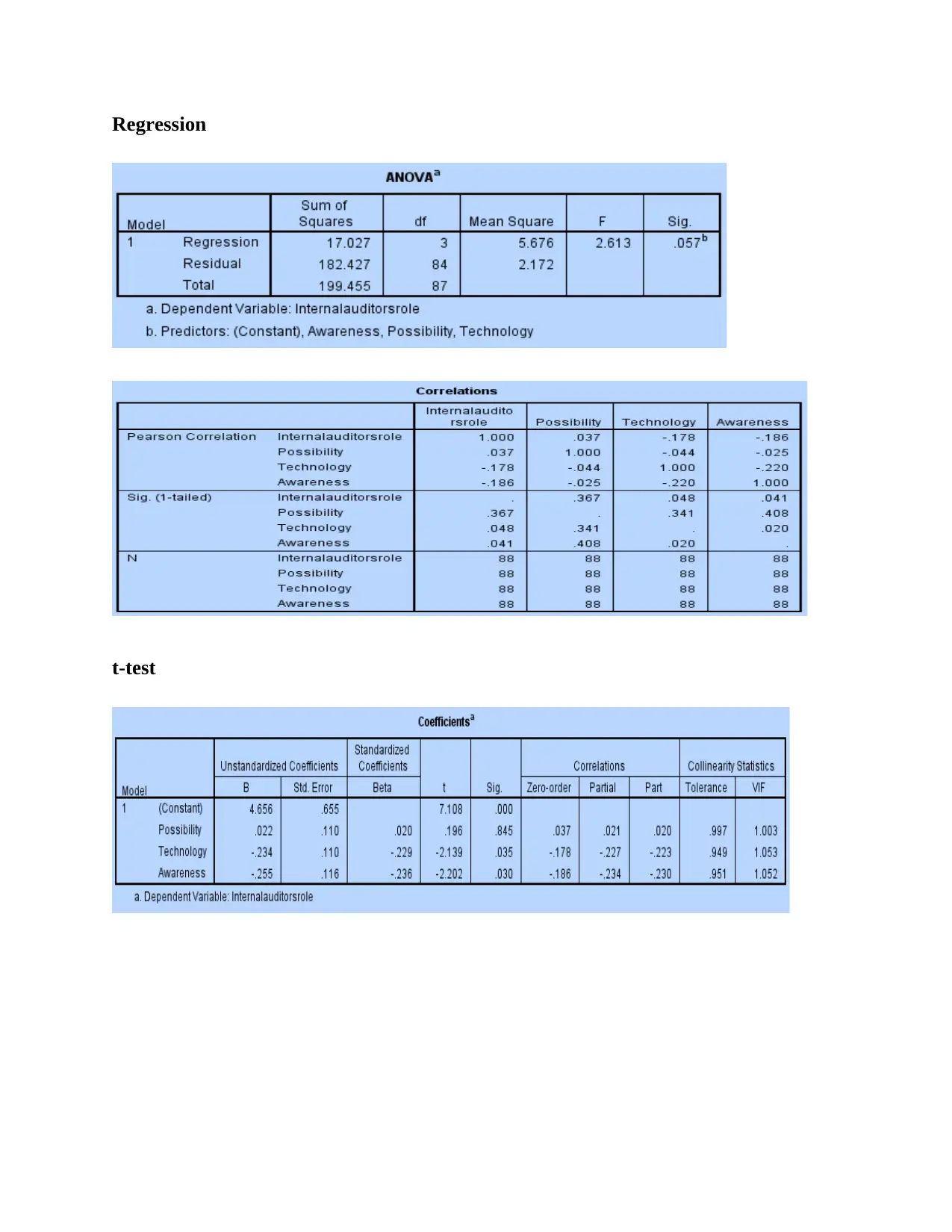

Regression

In examining the role of an auditor, the following regression model is used:

Auditor role=Intercept+ β1Awareness+ β2Technology+ β3Possibility

The regression results in table 2 below indicate that the R squared statistic is 0.085369 which

imply that the model is responsible for only 8.5369% of the variability in the data which is not a

good model fit. Whoever, the p-value of the F-statistic is 0.05 which is approximately equal to or

less than 0.05 indicating that the variables used in the model are significant in predicting the role

of an internal auditor in fraud detection. In addition, the multiple r-squared statistic has a value of

0.29217 while the adjusted r-squared is 0.0527 which implies that inclusion of more variables are

not significant in prediction of fraud.

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.292179

R Square 0.085369

Adjusted R0.052703

Standard E1.473687

Observatio 88

ANOVA

df SS MS F Significance F

Regression 3 17.02716 5.675721 2.613427 0.056546

Residual 84 182.4274 2.171755

Total 87 199.4545

CoefficientsStandard Error t Stat P-value Lower 95%Upper 95%Lower 95.0%Upper 95.0%

Intercept 4.656224 0.65511 7.107543 3.58E-10 3.353466 5.958982 3.353466 5.958982

Possibility 0.021508 0.109693 0.196076 0.845024 -0.19663 0.239644 -0.19663 0.239644

Technolog -0.23444 0.109624 -2.13858 0.035373 -0.45244 -0.01644 -0.45244 -0.01644

Table 2:Model goodness of fit and ANOVA

In examining the role of an auditor, the following regression model is used:

Auditor role=Intercept+ β1Awareness+ β2Technology+ β3Possibility

The regression results in table 2 below indicate that the R squared statistic is 0.085369 which

imply that the model is responsible for only 8.5369% of the variability in the data which is not a

good model fit. Whoever, the p-value of the F-statistic is 0.05 which is approximately equal to or

less than 0.05 indicating that the variables used in the model are significant in predicting the role

of an internal auditor in fraud detection. In addition, the multiple r-squared statistic has a value of

0.29217 while the adjusted r-squared is 0.0527 which implies that inclusion of more variables are

not significant in prediction of fraud.

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.292179

R Square 0.085369

Adjusted R0.052703

Standard E1.473687

Observatio 88

ANOVA

df SS MS F Significance F

Regression 3 17.02716 5.675721 2.613427 0.056546

Residual 84 182.4274 2.171755

Total 87 199.4545

CoefficientsStandard Error t Stat P-value Lower 95%Upper 95%Lower 95.0%Upper 95.0%

Intercept 4.656224 0.65511 7.107543 3.58E-10 3.353466 5.958982 3.353466 5.958982

Possibility 0.021508 0.109693 0.196076 0.845024 -0.19663 0.239644 -0.19663 0.239644

Technolog -0.23444 0.109624 -2.13858 0.035373 -0.45244 -0.01644 -0.45244 -0.01644

Table 2:Model goodness of fit and ANOVA

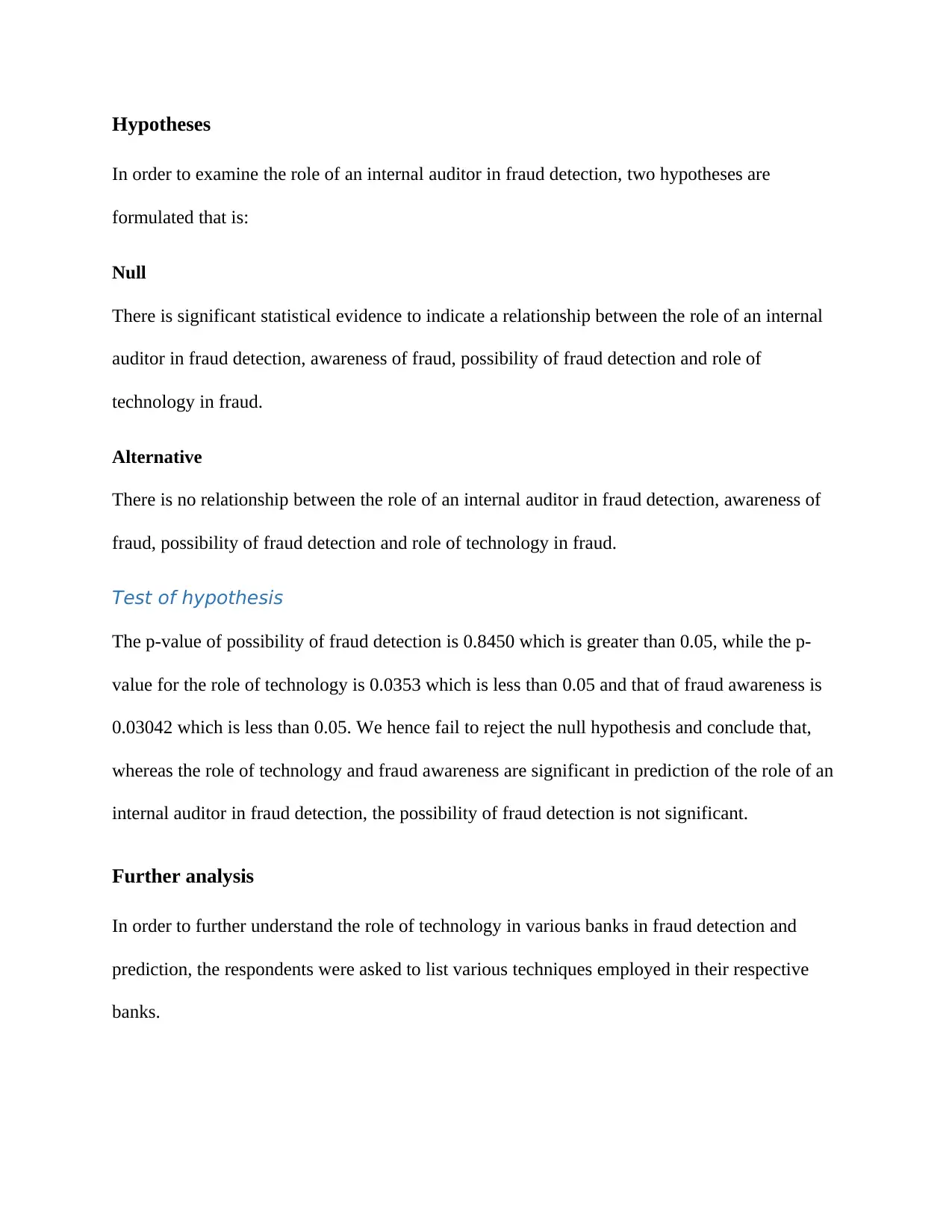

Hypotheses

In order to examine the role of an internal auditor in fraud detection, two hypotheses are

formulated that is:

Null

There is significant statistical evidence to indicate a relationship between the role of an internal

auditor in fraud detection, awareness of fraud, possibility of fraud detection and role of

technology in fraud.

Alternative

There is no relationship between the role of an internal auditor in fraud detection, awareness of

fraud, possibility of fraud detection and role of technology in fraud.

Test of hypothesis

The p-value of possibility of fraud detection is 0.8450 which is greater than 0.05, while the p-

value for the role of technology is 0.0353 which is less than 0.05 and that of fraud awareness is

0.03042 which is less than 0.05. We hence fail to reject the null hypothesis and conclude that,

whereas the role of technology and fraud awareness are significant in prediction of the role of an

internal auditor in fraud detection, the possibility of fraud detection is not significant.

Further analysis

In order to further understand the role of technology in various banks in fraud detection and

prediction, the respondents were asked to list various techniques employed in their respective

banks.

In order to examine the role of an internal auditor in fraud detection, two hypotheses are

formulated that is:

Null

There is significant statistical evidence to indicate a relationship between the role of an internal

auditor in fraud detection, awareness of fraud, possibility of fraud detection and role of

technology in fraud.

Alternative

There is no relationship between the role of an internal auditor in fraud detection, awareness of

fraud, possibility of fraud detection and role of technology in fraud.

Test of hypothesis

The p-value of possibility of fraud detection is 0.8450 which is greater than 0.05, while the p-

value for the role of technology is 0.0353 which is less than 0.05 and that of fraud awareness is

0.03042 which is less than 0.05. We hence fail to reject the null hypothesis and conclude that,

whereas the role of technology and fraud awareness are significant in prediction of the role of an

internal auditor in fraud detection, the possibility of fraud detection is not significant.

Further analysis

In order to further understand the role of technology in various banks in fraud detection and

prediction, the respondents were asked to list various techniques employed in their respective

banks.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

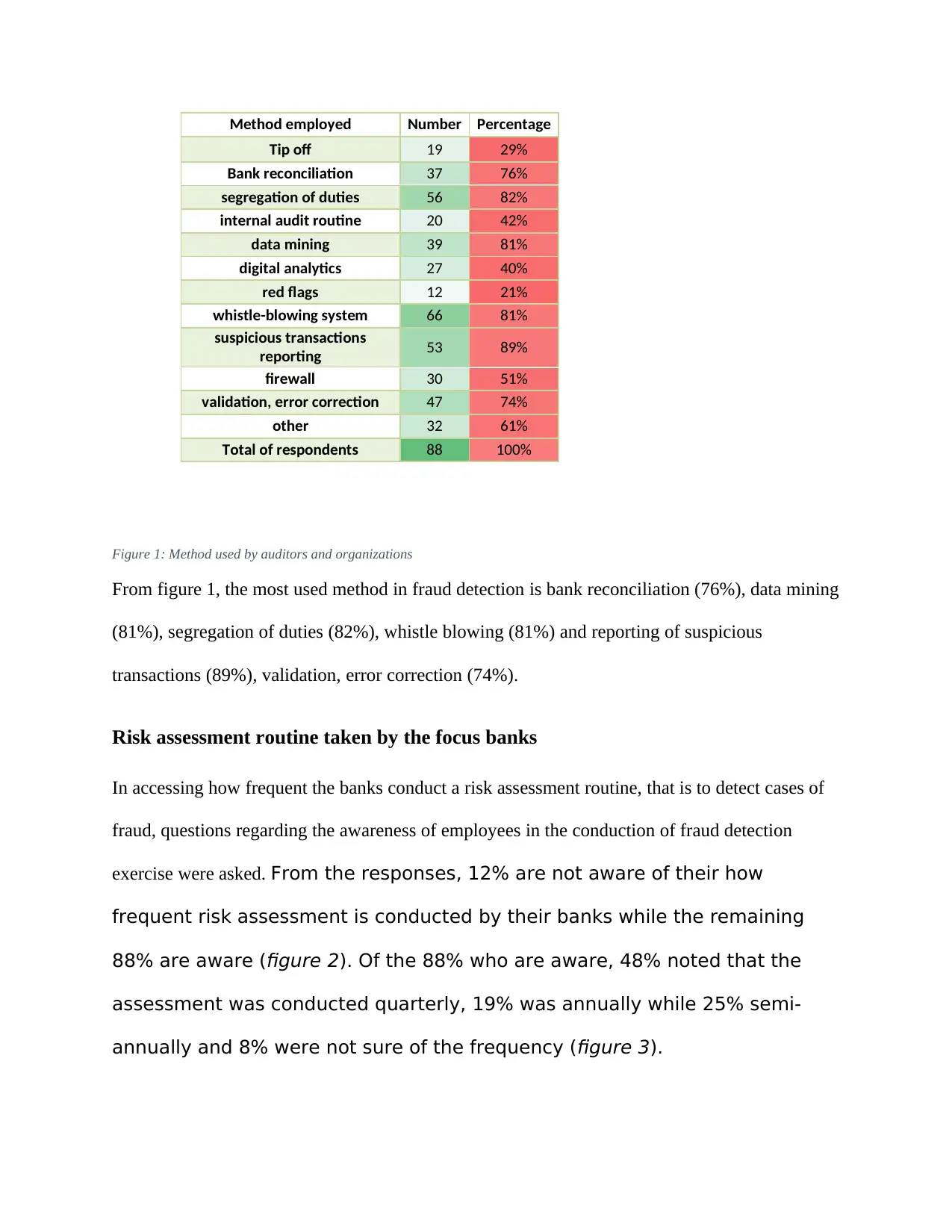

Method employed Number Percentage

Tip off 19 29%

Bank reconciliation 37 76%

segregation of duties 56 82%

internal audit routine 20 42%

data mining 39 81%

digital analytics 27 40%

red flags 12 21%

whistle-blowing system 66 81%

suspicious transactions

reporting 53 89%

firewall 30 51%

validation, error correction 47 74%

other 32 61%

Total of respondents 88 100%

Figure 1: Method used by auditors and organizations

From figure 1, the most used method in fraud detection is bank reconciliation (76%), data mining

(81%), segregation of duties (82%), whistle blowing (81%) and reporting of suspicious

transactions (89%), validation, error correction (74%).

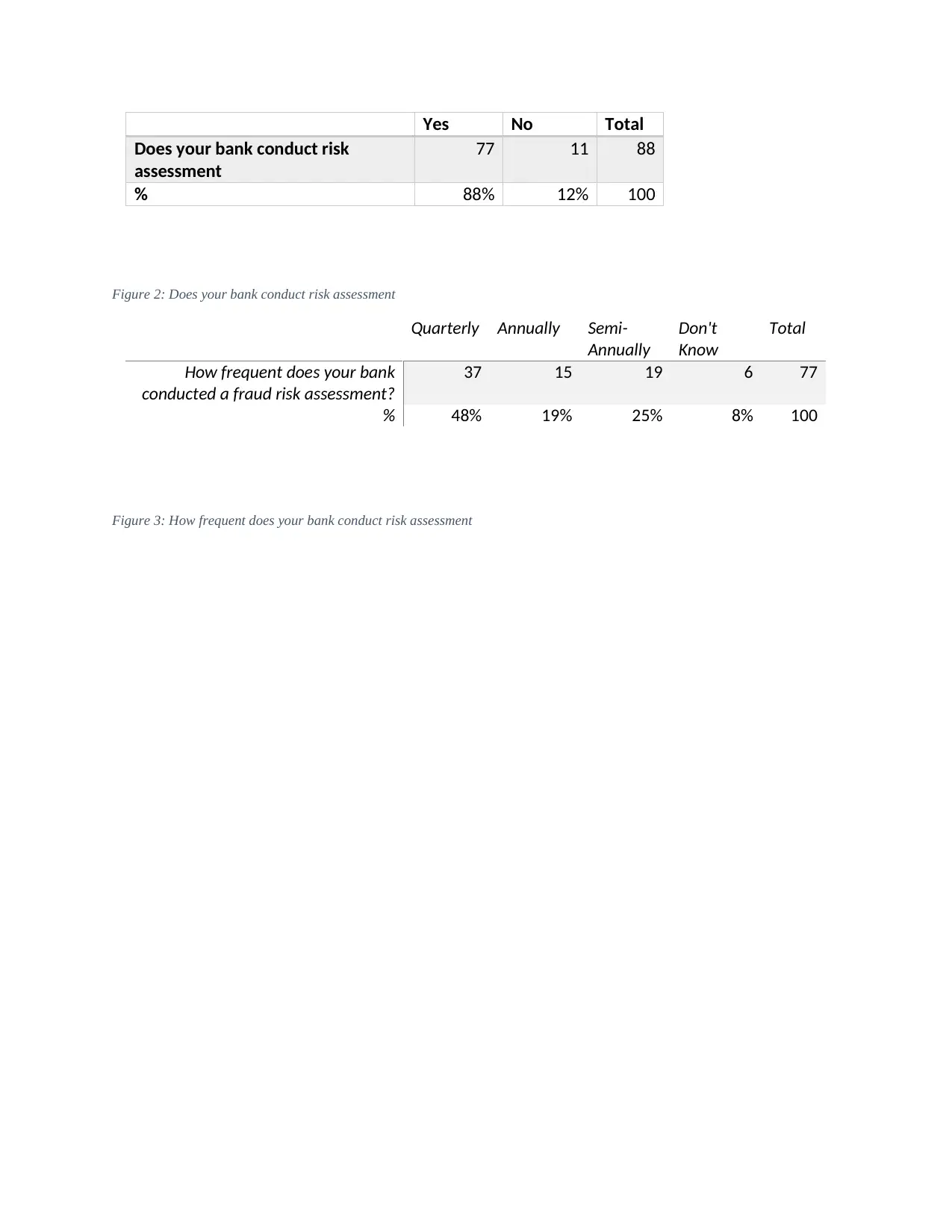

Risk assessment routine taken by the focus banks

In accessing how frequent the banks conduct a risk assessment routine, that is to detect cases of

fraud, questions regarding the awareness of employees in the conduction of fraud detection

exercise were asked. From the responses, 12% are not aware of their how

frequent risk assessment is conducted by their banks while the remaining

88% are aware (figure 2). Of the 88% who are aware, 48% noted that the

assessment was conducted quarterly, 19% was annually while 25% semi-

annually and 8% were not sure of the frequency (figure 3).

Tip off 19 29%

Bank reconciliation 37 76%

segregation of duties 56 82%

internal audit routine 20 42%

data mining 39 81%

digital analytics 27 40%

red flags 12 21%

whistle-blowing system 66 81%

suspicious transactions

reporting 53 89%

firewall 30 51%

validation, error correction 47 74%

other 32 61%

Total of respondents 88 100%

Figure 1: Method used by auditors and organizations

From figure 1, the most used method in fraud detection is bank reconciliation (76%), data mining

(81%), segregation of duties (82%), whistle blowing (81%) and reporting of suspicious

transactions (89%), validation, error correction (74%).

Risk assessment routine taken by the focus banks

In accessing how frequent the banks conduct a risk assessment routine, that is to detect cases of

fraud, questions regarding the awareness of employees in the conduction of fraud detection

exercise were asked. From the responses, 12% are not aware of their how

frequent risk assessment is conducted by their banks while the remaining

88% are aware (figure 2). Of the 88% who are aware, 48% noted that the

assessment was conducted quarterly, 19% was annually while 25% semi-

annually and 8% were not sure of the frequency (figure 3).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Yes No Total

Does your bank conduct risk

assessment

77 11 88

% 88% 12% 100

Figure 2: Does your bank conduct risk assessment

Quarterly Annually Semi-

Annually

Don't

Know

Total

How frequent does your bank

conducted a fraud risk assessment?

37 15 19 6 77

% 48% 19% 25% 8% 100

Figure 3: How frequent does your bank conduct risk assessment

Does your bank conduct risk

assessment

77 11 88

% 88% 12% 100

Figure 2: Does your bank conduct risk assessment

Quarterly Annually Semi-

Annually

Don't

Know

Total

How frequent does your bank

conducted a fraud risk assessment?

37 15 19 6 77

% 48% 19% 25% 8% 100

Figure 3: How frequent does your bank conduct risk assessment

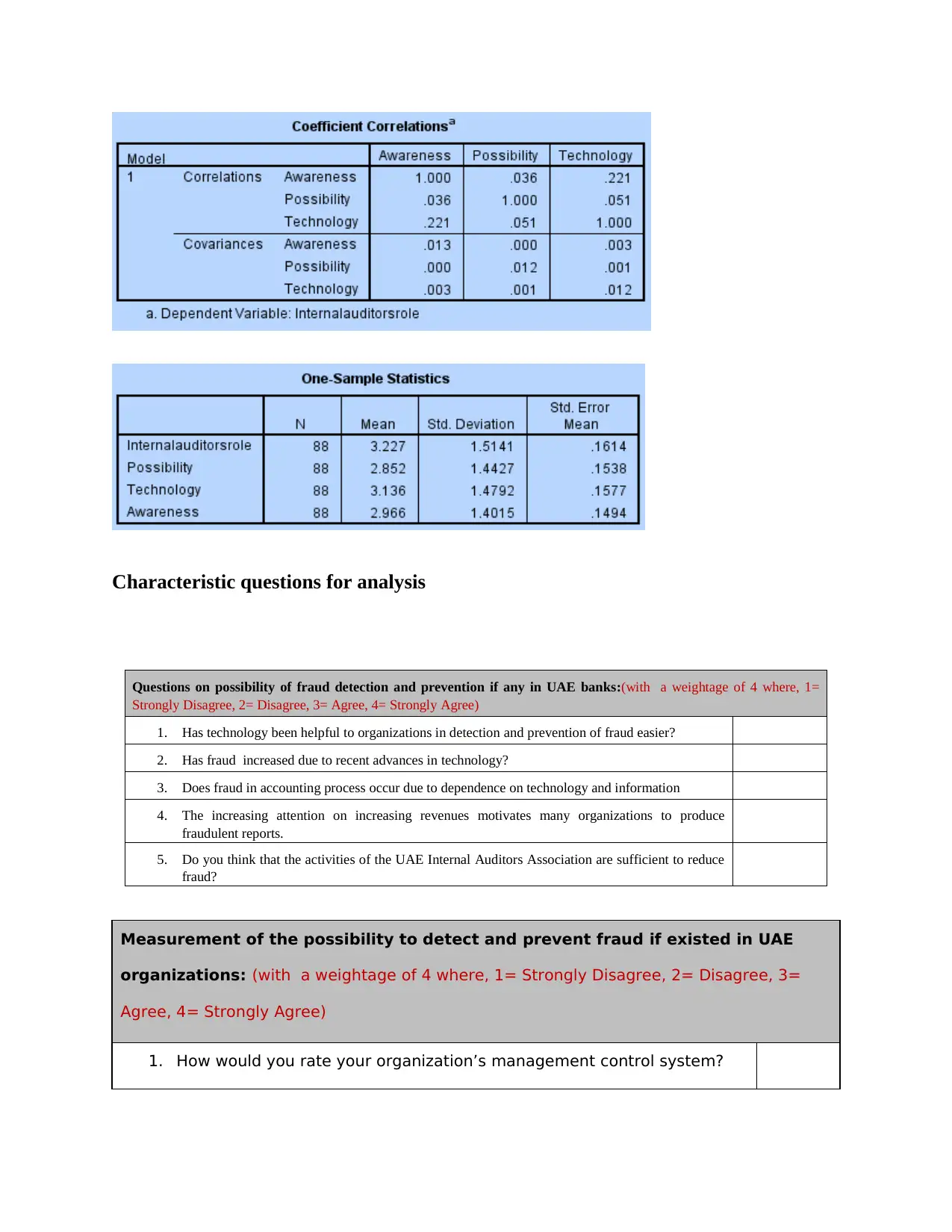

Appendix

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Regression

t-test

t-test

Characteristic questions for analysis

Questions on possibility of fraud detection and prevention if any in UAE banks:(with a weightage of 4 where, 1=

Strongly Disagree, 2= Disagree, 3= Agree, 4= Strongly Agree)

1. Has technology been helpful to organizations in detection and prevention of fraud easier?

2. Has fraud increased due to recent advances in technology?

3. Does fraud in accounting process occur due to dependence on technology and information

4. The increasing attention on increasing revenues motivates many organizations to produce

fraudulent reports.

5. Do you think that the activities of the UAE Internal Auditors Association are sufficient to reduce

fraud?

Measurement of the possibility to detect and prevent fraud if existed in UAE

organizations: (with a weightage of 4 where, 1= Strongly Disagree, 2= Disagree, 3=

Agree, 4= Strongly Agree)

1. How would you rate your organization’s management control system?

Questions on possibility of fraud detection and prevention if any in UAE banks:(with a weightage of 4 where, 1=

Strongly Disagree, 2= Disagree, 3= Agree, 4= Strongly Agree)

1. Has technology been helpful to organizations in detection and prevention of fraud easier?

2. Has fraud increased due to recent advances in technology?

3. Does fraud in accounting process occur due to dependence on technology and information

4. The increasing attention on increasing revenues motivates many organizations to produce

fraudulent reports.

5. Do you think that the activities of the UAE Internal Auditors Association are sufficient to reduce

fraud?

Measurement of the possibility to detect and prevent fraud if existed in UAE

organizations: (with a weightage of 4 where, 1= Strongly Disagree, 2= Disagree, 3=

Agree, 4= Strongly Agree)

1. How would you rate your organization’s management control system?

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.