FIN201: Balanced Investment Portfolio for a Fund Manager in Australia

VerifiedAdded on 2023/06/07

|15

|3305

|227

Project

AI Summary

This project outlines the development of a balanced investment portfolio for a fund manager with $A1 billion available for investment. The portfolio targets moderately risk-averse investors, aiming for a net annual return of 3% plus inflation. The analysis covers various asset classes, including cash equivalents, fixed deposits (domestic and overseas), equity investments, real estate, and private equity, with a focus on diversification and risk management. Economic factors such as inflation, country risk, and currency fluctuations are considered. The asset allocation strategy aims to balance risk and reward, with specific weightings assigned to each asset class based on their performance and the investors' risk tolerance. The document includes empirical data, trend analysis, and justifications for the selected asset allocations, providing a comprehensive overview of the balanced fund's investment strategy. Desklib provides students access to similar assignments and study tools.

Running head: BALANCED FUND

Balanced Fund

Name of the Student:

Name of the University:

Author’s Note:

Balanced Fund

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1BALANCED FUND

Balanced Portfolio

The Balanced Investment portfolio was constructed using the notional amount of $A1

billion, which was diversified with the preference of the investors. The type of investor studied

for this type of fund is the moderate risk averse investors whose risk preference towards the

assets is inclined by the amount of the return the assets class generates (Chow et al. 2014). The

wide class of investment, which were considered for investing, were the cash and cash

equivalents, fixed deposits domestic, fixed deposits in overseas, equity investment, real estate

and private equity were the type of assets class selected. The whole portfolio was viewed from

the context of equity and debt investment. The assets class selected are risky and less risky and

the weightage for the same has been allocated using the funds general principles and guidelines.

The recommendation and the weightage for the same assets class was provided after reviewing

the performance of the assets class and the risk clientele effect of the investors. The risk and

rewards of the investor towards the assets class was given in the recommendation section of the

assignment. The return provided by the assets classes can be more than the required rate of return

from the portfolio that is around 3%. The allocation of assets class was done accordingly to

achieve the return target demanded. The assignment also kept several economic factors under

consideration such as Inflation Rate, Country Risk, Sovereign Risk, International taxation and

Currency price movement were some of the key external or economic factors considered while

investment and making the fund (Guerard, Markowitz and Xu 2015).

The diversification benefits would be one of the main advantage the balance fund will

provide in term of assets class to the investors. The balanced fund is a blend of different assets

class that has different characteristics. The beta of the assets class selected ranges from 0 to 1.

The benefits of the fund will be in term of exposures to the short-term funds and deposits in the

Balanced Portfolio

The Balanced Investment portfolio was constructed using the notional amount of $A1

billion, which was diversified with the preference of the investors. The type of investor studied

for this type of fund is the moderate risk averse investors whose risk preference towards the

assets is inclined by the amount of the return the assets class generates (Chow et al. 2014). The

wide class of investment, which were considered for investing, were the cash and cash

equivalents, fixed deposits domestic, fixed deposits in overseas, equity investment, real estate

and private equity were the type of assets class selected. The whole portfolio was viewed from

the context of equity and debt investment. The assets class selected are risky and less risky and

the weightage for the same has been allocated using the funds general principles and guidelines.

The recommendation and the weightage for the same assets class was provided after reviewing

the performance of the assets class and the risk clientele effect of the investors. The risk and

rewards of the investor towards the assets class was given in the recommendation section of the

assignment. The return provided by the assets classes can be more than the required rate of return

from the portfolio that is around 3%. The allocation of assets class was done accordingly to

achieve the return target demanded. The assignment also kept several economic factors under

consideration such as Inflation Rate, Country Risk, Sovereign Risk, International taxation and

Currency price movement were some of the key external or economic factors considered while

investment and making the fund (Guerard, Markowitz and Xu 2015).

The diversification benefits would be one of the main advantage the balance fund will

provide in term of assets class to the investors. The balanced fund is a blend of different assets

class that has different characteristics. The beta of the assets class selected ranges from 0 to 1.

The benefits of the fund will be in term of exposures to the short-term funds and deposits in the

2BALANCED FUND

form of the cash and cash equivalents. While the exposure to assets class such as the equity class

will provide the investors with the exposure to the capital market. The empirical evidence for the

balanced fund shows that the consistency in the form of returns to the investors in the volatile

economy and macro-economic conditions. The balanced fund has proven to provide a

sustainable and better economically efficient returns form the equity-oriented returns where the

exposure and volatility to the economy and market is generally high. The risk and reward for the

same is high and the beta for such assets class is generally is high (Ackert, Church and Qi 2015).

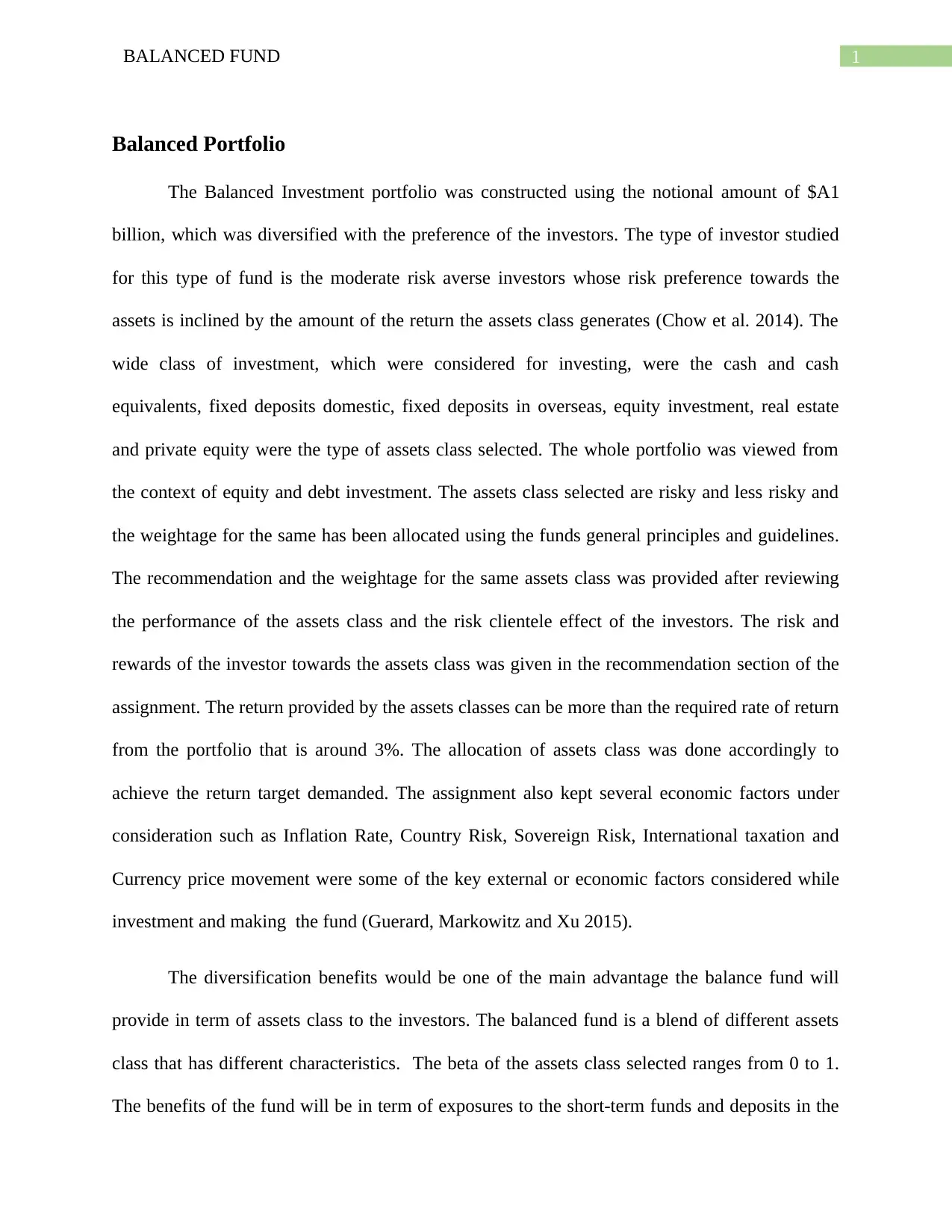

The risk hierarchy among the assets class is defined below:

Figure 1: Classification of Assets

The difference of risk preference and the difference or risk and return preference among the

investors make them the suitable investors according to their assets class. For the reason there,

reason of varied risk and rewards preference the investor can select the fund like the Balanced

Fund, which is less risky or the Equity Fund, which is risky. The percentage of asset allocation or

Cash and Cash

quivalentsE :

owL

i ed DepositsF x

Domestic: owL

quity ClassE :

ighH

Real Estate:

Medium

rivate quityP E :

Medium

form of the cash and cash equivalents. While the exposure to assets class such as the equity class

will provide the investors with the exposure to the capital market. The empirical evidence for the

balanced fund shows that the consistency in the form of returns to the investors in the volatile

economy and macro-economic conditions. The balanced fund has proven to provide a

sustainable and better economically efficient returns form the equity-oriented returns where the

exposure and volatility to the economy and market is generally high. The risk and reward for the

same is high and the beta for such assets class is generally is high (Ackert, Church and Qi 2015).

The risk hierarchy among the assets class is defined below:

Figure 1: Classification of Assets

The difference of risk preference and the difference or risk and return preference among the

investors make them the suitable investors according to their assets class. For the reason there,

reason of varied risk and rewards preference the investor can select the fund like the Balanced

Fund, which is less risky or the Equity Fund, which is risky. The percentage of asset allocation or

Cash and Cash

quivalentsE :

owL

i ed DepositsF x

Domestic: owL

quity ClassE :

ighH

Real Estate:

Medium

rivate quityP E :

Medium

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3BALANCED FUND

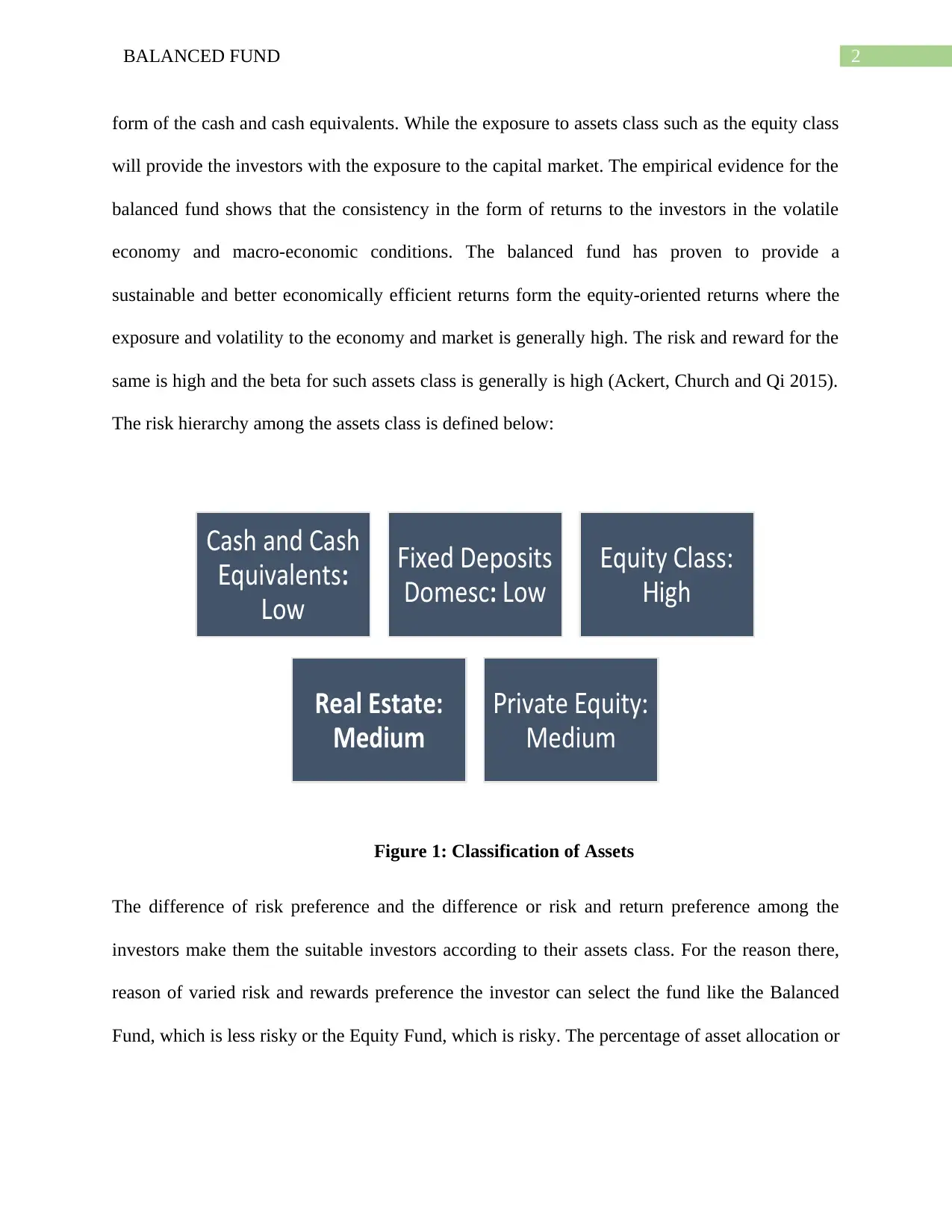

the weights to each assets class in this type of fund are given according to the type of fund

(Liagkouras and Metaxiotis 2015).

Balanced Fund

Asset Class

Risk

Associat

ed

% of

Assets

Invest

ed

Cash and Cash Equivalents Low 10%

Fixed Deposits Domestic Low 45%

Equity Class Medium 20%

Real Estate/Assets High 15%

Overseas Fixed Deposits Medium 5%

Private Equity High 5%

Total 100%

Table 1: Balanced Fund Overview

Figure 2: Balanced and Equity Fund Overview

10%

45%20%

15% 5% 5%

Balanced Fund

Cash and Cash quivalentsE i ed Deposits DomesticF x

quity ClassE Real state AssetsE /

verseas i ed DepositsO F x rivate quityP E

5% 5%

35%

30%

5%

20%

Equity Funds

Cash and Cash quivalentsE i ed Deposits DomesticF x

quity ClassE Real state AssetsE /

verseas i ed DepositsO F x rivate quityP E

the weights to each assets class in this type of fund are given according to the type of fund

(Liagkouras and Metaxiotis 2015).

Balanced Fund

Asset Class

Risk

Associat

ed

% of

Assets

Invest

ed

Cash and Cash Equivalents Low 10%

Fixed Deposits Domestic Low 45%

Equity Class Medium 20%

Real Estate/Assets High 15%

Overseas Fixed Deposits Medium 5%

Private Equity High 5%

Total 100%

Table 1: Balanced Fund Overview

Figure 2: Balanced and Equity Fund Overview

10%

45%20%

15% 5% 5%

Balanced Fund

Cash and Cash quivalentsE i ed Deposits DomesticF x

quity ClassE Real state AssetsE /

verseas i ed DepositsO F x rivate quityP E

5% 5%

35%

30%

5%

20%

Equity Funds

Cash and Cash quivalentsE i ed Deposits DomesticF x

quity ClassE Real state AssetsE /

verseas i ed DepositsO F x rivate quityP E

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4BALANCED FUND

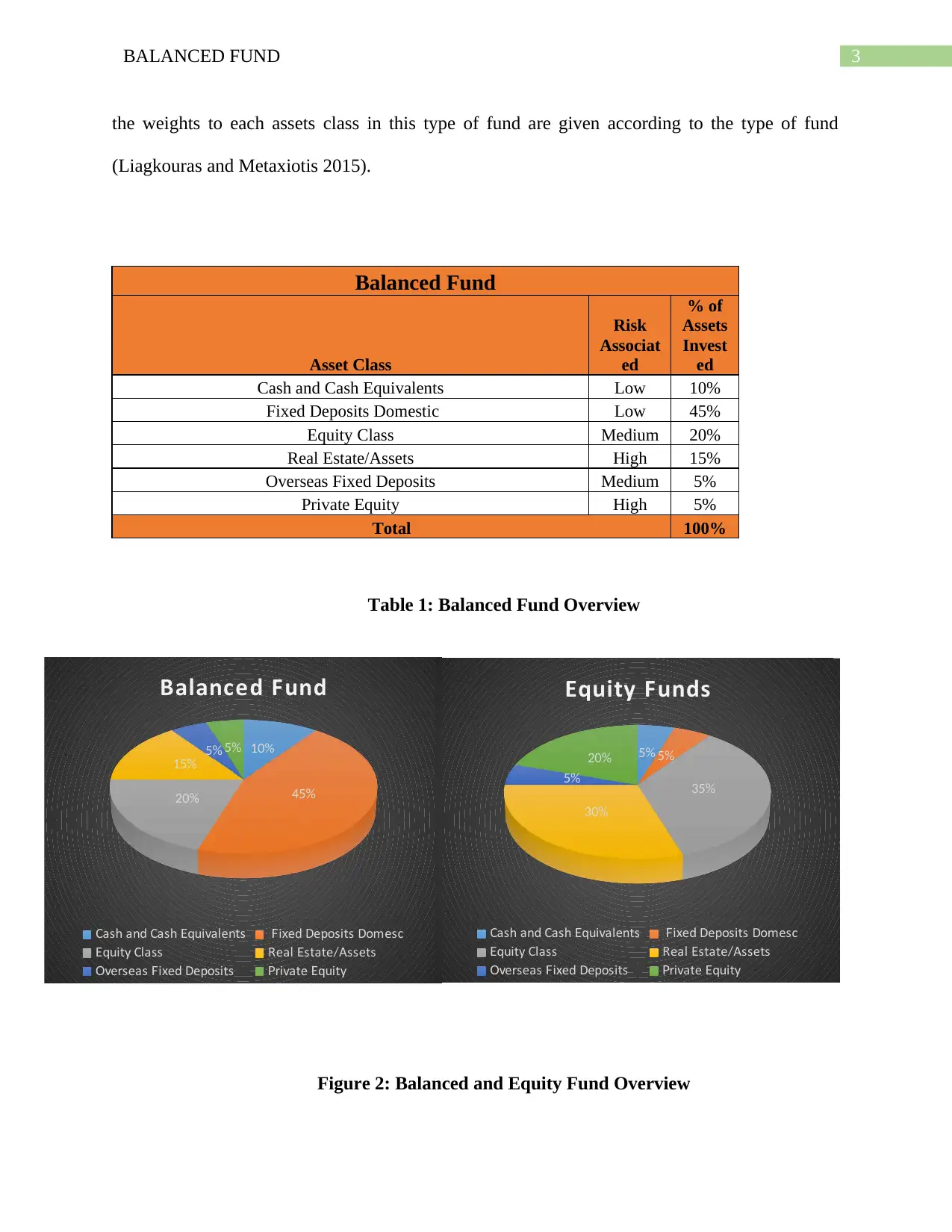

Cash and Cash investments are the short-term investments that is composed of investments in

treasury bills and short-term treasury bonds and commercial papers, the short-term investments

provide an edge to the fund in terms of cash requirement of the fund (He, Krishnamurthy and

Milbradt 2016). Such assets class meets the operating activities and the daily requirement of

small amount of redemption of funds. The empirical evidence for the same suggest that the

return on this type of assets class comprises of return from 1 month, 3 month, and 6 month of

treasury bills and bonds. The asset class has provided returns like 2.02% in one-month period,

while the return in three-month period was around 2.16% and returns in six-month trend period

was around 2.33%, while the return in one year treasury bonds and bills was around 2.56%

return (Bessembinder 2018).

Name Last 1M Returns 3M Returns 6M Returns 1Y Returns

Month reasury1- T 2.02% 1.96% 1.81% 1.71% 0.99%

Month reasury3- T 2.16% 2.07% 1.94% 1.76% 1.05%

Month reasury6- T 2.33% 2.24% 2.07% 1.94% 1.17%

ear reasury1-Y T 2.56% 2.45% 2.35% 2.05% 1.28%

ear reasury2-Y T 2.78% 2.63% 2.59% 2.26% 1.37%

ear reasury3-Y T 2.85% 2.70% 2.69% 2.41% 1.50%

ear reasury5-Y T 2.90% 2.75% 2.81% 2.61% 1.79%

ear reasury7-Y T 2.96% 2.82% 2.90% 2.75% 2.01%

ear reasury10-Y T 2.99% 2.87% 2.94% 2.81% 2.20%

Month reasury1- T Month reasury3- T Month reasury6- T ear reasury1-Y T

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

Interest Rate Analysis

astL M Returns1 M Returns3

M Returns6 Returns1Y

Cash and Cash investments are the short-term investments that is composed of investments in

treasury bills and short-term treasury bonds and commercial papers, the short-term investments

provide an edge to the fund in terms of cash requirement of the fund (He, Krishnamurthy and

Milbradt 2016). Such assets class meets the operating activities and the daily requirement of

small amount of redemption of funds. The empirical evidence for the same suggest that the

return on this type of assets class comprises of return from 1 month, 3 month, and 6 month of

treasury bills and bonds. The asset class has provided returns like 2.02% in one-month period,

while the return in three-month period was around 2.16% and returns in six-month trend period

was around 2.33%, while the return in one year treasury bonds and bills was around 2.56%

return (Bessembinder 2018).

Name Last 1M Returns 3M Returns 6M Returns 1Y Returns

Month reasury1- T 2.02% 1.96% 1.81% 1.71% 0.99%

Month reasury3- T 2.16% 2.07% 1.94% 1.76% 1.05%

Month reasury6- T 2.33% 2.24% 2.07% 1.94% 1.17%

ear reasury1-Y T 2.56% 2.45% 2.35% 2.05% 1.28%

ear reasury2-Y T 2.78% 2.63% 2.59% 2.26% 1.37%

ear reasury3-Y T 2.85% 2.70% 2.69% 2.41% 1.50%

ear reasury5-Y T 2.90% 2.75% 2.81% 2.61% 1.79%

ear reasury7-Y T 2.96% 2.82% 2.90% 2.75% 2.01%

ear reasury10-Y T 2.99% 2.87% 2.94% 2.81% 2.20%

Month reasury1- T Month reasury3- T Month reasury6- T ear reasury1-Y T

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

Interest Rate Analysis

astL M Returns1 M Returns3

M Returns6 Returns1Y

5BALANCED FUND

Figure 3: Interest Rate Analysis

(Source: Reserve Bank of Australia 2018)

Figure 3: Interest Rate Analysis

(Source: Reserve Bank of Australia 2018)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6BALANCED FUND

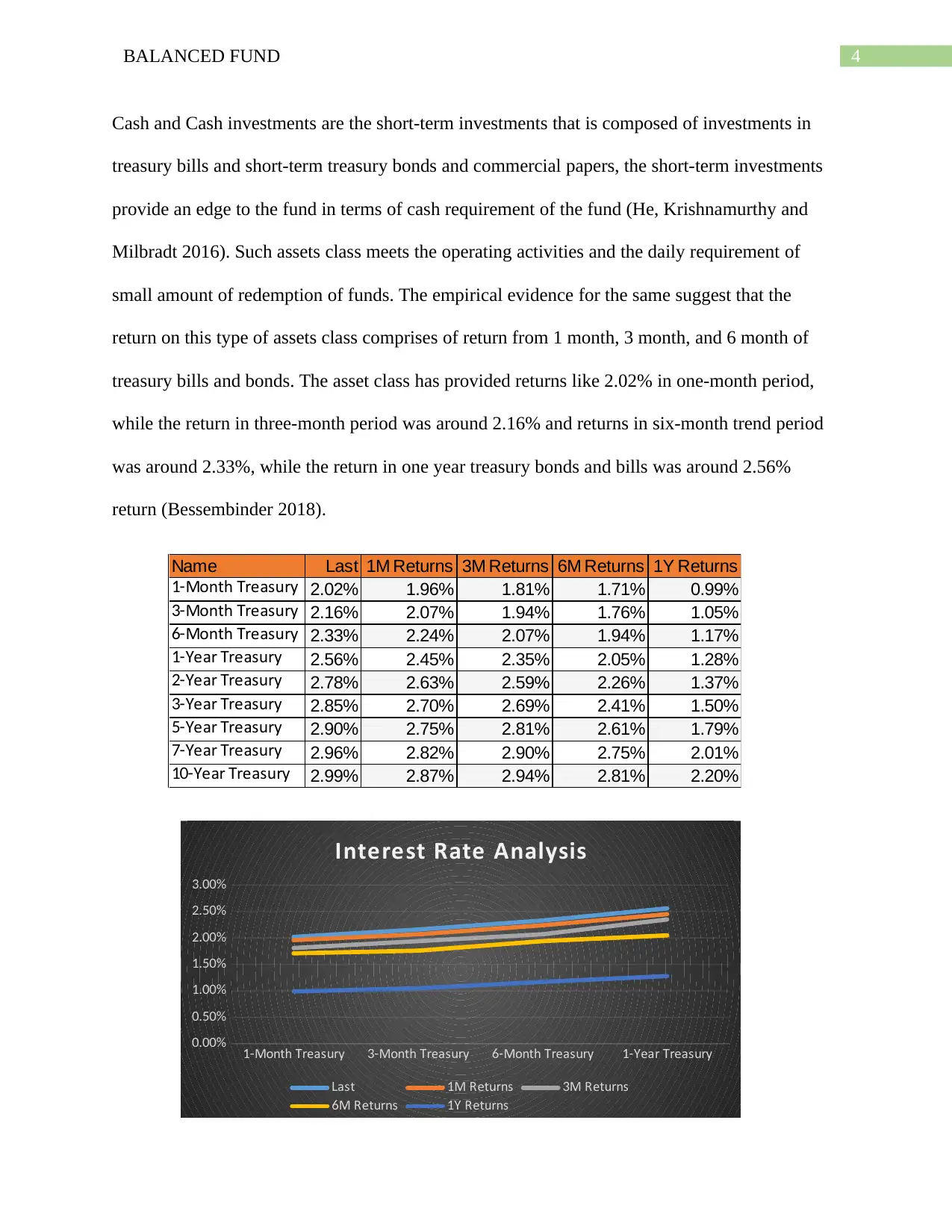

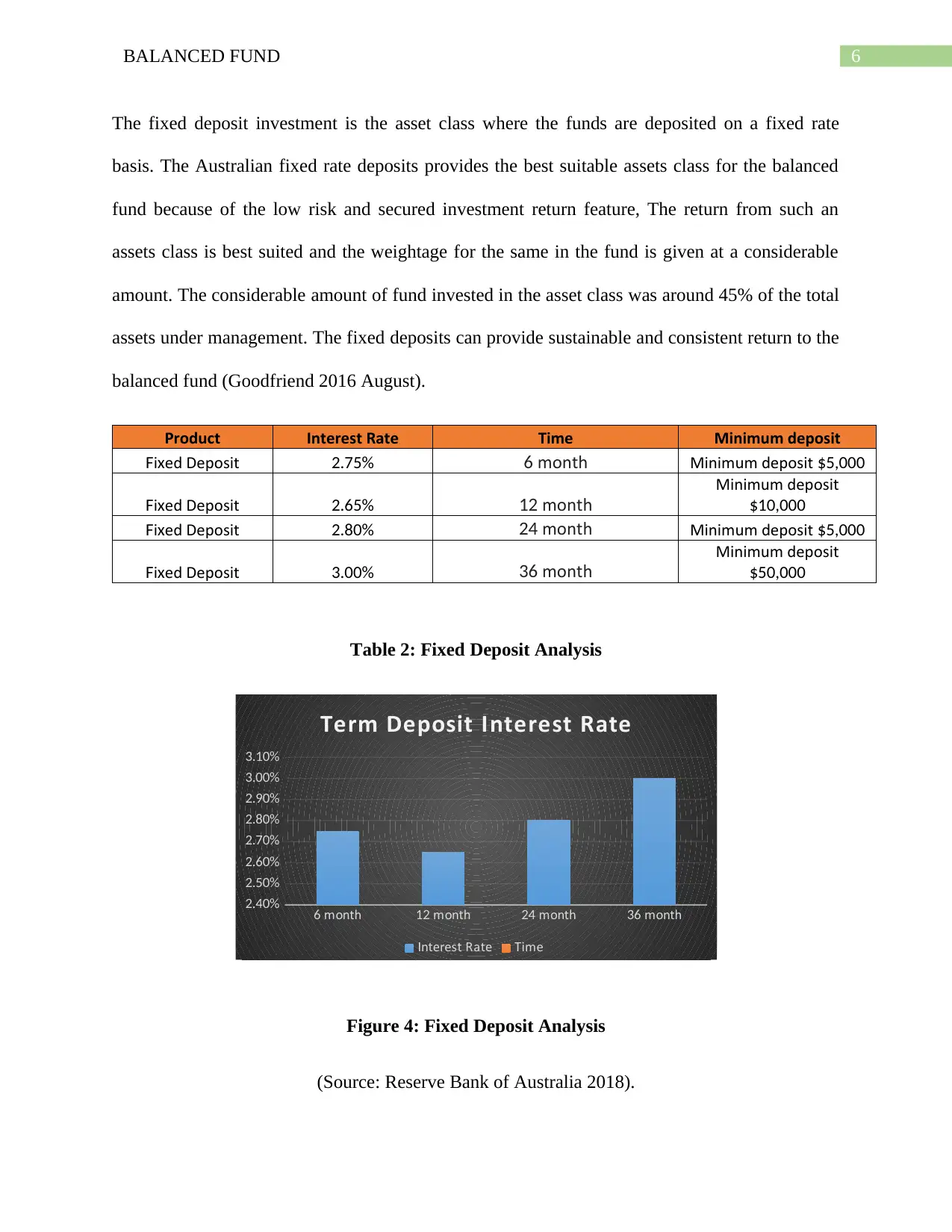

The fixed deposit investment is the asset class where the funds are deposited on a fixed rate

basis. The Australian fixed rate deposits provides the best suitable assets class for the balanced

fund because of the low risk and secured investment return feature, The return from such an

assets class is best suited and the weightage for the same in the fund is given at a considerable

amount. The considerable amount of fund invested in the asset class was around 45% of the total

assets under management. The fixed deposits can provide sustainable and consistent return to the

balanced fund (Goodfriend 2016 August).

Product Interest Rate Time Minimum deposit

i ed DepositF x 2.75% month6 Minimum deposit $5,000

i ed DepositF x 2.65% month12

Minimum deposit

$10,000

i ed DepositF x 2.80% month24 Minimum deposit $5,000

i ed DepositF x 3.00% month36

Minimum deposit

$50,000

Table 2: Fixed Deposit Analysis

Figure 4: Fixed Deposit Analysis

(Source: Reserve Bank of Australia 2018).

month6 month12 month24 month36

2.40%

2.50%

2.60%

2.70%

2.80%

2.90%

3.00%

3.10%

Term Deposit Interest Rate

nterest RateI imeT

The fixed deposit investment is the asset class where the funds are deposited on a fixed rate

basis. The Australian fixed rate deposits provides the best suitable assets class for the balanced

fund because of the low risk and secured investment return feature, The return from such an

assets class is best suited and the weightage for the same in the fund is given at a considerable

amount. The considerable amount of fund invested in the asset class was around 45% of the total

assets under management. The fixed deposits can provide sustainable and consistent return to the

balanced fund (Goodfriend 2016 August).

Product Interest Rate Time Minimum deposit

i ed DepositF x 2.75% month6 Minimum deposit $5,000

i ed DepositF x 2.65% month12

Minimum deposit

$10,000

i ed DepositF x 2.80% month24 Minimum deposit $5,000

i ed DepositF x 3.00% month36

Minimum deposit

$50,000

Table 2: Fixed Deposit Analysis

Figure 4: Fixed Deposit Analysis

(Source: Reserve Bank of Australia 2018).

month6 month12 month24 month36

2.40%

2.50%

2.60%

2.70%

2.80%

2.90%

3.00%

3.10%

Term Deposit Interest Rate

nterest RateI imeT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7BALANCED FUND

8BALANCED FUND

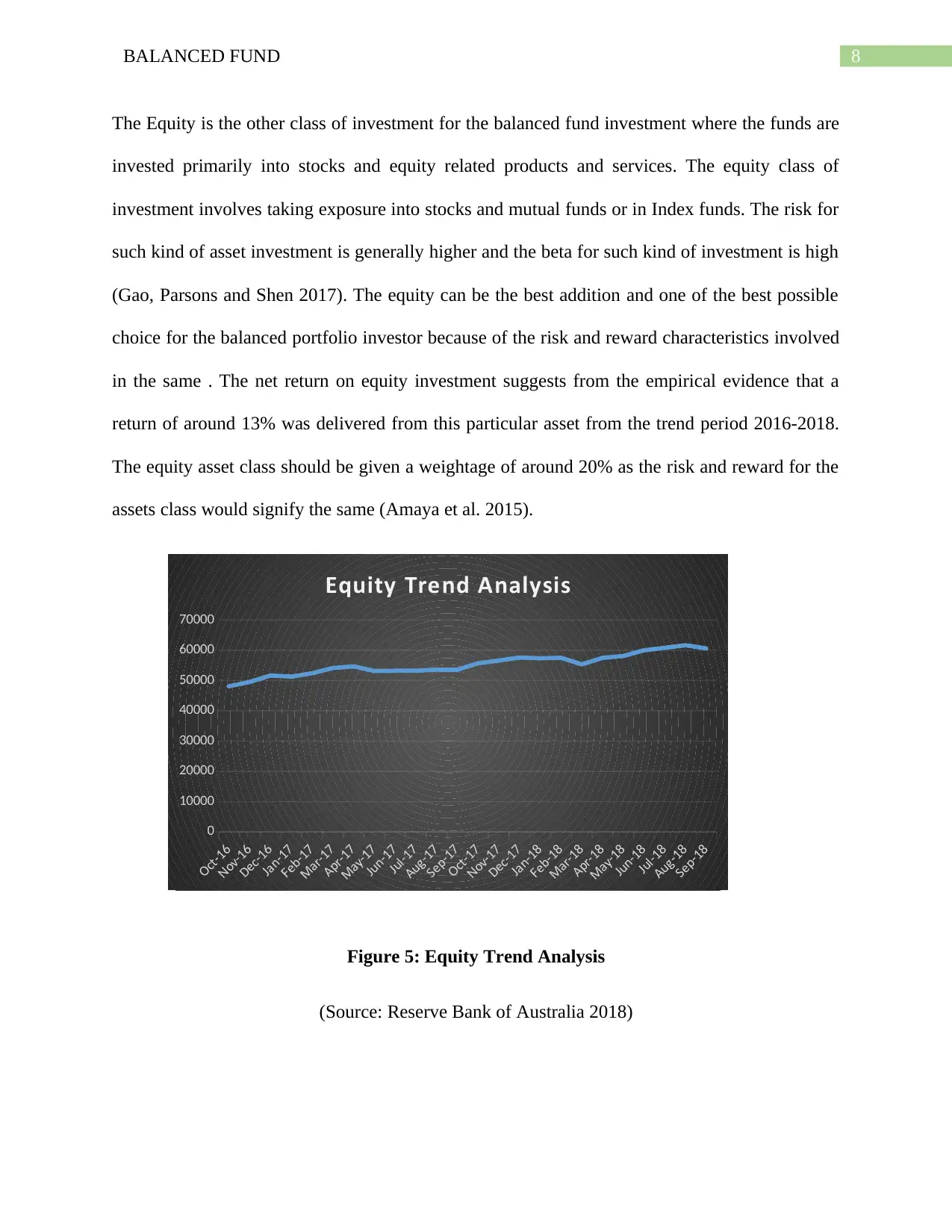

The Equity is the other class of investment for the balanced fund investment where the funds are

invested primarily into stocks and equity related products and services. The equity class of

investment involves taking exposure into stocks and mutual funds or in Index funds. The risk for

such kind of asset investment is generally higher and the beta for such kind of investment is high

(Gao, Parsons and Shen 2017). The equity can be the best addition and one of the best possible

choice for the balanced portfolio investor because of the risk and reward characteristics involved

in the same . The net return on equity investment suggests from the empirical evidence that a

return of around 13% was delivered from this particular asset from the trend period 2016-2018.

The equity asset class should be given a weightage of around 20% as the risk and reward for the

assets class would signify the same (Amaya et al. 2015).

Figure 5: Equity Trend Analysis

(Source: Reserve Bank of Australia 2018)

ctO -16

ovN -16

Dec-16

anJ -17

ebF -17

Mar-17

Apr-17

May-17

unJ -17

ulJ -17

Aug-17

Sep-17

ctO -17

ovN -17

Dec-17

anJ -18

ebF -18

Mar-18

Apr-18

May-18

unJ -18

ulJ -18

Aug-18

Sep-18

0

10000

20000

30000

40000

50000

60000

70000

Equity Trend Analysis

The Equity is the other class of investment for the balanced fund investment where the funds are

invested primarily into stocks and equity related products and services. The equity class of

investment involves taking exposure into stocks and mutual funds or in Index funds. The risk for

such kind of asset investment is generally higher and the beta for such kind of investment is high

(Gao, Parsons and Shen 2017). The equity can be the best addition and one of the best possible

choice for the balanced portfolio investor because of the risk and reward characteristics involved

in the same . The net return on equity investment suggests from the empirical evidence that a

return of around 13% was delivered from this particular asset from the trend period 2016-2018.

The equity asset class should be given a weightage of around 20% as the risk and reward for the

assets class would signify the same (Amaya et al. 2015).

Figure 5: Equity Trend Analysis

(Source: Reserve Bank of Australia 2018)

ctO -16

ovN -16

Dec-16

anJ -17

ebF -17

Mar-17

Apr-17

May-17

unJ -17

ulJ -17

Aug-17

Sep-17

ctO -17

ovN -17

Dec-17

anJ -18

ebF -18

Mar-18

Apr-18

May-18

unJ -18

ulJ -18

Aug-18

Sep-18

0

10000

20000

30000

40000

50000

60000

70000

Equity Trend Analysis

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9BALANCED FUND

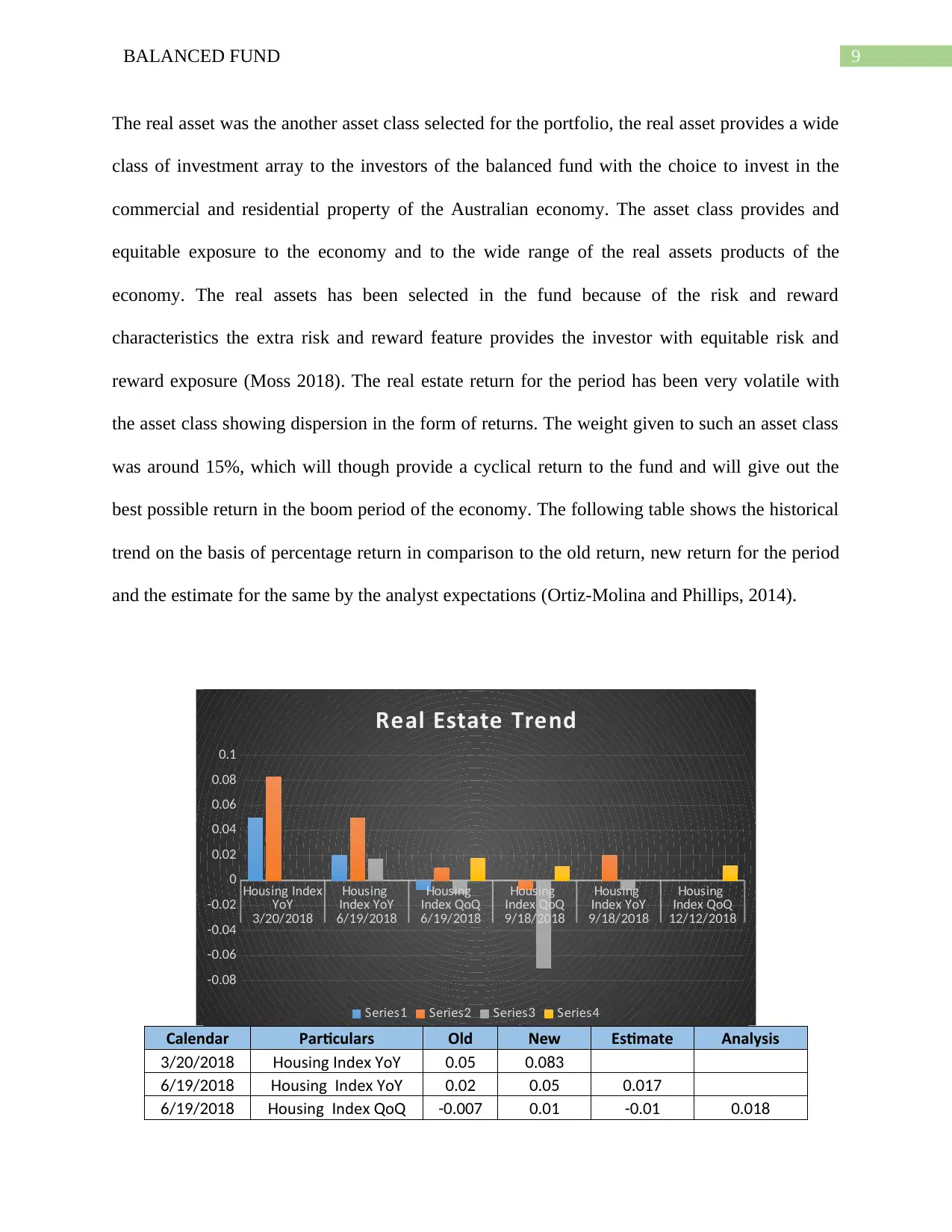

The real asset was the another asset class selected for the portfolio, the real asset provides a wide

class of investment array to the investors of the balanced fund with the choice to invest in the

commercial and residential property of the Australian economy. The asset class provides and

equitable exposure to the economy and to the wide range of the real assets products of the

economy. The real assets has been selected in the fund because of the risk and reward

characteristics the extra risk and reward feature provides the investor with equitable risk and

reward exposure (Moss 2018). The real estate return for the period has been very volatile with

the asset class showing dispersion in the form of returns. The weight given to such an asset class

was around 15%, which will though provide a cyclical return to the fund and will give out the

best possible return in the boom period of the economy. The following table shows the historical

trend on the basis of percentage return in comparison to the old return, new return for the period

and the estimate for the same by the analyst expectations (Ortiz-Molina and Phillips, 2014).

Calendar Particulars Old New Estimate Analysis

3/20/2018 ousing nde oH I x Y Y 0.05 0.083

6/19/2018 ousing nde oH I x Y Y 0.02 0.05 0.017

6/19/2018 ousing nde oH I x Q Q -0.007 0.01 -0.01 0.018

ousing ndeH I x

oY Y ousingH

nde oI x Y Y ousingH

nde oI x Q Q ousingH

nde oI x Q Q ousingH

nde oI x Y Y ousingH

nde oI x Q Q

3/20/2018 6/19/2018 6/19/2018 9/18/2018 9/18/2018 12/12/2018

-0.08

-0.06

-0.04

-0.02

0

0.02

0.04

0.06

0.08

0.1

Real Estate Trend

Series1 Series2 Series3 Series4

The real asset was the another asset class selected for the portfolio, the real asset provides a wide

class of investment array to the investors of the balanced fund with the choice to invest in the

commercial and residential property of the Australian economy. The asset class provides and

equitable exposure to the economy and to the wide range of the real assets products of the

economy. The real assets has been selected in the fund because of the risk and reward

characteristics the extra risk and reward feature provides the investor with equitable risk and

reward exposure (Moss 2018). The real estate return for the period has been very volatile with

the asset class showing dispersion in the form of returns. The weight given to such an asset class

was around 15%, which will though provide a cyclical return to the fund and will give out the

best possible return in the boom period of the economy. The following table shows the historical

trend on the basis of percentage return in comparison to the old return, new return for the period

and the estimate for the same by the analyst expectations (Ortiz-Molina and Phillips, 2014).

Calendar Particulars Old New Estimate Analysis

3/20/2018 ousing nde oH I x Y Y 0.05 0.083

6/19/2018 ousing nde oH I x Y Y 0.02 0.05 0.017

6/19/2018 ousing nde oH I x Q Q -0.007 0.01 -0.01 0.018

ousing ndeH I x

oY Y ousingH

nde oI x Y Y ousingH

nde oI x Q Q ousingH

nde oI x Q Q ousingH

nde oI x Y Y ousingH

nde oI x Q Q

3/20/2018 6/19/2018 6/19/2018 9/18/2018 9/18/2018 12/12/2018

-0.08

-0.06

-0.04

-0.02

0

0.02

0.04

0.06

0.08

0.1

Real Estate Trend

Series1 Series2 Series3 Series4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10BALANCED FUND

9/18/2018 ousing nde oH I x Q Q -0.007 -0.07 0.011

9/18/2018 ousing nde oH I x Y Y 0.02 -0.007

12/12/2018 ousing nde oH I x Q Q 0.012

Figure 6: Real Estate Trend

(Source: Reserve Bank of Australia 2018).

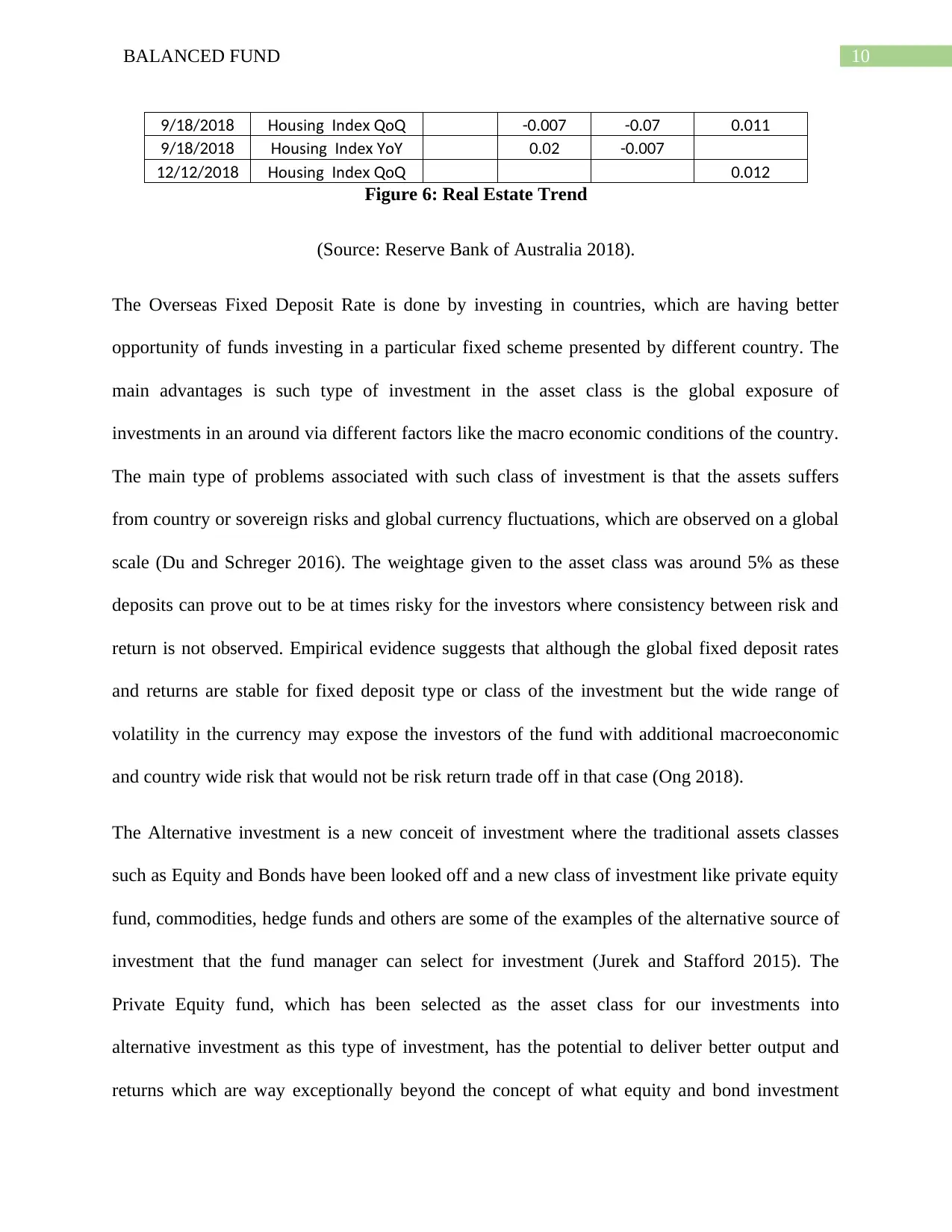

The Overseas Fixed Deposit Rate is done by investing in countries, which are having better

opportunity of funds investing in a particular fixed scheme presented by different country. The

main advantages is such type of investment in the asset class is the global exposure of

investments in an around via different factors like the macro economic conditions of the country.

The main type of problems associated with such class of investment is that the assets suffers

from country or sovereign risks and global currency fluctuations, which are observed on a global

scale (Du and Schreger 2016). The weightage given to the asset class was around 5% as these

deposits can prove out to be at times risky for the investors where consistency between risk and

return is not observed. Empirical evidence suggests that although the global fixed deposit rates

and returns are stable for fixed deposit type or class of the investment but the wide range of

volatility in the currency may expose the investors of the fund with additional macroeconomic

and country wide risk that would not be risk return trade off in that case (Ong 2018).

The Alternative investment is a new conceit of investment where the traditional assets classes

such as Equity and Bonds have been looked off and a new class of investment like private equity

fund, commodities, hedge funds and others are some of the examples of the alternative source of

investment that the fund manager can select for investment (Jurek and Stafford 2015). The

Private Equity fund, which has been selected as the asset class for our investments into

alternative investment as this type of investment, has the potential to deliver better output and

returns which are way exceptionally beyond the concept of what equity and bond investment

9/18/2018 ousing nde oH I x Q Q -0.007 -0.07 0.011

9/18/2018 ousing nde oH I x Y Y 0.02 -0.007

12/12/2018 ousing nde oH I x Q Q 0.012

Figure 6: Real Estate Trend

(Source: Reserve Bank of Australia 2018).

The Overseas Fixed Deposit Rate is done by investing in countries, which are having better

opportunity of funds investing in a particular fixed scheme presented by different country. The

main advantages is such type of investment in the asset class is the global exposure of

investments in an around via different factors like the macro economic conditions of the country.

The main type of problems associated with such class of investment is that the assets suffers

from country or sovereign risks and global currency fluctuations, which are observed on a global

scale (Du and Schreger 2016). The weightage given to the asset class was around 5% as these

deposits can prove out to be at times risky for the investors where consistency between risk and

return is not observed. Empirical evidence suggests that although the global fixed deposit rates

and returns are stable for fixed deposit type or class of the investment but the wide range of

volatility in the currency may expose the investors of the fund with additional macroeconomic

and country wide risk that would not be risk return trade off in that case (Ong 2018).

The Alternative investment is a new conceit of investment where the traditional assets classes

such as Equity and Bonds have been looked off and a new class of investment like private equity

fund, commodities, hedge funds and others are some of the examples of the alternative source of

investment that the fund manager can select for investment (Jurek and Stafford 2015). The

Private Equity fund, which has been selected as the asset class for our investments into

alternative investment as this type of investment, has the potential to deliver better output and

returns which are way exceptionally beyond the concept of what equity and bond investment

11BALANCED FUND

could fetch. The empirical evidence for the same suggests that these type of funds often provide

highly volatile returns as the nature of investments are into startups and new capital ventures

where risk is high (Platanakis, Sakkas and Sutcliffe 2018).

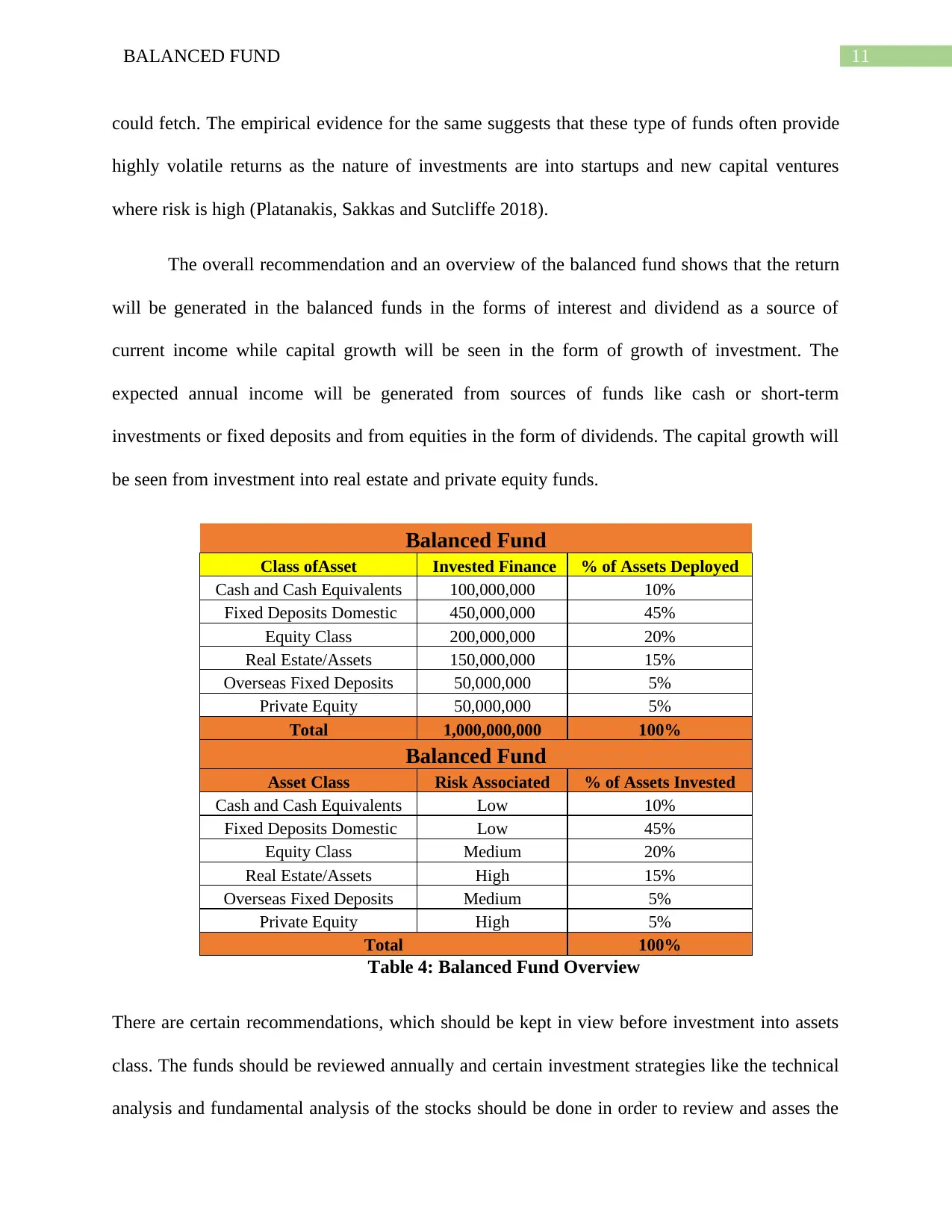

The overall recommendation and an overview of the balanced fund shows that the return

will be generated in the balanced funds in the forms of interest and dividend as a source of

current income while capital growth will be seen in the form of growth of investment. The

expected annual income will be generated from sources of funds like cash or short-term

investments or fixed deposits and from equities in the form of dividends. The capital growth will

be seen from investment into real estate and private equity funds.

Balanced Fund

Class ofAsset Invested Finance % of Assets Deployed

Cash and Cash Equivalents 100,000,000 10%

Fixed Deposits Domestic 450,000,000 45%

Equity Class 200,000,000 20%

Real Estate/Assets 150,000,000 15%

Overseas Fixed Deposits 50,000,000 5%

Private Equity 50,000,000 5%

Total 1,000,000,000 100%

Balanced Fund

Asset Class Risk Associated % of Assets Invested

Cash and Cash Equivalents Low 10%

Fixed Deposits Domestic Low 45%

Equity Class Medium 20%

Real Estate/Assets High 15%

Overseas Fixed Deposits Medium 5%

Private Equity High 5%

Total 100%

Table 4: Balanced Fund Overview

There are certain recommendations, which should be kept in view before investment into assets

class. The funds should be reviewed annually and certain investment strategies like the technical

analysis and fundamental analysis of the stocks should be done in order to review and asses the

could fetch. The empirical evidence for the same suggests that these type of funds often provide

highly volatile returns as the nature of investments are into startups and new capital ventures

where risk is high (Platanakis, Sakkas and Sutcliffe 2018).

The overall recommendation and an overview of the balanced fund shows that the return

will be generated in the balanced funds in the forms of interest and dividend as a source of

current income while capital growth will be seen in the form of growth of investment. The

expected annual income will be generated from sources of funds like cash or short-term

investments or fixed deposits and from equities in the form of dividends. The capital growth will

be seen from investment into real estate and private equity funds.

Balanced Fund

Class ofAsset Invested Finance % of Assets Deployed

Cash and Cash Equivalents 100,000,000 10%

Fixed Deposits Domestic 450,000,000 45%

Equity Class 200,000,000 20%

Real Estate/Assets 150,000,000 15%

Overseas Fixed Deposits 50,000,000 5%

Private Equity 50,000,000 5%

Total 1,000,000,000 100%

Balanced Fund

Asset Class Risk Associated % of Assets Invested

Cash and Cash Equivalents Low 10%

Fixed Deposits Domestic Low 45%

Equity Class Medium 20%

Real Estate/Assets High 15%

Overseas Fixed Deposits Medium 5%

Private Equity High 5%

Total 100%

Table 4: Balanced Fund Overview

There are certain recommendations, which should be kept in view before investment into assets

class. The funds should be reviewed annually and certain investment strategies like the technical

analysis and fundamental analysis of the stocks should be done in order to review and asses the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.