Basel III Impact on RBS Risk Management - Salford University

VerifiedAdded on 2023/04/20

|16

|3967

|380

Report

AI Summary

This report evaluates the risk management strategies of the Royal Bank of Scotland (RBS) since 2005, focusing on the impact of Basel III guidelines. It identifies various risks faced by RBS, including capital development, operational, credit, and reputational risks, and assesses the bank's efforts to manage them. The report also explains the regulatory relationship and its influence on RBS's risk management, highlighting the importance of corporate governance and compliance with regulations. A critical analysis of Basel III's impact on the bank's risk management capabilities is provided, emphasizing improvements in capital quality and liquidity management. The document is available on Desklib, a platform offering study tools and solved assignments for students.

Running head: BANK RISK MANAGEMENT AND BASEL III

Bank risk management and Basel III

Name of the Student

Name of the University

Author Note

Bank risk management and Basel III

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BANK RISK MANAGEMENT AND BASEL III

Table of Contents

Introduction:...............................................................................................................................3

Discussion:.................................................................................................................................3

Different types of risks managed by bank:............................................................................3

Evaluation of whether the risks have been sufficiently managed since 2005:.......................5

Explanation of regulatory relationship and its influence on the risks management of bank: 6

Analyzing the impact of guidelines of Basel III on the risk management of bank:...............8

Conclusion:..............................................................................................................................12

References list:.........................................................................................................................12

Table of Contents

Introduction:...............................................................................................................................3

Discussion:.................................................................................................................................3

Different types of risks managed by bank:............................................................................3

Evaluation of whether the risks have been sufficiently managed since 2005:.......................5

Explanation of regulatory relationship and its influence on the risks management of bank: 6

Analyzing the impact of guidelines of Basel III on the risk management of bank:...............8

Conclusion:..............................................................................................................................12

References list:.........................................................................................................................12

BANK RISK MANAGEMENT AND BASEL III

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BANK RISK MANAGEMENT AND BASEL III

Introduction:

The report is prepared for evaluating the different types of risk that is managed by the

specific banks of Europe and how such risks have been managed since 2005. For this

purpose, one of the specific banks of Europe has been selected and evaluation of the risk

management has been demonstrated as well. The selected European bank is Royal Bank of

Scotland (RBS) which is the large international financial service and banking company.

Customers are provided with the financial products and services throughout the United

Kingdom and beyond and they are supported by providing access to international market in

Asia, Europe, Middle East and North America. Later part of the report also evaluates the

impact of regulatory relationship of the risk management system of bank. Furthermore,

critical analysis in reference to both micro and macro prudential regulation and policy has

been done by evaluating the impact of Basel III guidelines on the banks risk management.

Discussion:

Different types of risks managed by bank:

The external political, economic and regulatory environment of RBS faces a range of

uncertainties and significant risks which they have to deal with. There is continuous progress

on part of bank in reducing the risks faced by them and strengthening its position of capital.

Risks faced by RBS can be categorized into capital development risk, emerging risk

scenarios, reputational and litigation risk, external and other macroeconomic risk and risks

related to operations of RBS (Billings 2016).

Capital development risks- The capital position of bank is strengthened and risk is

reduced on part of good progress made by bank. Establishment of risk reduction measures

helped the bank in removing the risks associated with their balance sheet so that the volatile

Introduction:

The report is prepared for evaluating the different types of risk that is managed by the

specific banks of Europe and how such risks have been managed since 2005. For this

purpose, one of the specific banks of Europe has been selected and evaluation of the risk

management has been demonstrated as well. The selected European bank is Royal Bank of

Scotland (RBS) which is the large international financial service and banking company.

Customers are provided with the financial products and services throughout the United

Kingdom and beyond and they are supported by providing access to international market in

Asia, Europe, Middle East and North America. Later part of the report also evaluates the

impact of regulatory relationship of the risk management system of bank. Furthermore,

critical analysis in reference to both micro and macro prudential regulation and policy has

been done by evaluating the impact of Basel III guidelines on the banks risk management.

Discussion:

Different types of risks managed by bank:

The external political, economic and regulatory environment of RBS faces a range of

uncertainties and significant risks which they have to deal with. There is continuous progress

on part of bank in reducing the risks faced by them and strengthening its position of capital.

Risks faced by RBS can be categorized into capital development risk, emerging risk

scenarios, reputational and litigation risk, external and other macroeconomic risk and risks

related to operations of RBS (Billings 2016).

Capital development risks- The capital position of bank is strengthened and risk is

reduced on part of good progress made by bank. Establishment of risk reduction measures

helped the bank in removing the risks associated with their balance sheet so that the volatile

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BANK RISK MANAGEMENT AND BASEL III

outcomes are reduced and released of capital is accelerated. However, under the adverse

stress scenarios and despite of the adoption of risk measures, the capital position of bank was

in threshold.

Other developmental risks- Such risks include the following and they are listed below

Operational risk- Management of operational risks faced by bank has been done by

implementation of a new functioning operational model and adopting a consistent

approach (Bianchi et al. 2018).

Credit risk- Continuous efforts was made by RBS in the euro zone periphery countries

and commercial real estate.

Litigation, regulatory and reputational risk- The costs related to litigation has

exceeded £ 9 billion since year 2011 and a considerable amount of management

attention is required to deal with such risks.

Country risk- The debt levels of RBS has been on continuous reduction due to the

client’s effort and maintenance of continuous stance by bank. This resulted in

reduction of exposure of net balance sheet of periphery zone.

Pension risk- The value of assets is lower than the value of liabilities in the main

scheme of funding violation. Elimination of such deficit by bank has been done by

making additional contribution (Investors.rbs.com 2019).

Market risk- There was significant reduction in the traded market risk profile of RBS

with reduction in risk limit of market across all the business.

Some of the emerging risky scenarios are attributable to the following and they are as

follows:

Political risk- The regulatory, fiscal, monetary landscape of bank and its operating

employment environment could be significantly impacted by general election of UK.

outcomes are reduced and released of capital is accelerated. However, under the adverse

stress scenarios and despite of the adoption of risk measures, the capital position of bank was

in threshold.

Other developmental risks- Such risks include the following and they are listed below

Operational risk- Management of operational risks faced by bank has been done by

implementation of a new functioning operational model and adopting a consistent

approach (Bianchi et al. 2018).

Credit risk- Continuous efforts was made by RBS in the euro zone periphery countries

and commercial real estate.

Litigation, regulatory and reputational risk- The costs related to litigation has

exceeded £ 9 billion since year 2011 and a considerable amount of management

attention is required to deal with such risks.

Country risk- The debt levels of RBS has been on continuous reduction due to the

client’s effort and maintenance of continuous stance by bank. This resulted in

reduction of exposure of net balance sheet of periphery zone.

Pension risk- The value of assets is lower than the value of liabilities in the main

scheme of funding violation. Elimination of such deficit by bank has been done by

making additional contribution (Investors.rbs.com 2019).

Market risk- There was significant reduction in the traded market risk profile of RBS

with reduction in risk limit of market across all the business.

Some of the emerging risky scenarios are attributable to the following and they are as

follows:

Political risk- The regulatory, fiscal, monetary landscape of bank and its operating

employment environment could be significantly impacted by general election of UK.

BANK RISK MANAGEMENT AND BASEL III

Macroeconomic risk- The macroeconomic risks associated with the bank is mitigated

by strengthening of liquidity, capital and leverage ratios and by way of exiting some

capital intensive and higher risk portfolios (Flannery and Giacomini 2015).

Some of the risks related to operations of business of RBS are as follows:

Information technology system failure- The resilience of such system has been

improved by a major investment program with an improvement in the sustainability of

back system.

Cyber attacks impact- Bank has put in place a large scale program for improving the

access control of users. Management has tightened the number of external websites

and has strengthened the protections of antivirus (Business.rbs.co.uk 2019).

Failure in successfully execution of major projects- Work is in progress for

implementation of change that is in line with the project plan that helps in assessing

risks associated with implementation.

Some of the litigation and reputational risks managed by bank are:

Past business conduct impact- A comprehensive and strong compliance and risk

culture is intended to be embedded by embarking on program that would help in

managing the past conduct of business.

Risks associated with business model, costs and income- The financial and strategic

plans take into account the implications of potential and proposed regulatory

requirements (Ertürk 2016).

Evaluation of whether the risks have been sufficiently managed since 2005:

RBS has been classified as a major bank with a significant increase in share of

market. Although, in recent years, many new programs have been implemented by RBS to

manage the risks on a sustainable basis, it failed in successfully managing the risks that led to

Macroeconomic risk- The macroeconomic risks associated with the bank is mitigated

by strengthening of liquidity, capital and leverage ratios and by way of exiting some

capital intensive and higher risk portfolios (Flannery and Giacomini 2015).

Some of the risks related to operations of business of RBS are as follows:

Information technology system failure- The resilience of such system has been

improved by a major investment program with an improvement in the sustainability of

back system.

Cyber attacks impact- Bank has put in place a large scale program for improving the

access control of users. Management has tightened the number of external websites

and has strengthened the protections of antivirus (Business.rbs.co.uk 2019).

Failure in successfully execution of major projects- Work is in progress for

implementation of change that is in line with the project plan that helps in assessing

risks associated with implementation.

Some of the litigation and reputational risks managed by bank are:

Past business conduct impact- A comprehensive and strong compliance and risk

culture is intended to be embedded by embarking on program that would help in

managing the past conduct of business.

Risks associated with business model, costs and income- The financial and strategic

plans take into account the implications of potential and proposed regulatory

requirements (Ertürk 2016).

Evaluation of whether the risks have been sufficiently managed since 2005:

RBS has been classified as a major bank with a significant increase in share of

market. Although, in recent years, many new programs have been implemented by RBS to

manage the risks on a sustainable basis, it failed in successfully managing the risks that led to

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BANK RISK MANAGEMENT AND BASEL III

its collapse. Bank in the aftermath of financial crisis 2007-2009 was highly exposed to the

liquidity risk and degree of leverage along with exposure to highly risky mortgage backed

financial products. After the crisis, bank well positioned themselves to make repayment to

debtors and has a very strong leverage movement. However, with the passing of time, there

was sufficient development of programs that focused managing different types of risks faced

by bank. RBS took continuous efforts in strengthening capital position and risk reduction

(Mckinsey.com 2019).

Explanation of regulatory relationship and its influence on the risks management of

bank:

In the European context, banking regulation is the issuance and formulation of

specific rules by authorized agencies under governing law for structure and conduct in

banking. The stability of the global financial system has been enhanced by banking sector

regulation since the financial crisis. Decisions of the banks are significantly impacted by any

change brought in by new regulations. Regulation is considered as the external force in the

optimization process of capital as it helps the bank to comply with the minimum capital ratio

by simultaneously setting the amount of risky assets and the level of capital. The risk and

capital decisions o bank is effectively influenced by the regulation. However, the

effectiveness of banking regulation being dependent upon several factors such as type of

capital country and economic cycle. The conduct and regulatory risks faced by bank can be

successfully mitigated by effective change management and early identification.

The regulatory requirements is associated with generation of risks related to costs,

income and business model and it is further exposed to increased regulatory capital

requirements and new regulation risks affecting its business model. The key elements of

corporate governance help in controlling the oversight and control for effective risk

management along with complying with the regulations. Since the business of the group are

its collapse. Bank in the aftermath of financial crisis 2007-2009 was highly exposed to the

liquidity risk and degree of leverage along with exposure to highly risky mortgage backed

financial products. After the crisis, bank well positioned themselves to make repayment to

debtors and has a very strong leverage movement. However, with the passing of time, there

was sufficient development of programs that focused managing different types of risks faced

by bank. RBS took continuous efforts in strengthening capital position and risk reduction

(Mckinsey.com 2019).

Explanation of regulatory relationship and its influence on the risks management of

bank:

In the European context, banking regulation is the issuance and formulation of

specific rules by authorized agencies under governing law for structure and conduct in

banking. The stability of the global financial system has been enhanced by banking sector

regulation since the financial crisis. Decisions of the banks are significantly impacted by any

change brought in by new regulations. Regulation is considered as the external force in the

optimization process of capital as it helps the bank to comply with the minimum capital ratio

by simultaneously setting the amount of risky assets and the level of capital. The risk and

capital decisions o bank is effectively influenced by the regulation. However, the

effectiveness of banking regulation being dependent upon several factors such as type of

capital country and economic cycle. The conduct and regulatory risks faced by bank can be

successfully mitigated by effective change management and early identification.

The regulatory requirements is associated with generation of risks related to costs,

income and business model and it is further exposed to increased regulatory capital

requirements and new regulation risks affecting its business model. The key elements of

corporate governance help in controlling the oversight and control for effective risk

management along with complying with the regulations. Since the business of the group are

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BANK RISK MANAGEMENT AND BASEL III

subjected to oversight and substantial regulations and such regulatory developments are

likely to increase the risks and its compliance and conduct.

The operation of bank is dependent upon the ability to accurately and efficiently deal

with transactions by effectively complying with the applicable regulations and rules.

Historical compliance of RBS with the applicable regulation and rules is being discussed for

conducting review of its procedures and policies. The European banking authority covered a

number of important areas in a banking organization such as risk management and internal

governance. For dealing with the credit risk, RBS has adopted an advanced and standardized

approach for calculating risk weighted assets to which the application of capital charges has

been done. For tackling with the market risk, regulation requires to adopt a building block

approach under which the capital is held against different risks such as commodities risk,

counterparty risk, position risk and large exposure risk. Furthermore, a leverage framework

ratio is implemented by prudential regulation authority that helps in addressing excessive

leverage for the firms providing critical services. All the PRA regulated banks need to apply

the prescribed leverage ratio and maintaining a minimum of 3% (Yushko 2016). Any further

amount of common equity Tier 1 capital which is greater than countercyclical ratio should be

reported. All such facts and figures are reported by RBS in its annual report along with

stating the fact that they have complied with the regulations or not. A variety of model is used

by RBS group as a part of activities and process of risk management. The assessment of risks

in various facets is supported by using output model. For assessing the prospects of risks

whether they are appropriate or not, bank conduct qualitative review including the risky

portfolios quality, adherence to risk appetite and policy compliance. Any emerging risks can

be identified in early stage by testing the exposure of bank to market risk and credit portfolio

(Langfield and Pagano 2016). Moreover, the group is involved in targeted work so that they

meet with the regulatory requirements.

subjected to oversight and substantial regulations and such regulatory developments are

likely to increase the risks and its compliance and conduct.

The operation of bank is dependent upon the ability to accurately and efficiently deal

with transactions by effectively complying with the applicable regulations and rules.

Historical compliance of RBS with the applicable regulation and rules is being discussed for

conducting review of its procedures and policies. The European banking authority covered a

number of important areas in a banking organization such as risk management and internal

governance. For dealing with the credit risk, RBS has adopted an advanced and standardized

approach for calculating risk weighted assets to which the application of capital charges has

been done. For tackling with the market risk, regulation requires to adopt a building block

approach under which the capital is held against different risks such as commodities risk,

counterparty risk, position risk and large exposure risk. Furthermore, a leverage framework

ratio is implemented by prudential regulation authority that helps in addressing excessive

leverage for the firms providing critical services. All the PRA regulated banks need to apply

the prescribed leverage ratio and maintaining a minimum of 3% (Yushko 2016). Any further

amount of common equity Tier 1 capital which is greater than countercyclical ratio should be

reported. All such facts and figures are reported by RBS in its annual report along with

stating the fact that they have complied with the regulations or not. A variety of model is used

by RBS group as a part of activities and process of risk management. The assessment of risks

in various facets is supported by using output model. For assessing the prospects of risks

whether they are appropriate or not, bank conduct qualitative review including the risky

portfolios quality, adherence to risk appetite and policy compliance. Any emerging risks can

be identified in early stage by testing the exposure of bank to market risk and credit portfolio

(Langfield and Pagano 2016). Moreover, the group is involved in targeted work so that they

meet with the regulatory requirements.

BANK RISK MANAGEMENT AND BASEL III

The risk management framework of RBS include three lines of defense out of which

one line relies on ensuring that the business culture of bank supports compliance with the

laws, policy and regulations and support the balanced risky decisions. Risks associated with

regulation and conducts are effectively managed by the early identification of change in

legislation. New regulation which the bank is required to comply with helps in managing

change to the requirements of capital that has the ultimate impact on the common equity tier

1 ratio alongside the strategy of de leveraging and reduction of risks (emeraldinsight.com

2019). Such strategy of risk management is achieved buy the group by way of making

transfers to interested parties and continued disposal and run off of assets that enables the

bank to focus on the productive returns generated on capital. Any failure to account for

changes in the regulations or laws can result in operational risk. The internal control system

and the risk management process of RBS have been designed to ensure that they are able to

obtain reasonable assurance in terms of complying with the regulations and laws (Jones and

Pollitt 2016).

One of the key elements of the regulatory relationship is that the companies in the

regulated sector should provide information in events of suspicions about provenance of

assets and funds. However, it is acknowledged that the business have tremendous regulatory

burden that is required to be reduced. Business should be refocused to concentrate their

resources in smartly deploying it to the greatest risky areas and adopting a risk based

approach to compliance and regulations (Cohen et al. 2016).

Analyzing the impact of guidelines of Basel III on the risk management of bank:

Basel accords are the set of rules on the regulations of banking concerning capital and

banks as per the guidelines of the Basel III are required to hold higher quality capital as

against traditionally computed risk weighted assets. It is so because such criteria help in

ensuring that there is n excess leverage and there is sufficient capital during stress. Greater

The risk management framework of RBS include three lines of defense out of which

one line relies on ensuring that the business culture of bank supports compliance with the

laws, policy and regulations and support the balanced risky decisions. Risks associated with

regulation and conducts are effectively managed by the early identification of change in

legislation. New regulation which the bank is required to comply with helps in managing

change to the requirements of capital that has the ultimate impact on the common equity tier

1 ratio alongside the strategy of de leveraging and reduction of risks (emeraldinsight.com

2019). Such strategy of risk management is achieved buy the group by way of making

transfers to interested parties and continued disposal and run off of assets that enables the

bank to focus on the productive returns generated on capital. Any failure to account for

changes in the regulations or laws can result in operational risk. The internal control system

and the risk management process of RBS have been designed to ensure that they are able to

obtain reasonable assurance in terms of complying with the regulations and laws (Jones and

Pollitt 2016).

One of the key elements of the regulatory relationship is that the companies in the

regulated sector should provide information in events of suspicions about provenance of

assets and funds. However, it is acknowledged that the business have tremendous regulatory

burden that is required to be reduced. Business should be refocused to concentrate their

resources in smartly deploying it to the greatest risky areas and adopting a risk based

approach to compliance and regulations (Cohen et al. 2016).

Analyzing the impact of guidelines of Basel III on the risk management of bank:

Basel accords are the set of rules on the regulations of banking concerning capital and

banks as per the guidelines of the Basel III are required to hold higher quality capital as

against traditionally computed risk weighted assets. It is so because such criteria help in

ensuring that there is n excess leverage and there is sufficient capital during stress. Greater

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BANK RISK MANAGEMENT AND BASEL III

flexibility was introduced by Basel III on part of banks when the risks associated with the

assets have to be determined (Black et al. 2016). The risk management capabilities of bank

has improved with the improvement in depth and quality of capital and focusing on liquidity

management. Introduction of the stressed value at risk under the new model will help in

bringing most of the changes in short term. RBS to identify the core driver of their market

risk and hedging them against the exposure to reduced stressed value at risk. Under the Basel

III guideline, banks are required to adopt a standardized approach for computing credit risk

and basic indicator approach for operational risk and for market risk, a standardized duration

method is used (Yan et al. 2016). The capital requirement of bank as per the guideline of

Basel III has been computed to be held at 10.75% for market, credit and operational risk.

Some of the important aspects of managing the risks of bank as per the Basel guideline is

well defined process, mechanism of robust risk approval and independent internal control

mechanism (Cabrera et al. 2017). All the key areas of risk such as market risk, operational

risk and credit risk and for the continuous and effective monitoring of risks, it is essential to

quantify these risks.

The framework of Basel III is based on three pillars which are listed below:

Pillar 1- The rules of minimum capital requirement is defined under this pillar and

such setting of limit helps in absorbing loss related to credit, operational and market risk.

Pillar 2- Bank under this pillar is required to undertake the risk assessment process

for assessing adequacy of internal capital.

Pillar 3- Under this, disclosure is published by individual banks that help market

participants in understanding the risk profiles (Laeven et al. 2016).

RBS has taken number of steps to improve the stress resilience of its capital position

along with reduction in certain credit portfolios, resolution of regulatory investigations and

flexibility was introduced by Basel III on part of banks when the risks associated with the

assets have to be determined (Black et al. 2016). The risk management capabilities of bank

has improved with the improvement in depth and quality of capital and focusing on liquidity

management. Introduction of the stressed value at risk under the new model will help in

bringing most of the changes in short term. RBS to identify the core driver of their market

risk and hedging them against the exposure to reduced stressed value at risk. Under the Basel

III guideline, banks are required to adopt a standardized approach for computing credit risk

and basic indicator approach for operational risk and for market risk, a standardized duration

method is used (Yan et al. 2016). The capital requirement of bank as per the guideline of

Basel III has been computed to be held at 10.75% for market, credit and operational risk.

Some of the important aspects of managing the risks of bank as per the Basel guideline is

well defined process, mechanism of robust risk approval and independent internal control

mechanism (Cabrera et al. 2017). All the key areas of risk such as market risk, operational

risk and credit risk and for the continuous and effective monitoring of risks, it is essential to

quantify these risks.

The framework of Basel III is based on three pillars which are listed below:

Pillar 1- The rules of minimum capital requirement is defined under this pillar and

such setting of limit helps in absorbing loss related to credit, operational and market risk.

Pillar 2- Bank under this pillar is required to undertake the risk assessment process

for assessing adequacy of internal capital.

Pillar 3- Under this, disclosure is published by individual banks that help market

participants in understanding the risk profiles (Laeven et al. 2016).

RBS has taken number of steps to improve the stress resilience of its capital position

along with reduction in certain credit portfolios, resolution of regulatory investigations and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BANK RISK MANAGEMENT AND BASEL III

various litigation cases. A revised capital plan was not requite to be submitted to the regulator

by bank in light of strengthening the capital position in year 2017 (Molyneux 2016).

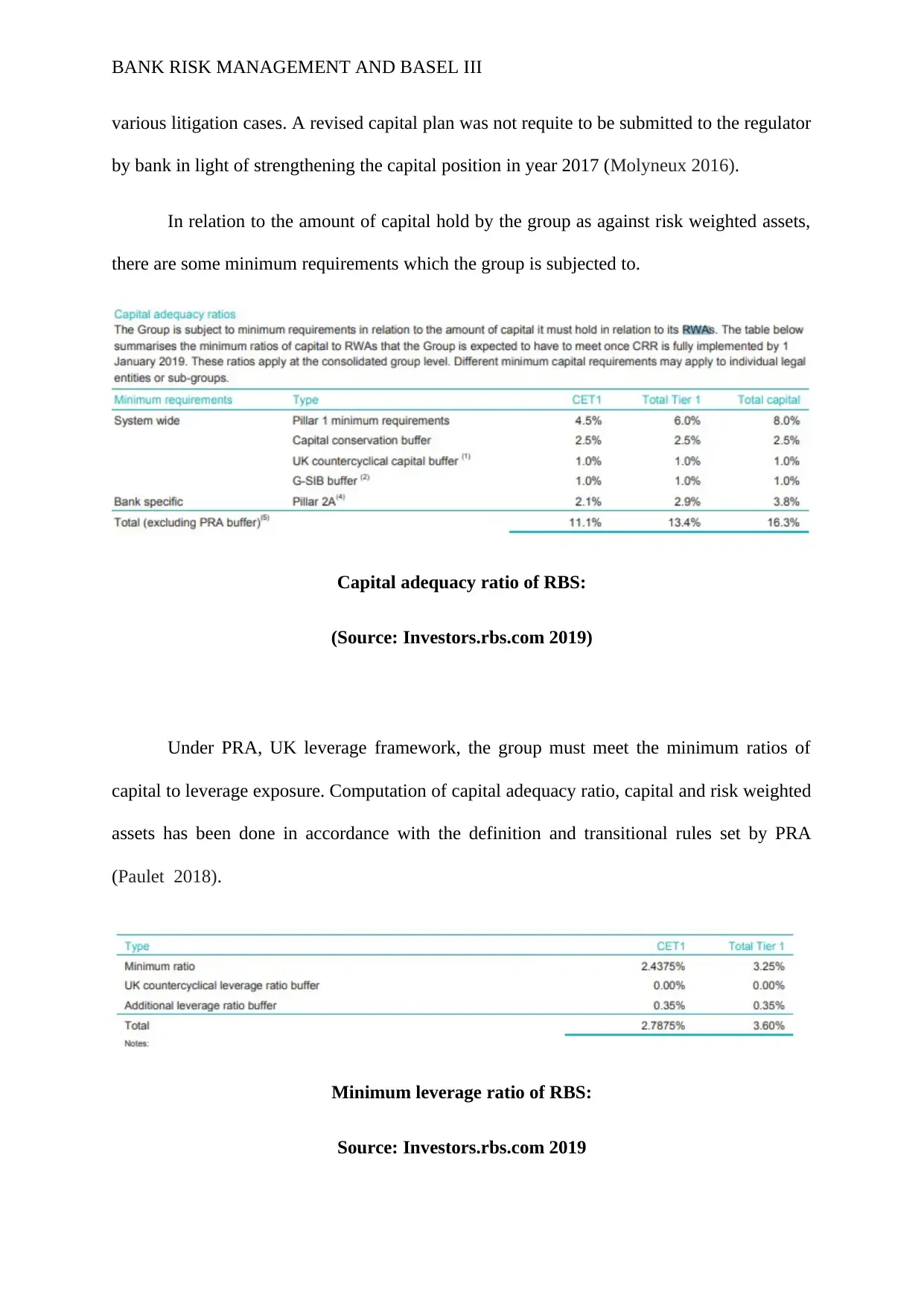

In relation to the amount of capital hold by the group as against risk weighted assets,

there are some minimum requirements which the group is subjected to.

Capital adequacy ratio of RBS:

(Source: Investors.rbs.com 2019)

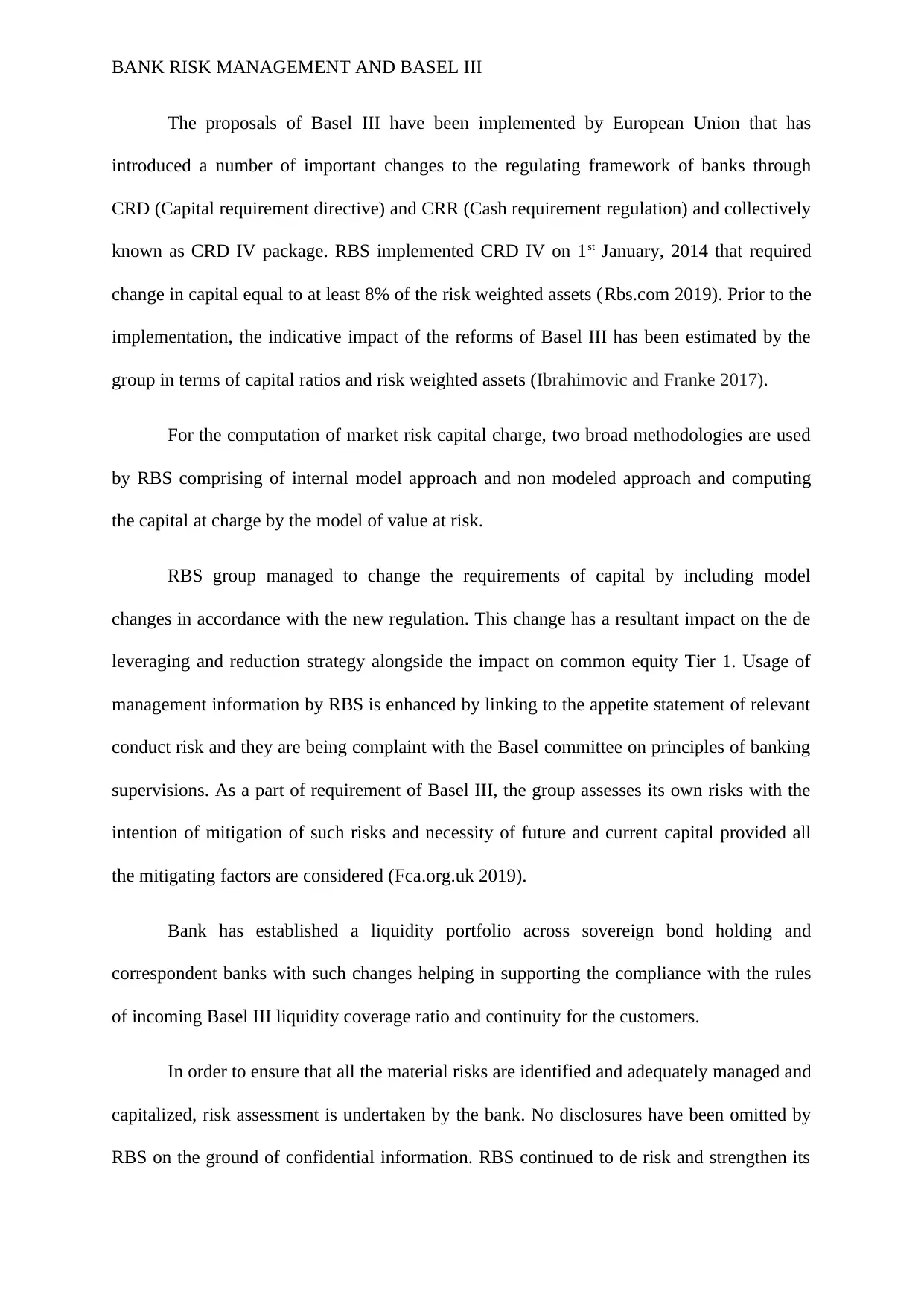

Under PRA, UK leverage framework, the group must meet the minimum ratios of

capital to leverage exposure. Computation of capital adequacy ratio, capital and risk weighted

assets has been done in accordance with the definition and transitional rules set by PRA

(Paulet 2018).

Minimum leverage ratio of RBS:

Source: Investors.rbs.com 2019

various litigation cases. A revised capital plan was not requite to be submitted to the regulator

by bank in light of strengthening the capital position in year 2017 (Molyneux 2016).

In relation to the amount of capital hold by the group as against risk weighted assets,

there are some minimum requirements which the group is subjected to.

Capital adequacy ratio of RBS:

(Source: Investors.rbs.com 2019)

Under PRA, UK leverage framework, the group must meet the minimum ratios of

capital to leverage exposure. Computation of capital adequacy ratio, capital and risk weighted

assets has been done in accordance with the definition and transitional rules set by PRA

(Paulet 2018).

Minimum leverage ratio of RBS:

Source: Investors.rbs.com 2019

BANK RISK MANAGEMENT AND BASEL III

The proposals of Basel III have been implemented by European Union that has

introduced a number of important changes to the regulating framework of banks through

CRD (Capital requirement directive) and CRR (Cash requirement regulation) and collectively

known as CRD IV package. RBS implemented CRD IV on 1st January, 2014 that required

change in capital equal to at least 8% of the risk weighted assets (Rbs.com 2019). Prior to the

implementation, the indicative impact of the reforms of Basel III has been estimated by the

group in terms of capital ratios and risk weighted assets (Ibrahimovic and Franke 2017).

For the computation of market risk capital charge, two broad methodologies are used

by RBS comprising of internal model approach and non modeled approach and computing

the capital at charge by the model of value at risk.

RBS group managed to change the requirements of capital by including model

changes in accordance with the new regulation. This change has a resultant impact on the de

leveraging and reduction strategy alongside the impact on common equity Tier 1. Usage of

management information by RBS is enhanced by linking to the appetite statement of relevant

conduct risk and they are being complaint with the Basel committee on principles of banking

supervisions. As a part of requirement of Basel III, the group assesses its own risks with the

intention of mitigation of such risks and necessity of future and current capital provided all

the mitigating factors are considered (Fca.org.uk 2019).

Bank has established a liquidity portfolio across sovereign bond holding and

correspondent banks with such changes helping in supporting the compliance with the rules

of incoming Basel III liquidity coverage ratio and continuity for the customers.

In order to ensure that all the material risks are identified and adequately managed and

capitalized, risk assessment is undertaken by the bank. No disclosures have been omitted by

RBS on the ground of confidential information. RBS continued to de risk and strengthen its

The proposals of Basel III have been implemented by European Union that has

introduced a number of important changes to the regulating framework of banks through

CRD (Capital requirement directive) and CRR (Cash requirement regulation) and collectively

known as CRD IV package. RBS implemented CRD IV on 1st January, 2014 that required

change in capital equal to at least 8% of the risk weighted assets (Rbs.com 2019). Prior to the

implementation, the indicative impact of the reforms of Basel III has been estimated by the

group in terms of capital ratios and risk weighted assets (Ibrahimovic and Franke 2017).

For the computation of market risk capital charge, two broad methodologies are used

by RBS comprising of internal model approach and non modeled approach and computing

the capital at charge by the model of value at risk.

RBS group managed to change the requirements of capital by including model

changes in accordance with the new regulation. This change has a resultant impact on the de

leveraging and reduction strategy alongside the impact on common equity Tier 1. Usage of

management information by RBS is enhanced by linking to the appetite statement of relevant

conduct risk and they are being complaint with the Basel committee on principles of banking

supervisions. As a part of requirement of Basel III, the group assesses its own risks with the

intention of mitigation of such risks and necessity of future and current capital provided all

the mitigating factors are considered (Fca.org.uk 2019).

Bank has established a liquidity portfolio across sovereign bond holding and

correspondent banks with such changes helping in supporting the compliance with the rules

of incoming Basel III liquidity coverage ratio and continuity for the customers.

In order to ensure that all the material risks are identified and adequately managed and

capitalized, risk assessment is undertaken by the bank. No disclosures have been omitted by

RBS on the ground of confidential information. RBS continued to de risk and strengthen its

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16