Bega Cheese Limited: Detailed Financial Analysis and Performance

VerifiedAdded on 2023/04/22

|22

|4445

|322

Report

AI Summary

This report provides a financial analysis of Bega Cheese Limited, an Australian dairy company, over a three-year period. It examines the company's income statement, statement of financial position, and key financial ratios to assess its performance. The analysis reveals fluctuations in net income, sales revenue, and profitability ratios. While sales revenue increased, the company experienced challenges in managing operating expenses and maintaining a consistent profit margin. Liquidity ratios indicate potential difficulties in meeting current liabilities, and solvency ratios suggest a high reliance on external financing. The report concludes that Bega Cheese's financial performance is unsatisfactory in several areas and recommends focusing on improving current and quick ratios, efficiently utilizing assets, and maintaining a consistent profit margin to ensure future success. Desklib offers similar solved assignments to aid students.

Running Head: BEGA CHEESE LIMITED 0

Bega Cheese Limited

Bega Cheese Limited

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BEGA CHEESE LIMITED 1

Executive Summary

Bega cheese is an Australian dairy company based in the town of New Bega, New South Wales.

It is the agriculture cooperative which is owned by the suppliers of the dairy products. Founded

in the year1899, the company is operating successfully in Australia. The company is listed on the

Australian Securities exchange and is considered to be the largest dairy company in Australia.

The valuation of the company is a$775 million and the Bega Cheese also owns the stakeholder

ship in the Capitol Chilled foods Private Limited @ 25%. In the month of January 2019, Bega

Cheese limited showcased A$460 million deal with multinational food conglomerate known as

Mondelez International to own most of the cheese and the grocery business. Further the company

is involved into the supply of the dairy products and currently the company is operating with the

net income of $28 million along with the sales revenue of $1438 million. This report is directly

showcasing the performance of the Bega cheese limited and the availability of the remedies in

case there are any variances the management had come across during the analysis of the last

three years (Bega Cheese, 2018).

Executive Summary

Bega cheese is an Australian dairy company based in the town of New Bega, New South Wales.

It is the agriculture cooperative which is owned by the suppliers of the dairy products. Founded

in the year1899, the company is operating successfully in Australia. The company is listed on the

Australian Securities exchange and is considered to be the largest dairy company in Australia.

The valuation of the company is a$775 million and the Bega Cheese also owns the stakeholder

ship in the Capitol Chilled foods Private Limited @ 25%. In the month of January 2019, Bega

Cheese limited showcased A$460 million deal with multinational food conglomerate known as

Mondelez International to own most of the cheese and the grocery business. Further the company

is involved into the supply of the dairy products and currently the company is operating with the

net income of $28 million along with the sales revenue of $1438 million. This report is directly

showcasing the performance of the Bega cheese limited and the availability of the remedies in

case there are any variances the management had come across during the analysis of the last

three years (Bega Cheese, 2018).

BEGA CHEESE LIMITED 2

Table of Contents

Executive Summary.....................................................................................................................................1

Introduction.................................................................................................................................................3

Income statement.........................................................................................................................................3

Statement of the Financial Position.............................................................................................................5

Ratio Analysis.............................................................................................................................................6

Conclusion.................................................................................................................................................10

References.................................................................................................................................................12

Appendix 1................................................................................................................................................14

Table of Contents

Executive Summary.....................................................................................................................................1

Introduction.................................................................................................................................................3

Income statement.........................................................................................................................................3

Statement of the Financial Position.............................................................................................................5

Ratio Analysis.............................................................................................................................................6

Conclusion.................................................................................................................................................10

References.................................................................................................................................................12

Appendix 1................................................................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BEGA CHEESE LIMITED 3

Introduction

Financial Analysis is an important tool which helps in the determination of the performance of

the company on the basis of analysis of the income statement, statement of financial position,

comparison using the trend analysis and the ratio analysis. In this report a detailed understanding

of these four events have been carried out for the Bega Cheese Limited company (Bega cheese

Limited, 2017).

Income statement

The main focus of any company is on the financial statements of the business and the users of the

financial statements are mainly interested in knowing the profitability position of the business.

The income statement is made in order to report how much profit is generated by the business

and what is the share of the investors. The increase in the equity section of the owners is

reflected by the financial profit earned by the company. The profit in the income statement is

calculated by the deducting the expenses. Further the increase in the income reflects the

enhancement in the economic benefits for the future.

Introduction

Financial Analysis is an important tool which helps in the determination of the performance of

the company on the basis of analysis of the income statement, statement of financial position,

comparison using the trend analysis and the ratio analysis. In this report a detailed understanding

of these four events have been carried out for the Bega Cheese Limited company (Bega cheese

Limited, 2017).

Income statement

The main focus of any company is on the financial statements of the business and the users of the

financial statements are mainly interested in knowing the profitability position of the business.

The income statement is made in order to report how much profit is generated by the business

and what is the share of the investors. The increase in the equity section of the owners is

reflected by the financial profit earned by the company. The profit in the income statement is

calculated by the deducting the expenses. Further the increase in the income reflects the

enhancement in the economic benefits for the future.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BEGA CHEESE LIMITED 4

2016-06 2017-06 2018-06

0

20

40

60

80

100

120

140

Net income

Net income

Axis Title

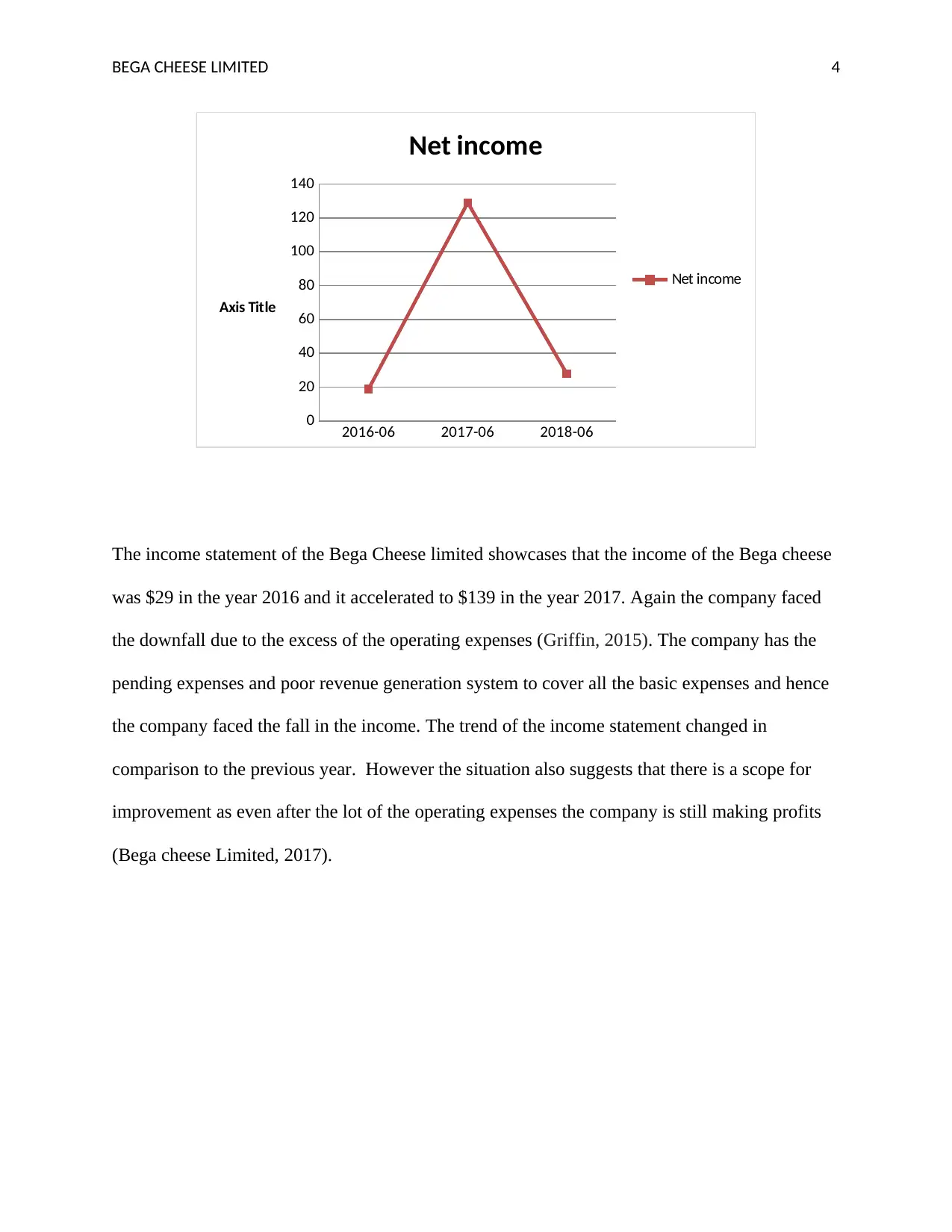

The income statement of the Bega Cheese limited showcases that the income of the Bega cheese

was $29 in the year 2016 and it accelerated to $139 in the year 2017. Again the company faced

the downfall due to the excess of the operating expenses (Griffin, 2015). The company has the

pending expenses and poor revenue generation system to cover all the basic expenses and hence

the company faced the fall in the income. The trend of the income statement changed in

comparison to the previous year. However the situation also suggests that there is a scope for

improvement as even after the lot of the operating expenses the company is still making profits

(Bega cheese Limited, 2017).

2016-06 2017-06 2018-06

0

20

40

60

80

100

120

140

Net income

Net income

Axis Title

The income statement of the Bega Cheese limited showcases that the income of the Bega cheese

was $29 in the year 2016 and it accelerated to $139 in the year 2017. Again the company faced

the downfall due to the excess of the operating expenses (Griffin, 2015). The company has the

pending expenses and poor revenue generation system to cover all the basic expenses and hence

the company faced the fall in the income. The trend of the income statement changed in

comparison to the previous year. However the situation also suggests that there is a scope for

improvement as even after the lot of the operating expenses the company is still making profits

(Bega cheese Limited, 2017).

BEGA CHEESE LIMITED 5

2016-06 2017-06 2018-06

0

200

400

600

800

1000

1200

1400

1600

Revenue

Cost of revenue

Gross profit

(Source: By Author)

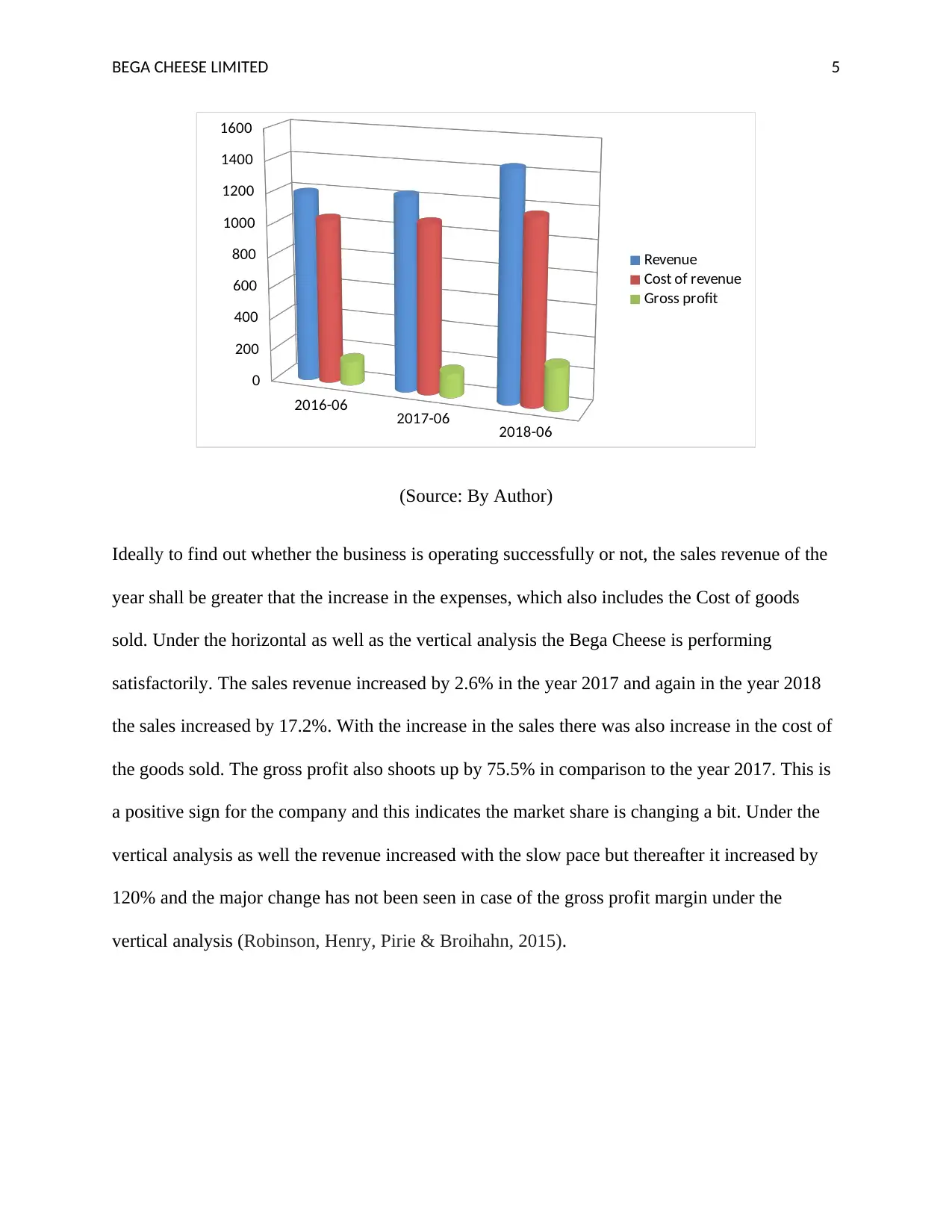

Ideally to find out whether the business is operating successfully or not, the sales revenue of the

year shall be greater that the increase in the expenses, which also includes the Cost of goods

sold. Under the horizontal as well as the vertical analysis the Bega Cheese is performing

satisfactorily. The sales revenue increased by 2.6% in the year 2017 and again in the year 2018

the sales increased by 17.2%. With the increase in the sales there was also increase in the cost of

the goods sold. The gross profit also shoots up by 75.5% in comparison to the year 2017. This is

a positive sign for the company and this indicates the market share is changing a bit. Under the

vertical analysis as well the revenue increased with the slow pace but thereafter it increased by

120% and the major change has not been seen in case of the gross profit margin under the

vertical analysis (Robinson, Henry, Pirie & Broihahn, 2015).

2016-06 2017-06 2018-06

0

200

400

600

800

1000

1200

1400

1600

Revenue

Cost of revenue

Gross profit

(Source: By Author)

Ideally to find out whether the business is operating successfully or not, the sales revenue of the

year shall be greater that the increase in the expenses, which also includes the Cost of goods

sold. Under the horizontal as well as the vertical analysis the Bega Cheese is performing

satisfactorily. The sales revenue increased by 2.6% in the year 2017 and again in the year 2018

the sales increased by 17.2%. With the increase in the sales there was also increase in the cost of

the goods sold. The gross profit also shoots up by 75.5% in comparison to the year 2017. This is

a positive sign for the company and this indicates the market share is changing a bit. Under the

vertical analysis as well the revenue increased with the slow pace but thereafter it increased by

120% and the major change has not been seen in case of the gross profit margin under the

vertical analysis (Robinson, Henry, Pirie & Broihahn, 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BEGA CHEESE LIMITED 6

Statement of the Financial Position

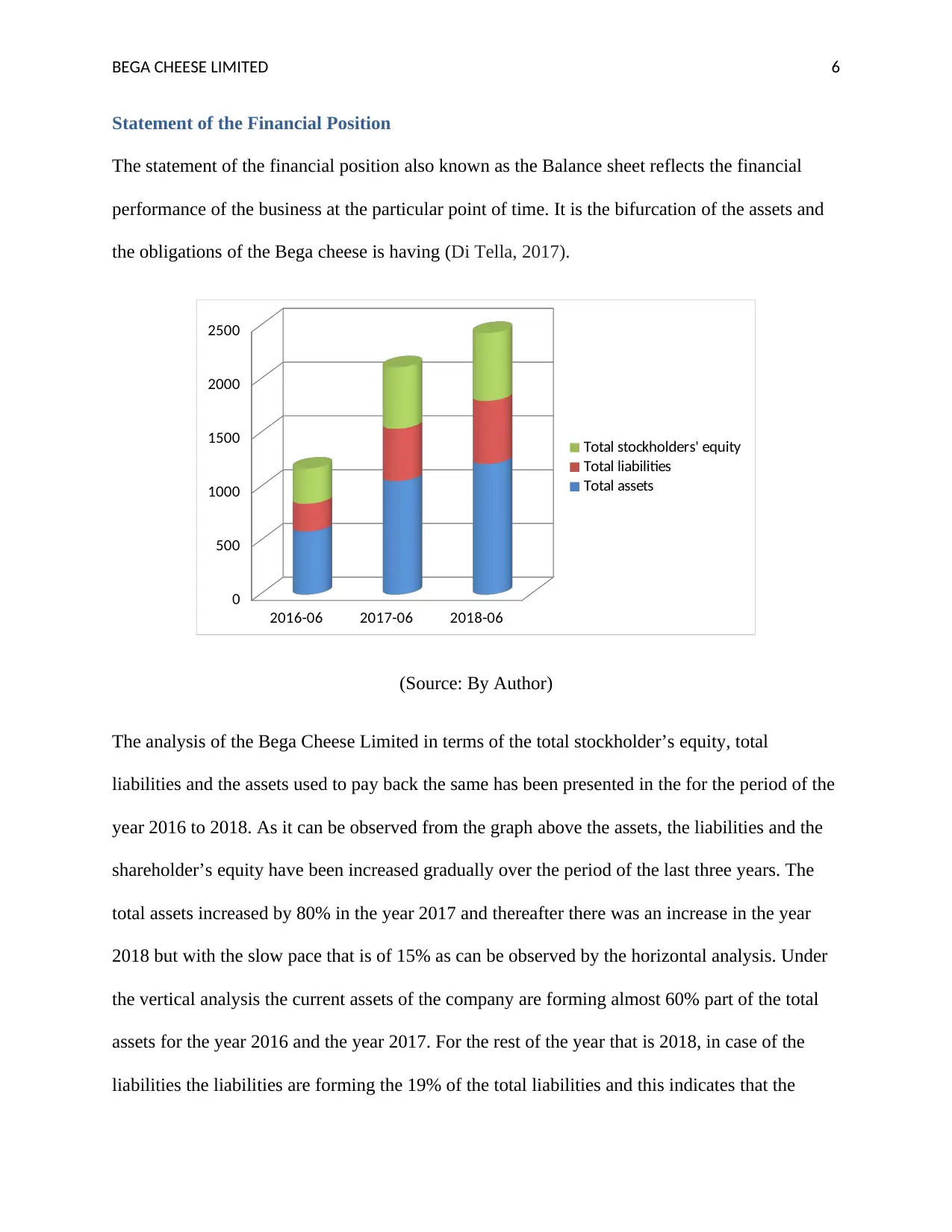

The statement of the financial position also known as the Balance sheet reflects the financial

performance of the business at the particular point of time. It is the bifurcation of the assets and

the obligations of the Bega cheese is having (Di Tella, 2017).

2016-06 2017-06 2018-06

0

500

1000

1500

2000

2500

Total stockholders' equity

Total liabilities

Total assets

(Source: By Author)

The analysis of the Bega Cheese Limited in terms of the total stockholder’s equity, total

liabilities and the assets used to pay back the same has been presented in the for the period of the

year 2016 to 2018. As it can be observed from the graph above the assets, the liabilities and the

shareholder’s equity have been increased gradually over the period of the last three years. The

total assets increased by 80% in the year 2017 and thereafter there was an increase in the year

2018 but with the slow pace that is of 15% as can be observed by the horizontal analysis. Under

the vertical analysis the current assets of the company are forming almost 60% part of the total

assets for the year 2016 and the year 2017. For the rest of the year that is 2018, in case of the

liabilities the liabilities are forming the 19% of the total liabilities and this indicates that the

Statement of the Financial Position

The statement of the financial position also known as the Balance sheet reflects the financial

performance of the business at the particular point of time. It is the bifurcation of the assets and

the obligations of the Bega cheese is having (Di Tella, 2017).

2016-06 2017-06 2018-06

0

500

1000

1500

2000

2500

Total stockholders' equity

Total liabilities

Total assets

(Source: By Author)

The analysis of the Bega Cheese Limited in terms of the total stockholder’s equity, total

liabilities and the assets used to pay back the same has been presented in the for the period of the

year 2016 to 2018. As it can be observed from the graph above the assets, the liabilities and the

shareholder’s equity have been increased gradually over the period of the last three years. The

total assets increased by 80% in the year 2017 and thereafter there was an increase in the year

2018 but with the slow pace that is of 15% as can be observed by the horizontal analysis. Under

the vertical analysis the current assets of the company are forming almost 60% part of the total

assets for the year 2016 and the year 2017. For the rest of the year that is 2018, in case of the

liabilities the liabilities are forming the 19% of the total liabilities and this indicates that the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BEGA CHEESE LIMITED 7

current assets are not sufficient to pay back the current liabilities on time (Uechi, et al 2015).

Moreover the total liabilities have increased over the period of the three years and the assets have

increased too. The long term debt of the company just multiplied by 5 times form the year 2016

to 2017 at 215 in dollars, whereas the current assets just multiplied by 3 times (ElFayoumi,

2018).

As a result the liabilities of the company are increasing more than the current assets and this is

the situation that the company needs to monitor and take care of.

Ratio Analysis

Profitability ratios

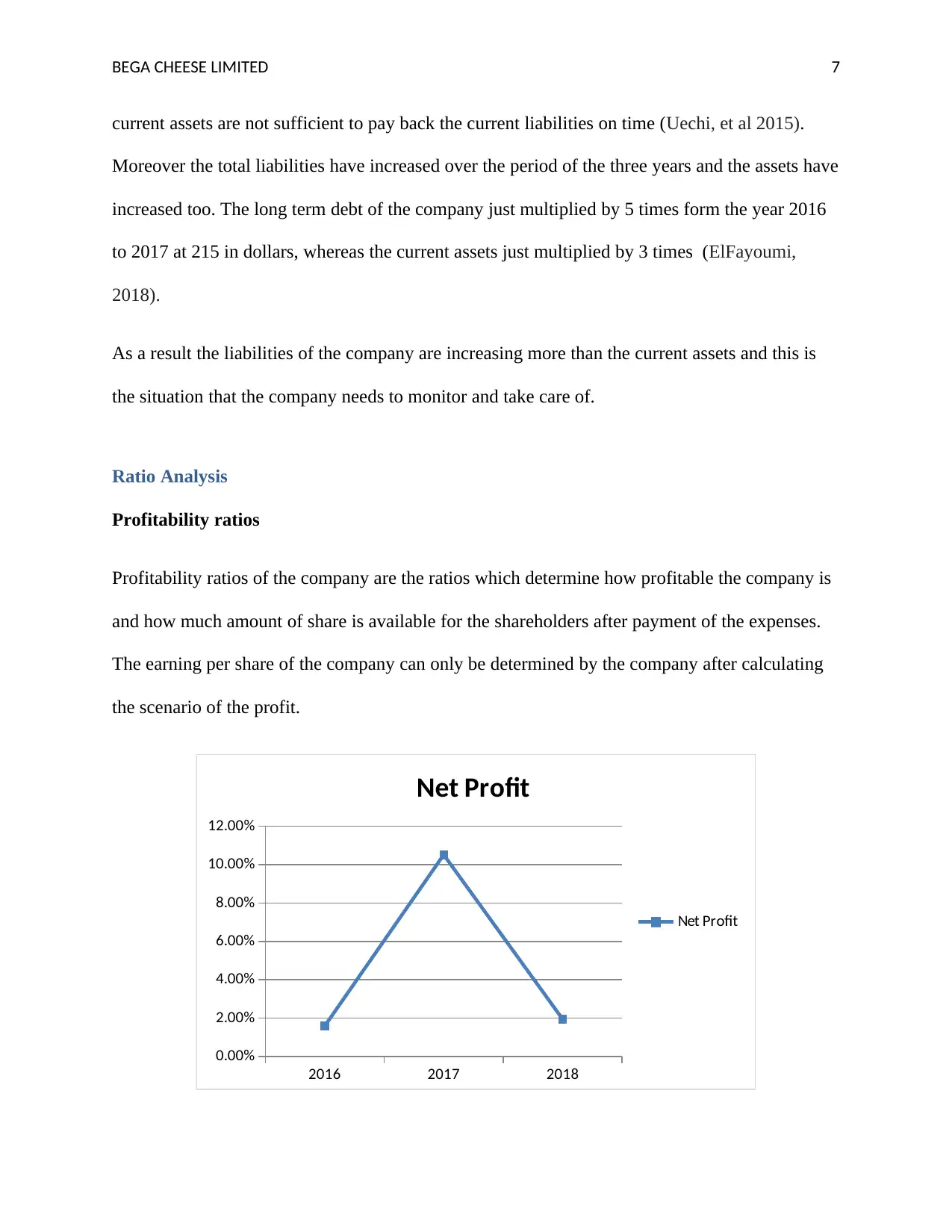

Profitability ratios of the company are the ratios which determine how profitable the company is

and how much amount of share is available for the shareholders after payment of the expenses.

The earning per share of the company can only be determined by the company after calculating

the scenario of the profit.

2016 2017 2018

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

Net Profit

Net Profit

current assets are not sufficient to pay back the current liabilities on time (Uechi, et al 2015).

Moreover the total liabilities have increased over the period of the three years and the assets have

increased too. The long term debt of the company just multiplied by 5 times form the year 2016

to 2017 at 215 in dollars, whereas the current assets just multiplied by 3 times (ElFayoumi,

2018).

As a result the liabilities of the company are increasing more than the current assets and this is

the situation that the company needs to monitor and take care of.

Ratio Analysis

Profitability ratios

Profitability ratios of the company are the ratios which determine how profitable the company is

and how much amount of share is available for the shareholders after payment of the expenses.

The earning per share of the company can only be determined by the company after calculating

the scenario of the profit.

2016 2017 2018

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

Net Profit

Net Profit

BEGA CHEESE LIMITED 8

Net profit ratio is the basic ratio which determines the ability of the company to generate the

revenues out of the sales made during a year. The net profit is the key criteria for any investor,

who has invested in the business, to judge the financial position of the business. The net profit of

the Bega Cheese Limited has increased from the year 2016. Earlier in the year 2016 the net profit

margin was so low at 2.42% and then it gradually increased and reached to 11.33%. As soon as

the position improved the company again falls down in terms of the profit margin and reached to

1.95% which is lower than the year 2016 (Bega cheese Limited, 2017).

Efficiency ratios

Efficiency ratios determine the efficiency of the company in utilizing the assets of the company

to manage the contractual obligations. It is used to measure the performance of the company in

the short term period (Riyadi, 2017).

The asset turnover ratio of the company earlier was 4.07 which indicated that the company is

able to utilize the assets well and thereafter the scenario changed and the assets held by the

company are not utilized in the effective manner or may be the obsolete assets are prevailing

more as the ratio fell down to 2.36 by the end of the year 2018 (Anwar, Fathoni & Gagah, 2018).

Net profit ratio is the basic ratio which determines the ability of the company to generate the

revenues out of the sales made during a year. The net profit is the key criteria for any investor,

who has invested in the business, to judge the financial position of the business. The net profit of

the Bega Cheese Limited has increased from the year 2016. Earlier in the year 2016 the net profit

margin was so low at 2.42% and then it gradually increased and reached to 11.33%. As soon as

the position improved the company again falls down in terms of the profit margin and reached to

1.95% which is lower than the year 2016 (Bega cheese Limited, 2017).

Efficiency ratios

Efficiency ratios determine the efficiency of the company in utilizing the assets of the company

to manage the contractual obligations. It is used to measure the performance of the company in

the short term period (Riyadi, 2017).

The asset turnover ratio of the company earlier was 4.07 which indicated that the company is

able to utilize the assets well and thereafter the scenario changed and the assets held by the

company are not utilized in the effective manner or may be the obsolete assets are prevailing

more as the ratio fell down to 2.36 by the end of the year 2018 (Anwar, Fathoni & Gagah, 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BEGA CHEESE LIMITED 9

2016

2017

2018

0.0

10.0

20.0

30.0

40.0

50.0

60.0

Days Inventory Outstanding

Days Payable Outstanding

Days Inventory

Outstanding

Days Receivable

Outstanding

Days Payable Outstanding

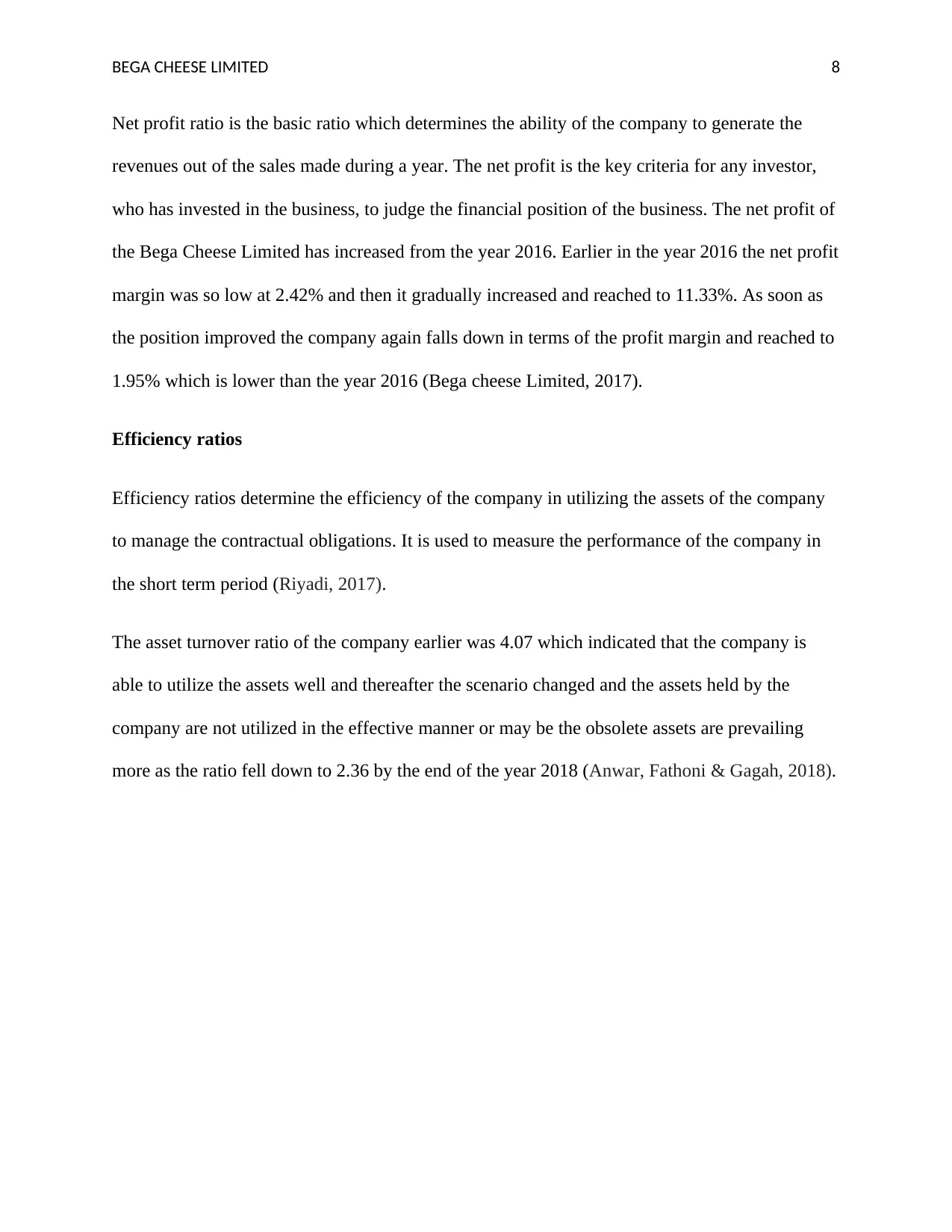

The inventory turnover ratio was a fluctuating one but a moderate fluctuation is seen and the

company is performing better in realizing the cash from the inventory soon. Secondly the

company has improved the position in payment to the creditors by reducing the number of days

to 47.4 from 52.3 days. Furthermore, the cash received by the company is in delay and it is

advised to the company to reframe the same so that the cash cycle of the company can be sorted

out (Bega cheese Limited, 2017).

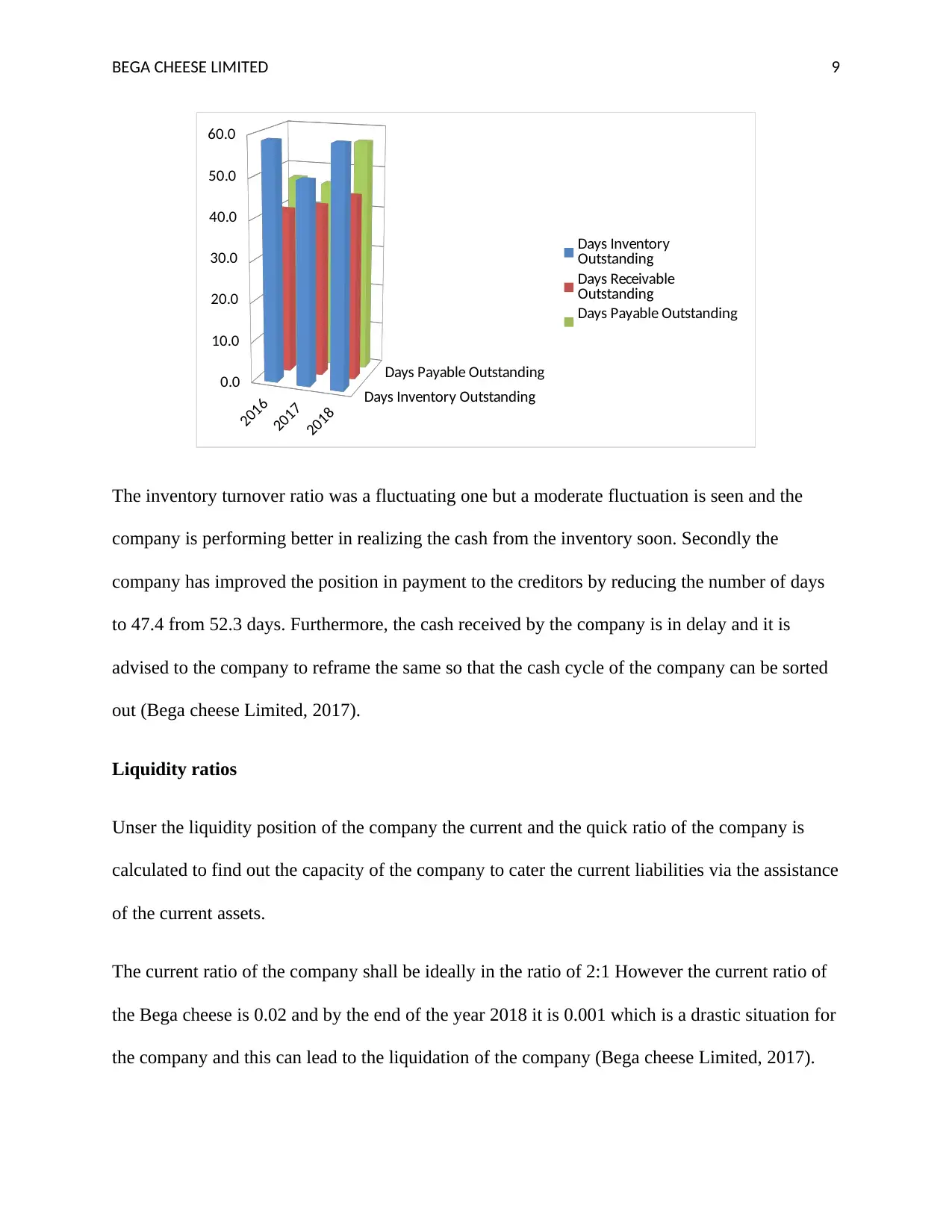

Liquidity ratios

Unser the liquidity position of the company the current and the quick ratio of the company is

calculated to find out the capacity of the company to cater the current liabilities via the assistance

of the current assets.

The current ratio of the company shall be ideally in the ratio of 2:1 However the current ratio of

the Bega cheese is 0.02 and by the end of the year 2018 it is 0.001 which is a drastic situation for

the company and this can lead to the liquidation of the company (Bega cheese Limited, 2017).

2016

2017

2018

0.0

10.0

20.0

30.0

40.0

50.0

60.0

Days Inventory Outstanding

Days Payable Outstanding

Days Inventory

Outstanding

Days Receivable

Outstanding

Days Payable Outstanding

The inventory turnover ratio was a fluctuating one but a moderate fluctuation is seen and the

company is performing better in realizing the cash from the inventory soon. Secondly the

company has improved the position in payment to the creditors by reducing the number of days

to 47.4 from 52.3 days. Furthermore, the cash received by the company is in delay and it is

advised to the company to reframe the same so that the cash cycle of the company can be sorted

out (Bega cheese Limited, 2017).

Liquidity ratios

Unser the liquidity position of the company the current and the quick ratio of the company is

calculated to find out the capacity of the company to cater the current liabilities via the assistance

of the current assets.

The current ratio of the company shall be ideally in the ratio of 2:1 However the current ratio of

the Bega cheese is 0.02 and by the end of the year 2018 it is 0.001 which is a drastic situation for

the company and this can lead to the liquidation of the company (Bega cheese Limited, 2017).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BEGA CHEESE LIMITED 10

2016

2017

2018

0.00 0.10 0.20 0.30 0.40 0.50 0.60

Liquidity Ratios

Quick Ratio

Current Ratio

The quick ratio of the company on the other hand was fair in the year 2017 but in the year 2018

again the ratio was deteriorated.

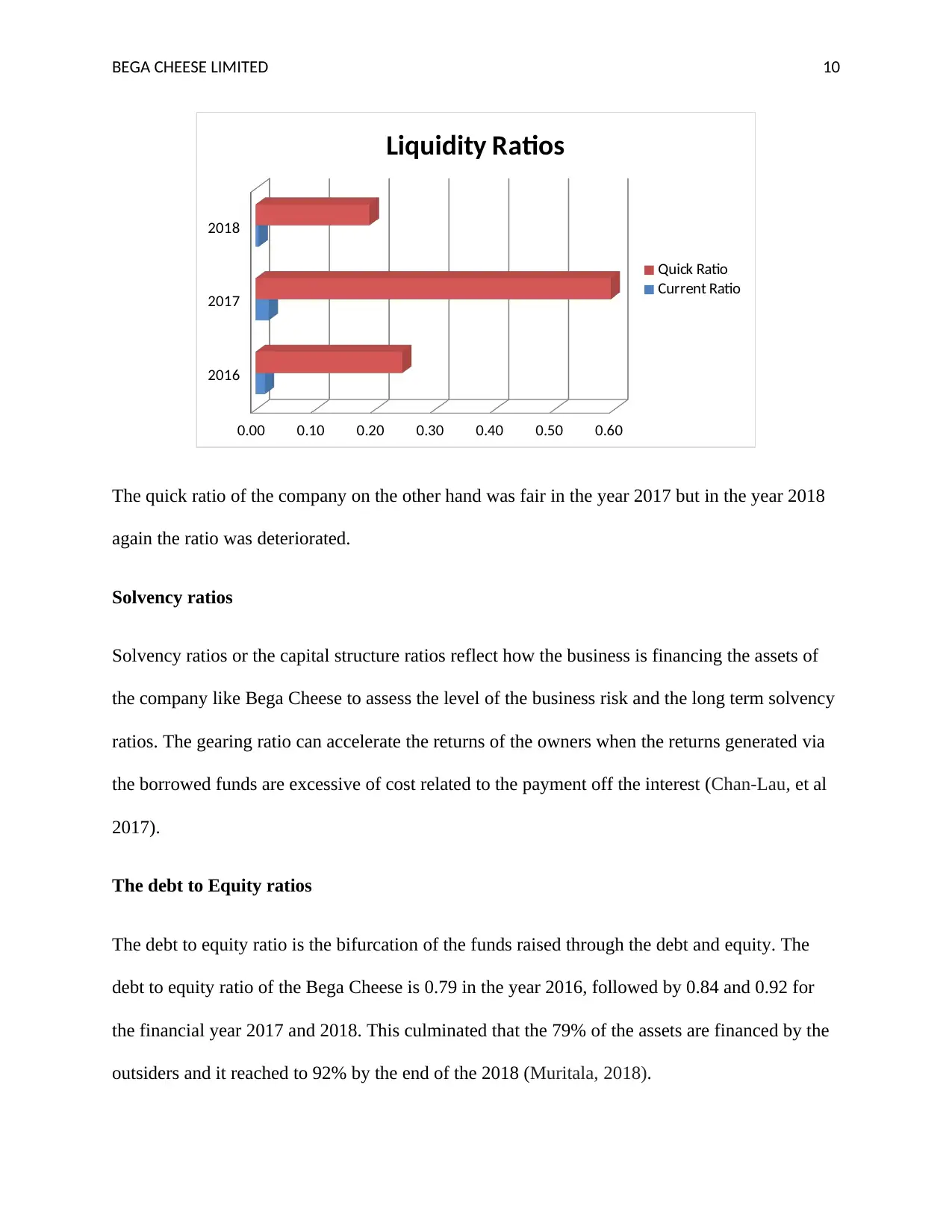

Solvency ratios

Solvency ratios or the capital structure ratios reflect how the business is financing the assets of

the company like Bega Cheese to assess the level of the business risk and the long term solvency

ratios. The gearing ratio can accelerate the returns of the owners when the returns generated via

the borrowed funds are excessive of cost related to the payment off the interest (Chan-Lau, et al

2017).

The debt to Equity ratios

The debt to equity ratio is the bifurcation of the funds raised through the debt and equity. The

debt to equity ratio of the Bega Cheese is 0.79 in the year 2016, followed by 0.84 and 0.92 for

the financial year 2017 and 2018. This culminated that the 79% of the assets are financed by the

outsiders and it reached to 92% by the end of the 2018 (Muritala, 2018).

2016

2017

2018

0.00 0.10 0.20 0.30 0.40 0.50 0.60

Liquidity Ratios

Quick Ratio

Current Ratio

The quick ratio of the company on the other hand was fair in the year 2017 but in the year 2018

again the ratio was deteriorated.

Solvency ratios

Solvency ratios or the capital structure ratios reflect how the business is financing the assets of

the company like Bega Cheese to assess the level of the business risk and the long term solvency

ratios. The gearing ratio can accelerate the returns of the owners when the returns generated via

the borrowed funds are excessive of cost related to the payment off the interest (Chan-Lau, et al

2017).

The debt to Equity ratios

The debt to equity ratio is the bifurcation of the funds raised through the debt and equity. The

debt to equity ratio of the Bega Cheese is 0.79 in the year 2016, followed by 0.84 and 0.92 for

the financial year 2017 and 2018. This culminated that the 79% of the assets are financed by the

outsiders and it reached to 92% by the end of the 2018 (Muritala, 2018).

BEGA CHEESE LIMITED 11

2016 2017 2018

-30.00

-25.00

-20.00

-15.00

-10.00

-5.00

0.00

5.00

10.00

15.00

Solvency Ratios

Debt to Equity

Times interest coverage

ratio

Debt to Total Assets

Times interest coverage ratio has been 14.6 times which the cost of thee financing is above

average. In the successive years the interest coverage ratio turned out to be negative due to

negative income. Therefore it can be clearly said that the Bega cheese company cannot readily

pay the interest expenses as its operating income is negative in nature even though the company

is improving (Du, Tepper & Verdelhan, 2018).

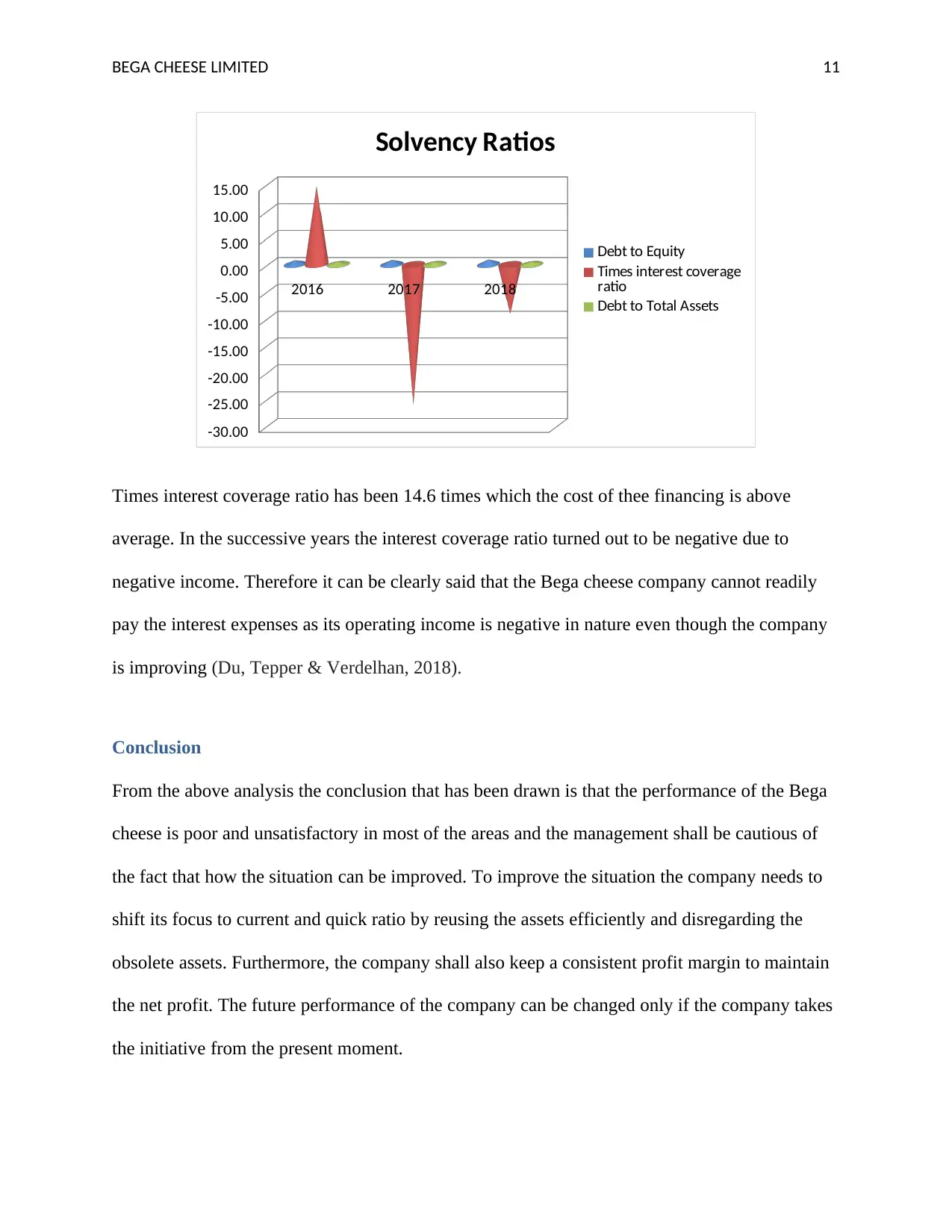

Conclusion

From the above analysis the conclusion that has been drawn is that the performance of the Bega

cheese is poor and unsatisfactory in most of the areas and the management shall be cautious of

the fact that how the situation can be improved. To improve the situation the company needs to

shift its focus to current and quick ratio by reusing the assets efficiently and disregarding the

obsolete assets. Furthermore, the company shall also keep a consistent profit margin to maintain

the net profit. The future performance of the company can be changed only if the company takes

the initiative from the present moment.

2016 2017 2018

-30.00

-25.00

-20.00

-15.00

-10.00

-5.00

0.00

5.00

10.00

15.00

Solvency Ratios

Debt to Equity

Times interest coverage

ratio

Debt to Total Assets

Times interest coverage ratio has been 14.6 times which the cost of thee financing is above

average. In the successive years the interest coverage ratio turned out to be negative due to

negative income. Therefore it can be clearly said that the Bega cheese company cannot readily

pay the interest expenses as its operating income is negative in nature even though the company

is improving (Du, Tepper & Verdelhan, 2018).

Conclusion

From the above analysis the conclusion that has been drawn is that the performance of the Bega

cheese is poor and unsatisfactory in most of the areas and the management shall be cautious of

the fact that how the situation can be improved. To improve the situation the company needs to

shift its focus to current and quick ratio by reusing the assets efficiently and disregarding the

obsolete assets. Furthermore, the company shall also keep a consistent profit margin to maintain

the net profit. The future performance of the company can be changed only if the company takes

the initiative from the present moment.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.