Financial Accounting Principles and Techniques

VerifiedAdded on 2023/01/12

|18

|3481

|25

AI Summary

This project report covers essential financial accounting principles and techniques. It includes topics like trial balance, ledger, and financial statements. The tasks cover recording business transactions, preparing final accounts, bank reconciliations, and control accounts.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

BO9237

FINANCIAL

ACCOUNTING

FINANCIAL

ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................3

Task 1.1............................................................................................................................................3

Task 1.2............................................................................................................................................4

Task 2.1............................................................................................................................................8

Task 2.2............................................................................................................................................9

Task 2.3..........................................................................................................................................10

Task 2.4..........................................................................................................................................11

Task 3.1..........................................................................................................................................12

Task 3.2..........................................................................................................................................13

Task 3.3..........................................................................................................................................13

Task 3.4..........................................................................................................................................14

Task 4.1..........................................................................................................................................14

Task 4.2..........................................................................................................................................15

Task 4.3..........................................................................................................................................15

Task 4.4..........................................................................................................................................16

CONCLUSION..............................................................................................................................17

REFERENCES:.............................................................................................................................18

INTRODUCTION...........................................................................................................................3

Task 1.1............................................................................................................................................3

Task 1.2............................................................................................................................................4

Task 2.1............................................................................................................................................8

Task 2.2............................................................................................................................................9

Task 2.3..........................................................................................................................................10

Task 2.4..........................................................................................................................................11

Task 3.1..........................................................................................................................................12

Task 3.2..........................................................................................................................................13

Task 3.3..........................................................................................................................................13

Task 3.4..........................................................................................................................................14

Task 4.1..........................................................................................................................................14

Task 4.2..........................................................................................................................................15

Task 4.3..........................................................................................................................................15

Task 4.4..........................................................................................................................................16

CONCLUSION..............................................................................................................................17

REFERENCES:.............................................................................................................................18

INTRODUCTION

The aim of this project is to introduce essential financial accounting principles and techniques

which enables financial accountant to record and prepare basic final accounts. This project report

consists of 4 tasks; each task covers different topic of financial accounting. In Task 1 business

transactions of sole proprietor is recorded through double entry book keeping and on the basis of

end balance trial balance is prepared. In Task 2; final accounts for Italian Wines Ltd. is prepared

by application of appropriate principles, this task will show how financial position statement is

adjusted according to additional information’s available like accruals, prepayments, bad debts,

etc. In Task 3; bank reconciliations concept is explained; how to reconcile cash book with bank

passbook, what adjustments required to tally both balances also discussed in report. In Task 4;

two types of control account (debtor’s and creditors control account) mentioned, it is also

explained how to rectify mismatch between sales ledger balance and debtor’s control account.

Treatment of suspense account is done at closing of report where rectification of error is done

through passing journal entries.

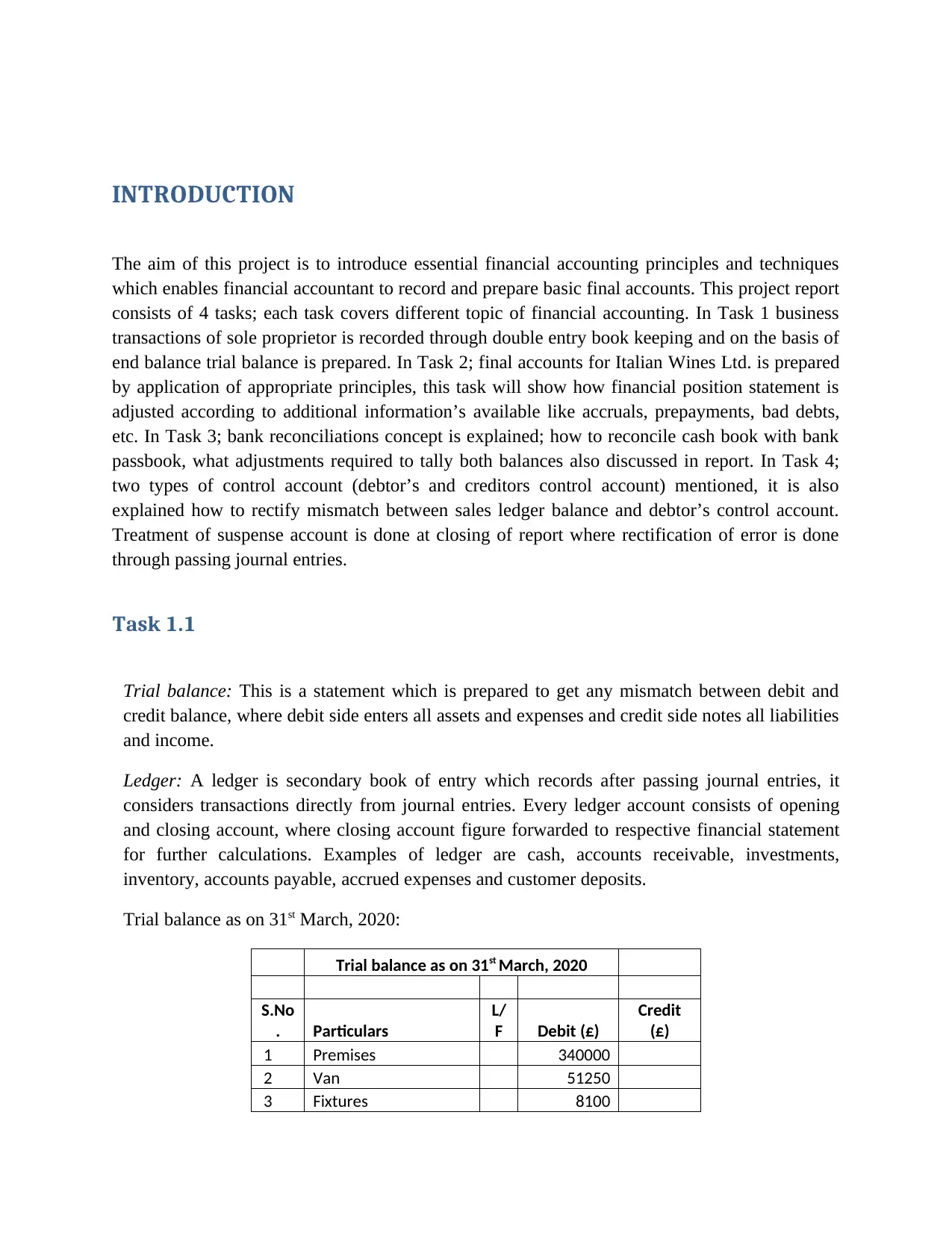

Task 1.1

Trial balance: This is a statement which is prepared to get any mismatch between debit and

credit balance, where debit side enters all assets and expenses and credit side notes all liabilities

and income.

Ledger: A ledger is secondary book of entry which records after passing journal entries, it

considers transactions directly from journal entries. Every ledger account consists of opening

and closing account, where closing account figure forwarded to respective financial statement

for further calculations. Examples of ledger are cash, accounts receivable, investments,

inventory, accounts payable, accrued expenses and customer deposits.

Trial balance as on 31st March, 2020:

Trial balance as on 31st March, 2020

S.No

. Particulars

L/

F Debit (£)

Credit

(£)

1 Premises 340000

2 Van 51250

3 Fixtures 8100

The aim of this project is to introduce essential financial accounting principles and techniques

which enables financial accountant to record and prepare basic final accounts. This project report

consists of 4 tasks; each task covers different topic of financial accounting. In Task 1 business

transactions of sole proprietor is recorded through double entry book keeping and on the basis of

end balance trial balance is prepared. In Task 2; final accounts for Italian Wines Ltd. is prepared

by application of appropriate principles, this task will show how financial position statement is

adjusted according to additional information’s available like accruals, prepayments, bad debts,

etc. In Task 3; bank reconciliations concept is explained; how to reconcile cash book with bank

passbook, what adjustments required to tally both balances also discussed in report. In Task 4;

two types of control account (debtor’s and creditors control account) mentioned, it is also

explained how to rectify mismatch between sales ledger balance and debtor’s control account.

Treatment of suspense account is done at closing of report where rectification of error is done

through passing journal entries.

Task 1.1

Trial balance: This is a statement which is prepared to get any mismatch between debit and

credit balance, where debit side enters all assets and expenses and credit side notes all liabilities

and income.

Ledger: A ledger is secondary book of entry which records after passing journal entries, it

considers transactions directly from journal entries. Every ledger account consists of opening

and closing account, where closing account figure forwarded to respective financial statement

for further calculations. Examples of ledger are cash, accounts receivable, investments,

inventory, accounts payable, accrued expenses and customer deposits.

Trial balance as on 31st March, 2020:

Trial balance as on 31st March, 2020

S.No

. Particulars

L/

F Debit (£)

Credit

(£)

1 Premises 340000

2 Van 51250

3 Fixtures 8100

4 Inventory 63900

5 Receivables 4500

6 Cash at bank 62400

7 Cash in hand 5600

8 Payables 8750

9 Owner's Capital 527000

Total 535750 535750

So, the balancing figure which is owner’s capital shows the balance of £8750 pounds.

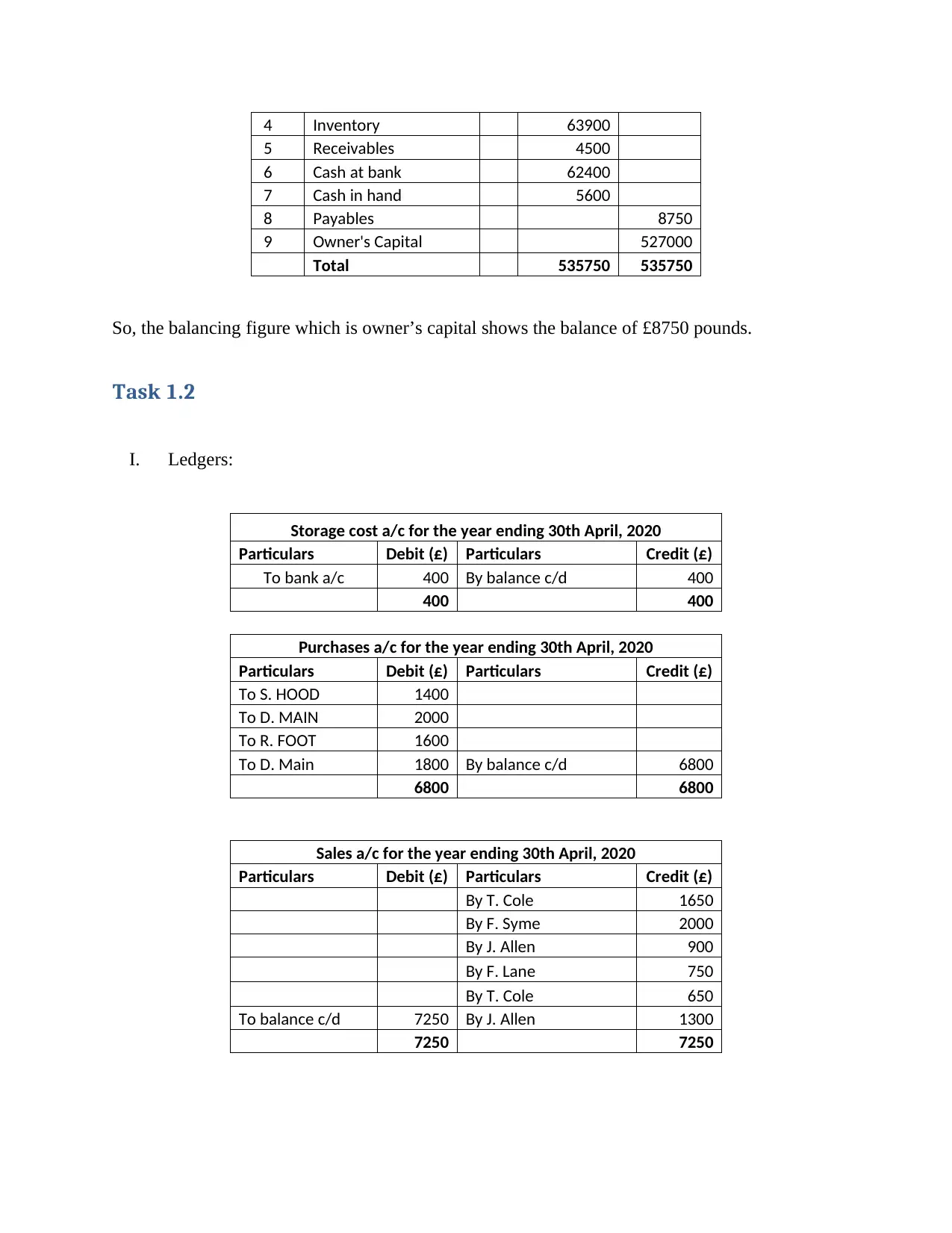

Task 1.2

I. Ledgers:

Storage cost a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To bank a/c 400 By balance c/d 400

400 400

Purchases a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To S. HOOD 1400

To D. MAIN 2000

To R. FOOT 1600

To D. Main 1800 By balance c/d 6800

6800 6800

Sales a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

By T. Cole 1650

By F. Syme 2000

By J. Allen 900

By F. Lane 750

By T. Cole 650

To balance c/d 7250 By J. Allen 1300

7250 7250

5 Receivables 4500

6 Cash at bank 62400

7 Cash in hand 5600

8 Payables 8750

9 Owner's Capital 527000

Total 535750 535750

So, the balancing figure which is owner’s capital shows the balance of £8750 pounds.

Task 1.2

I. Ledgers:

Storage cost a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To bank a/c 400 By balance c/d 400

400 400

Purchases a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To S. HOOD 1400

To D. MAIN 2000

To R. FOOT 1600

To D. Main 1800 By balance c/d 6800

6800 6800

Sales a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

By T. Cole 1650

By F. Syme 2000

By J. Allen 900

By F. Lane 750

By T. Cole 650

To balance c/d 7250 By J. Allen 1300

7250 7250

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

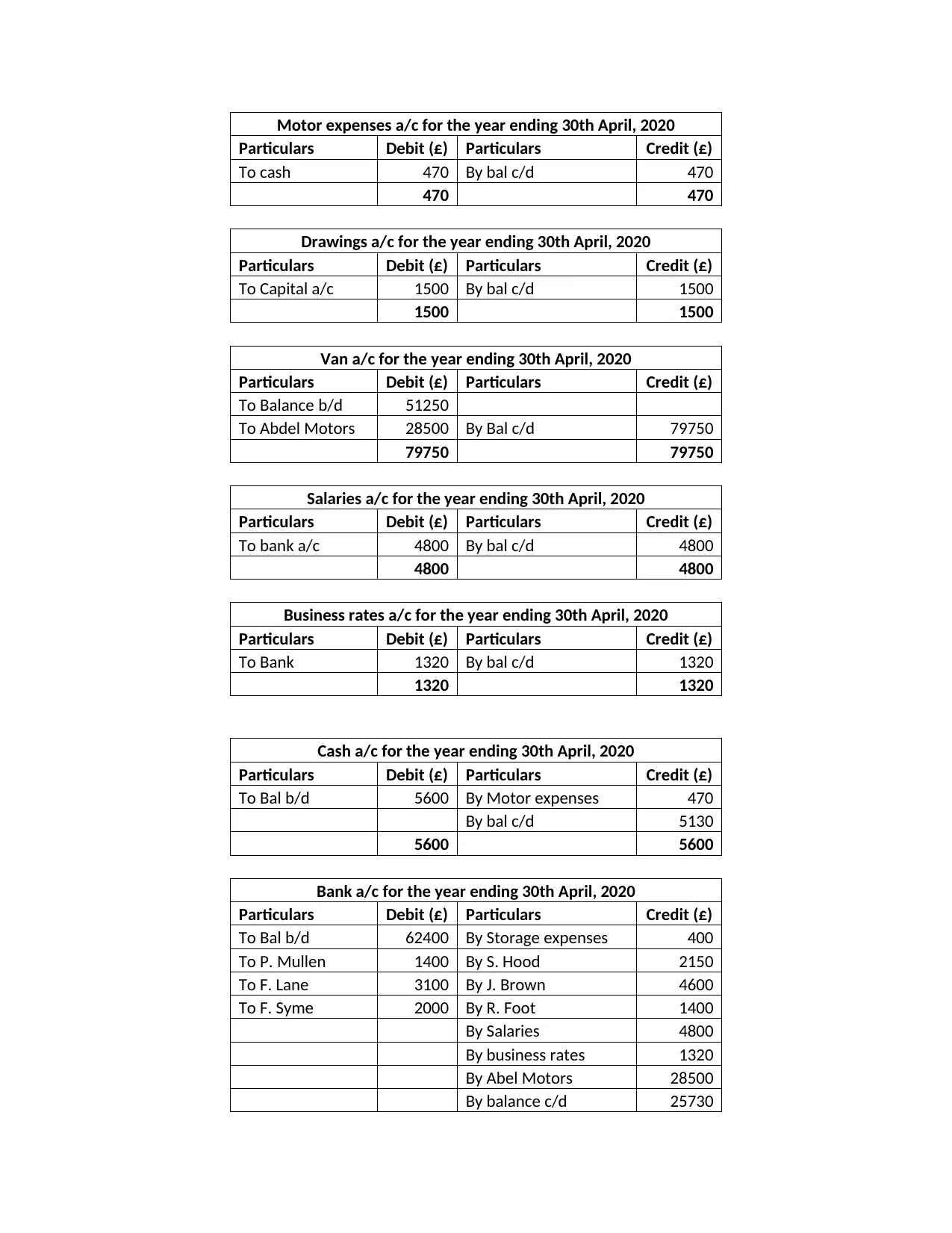

Motor expenses a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To cash 470 By bal c/d 470

470 470

Drawings a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Capital a/c 1500 By bal c/d 1500

1500 1500

Van a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Balance b/d 51250

To Abdel Motors 28500 By Bal c/d 79750

79750 79750

Salaries a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To bank a/c 4800 By bal c/d 4800

4800 4800

Business rates a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Bank 1320 By bal c/d 1320

1320 1320

Cash a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Bal b/d 5600 By Motor expenses 470

By bal c/d 5130

5600 5600

Bank a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Bal b/d 62400 By Storage expenses 400

To P. Mullen 1400 By S. Hood 2150

To F. Lane 3100 By J. Brown 4600

To F. Syme 2000 By R. Foot 1400

By Salaries 4800

By business rates 1320

By Abel Motors 28500

By balance c/d 25730

Particulars Debit (£) Particulars Credit (£)

To cash 470 By bal c/d 470

470 470

Drawings a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Capital a/c 1500 By bal c/d 1500

1500 1500

Van a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Balance b/d 51250

To Abdel Motors 28500 By Bal c/d 79750

79750 79750

Salaries a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To bank a/c 4800 By bal c/d 4800

4800 4800

Business rates a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Bank 1320 By bal c/d 1320

1320 1320

Cash a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Bal b/d 5600 By Motor expenses 470

By bal c/d 5130

5600 5600

Bank a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Bal b/d 62400 By Storage expenses 400

To P. Mullen 1400 By S. Hood 2150

To F. Lane 3100 By J. Brown 4600

To F. Syme 2000 By R. Foot 1400

By Salaries 4800

By business rates 1320

By Abel Motors 28500

By balance c/d 25730

68900 68900

S. Hood a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Bank 2150 By balance b/d 2150

To bal c/d 1400 By Purchases 1400

3550 3550

D. Main a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

By purchases 2000

To balance c/d 3800 By Purchases 1800

3800 3800

R. Foot a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To bank 1400 By purchases 1600

To bal c/d 200

1600 1600

T. Cole a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Sales 1650

To Sales 650 By bal c/d 2300

2300 2300

F. Syme a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Sales 2000 By bank 2000

2000 2000

J. Allen a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Sales 900

To Sales 1300 To Bal c/d 2200

2200 2200

F. Lane a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Balance b/d 3100 By Bank 3100

S. Hood a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Bank 2150 By balance b/d 2150

To bal c/d 1400 By Purchases 1400

3550 3550

D. Main a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

By purchases 2000

To balance c/d 3800 By Purchases 1800

3800 3800

R. Foot a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To bank 1400 By purchases 1600

To bal c/d 200

1600 1600

T. Cole a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Sales 1650

To Sales 650 By bal c/d 2300

2300 2300

F. Syme a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Sales 2000 By bank 2000

2000 2000

J. Allen a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Sales 900

To Sales 1300 To Bal c/d 2200

2200 2200

F. Lane a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Balance b/d 3100 By Bank 3100

To Sales 750 By bal c/d 750

3850 3850

P. Mullen a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Balance b/d 1400 By Bank 1400

1400 1400

J. Brown a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Bank 4600 By balance b/d 4600

4600 4600

Abdel Motors a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Bank 28500 By Van 28500

28500 28500

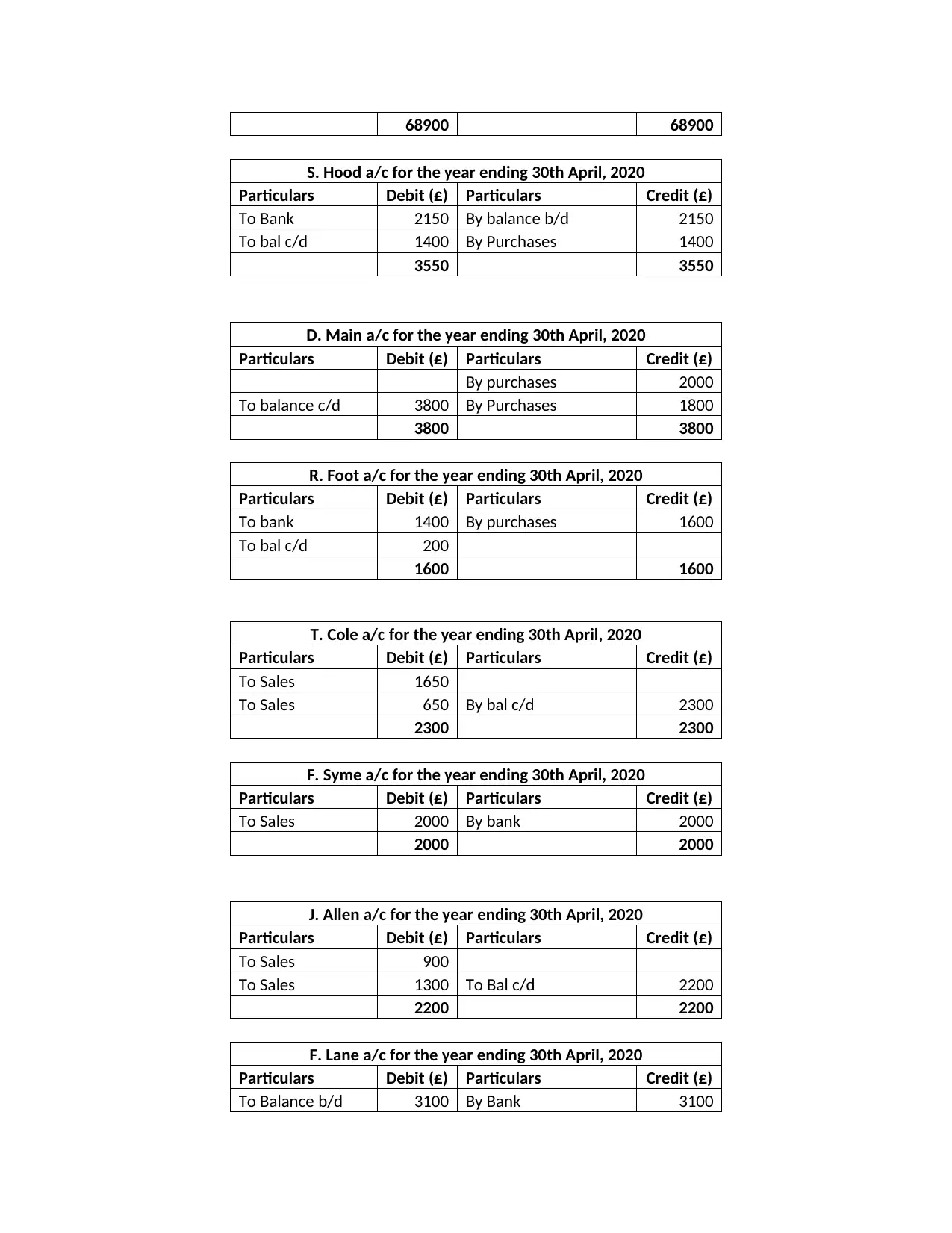

II. Trial balance as on 30th April, 2020

Trial balance as on 30th April, 2020

S.No. Particulars L/F Debit (£) Credit (£)

1 Sales 7250

2 Purchases 6800

3 Premises 340000

4 Van 79750

5 Fixtures 8100

6 Inventory 63900

7 Receivables 5250

8 Cash at bank 25730

9 Cash in hand 5130

10 Payables 5400

11 Storage cost 400

12 Motor expenses 470

13 Drawings 1500

14 Salaries 4800

15 Business rates 1320

16 Owner's Capital 530500

Total 543150 543150

III. Analyzing Trial balance of 31st March, 2020 and 30th April, 2020

3850 3850

P. Mullen a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Balance b/d 1400 By Bank 1400

1400 1400

J. Brown a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Bank 4600 By balance b/d 4600

4600 4600

Abdel Motors a/c for the year ending 30th April, 2020

Particulars Debit (£) Particulars Credit (£)

To Bank 28500 By Van 28500

28500 28500

II. Trial balance as on 30th April, 2020

Trial balance as on 30th April, 2020

S.No. Particulars L/F Debit (£) Credit (£)

1 Sales 7250

2 Purchases 6800

3 Premises 340000

4 Van 79750

5 Fixtures 8100

6 Inventory 63900

7 Receivables 5250

8 Cash at bank 25730

9 Cash in hand 5130

10 Payables 5400

11 Storage cost 400

12 Motor expenses 470

13 Drawings 1500

14 Salaries 4800

15 Business rates 1320

16 Owner's Capital 530500

Total 543150 543150

III. Analyzing Trial balance of 31st March, 2020 and 30th April, 2020

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

After analyzing both the trial balances following progression was found:

Payables: It decreases by £3350 due to payment paid to creditors from 31st March

to 30th April.

Receivables: It also decreases by £750, due to payment received from debtors.

Cash at bank: Balance of bank is decreased to £36670 due to payment done to

suppliers.

Cash in hand: This balance is also decreases by £470 due to payment of expenses

such as motor and salaries.

Total balance: Trial balance as on 31st March, 2020 shows an amount of £535750

while on 30th April, 2020 it shows £543150; additional to this owner’s capital is

also increased with approx. £10000 pounds due to increase in Sales, Purchases

and Van amount.

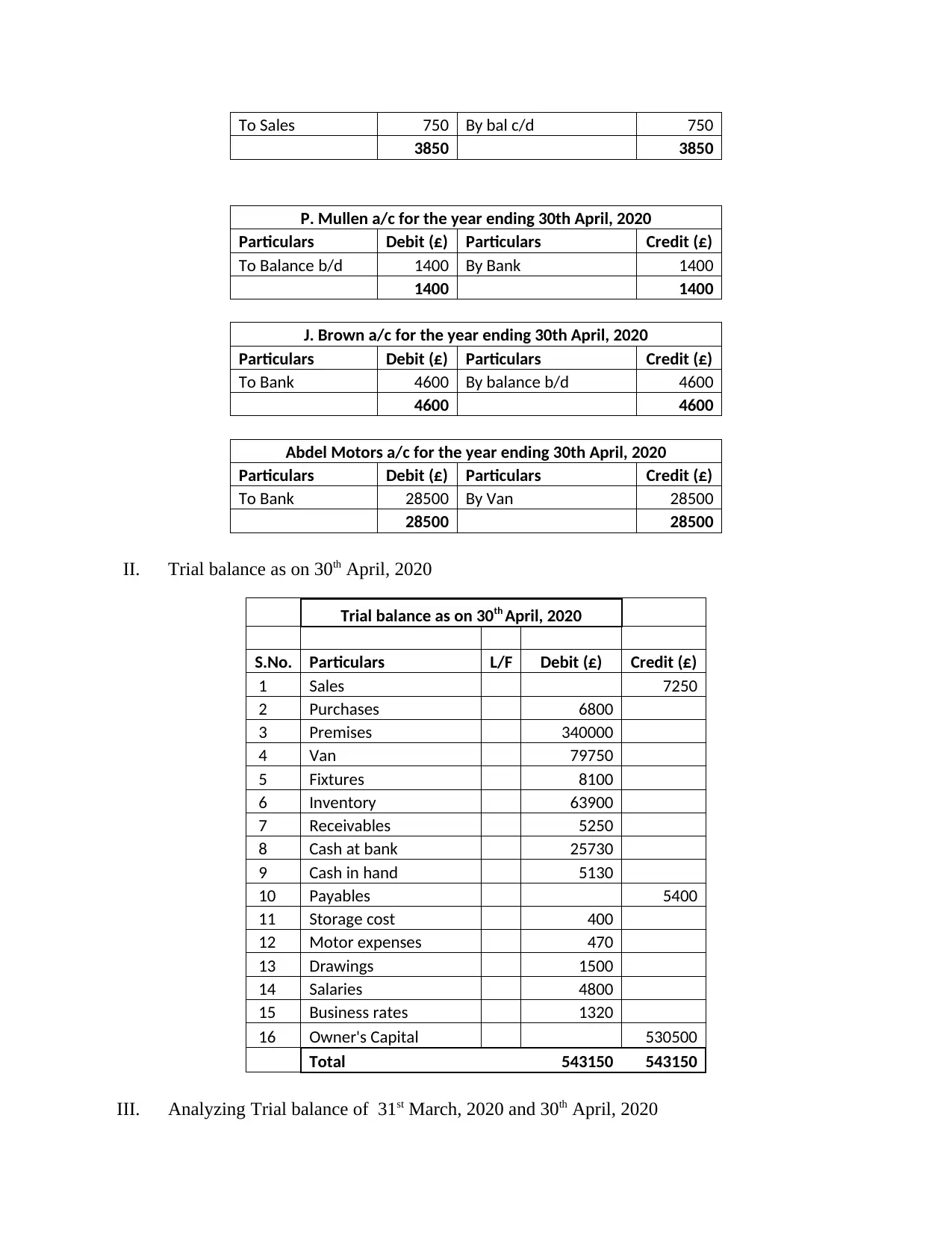

Task 2.1

Financial Accounting Statement: Financial statements shows point in time report and it is

prepared by managerial accounting heads. A financial accounting statement consists of

various statements such as balance sheet, income statements, statement of owner’s equity and

statement of cash flows. These statements mostly considered by outside stakeholders such

creditors, loan companies, tax department and Investors for their utmost interest.

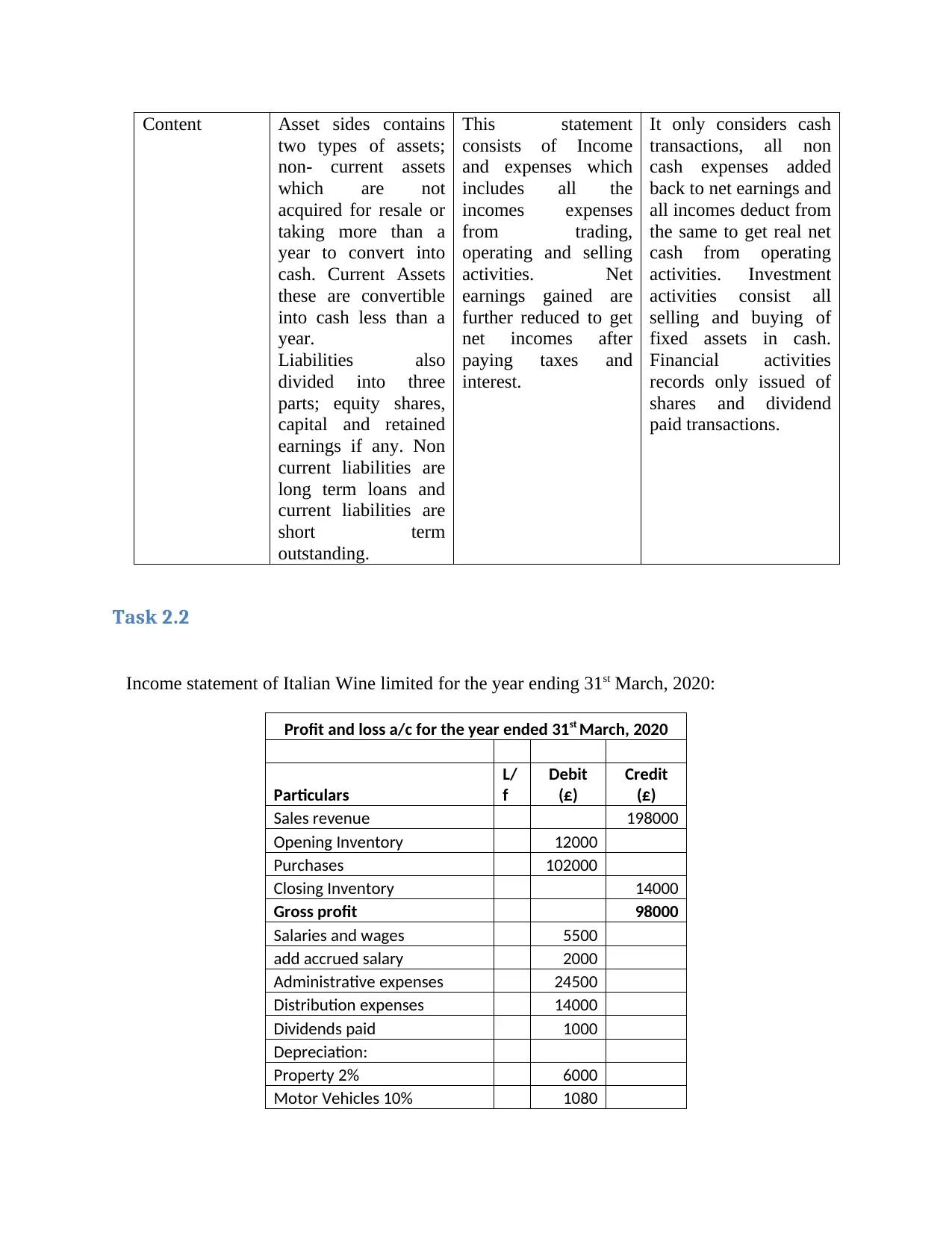

Comparison of different financial statements:

Bases Balance sheet Income statement Cash flow statements

Purpose It is set up to know

money related places

of the organization,

how much resources

organization needs to

break down its risk.

It is set up to get all

out net income during

a year by an

organization. These

net profit at that point

treated as held income

and added to

proprietor's value.

It is set up to get the

present status of money

development.

Structure It contains two sides

viz. Assets and

Liabilities. Total

Assets should match

with Total equity and

liabilities.

It also contains two

sides which are

income and expenses,

all the incomes during

a year deducts from

total expenses to get

net earnings during a

year.

This statement consists

of three different types

of activities which cash

from operating,

financing and investing

activities.

Payables: It decreases by £3350 due to payment paid to creditors from 31st March

to 30th April.

Receivables: It also decreases by £750, due to payment received from debtors.

Cash at bank: Balance of bank is decreased to £36670 due to payment done to

suppliers.

Cash in hand: This balance is also decreases by £470 due to payment of expenses

such as motor and salaries.

Total balance: Trial balance as on 31st March, 2020 shows an amount of £535750

while on 30th April, 2020 it shows £543150; additional to this owner’s capital is

also increased with approx. £10000 pounds due to increase in Sales, Purchases

and Van amount.

Task 2.1

Financial Accounting Statement: Financial statements shows point in time report and it is

prepared by managerial accounting heads. A financial accounting statement consists of

various statements such as balance sheet, income statements, statement of owner’s equity and

statement of cash flows. These statements mostly considered by outside stakeholders such

creditors, loan companies, tax department and Investors for their utmost interest.

Comparison of different financial statements:

Bases Balance sheet Income statement Cash flow statements

Purpose It is set up to know

money related places

of the organization,

how much resources

organization needs to

break down its risk.

It is set up to get all

out net income during

a year by an

organization. These

net profit at that point

treated as held income

and added to

proprietor's value.

It is set up to get the

present status of money

development.

Structure It contains two sides

viz. Assets and

Liabilities. Total

Assets should match

with Total equity and

liabilities.

It also contains two

sides which are

income and expenses,

all the incomes during

a year deducts from

total expenses to get

net earnings during a

year.

This statement consists

of three different types

of activities which cash

from operating,

financing and investing

activities.

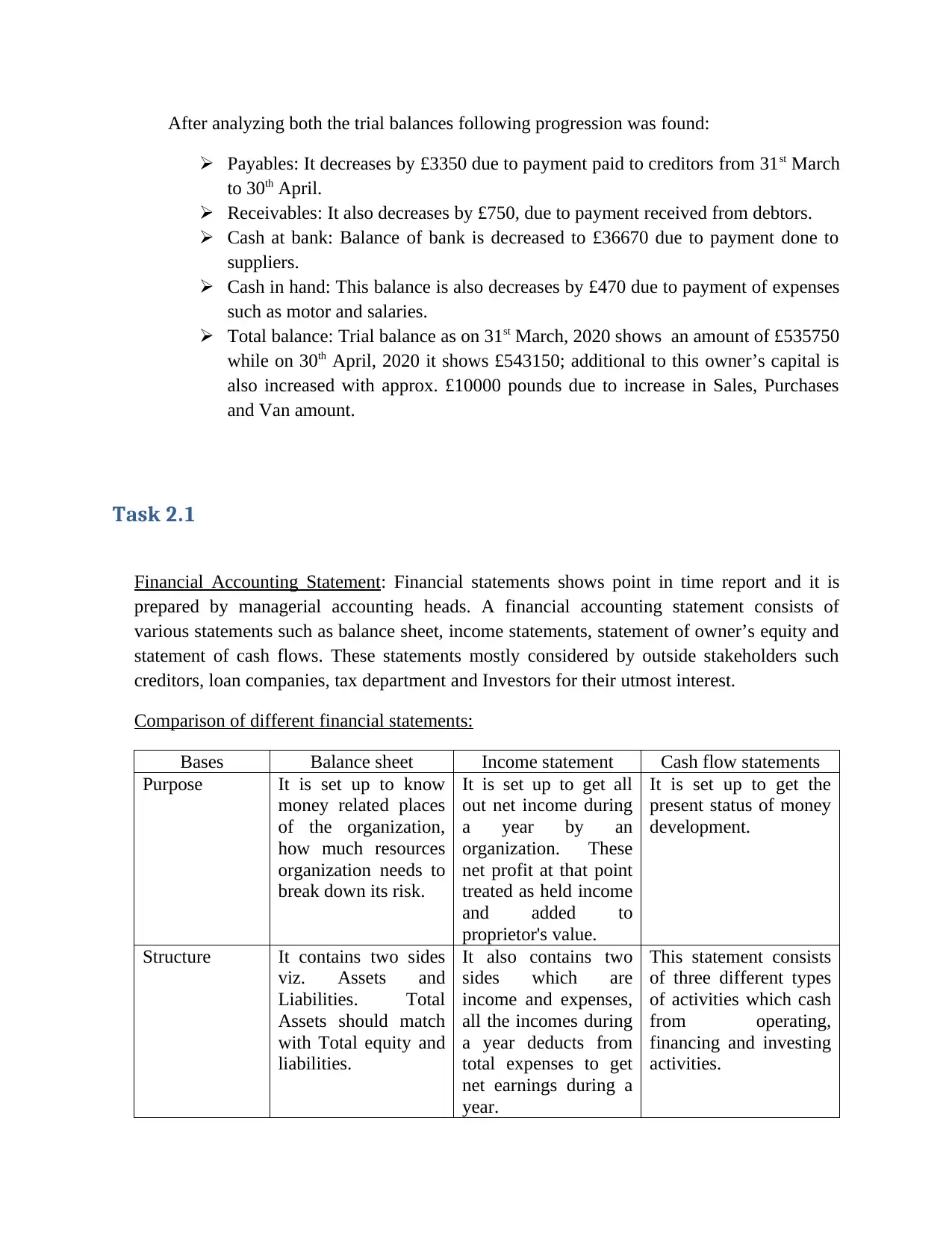

Content Asset sides contains

two types of assets;

non- current assets

which are not

acquired for resale or

taking more than a

year to convert into

cash. Current Assets

these are convertible

into cash less than a

year.

Liabilities also

divided into three

parts; equity shares,

capital and retained

earnings if any. Non

current liabilities are

long term loans and

current liabilities are

short term

outstanding.

This statement

consists of Income

and expenses which

includes all the

incomes expenses

from trading,

operating and selling

activities. Net

earnings gained are

further reduced to get

net incomes after

paying taxes and

interest.

It only considers cash

transactions, all non

cash expenses added

back to net earnings and

all incomes deduct from

the same to get real net

cash from operating

activities. Investment

activities consist all

selling and buying of

fixed assets in cash.

Financial activities

records only issued of

shares and dividend

paid transactions.

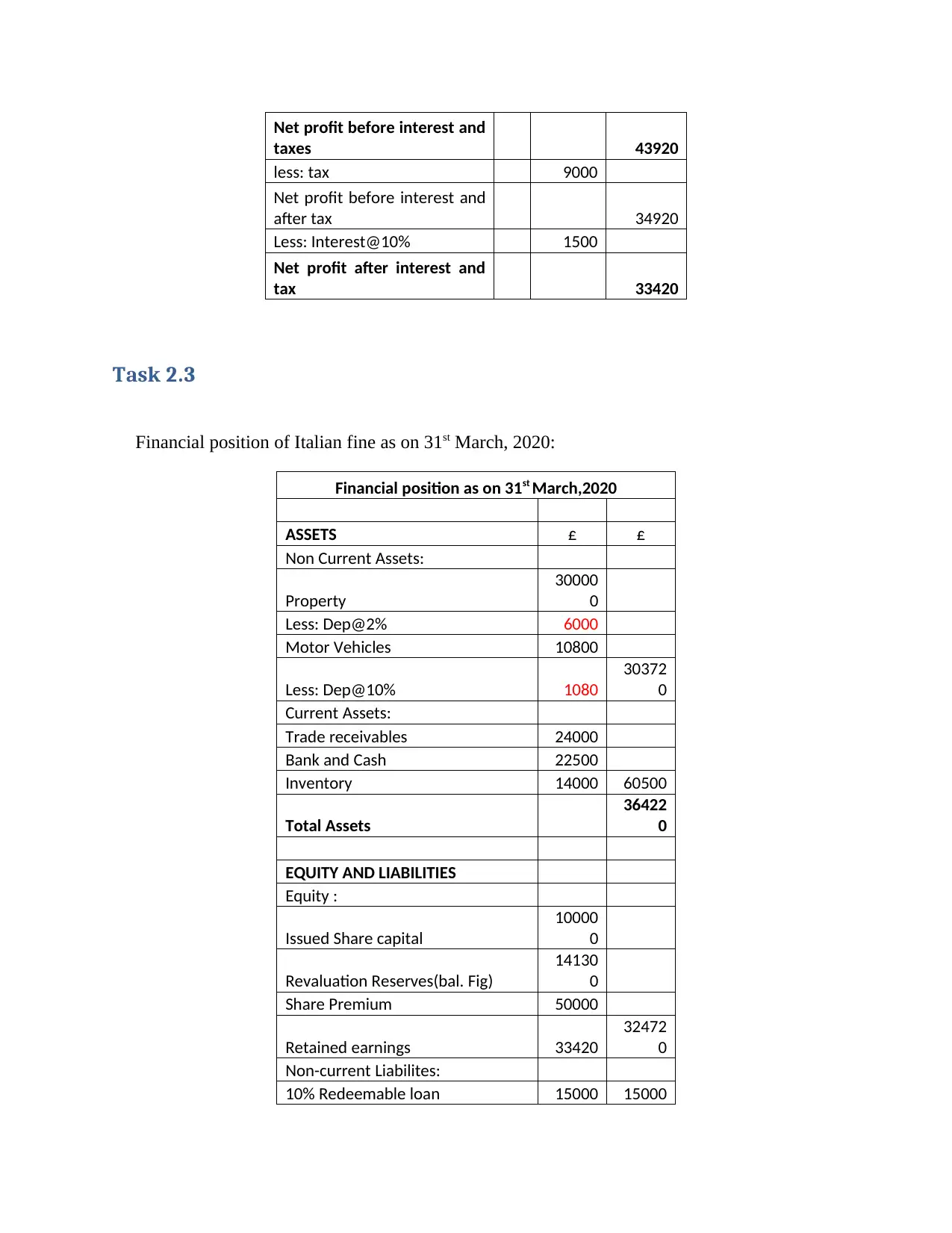

Task 2.2

Income statement of Italian Wine limited for the year ending 31st March, 2020:

Profit and loss a/c for the year ended 31st March, 2020

Particulars

L/

f

Debit

(£)

Credit

(£)

Sales revenue 198000

Opening Inventory 12000

Purchases 102000

Closing Inventory 14000

Gross profit 98000

Salaries and wages 5500

add accrued salary 2000

Administrative expenses 24500

Distribution expenses 14000

Dividends paid 1000

Depreciation:

Property 2% 6000

Motor Vehicles 10% 1080

two types of assets;

non- current assets

which are not

acquired for resale or

taking more than a

year to convert into

cash. Current Assets

these are convertible

into cash less than a

year.

Liabilities also

divided into three

parts; equity shares,

capital and retained

earnings if any. Non

current liabilities are

long term loans and

current liabilities are

short term

outstanding.

This statement

consists of Income

and expenses which

includes all the

incomes expenses

from trading,

operating and selling

activities. Net

earnings gained are

further reduced to get

net incomes after

paying taxes and

interest.

It only considers cash

transactions, all non

cash expenses added

back to net earnings and

all incomes deduct from

the same to get real net

cash from operating

activities. Investment

activities consist all

selling and buying of

fixed assets in cash.

Financial activities

records only issued of

shares and dividend

paid transactions.

Task 2.2

Income statement of Italian Wine limited for the year ending 31st March, 2020:

Profit and loss a/c for the year ended 31st March, 2020

Particulars

L/

f

Debit

(£)

Credit

(£)

Sales revenue 198000

Opening Inventory 12000

Purchases 102000

Closing Inventory 14000

Gross profit 98000

Salaries and wages 5500

add accrued salary 2000

Administrative expenses 24500

Distribution expenses 14000

Dividends paid 1000

Depreciation:

Property 2% 6000

Motor Vehicles 10% 1080

Net profit before interest and

taxes 43920

less: tax 9000

Net profit before interest and

after tax 34920

Less: Interest@10% 1500

Net profit after interest and

tax 33420

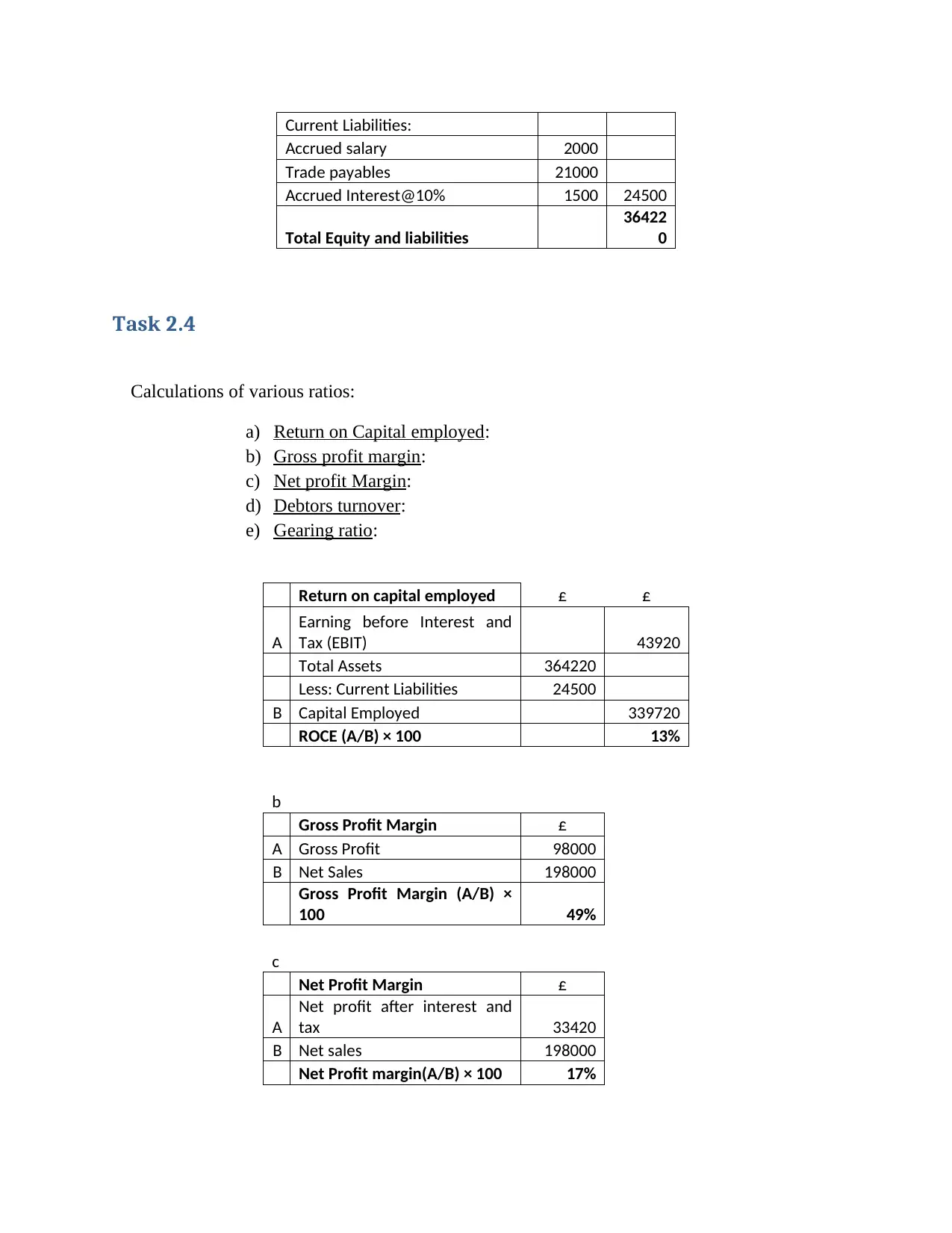

Task 2.3

Financial position of Italian fine as on 31st March, 2020:

Financial position as on 31st March,2020

ASSETS £ £

Non Current Assets:

Property

30000

0

Less: Dep@2% 6000

Motor Vehicles 10800

Less: Dep@10% 1080

30372

0

Current Assets:

Trade receivables 24000

Bank and Cash 22500

Inventory 14000 60500

Total Assets

36422

0

EQUITY AND LIABILITIES

Equity :

Issued Share capital

10000

0

Revaluation Reserves(bal. Fig)

14130

0

Share Premium 50000

Retained earnings 33420

32472

0

Non-current Liabilites:

10% Redeemable loan 15000 15000

taxes 43920

less: tax 9000

Net profit before interest and

after tax 34920

Less: Interest@10% 1500

Net profit after interest and

tax 33420

Task 2.3

Financial position of Italian fine as on 31st March, 2020:

Financial position as on 31st March,2020

ASSETS £ £

Non Current Assets:

Property

30000

0

Less: Dep@2% 6000

Motor Vehicles 10800

Less: Dep@10% 1080

30372

0

Current Assets:

Trade receivables 24000

Bank and Cash 22500

Inventory 14000 60500

Total Assets

36422

0

EQUITY AND LIABILITIES

Equity :

Issued Share capital

10000

0

Revaluation Reserves(bal. Fig)

14130

0

Share Premium 50000

Retained earnings 33420

32472

0

Non-current Liabilites:

10% Redeemable loan 15000 15000

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Current Liabilities:

Accrued salary 2000

Trade payables 21000

Accrued Interest@10% 1500 24500

Total Equity and liabilities

36422

0

Task 2.4

Calculations of various ratios:

a) Return on Capital employed:

b) Gross profit margin:

c) Net profit Margin:

d) Debtors turnover:

e) Gearing ratio:

Return on capital employed £ £

A

Earning before Interest and

Tax (EBIT) 43920

Total Assets 364220

Less: Current Liabilities 24500

B Capital Employed 339720

ROCE (A/B) × 100 13%

b

Gross Profit Margin £

A Gross Profit 98000

B Net Sales 198000

Gross Profit Margin (A/B) ×

100 49%

c

Net Profit Margin £

A

Net profit after interest and

tax 33420

B Net sales 198000

Net Profit margin(A/B) × 100 17%

Accrued salary 2000

Trade payables 21000

Accrued Interest@10% 1500 24500

Total Equity and liabilities

36422

0

Task 2.4

Calculations of various ratios:

a) Return on Capital employed:

b) Gross profit margin:

c) Net profit Margin:

d) Debtors turnover:

e) Gearing ratio:

Return on capital employed £ £

A

Earning before Interest and

Tax (EBIT) 43920

Total Assets 364220

Less: Current Liabilities 24500

B Capital Employed 339720

ROCE (A/B) × 100 13%

b

Gross Profit Margin £

A Gross Profit 98000

B Net Sales 198000

Gross Profit Margin (A/B) ×

100 49%

c

Net Profit Margin £

A

Net profit after interest and

tax 33420

B Net sales 198000

Net Profit margin(A/B) × 100 17%

d

Debtors Turnover Ratio £

A Net Credit Sales 198000

B Average accounts receivable: 24000

Debtors Turnover Ratio (A/B) 8.25

e

Gearing Ratio £ £

A Total Debts:

10% Loan 15000 15000

B Total Equity:

Issued share capital 100000

Share premium 50000 150000

Gearing Ratio (A/B) 0.1

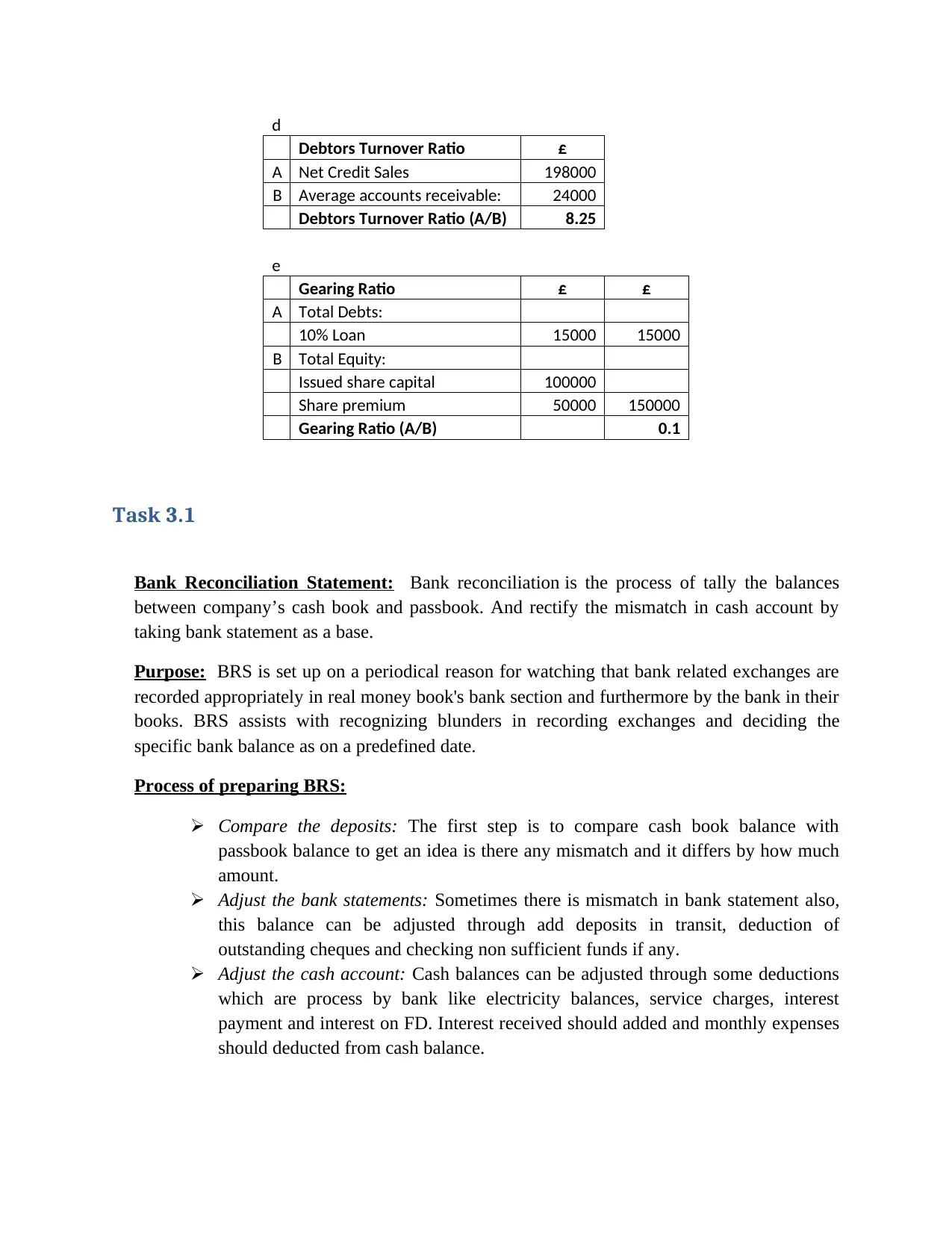

Task 3.1

Bank Reconciliation Statement: Bank reconciliation is the process of tally the balances

between company’s cash book and passbook. And rectify the mismatch in cash account by

taking bank statement as a base.

Purpose: BRS is set up on a periodical reason for watching that bank related exchanges are

recorded appropriately in real money book's bank section and furthermore by the bank in their

books. BRS assists with recognizing blunders in recording exchanges and deciding the

specific bank balance as on a predefined date.

Process of preparing BRS:

Compare the deposits: The first step is to compare cash book balance with

passbook balance to get an idea is there any mismatch and it differs by how much

amount.

Adjust the bank statements: Sometimes there is mismatch in bank statement also,

this balance can be adjusted through add deposits in transit, deduction of

outstanding cheques and checking non sufficient funds if any.

Adjust the cash account: Cash balances can be adjusted through some deductions

which are process by bank like electricity balances, service charges, interest

payment and interest on FD. Interest received should added and monthly expenses

should deducted from cash balance.

Debtors Turnover Ratio £

A Net Credit Sales 198000

B Average accounts receivable: 24000

Debtors Turnover Ratio (A/B) 8.25

e

Gearing Ratio £ £

A Total Debts:

10% Loan 15000 15000

B Total Equity:

Issued share capital 100000

Share premium 50000 150000

Gearing Ratio (A/B) 0.1

Task 3.1

Bank Reconciliation Statement: Bank reconciliation is the process of tally the balances

between company’s cash book and passbook. And rectify the mismatch in cash account by

taking bank statement as a base.

Purpose: BRS is set up on a periodical reason for watching that bank related exchanges are

recorded appropriately in real money book's bank section and furthermore by the bank in their

books. BRS assists with recognizing blunders in recording exchanges and deciding the

specific bank balance as on a predefined date.

Process of preparing BRS:

Compare the deposits: The first step is to compare cash book balance with

passbook balance to get an idea is there any mismatch and it differs by how much

amount.

Adjust the bank statements: Sometimes there is mismatch in bank statement also,

this balance can be adjusted through add deposits in transit, deduction of

outstanding cheques and checking non sufficient funds if any.

Adjust the cash account: Cash balances can be adjusted through some deductions

which are process by bank like electricity balances, service charges, interest

payment and interest on FD. Interest received should added and monthly expenses

should deducted from cash balance.

Stakeholders: Only owners and internal staff such as managerial accountant and junior

accountant would be interested in such a statement, to rectify any mismatch between

cashbook and passbook.

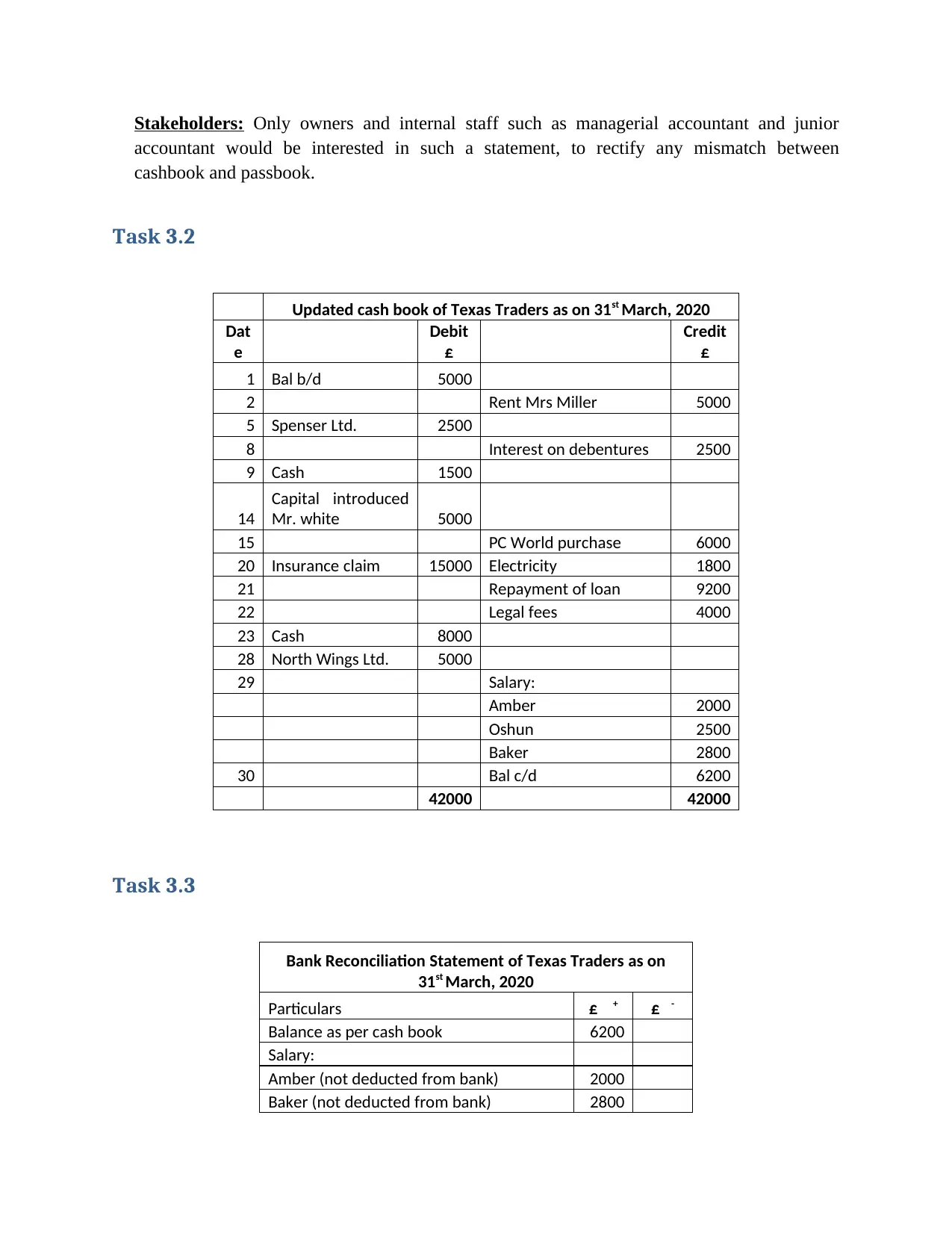

Task 3.2

Updated cash book of Texas Traders as on 31st March, 2020

Dat

e

Debit

£

Credit

£

1 Bal b/d 5000

2 Rent Mrs Miller 5000

5 Spenser Ltd. 2500

8 Interest on debentures 2500

9 Cash 1500

14

Capital introduced

Mr. white 5000

15 PC World purchase 6000

20 Insurance claim 15000 Electricity 1800

21 Repayment of loan 9200

22 Legal fees 4000

23 Cash 8000

28 North Wings Ltd. 5000

29 Salary:

Amber 2000

Oshun 2500

Baker 2800

30 Bal c/d 6200

42000 42000

Task 3.3

Bank Reconciliation Statement of Texas Traders as on

31st March, 2020

Particulars £ + £ -

Balance as per cash book 6200

Salary:

Amber (not deducted from bank) 2000

Baker (not deducted from bank) 2800

accountant would be interested in such a statement, to rectify any mismatch between

cashbook and passbook.

Task 3.2

Updated cash book of Texas Traders as on 31st March, 2020

Dat

e

Debit

£

Credit

£

1 Bal b/d 5000

2 Rent Mrs Miller 5000

5 Spenser Ltd. 2500

8 Interest on debentures 2500

9 Cash 1500

14

Capital introduced

Mr. white 5000

15 PC World purchase 6000

20 Insurance claim 15000 Electricity 1800

21 Repayment of loan 9200

22 Legal fees 4000

23 Cash 8000

28 North Wings Ltd. 5000

29 Salary:

Amber 2000

Oshun 2500

Baker 2800

30 Bal c/d 6200

42000 42000

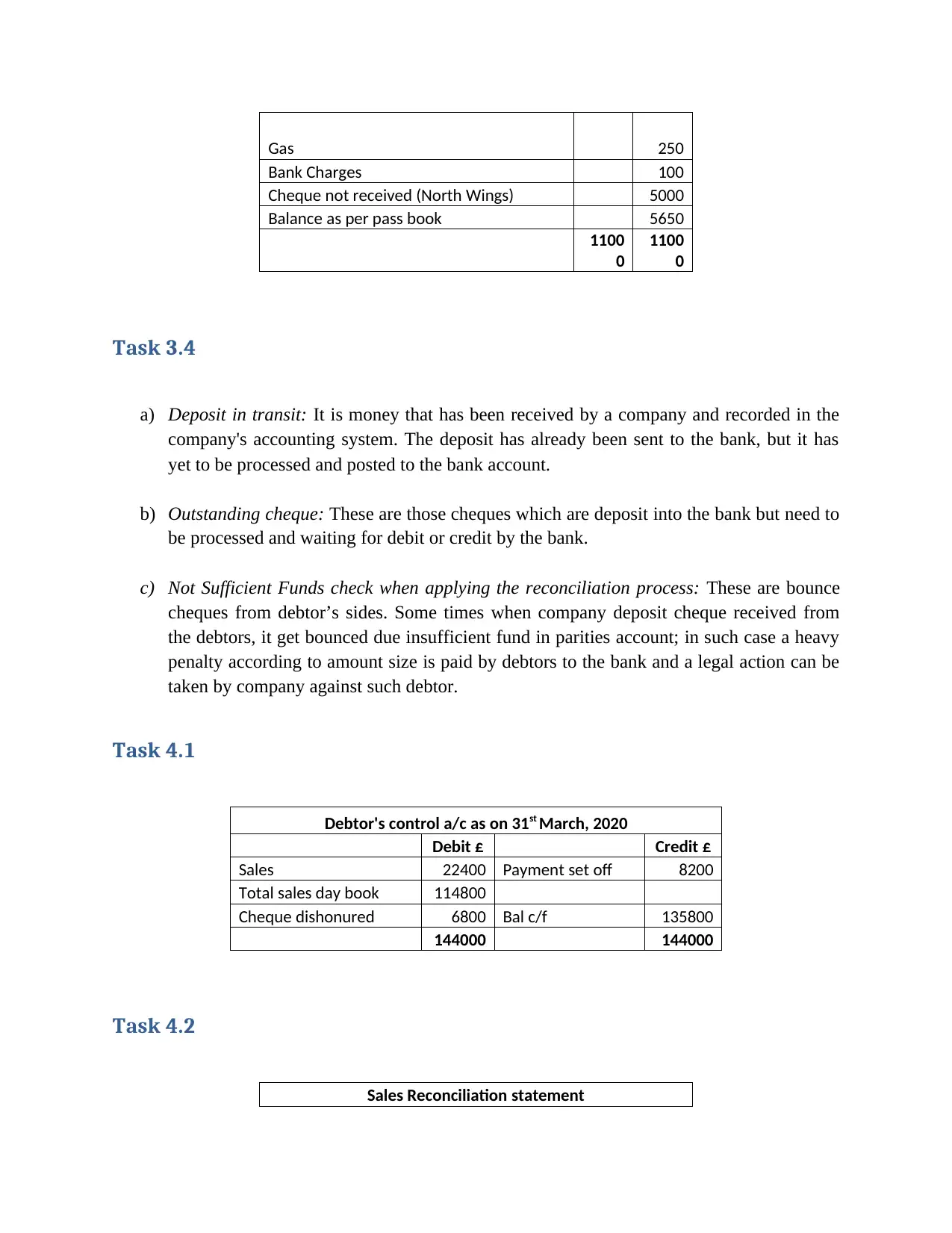

Task 3.3

Bank Reconciliation Statement of Texas Traders as on

31st March, 2020

Particulars £ + £ -

Balance as per cash book 6200

Salary:

Amber (not deducted from bank) 2000

Baker (not deducted from bank) 2800

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Gas 250

Bank Charges 100

Cheque not received (North Wings) 5000

Balance as per pass book 5650

1100

0

1100

0

Task 3.4

a) Deposit in transit: It is money that has been received by a company and recorded in the

company's accounting system. The deposit has already been sent to the bank, but it has

yet to be processed and posted to the bank account.

b) Outstanding cheque: These are those cheques which are deposit into the bank but need to

be processed and waiting for debit or credit by the bank.

c) Not Sufficient Funds check when applying the reconciliation process: These are bounce

cheques from debtor’s sides. Some times when company deposit cheque received from

the debtors, it get bounced due insufficient fund in parities account; in such case a heavy

penalty according to amount size is paid by debtors to the bank and a legal action can be

taken by company against such debtor.

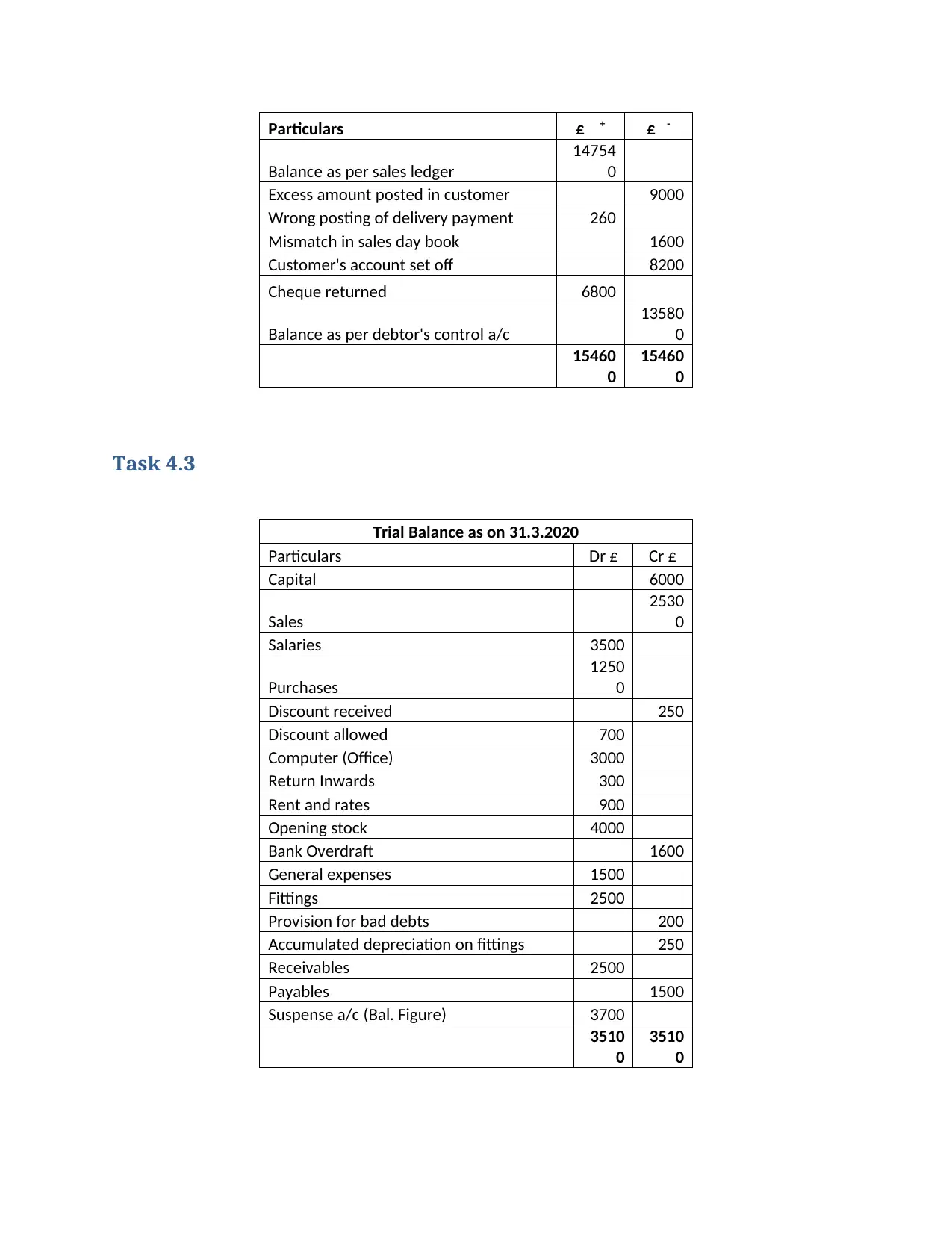

Task 4.1

Debtor's control a/c as on 31st March, 2020

Debit £ Credit £

Sales 22400 Payment set off 8200

Total sales day book 114800

Cheque dishonured 6800 Bal c/f 135800

144000 144000

Task 4.2

Sales Reconciliation statement

Bank Charges 100

Cheque not received (North Wings) 5000

Balance as per pass book 5650

1100

0

1100

0

Task 3.4

a) Deposit in transit: It is money that has been received by a company and recorded in the

company's accounting system. The deposit has already been sent to the bank, but it has

yet to be processed and posted to the bank account.

b) Outstanding cheque: These are those cheques which are deposit into the bank but need to

be processed and waiting for debit or credit by the bank.

c) Not Sufficient Funds check when applying the reconciliation process: These are bounce

cheques from debtor’s sides. Some times when company deposit cheque received from

the debtors, it get bounced due insufficient fund in parities account; in such case a heavy

penalty according to amount size is paid by debtors to the bank and a legal action can be

taken by company against such debtor.

Task 4.1

Debtor's control a/c as on 31st March, 2020

Debit £ Credit £

Sales 22400 Payment set off 8200

Total sales day book 114800

Cheque dishonured 6800 Bal c/f 135800

144000 144000

Task 4.2

Sales Reconciliation statement

Particulars £ + £ -

Balance as per sales ledger

14754

0

Excess amount posted in customer 9000

Wrong posting of delivery payment 260

Mismatch in sales day book 1600

Customer's account set off 8200

Cheque returned 6800

Balance as per debtor's control a/c

13580

0

15460

0

15460

0

Task 4.3

Trial Balance as on 31.3.2020

Particulars Dr £ Cr £

Capital 6000

Sales

2530

0

Salaries 3500

Purchases

1250

0

Discount received 250

Discount allowed 700

Computer (Office) 3000

Return Inwards 300

Rent and rates 900

Opening stock 4000

Bank Overdraft 1600

General expenses 1500

Fittings 2500

Provision for bad debts 200

Accumulated depreciation on fittings 250

Receivables 2500

Payables 1500

Suspense a/c (Bal. Figure) 3700

3510

0

3510

0

Balance as per sales ledger

14754

0

Excess amount posted in customer 9000

Wrong posting of delivery payment 260

Mismatch in sales day book 1600

Customer's account set off 8200

Cheque returned 6800

Balance as per debtor's control a/c

13580

0

15460

0

15460

0

Task 4.3

Trial Balance as on 31.3.2020

Particulars Dr £ Cr £

Capital 6000

Sales

2530

0

Salaries 3500

Purchases

1250

0

Discount received 250

Discount allowed 700

Computer (Office) 3000

Return Inwards 300

Rent and rates 900

Opening stock 4000

Bank Overdraft 1600

General expenses 1500

Fittings 2500

Provision for bad debts 200

Accumulated depreciation on fittings 250

Receivables 2500

Payables 1500

Suspense a/c (Bal. Figure) 3700

3510

0

3510

0

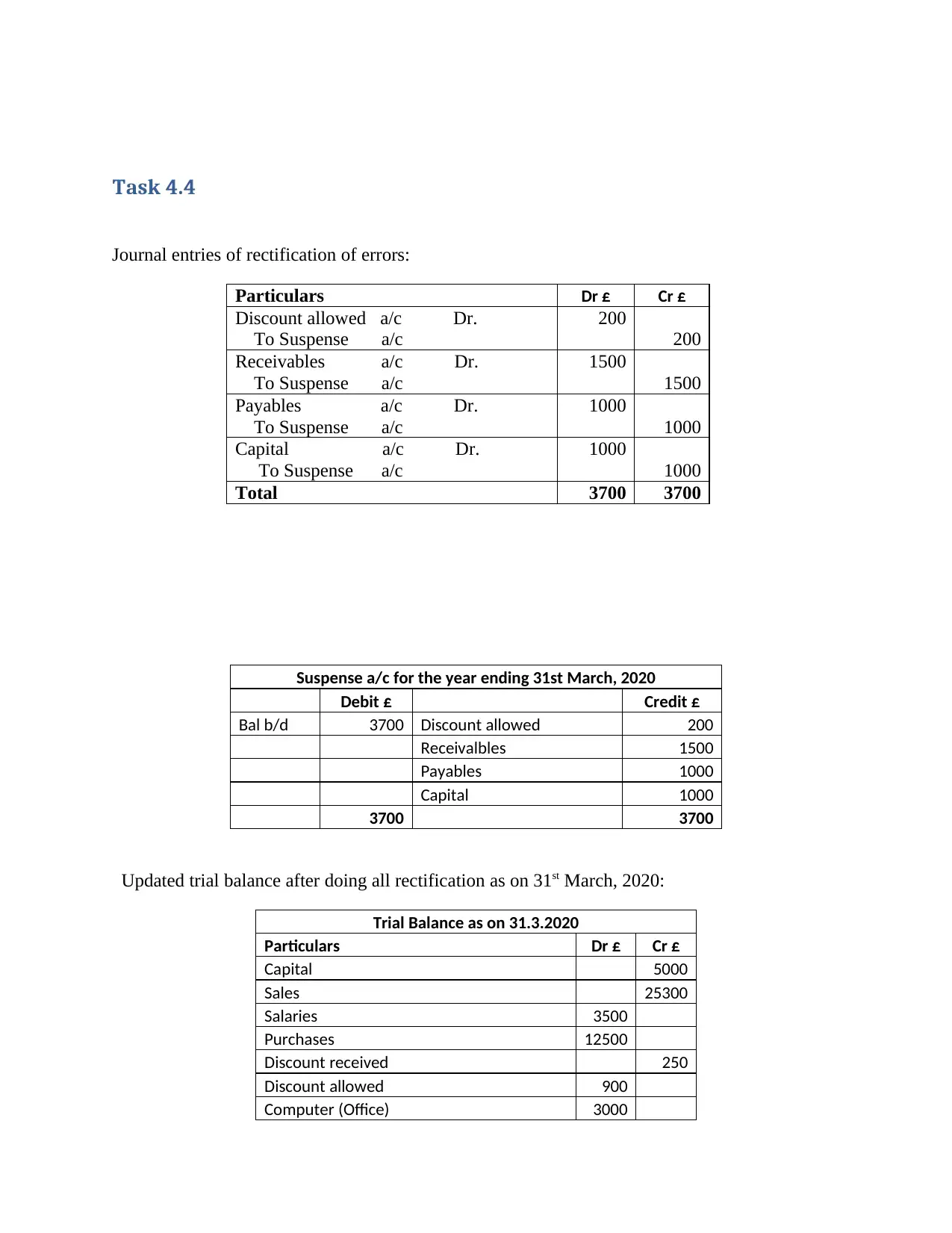

Task 4.4

Journal entries of rectification of errors:

Particulars Dr £ Cr £

Discount allowed a/c Dr.

To Suspense a/c

200

200

Receivables a/c Dr.

To Suspense a/c

1500

1500

Payables a/c Dr.

To Suspense a/c

1000

1000

Capital a/c Dr.

To Suspense a/c

1000

1000

Total 3700 3700

Suspense a/c for the year ending 31st March, 2020

Debit £ Credit £

Bal b/d 3700 Discount allowed 200

Receivalbles 1500

Payables 1000

Capital 1000

3700 3700

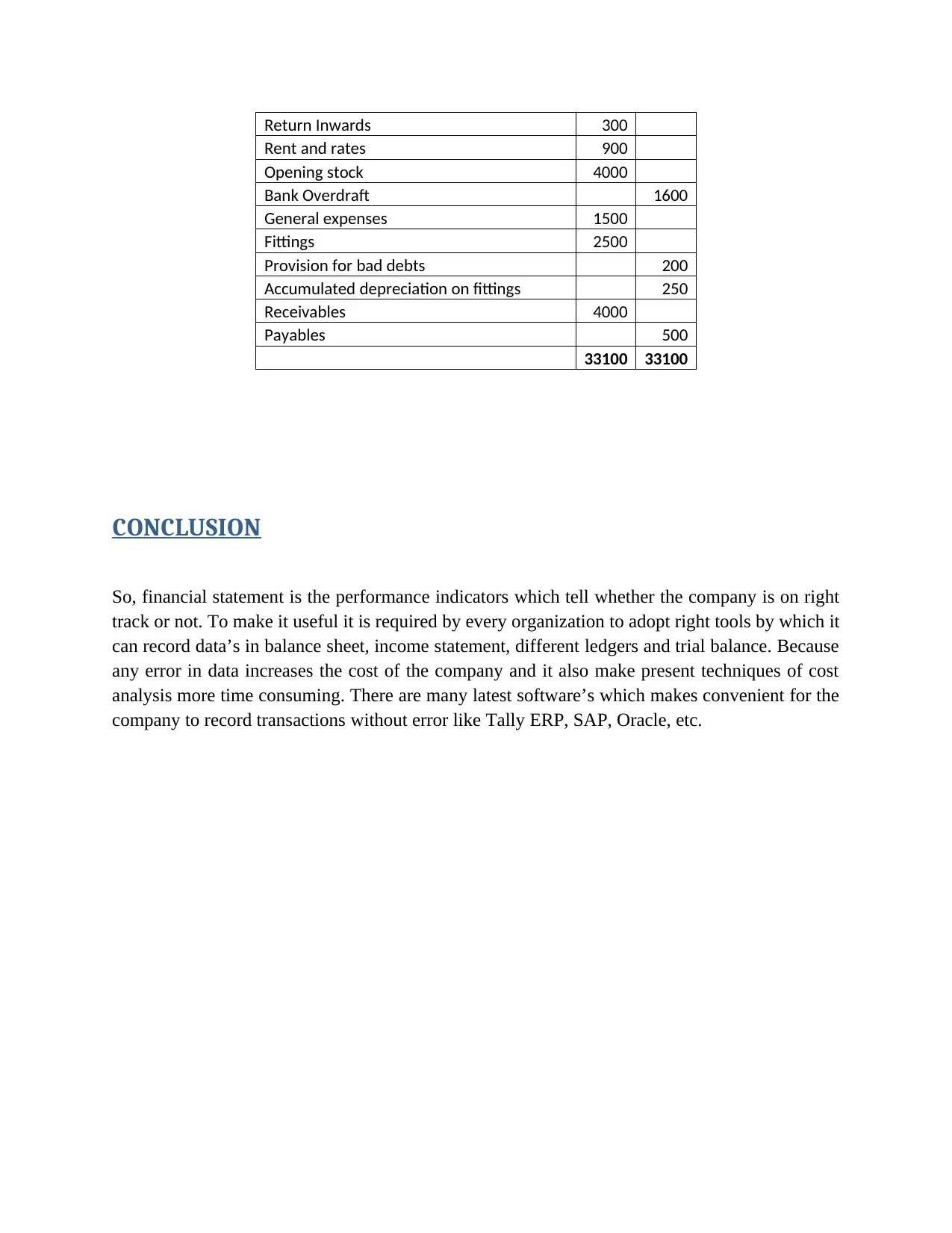

Updated trial balance after doing all rectification as on 31st March, 2020:

Trial Balance as on 31.3.2020

Particulars Dr £ Cr £

Capital 5000

Sales 25300

Salaries 3500

Purchases 12500

Discount received 250

Discount allowed 900

Computer (Office) 3000

Journal entries of rectification of errors:

Particulars Dr £ Cr £

Discount allowed a/c Dr.

To Suspense a/c

200

200

Receivables a/c Dr.

To Suspense a/c

1500

1500

Payables a/c Dr.

To Suspense a/c

1000

1000

Capital a/c Dr.

To Suspense a/c

1000

1000

Total 3700 3700

Suspense a/c for the year ending 31st March, 2020

Debit £ Credit £

Bal b/d 3700 Discount allowed 200

Receivalbles 1500

Payables 1000

Capital 1000

3700 3700

Updated trial balance after doing all rectification as on 31st March, 2020:

Trial Balance as on 31.3.2020

Particulars Dr £ Cr £

Capital 5000

Sales 25300

Salaries 3500

Purchases 12500

Discount received 250

Discount allowed 900

Computer (Office) 3000

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Return Inwards 300

Rent and rates 900

Opening stock 4000

Bank Overdraft 1600

General expenses 1500

Fittings 2500

Provision for bad debts 200

Accumulated depreciation on fittings 250

Receivables 4000

Payables 500

33100 33100

CONCLUSION

So, financial statement is the performance indicators which tell whether the company is on right

track or not. To make it useful it is required by every organization to adopt right tools by which it

can record data’s in balance sheet, income statement, different ledgers and trial balance. Because

any error in data increases the cost of the company and it also make present techniques of cost

analysis more time consuming. There are many latest software’s which makes convenient for the

company to record transactions without error like Tally ERP, SAP, Oracle, etc.

Rent and rates 900

Opening stock 4000

Bank Overdraft 1600

General expenses 1500

Fittings 2500

Provision for bad debts 200

Accumulated depreciation on fittings 250

Receivables 4000

Payables 500

33100 33100

CONCLUSION

So, financial statement is the performance indicators which tell whether the company is on right

track or not. To make it useful it is required by every organization to adopt right tools by which it

can record data’s in balance sheet, income statement, different ledgers and trial balance. Because

any error in data increases the cost of the company and it also make present techniques of cost

analysis more time consuming. There are many latest software’s which makes convenient for the

company to record transactions without error like Tally ERP, SAP, Oracle, etc.

REFERENCES:

Smith, S. S. (2019). Blockchain, Artificial Intelligence and Financial Services: Implications and Applications for

Finance and Accounting Professionals. Springer Nature.

Apostolides, N. (2016). Management Accounting for Beginners. Routledge.

Carey, M., Knowles, C., & Towers-Clark, J. (2017). Accounting: a smart approach. Oxford University Press.

Breton, G. (2018). A postmodern accounting theory: An institutional approach. Emerald Group Publishing.

Tracy, J. A. (2016). Accounting for dummies. John Wiley & Sons.

Clarke, E. A., & Wilson, M. (2018). Accounting: An Introduction to Principles and Practice 9ed. Cengage AU.

Ciftci, M., & Darrough, M. (2019). Inventory Policy Choice and Cost of Debt: A Private Debtholders’

Perspective. Journal of Accounting, Auditing & Finance, 0148558X19848881.

Bassemir, M., & Novotny‐Farkas, Z. (2018). IFRS adoption, reporting incentives and financial reporting quality in

private firms. Journal of Business Finance & Accounting, 45(7-8), 759-796.

Rouf, M. A. (2017). Firm-specific characteristics, corporate governance and voluntary disclosure in annual reports of

listed companies in Bangladesh. International Journal of Managerial and Financial Accounting, 9(3), 263-282.

Smith, S. S. (2019). Blockchain, Artificial Intelligence and Financial Services: Implications and Applications for

Finance and Accounting Professionals. Springer Nature.

Apostolides, N. (2016). Management Accounting for Beginners. Routledge.

Carey, M., Knowles, C., & Towers-Clark, J. (2017). Accounting: a smart approach. Oxford University Press.

Breton, G. (2018). A postmodern accounting theory: An institutional approach. Emerald Group Publishing.

Tracy, J. A. (2016). Accounting for dummies. John Wiley & Sons.

Clarke, E. A., & Wilson, M. (2018). Accounting: An Introduction to Principles and Practice 9ed. Cengage AU.

Ciftci, M., & Darrough, M. (2019). Inventory Policy Choice and Cost of Debt: A Private Debtholders’

Perspective. Journal of Accounting, Auditing & Finance, 0148558X19848881.

Bassemir, M., & Novotny‐Farkas, Z. (2018). IFRS adoption, reporting incentives and financial reporting quality in

private firms. Journal of Business Finance & Accounting, 45(7-8), 759-796.

Rouf, M. A. (2017). Firm-specific characteristics, corporate governance and voluntary disclosure in annual reports of

listed companies in Bangladesh. International Journal of Managerial and Financial Accounting, 9(3), 263-282.

1 out of 18

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.