Monash Uni ACC/ACF2200: Aventi Bags Case Study Analysis

VerifiedAdded on 2022/10/02

|9

|1698

|286

Case Study

AI Summary

This case study analyzes the Aventi Bags company, examining its competitive strategies and customer profitability. The solution begins by defining sustainable competitive advantage and explores strategies employed by Ford Motor Co. and Viva Energy Group, recommending an integrated strategy of cost leadership, differentiation, and focus for Aventi Bags. The analysis includes an Activity-Based Costing (ABC) model to calculate customer profitability, comparing results under ABC and traditional costing methods. The study highlights the profitability differences between customer segments and the overall impact of the costing methodologies, providing a comprehensive overview of the company's financial performance and strategic recommendations. The study also includes the absorption rate, cost drivers, and the profitability of each customer segment.

Running head: AVENTI BAGS CASE

Aventi Bags Case

Name

Institution

Aventi Bags Case

Name

Institution

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AVENTI BAGS CASE 2

Introduction

Sustainable competitive advantage is defined as a long-time ability to outperform

competitors in the market or industry. Aventi Bags seek to adopt a sustainable competitive

strategy that supports profitability, competitiveness, and efficiency. The common competitive

strategy used in the manufacturing industry is cost leadership, differentiation, and focus. This

section examines the viability of competitive strategy used by Ford Motor Co. and Viva

Energy Group for Aventi Bags.

a) Ford Motor Co. competitive strategy

Ford Motor Co. is a public company that trades in the New York Stock Market as

NYSE: F. The company is also listed among the S&P 100 companies. Ford is among the

leading automobile companies globally. Ford has managed to remain competitive in the

market since its establishment in 1903. The company relies on two sustainable competitive

strategies, which are low-cost leadership and product broad differentiation strategies.

However, Ford has changed its competitive strategy in line with the economic and business

dynamics in the global market. For instance, the company adopted a low-cost leadership

strategy in the 1900s (Caldicott, 2014). The strategy was adopted as it supported the

company’s low-cost production and low prices for finished automobiles. Subsequently, Ford

would attract more customers and expand its consumer base. The low-cost strategy was also

backed by the company’s vision, which focused on manufacturing automobiles that were

affordable to working-class consumers. Ford succeeded in implementing the strategy by

developing several assembly lines to maximise productivity and minimize production and

operation costs. Moreover, the company succeeded in streamlining its processes hence

reducing its costs and remaining competitive advantage (Barney, 2005).

Introduction

Sustainable competitive advantage is defined as a long-time ability to outperform

competitors in the market or industry. Aventi Bags seek to adopt a sustainable competitive

strategy that supports profitability, competitiveness, and efficiency. The common competitive

strategy used in the manufacturing industry is cost leadership, differentiation, and focus. This

section examines the viability of competitive strategy used by Ford Motor Co. and Viva

Energy Group for Aventi Bags.

a) Ford Motor Co. competitive strategy

Ford Motor Co. is a public company that trades in the New York Stock Market as

NYSE: F. The company is also listed among the S&P 100 companies. Ford is among the

leading automobile companies globally. Ford has managed to remain competitive in the

market since its establishment in 1903. The company relies on two sustainable competitive

strategies, which are low-cost leadership and product broad differentiation strategies.

However, Ford has changed its competitive strategy in line with the economic and business

dynamics in the global market. For instance, the company adopted a low-cost leadership

strategy in the 1900s (Caldicott, 2014). The strategy was adopted as it supported the

company’s low-cost production and low prices for finished automobiles. Subsequently, Ford

would attract more customers and expand its consumer base. The low-cost strategy was also

backed by the company’s vision, which focused on manufacturing automobiles that were

affordable to working-class consumers. Ford succeeded in implementing the strategy by

developing several assembly lines to maximise productivity and minimize production and

operation costs. Moreover, the company succeeded in streamlining its processes hence

reducing its costs and remaining competitive advantage (Barney, 2005).

AVENTI BAGS CASE 3

However, the low-cost strategy could not protect Ford from the increasing competition

from General Motors Co. General Motors Co. overtook Ford as the largest automobile

company in the global market. As a result, Ford adopted a broad differentiation strategy to

counter the increasing competition. The strategy focused on manufacturing a variety of

automobiles. Ford realised that the consumers were attracting high earnings hence turning

their attention towards better styles and design. Today, Ford has integrated both low cost and

differentiation strategies in its competitive advantage strategy plan. The broad differentiation

strategy allows Ford to compete with Toyota and General Motors through product innovation

(Caldicott, 2014).

b) Viva Energy Group (ASX: VEA)

Viva Energy Group is listed on the Australian stock exchange market as VEA. The company

operates in the Australian energy sector and specialises in the production of petroleum and

coal products. Viva is a multinational company that faces intense competition globally. The

company’s competitive advantage is based on Michael Porter’s generic model. Viva uses

different strategies such as focus, differentiation and cost leadership strategies to curb

competitive pressure. An integrated sustainable competitive advantage helps Viva to advance

its growth through product development, diversification, market development and market

penetration (Baldwin, 2015).

Viva’s cost leadership strategy is focused on easy accessibility and affordability of products

across the globe. The company focuses on low pricing of its products by lowering its cost of

production and maximising efficiency. The provision of coupons and discounts allows that

company to meets its sales targets and curb increasing competition. The objective of using

cost leadership strategy by Viva was to encourage consumption of its products, increase

brand awareness and enhance market share. Besides low-cost leadership, Viva also uses

However, the low-cost strategy could not protect Ford from the increasing competition

from General Motors Co. General Motors Co. overtook Ford as the largest automobile

company in the global market. As a result, Ford adopted a broad differentiation strategy to

counter the increasing competition. The strategy focused on manufacturing a variety of

automobiles. Ford realised that the consumers were attracting high earnings hence turning

their attention towards better styles and design. Today, Ford has integrated both low cost and

differentiation strategies in its competitive advantage strategy plan. The broad differentiation

strategy allows Ford to compete with Toyota and General Motors through product innovation

(Caldicott, 2014).

b) Viva Energy Group (ASX: VEA)

Viva Energy Group is listed on the Australian stock exchange market as VEA. The company

operates in the Australian energy sector and specialises in the production of petroleum and

coal products. Viva is a multinational company that faces intense competition globally. The

company’s competitive advantage is based on Michael Porter’s generic model. Viva uses

different strategies such as focus, differentiation and cost leadership strategies to curb

competitive pressure. An integrated sustainable competitive advantage helps Viva to advance

its growth through product development, diversification, market development and market

penetration (Baldwin, 2015).

Viva’s cost leadership strategy is focused on easy accessibility and affordability of products

across the globe. The company focuses on low pricing of its products by lowering its cost of

production and maximising efficiency. The provision of coupons and discounts allows that

company to meets its sales targets and curb increasing competition. The objective of using

cost leadership strategy by Viva was to encourage consumption of its products, increase

brand awareness and enhance market share. Besides low-cost leadership, Viva also uses

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

AVENTI BAGS CASE 4

differential as a second sustainable competitive strategy (Baldwin, 2015). Differentiation

strategies focus on creating unique products as a way of expanding the consumer base.

Lastly, Viva also uses the focus strategy to address the competitive needs of specific markets.

The focus strategy is divided into two strategies namely best value focus and low-cost focus.

Low-cost focus strategy is meant to meet the needs of low-income earners in the niche

market segment. On the other hand, best value strategy emphasizes the design, size, and taste

of the products to match the customer needs. The three strategies have helped Viva to

maximise value, meet customer expectations and develop products that best fit the customer's

needs.

Recommended the best strategy for Aventis Bags

Aventis Bags provides a thin product line to a lean market base. The company offers

leather and leather-like bags to retail stores and corporate consumers. Corporate consumers

make limited make purchases on order basis which limits the ability of the company to

maximise its profitability level. Viva’s integrated sustainable competitive model is the best

strategy that Aventis bags should adopt because it incorporates all the three strategies, that is,

low-cost leadership, differentiation, and focus. Aventis Bags can adopt low cost strategy by

identifying low-cost raw materials. Engaging suppliers in pre-sales contracts will ensure that

raw materials are maintained at a specific price over a given even when the market price

increases. Outsourcing of cheap raw materials would also ensure that the production cost is

reduced. A reduction in raw material prices would ensure that cost price is reduced leding to

a vast sales volume (Merchant, 2014).

Aventis Bags should adopt a broad differentiation strategy. Considering that the

company is currently operating in a small market, broad differentiation would expand both

the company’s product portfolio and target market segment. For instance, manufacturing of

differential as a second sustainable competitive strategy (Baldwin, 2015). Differentiation

strategies focus on creating unique products as a way of expanding the consumer base.

Lastly, Viva also uses the focus strategy to address the competitive needs of specific markets.

The focus strategy is divided into two strategies namely best value focus and low-cost focus.

Low-cost focus strategy is meant to meet the needs of low-income earners in the niche

market segment. On the other hand, best value strategy emphasizes the design, size, and taste

of the products to match the customer needs. The three strategies have helped Viva to

maximise value, meet customer expectations and develop products that best fit the customer's

needs.

Recommended the best strategy for Aventis Bags

Aventis Bags provides a thin product line to a lean market base. The company offers

leather and leather-like bags to retail stores and corporate consumers. Corporate consumers

make limited make purchases on order basis which limits the ability of the company to

maximise its profitability level. Viva’s integrated sustainable competitive model is the best

strategy that Aventis bags should adopt because it incorporates all the three strategies, that is,

low-cost leadership, differentiation, and focus. Aventis Bags can adopt low cost strategy by

identifying low-cost raw materials. Engaging suppliers in pre-sales contracts will ensure that

raw materials are maintained at a specific price over a given even when the market price

increases. Outsourcing of cheap raw materials would also ensure that the production cost is

reduced. A reduction in raw material prices would ensure that cost price is reduced leding to

a vast sales volume (Merchant, 2014).

Aventis Bags should adopt a broad differentiation strategy. Considering that the

company is currently operating in a small market, broad differentiation would expand both

the company’s product portfolio and target market segment. For instance, manufacturing of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AVENTI BAGS CASE 5

bags to young children and general female markets would increase the company’s sales

volume. Lastly, best value strategy will create a design, and value to customers who do not

care for price of products as far as quality is guaranteed. Ford's policy of adopting one

strategy at a time would not work at Aventis Bags because of the current dynamics in the

business environment. Incorporating all the three strategies into a single plan is the best way

of handling the problems facing Aventis Bags (Caldicott, 2014).

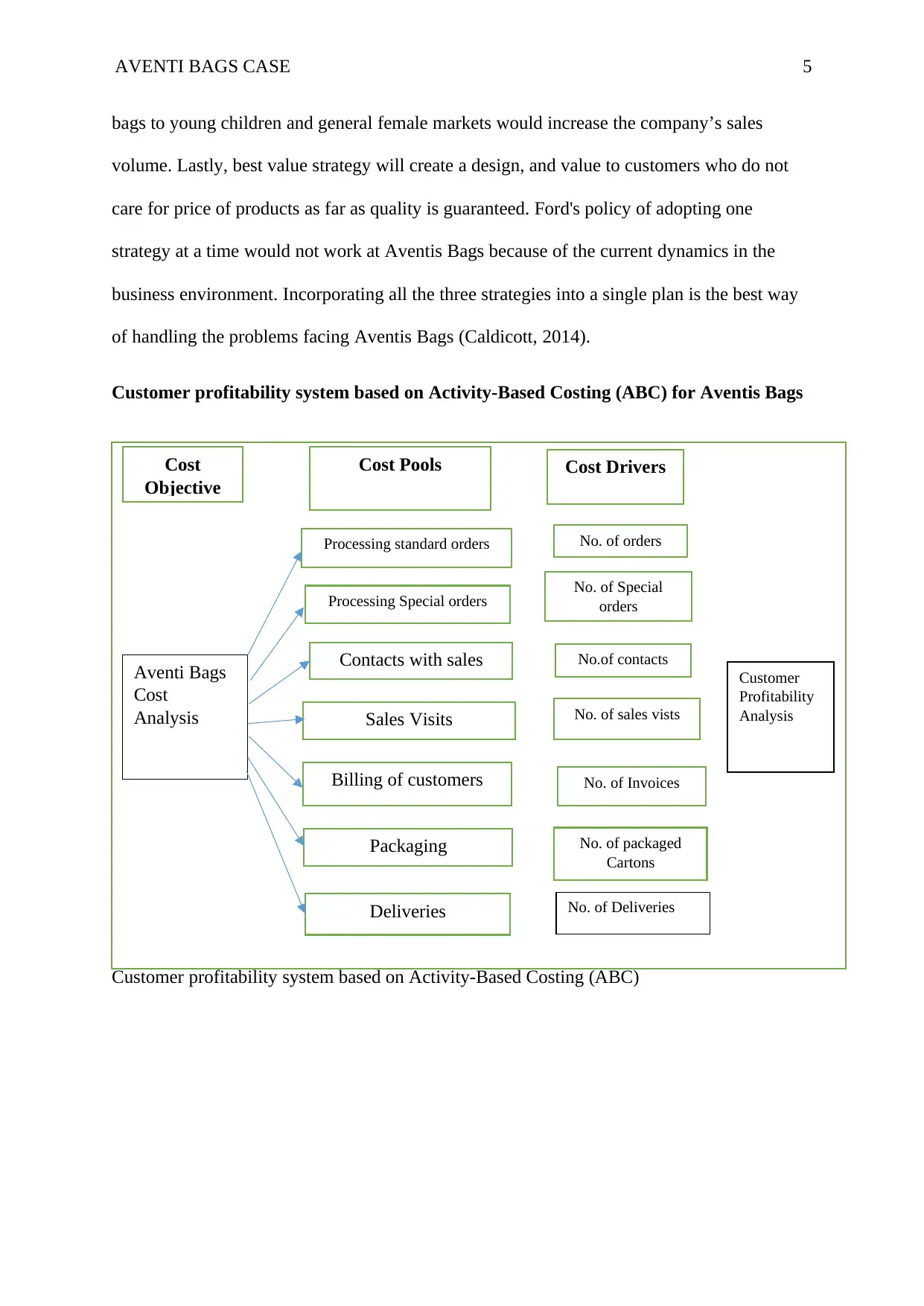

Customer profitability system based on Activity-Based Costing (ABC) for Aventis Bags

Customer profitability system based on Activity-Based Costing (ABC)

Cost

Objective

Cost Pools Cost Drivers

Processing standard orders

Processing Special orders

Contacts with sales

staff

Sales Visits

Billing of customers

Packaging

Deliveries

No. of orders

No. of Special

orders

No.of contacts

No. of sales vists

No. of Invoices

No. of packaged

Cartons

No. of Deliveries

Aventi Bags

Cost

Analysis

Customer

Profitability

Analysis

bags to young children and general female markets would increase the company’s sales

volume. Lastly, best value strategy will create a design, and value to customers who do not

care for price of products as far as quality is guaranteed. Ford's policy of adopting one

strategy at a time would not work at Aventis Bags because of the current dynamics in the

business environment. Incorporating all the three strategies into a single plan is the best way

of handling the problems facing Aventis Bags (Caldicott, 2014).

Customer profitability system based on Activity-Based Costing (ABC) for Aventis Bags

Customer profitability system based on Activity-Based Costing (ABC)

Cost

Objective

Cost Pools Cost Drivers

Processing standard orders

Processing Special orders

Contacts with sales

staff

Sales Visits

Billing of customers

Packaging

Deliveries

No. of orders

No. of Special

orders

No.of contacts

No. of sales vists

No. of Invoices

No. of packaged

Cartons

No. of Deliveries

Aventi Bags

Cost

Analysis

Customer

Profitability

Analysis

AVENTI BAGS CASE 6

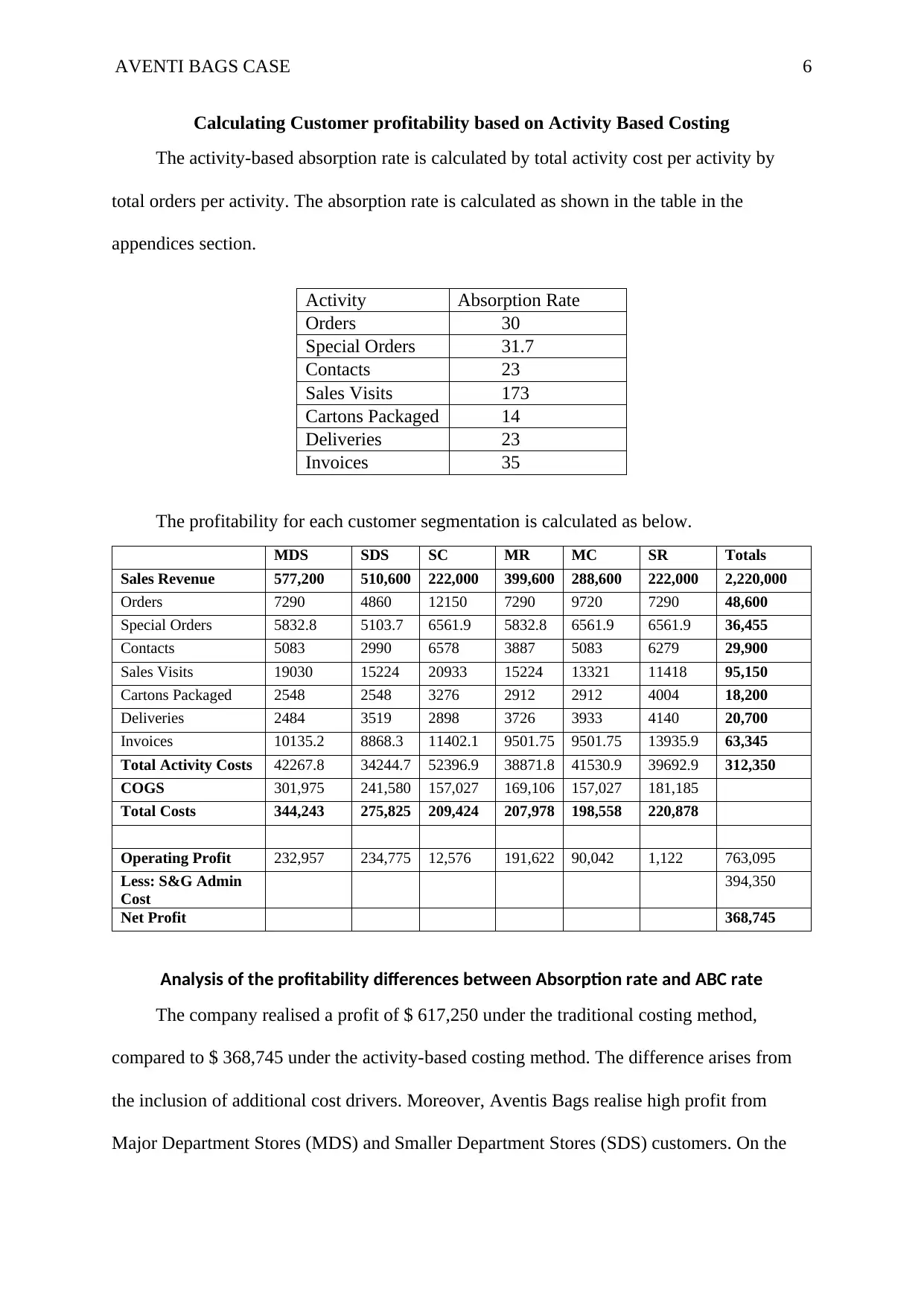

Calculating Customer profitability based on Activity Based Costing

The activity-based absorption rate is calculated by total activity cost per activity by

total orders per activity. The absorption rate is calculated as shown in the table in the

appendices section.

Activity Absorption Rate

Orders 30

Special Orders 31.7

Contacts 23

Sales Visits 173

Cartons Packaged 14

Deliveries 23

Invoices 35

The profitability for each customer segmentation is calculated as below.

MDS SDS SC MR MC SR Totals

Sales Revenue 577,200 510,600 222,000 399,600 288,600 222,000 2,220,000

Orders 7290 4860 12150 7290 9720 7290 48,600

Special Orders 5832.8 5103.7 6561.9 5832.8 6561.9 6561.9 36,455

Contacts 5083 2990 6578 3887 5083 6279 29,900

Sales Visits 19030 15224 20933 15224 13321 11418 95,150

Cartons Packaged 2548 2548 3276 2912 2912 4004 18,200

Deliveries 2484 3519 2898 3726 3933 4140 20,700

Invoices 10135.2 8868.3 11402.1 9501.75 9501.75 13935.9 63,345

Total Activity Costs 42267.8 34244.7 52396.9 38871.8 41530.9 39692.9 312,350

COGS 301,975 241,580 157,027 169,106 157,027 181,185

Total Costs 344,243 275,825 209,424 207,978 198,558 220,878

Operating Profit 232,957 234,775 12,576 191,622 90,042 1,122 763,095

Less: S&G Admin

Cost

394,350

Net Profit 368,745

Analysis of the profitability differences between Absorption rate and ABC rate

The company realised a profit of $ 617,250 under the traditional costing method,

compared to $ 368,745 under the activity-based costing method. The difference arises from

the inclusion of additional cost drivers. Moreover, Aventis Bags realise high profit from

Major Department Stores (MDS) and Smaller Department Stores (SDS) customers. On the

Calculating Customer profitability based on Activity Based Costing

The activity-based absorption rate is calculated by total activity cost per activity by

total orders per activity. The absorption rate is calculated as shown in the table in the

appendices section.

Activity Absorption Rate

Orders 30

Special Orders 31.7

Contacts 23

Sales Visits 173

Cartons Packaged 14

Deliveries 23

Invoices 35

The profitability for each customer segmentation is calculated as below.

MDS SDS SC MR MC SR Totals

Sales Revenue 577,200 510,600 222,000 399,600 288,600 222,000 2,220,000

Orders 7290 4860 12150 7290 9720 7290 48,600

Special Orders 5832.8 5103.7 6561.9 5832.8 6561.9 6561.9 36,455

Contacts 5083 2990 6578 3887 5083 6279 29,900

Sales Visits 19030 15224 20933 15224 13321 11418 95,150

Cartons Packaged 2548 2548 3276 2912 2912 4004 18,200

Deliveries 2484 3519 2898 3726 3933 4140 20,700

Invoices 10135.2 8868.3 11402.1 9501.75 9501.75 13935.9 63,345

Total Activity Costs 42267.8 34244.7 52396.9 38871.8 41530.9 39692.9 312,350

COGS 301,975 241,580 157,027 169,106 157,027 181,185

Total Costs 344,243 275,825 209,424 207,978 198,558 220,878

Operating Profit 232,957 234,775 12,576 191,622 90,042 1,122 763,095

Less: S&G Admin

Cost

394,350

Net Profit 368,745

Analysis of the profitability differences between Absorption rate and ABC rate

The company realised a profit of $ 617,250 under the traditional costing method,

compared to $ 368,745 under the activity-based costing method. The difference arises from

the inclusion of additional cost drivers. Moreover, Aventis Bags realise high profit from

Major Department Stores (MDS) and Smaller Department Stores (SDS) customers. On the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

AVENTI BAGS CASE 7

other hand, Smaller Retailers market segment performed poorly; the segment generated a

profit of $1,122.

other hand, Smaller Retailers market segment performed poorly; the segment generated a

profit of $1,122.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AVENTI BAGS CASE 8

References

Baldwin, R. E. (2015). Value creation and trade in 21st-century manufacturing. Journal of

Regional Science, 55(1), 31-50.

Barney, J. B. (2005). Looking inside for Competitive Advantage. The Academy of

Management Executive, 9(4), 49-61.

Caldicott, S. M. (2014, June 25). Why Ford's Alan Mulally Is An Innovation CEO For The

Record Books. Retrieved from Forbes:

hhttp://www.forbes.com/sites/sarahcaldicott/2014/06/25/why-fords-alan-mulally-is-

an-innovation-ceo-for-the-record-books/

Merchant, H. (2014). Configurations of governance structure, generic strategy, and firm size.

Global Strategy Journal, 4(4), 292-309.

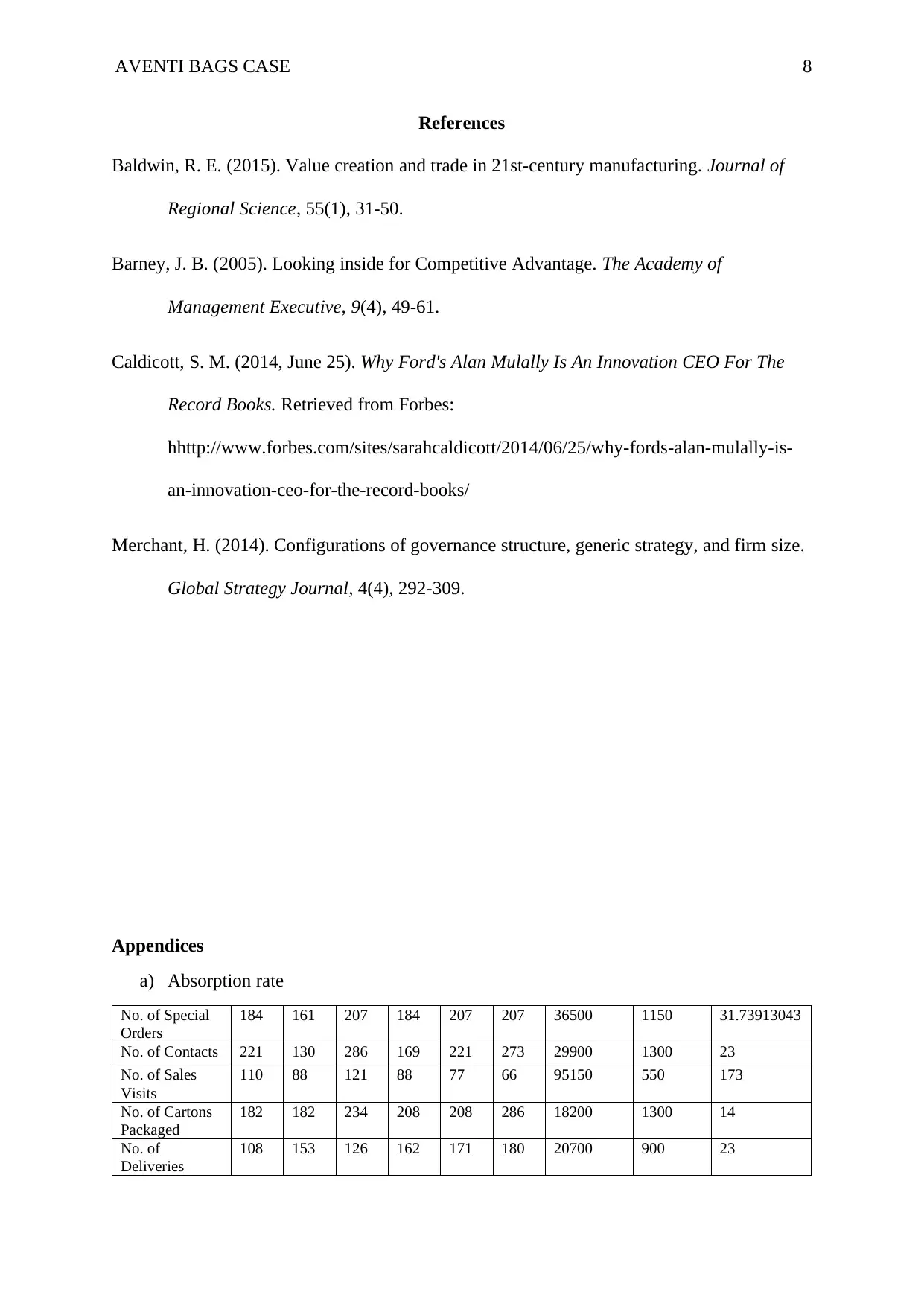

Appendices

a) Absorption rate

No. of Special

Orders

184 161 207 184 207 207 36500 1150 31.73913043

No. of Contacts 221 130 286 169 221 273 29900 1300 23

No. of Sales

Visits

110 88 121 88 77 66 95150 550 173

No. of Cartons

Packaged

182 182 234 208 208 286 18200 1300 14

No. of

Deliveries

108 153 126 162 171 180 20700 900 23

References

Baldwin, R. E. (2015). Value creation and trade in 21st-century manufacturing. Journal of

Regional Science, 55(1), 31-50.

Barney, J. B. (2005). Looking inside for Competitive Advantage. The Academy of

Management Executive, 9(4), 49-61.

Caldicott, S. M. (2014, June 25). Why Ford's Alan Mulally Is An Innovation CEO For The

Record Books. Retrieved from Forbes:

hhttp://www.forbes.com/sites/sarahcaldicott/2014/06/25/why-fords-alan-mulally-is-

an-innovation-ceo-for-the-record-books/

Merchant, H. (2014). Configurations of governance structure, generic strategy, and firm size.

Global Strategy Journal, 4(4), 292-309.

Appendices

a) Absorption rate

No. of Special

Orders

184 161 207 184 207 207 36500 1150 31.73913043

No. of Contacts 221 130 286 169 221 273 29900 1300 23

No. of Sales

Visits

110 88 121 88 77 66 95150 550 173

No. of Cartons

Packaged

182 182 234 208 208 286 18200 1300 14

No. of

Deliveries

108 153 126 162 171 180 20700 900 23

AVENTI BAGS CASE 9

No. of Invoices 288 252 324 270 270 396 63345 1800 35.19166667

No. of Invoices 288 252 324 270 270 396 63345 1800 35.19166667

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.