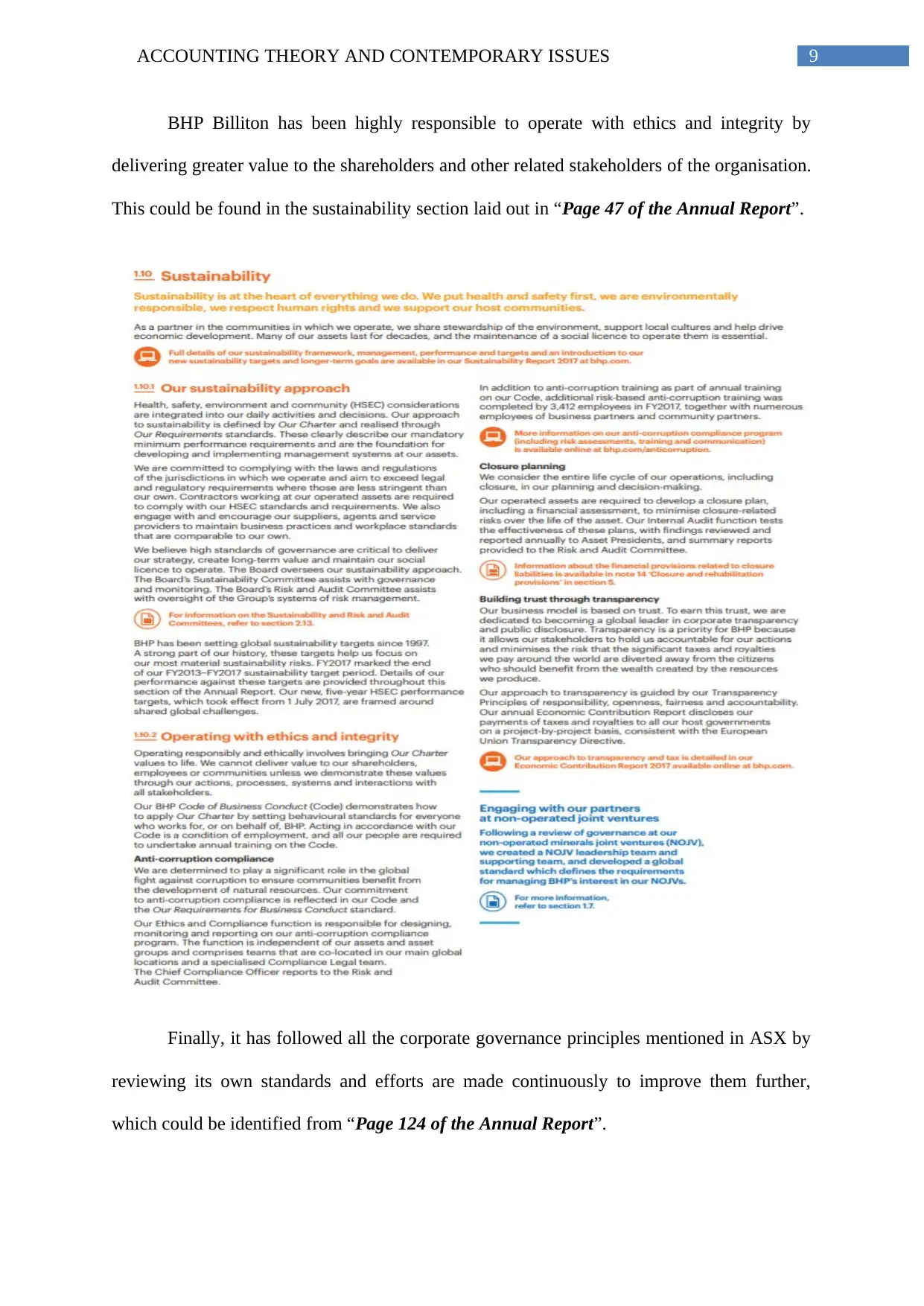

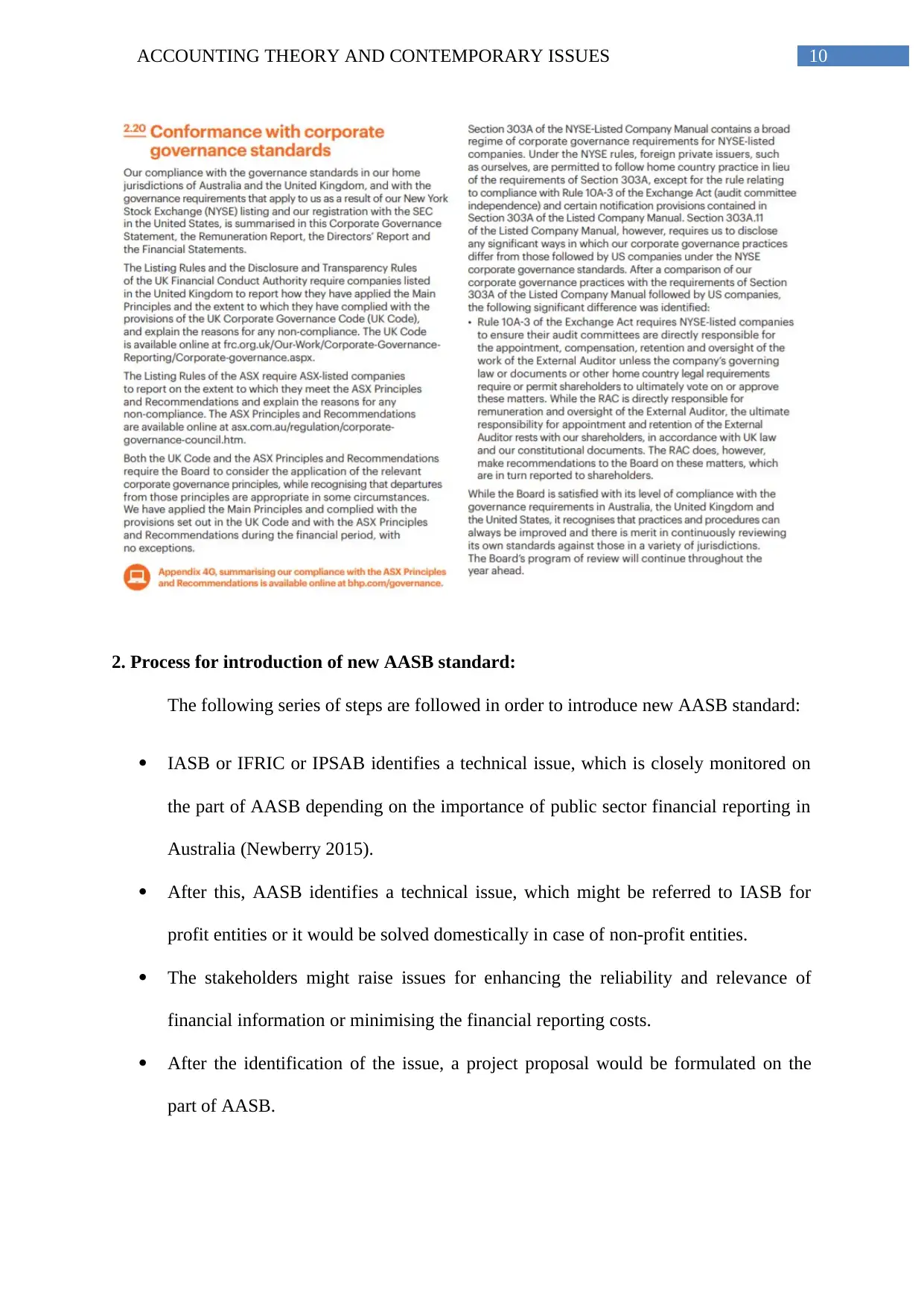

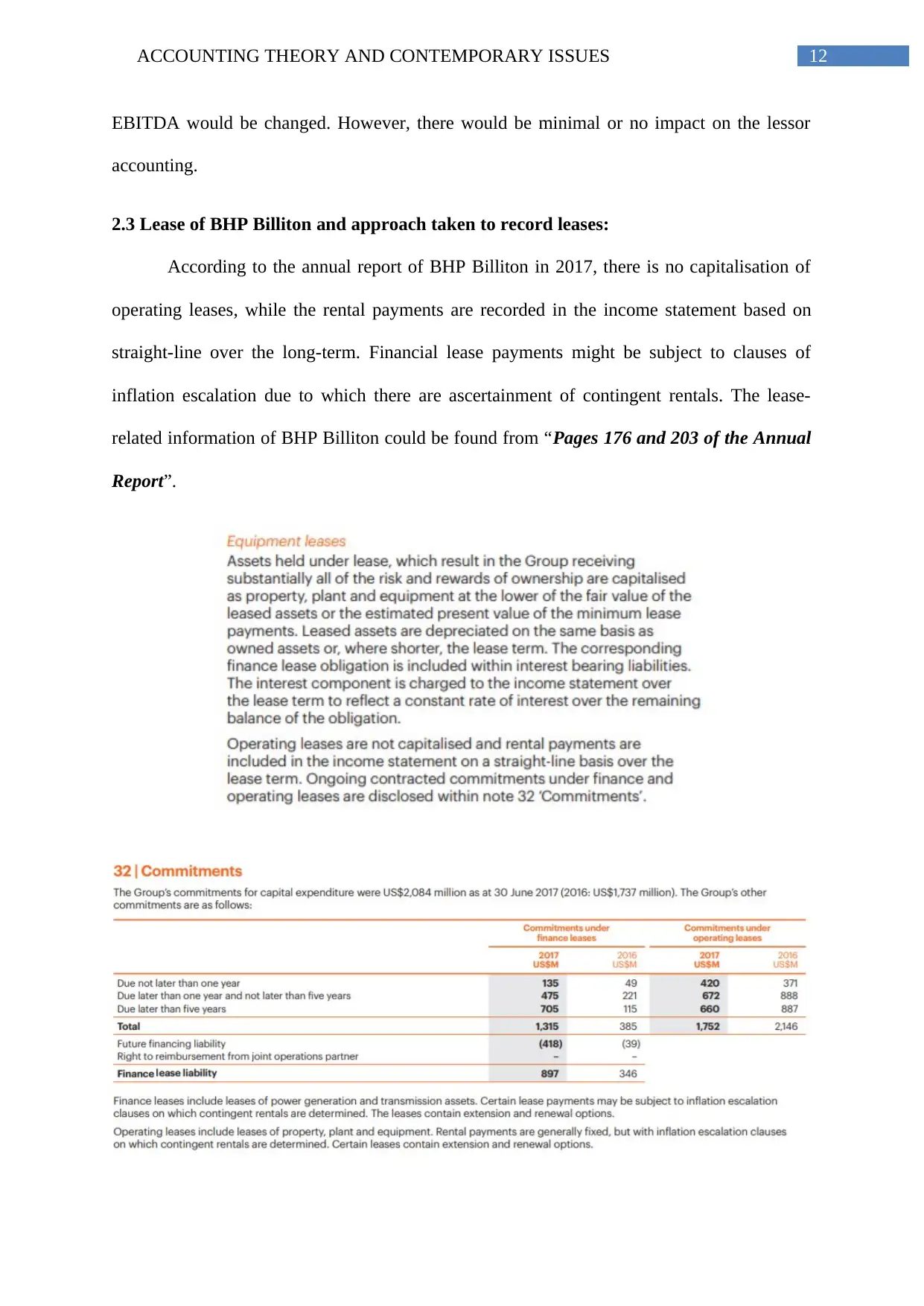

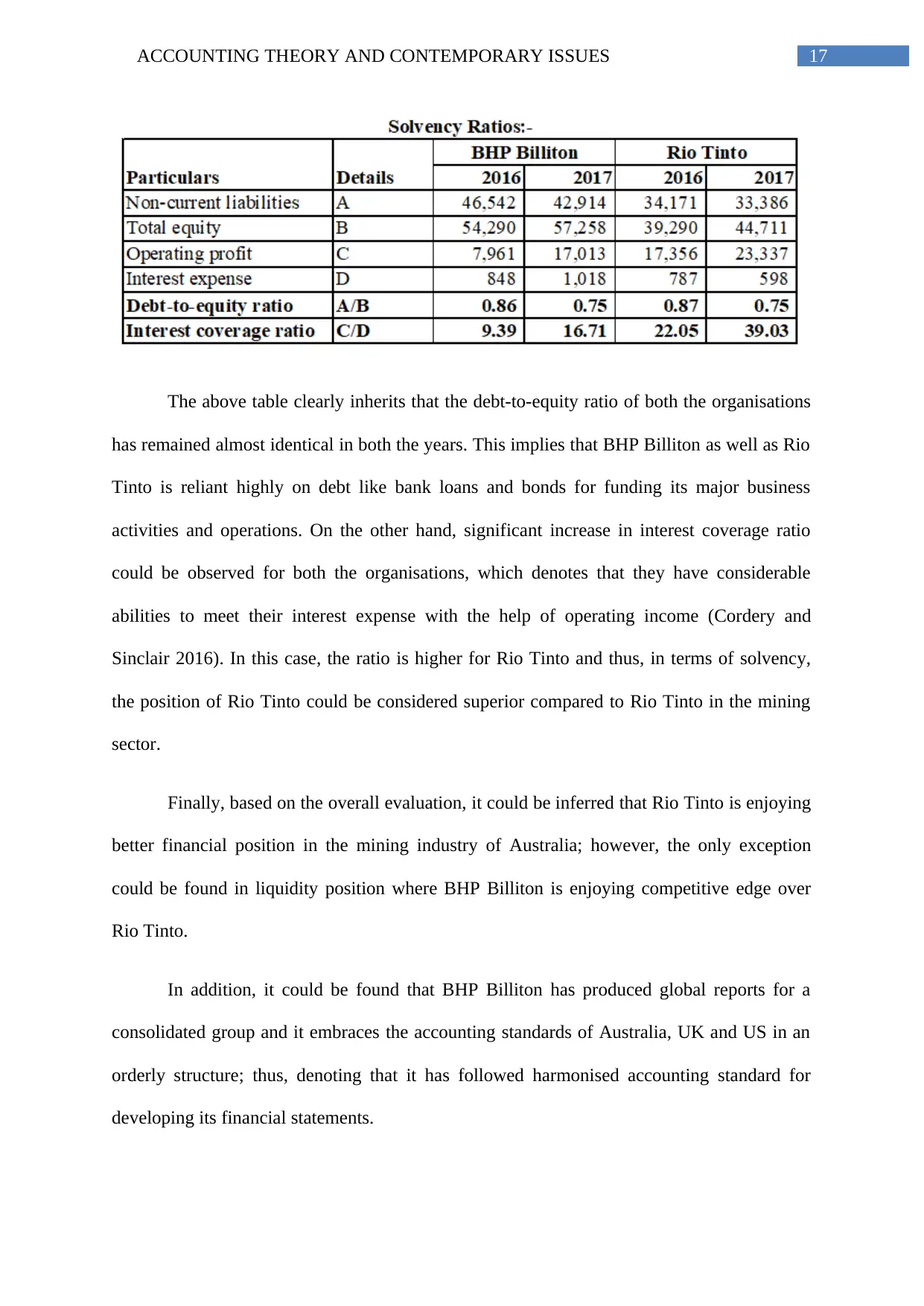

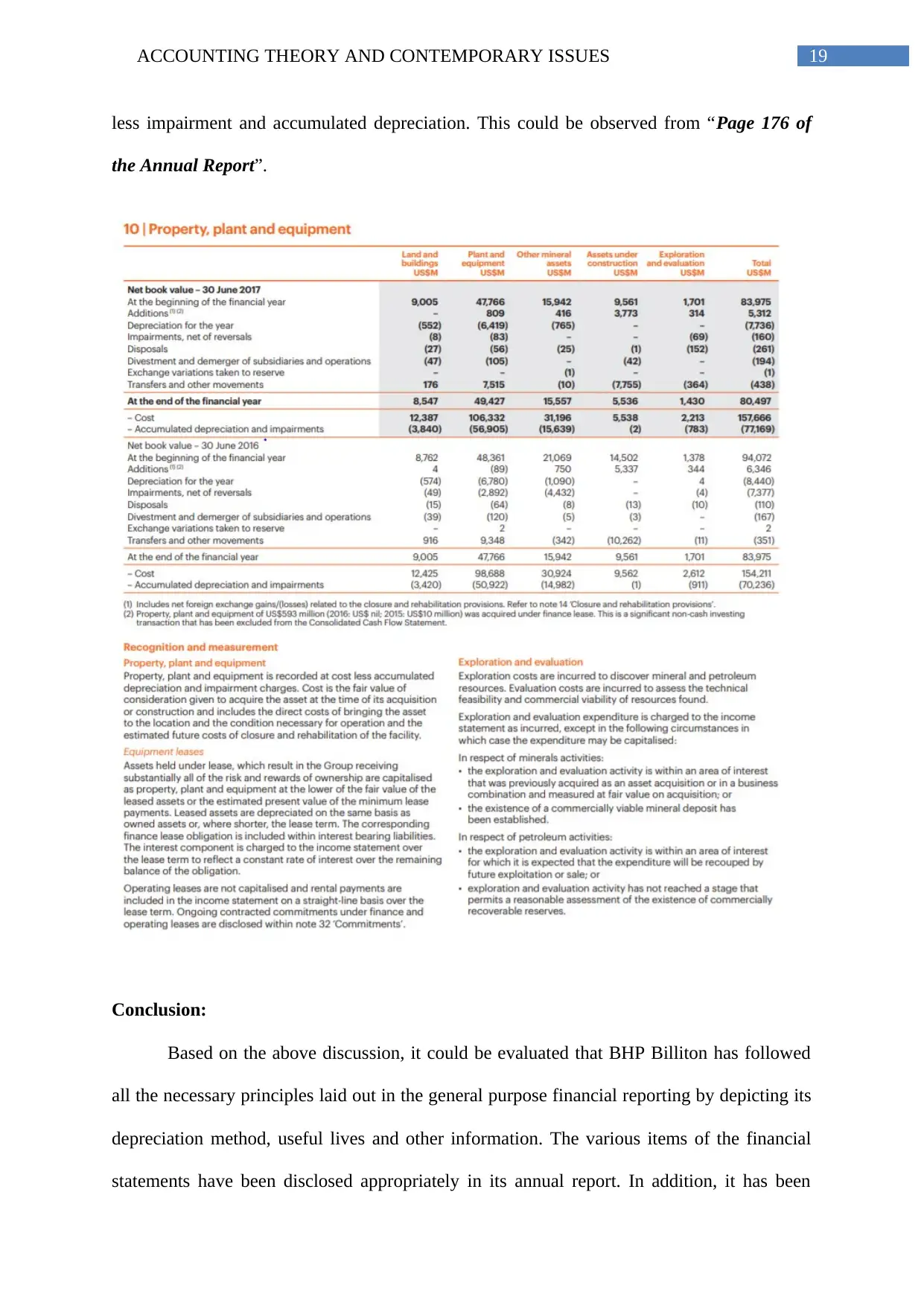

The report evaluates the methods employed by BHP Billiton in the construction of general purpose financial reporting (GPFR) and analyses its financial performance. It also discusses the ethical obligations of the company and compares its financial performance with its competitor Rio Tinto. The report concludes that BHP Billiton has failed to maintain competitive edge over Rio Tinto due to increased operating expenses and high leverage. It has followed all the corporate governance principles mentioned in ASX by reviewing its own standards and efforts are made continuously to improve them further. Finally, it could be assessed that the organisation uses historical cost approach for recognising its tangible assets such as property, plant and equipment.

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)