Australian Banking Industry: An Economic Analysis and Contribution

VerifiedAdded on 2023/04/07

|19

|3649

|400

Report

AI Summary

This report offers an in-depth analysis of the Australian banking industry, evaluating its contribution to the annual GDP, which stands at approximately 9.45%. It explores the industry's relationship with the Australian government, highlighting the regulatory framework governed by acts like the Banking Act 1959 and the roles of bodies such as APRA, ASIC, and RBA. The report also examines the potential impacts of economic shifts, including a 10% decrease in the value of the Australian dollar, a 10% reduction in imports from China, and a 10% increase in Australia's unemployment rate, detailing their effects on trade, inflation, employment, and the balance of payments. The analysis underscores the banking sector's significant role in the Australian economy, influencing financial stability, monetary policy, and overall economic growth, with key insights and recommendations provided based on the findings.

AUSTRALIAN ECONOMY

Australian Banking Industry in-depth Analysis

Australian Banking Industry in-depth Analysis

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AUSTRALIAN ECONOMY

Executive Summary

The following report is on in depth analysis of the banking industry of Australia. The report

contains details of the banking industry and the companies (Public and Private) and their

contribution to the industry and how much does it contributes to the GDP. The exchange rate of

the currency and how its deviation does affects the economy. Imports from China and its affects

as well as, the rate of unemployment in the economy and how it affects the economy is discussed

below. Moreover, the Government of Australia and their part of regulatory framework is also

discussed. The contribution of the banking industry in the economy is also given to analyse

growth of GDP and comparison between the companies. The insights and analysis after the

assessments is outlined briefly and the learning and recommendation is given based on the

findings.

Executive Summary

The following report is on in depth analysis of the banking industry of Australia. The report

contains details of the banking industry and the companies (Public and Private) and their

contribution to the industry and how much does it contributes to the GDP. The exchange rate of

the currency and how its deviation does affects the economy. Imports from China and its affects

as well as, the rate of unemployment in the economy and how it affects the economy is discussed

below. Moreover, the Government of Australia and their part of regulatory framework is also

discussed. The contribution of the banking industry in the economy is also given to analyse

growth of GDP and comparison between the companies. The insights and analysis after the

assessments is outlined briefly and the learning and recommendation is given based on the

findings.

AUSTRALIAN ECONOMY

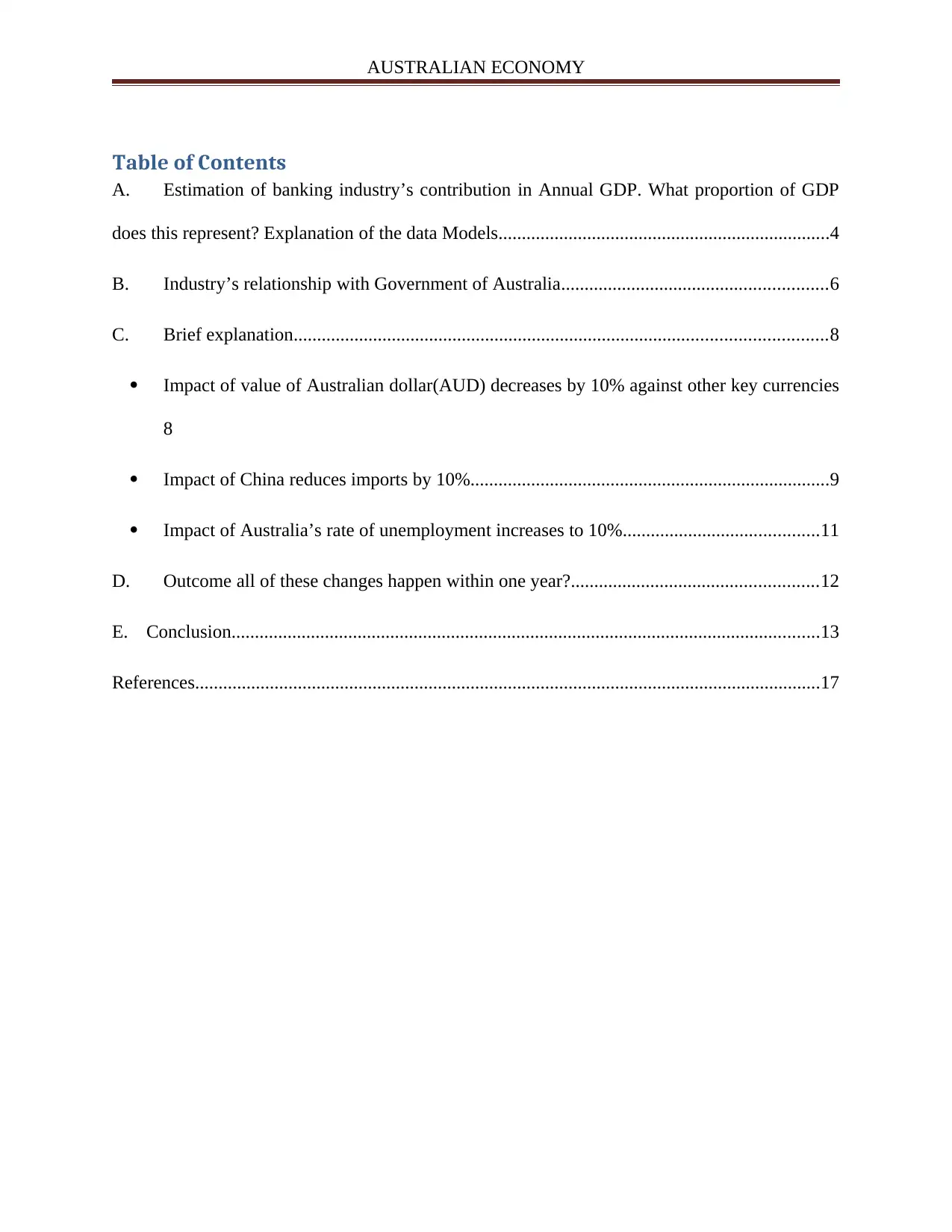

Table of Contents

A. Estimation of banking industry’s contribution in Annual GDP. What proportion of GDP

does this represent? Explanation of the data Models.......................................................................4

B. Industry’s relationship with Government of Australia.........................................................6

C. Brief explanation..................................................................................................................8

Impact of value of Australian dollar(AUD) decreases by 10% against other key currencies

8

Impact of China reduces imports by 10%.............................................................................9

Impact of Australia’s rate of unemployment increases to 10%..........................................11

D. Outcome all of these changes happen within one year?.....................................................12

E. Conclusion..............................................................................................................................13

References......................................................................................................................................17

Table of Contents

A. Estimation of banking industry’s contribution in Annual GDP. What proportion of GDP

does this represent? Explanation of the data Models.......................................................................4

B. Industry’s relationship with Government of Australia.........................................................6

C. Brief explanation..................................................................................................................8

Impact of value of Australian dollar(AUD) decreases by 10% against other key currencies

8

Impact of China reduces imports by 10%.............................................................................9

Impact of Australia’s rate of unemployment increases to 10%..........................................11

D. Outcome all of these changes happen within one year?.....................................................12

E. Conclusion..............................................................................................................................13

References......................................................................................................................................17

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

AUSTRALIAN ECONOMY

A. Estimation of banking industry’s contribution in Annual GDP. What proportion of

GDP does this represent? Explanation of the data Models

The banking system in Australia contributes to the growth of the Australian economy and

acts as important contributor of the annual growth of Australian GDP. GDP defines the

growth of an economy with respect to the monetary value of the products and services

produced by the economy. Creating jobs, injecting billions of dollars, and paying dividends,

interests and taxes are the some of the steps in contributing to the Australian economy. With

around 450,000 people, approximately 16.7 billion in paid taxes, 6 billion in dividends and

interest payments, the banks acquires more than 75% of the all banking operations in

Australia (Rba.gov.au, 2019). The big four banks (Westpac, National Australian Bank,

Australia and New Zealand Banking Group and Commonwealth bank) in Australia pays 45%

of the corporate tax in Australia. As one of the growing economy in the world the Australian

people enjoy a good standard of living. In 2017-18 the businesses with the biggest offer of

current value net esteem included (at basic prices) were Financial and Insurance Services

(9.5%), Mining (8.8%) and Construction (8.1%) (Rba.gov.au, 2019).

The GDP annual growth rate of Australia is 2.30% as of 4th quarter of 2018 calculation.

A. Estimation of banking industry’s contribution in Annual GDP. What proportion of

GDP does this represent? Explanation of the data Models

The banking system in Australia contributes to the growth of the Australian economy and

acts as important contributor of the annual growth of Australian GDP. GDP defines the

growth of an economy with respect to the monetary value of the products and services

produced by the economy. Creating jobs, injecting billions of dollars, and paying dividends,

interests and taxes are the some of the steps in contributing to the Australian economy. With

around 450,000 people, approximately 16.7 billion in paid taxes, 6 billion in dividends and

interest payments, the banks acquires more than 75% of the all banking operations in

Australia (Rba.gov.au, 2019). The big four banks (Westpac, National Australian Bank,

Australia and New Zealand Banking Group and Commonwealth bank) in Australia pays 45%

of the corporate tax in Australia. As one of the growing economy in the world the Australian

people enjoy a good standard of living. In 2017-18 the businesses with the biggest offer of

current value net esteem included (at basic prices) were Financial and Insurance Services

(9.5%), Mining (8.8%) and Construction (8.1%) (Rba.gov.au, 2019).

The GDP annual growth rate of Australia is 2.30% as of 4th quarter of 2018 calculation.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AUSTRALIAN ECONOMY

The Gross Domestic Product Annual change from 2005 – 2018 is shown in the chart and the

annual change in the value of GDP 1814778 million AUD (Rba.gov.au, 2019). The banking and

the insurance sector of Australia contributed $196.98 billion AUD to GDP in the last year

according to Treasury department of Government of Australia.

Country Subject Descriptor Units Scale 2017 2018 Estimates

Start

After

Australia Gross domestic product, current

prices

U.S. dollars Billions 1,379.55 1,500.2

6

2017

Australia Gross domestic product, current

prices

Purchasing

power

parity;

international

dollars

Billions 1,246.48 1,312.5

3

2017

Source : Abs.gov.au, 2019

GDP trend and quarterly change

percentage

GDP Annual Change measure

The Gross Domestic Product Annual change from 2005 – 2018 is shown in the chart and the

annual change in the value of GDP 1814778 million AUD (Rba.gov.au, 2019). The banking and

the insurance sector of Australia contributed $196.98 billion AUD to GDP in the last year

according to Treasury department of Government of Australia.

Country Subject Descriptor Units Scale 2017 2018 Estimates

Start

After

Australia Gross domestic product, current

prices

U.S. dollars Billions 1,379.55 1,500.2

6

2017

Australia Gross domestic product, current

prices

Purchasing

power

parity;

international

dollars

Billions 1,246.48 1,312.5

3

2017

Source : Abs.gov.au, 2019

GDP trend and quarterly change

percentage

GDP Annual Change measure

AUSTRALIAN ECONOMY

Therefore from the above approximated value of the GDP in 2018, the contribution of banking

and financial services is

1379.55 billion /140,000 million AUD = 9.45%

The 9.45% contributed by the banking sector and their services in the year of 2017-2018.

Source : Abs.gov.au, 2019

The above data model shows the shares of services industry in the Australian GDP which is

between 64.41% - 66.97% from 2007 to 2017 (Abs.gov.au, 2019). The whooping 12.96% is the

contribution of the banking sector among the 66.97% of the GDP (Rba.gov.au, 2019). Thus it

can be concluded that Banking is the major sector in the Australia for the growth of the

economy. During the last two years the National Net borrowing of the economy was 54.2 billion

which reflects the FDI flow in the economy (Abs.gov.au, 2019).

B. Industry’s relationship with Government of Australia

The legal framework of the banks is regulated by the Banking Act 1959. The Reserve Bank Act

1959, Financial Sector Act 1998 are some of the major constitution of the legal framework of the

banking institution of Australia. The above mentioned acts are the foundation of the regulatory

framework, business conduct guidelines and practice frameworks. Banks also plays a major role

Therefore from the above approximated value of the GDP in 2018, the contribution of banking

and financial services is

1379.55 billion /140,000 million AUD = 9.45%

The 9.45% contributed by the banking sector and their services in the year of 2017-2018.

Source : Abs.gov.au, 2019

The above data model shows the shares of services industry in the Australian GDP which is

between 64.41% - 66.97% from 2007 to 2017 (Abs.gov.au, 2019). The whooping 12.96% is the

contribution of the banking sector among the 66.97% of the GDP (Rba.gov.au, 2019). Thus it

can be concluded that Banking is the major sector in the Australia for the growth of the

economy. During the last two years the National Net borrowing of the economy was 54.2 billion

which reflects the FDI flow in the economy (Abs.gov.au, 2019).

B. Industry’s relationship with Government of Australia

The legal framework of the banks is regulated by the Banking Act 1959. The Reserve Bank Act

1959, Financial Sector Act 1998 are some of the major constitution of the legal framework of the

banking institution of Australia. The above mentioned acts are the foundation of the regulatory

framework, business conduct guidelines and practice frameworks. Banks also plays a major role

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

AUSTRALIAN ECONOMY

in Australia’s financial system. Some of the activities are insurance, fund management, stock

broking, business banking, and acts as an ultimate lender (Blount, Castleman and Swatman

2005). The banks act as the financial intermediary as well as the major enforcer of the strict

regulations regarding finance of the country. Among the 53 banks in Australia 14 companies are

predominantly owned by Australia. These domestic banks also occupy the 75% of the financial

services market in the economy (future of banking in australia., 2019). Foreign bank branches

and subsidiaries have also acquired significant part of the banking industry in the economy. The

Australian economy has a number of Authorised Deposit Taking Institutions listed above in the

tables. The three essential regulatory and management body of the Continent are Australian

Prudential Regulation Authority (APRA) established in 1998 (Maddock and McLean 2000). This

body is in the management of all the Deposit Taking Institution known as ADIs and for their

supervision. Australian Securities and Investments Commission (ASIC) established for the

corporate and financial markets. The Reserve Bank of Australia is the body to ensure financial

system stability as well as the payments system of the economy. Moreover, it also makes the

monetary policies. As one of the enforcer of prudential standards and practises APRA framework

follows the credit risk, capital adequacy, Outsourcing, Business Continuity management, Audit

and reporting, Prudential standard. These are properly reviewed and applied all over the country.

ASIC administers financial reporting, corporate fundraising, outward insolvency (Joshi, Cahill

and Sidhu 2010). Reviewing the security and budgetary framework and money related

arrangements, advancing the wellbeing and effectiveness of the installed framework, dealing

with the issuance of banknotes, giving financial administrations to the Government and its

organizations and abroad national banks are done by RBA (Oster and Antioch 1995). It also

deals with Australia's authentic resources and gives a liquidity facility to ADIs (Authorised

in Australia’s financial system. Some of the activities are insurance, fund management, stock

broking, business banking, and acts as an ultimate lender (Blount, Castleman and Swatman

2005). The banks act as the financial intermediary as well as the major enforcer of the strict

regulations regarding finance of the country. Among the 53 banks in Australia 14 companies are

predominantly owned by Australia. These domestic banks also occupy the 75% of the financial

services market in the economy (future of banking in australia., 2019). Foreign bank branches

and subsidiaries have also acquired significant part of the banking industry in the economy. The

Australian economy has a number of Authorised Deposit Taking Institutions listed above in the

tables. The three essential regulatory and management body of the Continent are Australian

Prudential Regulation Authority (APRA) established in 1998 (Maddock and McLean 2000). This

body is in the management of all the Deposit Taking Institution known as ADIs and for their

supervision. Australian Securities and Investments Commission (ASIC) established for the

corporate and financial markets. The Reserve Bank of Australia is the body to ensure financial

system stability as well as the payments system of the economy. Moreover, it also makes the

monetary policies. As one of the enforcer of prudential standards and practises APRA framework

follows the credit risk, capital adequacy, Outsourcing, Business Continuity management, Audit

and reporting, Prudential standard. These are properly reviewed and applied all over the country.

ASIC administers financial reporting, corporate fundraising, outward insolvency (Joshi, Cahill

and Sidhu 2010). Reviewing the security and budgetary framework and money related

arrangements, advancing the wellbeing and effectiveness of the installed framework, dealing

with the issuance of banknotes, giving financial administrations to the Government and its

organizations and abroad national banks are done by RBA (Oster and Antioch 1995). It also

deals with Australia's authentic resources and gives a liquidity facility to ADIs (Authorised

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AUSTRALIAN ECONOMY

Depository Institutions) (Reserve Bank of Australia, 2019). Thus it can be concluded the

monetary policies in a whole are particularly influenced by the government in Australia. The

four of the mega banks hold around 1.4 trillion dollar of total assets, which is equivalent to 140%

of GDP contribution in the country (Abs.gov.au, 2019). The banking sector included four major

banks which are Commonwealth Banks of Australia, Australia and New Zealand Banking group

Limited, National Australian Bank and Westpac Banking Corporation. The Government’s four

pillar and they have policy restrictions which prevents the four banks from mergers between

them. The corporate governance among the companies is also subjected to regulations of

Australian Exchange Board rules (Harris 2013). The supervisory regime, corporate governance,

licensing acts is there more to prevent the banks from deviating from the regulatory framework.

Australia or the Authority, Australian Prudential Regulation Authority (APRA) and the Reserve

Bank of Australia (RBA)) is a member of the Basel Committee on Banking Supervision (BCBS)

and APRA is vigorously involved in the effort of the BCBS provisions (Reserve Bank of

Australia, 2019).

C. Brief explanation

Impact of value of Australian dollar(AUD) decreases by 10% against other key

currencies

Key

Currencies

exchange rate

with respect

to 1 AUD

Exchange rate after

decrease in AUD by

10%=Present

exchange

Depository Institutions) (Reserve Bank of Australia, 2019). Thus it can be concluded the

monetary policies in a whole are particularly influenced by the government in Australia. The

four of the mega banks hold around 1.4 trillion dollar of total assets, which is equivalent to 140%

of GDP contribution in the country (Abs.gov.au, 2019). The banking sector included four major

banks which are Commonwealth Banks of Australia, Australia and New Zealand Banking group

Limited, National Australian Bank and Westpac Banking Corporation. The Government’s four

pillar and they have policy restrictions which prevents the four banks from mergers between

them. The corporate governance among the companies is also subjected to regulations of

Australian Exchange Board rules (Harris 2013). The supervisory regime, corporate governance,

licensing acts is there more to prevent the banks from deviating from the regulatory framework.

Australia or the Authority, Australian Prudential Regulation Authority (APRA) and the Reserve

Bank of Australia (RBA)) is a member of the Basel Committee on Banking Supervision (BCBS)

and APRA is vigorously involved in the effort of the BCBS provisions (Reserve Bank of

Australia, 2019).

C. Brief explanation

Impact of value of Australian dollar(AUD) decreases by 10% against other key

currencies

Key

Currencies

exchange rate

with respect

to 1 AUD

Exchange rate after

decrease in AUD by

10%=Present

exchange

AUSTRALIAN ECONOMY

rate(1+10/100)

U S Dollar 0.71 0.781

Euro 0.63 0.693

Japanese Yen 79.03 86.933

British Pound 0.54 0.594

Canadian

Dollar

0.95 1.045

Source : Author

Therefore from the above table it can be seen that when the value of the Australian dollar

decreases by 10% in the value, it may affect the economy ghastly as the value of other currencies

will increase and the exchange rate will also increase. As the exchange rate affects the financial

flow in Australia and rest of the world and flow of trades, the decrease in value affects directly to

the price of goods and services. Indirectly the reduction in value will affect the economy in

inflation rate, consumption and in factors of production. The depreciation will influence demand

of tradable and non-tradable goods. There is also an advantage of the depreciation of the

currency value in Australia as it will result increase in export and then decrease in import. It will

increase demand of non-tradable goods. In turn the demand will increase in Australian people

and to meet the demand, they will have to increase the production of the goods and services.

Thus it will affect the employment rate positively, increasing the rate.

rate(1+10/100)

U S Dollar 0.71 0.781

Euro 0.63 0.693

Japanese Yen 79.03 86.933

British Pound 0.54 0.594

Canadian

Dollar

0.95 1.045

Source : Author

Therefore from the above table it can be seen that when the value of the Australian dollar

decreases by 10% in the value, it may affect the economy ghastly as the value of other currencies

will increase and the exchange rate will also increase. As the exchange rate affects the financial

flow in Australia and rest of the world and flow of trades, the decrease in value affects directly to

the price of goods and services. Indirectly the reduction in value will affect the economy in

inflation rate, consumption and in factors of production. The depreciation will influence demand

of tradable and non-tradable goods. There is also an advantage of the depreciation of the

currency value in Australia as it will result increase in export and then decrease in import. It will

increase demand of non-tradable goods. In turn the demand will increase in Australian people

and to meet the demand, they will have to increase the production of the goods and services.

Thus it will affect the employment rate positively, increasing the rate.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

AUSTRALIAN ECONOMY

Impact of China reduces imports by 10%

China is one of the major import export destination of Australia contributing up to 24% in

imports and 35% of the exports goes to China in a year according the statistics of 2017-2018

Department of Foreign affairs and Trade (Ausbanking.org.au, 2019).

The top 10 trading partners of Australia is given below in the charts.

Germany

Thailand

United Kingdom

Singapore

New Zealand

India

Rep of Korea

United States

Japan

China

0 50 100 150 200 250

$20.9b

$21.8b

$27.6b

$24.7b

$26.4b

$25.7b

$38.6b

$66.6b

$68.5b

$174.2b

$22.4b

$24.7b

$27.8b

$27.8b

$28.3b

$29.1b

$52.3b

$70.2b

$77.6b

$194.6b

2017-18 2016-17

Source : Abs.gov.au, 2019

The above chart ranks China as the major trading partner in Australia.

as at ABS BOP Dec Qtr

2018

2012

-13

2013-

14

2014

-15

2015

-16

2016-

17

2017

-18

2017

-18

shar

e

2017-

18

grow

th

5

year

tren

d

$b $b $b $b $b $b % % %

1 China 46.5 52.6 59.5 64.2 64.2 71.3 18.0 11.1 8.4

2 United States 41.6 42.6 45.5 48.8 45.9 48.8 12.3 6.2 3.2

3 Republic of Korea 10.2 12.7 15.1 14.2 15.9 28.7 7.2 80.9 17.9

Impact of China reduces imports by 10%

China is one of the major import export destination of Australia contributing up to 24% in

imports and 35% of the exports goes to China in a year according the statistics of 2017-2018

Department of Foreign affairs and Trade (Ausbanking.org.au, 2019).

The top 10 trading partners of Australia is given below in the charts.

Germany

Thailand

United Kingdom

Singapore

New Zealand

India

Rep of Korea

United States

Japan

China

0 50 100 150 200 250

$20.9b

$21.8b

$27.6b

$24.7b

$26.4b

$25.7b

$38.6b

$66.6b

$68.5b

$174.2b

$22.4b

$24.7b

$27.8b

$27.8b

$28.3b

$29.1b

$52.3b

$70.2b

$77.6b

$194.6b

2017-18 2016-17

Source : Abs.gov.au, 2019

The above chart ranks China as the major trading partner in Australia.

as at ABS BOP Dec Qtr

2018

2012

-13

2013-

14

2014

-15

2015

-16

2016-

17

2017

-18

2017

-18

shar

e

2017-

18

grow

th

5

year

tren

d

$b $b $b $b $b $b % % %

1 China 46.5 52.6 59.5 64.2 64.2 71.3 18.0 11.1 8.4

2 United States 41.6 42.6 45.5 48.8 45.9 48.8 12.3 6.2 3.2

3 Republic of Korea 10.2 12.7 15.1 14.2 15.9 28.7 7.2 80.9 17.9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AUSTRALIAN ECONOMY

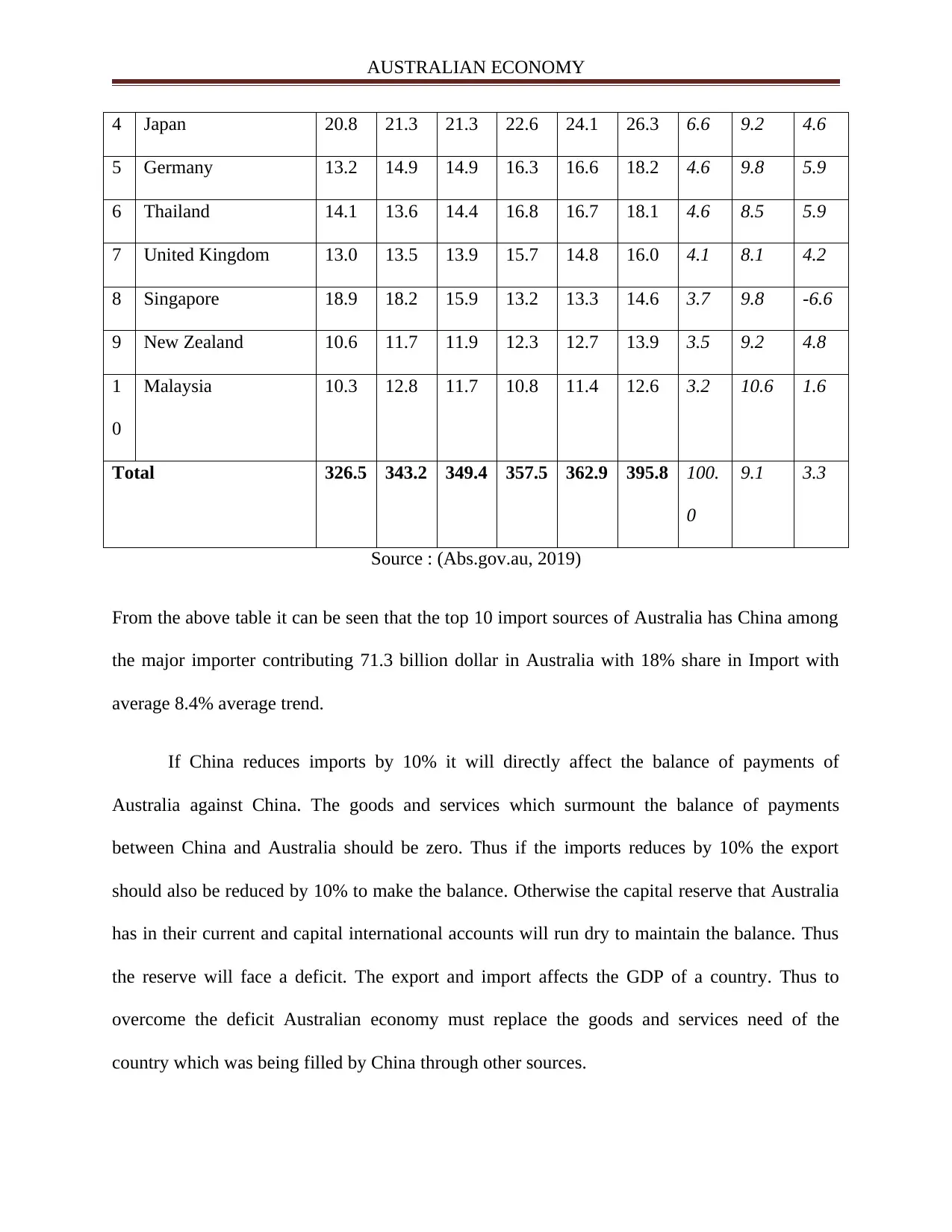

4 Japan 20.8 21.3 21.3 22.6 24.1 26.3 6.6 9.2 4.6

5 Germany 13.2 14.9 14.9 16.3 16.6 18.2 4.6 9.8 5.9

6 Thailand 14.1 13.6 14.4 16.8 16.7 18.1 4.6 8.5 5.9

7 United Kingdom 13.0 13.5 13.9 15.7 14.8 16.0 4.1 8.1 4.2

8 Singapore 18.9 18.2 15.9 13.2 13.3 14.6 3.7 9.8 -6.6

9 New Zealand 10.6 11.7 11.9 12.3 12.7 13.9 3.5 9.2 4.8

1

0

Malaysia 10.3 12.8 11.7 10.8 11.4 12.6 3.2 10.6 1.6

Total 326.5 343.2 349.4 357.5 362.9 395.8 100.

0

9.1 3.3

Source : (Abs.gov.au, 2019)

From the above table it can be seen that the top 10 import sources of Australia has China among

the major importer contributing 71.3 billion dollar in Australia with 18% share in Import with

average 8.4% average trend.

If China reduces imports by 10% it will directly affect the balance of payments of

Australia against China. The goods and services which surmount the balance of payments

between China and Australia should be zero. Thus if the imports reduces by 10% the export

should also be reduced by 10% to make the balance. Otherwise the capital reserve that Australia

has in their current and capital international accounts will run dry to maintain the balance. Thus

the reserve will face a deficit. The export and import affects the GDP of a country. Thus to

overcome the deficit Australian economy must replace the goods and services need of the

country which was being filled by China through other sources.

4 Japan 20.8 21.3 21.3 22.6 24.1 26.3 6.6 9.2 4.6

5 Germany 13.2 14.9 14.9 16.3 16.6 18.2 4.6 9.8 5.9

6 Thailand 14.1 13.6 14.4 16.8 16.7 18.1 4.6 8.5 5.9

7 United Kingdom 13.0 13.5 13.9 15.7 14.8 16.0 4.1 8.1 4.2

8 Singapore 18.9 18.2 15.9 13.2 13.3 14.6 3.7 9.8 -6.6

9 New Zealand 10.6 11.7 11.9 12.3 12.7 13.9 3.5 9.2 4.8

1

0

Malaysia 10.3 12.8 11.7 10.8 11.4 12.6 3.2 10.6 1.6

Total 326.5 343.2 349.4 357.5 362.9 395.8 100.

0

9.1 3.3

Source : (Abs.gov.au, 2019)

From the above table it can be seen that the top 10 import sources of Australia has China among

the major importer contributing 71.3 billion dollar in Australia with 18% share in Import with

average 8.4% average trend.

If China reduces imports by 10% it will directly affect the balance of payments of

Australia against China. The goods and services which surmount the balance of payments

between China and Australia should be zero. Thus if the imports reduces by 10% the export

should also be reduced by 10% to make the balance. Otherwise the capital reserve that Australia

has in their current and capital international accounts will run dry to maintain the balance. Thus

the reserve will face a deficit. The export and import affects the GDP of a country. Thus to

overcome the deficit Australian economy must replace the goods and services need of the

country which was being filled by China through other sources.

AUSTRALIAN ECONOMY

Impact of Australia’s rate of unemployment increases to 10%

From the above chart it can be seen that the unemployment rate of Australia is 4.6%. Thus, if the

unemployment rate of Australia increases by 10% more the standard of living will decrease,

saving ratio of the individual will decrease, consumption of the individual will decrease. On a

society level there will be inefficient use of resources, lesser tax revenue for government, loss in

human capital, lower GDP and political instability among the economy (Rba.gov.au, 2019).

D. Outcome all of these changes happen within one year?

If all the above mention changes happen at once or within a year, there will be a lot more

instability in the economy. The banks play a primary role in lending and depositing operations in

the country, with acquiring 9.5% of the GDP contribution. Therefore reduction in GDP per

capita from the affect in reduction in export and increase in unemployment rate will negatively

affect the economy. Savings rate will decrease, which will affect the banks performance. The

Undercapitalisation will affect the Major Banks in Australia and eventually affect its

performance (Aye 2012). The regulations forwarded by The Australian Prudential Regulation

Impact of Australia’s rate of unemployment increases to 10%

From the above chart it can be seen that the unemployment rate of Australia is 4.6%. Thus, if the

unemployment rate of Australia increases by 10% more the standard of living will decrease,

saving ratio of the individual will decrease, consumption of the individual will decrease. On a

society level there will be inefficient use of resources, lesser tax revenue for government, loss in

human capital, lower GDP and political instability among the economy (Rba.gov.au, 2019).

D. Outcome all of these changes happen within one year?

If all the above mention changes happen at once or within a year, there will be a lot more

instability in the economy. The banks play a primary role in lending and depositing operations in

the country, with acquiring 9.5% of the GDP contribution. Therefore reduction in GDP per

capita from the affect in reduction in export and increase in unemployment rate will negatively

affect the economy. Savings rate will decrease, which will affect the banks performance. The

Undercapitalisation will affect the Major Banks in Australia and eventually affect its

performance (Aye 2012). The regulations forwarded by The Australian Prudential Regulation

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.