Australian Taxation Law 2017

VerifiedAdded on 2020/02/19

|13

|2699

|29

AI Summary

This document provides a summary of key Australian tax laws relevant to the 2017 financial year. It covers various topics such as allowable work-related travel expenses, self-education expenses deductions, excess contributions tax, individual income tax rates, legal interpretations of specific tax rulings, and guidance for performing artists. The information is sourced from official ATO publications and resources.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: AUSTRALIA TAXATION LAW

Australia Taxation Law

Name of the University:

Name of the Student:

Authors Note:

Australia Taxation Law

Name of the University:

Name of the Student:

Authors Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1AUSTRALIA TAXATION LAW

Table of Contents

Question 1: Advising Client on the following items to be treated for tax purposes under

Australian Tax Law....................................................................................................................2

Answer to i)................................................................................................................................2

Answer to ii)...............................................................................................................................2

Answer to iii)..............................................................................................................................3

Answer to iv)..............................................................................................................................4

Answer to v)...............................................................................................................................4

Answer to vi)..............................................................................................................................5

Answer to vii).............................................................................................................................6

Answer to viii)............................................................................................................................7

Answer to ix)..............................................................................................................................8

Answer to x)...............................................................................................................................8

Question 2: Calculating Manpreet’s net tax payable for the year 2016/17 financial year.........9

Reference..................................................................................................................................12

Table of Contents

Question 1: Advising Client on the following items to be treated for tax purposes under

Australian Tax Law....................................................................................................................2

Answer to i)................................................................................................................................2

Answer to ii)...............................................................................................................................2

Answer to iii)..............................................................................................................................3

Answer to iv)..............................................................................................................................4

Answer to v)...............................................................................................................................4

Answer to vi)..............................................................................................................................5

Answer to vii).............................................................................................................................6

Answer to viii)............................................................................................................................7

Answer to ix)..............................................................................................................................8

Answer to x)...............................................................................................................................8

Question 2: Calculating Manpreet’s net tax payable for the year 2016/17 financial year.........9

Reference..................................................................................................................................12

2AUSTRALIA TAXATION LAW

Question 1: Advising Client on the following items to be treated for tax purposes under

Australian Tax Law

Answer to i)

The relevant point that is provided by Airline Company does not come under the

taxation ruling, which directly indicates that this type of benefit cannot be considered as a

income. However, there are certain rules regarding the benefits provided by a company to its

employees, which directly comes under fringe benefit tax. There are certain scenarios where

the reward points could be considered under the fringe benefit tax. For instances if the reward

points are received by the employee in form of benefits provided by the employer then it

could be considered as taxable amount coming under fringe benefit tax. The second instance

is mainly when the reward points are provided to the employee in a particular arrangement

with its company. However, in the particular case there are no circumstances identified,

which directly indicates that there will be no taxation on the reward points provided by the

Airline Company. The Taxation Ruling 1999/6 is mainly states that fight reward received by

employee from employer paid expenses is not considered under assessable income. The case

related to Foster J of the Federal Court in Payne v. FC of T (1996) 66 FCR 299; 96 ATC

4407; (1996) 32 ATR 516 (Payne's case) can be identified from the Tax ruling of 1999/61.

Answer to ii)

The overall case mainly depicts that damage payment has been conducted by the

service receiver, which directly states that overall tax needs to be provided by service

receiver. The damage that was conducted to the Capital Asset does not come under the

1 Legal Database (2017) Ato.gov.au <https://www.ato.gov.au/law/view/document?

docid=TXR/TR19996/NAT/ATO/00001>

Question 1: Advising Client on the following items to be treated for tax purposes under

Australian Tax Law

Answer to i)

The relevant point that is provided by Airline Company does not come under the

taxation ruling, which directly indicates that this type of benefit cannot be considered as a

income. However, there are certain rules regarding the benefits provided by a company to its

employees, which directly comes under fringe benefit tax. There are certain scenarios where

the reward points could be considered under the fringe benefit tax. For instances if the reward

points are received by the employee in form of benefits provided by the employer then it

could be considered as taxable amount coming under fringe benefit tax. The second instance

is mainly when the reward points are provided to the employee in a particular arrangement

with its company. However, in the particular case there are no circumstances identified,

which directly indicates that there will be no taxation on the reward points provided by the

Airline Company. The Taxation Ruling 1999/6 is mainly states that fight reward received by

employee from employer paid expenses is not considered under assessable income. The case

related to Foster J of the Federal Court in Payne v. FC of T (1996) 66 FCR 299; 96 ATC

4407; (1996) 32 ATR 516 (Payne's case) can be identified from the Tax ruling of 1999/61.

Answer to ii)

The overall case mainly depicts that damage payment has been conducted by the

service receiver, which directly states that overall tax needs to be provided by service

receiver. The damage that was conducted to the Capital Asset does not come under the

1 Legal Database (2017) Ato.gov.au <https://www.ato.gov.au/law/view/document?

docid=TXR/TR19996/NAT/ATO/00001>

3AUSTRALIA TAXATION LAW

taxable amount of the payment receiver. This directly indicates that the service receiver needs

to pay the overall tax for the capital damage that is been conducted. However, there are some

points that need to be considered before identifying the Asset to be taxed. That should be

considered as a capital and needs to be utilised by the organisation thoroughly. In addition,

the asset should also be depreciated under the depreciation clause and should be shown in the

annual report. Thus, the compensation payment of crane is not considered under taxable

income. The Taxation Ruling TR 95/35 mainly states the treatment of compensation receipts

by companies for their assets. The ruling directly states that compensation received for

damaged capital assets are not considered under assessable income of the individual2.

Answer to iii)

The overall case mainly indicates that the there is relevant gift, which is provided by

the supplier to the nightclub manager. However, according to the Australian taxation law for

individuals, gifts of small kind is relevantly not considered, while big and expensive gifts are

taken into consideration for the taxable income. In addition, the big gifts that could be

converted into cash or amounts of high cash value could be considered under the taxable

income of the receiver. Therefore, in the case scenario the manager of the nightclub has

received the overall a package for the overseas holidays, which has relevant monetary

benefits that is been received by the manager. This only indicates that individual taxation of

the manger will include the overall overseas packages provided by the supplier. TD 2016/14

mainly depicts that overall no deductions are provided when individual provide gifts3.

2 Legal Database (2017) Ato.gov.au <https://www.ato.gov.au/law/view/document?

DocID=TXR/TR9535/NAT/ATO/00001&PiT=99991231235958#P29>

3 Morgan, John, TD 2016/14 – A General Deduction Is Allowed For Gifts To Clients Of A

Business (Query Whether It Be Aimed At Getting Future Income) (2017) Tax Technical

taxable amount of the payment receiver. This directly indicates that the service receiver needs

to pay the overall tax for the capital damage that is been conducted. However, there are some

points that need to be considered before identifying the Asset to be taxed. That should be

considered as a capital and needs to be utilised by the organisation thoroughly. In addition,

the asset should also be depreciated under the depreciation clause and should be shown in the

annual report. Thus, the compensation payment of crane is not considered under taxable

income. The Taxation Ruling TR 95/35 mainly states the treatment of compensation receipts

by companies for their assets. The ruling directly states that compensation received for

damaged capital assets are not considered under assessable income of the individual2.

Answer to iii)

The overall case mainly indicates that the there is relevant gift, which is provided by

the supplier to the nightclub manager. However, according to the Australian taxation law for

individuals, gifts of small kind is relevantly not considered, while big and expensive gifts are

taken into consideration for the taxable income. In addition, the big gifts that could be

converted into cash or amounts of high cash value could be considered under the taxable

income of the receiver. Therefore, in the case scenario the manager of the nightclub has

received the overall a package for the overseas holidays, which has relevant monetary

benefits that is been received by the manager. This only indicates that individual taxation of

the manger will include the overall overseas packages provided by the supplier. TD 2016/14

mainly depicts that overall no deductions are provided when individual provide gifts3.

2 Legal Database (2017) Ato.gov.au <https://www.ato.gov.au/law/view/document?

DocID=TXR/TR9535/NAT/ATO/00001&PiT=99991231235958#P29>

3 Morgan, John, TD 2016/14 – A General Deduction Is Allowed For Gifts To Clients Of A

Business (Query Whether It Be Aimed At Getting Future Income) (2017) Tax Technical

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4AUSTRALIA TAXATION LAW

Answer to iv)

The overall scenario mainly indicates that extra funds were mainly collected from the

members for the purchase of Canoe for the club. This mainly helped in understanding that

individuals use the funds donated to Canoe club is not deductable under the taxation method.

Thus, any returns provided from the club cannot be considered an additional income. The

overall income for the individual members has already induced the overall funds that are paid

to be club. Therefore, the overall individual’s income tax of the members will not reflect the

returns of the money provided by the club as additional income and will be reflected as

taxable income4.

Answer to v)

The overall case scenario mainly indicates that relevant payment is been conducted to

a football player by a television company. According to the Taxation ruling in Australian TR

1999/17, it directly indicates that any sports person gaining income from individuals for its

performance in sports needs to be considered under taxable income. This mainly indicates

that the relevant income generated by the sports person from the television company will be

considered, as the taxable income. Therefore, the individual taxation law indicates that

relevant taxes needs to be paid by the footballer, as the money provided by the television

company is directly considered as taxable income. The taxable income needs to be considered

http://taxtechnical.com.au/td-201614-a-general-deduction-is-allowed-for-gifts-to-clients-of-a-

business-query-whether-it-be-aimed-at-getting-future-income/

4 Excess Contributions Tax Learner Guide (2017) Ato.gov.au

https://www.ato.gov.au/Super/APRA-regulated-funds/In-detail/APRA-resources/Learner-

guides/Excess-Contributions-Tax-learner-guide/?page=52

Answer to iv)

The overall scenario mainly indicates that extra funds were mainly collected from the

members for the purchase of Canoe for the club. This mainly helped in understanding that

individuals use the funds donated to Canoe club is not deductable under the taxation method.

Thus, any returns provided from the club cannot be considered an additional income. The

overall income for the individual members has already induced the overall funds that are paid

to be club. Therefore, the overall individual’s income tax of the members will not reflect the

returns of the money provided by the club as additional income and will be reflected as

taxable income4.

Answer to v)

The overall case scenario mainly indicates that relevant payment is been conducted to

a football player by a television company. According to the Taxation ruling in Australian TR

1999/17, it directly indicates that any sports person gaining income from individuals for its

performance in sports needs to be considered under taxable income. This mainly indicates

that the relevant income generated by the sports person from the television company will be

considered, as the taxable income. Therefore, the individual taxation law indicates that

relevant taxes needs to be paid by the footballer, as the money provided by the television

company is directly considered as taxable income. The taxable income needs to be considered

http://taxtechnical.com.au/td-201614-a-general-deduction-is-allowed-for-gifts-to-clients-of-a-

business-query-whether-it-be-aimed-at-getting-future-income/

4 Excess Contributions Tax Learner Guide (2017) Ato.gov.au

https://www.ato.gov.au/Super/APRA-regulated-funds/In-detail/APRA-resources/Learner-

guides/Excess-Contributions-Tax-learner-guide/?page=52

5AUSTRALIA TAXATION LAW

under the rulings TR 1999/17, where relevant taxes need to be paid by the footballer5.

Relevant measures are taken into consideration, where Income Tax Assessment Act

1936 (ITAA 1936) or the Income Tax Assessment Act 1997 (ITAA 1997) could be used. In

addition, relevant section 6-5 of the Income Tax Assessment Act 1996 helps in deriving the

ordinary income and detect the overall assemble income of an individual.

Answer to vi)

The overall scenario mainly indicates that expenses related to building qualification

for a building apprentice is been conducted. According to TR 95/22 relevant consideration for

the deduction of allowance to the employees of the construction company could be

identified6. This mainly indicates that relevant expenses conducted on the building

apprentices is relevantly deducted for the construction company. Therefore, the overall

expenses conducted by the construction could be used as deductible expenses, which directly

reduce the overall taxable amount of the company. There are relevant sections, which could

be seen under sections 25, 26AD, 27A, 27C, 27F and paragraphs 26(e) and 26(eaa) of

the Income Tax Assessment Act 1936 (the Act). There are relevant abbreviations mentioned in

TR 95/22, which are depicted as follows.

The labours, trainees, carpenters, and apprentices used for building are mainly considered

under the ruling.

The overall supervisors work conducted for the building purpose and project manager’s

work is considered under this ruling.

5 Legal Database (2017) Ato.gov.au https://www.ato.gov.au/law/view/document?

DocID=TXR/TR199917/NAT/ATO/00001&PiT=99991231235958

6 Legal Database (2017) Ato.gov.au <https://www.ato.gov.au/law/view/document?

docid=TXR/TR9522/NAT/ATO/00001>

under the rulings TR 1999/17, where relevant taxes need to be paid by the footballer5.

Relevant measures are taken into consideration, where Income Tax Assessment Act

1936 (ITAA 1936) or the Income Tax Assessment Act 1997 (ITAA 1997) could be used. In

addition, relevant section 6-5 of the Income Tax Assessment Act 1996 helps in deriving the

ordinary income and detect the overall assemble income of an individual.

Answer to vi)

The overall scenario mainly indicates that expenses related to building qualification

for a building apprentice is been conducted. According to TR 95/22 relevant consideration for

the deduction of allowance to the employees of the construction company could be

identified6. This mainly indicates that relevant expenses conducted on the building

apprentices is relevantly deducted for the construction company. Therefore, the overall

expenses conducted by the construction could be used as deductible expenses, which directly

reduce the overall taxable amount of the company. There are relevant sections, which could

be seen under sections 25, 26AD, 27A, 27C, 27F and paragraphs 26(e) and 26(eaa) of

the Income Tax Assessment Act 1936 (the Act). There are relevant abbreviations mentioned in

TR 95/22, which are depicted as follows.

The labours, trainees, carpenters, and apprentices used for building are mainly considered

under the ruling.

The overall supervisors work conducted for the building purpose and project manager’s

work is considered under this ruling.

5 Legal Database (2017) Ato.gov.au https://www.ato.gov.au/law/view/document?

DocID=TXR/TR199917/NAT/ATO/00001&PiT=99991231235958

6 Legal Database (2017) Ato.gov.au <https://www.ato.gov.au/law/view/document?

docid=TXR/TR9522/NAT/ATO/00001>

6AUSTRALIA TAXATION LAW

Therefore, the overall expenses conducted in the scenario mainly indicate that an expense

conducted on the building apprentice is directly stated as compensation, which is deductible

under the Taxation Ruling. The ruling also states whether the deduction is allowable or not

with the help of under subsections 51(1), 51(4) or 51(6), or sections 51AB, 51AF, 51AGA,

51AH, 51AL, 53, 54, 55, 61 or 82A of the Act.

Answer to vii)

The relevant situation mainly indicates that relevant expenses are mainly conducted

for a short course in art management in hope of becoming an art director. This directly

indicates that overall expenses are mainly conducted to enhance the career of an individual,

which under the taxation law of Australia is deductable from the taxable amount. However,

there are certain criteria’s, which needs to be evaluated before identifying the expenses as

deductable from taxable income. There are relevant criteria’s that need to be followed such as

education module and software that is conducted by the individual needs to improve its

income in future. In addition, short term fees course are mainly allowed as deduction, while

other education facilities are ignored. The D4 work related expense directly states that

relevant expenses of the course fees could be conducted for reducing the taxable income7.

Therefore, the situation where the individual used a short term course to enhance its

career and become the art director is considered under the deductions of taxation. Hence, the

deductions could directly help in reducing the overall taxable income of the individual.

Therefore, according to the D4 clause in ATO relevant expenses conducted by individual on

courses, which is work related is mainly deductable in nature.

7 D4 Work-Related Self-Education Expenses 2017 (2017) Ato.gov.au

<https://www.ato.gov.au/Individuals/Tax-Return/2017/Tax-return/Deduction-questions-D1-

D10/D4-Work-related-self-education-expenses-2017/?=redirected>

Therefore, the overall expenses conducted in the scenario mainly indicate that an expense

conducted on the building apprentice is directly stated as compensation, which is deductible

under the Taxation Ruling. The ruling also states whether the deduction is allowable or not

with the help of under subsections 51(1), 51(4) or 51(6), or sections 51AB, 51AF, 51AGA,

51AH, 51AL, 53, 54, 55, 61 or 82A of the Act.

Answer to vii)

The relevant situation mainly indicates that relevant expenses are mainly conducted

for a short course in art management in hope of becoming an art director. This directly

indicates that overall expenses are mainly conducted to enhance the career of an individual,

which under the taxation law of Australia is deductable from the taxable amount. However,

there are certain criteria’s, which needs to be evaluated before identifying the expenses as

deductable from taxable income. There are relevant criteria’s that need to be followed such as

education module and software that is conducted by the individual needs to improve its

income in future. In addition, short term fees course are mainly allowed as deduction, while

other education facilities are ignored. The D4 work related expense directly states that

relevant expenses of the course fees could be conducted for reducing the taxable income7.

Therefore, the situation where the individual used a short term course to enhance its

career and become the art director is considered under the deductions of taxation. Hence, the

deductions could directly help in reducing the overall taxable income of the individual.

Therefore, according to the D4 clause in ATO relevant expenses conducted by individual on

courses, which is work related is mainly deductable in nature.

7 D4 Work-Related Self-Education Expenses 2017 (2017) Ato.gov.au

<https://www.ato.gov.au/Individuals/Tax-Return/2017/Tax-return/Deduction-questions-D1-

D10/D4-Work-related-self-education-expenses-2017/?=redirected>

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7AUSTRALIA TAXATION LAW

Answer to viii)

Situation many indicates that relevant expenses on makeup and dresses related to

work are conducted by the individual. There is relevant taxation deduction for the expenses

conducted on artist who is going to perform. These tax deductions are mainly limited to

specified or subsequent individuals who are artists and can be provided the relevant

exemptions. Performing artist mentioned in the taxation rule can be an actor, singer, variety

artist, musician, circus performer, and dancer. Therefore, any kind of expenses that is

conducted on the performing artist is allowed, as a deduction on the taxable amount. Hence,

the expenses conducted on the makeup and dresses which work related are mainly deductible

from taxable income8. The performing artist clause mainly states that any kind of expenses,

which is conducted for work related, is deductible in nature. Therefore, the expenses

conducted on makeup and dresses are directly related to work expenses. The Taxation ruling

of TR 93/30 directly states any kind of expenses, which is directly related to work is

deductible in nature.

Answer to ix)

The situation many states in that overall expenses are been conducted by an individual

travelling from home to work. This only indicates that relevant deductions could be possible

under the taxation law, which travelling related to work activity could be deducted from the

taxable amount. However, any kind of non official expense that is conducted on travelling

cannot be identified, as the deductible expenses from the taxable income. Moreover, it is

assumed that the expenses conducted on travelling from home to office are for official

purposes, which is deductible in nature according to the Australian taxation law. However, on

a different assumption if the expenses conducted on travelling are for personal use then it is

8 Performing Artists 2017 (2017) Ato.gov.au <https://www.ato.gov.au/Forms/Performing-

artists-2017/>

Answer to viii)

Situation many indicates that relevant expenses on makeup and dresses related to

work are conducted by the individual. There is relevant taxation deduction for the expenses

conducted on artist who is going to perform. These tax deductions are mainly limited to

specified or subsequent individuals who are artists and can be provided the relevant

exemptions. Performing artist mentioned in the taxation rule can be an actor, singer, variety

artist, musician, circus performer, and dancer. Therefore, any kind of expenses that is

conducted on the performing artist is allowed, as a deduction on the taxable amount. Hence,

the expenses conducted on the makeup and dresses which work related are mainly deductible

from taxable income8. The performing artist clause mainly states that any kind of expenses,

which is conducted for work related, is deductible in nature. Therefore, the expenses

conducted on makeup and dresses are directly related to work expenses. The Taxation ruling

of TR 93/30 directly states any kind of expenses, which is directly related to work is

deductible in nature.

Answer to ix)

The situation many states in that overall expenses are been conducted by an individual

travelling from home to work. This only indicates that relevant deductions could be possible

under the taxation law, which travelling related to work activity could be deducted from the

taxable amount. However, any kind of non official expense that is conducted on travelling

cannot be identified, as the deductible expenses from the taxable income. Moreover, it is

assumed that the expenses conducted on travelling from home to office are for official

purposes, which is deductible in nature according to the Australian taxation law. However, on

a different assumption if the expenses conducted on travelling are for personal use then it is

8 Performing Artists 2017 (2017) Ato.gov.au <https://www.ato.gov.au/Forms/Performing-

artists-2017/>

8AUSTRALIA TAXATION LAW

not deductible according to the Australian taxation law. Therefore, determination of the

expense is necessary for identifying the overall measure that could be conducted on taxable

income9. Under the ruling of D2 relevant work related travel expense are directly deductible

in nature, which could help in reducing the overall assessable income of an individual. The

Taxation ruling TR 95/34 mainly includes relevant employees carrying out itinerant work.

Answer to x)

The scenario mainly states that overall expenses on travel are mainly conducted by

the individual for office purposes. This overall expenses conducted on travel is mainly

productively nature according to the Australian taxation law. The Australian taxation law

directly states that any kind of expenses that is conducted for official purposes are deductible

in nature, which could directly be used for reducing the taxable income. According to the

scenario, overall expenses were mainly conducted from one workplace to another, which in

the case could be used as a deduction amount for the taxable income. Therefore, the overall

expenses can be deducted by the employer from its taxable income. The TR 95/34 mainly

states that relevant expenses related to work is deductable in nature10. However, the TR 95/34

is not linked in the situation, as the individual is not conducting work related expense.

9 D2 Work-Related Travel Expenses 2017 (2017) Ato.gov.au

<https://www.ato.gov.au/Individuals/Tax-Return/2017/Tax-return/Deduction-questions-D1-

D10/D2-Work-related-travel-expenses-2017/?=redirected>

10 TR 95/34 - Income Tax: Employees Carrying Out Itinerant Work - Deductions, Allowances

And Reimbursements For Transport Expenses (As At 29 November 2006) (2017)

Law.ato.gov.au <http://law.ato.gov.au/atolaw/view.htm?docid=txr/tr9534/nat/ato/00001>

not deductible according to the Australian taxation law. Therefore, determination of the

expense is necessary for identifying the overall measure that could be conducted on taxable

income9. Under the ruling of D2 relevant work related travel expense are directly deductible

in nature, which could help in reducing the overall assessable income of an individual. The

Taxation ruling TR 95/34 mainly includes relevant employees carrying out itinerant work.

Answer to x)

The scenario mainly states that overall expenses on travel are mainly conducted by

the individual for office purposes. This overall expenses conducted on travel is mainly

productively nature according to the Australian taxation law. The Australian taxation law

directly states that any kind of expenses that is conducted for official purposes are deductible

in nature, which could directly be used for reducing the taxable income. According to the

scenario, overall expenses were mainly conducted from one workplace to another, which in

the case could be used as a deduction amount for the taxable income. Therefore, the overall

expenses can be deducted by the employer from its taxable income. The TR 95/34 mainly

states that relevant expenses related to work is deductable in nature10. However, the TR 95/34

is not linked in the situation, as the individual is not conducting work related expense.

9 D2 Work-Related Travel Expenses 2017 (2017) Ato.gov.au

<https://www.ato.gov.au/Individuals/Tax-Return/2017/Tax-return/Deduction-questions-D1-

D10/D2-Work-related-travel-expenses-2017/?=redirected>

10 TR 95/34 - Income Tax: Employees Carrying Out Itinerant Work - Deductions, Allowances

And Reimbursements For Transport Expenses (As At 29 November 2006) (2017)

Law.ato.gov.au <http://law.ato.gov.au/atolaw/view.htm?docid=txr/tr9534/nat/ato/00001>

9AUSTRALIA TAXATION LAW

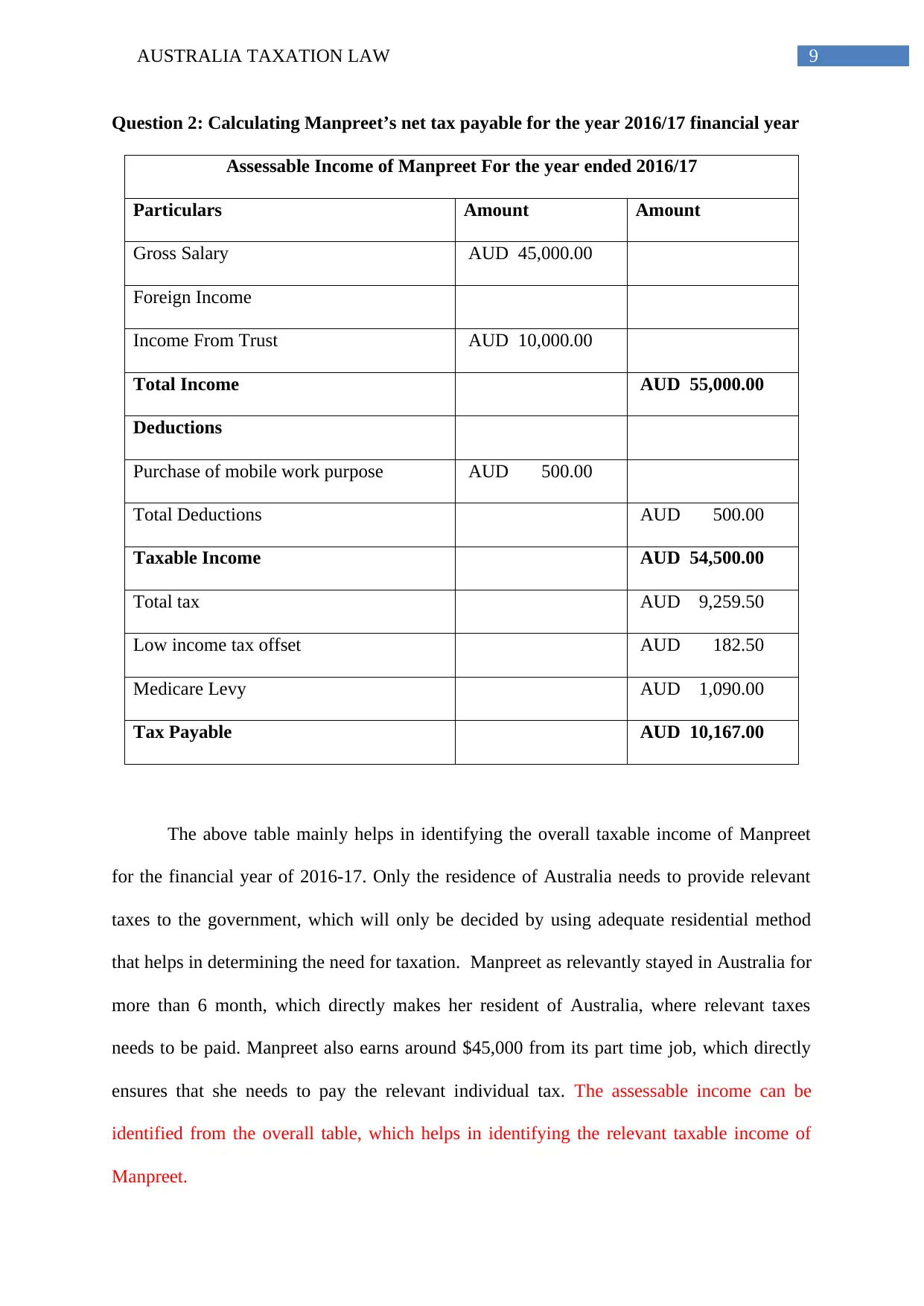

Question 2: Calculating Manpreet’s net tax payable for the year 2016/17 financial year

Assessable Income of Manpreet For the year ended 2016/17

Particulars Amount Amount

Gross Salary AUD 45,000.00

Foreign Income

Income From Trust AUD 10,000.00

Total Income AUD 55,000.00

Deductions

Purchase of mobile work purpose AUD 500.00

Total Deductions AUD 500.00

Taxable Income AUD 54,500.00

Total tax AUD 9,259.50

Low income tax offset AUD 182.50

Medicare Levy AUD 1,090.00

Tax Payable AUD 10,167.00

The above table mainly helps in identifying the overall taxable income of Manpreet

for the financial year of 2016-17. Only the residence of Australia needs to provide relevant

taxes to the government, which will only be decided by using adequate residential method

that helps in determining the need for taxation. Manpreet as relevantly stayed in Australia for

more than 6 month, which directly makes her resident of Australia, where relevant taxes

needs to be paid. Manpreet also earns around $45,000 from its part time job, which directly

ensures that she needs to pay the relevant individual tax. The assessable income can be

identified from the overall table, which helps in identifying the relevant taxable income of

Manpreet.

Question 2: Calculating Manpreet’s net tax payable for the year 2016/17 financial year

Assessable Income of Manpreet For the year ended 2016/17

Particulars Amount Amount

Gross Salary AUD 45,000.00

Foreign Income

Income From Trust AUD 10,000.00

Total Income AUD 55,000.00

Deductions

Purchase of mobile work purpose AUD 500.00

Total Deductions AUD 500.00

Taxable Income AUD 54,500.00

Total tax AUD 9,259.50

Low income tax offset AUD 182.50

Medicare Levy AUD 1,090.00

Tax Payable AUD 10,167.00

The above table mainly helps in identifying the overall taxable income of Manpreet

for the financial year of 2016-17. Only the residence of Australia needs to provide relevant

taxes to the government, which will only be decided by using adequate residential method

that helps in determining the need for taxation. Manpreet as relevantly stayed in Australia for

more than 6 month, which directly makes her resident of Australia, where relevant taxes

needs to be paid. Manpreet also earns around $45,000 from its part time job, which directly

ensures that she needs to pay the relevant individual tax. The assessable income can be

identified from the overall table, which helps in identifying the relevant taxable income of

Manpreet.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10AUSTRALIA TAXATION LAW

Manpreet has conducted different type of expenses for educational purposes, which

does not indicate any kind of improvement in the income from part time job. Therefore, both

educational expenses and computer expensive is not deductible from the taxable income.

According to Section 8-1 of the Income Tax Assessment Act, domestic or private nature

expenses are not deductible under this act11. Hence, both the expenses conducted in computer

and education is not deductible under the taxation law. However, any kind of expenses that is

conducted to enhance the career or income of the individual is deductible under the taxation

law. Relevant case laws such as Ronpibon Tin NL v. FC of T (1949), Lunney v. FC of T;

Hayley v. FC of T (1958) 100 CLR 478; (1958) and FC of T v. M I Roberts 92 ATC 4787

could be used in supporting the Individual taxation law12.

11 Individual Income Tax Rates (2017) Ato.gov.au <https://www.ato.gov.au/rates/individual-

income-tax-rates/>

12 Legal Database (2017) Ato.gov.au <https://www.ato.gov.au/law/view/document?

docid=PAC/19970038/8-1>

Manpreet has conducted different type of expenses for educational purposes, which

does not indicate any kind of improvement in the income from part time job. Therefore, both

educational expenses and computer expensive is not deductible from the taxable income.

According to Section 8-1 of the Income Tax Assessment Act, domestic or private nature

expenses are not deductible under this act11. Hence, both the expenses conducted in computer

and education is not deductible under the taxation law. However, any kind of expenses that is

conducted to enhance the career or income of the individual is deductible under the taxation

law. Relevant case laws such as Ronpibon Tin NL v. FC of T (1949), Lunney v. FC of T;

Hayley v. FC of T (1958) 100 CLR 478; (1958) and FC of T v. M I Roberts 92 ATC 4787

could be used in supporting the Individual taxation law12.

11 Individual Income Tax Rates (2017) Ato.gov.au <https://www.ato.gov.au/rates/individual-

income-tax-rates/>

12 Legal Database (2017) Ato.gov.au <https://www.ato.gov.au/law/view/document?

docid=PAC/19970038/8-1>

11AUSTRALIA TAXATION LAW

Reference

D2 Work-Related Travel Expenses 2017 (2017) Ato.gov.au

<https://www.ato.gov.au/Individuals/Tax-Return/2017/Tax-return/Deduction-questions-D1-

D10/D2-Work-related-travel-expenses-2017/?=redirected>

D4 Work-Related Self-Education Expenses 2017 (2017) Ato.gov.au

<https://www.ato.gov.au/Individuals/Tax-Return/2017/Tax-return/Deduction-questions-D1-

D10/D4-Work-related-self-education-expenses-2017/?=redirected>

Excess Contributions Tax Learner Guide (2017) Ato.gov.au

https://www.ato.gov.au/Super/APRA-regulated-funds/In-detail/APRA-resources/Learner-

guides/Excess-Contributions-Tax-learner-guide/?page=52

Individual Income Tax Rates (2017) Ato.gov.au <https://www.ato.gov.au/rates/individual-

income-tax-rates/>

Legal Database (2017) Ato.gov.au <https://www.ato.gov.au/law/view/document?

docid=TXR/TR19996/NAT/ATO/00001>

Legal Database (2017) Ato.gov.au <https://www.ato.gov.au/law/view/document?

docid=TXR/TR9522/NAT/ATO/00001>

Legal Database (2017) Ato.gov.au <https://www.ato.gov.au/law/view/document?

docid=PAC/19970038/8-1>

Legal Database (2017) Ato.gov.au https://www.ato.gov.au/law/view/document?

DocID=TXR/TR9535/NAT/ATO/00001&PiT=99991231235958#P29

Legal Database (2017) Ato.gov.au https://www.ato.gov.au/law/view/document?

DocID=TXR/TR199917/NAT/ATO/00001&PiT=99991231235958

Reference

D2 Work-Related Travel Expenses 2017 (2017) Ato.gov.au

<https://www.ato.gov.au/Individuals/Tax-Return/2017/Tax-return/Deduction-questions-D1-

D10/D2-Work-related-travel-expenses-2017/?=redirected>

D4 Work-Related Self-Education Expenses 2017 (2017) Ato.gov.au

<https://www.ato.gov.au/Individuals/Tax-Return/2017/Tax-return/Deduction-questions-D1-

D10/D4-Work-related-self-education-expenses-2017/?=redirected>

Excess Contributions Tax Learner Guide (2017) Ato.gov.au

https://www.ato.gov.au/Super/APRA-regulated-funds/In-detail/APRA-resources/Learner-

guides/Excess-Contributions-Tax-learner-guide/?page=52

Individual Income Tax Rates (2017) Ato.gov.au <https://www.ato.gov.au/rates/individual-

income-tax-rates/>

Legal Database (2017) Ato.gov.au <https://www.ato.gov.au/law/view/document?

docid=TXR/TR19996/NAT/ATO/00001>

Legal Database (2017) Ato.gov.au <https://www.ato.gov.au/law/view/document?

docid=TXR/TR9522/NAT/ATO/00001>

Legal Database (2017) Ato.gov.au <https://www.ato.gov.au/law/view/document?

docid=PAC/19970038/8-1>

Legal Database (2017) Ato.gov.au https://www.ato.gov.au/law/view/document?

DocID=TXR/TR9535/NAT/ATO/00001&PiT=99991231235958#P29

Legal Database (2017) Ato.gov.au https://www.ato.gov.au/law/view/document?

DocID=TXR/TR199917/NAT/ATO/00001&PiT=99991231235958

12AUSTRALIA TAXATION LAW

Morgan, John, TD 2016/14 – A General Deduction Is Allowed For Gifts To Clients Of A

Business (Query Whether It Be Aimed At Getting Future Income) (2017) Tax Technical

http://taxtechnical.com.au/td-201614-a-general-deduction-is-allowed-for-gifts-to-clients-of-a-

business-query-whether-it-be-aimed-at-getting-future-income/

Performing Artists 2017 (2017) Ato.gov.au <https://www.ato.gov.au/Forms/Performing-

artists-2017/>

TR 95/34 - Income Tax: Employees Carrying Out Itinerant Work - Deductions, Allowances

And Reimbursements For Transport Expenses (As At 29 November 2006) (2017)

Law.ato.gov.au <http://law.ato.gov.au/atolaw/view.htm?docid=txr/tr9534/nat/ato/00001>

Morgan, John, TD 2016/14 – A General Deduction Is Allowed For Gifts To Clients Of A

Business (Query Whether It Be Aimed At Getting Future Income) (2017) Tax Technical

http://taxtechnical.com.au/td-201614-a-general-deduction-is-allowed-for-gifts-to-clients-of-a-

business-query-whether-it-be-aimed-at-getting-future-income/

Performing Artists 2017 (2017) Ato.gov.au <https://www.ato.gov.au/Forms/Performing-

artists-2017/>

TR 95/34 - Income Tax: Employees Carrying Out Itinerant Work - Deductions, Allowances

And Reimbursements For Transport Expenses (As At 29 November 2006) (2017)

Law.ato.gov.au <http://law.ato.gov.au/atolaw/view.htm?docid=txr/tr9534/nat/ato/00001>

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.