BUS700 Economics: A Critical Review of Australia's Macroeconomy

VerifiedAdded on 2023/06/11

|14

|4385

|276

Report

AI Summary

This report provides a comprehensive analysis of the Australian economy from 1990 to 2016, examining key macroeconomic indicators such as GDP growth, unemployment, inflation, exchange rates, and net exports. The analysis explores the relationships between GDP growth and both unemployment and inflation, revealing an inverse association. It also examines the connection between net exports and exchange rates, noting an inverse relationship. Furthermore, the report investigates the interconnectedness of monetary policy by analyzing the trends in cash rates and fund rates, finding a positive association. The study identifies business cycle phases through upswings and downswings in economic growth rates, highlighting recessionary periods and subsequent recoveries. The report concludes with a discussion of the factors influencing Australia's economic performance, including the impact of global financial crises and monetary policy interventions, emphasizing the role of the Reserve Bank of Australia in managing inflation.

Running Head: ECONOMICS ASSIGNMENT

Economics Assignment

Name of the Student

Name of the University

Student ID

Course ID

Economics Assignment

Name of the Student

Name of the University

Student ID

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMICS ASSIGNMENT

Executive Summary

The report summarizes performance trend of Australian economy for a period extending from 1990 to

2016. In addition to narrates the trend in basic performance indicator, the paper explores the relation

between economic growth, inflation and unemployment. A relation also has also attempted to framed

between exchange rate and net export. Policy interconnectedness has been observed from trend

movement in cash rate and fund rate. Findings can be summarized as follows. Firstly, the paper finds an

inverse association of GDP growth both with unemployment and inflation. Second, net export also

constitutes an inverse association exchange rate. Thirdly, cash rate and funds rates have a positive

association.

Executive Summary

The report summarizes performance trend of Australian economy for a period extending from 1990 to

2016. In addition to narrates the trend in basic performance indicator, the paper explores the relation

between economic growth, inflation and unemployment. A relation also has also attempted to framed

between exchange rate and net export. Policy interconnectedness has been observed from trend

movement in cash rate and fund rate. Findings can be summarized as follows. Firstly, the paper finds an

inverse association of GDP growth both with unemployment and inflation. Second, net export also

constitutes an inverse association exchange rate. Thirdly, cash rate and funds rates have a positive

association.

2ECONOMICS ASSIGNMENT

Table of Contents

Introduction.................................................................................................................................................3

Growth performance of Australia along with inflation and unemployment................................................3

Business Cycle in Australia...........................................................................................................................6

Association between net export and exchange rate...................................................................................7

Fund rate and cash rate...............................................................................................................................9

Forecasting economic outlook...................................................................................................................10

Conclusion.................................................................................................................................................11

Reference list.............................................................................................................................................12

Data source............................................................................................................................................12

Table of Contents

Introduction.................................................................................................................................................3

Growth performance of Australia along with inflation and unemployment................................................3

Business Cycle in Australia...........................................................................................................................6

Association between net export and exchange rate...................................................................................7

Fund rate and cash rate...............................................................................................................................9

Forecasting economic outlook...................................................................................................................10

Conclusion.................................................................................................................................................11

Reference list.............................................................................................................................................12

Data source............................................................................................................................................12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMICS ASSIGNMENT

Introduction

Australia having a mixed market economy is in the list fastest developed nation of the world.

The nation has made rapid progress by exploring its huge reserves of minerals. Production and export of

minerals fueled economic growth of Australia. The nation however is dominated by its service sector

(Azad et al., 2014). Financial, travel and tourism and professional services of Australia are of particular

interest. Economic performance of a nation is attributed from performance of the economy in several

aspects. Some important aspects in performance evaluation of a nation are GDP, magnitude of

unemployment, inflation, trade balance, exchange rate and net export. Change in any one of the

variables has a direct or indirect effect on another (Fontana and Setterfield, 2016). Objective of current

research report is portrait macro level performance of Australian economy from 1990 to 2016. In the

process of analysis relation between GDO growth, inflation and unemployment has been analyzed. The

economic interdependence between USA and Australia has explored with movement in fund rate and

cash rate. Lastly economic prediction has made about the future state of Australian economy.

Growth performance of Australia along with inflation and unemployment

Real GDP is an indicative measure of total produced output in terms of a fixed base year prices.

As real GDP takes into consideration price of a fixed base year it by providing a price adjusted measure

of output signifies actual performance of the economy. Expansion and contraction of real GDP has

association with other related macroeconomic variable (Ravenhill, 2017). Unemployment and inflation

are the two such variable that likely to change as GDP changes. Unemployment is a symbolic measure of

labor market condition. Growth is GDP indicate a growth in overall output through more productive

activities. As labor is the primary input in the production process this generally increases demand for

labor causing a low rate of unemployment. Change in the price of consumption basket is captured by

the rate of inflation. A growth in real GDP implies high labor demand which by leads to a growth of

wages and hence, increases inflation through demand expansion. GDP growth of a nation thus increases

the price level. However, because of government policy intervention high growth might be associated

with a stable price level indicating a negative influence of GDP growth and price level (Goodwin et al.,

2015).

The proposed theoretical relation between real GDP and that of unemployment and inflation is

empirically tested by collecting data on GDP growth, inflation and unemployment. From the collected

data summary statistics of real GDP, inflation and unemployment is obtained as follows.

Table 1: Descriptive statistics of real GDP, unemployment and inflation

GDP UMEMPLOYEMENT RATE INFLATION RATE

Mean

0.75833333

3 Mean

6.72288757

7 Mean

0.64215

9

Standard Error

0.05920210

5 Standard Error

0.18124897

7 Standard Error

0.05632

2

Median 0.7 Median

6.16256126

7 Median

0.58962

8

Mode 0.7 Mode #N/A Mode 0

Standard

Deviation

0.61524632

3

Standard

Deviation

1.88359461

7

Standard

Deviation

0.58531

1

Sample

Variance

0.37852803

7

Sample

Variance

3.54792868

1

Sample

Variance

0.34258

9

Introduction

Australia having a mixed market economy is in the list fastest developed nation of the world.

The nation has made rapid progress by exploring its huge reserves of minerals. Production and export of

minerals fueled economic growth of Australia. The nation however is dominated by its service sector

(Azad et al., 2014). Financial, travel and tourism and professional services of Australia are of particular

interest. Economic performance of a nation is attributed from performance of the economy in several

aspects. Some important aspects in performance evaluation of a nation are GDP, magnitude of

unemployment, inflation, trade balance, exchange rate and net export. Change in any one of the

variables has a direct or indirect effect on another (Fontana and Setterfield, 2016). Objective of current

research report is portrait macro level performance of Australian economy from 1990 to 2016. In the

process of analysis relation between GDO growth, inflation and unemployment has been analyzed. The

economic interdependence between USA and Australia has explored with movement in fund rate and

cash rate. Lastly economic prediction has made about the future state of Australian economy.

Growth performance of Australia along with inflation and unemployment

Real GDP is an indicative measure of total produced output in terms of a fixed base year prices.

As real GDP takes into consideration price of a fixed base year it by providing a price adjusted measure

of output signifies actual performance of the economy. Expansion and contraction of real GDP has

association with other related macroeconomic variable (Ravenhill, 2017). Unemployment and inflation

are the two such variable that likely to change as GDP changes. Unemployment is a symbolic measure of

labor market condition. Growth is GDP indicate a growth in overall output through more productive

activities. As labor is the primary input in the production process this generally increases demand for

labor causing a low rate of unemployment. Change in the price of consumption basket is captured by

the rate of inflation. A growth in real GDP implies high labor demand which by leads to a growth of

wages and hence, increases inflation through demand expansion. GDP growth of a nation thus increases

the price level. However, because of government policy intervention high growth might be associated

with a stable price level indicating a negative influence of GDP growth and price level (Goodwin et al.,

2015).

The proposed theoretical relation between real GDP and that of unemployment and inflation is

empirically tested by collecting data on GDP growth, inflation and unemployment. From the collected

data summary statistics of real GDP, inflation and unemployment is obtained as follows.

Table 1: Descriptive statistics of real GDP, unemployment and inflation

GDP UMEMPLOYEMENT RATE INFLATION RATE

Mean

0.75833333

3 Mean

6.72288757

7 Mean

0.64215

9

Standard Error

0.05920210

5 Standard Error

0.18124897

7 Standard Error

0.05632

2

Median 0.7 Median

6.16256126

7 Median

0.58962

8

Mode 0.7 Mode #N/A Mode 0

Standard

Deviation

0.61524632

3

Standard

Deviation

1.88359461

7

Standard

Deviation

0.58531

1

Sample

Variance

0.37852803

7

Sample

Variance

3.54792868

1

Sample

Variance

0.34258

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMICS ASSIGNMENT

Kurtosis

2.02769367

7 Kurtosis

-

0.27241959

4 Kurtosis

8.22073

1

Skewness

0.25749205

3 Skewness

0.85784669

1 Skewness

1.90225

8

Range 4.3 Range

7.06125163

3 Range

4.29458

4

Minimum -1.3 Minimum

4.08456883

3 Minimum -0.44843

Maximum 3 Maximum

11.1458204

7 Maximum

3.84615

4

Sum 81.9 Sum

726.071858

3 Sum

69.3531

5

Count 108 Count 108 Count 108

The measure of quarterly GDP growth shows that Australia maintains an average GDP growth of 0.76

percent (Rickard, 2018). The fastest growth pace of the economy is during the second quarter of 1997

with a seasonally adjusted growth rate of 3 percent. The lowest ever growth rate is in the first quarter of

1991. The economy during this time recorded a significant slowdown with output fell by 1.30 percent.

Unemployment rate of Australia is averaged around 6.72%. The highest ever unemployment rate is 11.

15% during fourth quarter of 1992. In the first quarter of 2008, labor market constituted a strong

performance following the lowest unemployment rate of 4.08%. The average inflation rate is quite

lower in Australia as compared to standard of most developed nations (Hatfield-Dodd et al., 2015). The

mean inflation rate is 0.64 percent. Average price level reached to its lowest level in the third quarter of

1997. The associated growth rate was also very low with growth being only 0.10 percent. Price level rose

significantly in the first quarter of 2000 with a rate of inflation of 3.84 percent.

Statistically the relation between GDP growth and inflation and unemployment can be understood from

the correlation matrix showing relation between GDP and the two targeted variables.

Table 2: Correlation between real GDP and unemployment rate

DATE RGDP

UMEMPLOYEMENT

RATE

DATE 1

RGDP -0.0325 1

UMEMPLOYEMENT

RATE

-

0.77486

0.09217

3 1

The estimated correlation between unemployment rate and real GDP is 0.09. Positive value of

correlation symbolizes a positive effect of real GDP on unemployment rate. The obtained relation is not

much strong as indicated from a very low value of correlation.

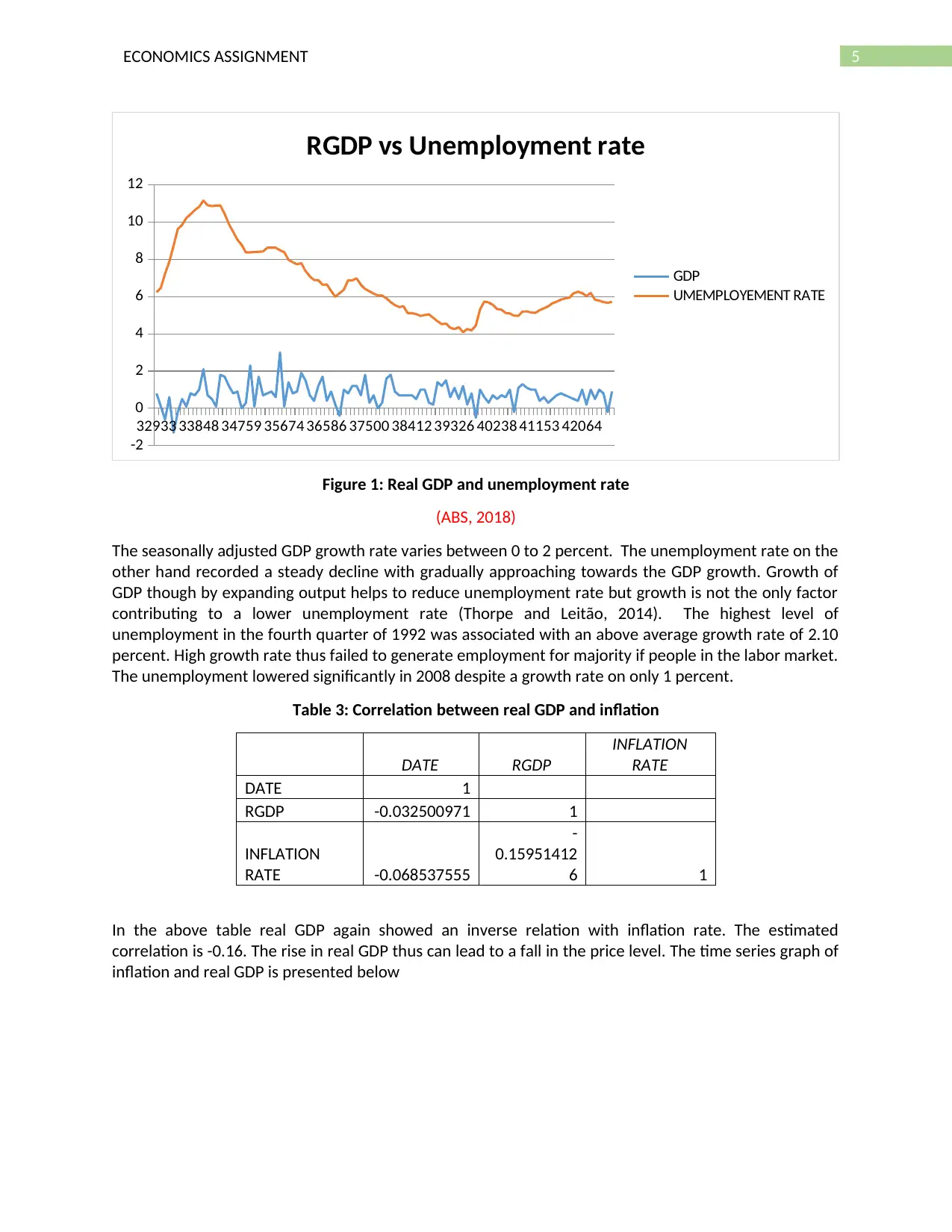

The obtained relationship can further be varied by using time series graph capturing simultaneous

movement of unemployment and real GDP.

Kurtosis

2.02769367

7 Kurtosis

-

0.27241959

4 Kurtosis

8.22073

1

Skewness

0.25749205

3 Skewness

0.85784669

1 Skewness

1.90225

8

Range 4.3 Range

7.06125163

3 Range

4.29458

4

Minimum -1.3 Minimum

4.08456883

3 Minimum -0.44843

Maximum 3 Maximum

11.1458204

7 Maximum

3.84615

4

Sum 81.9 Sum

726.071858

3 Sum

69.3531

5

Count 108 Count 108 Count 108

The measure of quarterly GDP growth shows that Australia maintains an average GDP growth of 0.76

percent (Rickard, 2018). The fastest growth pace of the economy is during the second quarter of 1997

with a seasonally adjusted growth rate of 3 percent. The lowest ever growth rate is in the first quarter of

1991. The economy during this time recorded a significant slowdown with output fell by 1.30 percent.

Unemployment rate of Australia is averaged around 6.72%. The highest ever unemployment rate is 11.

15% during fourth quarter of 1992. In the first quarter of 2008, labor market constituted a strong

performance following the lowest unemployment rate of 4.08%. The average inflation rate is quite

lower in Australia as compared to standard of most developed nations (Hatfield-Dodd et al., 2015). The

mean inflation rate is 0.64 percent. Average price level reached to its lowest level in the third quarter of

1997. The associated growth rate was also very low with growth being only 0.10 percent. Price level rose

significantly in the first quarter of 2000 with a rate of inflation of 3.84 percent.

Statistically the relation between GDP growth and inflation and unemployment can be understood from

the correlation matrix showing relation between GDP and the two targeted variables.

Table 2: Correlation between real GDP and unemployment rate

DATE RGDP

UMEMPLOYEMENT

RATE

DATE 1

RGDP -0.0325 1

UMEMPLOYEMENT

RATE

-

0.77486

0.09217

3 1

The estimated correlation between unemployment rate and real GDP is 0.09. Positive value of

correlation symbolizes a positive effect of real GDP on unemployment rate. The obtained relation is not

much strong as indicated from a very low value of correlation.

The obtained relationship can further be varied by using time series graph capturing simultaneous

movement of unemployment and real GDP.

5ECONOMICS ASSIGNMENT

32933 33848 34759 35674 36586 37500 38412 39326 40238 41153 42064

-2

0

2

4

6

8

10

12

RGDP vs Unemployment rate

GDP

UMEMPLOYEMENT RATE

Figure 1: Real GDP and unemployment rate

(ABS, 2018)

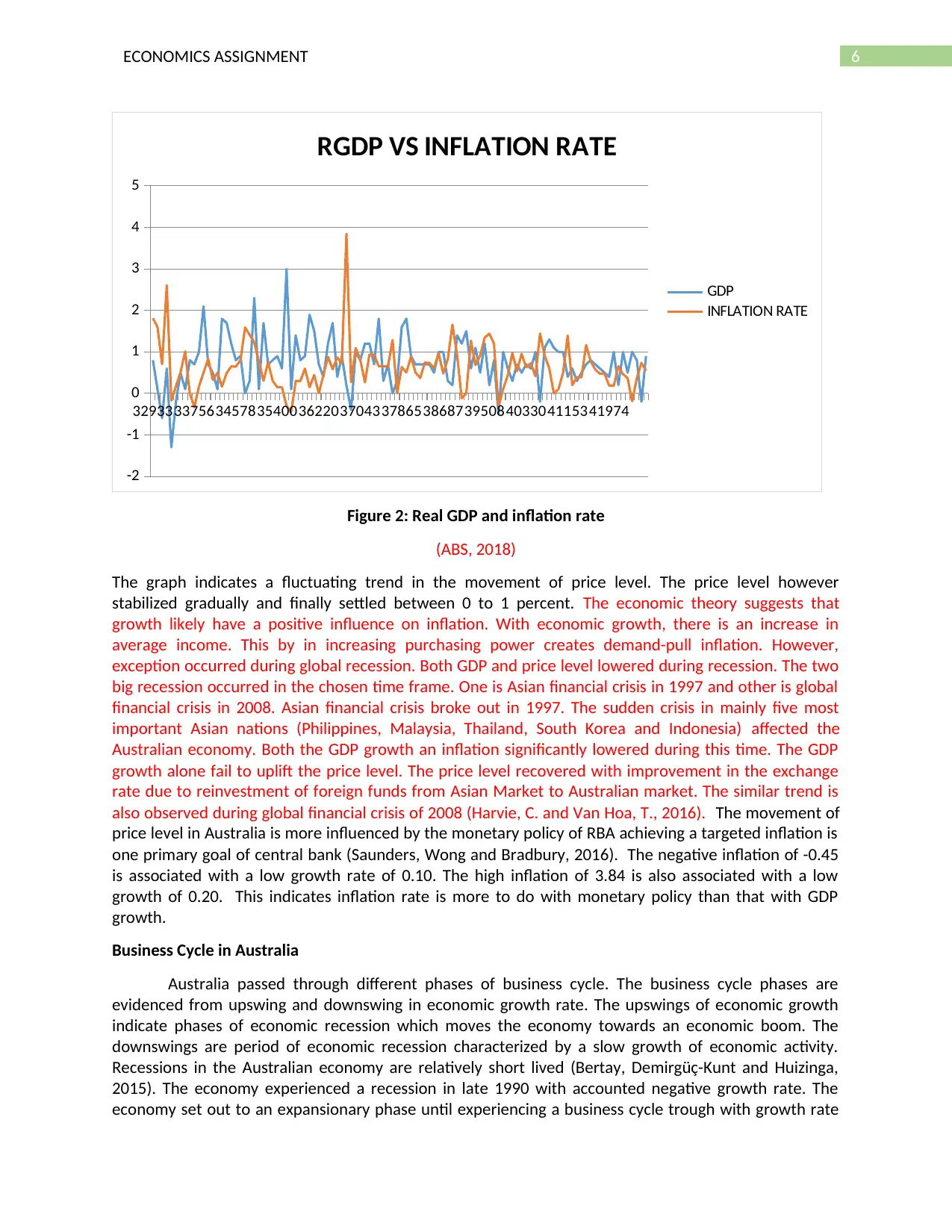

The seasonally adjusted GDP growth rate varies between 0 to 2 percent. The unemployment rate on the

other hand recorded a steady decline with gradually approaching towards the GDP growth. Growth of

GDP though by expanding output helps to reduce unemployment rate but growth is not the only factor

contributing to a lower unemployment rate (Thorpe and Leitão, 2014). The highest level of

unemployment in the fourth quarter of 1992 was associated with an above average growth rate of 2.10

percent. High growth rate thus failed to generate employment for majority if people in the labor market.

The unemployment lowered significantly in 2008 despite a growth rate on only 1 percent.

Table 3: Correlation between real GDP and inflation

DATE RGDP

INFLATION

RATE

DATE 1

RGDP -0.032500971 1

INFLATION

RATE -0.068537555

-

0.15951412

6 1

In the above table real GDP again showed an inverse relation with inflation rate. The estimated

correlation is -0.16. The rise in real GDP thus can lead to a fall in the price level. The time series graph of

inflation and real GDP is presented below

32933 33848 34759 35674 36586 37500 38412 39326 40238 41153 42064

-2

0

2

4

6

8

10

12

RGDP vs Unemployment rate

GDP

UMEMPLOYEMENT RATE

Figure 1: Real GDP and unemployment rate

(ABS, 2018)

The seasonally adjusted GDP growth rate varies between 0 to 2 percent. The unemployment rate on the

other hand recorded a steady decline with gradually approaching towards the GDP growth. Growth of

GDP though by expanding output helps to reduce unemployment rate but growth is not the only factor

contributing to a lower unemployment rate (Thorpe and Leitão, 2014). The highest level of

unemployment in the fourth quarter of 1992 was associated with an above average growth rate of 2.10

percent. High growth rate thus failed to generate employment for majority if people in the labor market.

The unemployment lowered significantly in 2008 despite a growth rate on only 1 percent.

Table 3: Correlation between real GDP and inflation

DATE RGDP

INFLATION

RATE

DATE 1

RGDP -0.032500971 1

INFLATION

RATE -0.068537555

-

0.15951412

6 1

In the above table real GDP again showed an inverse relation with inflation rate. The estimated

correlation is -0.16. The rise in real GDP thus can lead to a fall in the price level. The time series graph of

inflation and real GDP is presented below

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMICS ASSIGNMENT

329333375634578354003622037043378653868739508403304115341974

-2

-1

0

1

2

3

4

5

RGDP VS INFLATION RATE

GDP

INFLATION RATE

Figure 2: Real GDP and inflation rate

(ABS, 2018)

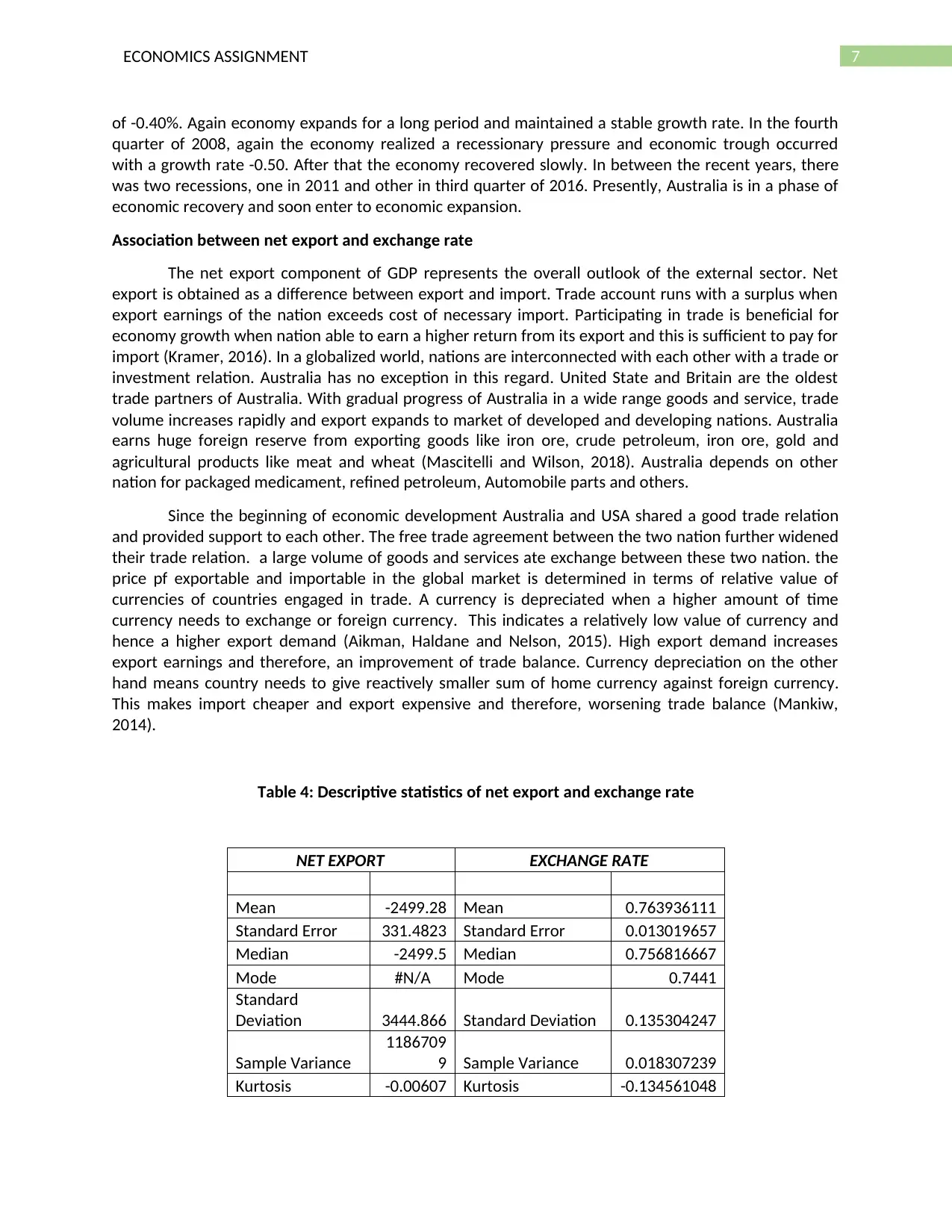

The graph indicates a fluctuating trend in the movement of price level. The price level however

stabilized gradually and finally settled between 0 to 1 percent. The economic theory suggests that

growth likely have a positive influence on inflation. With economic growth, there is an increase in

average income. This by in increasing purchasing power creates demand-pull inflation. However,

exception occurred during global recession. Both GDP and price level lowered during recession. The two

big recession occurred in the chosen time frame. One is Asian financial crisis in 1997 and other is global

financial crisis in 2008. Asian financial crisis broke out in 1997. The sudden crisis in mainly five most

important Asian nations (Philippines, Malaysia, Thailand, South Korea and Indonesia) affected the

Australian economy. Both the GDP growth an inflation significantly lowered during this time. The GDP

growth alone fail to uplift the price level. The price level recovered with improvement in the exchange

rate due to reinvestment of foreign funds from Asian Market to Australian market. The similar trend is

also observed during global financial crisis of 2008 (Harvie, C. and Van Hoa, T., 2016). The movement of

price level in Australia is more influenced by the monetary policy of RBA achieving a targeted inflation is

one primary goal of central bank (Saunders, Wong and Bradbury, 2016). The negative inflation of -0.45

is associated with a low growth rate of 0.10. The high inflation of 3.84 is also associated with a low

growth of 0.20. This indicates inflation rate is more to do with monetary policy than that with GDP

growth.

Business Cycle in Australia

Australia passed through different phases of business cycle. The business cycle phases are

evidenced from upswing and downswing in economic growth rate. The upswings of economic growth

indicate phases of economic recession which moves the economy towards an economic boom. The

downswings are period of economic recession characterized by a slow growth of economic activity.

Recessions in the Australian economy are relatively short lived (Bertay, Demirgüç-Kunt and Huizinga,

2015). The economy experienced a recession in late 1990 with accounted negative growth rate. The

economy set out to an expansionary phase until experiencing a business cycle trough with growth rate

329333375634578354003622037043378653868739508403304115341974

-2

-1

0

1

2

3

4

5

RGDP VS INFLATION RATE

GDP

INFLATION RATE

Figure 2: Real GDP and inflation rate

(ABS, 2018)

The graph indicates a fluctuating trend in the movement of price level. The price level however

stabilized gradually and finally settled between 0 to 1 percent. The economic theory suggests that

growth likely have a positive influence on inflation. With economic growth, there is an increase in

average income. This by in increasing purchasing power creates demand-pull inflation. However,

exception occurred during global recession. Both GDP and price level lowered during recession. The two

big recession occurred in the chosen time frame. One is Asian financial crisis in 1997 and other is global

financial crisis in 2008. Asian financial crisis broke out in 1997. The sudden crisis in mainly five most

important Asian nations (Philippines, Malaysia, Thailand, South Korea and Indonesia) affected the

Australian economy. Both the GDP growth an inflation significantly lowered during this time. The GDP

growth alone fail to uplift the price level. The price level recovered with improvement in the exchange

rate due to reinvestment of foreign funds from Asian Market to Australian market. The similar trend is

also observed during global financial crisis of 2008 (Harvie, C. and Van Hoa, T., 2016). The movement of

price level in Australia is more influenced by the monetary policy of RBA achieving a targeted inflation is

one primary goal of central bank (Saunders, Wong and Bradbury, 2016). The negative inflation of -0.45

is associated with a low growth rate of 0.10. The high inflation of 3.84 is also associated with a low

growth of 0.20. This indicates inflation rate is more to do with monetary policy than that with GDP

growth.

Business Cycle in Australia

Australia passed through different phases of business cycle. The business cycle phases are

evidenced from upswing and downswing in economic growth rate. The upswings of economic growth

indicate phases of economic recession which moves the economy towards an economic boom. The

downswings are period of economic recession characterized by a slow growth of economic activity.

Recessions in the Australian economy are relatively short lived (Bertay, Demirgüç-Kunt and Huizinga,

2015). The economy experienced a recession in late 1990 with accounted negative growth rate. The

economy set out to an expansionary phase until experiencing a business cycle trough with growth rate

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMICS ASSIGNMENT

of -0.40%. Again economy expands for a long period and maintained a stable growth rate. In the fourth

quarter of 2008, again the economy realized a recessionary pressure and economic trough occurred

with a growth rate -0.50. After that the economy recovered slowly. In between the recent years, there

was two recessions, one in 2011 and other in third quarter of 2016. Presently, Australia is in a phase of

economic recovery and soon enter to economic expansion.

Association between net export and exchange rate

The net export component of GDP represents the overall outlook of the external sector. Net

export is obtained as a difference between export and import. Trade account runs with a surplus when

export earnings of the nation exceeds cost of necessary import. Participating in trade is beneficial for

economy growth when nation able to earn a higher return from its export and this is sufficient to pay for

import (Kramer, 2016). In a globalized world, nations are interconnected with each other with a trade or

investment relation. Australia has no exception in this regard. United State and Britain are the oldest

trade partners of Australia. With gradual progress of Australia in a wide range goods and service, trade

volume increases rapidly and export expands to market of developed and developing nations. Australia

earns huge foreign reserve from exporting goods like iron ore, crude petroleum, iron ore, gold and

agricultural products like meat and wheat (Mascitelli and Wilson, 2018). Australia depends on other

nation for packaged medicament, refined petroleum, Automobile parts and others.

Since the beginning of economic development Australia and USA shared a good trade relation

and provided support to each other. The free trade agreement between the two nation further widened

their trade relation. a large volume of goods and services ate exchange between these two nation. the

price pf exportable and importable in the global market is determined in terms of relative value of

currencies of countries engaged in trade. A currency is depreciated when a higher amount of time

currency needs to exchange or foreign currency. This indicates a relatively low value of currency and

hence a higher export demand (Aikman, Haldane and Nelson, 2015). High export demand increases

export earnings and therefore, an improvement of trade balance. Currency depreciation on the other

hand means country needs to give reactively smaller sum of home currency against foreign currency.

This makes import cheaper and export expensive and therefore, worsening trade balance (Mankiw,

2014).

Table 4: Descriptive statistics of net export and exchange rate

NET EXPORT EXCHANGE RATE

Mean -2499.28 Mean 0.763936111

Standard Error 331.4823 Standard Error 0.013019657

Median -2499.5 Median 0.756816667

Mode #N/A Mode 0.7441

Standard

Deviation 3444.866 Standard Deviation 0.135304247

Sample Variance

1186709

9 Sample Variance 0.018307239

Kurtosis -0.00607 Kurtosis -0.134561048

of -0.40%. Again economy expands for a long period and maintained a stable growth rate. In the fourth

quarter of 2008, again the economy realized a recessionary pressure and economic trough occurred

with a growth rate -0.50. After that the economy recovered slowly. In between the recent years, there

was two recessions, one in 2011 and other in third quarter of 2016. Presently, Australia is in a phase of

economic recovery and soon enter to economic expansion.

Association between net export and exchange rate

The net export component of GDP represents the overall outlook of the external sector. Net

export is obtained as a difference between export and import. Trade account runs with a surplus when

export earnings of the nation exceeds cost of necessary import. Participating in trade is beneficial for

economy growth when nation able to earn a higher return from its export and this is sufficient to pay for

import (Kramer, 2016). In a globalized world, nations are interconnected with each other with a trade or

investment relation. Australia has no exception in this regard. United State and Britain are the oldest

trade partners of Australia. With gradual progress of Australia in a wide range goods and service, trade

volume increases rapidly and export expands to market of developed and developing nations. Australia

earns huge foreign reserve from exporting goods like iron ore, crude petroleum, iron ore, gold and

agricultural products like meat and wheat (Mascitelli and Wilson, 2018). Australia depends on other

nation for packaged medicament, refined petroleum, Automobile parts and others.

Since the beginning of economic development Australia and USA shared a good trade relation

and provided support to each other. The free trade agreement between the two nation further widened

their trade relation. a large volume of goods and services ate exchange between these two nation. the

price pf exportable and importable in the global market is determined in terms of relative value of

currencies of countries engaged in trade. A currency is depreciated when a higher amount of time

currency needs to exchange or foreign currency. This indicates a relatively low value of currency and

hence a higher export demand (Aikman, Haldane and Nelson, 2015). High export demand increases

export earnings and therefore, an improvement of trade balance. Currency depreciation on the other

hand means country needs to give reactively smaller sum of home currency against foreign currency.

This makes import cheaper and export expensive and therefore, worsening trade balance (Mankiw,

2014).

Table 4: Descriptive statistics of net export and exchange rate

NET EXPORT EXCHANGE RATE

Mean -2499.28 Mean 0.763936111

Standard Error 331.4823 Standard Error 0.013019657

Median -2499.5 Median 0.756816667

Mode #N/A Mode 0.7441

Standard

Deviation 3444.866 Standard Deviation 0.135304247

Sample Variance

1186709

9 Sample Variance 0.018307239

Kurtosis -0.00607 Kurtosis -0.134561048

8ECONOMICS ASSIGNMENT

Skewness -0.13247 Skewness 0.344643609

Range 17982 Range 0.5695

Minimum -11974 Minimum 0.508766667

Maximum 6008 Maximum 1.078266667

Sum -269922 Sum 82.5051

Count 108 Count 108

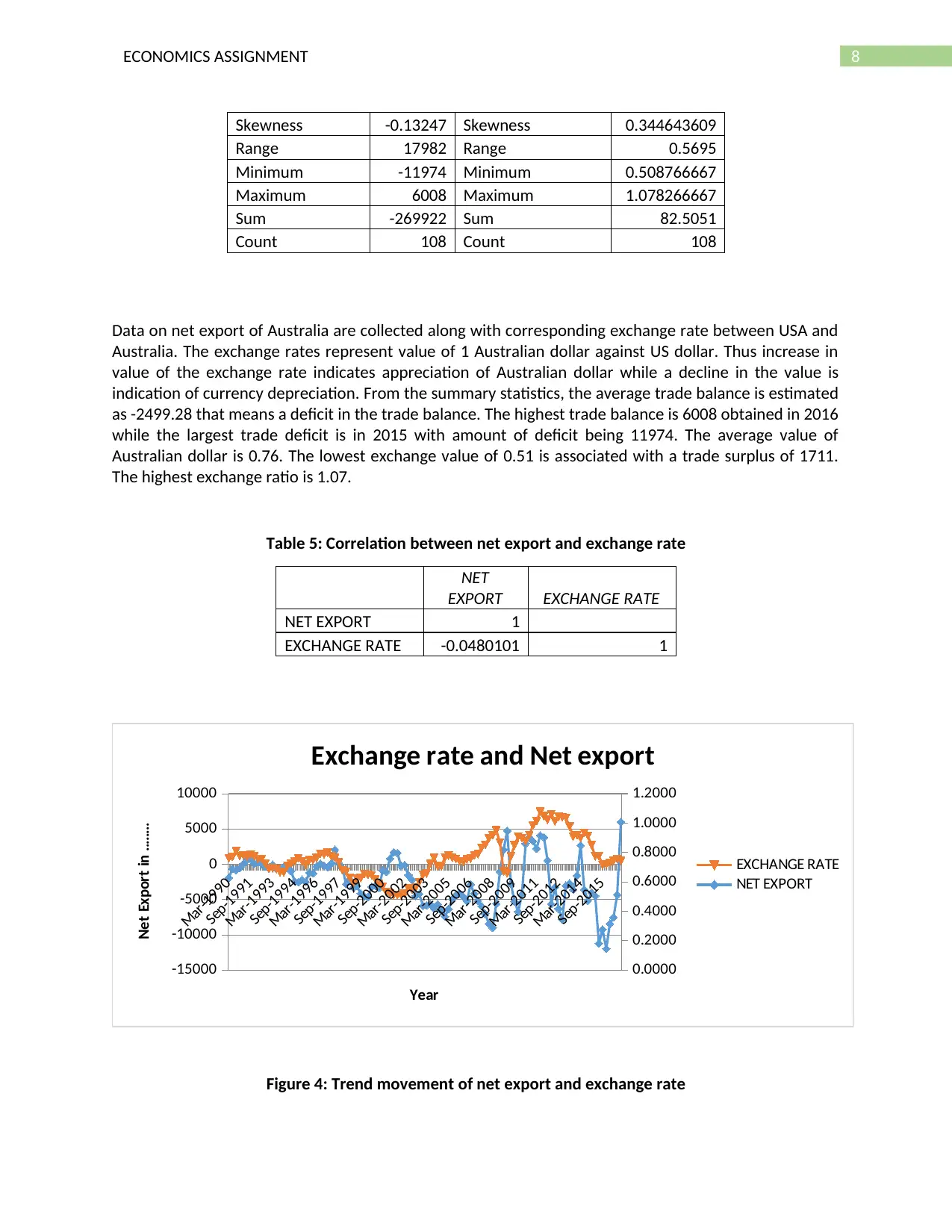

Data on net export of Australia are collected along with corresponding exchange rate between USA and

Australia. The exchange rates represent value of 1 Australian dollar against US dollar. Thus increase in

value of the exchange rate indicates appreciation of Australian dollar while a decline in the value is

indication of currency depreciation. From the summary statistics, the average trade balance is estimated

as -2499.28 that means a deficit in the trade balance. The highest trade balance is 6008 obtained in 2016

while the largest trade deficit is in 2015 with amount of deficit being 11974. The average value of

Australian dollar is 0.76. The lowest exchange value of 0.51 is associated with a trade surplus of 1711.

The highest exchange ratio is 1.07.

Table 5: Correlation between net export and exchange rate

NET

EXPORT EXCHANGE RATE

NET EXPORT 1

EXCHANGE RATE -0.0480101 1

Mar-1990

Sep-1991

Mar-1993

Sep-1994

Mar-1996

Sep-1997

Mar-1999

Sep-2000

Mar-2002

Sep-2003

Mar-2005

Sep-2006

Mar-2008

Sep-2009

Mar-2011

Sep-2012

Mar-2014

Sep-2015

-15000

-10000

-5000

0

5000

10000

0.0000

0.2000

0.4000

0.6000

0.8000

1.0000

1.2000

Exchange rate and Net export

EXCHANGE RATE

NET EXPORT

Year

Net Export in ........

Figure 4: Trend movement of net export and exchange rate

Skewness -0.13247 Skewness 0.344643609

Range 17982 Range 0.5695

Minimum -11974 Minimum 0.508766667

Maximum 6008 Maximum 1.078266667

Sum -269922 Sum 82.5051

Count 108 Count 108

Data on net export of Australia are collected along with corresponding exchange rate between USA and

Australia. The exchange rates represent value of 1 Australian dollar against US dollar. Thus increase in

value of the exchange rate indicates appreciation of Australian dollar while a decline in the value is

indication of currency depreciation. From the summary statistics, the average trade balance is estimated

as -2499.28 that means a deficit in the trade balance. The highest trade balance is 6008 obtained in 2016

while the largest trade deficit is in 2015 with amount of deficit being 11974. The average value of

Australian dollar is 0.76. The lowest exchange value of 0.51 is associated with a trade surplus of 1711.

The highest exchange ratio is 1.07.

Table 5: Correlation between net export and exchange rate

NET

EXPORT EXCHANGE RATE

NET EXPORT 1

EXCHANGE RATE -0.0480101 1

Mar-1990

Sep-1991

Mar-1993

Sep-1994

Mar-1996

Sep-1997

Mar-1999

Sep-2000

Mar-2002

Sep-2003

Mar-2005

Sep-2006

Mar-2008

Sep-2009

Mar-2011

Sep-2012

Mar-2014

Sep-2015

-15000

-10000

-5000

0

5000

10000

0.0000

0.2000

0.4000

0.6000

0.8000

1.0000

1.2000

Exchange rate and Net export

EXCHANGE RATE

NET EXPORT

Year

Net Export in ........

Figure 4: Trend movement of net export and exchange rate

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ECONOMICS ASSIGNMENT

(ABS, 2018)

A negative estimated correlation is obtained between net export and USD/AUD exchange rate. This

indicates as Australian dollar appreciates net export fall and increases with depreciation of Australian

dollar. The same pattern of relation has also been suggested from the time series graph of exchange and

net export

Fund rate and cash rate

Several factors are at play in the monetary policy decision of central bank. In addition to

domestic economic condition central bank needs to consider the possible effect of ease or tight

monetary policy of other nations having significant influence on the domestic economy (Laubach and

Williams, 2016). This is the reason why movement of fund rate might have an impact of cash rate. Both

are overnight bank rates that commercial banks are liable to pay. When Fed increase fund rate, then it

indicates a relatively strong position of the nation. This however is not matter of much concern. A lower

fund rate, on the other hand affects Australian economy through channel of currency appreciation. As a

result, counteractive policy of currency devaluation needs to be taken by RBA by cutting the cash rate

Table 6: Descriptive statistics of cash rate and fund rate

Australia's Cash Rate Federal Reserve Funds Rate US

Mean

5.45138

9 Mean 3.042315

Standard Error

0.50147

2 Standard Error 0.472257

Median 5.125 Median 3.213333

Mode #N/A Mode #N/A

Standard Deviation

2.60572

4 Standard Deviation 2.453919

Sample Variance

6.78979

7 Sample Variance 6.02172

Kurtosis

5.89279

5 Kurtosis -1.26609

Skewness

1.89975

2 Skewness 0.160086

Range

13.0833

3 Range 8.01

Minimum

1.72916

7 Minimum 0.089167

Maximum 14.8125 Maximum 8.099167

Sum

147.187

5 Sum 82.1425

Count 27 Count 27

(ABS, 2018)

A negative estimated correlation is obtained between net export and USD/AUD exchange rate. This

indicates as Australian dollar appreciates net export fall and increases with depreciation of Australian

dollar. The same pattern of relation has also been suggested from the time series graph of exchange and

net export

Fund rate and cash rate

Several factors are at play in the monetary policy decision of central bank. In addition to

domestic economic condition central bank needs to consider the possible effect of ease or tight

monetary policy of other nations having significant influence on the domestic economy (Laubach and

Williams, 2016). This is the reason why movement of fund rate might have an impact of cash rate. Both

are overnight bank rates that commercial banks are liable to pay. When Fed increase fund rate, then it

indicates a relatively strong position of the nation. This however is not matter of much concern. A lower

fund rate, on the other hand affects Australian economy through channel of currency appreciation. As a

result, counteractive policy of currency devaluation needs to be taken by RBA by cutting the cash rate

Table 6: Descriptive statistics of cash rate and fund rate

Australia's Cash Rate Federal Reserve Funds Rate US

Mean

5.45138

9 Mean 3.042315

Standard Error

0.50147

2 Standard Error 0.472257

Median 5.125 Median 3.213333

Mode #N/A Mode #N/A

Standard Deviation

2.60572

4 Standard Deviation 2.453919

Sample Variance

6.78979

7 Sample Variance 6.02172

Kurtosis

5.89279

5 Kurtosis -1.26609

Skewness

1.89975

2 Skewness 0.160086

Range

13.0833

3 Range 8.01

Minimum

1.72916

7 Minimum 0.089167

Maximum 14.8125 Maximum 8.099167

Sum

147.187

5 Sum 82.1425

Count 27 Count 27

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ECONOMICS ASSIGNMENT

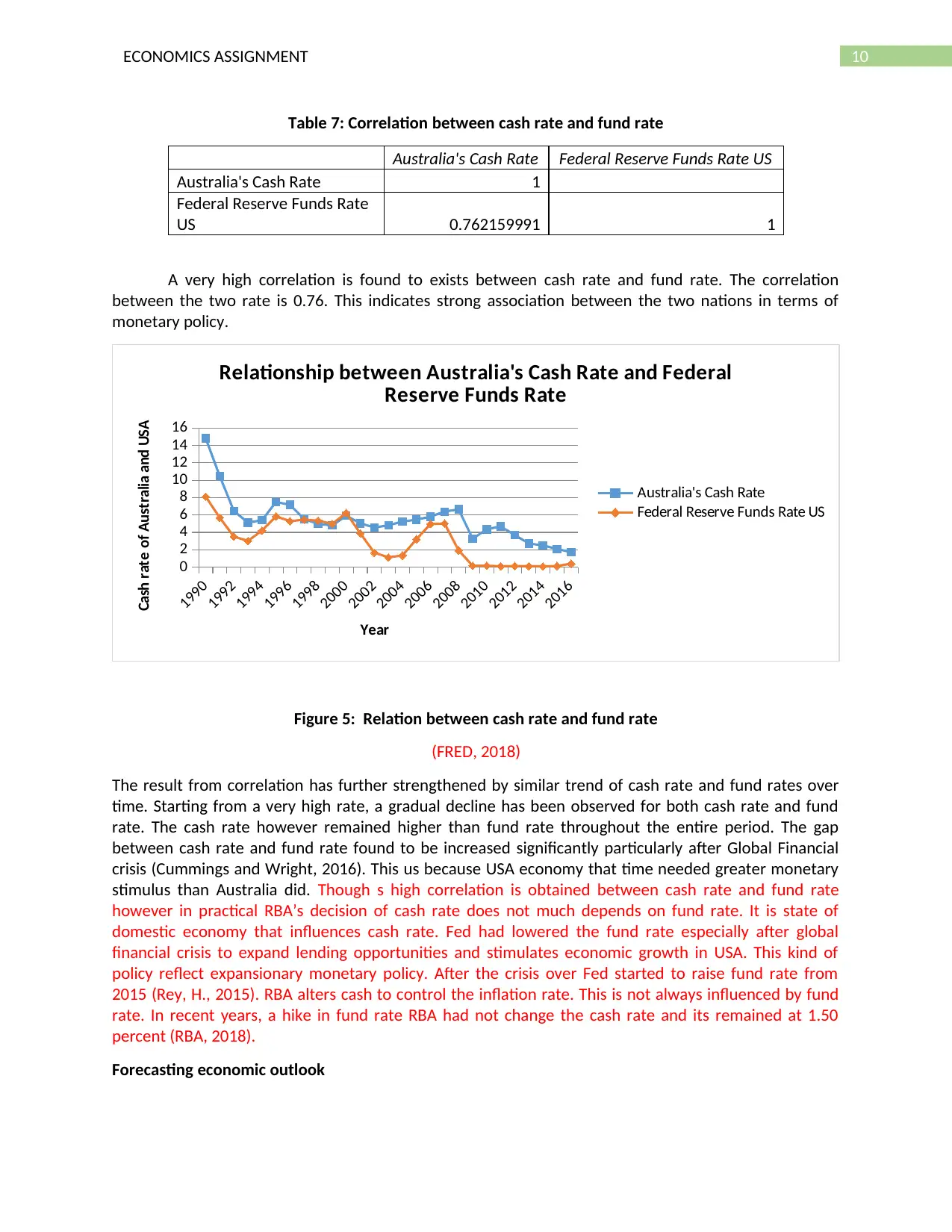

Table 7: Correlation between cash rate and fund rate

Australia's Cash Rate Federal Reserve Funds Rate US

Australia's Cash Rate 1

Federal Reserve Funds Rate

US 0.762159991 1

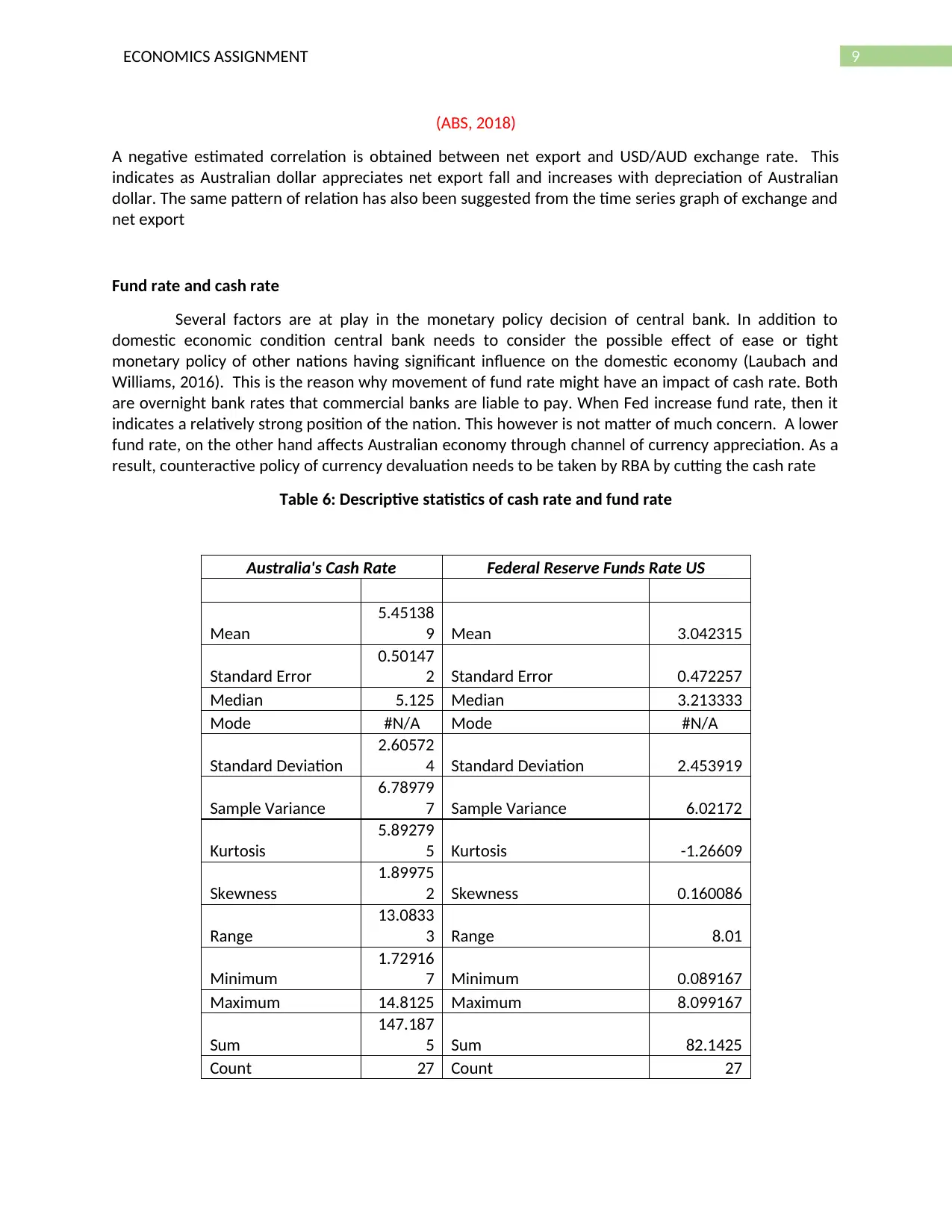

A very high correlation is found to exists between cash rate and fund rate. The correlation

between the two rate is 0.76. This indicates strong association between the two nations in terms of

monetary policy.

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

2012

2014

2016

0

2

4

6

8

10

12

14

16

Relationship between Australia's Cash Rate and Federal

Reserve Funds Rate

Australia's Cash Rate

Federal Reserve Funds Rate US

Year

Cash rate of Australia and USA

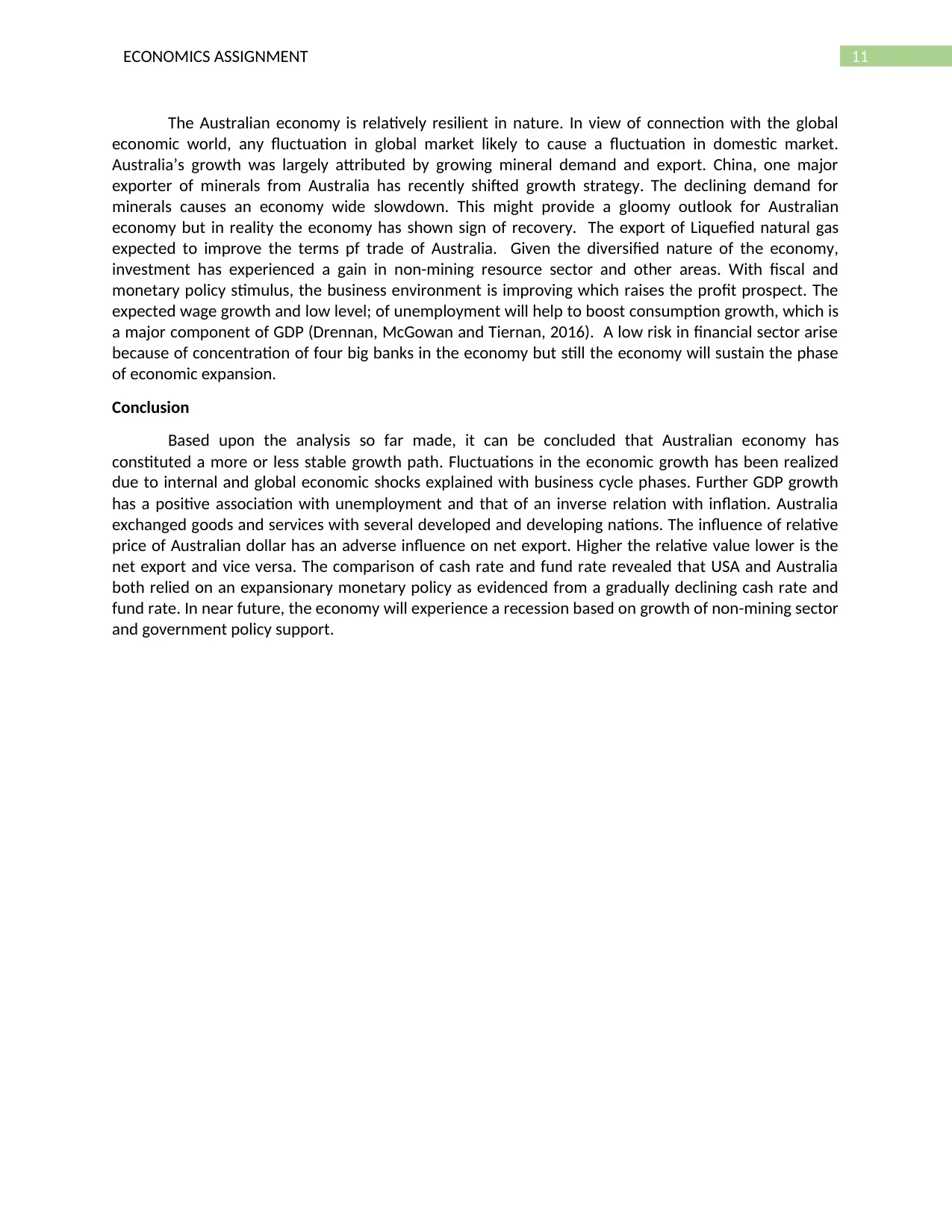

Figure 5: Relation between cash rate and fund rate

(FRED, 2018)

The result from correlation has further strengthened by similar trend of cash rate and fund rates over

time. Starting from a very high rate, a gradual decline has been observed for both cash rate and fund

rate. The cash rate however remained higher than fund rate throughout the entire period. The gap

between cash rate and fund rate found to be increased significantly particularly after Global Financial

crisis (Cummings and Wright, 2016). This us because USA economy that time needed greater monetary

stimulus than Australia did. Though s high correlation is obtained between cash rate and fund rate

however in practical RBA’s decision of cash rate does not much depends on fund rate. It is state of

domestic economy that influences cash rate. Fed had lowered the fund rate especially after global

financial crisis to expand lending opportunities and stimulates economic growth in USA. This kind of

policy reflect expansionary monetary policy. After the crisis over Fed started to raise fund rate from

2015 (Rey, H., 2015). RBA alters cash to control the inflation rate. This is not always influenced by fund

rate. In recent years, a hike in fund rate RBA had not change the cash rate and its remained at 1.50

percent (RBA, 2018).

Forecasting economic outlook

Table 7: Correlation between cash rate and fund rate

Australia's Cash Rate Federal Reserve Funds Rate US

Australia's Cash Rate 1

Federal Reserve Funds Rate

US 0.762159991 1

A very high correlation is found to exists between cash rate and fund rate. The correlation

between the two rate is 0.76. This indicates strong association between the two nations in terms of

monetary policy.

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

2012

2014

2016

0

2

4

6

8

10

12

14

16

Relationship between Australia's Cash Rate and Federal

Reserve Funds Rate

Australia's Cash Rate

Federal Reserve Funds Rate US

Year

Cash rate of Australia and USA

Figure 5: Relation between cash rate and fund rate

(FRED, 2018)

The result from correlation has further strengthened by similar trend of cash rate and fund rates over

time. Starting from a very high rate, a gradual decline has been observed for both cash rate and fund

rate. The cash rate however remained higher than fund rate throughout the entire period. The gap

between cash rate and fund rate found to be increased significantly particularly after Global Financial

crisis (Cummings and Wright, 2016). This us because USA economy that time needed greater monetary

stimulus than Australia did. Though s high correlation is obtained between cash rate and fund rate

however in practical RBA’s decision of cash rate does not much depends on fund rate. It is state of

domestic economy that influences cash rate. Fed had lowered the fund rate especially after global

financial crisis to expand lending opportunities and stimulates economic growth in USA. This kind of

policy reflect expansionary monetary policy. After the crisis over Fed started to raise fund rate from

2015 (Rey, H., 2015). RBA alters cash to control the inflation rate. This is not always influenced by fund

rate. In recent years, a hike in fund rate RBA had not change the cash rate and its remained at 1.50

percent (RBA, 2018).

Forecasting economic outlook

11ECONOMICS ASSIGNMENT

The Australian economy is relatively resilient in nature. In view of connection with the global

economic world, any fluctuation in global market likely to cause a fluctuation in domestic market.

Australia’s growth was largely attributed by growing mineral demand and export. China, one major

exporter of minerals from Australia has recently shifted growth strategy. The declining demand for

minerals causes an economy wide slowdown. This might provide a gloomy outlook for Australian

economy but in reality the economy has shown sign of recovery. The export of Liquefied natural gas

expected to improve the terms pf trade of Australia. Given the diversified nature of the economy,

investment has experienced a gain in non-mining resource sector and other areas. With fiscal and

monetary policy stimulus, the business environment is improving which raises the profit prospect. The

expected wage growth and low level; of unemployment will help to boost consumption growth, which is

a major component of GDP (Drennan, McGowan and Tiernan, 2016). A low risk in financial sector arise

because of concentration of four big banks in the economy but still the economy will sustain the phase

of economic expansion.

Conclusion

Based upon the analysis so far made, it can be concluded that Australian economy has

constituted a more or less stable growth path. Fluctuations in the economic growth has been realized

due to internal and global economic shocks explained with business cycle phases. Further GDP growth

has a positive association with unemployment and that of an inverse relation with inflation. Australia

exchanged goods and services with several developed and developing nations. The influence of relative

price of Australian dollar has an adverse influence on net export. Higher the relative value lower is the

net export and vice versa. The comparison of cash rate and fund rate revealed that USA and Australia

both relied on an expansionary monetary policy as evidenced from a gradually declining cash rate and

fund rate. In near future, the economy will experience a recession based on growth of non-mining sector

and government policy support.

The Australian economy is relatively resilient in nature. In view of connection with the global

economic world, any fluctuation in global market likely to cause a fluctuation in domestic market.

Australia’s growth was largely attributed by growing mineral demand and export. China, one major

exporter of minerals from Australia has recently shifted growth strategy. The declining demand for

minerals causes an economy wide slowdown. This might provide a gloomy outlook for Australian

economy but in reality the economy has shown sign of recovery. The export of Liquefied natural gas

expected to improve the terms pf trade of Australia. Given the diversified nature of the economy,

investment has experienced a gain in non-mining resource sector and other areas. With fiscal and

monetary policy stimulus, the business environment is improving which raises the profit prospect. The

expected wage growth and low level; of unemployment will help to boost consumption growth, which is

a major component of GDP (Drennan, McGowan and Tiernan, 2016). A low risk in financial sector arise

because of concentration of four big banks in the economy but still the economy will sustain the phase

of economic expansion.

Conclusion

Based upon the analysis so far made, it can be concluded that Australian economy has

constituted a more or less stable growth path. Fluctuations in the economic growth has been realized

due to internal and global economic shocks explained with business cycle phases. Further GDP growth

has a positive association with unemployment and that of an inverse relation with inflation. Australia

exchanged goods and services with several developed and developing nations. The influence of relative

price of Australian dollar has an adverse influence on net export. Higher the relative value lower is the

net export and vice versa. The comparison of cash rate and fund rate revealed that USA and Australia

both relied on an expansionary monetary policy as evidenced from a gradually declining cash rate and

fund rate. In near future, the economy will experience a recession based on growth of non-mining sector

and government policy support.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.