Economics Assignment: Australian Dollar (AUD) Exchange Rate Analysis

VerifiedAdded on 2021/04/21

|13

|2741

|39

Report

AI Summary

This economics assignment analyzes the Australian Dollar (AUD) exchange rate, focusing on its determination within the foreign exchange market using a demand-supply framework. The report explores the distinction between nominal and real exchange rates, presenting data on the fluctuations of the AUD and its trade-weighted index (TWI) over recent years, highlighting key influencing factors such as commodity prices, inflation, and government policies. It examines the impact of exchange rate fluctuations on imports, exports, and the balance of payments, with a particular focus on the relationship between the AUD and the USD. The assignment concludes by providing recommendations for the Australian government and the Reserve Bank of Australia to manage and influence the exchange rate, including export promotion, interest rate adjustments, and fiscal policies to address economic challenges such as stagflation.

Running head: ECONOMICS ASSIGNMENT

Economics Assignment

Name of the Student:

Name of the University:

Author’s Note:

Economics Assignment

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS ASSIGNMENT 1

Table of Contents

Answer to Question a:.....................................................................................................................2

Answer to Question c:.....................................................................................................................7

Answer to Question d:.....................................................................................................................8

Answer to Question e:.....................................................................................................................9

Reference List................................................................................................................................11

Table of Contents

Answer to Question a:.....................................................................................................................2

Answer to Question c:.....................................................................................................................7

Answer to Question d:.....................................................................................................................8

Answer to Question e:.....................................................................................................................9

Reference List................................................................................................................................11

ECONOMICS ASSIGNMENT 2

Answer to Question a:

Exchange rate can be characterized as the price of the domestic currency or the currency

of a nation stated in terms of the currency of a foreign country. In other words exchange rate can

be held responsible for comparing a currency with the other in terms of their values. There

different types of exchange rate regime such as the fixed, floating and pegged exchange rates and

due to this it becomes difficult to determine the actual rate of exchange (Ferraro et al., 2015).

Although, it can be stated that demand supply mechanism can be used to for the purpose of

determining the exchange rate in the given scenario as this is identified as an efficient tool by

many of the researchers. The aforementioned framework sometimes help to forecast the

exchange rate expected to prevail in the next period as well. On an added notion it traces out

different factors which in turn can affect and play a crucial role in determining the actual

exchange rate (Engel et al., 2015). This specific report will focus on the Australian economy and

how the value of AUD is obtained in the market of foreign exchange with the help of demand

supply framework will be shown in the next few paragraphs.

Answer to Question a:

Exchange rate can be characterized as the price of the domestic currency or the currency

of a nation stated in terms of the currency of a foreign country. In other words exchange rate can

be held responsible for comparing a currency with the other in terms of their values. There

different types of exchange rate regime such as the fixed, floating and pegged exchange rates and

due to this it becomes difficult to determine the actual rate of exchange (Ferraro et al., 2015).

Although, it can be stated that demand supply mechanism can be used to for the purpose of

determining the exchange rate in the given scenario as this is identified as an efficient tool by

many of the researchers. The aforementioned framework sometimes help to forecast the

exchange rate expected to prevail in the next period as well. On an added notion it traces out

different factors which in turn can affect and play a crucial role in determining the actual

exchange rate (Engel et al., 2015). This specific report will focus on the Australian economy and

how the value of AUD is obtained in the market of foreign exchange with the help of demand

supply framework will be shown in the next few paragraphs.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

AUD/USD

Q

USD 84C/1AUD

USD 76C/1 AUD

USD 80C/1 AUD

Q2 Q Q1

E

E1

S

D2 D

D1

E2

ECONOMICS ASSIGNMENT 3

Figure 1: Determining the Australian Exchange Rate in the Forex Market (Demand-

Supply Framework)

(Source: Created by Author)

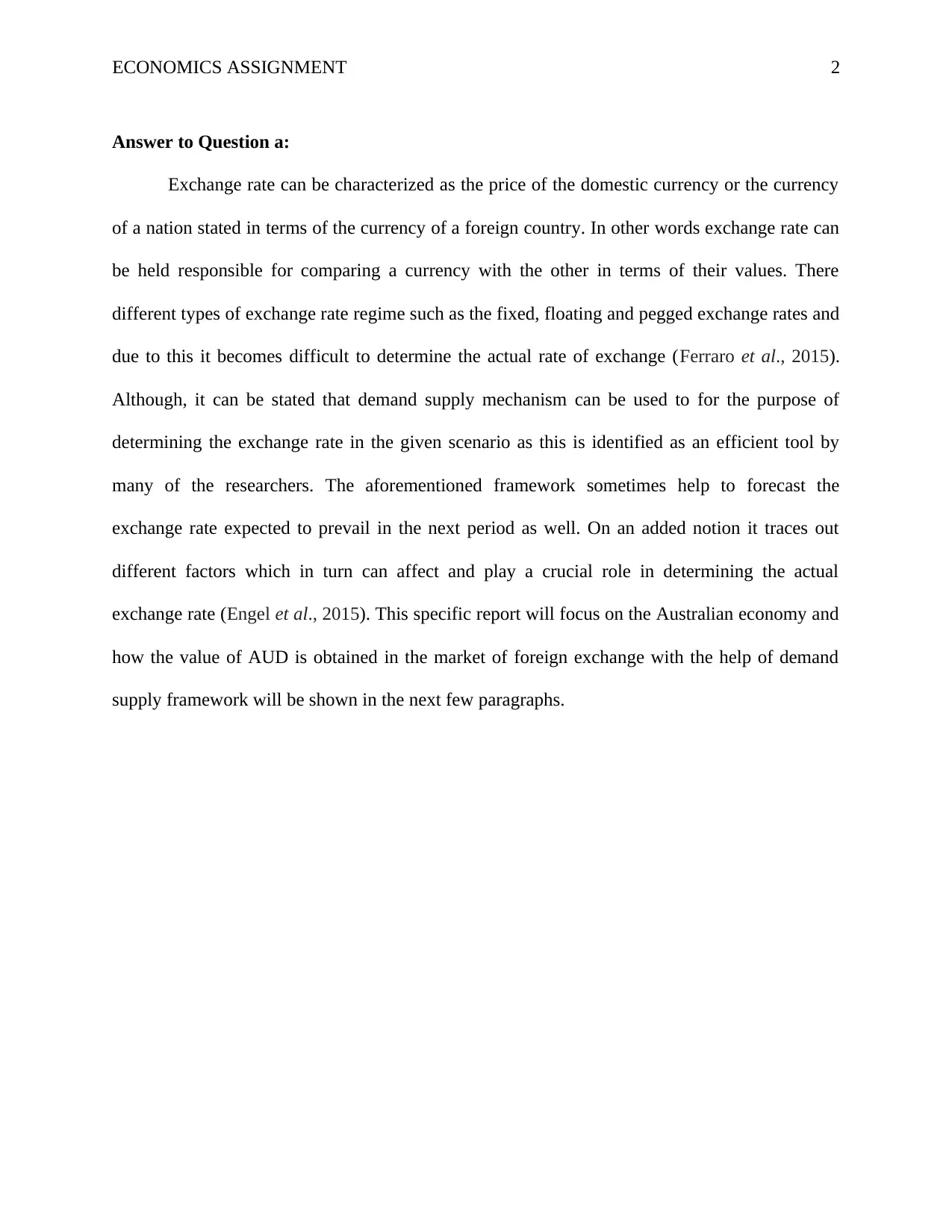

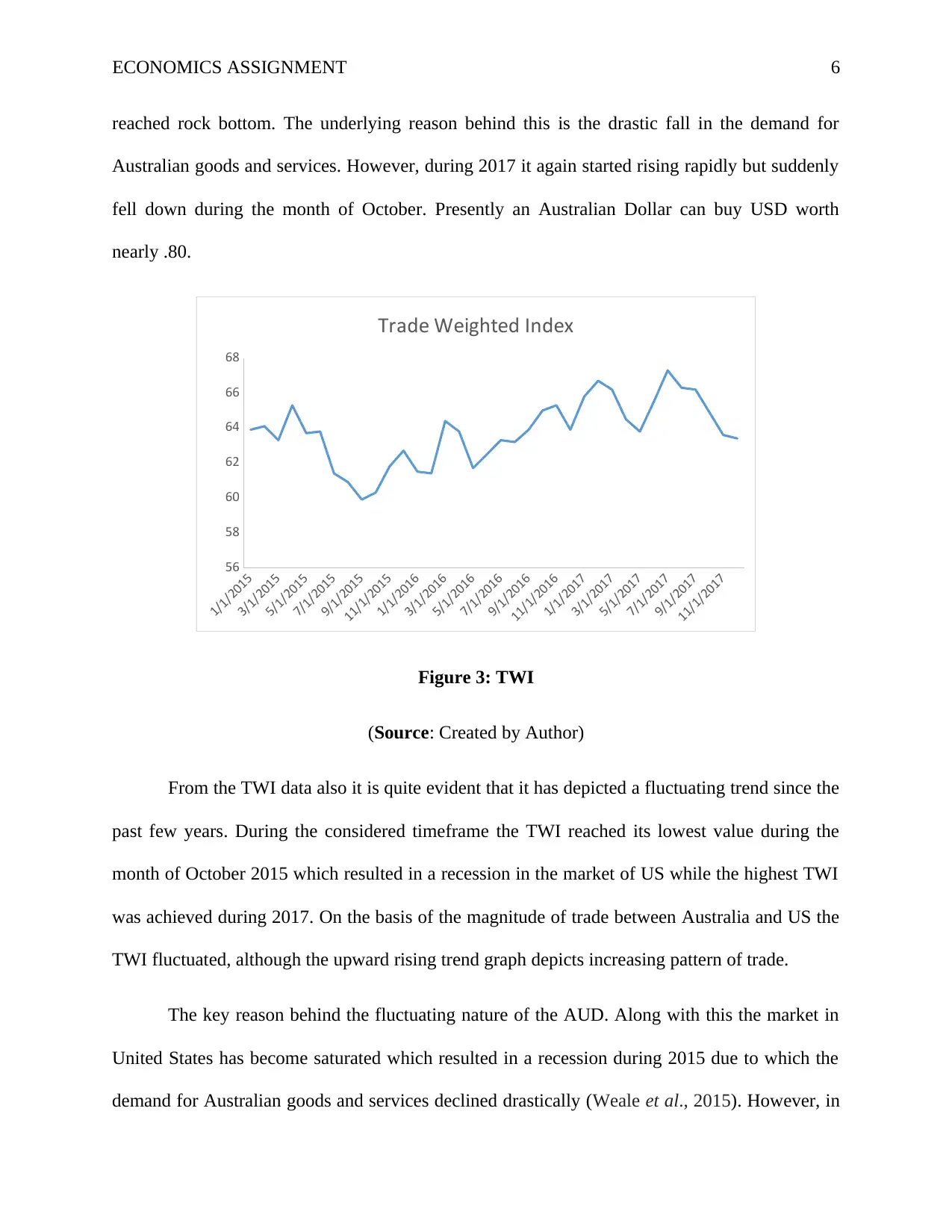

The figure above depicts the demand and supply framework of the foreign exchange

market. Through this demand supply framework the exchange rate of a country can be

determined. The export demand of a country determines the demand for currency and on the

other hand, the supply is dependent over the demand for the importable in the domestic country

(Engel, 2014). The demand curve is projected on the basis of the derived demand while the

supply curve is projected on the basis of the overall aggregate demand for the importable. Now it

can be observed that equilibrium is achieved where demand equals supply and at this point E the

exchange rate is 80 C USD for a unit Australian Dollar. At this point the supply of the currency

which is determined by the demand for importable in the domestic market is found to be

Q

USD 84C/1AUD

USD 76C/1 AUD

USD 80C/1 AUD

Q2 Q Q1

E

E1

S

D2 D

D1

E2

ECONOMICS ASSIGNMENT 3

Figure 1: Determining the Australian Exchange Rate in the Forex Market (Demand-

Supply Framework)

(Source: Created by Author)

The figure above depicts the demand and supply framework of the foreign exchange

market. Through this demand supply framework the exchange rate of a country can be

determined. The export demand of a country determines the demand for currency and on the

other hand, the supply is dependent over the demand for the importable in the domestic country

(Engel, 2014). The demand curve is projected on the basis of the derived demand while the

supply curve is projected on the basis of the overall aggregate demand for the importable. Now it

can be observed that equilibrium is achieved where demand equals supply and at this point E the

exchange rate is 80 C USD for a unit Australian Dollar. At this point the supply of the currency

which is determined by the demand for importable in the domestic market is found to be

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS ASSIGNMENT 4

represented by point Q. Now let us suppose that there is an increase in the demand for AUD and

it moves from Q to Q1, the demand curve shifts upwards to the right to D1 as a result there is a

increase in the rate of exchange for every unit of AUD in comparison to the initial equilibrium

condition. On the other hand, when there is a fall in the quantity demanded the demand curve

shift downwards to the left and a result of which the exchange rate further depreciates for each

unit of the AUD.

As per the analysis it can be stated that exchange rate in a floating exchange rate regime

is strictly determined by the interaction of demand and supply of currency and there are various

factors which contributes to the fluctuations in this demand and supply factors (Cenedese et al.,

2015). In brief these factors can be summarized as follows,

Rate of inflation: An increase in the rate of inflation will lead to a depreciation in the

AUD which will in turn shift the demand curve towards the left.

Growth rate: If the demand for the export of goods and services produced in Australia

increase due to an increased growth rate the exchange rate will be appreciated and shift

the demand curve to the right (McCombie and Thirlwall, 2016).

o Plans implemented by government: Implementing a policy that supports

promotion of exports and substitution of exports will help in appreciating the

exchange rate of the country.

Answer to Question b:

The exchange rate can be divided into two categories nominal exchange rate and real

exchange rate. The nominal exchange rate can be defined as the units or amount of domestic

currency needed for purchasing a single unit of the foreign currency (Jotikasthira et al., 2015). A

represented by point Q. Now let us suppose that there is an increase in the demand for AUD and

it moves from Q to Q1, the demand curve shifts upwards to the right to D1 as a result there is a

increase in the rate of exchange for every unit of AUD in comparison to the initial equilibrium

condition. On the other hand, when there is a fall in the quantity demanded the demand curve

shift downwards to the left and a result of which the exchange rate further depreciates for each

unit of the AUD.

As per the analysis it can be stated that exchange rate in a floating exchange rate regime

is strictly determined by the interaction of demand and supply of currency and there are various

factors which contributes to the fluctuations in this demand and supply factors (Cenedese et al.,

2015). In brief these factors can be summarized as follows,

Rate of inflation: An increase in the rate of inflation will lead to a depreciation in the

AUD which will in turn shift the demand curve towards the left.

Growth rate: If the demand for the export of goods and services produced in Australia

increase due to an increased growth rate the exchange rate will be appreciated and shift

the demand curve to the right (McCombie and Thirlwall, 2016).

o Plans implemented by government: Implementing a policy that supports

promotion of exports and substitution of exports will help in appreciating the

exchange rate of the country.

Answer to Question b:

The exchange rate can be divided into two categories nominal exchange rate and real

exchange rate. The nominal exchange rate can be defined as the units or amount of domestic

currency needed for purchasing a single unit of the foreign currency (Jotikasthira et al., 2015). A

ECONOMICS ASSIGNMENT 5

fall in this variable is generally termed as the nominal appreciation of the currency and an

increase on the other hand is termed as the nominal depreciation of the currency. On the

contrary, the real exchange rate can be defined as the ratio of price level abroad to the price level

prevailing in the domestic country.

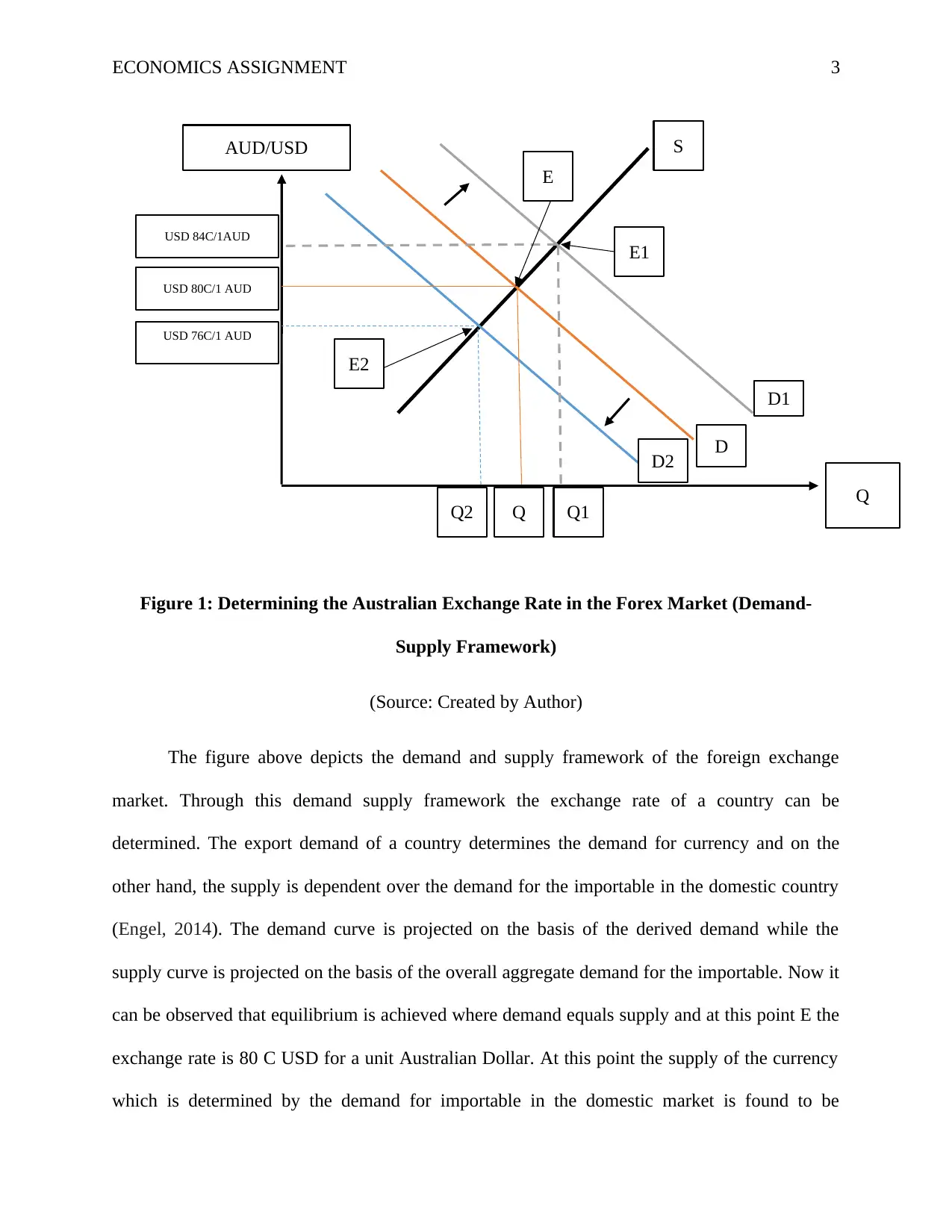

The trade weighted index is generally used to estimate the effective value of the exchange

rate of a country against a number of currencies. The significance of the other currencies used in

this regard is reliant on the percentage of trade performed with those countries (Cavusgil et al.,

2014). Generally the trade weighted index is calculated

04-Jan-2016

03-Feb-2016

04-Mar-2016

03-Apr-2016

03-May-2016

02-Jun-2016

02-Jul-2016

01-Aug-2016

31-Aug-2016

30-Sep-2016

30-Oct-2016

29-Nov-2016

29-Dec-2016

28-Jan-2017

27-Feb-2017

29-Mar-2017

28-Apr-2017

28-May-2017

27-Jun-2017

27-Jul-2017

26-Aug-2017

25-Sep-2017

25-Oct-2017

24-Nov-2017

24-Dec-2017

23-Jan-2018

22-Feb-2018

0.60

0.65

0.70

0.75

0.80

0.85

Nominal Exchange Rate

Figure 2: Nominal Exchange Rate of Australia

(Source: Created by Author)

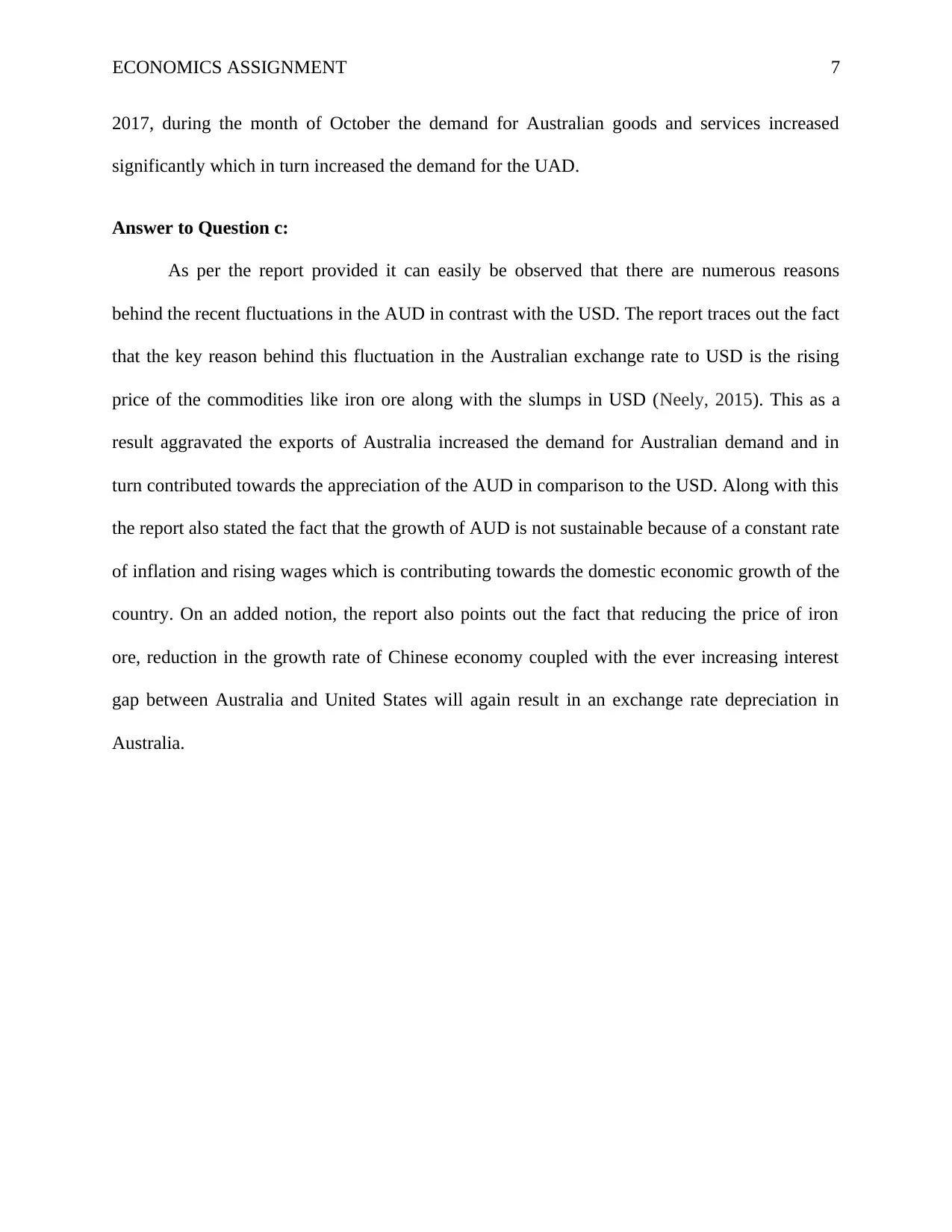

As depicted by the figure above the nominal exchange rate of has depicted rigorous

fluctuations since the past three years. From the figure it is quite evident that a major fluctuation

took place in the year 2015, because during the month of March, 2015 the Australian nominal

exchange rate reached its peak point while during the month of September of the same year it

fall in this variable is generally termed as the nominal appreciation of the currency and an

increase on the other hand is termed as the nominal depreciation of the currency. On the

contrary, the real exchange rate can be defined as the ratio of price level abroad to the price level

prevailing in the domestic country.

The trade weighted index is generally used to estimate the effective value of the exchange

rate of a country against a number of currencies. The significance of the other currencies used in

this regard is reliant on the percentage of trade performed with those countries (Cavusgil et al.,

2014). Generally the trade weighted index is calculated

04-Jan-2016

03-Feb-2016

04-Mar-2016

03-Apr-2016

03-May-2016

02-Jun-2016

02-Jul-2016

01-Aug-2016

31-Aug-2016

30-Sep-2016

30-Oct-2016

29-Nov-2016

29-Dec-2016

28-Jan-2017

27-Feb-2017

29-Mar-2017

28-Apr-2017

28-May-2017

27-Jun-2017

27-Jul-2017

26-Aug-2017

25-Sep-2017

25-Oct-2017

24-Nov-2017

24-Dec-2017

23-Jan-2018

22-Feb-2018

0.60

0.65

0.70

0.75

0.80

0.85

Nominal Exchange Rate

Figure 2: Nominal Exchange Rate of Australia

(Source: Created by Author)

As depicted by the figure above the nominal exchange rate of has depicted rigorous

fluctuations since the past three years. From the figure it is quite evident that a major fluctuation

took place in the year 2015, because during the month of March, 2015 the Australian nominal

exchange rate reached its peak point while during the month of September of the same year it

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECONOMICS ASSIGNMENT 6

reached rock bottom. The underlying reason behind this is the drastic fall in the demand for

Australian goods and services. However, during 2017 it again started rising rapidly but suddenly

fell down during the month of October. Presently an Australian Dollar can buy USD worth

nearly .80.

1/1/2015

3/1/2015

5/1/2015

7/1/2015

9/1/2015

11/1/2015

1/1/2016

3/1/2016

5/1/2016

7/1/2016

9/1/2016

11/1/2016

1/1/2017

3/1/2017

5/1/2017

7/1/2017

9/1/2017

11/1/2017

56

58

60

62

64

66

68

Trade Weighted Index

Figure 3: TWI

(Source: Created by Author)

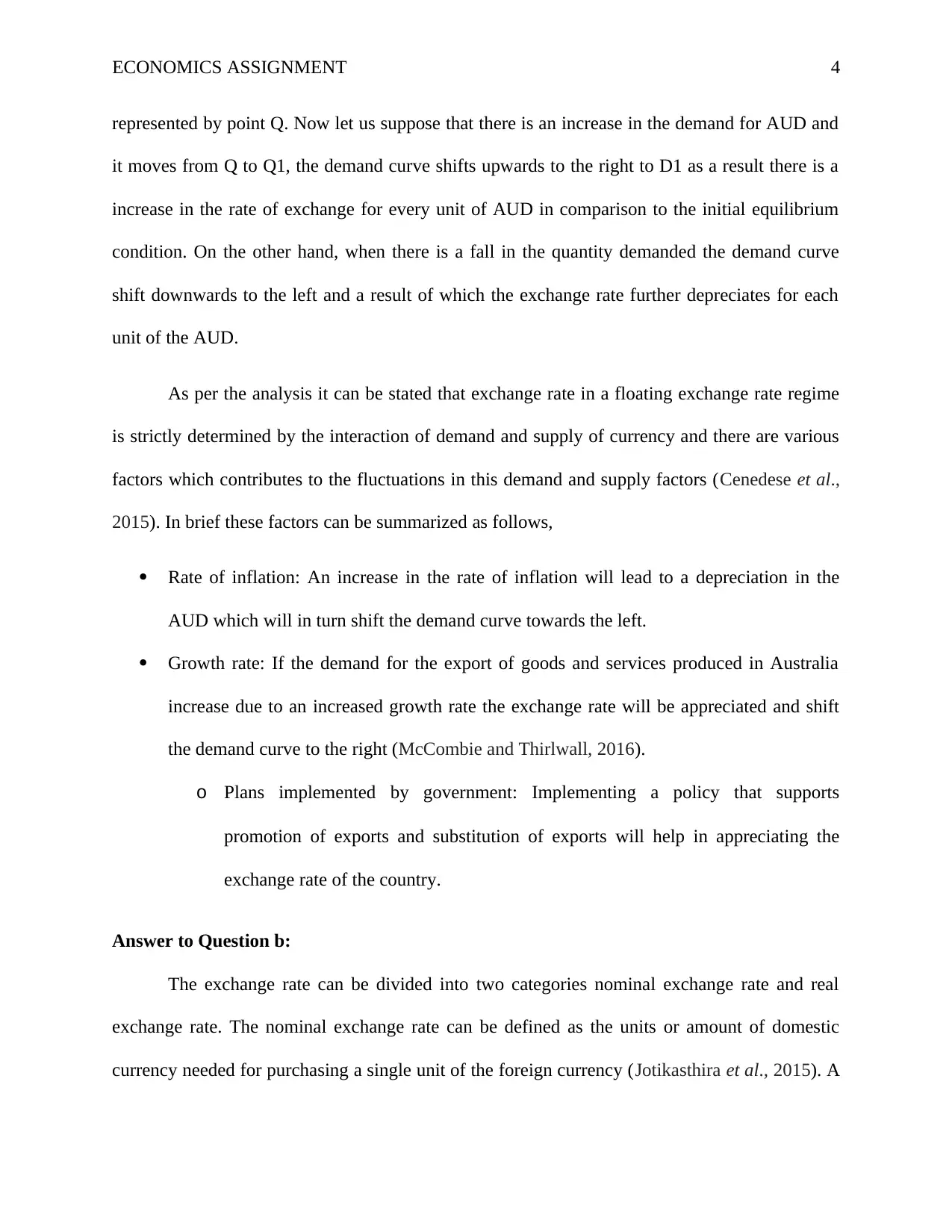

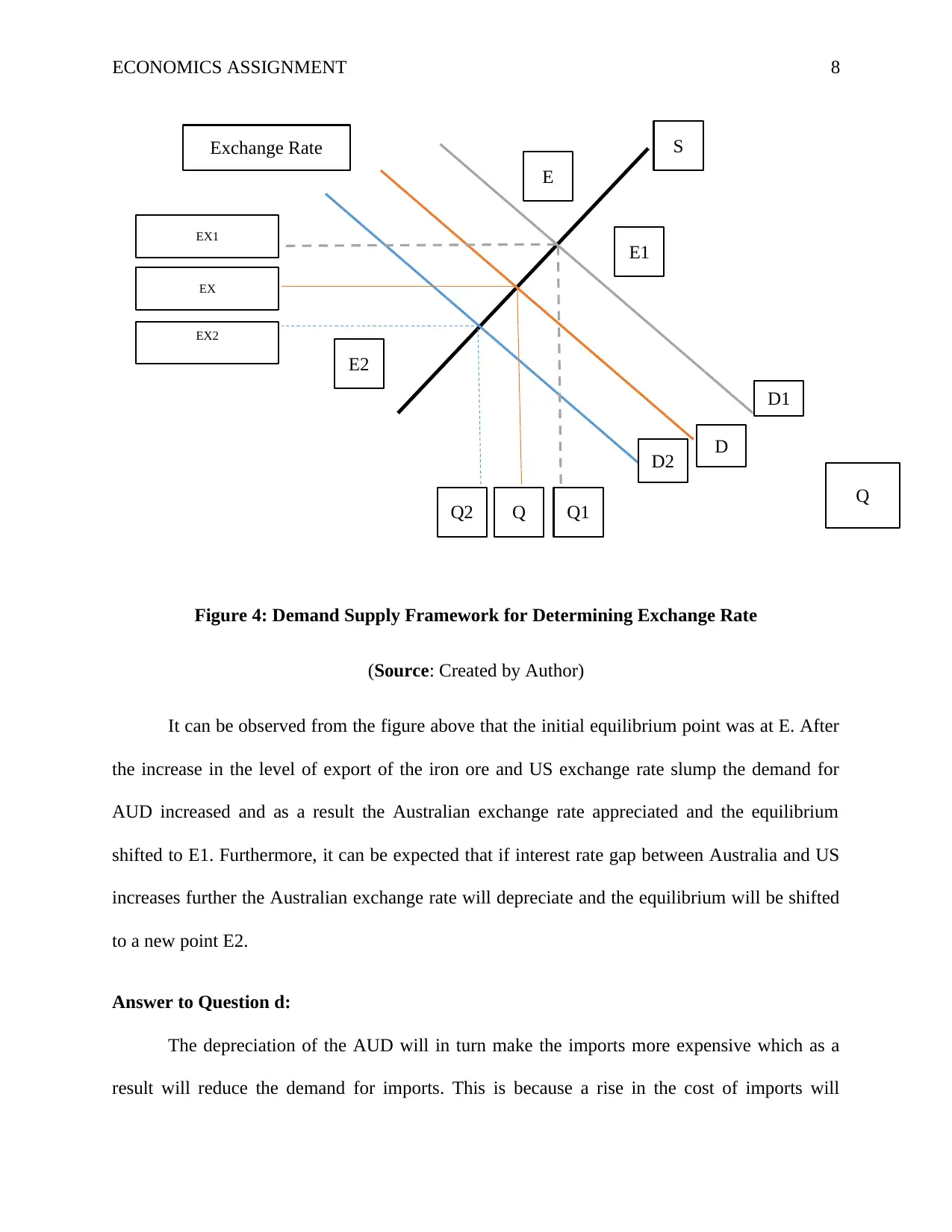

From the TWI data also it is quite evident that it has depicted a fluctuating trend since the

past few years. During the considered timeframe the TWI reached its lowest value during the

month of October 2015 which resulted in a recession in the market of US while the highest TWI

was achieved during 2017. On the basis of the magnitude of trade between Australia and US the

TWI fluctuated, although the upward rising trend graph depicts increasing pattern of trade.

The key reason behind the fluctuating nature of the AUD. Along with this the market in

United States has become saturated which resulted in a recession during 2015 due to which the

demand for Australian goods and services declined drastically (Weale et al., 2015). However, in

reached rock bottom. The underlying reason behind this is the drastic fall in the demand for

Australian goods and services. However, during 2017 it again started rising rapidly but suddenly

fell down during the month of October. Presently an Australian Dollar can buy USD worth

nearly .80.

1/1/2015

3/1/2015

5/1/2015

7/1/2015

9/1/2015

11/1/2015

1/1/2016

3/1/2016

5/1/2016

7/1/2016

9/1/2016

11/1/2016

1/1/2017

3/1/2017

5/1/2017

7/1/2017

9/1/2017

11/1/2017

56

58

60

62

64

66

68

Trade Weighted Index

Figure 3: TWI

(Source: Created by Author)

From the TWI data also it is quite evident that it has depicted a fluctuating trend since the

past few years. During the considered timeframe the TWI reached its lowest value during the

month of October 2015 which resulted in a recession in the market of US while the highest TWI

was achieved during 2017. On the basis of the magnitude of trade between Australia and US the

TWI fluctuated, although the upward rising trend graph depicts increasing pattern of trade.

The key reason behind the fluctuating nature of the AUD. Along with this the market in

United States has become saturated which resulted in a recession during 2015 due to which the

demand for Australian goods and services declined drastically (Weale et al., 2015). However, in

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS ASSIGNMENT 7

2017, during the month of October the demand for Australian goods and services increased

significantly which in turn increased the demand for the UAD.

Answer to Question c:

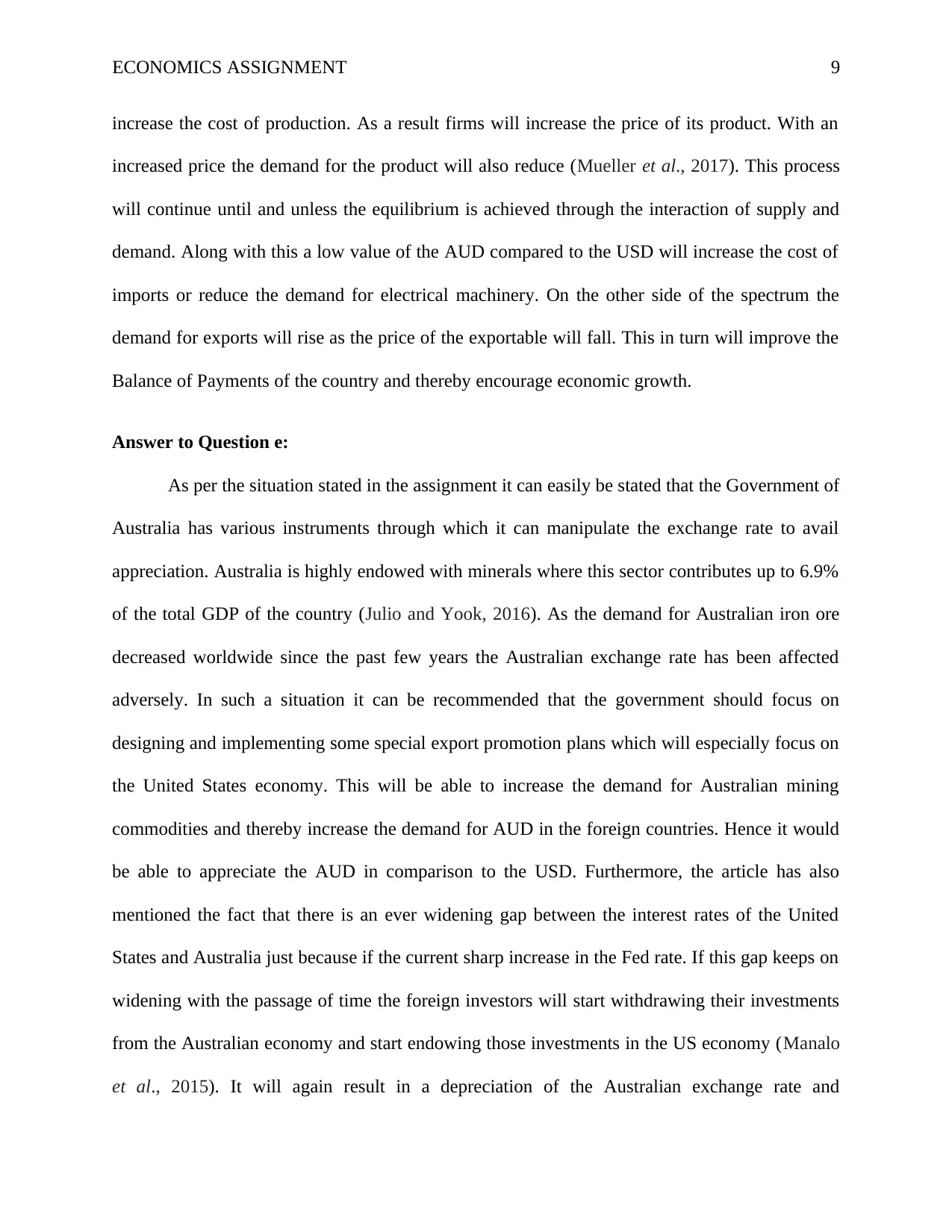

As per the report provided it can easily be observed that there are numerous reasons

behind the recent fluctuations in the AUD in contrast with the USD. The report traces out the fact

that the key reason behind this fluctuation in the Australian exchange rate to USD is the rising

price of the commodities like iron ore along with the slumps in USD (Neely, 2015). This as a

result aggravated the exports of Australia increased the demand for Australian demand and in

turn contributed towards the appreciation of the AUD in comparison to the USD. Along with this

the report also stated the fact that the growth of AUD is not sustainable because of a constant rate

of inflation and rising wages which is contributing towards the domestic economic growth of the

country. On an added notion, the report also points out the fact that reducing the price of iron

ore, reduction in the growth rate of Chinese economy coupled with the ever increasing interest

gap between Australia and United States will again result in an exchange rate depreciation in

Australia.

2017, during the month of October the demand for Australian goods and services increased

significantly which in turn increased the demand for the UAD.

Answer to Question c:

As per the report provided it can easily be observed that there are numerous reasons

behind the recent fluctuations in the AUD in contrast with the USD. The report traces out the fact

that the key reason behind this fluctuation in the Australian exchange rate to USD is the rising

price of the commodities like iron ore along with the slumps in USD (Neely, 2015). This as a

result aggravated the exports of Australia increased the demand for Australian demand and in

turn contributed towards the appreciation of the AUD in comparison to the USD. Along with this

the report also stated the fact that the growth of AUD is not sustainable because of a constant rate

of inflation and rising wages which is contributing towards the domestic economic growth of the

country. On an added notion, the report also points out the fact that reducing the price of iron

ore, reduction in the growth rate of Chinese economy coupled with the ever increasing interest

gap between Australia and United States will again result in an exchange rate depreciation in

Australia.

Exchange Rate

Q

EX1

EX2

EX

Q2 Q Q1

E

E1

S

D2 D

D1

E2

ECONOMICS ASSIGNMENT 8

Figure 4: Demand Supply Framework for Determining Exchange Rate

(Source: Created by Author)

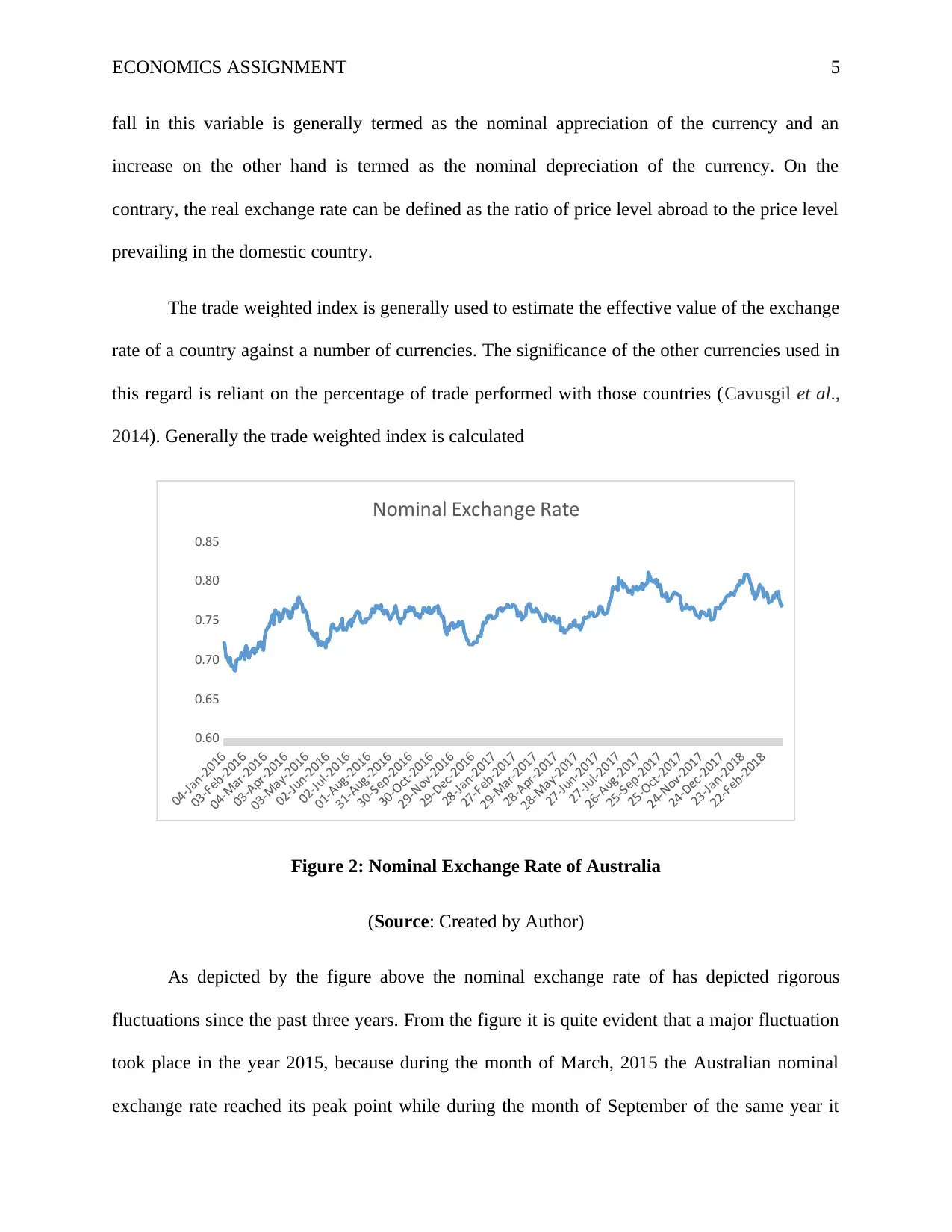

It can be observed from the figure above that the initial equilibrium point was at E. After

the increase in the level of export of the iron ore and US exchange rate slump the demand for

AUD increased and as a result the Australian exchange rate appreciated and the equilibrium

shifted to E1. Furthermore, it can be expected that if interest rate gap between Australia and US

increases further the Australian exchange rate will depreciate and the equilibrium will be shifted

to a new point E2.

Answer to Question d:

The depreciation of the AUD will in turn make the imports more expensive which as a

result will reduce the demand for imports. This is because a rise in the cost of imports will

Q

EX1

EX2

EX

Q2 Q Q1

E

E1

S

D2 D

D1

E2

ECONOMICS ASSIGNMENT 8

Figure 4: Demand Supply Framework for Determining Exchange Rate

(Source: Created by Author)

It can be observed from the figure above that the initial equilibrium point was at E. After

the increase in the level of export of the iron ore and US exchange rate slump the demand for

AUD increased and as a result the Australian exchange rate appreciated and the equilibrium

shifted to E1. Furthermore, it can be expected that if interest rate gap between Australia and US

increases further the Australian exchange rate will depreciate and the equilibrium will be shifted

to a new point E2.

Answer to Question d:

The depreciation of the AUD will in turn make the imports more expensive which as a

result will reduce the demand for imports. This is because a rise in the cost of imports will

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECONOMICS ASSIGNMENT 9

increase the cost of production. As a result firms will increase the price of its product. With an

increased price the demand for the product will also reduce (Mueller et al., 2017). This process

will continue until and unless the equilibrium is achieved through the interaction of supply and

demand. Along with this a low value of the AUD compared to the USD will increase the cost of

imports or reduce the demand for electrical machinery. On the other side of the spectrum the

demand for exports will rise as the price of the exportable will fall. This in turn will improve the

Balance of Payments of the country and thereby encourage economic growth.

Answer to Question e:

As per the situation stated in the assignment it can easily be stated that the Government of

Australia has various instruments through which it can manipulate the exchange rate to avail

appreciation. Australia is highly endowed with minerals where this sector contributes up to 6.9%

of the total GDP of the country (Julio and Yook, 2016). As the demand for Australian iron ore

decreased worldwide since the past few years the Australian exchange rate has been affected

adversely. In such a situation it can be recommended that the government should focus on

designing and implementing some special export promotion plans which will especially focus on

the United States economy. This will be able to increase the demand for Australian mining

commodities and thereby increase the demand for AUD in the foreign countries. Hence it would

be able to appreciate the AUD in comparison to the USD. Furthermore, the article has also

mentioned the fact that there is an ever widening gap between the interest rates of the United

States and Australia just because if the current sharp increase in the Fed rate. If this gap keeps on

widening with the passage of time the foreign investors will start withdrawing their investments

from the Australian economy and start endowing those investments in the US economy (Manalo

et al., 2015). It will again result in a depreciation of the Australian exchange rate and

increase the cost of production. As a result firms will increase the price of its product. With an

increased price the demand for the product will also reduce (Mueller et al., 2017). This process

will continue until and unless the equilibrium is achieved through the interaction of supply and

demand. Along with this a low value of the AUD compared to the USD will increase the cost of

imports or reduce the demand for electrical machinery. On the other side of the spectrum the

demand for exports will rise as the price of the exportable will fall. This in turn will improve the

Balance of Payments of the country and thereby encourage economic growth.

Answer to Question e:

As per the situation stated in the assignment it can easily be stated that the Government of

Australia has various instruments through which it can manipulate the exchange rate to avail

appreciation. Australia is highly endowed with minerals where this sector contributes up to 6.9%

of the total GDP of the country (Julio and Yook, 2016). As the demand for Australian iron ore

decreased worldwide since the past few years the Australian exchange rate has been affected

adversely. In such a situation it can be recommended that the government should focus on

designing and implementing some special export promotion plans which will especially focus on

the United States economy. This will be able to increase the demand for Australian mining

commodities and thereby increase the demand for AUD in the foreign countries. Hence it would

be able to appreciate the AUD in comparison to the USD. Furthermore, the article has also

mentioned the fact that there is an ever widening gap between the interest rates of the United

States and Australia just because if the current sharp increase in the Fed rate. If this gap keeps on

widening with the passage of time the foreign investors will start withdrawing their investments

from the Australian economy and start endowing those investments in the US economy (Manalo

et al., 2015). It will again result in a depreciation of the Australian exchange rate and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS ASSIGNMENT 10

appreciation of USD. Hence, it can be suggested that the Reserve Bank of Australia should

implement some remedial measures to cope with the situation. The stagnancy in the inflation rate

coupled with the increasing wage rate the Australian economy is slowing down gradually. In

order to cope with such a condition the Reserve Bank of Australia should raise the rate of interest

and take some expansionary fiscal policy in order to accumulate money within the economy

(Baker et al., 2016). This is expected to provide the economy with the much needed boost for

overcoming the stagflation. Then the government could be able to opt for import substitution and

impose quota so as to control the export deficits.

These plans are efficient enough in increasing the demand for AUD and reestablishing

the exchange rate at 80C USD for 1 AUD but it possesses some drawbacks. For instance export

promotion will lead to an appreciation in the AUD and there will be an increase in the demand

for importable. As the demand for importable increase net export will tend to go down and the

economy will remain at the same situation.

Taking into account the benefits and drawbacks of the policy it can be stated the

Australian government could be able to reestablish the exchange rate at 80c from 72c if the

aforementioned plans are improvised effectively. However, if the government maintains

appropriate balance between the interest rate and market liquidity it would be able to minimize

the side effects. The infrastructural enhancement can also be promoted on the part of the

government which will assist in enhancing the exchange rate (Neely, 2015).

appreciation of USD. Hence, it can be suggested that the Reserve Bank of Australia should

implement some remedial measures to cope with the situation. The stagnancy in the inflation rate

coupled with the increasing wage rate the Australian economy is slowing down gradually. In

order to cope with such a condition the Reserve Bank of Australia should raise the rate of interest

and take some expansionary fiscal policy in order to accumulate money within the economy

(Baker et al., 2016). This is expected to provide the economy with the much needed boost for

overcoming the stagflation. Then the government could be able to opt for import substitution and

impose quota so as to control the export deficits.

These plans are efficient enough in increasing the demand for AUD and reestablishing

the exchange rate at 80C USD for 1 AUD but it possesses some drawbacks. For instance export

promotion will lead to an appreciation in the AUD and there will be an increase in the demand

for importable. As the demand for importable increase net export will tend to go down and the

economy will remain at the same situation.

Taking into account the benefits and drawbacks of the policy it can be stated the

Australian government could be able to reestablish the exchange rate at 80c from 72c if the

aforementioned plans are improvised effectively. However, if the government maintains

appropriate balance between the interest rate and market liquidity it would be able to minimize

the side effects. The infrastructural enhancement can also be promoted on the part of the

government which will assist in enhancing the exchange rate (Neely, 2015).

ECONOMICS ASSIGNMENT 11

Reference List

Baker, S.R., Bloom, N. and Davis, S.J., 2016. Measuring economic policy uncertainty. The

Quarterly Journal of Economics, 131(4), pp.1593-1636.

Cavusgil, S.T., Knight, G., Riesenberger, J.R., Rammal, H.G. and Rose, E.L.,

2014. International business. Pearson Australia.

Cenedese, G., Payne, R., Sarno, L. and Valente, G., 2015. What do stock markets tell us about

exchange rates?. Review of Finance, 20(3), pp.1045-1080.

Engel, C., 2014. Exchange rates and interest parity. In Handbook of international

economics (Vol. 4, pp. 453-522). Elsevier.

Engel, C., Mark, N.C. and West, K.D., 2015. Factor model forecasts of exchange

rates. Econometric Reviews, 34(1-2), pp.32-55.

Ferraro, D., Rogoff, K. and Rossi, B., 2015. Can oil prices forecast exchange rates? An empirical

analysis of the relationship between commodity prices and exchange rates. Journal of

International Money and Finance, 54, pp.116-141.

Jotikasthira, C., Le, A. and Lundblad, C., 2015. Why do term structures in different currencies

co-move?. Journal of Financial Economics, 115(1), pp.58-83.

Julio, B. and Yook, Y., 2016. Policy uncertainty, irreversibility, and cross-border flows of

capital. Journal of International Economics, 103, pp.13-26.

Manalo, J., Perera, D. and Rees, D.M., 2015. Exchange rate movements and the Australian

economy. Economic Modelling, 47, pp.53-62.

Reference List

Baker, S.R., Bloom, N. and Davis, S.J., 2016. Measuring economic policy uncertainty. The

Quarterly Journal of Economics, 131(4), pp.1593-1636.

Cavusgil, S.T., Knight, G., Riesenberger, J.R., Rammal, H.G. and Rose, E.L.,

2014. International business. Pearson Australia.

Cenedese, G., Payne, R., Sarno, L. and Valente, G., 2015. What do stock markets tell us about

exchange rates?. Review of Finance, 20(3), pp.1045-1080.

Engel, C., 2014. Exchange rates and interest parity. In Handbook of international

economics (Vol. 4, pp. 453-522). Elsevier.

Engel, C., Mark, N.C. and West, K.D., 2015. Factor model forecasts of exchange

rates. Econometric Reviews, 34(1-2), pp.32-55.

Ferraro, D., Rogoff, K. and Rossi, B., 2015. Can oil prices forecast exchange rates? An empirical

analysis of the relationship between commodity prices and exchange rates. Journal of

International Money and Finance, 54, pp.116-141.

Jotikasthira, C., Le, A. and Lundblad, C., 2015. Why do term structures in different currencies

co-move?. Journal of Financial Economics, 115(1), pp.58-83.

Julio, B. and Yook, Y., 2016. Policy uncertainty, irreversibility, and cross-border flows of

capital. Journal of International Economics, 103, pp.13-26.

Manalo, J., Perera, D. and Rees, D.M., 2015. Exchange rate movements and the Australian

economy. Economic Modelling, 47, pp.53-62.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.