Financial Performance Analysis of Billabong International Limited

VerifiedAdded on 2023/06/08

|19

|3280

|306

AI Summary

The present report is developed for roving an analysis of the financial performance of an ASX listed entity. The company selected for the purpose is Billabong International Limited, a clothing retailer recognized as a leader in providing surfing product and accessories for both young men and women. The financial performance analysis is carried out with the use of ratio analysis technique.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1

BUACC1508 ACCOUNTING AND FINANCE

ASSESSMENT TASK 2: GROUP ASSIGNMENT

BUACC1508 ACCOUNTING AND FINANCE

ASSESSMENT TASK 2: GROUP ASSIGNMENT

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2

Executive Summary

The present report is developed for roving an analysis of the financial performance of an

ASX listed entity. The company selected for the purpose is Billabong International Limited, a

clothing retailer recognized as a leader in providing surfing product and accessories for both

young men and women. The financial performance analysis is carried out with the use of ratio

analysis technique. The analysis of profitability ratios has revealed that the company net profit

has declined from the year 2016 to 2017 while its efficiency and liquidity position is far better

than the profitability position. The company is also high on leverage which has subsequently

increased from the year 2016 to 2017. The earnings per share of the company is negative in both

the years from 2016-2017 and thus the company cannot be regarded as worthy of investment

from the perspective of current and potential investors. In this context, it is recommended to the

company for reducing its operational expenses on assets as compared to the sales realized from it

for improving its profitability position.

Executive Summary

The present report is developed for roving an analysis of the financial performance of an

ASX listed entity. The company selected for the purpose is Billabong International Limited, a

clothing retailer recognized as a leader in providing surfing product and accessories for both

young men and women. The financial performance analysis is carried out with the use of ratio

analysis technique. The analysis of profitability ratios has revealed that the company net profit

has declined from the year 2016 to 2017 while its efficiency and liquidity position is far better

than the profitability position. The company is also high on leverage which has subsequently

increased from the year 2016 to 2017. The earnings per share of the company is negative in both

the years from 2016-2017 and thus the company cannot be regarded as worthy of investment

from the perspective of current and potential investors. In this context, it is recommended to the

company for reducing its operational expenses on assets as compared to the sales realized from it

for improving its profitability position.

3

Contents

Executive Summary.........................................................................................................................2

Background: Company Overview...................................................................................................4

Ratio Analysis..................................................................................................................................5

Profitability Analysis.......................................................................................................................5

Efficiency Analysis..........................................................................................................................7

Liquidity Analysis...........................................................................................................................9

Gearing (Leverage) Analysis.........................................................................................................10

Investment or market analysis.......................................................................................................11

Conclusion and Findings...............................................................................................................12

Recommendations..........................................................................................................................12

References......................................................................................................................................14

Appendix........................................................................................................................................16

Contents

Executive Summary.........................................................................................................................2

Background: Company Overview...................................................................................................4

Ratio Analysis..................................................................................................................................5

Profitability Analysis.......................................................................................................................5

Efficiency Analysis..........................................................................................................................7

Liquidity Analysis...........................................................................................................................9

Gearing (Leverage) Analysis.........................................................................................................10

Investment or market analysis.......................................................................................................11

Conclusion and Findings...............................................................................................................12

Recommendations..........................................................................................................................12

References......................................................................................................................................14

Appendix........................................................................................................................................16

4

Background: Company Overview

This report is developed for presenting an analysis of the financial performance of

Billabong International Limited, an ASX listed entity for facilitating the decision-making process

of investors. Billabong International Limited is known to be a clothing retailer that is involved in

producing accessories such as watches, backpack and snowboard products. The company was

established in the year 1973 and since then has established itself as a major market apparel and

accessories company within Australia that design its product mainly for surfing, skateboarding

and snowboarding. The company at present is known to manufacture about 2,200 products that

includes shorts, t-shirts, swimwear, jackets and others surfing products for both men and women.

It has established its sports shops for delivering its products to the customers in about 6-countries

across the world. It is recognized as one of the leading brand involved in designing of surfing

apparel having about 6,000 employees (Annual Report, 2017).

It is known to be a retail company whose products reflect the idealistic lifestyle of a

surfer. The products of the company at present are officially licensed in about 100 countries and

it is listed since the year 2000 on the Australian Stock Exchange. The company realizes revenue

mainly from Australia, North America, Europe, Japan, New Zealand, Brazil and South Africa.

The company market itself on an international platform by associating with the professional

athletes, junior athletes and events. The major target population of the company is young

generation people and it adopts the use of sponsorship of young surfers and athletes for

advertising its products to the target population section. In this context, the present report is

developed for analyzing the financial performance of the company by the use of ratio analysis

technique. The ratio analysis examines the profitability, efficiency, liquidity, and leverage and

Background: Company Overview

This report is developed for presenting an analysis of the financial performance of

Billabong International Limited, an ASX listed entity for facilitating the decision-making process

of investors. Billabong International Limited is known to be a clothing retailer that is involved in

producing accessories such as watches, backpack and snowboard products. The company was

established in the year 1973 and since then has established itself as a major market apparel and

accessories company within Australia that design its product mainly for surfing, skateboarding

and snowboarding. The company at present is known to manufacture about 2,200 products that

includes shorts, t-shirts, swimwear, jackets and others surfing products for both men and women.

It has established its sports shops for delivering its products to the customers in about 6-countries

across the world. It is recognized as one of the leading brand involved in designing of surfing

apparel having about 6,000 employees (Annual Report, 2017).

It is known to be a retail company whose products reflect the idealistic lifestyle of a

surfer. The products of the company at present are officially licensed in about 100 countries and

it is listed since the year 2000 on the Australian Stock Exchange. The company realizes revenue

mainly from Australia, North America, Europe, Japan, New Zealand, Brazil and South Africa.

The company market itself on an international platform by associating with the professional

athletes, junior athletes and events. The major target population of the company is young

generation people and it adopts the use of sponsorship of young surfers and athletes for

advertising its products to the target population section. In this context, the present report is

developed for analyzing the financial performance of the company by the use of ratio analysis

technique. The ratio analysis examines the profitability, efficiency, liquidity, and leverage and

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

5

investment performance of the company for identifying the changes in the financial position

from the year 2016 to 2017. The findings of the ratio analysis are used for providing an overall

assessment of the company from the perspective of existing and potential equity investors

(Annual Report, 2017).

Ratio Analysis

Ratio analysis is regarded as an important tool for examining the financial performance

of a company. The calculation of the pertinent ratio’s such as profitability, liquidity and others

help in assessing the financial position of a company that can be used for decision-making from

the perspective of an investors. The accounting ratios are also very important for examining the

efficiency of a company in terms of its operations and management. They help in evaluating

whether the company is able to utilize its assets effectively for generating profits (Firer, 2012).

As such, the financial position of Billabong is determined with the use of ratio analysis

technique. The key ratios calculated for the company are discussed as follows:

Profitability Analysis

The profitability ratio’s can be classified as financial metrics ratio’s that are used for

assessing the ability of a company to generate earnings in comparison to the expenses incurred.

The profitability position of the company is assessed with the use of following ratios:

Return on Equity

investment performance of the company for identifying the changes in the financial position

from the year 2016 to 2017. The findings of the ratio analysis are used for providing an overall

assessment of the company from the perspective of existing and potential equity investors

(Annual Report, 2017).

Ratio Analysis

Ratio analysis is regarded as an important tool for examining the financial performance

of a company. The calculation of the pertinent ratio’s such as profitability, liquidity and others

help in assessing the financial position of a company that can be used for decision-making from

the perspective of an investors. The accounting ratios are also very important for examining the

efficiency of a company in terms of its operations and management. They help in evaluating

whether the company is able to utilize its assets effectively for generating profits (Firer, 2012).

As such, the financial position of Billabong is determined with the use of ratio analysis

technique. The key ratios calculated for the company are discussed as follows:

Profitability Analysis

The profitability ratio’s can be classified as financial metrics ratio’s that are used for

assessing the ability of a company to generate earnings in comparison to the expenses incurred.

The profitability position of the company is assessed with the use of following ratios:

Return on Equity

6

The return on equity (ROE) provides a major indicator of the profitability position of a

company by depicting the profit realized by it in comparison to the amount of money the

shareholders has invested. The formula for calculating the ratio can be described as follows:

Formula = Net Profit *100 /Average Shareholder’s equity (Koller, 2015)

As calculated from the ROE ratio of the company, its return on equity is negative for both

the years that are from 2016 to 2017. The negative ROE indicates that the shareholders of the

company are realizing losses instead of attaining profits. However, the ROE of the company has

somewhat recovered in the year 2017 which indicates that the financial capacity of the company

to realized earnings from shareholder wealth has somewhat improved.

Return on Assets (ROA) Ratio

It is a financial ratio that is used for depicting the percentage of profit realized by a

company by effective utilization of its asset base. The formula for the calculation of the ratio can

be depicted as follows:

Formula =EBIT *100 / Average Total Assets (Deegan, 2013)

It can be stated from the ROA ratio calculated for the years 2016 and 2017 that its

capability to realize profits from asset use have declined as the ratio has turned negative in the

year 2017. It indicates that the company is not able to generate revenue from its assets and is

realizing financial losses.

Net Profit Margin

The ratio can be described as the percentage of revenue realized by a company after

meeting all its expenses. The formula for its calculation is as follows:

The return on equity (ROE) provides a major indicator of the profitability position of a

company by depicting the profit realized by it in comparison to the amount of money the

shareholders has invested. The formula for calculating the ratio can be described as follows:

Formula = Net Profit *100 /Average Shareholder’s equity (Koller, 2015)

As calculated from the ROE ratio of the company, its return on equity is negative for both

the years that are from 2016 to 2017. The negative ROE indicates that the shareholders of the

company are realizing losses instead of attaining profits. However, the ROE of the company has

somewhat recovered in the year 2017 which indicates that the financial capacity of the company

to realized earnings from shareholder wealth has somewhat improved.

Return on Assets (ROA) Ratio

It is a financial ratio that is used for depicting the percentage of profit realized by a

company by effective utilization of its asset base. The formula for the calculation of the ratio can

be depicted as follows:

Formula =EBIT *100 / Average Total Assets (Deegan, 2013)

It can be stated from the ROA ratio calculated for the years 2016 and 2017 that its

capability to realize profits from asset use have declined as the ratio has turned negative in the

year 2017. It indicates that the company is not able to generate revenue from its assets and is

realizing financial losses.

Net Profit Margin

The ratio can be described as the percentage of revenue realized by a company after

meeting all its expenses. The formula for its calculation is as follows:

7

Formula = EBIT/ Sales or Revenue

The net profit ratio of the company has declined from the year 2016 to 2017 and has

attained a negative value in the year 2017. The negative value for the ratio indicates that the

business has incurred more expenses in comparison to the earnings realized during a particular

period.

Gross Profit Margin

The ratio is used for providing an assessment of the financial health of a company by

determine the percentage of revenue realized by it after meeting the cost of goods sold. The

formula for its calculation is as follows:

Formula = Gross Profit/Sales or Revenue (Koller, 2015)

It can be stated from analyzing the gross profit margin of the company during the

financial period 2016-2017 that the company has decreased its expense relating to the cost of

goods sold as its gross profit has increased.

Efficiency Analysis

The efficiency ratios are used for analyzing the ability of a company to use its assets and

liabilities internally in an effective manner for generating profit. The different type of efficiency

ratios used for analyzing the financial position of Billabong is as follows:

Asset turnover ratio:

The asset turnover ratio measures the efficiency of a company in utilizing its assets for

generating sales and can be calculated with the following formula:

Formula = EBIT/ Sales or Revenue

The net profit ratio of the company has declined from the year 2016 to 2017 and has

attained a negative value in the year 2017. The negative value for the ratio indicates that the

business has incurred more expenses in comparison to the earnings realized during a particular

period.

Gross Profit Margin

The ratio is used for providing an assessment of the financial health of a company by

determine the percentage of revenue realized by it after meeting the cost of goods sold. The

formula for its calculation is as follows:

Formula = Gross Profit/Sales or Revenue (Koller, 2015)

It can be stated from analyzing the gross profit margin of the company during the

financial period 2016-2017 that the company has decreased its expense relating to the cost of

goods sold as its gross profit has increased.

Efficiency Analysis

The efficiency ratios are used for analyzing the ability of a company to use its assets and

liabilities internally in an effective manner for generating profit. The different type of efficiency

ratios used for analyzing the financial position of Billabong is as follows:

Asset turnover ratio:

The asset turnover ratio measures the efficiency of a company in utilizing its assets for

generating sales and can be calculated with the following formula:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

Formula =Sales*100/Average total assets (Tracy, 2012)

The asset turnover ratio of the company has increased from 1.30 to 1.48 between the

financial years 2016-2017. This indicates that the ability of the company to generate sales from

the use of assets ahs improved. The net sales of the company have increased in comparison to the

average total assets for the year 2017 as compared to that of the year 2016.

Days Inventory Ratio

The ratio provides an estimate of the number of days a company holds its inventory

before it is sold. The formula for its calculation is as follows:

Formula =Average Inventory *365/Cost of Goods Sold

The inventory turnover ratio of the company has significantly increased from the year

2016 to 2017 from 126 to 131 depicting that the holding period of inventory has increased which

cannot be regarded good for the company. This is because it will eventually lead to increase in

the operational expenses of the company required for maintaining the inventory before it is

converted into sales.

Days Debtors Ratio

The ratio provides a measurement of the effectiveness of a company to collect cash from

its debtors. It is calculated by the use of following formula:

Formula =Average Trade Debtors *365/Sales (Tracy, 2012)

The ratio for the company has depicted an increasing pattern from the year 2016 to 2017

from 57 to 63. This indicates that the time-period taken by the company for collecting the cash

Formula =Sales*100/Average total assets (Tracy, 2012)

The asset turnover ratio of the company has increased from 1.30 to 1.48 between the

financial years 2016-2017. This indicates that the ability of the company to generate sales from

the use of assets ahs improved. The net sales of the company have increased in comparison to the

average total assets for the year 2017 as compared to that of the year 2016.

Days Inventory Ratio

The ratio provides an estimate of the number of days a company holds its inventory

before it is sold. The formula for its calculation is as follows:

Formula =Average Inventory *365/Cost of Goods Sold

The inventory turnover ratio of the company has significantly increased from the year

2016 to 2017 from 126 to 131 depicting that the holding period of inventory has increased which

cannot be regarded good for the company. This is because it will eventually lead to increase in

the operational expenses of the company required for maintaining the inventory before it is

converted into sales.

Days Debtors Ratio

The ratio provides a measurement of the effectiveness of a company to collect cash from

its debtors. It is calculated by the use of following formula:

Formula =Average Trade Debtors *365/Sales (Tracy, 2012)

The ratio for the company has depicted an increasing pattern from the year 2016 to 2017

from 57 to 63. This indicates that the time-period taken by the company for collecting the cash

9

from its debtors have increased which cannot be regarded good for its future growth and

development.

Liquidity Analysis

Liquidity ratios help to examine the company ability to pay the short term liabilities

through use of short term assets. The main purpose of liquidity analysis is to help creditors and

lenders in their decision making on whether to extend the credit or debt to company. It is also use

by the management to check the level of short term company have to pay the short term

liabilities.

Current Ratio or Working Capital Ratio

Current ratio is an indicator of company ability meets the short term obligations. This

ratio checks whether company has enough resources to meet the liabilities in next 12 months.

Formula: Current Assets/Current Liabilities (Fabozzi, 2008)

The current ratio of Billabong Group was 2.29 times in year 2016 that was increased to

2.42 times in year 2017. In both the years the current ratios has crossed the ideal benchmark of

2:1. The increase in current ratio from 2016 to 2017 clearly indicates the improvement in

liquidity position of Billabong in year 2017 as compared to year 2016. Billabong has current

assets more than 2 times the current liabilities with major portion consist of inventory that shows

company has blocked some part of its current assets in inventory and has failed to convert them

into sales at proper interval of time.

Quick Asset Ratio or Acid test Ratio

from its debtors have increased which cannot be regarded good for its future growth and

development.

Liquidity Analysis

Liquidity ratios help to examine the company ability to pay the short term liabilities

through use of short term assets. The main purpose of liquidity analysis is to help creditors and

lenders in their decision making on whether to extend the credit or debt to company. It is also use

by the management to check the level of short term company have to pay the short term

liabilities.

Current Ratio or Working Capital Ratio

Current ratio is an indicator of company ability meets the short term obligations. This

ratio checks whether company has enough resources to meet the liabilities in next 12 months.

Formula: Current Assets/Current Liabilities (Fabozzi, 2008)

The current ratio of Billabong Group was 2.29 times in year 2016 that was increased to

2.42 times in year 2017. In both the years the current ratios has crossed the ideal benchmark of

2:1. The increase in current ratio from 2016 to 2017 clearly indicates the improvement in

liquidity position of Billabong in year 2017 as compared to year 2016. Billabong has current

assets more than 2 times the current liabilities with major portion consist of inventory that shows

company has blocked some part of its current assets in inventory and has failed to convert them

into sales at proper interval of time.

Quick Asset Ratio or Acid test Ratio

10

It measures the short term liquidity position of the company similarly like to current ratio

but it does take into account the inventory value while making calculating the quick assets. The

main reason behind not considering the inventory in calculation of quick assets is its nature of

not converting into cash and cash equivalents in short period of time.

Formula: Quick Assets/Current Liabilities (Papadopoulos, 2011)

The acid test ratio of Billabong was 1.38 times in year 2016 and it was 1.49 times in year

2017 that clearly shows strong liquidity performance of Billabong in both the years. However the

liquidity performance has improved as acid test ratio has been increased in year 2017 as

compared to year 2016.

Gearing (Leverage) Analysis

The financial leverage ratios are also known as solvency ratios as it measures the ability

of company to meet the long term liabilities as and when it fall due. The purpose of gearing ratio

is to measure the long term solvency position of the company through comparing the debts of the

company to its assets.

Debt to Equity Ratio

Debt equity ratio is the measure relative proportion of debt and equity capital that has

been used to finance the assets of the company.

Formula: Total Liabilities/Total Equity (Brigham & Houston, 2012)

It measures the short term liquidity position of the company similarly like to current ratio

but it does take into account the inventory value while making calculating the quick assets. The

main reason behind not considering the inventory in calculation of quick assets is its nature of

not converting into cash and cash equivalents in short period of time.

Formula: Quick Assets/Current Liabilities (Papadopoulos, 2011)

The acid test ratio of Billabong was 1.38 times in year 2016 and it was 1.49 times in year

2017 that clearly shows strong liquidity performance of Billabong in both the years. However the

liquidity performance has improved as acid test ratio has been increased in year 2017 as

compared to year 2016.

Gearing (Leverage) Analysis

The financial leverage ratios are also known as solvency ratios as it measures the ability

of company to meet the long term liabilities as and when it fall due. The purpose of gearing ratio

is to measure the long term solvency position of the company through comparing the debts of the

company to its assets.

Debt to Equity Ratio

Debt equity ratio is the measure relative proportion of debt and equity capital that has

been used to finance the assets of the company.

Formula: Total Liabilities/Total Equity (Brigham & Houston, 2012)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

11

The debt to equity ratio of Billabong was 1.93 times in year 2016 and it was increased to

2.30 times in year 2017. It can be said that Billabong has been highly leveraged entity as major

of its assets has financed through used of debt capital.

Interest Coverage ratio

It is gearing ratio that measures company’s ability to meet the interest expenses. The

lower or negative interest coverage ratio signifies company has high debt burden and there is

possibility of bankruptcy of the company. High interest coverage ratio is good for company.

Formula: EBIT/Net Interest (Brealey, Myers & Marcus, 2010)

Interest coverage ratio was 0.47 times in year 2016 and it further reduced to negative 2.18

times in year 2017. The lower or negative interest coverage ratio signifies that Billabong has

high debt capital and also there is chance of bankruptcy of the company.

Investment or market analysis

Investment analysis aims to assist the investors as it tells the market performance of a

company. This analyse provides the information on return that investors has got while investing

the company shares.

Earnings per Share (EPS)

This ratio tells amount of net profit earned by the shareholders on each common equity

share held by them.

Formula: Net profit attributable to shareholders / Number of equity shares (Baker & Nofsinger,

2010)

The debt to equity ratio of Billabong was 1.93 times in year 2016 and it was increased to

2.30 times in year 2017. It can be said that Billabong has been highly leveraged entity as major

of its assets has financed through used of debt capital.

Interest Coverage ratio

It is gearing ratio that measures company’s ability to meet the interest expenses. The

lower or negative interest coverage ratio signifies company has high debt burden and there is

possibility of bankruptcy of the company. High interest coverage ratio is good for company.

Formula: EBIT/Net Interest (Brealey, Myers & Marcus, 2010)

Interest coverage ratio was 0.47 times in year 2016 and it further reduced to negative 2.18

times in year 2017. The lower or negative interest coverage ratio signifies that Billabong has

high debt capital and also there is chance of bankruptcy of the company.

Investment or market analysis

Investment analysis aims to assist the investors as it tells the market performance of a

company. This analyse provides the information on return that investors has got while investing

the company shares.

Earnings per Share (EPS)

This ratio tells amount of net profit earned by the shareholders on each common equity

share held by them.

Formula: Net profit attributable to shareholders / Number of equity shares (Baker & Nofsinger,

2010)

12

EPS of Billabong was negative in year 2016 as well as in year 2017 that indicates poor

financial position of the company in the market. There was decreasing trend in this ratio that

clearly signifies that future health of company was not good.

Conclusion and Findings

On the basis of overall ratio analysis of Billabong for year 2016 and year 2017 it has been

revealed that overall financial performance has declined in year 2017 as compared to year 2016.

Profitability analysis of Billabong for year 2016 and 2017 clearly reveals that in year 2017

Billabong has generated loss that widely impacts the profitability performance. There is no scope

that signifies that profitability performance will improve in future years. Efficiency analysis is

the best indicator of manager’s effectiveness to utilize the resources of the company to generate

good revenue and to collect the receivables from the debtors. The efficiency analysis of

Billabong clearly shows managers ineffectiveness collection of accounts receivables has

increased and also the inventory takes times to convert into cost of goods sold. Liquidity

performance was satisfactory as company was able to pay current liabilities as and when it arises.

The gearing analysis reveals poor long term solvency position of Billabong in both the years and

there is very high chance that company can opt for bankruptcy of condition does not improve in

future. There was very bad information for investors as Billabong has failed to provide required

returns to them.

Recommendations

It is recommended to the management or directors of the company on the basis of overall

analyses carried out in the report that the company should take strong measure for improving its

profitability position. This is necessary for creating value for the shareholders and thus ensuring

EPS of Billabong was negative in year 2016 as well as in year 2017 that indicates poor

financial position of the company in the market. There was decreasing trend in this ratio that

clearly signifies that future health of company was not good.

Conclusion and Findings

On the basis of overall ratio analysis of Billabong for year 2016 and year 2017 it has been

revealed that overall financial performance has declined in year 2017 as compared to year 2016.

Profitability analysis of Billabong for year 2016 and 2017 clearly reveals that in year 2017

Billabong has generated loss that widely impacts the profitability performance. There is no scope

that signifies that profitability performance will improve in future years. Efficiency analysis is

the best indicator of manager’s effectiveness to utilize the resources of the company to generate

good revenue and to collect the receivables from the debtors. The efficiency analysis of

Billabong clearly shows managers ineffectiveness collection of accounts receivables has

increased and also the inventory takes times to convert into cost of goods sold. Liquidity

performance was satisfactory as company was able to pay current liabilities as and when it arises.

The gearing analysis reveals poor long term solvency position of Billabong in both the years and

there is very high chance that company can opt for bankruptcy of condition does not improve in

future. There was very bad information for investors as Billabong has failed to provide required

returns to them.

Recommendations

It is recommended to the management or directors of the company on the basis of overall

analyses carried out in the report that the company should take strong measure for improving its

profitability position. This is necessary for creating value for the shareholders and thus ensuring

13

its continued growth and development. This can be done by taking effective steps for reducing

the operational costs and the cost of goods sold for improving the revenue realized through

reduction in the operational expenses. Also, it is recommended to the current and potential equity

investors that they should at present refrain themselves from investing in the company. The

investors need to examine the past, present and predicted future performance of the company

before taking investment decision. They need to wait and analyze its future performance before

making any final investment decision (Koller, 2015).

its continued growth and development. This can be done by taking effective steps for reducing

the operational costs and the cost of goods sold for improving the revenue realized through

reduction in the operational expenses. Also, it is recommended to the current and potential equity

investors that they should at present refrain themselves from investing in the company. The

investors need to examine the past, present and predicted future performance of the company

before taking investment decision. They need to wait and analyze its future performance before

making any final investment decision (Koller, 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

14

References

Annual Report. (2017). Billabong. Retrieved September 9, 2018 from Billabong Annual Report

2017

Baker, H.K. & Nofsinger, J.R. (2010). Behavioral Finance: Investors, Corporations, and

Markets. John Wiley & Sons.

Brealey, R., Myers, S.C. & Marcus, A.J. (2010). Fundamentals of Corporate Finance. Mc Graw

Hill.

Brigham, F., & Houston.J. (2012). Fundamentals of financial management. Cengage Learning.

Deegan, C., (2013). Financial accounting theory. McGraw-Hill Education Australia.

Fabozzi, F. (2008). The Complete CFO Handbook: From Accounting to Accountability. John

Wiley & Sons.

Firer, C. (2012). Fundamentals of Corporate Finance. McGraw-Hill Companies, Inc.

Koller, T. (2015). Valuation: Measuring and Managing the Value of Companies. John Wiley &

Sons.

Papadopoulos, P. (2011). Investment Report - Fundamental Analysis/ Ratio Analysis:

Comparative Approach between two FTSE 100 corporations Vodafone plc and British

Telecom Group. GRIN Verlag.

Tracy, A. (2012). Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to

Analyse Any Business on the Planet. RatioAnalysis.net.

References

Annual Report. (2017). Billabong. Retrieved September 9, 2018 from Billabong Annual Report

2017

Baker, H.K. & Nofsinger, J.R. (2010). Behavioral Finance: Investors, Corporations, and

Markets. John Wiley & Sons.

Brealey, R., Myers, S.C. & Marcus, A.J. (2010). Fundamentals of Corporate Finance. Mc Graw

Hill.

Brigham, F., & Houston.J. (2012). Fundamentals of financial management. Cengage Learning.

Deegan, C., (2013). Financial accounting theory. McGraw-Hill Education Australia.

Fabozzi, F. (2008). The Complete CFO Handbook: From Accounting to Accountability. John

Wiley & Sons.

Firer, C. (2012). Fundamentals of Corporate Finance. McGraw-Hill Companies, Inc.

Koller, T. (2015). Valuation: Measuring and Managing the Value of Companies. John Wiley &

Sons.

Papadopoulos, P. (2011). Investment Report - Fundamental Analysis/ Ratio Analysis:

Comparative Approach between two FTSE 100 corporations Vodafone plc and British

Telecom Group. GRIN Verlag.

Tracy, A. (2012). Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to

Analyse Any Business on the Planet. RatioAnalysis.net.

15

16

Appendix

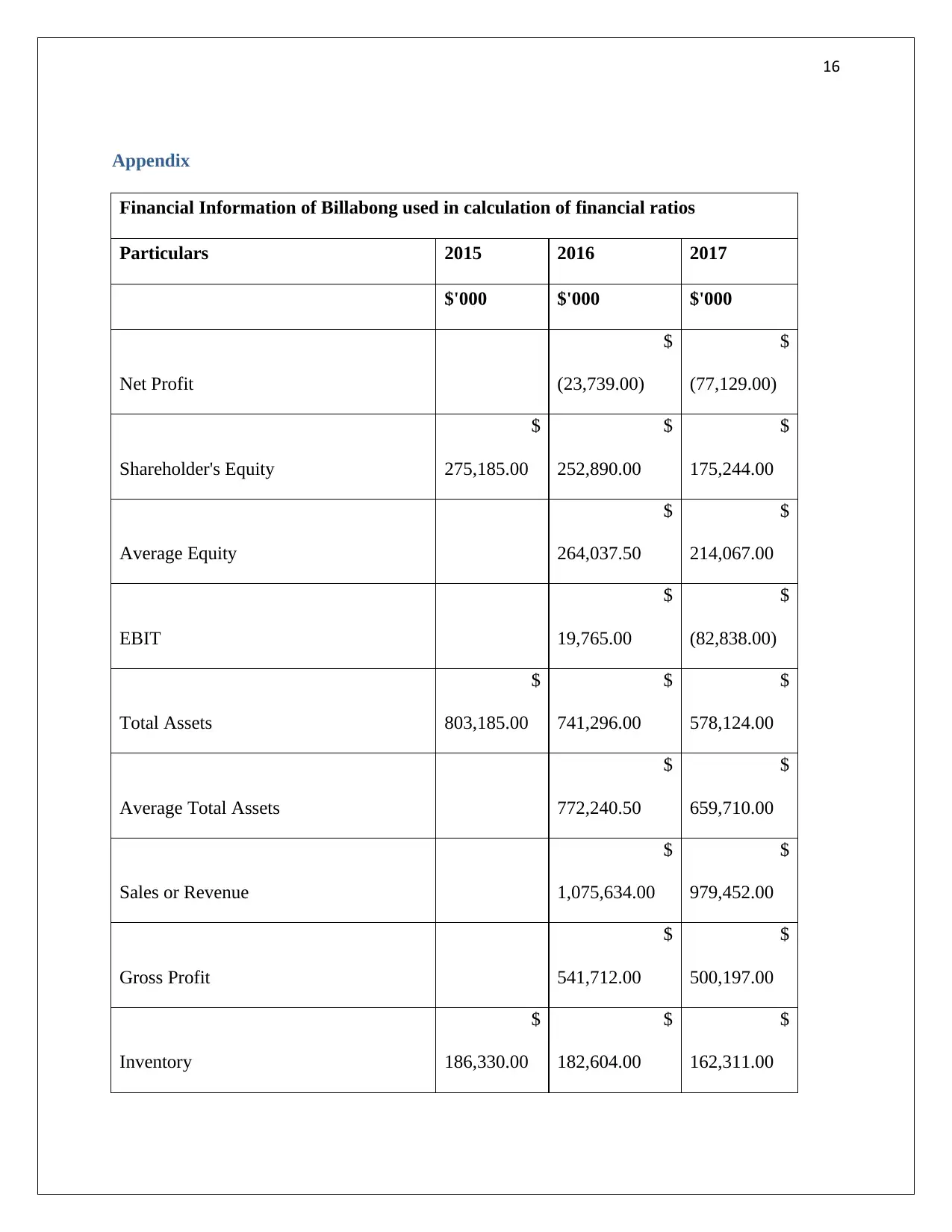

Financial Information of Billabong used in calculation of financial ratios

Particulars 2015 2016 2017

$'000 $'000 $'000

Net Profit

$

(23,739.00)

$

(77,129.00)

Shareholder's Equity

$

275,185.00

$

252,890.00

$

175,244.00

Average Equity

$

264,037.50

$

214,067.00

EBIT

$

19,765.00

$

(82,838.00)

Total Assets

$

803,185.00

$

741,296.00

$

578,124.00

Average Total Assets

$

772,240.50

$

659,710.00

Sales or Revenue

$

1,075,634.00

$

979,452.00

Gross Profit

$

541,712.00

$

500,197.00

Inventory

$

186,330.00

$

182,604.00

$

162,311.00

Appendix

Financial Information of Billabong used in calculation of financial ratios

Particulars 2015 2016 2017

$'000 $'000 $'000

Net Profit

$

(23,739.00)

$

(77,129.00)

Shareholder's Equity

$

275,185.00

$

252,890.00

$

175,244.00

Average Equity

$

264,037.50

$

214,067.00

EBIT

$

19,765.00

$

(82,838.00)

Total Assets

$

803,185.00

$

741,296.00

$

578,124.00

Average Total Assets

$

772,240.50

$

659,710.00

Sales or Revenue

$

1,075,634.00

$

979,452.00

Gross Profit

$

541,712.00

$

500,197.00

Inventory

$

186,330.00

$

182,604.00

$

162,311.00

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

17

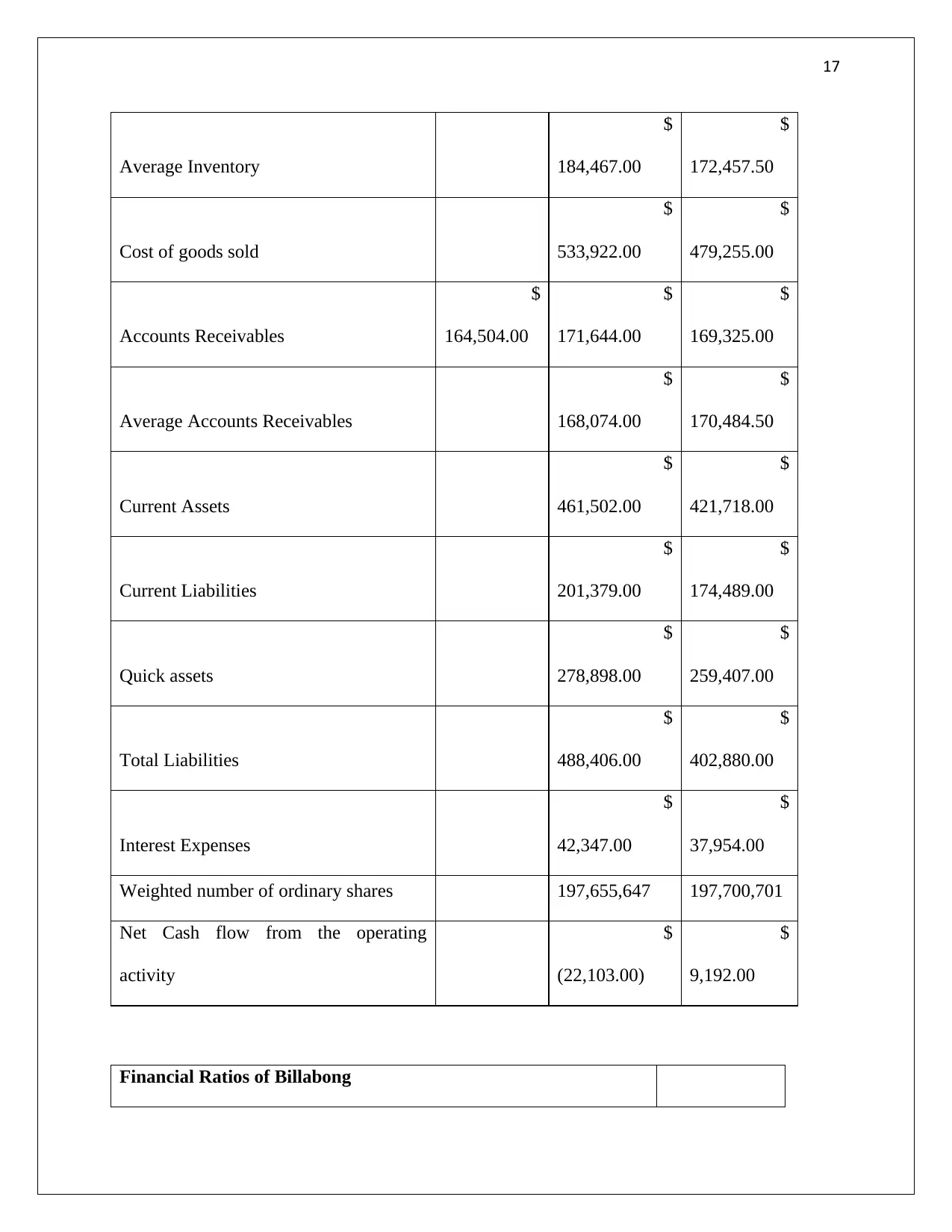

Average Inventory

$

184,467.00

$

172,457.50

Cost of goods sold

$

533,922.00

$

479,255.00

Accounts Receivables

$

164,504.00

$

171,644.00

$

169,325.00

Average Accounts Receivables

$

168,074.00

$

170,484.50

Current Assets

$

461,502.00

$

421,718.00

Current Liabilities

$

201,379.00

$

174,489.00

Quick assets

$

278,898.00

$

259,407.00

Total Liabilities

$

488,406.00

$

402,880.00

Interest Expenses

$

42,347.00

$

37,954.00

Weighted number of ordinary shares 197,655,647 197,700,701

Net Cash flow from the operating

activity

$

(22,103.00)

$

9,192.00

Financial Ratios of Billabong

Average Inventory

$

184,467.00

$

172,457.50

Cost of goods sold

$

533,922.00

$

479,255.00

Accounts Receivables

$

164,504.00

$

171,644.00

$

169,325.00

Average Accounts Receivables

$

168,074.00

$

170,484.50

Current Assets

$

461,502.00

$

421,718.00

Current Liabilities

$

201,379.00

$

174,489.00

Quick assets

$

278,898.00

$

259,407.00

Total Liabilities

$

488,406.00

$

402,880.00

Interest Expenses

$

42,347.00

$

37,954.00

Weighted number of ordinary shares 197,655,647 197,700,701

Net Cash flow from the operating

activity

$

(22,103.00)

$

9,192.00

Financial Ratios of Billabong

18

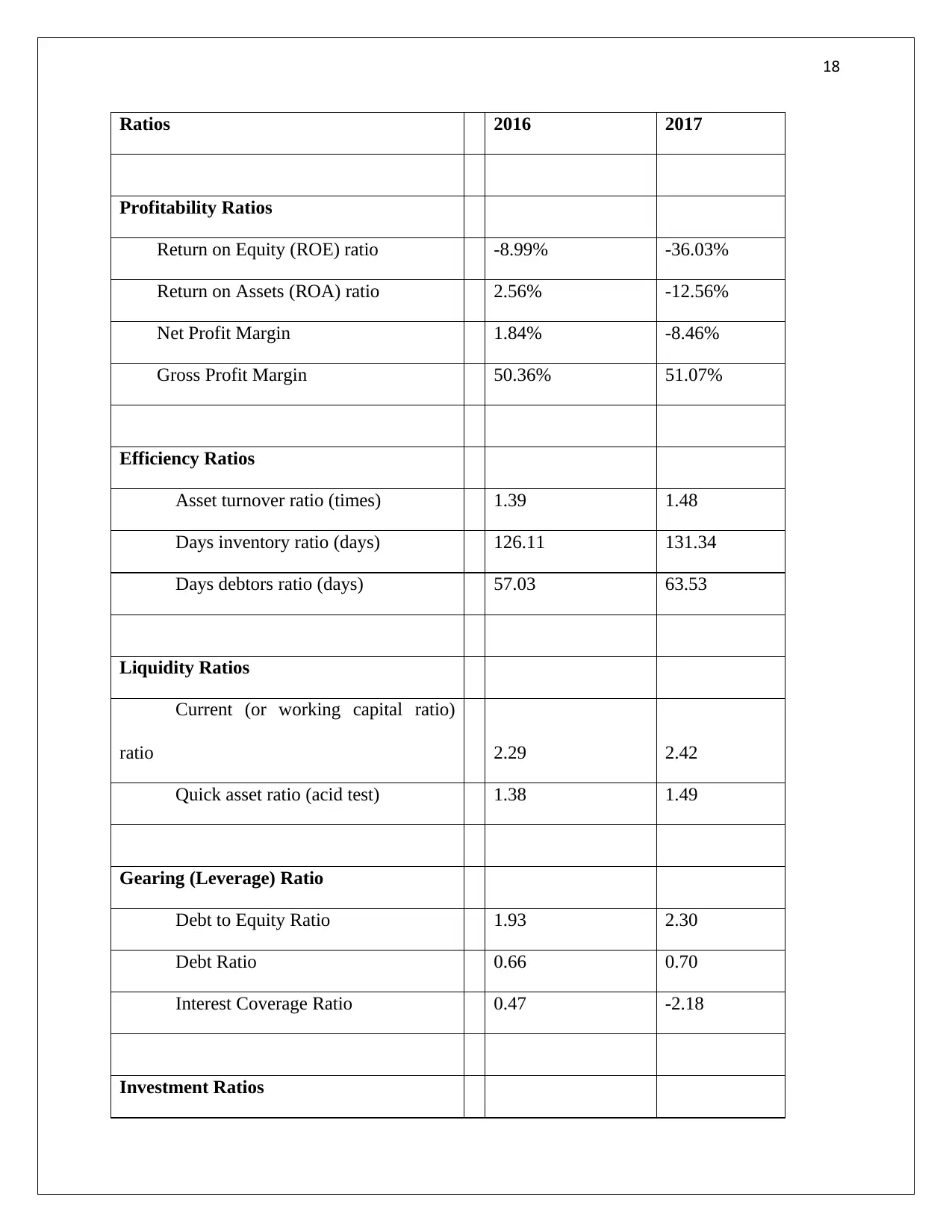

Ratios 2016 2017

Profitability Ratios

Return on Equity (ROE) ratio -8.99% -36.03%

Return on Assets (ROA) ratio 2.56% -12.56%

Net Profit Margin 1.84% -8.46%

Gross Profit Margin 50.36% 51.07%

Efficiency Ratios

Asset turnover ratio (times) 1.39 1.48

Days inventory ratio (days) 126.11 131.34

Days debtors ratio (days) 57.03 63.53

Liquidity Ratios

Current (or working capital ratio)

ratio 2.29 2.42

Quick asset ratio (acid test) 1.38 1.49

Gearing (Leverage) Ratio

Debt to Equity Ratio 1.93 2.30

Debt Ratio 0.66 0.70

Interest Coverage Ratio 0.47 -2.18

Investment Ratios

Ratios 2016 2017

Profitability Ratios

Return on Equity (ROE) ratio -8.99% -36.03%

Return on Assets (ROA) ratio 2.56% -12.56%

Net Profit Margin 1.84% -8.46%

Gross Profit Margin 50.36% 51.07%

Efficiency Ratios

Asset turnover ratio (times) 1.39 1.48

Days inventory ratio (days) 126.11 131.34

Days debtors ratio (days) 57.03 63.53

Liquidity Ratios

Current (or working capital ratio)

ratio 2.29 2.42

Quick asset ratio (acid test) 1.38 1.49

Gearing (Leverage) Ratio

Debt to Equity Ratio 1.93 2.30

Debt Ratio 0.66 0.70

Interest Coverage Ratio 0.47 -2.18

Investment Ratios

19

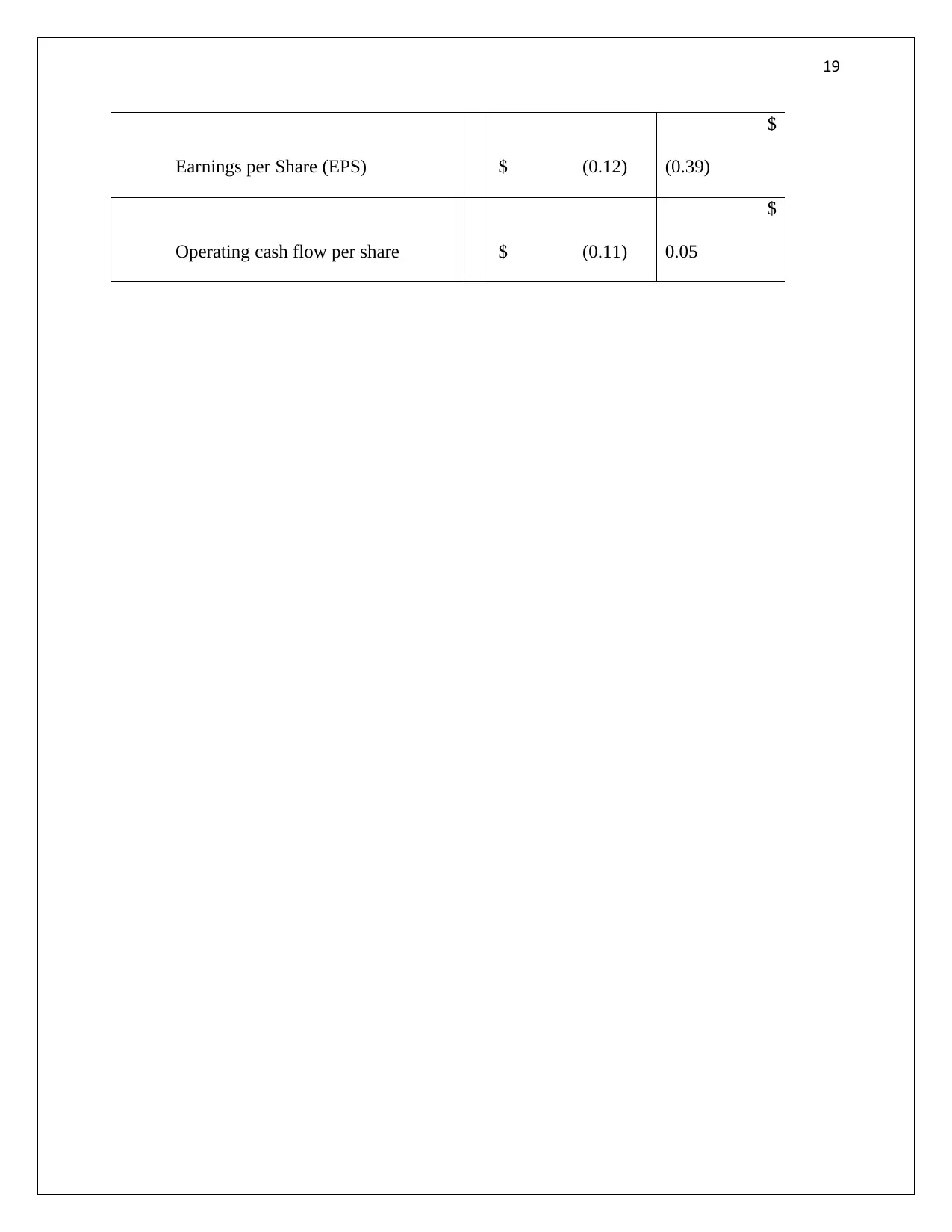

Earnings per Share (EPS) $ (0.12)

$

(0.39)

Operating cash flow per share $ (0.11)

$

0.05

Earnings per Share (EPS) $ (0.12)

$

(0.39)

Operating cash flow per share $ (0.11)

$

0.05

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.