Financial Analysis and Budgeting Project Report - BSBFIM501

VerifiedAdded on 2023/03/23

|8

|1395

|65

Project

AI Summary

This project report, submitted by a student, focuses on the financial analysis of a business, likely a bicycle company. The report analyzes efficiency performance by calculating key financial ratios such as average debtors days, creditors days, and stock turnover. The analysis delves into the company's working capital, cash conversion cycle (CCC), and suggests methods to reduce operating costs and improve cash collection. The project includes break-even analysis and explores the impact of variable costs on profit. It also covers GST calculations and recommendations for business diversification, including entering the Indian market to improve profitability and market position. References from financial and accounting journals are included to support the findings and recommendations. The report utilizes financial data to illustrate concepts like contribution margin, margin of safety, and break-even points, offering a comprehensive view of the company's financial health and strategic recommendations.

Australian Ideal College

RTO No.: 91679 CRICOS Provider Code: 03053G ABN: 15 126 592 756

Sydney Campus: Level 7 & 8, 75 King St, Sydney NSW 2000 Australia

Tel: +61-2-9262 2968 Fax: +61-2-9262 2938Educating for Excellence

Project Report: Assessment No. 3

RTO No.: 91679 CRICOS Provider Code: 03053G ABN: 15 126 592 756

Sydney Campus: Level 7 & 8, 75 King St, Sydney NSW 2000 Australia

Tel: +61-2-9262 2968 Fax: +61-2-9262 2938Educating for Excellence

Project Report: Assessment No. 3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Australian Ideal College

RTO No.: 91679 CRICOS Provider Code: 03053G ABN: 15 126 592 756

Sydney Campus: Level 7 & 8, 75 King St, Sydney NSW 2000 Australia

Tel: +61-2-9262 2968 Fax: +61-2-9262 2938Educating for Excellence

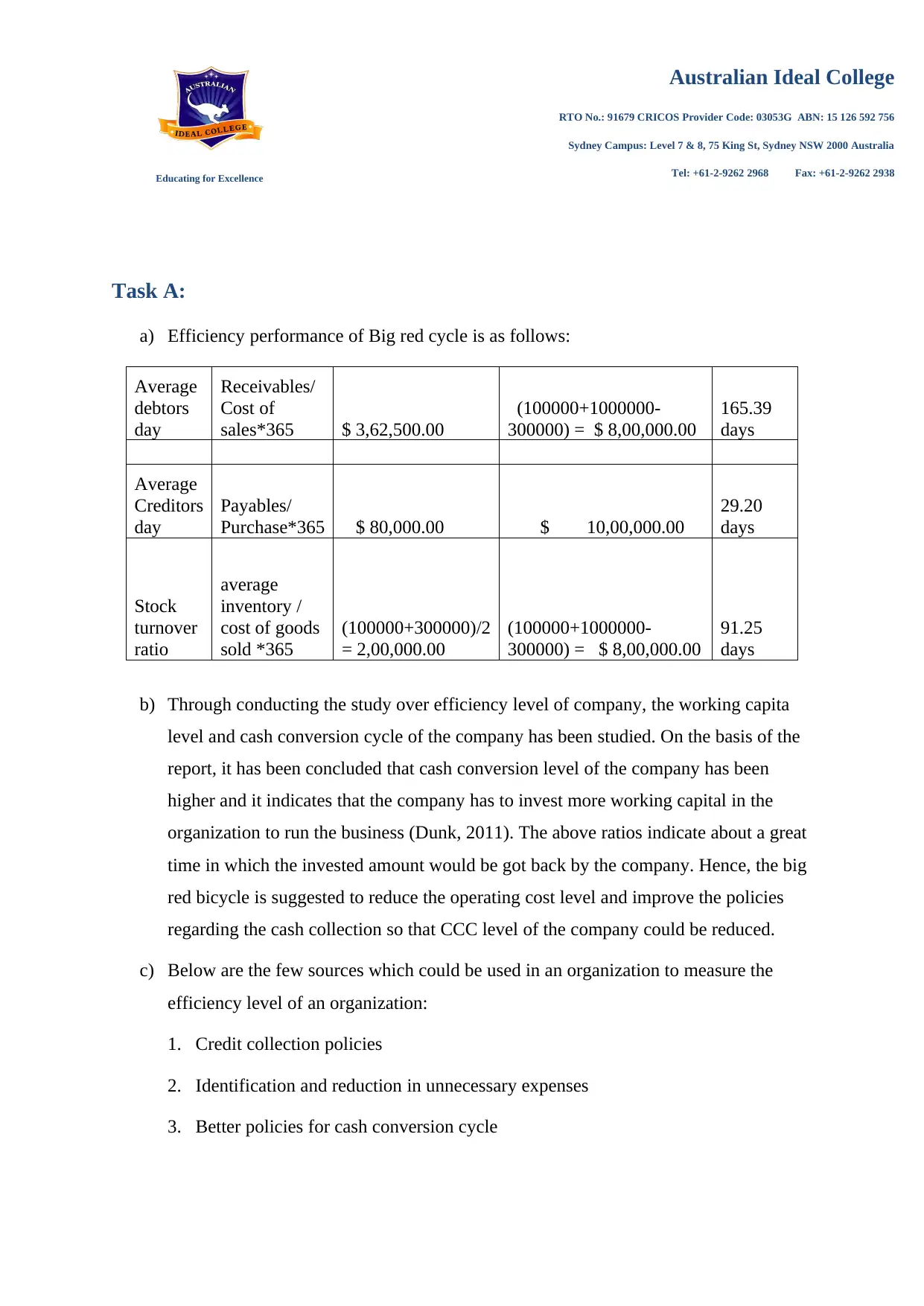

Task A:

a) Efficiency performance of Big red cycle is as follows:

Average

debtors

day

Receivables/

Cost of

sales*365 $ 3,62,500.00

(100000+1000000-

300000) = $ 8,00,000.00

165.39

days

Average

Creditors

day

Payables/

Purchase*365 $ 80,000.00 $ 10,00,000.00

29.20

days

Stock

turnover

ratio

average

inventory /

cost of goods

sold *365

(100000+300000)/2

= 2,00,000.00

(100000+1000000-

300000) = $ 8,00,000.00

91.25

days

b) Through conducting the study over efficiency level of company, the working capita

level and cash conversion cycle of the company has been studied. On the basis of the

report, it has been concluded that cash conversion level of the company has been

higher and it indicates that the company has to invest more working capital in the

organization to run the business (Dunk, 2011). The above ratios indicate about a great

time in which the invested amount would be got back by the company. Hence, the big

red bicycle is suggested to reduce the operating cost level and improve the policies

regarding the cash collection so that CCC level of the company could be reduced.

c) Below are the few sources which could be used in an organization to measure the

efficiency level of an organization:

1. Credit collection policies

2. Identification and reduction in unnecessary expenses

3. Better policies for cash conversion cycle

RTO No.: 91679 CRICOS Provider Code: 03053G ABN: 15 126 592 756

Sydney Campus: Level 7 & 8, 75 King St, Sydney NSW 2000 Australia

Tel: +61-2-9262 2968 Fax: +61-2-9262 2938Educating for Excellence

Task A:

a) Efficiency performance of Big red cycle is as follows:

Average

debtors

day

Receivables/

Cost of

sales*365 $ 3,62,500.00

(100000+1000000-

300000) = $ 8,00,000.00

165.39

days

Average

Creditors

day

Payables/

Purchase*365 $ 80,000.00 $ 10,00,000.00

29.20

days

Stock

turnover

ratio

average

inventory /

cost of goods

sold *365

(100000+300000)/2

= 2,00,000.00

(100000+1000000-

300000) = $ 8,00,000.00

91.25

days

b) Through conducting the study over efficiency level of company, the working capita

level and cash conversion cycle of the company has been studied. On the basis of the

report, it has been concluded that cash conversion level of the company has been

higher and it indicates that the company has to invest more working capital in the

organization to run the business (Dunk, 2011). The above ratios indicate about a great

time in which the invested amount would be got back by the company. Hence, the big

red bicycle is suggested to reduce the operating cost level and improve the policies

regarding the cash collection so that CCC level of the company could be reduced.

c) Below are the few sources which could be used in an organization to measure the

efficiency level of an organization:

1. Credit collection policies

2. Identification and reduction in unnecessary expenses

3. Better policies for cash conversion cycle

Australian Ideal College

RTO No.: 91679 CRICOS Provider Code: 03053G ABN: 15 126 592 756

Sydney Campus: Level 7 & 8, 75 King St, Sydney NSW 2000 Australia

Tel: +61-2-9262 2968 Fax: +61-2-9262 2938Educating for Excellence

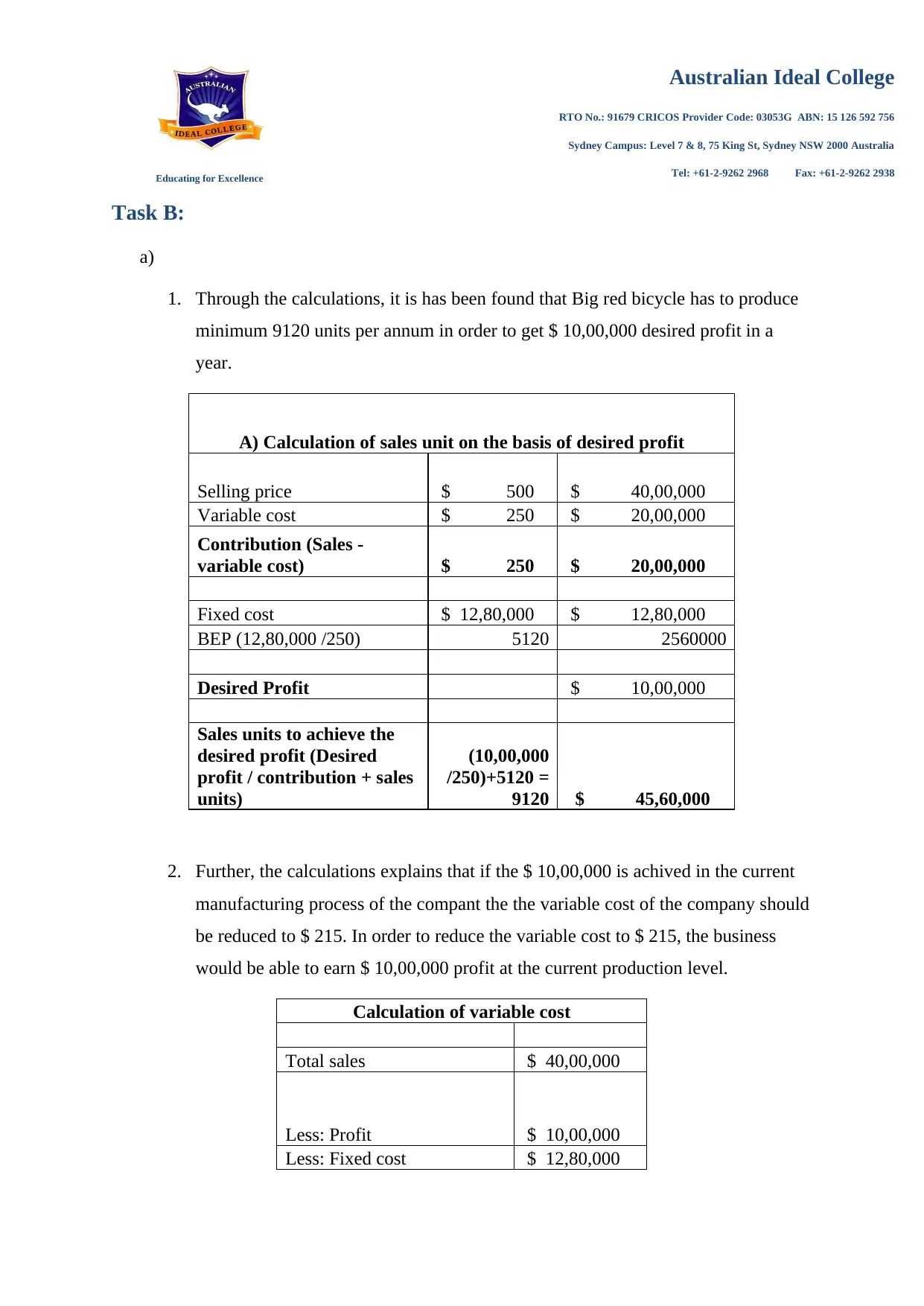

Task B:

a)

1. Through the calculations, it is has been found that Big red bicycle has to produce

minimum 9120 units per annum in order to get $ 10,00,000 desired profit in a

year.

A) Calculation of sales unit on the basis of desired profit

Selling price $ 500 $ 40,00,000

Variable cost $ 250 $ 20,00,000

Contribution (Sales -

variable cost) $ 250 $ 20,00,000

Fixed cost $ 12,80,000 $ 12,80,000

BEP (12,80,000 /250) 5120 2560000

Desired Profit $ 10,00,000

Sales units to achieve the

desired profit (Desired

profit / contribution + sales

units)

(10,00,000

/250)+5120 =

9120 $ 45,60,000

2. Further, the calculations explains that if the $ 10,00,000 is achived in the current

manufacturing process of the compant the the variable cost of the company should

be reduced to $ 215. In order to reduce the variable cost to $ 215, the business

would be able to earn $ 10,00,000 profit at the current production level.

Calculation of variable cost

Total sales $ 40,00,000

Less: Profit $ 10,00,000

Less: Fixed cost $ 12,80,000

RTO No.: 91679 CRICOS Provider Code: 03053G ABN: 15 126 592 756

Sydney Campus: Level 7 & 8, 75 King St, Sydney NSW 2000 Australia

Tel: +61-2-9262 2968 Fax: +61-2-9262 2938Educating for Excellence

Task B:

a)

1. Through the calculations, it is has been found that Big red bicycle has to produce

minimum 9120 units per annum in order to get $ 10,00,000 desired profit in a

year.

A) Calculation of sales unit on the basis of desired profit

Selling price $ 500 $ 40,00,000

Variable cost $ 250 $ 20,00,000

Contribution (Sales -

variable cost) $ 250 $ 20,00,000

Fixed cost $ 12,80,000 $ 12,80,000

BEP (12,80,000 /250) 5120 2560000

Desired Profit $ 10,00,000

Sales units to achieve the

desired profit (Desired

profit / contribution + sales

units)

(10,00,000

/250)+5120 =

9120 $ 45,60,000

2. Further, the calculations explains that if the $ 10,00,000 is achived in the current

manufacturing process of the compant the the variable cost of the company should

be reduced to $ 215. In order to reduce the variable cost to $ 215, the business

would be able to earn $ 10,00,000 profit at the current production level.

Calculation of variable cost

Total sales $ 40,00,000

Less: Profit $ 10,00,000

Less: Fixed cost $ 12,80,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Australian Ideal College

RTO No.: 91679 CRICOS Provider Code: 03053G ABN: 15 126 592 756

Sydney Campus: Level 7 & 8, 75 King St, Sydney NSW 2000 Australia

Tel: +61-2-9262 2968 Fax: +61-2-9262 2938Educating for Excellence

Variable cost $ 17,20,000

Divided: number of sales

units 8000

Variable cost per unit $ 215

b) The study explains that Big red bicycle is performing better in the market in terms of

profit level and production level. However, study explains that few changes into

variable cost of the company would help it to improve the profits of the business.

Moreover, diversification of business in Indian market would also be profitable for

the business in terms of financial and non financial position of the company.

c) In order to complete this activity, below are the main sources:

Contribution margin

MOS (margin of safety)

Break-even sales and point (Dunk, 2011)

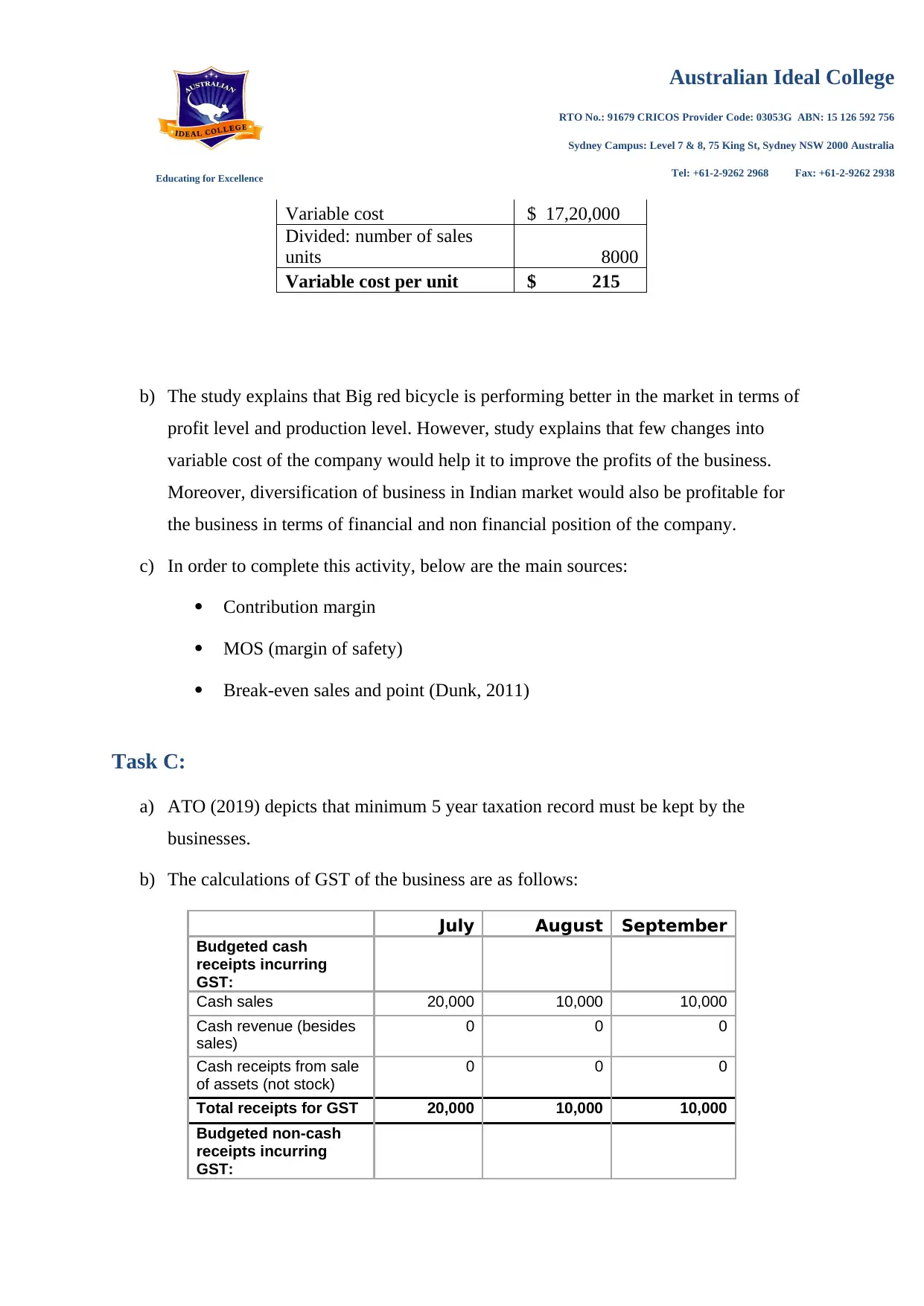

Task C:

a) ATO (2019) depicts that minimum 5 year taxation record must be kept by the

businesses.

b) The calculations of GST of the business are as follows:

July August September

Budgeted cash

receipts incurring

GST:

Cash sales 20,000 10,000 10,000

Cash revenue (besides

sales)

0 0 0

Cash receipts from sale

of assets (not stock)

0 0 0

Total receipts for GST 20,000 10,000 10,000

Budgeted non-cash

receipts incurring

GST:

RTO No.: 91679 CRICOS Provider Code: 03053G ABN: 15 126 592 756

Sydney Campus: Level 7 & 8, 75 King St, Sydney NSW 2000 Australia

Tel: +61-2-9262 2968 Fax: +61-2-9262 2938Educating for Excellence

Variable cost $ 17,20,000

Divided: number of sales

units 8000

Variable cost per unit $ 215

b) The study explains that Big red bicycle is performing better in the market in terms of

profit level and production level. However, study explains that few changes into

variable cost of the company would help it to improve the profits of the business.

Moreover, diversification of business in Indian market would also be profitable for

the business in terms of financial and non financial position of the company.

c) In order to complete this activity, below are the main sources:

Contribution margin

MOS (margin of safety)

Break-even sales and point (Dunk, 2011)

Task C:

a) ATO (2019) depicts that minimum 5 year taxation record must be kept by the

businesses.

b) The calculations of GST of the business are as follows:

July August September

Budgeted cash

receipts incurring

GST:

Cash sales 20,000 10,000 10,000

Cash revenue (besides

sales)

0 0 0

Cash receipts from sale

of assets (not stock)

0 0 0

Total receipts for GST 20,000 10,000 10,000

Budgeted non-cash

receipts incurring

GST:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Australian Ideal College

RTO No.: 91679 CRICOS Provider Code: 03053G ABN: 15 126 592 756

Sydney Campus: Level 7 & 8, 75 King St, Sydney NSW 2000 Australia

Tel: +61-2-9262 2968 Fax: +61-2-9262 2938Educating for Excellence

Debtors sales 180,000 230,000 150,000

Total non-cash

receipts:

180,000 230,000 150,000

Total budgeted

receipts incurring GST

200,000 240,000 160,000

Budgeted cash

payments incurring

GST

Cash purchases of

stock

0 0 0

Cash expenses 4,300 5,200 5,250

Total cash receipts

incurring GST

4,300 5,200 5,250

Budgeted credit

payments incurring

GST

Credit purchases of

stock incurring GST

25,000 30,000 25,000

Credit purchases of

assets (besides stock)

4,300 5,200 5,250

Total cash payments

incurring GST

29,300 35,200 30,250

Total budgeted cash

payments incurring

GST

33,600 40,400 35,500

GST cash budget

calculations

a) Cash

receipts

2000 1000 1000

b) Cash

payments

430 520 525

c) GST

liability

16640 19960 12450

Task D:

According to the study conducted over task B, it is recommended to the company to

diversify the business at Indian market. This diversification would help the company to

improve the profitability level and market level. It would also help the company to improve

the production capacity (Chapman, and Lili-Anne, 2009). The market study briefs about

better changes into the company in order to enter into the Indian market.

RTO No.: 91679 CRICOS Provider Code: 03053G ABN: 15 126 592 756

Sydney Campus: Level 7 & 8, 75 King St, Sydney NSW 2000 Australia

Tel: +61-2-9262 2968 Fax: +61-2-9262 2938Educating for Excellence

Debtors sales 180,000 230,000 150,000

Total non-cash

receipts:

180,000 230,000 150,000

Total budgeted

receipts incurring GST

200,000 240,000 160,000

Budgeted cash

payments incurring

GST

Cash purchases of

stock

0 0 0

Cash expenses 4,300 5,200 5,250

Total cash receipts

incurring GST

4,300 5,200 5,250

Budgeted credit

payments incurring

GST

Credit purchases of

stock incurring GST

25,000 30,000 25,000

Credit purchases of

assets (besides stock)

4,300 5,200 5,250

Total cash payments

incurring GST

29,300 35,200 30,250

Total budgeted cash

payments incurring

GST

33,600 40,400 35,500

GST cash budget

calculations

a) Cash

receipts

2000 1000 1000

b) Cash

payments

430 520 525

c) GST

liability

16640 19960 12450

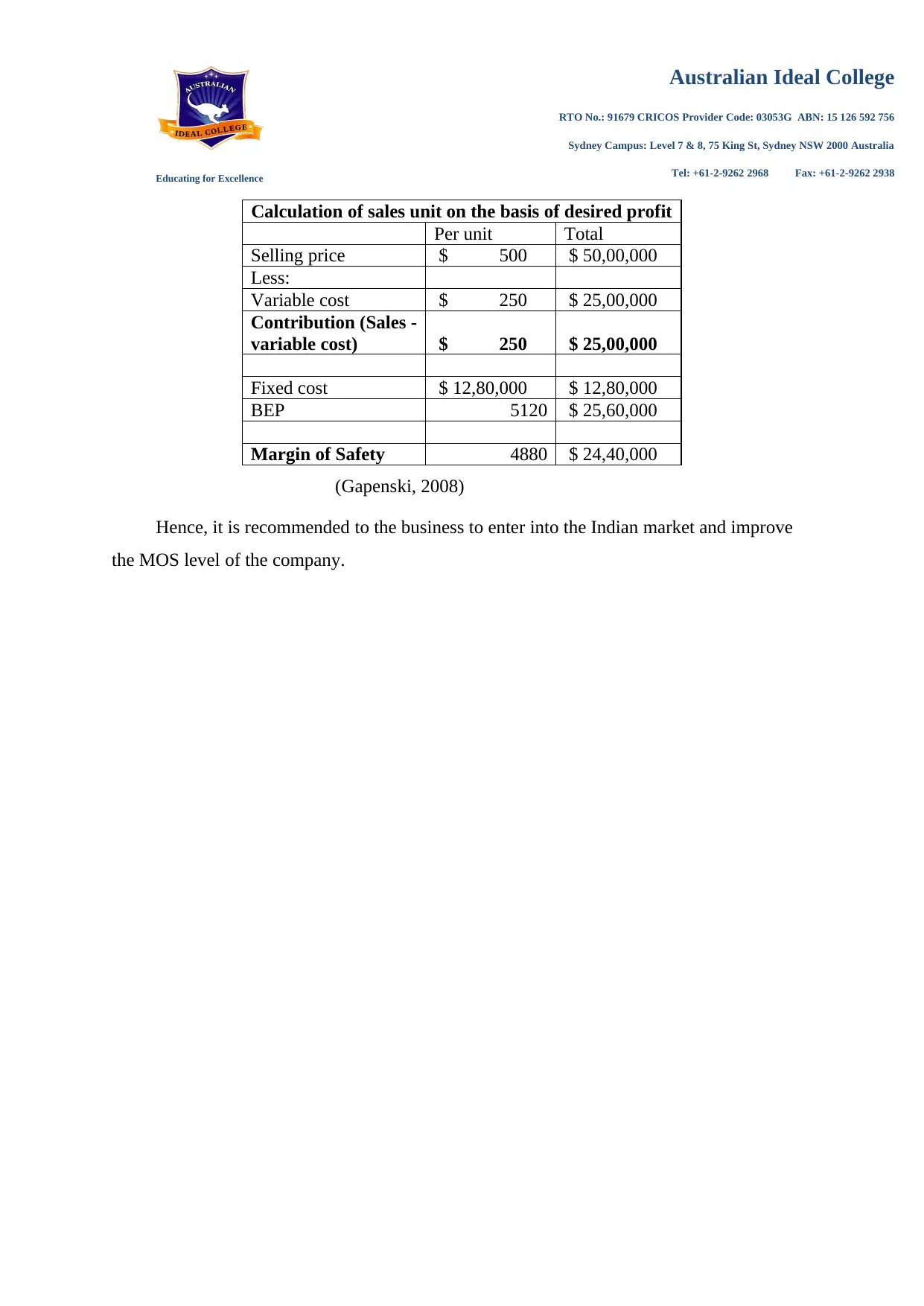

Task D:

According to the study conducted over task B, it is recommended to the company to

diversify the business at Indian market. This diversification would help the company to

improve the profitability level and market level. It would also help the company to improve

the production capacity (Chapman, and Lili-Anne, 2009). The market study briefs about

better changes into the company in order to enter into the Indian market.

Australian Ideal College

RTO No.: 91679 CRICOS Provider Code: 03053G ABN: 15 126 592 756

Sydney Campus: Level 7 & 8, 75 King St, Sydney NSW 2000 Australia

Tel: +61-2-9262 2968 Fax: +61-2-9262 2938Educating for Excellence

Calculation of sales unit on the basis of desired profit

Per unit Total

Selling price $ 500 $ 50,00,000

Less:

Variable cost $ 250 $ 25,00,000

Contribution (Sales -

variable cost) $ 250 $ 25,00,000

Fixed cost $ 12,80,000 $ 12,80,000

BEP 5120 $ 25,60,000

Margin of Safety 4880 $ 24,40,000

(Gapenski, 2008)

Hence, it is recommended to the business to enter into the Indian market and improve

the MOS level of the company.

RTO No.: 91679 CRICOS Provider Code: 03053G ABN: 15 126 592 756

Sydney Campus: Level 7 & 8, 75 King St, Sydney NSW 2000 Australia

Tel: +61-2-9262 2968 Fax: +61-2-9262 2938Educating for Excellence

Calculation of sales unit on the basis of desired profit

Per unit Total

Selling price $ 500 $ 50,00,000

Less:

Variable cost $ 250 $ 25,00,000

Contribution (Sales -

variable cost) $ 250 $ 25,00,000

Fixed cost $ 12,80,000 $ 12,80,000

BEP 5120 $ 25,60,000

Margin of Safety 4880 $ 24,40,000

(Gapenski, 2008)

Hence, it is recommended to the business to enter into the Indian market and improve

the MOS level of the company.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Australian Ideal College

RTO No.: 91679 CRICOS Provider Code: 03053G ABN: 15 126 592 756

Sydney Campus: Level 7 & 8, 75 King St, Sydney NSW 2000 Australia

Tel: +61-2-9262 2968 Fax: +61-2-9262 2938Educating for Excellence

References:

A.S. Dunk, "Product innovation, budgetary control, and the financial performance of

firms." The British Accounting Review, Vol.43.2, pp. 102-111, 2011.

Ato.gov.au. (2019). Keeping your tax records. [online] Available at:

https://www.ato.gov.au/Individuals/Income-and-deductions/In-detail/Keeping-your-tax-

records/ [Accessed 14 May 2019].

C. S. Chapman, and K. Lili-Anne. "Information system integration, enabling control and

performance." Accounting, organizations and society Vol. 34.2, pp, 151-169, 2009.

RTO No.: 91679 CRICOS Provider Code: 03053G ABN: 15 126 592 756

Sydney Campus: Level 7 & 8, 75 King St, Sydney NSW 2000 Australia

Tel: +61-2-9262 2968 Fax: +61-2-9262 2938Educating for Excellence

References:

A.S. Dunk, "Product innovation, budgetary control, and the financial performance of

firms." The British Accounting Review, Vol.43.2, pp. 102-111, 2011.

Ato.gov.au. (2019). Keeping your tax records. [online] Available at:

https://www.ato.gov.au/Individuals/Income-and-deductions/In-detail/Keeping-your-tax-

records/ [Accessed 14 May 2019].

C. S. Chapman, and K. Lili-Anne. "Information system integration, enabling control and

performance." Accounting, organizations and society Vol. 34.2, pp, 151-169, 2009.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Australian Ideal College

RTO No.: 91679 CRICOS Provider Code: 03053G ABN: 15 126 592 756

Sydney Campus: Level 7 & 8, 75 King St, Sydney NSW 2000 Australia

Tel: +61-2-9262 2968 Fax: +61-2-9262 2938Educating for Excellence

RTO No.: 91679 CRICOS Provider Code: 03053G ABN: 15 126 592 756

Sydney Campus: Level 7 & 8, 75 King St, Sydney NSW 2000 Australia

Tel: +61-2-9262 2968 Fax: +61-2-9262 2938Educating for Excellence

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.