HI5020 Corporate Accounting: Financial Statement Analysis of AUSDRILL

VerifiedAdded on 2023/06/11

|9

|1745

|409

Report

AI Summary

This report provides a detailed analysis of AUSDRILL Limited's corporate accounting practices based on its financial statements. The analysis includes a review of the cash flow statement, highlighting key items such as receipts from customers, payments to employees and suppliers, interest receipts, and income taxes paid. It also examines trends in cash flow from operations, investing activities, and financing activities. The report further discusses the other comprehensive income (OCI) statement, explaining items like exchange gains/losses on foreign operations, share of OCI from joint ventures, and gains/losses on asset revaluation. Additionally, the report covers accounting for corporate income tax, including deferred tax assets and liabilities, and reconciles the differences between accounting income and taxable income. The report concludes with personal reflections on the complexities of reconciling tax and accounting systems.

HI5020 Corporate Accounting

Assessment 2 – AUSDRILL LIMITED

STUDENT ID:

[Pick the date]

Assessment 2 – AUSDRILL LIMITED

STUDENT ID:

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Corporate Accounting

The ASX listed company that has been shortlisted is AUSDRILL.

CASH FLOWS STATEMENT

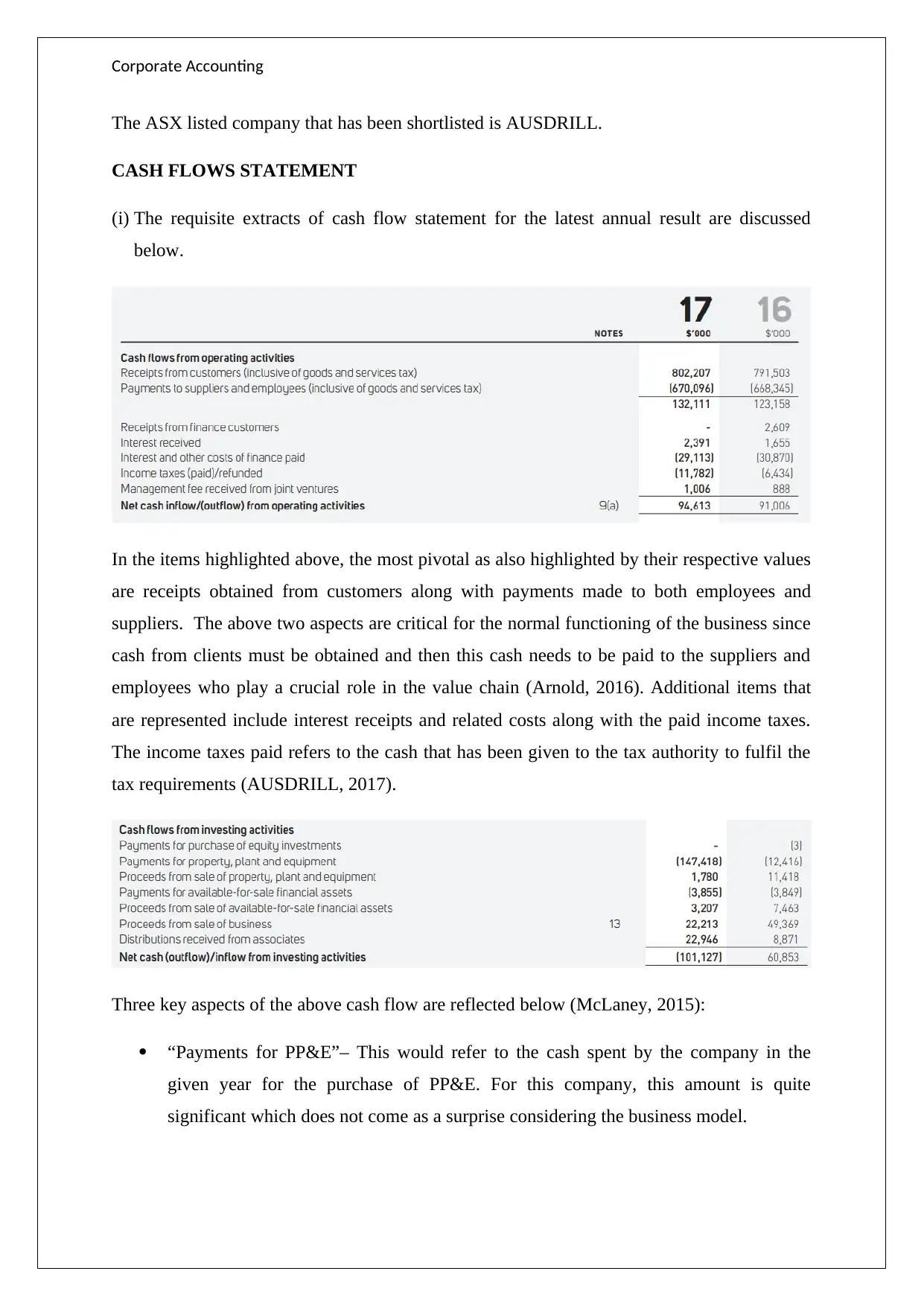

(i) The requisite extracts of cash flow statement for the latest annual result are discussed

below.

In the items highlighted above, the most pivotal as also highlighted by their respective values

are receipts obtained from customers along with payments made to both employees and

suppliers. The above two aspects are critical for the normal functioning of the business since

cash from clients must be obtained and then this cash needs to be paid to the suppliers and

employees who play a crucial role in the value chain (Arnold, 2016). Additional items that

are represented include interest receipts and related costs along with the paid income taxes.

The income taxes paid refers to the cash that has been given to the tax authority to fulfil the

tax requirements (AUSDRILL, 2017).

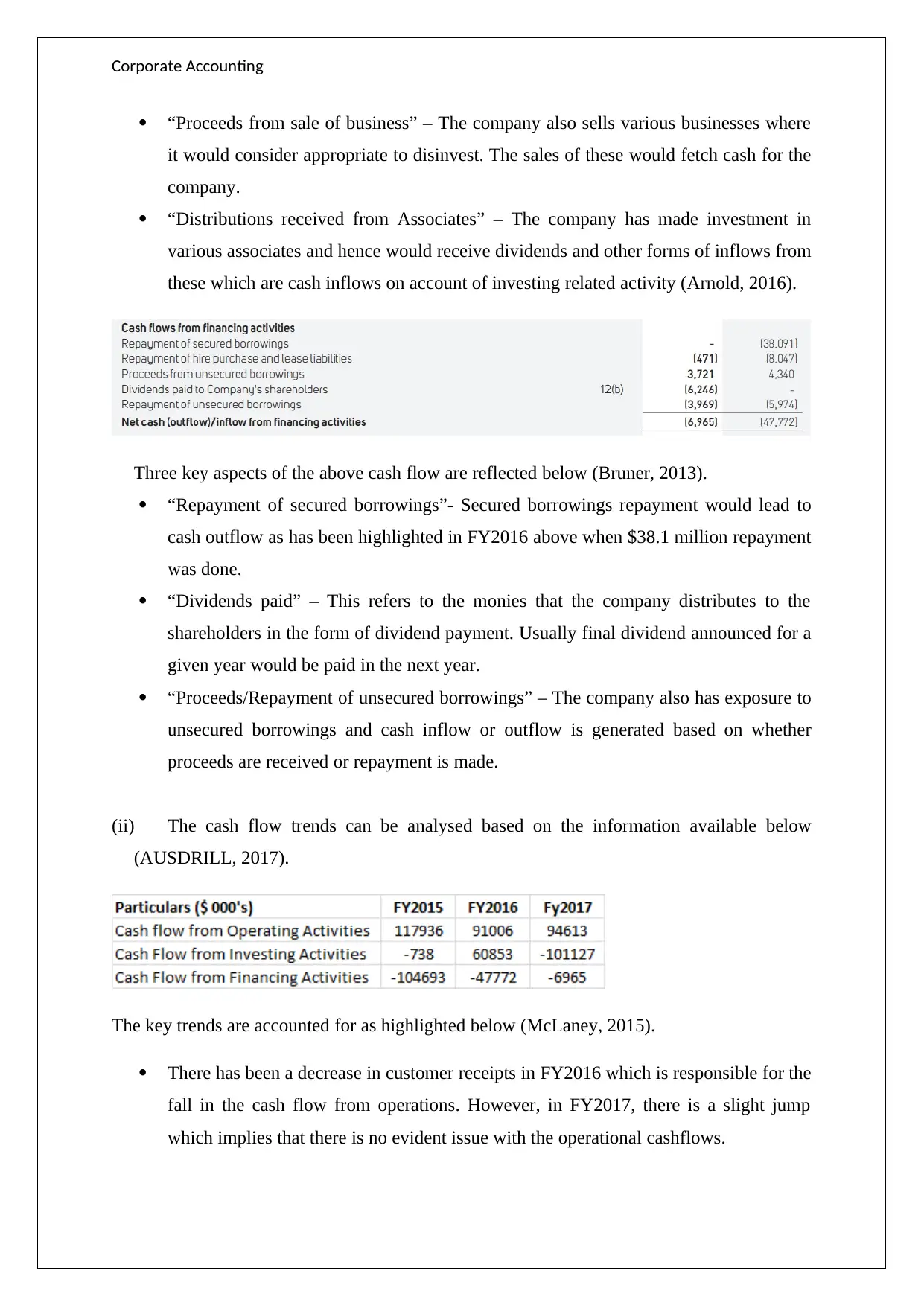

Three key aspects of the above cash flow are reflected below (McLaney, 2015):

“Payments for PP&E”– This would refer to the cash spent by the company in the

given year for the purchase of PP&E. For this company, this amount is quite

significant which does not come as a surprise considering the business model.

The ASX listed company that has been shortlisted is AUSDRILL.

CASH FLOWS STATEMENT

(i) The requisite extracts of cash flow statement for the latest annual result are discussed

below.

In the items highlighted above, the most pivotal as also highlighted by their respective values

are receipts obtained from customers along with payments made to both employees and

suppliers. The above two aspects are critical for the normal functioning of the business since

cash from clients must be obtained and then this cash needs to be paid to the suppliers and

employees who play a crucial role in the value chain (Arnold, 2016). Additional items that

are represented include interest receipts and related costs along with the paid income taxes.

The income taxes paid refers to the cash that has been given to the tax authority to fulfil the

tax requirements (AUSDRILL, 2017).

Three key aspects of the above cash flow are reflected below (McLaney, 2015):

“Payments for PP&E”– This would refer to the cash spent by the company in the

given year for the purchase of PP&E. For this company, this amount is quite

significant which does not come as a surprise considering the business model.

Corporate Accounting

“Proceeds from sale of business” – The company also sells various businesses where

it would consider appropriate to disinvest. The sales of these would fetch cash for the

company.

“Distributions received from Associates” – The company has made investment in

various associates and hence would receive dividends and other forms of inflows from

these which are cash inflows on account of investing related activity (Arnold, 2016).

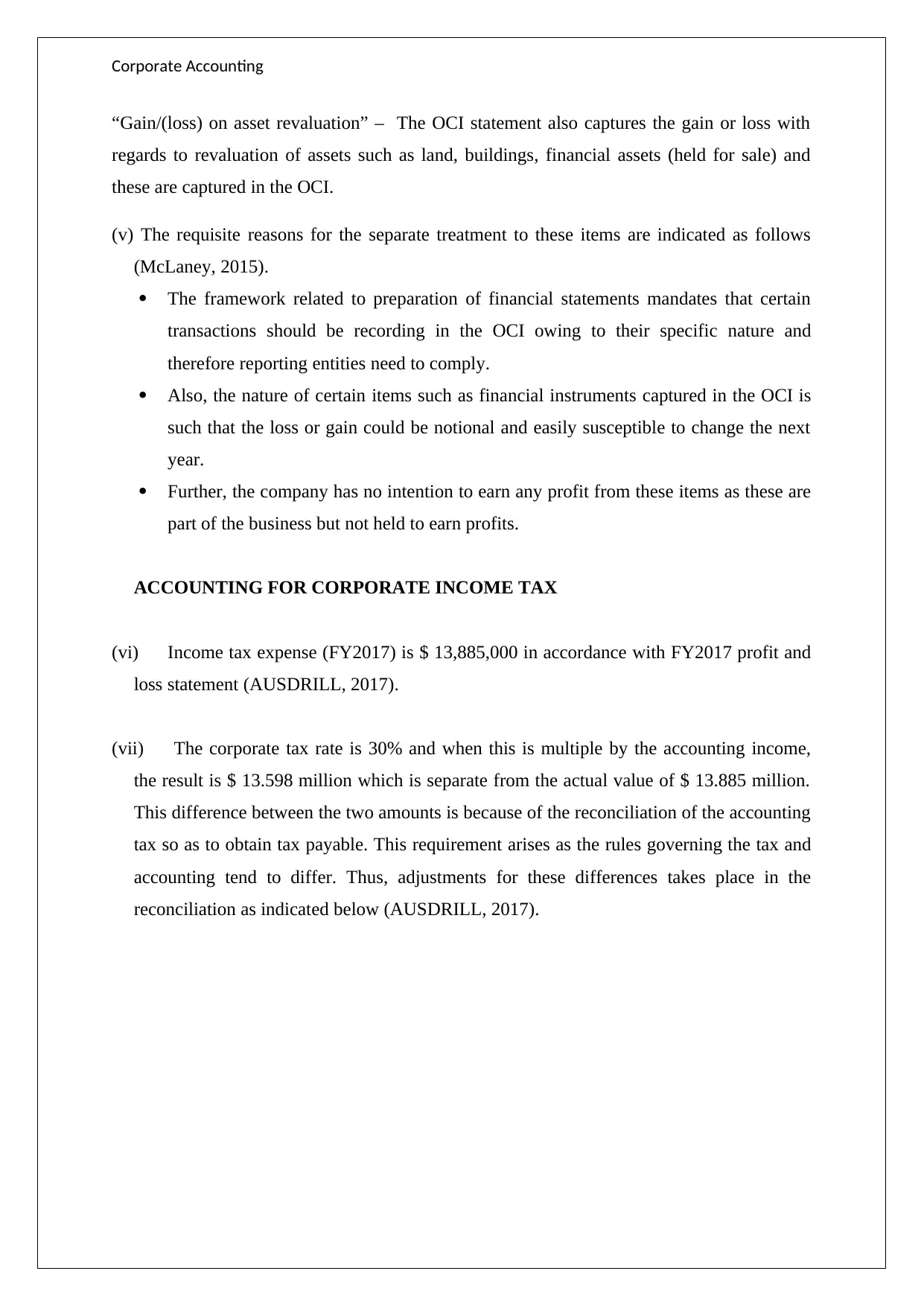

Three key aspects of the above cash flow are reflected below (Bruner, 2013).

“Repayment of secured borrowings”- Secured borrowings repayment would lead to

cash outflow as has been highlighted in FY2016 above when $38.1 million repayment

was done.

“Dividends paid” – This refers to the monies that the company distributes to the

shareholders in the form of dividend payment. Usually final dividend announced for a

given year would be paid in the next year.

“Proceeds/Repayment of unsecured borrowings” – The company also has exposure to

unsecured borrowings and cash inflow or outflow is generated based on whether

proceeds are received or repayment is made.

(ii) The cash flow trends can be analysed based on the information available below

(AUSDRILL, 2017).

The key trends are accounted for as highlighted below (McLaney, 2015).

There has been a decrease in customer receipts in FY2016 which is responsible for the

fall in the cash flow from operations. However, in FY2017, there is a slight jump

which implies that there is no evident issue with the operational cashflows.

“Proceeds from sale of business” – The company also sells various businesses where

it would consider appropriate to disinvest. The sales of these would fetch cash for the

company.

“Distributions received from Associates” – The company has made investment in

various associates and hence would receive dividends and other forms of inflows from

these which are cash inflows on account of investing related activity (Arnold, 2016).

Three key aspects of the above cash flow are reflected below (Bruner, 2013).

“Repayment of secured borrowings”- Secured borrowings repayment would lead to

cash outflow as has been highlighted in FY2016 above when $38.1 million repayment

was done.

“Dividends paid” – This refers to the monies that the company distributes to the

shareholders in the form of dividend payment. Usually final dividend announced for a

given year would be paid in the next year.

“Proceeds/Repayment of unsecured borrowings” – The company also has exposure to

unsecured borrowings and cash inflow or outflow is generated based on whether

proceeds are received or repayment is made.

(ii) The cash flow trends can be analysed based on the information available below

(AUSDRILL, 2017).

The key trends are accounted for as highlighted below (McLaney, 2015).

There has been a decrease in customer receipts in FY2016 which is responsible for the

fall in the cash flow from operations. However, in FY2017, there is a slight jump

which implies that there is no evident issue with the operational cashflows.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Corporate Accounting

The latest year i.e. FY2017 has seen significant uptick in cash outflow from investing

activities primarily on account of jump in spending on PP&E coupled with lower cash

inflows from business sale. FY2016 reported cash inflow on account of investing

activities mainly because of huge inflows on sale of business.

.

There is a deliberate attempt on the company to minimise the debt levels so that it can

raise incremental debt as and when required. Also, increasingly unsecured borrowing

is playing a more crucial role than secured borrowing.

OTHER COMPREHENSIVE INCOME STATEMENT

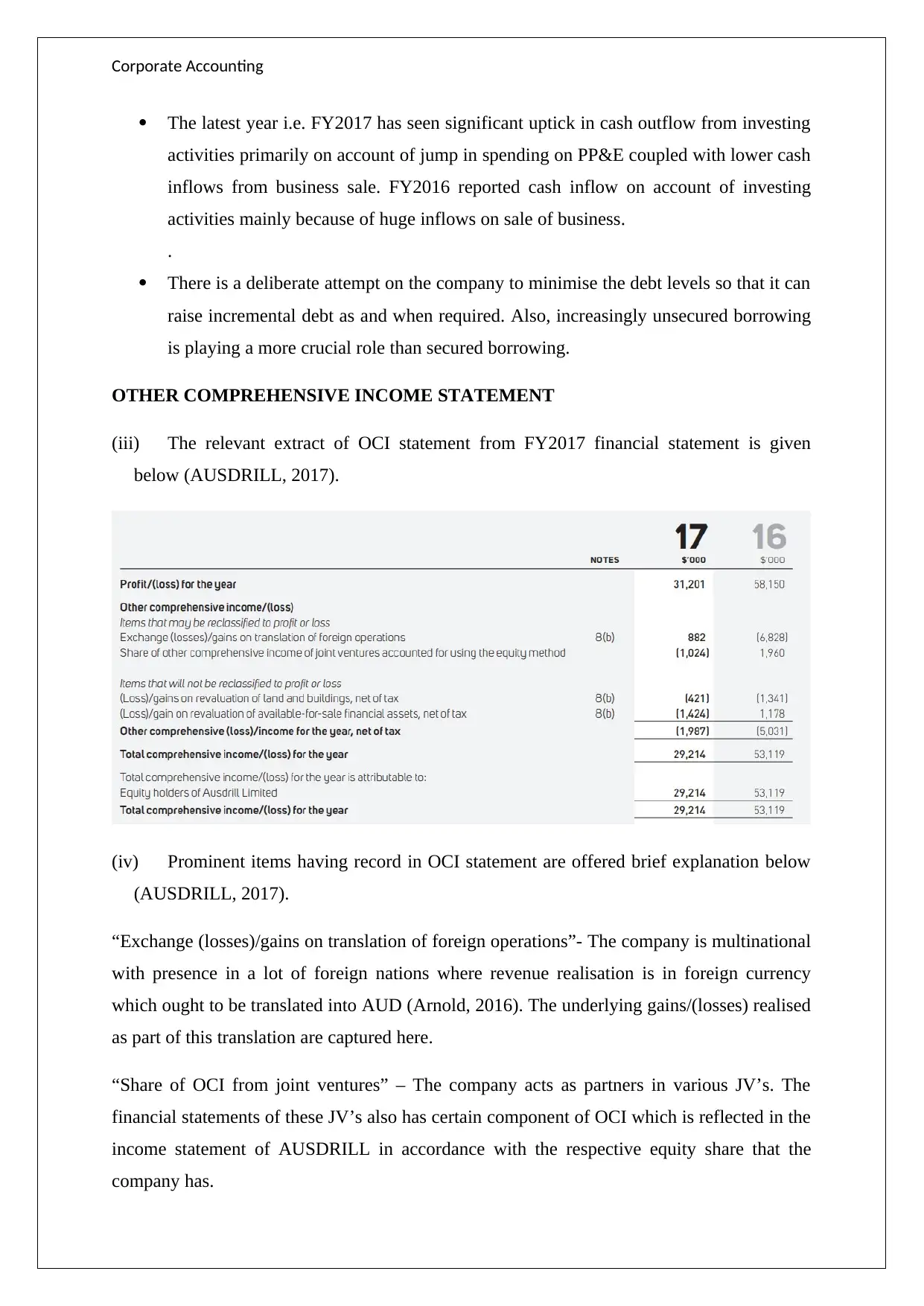

(iii) The relevant extract of OCI statement from FY2017 financial statement is given

below (AUSDRILL, 2017).

(iv) Prominent items having record in OCI statement are offered brief explanation below

(AUSDRILL, 2017).

“Exchange (losses)/gains on translation of foreign operations”- The company is multinational

with presence in a lot of foreign nations where revenue realisation is in foreign currency

which ought to be translated into AUD (Arnold, 2016). The underlying gains/(losses) realised

as part of this translation are captured here.

“Share of OCI from joint ventures” – The company acts as partners in various JV’s. The

financial statements of these JV’s also has certain component of OCI which is reflected in the

income statement of AUSDRILL in accordance with the respective equity share that the

company has.

The latest year i.e. FY2017 has seen significant uptick in cash outflow from investing

activities primarily on account of jump in spending on PP&E coupled with lower cash

inflows from business sale. FY2016 reported cash inflow on account of investing

activities mainly because of huge inflows on sale of business.

.

There is a deliberate attempt on the company to minimise the debt levels so that it can

raise incremental debt as and when required. Also, increasingly unsecured borrowing

is playing a more crucial role than secured borrowing.

OTHER COMPREHENSIVE INCOME STATEMENT

(iii) The relevant extract of OCI statement from FY2017 financial statement is given

below (AUSDRILL, 2017).

(iv) Prominent items having record in OCI statement are offered brief explanation below

(AUSDRILL, 2017).

“Exchange (losses)/gains on translation of foreign operations”- The company is multinational

with presence in a lot of foreign nations where revenue realisation is in foreign currency

which ought to be translated into AUD (Arnold, 2016). The underlying gains/(losses) realised

as part of this translation are captured here.

“Share of OCI from joint ventures” – The company acts as partners in various JV’s. The

financial statements of these JV’s also has certain component of OCI which is reflected in the

income statement of AUSDRILL in accordance with the respective equity share that the

company has.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Corporate Accounting

“Gain/(loss) on asset revaluation” – The OCI statement also captures the gain or loss with

regards to revaluation of assets such as land, buildings, financial assets (held for sale) and

these are captured in the OCI.

(v) The requisite reasons for the separate treatment to these items are indicated as follows

(McLaney, 2015).

The framework related to preparation of financial statements mandates that certain

transactions should be recording in the OCI owing to their specific nature and

therefore reporting entities need to comply.

Also, the nature of certain items such as financial instruments captured in the OCI is

such that the loss or gain could be notional and easily susceptible to change the next

year.

Further, the company has no intention to earn any profit from these items as these are

part of the business but not held to earn profits.

ACCOUNTING FOR CORPORATE INCOME TAX

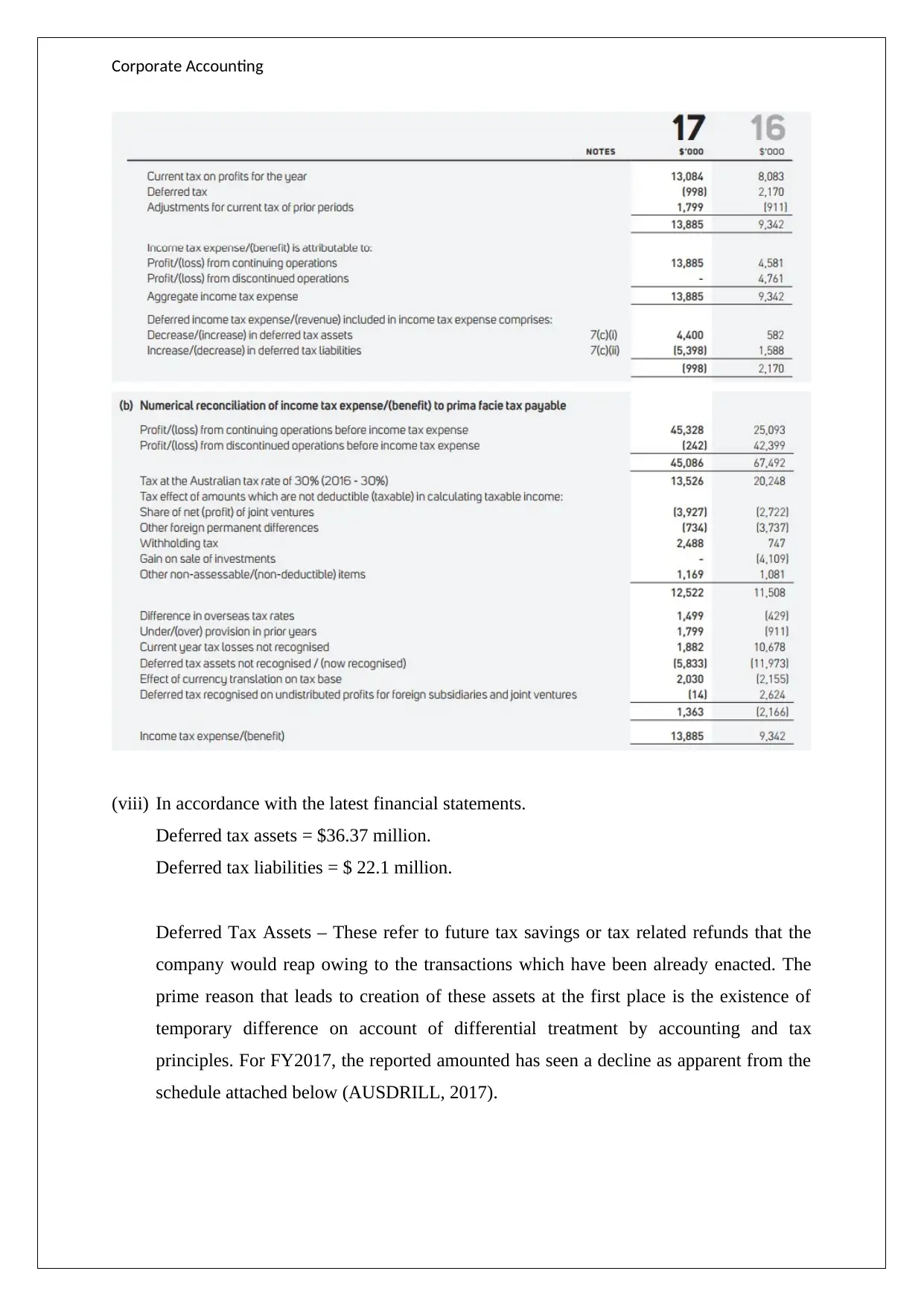

(vi) Income tax expense (FY2017) is $ 13,885,000 in accordance with FY2017 profit and

loss statement (AUSDRILL, 2017).

(vii) The corporate tax rate is 30% and when this is multiple by the accounting income,

the result is $ 13.598 million which is separate from the actual value of $ 13.885 million.

This difference between the two amounts is because of the reconciliation of the accounting

tax so as to obtain tax payable. This requirement arises as the rules governing the tax and

accounting tend to differ. Thus, adjustments for these differences takes place in the

reconciliation as indicated below (AUSDRILL, 2017).

“Gain/(loss) on asset revaluation” – The OCI statement also captures the gain or loss with

regards to revaluation of assets such as land, buildings, financial assets (held for sale) and

these are captured in the OCI.

(v) The requisite reasons for the separate treatment to these items are indicated as follows

(McLaney, 2015).

The framework related to preparation of financial statements mandates that certain

transactions should be recording in the OCI owing to their specific nature and

therefore reporting entities need to comply.

Also, the nature of certain items such as financial instruments captured in the OCI is

such that the loss or gain could be notional and easily susceptible to change the next

year.

Further, the company has no intention to earn any profit from these items as these are

part of the business but not held to earn profits.

ACCOUNTING FOR CORPORATE INCOME TAX

(vi) Income tax expense (FY2017) is $ 13,885,000 in accordance with FY2017 profit and

loss statement (AUSDRILL, 2017).

(vii) The corporate tax rate is 30% and when this is multiple by the accounting income,

the result is $ 13.598 million which is separate from the actual value of $ 13.885 million.

This difference between the two amounts is because of the reconciliation of the accounting

tax so as to obtain tax payable. This requirement arises as the rules governing the tax and

accounting tend to differ. Thus, adjustments for these differences takes place in the

reconciliation as indicated below (AUSDRILL, 2017).

Corporate Accounting

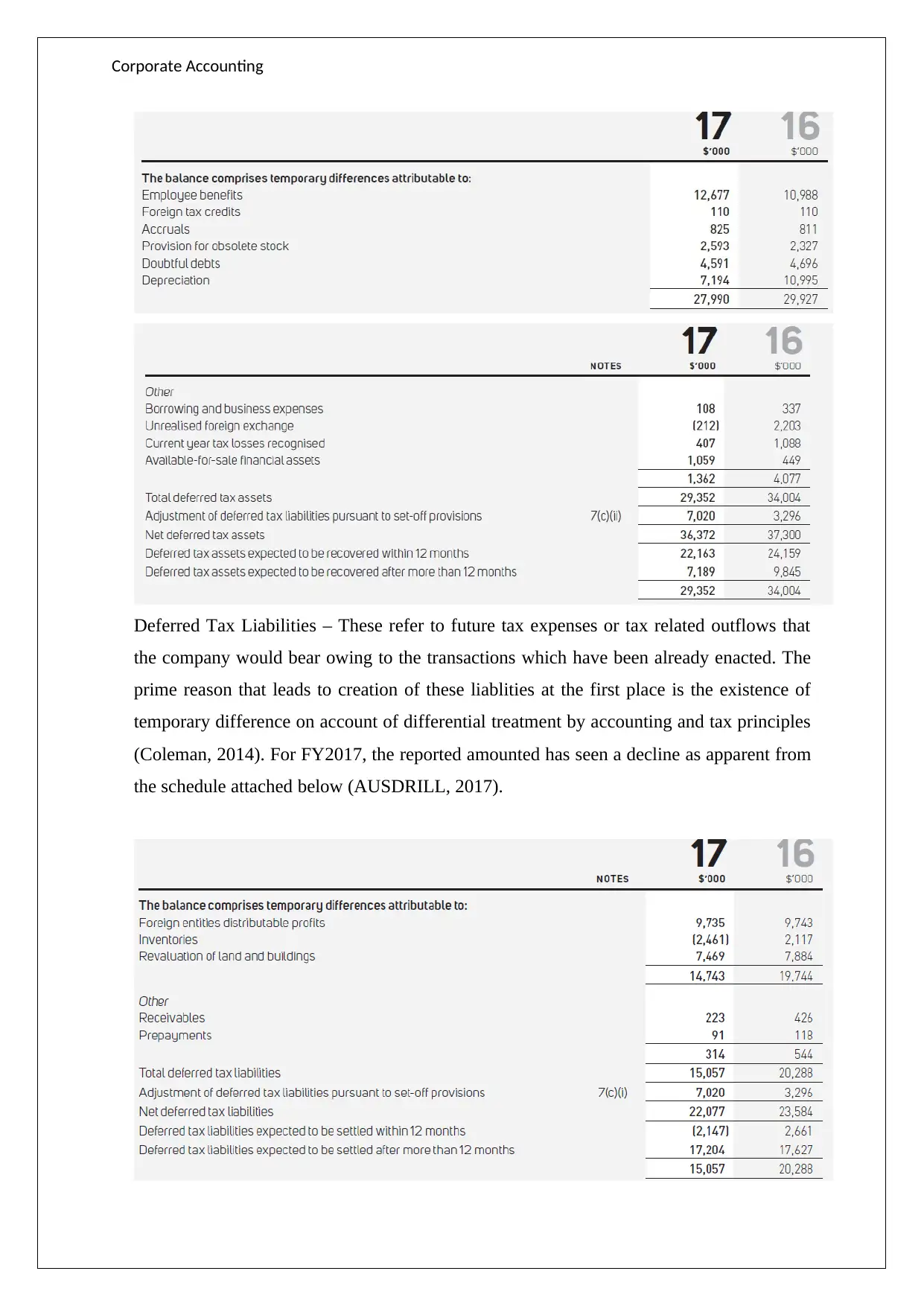

(viii) In accordance with the latest financial statements.

Deferred tax assets = $36.37 million.

Deferred tax liabilities = $ 22.1 million.

Deferred Tax Assets – These refer to future tax savings or tax related refunds that the

company would reap owing to the transactions which have been already enacted. The

prime reason that leads to creation of these assets at the first place is the existence of

temporary difference on account of differential treatment by accounting and tax

principles. For FY2017, the reported amounted has seen a decline as apparent from the

schedule attached below (AUSDRILL, 2017).

(viii) In accordance with the latest financial statements.

Deferred tax assets = $36.37 million.

Deferred tax liabilities = $ 22.1 million.

Deferred Tax Assets – These refer to future tax savings or tax related refunds that the

company would reap owing to the transactions which have been already enacted. The

prime reason that leads to creation of these assets at the first place is the existence of

temporary difference on account of differential treatment by accounting and tax

principles. For FY2017, the reported amounted has seen a decline as apparent from the

schedule attached below (AUSDRILL, 2017).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Corporate Accounting

Deferred Tax Liabilities – These refer to future tax expenses or tax related outflows that

the company would bear owing to the transactions which have been already enacted. The

prime reason that leads to creation of these liablities at the first place is the existence of

temporary difference on account of differential treatment by accounting and tax principles

(Coleman, 2014). For FY2017, the reported amounted has seen a decline as apparent from

the schedule attached below (AUSDRILL, 2017).

Deferred Tax Liabilities – These refer to future tax expenses or tax related outflows that

the company would bear owing to the transactions which have been already enacted. The

prime reason that leads to creation of these liablities at the first place is the existence of

temporary difference on account of differential treatment by accounting and tax principles

(Coleman, 2014). For FY2017, the reported amounted has seen a decline as apparent from

the schedule attached below (AUSDRILL, 2017).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Corporate Accounting

(ix) The company has reported current tax assets to the extent of $ 3.03 million in the

latest financial statements available for FY2017. This amount is lesser when compared to

the corresponding amount for FY2016 which was recorded as $4.80 million (AUSDRILL,

2017). These assets would allow the company to lower the tax outflow by the same

amount during the twelve month period of FY2018 (Coleman, 2014).

The income tax to be paid for a financial year is captured by the income tax expense.

However, income tax payable represents the outstanding tax for the year which additionally

needs to be paid over and above the tax that has already been paid for the current year on an

ongoing basis. Thus, tax payable reflects the part of the tax expense that has not been yet

paid.

(x) As is apparent from the reported numbers for FY2017, the two figures i.e. income tax

expense and the tax paid do not shoe congruence (AUSDRILL, 2017). This is on account

of the following two reasons.

Income tax expense is finalised after a given year ends and therefore tax paid in the

year is based on estimates.

Also, tax paid in a given year can potentially have some component from the

previous year in the form of current tax asset or liability which would influence the

amount paid.

(xi) One confusing aspect about the whole project was the continuation of two systems i.e.

tax and accounting and how the firms actually reconciles between the two through

mechanism such as deferred tax assets/(liabilities). Also, one aspects which was an eye

opener for me was the tax expense computation and the process of reconciliation based on

differences in tax and accounting treatment (Coleman, 2014).

(ix) The company has reported current tax assets to the extent of $ 3.03 million in the

latest financial statements available for FY2017. This amount is lesser when compared to

the corresponding amount for FY2016 which was recorded as $4.80 million (AUSDRILL,

2017). These assets would allow the company to lower the tax outflow by the same

amount during the twelve month period of FY2018 (Coleman, 2014).

The income tax to be paid for a financial year is captured by the income tax expense.

However, income tax payable represents the outstanding tax for the year which additionally

needs to be paid over and above the tax that has already been paid for the current year on an

ongoing basis. Thus, tax payable reflects the part of the tax expense that has not been yet

paid.

(x) As is apparent from the reported numbers for FY2017, the two figures i.e. income tax

expense and the tax paid do not shoe congruence (AUSDRILL, 2017). This is on account

of the following two reasons.

Income tax expense is finalised after a given year ends and therefore tax paid in the

year is based on estimates.

Also, tax paid in a given year can potentially have some component from the

previous year in the form of current tax asset or liability which would influence the

amount paid.

(xi) One confusing aspect about the whole project was the continuation of two systems i.e.

tax and accounting and how the firms actually reconciles between the two through

mechanism such as deferred tax assets/(liabilities). Also, one aspects which was an eye

opener for me was the tax expense computation and the process of reconciliation based on

differences in tax and accounting treatment (Coleman, 2014).

Corporate Accounting

References

Arnold,G. (2016). Corporate Financial Management (3rd ed.). Sydney: Finaicial Times

Management.

AUSDRILL (2017), Annual Report FY2017, [Online] Available at

http://www.ausdrill.com.au/images/ausdrill/files/20170823_AUSDRILL_ANNUAL_

REPORT_2017.pdf (Accessed May 24, 2018)

Bruner, R. F., (2013). Case Studies in Finance (7th ed.). New York City: McGraw-Hill

Education.

Coleman, C. (2014). Australian Tax Analysis (4th ed.). Sydney: Thomson Reuters

(Professional) Australia.

McLaney, E.J., (2015). Business Finance – Theory and Practice (8th ed.). New Jersey:

Prentice Hall.

References

Arnold,G. (2016). Corporate Financial Management (3rd ed.). Sydney: Finaicial Times

Management.

AUSDRILL (2017), Annual Report FY2017, [Online] Available at

http://www.ausdrill.com.au/images/ausdrill/files/20170823_AUSDRILL_ANNUAL_

REPORT_2017.pdf (Accessed May 24, 2018)

Bruner, R. F., (2013). Case Studies in Finance (7th ed.). New York City: McGraw-Hill

Education.

Coleman, C. (2014). Australian Tax Analysis (4th ed.). Sydney: Thomson Reuters

(Professional) Australia.

McLaney, E.J., (2015). Business Finance – Theory and Practice (8th ed.). New Jersey:

Prentice Hall.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.