Audit Risk: Definition, Types, Examples and Formula Explained

VerifiedAdded on 2019/10/09

|9

|2842

|200

Report

AI Summary

This report provides a comprehensive overview of audit risk, a critical concept in accounting and finance. It defines audit risk as the possibility of an auditor issuing an unqualified opinion on financial statements that contain material misstatements, whether due to fraud or error. The report details the three components of audit risk: inherent risk, control risk, and detection risk. Inherent risk refers to the susceptibility of an assertion to misstatement, control risk relates to the effectiveness of a company's internal controls, and detection risk pertains to the auditor's procedures. The document further classifies audit risks into the risk of material misstatement and detection risk. It offers examples and explains the formula for calculating audit risk, emphasizing the importance of auditors reducing risk to an acceptable level. The report also highlights the legal liabilities of audit firms if they fail to reduce audit risk. The report also includes an example of an audit scenario involving an IT company and illustrates how to calculate detection risk using the audit risk model, providing a practical understanding of the concepts discussed. This comprehensive analysis is essential for anyone studying accounting and finance, providing a solid foundation for understanding the complexities of audit risk.

BLOG: AUDIT RISK

WHAT IS AUDIT RISK?

WHAT IS AUDIT RISK?

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AUDIT RISK

13th August 2019

In the field of accounting and finance audit is something that verifies and inspects the degree of

accuracy and relevancy. Financial auditing refers to the procedure of examining an individual's

or a company’s financial records for determining whether they are reliable, accurate and made

accordingly with the applicable rules of accounting including the existing accounting standards,

theories, laws, and regulations. Audit work is conducted both internally and externally. Internal

auditing is done by a company’s employees i.e. the accounting personnel and executives whereas

external audit work is conducted by external auditors who come from outside of a company to

audit its accounts i.e. to examine its accounting as well as financial records for providing their

independent unbiased opinion on such records. According to law, all publicly owned and

operated companies need to audit their periodic financial statements and accounts externally.

Internal auditors of a company work for examining financial records and for ensuring

improvement in the internal processes of the company such as internal controls, operations,

governance, and risk management.

During the practice of internal and external auditing, the auditors use to face a number of risks

that are called audit risk. Audit risk(s) are the risks which an auditor might issue a non-qualified

report as a result of the failure of the auditor to detect the material misstatement in the financial

statements either due to fraud or error. Audit risk is also called as residual risk and it indicates

the chance for which financial statements of a company will be published with a number of

materials errors and incorrect financial information even though that has been examined,

reviewed, and approved by an external auditor. This type of risk arises when an auditor fails to

detect accounting fraud or errors while examining a company’s financial statements. In order to

eliminate or reduce the degree of audit risk, auditors need to increase the number of audit

procedures. The users of a company’s financial statements use to rely upon the auditors’

assurance in relation to accuracy and materiality of the reporting company’s financial statements

and due to this, it is very crucial for auditors to reduce audit risk at a modest level. The reduction

of audit risks stands as an integral part of a company’s and its auditors’ audit functions.

13th August 2019

In the field of accounting and finance audit is something that verifies and inspects the degree of

accuracy and relevancy. Financial auditing refers to the procedure of examining an individual's

or a company’s financial records for determining whether they are reliable, accurate and made

accordingly with the applicable rules of accounting including the existing accounting standards,

theories, laws, and regulations. Audit work is conducted both internally and externally. Internal

auditing is done by a company’s employees i.e. the accounting personnel and executives whereas

external audit work is conducted by external auditors who come from outside of a company to

audit its accounts i.e. to examine its accounting as well as financial records for providing their

independent unbiased opinion on such records. According to law, all publicly owned and

operated companies need to audit their periodic financial statements and accounts externally.

Internal auditors of a company work for examining financial records and for ensuring

improvement in the internal processes of the company such as internal controls, operations,

governance, and risk management.

During the practice of internal and external auditing, the auditors use to face a number of risks

that are called audit risk. Audit risk(s) are the risks which an auditor might issue a non-qualified

report as a result of the failure of the auditor to detect the material misstatement in the financial

statements either due to fraud or error. Audit risk is also called as residual risk and it indicates

the chance for which financial statements of a company will be published with a number of

materials errors and incorrect financial information even though that has been examined,

reviewed, and approved by an external auditor. This type of risk arises when an auditor fails to

detect accounting fraud or errors while examining a company’s financial statements. In order to

eliminate or reduce the degree of audit risk, auditors need to increase the number of audit

procedures. The users of a company’s financial statements use to rely upon the auditors’

assurance in relation to accuracy and materiality of the reporting company’s financial statements

and due to this, it is very crucial for auditors to reduce audit risk at a modest level. The reduction

of audit risks stands as an integral part of a company’s and its auditors’ audit functions.

Definition and Discussion on Audit Risk

Audit risk refers to the risk which makes financial statements of a company materially incorrect,

even after auditing and audit opinion’s stating that the statements are correct and free of material

misstatements. In other words, audit risk stands as the danger that errors or intended

miscalculations in the financial statements will not be caught by an auditor before they are

issued. It is a risk that a company’s auditor uses to express inappropriate opinion while making

his/her individual statement on the accuracy, relevancy, and materiality of the reporting

company’s financial statements. Audit risk arises at the time when an auditor fails to issue a

correct opinion on a reporting company’s financial statements. This kind of risk arises due to the

accounting errors or fraud, or intended miscalculations of the reporting company in its financial

statements that are not been caught by its auditors before these statements are issued. Followings

are some of the examples of inappropriately made audit opinions of auditors:

Issuing a specific qualified audit opinion on the financial statements where qualification

is not necessary

Issuing an audit report which is not qualified and where qualification is justified in

reasonably manner

Failing to emphasise the significant matters in the company’s audit report

Providing a statement or opinion on a company’s financial statements unreasonably due

to the limitation of audit scope.

There are three components of audit risk such as inherent risk, control risk, and detection risk.

This means audit Risk equals to Inherent Risk multiplied by Control Risk and Detection Risk. It

sometimes considered as a result of the several risks that could be encountered while conducting

auditing work. In terms of keeping the degree of audit risk engagements below the acceptable

limit, auditors need to assess the level of risk pertaining to each component of audit risk.

The main purpose behind initiating audit work is to eliminate or reduce audit risk, considering

the three above mentioned audit risk components, to the lowest level by sufficient evidence and

Audit risk refers to the risk which makes financial statements of a company materially incorrect,

even after auditing and audit opinion’s stating that the statements are correct and free of material

misstatements. In other words, audit risk stands as the danger that errors or intended

miscalculations in the financial statements will not be caught by an auditor before they are

issued. It is a risk that a company’s auditor uses to express inappropriate opinion while making

his/her individual statement on the accuracy, relevancy, and materiality of the reporting

company’s financial statements. Audit risk arises at the time when an auditor fails to issue a

correct opinion on a reporting company’s financial statements. This kind of risk arises due to the

accounting errors or fraud, or intended miscalculations of the reporting company in its financial

statements that are not been caught by its auditors before these statements are issued. Followings

are some of the examples of inappropriately made audit opinions of auditors:

Issuing a specific qualified audit opinion on the financial statements where qualification

is not necessary

Issuing an audit report which is not qualified and where qualification is justified in

reasonably manner

Failing to emphasise the significant matters in the company’s audit report

Providing a statement or opinion on a company’s financial statements unreasonably due

to the limitation of audit scope.

There are three components of audit risk such as inherent risk, control risk, and detection risk.

This means audit Risk equals to Inherent Risk multiplied by Control Risk and Detection Risk. It

sometimes considered as a result of the several risks that could be encountered while conducting

auditing work. In terms of keeping the degree of audit risk engagements below the acceptable

limit, auditors need to assess the level of risk pertaining to each component of audit risk.

The main purpose behind initiating audit work is to eliminate or reduce audit risk, considering

the three above mentioned audit risk components, to the lowest level by sufficient evidence and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

adequate testing. This is because, a company’s stakeholders like creditors, shareholders, existing

and potential investors, business analysts, along with some others internal and external

stakeholders use to rely on its financial statements, and it is their right to get a clear and bias-free

picture of a company's financial position via its financial statements for which auditors must

work on reducing audit risk at the lowest level. Furthermore, for Certified Professional Audit

firms those perform audit work, often become legally liable if they fail to reduce audit risk while

examining and making a statement declaring a company's financial status and performance

through financial statements.

Types of Audit Risks and their Assessment

There are three components of audit risk such as inherent risk, control risk and detection risk

whereas while classifying the audit risk, there are two kinds of audit risks like the risk of material

misstatements, and detection risk. The risk of material misstatement is associated with inherent

risk and control risk. In other words, at the level of assertion, the risk of material misstatement

consists of the two components naming inherent risk, and control risk.

1. Risk of Material Misstatement

The risk arises due to material misstatement refer to the risk which indicates that financial

statements of a company are not correct materially before to audit work is performed. Here, the

term ‘material’ refers to the dollar amount which is very and responsible to change the readers or

users opinion on the company after reading its financial statement and the dollar amount or

percentage is subjective. For example, if the inventory balance of a sporting product store of

$10,000,000 is incorrect by $250,000, the stakeholder reading the store’s financial statements

might consider it as a materially correct amount. The particular type of audit risk is even more if

the internal control of a company is insufficient. Moreover, insufficient control risk is also

responsible for arising fraud risk.

This risk makes a company’s financial statements susceptible to a number of material

misstatements. At the level of financial statement, this risk pervasively relates to the reporting

company’s financial statements (income statement, balance sheet, statement of financial position,

and potential investors, business analysts, along with some others internal and external

stakeholders use to rely on its financial statements, and it is their right to get a clear and bias-free

picture of a company's financial position via its financial statements for which auditors must

work on reducing audit risk at the lowest level. Furthermore, for Certified Professional Audit

firms those perform audit work, often become legally liable if they fail to reduce audit risk while

examining and making a statement declaring a company's financial status and performance

through financial statements.

Types of Audit Risks and their Assessment

There are three components of audit risk such as inherent risk, control risk and detection risk

whereas while classifying the audit risk, there are two kinds of audit risks like the risk of material

misstatements, and detection risk. The risk of material misstatement is associated with inherent

risk and control risk. In other words, at the level of assertion, the risk of material misstatement

consists of the two components naming inherent risk, and control risk.

1. Risk of Material Misstatement

The risk arises due to material misstatement refer to the risk which indicates that financial

statements of a company are not correct materially before to audit work is performed. Here, the

term ‘material’ refers to the dollar amount which is very and responsible to change the readers or

users opinion on the company after reading its financial statement and the dollar amount or

percentage is subjective. For example, if the inventory balance of a sporting product store of

$10,000,000 is incorrect by $250,000, the stakeholder reading the store’s financial statements

might consider it as a materially correct amount. The particular type of audit risk is even more if

the internal control of a company is insufficient. Moreover, insufficient control risk is also

responsible for arising fraud risk.

This risk makes a company’s financial statements susceptible to a number of material

misstatements. At the level of financial statement, this risk pervasively relates to the reporting

company’s financial statements (income statement, balance sheet, statement of financial position,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

and cash flow statement) as a whole. It potentially affects many assertions. Furthermore, at the

level of financial statement, this type of risk might be relevant to the consideration made by an

auditor of this due to internal fraud. For instance, an ineffective internal control environment,

lack of required cash to continue business operations, as well as declining conditions affect the

company's and create opportunities for the management to engage in manipulation while

preparing and presenting financial statements which ultimately lead to the very risk of material

misstatement.

At the level of assertion, the two components of risk of material misstatement are:

Inherent risk: It is the susceptibility in relation to a particular assertion which occurs due

to the presence of material error, omission, or fraud, individually or in combination with

other misstatements. This type of risk occurs before considering any kind of related

controls. Generally, this risk becomes high when a high degree of estimation and

judgment is involved as well as when the reporting company practices highly complex

financial transactions in order to conduct its regular course of business.

Control risk: This risk arises as a result of material fraud or error which use to occur

while making an assertion, individually or in combination with other misstatements. The

internal control system of a company is not capable of detecting or preventing this risk on

a regular basis. Control risk arises from the failure or absence of relevant operation

control mechanisms. This risk becomes high in the absence of adequate internal control

systems in a company which restricts the company to detect and prevent the instances of

material error, omission, and fraud in the company’s financial statements. Control risk

stands as the potential risk of material misstatements that are not be prevented or detected

by a company’s control systems.

Inherent risk along with control risk is solely related to a company, its environment, as well as its

internal control, and the auditors assess such risks on the basis of evidence they obtain. For

assessing control risk, the auditors use the evidence they obtain from tests of controls and other

sources.

level of financial statement, this type of risk might be relevant to the consideration made by an

auditor of this due to internal fraud. For instance, an ineffective internal control environment,

lack of required cash to continue business operations, as well as declining conditions affect the

company's and create opportunities for the management to engage in manipulation while

preparing and presenting financial statements which ultimately lead to the very risk of material

misstatement.

At the level of assertion, the two components of risk of material misstatement are:

Inherent risk: It is the susceptibility in relation to a particular assertion which occurs due

to the presence of material error, omission, or fraud, individually or in combination with

other misstatements. This type of risk occurs before considering any kind of related

controls. Generally, this risk becomes high when a high degree of estimation and

judgment is involved as well as when the reporting company practices highly complex

financial transactions in order to conduct its regular course of business.

Control risk: This risk arises as a result of material fraud or error which use to occur

while making an assertion, individually or in combination with other misstatements. The

internal control system of a company is not capable of detecting or preventing this risk on

a regular basis. Control risk arises from the failure or absence of relevant operation

control mechanisms. This risk becomes high in the absence of adequate internal control

systems in a company which restricts the company to detect and prevent the instances of

material error, omission, and fraud in the company’s financial statements. Control risk

stands as the potential risk of material misstatements that are not be prevented or detected

by a company’s control systems.

Inherent risk along with control risk is solely related to a company, its environment, as well as its

internal control, and the auditors assess such risks on the basis of evidence they obtain. For

assessing control risk, the auditors use the evidence they obtain from tests of controls and other

sources.

2. Detection Risk

Detection risk refers to the risk attached to audit procedures that are used by an auditor which are

incapable of detecting any kind of material misstatement from the reporting company’s financial

statements. While auditing a company’s financial statements, this risk arises due to the

inappropriate planning and designing of audit procedures by an auditor. Detection risk gets

affected by the effectiveness of substantive audit procedures, and the application of such

substantive audit procedures by an auditor which means whether the audit procedures are

performed by the auditors with due professional competence and care or not. This kind of risk is

solely dependent on auditors and their audit competences as well as their act of performing audit

work with due care. The more an auditor applied professional care while auditing a reporting

company’s financial statements, the less the chances of detection risk and vice versa.

Example and Formula of Audit Risk

Oliver works as an external auditor at an audit firm and asked for reviewing ABC Limited’s (an

Information Technology company), financial statements. The manager of Oliver has already

prepared a memo in order to specify the things to be considered with the highest concerns during

the audit process:

ABC Limited operates as an industry leader with a huge network of subsidiaries,

customers, and branches.

The company has a number of auditors its own but its management uses to suspect

control risk.

For ABC Limited, the acceptable level of audit risk is below or equal to 8%.

While reviewing the company’s financial statements, Oliver identifies both inherent risk and

control risk. The audit department of ABC Limited has not yet submitted its financial statements

to the company’s audit committee as well as it is suspected by Oliver that several errors of

auditing have by-passed control. Moreover, the technology industry is very complex and

Detection risk refers to the risk attached to audit procedures that are used by an auditor which are

incapable of detecting any kind of material misstatement from the reporting company’s financial

statements. While auditing a company’s financial statements, this risk arises due to the

inappropriate planning and designing of audit procedures by an auditor. Detection risk gets

affected by the effectiveness of substantive audit procedures, and the application of such

substantive audit procedures by an auditor which means whether the audit procedures are

performed by the auditors with due professional competence and care or not. This kind of risk is

solely dependent on auditors and their audit competences as well as their act of performing audit

work with due care. The more an auditor applied professional care while auditing a reporting

company’s financial statements, the less the chances of detection risk and vice versa.

Example and Formula of Audit Risk

Oliver works as an external auditor at an audit firm and asked for reviewing ABC Limited’s (an

Information Technology company), financial statements. The manager of Oliver has already

prepared a memo in order to specify the things to be considered with the highest concerns during

the audit process:

ABC Limited operates as an industry leader with a huge network of subsidiaries,

customers, and branches.

The company has a number of auditors its own but its management uses to suspect

control risk.

For ABC Limited, the acceptable level of audit risk is below or equal to 8%.

While reviewing the company’s financial statements, Oliver identifies both inherent risk and

control risk. The audit department of ABC Limited has not yet submitted its financial statements

to the company’s audit committee as well as it is suspected by Oliver that several errors of

auditing have by-passed control. Moreover, the technology industry is very complex and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

competitive, thus, it puts huge pressure on the IT companies in terms of representing strong and

sound financial results.

Oliver assumed ABC Limited’s inherent risk control risk is 30% and 40% respectively. Here, if

the level of acceptable audit risk of the company stands 8%, then its detection risk will be 67%.

Audit Risk = Inherent Risk * Control Risk * Detection Risk

8% = 30% * 40% * Y (detection risk)

Y = 8% / (30% * 40%)

Y = 8% / 12%

Y = 67%

Therefore, the total audit risk of ABC Limited stands at (30 % x 40% x 67%) = 8% (formula

proved).

The model of audit risk is understood best through the below stated mathematical formula is

Detection Risk (DR) = Audit Risk (AR) / Inherent Risk (IR) * Control Risk (CR).

The denominator IR (inherent risk) is the susceptibility/risk of an audit assertion in relation to

a misstatement which is material in nature without considering the internal controls. It denotes

that in the first place, there is already an error. CR (Control risk) stands as the risk which is

related to the internal controls system of a company that will fail to detect or prevent material

misstatements made in the financial statements. Here, the internal control system is the set of

procedures and policies that are placed by a company’s management for enhancing the reliability

and relevancy of its financial statements. Lastly, DR (detection risk) refers to the risk which

indicates that the auditors will fail to detect the material misstatements that exist in the assertion.

Thus, detection risk and audit risk both are dependent on a company’s auditor. On the other

hand, control risk and inherent risk are independent of an auditor because these two kinds of

risks exist within a company regardless of conducting an audit. Audit procedures are designed in

accordance with the decision made by an auditor on audit risk. A low level of detection risk

needs more persuasive evidence compared to high detection risk.

sound financial results.

Oliver assumed ABC Limited’s inherent risk control risk is 30% and 40% respectively. Here, if

the level of acceptable audit risk of the company stands 8%, then its detection risk will be 67%.

Audit Risk = Inherent Risk * Control Risk * Detection Risk

8% = 30% * 40% * Y (detection risk)

Y = 8% / (30% * 40%)

Y = 8% / 12%

Y = 67%

Therefore, the total audit risk of ABC Limited stands at (30 % x 40% x 67%) = 8% (formula

proved).

The model of audit risk is understood best through the below stated mathematical formula is

Detection Risk (DR) = Audit Risk (AR) / Inherent Risk (IR) * Control Risk (CR).

The denominator IR (inherent risk) is the susceptibility/risk of an audit assertion in relation to

a misstatement which is material in nature without considering the internal controls. It denotes

that in the first place, there is already an error. CR (Control risk) stands as the risk which is

related to the internal controls system of a company that will fail to detect or prevent material

misstatements made in the financial statements. Here, the internal control system is the set of

procedures and policies that are placed by a company’s management for enhancing the reliability

and relevancy of its financial statements. Lastly, DR (detection risk) refers to the risk which

indicates that the auditors will fail to detect the material misstatements that exist in the assertion.

Thus, detection risk and audit risk both are dependent on a company’s auditor. On the other

hand, control risk and inherent risk are independent of an auditor because these two kinds of

risks exist within a company regardless of conducting an audit. Audit procedures are designed in

accordance with the decision made by an auditor on audit risk. A low level of detection risk

needs more persuasive evidence compared to high detection risk.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

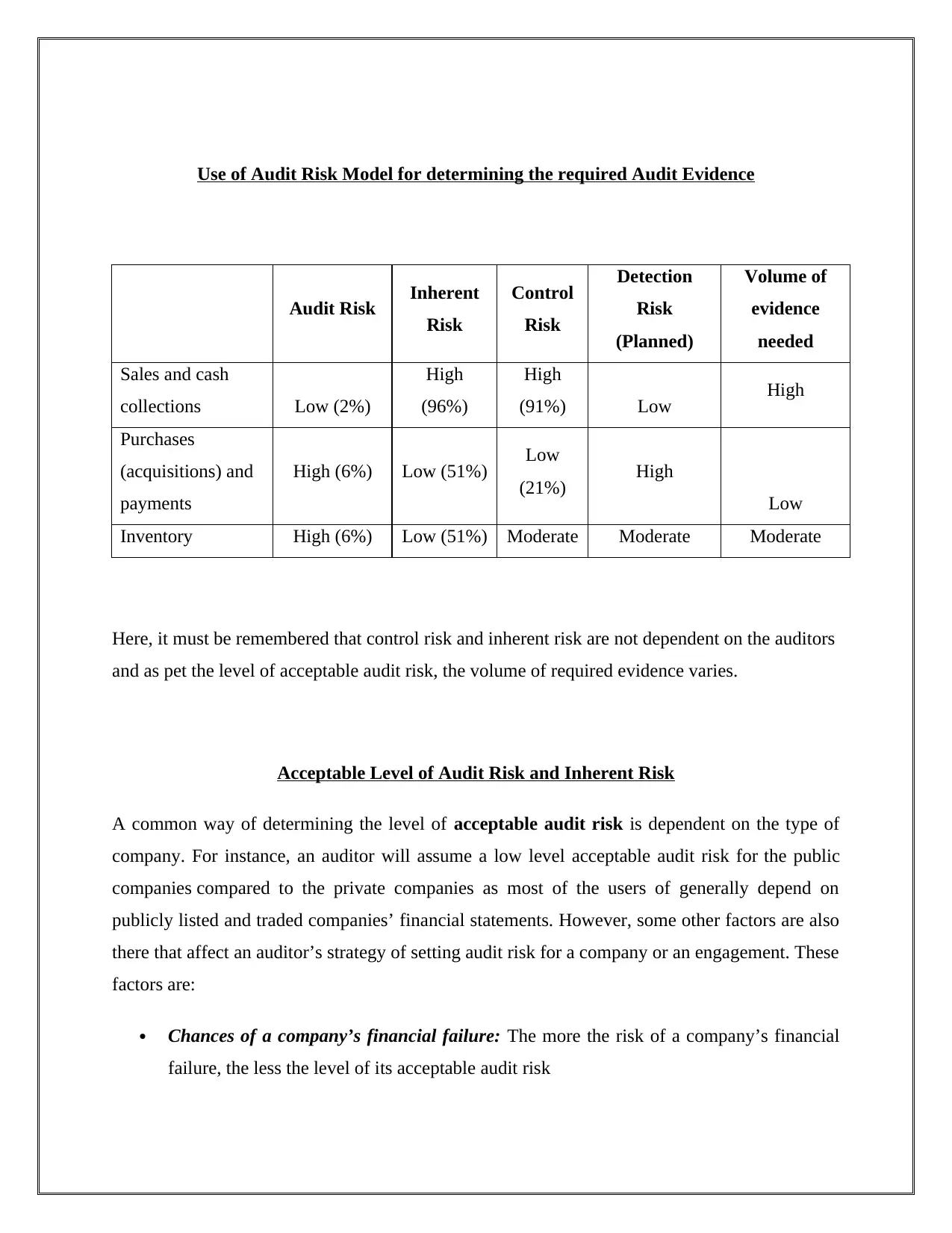

Use of Audit Risk Model for determining the required Audit Evidence

Audit Risk Inherent

Risk

Control

Risk

Detection

Risk

(Planned)

Volume of

evidence

needed

Sales and cash

collections Low (2%)

High

(96%)

High

(91%) Low High

Purchases

(acquisitions) and

payments

High (6%) Low (51%) Low

(21%) High

Low

Inventory High (6%) Low (51%) Moderate Moderate Moderate

Here, it must be remembered that control risk and inherent risk are not dependent on the auditors

and as pet the level of acceptable audit risk, the volume of required evidence varies.

Acceptable Level of Audit Risk and Inherent Risk

A common way of determining the level of acceptable audit risk is dependent on the type of

company. For instance, an auditor will assume a low level acceptable audit risk for the public

companies compared to the private companies as most of the users of generally depend on

publicly listed and traded companies’ financial statements. However, some other factors are also

there that affect an auditor’s strategy of setting audit risk for a company or an engagement. These

factors are:

Chances of a company’s financial failure: The more the risk of a company’s financial

failure, the less the level of its acceptable audit risk

Audit Risk Inherent

Risk

Control

Risk

Detection

Risk

(Planned)

Volume of

evidence

needed

Sales and cash

collections Low (2%)

High

(96%)

High

(91%) Low High

Purchases

(acquisitions) and

payments

High (6%) Low (51%) Low

(21%) High

Low

Inventory High (6%) Low (51%) Moderate Moderate Moderate

Here, it must be remembered that control risk and inherent risk are not dependent on the auditors

and as pet the level of acceptable audit risk, the volume of required evidence varies.

Acceptable Level of Audit Risk and Inherent Risk

A common way of determining the level of acceptable audit risk is dependent on the type of

company. For instance, an auditor will assume a low level acceptable audit risk for the public

companies compared to the private companies as most of the users of generally depend on

publicly listed and traded companies’ financial statements. However, some other factors are also

there that affect an auditor’s strategy of setting audit risk for a company or an engagement. These

factors are:

Chances of a company’s financial failure: The more the risk of a company’s financial

failure, the less the level of its acceptable audit risk

Reliance by the external users on a company’s financial statements: The more a

company’s external stakeholders, the lower the acceptable audit risk

The integrity of the management: The less questionable the honesty or integrity of a

company’s management, the higher the acceptable audit risk.

The inherent risk of audit is independent of an auditor. In order to take a close look to

understand the inherent risk of audit in a better manner, it is highly significant to understand a

company along with the environment from where it operates by considering the below stated

factors:

Nature of a company's business operations along with the products or services it offers.

For instance, a jewellery manufacturing company or high tech company is more risk

prone as these type of companies faces the risk of inventory obsolescence very often

IT environment of a company like a company which operated through decentralised and

highly complex processing systems are very inherent risk prone compared to other

companies those operate through centralised and less complex processing systems

The integrity of the company’s management

Objectives or motivations of the client company (i.e. offering stock options, allowing

bonuses on the basis of annual net income)

Non-routine transactions such as greater chances of accounting fraud and error as a result

of unorthodox financial transactions

Related parties

Estimation or judgment involved in issues related to accounting.

company’s external stakeholders, the lower the acceptable audit risk

The integrity of the management: The less questionable the honesty or integrity of a

company’s management, the higher the acceptable audit risk.

The inherent risk of audit is independent of an auditor. In order to take a close look to

understand the inherent risk of audit in a better manner, it is highly significant to understand a

company along with the environment from where it operates by considering the below stated

factors:

Nature of a company's business operations along with the products or services it offers.

For instance, a jewellery manufacturing company or high tech company is more risk

prone as these type of companies faces the risk of inventory obsolescence very often

IT environment of a company like a company which operated through decentralised and

highly complex processing systems are very inherent risk prone compared to other

companies those operate through centralised and less complex processing systems

The integrity of the company’s management

Objectives or motivations of the client company (i.e. offering stock options, allowing

bonuses on the basis of annual net income)

Non-routine transactions such as greater chances of accounting fraud and error as a result

of unorthodox financial transactions

Related parties

Estimation or judgment involved in issues related to accounting.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.