Critical Analysis of McDonald Company's Balance Sheet & Ratios

VerifiedAdded on 2023/06/15

|5

|629

|231

Report

AI Summary

This report critically examines the balance sheet of McDonald Company, identifying misclassifications of items such as prepaid insurance, notes payable, bonds payable, and dividends payable. The analysis then calculates and interprets key liquidity ratios, including the working capital ratio, current ratio, and quick ratio, to assess the company's short-term debt-paying ability. The corrected classifications and ratio analysis reveal a healthy liquidity position for McDonald Company, demonstrating the importance of accurate financial statement presentation. Desklib offers a wealth of similar solved assignments and resources for students.

BALANCE SHEET CRITICISM

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

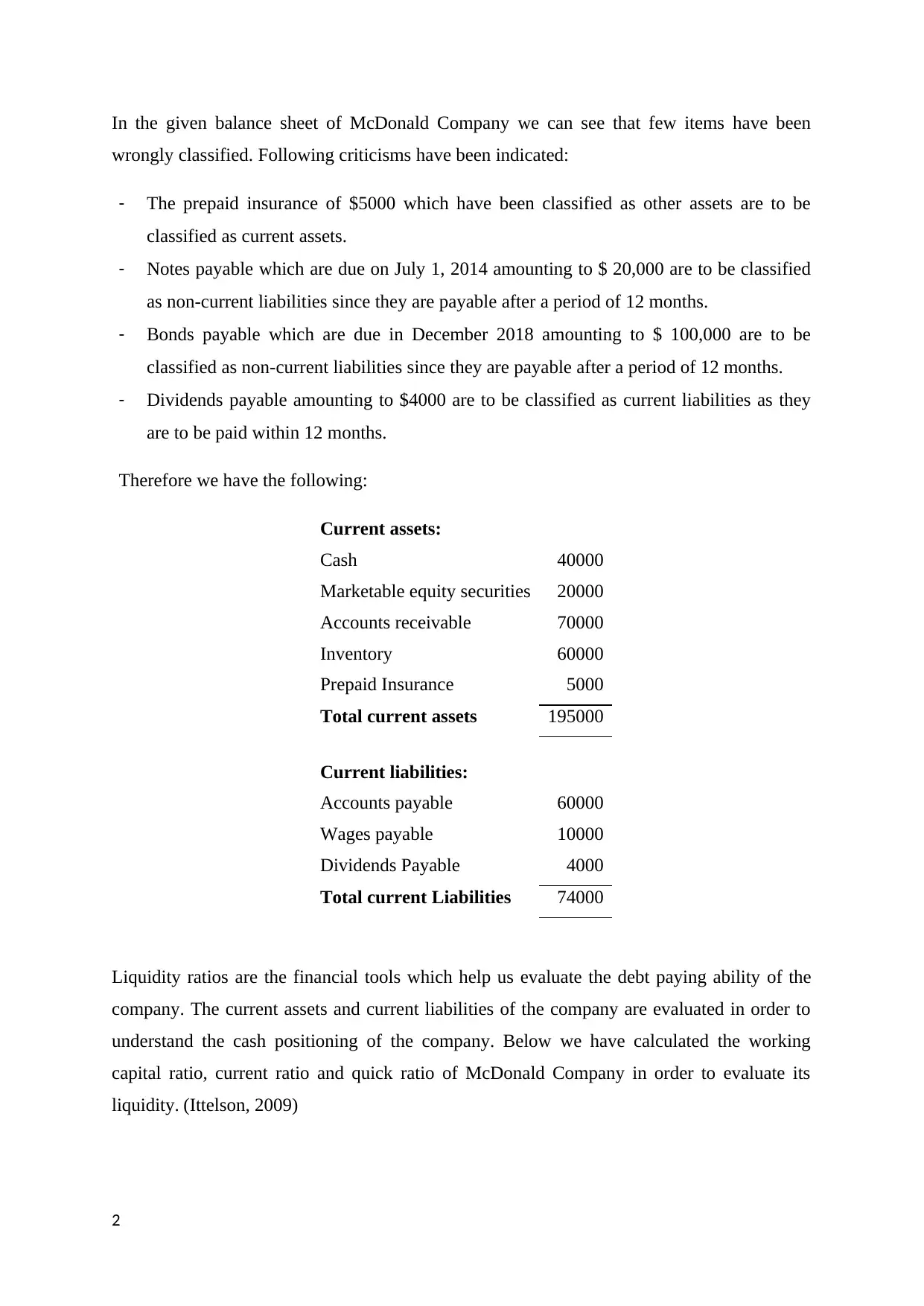

In the given balance sheet of McDonald Company we can see that few items have been

wrongly classified. Following criticisms have been indicated:

- The prepaid insurance of $5000 which have been classified as other assets are to be

classified as current assets.

- Notes payable which are due on July 1, 2014 amounting to $ 20,000 are to be classified

as non-current liabilities since they are payable after a period of 12 months.

- Bonds payable which are due in December 2018 amounting to $ 100,000 are to be

classified as non-current liabilities since they are payable after a period of 12 months.

- Dividends payable amounting to $4000 are to be classified as current liabilities as they

are to be paid within 12 months.

Therefore we have the following:

Current assets:

Cash 40000

Marketable equity securities 20000

Accounts receivable 70000

Inventory 60000

Prepaid Insurance 5000

Total current assets 195000

Current liabilities:

Accounts payable 60000

Wages payable 10000

Dividends Payable 4000

Total current Liabilities 74000

Liquidity ratios are the financial tools which help us evaluate the debt paying ability of the

company. The current assets and current liabilities of the company are evaluated in order to

understand the cash positioning of the company. Below we have calculated the working

capital ratio, current ratio and quick ratio of McDonald Company in order to evaluate its

liquidity. (Ittelson, 2009)

2

wrongly classified. Following criticisms have been indicated:

- The prepaid insurance of $5000 which have been classified as other assets are to be

classified as current assets.

- Notes payable which are due on July 1, 2014 amounting to $ 20,000 are to be classified

as non-current liabilities since they are payable after a period of 12 months.

- Bonds payable which are due in December 2018 amounting to $ 100,000 are to be

classified as non-current liabilities since they are payable after a period of 12 months.

- Dividends payable amounting to $4000 are to be classified as current liabilities as they

are to be paid within 12 months.

Therefore we have the following:

Current assets:

Cash 40000

Marketable equity securities 20000

Accounts receivable 70000

Inventory 60000

Prepaid Insurance 5000

Total current assets 195000

Current liabilities:

Accounts payable 60000

Wages payable 10000

Dividends Payable 4000

Total current Liabilities 74000

Liquidity ratios are the financial tools which help us evaluate the debt paying ability of the

company. The current assets and current liabilities of the company are evaluated in order to

understand the cash positioning of the company. Below we have calculated the working

capital ratio, current ratio and quick ratio of McDonald Company in order to evaluate its

liquidity. (Ittelson, 2009)

2

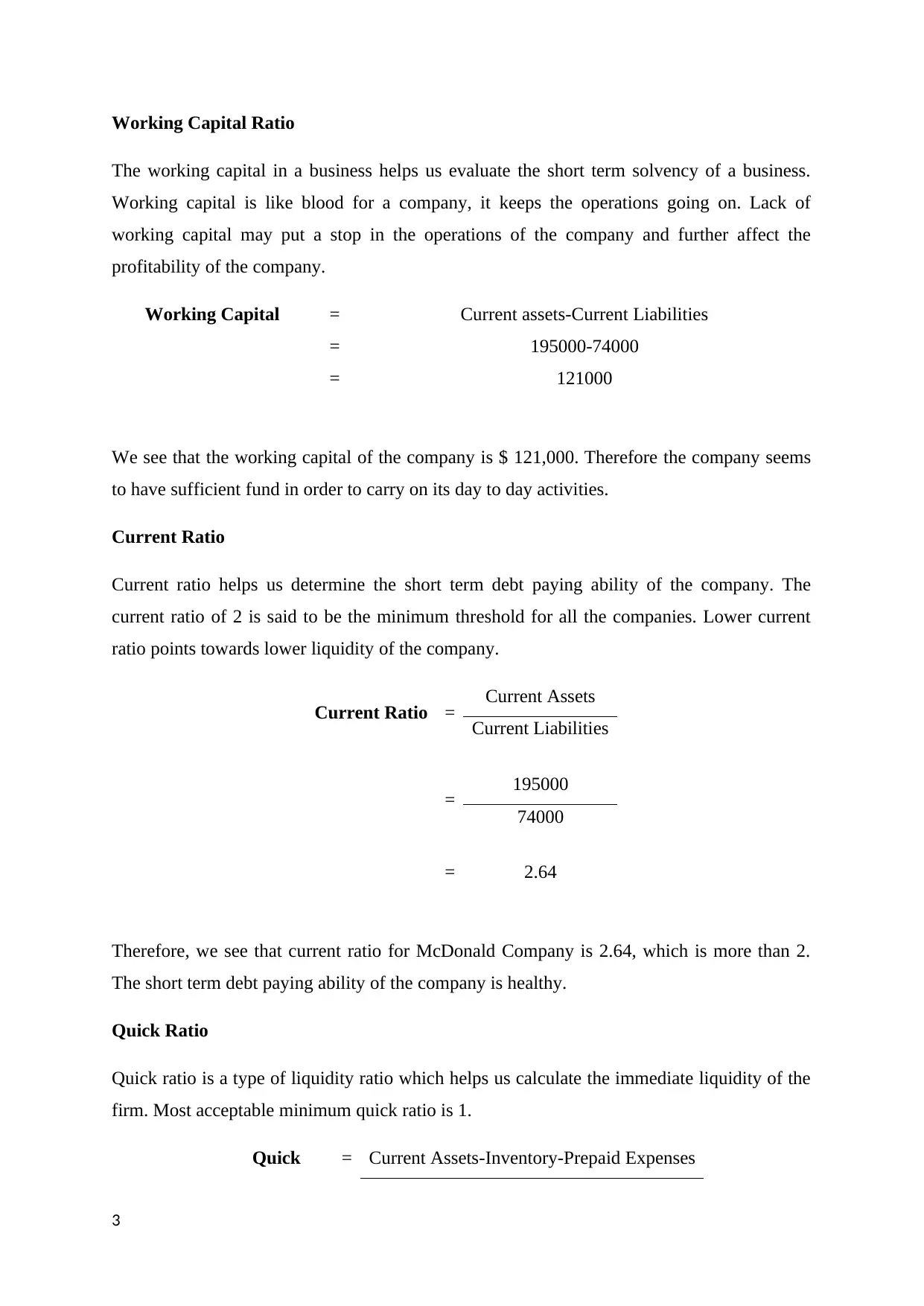

Working Capital Ratio

The working capital in a business helps us evaluate the short term solvency of a business.

Working capital is like blood for a company, it keeps the operations going on. Lack of

working capital may put a stop in the operations of the company and further affect the

profitability of the company.

Working Capital = Current assets-Current Liabilities

= 195000-74000

= 121000

We see that the working capital of the company is $ 121,000. Therefore the company seems

to have sufficient fund in order to carry on its day to day activities.

Current Ratio

Current ratio helps us determine the short term debt paying ability of the company. The

current ratio of 2 is said to be the minimum threshold for all the companies. Lower current

ratio points towards lower liquidity of the company.

Current Ratio = Current Assets

Current Liabilities

= 195000

74000

= 2.64

Therefore, we see that current ratio for McDonald Company is 2.64, which is more than 2.

The short term debt paying ability of the company is healthy.

Quick Ratio

Quick ratio is a type of liquidity ratio which helps us calculate the immediate liquidity of the

firm. Most acceptable minimum quick ratio is 1.

Quick = Current Assets-Inventory-Prepaid Expenses

3

The working capital in a business helps us evaluate the short term solvency of a business.

Working capital is like blood for a company, it keeps the operations going on. Lack of

working capital may put a stop in the operations of the company and further affect the

profitability of the company.

Working Capital = Current assets-Current Liabilities

= 195000-74000

= 121000

We see that the working capital of the company is $ 121,000. Therefore the company seems

to have sufficient fund in order to carry on its day to day activities.

Current Ratio

Current ratio helps us determine the short term debt paying ability of the company. The

current ratio of 2 is said to be the minimum threshold for all the companies. Lower current

ratio points towards lower liquidity of the company.

Current Ratio = Current Assets

Current Liabilities

= 195000

74000

= 2.64

Therefore, we see that current ratio for McDonald Company is 2.64, which is more than 2.

The short term debt paying ability of the company is healthy.

Quick Ratio

Quick ratio is a type of liquidity ratio which helps us calculate the immediate liquidity of the

firm. Most acceptable minimum quick ratio is 1.

Quick = Current Assets-Inventory-Prepaid Expenses

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

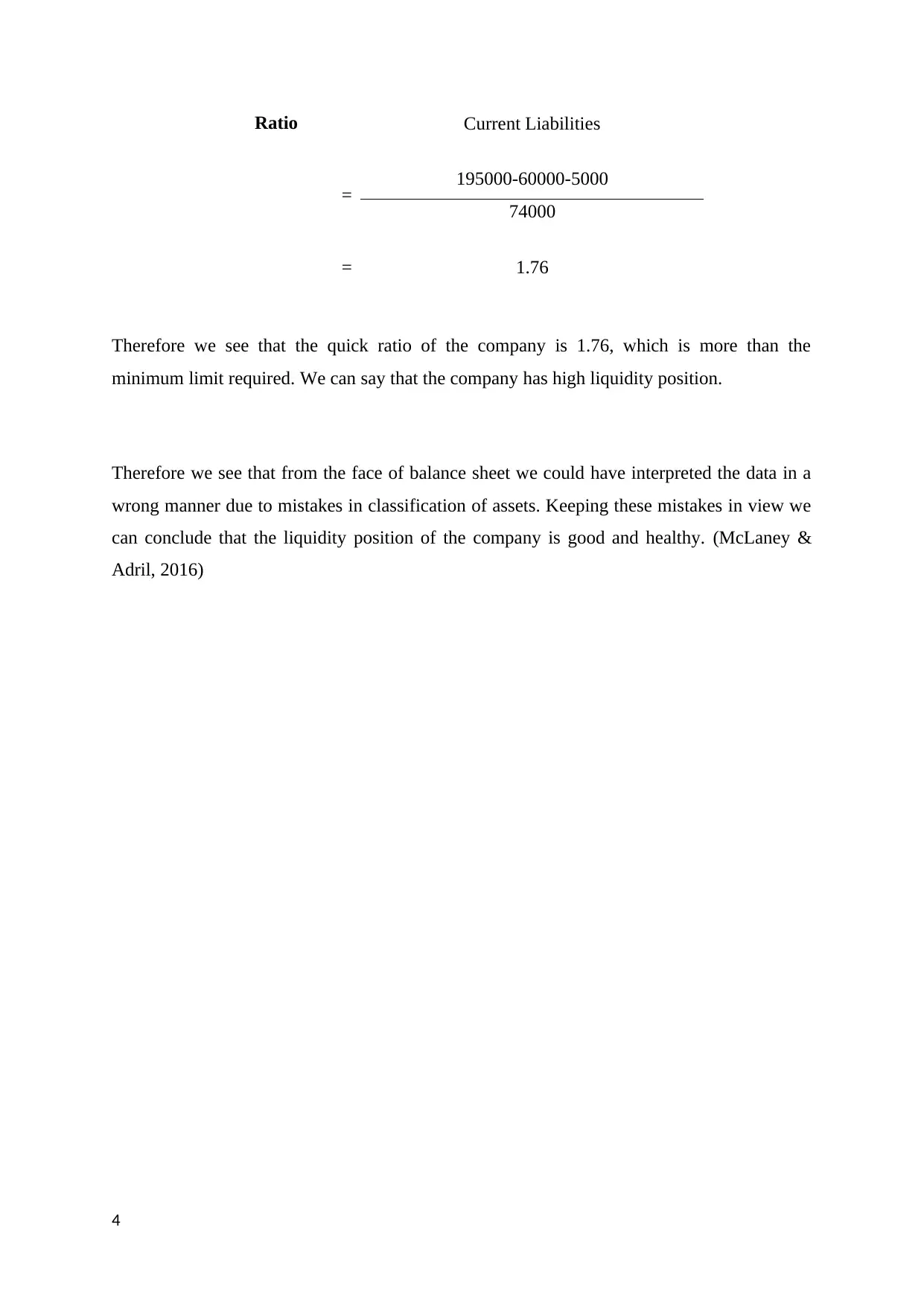

Ratio Current Liabilities

= 195000-60000-5000

74000

= 1.76

Therefore we see that the quick ratio of the company is 1.76, which is more than the

minimum limit required. We can say that the company has high liquidity position.

Therefore we see that from the face of balance sheet we could have interpreted the data in a

wrong manner due to mistakes in classification of assets. Keeping these mistakes in view we

can conclude that the liquidity position of the company is good and healthy. (McLaney &

Adril, 2016)

4

= 195000-60000-5000

74000

= 1.76

Therefore we see that the quick ratio of the company is 1.76, which is more than the

minimum limit required. We can say that the company has high liquidity position.

Therefore we see that from the face of balance sheet we could have interpreted the data in a

wrong manner due to mistakes in classification of assets. Keeping these mistakes in view we

can conclude that the liquidity position of the company is good and healthy. (McLaney &

Adril, 2016)

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

References:

Ittelson, T. (2009). Financial Statements: A Step-by-Step Guide to Understanding and

Creating Financial Reports. Franklin Lakes, N.J.: Career Press.

McLaney, E., & Adril, D. P. (2016). Accounting and Finance: An Introduction. United

Kingdom: Pearson.

5

Ittelson, T. (2009). Financial Statements: A Step-by-Step Guide to Understanding and

Creating Financial Reports. Franklin Lakes, N.J.: Career Press.

McLaney, E., & Adril, D. P. (2016). Accounting and Finance: An Introduction. United

Kingdom: Pearson.

5

1 out of 5

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.