A Report on Banking System: A Comparison between Indian and New Zealand Banking System

VerifiedAdded on 2023/06/07

|24

|5972

|65

AI Summary

The report discusses the importance of banking sector in the growth of an economy and compares the Indian and New Zealand banking system on the basis of regulatory body and other criteria. It also provides a qualitative and quantitative analysis of ICICI Bank and ANZ bank of New Zealand.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: A REPORT ON BANKING SYSTEM

A Report on Banking System

Name of the Student:

Name of the University:

Author Note:

A Report on Banking System

Name of the Student:

Name of the University:

Author Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1A REPORT ON BANKING SYSTEM

Executive Summary:

Banking sector is the most important element of the monetary system and it plays the essential

role in the growth and of an economy. The report is being designed to briefly discuss the banking

system. In this report comparison between the Indian Banking and New Zealand Banking system

is done on the basis of its regulatory body and other criteria. To conclude a clear picture on the

banking system of two countries the two leading banks of both the countries are taken for a

qualitative and quantitative analysis. The analysis is done on the financial data and on its

business.

Introduction:

Banking started at ancient times, when model type merchants use to give loans to the

framers and to the exporters who carried the products to different cities. This event was named as

barter system. The beginning of contemporary banking started from the medieval times. In the

17th century banking notes were emerged. In the traditional sense banking means a trend of

taking deposits of money from the citizen. These deposits are used as lending and investment by

the banks for the growth of economy. These deposits are done according to the distinct and

appropriate features of withdrawable by a slip called cheque. This is a unique system that no

other financial institution offers. An economy reflects the minor mirror of banking.( Acharya et

al. 2013). It is the most essential component of the world for its growth in the economy. The key

of success is banking for any country moving towards development. Bank and economy is

unified to each other. Banks are the important financial institution as they support economy in

creating and channelizing the flow of money. Banking is the helping hand for the citizen who are

Executive Summary:

Banking sector is the most important element of the monetary system and it plays the essential

role in the growth and of an economy. The report is being designed to briefly discuss the banking

system. In this report comparison between the Indian Banking and New Zealand Banking system

is done on the basis of its regulatory body and other criteria. To conclude a clear picture on the

banking system of two countries the two leading banks of both the countries are taken for a

qualitative and quantitative analysis. The analysis is done on the financial data and on its

business.

Introduction:

Banking started at ancient times, when model type merchants use to give loans to the

framers and to the exporters who carried the products to different cities. This event was named as

barter system. The beginning of contemporary banking started from the medieval times. In the

17th century banking notes were emerged. In the traditional sense banking means a trend of

taking deposits of money from the citizen. These deposits are used as lending and investment by

the banks for the growth of economy. These deposits are done according to the distinct and

appropriate features of withdrawable by a slip called cheque. This is a unique system that no

other financial institution offers. An economy reflects the minor mirror of banking.( Acharya et

al. 2013). It is the most essential component of the world for its growth in the economy. The key

of success is banking for any country moving towards development. Bank and economy is

unified to each other. Banks are the important financial institution as they support economy in

creating and channelizing the flow of money. Banking is the helping hand for the citizen who are

2A REPORT ON BANKING SYSTEM

depositors for banks to secure their money. The deposited money acts as a supply chain of

capital for the citizens establishing business in the economy and enhancing employment. Banks

are regulated worldwide.

In the nation to get it support and make stability in the monetary institution there is

banking structure nationally and internationally. The monetary institution that supports the

economy in being stabilized now days. In the globe of banking and investment nothi ng

stands still. The chief revolutionize of everyone is in the, range of the trade of banking.

Banking in its customary form is concerned with the approval of money deposited by the citizen

in their respective accounts, as deposits are lender to seekers. Apart from customary trade, banks

in today`s time offer a ample series of services to p l e a s e t h e c u s t o m e r s ’ n e e d s t h o u g h

t h e n e e d i t b e m o n e t a r y o r n o n - m o n e t a r y . The series of military accessible depends

on bank type and size. (Lee and Choi 2013).

Discussion:

Comparison between the Indian and New Zealand Banking System

Indian Banking System

Legal Framework:

Business related to banking and fiscal services are monitored by the Banking Regulation Act

1949. The act gives power to Reserve Bank of India regarding the issues of regulations,

guidelines, rules and direction on a broad variety of problems related to monetary and banking

sector. RBI is the primary and central bank of India.

depositors for banks to secure their money. The deposited money acts as a supply chain of

capital for the citizens establishing business in the economy and enhancing employment. Banks

are regulated worldwide.

In the nation to get it support and make stability in the monetary institution there is

banking structure nationally and internationally. The monetary institution that supports the

economy in being stabilized now days. In the globe of banking and investment nothi ng

stands still. The chief revolutionize of everyone is in the, range of the trade of banking.

Banking in its customary form is concerned with the approval of money deposited by the citizen

in their respective accounts, as deposits are lender to seekers. Apart from customary trade, banks

in today`s time offer a ample series of services to p l e a s e t h e c u s t o m e r s ’ n e e d s t h o u g h

t h e n e e d i t b e m o n e t a r y o r n o n - m o n e t a r y . The series of military accessible depends

on bank type and size. (Lee and Choi 2013).

Discussion:

Comparison between the Indian and New Zealand Banking System

Indian Banking System

Legal Framework:

Business related to banking and fiscal services are monitored by the Banking Regulation Act

1949. The act gives power to Reserve Bank of India regarding the issues of regulations,

guidelines, rules and direction on a broad variety of problems related to monetary and banking

sector. RBI is the primary and central bank of India.

3A REPORT ON BANKING SYSTEM

Regulatory authorities

Regulatory authority sets norms, give license and guidelines for banks even for those branches

that are out of India. They even set norms for the products and services given by the bank. They

also look after the debt management for the government and currencies are also managed by the

authority.

Other authorities

There sub divisions for regulating the different monetary sector in India. These are:

Insolvency and Bankruptcy Board of India (IBBI) that regulates the development

connecting to conduct bankruptcy procedures under the Insolvency and Bankruptcy Code

(IBC).

Securities Exchange Board of India (SEBI) that is the regulatory power for the securities

market in India.

Insurance Regulatory and Development Authority of India (IRDAI) that regulates the

insurance sector.

Others

The Ministry of Finance deals in legislating and supervising upon the functions of banks and

financial institutions. Acting all the way through its Department of Financial Services, it:

Monitoring the operations that is related in banking.

Lay down the guidelines of sound operating system and functions of public sector banks.

Regulatory authorities

Regulatory authority sets norms, give license and guidelines for banks even for those branches

that are out of India. They even set norms for the products and services given by the bank. They

also look after the debt management for the government and currencies are also managed by the

authority.

Other authorities

There sub divisions for regulating the different monetary sector in India. These are:

Insolvency and Bankruptcy Board of India (IBBI) that regulates the development

connecting to conduct bankruptcy procedures under the Insolvency and Bankruptcy Code

(IBC).

Securities Exchange Board of India (SEBI) that is the regulatory power for the securities

market in India.

Insurance Regulatory and Development Authority of India (IRDAI) that regulates the

insurance sector.

Others

The Ministry of Finance deals in legislating and supervising upon the functions of banks and

financial institutions. Acting all the way through its Department of Financial Services, it:

Monitoring the operations that is related in banking.

Lay down the guidelines of sound operating system and functions of public sector banks.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4A REPORT ON BANKING SYSTEM

Liquidity and capital adequacy

Role of international standards

It is mandatory from April 2013 to implement Basel III capital regulations. This is to ensure

sound transactions to meet the minimum requirement of Basel III capital ratios. The RBI has

previously unconfined guidelines on preservation and calculation of liquidity ratio, the RBI has

in recent times issued strategy on Net Stable Funding Ratio (NSFR) which is based on

concluding rules on NSFR available by the Basel Committee. The NSFR should be equivalent to

at least 100% on a continuing basis. Though, the NSFR would be supplemented by decision-

making appraisal of the steady financial support and liquidity risk figure of a bank. On the basis

of such assessment, the RBI may require a person bank to accept more rigorous standards. The

obligation to preserve 100% NSFR would be compulsory on banks with effect from a date which

will be communicated by the RBI in due route.

Main liquidity

The cash reserve ratio (CRR) is utmost important for every bank to maintain with RBI. It is

average day to day balance that every bank maintains as a part of the total demand and time

liabilities deposits (NDTL). Current rate is 4% the statutory liquidity ratio (SLR) is also

important for every bank to maintain in order to safeguard itself from the crisis impact. It should

also maintain liquid assets in way of gold, cash and government securities. SLR rate is 19.5% at

present.

Liquidity and capital adequacy

Role of international standards

It is mandatory from April 2013 to implement Basel III capital regulations. This is to ensure

sound transactions to meet the minimum requirement of Basel III capital ratios. The RBI has

previously unconfined guidelines on preservation and calculation of liquidity ratio, the RBI has

in recent times issued strategy on Net Stable Funding Ratio (NSFR) which is based on

concluding rules on NSFR available by the Basel Committee. The NSFR should be equivalent to

at least 100% on a continuing basis. Though, the NSFR would be supplemented by decision-

making appraisal of the steady financial support and liquidity risk figure of a bank. On the basis

of such assessment, the RBI may require a person bank to accept more rigorous standards. The

obligation to preserve 100% NSFR would be compulsory on banks with effect from a date which

will be communicated by the RBI in due route.

Main liquidity

The cash reserve ratio (CRR) is utmost important for every bank to maintain with RBI. It is

average day to day balance that every bank maintains as a part of the total demand and time

liabilities deposits (NDTL). Current rate is 4% the statutory liquidity ratio (SLR) is also

important for every bank to maintain in order to safeguard itself from the crisis impact. It should

also maintain liquid assets in way of gold, cash and government securities. SLR rate is 19.5% at

present.

5A REPORT ON BANKING SYSTEM

New Zealand Banking System

Legal framework

New Zealand has a two way approach towards banking regulations with a different prudential

and conduct regulator. The Reserve Bank of New Zealand Act 1989 (RBNZ Act) is the type

portion of legislation surroundings out the powers of Reserve Bank of New Zealand (RBNZ) as

New Zealand's canny regulator. The RBNZ Act regulates with bank registration and enables the

RBNZ to:

Lay conditions for process of registration

Outsourcing facts from the banks

Managing bank failure

The Financial Markets Conduct Act 2013 (FMCA) has the rules for conducting financial and in

fastidious of giving licensing for issuing derivatives, one who is operating in market and

different investment schemes managers.

Regulatory authorities

Lead bank regulators

Reserve Bank of New Zealand (RBNZ) is the primary regulators of banks in New Zealand that

got established by the Reserve Bank of New Zealand Act 1989. In New Zealand RBNZ act as a

canny regulator and regulates all aspects that come under the bank’s commerce. RBNZ does not

have a statutory objective to protect its depositors rather its statutory objective is managing

banking business. In New Zealand the Financial Market Authority (FMA) deals in all the

financial matters of the country. (Ball et al.2013).

New Zealand Banking System

Legal framework

New Zealand has a two way approach towards banking regulations with a different prudential

and conduct regulator. The Reserve Bank of New Zealand Act 1989 (RBNZ Act) is the type

portion of legislation surroundings out the powers of Reserve Bank of New Zealand (RBNZ) as

New Zealand's canny regulator. The RBNZ Act regulates with bank registration and enables the

RBNZ to:

Lay conditions for process of registration

Outsourcing facts from the banks

Managing bank failure

The Financial Markets Conduct Act 2013 (FMCA) has the rules for conducting financial and in

fastidious of giving licensing for issuing derivatives, one who is operating in market and

different investment schemes managers.

Regulatory authorities

Lead bank regulators

Reserve Bank of New Zealand (RBNZ) is the primary regulators of banks in New Zealand that

got established by the Reserve Bank of New Zealand Act 1989. In New Zealand RBNZ act as a

canny regulator and regulates all aspects that come under the bank’s commerce. RBNZ does not

have a statutory objective to protect its depositors rather its statutory objective is managing

banking business. In New Zealand the Financial Market Authority (FMA) deals in all the

financial matters of the country. (Ball et al.2013).

6A REPORT ON BANKING SYSTEM

Others

The council of Financial Regulators consists of:

Financial Markets Authority (FMA)

Ministry of Business, Innovation and Employment

New Zealand Treasury.

Reserve Bank of New Zealand (RBNZ).

Liquidity

Role of international standards

The Reserve Bank of New Zealand (RBNZ) has incorporated the major components of the Basel

Committee on Banking Supervision Basel III Capital Accords (Basel III) in New Zealand by

updating its capital adequacy and liquidity standards in the Banking Supervision Handbook to

replicate the Basel III necessities. Locally incorporated banks have been compulsory to comply

with the least amount capital ratios from January 2013. The capital conservation cushion came

into effect in New Zealand on January 2014, as did the Reserve Bank's power to locate a

countercyclical shock absorber.

Main liquidity

The Reserve Bank of New Zealand's (RBNZ) Liquidity Policy comprising BS13 and BS13A of

the Banking Supervision Handbook introduced in April 2010 in response to the global financial

crisis. The Liquidity Policy has four main apparatus:

Publicly disclosing the requirement of some information about liquidity risk and about

their management by the banks.

Standing orders on risk management.

Others

The council of Financial Regulators consists of:

Financial Markets Authority (FMA)

Ministry of Business, Innovation and Employment

New Zealand Treasury.

Reserve Bank of New Zealand (RBNZ).

Liquidity

Role of international standards

The Reserve Bank of New Zealand (RBNZ) has incorporated the major components of the Basel

Committee on Banking Supervision Basel III Capital Accords (Basel III) in New Zealand by

updating its capital adequacy and liquidity standards in the Banking Supervision Handbook to

replicate the Basel III necessities. Locally incorporated banks have been compulsory to comply

with the least amount capital ratios from January 2013. The capital conservation cushion came

into effect in New Zealand on January 2014, as did the Reserve Bank's power to locate a

countercyclical shock absorber.

Main liquidity

The Reserve Bank of New Zealand's (RBNZ) Liquidity Policy comprising BS13 and BS13A of

the Banking Supervision Handbook introduced in April 2010 in response to the global financial

crisis. The Liquidity Policy has four main apparatus:

Publicly disclosing the requirement of some information about liquidity risk and about

their management by the banks.

Standing orders on risk management.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7A REPORT ON BANKING SYSTEM

Regular updating of the liquidity position of the banks

Qualitative and Quantitative Analysis of ICICI Bank and ANZ bank of New Zealand:

Qualitative Analysis:

ANZ Bank:

In Australia ANZ is among the largest company who has attended the majority of hold in

international banking sector and monetary team. This is known amongst the big four banks of

Australia. In 1970 ANZ bank was established leading a merger with English, Scottish and

Australian Bank Limited (ES&A). After this merger Australia and New Zealand Banking Group

Limited was established. The team sustained to cultivate, regardless of the pay for the first and

foremost Indian-based Grind lays Bank, which submit an evidence of a not as much of ideal

commerce robust and the cluster deprived itself in year 1999. 16088 people were employees of

ANZ Bank and it had 807 branches in Australia by the end of 1999. In the year 1970 among the

lead the way banks of Australia it combined with the networks of SWIFT. The idea of electronic

services of banking started in 1997 but Internet banking was launched in April 1999.

Subsequently, it had a joint venture agreement with ERG and Telstra. This joint venture was

done to form a smart card association that followed an additional planned association with

E*Trade Australia. This association was to develop a foremost online stock market trading. From

the tactical perspective, it can be seen that ANZ has been taking a very practical move toward,

with cooperative ventures, association, and ventures into online banking for trading to linger

cutthroat. It has also incorporated its army, to tender the buyer a ‘one stop’ atmosphere.

Customer Relationship Management (CRM) -nearly everyone touted ready for action tool of

banks in attendance. At present, ANZ is contribution a variety of armed forces counting, account

Regular updating of the liquidity position of the banks

Qualitative and Quantitative Analysis of ICICI Bank and ANZ bank of New Zealand:

Qualitative Analysis:

ANZ Bank:

In Australia ANZ is among the largest company who has attended the majority of hold in

international banking sector and monetary team. This is known amongst the big four banks of

Australia. In 1970 ANZ bank was established leading a merger with English, Scottish and

Australian Bank Limited (ES&A). After this merger Australia and New Zealand Banking Group

Limited was established. The team sustained to cultivate, regardless of the pay for the first and

foremost Indian-based Grind lays Bank, which submit an evidence of a not as much of ideal

commerce robust and the cluster deprived itself in year 1999. 16088 people were employees of

ANZ Bank and it had 807 branches in Australia by the end of 1999. In the year 1970 among the

lead the way banks of Australia it combined with the networks of SWIFT. The idea of electronic

services of banking started in 1997 but Internet banking was launched in April 1999.

Subsequently, it had a joint venture agreement with ERG and Telstra. This joint venture was

done to form a smart card association that followed an additional planned association with

E*Trade Australia. This association was to develop a foremost online stock market trading. From

the tactical perspective, it can be seen that ANZ has been taking a very practical move toward,

with cooperative ventures, association, and ventures into online banking for trading to linger

cutthroat. It has also incorporated its army, to tender the buyer a ‘one stop’ atmosphere.

Customer Relationship Management (CRM) -nearly everyone touted ready for action tool of

banks in attendance. At present, ANZ is contribution a variety of armed forces counting, account

8A REPORT ON BANKING SYSTEM

administration, credit cards managing payments, payments of bills, trading shares, fund transfer

and investment administration. The reimburse anybody trait allows the client to shift finances to

the bank account of any individual with a participating fiscal organization. The bank was

performing upon buyer hassle to power. The result of internet banking is updated in the website

through monthly survey with a motive of improving and developing the new facilities. This has

helped the depositors to accept the internet based banking. The bank had achieved a great

success in transforming ATM, phone and branch customers to Internet form of banking. The

maximum exchange rate of 8.6 percent amongst its client is marked of achievement in internet

business by ANZ. (Adge et al. 2014).

ICICI Bank:

A clandestine assembly in India set ICICI bank under commercial banking head. In January 1994

it was registered and got the licensed by RBI for its operations. At the end of 1999, it had 64

branches at all over India that was featured by state of the art technology and systems.

Networking is done through V-SAT technology. At the end of the year 2000 it had more than

100 branches, 200 ATMs that were spread over the country. ICICI bank gives a wide variety of

banking services domestically and internationally. This done for facilitating the trade cross-

borders businesses and investment also the treasury and services provided in foreign exchanges.

ICICI bank was the first one to launch the Internet Banking named as Infinity. It also offer free

phone banking. The phone-banking offer services for transferring of funds, payments of bill and

payment of e-bills and e shopping. (Altman 2013).

Strategically, at the time when deregulation was at peak ICICI had a benefit of a first

mover advantage as it started it operations at the rising time of technologies that was lacking

administration, credit cards managing payments, payments of bills, trading shares, fund transfer

and investment administration. The reimburse anybody trait allows the client to shift finances to

the bank account of any individual with a participating fiscal organization. The bank was

performing upon buyer hassle to power. The result of internet banking is updated in the website

through monthly survey with a motive of improving and developing the new facilities. This has

helped the depositors to accept the internet based banking. The bank had achieved a great

success in transforming ATM, phone and branch customers to Internet form of banking. The

maximum exchange rate of 8.6 percent amongst its client is marked of achievement in internet

business by ANZ. (Adge et al. 2014).

ICICI Bank:

A clandestine assembly in India set ICICI bank under commercial banking head. In January 1994

it was registered and got the licensed by RBI for its operations. At the end of 1999, it had 64

branches at all over India that was featured by state of the art technology and systems.

Networking is done through V-SAT technology. At the end of the year 2000 it had more than

100 branches, 200 ATMs that were spread over the country. ICICI bank gives a wide variety of

banking services domestically and internationally. This done for facilitating the trade cross-

borders businesses and investment also the treasury and services provided in foreign exchanges.

ICICI bank was the first one to launch the Internet Banking named as Infinity. It also offer free

phone banking. The phone-banking offer services for transferring of funds, payments of bill and

payment of e-bills and e shopping. (Altman 2013).

Strategically, at the time when deregulation was at peak ICICI had a benefit of a first

mover advantage as it started it operations at the rising time of technologies that was lacking

9A REPORT ON BANKING SYSTEM

with older banks. A tie- up was made with the technology providers such as software trainers

like NIIT, ISP Satyam Online and Compaq to spread it reach. These types of alliances are

growing more than 50% every year. (Ball et al. 2013). The expansion of its own share prices is

analytic of the organization’s success. Pay seal was launched in July 2000 that was a payment

gateway ensuring the safety and security for the transactions done. It interfaces along the web

merchant, banking system and internet shopper to facilitate online payments in a safe

environment. On September 22, 1999 subsidiary of ICICI got listed on the NYSE. ICICI was a

commercial bank who was first from India to be listed on NYSE and second Asian bank. Since it

was listed the share price was constant any movements was seen due to the effect of US

elections. The growth trend shows overall a good health. The bank target young professionals

who belonged to urban areas to maintain its tag line. It strategy was based on services that were

on demand like payments of bills loans- car, home, education, products for investment. ICICI

planned for branching out from getting support of professionals and being amalgamated with

other private sector banks for enabling its growth in the rural sector. The continuous momentum

of internet development is estimated to assist its expansion. However, strategically in spite of

regulations and issues regarding infrastructure it had been able to make profit on the path of

technical growth. For boosting its competitive benefit it gives offers in a wide variety in online

banking. ( Laudon and Laudon 2016).

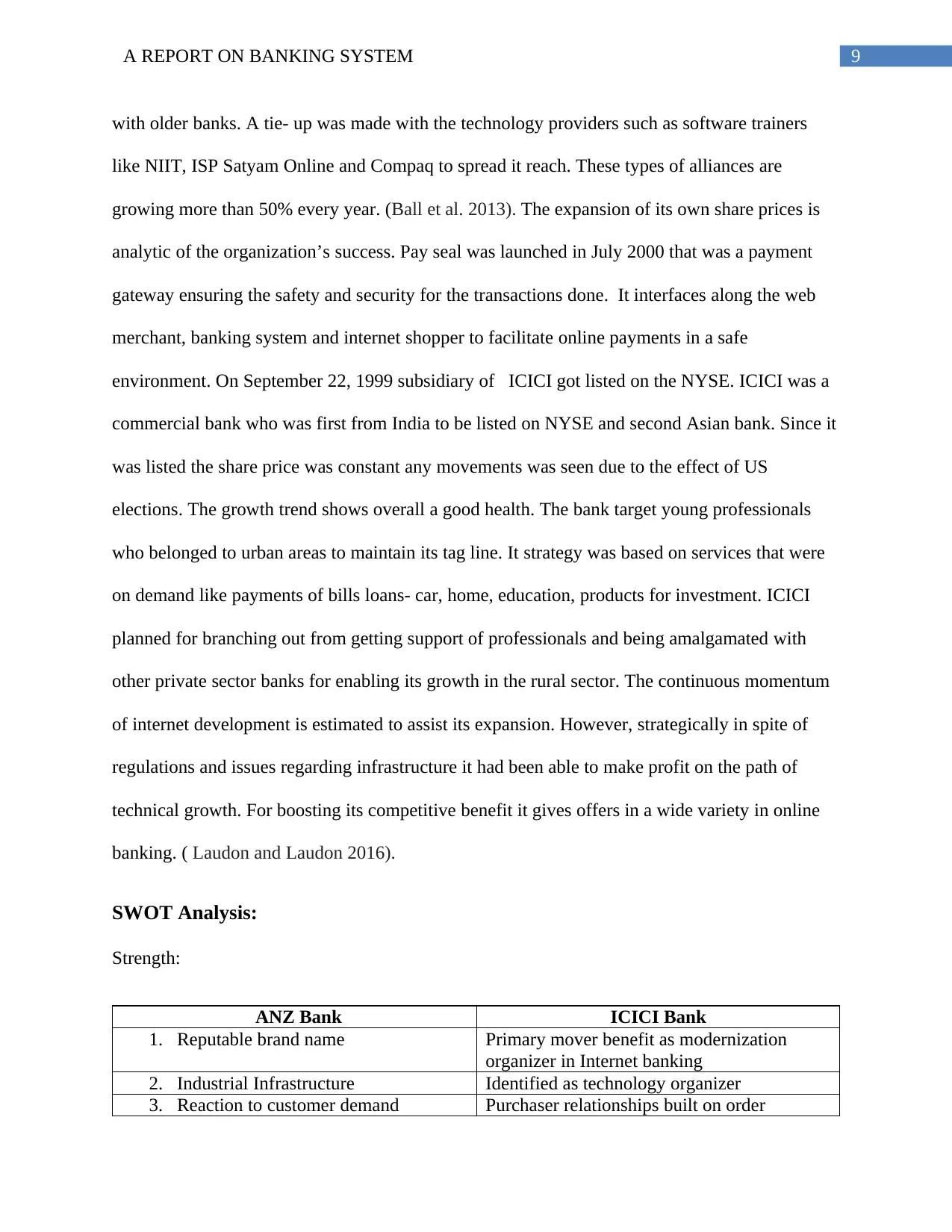

SWOT Analysis:

Strength:

ANZ Bank ICICI Bank

1. Reputable brand name Primary mover benefit as modernization

organizer in Internet banking

2. Industrial Infrastructure Identified as technology organizer

3. Reaction to customer demand Purchaser relationships built on order

with older banks. A tie- up was made with the technology providers such as software trainers

like NIIT, ISP Satyam Online and Compaq to spread it reach. These types of alliances are

growing more than 50% every year. (Ball et al. 2013). The expansion of its own share prices is

analytic of the organization’s success. Pay seal was launched in July 2000 that was a payment

gateway ensuring the safety and security for the transactions done. It interfaces along the web

merchant, banking system and internet shopper to facilitate online payments in a safe

environment. On September 22, 1999 subsidiary of ICICI got listed on the NYSE. ICICI was a

commercial bank who was first from India to be listed on NYSE and second Asian bank. Since it

was listed the share price was constant any movements was seen due to the effect of US

elections. The growth trend shows overall a good health. The bank target young professionals

who belonged to urban areas to maintain its tag line. It strategy was based on services that were

on demand like payments of bills loans- car, home, education, products for investment. ICICI

planned for branching out from getting support of professionals and being amalgamated with

other private sector banks for enabling its growth in the rural sector. The continuous momentum

of internet development is estimated to assist its expansion. However, strategically in spite of

regulations and issues regarding infrastructure it had been able to make profit on the path of

technical growth. For boosting its competitive benefit it gives offers in a wide variety in online

banking. ( Laudon and Laudon 2016).

SWOT Analysis:

Strength:

ANZ Bank ICICI Bank

1. Reputable brand name Primary mover benefit as modernization

organizer in Internet banking

2. Industrial Infrastructure Identified as technology organizer

3. Reaction to customer demand Purchaser relationships built on order

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10A REPORT ON BANKING SYSTEM

4. Growing customer adaptation rate of

internet banking

Online banking enlargement motivated by

buyer Perce

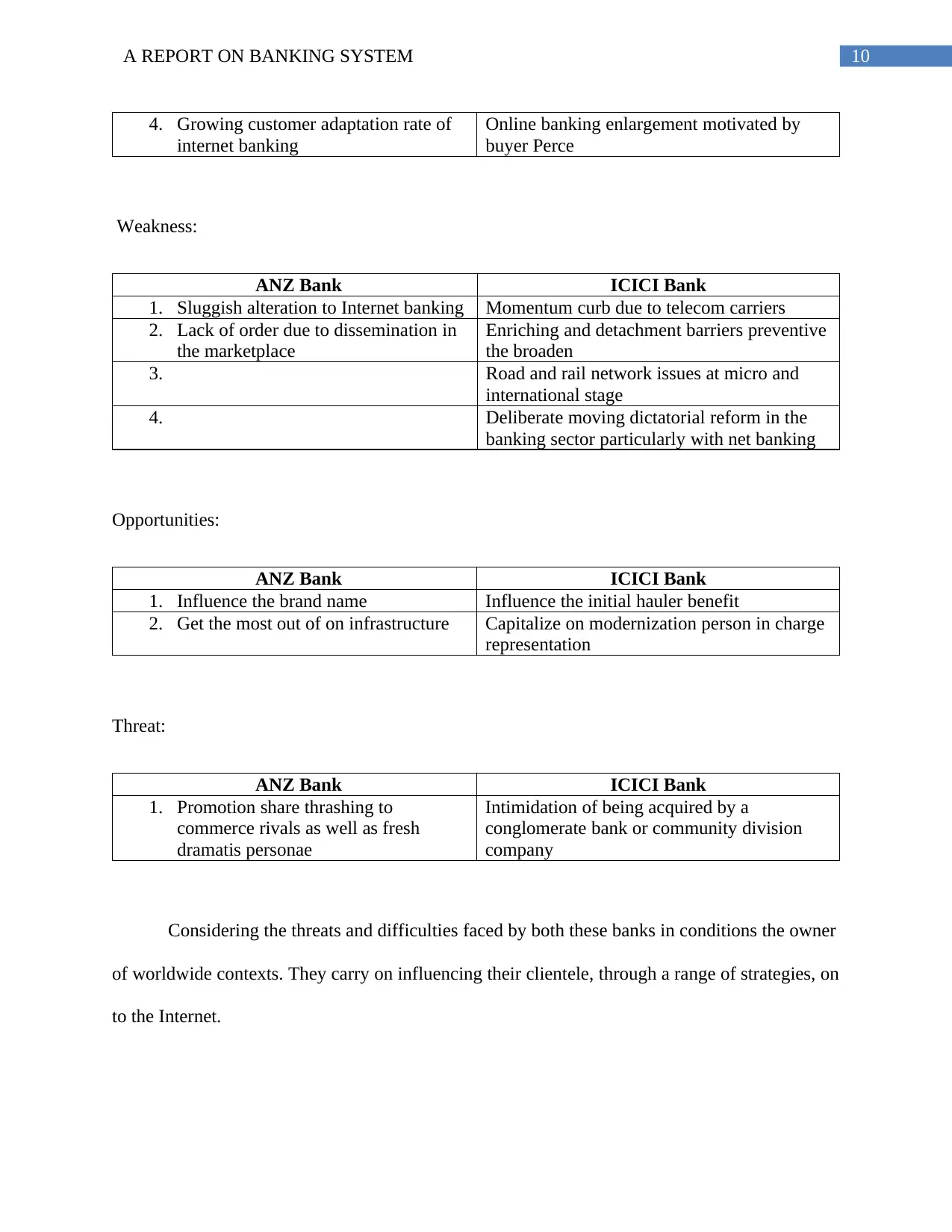

Weakness:

ANZ Bank ICICI Bank

1. Sluggish alteration to Internet banking Momentum curb due to telecom carriers

2. Lack of order due to dissemination in

the marketplace

Enriching and detachment barriers preventive

the broaden

3. Road and rail network issues at micro and

international stage

4. Deliberate moving dictatorial reform in the

banking sector particularly with net banking

Opportunities:

ANZ Bank ICICI Bank

1. Influence the brand name Influence the initial hauler benefit

2. Get the most out of on infrastructure Capitalize on modernization person in charge

representation

Threat:

ANZ Bank ICICI Bank

1. Promotion share thrashing to

commerce rivals as well as fresh

dramatis personae

Intimidation of being acquired by a

conglomerate bank or community division

company

Considering the threats and difficulties faced by both these banks in conditions the owner

of worldwide contexts. They carry on influencing their clientele, through a range of strategies, on

to the Internet.

4. Growing customer adaptation rate of

internet banking

Online banking enlargement motivated by

buyer Perce

Weakness:

ANZ Bank ICICI Bank

1. Sluggish alteration to Internet banking Momentum curb due to telecom carriers

2. Lack of order due to dissemination in

the marketplace

Enriching and detachment barriers preventive

the broaden

3. Road and rail network issues at micro and

international stage

4. Deliberate moving dictatorial reform in the

banking sector particularly with net banking

Opportunities:

ANZ Bank ICICI Bank

1. Influence the brand name Influence the initial hauler benefit

2. Get the most out of on infrastructure Capitalize on modernization person in charge

representation

Threat:

ANZ Bank ICICI Bank

1. Promotion share thrashing to

commerce rivals as well as fresh

dramatis personae

Intimidation of being acquired by a

conglomerate bank or community division

company

Considering the threats and difficulties faced by both these banks in conditions the owner

of worldwide contexts. They carry on influencing their clientele, through a range of strategies, on

to the Internet.

11A REPORT ON BANKING SYSTEM

As these banks are adapting internet banks and participating in their chain value in the internet

services that are helping them to cut down their transaction cost so that they can elevate their

picture as pioneer and innovative bankers. Acharya (2013) states that attractive the principal

agent role in banking delivers one’s participants with the chance to trail, with an improved-

intended or more urbane service. There is rising request for operational banking services, as the

involvements of these two innovator administrations have revealed.

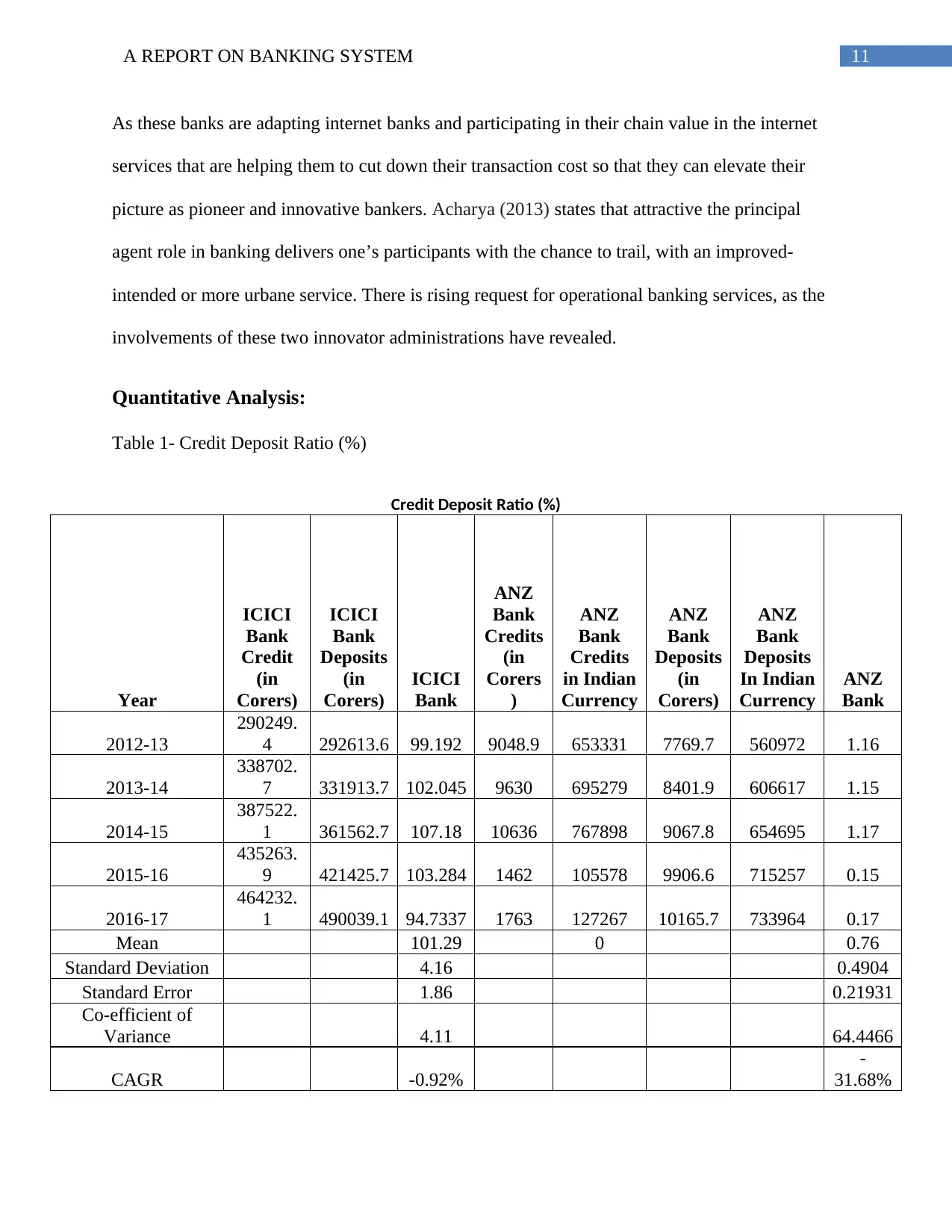

Quantitative Analysis:

Table 1- Credit Deposit Ratio (%)

Credit Deposit Ratio (%)

Year

ICICI

Bank

Credit

(in

Corers)

ICICI

Bank

Deposits

(in

Corers)

ICICI

Bank

ANZ

Bank

Credits

(in

Corers

)

ANZ

Bank

Credits

in Indian

Currency

ANZ

Bank

Deposits

(in

Corers)

ANZ

Bank

Deposits

In Indian

Currency

ANZ

Bank

2012-13

290249.

4 292613.6 99.192 9048.9 653331 7769.7 560972 1.16

2013-14

338702.

7 331913.7 102.045 9630 695279 8401.9 606617 1.15

2014-15

387522.

1 361562.7 107.18 10636 767898 9067.8 654695 1.17

2015-16

435263.

9 421425.7 103.284 1462 105578 9906.6 715257 0.15

2016-17

464232.

1 490039.1 94.7337 1763 127267 10165.7 733964 0.17

Mean 101.29 0 0.76

Standard Deviation 4.16 0.4904

Standard Error 1.86 0.21931

Co-efficient of

Variance 4.11 64.4466

CAGR -0.92%

-

31.68%

As these banks are adapting internet banks and participating in their chain value in the internet

services that are helping them to cut down their transaction cost so that they can elevate their

picture as pioneer and innovative bankers. Acharya (2013) states that attractive the principal

agent role in banking delivers one’s participants with the chance to trail, with an improved-

intended or more urbane service. There is rising request for operational banking services, as the

involvements of these two innovator administrations have revealed.

Quantitative Analysis:

Table 1- Credit Deposit Ratio (%)

Credit Deposit Ratio (%)

Year

ICICI

Bank

Credit

(in

Corers)

ICICI

Bank

Deposits

(in

Corers)

ICICI

Bank

ANZ

Bank

Credits

(in

Corers

)

ANZ

Bank

Credits

in Indian

Currency

ANZ

Bank

Deposits

(in

Corers)

ANZ

Bank

Deposits

In Indian

Currency

ANZ

Bank

2012-13

290249.

4 292613.6 99.192 9048.9 653331 7769.7 560972 1.16

2013-14

338702.

7 331913.7 102.045 9630 695279 8401.9 606617 1.15

2014-15

387522.

1 361562.7 107.18 10636 767898 9067.8 654695 1.17

2015-16

435263.

9 421425.7 103.284 1462 105578 9906.6 715257 0.15

2016-17

464232.

1 490039.1 94.7337 1763 127267 10165.7 733964 0.17

Mean 101.29 0 0.76

Standard Deviation 4.16 0.4904

Standard Error 1.86 0.21931

Co-efficient of

Variance 4.11 64.4466

CAGR -0.92%

-

31.68%

12A REPORT ON BANKING SYSTEM

This ratio indicates the percentage of loan-assets formed by a bank through the deposits

acknowledged. The credits given in the table below are the loans and advances that the bank

grants. In the simple language it is the amount that is being lent to a person or an association by a

bank that is being recovered after some time. On the amount provided as loan interest is charged

on it at a certain rate. Deposits are those amounts that the bank receives from the customers who

are holding savings accounts and interest is paid by the bank on them. (Ball et al. 2013).

The above table is designed to show the course of finance of five year. Studying the mean of

Credit Deposit Ratio in ICICI Bank was higher than ANZ Bank. The credit deposit ratio in the

year2014 and 2015 was highest and the lowest is marked in the year 2016 and 2017 for both

banks. Both the banks had created loan assets out of its respective deposits.

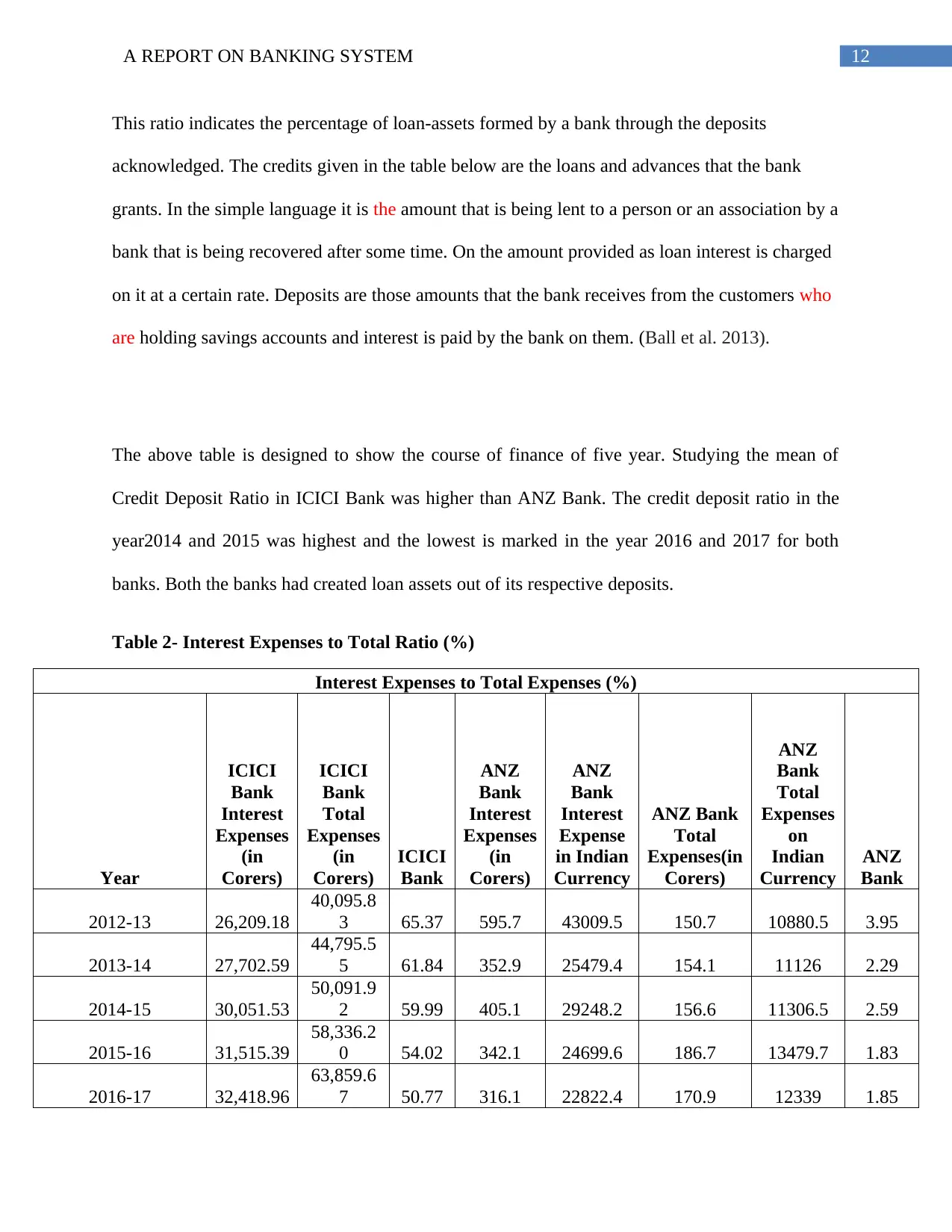

Table 2- Interest Expenses to Total Ratio (%)

Interest Expenses to Total Expenses (%)

Year

ICICI

Bank

Interest

Expenses

(in

Corers)

ICICI

Bank

Total

Expenses

(in

Corers)

ICICI

Bank

ANZ

Bank

Interest

Expenses

(in

Corers)

ANZ

Bank

Interest

Expense

in Indian

Currency

ANZ Bank

Total

Expenses(in

Corers)

ANZ

Bank

Total

Expenses

on

Indian

Currency

ANZ

Bank

2012-13 26,209.18

40,095.8

3 65.37 595.7 43009.5 150.7 10880.5 3.95

2013-14 27,702.59

44,795.5

5 61.84 352.9 25479.4 154.1 11126 2.29

2014-15 30,051.53

50,091.9

2 59.99 405.1 29248.2 156.6 11306.5 2.59

2015-16 31,515.39

58,336.2

0 54.02 342.1 24699.6 186.7 13479.7 1.83

2016-17 32,418.96

63,859.6

7 50.77 316.1 22822.4 170.9 12339 1.85

This ratio indicates the percentage of loan-assets formed by a bank through the deposits

acknowledged. The credits given in the table below are the loans and advances that the bank

grants. In the simple language it is the amount that is being lent to a person or an association by a

bank that is being recovered after some time. On the amount provided as loan interest is charged

on it at a certain rate. Deposits are those amounts that the bank receives from the customers who

are holding savings accounts and interest is paid by the bank on them. (Ball et al. 2013).

The above table is designed to show the course of finance of five year. Studying the mean of

Credit Deposit Ratio in ICICI Bank was higher than ANZ Bank. The credit deposit ratio in the

year2014 and 2015 was highest and the lowest is marked in the year 2016 and 2017 for both

banks. Both the banks had created loan assets out of its respective deposits.

Table 2- Interest Expenses to Total Ratio (%)

Interest Expenses to Total Expenses (%)

Year

ICICI

Bank

Interest

Expenses

(in

Corers)

ICICI

Bank

Total

Expenses

(in

Corers)

ICICI

Bank

ANZ

Bank

Interest

Expenses

(in

Corers)

ANZ

Bank

Interest

Expense

in Indian

Currency

ANZ Bank

Total

Expenses(in

Corers)

ANZ

Bank

Total

Expenses

on

Indian

Currency

ANZ

Bank

2012-13 26,209.18

40,095.8

3 65.37 595.7 43009.5 150.7 10880.5 3.95

2013-14 27,702.59

44,795.5

5 61.84 352.9 25479.4 154.1 11126 2.29

2014-15 30,051.53

50,091.9

2 59.99 405.1 29248.2 156.6 11306.5 2.59

2015-16 31,515.39

58,336.2

0 54.02 342.1 24699.6 186.7 13479.7 1.83

2016-17 32,418.96

63,859.6

7 50.77 316.1 22822.4 170.9 12339 1.85

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13A REPORT ON BANKING SYSTEM

Mean 58.40 2.50

Standard Deviation 5.30 0.87

Standard Error 2.37 0.39

Coefficient of

Variance 9.07 34.79

CAGR

-

4.93%

-

14.09%

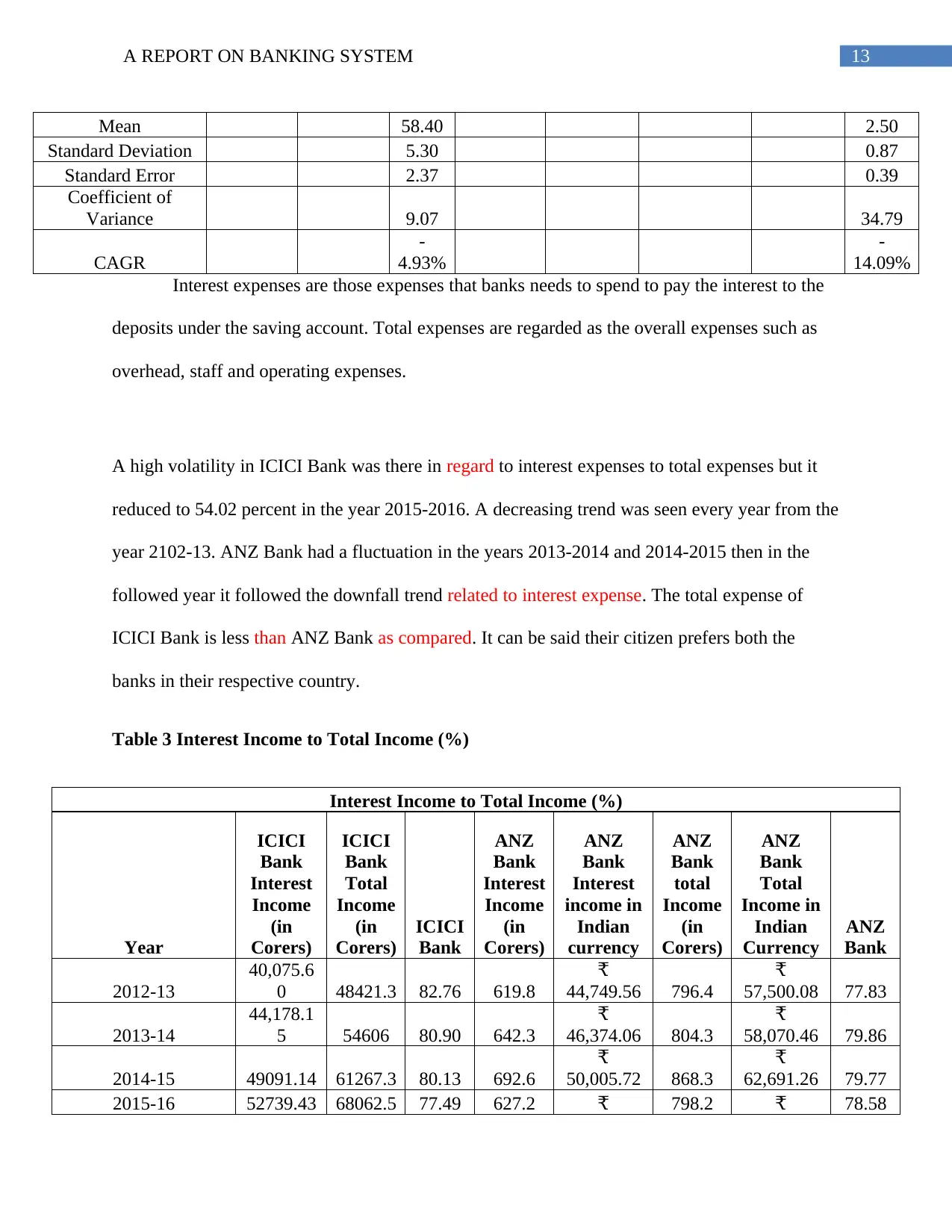

Interest expenses are those expenses that banks needs to spend to pay the interest to the

deposits under the saving account. Total expenses are regarded as the overall expenses such as

overhead, staff and operating expenses.

A high volatility in ICICI Bank was there in regard to interest expenses to total expenses but it

reduced to 54.02 percent in the year 2015-2016. A decreasing trend was seen every year from the

year 2102-13. ANZ Bank had a fluctuation in the years 2013-2014 and 2014-2015 then in the

followed year it followed the downfall trend related to interest expense. The total expense of

ICICI Bank is less than ANZ Bank as compared. It can be said their citizen prefers both the

banks in their respective country.

Table 3 Interest Income to Total Income (%)

Interest Income to Total Income (%)

Year

ICICI

Bank

Interest

Income

(in

Corers)

ICICI

Bank

Total

Income

(in

Corers)

ICICI

Bank

ANZ

Bank

Interest

Income

(in

Corers)

ANZ

Bank

Interest

income in

Indian

currency

ANZ

Bank

total

Income

(in

Corers)

ANZ

Bank

Total

Income in

Indian

Currency

ANZ

Bank

2012-13

40,075.6

0 48421.3 82.76 619.8

₹

44,749.56 796.4

₹

57,500.08 77.83

2013-14

44,178.1

5 54606 80.90 642.3

₹

46,374.06 804.3

₹

58,070.46 79.86

2014-15 49091.14 61267.3 80.13 692.6

₹

50,005.72 868.3

₹

62,691.26 79.77

2015-16 52739.43 68062.5 77.49 627.2 ₹ 798.2 ₹ 78.58

Mean 58.40 2.50

Standard Deviation 5.30 0.87

Standard Error 2.37 0.39

Coefficient of

Variance 9.07 34.79

CAGR

-

4.93%

-

14.09%

Interest expenses are those expenses that banks needs to spend to pay the interest to the

deposits under the saving account. Total expenses are regarded as the overall expenses such as

overhead, staff and operating expenses.

A high volatility in ICICI Bank was there in regard to interest expenses to total expenses but it

reduced to 54.02 percent in the year 2015-2016. A decreasing trend was seen every year from the

year 2102-13. ANZ Bank had a fluctuation in the years 2013-2014 and 2014-2015 then in the

followed year it followed the downfall trend related to interest expense. The total expense of

ICICI Bank is less than ANZ Bank as compared. It can be said their citizen prefers both the

banks in their respective country.

Table 3 Interest Income to Total Income (%)

Interest Income to Total Income (%)

Year

ICICI

Bank

Interest

Income

(in

Corers)

ICICI

Bank

Total

Income

(in

Corers)

ICICI

Bank

ANZ

Bank

Interest

Income

(in

Corers)

ANZ

Bank

Interest

income in

Indian

currency

ANZ

Bank

total

Income

(in

Corers)

ANZ

Bank

Total

Income in

Indian

Currency

ANZ

Bank

2012-13

40,075.6

0 48421.3 82.76 619.8

₹

44,749.56 796.4

₹

57,500.08 77.83

2013-14

44,178.1

5 54606 80.90 642.3

₹

46,374.06 804.3

₹

58,070.46 79.86

2014-15 49091.14 61267.3 80.13 692.6

₹

50,005.72 868.3

₹

62,691.26 79.77

2015-16 52739.43 68062.5 77.49 627.2 ₹ 798.2 ₹ 78.58

14A REPORT ON BANKING SYSTEM

45,283.84 57,630.04

2016-17 54156.28 73660.8 73.52 334.4

₹

24,143.68 464.4

₹

33,529.68 72.01

Mean 78.96 77.61

Standard Deviation 3.58 3.24

Standard Error 1.60 1.45

Coefficient of

Variance 4.54 4.18

CAGR

-

2.34%

-

1.54%

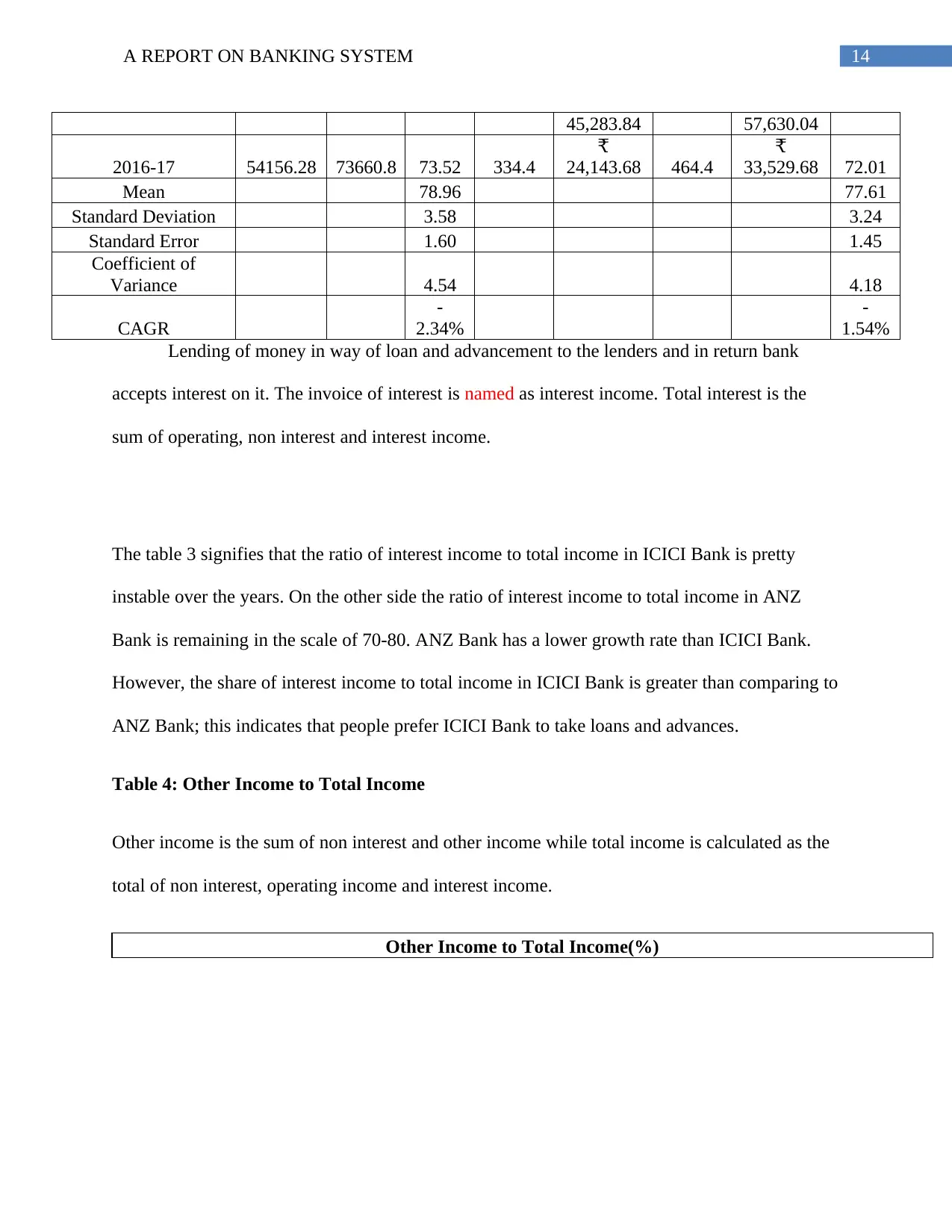

Lending of money in way of loan and advancement to the lenders and in return bank

accepts interest on it. The invoice of interest is named as interest income. Total interest is the

sum of operating, non interest and interest income.

The table 3 signifies that the ratio of interest income to total income in ICICI Bank is pretty

instable over the years. On the other side the ratio of interest income to total income in ANZ

Bank is remaining in the scale of 70-80. ANZ Bank has a lower growth rate than ICICI Bank.

However, the share of interest income to total income in ICICI Bank is greater than comparing to

ANZ Bank; this indicates that people prefer ICICI Bank to take loans and advances.

Table 4: Other Income to Total Income

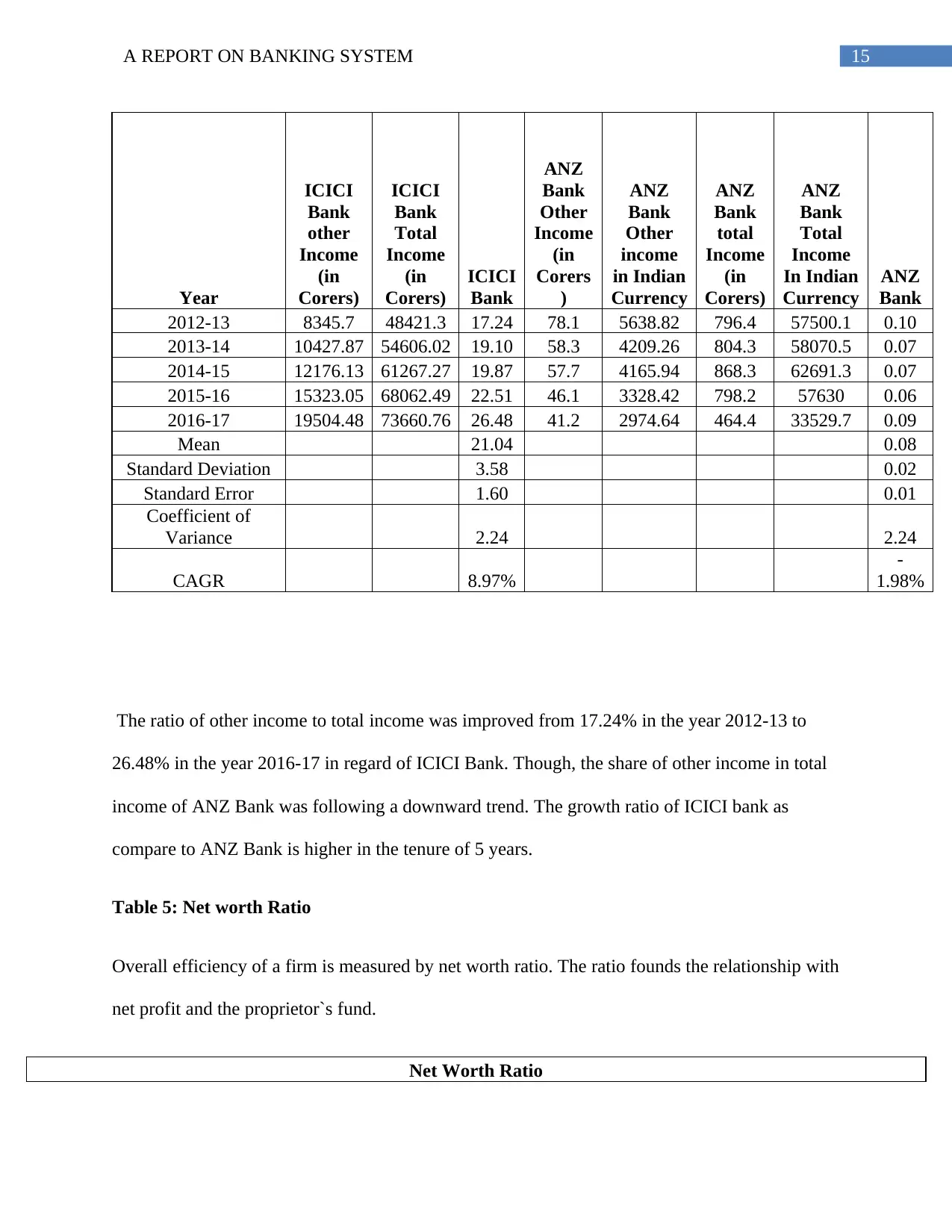

Other income is the sum of non interest and other income while total income is calculated as the

total of non interest, operating income and interest income.

Other Income to Total Income(%)

45,283.84 57,630.04

2016-17 54156.28 73660.8 73.52 334.4

₹

24,143.68 464.4

₹

33,529.68 72.01

Mean 78.96 77.61

Standard Deviation 3.58 3.24

Standard Error 1.60 1.45

Coefficient of

Variance 4.54 4.18

CAGR

-

2.34%

-

1.54%

Lending of money in way of loan and advancement to the lenders and in return bank

accepts interest on it. The invoice of interest is named as interest income. Total interest is the

sum of operating, non interest and interest income.

The table 3 signifies that the ratio of interest income to total income in ICICI Bank is pretty

instable over the years. On the other side the ratio of interest income to total income in ANZ

Bank is remaining in the scale of 70-80. ANZ Bank has a lower growth rate than ICICI Bank.

However, the share of interest income to total income in ICICI Bank is greater than comparing to

ANZ Bank; this indicates that people prefer ICICI Bank to take loans and advances.

Table 4: Other Income to Total Income

Other income is the sum of non interest and other income while total income is calculated as the

total of non interest, operating income and interest income.

Other Income to Total Income(%)

15A REPORT ON BANKING SYSTEM

Year

ICICI

Bank

other

Income

(in

Corers)

ICICI

Bank

Total

Income

(in

Corers)

ICICI

Bank

ANZ

Bank

Other

Income

(in

Corers

)

ANZ

Bank

Other

income

in Indian

Currency

ANZ

Bank

total

Income

(in

Corers)

ANZ

Bank

Total

Income

In Indian

Currency

ANZ

Bank

2012-13 8345.7 48421.3 17.24 78.1 5638.82 796.4 57500.1 0.10

2013-14 10427.87 54606.02 19.10 58.3 4209.26 804.3 58070.5 0.07

2014-15 12176.13 61267.27 19.87 57.7 4165.94 868.3 62691.3 0.07

2015-16 15323.05 68062.49 22.51 46.1 3328.42 798.2 57630 0.06

2016-17 19504.48 73660.76 26.48 41.2 2974.64 464.4 33529.7 0.09

Mean 21.04 0.08

Standard Deviation 3.58 0.02

Standard Error 1.60 0.01

Coefficient of

Variance 2.24 2.24

CAGR 8.97%

-

1.98%

The ratio of other income to total income was improved from 17.24% in the year 2012-13 to

26.48% in the year 2016-17 in regard of ICICI Bank. Though, the share of other income in total

income of ANZ Bank was following a downward trend. The growth ratio of ICICI bank as

compare to ANZ Bank is higher in the tenure of 5 years.

Table 5: Net worth Ratio

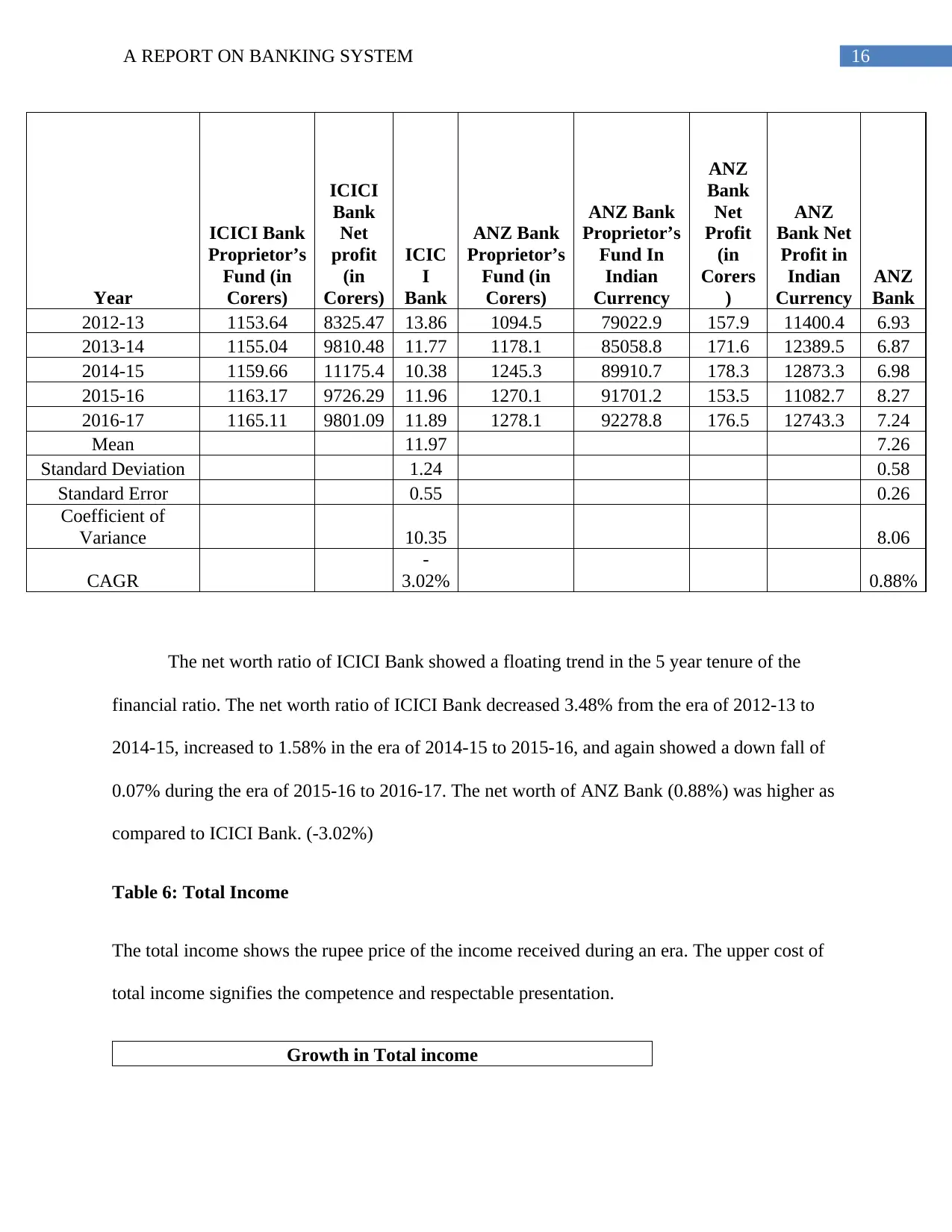

Overall efficiency of a firm is measured by net worth ratio. The ratio founds the relationship with

net profit and the proprietor`s fund.

Net Worth Ratio

Year

ICICI

Bank

other

Income

(in

Corers)

ICICI

Bank

Total

Income

(in

Corers)

ICICI

Bank

ANZ

Bank

Other

Income

(in

Corers

)

ANZ

Bank

Other

income

in Indian

Currency

ANZ

Bank

total

Income

(in

Corers)

ANZ

Bank

Total

Income

In Indian

Currency

ANZ

Bank

2012-13 8345.7 48421.3 17.24 78.1 5638.82 796.4 57500.1 0.10

2013-14 10427.87 54606.02 19.10 58.3 4209.26 804.3 58070.5 0.07

2014-15 12176.13 61267.27 19.87 57.7 4165.94 868.3 62691.3 0.07

2015-16 15323.05 68062.49 22.51 46.1 3328.42 798.2 57630 0.06

2016-17 19504.48 73660.76 26.48 41.2 2974.64 464.4 33529.7 0.09

Mean 21.04 0.08

Standard Deviation 3.58 0.02

Standard Error 1.60 0.01

Coefficient of

Variance 2.24 2.24

CAGR 8.97%

-

1.98%

The ratio of other income to total income was improved from 17.24% in the year 2012-13 to

26.48% in the year 2016-17 in regard of ICICI Bank. Though, the share of other income in total

income of ANZ Bank was following a downward trend. The growth ratio of ICICI bank as

compare to ANZ Bank is higher in the tenure of 5 years.

Table 5: Net worth Ratio

Overall efficiency of a firm is measured by net worth ratio. The ratio founds the relationship with

net profit and the proprietor`s fund.

Net Worth Ratio

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16A REPORT ON BANKING SYSTEM

Year

ICICI Bank

Proprietor’s

Fund (in

Corers)

ICICI

Bank

Net

profit

(in

Corers)

ICIC

I

Bank

ANZ Bank

Proprietor’s

Fund (in

Corers)

ANZ Bank

Proprietor’s

Fund In

Indian

Currency

ANZ

Bank

Net

Profit

(in

Corers

)

ANZ

Bank Net

Profit in

Indian

Currency

ANZ

Bank

2012-13 1153.64 8325.47 13.86 1094.5 79022.9 157.9 11400.4 6.93

2013-14 1155.04 9810.48 11.77 1178.1 85058.8 171.6 12389.5 6.87

2014-15 1159.66 11175.4 10.38 1245.3 89910.7 178.3 12873.3 6.98

2015-16 1163.17 9726.29 11.96 1270.1 91701.2 153.5 11082.7 8.27

2016-17 1165.11 9801.09 11.89 1278.1 92278.8 176.5 12743.3 7.24

Mean 11.97 7.26

Standard Deviation 1.24 0.58

Standard Error 0.55 0.26

Coefficient of

Variance 10.35 8.06

CAGR

-

3.02% 0.88%

The net worth ratio of ICICI Bank showed a floating trend in the 5 year tenure of the

financial ratio. The net worth ratio of ICICI Bank decreased 3.48% from the era of 2012-13 to

2014-15, increased to 1.58% in the era of 2014-15 to 2015-16, and again showed a down fall of

0.07% during the era of 2015-16 to 2016-17. The net worth of ANZ Bank (0.88%) was higher as

compared to ICICI Bank. (-3.02%)

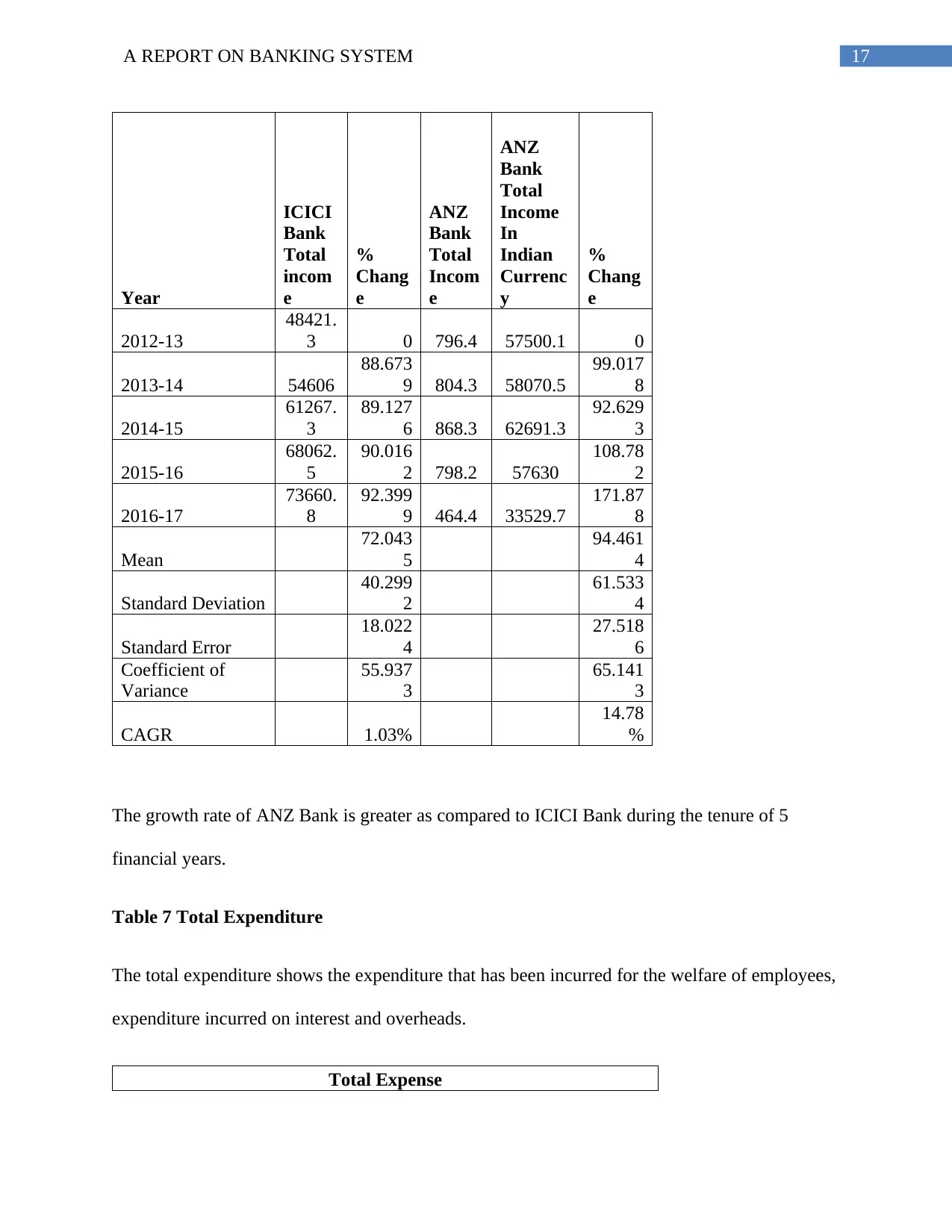

Table 6: Total Income

The total income shows the rupee price of the income received during an era. The upper cost of

total income signifies the competence and respectable presentation.

Growth in Total income

Year

ICICI Bank

Proprietor’s

Fund (in

Corers)

ICICI

Bank

Net

profit

(in

Corers)

ICIC

I

Bank

ANZ Bank

Proprietor’s

Fund (in

Corers)

ANZ Bank

Proprietor’s

Fund In

Indian

Currency

ANZ

Bank

Net

Profit

(in

Corers

)

ANZ

Bank Net

Profit in

Indian

Currency

ANZ

Bank

2012-13 1153.64 8325.47 13.86 1094.5 79022.9 157.9 11400.4 6.93

2013-14 1155.04 9810.48 11.77 1178.1 85058.8 171.6 12389.5 6.87

2014-15 1159.66 11175.4 10.38 1245.3 89910.7 178.3 12873.3 6.98

2015-16 1163.17 9726.29 11.96 1270.1 91701.2 153.5 11082.7 8.27

2016-17 1165.11 9801.09 11.89 1278.1 92278.8 176.5 12743.3 7.24

Mean 11.97 7.26

Standard Deviation 1.24 0.58

Standard Error 0.55 0.26

Coefficient of

Variance 10.35 8.06

CAGR

-

3.02% 0.88%

The net worth ratio of ICICI Bank showed a floating trend in the 5 year tenure of the

financial ratio. The net worth ratio of ICICI Bank decreased 3.48% from the era of 2012-13 to

2014-15, increased to 1.58% in the era of 2014-15 to 2015-16, and again showed a down fall of

0.07% during the era of 2015-16 to 2016-17. The net worth of ANZ Bank (0.88%) was higher as

compared to ICICI Bank. (-3.02%)

Table 6: Total Income

The total income shows the rupee price of the income received during an era. The upper cost of

total income signifies the competence and respectable presentation.

Growth in Total income

17A REPORT ON BANKING SYSTEM

Year

ICICI

Bank

Total

incom

e

%

Chang

e

ANZ

Bank

Total

Incom

e

ANZ

Bank

Total

Income

In

Indian

Currenc

y

%

Chang

e

2012-13

48421.

3 0 796.4 57500.1 0

2013-14 54606

88.673

9 804.3 58070.5

99.017

8

2014-15

61267.

3

89.127

6 868.3 62691.3

92.629

3

2015-16

68062.

5

90.016

2 798.2 57630

108.78

2

2016-17

73660.

8

92.399

9 464.4 33529.7

171.87

8

Mean

72.043

5

94.461

4

Standard Deviation

40.299

2

61.533

4

Standard Error

18.022

4

27.518

6

Coefficient of

Variance

55.937

3

65.141

3

CAGR 1.03%

14.78

%

The growth rate of ANZ Bank is greater as compared to ICICI Bank during the tenure of 5

financial years.

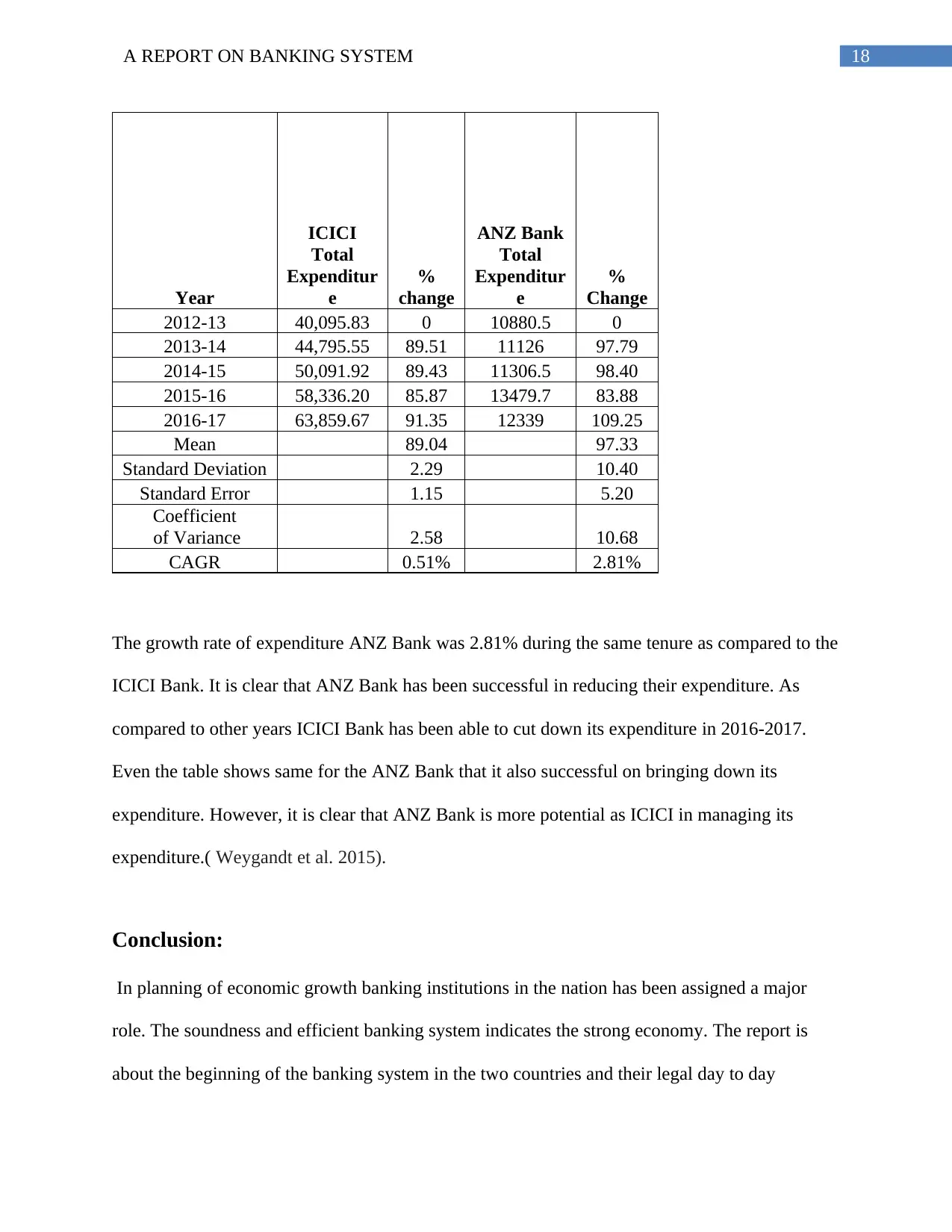

Table 7 Total Expenditure

The total expenditure shows the expenditure that has been incurred for the welfare of employees,

expenditure incurred on interest and overheads.

Total Expense

Year

ICICI

Bank

Total

incom

e

%

Chang

e

ANZ

Bank

Total

Incom

e

ANZ

Bank

Total

Income

In

Indian

Currenc

y

%

Chang

e

2012-13

48421.

3 0 796.4 57500.1 0

2013-14 54606

88.673

9 804.3 58070.5

99.017

8

2014-15

61267.

3

89.127

6 868.3 62691.3

92.629

3

2015-16

68062.

5

90.016

2 798.2 57630

108.78

2

2016-17

73660.

8

92.399

9 464.4 33529.7

171.87

8

Mean

72.043

5

94.461

4

Standard Deviation

40.299

2

61.533

4

Standard Error

18.022

4

27.518

6

Coefficient of

Variance

55.937

3

65.141

3

CAGR 1.03%

14.78

%

The growth rate of ANZ Bank is greater as compared to ICICI Bank during the tenure of 5

financial years.

Table 7 Total Expenditure

The total expenditure shows the expenditure that has been incurred for the welfare of employees,

expenditure incurred on interest and overheads.

Total Expense

18A REPORT ON BANKING SYSTEM

Year

ICICI

Total

Expenditur

e

%

change

ANZ Bank

Total

Expenditur

e

%

Change

2012-13 40,095.83 0 10880.5 0

2013-14 44,795.55 89.51 11126 97.79

2014-15 50,091.92 89.43 11306.5 98.40

2015-16 58,336.20 85.87 13479.7 83.88

2016-17 63,859.67 91.35 12339 109.25

Mean 89.04 97.33

Standard Deviation 2.29 10.40

Standard Error 1.15 5.20

Coefficient

of Variance 2.58 10.68

CAGR 0.51% 2.81%

The growth rate of expenditure ANZ Bank was 2.81% during the same tenure as compared to the

ICICI Bank. It is clear that ANZ Bank has been successful in reducing their expenditure. As

compared to other years ICICI Bank has been able to cut down its expenditure in 2016-2017.

Even the table shows same for the ANZ Bank that it also successful on bringing down its

expenditure. However, it is clear that ANZ Bank is more potential as ICICI in managing its

expenditure.( Weygandt et al. 2015).

Conclusion:

In planning of economic growth banking institutions in the nation has been assigned a major

role. The soundness and efficient banking system indicates the strong economy. The report is

about the beginning of the banking system in the two countries and their legal day to day

Year

ICICI

Total

Expenditur

e

%

change

ANZ Bank

Total

Expenditur

e

%

Change

2012-13 40,095.83 0 10880.5 0

2013-14 44,795.55 89.51 11126 97.79

2014-15 50,091.92 89.43 11306.5 98.40

2015-16 58,336.20 85.87 13479.7 83.88

2016-17 63,859.67 91.35 12339 109.25

Mean 89.04 97.33

Standard Deviation 2.29 10.40

Standard Error 1.15 5.20

Coefficient

of Variance 2.58 10.68

CAGR 0.51% 2.81%

The growth rate of expenditure ANZ Bank was 2.81% during the same tenure as compared to the

ICICI Bank. It is clear that ANZ Bank has been successful in reducing their expenditure. As

compared to other years ICICI Bank has been able to cut down its expenditure in 2016-2017.

Even the table shows same for the ANZ Bank that it also successful on bringing down its

expenditure. However, it is clear that ANZ Bank is more potential as ICICI in managing its

expenditure.( Weygandt et al. 2015).

Conclusion:

In planning of economic growth banking institutions in the nation has been assigned a major

role. The soundness and efficient banking system indicates the strong economy. The report is

about the beginning of the banking system in the two countries and their legal day to day

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

19A REPORT ON BANKING SYSTEM

process. The study is to judge the overall performance of ICICI Bank and ANZ Bank of New

Zealand. The study is based on the tenure of 5 years that is from 2013-2017. Percentage scrutiny

was allied to dismember and believe on the subject of the patterns in administration account

commerce and fiscal implementation, for example, Interest Income to Total Income, Credit

Deposits, Interest Expenses to Total Expenses and their statistical analysis with Compounded

Annual Growth Rate for investigating the patterns in banking business. ( Laudon and Laudon

2016).

process. The study is to judge the overall performance of ICICI Bank and ANZ Bank of New

Zealand. The study is based on the tenure of 5 years that is from 2013-2017. Percentage scrutiny

was allied to dismember and believe on the subject of the patterns in administration account

commerce and fiscal implementation, for example, Interest Income to Total Income, Credit

Deposits, Interest Expenses to Total Expenses and their statistical analysis with Compounded

Annual Growth Rate for investigating the patterns in banking business. ( Laudon and Laudon

2016).

20A REPORT ON BANKING SYSTEM

Reference:

2. Acharya, V.V., Khandwala, H. and Öncü, T.S., 2013. The growth of a shadow banking

system in emerging markets: Evidence from India. Journal of International Money and

Finance, 39, pp.207-230.

3. Lee, S. and Choi, W.S., 2013. A multi-industry bankruptcy prediction model using back-

propagation neural network and multivariate discriminant analysis. Expert Systems with

Applications, 40(8), pp.2941-2946.

4. Ball, R., Kothari, S.P. and Nikolaev, V.V., 2013. Econometrics of the Basu asymmetric

timeliness coefficient and accounting conservatism. Journal of accounting

research, 51(5), pp.1071-1097.

5. Boginski, V., Butenko, S. and Pardalos, P.M., 2005. Statistical analysis of financial

networks. Computational statistics & data analysis, 48(2), pp.431-443.

6. Choi, J.H., Choi, S., Myers, L.A. and Ziebart, D., 2014. Financial statement

comparability and the ability of current stock returns to reflect the information in future

earnings. Available at SSRN.

7. Deb, M. and Lomo-David, E., 2014. An empirical examination of customers’ adoption of

m-banking in India. Marketing Intelligence & Planning, 32(4), pp.475-494.

8. Dhar, S., 2015. A Study on Comparative Analysis of HDFC Bank and ICICI Bank on the

Basis of Capital Market Performance.

9. Dixit, R. and Ghosh, M., 2013. Financial inclusion for inclusive growth of India-A study

of Indian states. International Journal of Business Management & Research

(IJBMR), 3(1), pp.147-156.

Reference:

2. Acharya, V.V., Khandwala, H. and Öncü, T.S., 2013. The growth of a shadow banking

system in emerging markets: Evidence from India. Journal of International Money and

Finance, 39, pp.207-230.

3. Lee, S. and Choi, W.S., 2013. A multi-industry bankruptcy prediction model using back-

propagation neural network and multivariate discriminant analysis. Expert Systems with

Applications, 40(8), pp.2941-2946.

4. Ball, R., Kothari, S.P. and Nikolaev, V.V., 2013. Econometrics of the Basu asymmetric

timeliness coefficient and accounting conservatism. Journal of accounting

research, 51(5), pp.1071-1097.

5. Boginski, V., Butenko, S. and Pardalos, P.M., 2005. Statistical analysis of financial

networks. Computational statistics & data analysis, 48(2), pp.431-443.

6. Choi, J.H., Choi, S., Myers, L.A. and Ziebart, D., 2014. Financial statement

comparability and the ability of current stock returns to reflect the information in future

earnings. Available at SSRN.

7. Deb, M. and Lomo-David, E., 2014. An empirical examination of customers’ adoption of

m-banking in India. Marketing Intelligence & Planning, 32(4), pp.475-494.

8. Dhar, S., 2015. A Study on Comparative Analysis of HDFC Bank and ICICI Bank on the

Basis of Capital Market Performance.

9. Dixit, R. and Ghosh, M., 2013. Financial inclusion for inclusive growth of India-A study

of Indian states. International Journal of Business Management & Research

(IJBMR), 3(1), pp.147-156.

21A REPORT ON BANKING SYSTEM

10. Fatima, N., 2014. Capital Adequacy: A Financial Soundness Indicator for Banks. Global

Journal of Finance and Management, 6(8), pp.771-776.

11. Gupta, M.S., 2014. An Empirical Study of Financial Performance of Icici Bank–A

Comparative Analysis. Journal of Business Studies (JBS), 1(1).

12. Kamber, G., McDonald, C. and Price, G., 2013. Drying out: Investigating the economic

effects of drought in New Zealand(No. AN2013/02). Wellington: Reserve Bank of New

Zealand.

13. Kaplan, M.J., 2013. Growing the next generation of social entrepreneurs and start-ups in

New Zealand. Fulbright New Zealand.

14. Kaur, H. and Singh, K.N., 2015. Pradhan Mantri Jan Dhan Yojana (PMJDY): a leap

towards financial inclusion in India. International Journal of Emerging Research in

Management

15. Keller, G., 2015. Statistics for Management and Economics, Abbreviated. Cengage

Learning.

16. Kelsey, J., 2015. The New Zealand experiment: A world model for structural

adjustment?. Bridget Williams Books.

17. Laudon, K.C. and Laudon, J.P., 2016. Management information system. Pearson

Education India.

18. Leys, C., Ley, C., Klein, O., Bernard, P. and Licata, L., 2013. Detecting outliers: Do not

use standard deviation around the mean, use absolute deviation around the

median. Journal of Experimental Social Psychology, 49(4), pp.764-766.

10. Fatima, N., 2014. Capital Adequacy: A Financial Soundness Indicator for Banks. Global

Journal of Finance and Management, 6(8), pp.771-776.

11. Gupta, M.S., 2014. An Empirical Study of Financial Performance of Icici Bank–A

Comparative Analysis. Journal of Business Studies (JBS), 1(1).

12. Kamber, G., McDonald, C. and Price, G., 2013. Drying out: Investigating the economic

effects of drought in New Zealand(No. AN2013/02). Wellington: Reserve Bank of New

Zealand.

13. Kaplan, M.J., 2013. Growing the next generation of social entrepreneurs and start-ups in

New Zealand. Fulbright New Zealand.

14. Kaur, H. and Singh, K.N., 2015. Pradhan Mantri Jan Dhan Yojana (PMJDY): a leap

towards financial inclusion in India. International Journal of Emerging Research in

Management

15. Keller, G., 2015. Statistics for Management and Economics, Abbreviated. Cengage

Learning.

16. Kelsey, J., 2015. The New Zealand experiment: A world model for structural

adjustment?. Bridget Williams Books.

17. Laudon, K.C. and Laudon, J.P., 2016. Management information system. Pearson

Education India.

18. Leys, C., Ley, C., Klein, O., Bernard, P. and Licata, L., 2013. Detecting outliers: Do not

use standard deviation around the mean, use absolute deviation around the

median. Journal of Experimental Social Psychology, 49(4), pp.764-766.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

22A REPORT ON BANKING SYSTEM

19. Leys, C., Ley, C., Klein, O., Bernard, P. and Licata, L., 2013. Detecting outliers: Do not

use standard deviation around the mean, use absolute deviation around the

median. Journal of Experimental Social Psychology, 49(4), pp.764-766.

20. Manikyam, K.R., 2014. Indian Banking Sector–Challenges and Opportunities. IOSR

Journal of Business and Management, 16(2), pp.52-61.

21. Mubashir, M., 2013. Fundamental Analysis of Banking Industry.

22. Oh, C.H., Park, J.H. and Ghauri, P.N., 2013. Doing right, investing right: Socially

responsible investing and shareholder activism in the financial sector. Business

Horizons, 56(6), pp.703-714.

23. Parameswar, N., Dhir, S. and Dhir, S., 2017. Banking on innovation, innovation in

banking at ICICI bank. Global Business and Organizational Excellence, 36(2), pp.6-16.

24. Rodriguez‐Marek, A., Cotton, F., Abrahamson, N.A., Akkar, S., Al Atik, L., Edwards,

B., Montalva, G.A. and Dawood, H.M., 2013. A model for single‐station standard

deviation using data from various tectonic regions. Bulletin of the seismological society

of America, 103(6), pp.3149-3163.

25. Saeidipour, B., Ranjbar, H. and Ranjbar, S., 2013. Adoption of Internet banking. IOSR

Journal of Business and Management, 11(2), pp.46-51.

26. Sikdar, P. and Makkad, M., 2013. ROLE OF NON PERFORMING ASSETS IN THE

RISK FRAMEWORK OF COMMERCIAL BANKS–AStudy OF SELECT INDIAN

COMMERCIAL BANKS. AIMA Journal of Management & Research, 7(2/4), pp.0974-

497.

27. Subbarao, D., 2013, August. Banking structure in India: Looking ahead by looking back.

In Speaking notes at the FICCI-IBA Annual banking conference in Mumbai, August.

19. Leys, C., Ley, C., Klein, O., Bernard, P. and Licata, L., 2013. Detecting outliers: Do not

use standard deviation around the mean, use absolute deviation around the

median. Journal of Experimental Social Psychology, 49(4), pp.764-766.

20. Manikyam, K.R., 2014. Indian Banking Sector–Challenges and Opportunities. IOSR

Journal of Business and Management, 16(2), pp.52-61.

21. Mubashir, M., 2013. Fundamental Analysis of Banking Industry.

22. Oh, C.H., Park, J.H. and Ghauri, P.N., 2013. Doing right, investing right: Socially

responsible investing and shareholder activism in the financial sector. Business

Horizons, 56(6), pp.703-714.

23. Parameswar, N., Dhir, S. and Dhir, S., 2017. Banking on innovation, innovation in

banking at ICICI bank. Global Business and Organizational Excellence, 36(2), pp.6-16.

24. Rodriguez‐Marek, A., Cotton, F., Abrahamson, N.A., Akkar, S., Al Atik, L., Edwards,

B., Montalva, G.A. and Dawood, H.M., 2013. A model for single‐station standard

deviation using data from various tectonic regions. Bulletin of the seismological society

of America, 103(6), pp.3149-3163.

25. Saeidipour, B., Ranjbar, H. and Ranjbar, S., 2013. Adoption of Internet banking. IOSR

Journal of Business and Management, 11(2), pp.46-51.

26. Sikdar, P. and Makkad, M., 2013. ROLE OF NON PERFORMING ASSETS IN THE

RISK FRAMEWORK OF COMMERCIAL BANKS–AStudy OF SELECT INDIAN

COMMERCIAL BANKS. AIMA Journal of Management & Research, 7(2/4), pp.0974-

497.

27. Subbarao, D., 2013, August. Banking structure in India: Looking ahead by looking back.

In Speaking notes at the FICCI-IBA Annual banking conference in Mumbai, August.

23A REPORT ON BANKING SYSTEM

28. Thompson, P.A., 2013. Invested interests? Reflexivity, representation and reporting in

financial markets. Journalism, 14(2), pp.208-227.

29. Toledano, M. and Riches, M., 2014. Brand alliance and event management for social

causes: Evidence from New Zealand. Public Relations Review, 40(5), pp.807-814.

30. Vaz, S., Falkmer, T., Passmore, A.E., Parsons, R. and Andreou, P., 2013. The case for

using the repeatability coefficient when calculating test–retest reliability. PLoS One, 8(9),

p.e73990.

31. Voit, J., 2013. The statistical mechanics of financial markets. Springer Science &

Business Media.

32. Ward, A., 2015. An unsettled history: Treaty claims in New Zealand today. Bridget

Williams Books.

33. Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & managerial accounting. John

Wiley & Sons.

28. Thompson, P.A., 2013. Invested interests? Reflexivity, representation and reporting in

financial markets. Journalism, 14(2), pp.208-227.

29. Toledano, M. and Riches, M., 2014. Brand alliance and event management for social

causes: Evidence from New Zealand. Public Relations Review, 40(5), pp.807-814.

30. Vaz, S., Falkmer, T., Passmore, A.E., Parsons, R. and Andreou, P., 2013. The case for

using the repeatability coefficient when calculating test–retest reliability. PLoS One, 8(9),

p.e73990.

31. Voit, J., 2013. The statistical mechanics of financial markets. Springer Science &

Business Media.

32. Ward, A., 2015. An unsettled history: Treaty claims in New Zealand today. Bridget

Williams Books.

33. Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & managerial accounting. John

Wiley & Sons.

1 out of 24

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.