Analysis of the Australian Oil Industry and Petrol Demand

VerifiedAdded on 2023/01/10

|11

|2649

|52

Report

AI Summary

This report delves into the Australian oil industry, examining the key issues affecting its operations and the demand and supply of petrol. It explores challenges such as environmental costs, regulatory uncertainties, and operational social licenses, as well as the impact of global oil prices and technological innovation. The report analyzes factors influencing petrol demand, including price fluctuations, government taxes, and consumer preferences, while also considering the influence of political stability in oil-importing nations. Relevant economic theories, including absolute advantage, comparative advantage, and free international trade, are discussed to provide context. The report concludes by highlighting long-term implications and broader factors affecting the Australian oil industry, emphasizing the need for strategic improvements and investment in research and development.

AUSTRALIAN OIL INDUSTRY AND PETROL DEMAND AND SUPPLY 1

AUSTRALIAN OIL INDUSTRY AND PETROL DEMAND AND SUPPLY

Student Name

Institutional Affiliation

Facilitator

Course

Date

AUSTRALIAN OIL INDUSTRY AND PETROL DEMAND AND SUPPLY

Student Name

Institutional Affiliation

Facilitator

Course

Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AUSTRALIAN OIL INDUSTRY AND PETROL DEMAND AND SUPPLY 2

Introduction

Australia has numerous natural resources and its oil industry has been contributing a greater

percentage towards economic growth for decades. The oil industry accounts for 37 percent of the

Australian total energy consumption and oil demand has been on the rise for the past period

actually decades. The rising demand has been contributed by the Australian expanding transport

sector which highly relies on the derivatives of crude oil accumulating to 95 percent of its total

energy consumption. Centrally to this, the crude oil production in Australia has been on the

decline for the past years. For instance, from the year 1994 to 2018, an average of 475000 daily

barrels (bpd) have been recorded. The highest productivity was recorded in the year 2000 which

was 781000 daily barrels and lowest productivity was recorded in 2018 January which was

240000 daily barrels. The Bass Straight has shielded Australia from the price of oil shocks due to

its considerable large amounts of domestic oil production which totaled to more than 4 billion

barrels as from the 1960s (Davies et al 2014, p.239). from the year 1985, the Australian Bass

Straight has been on the decline which has not to be been able to be countered by other fields’ oil

production and this has made Australia rely much on oil importation. Australia is blessed with

large oil deposits, especially in Queensland and Northern Territory. However, oil production

from these areas has not been possible due to their geographical challenges and concerns related

to the environment as well as economic issues. There are various issues affecting the operations

of the Australian oil industry and the demand and supply for the nation’s petrol as discussed

below.

Issues affecting the Australian Oil Industry

Introduction

Australia has numerous natural resources and its oil industry has been contributing a greater

percentage towards economic growth for decades. The oil industry accounts for 37 percent of the

Australian total energy consumption and oil demand has been on the rise for the past period

actually decades. The rising demand has been contributed by the Australian expanding transport

sector which highly relies on the derivatives of crude oil accumulating to 95 percent of its total

energy consumption. Centrally to this, the crude oil production in Australia has been on the

decline for the past years. For instance, from the year 1994 to 2018, an average of 475000 daily

barrels (bpd) have been recorded. The highest productivity was recorded in the year 2000 which

was 781000 daily barrels and lowest productivity was recorded in 2018 January which was

240000 daily barrels. The Bass Straight has shielded Australia from the price of oil shocks due to

its considerable large amounts of domestic oil production which totaled to more than 4 billion

barrels as from the 1960s (Davies et al 2014, p.239). from the year 1985, the Australian Bass

Straight has been on the decline which has not to be been able to be countered by other fields’ oil

production and this has made Australia rely much on oil importation. Australia is blessed with

large oil deposits, especially in Queensland and Northern Territory. However, oil production

from these areas has not been possible due to their geographical challenges and concerns related

to the environment as well as economic issues. There are various issues affecting the operations

of the Australian oil industry and the demand and supply for the nation’s petrol as discussed

below.

Issues affecting the Australian Oil Industry

AUSTRALIAN OIL INDUSTRY AND PETROL DEMAND AND SUPPLY 3

Despite the fact that the Australian oil industry accounts for a greater percentage in the nation’s

energy consumption and economic growth, there are various issues which pose great challenges

towards this industry’s operations. They include Environmental costs, Regulatory Uncertainties,

Operational Social Licenses, Declining prices and exploration as well as commoditization and

Commercialization and domestic innovation challenges among others.

High environmental costs: The Australian oil industry has been facing higher production and

exploration costs (Limkriangkrai, Koh and Durand 2017, p.461). For example, comparing the

onshore exploration drilling costs between Australia and the United States, Australia incurs twice

the cost incurred by the US. Offshore North West shelf has also experienced an increase in

exploration costs in the past years. Also, Australian multibillion-dollar oil projects have been

experiencing increased construction costs. The Greenfield East African LNG project also has an

estimated cost which ranges between 20 to 30 percent lesser than costs experienced in Australia.

Higher costs in production and exploration mean that the Australian Oil Industry has its

competition based on cost as compared to other nations which produce oil, gas, and petrol

cheaply like East Africa and the United States. This means that Australia has to struggle in order

to develop its resources which are unconventional and this would affect the LNG infrastructure

in the East Coast and future unlocks of the shale gas resources in the nation. Hence higher

environmental costs have made Australia lose its competitive advantage in the international oil

market.

The Australian oil industry has also faced regulatory uncertainties (Ford, Steen and Verreynne

2014, p.204). Previous the Australian oil industry was highly attracting investors into the

industry as the nation’s economy remained stable and democracy prevailed in the nation.

Despite the fact that the Australian oil industry accounts for a greater percentage in the nation’s

energy consumption and economic growth, there are various issues which pose great challenges

towards this industry’s operations. They include Environmental costs, Regulatory Uncertainties,

Operational Social Licenses, Declining prices and exploration as well as commoditization and

Commercialization and domestic innovation challenges among others.

High environmental costs: The Australian oil industry has been facing higher production and

exploration costs (Limkriangkrai, Koh and Durand 2017, p.461). For example, comparing the

onshore exploration drilling costs between Australia and the United States, Australia incurs twice

the cost incurred by the US. Offshore North West shelf has also experienced an increase in

exploration costs in the past years. Also, Australian multibillion-dollar oil projects have been

experiencing increased construction costs. The Greenfield East African LNG project also has an

estimated cost which ranges between 20 to 30 percent lesser than costs experienced in Australia.

Higher costs in production and exploration mean that the Australian Oil Industry has its

competition based on cost as compared to other nations which produce oil, gas, and petrol

cheaply like East Africa and the United States. This means that Australia has to struggle in order

to develop its resources which are unconventional and this would affect the LNG infrastructure

in the East Coast and future unlocks of the shale gas resources in the nation. Hence higher

environmental costs have made Australia lose its competitive advantage in the international oil

market.

The Australian oil industry has also faced regulatory uncertainties (Ford, Steen and Verreynne

2014, p.204). Previous the Australian oil industry was highly attracting investors into the

industry as the nation’s economy remained stable and democracy prevailed in the nation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

AUSTRALIAN OIL INDUSTRY AND PETROL DEMAND AND SUPPLY 4

Democracy has deteriorated of late and companies are uncertain about investing in Australian

industry inclusive of the oil industry. Australian unconventional resources have been deterred

from development by the onshore exploration constraints put in place. Restrictions on onshore

exploration have already been put in place in Tasmania, Northern Territory, New South Wales,

and Victoria and are anticipated to be extended to cover South and Western Australia. Policies

and regulations have been established in the past to control climate change in Australia and there

is uncertainty about future policies. Previous environmental policies have decreased investment

in Australian industries including the oil and gas sectors. The regulatory system of Australia has

also been complex as 50 agencies regulate the oil industry and this has undermined operations in

the sector and created future uncertainty.

The Australian oil industry has been faced with the problem of establishing operational social

licenses. Obtaining a social license for operations of both offshore and onshore explorations has

not been easy and this has led to delayed investments in the industry and even some projects end

up being canceled. This has negatively impacted the Australian economic growth as many

investors view the nation as unattractive in as much as the oil industry is concerned.

LNG commoditization and the decline in global oil prices have highly impacted the Australian

oil industry by decreasing oil and gas exploration in the nation (Byrne 2014, p.523). Since the

year 2008, estimates show that offshore exploration of petroleum products has declined by

almost 90 percent. Exploration expenditure has also declined by almost 27 percent in

Queensland. This means that Australian unconventional resources will face underdevelopment

due to decline in exploration in the oil industry.

Democracy has deteriorated of late and companies are uncertain about investing in Australian

industry inclusive of the oil industry. Australian unconventional resources have been deterred

from development by the onshore exploration constraints put in place. Restrictions on onshore

exploration have already been put in place in Tasmania, Northern Territory, New South Wales,

and Victoria and are anticipated to be extended to cover South and Western Australia. Policies

and regulations have been established in the past to control climate change in Australia and there

is uncertainty about future policies. Previous environmental policies have decreased investment

in Australian industries including the oil and gas sectors. The regulatory system of Australia has

also been complex as 50 agencies regulate the oil industry and this has undermined operations in

the sector and created future uncertainty.

The Australian oil industry has been faced with the problem of establishing operational social

licenses. Obtaining a social license for operations of both offshore and onshore explorations has

not been easy and this has led to delayed investments in the industry and even some projects end

up being canceled. This has negatively impacted the Australian economic growth as many

investors view the nation as unattractive in as much as the oil industry is concerned.

LNG commoditization and the decline in global oil prices have highly impacted the Australian

oil industry by decreasing oil and gas exploration in the nation (Byrne 2014, p.523). Since the

year 2008, estimates show that offshore exploration of petroleum products has declined by

almost 90 percent. Exploration expenditure has also declined by almost 27 percent in

Queensland. This means that Australian unconventional resources will face underdevelopment

due to decline in exploration in the oil industry.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AUSTRALIAN OIL INDUSTRY AND PETROL DEMAND AND SUPPLY 5

Players in the Australian oil industry have not been able to adopt modern technologies in oil

exploration. This is because they fear new technologies and prefer using the already tested well-

known technologies in production in their daily operations (Fingas 2016, p.24). This means that

Australia has experienced decreased innovation in its oil industry and hence relies much on

technology from foreign companies especially those headquartered in the United States.

Issues affecting the demand and supply for petrol in Australia

There are various factors which affect the Australian demand and supply for petrol as explained.

Australian regulatory environmental policies highly impact the supply of petrol. For the past

years, Australian regulatory authorities have come up with policies which total to 50 in number

aimed at minimizing pollution in order to conserve the environment and avoid climatic change

(Cordes 2016, p.58). These policies are formulated without alternatives or rather significant

investments in research and development to help come up with safe methods of petrol and oil

exploration. As a result, petrol and oil exploration in Australia has declined for the past years

leading to a decline in petrol and oil supply and due to future uncertainty about upcoming

policies further decline in petrol supply is anticipated in future.

Petrol prices impact the demand for petrol in Australia. The demand for petrol in Australia is

highly determined by its price. Recently, petrol prices have risen due to an increase in the price

for crude oil from which petrol is made, depreciation of the Australian dollar and fuel retailing

costs increase. This has highly affected motorists who have vowed to demonstrate for petrol

prices to be lowered. As a result, the demand for petrol although inelastic has decreased by a

certain degree as Australians cut their petrol usage.

Players in the Australian oil industry have not been able to adopt modern technologies in oil

exploration. This is because they fear new technologies and prefer using the already tested well-

known technologies in production in their daily operations (Fingas 2016, p.24). This means that

Australia has experienced decreased innovation in its oil industry and hence relies much on

technology from foreign companies especially those headquartered in the United States.

Issues affecting the demand and supply for petrol in Australia

There are various factors which affect the Australian demand and supply for petrol as explained.

Australian regulatory environmental policies highly impact the supply of petrol. For the past

years, Australian regulatory authorities have come up with policies which total to 50 in number

aimed at minimizing pollution in order to conserve the environment and avoid climatic change

(Cordes 2016, p.58). These policies are formulated without alternatives or rather significant

investments in research and development to help come up with safe methods of petrol and oil

exploration. As a result, petrol and oil exploration in Australia has declined for the past years

leading to a decline in petrol and oil supply and due to future uncertainty about upcoming

policies further decline in petrol supply is anticipated in future.

Petrol prices impact the demand for petrol in Australia. The demand for petrol in Australia is

highly determined by its price. Recently, petrol prices have risen due to an increase in the price

for crude oil from which petrol is made, depreciation of the Australian dollar and fuel retailing

costs increase. This has highly affected motorists who have vowed to demonstrate for petrol

prices to be lowered. As a result, the demand for petrol although inelastic has decreased by a

certain degree as Australians cut their petrol usage.

AUSTRALIAN OIL INDUSTRY AND PETROL DEMAND AND SUPPLY 6

Australian government tax levied on fuels impacts both the demand and supply for petrol in

Australia. Tax levied on Australian fuels has been on the rise despite the international crude oil

price increase (Pearce 2014, p.39). This has lowered supply and demand for fuel as suppliers

view petrol as less profitable due to increased costs and consumers reduce their oil usage due to

higher prices.

The political stability of the nations from which Australia imports its petrol from highly affects

the petrol supply in Australia. Due to a lack of competitive advantage in oil production, Australia

highly depends on oil importation. Australia obtains crude oil from the Middle East and it is

refined in Singapore, South Korea, and China before being shipped to Australia. Political

instability in any of the nations from which Australia imports its petrol might lead to insufficient

petrol supply in Australia. For example, Australia has been on the fear that security deterioration,

especially in Syria and Middle Eastern countries, might lead to petrol and fuel shortage.

Changes in consumer tastes and preferences affect the demand for petrol in Australia. The petrol

price increase has made customers to change their usage of SUVs and large passenger vehicles

and start purchasing the majority of the nation’s smaller cars (Conlon and Perkins 2018, p.53).

This has highly impacted fuel consumption in the nation by reducing its aggregate demand and

hence has decreased petrol usage in Australia.

Relevant Economic Theories

The theory of absolute advantage is relevant to factors determining demand and supply for petrol

in Australia. This theory was put forward by Adam Smith and advocated for nations to produce

commodities for which they have an absolute advantage in producing. A country is said to have

Australian government tax levied on fuels impacts both the demand and supply for petrol in

Australia. Tax levied on Australian fuels has been on the rise despite the international crude oil

price increase (Pearce 2014, p.39). This has lowered supply and demand for fuel as suppliers

view petrol as less profitable due to increased costs and consumers reduce their oil usage due to

higher prices.

The political stability of the nations from which Australia imports its petrol from highly affects

the petrol supply in Australia. Due to a lack of competitive advantage in oil production, Australia

highly depends on oil importation. Australia obtains crude oil from the Middle East and it is

refined in Singapore, South Korea, and China before being shipped to Australia. Political

instability in any of the nations from which Australia imports its petrol might lead to insufficient

petrol supply in Australia. For example, Australia has been on the fear that security deterioration,

especially in Syria and Middle Eastern countries, might lead to petrol and fuel shortage.

Changes in consumer tastes and preferences affect the demand for petrol in Australia. The petrol

price increase has made customers to change their usage of SUVs and large passenger vehicles

and start purchasing the majority of the nation’s smaller cars (Conlon and Perkins 2018, p.53).

This has highly impacted fuel consumption in the nation by reducing its aggregate demand and

hence has decreased petrol usage in Australia.

Relevant Economic Theories

The theory of absolute advantage is relevant to factors determining demand and supply for petrol

in Australia. This theory was put forward by Adam Smith and advocated for nations to produce

commodities for which they have an absolute advantage in producing. A country is said to have

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

AUSTRALIAN OIL INDUSTRY AND PETROL DEMAND AND SUPPLY 7

an absolute advantage in a certain good if it can produce it cheaply (at lower production costs) as

compared to another (Seretis and Tsaliki 2016, p.438). Australia lacks absolute advantage at

producing oil and as a result, has been relying much on oil importation especially from

Singapore, China, and South Korea among others. Australia experiences higher production costs

in oil exploration as compared to nations such as Easter Africa, Singapore, and South Korea

among others and hence lacks competitive advantage in petrol production. This makes Australia

find it necessary to rely on oil importation.

The theory of comparative advantage is also relevant to Australian petrol demand and supply.

This theory was put forward by David Ricardo as he argued that a nation should produce goods

for which it can produce cheaply (lower opportunity cost) as compared to others (Morrow 2010,

p.137). Australia produces domestic petrol and petroleum products at lower amounts as

compared to goods such as iron core, gold, and coal among others. It has been exporting only a

lower percentage of petroleum products actually 4.7 percentage as compared to exports for

which it has absolute and comparative advantage naturally.

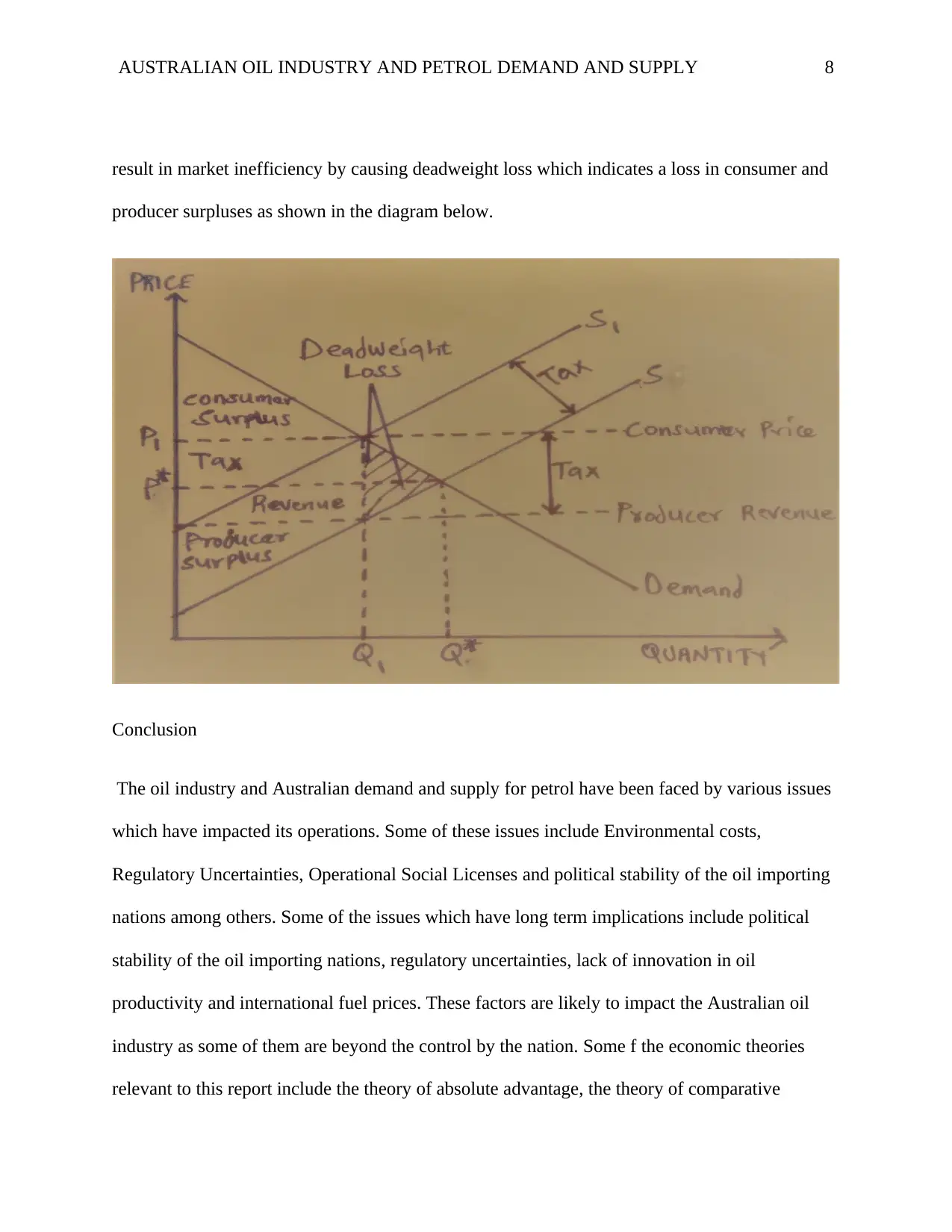

The economic theory of free international trade is also relevant for this report. This theory was

put forward by David Ricardo who supported free trade where government intervention is not

required and price for commodities should be left to be determined by the market forces of

demand and supply (Suranovic 2010, p.13). From the study, government taxation, especially on

Australian fuels, is viewed as a causative agent of market inefficiency distorting the nation’s

demand and supply. Government fuel taxes have led to low supply and demand for Australian

petrol due to increased production costs and higher prices respectively. Government fuel taxes

an absolute advantage in a certain good if it can produce it cheaply (at lower production costs) as

compared to another (Seretis and Tsaliki 2016, p.438). Australia lacks absolute advantage at

producing oil and as a result, has been relying much on oil importation especially from

Singapore, China, and South Korea among others. Australia experiences higher production costs

in oil exploration as compared to nations such as Easter Africa, Singapore, and South Korea

among others and hence lacks competitive advantage in petrol production. This makes Australia

find it necessary to rely on oil importation.

The theory of comparative advantage is also relevant to Australian petrol demand and supply.

This theory was put forward by David Ricardo as he argued that a nation should produce goods

for which it can produce cheaply (lower opportunity cost) as compared to others (Morrow 2010,

p.137). Australia produces domestic petrol and petroleum products at lower amounts as

compared to goods such as iron core, gold, and coal among others. It has been exporting only a

lower percentage of petroleum products actually 4.7 percentage as compared to exports for

which it has absolute and comparative advantage naturally.

The economic theory of free international trade is also relevant for this report. This theory was

put forward by David Ricardo who supported free trade where government intervention is not

required and price for commodities should be left to be determined by the market forces of

demand and supply (Suranovic 2010, p.13). From the study, government taxation, especially on

Australian fuels, is viewed as a causative agent of market inefficiency distorting the nation’s

demand and supply. Government fuel taxes have led to low supply and demand for Australian

petrol due to increased production costs and higher prices respectively. Government fuel taxes

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AUSTRALIAN OIL INDUSTRY AND PETROL DEMAND AND SUPPLY 8

result in market inefficiency by causing deadweight loss which indicates a loss in consumer and

producer surpluses as shown in the diagram below.

Conclusion

The oil industry and Australian demand and supply for petrol have been faced by various issues

which have impacted its operations. Some of these issues include Environmental costs,

Regulatory Uncertainties, Operational Social Licenses and political stability of the oil importing

nations among others. Some of the issues which have long term implications include political

stability of the oil importing nations, regulatory uncertainties, lack of innovation in oil

productivity and international fuel prices. These factors are likely to impact the Australian oil

industry as some of them are beyond the control by the nation. Some f the economic theories

relevant to this report include the theory of absolute advantage, the theory of comparative

result in market inefficiency by causing deadweight loss which indicates a loss in consumer and

producer surpluses as shown in the diagram below.

Conclusion

The oil industry and Australian demand and supply for petrol have been faced by various issues

which have impacted its operations. Some of these issues include Environmental costs,

Regulatory Uncertainties, Operational Social Licenses and political stability of the oil importing

nations among others. Some of the issues which have long term implications include political

stability of the oil importing nations, regulatory uncertainties, lack of innovation in oil

productivity and international fuel prices. These factors are likely to impact the Australian oil

industry as some of them are beyond the control by the nation. Some f the economic theories

relevant to this report include the theory of absolute advantage, the theory of comparative

AUSTRALIAN OIL INDUSTRY AND PETROL DEMAND AND SUPPLY 9

advantage and the international free trade theory. In a nutshell, the Australian oil industry has

been faced by various issues which tame its growth and hence the nation should work towards

improving the industry through various means such heavily investing in research and

development to come up modern methods of oil exploration and minimize the nation’s

overdependence on oil importation.

advantage and the international free trade theory. In a nutshell, the Australian oil industry has

been faced by various issues which tame its growth and hence the nation should work towards

improving the industry through various means such heavily investing in research and

development to come up modern methods of oil exploration and minimize the nation’s

overdependence on oil importation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

AUSTRALIAN OIL INDUSTRY AND PETROL DEMAND AND SUPPLY 10

References

Byrne, D.P., 2014. Fuelling Australia: structural changes and new policy challenges in the petrol

industry. Australian Economic Review, 47(4), pp.523-539.

Conlon, R. and Perkins, J., 2018. Wheels and deals: The automotive industry in twentieth-century

Australia. Routledge, 50(4), pp.53-59.

Cordes, E.E., Jones, D.O., Schlacher, T.A., Amon, D.J., Bernardino, A.F., Brooke, S., Carney,

R., DeLeo, D.M., Dunlop, K.M., Escobar-Briones, E.G. and Gates, A.R., 2016. Environmental

impacts of the deep-water oil and gas industry: a review to guide management

strategies. Frontiers in Environmental Science, 4, p.58.

Davies, R.J., Almond, S., Ward, R.S., Jackson, R.B., Adams, C., Worrall, F., Herringshaw, L.G.,

Gluyas, J.G. and Whitehead, M.A., 2014. Oil and gas wells and their integrity: Implications for

shale and unconventional resource exploitation. Marine and Petroleum Geology, 56, pp.239-254.

Fingas, M., 2016. Oil spill science and technology. Gulf professional publishing, 84, pp.24-43.

Ford, J.A., Steen, J. and Verreynne, M.L., 2014. How environmental regulations affect

innovation in the Australian oil and gas industry: going beyond the Porter Hypothesis. Journal of

Cleaner Production, 84, pp.204-213.

Limkriangkrai, M., Koh, S. and Durand, R.B., 2017. Environmental, social, and governance

(ESG) profiles, stock returns, and financial policy: Australian evidence. International Review of

Finance, 17(3), pp.461-471.

References

Byrne, D.P., 2014. Fuelling Australia: structural changes and new policy challenges in the petrol

industry. Australian Economic Review, 47(4), pp.523-539.

Conlon, R. and Perkins, J., 2018. Wheels and deals: The automotive industry in twentieth-century

Australia. Routledge, 50(4), pp.53-59.

Cordes, E.E., Jones, D.O., Schlacher, T.A., Amon, D.J., Bernardino, A.F., Brooke, S., Carney,

R., DeLeo, D.M., Dunlop, K.M., Escobar-Briones, E.G. and Gates, A.R., 2016. Environmental

impacts of the deep-water oil and gas industry: a review to guide management

strategies. Frontiers in Environmental Science, 4, p.58.

Davies, R.J., Almond, S., Ward, R.S., Jackson, R.B., Adams, C., Worrall, F., Herringshaw, L.G.,

Gluyas, J.G. and Whitehead, M.A., 2014. Oil and gas wells and their integrity: Implications for

shale and unconventional resource exploitation. Marine and Petroleum Geology, 56, pp.239-254.

Fingas, M., 2016. Oil spill science and technology. Gulf professional publishing, 84, pp.24-43.

Ford, J.A., Steen, J. and Verreynne, M.L., 2014. How environmental regulations affect

innovation in the Australian oil and gas industry: going beyond the Porter Hypothesis. Journal of

Cleaner Production, 84, pp.204-213.

Limkriangkrai, M., Koh, S. and Durand, R.B., 2017. Environmental, social, and governance

(ESG) profiles, stock returns, and financial policy: Australian evidence. International Review of

Finance, 17(3), pp.461-471.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AUSTRALIAN OIL INDUSTRY AND PETROL DEMAND AND SUPPLY 11

Morrow, P.M., 2010. Ricardian–Heckscher–Ohlin comparative advantage: Theory and

evidence. Journal of International Economics, 82(2), pp.137-151.

Pearce, P., 2014. The role of the precautionary principle in designing energy taxes in

Australia. Kreiser L et al, Environmental Taxation and Green Fiscal Reform Theory and Impact,

Critical Issues in Environmental Taxation, 14, pp.39-51.

Seretis, S.A. and Tsaliki, P.V., 2016. Absolute advantage and international trade: Evidence from

four Euro-zone economies. Review of Radical Political Economics, 48(3), pp.438-451.

Suranovic, S., 2010. International trade: Theory and policy, 40(2), pp.13-15.

Morrow, P.M., 2010. Ricardian–Heckscher–Ohlin comparative advantage: Theory and

evidence. Journal of International Economics, 82(2), pp.137-151.

Pearce, P., 2014. The role of the precautionary principle in designing energy taxes in

Australia. Kreiser L et al, Environmental Taxation and Green Fiscal Reform Theory and Impact,

Critical Issues in Environmental Taxation, 14, pp.39-51.

Seretis, S.A. and Tsaliki, P.V., 2016. Absolute advantage and international trade: Evidence from

four Euro-zone economies. Review of Radical Political Economics, 48(3), pp.438-451.

Suranovic, S., 2010. International trade: Theory and policy, 40(2), pp.13-15.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.