Analysis of Australian Mining Industry: Present Condition and Future Prospects

VerifiedAdded on 2023/06/12

|8

|2097

|351

AI Summary

This report provides an in-depth analysis of the Australian mining industry, its present condition, and future prospects. It covers various aspects of the industry, including demand, supply, market equilibrium, and job opportunities.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: MICROECONOMICS

Microeconomics

Name of the Student:

Name of the University:

Author note

Microeconomics

Name of the Student:

Name of the University:

Author note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1MICROECONOMICS

Table of Contents

Introduction:...............................................................................................................................2

Analysis of paper 1:...................................................................................................................2

Analysis of paper 2:...................................................................................................................3

Analysis of paper 3:...................................................................................................................3

Analysis of paper 4:...................................................................................................................4

Analysis of paper 5:...................................................................................................................5

Conclusion:................................................................................................................................6

Reference:..................................................................................................................................7

Table of Contents

Introduction:...............................................................................................................................2

Analysis of paper 1:...................................................................................................................2

Analysis of paper 2:...................................................................................................................3

Analysis of paper 3:...................................................................................................................3

Analysis of paper 4:...................................................................................................................4

Analysis of paper 5:...................................................................................................................5

Conclusion:................................................................................................................................6

Reference:..................................................................................................................................7

2MICROECONOMICS

Introduction:

Australia is one of the mixed developed nation that has been facing going through its

27th consecutive growth year, which makes it stand out from the crowd (Foster 2015).

Owing to the large natural resource, Australia is accounted for the most of the coal and iron

export in the world till the days, when the Asian countries like China were silent (Giles et al.

2015). Once the international market being captured by the Chinese mining product

producers, then the economic condition of the Australian mining industry started to

deteriorate (Wright et al. 2016). Under this situation this report is meant to provide in-

depth details regarding the Australian mining industry through utilising the various models

sourced from the different source

Analysis of paper 1:

Source: https://www.smh.com.au/business/the-economy/2018-the-end-of-the-resources-

boom-as-falling-commodity-prices-bite-20180107-p4yyaa.html

Summary:

Considering the selected article it can be seen that the Australia has been falling

apart from its desired position of becoming the market leader in the mining product export

due to the fact that Australiana mining industry has ran out of the boom in the present date

(Duke 2018). The economy has been now focusing on the energy export as the substitute

product of the mining industry, which is aimed to provide the economy much amount of

boost towards prosperity.

Analysis:

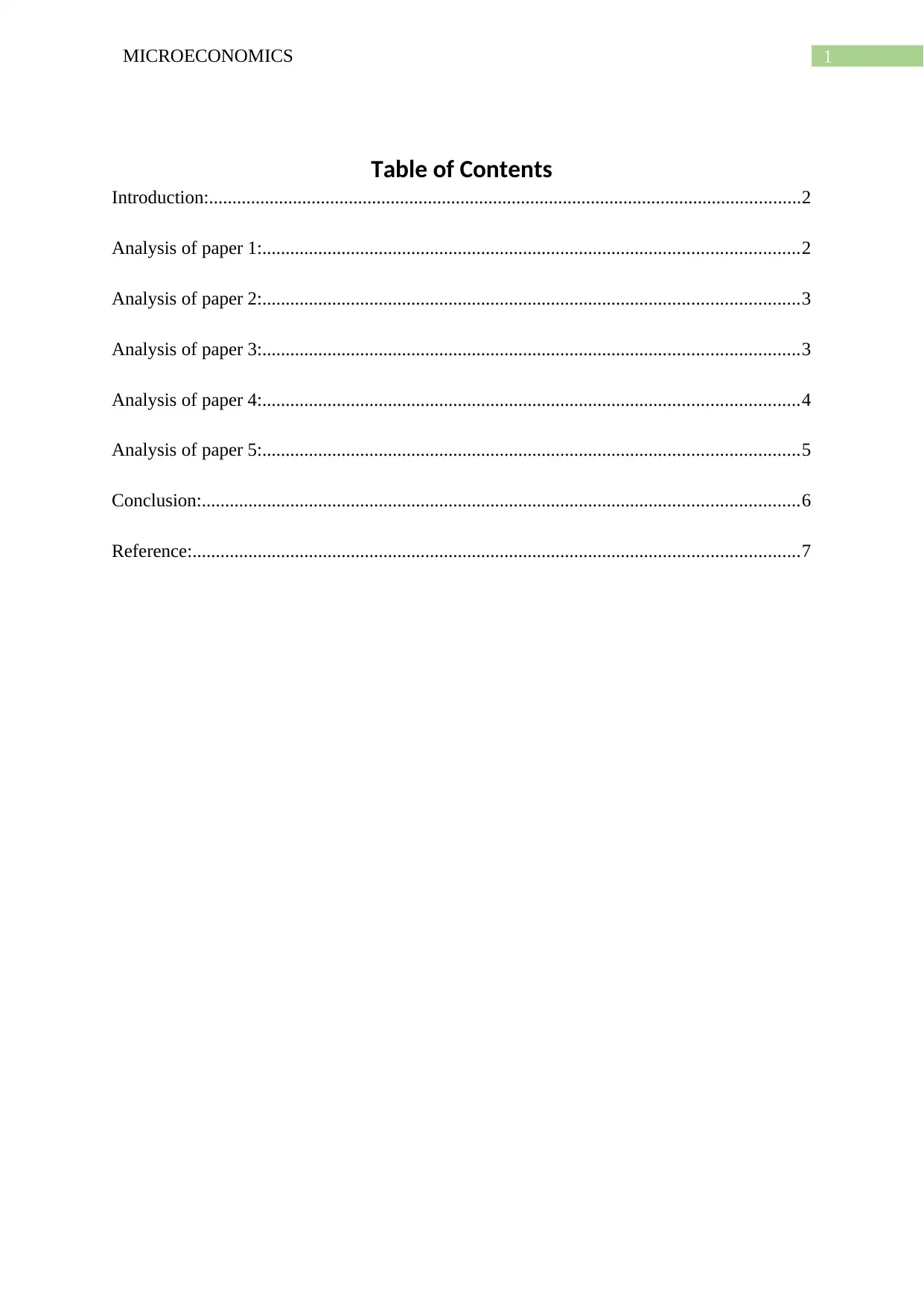

Australia has potential to become the largest power exporter of the world with the

presence of LNG resources in the country. Considering the figure 1, it can be seen that, if the

economy moves from mining goods to export service, then the opportunity cost will be

lower compared to sticking with the core mining product.

Figure 1: PPF of Australian mining industry

Source: (Olav, Gael and Fuvya 2015)

The reduced amount of the opportunity cost serviced tom the Production Possibility

frontier is certainly impressing, however it does not indicated the ideal time or optimal

production amount of the natural resource trade off. Thus according to the selected article,

it would be ideal to shift to the LNG export as soon as possible because the iron and coal

Introduction:

Australia is one of the mixed developed nation that has been facing going through its

27th consecutive growth year, which makes it stand out from the crowd (Foster 2015).

Owing to the large natural resource, Australia is accounted for the most of the coal and iron

export in the world till the days, when the Asian countries like China were silent (Giles et al.

2015). Once the international market being captured by the Chinese mining product

producers, then the economic condition of the Australian mining industry started to

deteriorate (Wright et al. 2016). Under this situation this report is meant to provide in-

depth details regarding the Australian mining industry through utilising the various models

sourced from the different source

Analysis of paper 1:

Source: https://www.smh.com.au/business/the-economy/2018-the-end-of-the-resources-

boom-as-falling-commodity-prices-bite-20180107-p4yyaa.html

Summary:

Considering the selected article it can be seen that the Australia has been falling

apart from its desired position of becoming the market leader in the mining product export

due to the fact that Australiana mining industry has ran out of the boom in the present date

(Duke 2018). The economy has been now focusing on the energy export as the substitute

product of the mining industry, which is aimed to provide the economy much amount of

boost towards prosperity.

Analysis:

Australia has potential to become the largest power exporter of the world with the

presence of LNG resources in the country. Considering the figure 1, it can be seen that, if the

economy moves from mining goods to export service, then the opportunity cost will be

lower compared to sticking with the core mining product.

Figure 1: PPF of Australian mining industry

Source: (Olav, Gael and Fuvya 2015)

The reduced amount of the opportunity cost serviced tom the Production Possibility

frontier is certainly impressing, however it does not indicated the ideal time or optimal

production amount of the natural resource trade off. Thus according to the selected article,

it would be ideal to shift to the LNG export as soon as possible because the iron and coal

3MICROECONOMICS

export market has been evaporated for the Australia for the present time being (Duke

2018).

Analysis of paper 2:

Source: http://www.abc.net.au/news/rural/2017-04-17/next-mining-boom-in-australia-is-

tech-metals/8443172

Summary:

Considering the second resource of this research it can be seen that, it has been

argued by the reporter, that the next mining boom in Australia will be driven by the tech

metals. as the demand of the Australian mining resources are failing in the international

market due to the presence of the suppliers like china, who can provide more goods at

smaller price as compared to Australia (McHugh 2018). Demand of the Australian mining

good has been falling for the coal and the iron ore, however, if the tech metals can be

considered, then it is on rise.

Analysis:

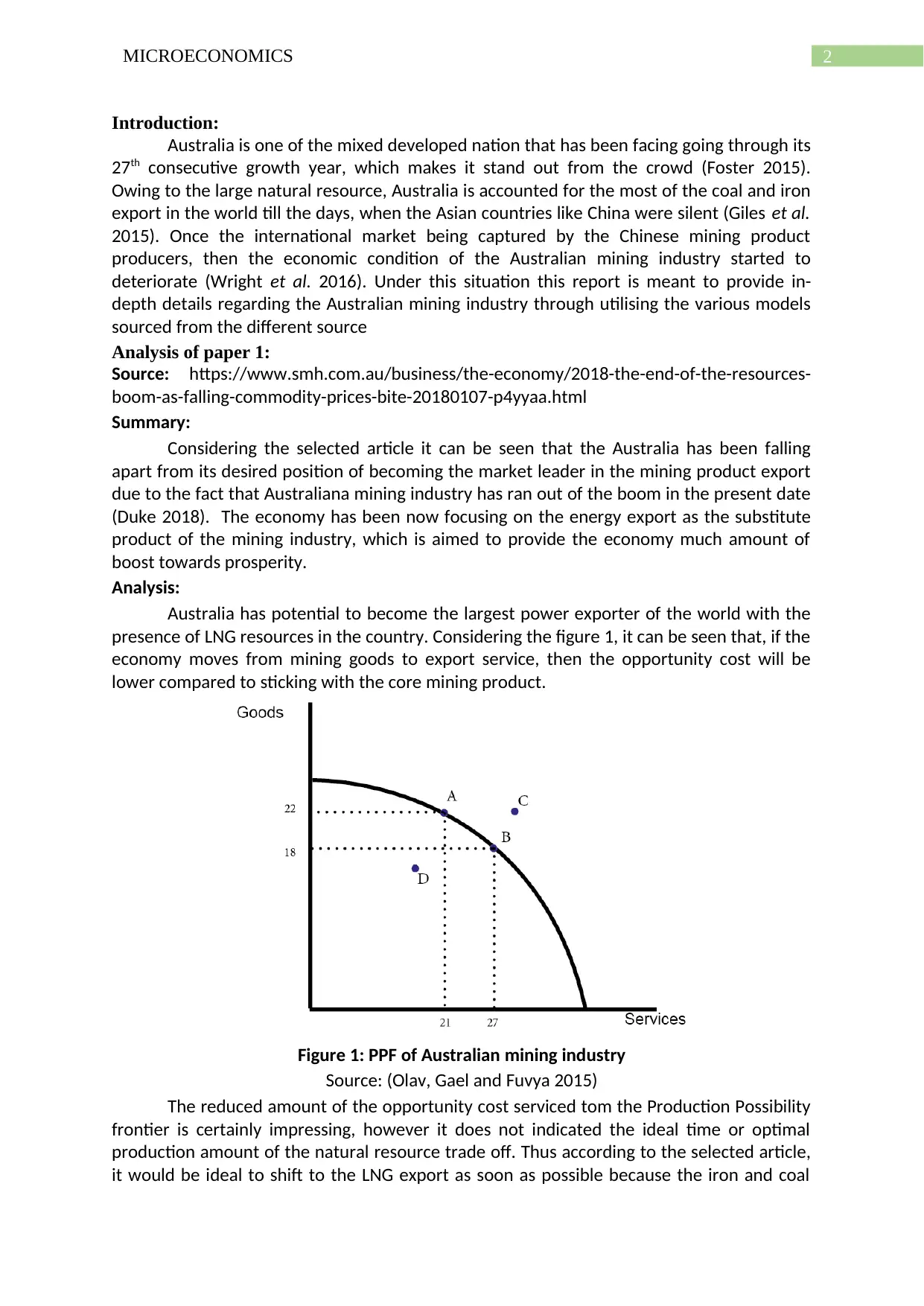

From the selected article, it can be seen that the demand of the Australian mining

product has been falling however, if it focuses on the production of the tech metals, then it

can move towards a better situation.

Figure 2: supply and demand framework of the Australian mining industry

Source: (Created by Author)

Considering the figure 2, it can be seen that, as the supply of the tech metals

increases, it will provide the Australian mining industry much needed boom. With the shift

of the supply curve from S1 to S2 and to S3 further will reduce the price, enhance the

demand of the same and lead to rise in the overall surplus of the economy, in addition it will

enhance the producer surplus too, with the enhanced market share (Azevedo and Leshno

2016).

Analysis of paper 3:

Source: http://www.abc.net.au/news/2017-05-09/adanis-carmichael-mine-will-cause-

global-coal-price-drop-report/8505564

export market has been evaporated for the Australia for the present time being (Duke

2018).

Analysis of paper 2:

Source: http://www.abc.net.au/news/rural/2017-04-17/next-mining-boom-in-australia-is-

tech-metals/8443172

Summary:

Considering the second resource of this research it can be seen that, it has been

argued by the reporter, that the next mining boom in Australia will be driven by the tech

metals. as the demand of the Australian mining resources are failing in the international

market due to the presence of the suppliers like china, who can provide more goods at

smaller price as compared to Australia (McHugh 2018). Demand of the Australian mining

good has been falling for the coal and the iron ore, however, if the tech metals can be

considered, then it is on rise.

Analysis:

From the selected article, it can be seen that the demand of the Australian mining

product has been falling however, if it focuses on the production of the tech metals, then it

can move towards a better situation.

Figure 2: supply and demand framework of the Australian mining industry

Source: (Created by Author)

Considering the figure 2, it can be seen that, as the supply of the tech metals

increases, it will provide the Australian mining industry much needed boom. With the shift

of the supply curve from S1 to S2 and to S3 further will reduce the price, enhance the

demand of the same and lead to rise in the overall surplus of the economy, in addition it will

enhance the producer surplus too, with the enhanced market share (Azevedo and Leshno

2016).

Analysis of paper 3:

Source: http://www.abc.net.au/news/2017-05-09/adanis-carmichael-mine-will-cause-

global-coal-price-drop-report/8505564

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4MICROECONOMICS

Summary:

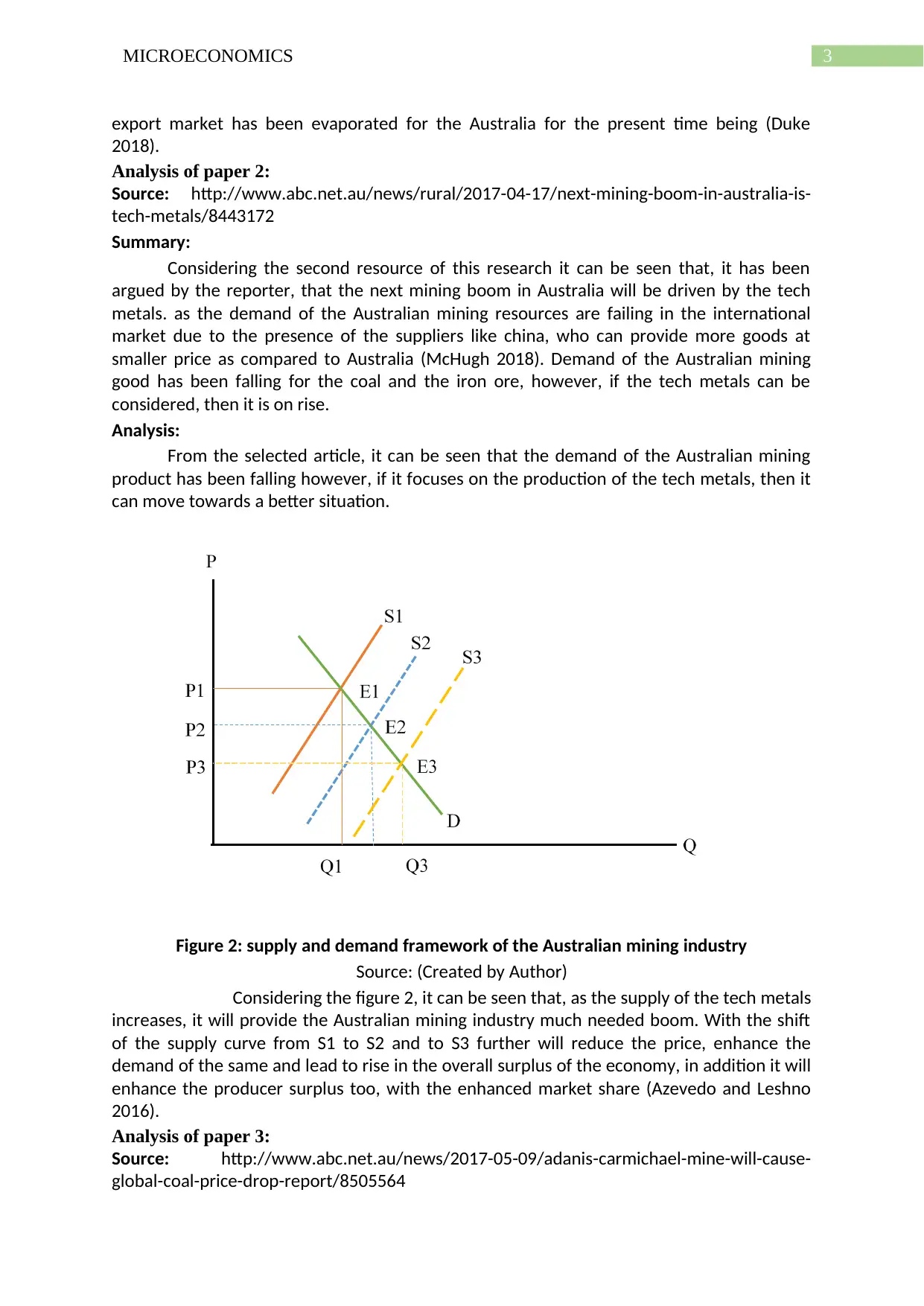

Selected article highlights that incoming price of all the Australian mining product

will be falling as the economy has been producing more mining goods compared to before

which will lead the price to fall.

Analysis:

Considering the report from the newspaper report it can be seen that in coming

years coal price as well as the price of iron and gold will fall substantially leading the

economy towards equilibrium, where the price of the Australian mining products will be

lower (Long 2018). With the presence of strong governmental hold on the mining industry,

and the investment from the private parties will help the economy to face higher demand

along with higher supply, which will form the new market equilibrium.

Figure 3: market equilibrium

Source: (Wang, Ge and Han 2017)

From the chosen figure it can be seen that the market equilibrium can occur at the

point where supply (s) and demand (d) intercept with each other. With the rising demand

and the falling price of the Australian mining goods, equilibrium will take place soon,

because it will crowd out the recent demand-supply gap in the economy (Mikesell and

Whitney 2017).

Analysis of paper 4:

Source: http://www.abc.net.au/news/rural/2017-07-05/mining-oil-gas-job-numbers-rising-

commodity-prices/8676116

Summary:

According to the selected article it can be seen that the Australian mining jobs are

gaining momentum again with the rise in the demand of the Australian minerals in the

world market. Considering the market strategy of China, Australia has started to label their

products as premium quality output, which can compete with the Chinese superior quality

steels (McHugh 2018). It has enhanced the sale of the same and through the inelastic

demand of the premium product market Australian mining industry has been enjoying the

profit too.

Analysis:

Summary:

Selected article highlights that incoming price of all the Australian mining product

will be falling as the economy has been producing more mining goods compared to before

which will lead the price to fall.

Analysis:

Considering the report from the newspaper report it can be seen that in coming

years coal price as well as the price of iron and gold will fall substantially leading the

economy towards equilibrium, where the price of the Australian mining products will be

lower (Long 2018). With the presence of strong governmental hold on the mining industry,

and the investment from the private parties will help the economy to face higher demand

along with higher supply, which will form the new market equilibrium.

Figure 3: market equilibrium

Source: (Wang, Ge and Han 2017)

From the chosen figure it can be seen that the market equilibrium can occur at the

point where supply (s) and demand (d) intercept with each other. With the rising demand

and the falling price of the Australian mining goods, equilibrium will take place soon,

because it will crowd out the recent demand-supply gap in the economy (Mikesell and

Whitney 2017).

Analysis of paper 4:

Source: http://www.abc.net.au/news/rural/2017-07-05/mining-oil-gas-job-numbers-rising-

commodity-prices/8676116

Summary:

According to the selected article it can be seen that the Australian mining jobs are

gaining momentum again with the rise in the demand of the Australian minerals in the

world market. Considering the market strategy of China, Australia has started to label their

products as premium quality output, which can compete with the Chinese superior quality

steels (McHugh 2018). It has enhanced the sale of the same and through the inelastic

demand of the premium product market Australian mining industry has been enjoying the

profit too.

Analysis:

5MICROECONOMICS

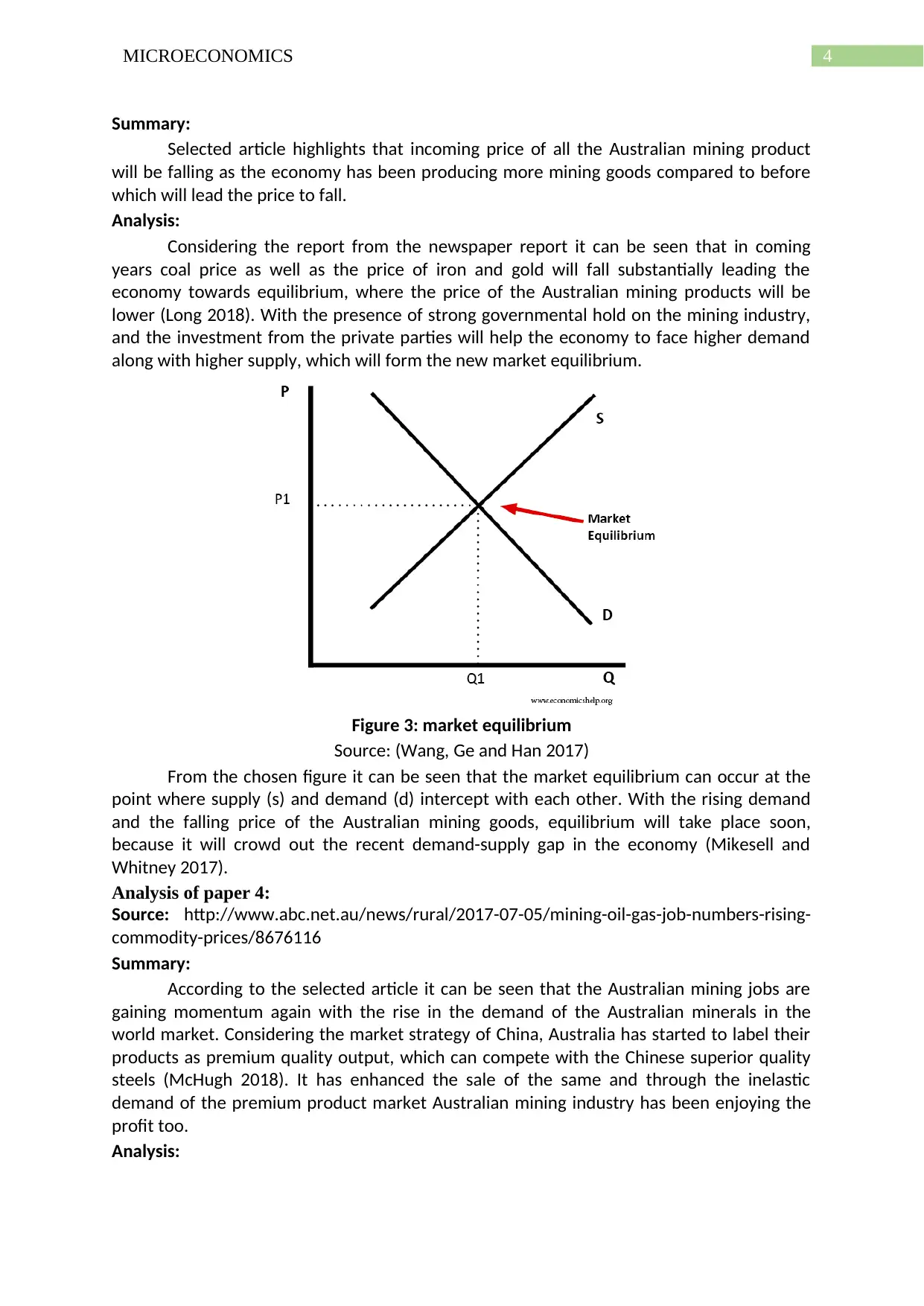

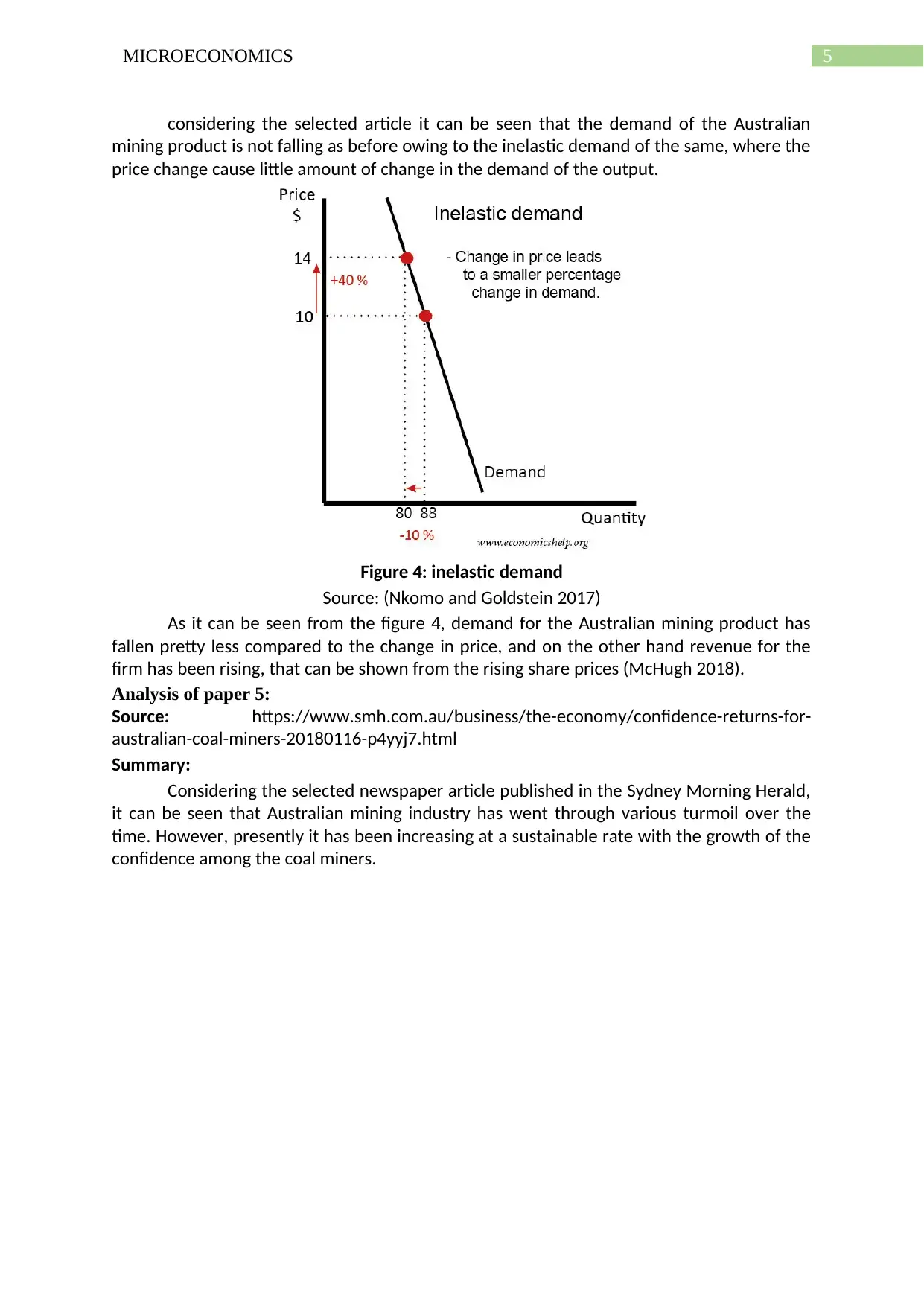

considering the selected article it can be seen that the demand of the Australian

mining product is not falling as before owing to the inelastic demand of the same, where the

price change cause little amount of change in the demand of the output.

Figure 4: inelastic demand

Source: (Nkomo and Goldstein 2017)

As it can be seen from the figure 4, demand for the Australian mining product has

fallen pretty less compared to the change in price, and on the other hand revenue for the

firm has been rising, that can be shown from the rising share prices (McHugh 2018).

Analysis of paper 5:

Source: https://www.smh.com.au/business/the-economy/confidence-returns-for-

australian-coal-miners-20180116-p4yyj7.html

Summary:

Considering the selected newspaper article published in the Sydney Morning Herald,

it can be seen that Australian mining industry has went through various turmoil over the

time. However, presently it has been increasing at a sustainable rate with the growth of the

confidence among the coal miners.

considering the selected article it can be seen that the demand of the Australian

mining product is not falling as before owing to the inelastic demand of the same, where the

price change cause little amount of change in the demand of the output.

Figure 4: inelastic demand

Source: (Nkomo and Goldstein 2017)

As it can be seen from the figure 4, demand for the Australian mining product has

fallen pretty less compared to the change in price, and on the other hand revenue for the

firm has been rising, that can be shown from the rising share prices (McHugh 2018).

Analysis of paper 5:

Source: https://www.smh.com.au/business/the-economy/confidence-returns-for-

australian-coal-miners-20180116-p4yyj7.html

Summary:

Considering the selected newspaper article published in the Sydney Morning Herald,

it can be seen that Australian mining industry has went through various turmoil over the

time. However, presently it has been increasing at a sustainable rate with the growth of the

confidence among the coal miners.

6MICROECONOMICS

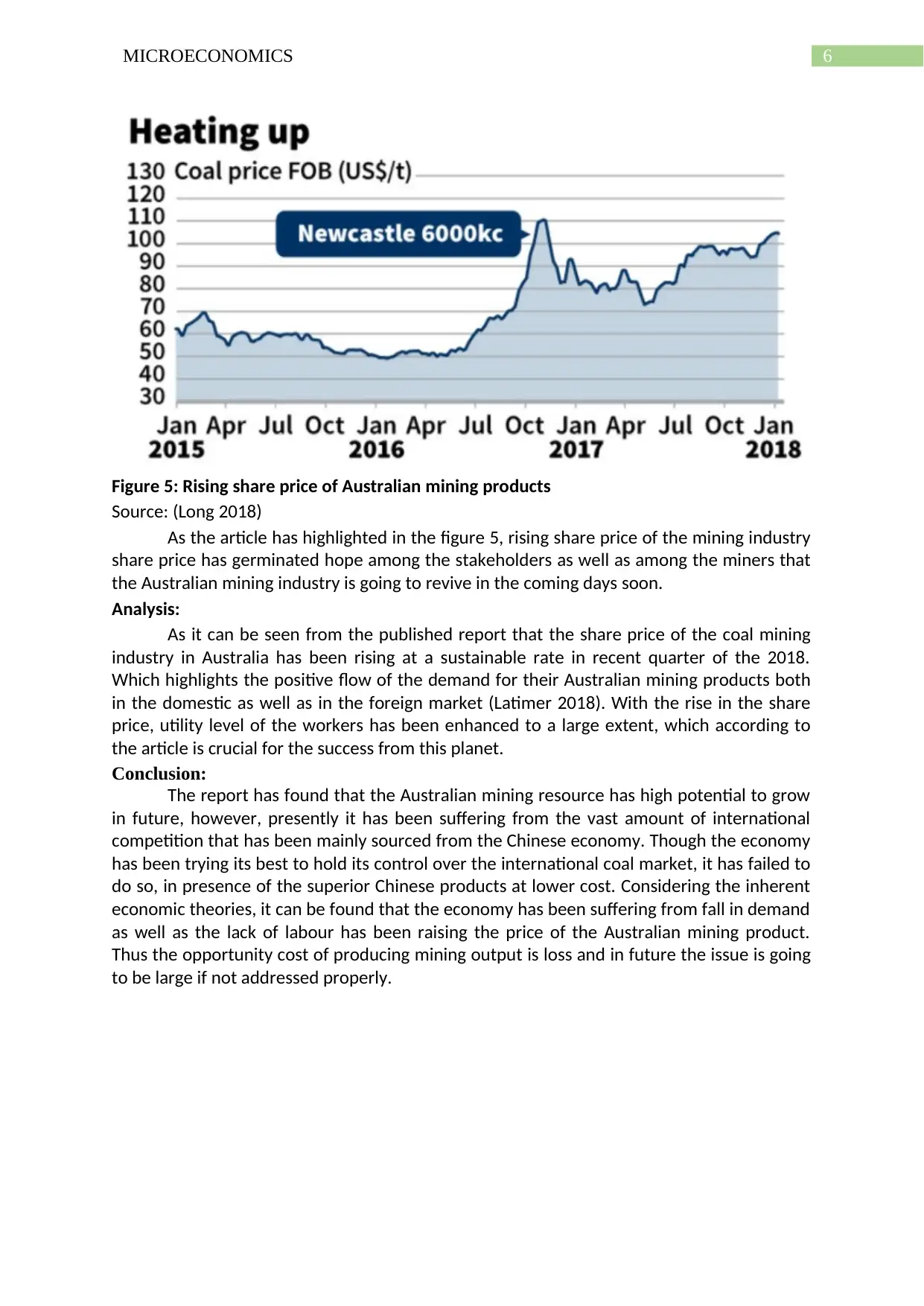

Figure 5: Rising share price of Australian mining products

Source: (Long 2018)

As the article has highlighted in the figure 5, rising share price of the mining industry

share price has germinated hope among the stakeholders as well as among the miners that

the Australian mining industry is going to revive in the coming days soon.

Analysis:

As it can be seen from the published report that the share price of the coal mining

industry in Australia has been rising at a sustainable rate in recent quarter of the 2018.

Which highlights the positive flow of the demand for their Australian mining products both

in the domestic as well as in the foreign market (Latimer 2018). With the rise in the share

price, utility level of the workers has been enhanced to a large extent, which according to

the article is crucial for the success from this planet.

Conclusion:

The report has found that the Australian mining resource has high potential to grow

in future, however, presently it has been suffering from the vast amount of international

competition that has been mainly sourced from the Chinese economy. Though the economy

has been trying its best to hold its control over the international coal market, it has failed to

do so, in presence of the superior Chinese products at lower cost. Considering the inherent

economic theories, it can be found that the economy has been suffering from fall in demand

as well as the lack of labour has been raising the price of the Australian mining product.

Thus the opportunity cost of producing mining output is loss and in future the issue is going

to be large if not addressed properly.

Figure 5: Rising share price of Australian mining products

Source: (Long 2018)

As the article has highlighted in the figure 5, rising share price of the mining industry

share price has germinated hope among the stakeholders as well as among the miners that

the Australian mining industry is going to revive in the coming days soon.

Analysis:

As it can be seen from the published report that the share price of the coal mining

industry in Australia has been rising at a sustainable rate in recent quarter of the 2018.

Which highlights the positive flow of the demand for their Australian mining products both

in the domestic as well as in the foreign market (Latimer 2018). With the rise in the share

price, utility level of the workers has been enhanced to a large extent, which according to

the article is crucial for the success from this planet.

Conclusion:

The report has found that the Australian mining resource has high potential to grow

in future, however, presently it has been suffering from the vast amount of international

competition that has been mainly sourced from the Chinese economy. Though the economy

has been trying its best to hold its control over the international coal market, it has failed to

do so, in presence of the superior Chinese products at lower cost. Considering the inherent

economic theories, it can be found that the economy has been suffering from fall in demand

as well as the lack of labour has been raising the price of the Australian mining product.

Thus the opportunity cost of producing mining output is loss and in future the issue is going

to be large if not addressed properly.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MICROECONOMICS

Reference:

Azevedo, E.M. and Leshno, J.D., 2016. A supply and demand framework for two-sided

matching markets. Journal of Political Economy, 124(5), pp.1235-1268.

Duke, J. (2018). 2018 ‘the end’ of resources boom as commodity price drops bite. [online]

The Sydney Morning Herald. Available at: https://www.smh.com.au/business/the-

economy/2018-the-end-of-the-resources-boom-as-falling-commodity-prices-bite-20180107-

p4yyaa.html [Accessed 25 Apr. 2018].

Foster, J., 2015. The Australian growth miracle: an evolutionary macroeconomic

explanation. Cambridge Journal of Economics, 40(3), pp.871-894.

Giles, L.C., Whitrow, M.J., Davies, M.J., Davies, C.E., Rumbold, A.R. and Moore, V.M., 2015.

Growth trajectories in early childhood, their relationship with antenatal and postnatal

factors, and development of obesity by age 9 years: results from an Australian birth cohort

study. International Journal of Obesity, 39(7), p.1049.

Latimer, C. (2018). Confidence returns for Australian coal miners. [online] The Sydney

Morning Herald. Available at: https://www.smh.com.au/business/the-economy/confidence-

returns-for-australian-coal-miners-20180116-p4yyj7.html [Accessed 25 Apr. 2018].

Long, S. (2018). Adani's Carmichael mine will cause global coal price drop: report. [online]

ABC News. Available at: http://www.abc.net.au/news/2017-05-09/adanis-carmichael-mine-

will-cause-global-coal-price-drop-report/8505564 [Accessed 25 Apr. 2018].

McHugh, B. (2018). Number of mining job vacancies up 70 per cent on last year. [online]

ABC Rural. Available at: http://www.abc.net.au/news/rural/2017-07-05/mining-oil-gas-job-

numbers-rising-commodity-prices/8676116 [Accessed 25 Apr. 2018].

McHugh, B. (2018). Why the next mining boom will be driven by tech metals. [online] ABC

Rural. Available at: http://www.abc.net.au/news/rural/2017-04-17/next-mining-boom-in-

australia-is-tech-metals/8443172 [Accessed 25 Apr. 2018].

Mikesell, R.F. and Whitney, J.W., 2017. The world mining industry: Investment strategy and

public policy. Routledge.

Nkomo, J.C. and Goldstein, H.E., 2017. Energy price responsiveness in Zimbabwean mining

and manufacturing: a disaggregated demand analysis. Journal of Energy in Southern Africa,

17(3), pp.49-57.

Olav, L., Gaël, R. and Fuvya, N., 2015. Low Government Revenue from the Mining Sector in

Zambia and Tanzania: Fiscal Design, Technical Capacity or Political Will?.

Wang, X., Ge, J., Li, J. and Han, A., 2017. Market impacts of environmental regulations on the

production of rare earths: A computable general equilibrium analysis for China. Journal of

Cleaner Production, 154, pp.614-620.

Wright, M.H., Matthews, B., Arnold, M.S.J., Greene, A.C. and Cock, I.E., 2016. The prevention

of fish spoilage by high antioxidant Australian culinary plants: Shewanella putrefaciens

growth inhibition. International journal of food science & technology, 51(3), pp.801-813.

Reference:

Azevedo, E.M. and Leshno, J.D., 2016. A supply and demand framework for two-sided

matching markets. Journal of Political Economy, 124(5), pp.1235-1268.

Duke, J. (2018). 2018 ‘the end’ of resources boom as commodity price drops bite. [online]

The Sydney Morning Herald. Available at: https://www.smh.com.au/business/the-

economy/2018-the-end-of-the-resources-boom-as-falling-commodity-prices-bite-20180107-

p4yyaa.html [Accessed 25 Apr. 2018].

Foster, J., 2015. The Australian growth miracle: an evolutionary macroeconomic

explanation. Cambridge Journal of Economics, 40(3), pp.871-894.

Giles, L.C., Whitrow, M.J., Davies, M.J., Davies, C.E., Rumbold, A.R. and Moore, V.M., 2015.

Growth trajectories in early childhood, their relationship with antenatal and postnatal

factors, and development of obesity by age 9 years: results from an Australian birth cohort

study. International Journal of Obesity, 39(7), p.1049.

Latimer, C. (2018). Confidence returns for Australian coal miners. [online] The Sydney

Morning Herald. Available at: https://www.smh.com.au/business/the-economy/confidence-

returns-for-australian-coal-miners-20180116-p4yyj7.html [Accessed 25 Apr. 2018].

Long, S. (2018). Adani's Carmichael mine will cause global coal price drop: report. [online]

ABC News. Available at: http://www.abc.net.au/news/2017-05-09/adanis-carmichael-mine-

will-cause-global-coal-price-drop-report/8505564 [Accessed 25 Apr. 2018].

McHugh, B. (2018). Number of mining job vacancies up 70 per cent on last year. [online]

ABC Rural. Available at: http://www.abc.net.au/news/rural/2017-07-05/mining-oil-gas-job-

numbers-rising-commodity-prices/8676116 [Accessed 25 Apr. 2018].

McHugh, B. (2018). Why the next mining boom will be driven by tech metals. [online] ABC

Rural. Available at: http://www.abc.net.au/news/rural/2017-04-17/next-mining-boom-in-

australia-is-tech-metals/8443172 [Accessed 25 Apr. 2018].

Mikesell, R.F. and Whitney, J.W., 2017. The world mining industry: Investment strategy and

public policy. Routledge.

Nkomo, J.C. and Goldstein, H.E., 2017. Energy price responsiveness in Zimbabwean mining

and manufacturing: a disaggregated demand analysis. Journal of Energy in Southern Africa,

17(3), pp.49-57.

Olav, L., Gaël, R. and Fuvya, N., 2015. Low Government Revenue from the Mining Sector in

Zambia and Tanzania: Fiscal Design, Technical Capacity or Political Will?.

Wang, X., Ge, J., Li, J. and Han, A., 2017. Market impacts of environmental regulations on the

production of rare earths: A computable general equilibrium analysis for China. Journal of

Cleaner Production, 154, pp.614-620.

Wright, M.H., Matthews, B., Arnold, M.S.J., Greene, A.C. and Cock, I.E., 2016. The prevention

of fish spoilage by high antioxidant Australian culinary plants: Shewanella putrefaciens

growth inhibition. International journal of food science & technology, 51(3), pp.801-813.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.