Aviation Management Report: Financial, Operational, and SWOT Analysis

VerifiedAdded on 2021/04/17

|16

|2136

|73

Report

AI Summary

This report offers a critical analysis of Virgin Atlantic's commercial and operational performance. It begins with an introduction to the airline, followed by a detailed financial analysis using various ratios such as net profit margin, return on equity, current ratio, debt-equity ratio, and debt-asset ratio, providing insights into the company's financial health. The operational performance analysis examines key performance indicators like safety, customer numbers, capacity, and revenue, supported by relevant figures. A SWOT analysis is then conducted to evaluate the airline's strengths, weaknesses, opportunities, and threats, informing strategic recommendations. The report concludes with suggestions for improvement, including brand promotion, customer experience enhancement, and asset modernization. Appendices include consolidated financial statements and ratio analysis. This report is a comprehensive assessment of Virgin Atlantic's position within the airline industry.

Running head: AVIATION MANAGEMENT

Aviation Management

Name of the Student:

Name of the University:

Authors Note:

Aviation Management

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2AVIATION MANAGEMENT

Table of Contents

Introduction................................................................................................................................3

Financial Analysis:.....................................................................................................................3

Operational performance analysis of the entity:........................................................................6

SWOT Analysis:........................................................................................................................9

Recommendations and suggestions:........................................................................................10

Reference..................................................................................................................................12

Appendix 1: Consolidated Income Statement..........................................................................14

Appendix 2: Consolidated financial position...........................................................................15

Appendix 3: Financial Ratio Analysis.....................................................................................16

Table of Contents

Introduction................................................................................................................................3

Financial Analysis:.....................................................................................................................3

Operational performance analysis of the entity:........................................................................6

SWOT Analysis:........................................................................................................................9

Recommendations and suggestions:........................................................................................10

Reference..................................................................................................................................12

Appendix 1: Consolidated Income Statement..........................................................................14

Appendix 2: Consolidated financial position...........................................................................15

Appendix 3: Financial Ratio Analysis.....................................................................................16

3AVIATION MANAGEMENT

Introduction

In this report, an attempt is made to critically analyse the commercial and operational

performance of Virgin Atlantic. It is one of the most popular British airlines company. It is

the trading name of Virgin Atlantic Airways Limited and Virgin Atlantic International

Limited. Virgin Atlantic makes use of Boeing and Airbus wide-body aircraft for carrying out

the operations. It has operations in North America, Africa, Caribbean, Middle East and Asia,

which is conducted from its main head office at London Heathrow and Gatwick Airport. The

company is currently considered the main competitor of British Airlines (Grant, 2016). The

main aim of this report is to critically analyse the financial and other metrics in order to gain

an understanding of the position of the company as compared to industry. Further, the report

provides strategic recommendations.

Financial Analysis:

In order to conduct the financial analysis of the entity various ratios have been used. It

will be very effective and efficient way of finding out the current financial position and the

financial performance of the entity. The ratios are as follows:

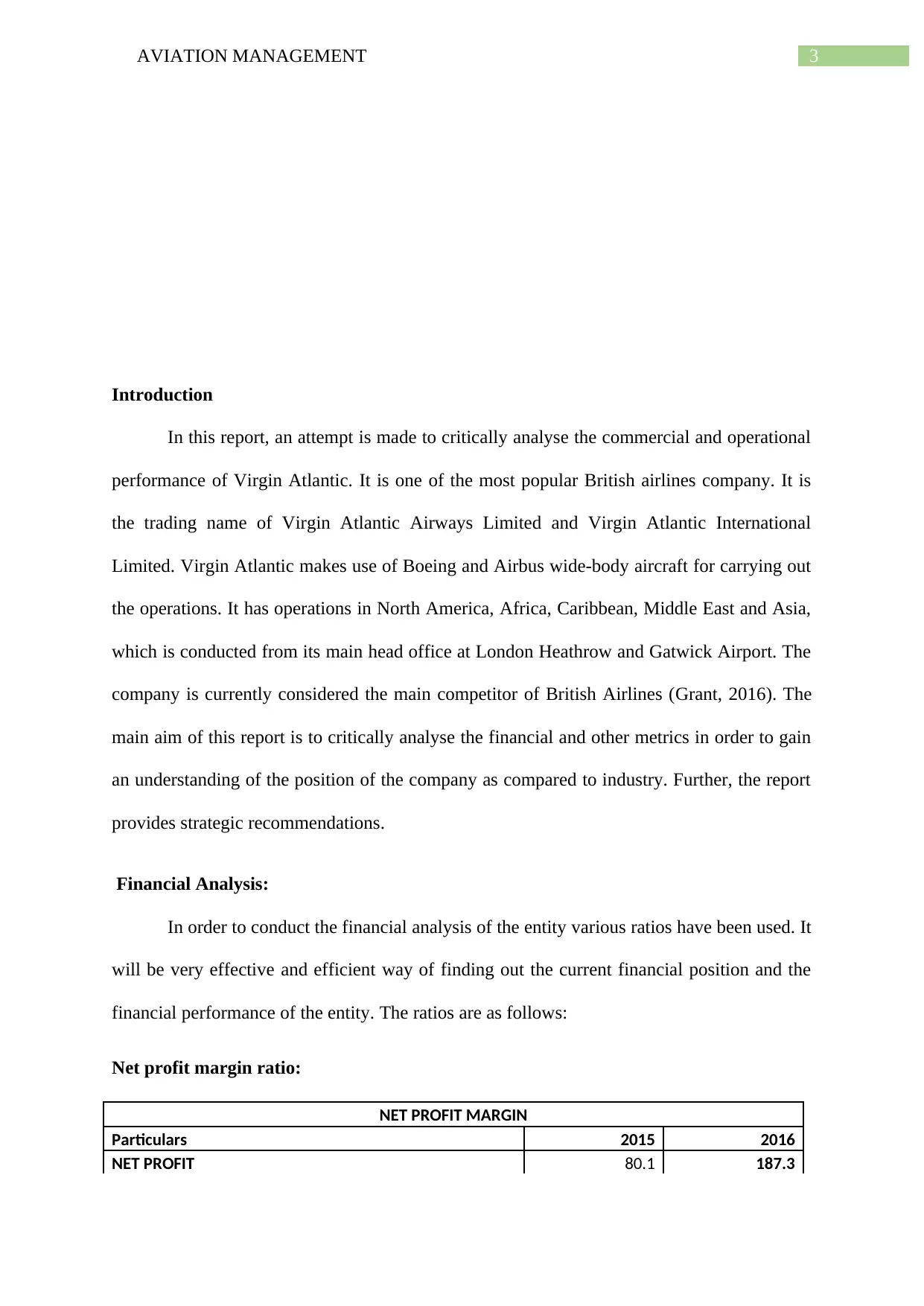

Net profit margin ratio:

NET PROFIT MARGIN

Particulars 2015 2016

NET PROFIT 80.1 187.3

Introduction

In this report, an attempt is made to critically analyse the commercial and operational

performance of Virgin Atlantic. It is one of the most popular British airlines company. It is

the trading name of Virgin Atlantic Airways Limited and Virgin Atlantic International

Limited. Virgin Atlantic makes use of Boeing and Airbus wide-body aircraft for carrying out

the operations. It has operations in North America, Africa, Caribbean, Middle East and Asia,

which is conducted from its main head office at London Heathrow and Gatwick Airport. The

company is currently considered the main competitor of British Airlines (Grant, 2016). The

main aim of this report is to critically analyse the financial and other metrics in order to gain

an understanding of the position of the company as compared to industry. Further, the report

provides strategic recommendations.

Financial Analysis:

In order to conduct the financial analysis of the entity various ratios have been used. It

will be very effective and efficient way of finding out the current financial position and the

financial performance of the entity. The ratios are as follows:

Net profit margin ratio:

NET PROFIT MARGIN

Particulars 2015 2016

NET PROFIT 80.1 187.3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4AVIATION MANAGEMENT

TOTAL REVENUE 2781.9 2689.9

NET PROFIT MARGIN 3% 7%

This ratio indicates the profit earning ability of the company. This ratio further

indicates the operational efficiency of the company. In the present case, it is clear that the

company has been able to significantly increase its profitability from the year 2015 to 2016.

This indicates that the operational efficiency of the company has increased (Treanor et al.,

2014).

Return on equity ratio:

RETURN ON EQUITY

2015 2016

NET INCOME 80.1 186.4

SHAREHOLDERS EQUITY 100 100

RETURN ON EQUITY 80% 186%

This ratio indicates the ability of the company to earn profit by utilising the funds of the

investor. The company must ensure that the returns of offered by the company matches with

the expectations of the shareholders because that is the sole reason of investment of the

shareholders in the company (Vogel, 2014). In the given case, it can be seen that in the year

2016 the return on equity of the company has increased in comparison to the previous year.

This shows that the company has improved the ability to utilise the funds of the investors.

Current Ratio:

CURRENT RATIO

2015 2016

CURRENT ASSETS 970.1 895.7

CURRENT LIABILITIES 401.4 228.1

CURRENT RATIO 2.42 3.93

TOTAL REVENUE 2781.9 2689.9

NET PROFIT MARGIN 3% 7%

This ratio indicates the profit earning ability of the company. This ratio further

indicates the operational efficiency of the company. In the present case, it is clear that the

company has been able to significantly increase its profitability from the year 2015 to 2016.

This indicates that the operational efficiency of the company has increased (Treanor et al.,

2014).

Return on equity ratio:

RETURN ON EQUITY

2015 2016

NET INCOME 80.1 186.4

SHAREHOLDERS EQUITY 100 100

RETURN ON EQUITY 80% 186%

This ratio indicates the ability of the company to earn profit by utilising the funds of the

investor. The company must ensure that the returns of offered by the company matches with

the expectations of the shareholders because that is the sole reason of investment of the

shareholders in the company (Vogel, 2014). In the given case, it can be seen that in the year

2016 the return on equity of the company has increased in comparison to the previous year.

This shows that the company has improved the ability to utilise the funds of the investors.

Current Ratio:

CURRENT RATIO

2015 2016

CURRENT ASSETS 970.1 895.7

CURRENT LIABILITIES 401.4 228.1

CURRENT RATIO 2.42 3.93

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

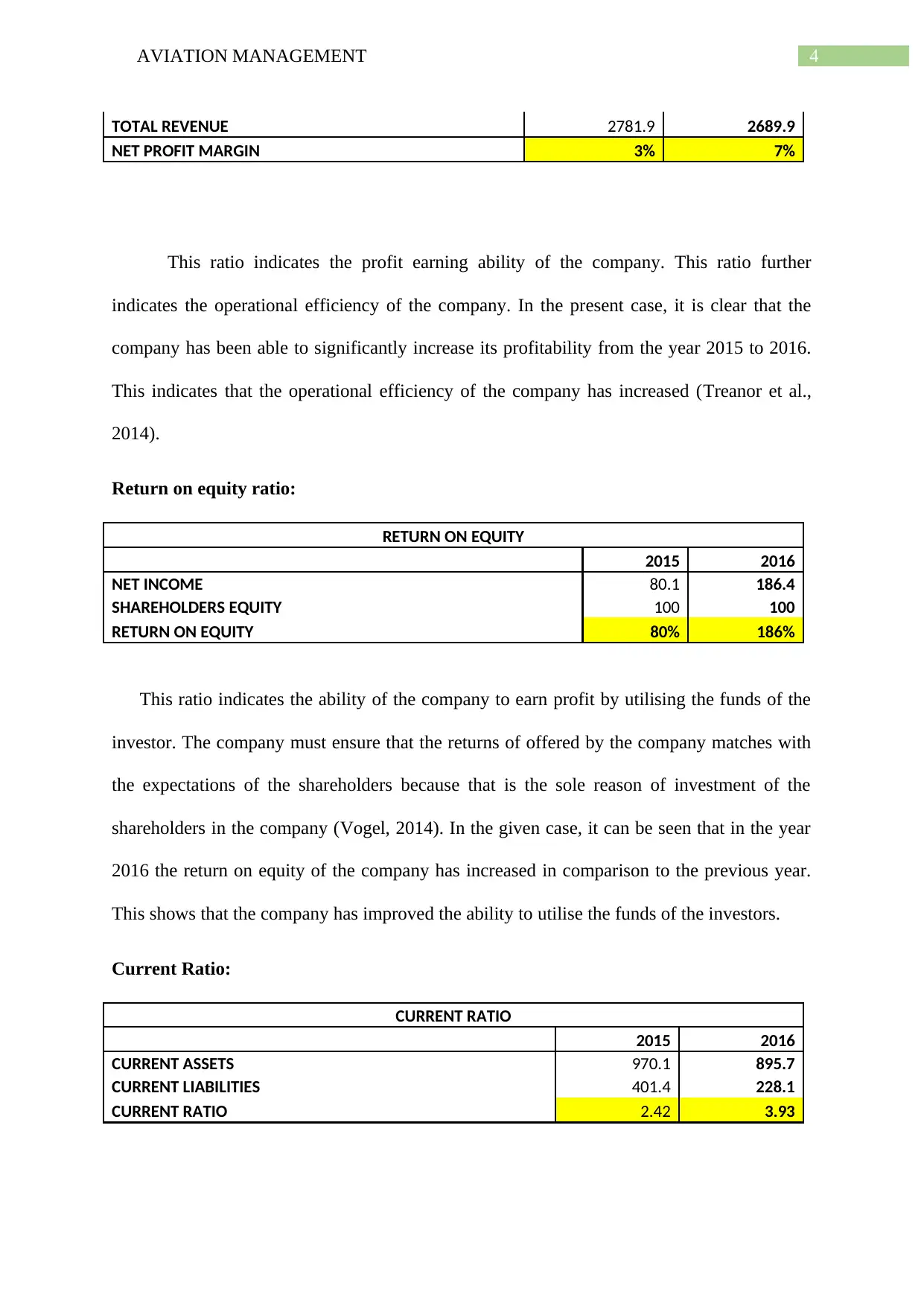

5AVIATION MANAGEMENT

This ratio shows indicates the ability of the entity to meet up its day-to-day current

liabilities with the help of its current asset. A good current ratio suggests that the company is

in a healthy situation and is capable of meeting up its operational liabilities. In the given case,

it can be seen that the current ratio of the entity is moving up from 2.42 in the year 2015 to

3.93 in the year 2016. It is a good sign that the company has enough current asset but also

noteworthy that the company might be in an over invested situation and need to invest more

judiciously in its working capital (Wiegmann & Shappell, 2017).

Debt-equity ratio:

DEBT EQUITY RATIO

2015 2016

TOTAL LIABILITIES 891.5 852.6

EQUITY 100 100

DEBT EQUITY RATIO 8.92 8.53

This ratio provides an idea about the capital structure of the entity and the liquidity

position of the entity. In the given case, it can be seen that the liabilities of the company with

respect to the previous year has decreased. At the same time the equity has remained same

this suggests that the liquidity position of the company has improved over the period of one

year.

Debt-Asset ratio:

DEBT ASSET RATIO

2015 2016

TOTAL LIABILITIES 891.5 852.6

TOTAL ASSETS 1697.6 1771.6

DEBT ASSET RATIO 0.53 0.48

This ratio highlights the relation between the total assets and the total liabilities of the

entity. In the case of the entity, it can be observed that the total assets of the company have

This ratio shows indicates the ability of the entity to meet up its day-to-day current

liabilities with the help of its current asset. A good current ratio suggests that the company is

in a healthy situation and is capable of meeting up its operational liabilities. In the given case,

it can be seen that the current ratio of the entity is moving up from 2.42 in the year 2015 to

3.93 in the year 2016. It is a good sign that the company has enough current asset but also

noteworthy that the company might be in an over invested situation and need to invest more

judiciously in its working capital (Wiegmann & Shappell, 2017).

Debt-equity ratio:

DEBT EQUITY RATIO

2015 2016

TOTAL LIABILITIES 891.5 852.6

EQUITY 100 100

DEBT EQUITY RATIO 8.92 8.53

This ratio provides an idea about the capital structure of the entity and the liquidity

position of the entity. In the given case, it can be seen that the liabilities of the company with

respect to the previous year has decreased. At the same time the equity has remained same

this suggests that the liquidity position of the company has improved over the period of one

year.

Debt-Asset ratio:

DEBT ASSET RATIO

2015 2016

TOTAL LIABILITIES 891.5 852.6

TOTAL ASSETS 1697.6 1771.6

DEBT ASSET RATIO 0.53 0.48

This ratio highlights the relation between the total assets and the total liabilities of the

entity. In the case of the entity, it can be observed that the total assets of the company have

6AVIATION MANAGEMENT

increased and the total liabilities of the assets have decreased. This suggests that the liquidity

position of the entity has improved over the span of one year (Vasigh, 2017).

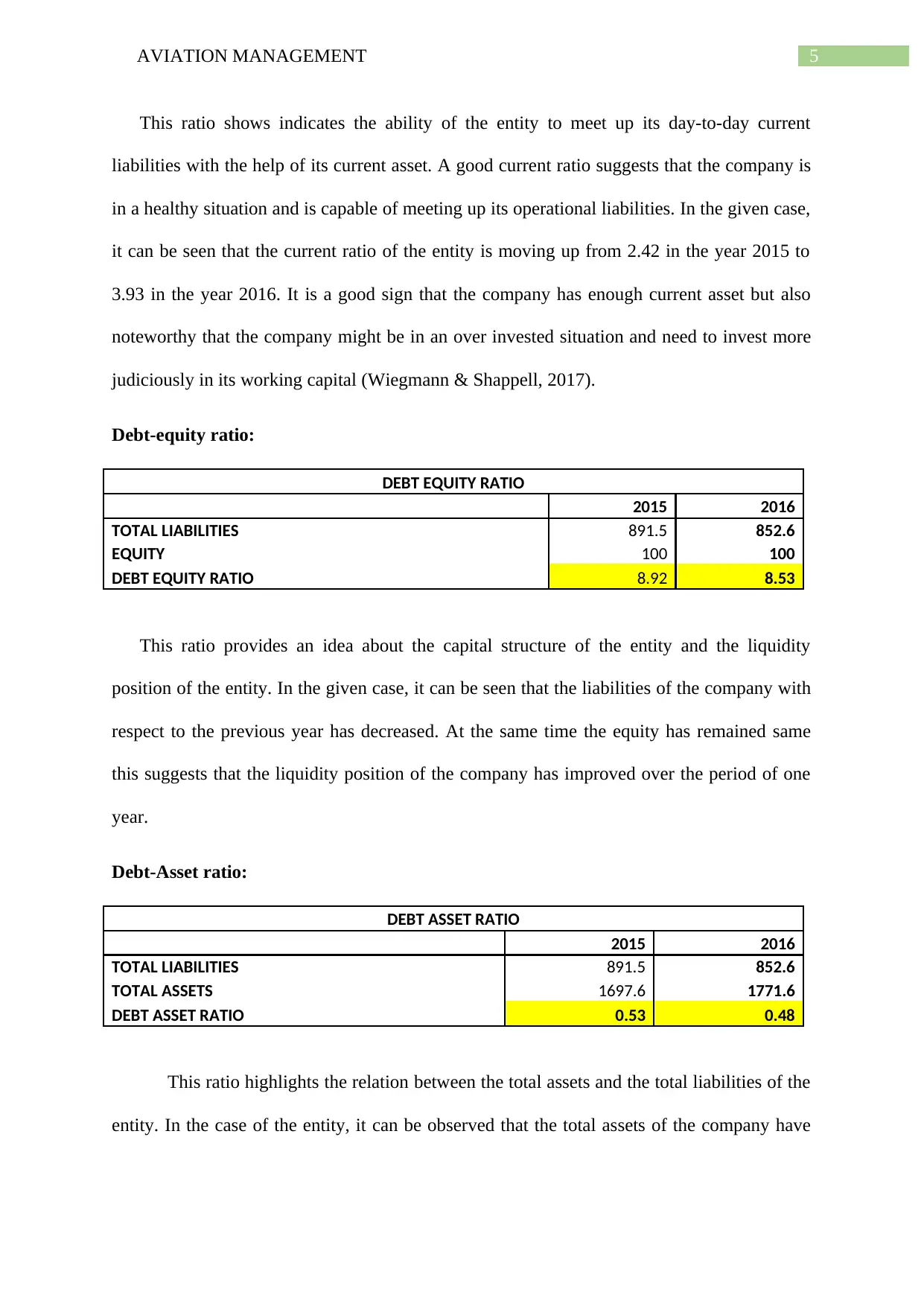

Operational performance analysis of the entity:

The operational performance of an entity can be judged from the trends presented via

key performance indicators and other important factors that play a critical role in influencing

the overall performance of the entity. Some of them are as follows:

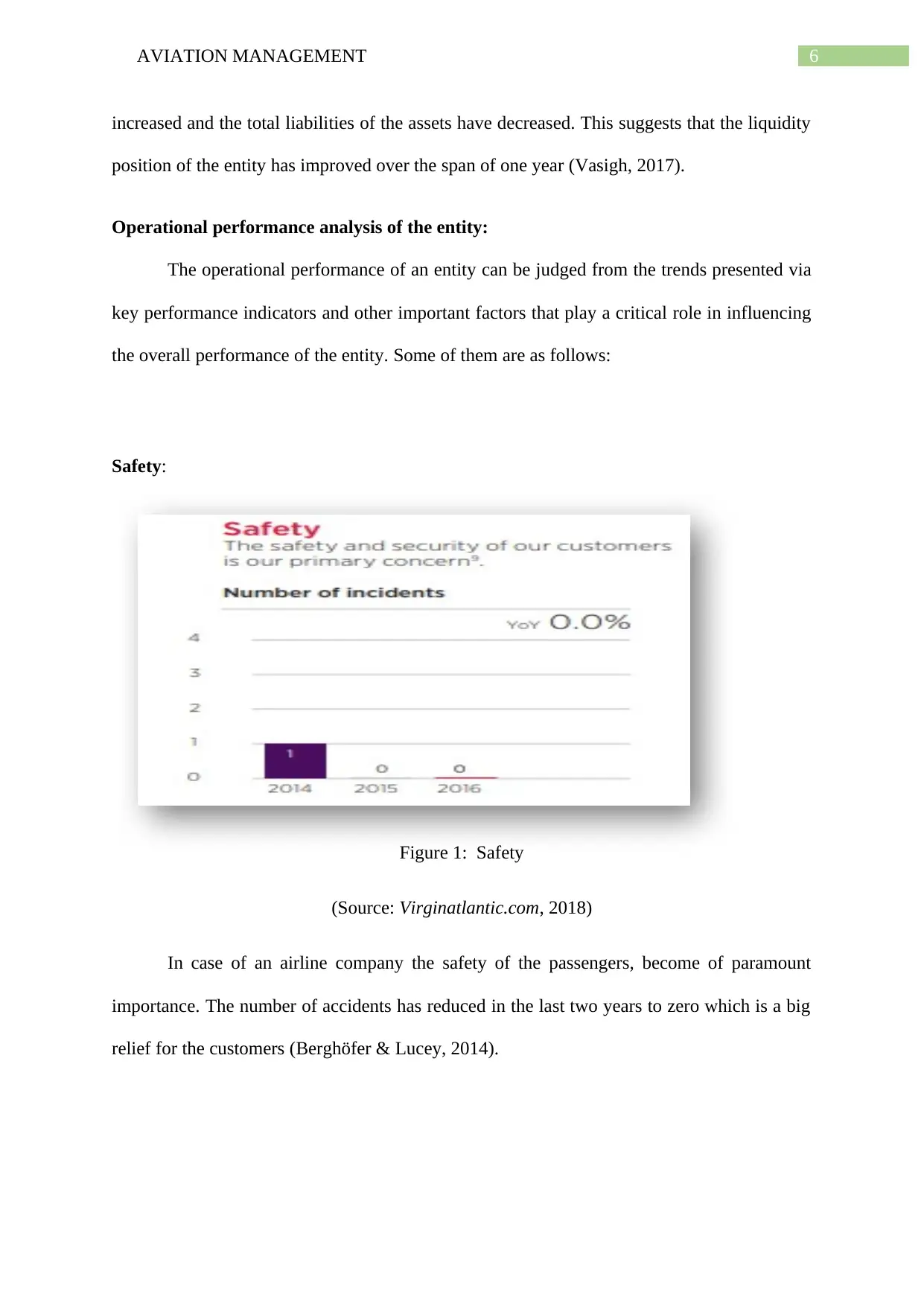

Safety:

Figure 1: Safety

(Source: Virginatlantic.com, 2018)

In case of an airline company the safety of the passengers, become of paramount

importance. The number of accidents has reduced in the last two years to zero which is a big

relief for the customers (Berghöfer & Lucey, 2014).

increased and the total liabilities of the assets have decreased. This suggests that the liquidity

position of the entity has improved over the span of one year (Vasigh, 2017).

Operational performance analysis of the entity:

The operational performance of an entity can be judged from the trends presented via

key performance indicators and other important factors that play a critical role in influencing

the overall performance of the entity. Some of them are as follows:

Safety:

Figure 1: Safety

(Source: Virginatlantic.com, 2018)

In case of an airline company the safety of the passengers, become of paramount

importance. The number of accidents has reduced in the last two years to zero which is a big

relief for the customers (Berghöfer & Lucey, 2014).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7AVIATION MANAGEMENT

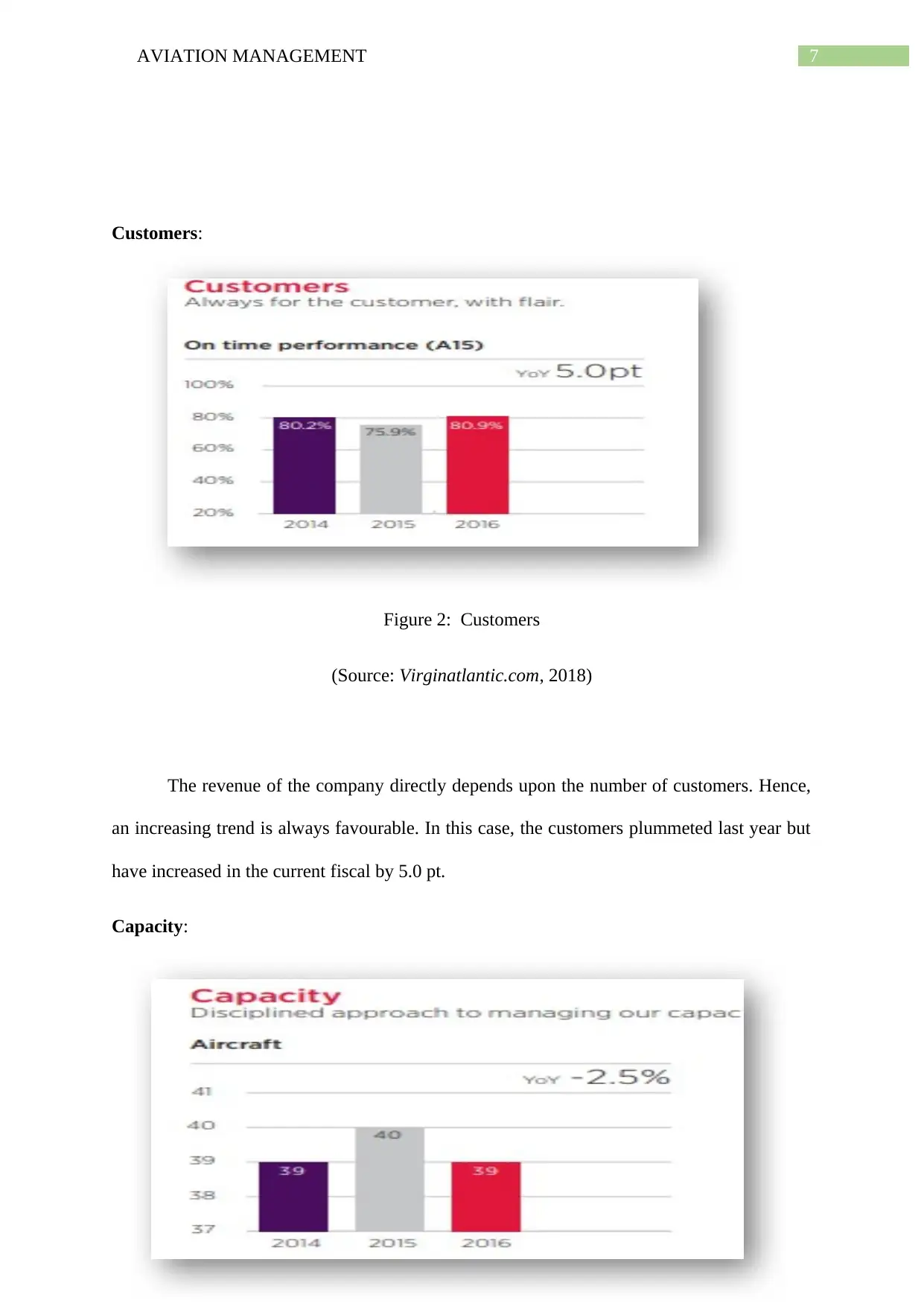

Customers:

Figure 2: Customers

(Source: Virginatlantic.com, 2018)

The revenue of the company directly depends upon the number of customers. Hence,

an increasing trend is always favourable. In this case, the customers plummeted last year but

have increased in the current fiscal by 5.0 pt.

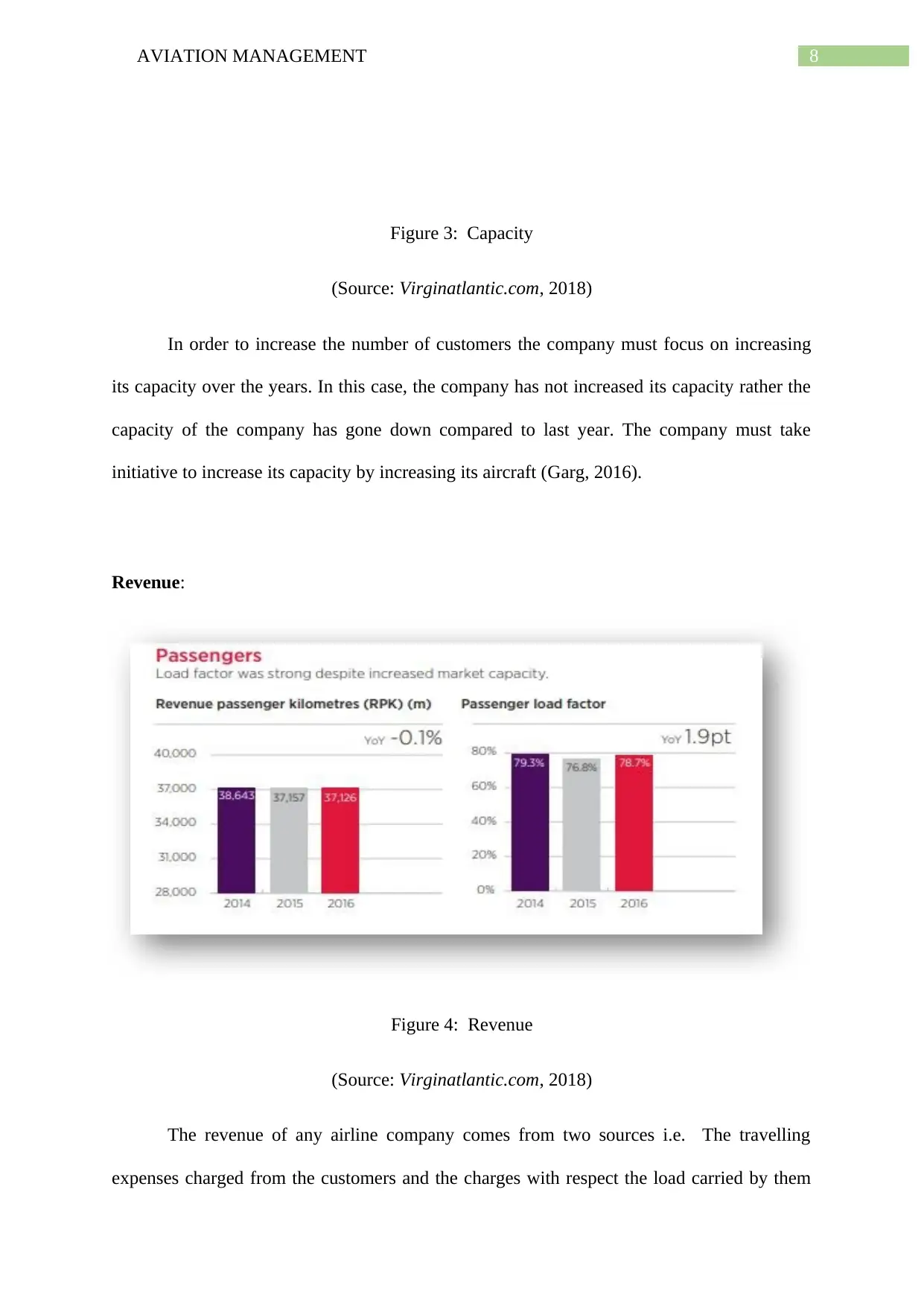

Capacity:

Customers:

Figure 2: Customers

(Source: Virginatlantic.com, 2018)

The revenue of the company directly depends upon the number of customers. Hence,

an increasing trend is always favourable. In this case, the customers plummeted last year but

have increased in the current fiscal by 5.0 pt.

Capacity:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8AVIATION MANAGEMENT

Figure 3: Capacity

(Source: Virginatlantic.com, 2018)

In order to increase the number of customers the company must focus on increasing

its capacity over the years. In this case, the company has not increased its capacity rather the

capacity of the company has gone down compared to last year. The company must take

initiative to increase its capacity by increasing its aircraft (Garg, 2016).

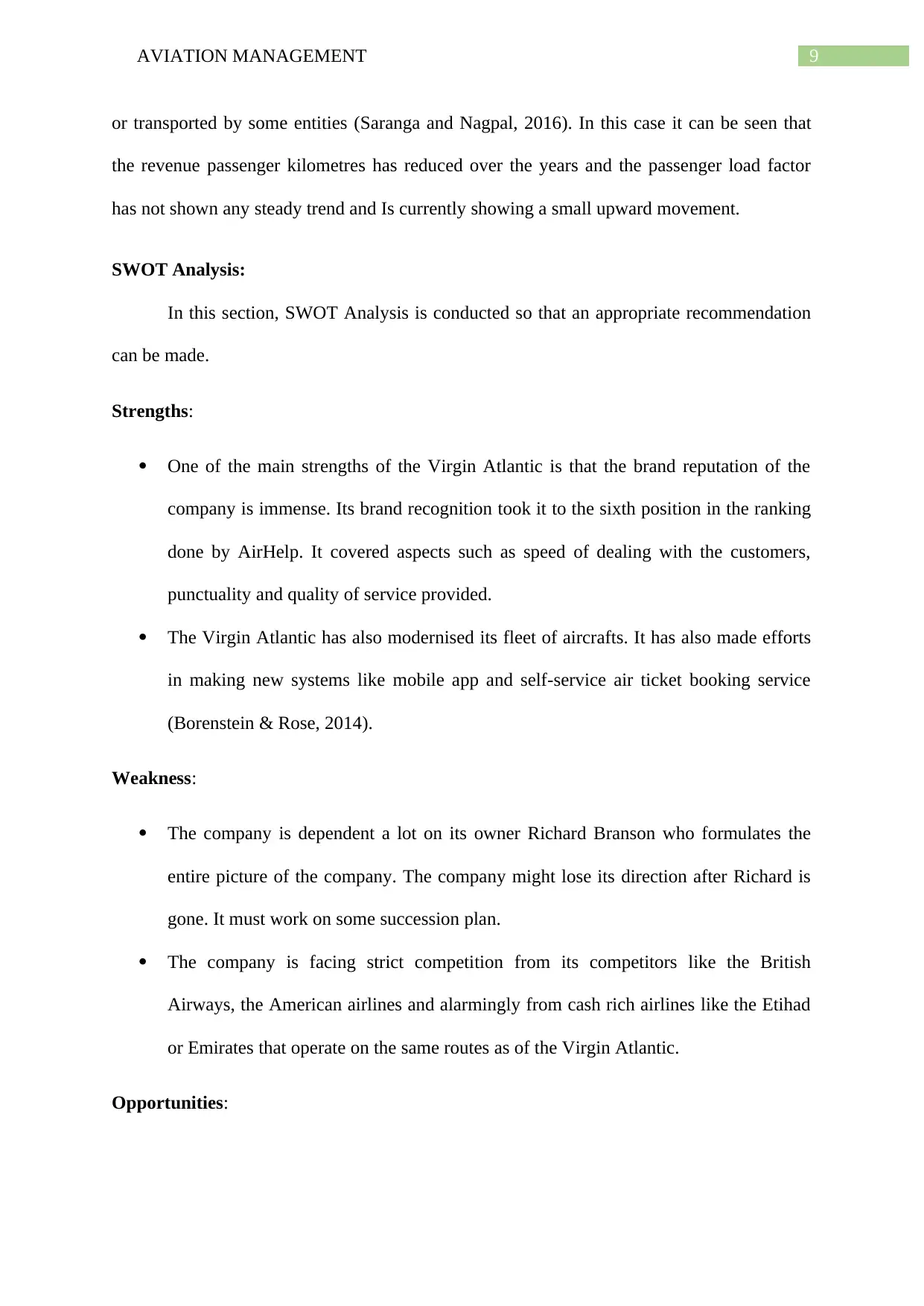

Revenue:

Figure 4: Revenue

(Source: Virginatlantic.com, 2018)

The revenue of any airline company comes from two sources i.e. The travelling

expenses charged from the customers and the charges with respect the load carried by them

Figure 3: Capacity

(Source: Virginatlantic.com, 2018)

In order to increase the number of customers the company must focus on increasing

its capacity over the years. In this case, the company has not increased its capacity rather the

capacity of the company has gone down compared to last year. The company must take

initiative to increase its capacity by increasing its aircraft (Garg, 2016).

Revenue:

Figure 4: Revenue

(Source: Virginatlantic.com, 2018)

The revenue of any airline company comes from two sources i.e. The travelling

expenses charged from the customers and the charges with respect the load carried by them

9AVIATION MANAGEMENT

or transported by some entities (Saranga and Nagpal, 2016). In this case it can be seen that

the revenue passenger kilometres has reduced over the years and the passenger load factor

has not shown any steady trend and Is currently showing a small upward movement.

SWOT Analysis:

In this section, SWOT Analysis is conducted so that an appropriate recommendation

can be made.

Strengths:

One of the main strengths of the Virgin Atlantic is that the brand reputation of the

company is immense. Its brand recognition took it to the sixth position in the ranking

done by AirHelp. It covered aspects such as speed of dealing with the customers,

punctuality and quality of service provided.

The Virgin Atlantic has also modernised its fleet of aircrafts. It has also made efforts

in making new systems like mobile app and self-service air ticket booking service

(Borenstein & Rose, 2014).

Weakness:

The company is dependent a lot on its owner Richard Branson who formulates the

entire picture of the company. The company might lose its direction after Richard is

gone. It must work on some succession plan.

The company is facing strict competition from its competitors like the British

Airways, the American airlines and alarmingly from cash rich airlines like the Etihad

or Emirates that operate on the same routes as of the Virgin Atlantic.

Opportunities:

or transported by some entities (Saranga and Nagpal, 2016). In this case it can be seen that

the revenue passenger kilometres has reduced over the years and the passenger load factor

has not shown any steady trend and Is currently showing a small upward movement.

SWOT Analysis:

In this section, SWOT Analysis is conducted so that an appropriate recommendation

can be made.

Strengths:

One of the main strengths of the Virgin Atlantic is that the brand reputation of the

company is immense. Its brand recognition took it to the sixth position in the ranking

done by AirHelp. It covered aspects such as speed of dealing with the customers,

punctuality and quality of service provided.

The Virgin Atlantic has also modernised its fleet of aircrafts. It has also made efforts

in making new systems like mobile app and self-service air ticket booking service

(Borenstein & Rose, 2014).

Weakness:

The company is dependent a lot on its owner Richard Branson who formulates the

entire picture of the company. The company might lose its direction after Richard is

gone. It must work on some succession plan.

The company is facing strict competition from its competitors like the British

Airways, the American airlines and alarmingly from cash rich airlines like the Etihad

or Emirates that operate on the same routes as of the Virgin Atlantic.

Opportunities:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10AVIATION MANAGEMENT

One of the most promising opportunities that have presented itself in front of the

company is that there has been a proposal to add an extra airstrip at the HEATHROW

airport. This can prove immensely beneficial for the company (Choi et al., 2015).

The previous fiscal year was characterised by low fuel prices, interest rates and if

such favourable factors continue to occur, the company will definitely set sail for a

higher return.

Threats:

There is a lot of uncertainty and threat to business with respect to the aftermath of the

Brexit.

The weather condition of the UK is becoming worse day by day which includes

sudden dangerous storms and extreme water conditions (Wu, 2016).

Recommendations and suggestions:

After analysing the financial and operational performance of the entity, the following

recommendations are discussed below.

The company should increase the influence of its operations on a global scale by way

of promoting its brand value all over the market place. This will help the company to increase

the number of customers. By promoting its brand, the company is trying to capitalise on its

strength that is the ability to make use of its brand name.

Another strategy that can be recommended to the company is to improve its skill to

improve the experience of the customers and reduce their service costs while providing an

outstanding experience to the customers.

The company should focus on modernising its assets and its business strategy. This

will enable the company to reduce its operational costs and increase the profitability of the

One of the most promising opportunities that have presented itself in front of the

company is that there has been a proposal to add an extra airstrip at the HEATHROW

airport. This can prove immensely beneficial for the company (Choi et al., 2015).

The previous fiscal year was characterised by low fuel prices, interest rates and if

such favourable factors continue to occur, the company will definitely set sail for a

higher return.

Threats:

There is a lot of uncertainty and threat to business with respect to the aftermath of the

Brexit.

The weather condition of the UK is becoming worse day by day which includes

sudden dangerous storms and extreme water conditions (Wu, 2016).

Recommendations and suggestions:

After analysing the financial and operational performance of the entity, the following

recommendations are discussed below.

The company should increase the influence of its operations on a global scale by way

of promoting its brand value all over the market place. This will help the company to increase

the number of customers. By promoting its brand, the company is trying to capitalise on its

strength that is the ability to make use of its brand name.

Another strategy that can be recommended to the company is to improve its skill to

improve the experience of the customers and reduce their service costs while providing an

outstanding experience to the customers.

The company should focus on modernising its assets and its business strategy. This

will enable the company to reduce its operational costs and increase the profitability of the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11AVIATION MANAGEMENT

operations in a relatively short period of time. Due to the reduction in the cost of operation

the company will be able to enjoy profitability even if there is no substantial increase in the

customers immediately.

The company is increasing its current ratio over the years that shows that the company

is losing returns on a substantial amount of capital which is earning no return due to the fact

that it is remaining invested in the working capital of the firm instead of any other avenues

which would have earned good returns for the company.

operations in a relatively short period of time. Due to the reduction in the cost of operation

the company will be able to enjoy profitability even if there is no substantial increase in the

customers immediately.

The company is increasing its current ratio over the years that shows that the company

is losing returns on a substantial amount of capital which is earning no return due to the fact

that it is remaining invested in the working capital of the firm instead of any other avenues

which would have earned good returns for the company.

12AVIATION MANAGEMENT

Reference

(2018). Virginatlantic.com. Retrieved 21 March 2018, from

https://www.virginatlantic.com/content/dam/vaa/documents/footer/mediacentre/

VAL_FY16_Annual_Report.pdf

Berghöfer, B., & Lucey, B. (2014). Fuel hedging, operational hedging and risk exposure—

Evidence from the global airline industry. International Review of Financial

Analysis, 34, 124-139.

Borenstein, S., & Rose, N. L. (2014). How airline markets work… or do they? Regulatory

reform in the airline industry. In Economic Regulation and Its Reform: What Have We

Learned? (pp. 63-135). University of Chicago Press.

Choi, K., Lee, D., & Olson, D. L. (2015). Service quality and productivity in the US airline

industry: a service quality-adjusted DEA model. Service Business, 9(1), 137-160.

Garg, C. P. (2016). A robust hybrid decision model for evaluation and selection of the

strategic alliance partner in the airline industry. Journal of Air Transport

Management, 52, 55-66.

Grant, R. M. (2016). Contemporary strategy analysis: Text and cases edition. John Wiley &

Sons.

Saranga, H. and Nagpal, R., 2016. Drivers of operational efficiency and its impact on market

performance in the Indian Airline industry. Journal of Air Transport Management, 53,

pp.165-176.

Reference

(2018). Virginatlantic.com. Retrieved 21 March 2018, from

https://www.virginatlantic.com/content/dam/vaa/documents/footer/mediacentre/

VAL_FY16_Annual_Report.pdf

Berghöfer, B., & Lucey, B. (2014). Fuel hedging, operational hedging and risk exposure—

Evidence from the global airline industry. International Review of Financial

Analysis, 34, 124-139.

Borenstein, S., & Rose, N. L. (2014). How airline markets work… or do they? Regulatory

reform in the airline industry. In Economic Regulation and Its Reform: What Have We

Learned? (pp. 63-135). University of Chicago Press.

Choi, K., Lee, D., & Olson, D. L. (2015). Service quality and productivity in the US airline

industry: a service quality-adjusted DEA model. Service Business, 9(1), 137-160.

Garg, C. P. (2016). A robust hybrid decision model for evaluation and selection of the

strategic alliance partner in the airline industry. Journal of Air Transport

Management, 52, 55-66.

Grant, R. M. (2016). Contemporary strategy analysis: Text and cases edition. John Wiley &

Sons.

Saranga, H. and Nagpal, R., 2016. Drivers of operational efficiency and its impact on market

performance in the Indian Airline industry. Journal of Air Transport Management, 53,

pp.165-176.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.