Financial Analysis of BHP Group Limited: Capital Structure and Bonds

VerifiedAdded on 2023/06/09

|10

|2407

|438

Report

AI Summary

This report provides a comprehensive corporate finance analysis of BHP Group Limited, an Australian company involved in petroleum, copper, and coal exploration and production. It covers various aspects, including bond valuation, focusing on a specific BHP GROUP bond maturing in 2022, and share valuation, utilizing the dividend discount model. The analysis also examines the company's capital structure, comparing it with competitors like Rio Tinto and Anglo American Plc, and assesses market efficiency based on earnings announcements. The report concludes that BHP Group's capital structure relies more on share capital than debt and that the company is profitable and regularly pays dividends, though there's room for improving share price growth by retaining funds for future needs. Desklib is a platform where students can find similar solved assignments and study resources.

Corporate finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY..................................................................................................................................3

Part A- Selection of Company.....................................................................................................3

Part-B Company financials..........................................................................................................4

Part C: - Bond Analysis of one of outstanding bonds of BHP Group Limited...........................4

Part D: - Share Analysis of BHP Group Limited Shares.............................................................5

Part E: - Market Efficiency Analysis of the BHP Group Limited...............................................7

PART-F Capital structure and Cost of Capital...........................................................................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION...........................................................................................................................3

MAIN BODY..................................................................................................................................3

Part A- Selection of Company.....................................................................................................3

Part-B Company financials..........................................................................................................4

Part C: - Bond Analysis of one of outstanding bonds of BHP Group Limited...........................4

Part D: - Share Analysis of BHP Group Limited Shares.............................................................5

Part E: - Market Efficiency Analysis of the BHP Group Limited...............................................7

PART-F Capital structure and Cost of Capital...........................................................................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION

Corporate Finance is a crucial area of finance which address questions regarding how a

company should finance itself, what will be its finance sources and capital structure. It plays a

vital role in each and every business. It is concerned with the planning finance, raising funds

from various sources, investing and monitoring of the financial sources of any business (Zheng,

2022). This report includes analysis of Bond valuation, share valuation, cost of capital, capital

structure and market efficiency of the BHP Group Limited which is listed in Australia.

MAIN BODY

Part A- Selection of Company

An overview of the BHP Group limited which is registered in Australia in 1851. Using of

Petroleum, Copper and Coal segment doing in the exploration and production of oil and gas

properties and also engage in mining, smelting and potash development. It is registered in

BHP.AX stock exchange and its ticker symbol is USD. It is doing the business of following

principles. In compare to 2020 BHP GROUP Company decreases the net income due to achieve

the maximization of profit rather than focusing on customer (Pham and et.al., 2021).

Sustainability- It is help in communities like employees, shareholder and creditors and

environment friendly.

Integrity- Operating the business in according to ethical values. The moral principal of

integrity is doing the work is set of the principal.

Accountability- The individuals and team members which is doing the work positively

that those rewarded by high quality performance word, increasing job satisfaction.

Simplicity- The basic principle of simplicity is satisfying the customer to provide a good

quality product at reasonable rate so the business is continuous for a long term.

The details of bonds are as follow.

Out of which one bond is BHP GROUP, 6.55% which is mature on 22oct.2077 in GBP.

Second bond is BHP GROUP,0.75% and mature on 28 October 2022in EUR.

Third bond is BHP GROUP, 5.625% and maturity date is 22october 2079 in EUR.

Fourth bond is BHP GROUP,1.5% mature on 29April 2030 in EUR.

Fifth bond is BHP GROUP, 3.125% mature on 29 April 2033 in EUR.

Corporate Finance is a crucial area of finance which address questions regarding how a

company should finance itself, what will be its finance sources and capital structure. It plays a

vital role in each and every business. It is concerned with the planning finance, raising funds

from various sources, investing and monitoring of the financial sources of any business (Zheng,

2022). This report includes analysis of Bond valuation, share valuation, cost of capital, capital

structure and market efficiency of the BHP Group Limited which is listed in Australia.

MAIN BODY

Part A- Selection of Company

An overview of the BHP Group limited which is registered in Australia in 1851. Using of

Petroleum, Copper and Coal segment doing in the exploration and production of oil and gas

properties and also engage in mining, smelting and potash development. It is registered in

BHP.AX stock exchange and its ticker symbol is USD. It is doing the business of following

principles. In compare to 2020 BHP GROUP Company decreases the net income due to achieve

the maximization of profit rather than focusing on customer (Pham and et.al., 2021).

Sustainability- It is help in communities like employees, shareholder and creditors and

environment friendly.

Integrity- Operating the business in according to ethical values. The moral principal of

integrity is doing the work is set of the principal.

Accountability- The individuals and team members which is doing the work positively

that those rewarded by high quality performance word, increasing job satisfaction.

Simplicity- The basic principle of simplicity is satisfying the customer to provide a good

quality product at reasonable rate so the business is continuous for a long term.

The details of bonds are as follow.

Out of which one bond is BHP GROUP, 6.55% which is mature on 22oct.2077 in GBP.

Second bond is BHP GROUP,0.75% and mature on 28 October 2022in EUR.

Third bond is BHP GROUP, 5.625% and maturity date is 22october 2079 in EUR.

Fourth bond is BHP GROUP,1.5% mature on 29April 2030 in EUR.

Fifth bond is BHP GROUP, 3.125% mature on 29 April 2033 in EUR.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Part-B Company financials

Financial Situation of the company: The person which is manage the money of the

company known as finance manager. Company’s financial position depends on the net worth.

Net worth means total assets minus liabilities (Lai and et.al., 2020).

In 2021 the financial results were good and helped to operate strong performance of the

company, strong capital structure. The sales team ability to change the product according to

market requirements. Profit increased 88%i.e. US$17.1billion through the business of iron ore

and copper. The dividend was paid in 2021 in 301US Cents per share. In compare to 2020 the

profit is increased by 3348US$.

The factors effect of BHP GROUP in last years-

To make agreement, petrol business with Woodside to develop large scale portfolio to

developing and exploration of assets.

The profit has increased two largest asset assets, one is Iron ore and copper mine, it

continuous supply the product at timely.

To merge strong reliability and cost reduction which is help to achieve the higher benefit

of iron ore and copper prices.

Global steel production was unbalanced because china was continuous supply of the

product at lower rate, so profit of the product was down. The expected cost has reduced which is

result of change in portfolio and corporate structure and direct impact on the financial

performance of the company.

To improve the unify structure of petroleum helps in increasing the value of shareholder

and creating the good operating environment. Changing in portfolio will result in reduce the

material cost.

Part C: - Bond Analysis of one of outstanding bonds of BHP Group Limited

Bond is a recognised instrument of finance, by issuing bonds company collects funds from

investors. It is a fixed income source of funds. It includes coupon rates and maturity dates. BHP

Group have issued so many bonds over the last 5 years to generate funds.

Out of those, one bond is BHP GROUP, 0.75% 28oct2022, EUR

XS1225004461 which is issued for 650,000,000 EUR having maturity date 28 oct 2022 and

coupon rate 0.75% for which minimum settlement amount is 1,00,000 EUR.

Financial Situation of the company: The person which is manage the money of the

company known as finance manager. Company’s financial position depends on the net worth.

Net worth means total assets minus liabilities (Lai and et.al., 2020).

In 2021 the financial results were good and helped to operate strong performance of the

company, strong capital structure. The sales team ability to change the product according to

market requirements. Profit increased 88%i.e. US$17.1billion through the business of iron ore

and copper. The dividend was paid in 2021 in 301US Cents per share. In compare to 2020 the

profit is increased by 3348US$.

The factors effect of BHP GROUP in last years-

To make agreement, petrol business with Woodside to develop large scale portfolio to

developing and exploration of assets.

The profit has increased two largest asset assets, one is Iron ore and copper mine, it

continuous supply the product at timely.

To merge strong reliability and cost reduction which is help to achieve the higher benefit

of iron ore and copper prices.

Global steel production was unbalanced because china was continuous supply of the

product at lower rate, so profit of the product was down. The expected cost has reduced which is

result of change in portfolio and corporate structure and direct impact on the financial

performance of the company.

To improve the unify structure of petroleum helps in increasing the value of shareholder

and creating the good operating environment. Changing in portfolio will result in reduce the

material cost.

Part C: - Bond Analysis of one of outstanding bonds of BHP Group Limited

Bond is a recognised instrument of finance, by issuing bonds company collects funds from

investors. It is a fixed income source of funds. It includes coupon rates and maturity dates. BHP

Group have issued so many bonds over the last 5 years to generate funds.

Out of those, one bond is BHP GROUP, 0.75% 28oct2022, EUR

XS1225004461 which is issued for 650,000,000 EUR having maturity date 28 oct 2022 and

coupon rate 0.75% for which minimum settlement amount is 1,00,000 EUR.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Credit Spread is the difference between the U.S. Treasury rates and yield to maturity of

specific debt security. For computing the credit spread of the above mentioned bond of BHP

Group, U.S. Treasury rate is considered to 3.09% for May 2022 assuming that the bond is issued

for 5 years.

Yield to maturity is the discount rate by which present value of the future net cash flows

from a bond will be equals to market rate. For the above bonds yield to maturity is considered

the same rate as of coupon rate that is 0.75% by assuming that bonds are issued at market rate.

Therefore, the credit spread for the above bond will 3.09 – 0.75 = 2.34. that means that this

bond has credit spread of negative 234 basis point over the treasury rates (Kaur and Vij, 2018).

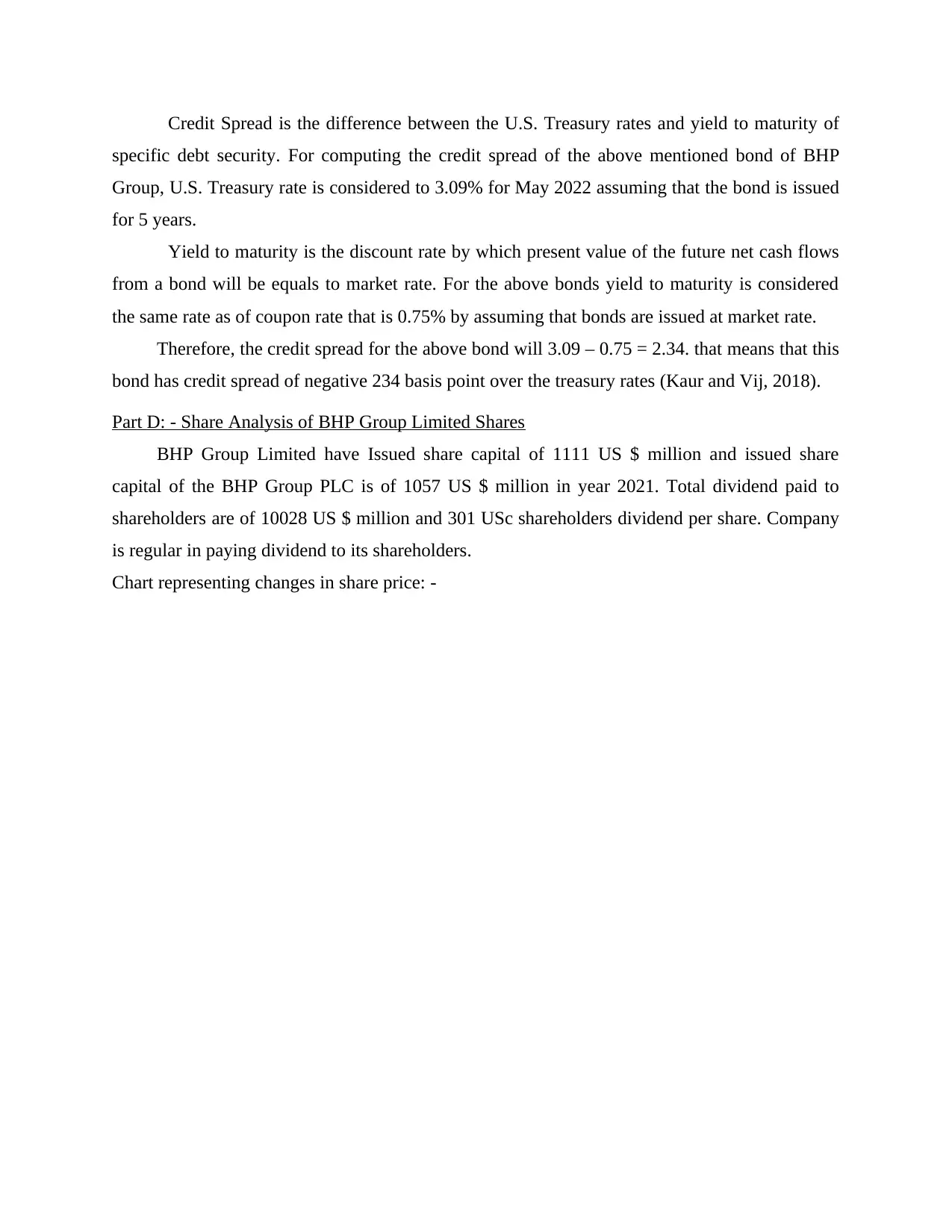

Part D: - Share Analysis of BHP Group Limited Shares

BHP Group Limited have Issued share capital of 1111 US $ million and issued share

capital of the BHP Group PLC is of 1057 US $ million in year 2021. Total dividend paid to

shareholders are of 10028 US $ million and 301 USc shareholders dividend per share. Company

is regular in paying dividend to its shareholders.

Chart representing changes in share price: -

specific debt security. For computing the credit spread of the above mentioned bond of BHP

Group, U.S. Treasury rate is considered to 3.09% for May 2022 assuming that the bond is issued

for 5 years.

Yield to maturity is the discount rate by which present value of the future net cash flows

from a bond will be equals to market rate. For the above bonds yield to maturity is considered

the same rate as of coupon rate that is 0.75% by assuming that bonds are issued at market rate.

Therefore, the credit spread for the above bond will 3.09 – 0.75 = 2.34. that means that this

bond has credit spread of negative 234 basis point over the treasury rates (Kaur and Vij, 2018).

Part D: - Share Analysis of BHP Group Limited Shares

BHP Group Limited have Issued share capital of 1111 US $ million and issued share

capital of the BHP Group PLC is of 1057 US $ million in year 2021. Total dividend paid to

shareholders are of 10028 US $ million and 301 USc shareholders dividend per share. Company

is regular in paying dividend to its shareholders.

Chart representing changes in share price: -

As presenting from the above chart, share price of the shares of BHP Group Limited is

increasing from the last 3 years not drastically but gradually. In 2019 where share price is 35

USD, in 2020 it has increased to 40 USD and in 2021 it crossed 45 USD.

BHP Group Limited is a profit making company for the last 3 years as well as it is regular

in paying dividend to its shareholders. As it is not focusing on retaining funds for future but to

focus on making investors happy by paying returns its share price is not increasing at a higher

rate.

For year 2016 -17 BHP Group paid dividends in September 2017 of 0.529491 USD $ per

share, then for year 2017-18 paid interim dividend of 0.705852 USD $ per share in march 2018,

final dividend for year 2017-18 was of 0.855978 USD $ per share in September 2018.

For year 2018-19 it paid dividend of 1.412742 USD $ per share in Jan 2019 and final

dividend of 0.780806 USD $ per share in march 2019. For last 2020-21 it paid interim dividend

increasing from the last 3 years not drastically but gradually. In 2019 where share price is 35

USD, in 2020 it has increased to 40 USD and in 2021 it crossed 45 USD.

BHP Group Limited is a profit making company for the last 3 years as well as it is regular

in paying dividend to its shareholders. As it is not focusing on retaining funds for future but to

focus on making investors happy by paying returns its share price is not increasing at a higher

rate.

For year 2016 -17 BHP Group paid dividends in September 2017 of 0.529491 USD $ per

share, then for year 2017-18 paid interim dividend of 0.705852 USD $ per share in march 2018,

final dividend for year 2017-18 was of 0.855978 USD $ per share in September 2018.

For year 2018-19 it paid dividend of 1.412742 USD $ per share in Jan 2019 and final

dividend of 0.780806 USD $ per share in march 2019. For last 2020-21 it paid interim dividend

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

of 1.311347 USD $ per share in march 2021 and final dividend of 2.71527 USD $ per share in

September 2021.

Using dividend discount model, assuming that the firm's dividends will continue to grow

indefinitely at constant rate as the average dividend growth rate in the previous five years the

investors currently require 9.36% for holding the company's share.

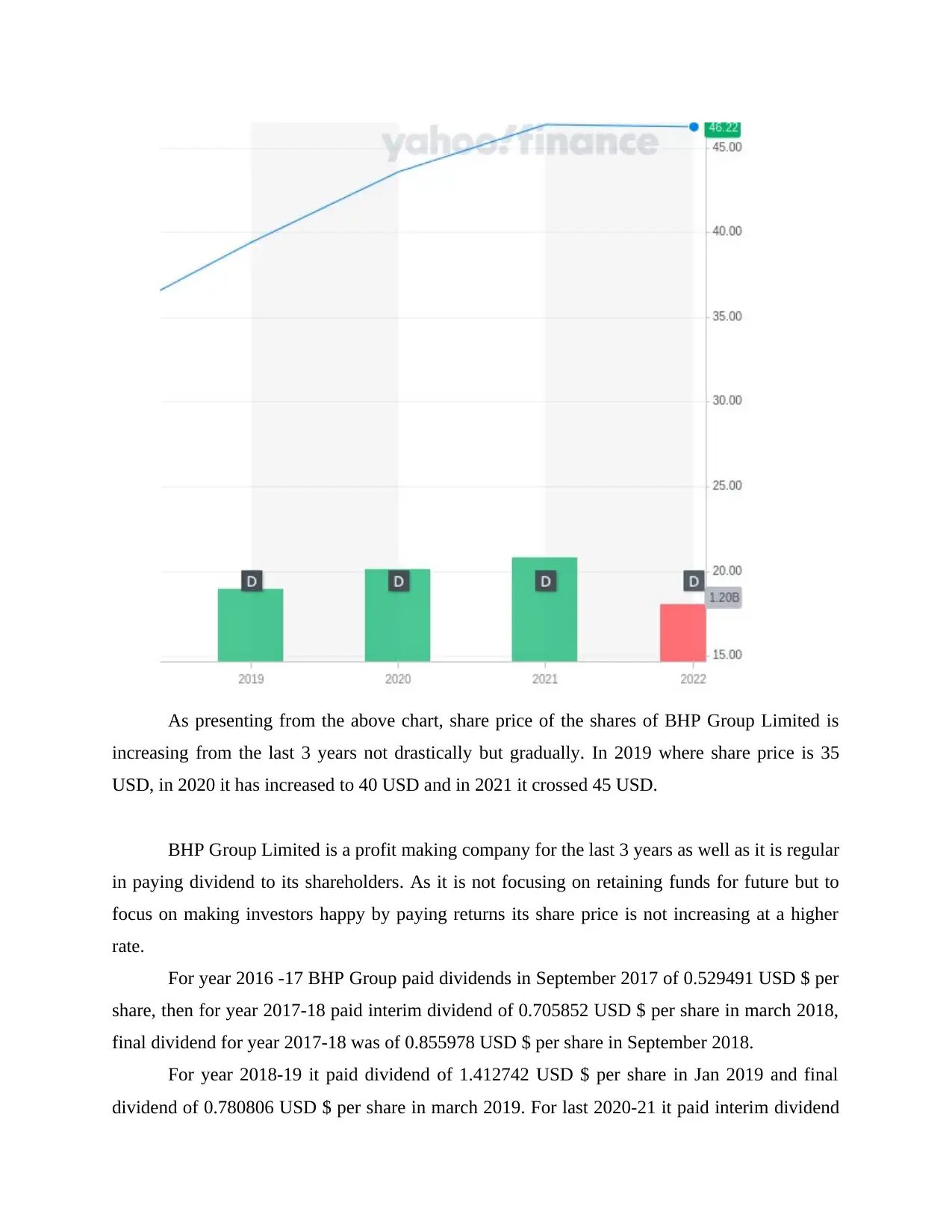

Part E: - Market Efficiency Analysis of the BHP Group Limited

The date on which BHP Group has done an earnings announcement is 24 Feb 2022. This

date is termed as Day 0.

Graph of the stock prices from the trading day -5 to trading day 5 is shown below: -

Efficient Market Hypothesis: -

Efficient Market Hypothesis is a theory that was developed in 19th century by a professor

Eugen Fama. As per this theory, at any given time, all available price sensitive information is

fully reflected in securities prices. Thus, this theory implies that no investor can consistently

September 2021.

Using dividend discount model, assuming that the firm's dividends will continue to grow

indefinitely at constant rate as the average dividend growth rate in the previous five years the

investors currently require 9.36% for holding the company's share.

Part E: - Market Efficiency Analysis of the BHP Group Limited

The date on which BHP Group has done an earnings announcement is 24 Feb 2022. This

date is termed as Day 0.

Graph of the stock prices from the trading day -5 to trading day 5 is shown below: -

Efficient Market Hypothesis: -

Efficient Market Hypothesis is a theory that was developed in 19th century by a professor

Eugen Fama. As per this theory, at any given time, all available price sensitive information is

fully reflected in securities prices. Thus, this theory implies that no investor can consistently

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

outperform the market as every stock is appropriately priced based on available information

(Illiashenko, 2019).

Security Analysis involves a systematic analysis of the risk return profiles of various

securities which is to help a rational investor to estimate a value for a company from all the price

sensitive information/data so that he can make purchases when the market under-prices some of

them and thereby earn a reasonable rate of return. Two approaches viz. fundamental analysis and

technical analysis are in vogue for carrying out Security Analysis.

In fundamental analysis, factors affecting risk-return characteristics of securities are

looked into while in technical analysis, demand/ supply position of the securities along with

prevalent share price trends are examined.

From the above chart, it is clear that the market is efficient for the BHP Group. On the basis of

above, the expected stock price reaction to an earnings announcement can be done as follows: -

Earning Announcement Expected Stock Price Reaction

Before day 0 Positive

On day 0 Positive

After day 0 Negative

By Considering the stock price of BHP Group, it can be say that market is still efficient as before

the day 0 price is increasing but after the day 0 it is slightly decreasing but not drastically.

PART-F Capital structure and Cost of Capital.

Capital Structure- It is combination of debt and equity to finance increasing the value of

company. Capital Structure is process which includes the overall operations of the company and

its growth. The debt-to-equity (D/E) ratio is useful in determining the riskiness of a company's

borrowing practices. Equity is ownership of the company while debt is liability of company.

BHP Group LTD capital structure is consists of both Equity and debt (De La Cruz, Medina and

Tang, 2019).

Equity:

Total equity share capital $556Billion

(Illiashenko, 2019).

Security Analysis involves a systematic analysis of the risk return profiles of various

securities which is to help a rational investor to estimate a value for a company from all the price

sensitive information/data so that he can make purchases when the market under-prices some of

them and thereby earn a reasonable rate of return. Two approaches viz. fundamental analysis and

technical analysis are in vogue for carrying out Security Analysis.

In fundamental analysis, factors affecting risk-return characteristics of securities are

looked into while in technical analysis, demand/ supply position of the securities along with

prevalent share price trends are examined.

From the above chart, it is clear that the market is efficient for the BHP Group. On the basis of

above, the expected stock price reaction to an earnings announcement can be done as follows: -

Earning Announcement Expected Stock Price Reaction

Before day 0 Positive

On day 0 Positive

After day 0 Negative

By Considering the stock price of BHP Group, it can be say that market is still efficient as before

the day 0 price is increasing but after the day 0 it is slightly decreasing but not drastically.

PART-F Capital structure and Cost of Capital.

Capital Structure- It is combination of debt and equity to finance increasing the value of

company. Capital Structure is process which includes the overall operations of the company and

its growth. The debt-to-equity (D/E) ratio is useful in determining the riskiness of a company's

borrowing practices. Equity is ownership of the company while debt is liability of company.

BHP Group LTD capital structure is consists of both Equity and debt (De La Cruz, Medina and

Tang, 2019).

Equity:

Total equity share capital $556Billion

Total DEBT $4.1 Billion

TOTAL CAPITAL STURCTURE-$560.1Billion

The estimated WACC of BHP Group is 8.98%

The competitors of BHP Group are Rio Tinto and Anglo American Plc having capital structure

of $565.6 Billion and $ 322.8 Billion.

The equity of BHP Group is higher than the Anglo American Plc's equity that is $ 319 Billion by

$237Billion but the debt of the Anglo American Plc is lower than the debt of the BHP Group by

$0.3Billion that shows that the BHP Group have issued higher debt than the Anglo American.

Plc.

The equity of BHP Group is less than the Rio Tinto $9Billion but the debt of the Rio Tinto is

lower than the BHP Group by $3.5Billion that shows BHP have issue higher debt than the Rio

Tinto and issued share less than in compare to Rio Tanto.

In the above information says that the ownership control is less than compare to both companies

the outsider employees have more control. The company has more debt that the financial risk is

more than compare to Rio Tanto and Anglo American Plc (Alperovych, Calcagno and Geiler,

2018).

CONCLUSION

By considering above analysis, it can be say that BHP Group 's capital structure includes

both share capital and debt capital. But maximum of the capital is funded in the form of share

capital rather than debt which cost more to the company than the interest cost. But the

environment it is operating it can be considered as profit generating company which generates

returns to its shareholders. Moreover, it is paying dividend regularly to its shareholders. The

share price of company has witnessed the growth in the last 5 years but it is competing for

increasing it drastically. It required to consider the strategy of retention of the fund rather than to

distribute it in the shareholders in the form of dividends that will help the company to

accomplish its sudden fund requirements.

TOTAL CAPITAL STURCTURE-$560.1Billion

The estimated WACC of BHP Group is 8.98%

The competitors of BHP Group are Rio Tinto and Anglo American Plc having capital structure

of $565.6 Billion and $ 322.8 Billion.

The equity of BHP Group is higher than the Anglo American Plc's equity that is $ 319 Billion by

$237Billion but the debt of the Anglo American Plc is lower than the debt of the BHP Group by

$0.3Billion that shows that the BHP Group have issued higher debt than the Anglo American.

Plc.

The equity of BHP Group is less than the Rio Tinto $9Billion but the debt of the Rio Tinto is

lower than the BHP Group by $3.5Billion that shows BHP have issue higher debt than the Rio

Tinto and issued share less than in compare to Rio Tanto.

In the above information says that the ownership control is less than compare to both companies

the outsider employees have more control. The company has more debt that the financial risk is

more than compare to Rio Tanto and Anglo American Plc (Alperovych, Calcagno and Geiler,

2018).

CONCLUSION

By considering above analysis, it can be say that BHP Group 's capital structure includes

both share capital and debt capital. But maximum of the capital is funded in the form of share

capital rather than debt which cost more to the company than the interest cost. But the

environment it is operating it can be considered as profit generating company which generates

returns to its shareholders. Moreover, it is paying dividend regularly to its shareholders. The

share price of company has witnessed the growth in the last 5 years but it is competing for

increasing it drastically. It required to consider the strategy of retention of the fund rather than to

distribute it in the shareholders in the form of dividends that will help the company to

accomplish its sudden fund requirements.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and Journals

Aktas, N and et.al., 2021. Reductions in CEO career horizons and corporate policies. Journal of

Corporate Finance. 66. p.101862.

Alperovych, Y., Calcagno, R. and Geiler, P., 2018. Corporate governance and fraud: Causes and

consequences. In Research handbook of finance and sustainability. Edward Elgar

Publishing.

De La Cruz, A., Medina, A. and Tang, Y., 2019. Owners of the world's listed companies. De La

Cruz, A., A. Medina and Y. Tang (2019),“Owners of the World’s Listed Companies”,

OECD Capital Market Series, Paris.

Illiashenko, P., 2019. “Tough Guy” vs.“Cushion” hypothesis: How does individualism affect

risk-taking?. Journal of Behavioral and Experimental Finance. 24. p.100212.

Kaur, M. and Vij, M., 2018. Corporate governance index and firm performance: empirical

evidence from Indian banking. Afro-Asian Journal of Finance and Accounting. 8(2).

pp.190-207.

Lai, K and et.al., 2020. Corporate deleveraging and financial flexibility: A Chinese case-

study. Pacific-Basin Finance Journal. 61. p.101299.

Pham, D and et.al., 2021. Corporate divestiture decisions and long-run performance. Journal of

Behavioral Finance. 22(2). pp.126-140.

Zheng, M., 2022. Is cash the panacea of the COVID-19 pandemic: Evidence from corporate

performance. Finance Research Letters. 45. p.102151.

Books and Journals

Aktas, N and et.al., 2021. Reductions in CEO career horizons and corporate policies. Journal of

Corporate Finance. 66. p.101862.

Alperovych, Y., Calcagno, R. and Geiler, P., 2018. Corporate governance and fraud: Causes and

consequences. In Research handbook of finance and sustainability. Edward Elgar

Publishing.

De La Cruz, A., Medina, A. and Tang, Y., 2019. Owners of the world's listed companies. De La

Cruz, A., A. Medina and Y. Tang (2019),“Owners of the World’s Listed Companies”,

OECD Capital Market Series, Paris.

Illiashenko, P., 2019. “Tough Guy” vs.“Cushion” hypothesis: How does individualism affect

risk-taking?. Journal of Behavioral and Experimental Finance. 24. p.100212.

Kaur, M. and Vij, M., 2018. Corporate governance index and firm performance: empirical

evidence from Indian banking. Afro-Asian Journal of Finance and Accounting. 8(2).

pp.190-207.

Lai, K and et.al., 2020. Corporate deleveraging and financial flexibility: A Chinese case-

study. Pacific-Basin Finance Journal. 61. p.101299.

Pham, D and et.al., 2021. Corporate divestiture decisions and long-run performance. Journal of

Behavioral Finance. 22(2). pp.126-140.

Zheng, M., 2022. Is cash the panacea of the COVID-19 pandemic: Evidence from corporate

performance. Finance Research Letters. 45. p.102151.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.