Financial Statement Analysis: A Performance Report on Bellamy's Ltd

VerifiedAdded on 2023/06/04

|18

|5272

|297

Report

AI Summary

This report provides a detailed financial statement analysis of Bellamy's Australia Ltd, focusing on the period from 2016 to 2018. It examines the company's performance through various financial ratios, including profitability, efficiency, solvency, and market-based ratios. The analysis reveals fluctuations in Bellamy's performance, with a significant decline in 2017 followed by a notable turnaround in 2018. The report highlights the impact of factors such as revenue growth, cost management, and strategic acquisitions on the company's financial health. Key performance measures like gross profit margin, return on total assets, and return on equity are thoroughly evaluated, providing insights into the strengths and weaknesses of Bellamy's Australia Ltd over the analyzed period.

Financial Statement Analysis –Analysis of the profitability and overall performance

Case of Bellamy’s Australia Ltd

Case of Bellamy’s Australia Ltd

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Executive summary

The study tries to analyze financial statements of Bellamy’s and equally ration the performance

in terms of assets that were utilized, and overall profit. The research method adopted for the

report looked at the previous and current financial reports of Australian baby products industry.

The report entirely depends on the information available, that were composed for a period of

three years (2016 to June 2018) for the yearly and reviewed information of the corporation that

were preserved and availed through various organizations including the Australian stocks

exchange for periodic analysis. To find out the performance of the company we shall evaluate it

with the help of ratios. This report used this ratios and statement provided to analyze, this

included profitability ratios which may affect the company performance. The following ratios

were looked at Gross profit margin (GPM). Return on total assets (ROTA), Return on equity

(ROE), turnover ratios as well as solvency ratios. All the analysis was done to the case of

Bellamy’s Australia Ltd. The study reveals strengths and weakness of the company over the

financial period 2016 to 2018. In the year 2017 there was a significant decline in the

performance however in the following year there was much turn around for the company.

Keywords: Financial ratios, Solvency Ratios, Profit Ratios, and Market Ratios, Bellamy’s

Australia Ltd

2

The study tries to analyze financial statements of Bellamy’s and equally ration the performance

in terms of assets that were utilized, and overall profit. The research method adopted for the

report looked at the previous and current financial reports of Australian baby products industry.

The report entirely depends on the information available, that were composed for a period of

three years (2016 to June 2018) for the yearly and reviewed information of the corporation that

were preserved and availed through various organizations including the Australian stocks

exchange for periodic analysis. To find out the performance of the company we shall evaluate it

with the help of ratios. This report used this ratios and statement provided to analyze, this

included profitability ratios which may affect the company performance. The following ratios

were looked at Gross profit margin (GPM). Return on total assets (ROTA), Return on equity

(ROE), turnover ratios as well as solvency ratios. All the analysis was done to the case of

Bellamy’s Australia Ltd. The study reveals strengths and weakness of the company over the

financial period 2016 to 2018. In the year 2017 there was a significant decline in the

performance however in the following year there was much turn around for the company.

Keywords: Financial ratios, Solvency Ratios, Profit Ratios, and Market Ratios, Bellamy’s

Australia Ltd

2

Table of Contents

Executive summary.........................................................................................................................2

1.0 Introduction................................................................................................................................4

1.1 Company overview and its operations.......................................................................................4

1.1.1 Operational review..............................................................................................................4

1.1.2 Financial Review.................................................................................................................5

1.1.3 Revenue and profitability....................................................................................................5

1.2 Corporate social and environmental reporting analysis.............................................................5

2.0 Analysis of the firm...................................................................................................................5

2.1 Profitability................................................................................................................................7

2.1.1 Profit margin.......................................................................................................................8

2.1.2 Return on Total Assets........................................................................................................8

2.1.3 Return on Equity.................................................................................................................8

2.2 Efficiency...................................................................................................................................8

2.3 Short-term solvency...................................................................................................................9

2.4 Long-term solvency...................................................................................................................9

2.5 Market-based ratios.................................................................................................................10

2.6 Other analyses..........................................................................................................................10

2.6.1 Performance Measures.....................................................................................................10

3.0 Conclusions..............................................................................................................................10

3.1 Recommendations....................................................................................................................11

3.2 Limitations...............................................................................................................................11

References......................................................................................................................................12

Appendices....................................................................................................................................14

Appendix 1; Income statement Analysis for the three years.....................................................14

Appendix 2 . Balance Sheet Analysis for Three financial Periods............................................16

3

Executive summary.........................................................................................................................2

1.0 Introduction................................................................................................................................4

1.1 Company overview and its operations.......................................................................................4

1.1.1 Operational review..............................................................................................................4

1.1.2 Financial Review.................................................................................................................5

1.1.3 Revenue and profitability....................................................................................................5

1.2 Corporate social and environmental reporting analysis.............................................................5

2.0 Analysis of the firm...................................................................................................................5

2.1 Profitability................................................................................................................................7

2.1.1 Profit margin.......................................................................................................................8

2.1.2 Return on Total Assets........................................................................................................8

2.1.3 Return on Equity.................................................................................................................8

2.2 Efficiency...................................................................................................................................8

2.3 Short-term solvency...................................................................................................................9

2.4 Long-term solvency...................................................................................................................9

2.5 Market-based ratios.................................................................................................................10

2.6 Other analyses..........................................................................................................................10

2.6.1 Performance Measures.....................................................................................................10

3.0 Conclusions..............................................................................................................................10

3.1 Recommendations....................................................................................................................11

3.2 Limitations...............................................................................................................................11

References......................................................................................................................................12

Appendices....................................................................................................................................14

Appendix 1; Income statement Analysis for the three years.....................................................14

Appendix 2 . Balance Sheet Analysis for Three financial Periods............................................16

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1.0 Introduction

Laitinen (2002) describes financial analysis as the process of assessing the financial position of a

corporation by evaluating its steadiness, feasibility and productivity. The main objectives of

financial analysis are to identify variations in financial tendencies, that enable measurement of

the advancement made by a firm and recognize a connection to make deduction on the

performance of the corporation. Another major feature of a financial analysis is comparison of

performance of the corporation with its opponents. According to Maggina (2008) the financial

ratios are always drawn from annual financial reports that must be used in extensive way in

preceding exploration for several reasons such as estimates in the commercial sectors. According

to Gibson (2013) the primary financial statement of a company is a statement of income (profit

and loss statement) and statement of financial position that can be prepared directly from the

adjustments made in the ledger accounts. Helfert (2003) further explains the statement of

financial position as a static like snapshot, that replicates situations on specific time lines of its

presentation, consider the groups besides sums of assets used by the firm and settling the

obligations sustained to creditors and equity holders. Reeves (2011) financial reports are very

important in evaluating the condition and state of a corporation.

According to Bodie et al., (2009) financial statements aid very important financial functions:

through provision of data to the equity holders and lenders of the corporation concerning the

corporation’s present positions and previous financial performance; financial statements also

give a better means for equity owners and lenders to have goals and can enforce limitations on

the management of the company; and, they offer appropriate models for financial forecasting.

1.1 Company overview and its operations

1.1.1 Operational review

Bellamy’s ltd is a leading infant nutrition brand in the Australian market and Chinese market.

Following a tough 2017 year, the company has experienced a major turn around and has

delivered tangible results in terms of the growth of revenue, profitability, and cashflow.

Bellamy’s remains confident in its application of the technical merit and further prospects for

registration specifically in the Chinese market. The Chinese label product sold all round

channels including off line and it contributed to 6% of sales revenue of the company. This

current financial year 2018 has ensured that there is restructuring of overheads, the distribution

channels and the value chain of the supply end. The company raised funds to fund the restructure

and acquire the Chinese license in one of the manufacturing facilities during the opening period

of the current year.

The company adopted a business model that was sustainable, and it improved the profit structure

which is now established under various changes that the company implemented over the

financial year. For instance the growth of the portfolio was initiated that included an

establishment of a food business unit that was waiting for full registration, the company further

venture into new markets like the Vietnam market and the new product development has been so

far good., looking at the value chain supply the integral part is in the acquisition of the

4

Laitinen (2002) describes financial analysis as the process of assessing the financial position of a

corporation by evaluating its steadiness, feasibility and productivity. The main objectives of

financial analysis are to identify variations in financial tendencies, that enable measurement of

the advancement made by a firm and recognize a connection to make deduction on the

performance of the corporation. Another major feature of a financial analysis is comparison of

performance of the corporation with its opponents. According to Maggina (2008) the financial

ratios are always drawn from annual financial reports that must be used in extensive way in

preceding exploration for several reasons such as estimates in the commercial sectors. According

to Gibson (2013) the primary financial statement of a company is a statement of income (profit

and loss statement) and statement of financial position that can be prepared directly from the

adjustments made in the ledger accounts. Helfert (2003) further explains the statement of

financial position as a static like snapshot, that replicates situations on specific time lines of its

presentation, consider the groups besides sums of assets used by the firm and settling the

obligations sustained to creditors and equity holders. Reeves (2011) financial reports are very

important in evaluating the condition and state of a corporation.

According to Bodie et al., (2009) financial statements aid very important financial functions:

through provision of data to the equity holders and lenders of the corporation concerning the

corporation’s present positions and previous financial performance; financial statements also

give a better means for equity owners and lenders to have goals and can enforce limitations on

the management of the company; and, they offer appropriate models for financial forecasting.

1.1 Company overview and its operations

1.1.1 Operational review

Bellamy’s ltd is a leading infant nutrition brand in the Australian market and Chinese market.

Following a tough 2017 year, the company has experienced a major turn around and has

delivered tangible results in terms of the growth of revenue, profitability, and cashflow.

Bellamy’s remains confident in its application of the technical merit and further prospects for

registration specifically in the Chinese market. The Chinese label product sold all round

channels including off line and it contributed to 6% of sales revenue of the company. This

current financial year 2018 has ensured that there is restructuring of overheads, the distribution

channels and the value chain of the supply end. The company raised funds to fund the restructure

and acquire the Chinese license in one of the manufacturing facilities during the opening period

of the current year.

The company adopted a business model that was sustainable, and it improved the profit structure

which is now established under various changes that the company implemented over the

financial year. For instance the growth of the portfolio was initiated that included an

establishment of a food business unit that was waiting for full registration, the company further

venture into new markets like the Vietnam market and the new product development has been so

far good., looking at the value chain supply the integral part is in the acquisition of the

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Camperdown facility ,the company procurement has been diversified to ensure there is a

competitive capacity that can be able to support growth, the processing channels too have

experienced improved manufacturing and production decisions that have ensured a greater

flexibility and reduced inventory position. Furthermore, the sales have improved and leading to

stable pricing, the overall marketing strategy of the firm has been more effective and increased

materially.

1.1.2 Financial Review

The company achieved a Profit after tax of $38.3 M in the year 2018 u from a loss of ($0.8M) in

the financial year 2017. The revenue achieved was $328.7M in 2018 up from $240.2M in 2017

this was predominantly volume driven and included contribution from the outlets in China that

also contributed to it. Drake (2011), analysis involves the selection of information to assist in

decision making.

1.1.3 Revenue and profitability

In general, the Bellamy’s group revenue grew by 37% up from the year 2017. This can be

attributed to the contribution from the subsidiary open in Camperdown China, through the

support of the brand it has seen the price of products stabilize, excluding the expansion in

Camperdown the revenue growth standards at 33.2% compared to the 24% in the previous year.

1.2 Corporate social and environmental reporting analysis

Hopwood (2009), states that Corporate Social and Environmental Reporting (CSER) is an

essential constituent of corporate social responsibility, emphasizing the necessity to recognize

communally relevant behavior, and to determine individuals to whom the company is to be held

responsible, and to develop fitting measures and reporting techniques. This has resulted to

demands for firms to become more responsible and to manage its effect on the environment in a

better way.

2.0 Analysis of the firm

Table no.1

2018 2017 2016

Revenue 328,704.00 240,182.00 244,583.00

Cost of sales 199,830.00 148,661.00 132,855.00

gross profit 128,874.00 91,521.00 111,728.00

net profit or loss 42,816.00 (807.00) 38,328.00

profit margin % 13% -0.3% 16%

gross profit margin % 39% 38% 46%

Return of total assets 0.196 (0.005) 0.355

5

competitive capacity that can be able to support growth, the processing channels too have

experienced improved manufacturing and production decisions that have ensured a greater

flexibility and reduced inventory position. Furthermore, the sales have improved and leading to

stable pricing, the overall marketing strategy of the firm has been more effective and increased

materially.

1.1.2 Financial Review

The company achieved a Profit after tax of $38.3 M in the year 2018 u from a loss of ($0.8M) in

the financial year 2017. The revenue achieved was $328.7M in 2018 up from $240.2M in 2017

this was predominantly volume driven and included contribution from the outlets in China that

also contributed to it. Drake (2011), analysis involves the selection of information to assist in

decision making.

1.1.3 Revenue and profitability

In general, the Bellamy’s group revenue grew by 37% up from the year 2017. This can be

attributed to the contribution from the subsidiary open in Camperdown China, through the

support of the brand it has seen the price of products stabilize, excluding the expansion in

Camperdown the revenue growth standards at 33.2% compared to the 24% in the previous year.

1.2 Corporate social and environmental reporting analysis

Hopwood (2009), states that Corporate Social and Environmental Reporting (CSER) is an

essential constituent of corporate social responsibility, emphasizing the necessity to recognize

communally relevant behavior, and to determine individuals to whom the company is to be held

responsible, and to develop fitting measures and reporting techniques. This has resulted to

demands for firms to become more responsible and to manage its effect on the environment in a

better way.

2.0 Analysis of the firm

Table no.1

2018 2017 2016

Revenue 328,704.00 240,182.00 244,583.00

Cost of sales 199,830.00 148,661.00 132,855.00

gross profit 128,874.00 91,521.00 111,728.00

net profit or loss 42,816.00 (807.00) 38,328.00

profit margin % 13% -0.3% 16%

gross profit margin % 39% 38% 46%

Return of total assets 0.196 (0.005) 0.355

5

return on equity 0.206 (0.009) 0.461

inventory turnover ratio 2.17 1.84 3.13

accounts receivable ratio 7.611 6.771 8.934

equity ratio 74% 58% 58%

capital employed 207,403.00 91,288.00 83,385.00

PBT 61196 -677 54894

ROCE 0.29505841 -0.00741609 0.65831984

current ratio 3.13521503 2.3007054 2.31539025

acid test ratio 1.90 0.87 1.19

For the start of an analysis ratios are a good indicator, however they do not give the full scenario

of a cooperation’s investment ability (Young, 2014). Revenues are from the sale of organic baby

food and products. The revenues increased for a shared 37% from January 2016 to January 2018

mainly because of the healthy economy, the health of any economy is critical for the survival if

the company. This is explained through the decline in revenues in the 2017 fiscal year through to

2018 (a -2% which is a drop-in comparison to the prior year. The efficiency of activities with

respect to revenue and profits is very critical to any business (Mintz & Currim, 2013; Roberts,

Kayande, & Stermersch, 2013).

Cost of sales and issued services have been constant though it has increased from 54% in 2016 to

62% in 2017 and 61% in 2018.The net profit of the corporation has been exceptional for the

fiscal year 2018 with a 13% increase up from the prior year. The immense increase in net profits

resulted in a 13% increase in the profit margin and a 20% progress in ROTA (return on total

assets). The high returns and good cost contributed to these growths. The fiscal year 2017 had an

advance decline in net profits of -0.34% mainly due to the decrease in proceeds and increase in

administrative costs of $41.4 M, where $6.8 M inventory provision and write-offs, $27.5M in

payments made to Fonterra as part of boarder supply chain reset and $6.8M other cost relating to

acquisition of Camperdown Powder. The analysis of financial statement helps to identify the

major strong points and areas where there is a weak line in a business firm. (Moyer, McGuigan,

Kretlow, 2005).

Current assets of the firm improved to $230M from the previous year, from $153M in the year

2017 to $230M, however the ratios show a significant decrease from 96% to 82% this is a result

of major acquisition.Also, the corporation identifies all vastly liquid investments this is inclusive

receivables due from the debtors, the increase is described by the rise in proceeds so cash and

providing for the operations. Holding off assets is a better option to trading off the expected

returns this keeps the company liquid (Harness, Chatterjee, Finke, 2008).

The profit margin improved to 13% in fiscal year 2018 up from -0.34% in 2017, also the return

on assets improved significantly to 0.2 (20%) up from (-0.01) in the previous period.

6

inventory turnover ratio 2.17 1.84 3.13

accounts receivable ratio 7.611 6.771 8.934

equity ratio 74% 58% 58%

capital employed 207,403.00 91,288.00 83,385.00

PBT 61196 -677 54894

ROCE 0.29505841 -0.00741609 0.65831984

current ratio 3.13521503 2.3007054 2.31539025

acid test ratio 1.90 0.87 1.19

For the start of an analysis ratios are a good indicator, however they do not give the full scenario

of a cooperation’s investment ability (Young, 2014). Revenues are from the sale of organic baby

food and products. The revenues increased for a shared 37% from January 2016 to January 2018

mainly because of the healthy economy, the health of any economy is critical for the survival if

the company. This is explained through the decline in revenues in the 2017 fiscal year through to

2018 (a -2% which is a drop-in comparison to the prior year. The efficiency of activities with

respect to revenue and profits is very critical to any business (Mintz & Currim, 2013; Roberts,

Kayande, & Stermersch, 2013).

Cost of sales and issued services have been constant though it has increased from 54% in 2016 to

62% in 2017 and 61% in 2018.The net profit of the corporation has been exceptional for the

fiscal year 2018 with a 13% increase up from the prior year. The immense increase in net profits

resulted in a 13% increase in the profit margin and a 20% progress in ROTA (return on total

assets). The high returns and good cost contributed to these growths. The fiscal year 2017 had an

advance decline in net profits of -0.34% mainly due to the decrease in proceeds and increase in

administrative costs of $41.4 M, where $6.8 M inventory provision and write-offs, $27.5M in

payments made to Fonterra as part of boarder supply chain reset and $6.8M other cost relating to

acquisition of Camperdown Powder. The analysis of financial statement helps to identify the

major strong points and areas where there is a weak line in a business firm. (Moyer, McGuigan,

Kretlow, 2005).

Current assets of the firm improved to $230M from the previous year, from $153M in the year

2017 to $230M, however the ratios show a significant decrease from 96% to 82% this is a result

of major acquisition.Also, the corporation identifies all vastly liquid investments this is inclusive

receivables due from the debtors, the increase is described by the rise in proceeds so cash and

providing for the operations. Holding off assets is a better option to trading off the expected

returns this keeps the company liquid (Harness, Chatterjee, Finke, 2008).

The profit margin improved to 13% in fiscal year 2018 up from -0.34% in 2017, also the return

on assets improved significantly to 0.2 (20%) up from (-0.01) in the previous period.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Furthermore, the returns on equity also improved from a low of 0.0088 to 0.2064 in the fiscal

year 2018. Another strong aspect about the firm on its activities is its liquidness. As the current

assets improved the current liabilities declined, both the quick ratio and the current ratio

improved significantly 0.87 and 2.3 in fiscal year 2017 to 1.90 and 3.13 respectively. Due to the

rise in total assets, current liabilities declined from 42% to 26% from the previous year. This

helps Bellamy’s to be more liquid which a benefit to the company. According to Brigham and

Houston (2009), Analysis involves a comparison of the corporation’s performance over a period

of time to evaluate the trends.

The corporation borrows on a long-term basis this exposes Bellamy’s to the effect of interest rate

changes and forex variations in the market. The fair value of its debt obligation in 2017 totaled

$25M compared to $0.0062M in 2018. In general debt represents a cost which is fixed to funding

a firm, at times a firm can gain more on the assets that are funded through loans than the

servicing cost of the borrowings that will the extra earnings will flow to equity holders (B.F

Online,2014)

The stockholder’s equity went up to $207M in the fiscal year 2018 compared to $91M in the

previous fiscal year 2017. This growth is as a result to a rise of the reserved profits, as the net

profits improved more than the stockholder’s equity, the ROE (return on equity) went from -1%

in the fiscal year 2017 to 21% in the fiscal year 2018. The equity ratio also went up from 58% in

fiscal year 2017 to 74% in the fiscal year 2018 this shows that Bellamy’s have an improved long-

term solvency. Lan (2012), emphasizes on the importance of the ratios on the attractiveness of a

corporation.

2.1 Profitability

profit margin % gross profit margin % Return on Total Asset return on equity

-10%

0%

10%

20%

30%

40%

50%

Profitability

2018 2017 2016

According to Gibson (2013), ratios on profitability measures the profits or operation

achievement of a corporation for a specified time line, profits otherwise the deficiency of it,

disturbs companies capacity to obtain loans and finances from shareholders, it also moves the

7

year 2018. Another strong aspect about the firm on its activities is its liquidness. As the current

assets improved the current liabilities declined, both the quick ratio and the current ratio

improved significantly 0.87 and 2.3 in fiscal year 2017 to 1.90 and 3.13 respectively. Due to the

rise in total assets, current liabilities declined from 42% to 26% from the previous year. This

helps Bellamy’s to be more liquid which a benefit to the company. According to Brigham and

Houston (2009), Analysis involves a comparison of the corporation’s performance over a period

of time to evaluate the trends.

The corporation borrows on a long-term basis this exposes Bellamy’s to the effect of interest rate

changes and forex variations in the market. The fair value of its debt obligation in 2017 totaled

$25M compared to $0.0062M in 2018. In general debt represents a cost which is fixed to funding

a firm, at times a firm can gain more on the assets that are funded through loans than the

servicing cost of the borrowings that will the extra earnings will flow to equity holders (B.F

Online,2014)

The stockholder’s equity went up to $207M in the fiscal year 2018 compared to $91M in the

previous fiscal year 2017. This growth is as a result to a rise of the reserved profits, as the net

profits improved more than the stockholder’s equity, the ROE (return on equity) went from -1%

in the fiscal year 2017 to 21% in the fiscal year 2018. The equity ratio also went up from 58% in

fiscal year 2017 to 74% in the fiscal year 2018 this shows that Bellamy’s have an improved long-

term solvency. Lan (2012), emphasizes on the importance of the ratios on the attractiveness of a

corporation.

2.1 Profitability

profit margin % gross profit margin % Return on Total Asset return on equity

-10%

0%

10%

20%

30%

40%

50%

Profitability

2018 2017 2016

According to Gibson (2013), ratios on profitability measures the profits or operation

achievement of a corporation for a specified time line, profits otherwise the deficiency of it,

disturbs companies capacity to obtain loans and finances from shareholders, it also moves the

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

liquidity position and the corporation’s ability to develop. Reale (2011) measured the importance

of ratios in a business as it helps the management to be critical of the firms position.

2.1.1 Profit margin

According to Weygandt et al., (2009) margin of profit is a ration of percentage of sales that will

results net profits. It further shows the productivity produced from returns and henceforth is an

significant performance indicator. As it stands, there was an increase in the profit margin from

the fiscal year 2017 at -0.3% to 13% in the fiscal year 2018 this implies that the Bellamy’s was

more profitable in the current financial period which is a turnaround from the previous losses

made in the previous year.

2.1.2 Return on Total Assets

According to Weygandt et al., (2009) is a measure of by what means a company resources are

used to produce proceeds. it is the ratio of net return after tax divided by total assets and is the

most prevalent ratio for calculating the absolute performance of the firm. The return on total

assets increased from -1% to 20% in the fiscal year 2018 from 2017 this implies that Bellamy’s

that the firm can use its assets effectively.

2.1.3 Return on Equity

According to Gibson (2013) equity return is extent of revenues per unit of investment and

precisely used for calculating the return on stockholder’s investment. Looking at Bellamy’s the

return on equity also increased from -1% to 21% in the fiscal year 2018, this implies that the

company can generate cash internally and therefore its less dependent on debt financing. It’s a

good indicator for an investor to buy stock of the company

2.2 Efficiency

2018 2017 2016

2.17 1.84

3.13

7.611 6.771

8.934

efficiency ratios

inventory turnover ratio times accounts receivable ratio times

Ahmet (2012). Explains that the efficient accounts receivable management will make the firm to

improve of making profits through reduction of transaction cost and can raise cash. The accounts

receivable ratio of Bellamy’s Ltd increased from 6.771 times to 7.611 times in the fiscal year

2018, the greater the turnover the better for the company as it shows the company is not having

8

of ratios in a business as it helps the management to be critical of the firms position.

2.1.1 Profit margin

According to Weygandt et al., (2009) margin of profit is a ration of percentage of sales that will

results net profits. It further shows the productivity produced from returns and henceforth is an

significant performance indicator. As it stands, there was an increase in the profit margin from

the fiscal year 2017 at -0.3% to 13% in the fiscal year 2018 this implies that the Bellamy’s was

more profitable in the current financial period which is a turnaround from the previous losses

made in the previous year.

2.1.2 Return on Total Assets

According to Weygandt et al., (2009) is a measure of by what means a company resources are

used to produce proceeds. it is the ratio of net return after tax divided by total assets and is the

most prevalent ratio for calculating the absolute performance of the firm. The return on total

assets increased from -1% to 20% in the fiscal year 2018 from 2017 this implies that Bellamy’s

that the firm can use its assets effectively.

2.1.3 Return on Equity

According to Gibson (2013) equity return is extent of revenues per unit of investment and

precisely used for calculating the return on stockholder’s investment. Looking at Bellamy’s the

return on equity also increased from -1% to 21% in the fiscal year 2018, this implies that the

company can generate cash internally and therefore its less dependent on debt financing. It’s a

good indicator for an investor to buy stock of the company

2.2 Efficiency

2018 2017 2016

2.17 1.84

3.13

7.611 6.771

8.934

efficiency ratios

inventory turnover ratio times accounts receivable ratio times

Ahmet (2012). Explains that the efficient accounts receivable management will make the firm to

improve of making profits through reduction of transaction cost and can raise cash. The accounts

receivable ratio of Bellamy’s Ltd increased from 6.771 times to 7.611 times in the fiscal year

2018, the greater the turnover the better for the company as it shows the company is not having

8

any difficulties in collection and granting the credits. The ratio further measures how quickly a

company to collects bills from its creditors through its policies.

According to Dansby et al (2008) stock turnover analyzes the sum of times by which the average

stock will be traded in a specified date. The inventory turnover ratio also increased from 1.84 in

the fiscal year 2017 to 2.17 in the fiscal year 2018, this indicates that the inventory of the firm

does not remain on the shelves but rather it turns over rapidly and faster.

2.3 Short-term solvency

2018 2017 2016

0

0.5

1

1.5

2

2.5

3

3.5

3.1352150281

3007 2.3007053999

0513

2.3153902455

2532

1.90

0.87 1.19

short-term solvency

current ratio Series2 acid test ratio

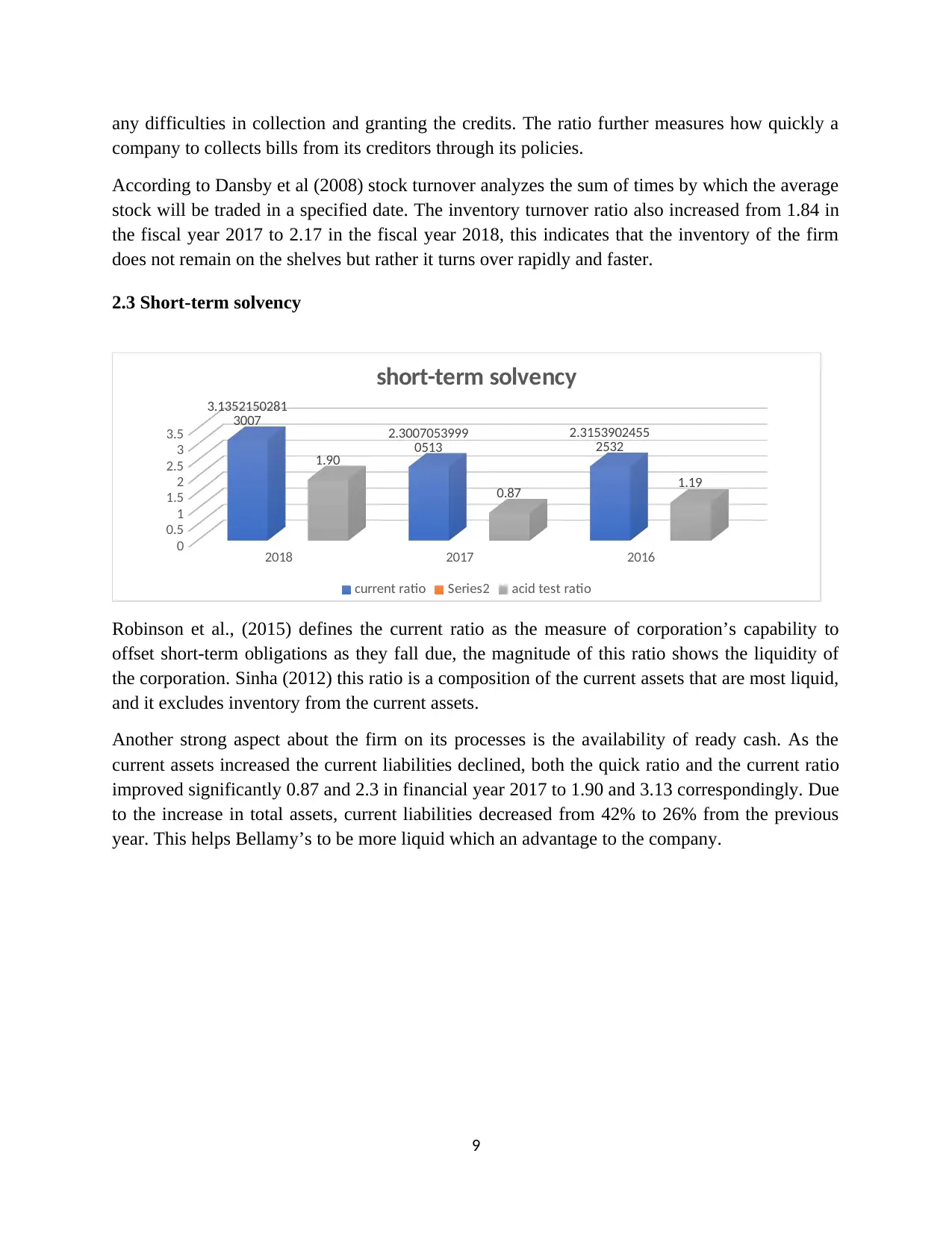

Robinson et al., (2015) defines the current ratio as the measure of corporation’s capability to

offset short-term obligations as they fall due, the magnitude of this ratio shows the liquidity of

the corporation. Sinha (2012) this ratio is a composition of the current assets that are most liquid,

and it excludes inventory from the current assets.

Another strong aspect about the firm on its processes is the availability of ready cash. As the

current assets increased the current liabilities declined, both the quick ratio and the current ratio

improved significantly 0.87 and 2.3 in financial year 2017 to 1.90 and 3.13 correspondingly. Due

to the increase in total assets, current liabilities decreased from 42% to 26% from the previous

year. This helps Bellamy’s to be more liquid which an advantage to the company.

9

company to collects bills from its creditors through its policies.

According to Dansby et al (2008) stock turnover analyzes the sum of times by which the average

stock will be traded in a specified date. The inventory turnover ratio also increased from 1.84 in

the fiscal year 2017 to 2.17 in the fiscal year 2018, this indicates that the inventory of the firm

does not remain on the shelves but rather it turns over rapidly and faster.

2.3 Short-term solvency

2018 2017 2016

0

0.5

1

1.5

2

2.5

3

3.5

3.1352150281

3007 2.3007053999

0513

2.3153902455

2532

1.90

0.87 1.19

short-term solvency

current ratio Series2 acid test ratio

Robinson et al., (2015) defines the current ratio as the measure of corporation’s capability to

offset short-term obligations as they fall due, the magnitude of this ratio shows the liquidity of

the corporation. Sinha (2012) this ratio is a composition of the current assets that are most liquid,

and it excludes inventory from the current assets.

Another strong aspect about the firm on its processes is the availability of ready cash. As the

current assets increased the current liabilities declined, both the quick ratio and the current ratio

improved significantly 0.87 and 2.3 in financial year 2017 to 1.90 and 3.13 correspondingly. Due

to the increase in total assets, current liabilities decreased from 42% to 26% from the previous

year. This helps Bellamy’s to be more liquid which an advantage to the company.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2.4 Long-term solvency

2018 2017 2016

-

0.100000

0.200000

0.300000

0.400000

0.500000

longterm solvency

Debts equity ratio debt ratio

Sinha (2012) defines debt to equity ratio as all debts attributed to owners’ equity. Looking at

Bellamy’s debt ratio in has reduced significantly over the financial period given from 0.4 in 2017

to 0.2 in 2018 this is because of the firms shift to equity as the main source of financing for the

business. Besides, the debt to equity ratio too reduced from 0.2 to 0.002 this is as effect of

Bellamy’s inducing more funds from stockholders.

2.5 Market-based ratios

2018 2017 2016 2015(5.00)

-

5.00

10.00

15.00

20.00

25.00

30.00

35.00

40.00

39.20

(0.80)

39.80

9.80

37.20

(0.80)

38.60

9.50

market based ratio

EPS DILUTED EPS

There has been a great increase on the earnings per share of the firm’s stock from a low of -0.80

in the fiscal year 2017 to 39.20 in the year 2018 this an indicator of the firm’s ability to payout

dividends to the stockholders, it also shows that the company is creating value for its investors.

This shows how a corporation is regarded in terms of the market price of stock to its book value

(Brigham & Houston, 2009)

2.6 Other analyses

2.6.1 Performance Measures

The performance measure is best when being used to calculate the overall income made by a

corporate entity, where, investments, activities and funds controlled and managed by an expert

10

2018 2017 2016

-

0.100000

0.200000

0.300000

0.400000

0.500000

longterm solvency

Debts equity ratio debt ratio

Sinha (2012) defines debt to equity ratio as all debts attributed to owners’ equity. Looking at

Bellamy’s debt ratio in has reduced significantly over the financial period given from 0.4 in 2017

to 0.2 in 2018 this is because of the firms shift to equity as the main source of financing for the

business. Besides, the debt to equity ratio too reduced from 0.2 to 0.002 this is as effect of

Bellamy’s inducing more funds from stockholders.

2.5 Market-based ratios

2018 2017 2016 2015(5.00)

-

5.00

10.00

15.00

20.00

25.00

30.00

35.00

40.00

39.20

(0.80)

39.80

9.80

37.20

(0.80)

38.60

9.50

market based ratio

EPS DILUTED EPS

There has been a great increase on the earnings per share of the firm’s stock from a low of -0.80

in the fiscal year 2017 to 39.20 in the year 2018 this an indicator of the firm’s ability to payout

dividends to the stockholders, it also shows that the company is creating value for its investors.

This shows how a corporation is regarded in terms of the market price of stock to its book value

(Brigham & Houston, 2009)

2.6 Other analyses

2.6.1 Performance Measures

The performance measure is best when being used to calculate the overall income made by a

corporate entity, where, investments, activities and funds controlled and managed by an expert

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

managerial body. It may be probable to stem both the return on equity and return on the capital

employed. According to Helfert (2003) analysis of statement of finance is mainly based on

looking at financial reports and bookkeeping information since the duty of examining, arbitrating

and controlling a organization’s events are far wider and tougher than the simple handling data

being reported. Benchmarking process enable’s the potential customers and investors to locate

the best companies to invest in they therefore rely mostly on results. (Boundless, 2014).

3.0 Conclusions

The study provides the model for the financial report examination of Bellamy’s Australia Ltd

period from 2016 to 2018 on revenue generation that can be used to draw the measurement of

performance. From the examination its revealed that the profitability of the firm improved

significantly. In conclusion its ROCE (return on capital employed) has increased over the past

three years and its above the benchmarks this makes the company a potential attractive stock that

can achieve a solid return on investment. Further more as we look in the next fiscal year 2019 ,

Bellamy’s expects more sales growth and expects a more difficult trade environment this is

inclusive of the new market like the China market however the company expects to realize a

10% growth on comparative revenue this will be acquired through full acquisition of

Camperdown and increase its revenue through the long term premium brand and volume growth

and margin expansions going forward. Financial ratios are meant to show profits, the activities

and the firms capital structure that provide the image about a corporation. (Monea, 2009)

3.1 Recommendations

Bellamy’s 30% ROCE (return on capital employed) presumes every A$100 invested, the

corporation generates A$30 for the investor, the strong ROCE is tied to the movement of two

factors that change over time which are earnings and capital requirements. Now Bellamy’s

Australia Ltd is operating at a favorable position. looking back in the three years Bellamy’s

stocks hit a rock bottom in the year 2017 this was a result of losses that were made however the

firm managed to turn around the situation, and it is expected that the company will continue in

the solid returns. The ROCE has increased from -1% to 30% and with this the current earnings

improved from -A$0.8M to A$42M, and the capital employed also grew significantly that further

suggest that due to a growth in earnings which is relative to capital requirements.

3.2 Limitations

The study suffers from several limiting factors; its exclusively depends on available monetary

information, so it focuses on restrictions that are essential in the financial declarations;

competing nature of the corporation avoids reassessment of a private information.; industry

based firm comparison is hard as the study focuses on one organization.

11

employed. According to Helfert (2003) analysis of statement of finance is mainly based on

looking at financial reports and bookkeeping information since the duty of examining, arbitrating

and controlling a organization’s events are far wider and tougher than the simple handling data

being reported. Benchmarking process enable’s the potential customers and investors to locate

the best companies to invest in they therefore rely mostly on results. (Boundless, 2014).

3.0 Conclusions

The study provides the model for the financial report examination of Bellamy’s Australia Ltd

period from 2016 to 2018 on revenue generation that can be used to draw the measurement of

performance. From the examination its revealed that the profitability of the firm improved

significantly. In conclusion its ROCE (return on capital employed) has increased over the past

three years and its above the benchmarks this makes the company a potential attractive stock that

can achieve a solid return on investment. Further more as we look in the next fiscal year 2019 ,

Bellamy’s expects more sales growth and expects a more difficult trade environment this is

inclusive of the new market like the China market however the company expects to realize a

10% growth on comparative revenue this will be acquired through full acquisition of

Camperdown and increase its revenue through the long term premium brand and volume growth

and margin expansions going forward. Financial ratios are meant to show profits, the activities

and the firms capital structure that provide the image about a corporation. (Monea, 2009)

3.1 Recommendations

Bellamy’s 30% ROCE (return on capital employed) presumes every A$100 invested, the

corporation generates A$30 for the investor, the strong ROCE is tied to the movement of two

factors that change over time which are earnings and capital requirements. Now Bellamy’s

Australia Ltd is operating at a favorable position. looking back in the three years Bellamy’s

stocks hit a rock bottom in the year 2017 this was a result of losses that were made however the

firm managed to turn around the situation, and it is expected that the company will continue in

the solid returns. The ROCE has increased from -1% to 30% and with this the current earnings

improved from -A$0.8M to A$42M, and the capital employed also grew significantly that further

suggest that due to a growth in earnings which is relative to capital requirements.

3.2 Limitations

The study suffers from several limiting factors; its exclusively depends on available monetary

information, so it focuses on restrictions that are essential in the financial declarations;

competing nature of the corporation avoids reassessment of a private information.; industry

based firm comparison is hard as the study focuses on one organization.

11

References

Ahmet, G. S. a. E. H. C., (2012).. Effects of working capital management on firms performance..

International Journal of Economics and Financial Issues,, 2(4), pp. 488-495

B.F Online, (2014). (Business Finance Online), Accessed 1 May 2014 Available

www.businessfinanceceonline.com.

Bodie, Zvi, Robert, C. Merton, and, Cleeton, D. (2009). Financial Economics, Person Prentice

Hall, London, 2nd Edition.

Boundless, (2014). Accessed 2 May 2014. Available at www.boundless.com

Brigham, E., & Houston, J. (2009). Fundamentals of Financial Management. Mason: Cengage

Learning.

Brigham, E., & Houston, J. (2009). Fundamentals of Financial Management. Mason: Cengage

Learning.

Dansby, Robert l., Burton, S. Kaliski, and Lawrence, M. (2008). Paracligin college Accounting.

4th ed. st paul,mN: paradigm publishing Inc.

Drake, P.P. (2011). Financial Ratio Analysis: A reading prepared by Pamela Peterson Drake.

Virginia: James Madison University. [Accessed 19 December 2014]. Available at:

http://educ.jmu.edu/~drakepp/principles/module2/fin_rat.pdf

Gibson, S. and Charles, H. (2013). Financial Statement Analysis. South-Western Cengage

Learning, 13th Edition.

Harness, Nathaniel J., Chatterjee, Warn, Michael Finke, (2008). "Household Financial Ratios: A

review of Literature" Journal of Personal Finance. Volume 6, Issue 4. pp77.

12

Ahmet, G. S. a. E. H. C., (2012).. Effects of working capital management on firms performance..

International Journal of Economics and Financial Issues,, 2(4), pp. 488-495

B.F Online, (2014). (Business Finance Online), Accessed 1 May 2014 Available

www.businessfinanceceonline.com.

Bodie, Zvi, Robert, C. Merton, and, Cleeton, D. (2009). Financial Economics, Person Prentice

Hall, London, 2nd Edition.

Boundless, (2014). Accessed 2 May 2014. Available at www.boundless.com

Brigham, E., & Houston, J. (2009). Fundamentals of Financial Management. Mason: Cengage

Learning.

Brigham, E., & Houston, J. (2009). Fundamentals of Financial Management. Mason: Cengage

Learning.

Dansby, Robert l., Burton, S. Kaliski, and Lawrence, M. (2008). Paracligin college Accounting.

4th ed. st paul,mN: paradigm publishing Inc.

Drake, P.P. (2011). Financial Ratio Analysis: A reading prepared by Pamela Peterson Drake.

Virginia: James Madison University. [Accessed 19 December 2014]. Available at:

http://educ.jmu.edu/~drakepp/principles/module2/fin_rat.pdf

Gibson, S. and Charles, H. (2013). Financial Statement Analysis. South-Western Cengage

Learning, 13th Edition.

Harness, Nathaniel J., Chatterjee, Warn, Michael Finke, (2008). "Household Financial Ratios: A

review of Literature" Journal of Personal Finance. Volume 6, Issue 4. pp77.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.