ACC140 Winter 2018: Financial Statement Analysis of BCE Company

VerifiedAdded on 2023/06/15

|7

|802

|254

Report

AI Summary

This report provides a financial statement analysis of BCE Company, focusing on the parent firm, Bell Company, over three years. It evaluates the company's cash flow performance, highlighting its ability to generate cash from operating, financing, and investing activities. The analysis notes an increase...

Running head: FINANCIAL STATEMENT ANALYSIS OF BCE COMPANY

Financial Statement Analysis of BCE Company

Name of the University:

Name of the Student:

Author’s Note:

Financial Statement Analysis of BCE Company

Name of the University:

Name of the Student:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL STATEMENT ANALYSIS OF BCE COMPANY

Table of Contents

Analysis of Cash Flows of BCE Company..........................................................................2

References............................................................................................................................4

Appendix..............................................................................................................................5

Table of Contents

Analysis of Cash Flows of BCE Company..........................................................................2

References............................................................................................................................4

Appendix..............................................................................................................................5

2FINANCIAL STATEMENT ANALYSIS OF BCE COMPANY

Analysis of Cash Flows of BCE Company

Cash flow statement analysis of BCE Company is carried out by taking into account the

parent firm, Bell Company for the past three years. Such analysis is focused on evaluating the

cash flow performance of the company and explaining the ways in which the company is

performing in a better manner. It is gathered from the analysis that the company is generating

enough cash from its operating, financing and investing activities. In these major areas, all the

vital aspects of the business transactions are covered. For instance, it indicates the ways in which

BCE Company finances and purchases all its assets rather than just indicating the amount. It is

also observed that the cash and cash equivalents have increased from the year 2014 to 2016;

however, they have fallen significantly in 2015.

However, cash flow from the financing activities is observed to decrease and indicate a

negative change percentage of 13.40% in 2015 and 13.91% in 2016. Capital expenditures of the

company are observed to increase over the years from 2014 to 2016 with a percentage change of

4%. It is also observed from the cash flow statement of BCE Company that in the year 2016, the

operating activities cash flow increased by $369 million in contrast to the year 2015. This

happened mainly because of the reason of higher adjusted EBITDA, decreased acquisition along

with several costs paid.

In 2016, operating activities cash flows of BCE Company increased from $369 million in

contrast to 2015. This is basically because of highly adjusted EBITDA, decreased acquisition

along with several costs paid. This is partially offset by increased voluntary DB pension plan

contribution conducted in 2016. Free cash flow hat is present within the BCE’s common

shareholders increased by $227 million in 2016 because of increased cash flows from operating

Analysis of Cash Flows of BCE Company

Cash flow statement analysis of BCE Company is carried out by taking into account the

parent firm, Bell Company for the past three years. Such analysis is focused on evaluating the

cash flow performance of the company and explaining the ways in which the company is

performing in a better manner. It is gathered from the analysis that the company is generating

enough cash from its operating, financing and investing activities. In these major areas, all the

vital aspects of the business transactions are covered. For instance, it indicates the ways in which

BCE Company finances and purchases all its assets rather than just indicating the amount. It is

also observed that the cash and cash equivalents have increased from the year 2014 to 2016;

however, they have fallen significantly in 2015.

However, cash flow from the financing activities is observed to decrease and indicate a

negative change percentage of 13.40% in 2015 and 13.91% in 2016. Capital expenditures of the

company are observed to increase over the years from 2014 to 2016 with a percentage change of

4%. It is also observed from the cash flow statement of BCE Company that in the year 2016, the

operating activities cash flow increased by $369 million in contrast to the year 2015. This

happened mainly because of the reason of higher adjusted EBITDA, decreased acquisition along

with several costs paid.

In 2016, operating activities cash flows of BCE Company increased from $369 million in

contrast to 2015. This is basically because of highly adjusted EBITDA, decreased acquisition

along with several costs paid. This is partially offset by increased voluntary DB pension plan

contribution conducted in 2016. Free cash flow hat is present within the BCE’s common

shareholders increased by $227 million in 2016 because of increased cash flows from operating

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL STATEMENT ANALYSIS OF BCE COMPANY

activities. Moreover, this is partly offset through increased capital expenditures (Bhandari &

Adams, 2017).

In addition, it has been found out that the cash flows used in financing activities have

shown a declining trend of $327 million in 2015 and $294 million in 2015. This is because of the

increase in issuance of debt instruments and earnings from common shares. With the help of

such declining cash outflows, BCE Company has been able to retain higher cash in hand, which

would help them to invest in future business operations (Chen & Teng, 2015).

Along with this, the free cash flow depicts the cash that an organization could generate

after it has incurred amount needed to expand or diversify its asset base. In case of BCE

Company, increase in free cash flow could be observed due to the rise in operating cash flows

and fall in financing cash flows, even though the investing cash flows have increased

significantly over the years. With such trend, there has been decline in net cash at the end of

2015 for the organization by -79.65% due to significant rise in capital expenditures. However,

such expenditure is offset due to fall in financing cash flows in 2016. As a result, the net cash at

the end of the year 2016 has increased by 410.64%.

activities. Moreover, this is partly offset through increased capital expenditures (Bhandari &

Adams, 2017).

In addition, it has been found out that the cash flows used in financing activities have

shown a declining trend of $327 million in 2015 and $294 million in 2015. This is because of the

increase in issuance of debt instruments and earnings from common shares. With the help of

such declining cash outflows, BCE Company has been able to retain higher cash in hand, which

would help them to invest in future business operations (Chen & Teng, 2015).

Along with this, the free cash flow depicts the cash that an organization could generate

after it has incurred amount needed to expand or diversify its asset base. In case of BCE

Company, increase in free cash flow could be observed due to the rise in operating cash flows

and fall in financing cash flows, even though the investing cash flows have increased

significantly over the years. With such trend, there has been decline in net cash at the end of

2015 for the organization by -79.65% due to significant rise in capital expenditures. However,

such expenditure is offset due to fall in financing cash flows in 2016. As a result, the net cash at

the end of the year 2016 has increased by 410.64%.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL STATEMENT ANALYSIS OF BCE COMPANY

References

Bhandari, S. B., & Adams, M. T. (2017). On the Definition, Measurement, and Use of the Free

Cash Flow Concept in Financial Reporting and Analysis: A Review and

Recommendations. Journal of Accounting and Finance, 17(1), 11-19.

Chen, S. C., & Teng, J. T. (2015). Inventory and credit decisions for time-varying deteriorating

items with up-stream and down-stream trade credit financing by discounted cash flow

analysis. European Journal of Operational Research, 243(2), 566-575.

References

Bhandari, S. B., & Adams, M. T. (2017). On the Definition, Measurement, and Use of the Free

Cash Flow Concept in Financial Reporting and Analysis: A Review and

Recommendations. Journal of Accounting and Finance, 17(1), 11-19.

Chen, S. C., & Teng, J. T. (2015). Inventory and credit decisions for time-varying deteriorating

items with up-stream and down-stream trade credit financing by discounted cash flow

analysis. European Journal of Operational Research, 243(2), 566-575.

5FINANCIAL STATEMENT ANALYSIS OF BCE COMPANY

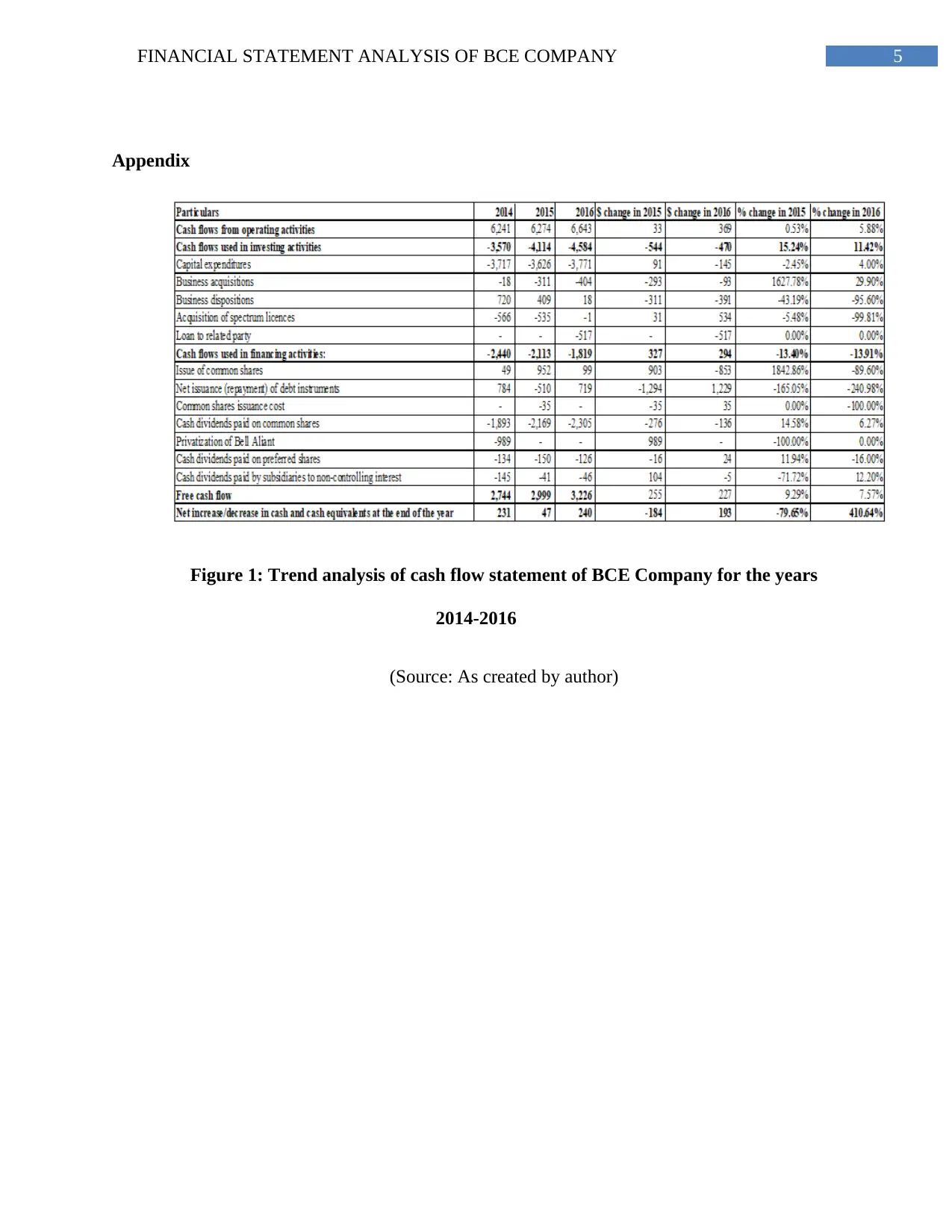

Appendix

Figure 1: Trend analysis of cash flow statement of BCE Company for the years

2014-2016

(Source: As created by author)

Appendix

Figure 1: Trend analysis of cash flow statement of BCE Company for the years

2014-2016

(Source: As created by author)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL STATEMENT ANALYSIS OF BCE COMPANY

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.