Banking Risks: Credit Risk Assessment and CVA Analysis

VerifiedAdded on 2023/05/29

|8

|1820

|244

Report

AI Summary

This report provides an in-depth analysis of banking risks, focusing on credit risk assessment and credit value adjustment (CVA). It begins by examining the Bank of International Settlements (BIS)'s preferred credit risk measurement approach, highlighting the importance of credit ratings and the Know Your Customer (KYC) norms in assessing creditworthiness. The report then delves into the evaluation of credit value adjustment (CVA), tracing its origins to counterparty credit risk during the 2007-08 financial crisis. It discusses the challenges associated with implementing CVA, such as the lack of robust credit management tools and difficulties in calculating and reporting potential future exposures. The report concludes by emphasizing the importance of credit risk management and the role of credit ratings in minimizing banking risks, offering valuable insights for financial institutions and students alike. The report uses various sources, including academic research papers and industry reports, to support its findings.

Running head: BANKING RISKS

Banking Risks

Name of the Student:

Name of the University:

Author’s Note:

Banking Risks

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

BANKING RISKS

Table of Contents

Introduction......................................................................................................................................2

Discussion........................................................................................................................................2

Evaluation of Most Preferred Credit Risk Assessment Methods................................................2

Evaluation of Credit Value Adjustment......................................................................................5

Conclusion.......................................................................................................................................6

Reference.........................................................................................................................................7

BANKING RISKS

Table of Contents

Introduction......................................................................................................................................2

Discussion........................................................................................................................................2

Evaluation of Most Preferred Credit Risk Assessment Methods................................................2

Evaluation of Credit Value Adjustment......................................................................................5

Conclusion.......................................................................................................................................6

Reference.........................................................................................................................................7

2

BANKING RISKS

Introduction

The main purpose of this assessment is to analyze the Bank of International Settlements

(BIS)’s most preferred credit risk measurement approach for other banks. The assessment

considers the operations of Bank of International Settlements (BIS) which is engaged in the

business of providing financial services and maintaining financial cooperation in business

organization (Laurent, 2014). The assessment considers the best practices which can be taken by

bank for the purpose of reducing the credit risks which are faced by most of the banks. The risks

which banks faces are mostly credit risks as defaults in credit facilities has increased in recent

times. The assessment also deals with the challenges which are faced by Banking Institutions in

relation to Credit value adjustment and how the same can have impact the banks.

Discussion

Evaluation of Most Preferred Credit Risk Assessment Methods

In a banking sector, the initial step which is followed by banks while providing credit to

any business or individual is assessment of the credit risk. The credit risks assessment allows the

bank to appropriately decide whether the credit facility would be offered to that particular client

or not. As per the internal business analysis of Bank of International Settlements (BIS) follows

the credit ratings of the clients in order to decide whether the credit facility is to be offered to the

client or not (Bluhm, Overbeck & Wagner, 2016). Every business or clients who have take loan

in past has credit record which is considered by Bank of International Settlements (BIS) and if

the same is shown to be favorable than only the loan amount is approved and sanctioned by the

bank.

BANKING RISKS

Introduction

The main purpose of this assessment is to analyze the Bank of International Settlements

(BIS)’s most preferred credit risk measurement approach for other banks. The assessment

considers the operations of Bank of International Settlements (BIS) which is engaged in the

business of providing financial services and maintaining financial cooperation in business

organization (Laurent, 2014). The assessment considers the best practices which can be taken by

bank for the purpose of reducing the credit risks which are faced by most of the banks. The risks

which banks faces are mostly credit risks as defaults in credit facilities has increased in recent

times. The assessment also deals with the challenges which are faced by Banking Institutions in

relation to Credit value adjustment and how the same can have impact the banks.

Discussion

Evaluation of Most Preferred Credit Risk Assessment Methods

In a banking sector, the initial step which is followed by banks while providing credit to

any business or individual is assessment of the credit risk. The credit risks assessment allows the

bank to appropriately decide whether the credit facility would be offered to that particular client

or not. As per the internal business analysis of Bank of International Settlements (BIS) follows

the credit ratings of the clients in order to decide whether the credit facility is to be offered to the

client or not (Bluhm, Overbeck & Wagner, 2016). Every business or clients who have take loan

in past has credit record which is considered by Bank of International Settlements (BIS) and if

the same is shown to be favorable than only the loan amount is approved and sanctioned by the

bank.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

BANKING RISKS

Credit risk is general terms is defined as the potential that a borrower of a bank would not

be able to meet the obligations of the loan within agreed term. The goal of credit risk

management is to maximize the bank’s risk adjusted rate of return (Bielecki & Rutkowski,

2013). The credit risks have significantly enhanced during the recent years which is a

consideration. As per the policy of Bank of International Settlements (BIS), a key element in risk

measurement approach is that the role of credit rating system in a business organization (Ang &

Longstaff, 2013). In case of measuring credit risks of a business, the basic thing which need to

establish is that some measure of dispersion of possible future outcomes can be made available

for the purpose of taking decisions. In case of an individual bank, the dispersion of future returns

on its own portfolio is a matter of concern while in case of policymaker, the dispersion of future

return is concern and the same is also linked with financial stability of a business (Van Deventer,

Imai & Mesler, 2013).

The Bank of International Settlements (BIS) is of the opinion that an appropriate rating

system for the loans is an important consideration which should be considered by banks before

making any credit allowances to individuals or businesses. The two types of rating system which

is available to the bank is the market-based rating system and other road set of information. The

market-based rating system requires banks to assess the credit ratings of the clients before a

significant amount of loan is offered. There are a lot of credit risk models which are present such

as JP Morgan’s Credit Metrics, McKinsey’s Credit Portfolio view and similar other models. The

common building blocks for all such models ate in most case the same. The building blocks of

credit risk assessment are made up of two elements which are finding out the credit worthiness of

individual borrowers and the second factor which is considered is the transition matrix which

consider that the credit rating of the borrowers would change over time horizon (Fredrick, 2013).

BANKING RISKS

Credit risk is general terms is defined as the potential that a borrower of a bank would not

be able to meet the obligations of the loan within agreed term. The goal of credit risk

management is to maximize the bank’s risk adjusted rate of return (Bielecki & Rutkowski,

2013). The credit risks have significantly enhanced during the recent years which is a

consideration. As per the policy of Bank of International Settlements (BIS), a key element in risk

measurement approach is that the role of credit rating system in a business organization (Ang &

Longstaff, 2013). In case of measuring credit risks of a business, the basic thing which need to

establish is that some measure of dispersion of possible future outcomes can be made available

for the purpose of taking decisions. In case of an individual bank, the dispersion of future returns

on its own portfolio is a matter of concern while in case of policymaker, the dispersion of future

return is concern and the same is also linked with financial stability of a business (Van Deventer,

Imai & Mesler, 2013).

The Bank of International Settlements (BIS) is of the opinion that an appropriate rating

system for the loans is an important consideration which should be considered by banks before

making any credit allowances to individuals or businesses. The two types of rating system which

is available to the bank is the market-based rating system and other road set of information. The

market-based rating system requires banks to assess the credit ratings of the clients before a

significant amount of loan is offered. There are a lot of credit risk models which are present such

as JP Morgan’s Credit Metrics, McKinsey’s Credit Portfolio view and similar other models. The

common building blocks for all such models ate in most case the same. The building blocks of

credit risk assessment are made up of two elements which are finding out the credit worthiness of

individual borrowers and the second factor which is considered is the transition matrix which

consider that the credit rating of the borrowers would change over time horizon (Fredrick, 2013).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

BANKING RISKS

It is also prescribed to international banks that they should have first have a background check on

the clients to whom credit facility is being offered. This can be done by banks by strictly

following and implementing the Know your Customers norms. These norms allow banks to

appropriately keep tabs about the customers and also helps banks in conducting a background

check for the banks. The Know Your Customers norms of a business would enable the business

to have an access to the track record of the customer to whom the loan amount is provided. The

rating system of the customers would appropriately act as a guide to the banks as to which

customers are to be offered loans.

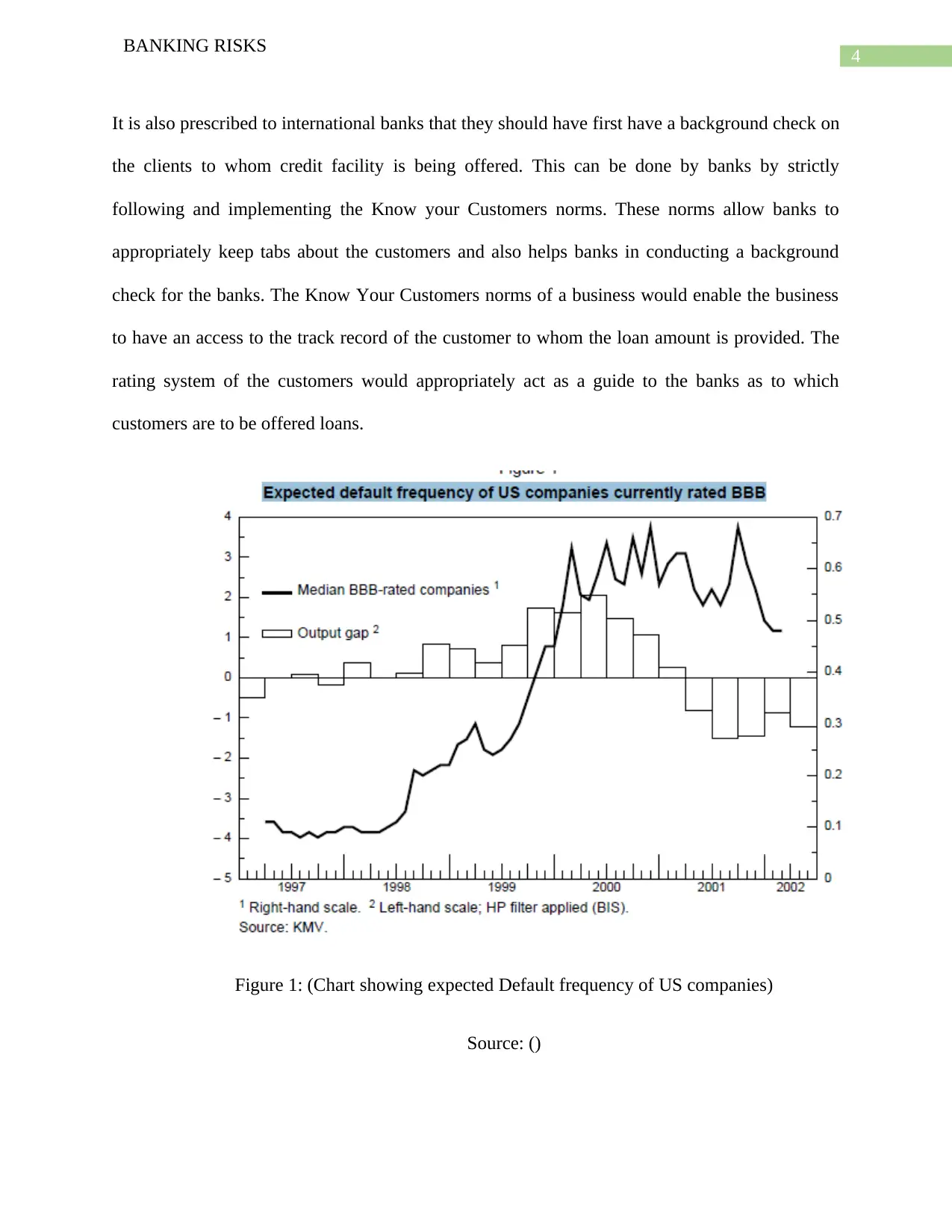

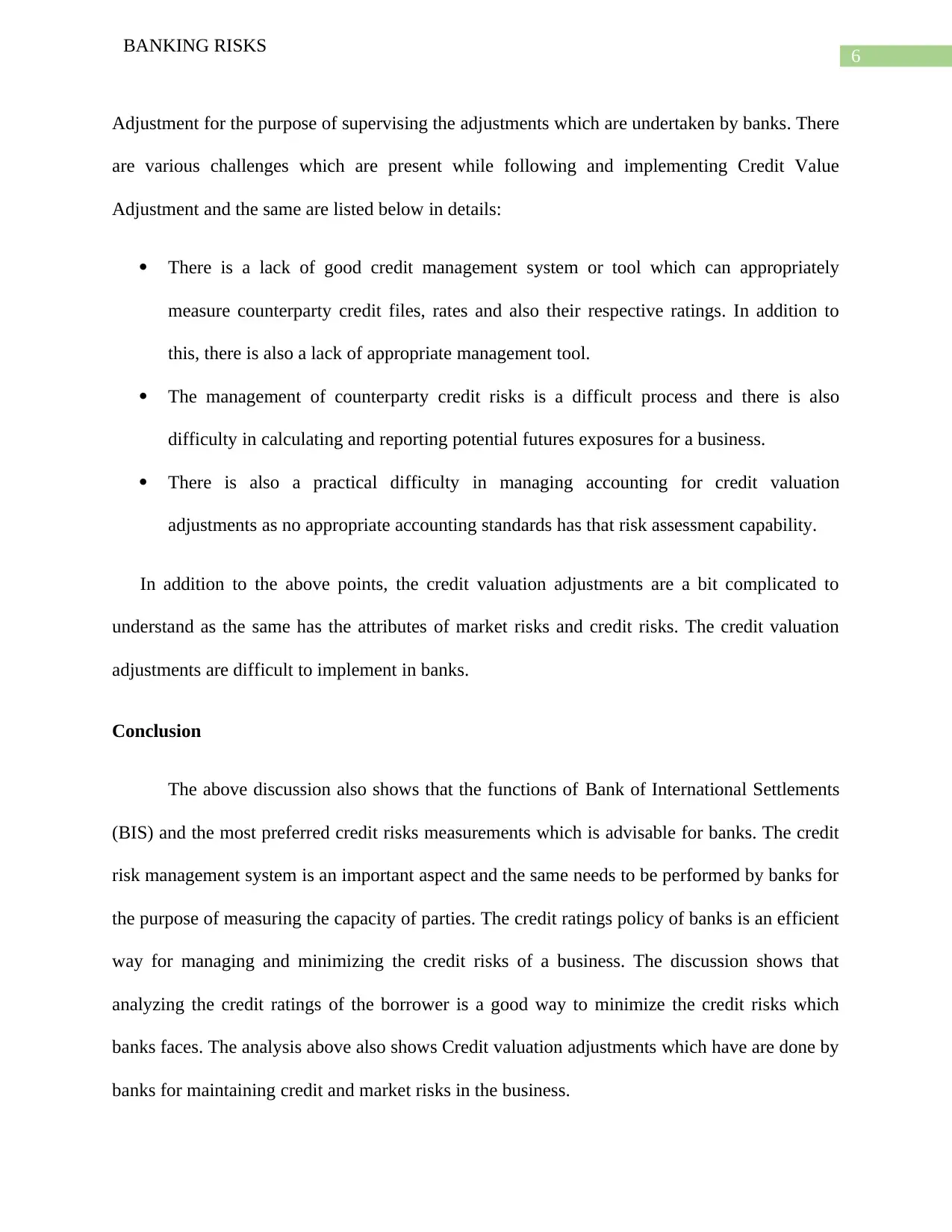

Figure 1: (Chart showing expected Default frequency of US companies)

Source: ()

BANKING RISKS

It is also prescribed to international banks that they should have first have a background check on

the clients to whom credit facility is being offered. This can be done by banks by strictly

following and implementing the Know your Customers norms. These norms allow banks to

appropriately keep tabs about the customers and also helps banks in conducting a background

check for the banks. The Know Your Customers norms of a business would enable the business

to have an access to the track record of the customer to whom the loan amount is provided. The

rating system of the customers would appropriately act as a guide to the banks as to which

customers are to be offered loans.

Figure 1: (Chart showing expected Default frequency of US companies)

Source: ()

5

BANKING RISKS

The above figure shows the default rate frequency of US companies and the rate is shown

to be high as per 2002 estimates. The default rate for credits for banks has been rising as per the

figure which is shown (Noh, 2013). Therefore, the credit ratings analysis is necessary so that all

such defaults in appropriate servicing of credit can be prevented,

Evaluation of Credit Value Adjustment

The historical background of Credit Value Adjustment (CVA) can be traced back to

Counterparty credit risk which was developed during the financial crisis of 2007-08.

Counterparty credit risks is closely related credit risks but are not strictly. Counterparty credit

risks is referred to the risk where counterparty defaults before honouring the engagement which

has been entered not. The special thing about Counterparty credit risks is that it inherits both

market and credit risks. The Counterparty credit risks are somewhere between credit risks and

market risks. This was further developed into credit valuation risks in 2004 after accounting

standards was introduced for counterparty (Blankespoor et al., 2015). After this process, banks

started using a measure called credit valuation adjustment which is on monthly basis. During the

financial crisis, banks suffered significantly for counterparty credit risk (CCR) losses on their

OTC derivatives portfolios. The majority of these losses came not from counterparty defaults but

also significantly from losses which the banks suffered from derivatives. The value of

outstanding derivative assets was written down as it became apparent that counterparties were

less likely than expected to meet their obligations

Credit value adjustments is the difference between the risk free portfolio value and the

true portfolio value that takes into consideration any default situation which can arise. Under the

Basel II regulations of Credit Value Adjustment is being analyzed in order to identify the

advantages and limitation of the same. The Basel II regulations would be evaluate Credit Value

BANKING RISKS

The above figure shows the default rate frequency of US companies and the rate is shown

to be high as per 2002 estimates. The default rate for credits for banks has been rising as per the

figure which is shown (Noh, 2013). Therefore, the credit ratings analysis is necessary so that all

such defaults in appropriate servicing of credit can be prevented,

Evaluation of Credit Value Adjustment

The historical background of Credit Value Adjustment (CVA) can be traced back to

Counterparty credit risk which was developed during the financial crisis of 2007-08.

Counterparty credit risks is closely related credit risks but are not strictly. Counterparty credit

risks is referred to the risk where counterparty defaults before honouring the engagement which

has been entered not. The special thing about Counterparty credit risks is that it inherits both

market and credit risks. The Counterparty credit risks are somewhere between credit risks and

market risks. This was further developed into credit valuation risks in 2004 after accounting

standards was introduced for counterparty (Blankespoor et al., 2015). After this process, banks

started using a measure called credit valuation adjustment which is on monthly basis. During the

financial crisis, banks suffered significantly for counterparty credit risk (CCR) losses on their

OTC derivatives portfolios. The majority of these losses came not from counterparty defaults but

also significantly from losses which the banks suffered from derivatives. The value of

outstanding derivative assets was written down as it became apparent that counterparties were

less likely than expected to meet their obligations

Credit value adjustments is the difference between the risk free portfolio value and the

true portfolio value that takes into consideration any default situation which can arise. Under the

Basel II regulations of Credit Value Adjustment is being analyzed in order to identify the

advantages and limitation of the same. The Basel II regulations would be evaluate Credit Value

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

BANKING RISKS

Adjustment for the purpose of supervising the adjustments which are undertaken by banks. There

are various challenges which are present while following and implementing Credit Value

Adjustment and the same are listed below in details:

There is a lack of good credit management system or tool which can appropriately

measure counterparty credit files, rates and also their respective ratings. In addition to

this, there is also a lack of appropriate management tool.

The management of counterparty credit risks is a difficult process and there is also

difficulty in calculating and reporting potential futures exposures for a business.

There is also a practical difficulty in managing accounting for credit valuation

adjustments as no appropriate accounting standards has that risk assessment capability.

In addition to the above points, the credit valuation adjustments are a bit complicated to

understand as the same has the attributes of market risks and credit risks. The credit valuation

adjustments are difficult to implement in banks.

Conclusion

The above discussion also shows that the functions of Bank of International Settlements

(BIS) and the most preferred credit risks measurements which is advisable for banks. The credit

risk management system is an important aspect and the same needs to be performed by banks for

the purpose of measuring the capacity of parties. The credit ratings policy of banks is an efficient

way for managing and minimizing the credit risks of a business. The discussion shows that

analyzing the credit ratings of the borrower is a good way to minimize the credit risks which

banks faces. The analysis above also shows Credit valuation adjustments which have are done by

banks for maintaining credit and market risks in the business.

BANKING RISKS

Adjustment for the purpose of supervising the adjustments which are undertaken by banks. There

are various challenges which are present while following and implementing Credit Value

Adjustment and the same are listed below in details:

There is a lack of good credit management system or tool which can appropriately

measure counterparty credit files, rates and also their respective ratings. In addition to

this, there is also a lack of appropriate management tool.

The management of counterparty credit risks is a difficult process and there is also

difficulty in calculating and reporting potential futures exposures for a business.

There is also a practical difficulty in managing accounting for credit valuation

adjustments as no appropriate accounting standards has that risk assessment capability.

In addition to the above points, the credit valuation adjustments are a bit complicated to

understand as the same has the attributes of market risks and credit risks. The credit valuation

adjustments are difficult to implement in banks.

Conclusion

The above discussion also shows that the functions of Bank of International Settlements

(BIS) and the most preferred credit risks measurements which is advisable for banks. The credit

risk management system is an important aspect and the same needs to be performed by banks for

the purpose of measuring the capacity of parties. The credit ratings policy of banks is an efficient

way for managing and minimizing the credit risks of a business. The discussion shows that

analyzing the credit ratings of the borrower is a good way to minimize the credit risks which

banks faces. The analysis above also shows Credit valuation adjustments which have are done by

banks for maintaining credit and market risks in the business.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

BANKING RISKS

Reference

Ang, A., & Longstaff, F. A. (2013). Systemic sovereign credit risk: Lessons from the US and

Europe. Journal of Monetary Economics, 60(5), 493-510.

Bielecki, T. R., & Rutkowski, M. (2013). Credit risk: modeling, valuation and hedging. Springer

Science & Business Media.

Blankespoor, E., Linsmeier, T. J., Petroni, K. R., & Shakespeare, C. (2013). Fair value

accounting for financial instruments: Does it improve the association between bank

leverage and credit risk?. The Accounting Review, 88(4), 1143-1177.

Bluhm, C., Overbeck, L., & Wagner, C. (2016). Introduction to credit risk modeling. Chapman

and Hall/CRC.

Fredrick, O. (2013). The impact of credit risk management on financial performance of

commercial banks in Kenya. DBA Africa Management Review, 3(1).

Laurent, J. P. (2014). Credit risk models. Wiley StatsRef: Statistics Reference Online.

Noh, J. (2013). BASEL III counterparty risk and credit value adjustment: Impact of the wrong-

way risk. Global Economic Review, 42(4), 346-361.

Van Deventer, D. R., Imai, K., & Mesler, M. (2013). Advanced financial risk management: tools

and techniques for integrated credit risk and interest rate risk management. John Wiley

& Sons.

BANKING RISKS

Reference

Ang, A., & Longstaff, F. A. (2013). Systemic sovereign credit risk: Lessons from the US and

Europe. Journal of Monetary Economics, 60(5), 493-510.

Bielecki, T. R., & Rutkowski, M. (2013). Credit risk: modeling, valuation and hedging. Springer

Science & Business Media.

Blankespoor, E., Linsmeier, T. J., Petroni, K. R., & Shakespeare, C. (2013). Fair value

accounting for financial instruments: Does it improve the association between bank

leverage and credit risk?. The Accounting Review, 88(4), 1143-1177.

Bluhm, C., Overbeck, L., & Wagner, C. (2016). Introduction to credit risk modeling. Chapman

and Hall/CRC.

Fredrick, O. (2013). The impact of credit risk management on financial performance of

commercial banks in Kenya. DBA Africa Management Review, 3(1).

Laurent, J. P. (2014). Credit risk models. Wiley StatsRef: Statistics Reference Online.

Noh, J. (2013). BASEL III counterparty risk and credit value adjustment: Impact of the wrong-

way risk. Global Economic Review, 42(4), 346-361.

Van Deventer, D. R., Imai, K., & Mesler, M. (2013). Advanced financial risk management: tools

and techniques for integrated credit risk and interest rate risk management. John Wiley

& Sons.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.