Report on Financial Decision Making, Accounting & Finance - Alpha Ltd

VerifiedAdded on 2023/01/12

|15

|4212

|24

Report

AI Summary

This report provides a comprehensive analysis of financial decision-making within Alpha Ltd, encompassing accounting and finance functions, along with ratio analysis. Task 1 details the roles of accounting and finance within Alpha Ltd, illustrating key concepts with examples and explaining the structure of financial statements. Task 2 focuses on ratio analysis, calculating metrics such as return on capital employed, net profit margin, current ratio, and average collection period for debtors and creditors. The significance of these ratios for users is highlighted, and the outcomes are supported with related comments, cause-and-effect explanations. The report concludes by emphasizing how financial statements and ratios work together to depict the company's performance and reveal the underlying reasons behind the outcomes, supported with references.

B10195

Financial Decision

Making

Financial Decision

Making

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY:

This project consists of two parts; Task 1 and Task 2. First task carries report on accounting and

financing functions within Alpha Ltd., it will evaluate role of both with certain illustrations for

better clarification of concepts. Alpha Limited is a manufacturing company which is based in UK

and established in 1954; the upcoming target of company is to expand in other parts of UK in 10

years. Financial statements structure with elements use in it is explained in Task1. On the other

hand Task 2 focuses on outstanding tools ratio analysis; calculation of various ratios like return

on capital employed, net profit margin, current ratio and average collection period for both

debtors and creditors has done. Significance of these ratios to users will provide more knowledge

and acknowledgement. The outcomes of ratios are supported with related comments, cause and

effect of the result. Overall financial statement and ratios work together to show performance of

the company and also reveals cause behind outcomes.

This project consists of two parts; Task 1 and Task 2. First task carries report on accounting and

financing functions within Alpha Ltd., it will evaluate role of both with certain illustrations for

better clarification of concepts. Alpha Limited is a manufacturing company which is based in UK

and established in 1954; the upcoming target of company is to expand in other parts of UK in 10

years. Financial statements structure with elements use in it is explained in Task1. On the other

hand Task 2 focuses on outstanding tools ratio analysis; calculation of various ratios like return

on capital employed, net profit margin, current ratio and average collection period for both

debtors and creditors has done. Significance of these ratios to users will provide more knowledge

and acknowledgement. The outcomes of ratios are supported with related comments, cause and

effect of the result. Overall financial statement and ratios work together to show performance of

the company and also reveals cause behind outcomes.

Table of Contents

EXECUTIVE SUMMARY:...............................................................................................................

INTRODUCTION...........................................................................................................................1

TASK 1

Role of accounting and finance within ALPHA:.............................................................................2

TASK 2

A. Calculations:.........................................................................................................................6

B. Comments on the performance of ALPHA LTD. results and position:...............................8

CONCLUSION:............................................................................................................................11

REFERENCES..............................................................................................................................12

EXECUTIVE SUMMARY:...............................................................................................................

INTRODUCTION...........................................................................................................................1

TASK 1

Role of accounting and finance within ALPHA:.............................................................................2

TASK 2

A. Calculations:.........................................................................................................................6

B. Comments on the performance of ALPHA LTD. results and position:...............................8

CONCLUSION:............................................................................................................................11

REFERENCES..............................................................................................................................12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Financing and Accounting plays a major role together but they have different functions; to show

financial health of company; financial statement plays a major role in evaluating company’s

assets performance; additional to this it also helps in knowing details about non-performing

assets of the organization. Bookkeeping is progressively about exact revealing of what has just

occurred and consistence with laws and benchmarks. Account is tied in with looking forward and

growing a pot of cash or alleviating misfortunes. On the off chance that you like intuition as far

as a more extended time skyline you might be more joyful in fund than in bookkeeping. Decision

making is the process of choosing best alternatives among available choices. In case of Alpha;

company has to take decision on various issues such whether to buy or manufacture the product;

how to raise funds equity or debts; how much credit should be allowed to debtors, etc. Taking

proper decision on right time is the main key to success. Each budget summary has a heading,

which gives the name of the element, the name of the announcement, and the date or time

secured by the announcement. The data gave in fiscal summaries is essentially budgetary in

nature and communicated in units of cash. The data identifies with an individual business

undertaking.

1 | P a g e

Financing and Accounting plays a major role together but they have different functions; to show

financial health of company; financial statement plays a major role in evaluating company’s

assets performance; additional to this it also helps in knowing details about non-performing

assets of the organization. Bookkeeping is progressively about exact revealing of what has just

occurred and consistence with laws and benchmarks. Account is tied in with looking forward and

growing a pot of cash or alleviating misfortunes. On the off chance that you like intuition as far

as a more extended time skyline you might be more joyful in fund than in bookkeeping. Decision

making is the process of choosing best alternatives among available choices. In case of Alpha;

company has to take decision on various issues such whether to buy or manufacture the product;

how to raise funds equity or debts; how much credit should be allowed to debtors, etc. Taking

proper decision on right time is the main key to success. Each budget summary has a heading,

which gives the name of the element, the name of the announcement, and the date or time

secured by the announcement. The data gave in fiscal summaries is essentially budgetary in

nature and communicated in units of cash. The data identifies with an individual business

undertaking.

1 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 1

Role of accounting and finance within ALPHA:

Accounting: It is the process of recording day to day transactions into accounting books such as

Journal, ledger, sales, purchases and petty cash book. Its main objective is to follow double book

keeping principle while recording business transactions (Ingersoll, 1987).

Financing: It is the process of arranging of funds for operational activities specially for fulfilling

working capital requirement of the company. It involves activities such as purchasing and

investing which use by various economic systems (Schall and Haley, 1979).

Difference between financing and accounting:

The contrast among fund and bookkeeping is that bookkeeping centers on the everyday

progression of cash all through an organization or foundation, while account is a more extensive

term for the administration of benefits and liabilities and the arranging of future development

(Schwartz, 1998).

ALPHA uses mix of both financing and accounting to prepare its financial statement:

Accounting

2 | P a g e

Financing

Financial statement

Role of accounting and finance within ALPHA:

Accounting: It is the process of recording day to day transactions into accounting books such as

Journal, ledger, sales, purchases and petty cash book. Its main objective is to follow double book

keeping principle while recording business transactions (Ingersoll, 1987).

Financing: It is the process of arranging of funds for operational activities specially for fulfilling

working capital requirement of the company. It involves activities such as purchasing and

investing which use by various economic systems (Schall and Haley, 1979).

Difference between financing and accounting:

The contrast among fund and bookkeeping is that bookkeeping centers on the everyday

progression of cash all through an organization or foundation, while account is a more extensive

term for the administration of benefits and liabilities and the arranging of future development

(Schwartz, 1998).

ALPHA uses mix of both financing and accounting to prepare its financial statement:

Accounting

2 | P a g e

Financing

Financial statement

It’s impossible for any business to survive only on one accounting concept, It is the soul

everything being equal and the shared factor by which most business execution is estimated both

inside and remotely. The bookkeeping and fund office is at the focal point of any association and

is answerable for guaranteeing the productive money related administration and budgetary

controls important to help all business exercises.

The various roles of accounting and financing within ALPHA Company are discussed below:

1. Financial Accounting: This is worried about keeping record everything being equal,

utilizing the twofold passage accounting framework and planning last records reasonable

for meeting the different administrative necessities for statutory revealing, the stock trade

and tax collection specialists. The individual answerable for this capacity in generally

medium to enormous associations is the money related bookkeeper, who will regularly

answer to the account chief.

2. Financial Systems: Medium-to huge estimated associations may utilize a frameworks

bookkeeper, who will dissect the monetary data needs of an association and audit existing

frameworks. Manager is answerable for the plan and support of monetary frameworks

and for giving an interface between the account and innovation/frameworks divisions.

Inside the bookkeeping and money work frameworks bookkeeper may answer to the

budgetary bookkeeper, the board bookkeeper or monetary chief.

3. Budgeting: The future estimation of expenses on the basis of past sales trend is known as

budgeting. It helps organization in making planning, control and making proper decision.

For example; Alpha wants to expand its business within 10 years in UK; so to fulfill this

goal it requires proper plan about how to achieve this target; how to raise fund from

various resources and how much employee it requires. Budgeting will help company in

estimating the total budget requires achieving desired aim. To get budget successful; it

necessary that company should control and monitored its cost regularly.

4. Management Accounting: The Management accounting is worried about the

examination and control of budgetary data to aid the everyday tasks of an association.

Generally medium-to enormous estimated organizations will have an administration

bookkeeper liable for this capacity who will answer to the money related executive.

The Accounting and monetary bookkeeping are regularly founded on data

gotten from the money related bookkeeping records. For instance, the 'real' consumption

3 | P a g e

everything being equal and the shared factor by which most business execution is estimated both

inside and remotely. The bookkeeping and fund office is at the focal point of any association and

is answerable for guaranteeing the productive money related administration and budgetary

controls important to help all business exercises.

The various roles of accounting and financing within ALPHA Company are discussed below:

1. Financial Accounting: This is worried about keeping record everything being equal,

utilizing the twofold passage accounting framework and planning last records reasonable

for meeting the different administrative necessities for statutory revealing, the stock trade

and tax collection specialists. The individual answerable for this capacity in generally

medium to enormous associations is the money related bookkeeper, who will regularly

answer to the account chief.

2. Financial Systems: Medium-to huge estimated associations may utilize a frameworks

bookkeeper, who will dissect the monetary data needs of an association and audit existing

frameworks. Manager is answerable for the plan and support of monetary frameworks

and for giving an interface between the account and innovation/frameworks divisions.

Inside the bookkeeping and money work frameworks bookkeeper may answer to the

budgetary bookkeeper, the board bookkeeper or monetary chief.

3. Budgeting: The future estimation of expenses on the basis of past sales trend is known as

budgeting. It helps organization in making planning, control and making proper decision.

For example; Alpha wants to expand its business within 10 years in UK; so to fulfill this

goal it requires proper plan about how to achieve this target; how to raise fund from

various resources and how much employee it requires. Budgeting will help company in

estimating the total budget requires achieving desired aim. To get budget successful; it

necessary that company should control and monitored its cost regularly.

4. Management Accounting: The Management accounting is worried about the

examination and control of budgetary data to aid the everyday tasks of an association.

Generally medium-to enormous estimated organizations will have an administration

bookkeeper liable for this capacity who will answer to the money related executive.

The Accounting and monetary bookkeeping are regularly founded on data

gotten from the money related bookkeeping records. For instance, the 'real' consumption

3 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

figures appeared in the executives records will be taken from the money related

bookkeeping records. In some cases money related bookkeeping and the executives

bookkeeping are coordinated. A case of this would be the completely coordinated

standard costing framework where the money related records are organized so as to give

cost and the executive’s data straightforwardly.

5. Taxation: Most enormous organizations will have a tax collection office managing all

expense issues. In a littler organization this might be dealt with by the fund executive or

potentially the monetary bookkeeper.

Just as everyday tax assessment the executives and revealing, all choices made by

an organization will have charge suggestions and these should be recognized and

incorporated with the dynamic procedure and money related plans. In addition to the fact

that tax has to be represented money should be made accessible at the ideal time to pay it

to the specialists. Duty does, in this manner, influence money arranging and spending

plans.

Tax avoidance is illicit and, furthermore, most nations likewise have hostile to

shirking laws. It is the expense division's obligation to guarantee that all laws are

conformed to. As in the case of Alpha; companies has two choices of raising fund; either

by issuing equity shares or through debt financing. If company goes with raising fund by

issuing equity funds; then it has to pay heavy tax on both net earnings and dividend

payment to shareholders; on the other hand, debt financing relief company from paying

high amount of taxes (Ingersoll, 1987).

6. Preparing financial statement: This is the main role of both financing and accounting;

as discussed earlier financial statement is the mix approach of both financing and

accounting technique. It shows how much earnings generate by company at the end of

financial year, its financial health and liquidity nature. Financial statement report of

Alpha shows figure of balance sheet, income statement, cash flow statement and

statement of changes in owner’s equity or shareholders’. The monetary record gives a

preview of a substance starting at a specific date. It list the element's benefits, liabilities,

and on account of a partnership, the investors' value on a particular date. The salary

articulation presents an outline of the incomes, gains, costs, misfortunes, and total

compensation or overall deficit of an element for a particular period. This announcement

4 | P a g e

bookkeeping records. In some cases money related bookkeeping and the executives

bookkeeping are coordinated. A case of this would be the completely coordinated

standard costing framework where the money related records are organized so as to give

cost and the executive’s data straightforwardly.

5. Taxation: Most enormous organizations will have a tax collection office managing all

expense issues. In a littler organization this might be dealt with by the fund executive or

potentially the monetary bookkeeper.

Just as everyday tax assessment the executives and revealing, all choices made by

an organization will have charge suggestions and these should be recognized and

incorporated with the dynamic procedure and money related plans. In addition to the fact

that tax has to be represented money should be made accessible at the ideal time to pay it

to the specialists. Duty does, in this manner, influence money arranging and spending

plans.

Tax avoidance is illicit and, furthermore, most nations likewise have hostile to

shirking laws. It is the expense division's obligation to guarantee that all laws are

conformed to. As in the case of Alpha; companies has two choices of raising fund; either

by issuing equity shares or through debt financing. If company goes with raising fund by

issuing equity funds; then it has to pay heavy tax on both net earnings and dividend

payment to shareholders; on the other hand, debt financing relief company from paying

high amount of taxes (Ingersoll, 1987).

6. Preparing financial statement: This is the main role of both financing and accounting;

as discussed earlier financial statement is the mix approach of both financing and

accounting technique. It shows how much earnings generate by company at the end of

financial year, its financial health and liquidity nature. Financial statement report of

Alpha shows figure of balance sheet, income statement, cash flow statement and

statement of changes in owner’s equity or shareholders’. The monetary record gives a

preview of a substance starting at a specific date. It list the element's benefits, liabilities,

and on account of a partnership, the investors' value on a particular date. The salary

articulation presents an outline of the incomes, gains, costs, misfortunes, and total

compensation or overall deficit of an element for a particular period. This announcement

4 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

is like a moving image of the substance's tasks during this timeframe. The income

proclamation condenses an element's money receipts and money installments identifying

with its working, contributing, and financing exercises during a specific period. An

announcement of changes in proprietors' value or investors' value accommodates the start

of the period value of a venture with its completion balance (DeFranco and Lattin, 2007).

Things as of now revealed in budget summaries are estimated by various qualities

(for instance, recorded cost, current cost, current market esteem, net dependable worth,

and present estimation of future incomes). Chronicled cost is the customary methods for

introducing resources and liabilities.

Notes to fiscal summaries are useful revelations annexed as far as possible of budget

reports. They give significant data concerning such issues as deterioration and stock

strategies utilized subtleties of long haul obligation, annuities, leases, personal duties,

unforeseen liabilities, techniques for union, and different issues. Notes are viewed as an

indispensable piece of the budget reports (Fabozzi, 2010). Timetables and incidental

revelations are likewise used to introduce data not gave somewhere else in the fiscal

reports.

Elements of financial statement:

Assets: These are the investment made by Alpha to run its business. Assets are of

two types; current and non-current. Current assets are those which can be

converted into cash before one year; while non-current assets or fixed assets

cannot be converted into cash before one year.

Comprehensive income: It is the change in net assets transactions during a year. It

doesn’t include those transactions which results from investments or any other

incomes.

Distribution to owners: Any reduction in net assets of Alpha Company due to

transferring of assets, providing services and acquiring liabilities for owners

comes under this category.

Equity: It is the balancing figure which remains with Alpha after deducting total

liabilities (Non-current and Current both) from total assets. The balance sheet of

Alpha shows equity of £1,162.50 as on 2017 and £1,425 in 2018.

5 | P a g e

proclamation condenses an element's money receipts and money installments identifying

with its working, contributing, and financing exercises during a specific period. An

announcement of changes in proprietors' value or investors' value accommodates the start

of the period value of a venture with its completion balance (DeFranco and Lattin, 2007).

Things as of now revealed in budget summaries are estimated by various qualities

(for instance, recorded cost, current cost, current market esteem, net dependable worth,

and present estimation of future incomes). Chronicled cost is the customary methods for

introducing resources and liabilities.

Notes to fiscal summaries are useful revelations annexed as far as possible of budget

reports. They give significant data concerning such issues as deterioration and stock

strategies utilized subtleties of long haul obligation, annuities, leases, personal duties,

unforeseen liabilities, techniques for union, and different issues. Notes are viewed as an

indispensable piece of the budget reports (Fabozzi, 2010). Timetables and incidental

revelations are likewise used to introduce data not gave somewhere else in the fiscal

reports.

Elements of financial statement:

Assets: These are the investment made by Alpha to run its business. Assets are of

two types; current and non-current. Current assets are those which can be

converted into cash before one year; while non-current assets or fixed assets

cannot be converted into cash before one year.

Comprehensive income: It is the change in net assets transactions during a year. It

doesn’t include those transactions which results from investments or any other

incomes.

Distribution to owners: Any reduction in net assets of Alpha Company due to

transferring of assets, providing services and acquiring liabilities for owners

comes under this category.

Equity: It is the balancing figure which remains with Alpha after deducting total

liabilities (Non-current and Current both) from total assets. The balance sheet of

Alpha shows equity of £1,162.50 as on 2017 and £1,425 in 2018.

5 | P a g e

Expenses: This are also know as expenditures or cost involve in acquiring assets;

it is treated as outflow for the business.

Incomes: Also know as gain or earnings; it is earned by Alpha in buying and

selling activities. Incomes are cash inflows for the company and increase its net

worth. Without it business cannot run for longer period of time.

Investment by owners: Increase in net assets of Alpha can be resulted from

receiving funds from other company as investment.

Liabilities: It is the amount which increases net assets; because company should

raise its fund for the equal amount of its equity. It is the responsibility of Alpha to

payback its outstanding taken from suppliers, banks or other business firms on

time, to maintain its credibility in market (Arnold, 2012).

7. Treasury and financial planning: Financing and accounting plays major role in

maintain proper fund through great financial planning. Treasury is the reserves of Alpha;

which is handled to pay working capital expenses and at the time of expansion of

business. Normally treasurer has direct link with financial department; because he is

responsible for efficient provision, investment and fund utilization (Brigham, 1996).

8. Creating value: Inside the setting of the strategy the fund chief has a duty to make

esteem. This should be possible through, for instance, getting the most ideal acquiring

rates, cutting/controlling costs, decreasing money related dangers, improving obligation

assortment, better money the executives and numerous different exercises (WEBSTER,

2014).

TASK 2

A. Calculations:

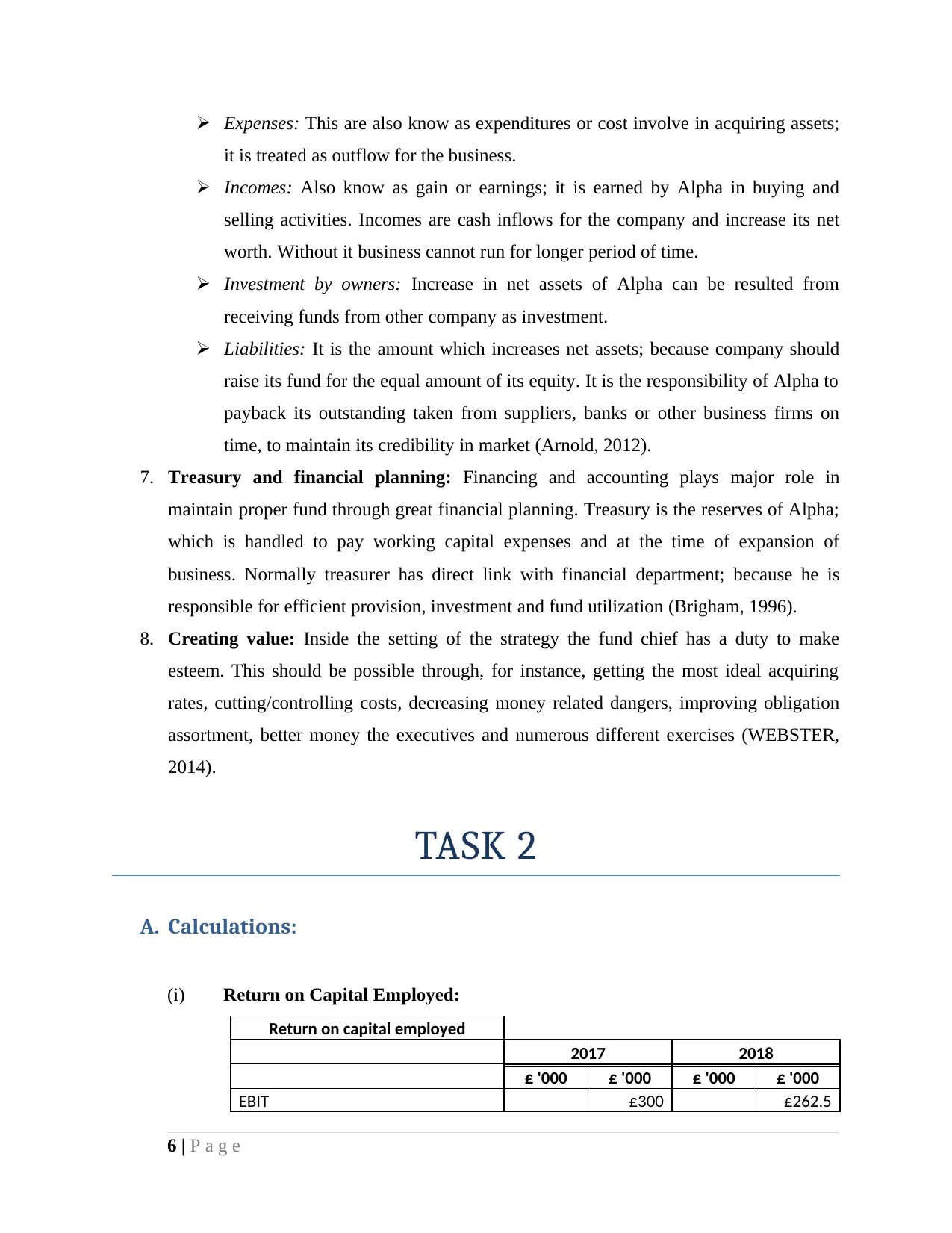

(i) Return on Capital Employed:

Return on capital employed

2017 2018

£ '000 £ '000 £ '000 £ '000

EBIT £300 £262.5

6 | P a g e

it is treated as outflow for the business.

Incomes: Also know as gain or earnings; it is earned by Alpha in buying and

selling activities. Incomes are cash inflows for the company and increase its net

worth. Without it business cannot run for longer period of time.

Investment by owners: Increase in net assets of Alpha can be resulted from

receiving funds from other company as investment.

Liabilities: It is the amount which increases net assets; because company should

raise its fund for the equal amount of its equity. It is the responsibility of Alpha to

payback its outstanding taken from suppliers, banks or other business firms on

time, to maintain its credibility in market (Arnold, 2012).

7. Treasury and financial planning: Financing and accounting plays major role in

maintain proper fund through great financial planning. Treasury is the reserves of Alpha;

which is handled to pay working capital expenses and at the time of expansion of

business. Normally treasurer has direct link with financial department; because he is

responsible for efficient provision, investment and fund utilization (Brigham, 1996).

8. Creating value: Inside the setting of the strategy the fund chief has a duty to make

esteem. This should be possible through, for instance, getting the most ideal acquiring

rates, cutting/controlling costs, decreasing money related dangers, improving obligation

assortment, better money the executives and numerous different exercises (WEBSTER,

2014).

TASK 2

A. Calculations:

(i) Return on Capital Employed:

Return on capital employed

2017 2018

£ '000 £ '000 £ '000 £ '000

EBIT £300 £262.5

6 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Capital Employed

Total Assets £2,235 £4,035

Less: Current Liabilities £322.5 £1,913 £1,110 £2,925

Return on Capital Employed (A÷ B) 16% 9%

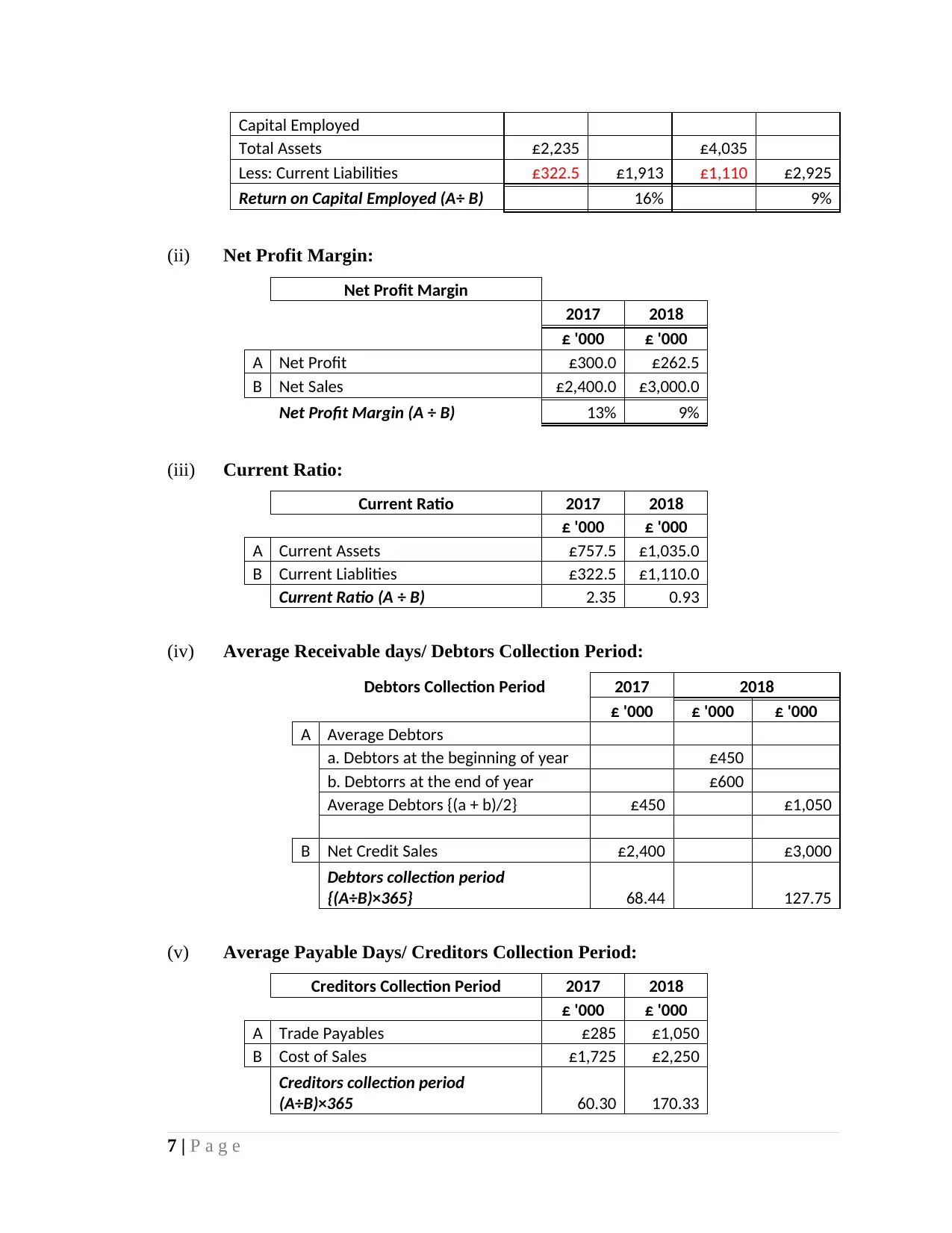

(ii) Net Profit Margin:

Net Profit Margin

2017 2018

£ '000 £ '000

A Net Profit £300.0 £262.5

B Net Sales £2,400.0 £3,000.0

Net Profit Margin (A ÷ B) 13% 9%

(iii) Current Ratio:

Current Ratio 2017 2018

£ '000 £ '000

A Current Assets £757.5 £1,035.0

B Current Liablities £322.5 £1,110.0

Current Ratio (A ÷ B) 2.35 0.93

(iv) Average Receivable days/ Debtors Collection Period:

Debtors Collection Period 2017 2018

£ '000 £ '000 £ '000

A Average Debtors

a. Debtors at the beginning of year £450

b. Debtorrs at the end of year £600

Average Debtors {(a + b)/2} £450 £1,050

B Net Credit Sales £2,400 £3,000

Debtors collection period

{(A÷B)×365} 68.44 127.75

(v) Average Payable Days/ Creditors Collection Period:

Creditors Collection Period 2017 2018

£ '000 £ '000

A Trade Payables £285 £1,050

B Cost of Sales £1,725 £2,250

Creditors collection period

(A÷B)×365 60.30 170.33

7 | P a g e

Total Assets £2,235 £4,035

Less: Current Liabilities £322.5 £1,913 £1,110 £2,925

Return on Capital Employed (A÷ B) 16% 9%

(ii) Net Profit Margin:

Net Profit Margin

2017 2018

£ '000 £ '000

A Net Profit £300.0 £262.5

B Net Sales £2,400.0 £3,000.0

Net Profit Margin (A ÷ B) 13% 9%

(iii) Current Ratio:

Current Ratio 2017 2018

£ '000 £ '000

A Current Assets £757.5 £1,035.0

B Current Liablities £322.5 £1,110.0

Current Ratio (A ÷ B) 2.35 0.93

(iv) Average Receivable days/ Debtors Collection Period:

Debtors Collection Period 2017 2018

£ '000 £ '000 £ '000

A Average Debtors

a. Debtors at the beginning of year £450

b. Debtorrs at the end of year £600

Average Debtors {(a + b)/2} £450 £1,050

B Net Credit Sales £2,400 £3,000

Debtors collection period

{(A÷B)×365} 68.44 127.75

(v) Average Payable Days/ Creditors Collection Period:

Creditors Collection Period 2017 2018

£ '000 £ '000

A Trade Payables £285 £1,050

B Cost of Sales £1,725 £2,250

Creditors collection period

(A÷B)×365 60.30 170.33

7 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

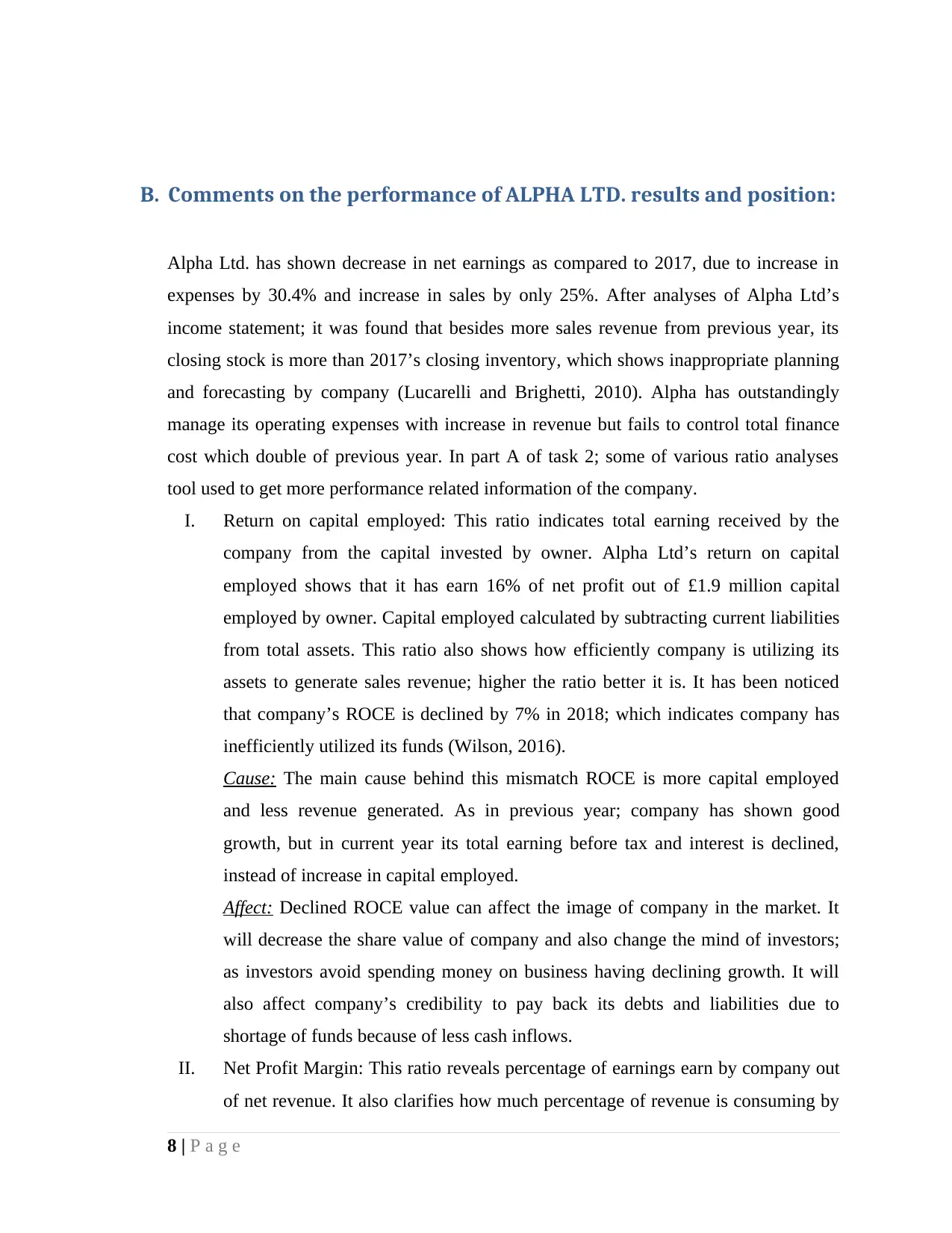

B. Comments on the performance of ALPHA LTD. results and position:

Alpha Ltd. has shown decrease in net earnings as compared to 2017, due to increase in

expenses by 30.4% and increase in sales by only 25%. After analyses of Alpha Ltd’s

income statement; it was found that besides more sales revenue from previous year, its

closing stock is more than 2017’s closing inventory, which shows inappropriate planning

and forecasting by company (Lucarelli and Brighetti, 2010). Alpha has outstandingly

manage its operating expenses with increase in revenue but fails to control total finance

cost which double of previous year. In part A of task 2; some of various ratio analyses

tool used to get more performance related information of the company.

I. Return on capital employed: This ratio indicates total earning received by the

company from the capital invested by owner. Alpha Ltd’s return on capital

employed shows that it has earn 16% of net profit out of £1.9 million capital

employed by owner. Capital employed calculated by subtracting current liabilities

from total assets. This ratio also shows how efficiently company is utilizing its

assets to generate sales revenue; higher the ratio better it is. It has been noticed

that company’s ROCE is declined by 7% in 2018; which indicates company has

inefficiently utilized its funds (Wilson, 2016).

Cause: The main cause behind this mismatch ROCE is more capital employed

and less revenue generated. As in previous year; company has shown good

growth, but in current year its total earning before tax and interest is declined,

instead of increase in capital employed.

Affect: Declined ROCE value can affect the image of company in the market. It

will decrease the share value of company and also change the mind of investors;

as investors avoid spending money on business having declining growth. It will

also affect company’s credibility to pay back its debts and liabilities due to

shortage of funds because of less cash inflows.

II. Net Profit Margin: This ratio reveals percentage of earnings earn by company out

of net revenue. It also clarifies how much percentage of revenue is consuming by

8 | P a g e

Alpha Ltd. has shown decrease in net earnings as compared to 2017, due to increase in

expenses by 30.4% and increase in sales by only 25%. After analyses of Alpha Ltd’s

income statement; it was found that besides more sales revenue from previous year, its

closing stock is more than 2017’s closing inventory, which shows inappropriate planning

and forecasting by company (Lucarelli and Brighetti, 2010). Alpha has outstandingly

manage its operating expenses with increase in revenue but fails to control total finance

cost which double of previous year. In part A of task 2; some of various ratio analyses

tool used to get more performance related information of the company.

I. Return on capital employed: This ratio indicates total earning received by the

company from the capital invested by owner. Alpha Ltd’s return on capital

employed shows that it has earn 16% of net profit out of £1.9 million capital

employed by owner. Capital employed calculated by subtracting current liabilities

from total assets. This ratio also shows how efficiently company is utilizing its

assets to generate sales revenue; higher the ratio better it is. It has been noticed

that company’s ROCE is declined by 7% in 2018; which indicates company has

inefficiently utilized its funds (Wilson, 2016).

Cause: The main cause behind this mismatch ROCE is more capital employed

and less revenue generated. As in previous year; company has shown good

growth, but in current year its total earning before tax and interest is declined,

instead of increase in capital employed.

Affect: Declined ROCE value can affect the image of company in the market. It

will decrease the share value of company and also change the mind of investors;

as investors avoid spending money on business having declining growth. It will

also affect company’s credibility to pay back its debts and liabilities due to

shortage of funds because of less cash inflows.

II. Net Profit Margin: This ratio reveals percentage of earnings earn by company out

of net revenue. It also clarifies how much percentage of revenue is consuming by

8 | P a g e

expenses like operating, cost of sales and selling & distribution. Higher the ratio

better for the company. Alpha Ltd net margin ratio shows that company earning is

13% of net sales in 2017; but in 2018 it reduced to just 9%. Which is not

acceptable at market level? Company needs to review its strategy to improve this

ratio; to avoid further declining in next year (Peterson and Fabozzi, 1994).

Cause: The main reason behind this declining might be increase in expenses by

the company. But fail to generate sales revenue in 2018; last year’s net profit was

0.3 million on 2.4 million pound sales; while in 2017 instead of 3 million pound

sale, company’s net earning has declined to 0.26 million pound; due to failure in

maintaining variable cost.

Affect: Low net profit margin Affects Company’s retained earnings and reserves.

Company could be collapsed if wastage of funds on unnecessary sales activities

stopped. It requires supervision and proper financing model to handle this issue.

Unless Alpha’s finance team manage to control excess cost; company will not

able to increase its total net profit; and this will also affect liquidity of firm.

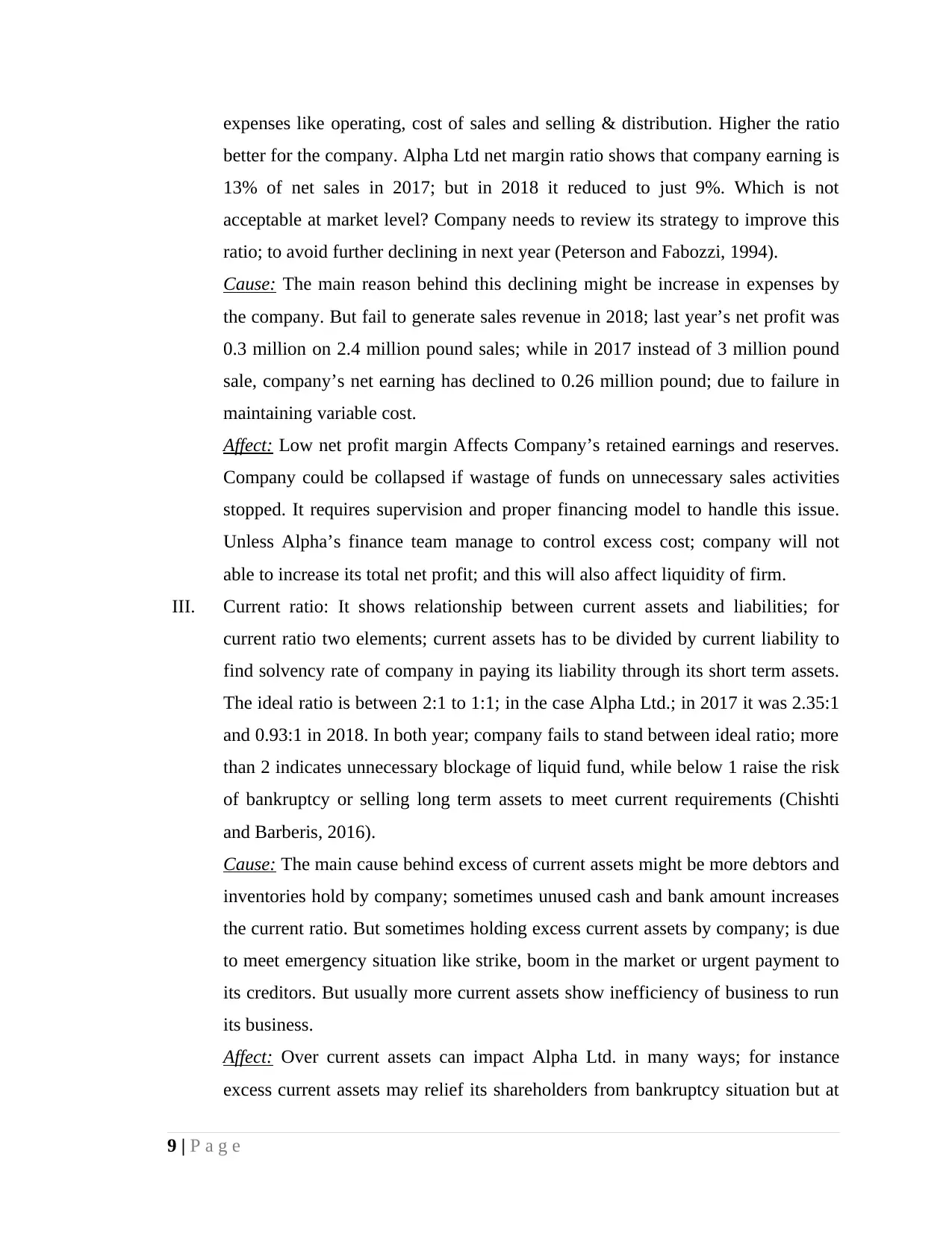

III. Current ratio: It shows relationship between current assets and liabilities; for

current ratio two elements; current assets has to be divided by current liability to

find solvency rate of company in paying its liability through its short term assets.

The ideal ratio is between 2:1 to 1:1; in the case Alpha Ltd.; in 2017 it was 2.35:1

and 0.93:1 in 2018. In both year; company fails to stand between ideal ratio; more

than 2 indicates unnecessary blockage of liquid fund, while below 1 raise the risk

of bankruptcy or selling long term assets to meet current requirements (Chishti

and Barberis, 2016).

Cause: The main cause behind excess of current assets might be more debtors and

inventories hold by company; sometimes unused cash and bank amount increases

the current ratio. But sometimes holding excess current assets by company; is due

to meet emergency situation like strike, boom in the market or urgent payment to

its creditors. But usually more current assets show inefficiency of business to run

its business.

Affect: Over current assets can impact Alpha Ltd. in many ways; for instance

excess current assets may relief its shareholders from bankruptcy situation but at

9 | P a g e

better for the company. Alpha Ltd net margin ratio shows that company earning is

13% of net sales in 2017; but in 2018 it reduced to just 9%. Which is not

acceptable at market level? Company needs to review its strategy to improve this

ratio; to avoid further declining in next year (Peterson and Fabozzi, 1994).

Cause: The main reason behind this declining might be increase in expenses by

the company. But fail to generate sales revenue in 2018; last year’s net profit was

0.3 million on 2.4 million pound sales; while in 2017 instead of 3 million pound

sale, company’s net earning has declined to 0.26 million pound; due to failure in

maintaining variable cost.

Affect: Low net profit margin Affects Company’s retained earnings and reserves.

Company could be collapsed if wastage of funds on unnecessary sales activities

stopped. It requires supervision and proper financing model to handle this issue.

Unless Alpha’s finance team manage to control excess cost; company will not

able to increase its total net profit; and this will also affect liquidity of firm.

III. Current ratio: It shows relationship between current assets and liabilities; for

current ratio two elements; current assets has to be divided by current liability to

find solvency rate of company in paying its liability through its short term assets.

The ideal ratio is between 2:1 to 1:1; in the case Alpha Ltd.; in 2017 it was 2.35:1

and 0.93:1 in 2018. In both year; company fails to stand between ideal ratio; more

than 2 indicates unnecessary blockage of liquid fund, while below 1 raise the risk

of bankruptcy or selling long term assets to meet current requirements (Chishti

and Barberis, 2016).

Cause: The main cause behind excess of current assets might be more debtors and

inventories hold by company; sometimes unused cash and bank amount increases

the current ratio. But sometimes holding excess current assets by company; is due

to meet emergency situation like strike, boom in the market or urgent payment to

its creditors. But usually more current assets show inefficiency of business to run

its business.

Affect: Over current assets can impact Alpha Ltd. in many ways; for instance

excess current assets may relief its shareholders from bankruptcy situation but at

9 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.