Determinants of AUD/USD Exchange Rate

VerifiedAdded on 2020/07/23

|9

|2205

|50

AI Summary

The assignment explores various determinants of the AUD/USD exchange rate, including government policies, market demand and supply, and economic factors such as the impact of the Asian financial crisis, inflation rates, and trade-weighted indexes. It also examines the role of the Reserve Bank of Australia in maintaining a stable economy and discusses the potential effects of changes in interest rates on the exchange rate.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

AUSTRALIAN DOLLAR

TIPPED TO SLIDE BACK

TO 70 US CENTS

TIPPED TO SLIDE BACK

TO 70 US CENTS

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

(a) Demand and Supply model of exchange rate determination and the various factors

influencing its fluctuations.....................................................................................................3

(b) Analyses of the movement of the AUD in relation to that of the USD...........................4

(c) Factors affecting the AUD/USD exchange rate................................................................5

(d) Impact of the depreciation of the Australian dollar on an electrical machinery firm

engaged in importing..............................................................................................................6

(d) Action Reserve Bank of Australia takes in order to bring the exchange rate back to US

80C per AUD, and the side effects on the Australian economy. ...........................................7

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................9

INTRODUCTION...........................................................................................................................3

(a) Demand and Supply model of exchange rate determination and the various factors

influencing its fluctuations.....................................................................................................3

(b) Analyses of the movement of the AUD in relation to that of the USD...........................4

(c) Factors affecting the AUD/USD exchange rate................................................................5

(d) Impact of the depreciation of the Australian dollar on an electrical machinery firm

engaged in importing..............................................................................................................6

(d) Action Reserve Bank of Australia takes in order to bring the exchange rate back to US

80C per AUD, and the side effects on the Australian economy. ...........................................7

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................9

INTRODUCTION

The Australian dollar as compared to the US dollar is shifting to a low grade due to the

imbalances in global finances. The AUD is trading low as compared to the USD according to the

Federal Reserve which entails the Reserve Bank of Australia (RBA) to reduce its borrowing cost.

The currency has appreciated for few weeks as the US dollar slouched due to the increase in the

prices of iron ore which have given a boost to Australia’s exports. The broadening interest rate

differentials between Australia and U.S, has resulted in depreciation of the Australian dollar. The

Bloomberg index of US dollar, which measures the currency against a TWI (Trade-Weighted

Index) of others is down by more than 3 per cent in 2018.

(a) Demand and Supply model of exchange rate determination and the various factors

influencing its fluctuations.

The main aim behind this study is to apply demand and supply model to determine the

AUD/USD exchange rate and the factors which have impact on it. The demand and supply

analysis helps to find out whether a currency will appreciate or depreciate against other

currencies. The exchange rate is termed as the value of one currency expressed in terms of

another currency (Garnaut and Smith, 2009). In other words, Aussie-Greenback exchange rate

implies how many Australian dollar is spend to buy one US dollar. AUD has a floating rate of

exchange.

The AUD has traded against the US dollar in the foreign exchange market as the US

dollar is the main international exchange medium.

The Trade-Weighted Index on the other hand, is responsible for providing the measures

weather the AUD is falling or rising against the average of other basket of currencies.

The various factors which brings fluctuations in the exchange rate of Aussie-Greenback are: Inflation rate: In generic, the inflation rate is the rate at which the price of goods and

service is increasing as compared to the decrease in the purchasing power of a currency.

The Australian dollar has jumped above 79 US cents with the US currency remaining

weak after US inflation figures came in higher than expected (Morris, 2008). Growth rate: The percentage change of a particular measure in contrast to similar

measure over a certain time period is termed as change in growth rate. The AUD moves

3

The Australian dollar as compared to the US dollar is shifting to a low grade due to the

imbalances in global finances. The AUD is trading low as compared to the USD according to the

Federal Reserve which entails the Reserve Bank of Australia (RBA) to reduce its borrowing cost.

The currency has appreciated for few weeks as the US dollar slouched due to the increase in the

prices of iron ore which have given a boost to Australia’s exports. The broadening interest rate

differentials between Australia and U.S, has resulted in depreciation of the Australian dollar. The

Bloomberg index of US dollar, which measures the currency against a TWI (Trade-Weighted

Index) of others is down by more than 3 per cent in 2018.

(a) Demand and Supply model of exchange rate determination and the various factors

influencing its fluctuations.

The main aim behind this study is to apply demand and supply model to determine the

AUD/USD exchange rate and the factors which have impact on it. The demand and supply

analysis helps to find out whether a currency will appreciate or depreciate against other

currencies. The exchange rate is termed as the value of one currency expressed in terms of

another currency (Garnaut and Smith, 2009). In other words, Aussie-Greenback exchange rate

implies how many Australian dollar is spend to buy one US dollar. AUD has a floating rate of

exchange.

The AUD has traded against the US dollar in the foreign exchange market as the US

dollar is the main international exchange medium.

The Trade-Weighted Index on the other hand, is responsible for providing the measures

weather the AUD is falling or rising against the average of other basket of currencies.

The various factors which brings fluctuations in the exchange rate of Aussie-Greenback are: Inflation rate: In generic, the inflation rate is the rate at which the price of goods and

service is increasing as compared to the decrease in the purchasing power of a currency.

The Australian dollar has jumped above 79 US cents with the US currency remaining

weak after US inflation figures came in higher than expected (Morris, 2008). Growth rate: The percentage change of a particular measure in contrast to similar

measure over a certain time period is termed as change in growth rate. The AUD moves

3

up to 80 US cents as the US dollar weakens to a three-year low against a basket of

currencies. Interest rate: In general, the term interest rate is defined as the rate at which the borrower

will repay the amount along with principal amount to the lender. The interest rate held by

RBA is 1.5% as they believe the economic growth with increase in 2018.

Government restrictions: The changes in the tax reforms and government policies had a

great impact on the demolition of Australian dollar due to the changes in the US

economy.

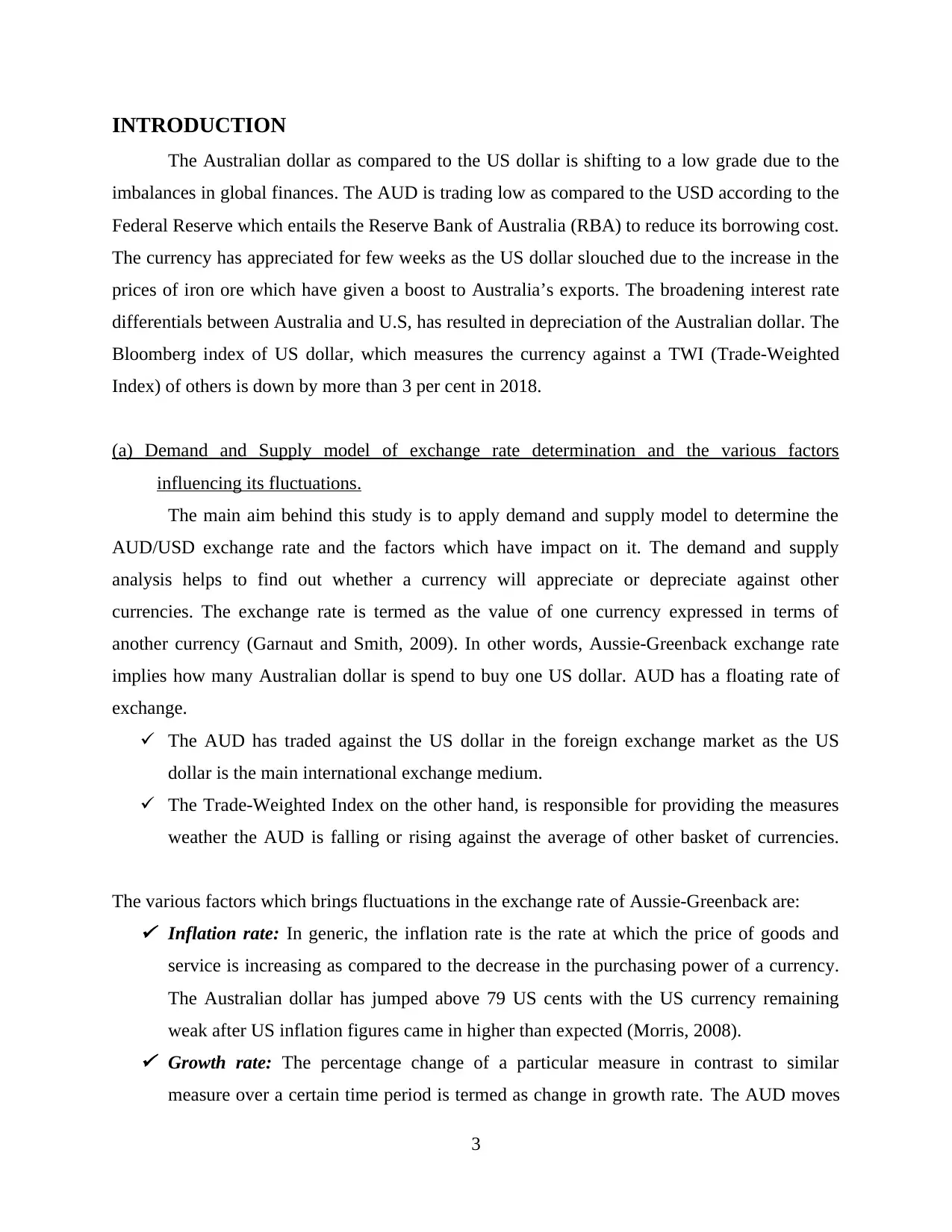

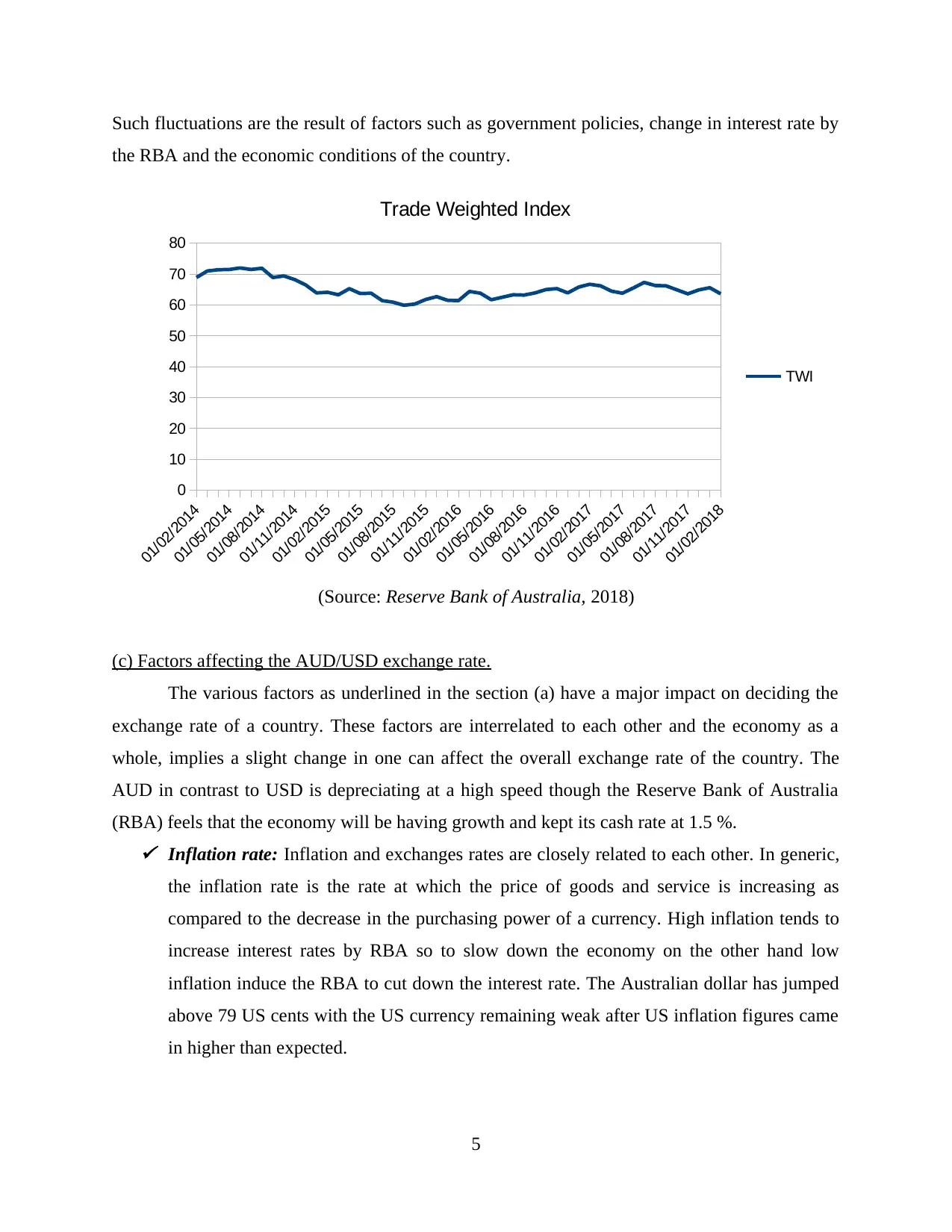

(b) Analyses of the movement of the AUD in relation to that of the USD

(Source: Reserve Bank of Australia, 2018)

The AUD/USD nominal exchange rate is determined by the market demand and supply

plus fluctuations are monitored by the foreign exchange dealers which vary from time to time.

The graphs depicts data from the year 2014 to 2018 and shows how each month has a different

exchange rate due to the factors affecting the market demand and supply. The Trade-Weighted

Index on the other hand is determined on the basis of rate of the US dollar in contrast to the rates

of the AUD (Farrell, 2009). Further, the movement of the AUD in contrast to the USD is

depicted in the graphs below. The nominal exchange rate in the year 2014 depicts a rise in the

USD to 0.9 which till now has not increased and remains to 0.7. In addition, the TWI shows

value of AUD/USD in the year 2014 was 72.5 which has decreased to 62.7 in the year 2018.

4

01/01/2014

01/05/2014

01/09/2014

01/01/2015

01/05/2015

01/09/2015

01/01/2016

01/05/2016

01/09/2016

01/01/2017

01/05/2017

01/09/2017

01/01/2018

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

Nominal Exchange Rate

Exchange rate

currencies. Interest rate: In general, the term interest rate is defined as the rate at which the borrower

will repay the amount along with principal amount to the lender. The interest rate held by

RBA is 1.5% as they believe the economic growth with increase in 2018.

Government restrictions: The changes in the tax reforms and government policies had a

great impact on the demolition of Australian dollar due to the changes in the US

economy.

(b) Analyses of the movement of the AUD in relation to that of the USD

(Source: Reserve Bank of Australia, 2018)

The AUD/USD nominal exchange rate is determined by the market demand and supply

plus fluctuations are monitored by the foreign exchange dealers which vary from time to time.

The graphs depicts data from the year 2014 to 2018 and shows how each month has a different

exchange rate due to the factors affecting the market demand and supply. The Trade-Weighted

Index on the other hand is determined on the basis of rate of the US dollar in contrast to the rates

of the AUD (Farrell, 2009). Further, the movement of the AUD in contrast to the USD is

depicted in the graphs below. The nominal exchange rate in the year 2014 depicts a rise in the

USD to 0.9 which till now has not increased and remains to 0.7. In addition, the TWI shows

value of AUD/USD in the year 2014 was 72.5 which has decreased to 62.7 in the year 2018.

4

01/01/2014

01/05/2014

01/09/2014

01/01/2015

01/05/2015

01/09/2015

01/01/2016

01/05/2016

01/09/2016

01/01/2017

01/05/2017

01/09/2017

01/01/2018

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

Nominal Exchange Rate

Exchange rate

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

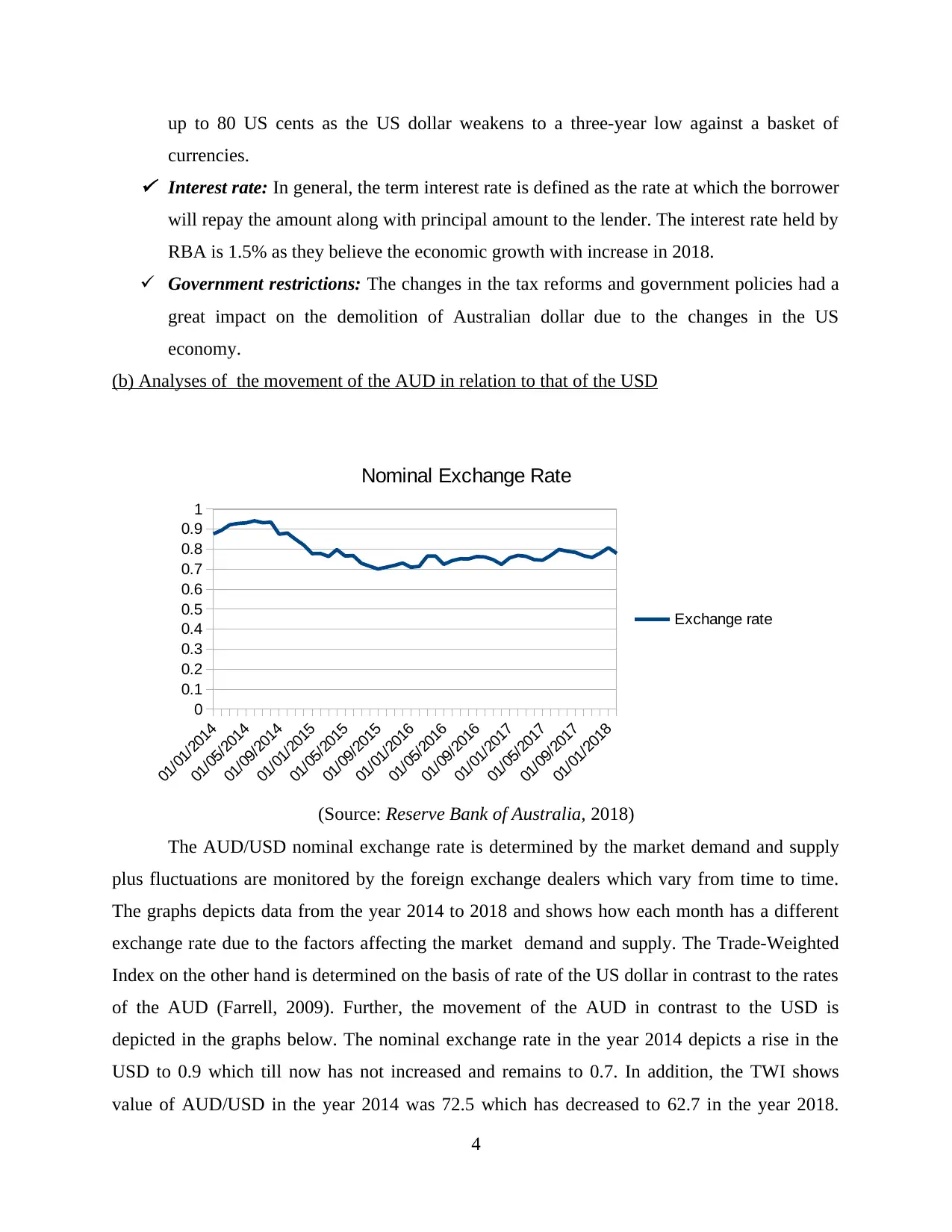

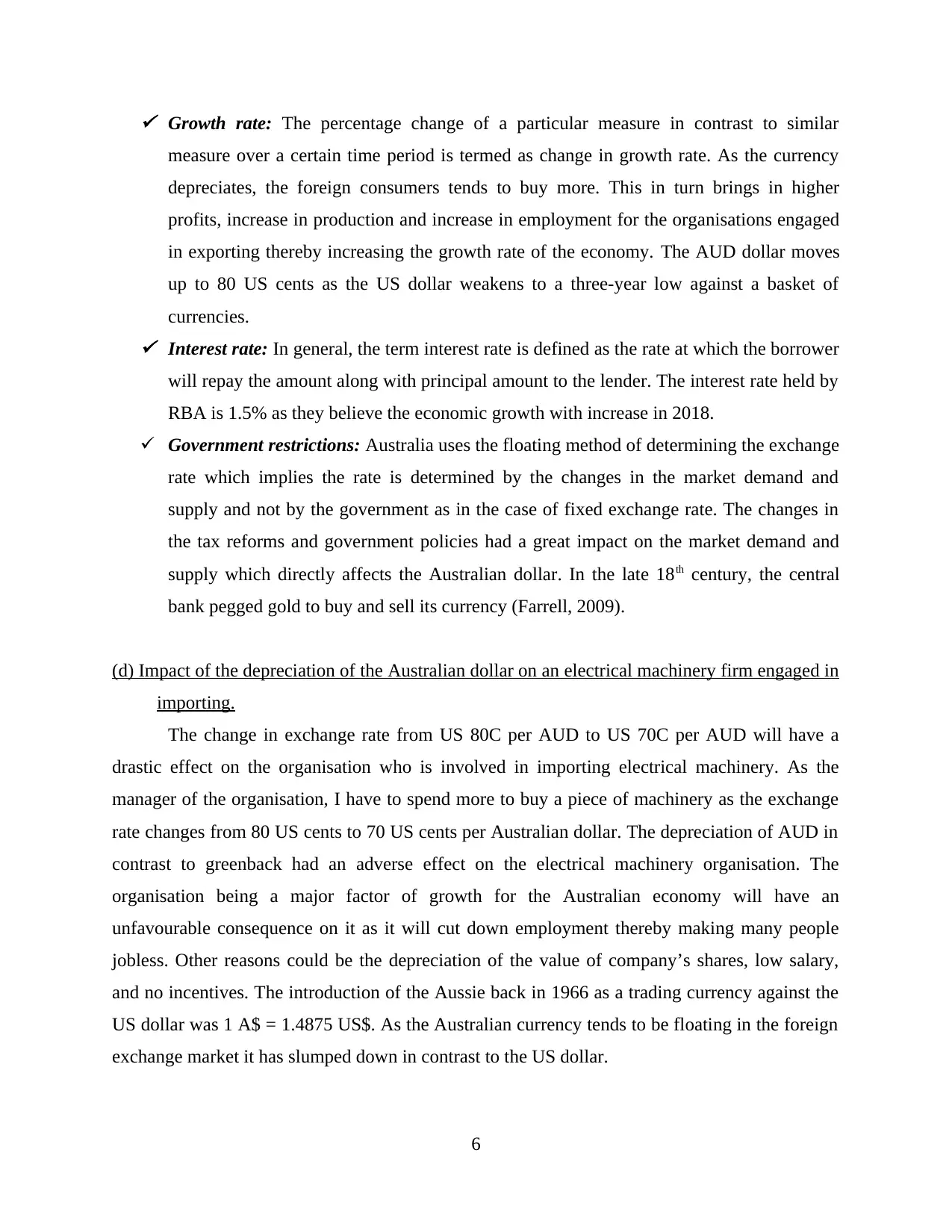

Such fluctuations are the result of factors such as government policies, change in interest rate by

the RBA and the economic conditions of the country.

(Source: Reserve Bank of Australia, 2018)

(c) Factors affecting the AUD/USD exchange rate.

The various factors as underlined in the section (a) have a major impact on deciding the

exchange rate of a country. These factors are interrelated to each other and the economy as a

whole, implies a slight change in one can affect the overall exchange rate of the country. The

AUD in contrast to USD is depreciating at a high speed though the Reserve Bank of Australia

(RBA) feels that the economy will be having growth and kept its cash rate at 1.5 %. Inflation rate: Inflation and exchanges rates are closely related to each other. In generic,

the inflation rate is the rate at which the price of goods and service is increasing as

compared to the decrease in the purchasing power of a currency. High inflation tends to

increase interest rates by RBA so to slow down the economy on the other hand low

inflation induce the RBA to cut down the interest rate. The Australian dollar has jumped

above 79 US cents with the US currency remaining weak after US inflation figures came

in higher than expected.

5

01/02/2014

01/05/2014

01/08/2014

01/11/2014

01/02/2015

01/05/2015

01/08/2015

01/11/2015

01/02/2016

01/05/2016

01/08/2016

01/11/2016

01/02/2017

01/05/2017

01/08/2017

01/11/2017

01/02/2018

0

10

20

30

40

50

60

70

80

Trade Weighted Index

TWI

the RBA and the economic conditions of the country.

(Source: Reserve Bank of Australia, 2018)

(c) Factors affecting the AUD/USD exchange rate.

The various factors as underlined in the section (a) have a major impact on deciding the

exchange rate of a country. These factors are interrelated to each other and the economy as a

whole, implies a slight change in one can affect the overall exchange rate of the country. The

AUD in contrast to USD is depreciating at a high speed though the Reserve Bank of Australia

(RBA) feels that the economy will be having growth and kept its cash rate at 1.5 %. Inflation rate: Inflation and exchanges rates are closely related to each other. In generic,

the inflation rate is the rate at which the price of goods and service is increasing as

compared to the decrease in the purchasing power of a currency. High inflation tends to

increase interest rates by RBA so to slow down the economy on the other hand low

inflation induce the RBA to cut down the interest rate. The Australian dollar has jumped

above 79 US cents with the US currency remaining weak after US inflation figures came

in higher than expected.

5

01/02/2014

01/05/2014

01/08/2014

01/11/2014

01/02/2015

01/05/2015

01/08/2015

01/11/2015

01/02/2016

01/05/2016

01/08/2016

01/11/2016

01/02/2017

01/05/2017

01/08/2017

01/11/2017

01/02/2018

0

10

20

30

40

50

60

70

80

Trade Weighted Index

TWI

Growth rate: The percentage change of a particular measure in contrast to similar

measure over a certain time period is termed as change in growth rate. As the currency

depreciates, the foreign consumers tends to buy more. This in turn brings in higher

profits, increase in production and increase in employment for the organisations engaged

in exporting thereby increasing the growth rate of the economy. The AUD dollar moves

up to 80 US cents as the US dollar weakens to a three-year low against a basket of

currencies. Interest rate: In general, the term interest rate is defined as the rate at which the borrower

will repay the amount along with principal amount to the lender. The interest rate held by

RBA is 1.5% as they believe the economic growth with increase in 2018.

Government restrictions: Australia uses the floating method of determining the exchange

rate which implies the rate is determined by the changes in the market demand and

supply and not by the government as in the case of fixed exchange rate. The changes in

the tax reforms and government policies had a great impact on the market demand and

supply which directly affects the Australian dollar. In the late 18th century, the central

bank pegged gold to buy and sell its currency (Farrell, 2009).

(d) Impact of the depreciation of the Australian dollar on an electrical machinery firm engaged in

importing.

The change in exchange rate from US 80C per AUD to US 70C per AUD will have a

drastic effect on the organisation who is involved in importing electrical machinery. As the

manager of the organisation, I have to spend more to buy a piece of machinery as the exchange

rate changes from 80 US cents to 70 US cents per Australian dollar. The depreciation of AUD in

contrast to greenback had an adverse effect on the electrical machinery organisation. The

organisation being a major factor of growth for the Australian economy will have an

unfavourable consequence on it as it will cut down employment thereby making many people

jobless. Other reasons could be the depreciation of the value of company’s shares, low salary,

and no incentives. The introduction of the Aussie back in 1966 as a trading currency against the

US dollar was 1 A$ = 1.4875 US$. As the Australian currency tends to be floating in the foreign

exchange market it has slumped down in contrast to the US dollar.

6

measure over a certain time period is termed as change in growth rate. As the currency

depreciates, the foreign consumers tends to buy more. This in turn brings in higher

profits, increase in production and increase in employment for the organisations engaged

in exporting thereby increasing the growth rate of the economy. The AUD dollar moves

up to 80 US cents as the US dollar weakens to a three-year low against a basket of

currencies. Interest rate: In general, the term interest rate is defined as the rate at which the borrower

will repay the amount along with principal amount to the lender. The interest rate held by

RBA is 1.5% as they believe the economic growth with increase in 2018.

Government restrictions: Australia uses the floating method of determining the exchange

rate which implies the rate is determined by the changes in the market demand and

supply and not by the government as in the case of fixed exchange rate. The changes in

the tax reforms and government policies had a great impact on the market demand and

supply which directly affects the Australian dollar. In the late 18th century, the central

bank pegged gold to buy and sell its currency (Farrell, 2009).

(d) Impact of the depreciation of the Australian dollar on an electrical machinery firm engaged in

importing.

The change in exchange rate from US 80C per AUD to US 70C per AUD will have a

drastic effect on the organisation who is involved in importing electrical machinery. As the

manager of the organisation, I have to spend more to buy a piece of machinery as the exchange

rate changes from 80 US cents to 70 US cents per Australian dollar. The depreciation of AUD in

contrast to greenback had an adverse effect on the electrical machinery organisation. The

organisation being a major factor of growth for the Australian economy will have an

unfavourable consequence on it as it will cut down employment thereby making many people

jobless. Other reasons could be the depreciation of the value of company’s shares, low salary,

and no incentives. The introduction of the Aussie back in 1966 as a trading currency against the

US dollar was 1 A$ = 1.4875 US$. As the Australian currency tends to be floating in the foreign

exchange market it has slumped down in contrast to the US dollar.

6

The Reserve bank of Australia believes that the economy will grow and the AUD will

rise above in the next year (Garnaut and Smith, 2009). For the electrical machinery company, the

turnover as a whole will be affected as more money goes out of the company as compared to

before the change in exchange rate. This in turn will affect the country economy as more Aussie

goes out in exchange of the foreign currency coming in the country. Thus, to conclude, the

change in foreign exchange rate will have a drastic effect on the country's economy as more

money goes out of the country in comparison to lesser amount of foreign currency coming in the

economy.

(d) Action Reserve Bank of Australia takes in order to bring the exchange rate back to US 80C

per AUD, and the side effects on the Australian economy.

The Aussie-Greenback exchange rate has been affected by many factors. The Australian

dollar depreciated to 35.48% against the US dollar during the Asian financial crisis. As the

AUD/USD exchange rate stabilises to 72 US cents in the coming year as compared to the

previous rate of exchange where 1 AUD was able to get 80 US cents. It is a crucial condition for

the Australian government to bring down the exchange rate back to 80 US cents.

The focus of the Reserve Bank of Australia is on the Australian economy as it forecasts

its growth in the coming year. As the inflation is low globally, markets reactivity has increased.

Investment in infrastructure has increased which will support the economy to a great extent.

Growth in exports of iron ore is another key factor of bringing stability in the economy which

infact results in bring the exchange rate back to 80 US cents (Barnes and Jackson, 2012). The

country is experiencing higher rate of employment as compared to the decline in the

unemployment rate which again helps in bringing back the stable exchange rate. On the basis of

trade-weighted index, the AUD in contrast to USD remains the same.

CONCLUSION

The study shows the various determinants of AUD/USD exchange rate which affects

their change and impacts the economy as a whole. The government policies have an impact on

the determination of exchange rate as the market demand and supply are the major variables

determining the exchange rate. Moreover, the major factors responsible for fluctuations in the

Australian currency are: falling prices of iron-ore, exponential growth of Chinese market and the

7

rise above in the next year (Garnaut and Smith, 2009). For the electrical machinery company, the

turnover as a whole will be affected as more money goes out of the company as compared to

before the change in exchange rate. This in turn will affect the country economy as more Aussie

goes out in exchange of the foreign currency coming in the country. Thus, to conclude, the

change in foreign exchange rate will have a drastic effect on the country's economy as more

money goes out of the country in comparison to lesser amount of foreign currency coming in the

economy.

(d) Action Reserve Bank of Australia takes in order to bring the exchange rate back to US 80C

per AUD, and the side effects on the Australian economy.

The Aussie-Greenback exchange rate has been affected by many factors. The Australian

dollar depreciated to 35.48% against the US dollar during the Asian financial crisis. As the

AUD/USD exchange rate stabilises to 72 US cents in the coming year as compared to the

previous rate of exchange where 1 AUD was able to get 80 US cents. It is a crucial condition for

the Australian government to bring down the exchange rate back to 80 US cents.

The focus of the Reserve Bank of Australia is on the Australian economy as it forecasts

its growth in the coming year. As the inflation is low globally, markets reactivity has increased.

Investment in infrastructure has increased which will support the economy to a great extent.

Growth in exports of iron ore is another key factor of bringing stability in the economy which

infact results in bring the exchange rate back to 80 US cents (Barnes and Jackson, 2012). The

country is experiencing higher rate of employment as compared to the decline in the

unemployment rate which again helps in bringing back the stable exchange rate. On the basis of

trade-weighted index, the AUD in contrast to USD remains the same.

CONCLUSION

The study shows the various determinants of AUD/USD exchange rate which affects

their change and impacts the economy as a whole. The government policies have an impact on

the determination of exchange rate as the market demand and supply are the major variables

determining the exchange rate. Moreover, the major factors responsible for fluctuations in the

Australian currency are: falling prices of iron-ore, exponential growth of Chinese market and the

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

widening interest rate which is in favour of the USD. The RBA being stiff about the growth of

Australian market believes the economy will grow as the year expands in 2018.

8

Australian market believes the economy will grow as the year expands in 2018.

8

REFERENCES

Books and Journals:

Barnes, C. and Jackson, S., 2012. Staging Identity: Australian Design Innovation at Expo ‘70,

Osaka. Journal of Design History. 25(4). pp.400-413.

Farrell, T., 2009. 5th Ed. Wool Marketing in Australia.

Garnaut, R. and Smith, L. D., 2009. The great crash of 2008. Melbourne Univ. Publishing.

Morris, C. R., 2008. The two trillion dollar meltdown: Easy money, high rollers, and the great

credit crash. Public Affairs.

Online:

Reserve Bank of Australia. 2018 [Online]. Available through:

<https://www.rba.gov.au/statistics/frequency/exchange-rates.html>

Australian dollar tipped to slide back to 70 US cents. 2018. [Online]. Available through:

<https://www.smh.com.au/business/investments/australian-dollar-tipped-to-slide-back-to-

70-us-cents-20180129-h0pp8v.html>

Stronger Aussie a bump on RBA's slow path back to normal. 2018. [Online]. Available through:

<https://www.smh.com.au/business/investments/stronger-aussie-a-bump-on-rbas-slowpath-

back-to-normal-20180128-h0peeo.html>

9

Books and Journals:

Barnes, C. and Jackson, S., 2012. Staging Identity: Australian Design Innovation at Expo ‘70,

Osaka. Journal of Design History. 25(4). pp.400-413.

Farrell, T., 2009. 5th Ed. Wool Marketing in Australia.

Garnaut, R. and Smith, L. D., 2009. The great crash of 2008. Melbourne Univ. Publishing.

Morris, C. R., 2008. The two trillion dollar meltdown: Easy money, high rollers, and the great

credit crash. Public Affairs.

Online:

Reserve Bank of Australia. 2018 [Online]. Available through:

<https://www.rba.gov.au/statistics/frequency/exchange-rates.html>

Australian dollar tipped to slide back to 70 US cents. 2018. [Online]. Available through:

<https://www.smh.com.au/business/investments/australian-dollar-tipped-to-slide-back-to-

70-us-cents-20180129-h0pp8v.html>

Stronger Aussie a bump on RBA's slow path back to normal. 2018. [Online]. Available through:

<https://www.smh.com.au/business/investments/stronger-aussie-a-bump-on-rbas-slowpath-

back-to-normal-20180128-h0peeo.html>

9

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.